- 1Accounting, Audit and Finance Department, Stefan cel Mare University, Suceava, Romania

- 2Accounting and Auditing Department, Babes-Bolyai University, Cluj-Napoca, Romania

The crisis situations that have affected the oil and gas market have had a significant impact on the companies’ performance from this sector and especially on their customers. In these circumstances, many companies faced increasing difficulties and in some cases, in order to survive, they had to restructure their business or even leave the market. Considering this context, this kind of situations are also manifesting in Romania where we can identify companies facing the erosion of their competitive position, with economic, financial and capital consequences, while other companies still managed to react positively to the crisis generated by the energy sector through innovation and internationalization. This article analyses the sustainability of the operational activity of oil and gas extraction companies from Romania, based on financial and economic data and information, having the aim of investigating the way in which the performance of different markets has influenced the economic and financial results and consequently, the implications of this influence for the structure of the activity and on the financial-economic sustainability. The research methodology is specific to a quantitative research, based on a sample of financial and economic data reported by all 29 oil and gas extraction companies from Romania over the period of 2008–2022. The data collected from the financial reports formed the basis for the calculation of the financial indicators and ratios considered relevant in forecasting the economic and financial sustainability of these companies. The results obtained are materialised in the development of a model whose aim is to assess the financial and economic sustainability, its independent variables being grouped into performance, activity and risk indicators. The usefulness of the results obtained is relevant both for the companies concerned and for their customers and suppliers who will show a visible dependence on energy costs, but also for investors and financiers directly interested in performance and sustainability information, on the basis of which they will determine the value of their own economic benefits.

1 Introduction

A first definition of financial sustainability was developed by the European Commission, according to which “sustainable finance is the provision of finance to investments taking into account Environmental, Social and Governance (ESG) considerations. Sustainable finance includes a strong green finance component that aims to support economic growth while: reducing pressures on the environment; addressing green-house gas emissions and tackling pollution; minimizing waste and improving efficiency in the use of natural resources” (European Comission, 2015). Seen from this perspective, financial sustainability operates as a process that goes beyond the traditional neoclassical logic of interpreting sustainability based solely on bottom-line economic value, oriented to the triple bottom line of investment activity (Bertonello, 2023). Nowadays, the focus is increasingly on socially responsible investments, which means that it is not so much about the importance of obtaining the profit or about the quantitative and intrinsic value of it, but rather about the effects that such investments can generate in terms of increasing the social quality of life or protecting the environment. In other words, the exclusive focus on profit maximization ignores the environmental and social components, which is why companies cannot perform in the long term, as stakeholders become increasingly aware of the impact that these companies’ decisions can have on the environment and the society in which they operate. Prioritizing these investments will therefore have a medium to long-term impact as more and more investors share the policies of business ethics and responsibility towards the environment and the community in which they operate. As far as the activity of oil and gas companies is concerned, the effects on the environment in general and on society in particular are well known globally, which is why indicators reflecting performance and those assessing the dynamics of operational activity are considered insufficient to ensure the sustainability of the activity of these companies. The aim of this paper is to draw attention to the risk indicators that can jeopardize the smooth operation of companies at any time, even though they are considered to be performing and useful in terms of serving the interests of the general public. However, as mentioned earlier, investors and financiers may be discouraged from participating in a business that does not include a strong green finance component and that damages the environment, increases its greenhouse gas emissions footprint and does not combat pollution. Companies need to bear in mind that integrating sustainability policies into corporate strategy can be an opportunity to improve their relationships with stakeholders, primarily by increasing trust and gaining easier access to resources, which ultimately benefits performance.

In order to clarify this threefold issue (related to the three aggregated indicators of influence on financial sustainability), the objective of the research was to answer the following question: What is the impact of activity, performance and risk indicators on the sustainability of oil and gas extraction companies? To answer this questions we have to take into account some indicators like net margin, return on equity, working capital turnover, fixed asset turnover, total asset turnover, receivables turnover, as well as general and immediate liquidity, which reflect in an objective and accurate manner both the risks and benefits of financial sustainability.

In this context, the main objective is focused on the analysis of indicators aimed at measuring the economic and financial performance, the main indicators that characterize the dynamics of the operational activity, but also the risk indicators that may threaten at any time the continuation of the activity, due exclusively to the management of resources, which can disrupt the entire economic and financial balance. In order to achieve the proposed objective, an econometric analysis was carried out on a sample of 29 Romanian companies operating in the oil and gas extraction sector. We measured the effects that the results of operating activities, the dynamics of revenues and expenses (reflected by performance indicators), or the presence or lack of cash flow have on the financial sustainability of these companies. It is important to underline that the developed indicators are also a management tool for measuring and evaluating how available resources are used. For the construction of the econometric model, the economic and financial data of the 29 companies operating in the oil and gas extraction sector were used. These data have been taken from the financial reports, in particular the balance sheet, income statement, statement of changes in equity and cash flow and where appropriate, from the sustainability reports. The reason for constructing these variables is to measure the financial dynamics of the company, on the basis of which average sustainability ranges can then be determined.

The results of the research are materialized in the development of a model for evaluating the financial and economic sustainability of oil and gas enterprises in Romania. The importance of the obtained results is relevant for both the management of these companies and for the investors in this field, but especially for both domestic and industrial consumers who depend on the sustainability of these companies’ businesses, especially in the current multiple crisis conditions.

2 Literature review

The term sustainability has now gained greater interest from managers, investors, world leaders and from the majority of citizens who face price increases and economic, political, social and environmental instability. In broad sense, the concept of sustainability refers to the ability “to maintain or support a continuous process over time”, i.e., to be sustainable in the long term. Sustainability is a multidimensional concept, which aims in particular to highlight the main problem of humanity - “depletion of natural resources” - aiming in particular at the unification of economic and social resources in the creation of a sustainable development environment. In 1987, the Brundtland Commission of the United Nations defined sustainability as the process of “meeting the needs of the present without compromising the ability of future generations to meet their own needs” (WCED, 1987). According to Clarke and Clegg. (2000), “sustainability is becoming a key imperative in business, as the eternal quest for dominance over nature is replaced by the challenge of achieving environmental balance.” Sustainability is not only about the development at all costs and achieving a high level of economic performance, but also about the development through the aggregation of social, environmental and economic dimensions. Achieving a high performance in terms of economic-financial indicators does not show the ability to be sustainable, but only the ability to be profitable, or to be sustainable from an economic point of view. In the new context, investors are looking not only at the company’s ability to generate profit, but also at its ability to record social and environmental performance where it operates. Sustainability is a transdisciplinary concept that succeeds in bringing together all sciences around a development path focused on economic, social and environmental wellbeing.

For oil and gas companies, sustainability is a key topic as they are forced to comply with safety, environmental and health regulations in order to have a sustainable production. Changing investment strategies, civic activism from civil society, as well as the new socio-economic context are forcing companies operating in the oil and gas industry to reduce emissions. Achieving the lowest level of emissions can only be done through sustainable technological equipment, which involves high costs, the purchase of such equipment generating an increase in the production cost. According to Branson. (2022), the competitiveness of low-carbon energies creates a number of opportunities and threats for firms in the oil and gas industry. In order to be sustainable, oil and gas companies need to re-evaluate their business policies and objectives by applying proactive sustainability practices. Currently, oil and gas still remain essential elements of the energy mix, the current energy crisis highlighting the vulnerability of the world’s economies determined by the dependence on Russia’s resources (Grosu et al., 2022a; Grosu et al., 2022b). At the same time, this crisis highlights the problems related to social, environmental and economic sustainability, redirecting the route of the world’s economies towards the identification of new energy solutions. In the future, the oil and gas industry will have to make a transition to sustainable energy sources in order to continue to maintain their license to operate (Branson, 2022). Some businesses have already defined sustainability plans, but they are difficult to implement due to high costs.

The energy dependence on the oil and gas industry has contributed to the development of this sector and at the same time to a lot of negligence in terms of social and especially environmental sustainability. For example, in 1969, one of the largest oil spills in the history of the oil industry took place in the waters of California, Santa Barbara being known as an offshore oil extraction area. The oil spills did not stop there, another one (Deep water Horizon oil spill) occuring in 2010 and being labelled as the biggest environmental disaster in the history of the oil industry. Another conflict in which the oil industry has been involved is in Ecuador, where indigenous people sued the Chevron oil company, accusing it of polluting the rainforest. The list of conflicts between environmental activists and oil companies is quite extensive. However, the oil and gas industry records year-on-year increasing revenues, being the largest industrial sector in the world. It should be noted, however, that this industry has taken important steps towards sustainability (Elhuni and Ahmad, 2017), trying to reduce as much as possible the impact of production on the environment and society. The literature provides solid evidence regarding the correlation of indicators of operational activities and sustainability practices. For example, Al Alawi et al. (2022) analyzed the correlation between operational risk and sustainability practices of firms in the oil and gas industry in Oman, as well as the relationship between sustainability and financial performance of companies in the oil and gas industry, concretizing that sustainability practices have a significant influence on the financial performance of the company. At the same time, the results indicate that the financial performance of companies is affected by the environment in which they operate, i.e., risk conditions, which highlights the importance of implementing and improving sustainability practices of companies in the oil and gas industry. At the same time, research by Al Alawi et al. (2022) elucidates the impact of sustainability practices on the sustainable development of companies in the oil and gas industry. This circumscribes hypothesis 1 of the research:

H 1—Operational activity indicators have a positive influence on the sustainability of companies in the oil and gas industry:

Companies in the oil and gas industry must implement systematic processes in terms of managing and reducing the impact of production on the environment. In their development reports and plans, they must describe their steps and contributions to sustainable development, so that investors, society and other stakeholders would be informed regarding their development journey. Rushton. (2021) argues that for a better relationship with society, companies should include in their reports the social initiatives that are either implemented by the company or simply facilitated by them. Communication is the key to higher performance both from an economic, social and environmental point of view, because stakeholders must know the company’s development directions, decision-making criteria, contributions to community development and so on. Given the current trend towards sustainable development associated with the transition to a low-carbon development environment, the question arises as to whether current production systems from different industries are developing in a sustainable way. Along with the accentuation of the social, economic, sanitary and environmental crises, there is an increase in the level of public awareness and involvement in sustainable development. To move sustainable development out of the realm of the abstract, it must be controllable and measurable through a set of well-defined indicators. Planning and evaluation are two essential elements for pursuing sustainable development. According to Jooh et al. (2011), through well-defined indicators, it would be possible to measure, monitor and adjust the vector of development when it deviates from the sustainable development plan. Sustainability indicators represent a decision-making tool both for company’s managers and for other stakeholders: investors, state, customers, suppliers, etc. In this sense, organizations such as the World Bank, the OECD and the United Nations have developed a set of sustainability indicators for different systems.

Cherepovitsyn et al. (2021) identified a set of basic principles for the measurement of the sustainable development through some indicators, principles that companies must take into account in order to ensure performance in all the three components—economic, social and environmental -, pursuing to reflect “the key areas of sustainable development: balance between the components of sustainable development; the sufficiency of indicators to ensure an objective assessment of sustainable development; measurability of indicators to ensure they are comparable; mutual exclusion and complementarity of sustainable development indicators; ease of interpretation and reliability of results.” Achieving an optimal and efficient level of sustainable development can only be done by creating a balance between all the components of sustainable development. In implementing a sustainable development plan, businesses must take into account their specific characteristics, as well as the socio-economic context in which they operate. According to Dabhadkar. (2015), the big challenge for the oil and gas industry is “to engage and adapt to a changing policy and investment landscape, but also to evolve in ways that not only support, but also contribute to and even lead the efforts to decarbonisation of the energy sector.” This circumscribes the second hypothesis of the research:

H 2—Business sustainability is influenced by performance indicators.

Globally, there is a shift from policies that support oil and gas production towards policies that support the use of sustainable energy resources and discourage fossil fuels. The circular economy plays an important role in reducing carbon consumption, because it requires materials to be reused or recycled instead of being disposed of at the end of their life (Augustine, 2021).

The code of business ethics subscribes to the principles of sustainability and companies operating in the oil and gas industry carry out their activities in compliance with this code, which provides—among other things—the protection of the environment, respect for the right of stakeholders to be informed about the company’s activity, environmental protection, community relations and corporate social responsibility (Gyane et al., 2021). According to Galer. (2021), the factors influencing sustainability efforts in the oil, gas and energy industry are government regulations, diversification and changing cost structures, digitization, changing customer, investor and employee expectations. The sustainable development process is directly influenced by various factors (Chernyaev and Irina, 2017) such as: organizational and managerial factors, social factors, environmental factors, marketing factors, nano-environmental factors and informational factors. The sustainable development of an enterprise is in close correlation with the organizational objectives and the development strategy of the enterprise, as well as with the workforce structure. The level of qualification and education of the employees has a significant impact on the social and economic sustainability of the company, the higher the level of education, the higher the social and economic performance of the company.

This group of factors has a major impact on the sustainable development process, as the control subsystem determines the company’s development strategies, its main objectives, methods and ways of achieving them. Thus, in the process of transition and adoption of sustainability practices, managers must structure a plan with long-term objectives and sustainability must be a component in any process, taking into account all the factors involved. Gyane et al. (2021) argue that in order to achieve an optimal level of sustainability practices implementation, companies should: “create a long-term strategy for fundamental change, considering sustainability in every process; use data to influence decisions about implementing sustainable practices in the design, engineering and manufacturing stages to track, measure and reduce emissions at each stage; to use transport and delivery methods that optimize loads and reduce mileage, emissions and carbon footprint; to use source materials ethically and in the most sustainable way possible; to operate assets and equipment in the most energy-efficient manner that is safe for the environment and the workforce.”

In literature, the sustainability concept is approached in a diversified way according to the three pillars: economic, environmental and social, analyzing the impact of companies from various industries on the environment and society, as well as the relationship between various factors that influence the sustainability level of the company. For example, Zhao et al. (2022) analyzed the determinants of economic sustainability of firms in China and according to them, the capital structure has a significant influence on the financial sustainability of Chinese enterprises because “it represents the power and the resources that firms possess to enable managers to make financial decisions.” The main purpose of businesses is to manage resources and direct them towards obtaining or increasing profit, through the lowest possible costs. Sustainable development requires high costs, so companies that are trained in this process register a lower level of profit compared to the others. Thus, they become more competitive regarding their innovation capacity and sustainable development, but less competitive regarding their financial performance. Investments should help a company to improve its financial, social and environmental performance. Pham et al. (2021) argue that companies that make investments that are not beneficial to staff, shareholders or customers are abusing the company’s resources. Shad et al. (2019) analyzed the impact of the sustainability reporting practices of companies in the oil and gas industry on the company’s economic value added (EVA) and the effectiveness of the company’s operational risk management implementation, concluding that sustainable reporting has an essential role in operational risk management and in the performance of the enterprise. Achieving a high level of performance is only possible by aggregating economic, environmental and social factors. Ngwakwe (2009) analyzed the relationship between corporate performance of Nigerian firms and environmental responsibility, concluding that firm performance is influenced by the firm’s sustainability practices. Economic-financial indicators, such as liquidity (Ruhana and Hidayah, 2019) and solvency, have an essential role in the development of enterprise sustainability practices. According to researchers, between the sustainability of the enterprise and liquidity there is a significant positive correlation, the more the level of liquidity of the enterprise increases, the more sustainability increases (Ruhana and Hidayah, 2019; Grosu et al., 2020). However, some researchers (Adhipradana and Daljono, 2013) argue that the liquidity indicator does not influence the sustainability of the enterprise, solvency being the key indicator in evaluating the economic sustainability of the enterprise. Zabolotnyy and Wsilewski. (2019) analyzed the relationship between sustainability of companies in the food industry in Northern Europe and solvency, liquidity, profitability, operational efficiency and market capitalization. The research results highlighted the fact that “companies with high value and continuity sub-indicators demonstrated a high level of financial sustainability, while undervalued and insolvent entities with low sub-indicator values had a low level of sustainability compared to other companies.” This circumscribes the third hypothesis of the research:

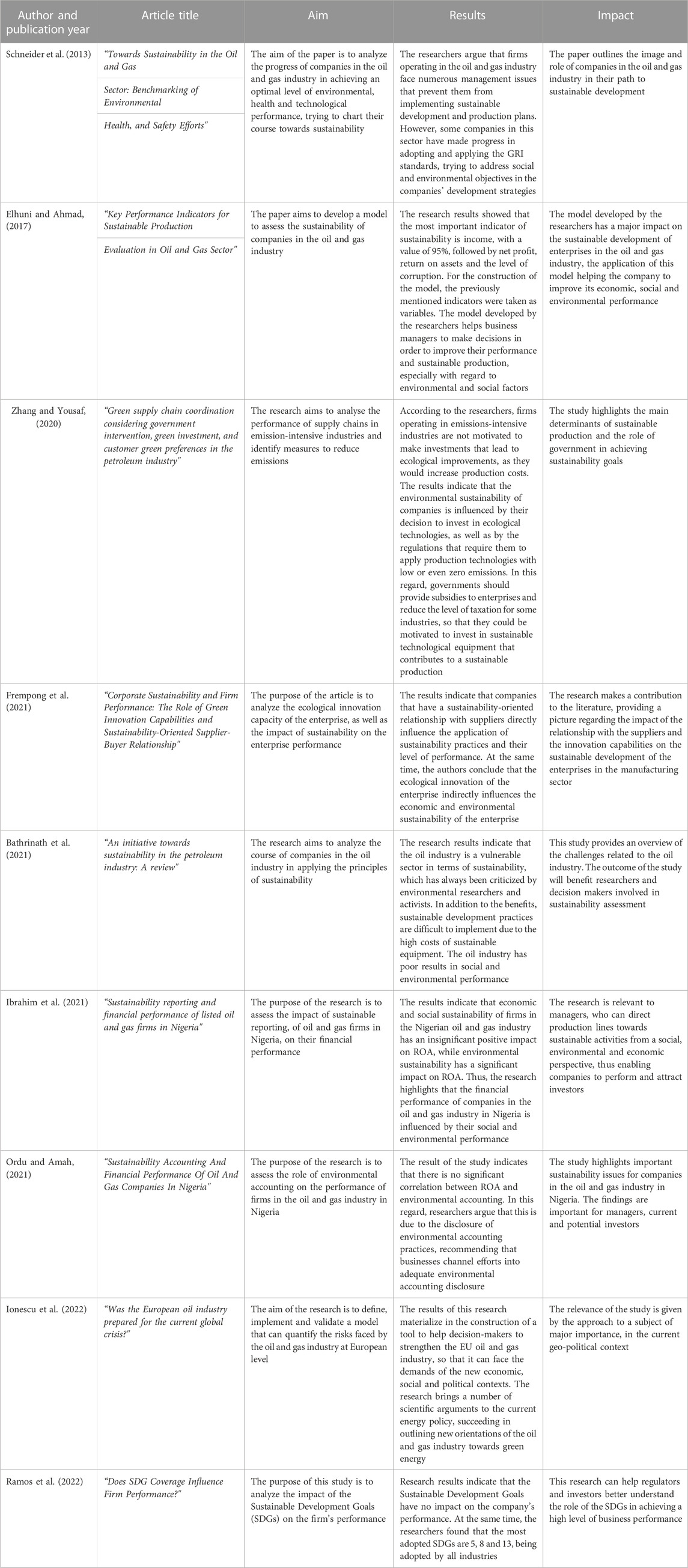

H 3—There is a positive correlation between the sustainability of the company and the liquidity indicator In order to synthesize and highlight the most significant findings of the most recent research studies in the field of financial sustainability, we conduct a meta-analysis of the literature, including only the most relevant and current research in the field (presented in Table 1), which had similar objectives and methods.

It is important to emphasize that by sustainable behaviour on the part of companies, we understand those actions aimed at reducing the negative impacts on the natural environment arising from their activities, such as, for example, controlling and reducing energy consumption, increasing the use of energy from renewable sources, control for reducing water consumption, recycling and waste treatment, reducing emissions into the atmosphere, reuse of secondary raw materials, etc. (INS, 2020).

The literature review found that there is no study that directly analyses the relationship between financial sustainability and aggregate indicators specific to operational activities, performance and risks. This paper adds value by demonstrating the interdependent relationship between these three indicators and financial sustainability. As financial sustainability increases, activity indicators tend to decrease up to a certain point, beyond which the relationship becomes positive, the values of performance and risk indicators being associated with higher financial sustainability. In other words, a simple implementation of management policies strictly oriented towards business profitability is not sufficient to improve financial sustainability, which, on the other hand, is negatively influenced by the low attention paid by management to these practices. This study also demonstrates that exploiting the benefits of continuous operational risk monitoring depends on the ability of firms to leverage their efforts in such activities, as good business management also leads to higher performance through improved stakeholder relations.

3 Materials and methods

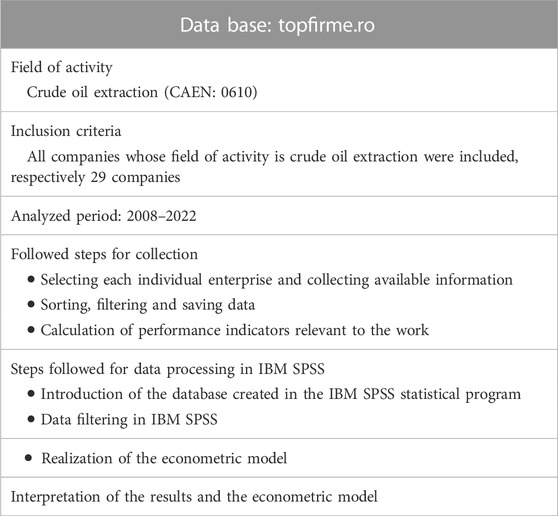

To achieve the proposed goal, we followed the steps suggested by other authors in the literature for data collection and processing (Stahl and King, 2020). The first stage consists in the collection and formation of the working sample, consisting of financial and economic data reported by the 29 companies whose activity is oil extraction during the last 14 years (2008–2022). Later, based on the data collected from the financial reports, a series of indicators and financial ratios considered relevant in forecasting the economic and financial sustainability of these companies were calculated. With the use of these indicators, it was possible to design an econometric model that can be used to test the business sustainability of the companies in the field of crude oil extraction by segments of activity, risks and performance.

3.1 Collection and processing of economic and financial data

In the data collection process we used the financial reports published by the analyzed companies to the Romanian Ministry of Finance. Thus, information was collected for all enterprises in Romania whose field of activity is the extraction of crude oil in the period of 2008–2022. The methodology of information collection and processing can be seen in Table 2.

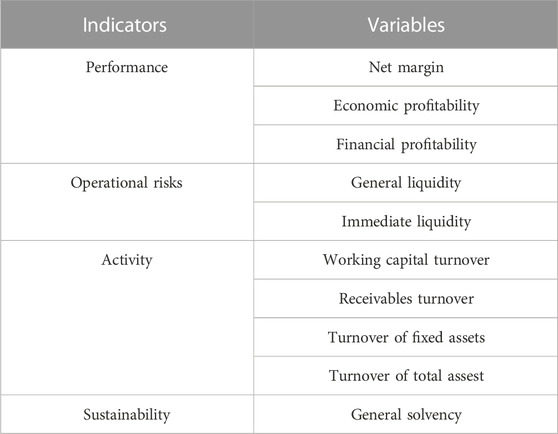

3.2 Identifying, compiling financial ratios and creating the econometric model

In order to identify the most relevant financial rates, we consulted manuals and accounting documents and we also considered the existing quantitative sustainability assessment approaches. We also reviewed the European and American literature. Following this analysis, we selected and calculated the following financial rates for the previously collected companies (Table 3).

In the econometric model created in this paper, we used aggregated indicators as can be seen in the figure above, these being useful in approximating economic sustainability. Also, this type of indicators allow companies to be compared in a credible and easy way because economic information is condensed and effectively communicated (Jollands, 2003). At the same time, the use of aggregated indicators allows the complementary calculation of other financial rates, thus being useful in creating an econometric model (Lebacq et al., 2013).

The objective of the analysis that we are going to carry out is to determine the dependency relationship of the sustainability indicator in relation to the dynamics of several factors of Performance Indicator, Liquidity Indicator and Activity Indicator using in this sense the multiple linear regression model of the type:

where.

⁃ Sustainability indicator—is the dependent variable of the model,

⁃ Performance Indicator, Risk/Liquidity Indicator and Activity Indicator - are the independent variables,

⁃ α, β1, β2 are β3 are the parameters of the regression model,

⁃

4 Results and discussions

In this section, we first analyze the most relevant financial ratios of the companies whose field of activity is the extraction of crude oil and after that we formed our targeted aggregate indicators, which were used in the design of an econometric model that can explain the impact that financial rates have on the sustainability of companies in the oil and gas industry in Romania.

In recent years, the term sustainability has been increasingly associated with the business world, drawing attention on the impact of companies’ activities on the natural environment and on the wellbeing of people and the territories in which they operate (Sen et al., 2018).

If until some time ago the issue of sustainability mainly led to ecological and environmental problems, today the economic-productive sector is increasingly affected. From the perspective of a company, being sustainable does not only mean to reduce the impact on the environment, but also to implement processes aimed at guaranteeing economic and social wellbeing without compromising the company’s competitiveness and obviously, ensuring the continuity of the activity and improving it. The integration of business sustainability into the major objectives of the oil extraction companies in Romania has led to visible results, despite the particularly complicated context of the last 3 years marked by the pandemic, the military conflict in Ukraine and the energy crisis. Data that can be gleaned from financial reports highlights this new scenario in which Romanian oil companies are accelerating their commitment to sustainability issues.

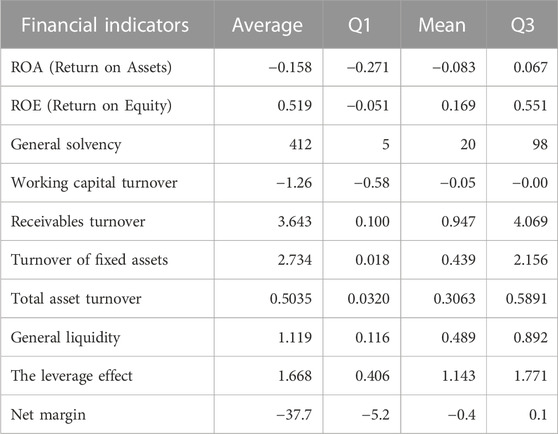

Table 4 presents the descriptive statistics of the raw data collected (untransformed) and processed in the form of financial rates. The information in the table includes the mean, coefficient of variation and three percentiles (25th, 50th percentiles = median and 75th).

According to the data in Table 4, we observe that financial profitability ratios generally reflect a high level of performance of companies in the field of crude oil extraction during the analyzed period. For example, the mean and median of the performance indicators ROE and ROA have low values which indicate a poor performance (Habibniya and Dsouza, 2018; Socoliuc et al., 2020a; Grosu et al., 2020; Cosmulese et al., 2021). The extreme negative values of the net margin indicate that most of the companies in this field fail to transform the achieved sales (reflected in the value of the turnover) into net profit, the situation being an unfavorable one, given the fact that 75% of them recorded a value between—520% and 10%. The rates that make up the activity indicator contain information about the structure of the turnover of assets, respectively equity in relation to the turnover of the enterprises, i.e., the efficiency and the ability of the enterprises to use the assets (Warrad and Rania, 2015). Extreme debt-to-equity ratios are below zero due to negative equity, producing unexpected values. In the table above we observe that the companies in the analyzed field have the ability to generate high turnover, using assets effectively.

As for the liquidity indicator, it includes general and immediate liquidity, which measures the ability of companies to honor their short-term obligations (Sitnikova et al., 2019). General solvency mainly reflects the ability of an enterprise to face all its maturities (Grosu et al., 2020; Dahiyat et al., 2021; Danescu, 2021), in the short, medium and long term. Thus, as we can see in the table above, the situation is favorable, with most companies having a high value regarding this indicator, which indicates that either the accounting value of these companies (total assets) is high, or the total liabilities, both in the long and short term have small values. The last observation is also confirmed by the values of the debt ratio indicator (expressed by the leverage effect).

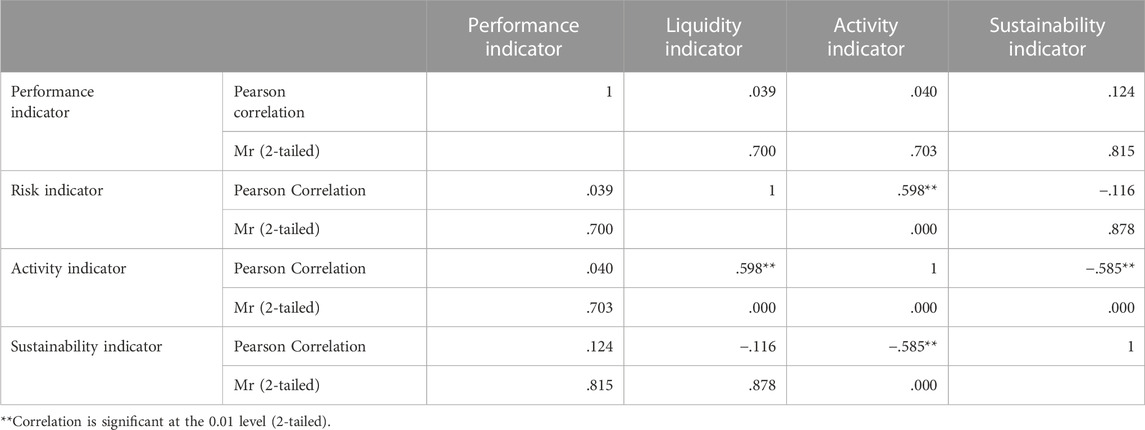

The results obtained after filtering the database composed of the 29 companies in the crude oil extraction industry were used in the creation of an econometric model. In the development of the model we used the following aggregated indicators: performance, liquidity, activity and sustainability. The variables used, as well as their correlation, can be seen in Table 5.

As we can see in the table above, there are significant individual correlations between the aggregated indicators. The most notable correlation is between the activity indicator and the liquidity indicator with a confidence level of 99%. This can be explained by the fact that an activity, i.e., a high turnover of assets/capital leads to greater liquidity for enterprises in this field. We also find that the weakest correlation is between the liquidity indicator and the performance indicator of enterprises. This explanation is obvious, because any non-collection of income can lead to the insolvency of these companies, and the weak correlation between performance and liquidity is explainable because most of the income that is included in the profit component is of a monetary nature, i.e., uncollectible.

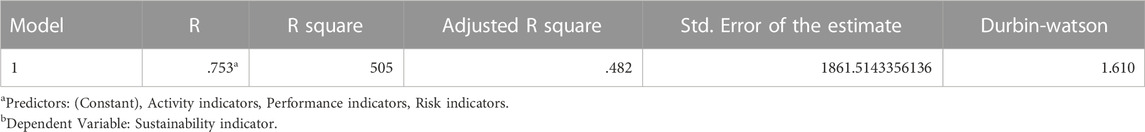

In creating the econometric model, the sustainability indicator was established as a dependent variable and the following aggregated indicators as independent variables: performance, activity, risk. The correlation and determination coefficients of the created model can be seen in Table 6.

As can be seen in the table above, the value of the correlation ratio (R) of the created model is 0.753. Therefore, the model reveals the existence of a significant link between the sustainability indicator (dependent variable) and the activity, performance and risk indicators (independent variables) for companies in the crude oil extraction industry in Romania. Also, according to the determination ratio (R^2), it is found that the three predictor variables significantly predict the sustainability indicator, explaining a substantial proportion of the variation of the dependent variable, i.e., the variation of the sustainability indicator being explained in a proportion of 50.5% by the variation of the predictor variables: activity, performance and risk indicators.

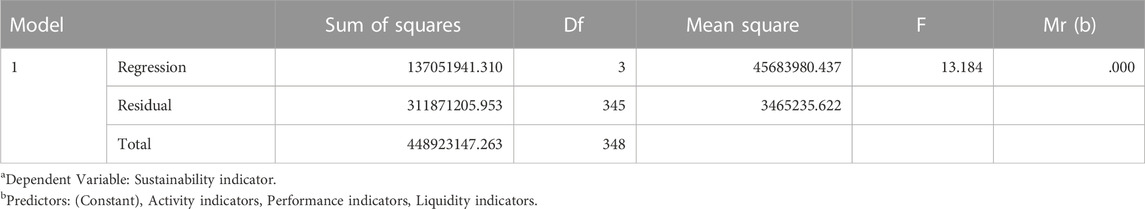

According to the ANOVA test (see Table 7), the regression model is significant as there is a low p-value (less than 0.05) for the F-test, which means that the predictor variables are collectively associated with the dependent variable (sustainability indicator). According to the Sum of Squares, the regression model explains 137,051,941,310 units of variability of the sustainability indicator. Thus, the regression model with the three predictor variables significantly predicts the sustainability indicator, explaining a substantial amount of the variability of the dependent variable.

According to Table 8, the value of the Fisher coefficient is high, F = 13.184 and the value of Sig. for the F test is less than 0.05, which means that the constructed model has a confidence level of more than 95% that can explain the significant relationship between the sustainability indicator and activity, performance and risk indicators through a multiple linear relationship. The values of the model coefficients can be seen in Table 8.

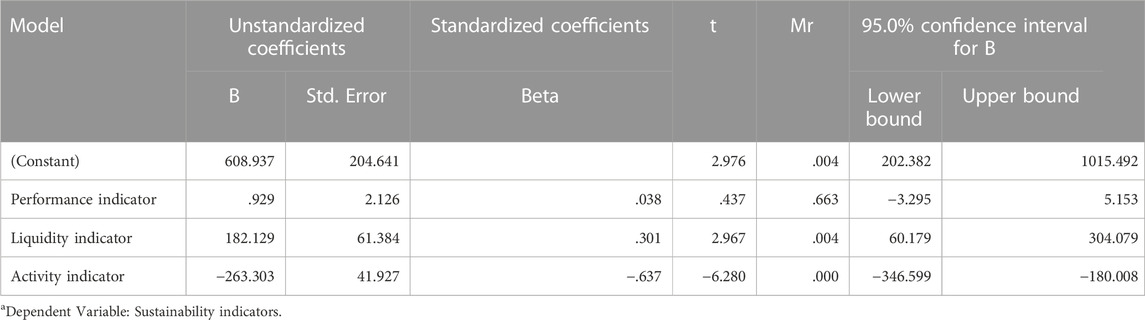

The determination of the regression parameters of the multiple linear model leads to the determination of the estimated equation, namely, to the rewriting of the Sustainability Indicator according to the influencing factors Performance Indicator, Liquidity Indicator and Activity Indicator. The unstandardized equation of the model has the form:

According to the equation of the obtained model, we find that an increase in the performance indicator leads to a small increase in the sustainability indicator. The increase in the liquidity indicator, i.e., reducing the risk of insolvency, leads to a significant increase in the sustainability indicator, while the increase in the activity indicator leads to a large decrease in the sustainability indicator, which means that the management of these companies is more focused on obtaining profit (reflected also by increasing the return on invested capital, assets or by increasing turnover).

The standardized equation has the form:

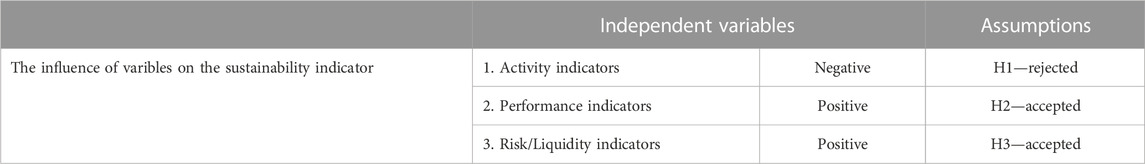

The coefficients of the standardized model are useful in determining the model Equation 3, which shows us the order of influence of the independent variables on the sustainability indicator (the dependent variable), as well as their type of influence (positive or negative). Thus, following the analysis of the coefficients in the table above, the order and type of influence of activity, performance and risk/liquidity indicators on the sustainability indicator are as it follows (Table 9).

Therefore, the influence order of the independent variables on the sustainability indicator is as it follows: activity indicators have a negative influence and the risk/liquidity and performance indicators have a positive influence on the sustainability indicator. The activity indicator is composed of the turnover indicators of working capital, receivables, fixed assets and total assets. Thus, this aggregate indicator exerts a negative influence on the sustainability indicator because the first one is formed by the rotation of the ratio between assets, respectively equity and turnover and as we observed above, a high turnover of Romanian enterprises from the field of crude oil extraction translates in most cases into a negative net margin. Also, this influence reflects the fact that the activity of businesses in this field is inefficient and an increase in activity will have a negative impact on sustainability. Thus, our model reflects a problem from the perspective of the activity of crude oil extraction enterprises.

In terms of risk indicators, it is the second in order of influence on the sustainability of the analyzed companies, having a positive influence. This influence was also confirmed by other works from various fields, having a general applicability (Socoliuc et al., 2020b; Mihaila and Grosu, 2020; Sadiq et al., 2022). In general, an increase in liquidity implies a reduction in risks, which translates into an increase in sustainability for almost any type of economic activity. The entity’s aggregate performance indicator has the least influence on sustainability according to the obtained model. Its influence is of a positive type and is in accordance with other results from the literature (Raucci and Tarquinio, 2020; Melega et al., 2021). Of course, a better performance (net margin, economic and financial profitability) of companies in the field of crude oil extraction will lead to an increase in sustainability, but the influence of this aggregate indicator is lower than that of liquidity and activity, therefore the top management of these businesses should pay less attention to it and focus their attention on activity and liquidity indicators.

5 Conclusion

The sustainability of companies in the oil and gas industry in Romania is positively influenced by the liquidity and solvency indicator. The higher the liquidity and solvency indicator, the higher the level of discovery of the company’s sustainability. As for the indicators regarding the operational activity, they have an insignificant influence on the sustainability of the company. Business performance and sustainability are in a complementary relationship, influencing each other. In order to achieve a high level of sustainability, the company must effectively manage its resources and improve its level of investment, through investment projects that ensure the development of the production activity in an economically, socially and environmentally sustainable way.

Based on the elaborated analysis, it was found that there is a positive association between the integration of sustainability measures and the company’s performance data, reflected by the adoption of ethical behaviors and the levels of performance obtained (measured by efficiency, profitability and profit indicators). In similar operating conditions, we can observe the existence of extra sustainability in terms of increases in cash flows and a dynamic and flexible activity, which in turn determines the corresponding increase in the degree of company’s ecological and social sustainability.

However, this relationship seems to be valid only for firms with endowments of intangible fixed assets and profitable long-term investments, with a turnover speed of stocks and receipts higher than the median values of the observed firms (29), in fact, the extra sustainability being null if the levels of long-term and short-term invested capital are lower than this threshold.

Oil and gas companies need to become aware of these issues in the sense that when sustainability performance exceeds a certain critical threshold, performance indicators may perform much better than they would have if lower commitments have been made to monitor and manage operational risks or if key activity indicator signals have been ignored. Therefore, managers wishing to undertake initiatives to maintain and increase financial sustainability need to be aware of the need to achieve consistent results in order to overcome the threshold effect. The results obtained are very important both for companies in this field and for decision-makers, as they demonstrate that the more efficiently resources are managed (in terms of activity indicators correlated with performance indicators), the higher the financial returns will be (in terms of performance indicators correlated with risk indicators), and the symbiosis of increasing the aggregated performance indicators with the risk indicators, while reducing the activity indicators, provides a picture of current financial sustainability, on the basis of which a predictability analysis of medium and long-term financial sustainability can be carried out. These considerations lead oil and gas companies to continue in investing in cost-effective and sustainable resource management policies.

In this vein, the following conclusions and recommendations emerge from the study.

• It is important that the management of the companies under review also engage effectively in the application of social responsibility practices, such as committing to biodiversity conservation, investing in staff training and carefully selecting partners and suppliers who are also engaged in sustainability activities.

• In addition to assessing financial sustainability, companies should stop engaging in activities that are perceived by stakeholders as inconsistent with their sustainability and social responsibility policies, practices and claims. Otherwise, such behaviours may entail risks of different natures and intensities for the environment and communities in which they operate, these being negatively recognised and evaluated by stakeholder.

• Our research suggests that adopting social responsibility policies and practices quantified using ESG, may be a strategy that management of oil and gas extraction companies should adopt, as it could objectively contribute to maintaining overall sustainability, not only financial, but also environmental and social sustainability.

• In order to avoid potential stakeholder suspicions about how companies measure and report their sustainability, it is recommended that companies in the oil and gas sector—even if they are not listed on a regulated market—apply the ESG system in their sustainability reporting, as it provides a baseline for environmental, social and governance policies.

The limitations of the research are the analysis of a small number of companies in the oil and gas industry and the lack of information on environmental and social sustainability for unlisted companies. In order to develop a more comprehensive research and develop an overall sustainability index that includes financial, social and environmental sustainability, a more detailed analysis of the selected companies is needed.

Future research directions could focus on the use of the research methodology applied to oil and gas companies in other fields, i.e., profiling investors and financiers in the oil and gas extraction industry, correlated with the level of business sustainability, management performance and long-term risk mitigation potential. In the same context, it is also important to profile consumers and customers, in particular in terms of trust in the information provided by these companies and their social responsibility commitments.

In conclusion, in the development of a sustainability index of the companies in the oil extraction industry in Romania—which present the highest financial sustainability values—we notice that from the point of view of total sustainability (which includes the environmental and social components), they are on average older/newer than the companies with lower values and have a lower profitability, but a higher and more dynamic turnover (expressed by the total revenues recorded from the operational activity), a greater incidence of exports and imports on turnover and a more consistent value of equity, implicitly of its profitability.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

Conceptualization, VG, AT-T, and MS; methodology, M-SC, MT, and EH; data curation, A-GM and AM; writing-original draft preparation, EH, MT, C-CM, and AM; formal analysis, investigation, visualization, VG, AT-T, M-SC, and C-CM, supervision, validation, MS, AT-T, M-SC, and AM. All authors have read and agreed to the published version of the manuscript. All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication. All authors contributed to the article and approved the submitted version.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adhipradana, F., and Daljono, D. (2013). Pengaruh kinerja keuangan, ukuran perusahaan, dan coporate governance terhadap pengungkapan sustainability report. Diponegoro J. Acc. 3, 80–91.

Al Alawi, A., Abdel Fattah, F., and Dulal, M. (2022). “Financial performance analysis of firms: A focus on oil and gas industry sustainable practices in Oman,” in Lecture notes in networks and systems (Springer Nature Switzerland), 91–103. doi:10.1007/978-3-030-93464-4_9

Augustine, O. (2021). Towards sustainability in the global oil and gas industry: Identifying where the emphasis lies. Environ. Sustain. Indic. 12, 1–15. doi:10.1016/j.indic.2021.100145

Bathrinath, S., Abuthakir, N., Koppiahraj, K., Saravanasankar, S., Rajpradeesh, T., and Manikandan, R. (2021). An initiative towards sustainability in the petroleum industry: A review. Mat. Tod. Proc. 46 (17), 7798–7802. doi:10.1016/j.matpr.2021.02.330

Bertonello, L. (2023). Il principio de sostenabilita finanziaria nelle politiche europee. Riv. Stiint. 3. 543. Available at: https://rivista.camminodiritto.it/articolo.asp?id=9345.

Branson, D. (2022). Sustainability in the oil and gas industry. Available at: https://www.pwc.de/en/sustainability/sustainability-in-the-oil-and-gas-industry.html.

Cherepovitsyn, A., Rutenko, E., and Solovyova, V. (2021). Sustainable development of oil and gas resources: A system of environmental, socio-economic, and innovation indicators. J. Mar. Sci. Eng. 9 (1307), 1307–1327. doi:10.3390/jmse9111307

Chernyaev, M. ., V., and Irina, R. (2017). Analysis of sustainable development factors in fuel and energy industry and conditions for achievement energy efficiency and energy security. Int. J. Energy Econ. Pol. 7 (5), 16–27.

Cosmulese, C. G., Socoliuc, M., Ciubotariu, M., Kicsi, R., and Grosu, V. (2021). Optimization model for sustainable food supply based on consumer behaviour typology. The case of the chisinau urban area. Argum. Oecon. 1, 239–280. doi:10.15611/aoe.2021.1.11

Dabhadkar, G. (2015). Incorporating environmental and social factors into decision-making of an oil and gas industry to improve sustainability. Graduate Theses and Dissertations. Fayetteville: University of Arkansas. Available at: https://scholarworks.uark.edu/etd/1075.

Dahiyat, A. A., Weshah, S. R., and Aldahiyat, M. (2021). Liquidity and solvency management and its impact on financial performance: Empirical evidence from Jordan. J. Asian Finan. Econ. Bus. 8 (5), 135–141. doi:10.13106/JAFEB.2021.VOL8.NO5.0135

Danescu, M. (2021). Evaluation of the performances of economic entities under the impact of the accounting model. Acta Univ. Danub. Econ. 17 (5), 123–141.

Elhuni, R. M., and Ahmad, M. M. (2017). Key performance indicators for sustainable production evaluation in oil and gas sector. Proc. Manufac. 11, 718–724. doi:10.1016/j.promfg.2017.07.172

European Comission (2015). The EU action plan on financing sustainable growth. Available at: https://www.switchtogreen.eu/the-eu-action-plan-on-financing-sustainable-growth/.

Frempong, M. F., Mu, Y., Adu-Yeboah, S. S., Hossin, M. A., and Adu-Gyamfi, M. (2021). Corporate sustainability and firm performance: The role of green innovation capabilities and sustainability oriented supplier–buyer relationship. Sustain 13, 10414. doi:10.3390/su131810414

Galer, S. (2021). How the oil and gas industry is building A sustainable future forbes. Available at: https://www.forbes.com/sites/sap/2021/10/23/how-the-oil-and-gas-industry-is-building-a-sustainable-future/?sh=1deaa24472ce.

Grosu, V., Mateș, D., Zlati, M. L., Mihaila, S., Socoliuc, M., Ciubotariu, M. S., et al. (2020). Econometric model for readjusting significance threshold levels through quick audit tests used on sustainable companies. Sustain 12 (19), 8136. doi:10.3390/su12198136

Grosu, V., Socoliuc, M., Ciubotariu, M. S., Hlaciuc, E., Tulvinschi, M., Macovei, A. G., et al. (2022a). Designing the profile of industrial consumers of renewable energy in Romania under the impact of the overlapping crisis. Front. Energy Res. 1739, 1–18. doi:10.3389/fenrg.2022.1016075

Grosu, V., Socoliuc, M., Hlaciuc, E., Ciubotariu, M. S., and Tulvinschi, M. (2022b). Design of an innovative dashboard for assessment of risks that are specific to E-commerce activity. Mark. Manag. Innov. 1, 186–201. doi:10.21272/mmi.2022.1-14

Gyane, T. A., Edward, K. N., Suleman, S., and Joseph, E. Y. (2021). Sustaining oil and gas multinational operations through corporate social responsibility practices. Discov. Sustain. 2, 34. doi:10.1007/s43621-021-00042-x

Habibniya, H., and Dsouza, S. (2018). Impact of performance measurements against market value of shares in Indian banks an empirical study specific to EVA, EPS, ROA, and ROE. J. Manage. Res. 18 (4), 203–210.

Ibrahim, Y. K., Mohammed, A. N., Agbi, S. E., Kaoje, N. A., and Abdulkarim, U. F. (2021). Sustainability reporting and financial performance of listed oil and gas firms in Nigeria. Gusau J. Acc. Fin. 2 (3), 2–17. doi:10.57233/gujaf.v2i3.76

Ionescu, R. V., Zlati, M. L., Antohi, V. M., and Stanciu, S. (2022). Was the European oil industry prepared for the current global crisis? J. Pet. Explor. Prod. Technol. 12, 3357–3372. doi:10.1007/s13202-022-01529-7

Istituto Nazionale di Statistica (INS) (2020). Comportamenti d’impresa e sviluppo sostenibile Experimental statistical report. Available at: https://www.istat.it/it/files/2020/03/Imprese-e-sostenibilita-statistiche-sperimentali.pdf.

Jollands, N. (2003). The usefulness of aggregate indicators in policy making and evaluation: A discussion with application to eco-efficiency indicators in New Zealand. New Zealand: Australian National University Publications. Available at: https://openresearch-repository.anu.edu.au/bitstream/1885/41033/3/jolland1.pdf.

Jooh, L., Pati, N., and Roh, J. (2011). Relationship between corporate sustainability performance and tangible business performance: Evidence from oil and gas industry. Int. J. Bus. Insights Transf. 3 (3), 72–82.

Lebacq, T., Baret, P. V., and Stilmant, D. (2013). Sustainability indicators for livestock farming. A review. Agron. Sustain. Dev. 33 (2), 311–327. doi:10.1007/s13593-012-0121-x

Melega, A., Macovei, A. G., Grosu, V., and Socoliuc, M. (2021). Analysis of the correlations between the degree of indebtedness and the performance of the economic entities from emerging economy. Ann. Univ. Apulensis-Ser. Oecon. 23 (2), 55–67. doi:10.29302/oeconomica.2021.23.2.6

Mihaila, S., and Grosu, V. (2020). “Integrated reporting–an influencing factor on the solvency and liquidity of a company and its role in the managerial decision-making process,” in International conference on management science and engineering management (Cham: Springer), 783–794.

Ngwakwe, C. C. (2009). Environmental responsibility and firm performance: Evidence from Nigeria. Int. J. Humanit. Soc. Sci. 3 (2), 97–103.

Ordu, P., and Amah, C. (2021). Sustainability accounting and financial performance of oil and gas companies in Nigeria. Int. J. Innov. Finan. Econ. Res. 9 (1), 182–192.

Pham, D. C., Thi, N. A., Thanh, N. D., Xuan, H. N., Kim, Y. P., and Albert, W. K. (2021). The impact of sustainability practices on financial performance: Empirical evidence from Sweden. Cogent Bus. Manage. 8 (1), 1912526. doi:10.1080/23311975.2021.1912526

Ramos, D. L., Chen, S., Rabeeu, A., and Abdul Rahim, A. B. (2022). Does SDG coverage influence firm performance? Sustain 14, 4870. doi:10.3390/su14094870

Raucci, D., and Tarquinio, L. (2020). Sustainability performance indicators and non-financial information reporting. Evidence from the Italian case. Adm. Sc. 10 (1), 13. doi:10.3390/admsci10010013

Ruhana, A., and Hidayah, N. (2019). “The effect of liquidity, FirmSize, and corporate governance toward sustainability report disclosures, advances in economics,” in 4th international conference on management, economicsand business (ICMEB 2019) (Jakarta, Indonesia: Business and Management Research). doi:10.2991/aebmr.k.200205.048

Rushton, L. (2021). Esg: How it applies to the oil & gas industry and why it matters. Available at: https://www.womblebonddickinson.com/us/insights/articles-and-briefings/esg-how-it-applies-oil-gas-industry-and-why-it-matters.

Sadiq, M., Alajlani, S., Hussain, M. S., Ahmad, R., Bashir, F., and Chupradit, S. (2022). Impact of credit, liquidity, and systematic risk on financial structure: Comparative investigation from sustainable production. Environ. Sci. Pollut. Res. 29 (14), 20963–20975. doi:10.1007/s11356-021-17276-x

Schneider, J., Ghettas, S., Merdaci, N., Brown, M., Martyniuk, J., Alshehri, W., et al. (2013). Towards sustainability in the oil and gas sector: Benchmarking of environmental, health, and safety efforts. J. Environ. Sustain. 3, 3.

Sen, A., Stiglitz, J., and Fitoussi, J. P. (2018). Report by the commission on the measurement of economic performance and social progress European commission. Available at: https://ec.europa.eu/eurostat/documents/8131721/8131772/Stiglitz-Sen-Fitoussi-Commission-report.pdf.

Shad, M. K., Lai, F. W., Fatt, C. L., Klemeš, J. J., and Bokhari, A. (2019). Integrating sustainability reporting into enterprise risk management and its relationship with business performance: A conceptual framework. J. Clean. Prod. 208, 415–425. doi:10.1016/j.jclepro.2018.10.120

Sitnikova, E. V., Kolmykova, T. S., Astapenko, E. O., and Grivachev, E. A. (2019). “An assessment of commercial banks’ financial sustainability,” in The international scientific and practical forum industry. Science. Competence. Integration (Cham: Springer), 370–378.

Socoliuc, M., Cosmulese, C. G., Ciubotariu, M. S., Mihaila, S., Arion, I. D., and Grosu, V. (2020a). Sustainability reporting as a mixture of CSR and sustainable development. A model for micro-enterprises within the Romanian forestry sector. Sustain 12 (2), 603. doi:10.3390/su12020603

Socoliuc, M., Grosu, V., Cosmulese, C. G., and Kicsi, R. (2020b). Determinants of sustainable performance and convergence with EU agenda 2030: The case of Romanian forest enterprises. Pol. J. Environ. Stud. 29 (3), 2339–2353. doi:10.15244/pjoes/110757

Stahl, N. A., and King, J. R. (2020). Expanding approaches for research: Understanding and using trustworthiness in qualitative research. J. Dev. Educ. 44 (1), 26–28.

Warrad, L., and Rania, A. O. (2015). The impact of activity ratios among industrial sectors’ performance: Jordanian case. Res. J. Finance Acc. 6 (6), 173–178.

World Commission on Environment and Development (WCED) (1987). Our common future. Oxford: Oxford University Press. Available at: https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf.

Zabolotnyy, S., and Wsilewski, M. (2019). The concept of FinancialSustainabilityMeasurement: A case of FoodCompaniesfromNorthern Europe. Sustain 11 (18), 5139. doi:10.3390/su11185139

Zhang, X., and Yousaf, H. M. A. U. (2020). Green supply chain coordination considering government intervention, green investment, and customer green preferences in the petroleum industry. J. Clean. Prod. 246, 118984. doi:10.1016/j.jclepro.2019.118984

Keywords: environmental sustainability, economic sustainability, social sustainability, risks, crisis, firms performance, business model

Citation: Grosu V, Tiron-Tudor A, Socoliuc M, Ciubotariu M-S, Hlaciuc E, Macovei A-G, Tulvinschi M, Mihalciuc C-C and Melega A (2023) Financial sustainability of oil and gas companies—basis for building resilience strategies. Front. Environ. Sci. 11:1205522. doi: 10.3389/fenvs.2023.1205522

Received: 13 April 2023; Accepted: 02 May 2023;

Published: 11 May 2023.

Edited by:

Alina Cristina Nuta, Danubius University of Galaţi, RomaniaReviewed by:

Pradeep Mishra, Jawaharlal Nehru Agricultural University, IndiaBybert Moudjaré Helgath, University of Maroua, Cameroon

Copyright © 2023 Grosu, Tiron-Tudor, Socoliuc, Ciubotariu, Hlaciuc, Macovei, Tulvinschi, Mihalciuc and Melega. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Veronica Grosu, dmVyb25pY2EuZ3Jvc3VAdXNtLnJv

Veronica Grosu

Veronica Grosu Adriana Tiron-Tudor

Adriana Tiron-Tudor Marian Socoliuc

Marian Socoliuc Marius-Sorin Ciubotariu

Marius-Sorin Ciubotariu Elena Hlaciuc1

Elena Hlaciuc1 Anamaria-Geanina Macovei

Anamaria-Geanina Macovei Mihaela Tulvinschi

Mihaela Tulvinschi Camelia-Cătălina Mihalciuc

Camelia-Cătălina Mihalciuc Anatol Melega

Anatol Melega