- 1School of Environment and Natural Resource, Renmin University of China, Beijing, China

- 2Business School, Xiangtan University, Xiangtan, Hunan, China

- 3Institute of Geographic Sciences and Natural Resources Research, Chinese Academy of Sciences, Beijing, China

- 4International Ecosystem Management Partnership, United Nations Environment Programme, Beijing, China

- 5Policy Research Center for Environmental and Economic, Ministry of Ecology and Environment of the People’s Republic of China, Beijing, China

Government green investment (GGI) is one of the effective tools for reducing carbon emissions (CEs). This is of great significance for the realization of “carbon peaking and carbon neutrality.” This study innovatively considers the multidimensional CE reduction (CER) process indexes to explore the impact mechanism of GGI on China’s CER process. At the same time, CER is particularly critical in resource-dependent regions. This study incorporates this perspective to explore the CER effect of GGI in these regions. This paper developed a multidimensional evaluation system for China’s CER process, using panel data of 269 prefecture-level cities from 2008 to 2019 to explore the impact of GGI on China’s CER process. The results indicated that 1) GGI promotes CER in China as a whole and effectively inhibits CEs, per capita CEs, and CE intensity; 2) GGI promotes CER to some extent by enhancing the energy efficiency and total factor productivity; 3) it plays a larger role in CER in regions with a high energy endowment; and 4) the impact of GGI on CER is heterogeneous in geographical regions, city sizes, and economic development levels. This study makes policy recommendations for reducing CEs, including intensifying GGI and playing its investment-pulling role, thereby increasing the investment related to improving energy efficiency and total factor productivity and promoting government intervention in areas with high energy endowments.

1 Introduction

During the General Debate of the 75th Session of the United Nations General Assembly in September 2020, China’s President, Xi Jinping, announced that China would increase its Intended Nationally Determined Contributions by adopting more stringent policies and measures to reach carbon neutrality before 2060. In September 2021, the State Council issued the Working Guidance for Carbon Dioxide Peaking and Carbon Neutrality in Full and Faithful Implementation of the New Development Philosophy, which stated that by 2025, an economic system of green and low-carbon circular development will begin to take shape. Moreover, the energy utilization efficiency of key industries will be substantially enhanced. In May 2022, the Ministry of Finance issued Opinions on Financial Support for Carbon Peaking and Carbon Neutrality, which elucidated the central role of green fiscal and taxation policies in promoting the low-carbon transformation of the industrial sector. Climate change resulting from carbon emissions (CEs) is regarded as one of the most influential factors in sustainable growth (Raihan and Tuspekova, 2022).

Industrial low-carbon transformation is a crucial link in China’s pursuit of “carbon peaking and carbon neutrality,” which cannot be achieved without government support. On one hand, the government plays a pre-eminent role in environmental governance, and government intervention can promote CE reduction (CER) more than the market mechanism (Lin and Huang, 2022), and its impact is also more direct and consequential. Government green investment (GGI) can also play an educational role, for example, by funding projects to encourage green household consumption. The reduction of household consumption of carbon-intensive products plays an important role in the reduction of CEs (Song et al., 2022). In contrast to government financial support, private financial systems are likely to contribute to environmental degradation in most developing countries (Ponce et al., 2022). On the other hand, governments can increase their investment in renewable energy technologies and systems in energy transition programs. This will help reduce CEs and promote sustainable economic development (Samsul et al., 2020). In addition, development of renewable energy is a key strategy in the context of the urgent task of global climate change. In recent years, some studies have focused on the social impact of renewable energy transition, considering the social impact of implementing renewable energy transition policies in countries at different levels of development, including social equity, income inequality, and the potential to build global peace (Destek et al., 2022; Timothy et al., 2023). There have also been studies about investment issues, arguing that investment in renewable energy must be increased in order to lower its acquisition price. This would reduce the consumption of non-renewable energy sources and, thus, mitigate environmental degradation (Ponce et al., 2020a). According to the study, the EU internal energy market can stimulate the production and consumption of renewable energy suppliers by providing them with financial and operational facilities, and the government promotes the efficient use of resources through environmental public policies (Ponce et al., 2020b).Therefore, it is of great practical significance to examine how the economic environmental regulation of GGI affects regional CEs, carbon intensity, and even China’s CER process to accelerate the realization of “carbon peaking and carbon neutrality” and promote the development of a green and low-carbon cycle.

The existing research focuses on the relationship between green investment (GI) and single CER targets, such as the total CEs, with contradictory conclusions. Few studies considered the impact of GI on China’s overall CER process and its primary mechanism. With the deepening of the concept of CER, important issues in the process of low-carbon transition, such as carbon emission intensity, economic growth, and carbon decoupling, have attracted attention (Li et al., 2022). Improving energy efficiency (EE) is a crucial link in reducing CEs, which is partially reflected in the energy utilization efficiency of an economy. Total factor productivity (TFP) reflects changes in industrial structure, supply and demand policies, and technological advancement. Thus, improving EE and TFP is crucial to achieving a green, low-carbon, and sustainable economic model (Fang et al., 2022). Energy endowment may play a crucial regulatory role in the process of GGI contributing to CER. How to better play the role of government intervention in environmental regulation and break the ‘resource curse’ is an important issue for resource-dependent regions with abundant energy resources. The existing study has focused on the differences in the quality of natural resources and the environment between Chinese provinces, which believes that only by providing huge green investment support to less-developed provinces can the investment serve the use of clean energy and the development of technology-intensive industries and achieve sustainable development (Ahmad et al., 2022). Therefore, it is of practical significance to test whether GGI really plays a role in CER in resource-dependent regions. Based on this practical context, this study poses the following research questions: How do government investments in green technology affect China’s multidimensional CER process? What is the mechanism of the influence? Will the CER effect of GGI in resource-dependent regions be affected?

Using the panel data of 269 prefecture-level cities in China from 2008 to 2019, this study focused on the multidimensional indicators of the CER process and the problems of energy endowment areas from the perspective of essential mechanisms of EE and TFP. It explored the impact of GI on China’s CER process comprehensively.

The marginal contributions of this paper are as follows: First, different from a single CEs measurement index, this paper constructs a multidimensional CER process index system. GGI has differentiated effects on the key indicators of the CER process, namely, CEs, per capita CEs, CE intensity, and carbon decoupling, which enriches the existing literature. Second, this paper explores how green investment affects CEs. GGI affects CER by enhancing the EE and TFP, which deepens the understanding of the GGI mechanism. Third, this paper includes the perspective of resource-dependent regional characteristics. Regional energy endowment differences play a moderating role in the CER effect of GGI and supplement empirical evidence for the study of whether government environmental regulation intervention can break the ‘resource curse’. The research provides a reference for relevant departments to formulate government GI and carbon emission reduction policies.

2 Literature review

2.1 Research on green investment

Climate change is currently a major issue in the field of sustainable development. A major topic of study has been how to strike a balance between environmental protection and economic growth to achieve a green and low-carbon sustainable development. Green public investment has significantly reduced greenhouse gas emissions, adjusted the energy structure, and stabilized the climate (He et al., 2023). Countries must adopt appropriate strategies to use green financial instruments to address climate challenges to meet the growing demand for financing low-carbon projects (Li et al., 2019). China is also in a crucial phase of transforming its mode of production and modifying its industrial structure. At this juncture, the question of using GI to promote high-quality economic development and increase TFP is a research hotspot.

GI aims to promote the development of a low-carbon economy and is a crucial financial tool for achieving the transition from rapid growth to high-quality development. The existing research lacks a unified definition of GI, and different scholars have provided definitions from various categories. From the perspective of investment utility, GI is an investment to reduce and control the emission of greenhouse gases or various pollutants without significantly reducing the production and consumption of non-energy products (Chen and Ma, 2021). Examples include investments in energy conservation and the R&D of renewable energy technologies (Eyraud et al., 2013). From the standpoint of investment objectives, GI is a crucial strategy to improve the capacity of ecologically sustainable economic systems (Campiglio, 2016), as well as environmental protection and ecological balance (Pagell et al., 2013). According to the research, GI aims to transform production activities into a model that can support sustainable growth to realize economic transformation to circular sustainability (Acemoglu et al., 2012). As the research has progressed, the study of GI has shifted from a conceptual definition to detailed calculation, such as defining GI as a government-funded investment in environmental pollution control (Xiaochun et al., 2022) or focusing on corporate GI (Siedschlag and Yan, 2021). Some researchers have examined government environmental protection expenditure as the representative of GGI (Li and Bai, 2021), and others have measured the eco-efficiency improvement brought about by GI at a macro level (Becchetti et al., 2022).

2.2 Study on the relationship between green investment and carbon emission reduction

From the standpoint of CE research, many studies focused on CEs from the perspective of various macroeconomic variables, such as the relationship between economic growth, trade openness, and CEs (Zhang et al., 2022). Then, they gradually began to focus on the impact of various policy pilots, such as low-carbon cities and national carbon trading markets, on CEs (Nie et al., 2022). The existing research has not fully considered the perspective of green fiscal policy that promotes CER, and the research conclusions were contentious.

Regarding the relationship between GI and CEs, most studies have concluded that GI can negatively impact the CE intensity (Shen et al., 2020). Using the government’s investment in renewable energy as an example, some researchers concluded that renewable energy investment has a strong government investment attribute, which has a significant impact on EE, and the majority of them affirmed its positive impact on CER (Yang et al., 2022). However, according to the result of a study, GI has a significant impact on clean energy consumption and economic growth but not on CEs (Wan and Sheng, 2022). With the gradual expansion of research on GI and CER, some scholars have found a non-linear relationship between the two, that is, an inverted ‘U’ relationship between GI and CE intensity. Low-level GI has no significant impact on CER, and this impact varies with the investment scale, investment field, and investment mode (Shi and Shi, 2022). The problem of GGI and CEs is also an extension of the controversial existing research on environmental regulation and CEs in a broad sense. In other words, an increase in the intensity of environmental regulation may cause polluters to increase their expectations for future regulation intensity, thereby increasing their current emissions (Smulders et al., 2012; van der Ploeg and Withagen, 2012). The opposing viewpoint held that environmental regulation raises the cost of emissions, thereby achieving ‘forced emission reduction’ through the promotion of TFP and other mechanisms, which is conducive to reducing urban CEs (Gu et al., 2022).

As for the GI mechanism and CER from the standpoint of carbon pricing, some researchers viewed it as the mechanism between GI and low-carbon economic transformation and found that GI can promote sustainable development via the carbon market (Sachs et al., 2019). From the perspective of green finance, some researchers examined the relationship between GI, carbon pricing, and CEs (Dikau, 2019; Ren et al., 2020). By reallocating funds from highly polluting industries to eco-friendly industries, GI improves environmental benefits and the economic resource allocation efficiency (Dmytro and Olga, 2018). This process illustrates the mechanism between GI and CEs, which manifests itself in the reorientation of enterprise R&D investment and the modification of the industrial energy structure. GGI is a crucial green fiscal expenditure policy that encourages enterprises to increase their green innovation capacity and, thereby, contributes to emission reduction (Zhang et al., 2022). Moreover, based on the relationship between GI and CEs, we should consider its contribution to sustainable economic development (Hung, 2023) and residents’ welfare (Ottelin et al., 2018). Some studies examined the change in TFP under the constraint of CER and concluded that the pressure of industrial transformation under the constraint of CER will encourage the continuous improvement of TFP (Jiang et al., 2021; Hao et al., 2022; Wu and Wang, 2022). Some scholars believe that the improvement of TFP can promote the process of CER through technological progress and production efficiency improvement, thereby substantially reducing CEs. Some researchers also considered the crucial relationship between energy consumption and CEs and found that GI is essential for reducing traditional fossil energy consumption, promoting clean energy consumption, and enhancing EE (Wan and Sheng, 2022). Carbon emission reduction in China’s energy sector is primarily accomplished by increasing the EE (Peng et al., 2022), and GI has a positive impact on environmental governance by encouraging producers and consumers to use clean energy (Zahan and Chuanmin, 2021).

To sum up, researchers continue to pay attention to the important issue of green investment and CEs, but they tend to start from a single measurement index and rarely explore its impact mechanism in depth. Energy endowment is a key factor affecting the environmental regulation and CER process of the regional government. The existing green investment research has not considered this perspective. In the context of China’s"carbon peaking and carbon neutrality” strategy, the comprehensive impact of GGI on the process of CER needs to be further studied. Based on the panel data of 269 prefecture-level cities from 2008 to 2019, this paper explores the impact of GGI on the comprehensive index system of the CER process, which can deepen the understanding of existing studies on the CER effect of GI. The study explores the effect of GGI in resource-dependent regions, so as to support the government to implement regionally differentiated CER policies.

3 Theoretical analysis and research hypothesis

This study aimed to investigate the specific impact of GGI on the CER process, as well as the impact mechanism from the standpoint of TFP. On this basis, this paper focused on the theoretical analysis of the central research issues and advanced research hypotheses.

3.1 Impact of government green investment on carbon emission reduction

An increasing GGI has, for one thing, an investment-oriented function. GGI reflects government support for enterprises providing environmental protection products and services, which is conducive to accelerating the transformation of traditional energy enterprises and indirectly encourages enterprises to put more production factors into the CER process. In the process of achieving “carbon peaking and carbon neutrality,” government investment-oriented green projects will contribute to the achievement of sustainable development goals (Stucki, 2019). Moreover, GGIs directly impact businesses and can encourage green technology innovation. The ‘Porter Hypothesis’ posits that an appropriate level of environmental regulation can stimulate firms’ innovation, improve their innovation capacity, and increase their intangible assets by enhancing the production efficiency and the scientific and technological patent income (Porter and Linde, 1995). GGI acts on enterprises, thereby reducing the proportion of productive capital, such as pollution control enterprises and environmental litigation costs, and promoting the transfer of social investment to green production and CER. Industrial enterprises are a significant source of CEs, which is crucial to achieving the “carbon peaking and carbon neutrality” significance. The mode and scale of industrial production directly impact CEs, emission intensity, and decoupling of CEs from economic growth. Therefore, GGI significantly impacts CEs and the intensity of CEs. According to the preceding analysis, H1 was proposed.

H1. GGI can promote the CER process in China.

3.2 Mechanism of government green investment affecting carbon emission reduction

From the perspective of EE, improving EE is of great significance for reducing greenhouse gas emissions and fostering economic growth. Improving EE is necessary for China to reach its “carbon peaking and carbon neutralisation” objective (Tauseef et al., 2022). GGI, such as investments in renewable energy, has a strong multiplier effect and can also attract private capital to the field of GI through its investment-oriented role, thereby fostering green technology innovation among enterprises and enhancing energy utilization. Thus, it is possible to maximize energy utilization by maintaining energy demand and economic growth, thereby reducing carbon dioxide emissions.

According to some studies, GI positively impacts green TFP from the standpoint of TFP (Fang et al., 2022). Some studies have also demonstrated a non-linear relationship between them, as well as a threshold effect and substantial regional heterogeneity (Zhang, 2022). Most existing studies focus on the measurement and influencing factors of green TFP in the context of energy conservation and emission reduction, while there are comparatively fewer studies on the relationship between GI and TFP. GI can effectively stimulate the R&D of energy-saving and environmental protection technologies in enterprises, as well as promote innovation competition and exert a technology spillover effect, thereby accelerating the production efficiency. Moreover, it exerts a certain amount of pressure on the traditional energy industry and its dependent production mode, indirectly promotes the expansion of the green industry’s scale, raises the investment value of the green industry, reduces its financing costs, generates the scale effect, and ultimately increases the TFP (Tong et al., 2022). Furthermore, the impact of GI on the TFP will impact the process of CER. Moreover, the improvement of TFP will promote carbon reduction via low-carbon energy transformation. On the road to China’s strategic development of “carbon peaking and carbon neutrality,” resolving the problem of decoupling between CEs and economic growth has become the principal objective. Improving the TFP of CEs is a crucial step toward decoupling economic growth and CEs. According to the analysis presented, we proposed H2.

H2. GI can promote China’s CER process by improving the EE and TFP.

3.3 Impact of energy endowment on government green investment

The inability of high-energy-abundant regions to reduce CEs due to their reliance on non-renewable resources and high carbonization of industrial structures is known as the ‘resource curse’. Numerous studies have been conducted on the theory and demonstration of the ‘resource curse’ (Inuwa et al., 2021; Wu et al., 2021; Inuwa et al., 2022). Some scholars believe that the phenomenon of the “resource curse” does not exist in all resource-rich regions but only in those with the government system design flaws (Bulte, 2005). Some Chinese scholars have also considered whether energy-rich regions can escape the ‘resource curse’ if the government intervenes in environmental regulations (Lu, 2009; Wang et al., 2022). GGI is a form of government intervention that broadly falls under environmental regulation. According to the factor endowment theory, regions with high energy endowment will have obvious advantages in energy supply and utilization (Olivera and Upton Jr, 2022), which makes it easier to modify energy consumption and utilization efficiency. Some scholars have argued that against the backdrop of the climate change challenge, the adjustment of an economy’s energy structure and industrial structure depends more on its own resource endowment (Mab et al., 2022). In addition, regions with greater energy resources may have more severe environmental pollution issues and GGI will often increase, impacting these regions’ CER process. Accordingly, H3 was proposed.

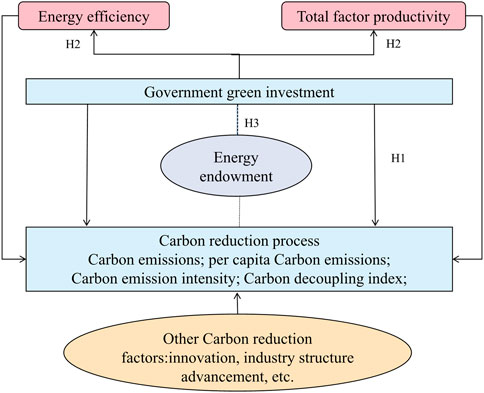

H3. The role of GI in the CER process is affected by energy endowment.Figure 1 depicts the correlation between the three research hypotheses proposed by theoretical analysis. H1 discusses the direct impact of GGI on the process of CER. In contrast, H2 affects how GGI influences the process of CER by affecting the EE and TFP from the perspective of mechanism analysis. H3 examines the relationship between the ‘resource curse’ and energy endowment and the impact of GGI on the CER process under various energy endowment scenarios. Through empirical analysis of the three research hypotheses, this paper explored the systemic impact of GGI on the CER process and its specific mechanism from the standpoint of energy endowment.

4 Models, variables, and data

4.1 Benchmark model and variable selection

To explore the direct impact of GI on CER, this study constructed a panel measurement model as follows:

In formula (1),

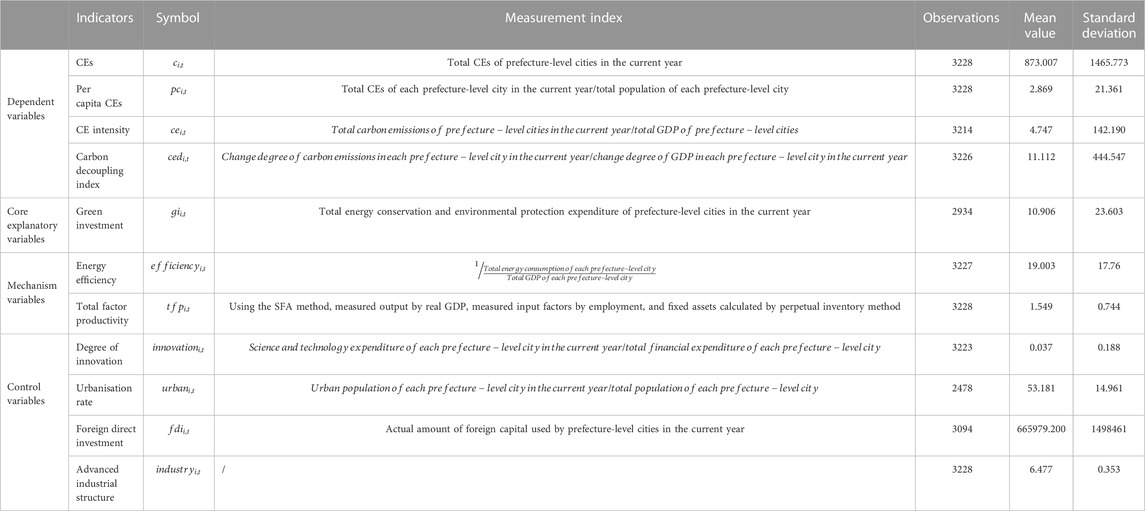

Explained variable: Evaluation system of the CER process: Most existing studies simply explore the relationship between green investment and carbon dioxide emissions, using only single indicators such as carbon dioxide emissions. Combined with the characteristics of the carbon emission reduction process, this study established a comprehensive index system including total carbon dioxide emissions, per capita emissions, emission intensity, and carbon decoupling. The four indicators reflect different stages of the carbon emission reduction process. Combined with China’s goal of ‘peaking carbon neutral’, the total carbon dioxide emission and per capita emissions belong to the initial stage of the carbon emission reduction process. A more rigorous carbon reduction process would require reductions in emissions intensity and decoupling of carbon emissions from economic growth. To comprehensively reflect the impact of GI on the CER, this study selected four indicators to measure CER: total CE (

Core explanatory variable: GGI: Researchers have not reached a consensus on the definition and calculation caliber of GI. The existing studies rely primarily on environmental protection investment for measurement, including the concept of productive GI (i.e., water conservation construction investment and forest management investment) and the amount of green enterprise financing to reflect GI as a whole. This paper focused on GGI at the prefecture-level cities, excluding the financing amount of green enterprises and the cities with a serious lack of productive GI data. As a measure of GI, the total expenditure on energy conservation and environmental protection within the fiscal expenditures of the prefecture-level cities was chosen as an index in this paper.

Mechanism variables: 1) EE: This paper utilized energy intensity to measure EE, i.e., the lower the energy consumption per unit of GDP, the greater the EE (Lin and Wu, 2020; Xue and Zhou, 2022). The data on energy consumption are derived from four parts of energy consumption: natural gas, liquefied petroleum gas, electricity consumption of the whole society, and urban heating (steam heating and thermal power plant heating), as reported in the China City Statistical Yearbook. The total energy consumption is calculated using the standard coal conversion coefficient. 2) TFP refers to the portion that can still increase when the inputs of all production factors (including capital, labor, and land) remain constant; it is a measurement of production efficiency. This study utilized statistical yearbooks, the CSMAR and CNRDS databases of prefecture-level cities, measured output by real GDP, measured input factors by employment, calculated fixed assets to measure capital stock using the perpetual inventory method, and calculated TFP using the stochastic Frontier analysis (SFA) method (Battese and Coelli, 1995).

Control variables: To ensure the validity and accuracy of the model, the following socio-economic indicators that may have an impact on CEs were chosen as control variables: 1) innovation level (

4.2 Data sources and descriptive analysis

Most of the existing studies on carbon emissions in China adopt the emission factor method to calculate carbon emissions. The emission factor method is also the most widely used in China’s carbon market. This paper conducts carbon emission accounting at the prefecture-level city, which is more detailed than that at the provincial level. The accounting covers key sectors and links of carbon dioxide generation such as direct energy, electric energy, transportation, and heat energy. All carbon dioxide emission factors are derived from authoritative databases such as China Provincial Greenhouse Gas Inventory Guide. Data, including sectoral carbon emission activity levels and other variables, are from the China City Statistical Yearbook, China Statistical Yearbook, China Statistical Yearbook for Regional Economy, China Urban Construction Statistical Yearbook, statistical yearbooks of all provinces (autonomous regions and municipalities directly under the Central Government), the China Stock Market & Accounting Research Database (CSMAR,) and the Chinese Research Data Services Platform (CNRDS) database. Due to the lack of diverse energy consumption data of the prefecture-level cities required for CE accounting, the data year used in this paper represents the most recent data. After eliminating prefecture-level cities with significant data gaps and interpolating a few data gaps, this paper selected, as research samples, 269 prefecture-level cities from 2008 to 2019. Table 1 shows the definitions and units of measurement for each variable.

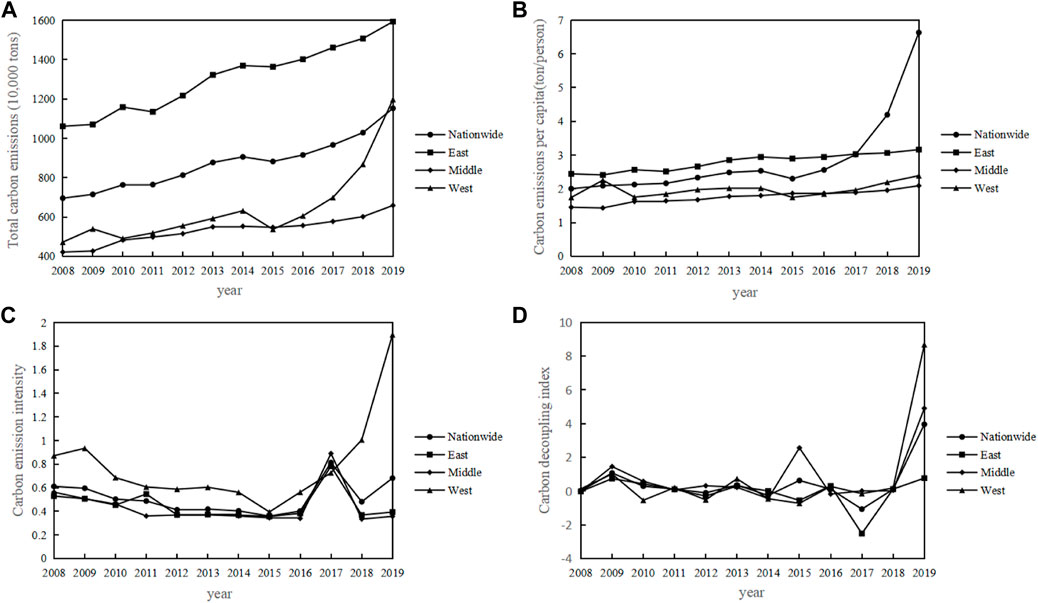

The four indicators of CER reflect the actual process of CER in China’s prefecture-level cities from multiple perspectives. As natural resource endowments, economic development, social and demographic conditions, industrial structure, and energy utilization characteristics vary greatly in different regions of China, and the CER process varies greatly in different regions (Liu et al., 2022; Wang, X. et al., 2022). In this paper, 269 prefecture-level cities were divided into eastern, central, and western regions based on their economic and geographical characteristics. Descriptive analysis was conducted based on the annual change trend of four indicators of the CER process in China and sub-regions in order to better understand the CER process. As shown in Figure 2, the total CEs in the entire country and region are increasing each year, while the increase rate of CEs per capita is relatively lower than that of the total CEs. Prior to 2017, the total CEs in the eastern region were consistently higher than the national average, as were the per capita CEs. The total and per capita CEs in the central and western regions are substantially lower than the national average, with the western regions emitting slightly more carbon per person than the central regions. The change in the carbon decoupling index is complicated. The change in CE intensity is characterized by a ‘slow decline-fluctuation rise’ pattern across the country and its regions. The CE intensity in the western region is always slightly higher than the average level in the eastern, central, and national regions. In general, there is a ‘decline with fluctuation-rise with fluctuation’ process. It should be noted that the decoupling between economic growth and CEs only occurs in the range where the carbon decoupling index is less than 1, which is particularly important. This index indicates that the majority of years in the western region and a few years in the central and eastern regions are within the range for carbon decoupling. The national average level is basically in a state of no decoupling each year.

FIGURE 2. Change trend of the carbon emission reduction process by region from 2008 to 2019. (A) Total carbon emissions; (B) per capita carbon emissions; (C) carbon emission intensity; and (D) carbon decoupling index.

5 Results and discussion

5.1 Baseline regression results

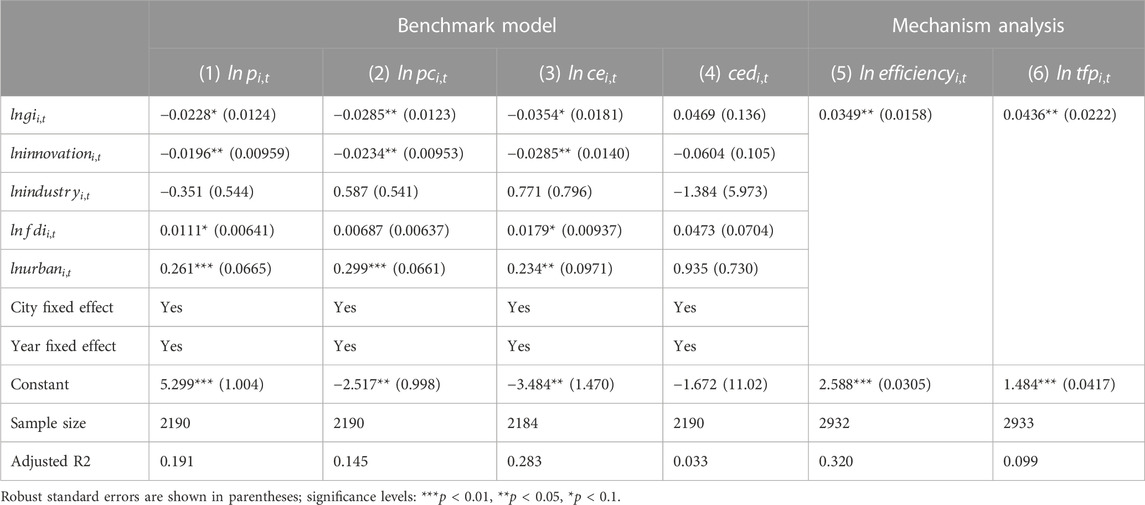

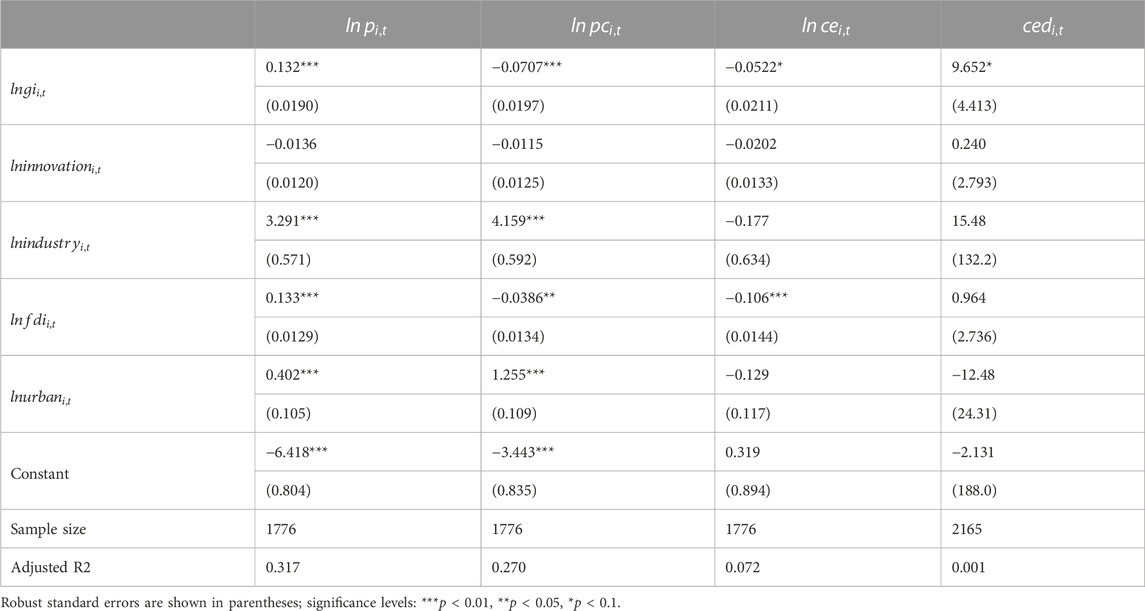

Columns 1–4 of Table 2 display the baseline model’s regression results. According to the regression results, when GGI increases, the CEs, per capita CEs, and intensity of CEs significantly decrease. The relationship between GGI and carbon decoupling is positive but not significant. Combined with the goal of “carbon peaking and carbon neutrality,” China’s total CEs have not yet reached their peak and are increasing. However, GGI significantly inhibits CEs, per capita CEs, and CE intensity, indicating that GGI has played a certain role in the green transformation of production modes. Moreover, GGI can accelerate the peak rate of CEs. There is no significant correlation between GI and carbon decoupling, reflecting that the current economic structure is still highly reliant on conventional energy. Considering the descriptive statistical results that the average value of the carbon decoupling index is significantly greater than 1, the carbon footprint of energy consumption in most prefecture-level cities is still significantly higher than the economic growth rate, and decoupling has not yet been achieved. In summary, GGIs can facilitate the reduction of CEs in China to some extent.

5.2 Mechanism analysis

To explore whether GGI affects CER through the mechanism of improving EE and TFP, first, we regress the explanatory variable to the mechanism variables and then use the literature research and theoretical analysis to explain the influence of mechanism variables on explained variables.

Among them,

The first is the EE intermediate effect test. According to the mechanism test results in column 5 of Table 2 and the benchmark results in columns 1–3 of Table 2, GI has a positive impact on EE promotion. The coefficient of equation (2)

The first is the TFP intermediate effect test. According to the mechanism test results in column 6 of Table 2 and the benchmark results in column 1–3 of Table 2, the coefficient

Presently, there is no significant relationship between GGI and carbon decoupling, nor there is any effect mediated by EE or TFP. According to research on the TFP of Chinese cities based on carbon decoupling (Fang et al., 2022), economic development and CEs are weakly decoupled in Chinese cities. In addition, the low level of TFP limits its effect on the carbon decoupling index as an intermediate path. Therefore, the government’s GI to promote economic development and reduce reliance on carbon-intensive industries has not yet been achieved.

5.3 Impact of energy endowment on carbon emission reduction effect of green investment

Energy endowment represents a region’s energy retention, production, and exploitation and indicates whether or not a region is resource dependent. The existing research lacks an all-encompassing definition of energy endowment. Some studies used the ratio of regional energy production to energy consumption to measure the energy endowment of a region, using ‘energy self-sufficiency’ as the benchmark (Ma, 2022). There are also studies involving the use of employees in extractive industries to measure energy endowments so as to include sub-sectors directly related to natural resources, such as coal, oil, natural gas, metal and non-metal mining, and processing industries (Li and Zou, 2018). The term ‘energy self-sufficiency’ was chosen as the measurement method for this paper due to the fact that the measurement method for energy production and energy consumption takes production and consumption into account comprehensively. In this paper, the data of each province’s primary energy production from the China Energy Statistical Yearbook, i.e., raw coal production, crude oil production, and natural gas production, were converted into standard coal using the discount coefficient. The energy endowment of each province was then determined by combining each province’s energy consumption data. The results of each province’s energy endowment calculation were then grouped into three quantiles, and three distinct energy endowment intervals, namely, ‘high’, ‘medium’, and ‘low’, were obtained and matched with the prefecture-level cities included. Following this, the benchmark regression model (1) was estimated based on grouping various energy endowment intervals, and the estimated results are presented in Table 3.

TABLE 3. Estimation results of the impact of GGI on various CER targets under different energy endowment intervals.

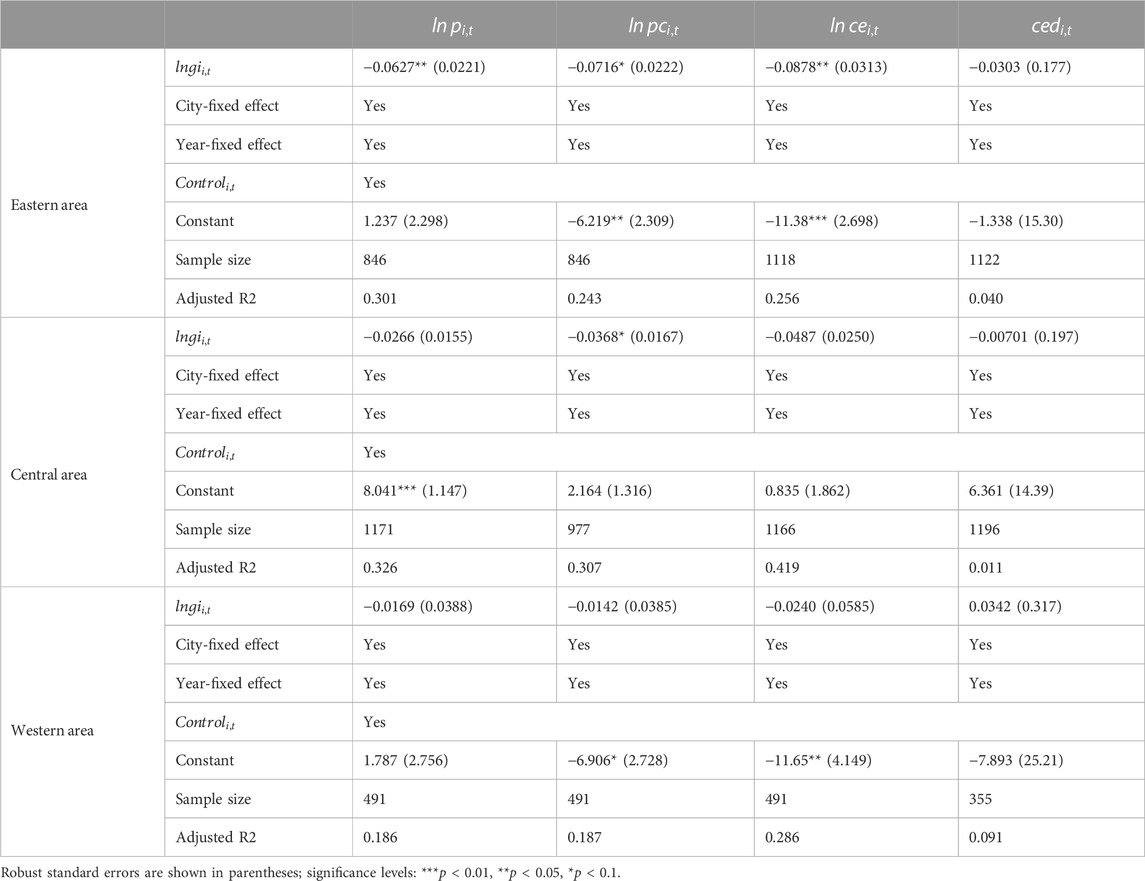

First, the magnitude and direction of the direct impact coefficient of GGI on the four specific indicators of CER are in line with the regression standard. Second, the more significant the negative impact of GI on CEs, per capita CEs, and CE intensity in regions with greater energy endowments, the greater the energy endowment. In other words, the greater the resource reliance, the greater the role of government environmental regulation tools such as GGI, which plays a role in improving EE, guiding GI, green technology innovation, low-carbon industrial development, and to some extent reducing the ‘resource curse’ effect. This result aligns with the findings of some researchers on energy endowment and CE under environmental regulation (Yu et al., 2019; Zhou and Fang, 2019).

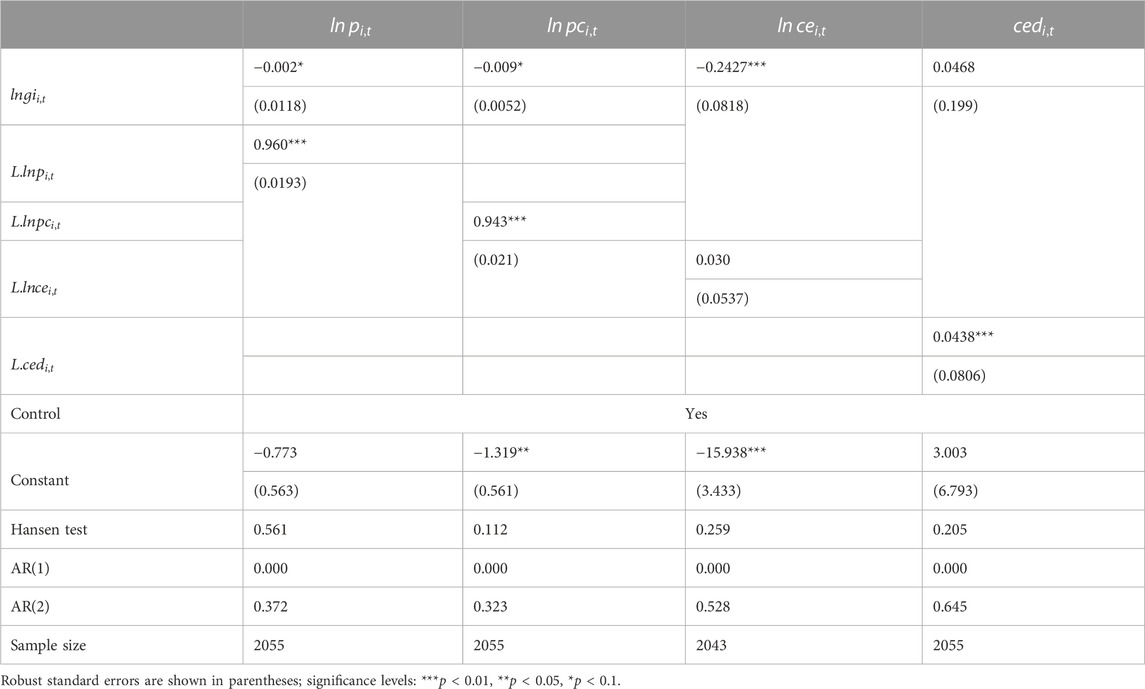

5.4 Robustness test

First, the explained variable’s first-order lag term was considered. Since the role of GGI may lag behind, it has a multi-period impact on CER indicators. Therefore, the lag period of CER-related indicators was included as an explanatory variable in the benchmark model. Since the model becomes a dynamic panel after the first-order lag term of the explained variable is added, the estimation results are inconsistent, so the GMM method is adopted for estimation.

Second, the replacement variable robustness test method was considered. In this paper, China Emission Accounts and Datasets were used to recalculate the CE data, and other data in the CER process index system were updated to reflect the new CE data.

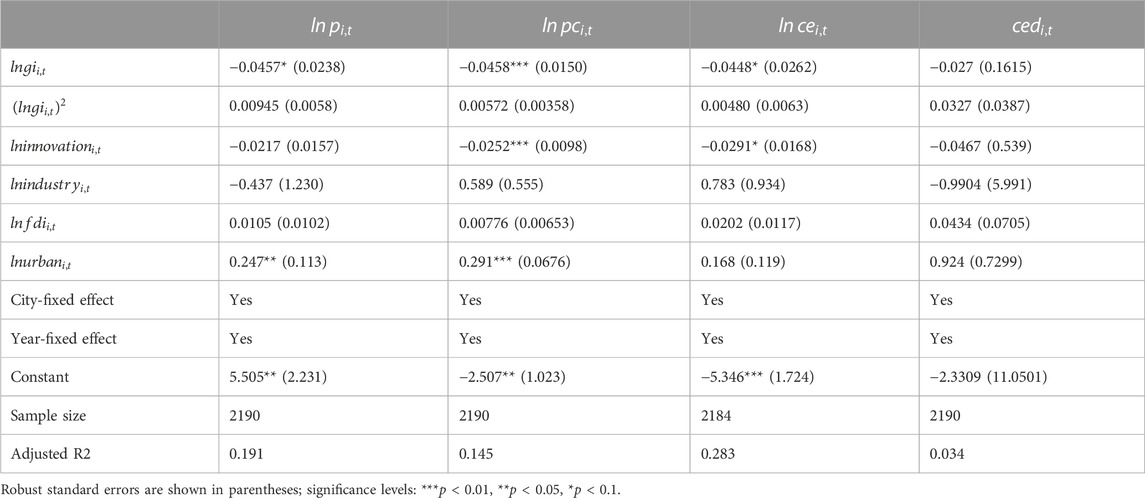

Third, given that GGI in China has developed over the years, its impact on the CER process may vary at different stages. There may be a non-linear relationship between GGI and CER. In order to test whether there is a non-linear relationship, the square term of GGI is added to the four equations of benchmark regression. The estimated results of the three robustness tests are shown in Tables 4–6, respectively. The coefficient of the square term of GGI is not statistically significant, and there is no non-linear causal relationship between it and the CER process. The direction and significance of the influence coefficient of GGI on total CEs, per capita CEs, CE intensity, and carbon decoupling index are consistent with the reference model, and the estimation results are largely reliable.

5.5 Heterogeneity analysis

5.5.1 Geographical region

Regional heterogeneity in the CER effect of GGI will result from differences in the stages of economic development across regions and the implementation of various regional policies. To further explore the role of GGI in CER and the regional heterogeneity of its impact mechanism, this paper distinguishes the eastern, central, and western regions based on their economic and geographical characteristics and estimates the benchmark model using samples. Table 7 demonstrates the results. In different regions, the influence coefficients of GGI on the four dimensions of the CER effect are in the same direction, but the significance of the coefficients and the influence size indicate regional heterogeneity. Specifically, first, the eastern region as a whole has the strongest impact on CER, as evidenced by the fact that the estimated coefficients of per capita CEs and CE intensity are significantly negative, and the absolute value is the highest. Second, the central region also has the characteristic that GGI inhibits per capita CEs and CE intensity significantly, but the inhibition effect is less than that of the central region. Third, the positive effect of GGI on carbon decoupling was only found in the western region. According to a descriptive analysis, the average value of the carbon decoupling index in western China is less than 1, indicating that economic development and energy carbon footprint are in the decoupling stage. However, the degree of economic development in western China is also low, so CEs and economic aggregate may be at a low level.

5.5.2 City size

Big cities have the agglomeration effect of production factors and the spillover effect of technology, and the marginal cost of production factors such as labor, capital, and knowledge is lower. At the same time, big cities easily attract manufacturers together, with a strong scale effect, bringing green technology innovation and low-carbon production revolution. However, the agglomeration effect of big cities will also lead to the over-exploitation of resources, energy consumption, and the rise of carbon emissions. Therefore, this paper considers different city sizes and divides the sample into large cities and small cities according to the number of permanent residents to further investigate the CER effect of GGI in the cities of different sizes. The estimated results are shown in Table 8. It can be found that large-scale cities have stronger CER effect of GGI than small-scale cities on the whole, which is related to the scale effect brought by city size.

TABLE 8. Estimation results of city size and urban economic development level heterogeneity analysis.

5.5.3 Urban economic development

The level of economic development represents a city’s market vitality, endowment conditions, and social foundation. Cities at a higher stage of economic development are better than cities at a lower stage of economic development in terms of financial capacity, and their ability and effect of implementing GGI may be stronger. However, cities in higher stages of economic development also tend to be more polluted. Therefore, this paper considers different levels of urban economic development and divides the sample into high-economic-development-level cities and low-economic-development-level cities according to the GDP. The estimated results are shown in Table 8. It can be found that the multidimensional CER effect of GGI is more strongly present in low-economic-development-level cities. This may be related to the preference of industries to those with high pollution and emissions.

5.6 Summary

Compared with the existing studies, the differences in this paper are as follows: on one hand, the idea of a carbon emission reduction process is established to construct multiple explained variables from different dimensions of CER. In this paper, the conclusion that GI has different dimensions of impact on the CER process indicators can further enrich the existing research. On the other hand, this paper provides a comprehensive analysis of the relationship between GGI and the CER process, and tested the important influencing mechanism of the existing research studies. At the same time, China’s ‘peaking carbon neutral’ strategy poses a major challenge to resource-intensive cities with high energy endowments. Such cities rely on traditional fossil fuel consumption, and it is difficult to upgrade production and technology to green. This study examines whether the CER effect of GI in resource-intensive cities will be affected by this real challenge. It links the research in related fields of ‘resource curse’ and ‘carbon emission reduction’ and has a strong practical significance.

6 Conclusion, policy recommendations, and limitations

6.1 Conclusion

This study examines how GGI affects the comprehensive carbon emission reduction process of multidimensional indicators under the constraint of global Carbon Dioxide Peaking and Carbon Neutrality and identifies the important influencing paths of energy efficiency and total factor productivity. Carbon emission reduction is often multidimensional, meaning not only the reduction of total carbon emissions but also a series of important indicators to represent per capita emissions, emission intensity, and structure. As an important environmental regulation tool, GGI is characterized by guiding investment and promoting transformation. Therefore, through GGI to transform the development inertia of existing resource-dependent industries and improve energy efficiency, the dual goals of economic improvement and carbon emission reduction can be achieved. It is of practical significance for China and other developing countries to explore the comprehensive carbon emission reduction effect of GGI in the context of global climate change. Based on the panel data of 269 prefecture-level cities in China from 2008 to 2019, this study explored the impact of GGI on the CER process and the mechanism of TFP in it. The key findings are as follows: 1) GGI reduces CEs, per capita CEs, and CE intensity, accelerates the achievement of the strategic goal of “carbon peaking and carbon neutrality,” and promotes the process of CER. Currently, GGIs have little effect on carbon decoupling. 2) GGI has inhibited CEs, per capita CEs, and CE intensity by improving EE and TFP. 3) The greater the energy endowment, the stronger the inhibitory effect of GGI on CEs, per capita CEs, and CE intensity. 4) The impact of GGI on various indicators of the CER process has geographical regional, city size, and economic development level heterogeneity, and the overall CER impact of GGI in the eastern region, big size cities and low-economic-development cities are stronger. In the future, the effect of CER can be further expanded from the consumption side to enrich the influence mechanism of GGI on the process of CER.

The contribution of this paper is to enrich the literature research in the field of GI and CEs and explore how GGI plays a role in the process of CER from different evaluation indicators. This paper also examines the CER effect of GGI in resource-dependent areas, bringing a new perspective to the study of GI and CEs.

6.2 Policy recommendations

Based on the conclusions, this study proposes the following suggestions: 1) strengthening the investment orientation role of GGI and increasing the proportion of energy conservation and environmental protection expenditure in general fiscal expenditure and Introducing environmental regulations and increasing support for green industries; 2) by increasing investment in renewable energy and technology, we aim to increase EE and TFP, fully leveraging the inhibitory effect of GI on CE, CE intensity, and per capita CE; 3) considering the significant differences in the energy industry structure and CE characteristics in different regions, efforts should be made to rationally adjust the level of GGI and optimize the influence mechanism of GGI in the CER process. On this basis, the government should formulate corresponding investment policies and plans to ensure the effective allocation of funds according to the economic development stage of the region and the actual CER process; and 4) regions with abundant energy endowments need to strengthen environmental regulations through government intervention such as GGI, continuously optimize energy and industrial structures, and effectively respond to the dual challenges of economic transformation and CER.

6.3 Limitations and directions for future research

In our study, due to the lack of specific and detailed data, the index of GGI is measured by the total expenditure of the prefecture-level city governments on energy conservation and environmental protection. It fails to specify various types of GGI, such as investment in public environmental infrastructure, such as water conservancy facilities, and investment in supporting green and low-carbon enterprises. Future research can further obtain the data of sub-project types of GGI so as to refine the analysis. Although the existing results are not perfect, they still have some reference values. This paper can provide a basis for further research in the future, remind relevant departments to pay attention to the guiding role of GGI, and promote the role of government environmental regulation in areas with abundant energy endowment.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Materials, Further inquiries can be directed to the corresponding author.

Author contributions

RP: conceptualization, writing original draft, data curation, and software. YH: methodology, writing original draft, software, and data curation. XX: data curation, software, and writing review and editing. NY: data curation, software, and writing review and editing. KZ: supervision, investigation, and validation. All authors contributed to the article and approved the submitted version.

Funding

This study was supported by the support of the National Natural Science Foundation of China (Project No. 7201101167; 41901255).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acemoglu, D., Aghion, P., Bursztyn, L., and Hemous, D. (2012). The environment and directed technical change. Am. Econ. Rev. 102 (1), 131–166. doi:10.1257/aer.102.1.131

Ahmad, F., Draz, M., Chandio, A. A., Ahmad, M., Su, L. J., Shahzad, F., et al. (2022). Natural resources and environmental quality: Exploring the regional variations among Chinese provinces with a novel approach. Resour. Policy 77, 102745. doi:10.1016/j.resourpol.2022.102745

Akram, R., Chen, F. Z., Khalid, F., Ye, Z. W., and Majeed, M. T. (2020). Heterogeneous effects of energy efficiency and renewable energy on carbon emissions: Evidence from developing countries. J. Clean. Prod. 247 (C), 119122. doi:10.1016/j.jclepro.2019.119122

Battese, G. E., and Coelli, T. J. (1995). A model for technical inefficiency effects in a stochastic frontier production function for panel data. Empir. Econ. 20 (2), 325–332. doi:10.1007/bf01205442

Bayar, Y., and Dan Gavriletea, M. (2019). Energy efficiency, renewable energy, economic growth: Evidence from emerging market economies. Qual. Quantity 53 (4), 2221–2234. doi:10.1007/s11135-019-00867-9

Becchetti, L., Cordella, M., and Morone, P. (2022). Measuring investments progress in ecological transition: The Green Investment Financial Tool (GIFT) approach. J. Clean. Prod. 357, 131915. doi:10.1016/j.jclepro.2022.131915

Bulte, E. H., Damania, R., and Deacon, R. T. (2005). Resource intensity, institutions, and development. World Dev. 33 (7), 1029–1044. doi:10.1016/j.worlddev.2005.04.004

Camioto, F. D. C., Moralles, H. F., Mariano, E. B., and Rebelatto, D. A. d. N. (2016). Energy efficiency analysis of G7 and BRICS considering total-factor structure. J. Clean. Prod. 122 (20), 67–77. doi:10.1016/j.jclepro.2016.02.061

Campiglio, E. (2016). Beyond carbon pricing: The role of banking and monetary policy in financing the transition to a low-carbon economy. Ecol. Econ. 121, 220–230. doi:10.1016/j.ecolecon.2015.03.020

Chang, J., Sun, P., and Wei, G. (2012). Spatial driven effects of multi-dimensional urbanization on carbon emissions: A case study in chengdu-chongqing urban agglomeration. Land 11(10), 1858. doi:10.3390/land11101858

Chen, P. Y., Chen, S. T., Hsu, C. S., and Chen, C. C. (2016). Modeling the global relationships among economic growth, energy consumption and CO2 emissions. Renew. Sustain. Energy Rev. 65, 420–431. doi:10.1016/j.rser.2016.06.074

Chen, Y. F., and Ma, Y. B. (2021). Does green investment improve energy firm performance? Energy Policy 153, 112252. doi:10.1016/j.enpol.2021.112252

Cheng, Y. Y., and Yao, X. (2021). Carbon intensity reduction assessment of renewable energy technology innovation in China: A panel data model with cross-section dependence and slope heterogeneity. Renew. Sustain. Energy Rev. 2021, 110157. doi:10.1016/j.rser.2020.110157

Destek, M. A., Manga, M., Cengiz, O., and Destek, G. (2022). Investigating the potential of renewable energy in establishing global peace: Fresh evidence from top energy consumer countries. Renew. Energy 197, 170–177. doi:10.1016/j.renene.2022.07.097

Dikau, S. V. a. (2019). Central banking, climate change, and green finance Simon Dikau and Ulrich Volz. Berlin,Germany: Springer.

Dmytro, S., and Olga, S. (2018). Assessment of ecological and economic efficiency of agricultural lands preservation. Environ. Econ. 9 (1), 47–56. doi:10.21511/ee.09(1).2018.04

Du, K. R., Li, P. Z., and Yan, Z. M. (2019). Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technol. Forecast. Soc. Change 146, 297–303. doi:10.1016/j.techfore.2019.06.010

Eyraud, L., Clements, B., and Wane, A. (2013). Green investment: Trends and determinants. Energy Policy 60, 852–865. doi:10.1016/j.enpol.2013.04.039

Fang, C., Tao, Z., and Di, W. (2022). Research on China cities’ total factor productivity of carbon emission: Based on decoupling effect. Int. J. Environ. Res. Public Health 19 (4), 2007. doi:10.3390/ijerph19042007

Fu, L. H. (2010). An empirical study on the relationship between the upgrading of industrial structure and economic growth in China. Stat. Res. 27 (08), 79–81.

Glaeser, E. L., and Kahn, M. E. (2010). The greenness of cities: Carbon dioxide emissions and urban development. J. urban Econ. 67 (3), 404–418. doi:10.1016/j.jue.2009.11.006

Gu, G., Zheng, H., Tong, L., and Dai, Y. (2022). Does carbon financial market as an environmental regulation policy tool promote regional energy conservation and emission reduction? Empirical evidence from China. Energy Policy 163, 112826. doi:10.1016/j.enpol.2022.112826

Hao, A., Tan, J., Ren, Z., and Zhang, Z. (2022). A spatial empirical examination of the relationship between agglomeration and green total-factor productivity in the context of the carbon emission peak. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.829160

He, J. M., Iqbal, W., and Su, F. L. (2023). Nexus between renewable energy investment, green finance, and sustainable development: Role of industrial structure and technical innovations[J]. Renew. Energy 210.

Hung, N. T. (2023). Green investment, financial development, digitalization and economic sustainability in Vietnam: Evidence from a quantile-on-quantile regression and wavelet coherence. Technol. Forecast. Soc. Change 186, 122185. (Part B). doi:10.1016/j.techfore.2022.122185

Inuwa, N., Modibbo, H. U., Adamu, S., and Sani, M. B. (2021). Resource curse hypothesis: Fresh evidence from OPEC member countries. OPEC Energy Rev. 45 (4), 462–474. doi:10.1111/opec.12217

Inuwa, N., Sani, M. B., Adamu, S., Modibbo, H. U., and Saidu, A. M. (2022). Testing the resource curse hypothesis: Evidence from top ten resource-rich countries in africa. Afr. J. Bus. Econ. Res. 17 (2), 205–223. doi:10.31920/1750-4562/2022/v17n2a9

Jiang, M. H., An, H. Z., and Gao, X. Y. (2022). Adjusting the global industrial structure for minimizing global carbon emissions: A network-based multi-objective optimization approach. Sci. total Environ. 829, 154653. doi:10.1016/j.scitotenv.2022.154653

Jiang, Y., Wang, H., and Liu, Z. (2021). The impact of the free trade zone on green total factor productivity —Evidence from the shanghai pilot free trade zone. Energy Policy 148, 112000. (Part B). doi:10.1016/j.enpol.2020.112000

Li, H., Lu, Y., Zhang, J., and Wang, T. (2013). Trends in road freight transportation carbon dioxide emissions and policies in China. Energy Policy 57, 99–106. doi:10.1016/j.enpol.2012.12.070

Li, H., and Zou, Q. (2018). Environmental regulation, resource endowment and urban industrial transformation: A comparative analysis of resource-based cities and non-resource-based cities. Econ. Res. 53 (11), 182–198.

Li, R. R., Yang, T., and Wang, Q. (2022). Does income inequality reshape the environmental kuznets curve (ekc) hypothesis? A nonlinear panel data analysis. Environ. Res. 216 (P2), 114575. doi:10.1016/j.envres.2022.114575

Li, X., Du, J., and Long, H. (2019). Green development behavior and performance of industrial enterprises based on grounded theory study: Evidence from China. Sustainability 11 (15), 4133. doi:10.3390/su11154133

Li, Z. H., and Bai, T. T. (2021). Government expenditure on environmental protection, green technology innovation and smog pollution. Res. Manag. 42 (02), 52–63.

Lin, B. Q., and Wu, W. (2020). Evolution and implications of global energy efficiency: An empirical study based on SDA decomposition of global input-output data. Econ. Q. J. 19 (02), 663–684.

Lin, B., and Huang, C. (2022). Analysis of emission reduction effects of carbon trading: Market mechanism or government intervention? Sustain. Prod. Consum. 33, 28–37. doi:10.1016/j.spc.2022.06.016

Liu, Y. S., Yang, M., Cheng, F. Y., Du, Z., and Song, P. (2022). Analysis of regional differences and decomposition of carbon emissions in China based on generalized divisia index method[J]. Energy 256.

López-Peña, A., Pérez-Arriaga, I., and Linares, P. (2012). Renewables vs. energy efficiency: The cost of carbon emissions reduction in Spain. Energy Policy 50, 659–668. doi:10.1016/j.enpol.2012.08.006

Ma, L. J. (2022). Study on the influence of energy endowment on carbon emission reduction effect of environmental tax. Chin. Acad. Fiscal Sci. 2022.

Mab, A., Hd, B., Sy, B., Am, C., Mssd, D., Gp, E., et al. (2022). Economic indicators and bioenergy supply in developed economies: QROF-DEMATEL and random forest models. Energy Rep. 8, 561–570. doi:10.1016/j.egyr.2021.11.278

Nie, X., Chen, Z., Wang, H., Wu, J., Wu, X., Lu, B., et al. (2022). Is the “pollution haven hypothesis” valid for China’s carbon trading system? A re-examination based on inter-provincial carbon emission transfer. Environ. Sci. Pollut. Res. 29, 40110–40122. doi:10.1007/s11356-022-18737-7

Olivera, M. E., and Upton, G. B. (2022). Are energy endowed countries responsible for conditional convergence? Energy J. 43 (3), 205–228.

Ottelin, J., Heinonen, J., and Junnila, S. (2018). Carbon and material footprints of a welfare state: Why and how governments should enhance green investments. Environ. Sci. Policy 86, 1–10. doi:10.1016/j.envsci.2018.04.011

Pagell, M., Wiengarten, F., and Fynes, B. (2013). Institutional effects and the decision to make environmental investments. Int. J. Prod. Res. 51 (2), 427–446. doi:10.1080/00207543.2011.651539

Peng, Q., Wang, C., and Tang, W. J. (2022). The impact of carbon emission reduction on provincial green total factor productivity. Sci. Decis. Mak. 04, 94–113.

Ponce, P., ÁlvarezGarcía, J., Álvarez, V., and Irfan, M. (2022). Analysing the influence of foreign direct investment and urbanization on the development of private financial system and its ecological footprint. Environ. Sci. Pollut. Res. Int. 30 (4), 9624–9641. doi:10.1007/s11356-022-22772-9

Ponce, P., López-Sánchez, M., Guerrero-Riofrío, P., and Flores-Chamba, J. (2020a). Determinants of renewable and non-renewable energy consumption in hydroelectric countries. Environ. Sci. Pollut. Res. Int. 27 (23), 29554–29566. doi:10.1007/s11356-020-09238-6

Ponce, P., Oliveira, C., Álvarez, V., and del RíoRama María de la Cruz., (2020b). The liberalization of the internal energy market in the European union: Evidence of its influence on reducing environmental pollution. Energies 13 (22), 6116. doi:10.3390/en13226116

Porter, M. E., and Linde, C. v. d. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Raihan, A., and Tuspekova, A. (2022). Towards sustainability: Dynamic nexus between carbon emission and its determining factors in Mexico. Energy Nexus 8, 100148. doi:10.1016/j.nexus.2022.100148

Ren, X., Shao, Q., and Zhong, R. (2020). Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. J. Clean. Prod. 277, 122844. doi:10.1016/j.jclepro.2020.122844

Sachs, J. D., Woo, W. T., Yoshino, N., and Taghizadeh-Hesary, F. (2019). Importance of green finance for achieving sustainable development goals and energy security. Singapore: Springer Singapore.

Samsul, A. M., Nicholas, A., Reddy, P. S., and Jianchun, F. (2020). The impacts of R&D investment and stock markets on clean-energy consumption and CO2 emissions in OECD economies. Int. J. Finance Econ. 26 (4).

Shen, Y., Su, Z.-W., Yousaf, M., Umar, M., Khan, Z., and Khan, M. (2020). Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total Environ. 755 (P2), 142538. doi:10.1016/j.scitotenv.2020.142538

Shi, D. M., and Shi, X. Y. (2022). Green finance and high-quality economic development: Mechanism, characteristics and empirical study. Stat. Res. 39 (01), 31–48.

Siedschlag, I., and Yan, W. (2021). Firms’ green investments: What factors matter? J. Clean. Prod. 310, 127554. doi:10.1016/j.jclepro.2021.127554

Smulders, S., Tsur, Y., and Zemel, A. (2012). Announcing climate policy: Can a green paradox arise without scarcity? J. Environ. Econ. Manag. 64 (3), 364–376. doi:10.1016/j.jeem.2012.02.007

Song, K. H., Baiocchi, G., Feng, K. S., Hubacek, K., and Sun, L. X. (2022). Unequal household carbon footprints in the peak-and-decline pattern of U.S. greenhouse gas emissions. J. Clean. Prod. 368, 132650. doi:10.1016/j.jclepro.2022.132650

Stucki, T. (2019). Which firms benefit from investments in green energy technologies? – The effect of energy costs. Res. Policy 48 (3), 546–555. doi:10.1016/j.respol.2018.09.010

Tapio, P. (2005). Towards a theory of decoupling: Degrees of decoupling in the EU and the case of road traffic in Finland between 1970 and 2001. Transp. Policy 12 (2), 137–151. doi:10.1016/j.tranpol.2005.01.001

Tauseef, H. S., Bushra, B., Muhammad, S., and Bangzhu, Z. (2022). How do green energy investment, economic policy uncertainty, and natural resources affect greenhouse gas emissions? A markov-switching equilibrium approach. Environ. Impact Assess. Rev. 97, 106887. doi:10.1016/j.eiar.2022.106887

Timothy, F., Andrew, J. C., and Yosuke, S. (2023). Leapfrogging or lagging? Drivers of social equity from renewable energy transitions globally. Energy Res. Soc. Sci. 98, 103006. doi:10.1016/j.erss.2023.103006

Tong, L., Chiappetta Jabbour, C. J., belgacem, S. b., Najam, H., and Abbas, J. (2022). Role of environmental regulations, green finance, and investment in green technologies in green total factor productivity: Empirical evidence from Asian region. J. Clean. Prod. 380, 134930. doi:10.1016/j.jclepro.2022.134930

van der Ploeg, F., and Withagen, C. (2012). Is there really a green paradox? J. Environ. Econ. Manag. 64 (3), 342–363. doi:10.1016/j.jeem.2012.08.002

Wan, Y., and Sheng, N. (2022). Clarifying the relationship among green investment, clean energy consumption, carbon emissions, and economic growth: A provincial panel analysis of China. Environ. Sci. Pollut. Res. 29 (6), 9038–9052. doi:10.1007/s11356-021-16170-w

Wang, Y., Deng, X., Zhang, H., Liu, Y., Yue, T., and Liu, G. (2022). Energy endowment, environmental regulation, and energy efficiency: Evidence from China. Technol. Forecast. Soc. Change 177, 121528. doi:10.1016/j.techfore.2022.121528

Wu, L. Y., and Zeng, W. H. (2013). Research on the contribution of structure adjustment on carbon dioxide emissions reduction based on LMDI method[J]. Procedia Comput. Sci. 17.

Wu, L., Sun, L., Qi, P., Ren, X., and Sun, X. (2021). Energy endowment, industrial structure upgrading, and CO2 emissions in China: Revisiting resource curse in the context of carbon emissions. Resour. Policy 74, 102329. doi:10.1016/j.resourpol.2021.102329

Wu, Q., and Wang, Y. (2022). How does carbon emission price stimulate enterprises' total factor productivity? Insights from China's emission trading scheme pilots. Energy Econ. 109, 105990. doi:10.1016/j.eneco.2022.105990

Xiaochun, Z., Laichun, L., Qun, S., and Wei, Z. (2022). How to evaluate investment efficiency of environmental pollution control: Evidence from China. Int. J. Environ. Res. Public Health 19 (7252), 7252.

Xue, F., and Zhou, M. L. (2022). Can energy use trading system improve energy efficiency? China Popul. Resour. Environ. 32 (01), 54–66.

Yang, Z. K., Zhang, M. M., Liu, L. Y., and Zhou, D. (2022). Can renewable energy investment reduce carbon dioxide emissions? Evidence from scale and structure. Energy Econ. 112, 106181. doi:10.1016/j.eneco.2022.106181

Yu, X. Y., Li, Y., and Chen, H. Y. (2019). The impact of environmental regulation and energy endowment on regional carbon emissions from the perspective of "resource curse. China Popul. Resour. Environ. 29 (05), 52–60.

Zahan, I., and Chuanmin, S. (2021). Towards a green economic policy framework in China: Role of green investment in fostering clean energy consumption and environmental sustainability. Environ. Sci. Pollut. Res. 28 (32), 43618–43628. doi:10.1007/s11356-021-13041-2

Zhang, B., Yin, J., Jiang, H., and Qiu, Y. (2022). Spatial–temporal pattern evolution and influencing factors of coupled coordination between carbon emission and economic development along the Pearl River Basin in China. Environ. Sci. Pollut. Res. 30, 6875–6890. doi:10.1007/s11356-022-22685-7

Zhang, H., Geng, C., and Wei, J. (2022). Coordinated development between green finance and environmental performance in China: The spatial-temporal difference and driving factors. J. Clean. Prod. 346, 131150. doi:10.1016/j.jclepro.2022.131150

Zhang, S. X., Wang, H., and Xu, R. N. (2021). Relationship between scientific and technological progress, green total factor productivity and agricultural carbon emissions: Based on panel data of 26 cities in Pan-Yangtze River Delta. Sci. Technol. Manag. Res. 41 (02), 211–218.

Zhang, Y. (2022). A study on the impact of green finance on green total factor productivity. Taiyuan, China: Shanxi University of Finance and Economics.

Keywords: green investment, carbon emission reduction process, energy efficiency, energy endowment, total factor productivity

Citation: Pan R, Hu Y, Xu X, Yuan N and Zhou K (2023) How government green investment affects the carbon emission reduction process: empirical evidence from prefecture-level cities in China. Front. Environ. Sci. 11:1202978. doi: 10.3389/fenvs.2023.1202978

Received: 10 April 2023; Accepted: 31 May 2023;

Published: 13 June 2023.

Edited by:

Elias T. Ayuk, Independent Researcher, Accra, GhanaReviewed by:

Pablo Ponce, National University of Loja, EcuadorJijian Zhang, Jiangsu University, China

Copyright © 2023 Pan, Hu, Xu, Yuan and Zhou. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Kai Zhou, emhvdS5rYWlAcHJjZWUub3Jn

Ruoxi Pan1

Ruoxi Pan1 Xiangbo Xu

Xiangbo Xu Kai Zhou

Kai Zhou