- School of Business, Qingdao University, Qingdao, China

Introduction: Objective environmental uncertainty has important impacts on entrepreneurial decision-making, but entrepreneurs’ perception of uncertainty may be a more crucial factor. This is because objective environmental uncertainty may need to be filtered through entrepreneurs’ perceptions to influence their decision-making. Therefore, exploring how entrepreneurs’ perceived environmental uncertainty (PEU) affects their corporate eco-innovation behavior has significant theoretical and practical implications.

Methods: Drawing on the dynamic capability view, we utilize data from the 2016 China Private Enterprise Survey (CPES) on 2,733 small and medium-sized enterprises (SEMs) to highlight the impact of entrepreneurs’ PEU on corporate eco-innovation. We also examine the moderating effect of government intervention (government subsidies and government official visiting) on this relationship.

Results: Our study reveals a positive impact of entrepreneurs’ PEU on corporate eco-innovation, confirming the critical role of dynamic capability in corporate strategic adjustment under uncertain conditions. Additionally, we find that government intervention (government subsidies and official visits) has a positive moderating effect on this relationship, with entrepreneurs’ PEU and eco-innovation being mediated by corporate dynamic capability.

Discussion: The study contributes to the literature on environmental uncertainty, dynamic capabilities, and eco-innovation, and provides practical implications for SMEs in developing countries. The findings highlight the importance of subjective perceptions of environmental uncertainty over objective uncertainty. The study also demonstrates that environmental uncertainty is not inherently negative, but can be managed strategically with dynamic adjustment and government support.

1 Introduction

Uncertainty, which is defined as the inability to assign an objective probability to each potential outcome or the inability to predict the likelihood of an event occurring (Knight, 1921), has emerged as a salient feature of the contemporary business environment that shapes firms’ innovation efforts (Gulen and Ion, 2016; Hanlon et al., 2017; Nagar et al., 2019; Zayadin et al., 2022). However, real options theory and strategic growth options theory have contradictory perspectives regarding the effect of uncertainty on innovation investment. Based on the premise that investments are irreversible, real options theory argues that uncertainty increases the value of the waiting option for an innovative investment opportunity held by the firm. Consequently, firms may choose to reduce or delay investment activities in response to external environmental uncertainty when uncertainty levels rise (Cui et al., 2021; Wang et al., 2021; Li et al., 2022). In contrast, strategic growth option theory posits that firms facing uncertainty are more likely to increase innovation investment, as uncertainty enhances the value of growth options, and the value of these options may be further augmented when the firm’s growth strategy aligns with uncertainty (Bromiley et al., 2017; Belderbos et al., 2019).

However, the uncertainty discussed by scholars is primarily an objective entity. Specifically, the majority of prior literature captures environmental uncertainty at the macro-level, rather than the environmental uncertainty perceived by decision-makers (Gulen and Ion, 2016; Hanlon et al., 2017). This is a significant factor contributing to the differential impact of environmental uncertainty on firm innovation investment (McKelvie et al., 2011), as even objective environmental uncertainty may need to be filtered through entrepreneurs’ perceptions to affect firm decision-making. According to Milliken (1987), it is challenging to treat uncertainty as an objective, externally measurable term, because there is no clear evidence of a relationship between objective environmental features and perceived environmental uncertainty (Zayadin et al., 2022). Therefore, bridging the gap between the two perspectives requires a shift in focus towards how entrepreneurs perceive environmental uncertainty and how this perception influences their strategic decisions. Moreover, in emerging economies, the role of the government as a significant external stakeholder of firms is controversial, as to whether government intervention serves as a “helping hand” or a “grabbing hand” in business. Addressing this issue requires consideration of specific scenarios. By situating government intervention in uncertain situations, we can understand the role it plays under conditions of uncertainty. This is particularly critical for small and medium-sized enterprises (SEMs) in developing countries undergoing economic transformation, as they face not only higher levels of environmental uncertainty than their counterparts in developed countries but also more intense government intervention.

To address this research gap, our study examines the impact of Chinese entrepreneurs’ PEU on corporate eco-innovation, while highlighting the role of dynamic capabilities. Given their heightened sensitivity to environmental uncertainty and strategic flexibility, SMEs are better equipped to adapt when entrepreneurs perceive an increase in external environmental uncertainty. In response, they can identify opportunities and threats in the field of eco-innovation, integrate existing internal and external resources, and reallocate resources to eco-innovation activities through strategic foresight, product portfolios, technology investment, and innovation activities, thus establishing a competitive advantage in the field of eco-innovation and promoting eco-innovation activities. Therefore, we expect that entrepreneurs’ PEU has a positive impact on corporate eco-innovation. Furthermore, we argue that in an uncertain environment, it is imperative to integrate government forces into firms’ innovation processes. This means that firms require government intervention to guide them in a turbulent market environment. In our study, we focus on two types of government interventions: government subsidies and government official visits. We contend that these interventions improve firms’ resource allocation flexibility and ability to recognize uncertainty, both of which are beneficial for reducing firms’ eco-innovation costs and enhancing resource allocation efficiency. Therefore, we expect that government intervention will mitigate the impact of PEU on eco-innovation.

To test our hypothesis, we utilize data from the 2016 China Private Enterprise Survey (CPES), which is the most comprehensive and widely used dataset on Chinese SMEs (Zhao and Lu, 2016). Our findings provide strong evidence that entrepreneurs’ PEU has a positive impact on corporate eco-innovation and that this positive relationship is moderated by government intervention. Specifically, we observe that when firms receive government subsidies or are visited by government officials, the positive relationship between entrepreneurs’ PEU and eco-innovation is stronger. These results support our hypotheses even after conducting various robustness tests. Moreover, our research on mediating effects highlights that a firm’s dynamic capabilities play a crucial role in linking PEU to eco-innovation.

We try to make four main contributions. Firstly, beginning with the competitive conclusion between real options and strategic options, our study reveals that subjective perceptions of environmental uncertainty by entrepreneurs are more important than objective uncertainty. Additionally, our findings indicate that small and medium-sized enterprises exhibit greater strategic flexibility in responding to environmental uncertainty. This perspective offers a new way to reconcile the conflicting conclusions from prior literature on the competition conclusion between these two types of options.

Secondly, our study broadens prior research on the influence of environmental uncertainty on corporate investment decisions, as much of the past research has focused solely on the impact of objective environmental uncertainty on firm decisions, particularly when considering long-term innovation investments. Our research, by contrast, attempts to enrich this stream of literature by introducing the concept of entrepreneur’s subjective perception of environmental uncertainty.

Thirdly, our study demonstrates that environmental uncertainty is not inherently negative. In fact, with sufficient strategic foresight and dynamic capabilities, coupled with government policy support and strategic guidance, SMEs can seize opportunities within uncertain environments and pursue sustainable innovation and achieve low-carbon development. Our findings highlight the potential benefits of uncertainty and emphasize the importance of strategically managing it for SMEs to achieve sustainable innovation outcomes.

Finally, we emphasize the strategic guidance role of proactive government intervention in uncertain contexts for firms’ innovative actions, and investigate the boundary conditions of the impact of entrepreneurs’ PEU on eco-innovation. Our research findings suggest that proactive government intervention can serve as a “helping hand” for businesses during uncertain times, and become an important source for enhancing their dynamic capabilities. This provides further theoretical support for emerging economies to view government intervention as a complementary mechanism to the market.

2 Literature review and hypotheses

2.1 SME entrepreneurs perceived environmental uncertainty

Perceived environmental uncertainty (PEU) is a perceptual phenomenon that primarily exists in the “eyes” of the observer (Duncan, 1972). It describes entrepreneurs’ lack of critical information about the external environment. The three primary types of perceptual uncertainty are state uncertainty, effect uncertainty, and response uncertainty. State uncertainty refers to the inability to predict the probability of a particular event occurring or changing; effect uncertainty refers to the inability to predict the impact of external environmental fluctuations on the firm; and reaction uncertainty refers to the inability of entrepreneurs to predict the effect of strategic decisions in response to uncertainty. Empirical evidence suggests that this uncertainty plays a secondary role in determining a company’s strategy. What is more important is how decision-makers perceive the uncertainty.

Environmental uncertainty has a greater impact on SMEs than on large corporations. Turbulence in the external environment may easily impede the success of or lead to the failure of these businesses, as they have fewer resources and limited capabilities (García-Pérez and Yanes-Estévez, 2022). Furthermore, SME decision-makers, as the firm’s external environment analysts, are more sensitive to environmental uncertainty under the influence of a turbulent environment (Gaur et al., 2011). Specifically, in most SMEs, decision-makers are closer to the objective environment (Robinson and Simmons, 2018); they function as both analysts and collectors of environmental information (Aldehayyat, 2015); they usually rely on common sense or intuition rather than sophisticated analytical tools to analyze the environment (Wong et al., 2014); and their perception of environmental uncertainty frequently influences firms’ strategic choices (Robinson and Simmons, 2018).

As reform and opening up have progressed, tens of millions of SMEs have been developed in China. However, they face more severe external environmental uncertainties than state-owned firms or large enterprises due to flawed market mechanisms and arbitrary resource allocation (Liu et al., 2021). With regard to strategic decision-making, Chinese entrepreneurs tend to rely on their accumulated knowledge and experience to make decisions, and experience or perceptions play a pivotal role in entrepreneurial decision-making. In China, experienced managers are not necessarily well-educated and systematically trained (Parnell et al., 2012). Given the massive number of Chinese SMEs and the entrepreneurs who base their strategic decisions on experience or perception, it is appropriate to focus our research on Chinese SMEs.

2.2 Uncertainty and corporate eco-innovation

Dynamic capabilities are considered a pre-tension to the resource-based view of the firm (RBV), which emphasizes an organization’s ability to renew or reconfigure its internal and external resources in response to environmental uncertainty (Teece et al., 1997). Dynamic capabilities are particularly valuable in turbulent environments, as they enable firms to integrate, build and reconfigure internal and external resources to address and shape rapidly changing business environments (Teece and Leih, 2016), and help managers to navigate when and how to manage under conditions of deep uncertainty. The actions and adjustments associated with dynamic capabilities can be broadly categorized as perceiving, reconfiguring, and continuously adjusting (Teece, 2012). Given the significance of a firm’s dynamic capabilities during periods of uncertainty, we argue that SMEs rely on their strategic flexibility. Upon perceiving heightened environmental uncertainty, these firms can effectively integrate and allocate resources by coordinating these three sets of activities to drive corporate eco-innovation and establish a first-mover advantage.

Firstly, the perceptiveness with which SME decision-makers sense uncertainty enables them to promptly recognize market dangers and opportunities and remain fully aware of changes in the external environment. Despite lacking the technology and resources for environmental information collection and analysis (García-Pérez and Yanes-Estévez, 2022), the qualities of being closer to the objective environment and more perceptive are more likely to stimulate strategic foresight activities and provide them with more time to respond to external shocks (Teece and Leih, 2016). Through strategic foresight activities, companies can accurately detect external opportunities and risks, thereby improving their external competitive environment (Heger and Rohrbeck, 2012; Haarhaus and Liening, 2020). Secondly, the high-level strategic adaptability and flexibility of SMEs enable them to respond effectively to opportunities and threats in turbulent markets, including decisions regarding product portfolios, technology, and human resource investments (Weaven et al., 2021). Ross et al. (2018) indicate that market uncertainty, while reducing investment in new products, also encourages enterprises to engage in research and development activities. These flexible strategic decisions not only mitigate unexpected income shocks but also provide market information that other competitors may not be able to obtain. Finally, innovation is vital to the survival of SMEs (Zouaghi et al., 2018), and it has significant value during periods of external environmental uncertainty. Innovative organizations exhibit better responsiveness by grasping emerging opportunities when they detect heightened environmental uncertainty, and they respond to tumultuous environments by engaging in innovative conduct (Han et al., 1998). Even conservative companies are compelled to innovation as a kind of strategic adaptation (Russell and Russell, 1992).

As a fusion of innovation and sustainability, eco-innovation not only meets the expectations of external stakeholders but also addresses enterprises’ needs to develop disruptive technologies and gain competitive advantages. When entrepreneurs perceive uncertainty, they integrate and allocate existing internal and external resources, creating competitive advantages in the field of eco-innovation through activities such as strategic foresight, product portfolio management, technology investment, and innovation. Conversely, in the absence of perceived uncertainty in the external environment, entrepreneurs’ dynamic capabilities may not be fully activated, and eco-innovation activities may be postponed, as dynamic capabilities become less significant in a stable context (Drnevich and Kriauciunas, 2011; Teece, 2014). Therefore, we propose:

Hypothesis 1:. Entrepreneurs’ PEU is positive associated with corporate eco-innovation

2.3 The moderating effect of government intervention

Compared to conventional innovation efforts, eco-innovation has a dual externality, as firms may face “free-rider” behavior (knowledge spillover or environmental spillover) from other market participants, and the firms themselves might not fully reap the benefits of eco-innovation (Yi et al., 2020). When market mechanisms fail to address the dual externalities of eco-innovation, government policy instruments might encourage enterprises to engage in eco-innovation by reducing the disparity between social and private profits (Long and Liao, 2021). Thus, the eco-innovation of companies is internally dependent on government forces. In our research, we emphasized the moderating impacts of two distinct types of government involvement: government subsidies and government official visits (GOV).

Government subsidies are one of the most common government intervention strategies (Shao et al., 2020), and their positive influence on eco-innovation has been consistently demonstrated, despite ongoing concerns about the crowding-out effect of government subsidies on enterprises’ R&D spending (Long and Liao, 2021). In reality, most studies have found that government subsidies have an “additional effect” on enterprises’ R&D activities, reducing the cost of R&D and hastening the completion of R&D projects (Görg and Strobl, 2007), revitalizing previously unprofitable R&D programs. Furthermore, government subsidies serve as a guide, encouraging enterprises to allocate resources to production technologies and opportunities that meet society’s expectations, allowing firms to benefit economically while focusing on societal rewards (Tsai and Liao, 2017b). As a result, corporations are more willing to engage in eco-innovation activities with government subsidies (Tsai and Liao, 2017a; Tsai and Liao, 2017b; Long and Liao, 2021).

Corporate eco-innovation activities entail significant environmental uncertainty and variability, requiring a keen perception of external opportunities and threats, as well as the full utilization of current resources and the introduction of new external resources into innovation activities (Demirel and Kesidou, 2019). Due to the dual externalities of eco-innovation activities, even though SMEs have greater strategic flexibility and adaptability in uncertain environments, the lack of external resource support or meager economic returns over time may lead firms to abandon investing in eco-innovation. Government financial incentives are crucial to a company’s resource base (Melander, 2018). In a volatile market environment, SMEs that receive government subsidies can combine them with their existing knowledge and experience. These new combinations not only enhance SMEs’ resource allocation flexibility but also strengthen their organizational learning capacity. Therefore, after receiving government subsidies, companies can reallocate cross-functional teams, restructure their resource portfolios, and participate more effectively in eco-innovation activities in uncertain situations. Therefore, we propose:

Hypothesis 2a:. The positive relationship between the entrepreneurs’ PEU and corporate eco-innovation is stronger for firms that receive government subsidies.In emerging economies, governments as social resource allocators and institutional authorities not only control scarce resources (land, industry access, etc.) but also have a strong voice in determining the legitimacy of firms’ strategies and can exert significant influence on firms’ innovation activities (Liu et al., 2021). GOV provides an opportunity to enhance enterprise and government information communication, improve corporate legitimacy, and reduce risk in strategic decision-making.Firstly, corporations can increase their political uncertainty perception by utilizing GOV to obtain political information, such as the dynamics of government policy, changes in government officials, and the political philosophy of these officials (Yunxia and Qiu, 2021). This crucial information can strengthen firms’ willingness to take risks in implementing innovation activities, reducing their inclination to be risk-averse and exhibit short-term investment tendencies. Secondly, during government officials’ visits, companies can consult with them on major issues they face by showcasing their current achievements and long-term plans. In this manner, the corporation can assess the authorities’ basic attitude toward the company’s strategy and seek their feedback and recommendations, thereby earning the government’s recognition and support (Jia et al., 2019). Thirdly, government officials’ visits to target firms not only imply that the firms’ ability to use scarce government resources has improved but also indicate the government’s attention and support for firms’ risky behavior (Yunxia and Qiu, 2021), which will attract the support of more external stakeholders. Therefore, GOV is conducive to enhancing firms’ willingness to invest in eco-innovation and resource security.The primary cause of entrepreneurs’ perception of uncertainty is the lack of access to vital external information. In contrast to firms, governments possess a vast quantity of critical external information and scarce resources. Therefore, GOV provides opportunities for enterprises to gain information and enhance their dynamic capacities during times of uncertainty. Specifically, during government officials’ visits, their views and suggestions on the company’s technological strengths, production processes, and product innovation provide crucial information for strategic decisions and adjustments. The government can even assist the company in identifying appropriate technologies and recruiting professional staff, which are essential for driving the company’s eco-innovation. GOV also enables corporations to learn about policy changes, turnover of officials, and other political information, improving their ability to perceive uncertainty and make their strategic decisions more rational in an uncertain environment. Moreover, similar to government subsidies, GOV can provide scarce resources to companies, enhancing their resource flexibility. Therefore, we propose:

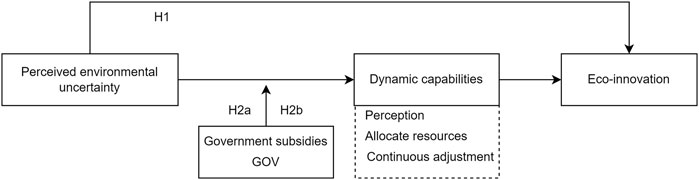

Hypothesis 2b:. The positive relationship between the entrepreneurs’ PEU and corporate eco-innovation is stronger for firms that visited by government officials.Based on the hypotheses developed above, the dynamic capabilities perspective is employed in this study to posit a positive relationship between entrepreneurs’ perceived environmental uncertainty and eco-innovation. Additionally, government subsidies and official visits are identified as moderators of this relationship, while firms’ dynamic capabilities are found to mediate the relationship between perceived environmental uncertainty and eco-innovation. The theoretical model of this study is illustrated in Figure 1.

3 Methodology

3.1 Sample and data

The data on SMEs used in this study were obtained from the 2016 China Private Enterprise Survey (CPES) data, which is a collaborative effort between the United Front Work Department of CPC Central Committee, All-China Federation of Industry and Commerce, and State Administration for Industry and Commerce of the People’s Republic of China. The survey project began in 1993 and is conducted every 2 years, with the most recent publicly available data being from 2016. The CPES database employs a multi-stage stratified random sampling survey of private enterprises in China, which ensures data universality and representativeness and reduces the potential for sample selection bias. Additionally, the CPES database provides information on firms’ operations, entrepreneurs’ socio-economic backgrounds, and entrepreneurs’ perceived evaluation of external environmental conditions. As the founder is the provider of information, this is the most knowledgeable and effective source of information (Lechner et al., 2006). This data has been extensively employed in previous studies (Ma et al., 2015; Zhao and Lu, 2016).

We selected the 2016 survey data as the research sample because only this year’s data provided a detailed description of entrepreneurs’ perceptions of environmental uncertainty. After winsorizing some continuous variables at the 1st and 99th percentiles, we obtained a sample of 2733 (Li et al., 2020).

3.2 Measurements

3.2.1 Dependent variable

Previous empirical studies have used patents or green management practices, such as reducing fossil energy consumption, to measure firms’ eco-innovation or green innovation (Tsai and Liao, 2017a; He et al., 2018). In contrast to previous studies, we focused on eco-product innovation and eco-process innovation through two items in the CPES dataset. These two items are “developing new environmental technology equipment or environmental products” and “adding new environmental technology equipment or improving the environmental quality of products.” Firm’s Eco-Innovation is coded as 1 if the firm participated in either of these two items, and 0 otherwise. Furthermore, we conducted a robustness test by measuring the sum of these two item scores (Score_Eco) as an alternative dependent variable for Eco-Innovation.

3.2.2 Independent variable

The independent variable in our study is PEU, which was measured based on entrepreneurs’ perceptions of nine macro-environmental risks in the CPES over the next 5 years (Roper and Tapinos, 2016). Similar to Haarhaus and Liening (2020), these risks mainly include social and economic risks, namely “economic depression,” “worker unemployment,” “rising prices,” “bursting of the housing bubble,” “financial crisis,” “local government bankruptcy,” “ecological degradation,” “intensification of social conflicts,” and “terrorism.” The options for these items range from 1 to 5, with 1 representing “strongly disagree” and 5 representing “strongly agree” (Afshar Jahanshahi and Brem, 2020). PEU was calculated as the ratio of the sum of these nine items’ scores to the maximum of the item scores. The specific formula is as follows:

where

In addition, we employed the natural logarithm of the sum of these nine items’ scores (LnPEU) as an alternative independent variable to measure PEU, which can be used to test the robustness of our results.

The research methodology included two moderators: government subsidies (Gov_Subsidy) and government official visiting (GOV). Additionally, we included the moderator of government intervention (Gov_Intervention) to evaluate the moderating effect of government involvement on the relationship between PEU and corporate eco-innovation from a holistic perspective. In CPES, government subsidy was measured by querying whether the firm received special incentives and financial support from the local government, with the variable coded as 1 if the answer was “yes” and 0 if the answer was “no” (Tsai and Liao, 2017b; Long and Liao, 2021). GOV was measured by querying whether local officials visited or worked on-site at the firm, with the variable coded as 1 if “yes” and 0 if “no” (Yunxia and Qiu, 2021). Government_ Intervention was measured by inquiring about the firm’s level of satisfaction with the local government’s intervention, with a score of 5 assigned if “very satisfied” was selected, and a score of 1 assigned if “very dissatisfied” was selected.

3.2.3 Control variables

We selected control variables at the company, entrepreneurial qualities, and external environmental levels to control for potential effects on eco-innovation.

At the firm level, we used the natural logarithm of revenue to measure the firm size (Size) and the number of years since the firm was founded to measure firm age (Firm_Age). Previous research has found that larger or longer-established enterprises may have greater resources, which may benefit the firm’s eco-innovation (Afshar Jahanshahi and Brem, 2020). We measured firms’ financial leverage with the debt-to-assets ratio (Lev) and profitability with return on equity (ROE) (Cui et al., 2021). In addition, we controlled whether the firms were ready to go public (Pre_IPO), as these firms may face greater normative pressure, which is an important factor influencing firms’ eco-innovation (Cai and Li, 2018).

At the entrepreneurial characteristic level, we controlled for entrepreneur age (Entrepreneur_Age) and education (Education). Education was measured as an ordered variable, with a code of 1 for junior high school or less, and a code of 6 for doctorate degrees. Younger entrepreneurs may be more inclined to pursue innovative and risky behaviors, while entrepreneurs with higher education possess stronger learning abilities and more inventive ideas.

At the external environment level, we controlled for government environmental regulatory pressure (Gov_ Regulation) and competitive pressure (Competitive pressure). Both of these variables were coded as 1 for no pressure and 5 for very high pressure. Flexible environmental regulations (Tsai and Liao, 2017b) and suitable competitive pressures (Cai and Li, 2018) can increase firms’ innovation motivation. Finally, we controlled for the province and industry effects to capture changes in province and industry.

3.3 Estimation method

In our research, we utilized ordinary least squares (OLS) to estimate regression (2) and incorporated fixed effects at the industry and province levels in our estimation to investigate the relationship between entrepreneurial PEU and eco-innovation.

Where,

To further examine the moderating effect, we estimated regression (3) by introducing interaction terms between the moderators and independent variables in regression (2).

Where,

4 Results

4.1 Descriptive statistics and correlation

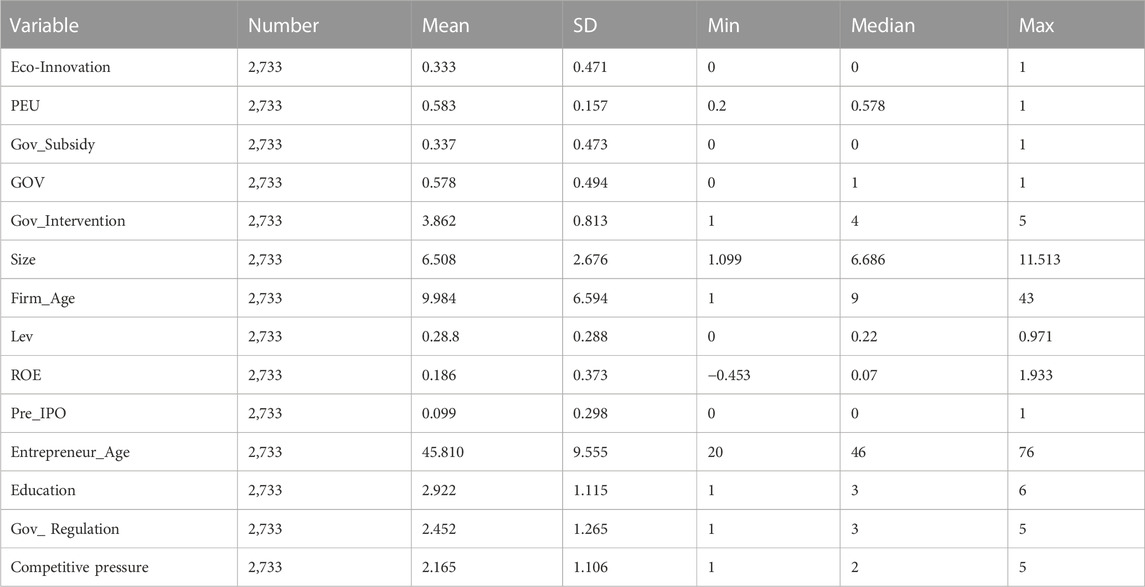

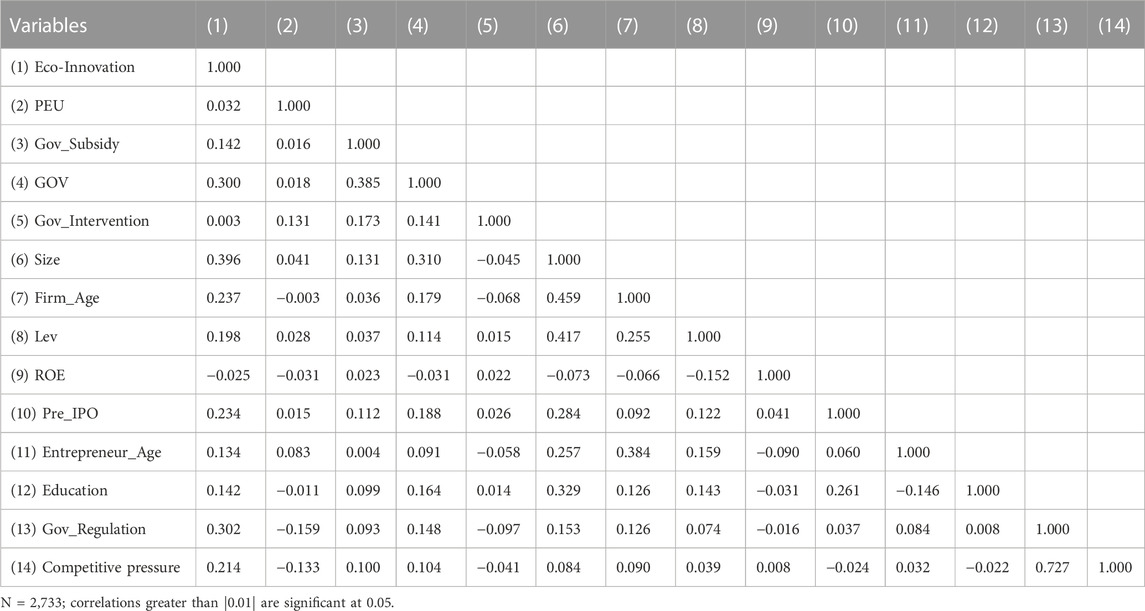

Table 1 presents the descriptive statistics for all variables included in this study. The mean value and standard deviation of Eco-Innovation among firms were 0.333 and 0.471, respectively, indicating significant variation in the extent to which firms engage in eco-innovation, with only 33.3% of firms engaging in such activities. This finding is consistent with Long and Liao (2021). Similarly, there was a significant variation in the extent to which firms received government subsidies (mean value of 0.337, standard deviation of 0.473). The mean value of entrepreneurs’ PEU was 0.583, with a standard deviation of 0.157, indicating a generally strong perception of future environmental uncertainty among entrepreneurs.

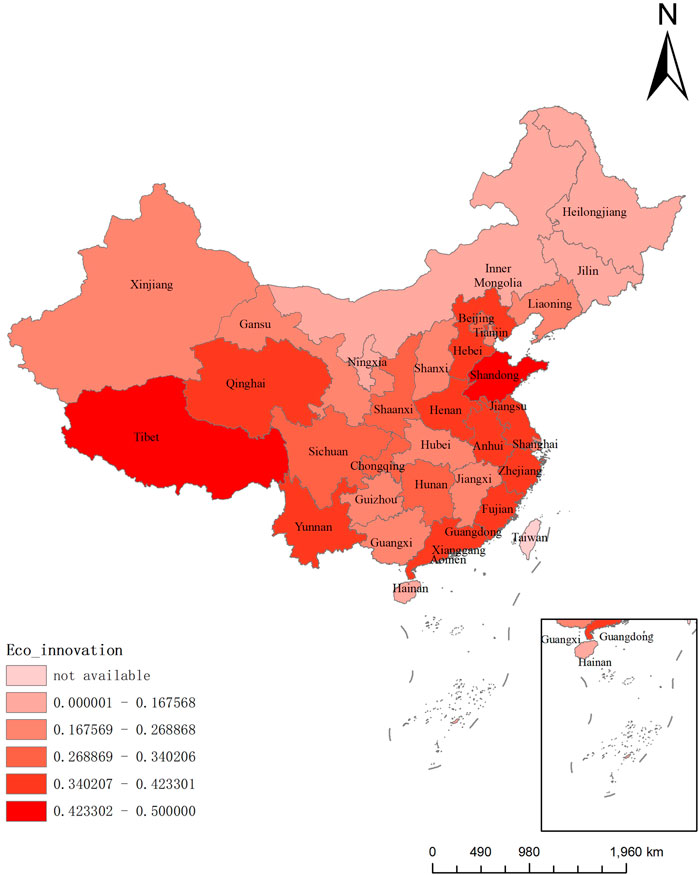

In addition, in order to depict the spatial distribution of eco-innovation levels among SMEs, we presented the average eco-innovation level at the provincial level in Figure 2. The results revealed that the average eco-innovation level in the eastern coastal region of China was significantly higher than that in the central and western regions. Specifically, the average level of eco-innovation in coastal provinces in eastern China was 0.344, while it was 0.273 in other regions. The adoption of more environmentally-friendly production processes and technologies in the eastern coastal provinces, as well as the imposition of stricter environmental regulations by the government, may be internal factors contributing to this difference.

The Pearson correlation coefficients between the variables are presented in Table 2. Consistent with our hypothesis, there is a positive correlation between Eco-Innovation and entrepreneurs’ PEU, with a correlation coefficient of 0.032. Moreover, the correlation coefficients between Eco-Innovation and the other variables are less than 0.5. In addition, we calculated variance inflation factors (VIFs) for the estimated models, which ranged from 1.04 to 2.22. These values are considerably below the acceptable level of 10 (Wang and Qian, 2011), indicating that multicollinearity was not a serious problem in this study.

4.2 Multivariate regression test

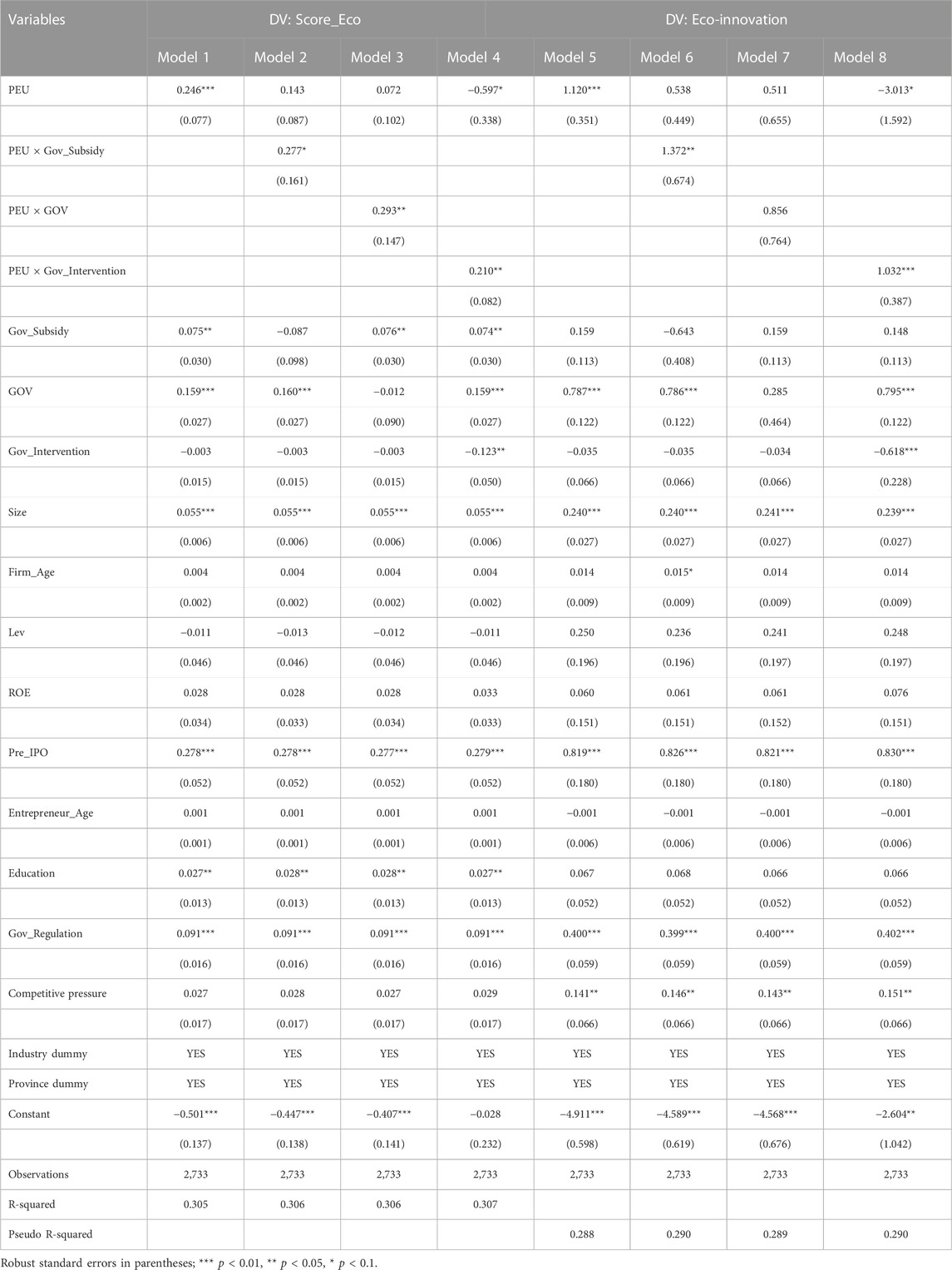

The regression results are presented in Table 3. Model 1 serves as the baseline model with only control variables. In Model 2, we introduced PEU to test Hypothesis 1. The results demonstrate a positive and significant effect of PEU on Eco-Innovation (

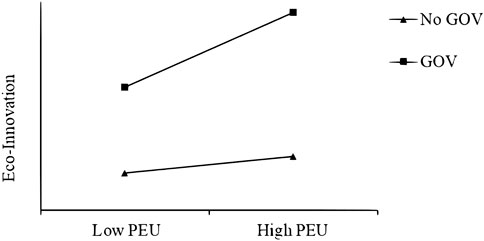

The results of the moderating effect are presented in Models 3 and 4. Model 3 examined the moderating effect of government subsidies by introducing the interaction term between Gov_Subsidy and PEU, which produces a positive and significant coefficient (

To further illustrate the moderating effects of the selected moderators, we plotted the estimated values of these moderating relationships as shown in Figures 3, 4. The results in Figure 3 indicate that firm eco-innovation intensity is higher when they receive government subsidies, suggesting that such subsidies increase firm motivation to engage in eco-innovation activities, thus providing further support for Hypothesis 2a. Similarly, Figure 4 demonstrates that GOV significantly strengthens the relationship between entrepreneurs’ PEU and eco-innovation, thereby providing additional evidence for Hypothesis 2b.

FIGURE 4. The effect of PEU on eco-innovation under different levels of government official visiting.

4.3 Robustness check

We performed several analyses to ensure the robustness of our results. Firstly, we used the eco-innovation score (Score_Eco) as an alternative indicator for Eco-Innovation, which may more accurately reflect the eco-innovation intensity of a firm. The findings are presented in Models 1-4 in Table 4. The results of Models 1-4 show that the coefficients of PEU, PEU × Gov_Subsidy, PEU × GOV, and PEU × Gov_Intervention are positive and significant (

Secondly, as the dependent variable in this study is a categorical variable with only two values, 0 and 1, we employed the Logit model to test the research hypotheses again for robustness. The results of the Logit model are presented in Models 5-8 in Table 4. The regression coefficients of PEU, PEU × Gov_Subsidy, and PEU × Gov_Intervention remained positive and significant (

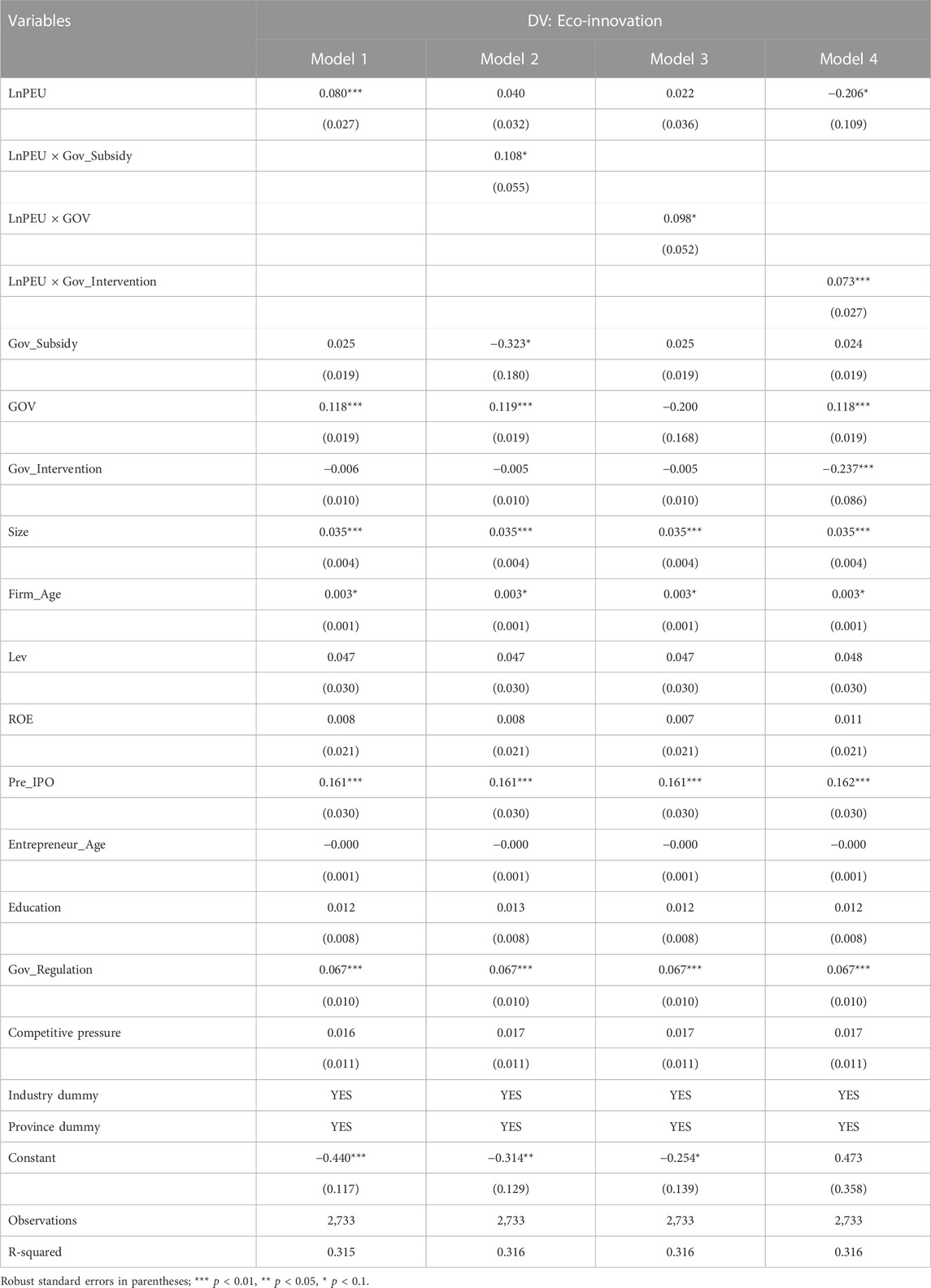

Thirdly, we used LnPEU as an alternative independent variable for PEU. Table 5 presents the results of replacing the independent variables. Models 1-4 demonstrate that the coefficients of LnPEU, LnPEU × Gov_Subsidy, LnPEU × GOV, and LnPEU × Gov_Intervention are all positive and significant (

Another issue that may affect the robustness of our research is the existence of omitted variables and reverse causality in our regressions, which can lead to endogeneity problems. For instance, firms with higher eco-innovation intensity may be more sensitive to external environmental uncertainty. To address this endogeneity problem, we utilized two-stage least squares (2SLS) estimation with an instrumental variable, the industry PEU mean.

The validity of instrumental variables depends on the relevance condition and the exclusion restriction. Firstly, regarding the relevance condition, we argue that the average level of PEU at the provincial level mainly reflects the degree of regional environmental uncertainty, and thus is correlated with entrepreneurs’ perception of external environmental uncertainty, satisfying the relevance condition. Secondly, with respect to the exclusion restriction, we contend that in the context of this study, unobserved firm-specific characteristics related to eco-innovation are unlikely to affect the regional-level environmental variable, that is, used as the instrumental variable, thereby satisfying the exclusion restriction (Fisman and Svensson, 2007).

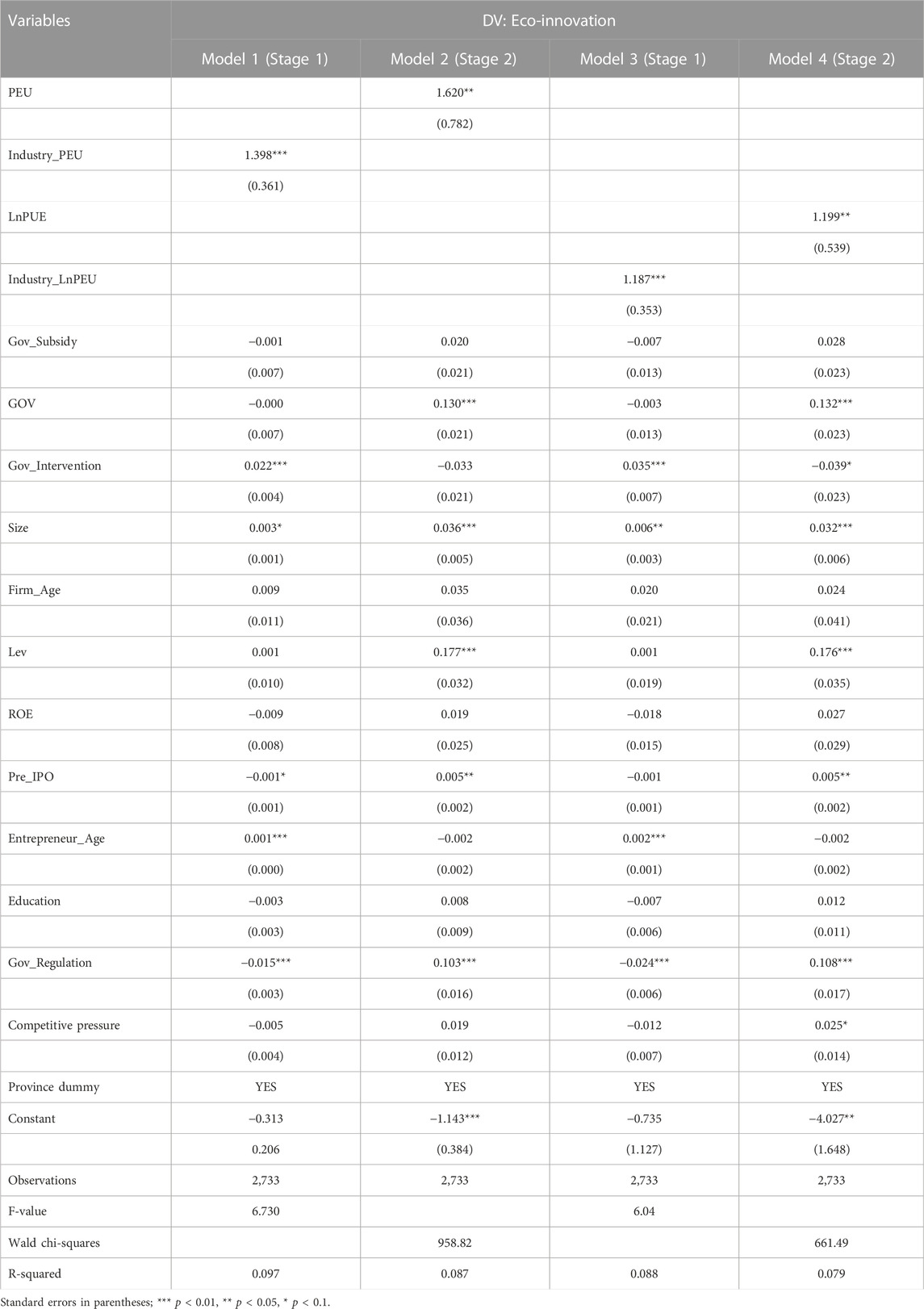

Table 6 presents the estimation results using 2SLS, and we report the results for both stages. The findings of the first stage of Model 1 and Model 3 reveal that both instrumental variables (Industry_PEU and Industry_LnPEU) are significantly associated with entrepreneurs’ PEU. In the second stage, all coefficients, PEU in model 2 (

4.4 Test for mechanism of perceived environmental uncertainty

According to our theory, when entrepreneurs perceive higher levels of environmental uncertainty, the dynamic capabilities of SMEs can be enhanced, leading to a positive impact on the firm’s eco-innovation. To measure a company’s dynamic capabilities, we utilized a CPES item that asks, “What are the most significant changes that companies undertake to adapt to environmental changes?” A company’s Dynamic_Capability is coded as 1 if it has upgraded its technology, transferred its product production to high-end products, and reduced the pollution generated by its production process as part of its transformation; otherwise, it is coded as 0.

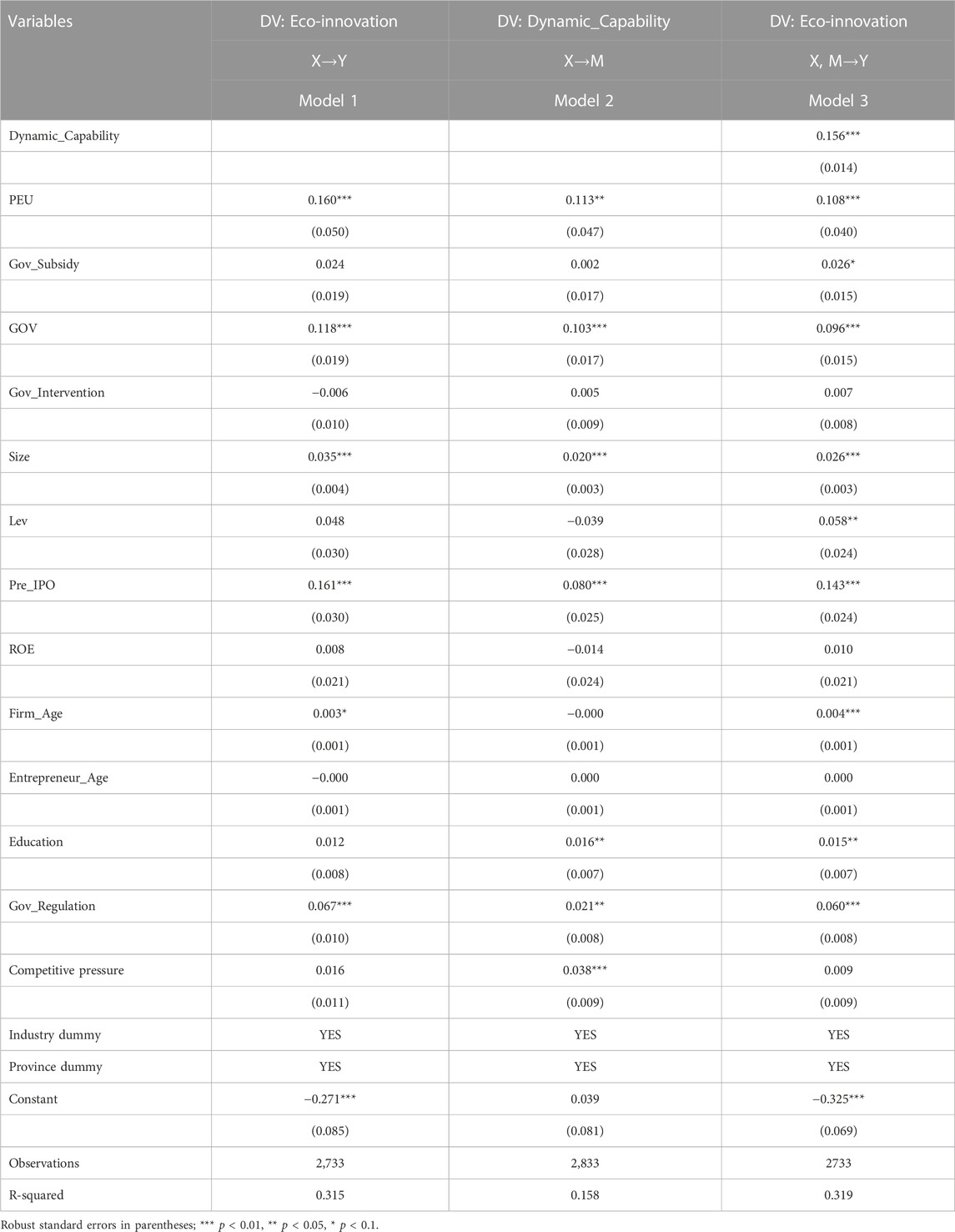

We estimated a mediation model using the firm’s dynamic capabilities as a mediator, and Table 7 reports the results of the analysis of our mediation model. In the first step, we estimated the impact of PEU on Eco-Innovation and the results are consistent with the previous ones. In the second step, we estimated the effect of PEU on firm Dynamic_Capability, and Model 2 demonstrates that PEU has a positive and significant effect on Dynamic_Capability (

5 Conclusion

The impact of objective environmental uncertainty on entrepreneurs’ decisions needs to be realized by influencing entrepreneurs’ perceptions of uncertainty, which means that perceived environmental uncertainty is the deeper factor influencing the firm’s strategic adjustment. This study examines the impact of SME entrepreneurs’ PEU on their eco-innovation activities, and investigates the moderating role of government intervention (government subsidies and government official visits) on this relationship. Our findings, based on a sample of 2,733 SMEs from the 2016 CPES, provide robust evidence that perceived environmental uncertainty has a significant and positive effect on eco-innovation. In addition, we find that the positive relationship between entrepreneurs’ PEU and eco-innovation is strengthened by government subsidies or official visits. Firms’ dynamic capabilities are critical in overcoming environmental uncertainty and driving eco-innovation, enabling them to detect opportunities and threats in the external environment, and effectively mobilize internal and external resources to capture opportunities and continuously adapt their strategies to the dynamic environment. Our conclusions have significant implications for how firms and governments can collaborate in uncertain environments to achieve low-carbon development.

5.1 Theoretical contributions

As the primary theoretical contribution of this study, we emphasize the influence of entrepreneurs’ PEU on corporate eco-innovation from a dynamic capability viewpoint, thereby enhancing the literature on uncertainty and corporate innovation. Previous research has mainly assumed that the risk of external environmental uncertainty prompts entrepreneurs to delay innovation investment decisions. However, they primarily focused on objective macro-environmental risks rather than entrepreneurs’ attitudes towards risk (Roper and Tapinos, 2016). In fact, entrepreneurs’ attitudes or perceptions of risk are essential factors influencing business decisions (Zayadin et al., 2022). We have linked entrepreneurial PEU with corporate eco-innovation decisions based on the dynamic capabilities of the organization. Our findings not only bridge the gap between objective environmental uncertainty and PEU but also enable researchers to gain a deeper understanding of how dynamic capabilities function in uncertain environments.

Furthermore, we found that government intervention significantly contributes to improving the strategic flexibility of enterprises in an uncertain environment, providing theoretical support for the rationality of government intervention behavior in uncertain situations. Whether the influence of government interference on innovation activities is a “helping hand” or a “grabbing hand” has been the focus of academic discussion. Some scholars argue that government public funding has a crowding-out effect on firms’ innovation investments (Dimos and Pugh, 2016), while others contend that government financial support reduces firms’ R&D costs and risks (Long and Liao, 2021), thereby increasing firms’ willingness to research eco-product innovation. Our study emphasizes the positive effect of government involvement on company eco-innovation under uncertainty, providing theoretical evidence for government intervention under uncertainty. These findings further clarify the boundary conditions for the impact of PEU on eco-innovation.

5.2 Practical implications

More practically, this research provides new evidence and insights for corporate decision-makers and government policymakers about managing corporate eco-innovation in an uncertain environment. Based on our results, they can have a more transparent and comprehensive understanding of the risks and opportunities arising from environmental uncertainty.

First, corporate decision-makers, especially SMEs, should clearly recognize the opportunities and challenges brought by the changing environment when they perceive the uncertainty of the external environment as elevated. Although eco-innovation in an unpredictable environment carries the risk of revenue decreases, organizations can obtain a first-mover advantage and turn challenges into opportunities in a crisis if they are adaptable and have a solid dynamic capability. They should be willing to embrace technological advancements in an uncertain environment, strive to enhance their dynamic capabilities, and actively seek government resource support. Based on the resources available, companies should fully leverage their dynamic capacities to integrate and reconfigure resources to address the difficulties of uncertainty.

Second, in an unpredictable environment, policymakers should support the eco-innovation activities of businesses with financial support and strategic direction. This is because government interventions can increase the strategic flexibility of businesses and decrease the cost of eco-innovation, thereby increasing their motivation to participate in eco-innovation. In addition, the government should value government official visits as a means of government intervention, that is, significantly different from government subsidies. It improves business-government interaction and reduces the information asymmetry between the two parties. Policymakers can conduct more effective and long-term strategic planning based on corporate strategic information, a substantial amount of which is unavailable without in-depth enterprise access. Companies can make timely strategic adjustments based on government officials’ policy priorities.

5.3 Limitations and directions for future research

Our research also has some limitations. Firstly, we used cross-sectional data, and although we eliminated some adverse effects by using instrumental variables, we cannot entirely exclude any unfavorable impacts from the use of cross-sectional data. In the future, longitudinal data could be used to further validate the relationship between entrepreneurs’ PEU and company eco-innovation. Secondly, we used a sample of SMEs to test our hypothesis, without considering large enterprises. SMEs may be compelled to engage in eco-innovation due to survival pressure or resource constraints, whereas large enterprises have fewer of these constraints and may be less sensitive to perceptions of environmental uncertainty. They may not have a positive attitude towards eco-innovation in an uncertain environment. Therefore, using a sample of large enterprises in future research could be interesting for studying this issue.

Data availability statement

The data that support the findings of this study are available from the corresponding author upon reasonable request. Requests to access these datasets should be directed to BY MTg4NDQxOTA2MTVAMTYzLmNvbQ==.

Author contributions

XH: data collection, conceptualization, and writing—original draft. BY: writing—review and editing, and supervision. ZH: methodology. All authors contributed to the article and approved the submitted version.

Funding

This work was supported by the National Natural Science Foundation of China (No.72202114) and Natural Science Foundation of Shandong Province (No. ZR2022QG024).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Afshar Jahanshahi, A., and Brem, A. (2020). Entrepreneurs in post-sanctions Iran: Innovation or imitation under conditions of perceived environmental uncertainty? Asia Pac. J. Manag. 37 (2), 531–551.

Aldehayyat, J. S. (2015). Environmental scanning in business organisations: Empirical evidence from a Middle Eastern country context. Manag. Res. Rev.,

Belderbos, R., Tong, T. W., and Wu, S. (2019). Multinational investment and the value of growth options: Alignment of incremental strategy to environmental uncertainty. Strategic Manag. J. 40 (1), 127–152.

Cai, W., and Li, G. (2018). The drivers of eco-innovation and its impact on performance: Evidence from China. J. Clean. Prod. 176, 110–118.

Cui, X., Wang, C., Liao, J., Fang, Z., and Cheng, F. (2021). Economic policy uncertainty exposure and corporate innovation investment: Evidence from China. Pacific-Basin Finance J. 67, 101533.

Demirel, P., and Kesidou, E. (2019). Sustainability-oriented capabilities for eco-innovation: Meeting the regulatory, technology, and market demands. Bus. Strategy Environ. 28 (5), 847–857.

Dimos, C., and Pugh, G. (2016). The effectiveness of R&D subsidies: A meta-regression analysis of the evaluation literature. Res. Policy 45 (4), 797–815.

Drnevich, P. L., and Kriauciunas, A. P. (2011). Clarifying the conditions and limits of the contributions of ordinary and dynamic capabilities to relative firm performance. Strategic Manag. J. 32 (3), 254–279.

Duncan, R. B. (1972). Characteristics of organizational environments and perceived environmental uncertainty. Adm. Sci. Q., 313–327.

Fisman, R., and Svensson, J. (2007). Are corruption and taxation really harmful to growth? Firm level evidence. J. Dev. Econ. 83 (1), 63–75.

García-Pérez, A. M., and Yanes-Estévez, V. (2022). Longitudinal study of perceived environmental uncertainty. An application of Rasch methodology to SMES. J. Adv. Manag. Res.,

Gaur, A. S., Mukherjee, D., Gaur, S. S., and Schmid, F. (2011). Environmental and firm level influences on inter-organizational trust and SME performance. J. Manag. Stud. 48 (8), 1752–1781.

Görg, H., and Strobl, E. (2007). The effect of R&D subsidies on private R&D. Economica 74 (294), 215–234.

Gulen, H., and Ion, M. (2016). Policy uncertainty and corporate investment. Rev. Financial Stud. 29 (3), 523–564.

Haarhaus, T., and Liening, A. (2020). Building dynamic capabilities to cope with environmental uncertainty: The role of strategic foresight. Technol. Forecast. Soc. Change 155, 120033.

Han, J. K., Kim, N., and Srivastava, R. K. (1998). Market orientation and organizational performance: Is innovation a missing link? J. Mark. 62 (4), 30–45.

Hanlon, M., Maydew, E. L., and Saavedra, D. (2017). The taxman cometh: Does tax uncertainty affect corporate cash holdings? Rev. Account. Stud. 22 (3), 1198–1228.

He, F., Miao, X., Wong, C. W., and Lee, S. (2018). Contemporary corporate eco-innovation research: A systematic review. J. Clean. Prod. 174, 502–526.

Heger, T., and Rohrbeck, R. (2012). Strategic foresight for collaborative exploration of new business fields. Technol. Forecast. Soc. Change 79 (5), 819–831.

Jia, M., Xiang, Y., and Zhang, Z. (2019). Indirect reciprocity and corporate philanthropic giving: How visiting officials influence investment in privately owned Chinese firms. J. Manag. Stud. 56 (2), 372–407.

Lechner, C., Dowling, M., and Welpe, I. (2006). Firm networks and firm development: The role of the relational mix. J. Bus. Ventur. 21 (4), 514–540.

Li, D., Tong, T. W., Xiao, Y., and Zhang, F. (2022). Terrorism-induced uncertainty and firm R&D investment: A real options view. J. Int. Bus. Stud. 53 (2), 255–267.

Li, J., Liu, W., and Yuan, D. (2020). Private entrepreneurs of Communist party members and corporate social responsibility: Evidence from Chinese private enterprise survey. Theor. Econ. Lett. 10 (3), 635–654.

Liu, W., De Sisto, M., and Li, W. H. (2021). How does the turnover of local officials make firms more charitable? A comprehensive analysis of corporate philanthropy in China. Emerg. Mark. Rev. 46, 100748.

Long, S., and Liao, Z. (2021). Are fiscal policy incentives effective in stimulating firms' eco-product innovation? The moderating role of dynamic capabilities. Bus. Strategy Environ. 30 (7), 3095–3104.

Ma, G., Rui, O. M., and Wu, Y. (2015). A springboard into politics: Do Chinese entrepreneurs benefit from joining the government-controlled business associations? China Econ. Rev. 36, 166–183.

McKelvie, A., Haynie, J. M., and Gustavsson, V. (2011). Unpacking the uncertainty construct: Implications for entrepreneurial action. J. Bus. Ventur. 26 (3), 273–292.

Melander, L. (2018). Customer and supplier collaboration in green product innovation: External and internal capabilities. Bus. Strategy Environ. 27 (6), 677–693.

Milliken, F. J. (1987). Three types of perceived uncertainty about the environment: State, effect, and response uncertainty. Acad. Manag. Rev. 12 (1), 133–143.

Nagar, V., Schoenfeld, J., and Wellman, L. (2019). The effect of economic policy uncertainty on investor information asymmetry and management disclosures. J. Account. Econ. 67 (1), 36–57.

Parnell, J. A., Lester, D. L., Long, Z., and Köseoglu, M. A. (2012). How environmental uncertainty affects the link between business strategy and performance in SMEs: Evidence from China, Turkey, and the USA. Management Decision.

Robinson, C. V., and Simmons, J. E. (2018). Organising environmental scanning: Exploring information source, mode and the impact of firm size. Long. Range Plan. 51 (4), 526–539.

Roper, S., and Tapinos, E. (2016). Taking risks in the face of uncertainty: An exploratory analysis of green innovation. Technol. Forecast. Soc. Change 112, 357–363.

Ross, J. M., Fisch, J. H., and Varga, E. (2018). Unlocking the value of real options: How firm-specific learning conditions affect R&D investments under uncertainty. Strategic Entrepreneursh. J. 12 (3), 335–353.

Russell, R. D., and Russell, C. J. (1992). An examination of the effects of organizational norms, organizational structure, and environmental uncertainty on entrepreneurial strategy. J. Manag. 18 (4), 639–656.

Shao, S., Hu, Z., Cao, J., Yang, L., and Guan, D. (2020). Environmental regulation and enterprise innovation: A review. Bus. Strategy Environ. 29 (3), 1465–1478.

Teece, D. J. (2012). Dynamic capabilities: Routines versus entrepreneurial action. J. Manag. Stud. 49 (8), 1395–1401.

Teece, D. J., Pisano, G., and Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Manag. J. 18 (7), 509–533.

Teece, D. J. (2014). The foundations of enterprise performance: Dynamic and ordinary capabilities in an (economic) theory of firms. Acad. Manag. Perspect. 28 (4), 328–352.

Teece, D., and Leih, S. (2016). Uncertainty, innovation, and dynamic capabilities: An introduction. Calif. Manag. Rev. 58 (4), 5–12.

Tsai, K. H., and Liao, Y. C. (2017). Innovation capacity and the implementation of eco-innovation: Toward a contingency perspective. Bus. Strategy Environ. 26 (7), 1000–1013.

Tsai, K. H., and Liao, Y. C. (2017). Sustainability strategy and eco-innovation: A moderation model. Bus. Strategy Environ. 26 (4), 426–437.

Wang, H., and Qian, C. (2011). Corporate philanthropy and corporate financial performance: The roles of stakeholder response and political access. Acad. Manag. J. 54 (6), 1159–1181.

Wang, L., Kong, D., and Zhang, J. (2021). Does the political promotion of local officials impede corporate innovation? Emerg. Mark. Finance Trade 57 (4), 1159–1181.

Weaven, S., Quach, S., Thaichon, P., Frazer, L., Billot, K., and Grace, D. (2021). Surviving an economic downturn: Dynamic capabilities of SMEs. J. Bus. Res. 128, 109–123.

Wong, H. Y., Sultan, P., Sit, J. K., Li, E., and Hung, J.-Y. (2014). “Environmental scanning–an information system framework for strategic decisions in SMEs: A case study analysis,” in Handbook of research on strategic management in small and medium enterprises (Hershey, PA: IGI Global), 40–54.

Yi, M., Wang, Y., Yan, M., Fu, L., and Zhang, Y. (2020). Government R&D subsidies, environmental regulations, and their effect on green innovation efficiency of manufacturing industry: Evidence from the Yangtze River economic belt of China. Int. J. Environ. Res. Public Health 17 (4), 1330.

Yunxia, B., and Qiu, M. (2021). Official visit, Bank credit and maturity mismatch: Evidence from Chinese listed firms. Emerg. Mark. Finance Trade, 57 (15), 4361–4379.

Zayadin, R., Zucchella, A., Anand, A., Jones, P., and Ameen, N. (2022). Entrepreneurs’ decisions in perceived environmental uncertainty. Br. J. Manag.,

Zhao, H., and Lu, J. (2016). Contingent value of political capital in bank loan acquisition: Evidence from founder-controlled private enterprises in China. J. Bus. Ventur. 31 (2), 153–174.

Keywords: dynamic capability, eco-innovation, perceived environmental uncertainty, government subsidy, government official visiting

Citation: Han X, Yue B and He Z (2023) Thriving in uncertainty: examining the relationship between perceived environmental uncertainty and corporate eco-innovation through the lens of dynamic capabilities. Front. Environ. Sci. 11:1196997. doi: 10.3389/fenvs.2023.1196997

Received: 30 March 2023; Accepted: 18 May 2023;

Published: 05 June 2023.

Edited by:

Xiao-Guang Yue, European University Cyprus, CyprusReviewed by:

Yuanjun Zhao, Nanjing Audit University, ChinaXuefeng Shao, The University of Newcastle, Australia

Copyright © 2023 Han, Yue and He. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Beibei Yue, MTg4NDQxOTA2MTVAMTYzLmNvbQ==

Xiang Han

Xiang Han Beibei Yue*

Beibei Yue* Zhiwei He

Zhiwei He