- 1Department of Economics, Shanghai University, Shanghai, China

- 2Department of Management, Shanghai University, Shanghai, China

ESG information disclosure is an essential aspect of corporate ESG responsibility and has gained significant attention in the context of ecological civilization development within the socialist market economy. However, in China’s early stage of ESG development, challenges such as ESG rating discrepancies, “greenwashing”, and corporate “cleansing” accompany ESG information disclosure. This study aims to investigate the impact of corporate ESG information disclosure on audit fees using a sample of non-financial A-share listed companies in China from 2011 to 2020. Drawing on the “deep pocket” theory, risk premium theory, and cost-benefit principle, the research examines the relationship between ESG information disclosure and audit fees. The findings reveal that approximately one-third of Chinese enterprises disclose ESG information, and substantial variation exists in the disclosure scores among the disclosed firms. The empirical analysis further demonstrates that firms disclosing ESG information tend to face higher audit fees, with higher ESG disclosure scores associated with increased audit fees. Moreover, an increase in the disclosure score of any ESG dimension (environment, social responsibility, and corporate governance) leads to higher audit fees. The study also identifies operational risk as a mediating factor in the relationship between ESG disclosure and audit fees. Additionally, media attention can dampen the positive effect of ESG disclosure scores on audit fees. Furthermore, the impact of ESG disclosure scores on audit fees is more pronounced in firms that voluntarily disclose ESG information before the implementation of the new Environmental Protection Law. These findings contribute to the literature and provide theoretical insights for governmental and regulatory decision-making, corporate managers, auditors, and ESG investors in China.

1 Introduction

ESG (Environment, Social, and Corporate Governance) has gained significant recognition as a crucial factor in investment decisions since its inception in the 1970s. In recent years, ESG investment and information disclosure have become increasingly important in China, with the government actively promoting the implementation of green finance and carbon neutrality (Chen and Xie, 2022; Luo, 2022). However, several challenges and issues persist in relation to ESG disclosure, including the lack of standardization, low levels of disclosure, and the prevalence of “greenwashing” and corporate “laundering” practices.

In the current ESG landscape, understanding the effects of ESG disclosure and disclosure scoring on audit fees and associated mechanisms is crucial (Simunic, 1980). Previous research indicates that incorporating ESG information into audits can introduce complexity and increase costs. However, alternative studies argue that ESG information can complement financial statement information, mitigating corporate information risk and operational risk (Zhang, 2017; Ma, 2019; Xiao et al., 2021). Furthermore, it is essential to have a comprehensive understanding of the different dimensions of ESG information, as stakeholders may assign varying levels of importance to each dimension. Some studies highlight the positive impact of social aspects of ESG on stock returns, while others emphasize the role of environmental and governance dimensions in reducing financing costs (Brammer and Pavelin, 2006; Marcel, 2019; Qiu and Yin, 2019). Therefore, addressing challenges and controversies related to ESG ratings and considering the influence of media attention on environmental responsibility and audit fees are crucial for building stakeholder trust and establishing corporate differentiation (Christensen et al., 2021; Raghunandan and Rajgopal, 2022).

In the pursuit of high-quality and cost-effective audits, prior studies emphasize the consideration of client characteristics and the potential presence of agency issues to ensure the reliable assessment of ESG data and scores (Ali and Lesage, 2013; Griffin et al., 2010; Zahid et al., 2022). Research findings indicate that ESG factors are associated with increased costs and diminished profitability (Griffin et al., 2010). However, companies with robust ESG strategies tend to be rewarded by customers, leading to benefits (Galant and Cadez, 2017; Saygili et al., 2022; Okafor et al., 2021). Additionally, green financing emerges as a significant approach with profound implications for advancing sustainable development by providing financial support for environmentally focused projects and prioritizing climate change mitigation (Desalegn and Tangl, 2022). Studies have explored the impact of the contemporary media environment and environmental regulations on green technology innovation in highly polluting industries in China, underscoring the importance of understanding the strength, effects, and heterogeneity of this relationship (Şimşek and Öztürk, 2021; Li et al., 2023). Furthermore, research has examined the association between Chinese traditional culture and corporate environmental responsibility, emphasizing the need to analyze the strength, effect, and heterogeneity of this relationship while considering relevant moderating factors (Li et al., 2020; Li and Wang, 2022; Huang et al., 2022).

This study aims to examine the factors auditors consider when determining audit fees within the context of ESG disclosure. The objective is to provide insights into the mechanisms that drive the impact of ESG disclosure on audit fees, informing the development of effective ESG disclosure policies and regulations that reduce corporate information risk and operational risk while ensuring efficient and effective audits. Given that China is in the early stages of ESG development, the study investigates the impact of ESG information disclosure on audit fees from 2011 to 2020. Drawing on the “deep pocket” theory, risk premium theory, and cost-benefit principle, the study employs inductive and empirical analysis to explore the relationship between ESG information disclosure, disclosure scores, and audit fees. Additionally, the study examines the mediating effect of operational risk and the moderating effect of media attention on this relationship.

In terms of contribution and novelty, this paper significantly advances our understanding of the relationship between corporate ESG information disclosure and audit fees. By incorporating multiple theoretical perspectives, including the “deep pocket” theory, risk premium theory, and cost-benefit principle, this study provides a robust foundation for analysis. The research hypotheses proposed in this study guide the comprehensive investigation of the impact of ESG information disclosure, disclosure scores, and the three dimensions of disclosure on audit fees. This holistic understanding of the interplay between these factors contributes to the existing body of knowledge. Furthermore, this study introduces the mediating variable of operational risk and the moderating variable of media attention, adding depth and breadth to the examination of the relationship between ESG and audit fees. By uncovering the nuanced mechanisms and contextual factors influencing this relationship, the study offers valuable insights for various stakeholders, including government decision-makers, regulators, corporate managers, auditors, and ESG investors in China. Moreover, this paper conducts heterogeneity analysis, grouping the samples to explore the differential effects of disclosure nature and the policy implications of the new Environmental Protection Law. This approach enhances the relevance of the study and contributes to the knowledge base by addressing the unique characteristics and dynamics of the Chinese ESG disclosure landscape.

The paper is structured into four sections: Section 2 presents the theoretical analysis and research hypotheses; Section 3 describes the research design; Section 4 presents the empirical findings and analysis; and finally, Section 5 provides conclusions and recommendations.

2 Literature review and hypothesis development

2.1 ESG information disclosure and its impact on audit fees

The role of auditors as independent third parties in reviewing the financial reports of audited entities and expressing audit opinions is crucial in the capital market. As the audit function evolves, auditors are now required to examine both the financial and non-financial information of audited entities during the audit of financial statements. Corporate ESG information, being a vital non-financial aspect, must be read, considered, checked, and reported on by auditors in their financial statement audits.

Companies that exhibit strong corporate ESG performance strive to differentiate themselves by providing appropriate disclosures, thereby gaining higher levels of trust from stakeholders (Jensen and Meckling, 1976). To meet stakeholder expectations, companies must actively engage in ESG practices, pay attention to the corporate ESG system, and disclose relevant information. However, corporate ESG information disclosure in China is still in its early stages, necessitating a unified standard for information disclosure. Consequently, the introduction of corporate ESG matters and the implementation of ESG strategic management systems have increased the complexity of the audit environment.

Companies that actively disclose ESG information may be seeking to divert attention from negative behaviors and create a positive image. Moreover, such companies may imply a higher level of surplus management, leading to potential operational risks and increased litigation risks. Additionally, companies with poor environmental performance may disclose environmental information to justify their actual performance (Huang, 2020). The heightened complexity of the audit environment exposes auditors to greater litigation risk, resulting in increased audit fees. Based on the aforementioned statements, we propose the following hypothesis:

H1: Companies that actively disclose ESG information have higher audit fees compared to companies that do not disclose ESG information, even after controlling for other relevant factors.

2.2 The relationship between ESG disclosure scores and audit fees

In recent years, there has been an increasing focus on environmental, social, and corporate governance (ESG) performance (Raghunandan and Rajgopal, 2022). However, the validity and reliability of ESG ratings remain a subject of controversy. Studies have revealed variations among different rating agencies in terms of the scope and measurement methods of ESG selection, leading to inconsistent rating outcomes (Berg et al., 2022). Additionally, some companies may strive for high ESG ratings through superficial symbolic activities without genuinely implementing ESG practices. Therefore, in the context of inadequate ESG information disclosure, companies with higher ESG disclosure scores face elevated audit risks.

According to the risk premium theory, audit fees increase in response to higher risk levels. When auditing companies with high ESG disclosure scores, auditors typically exert additional effort in reviewing, assessing, and verifying the information to fulfill their ethical obligations and exercise professional prudence (Raghunandan and Rajgopal, 2022). This approach aligns with the cost-effective principle that audit fees should reflect the exertion of comprehensive audit efforts and allocation of resources.

Furthermore, research suggests that some companies engage in ESG practices to cultivate a favorable public image and secure financing. However, highly rated firms may increase pollution in pursuit of profitability expectations, leveraging their good reputation to mitigate adverse impacts (Thomas et al., 2022). This behavior may result from autonomous choices made by firms, reflecting effective communication and interaction with stakeholders or potentially masking corporate misconduct (Verrecchia, 1990). Additionally, there exists a phenomenon known as “greenwashing”, wherein companies undertake symbolic activities to achieve higher ESG ratings without genuinely implementing substantial ESG practices (Li and Xu, 2022).

In summary, within the context of insufficient ESG disclosure, companies with higher ESG disclosure scores face heightened audit risks. The increase in audit fees can be seen as an adjustment based on the risk premium theory, while also reflecting the additional workload and resource commitment required by auditors to fulfill their ethical obligations and exercise professional care (Raghunandan and Rajgopal, 2022). Based on the above analysis, we propose Hypothesis 2:

H2: Companies with higher ESG disclosure scores will incur higher audit fees.

2.3 Three-dimensional ESG disclosure scores and audit fees

Different stakeholders attribute different levels of importance to each dimension of ESG disclosure. For example, investors may prioritize disclosures on corporate governance, consumers may exhibit greater interest in labor and procurement policies, and governments may emphasize compliance with regulatory requirements (Marcel, 2019). However, auditors need to clarify the most important dimension of ESG disclosure during the audit process.

Considering the significant impact that ESG initiatives can have on the financial position of a company, auditors need to review disclosure scores for all ESG dimensions (i.e., environmental, social, and corporate governance) and ensure their alignment with financial information to avoid potential errors in audit opinions. Therefore, irrespective of the dimension in which a company scores higher, auditors may need to perform additional audit procedures and allocate more resources to minimize the risk of issuing erroneous audit opinions, which could result in higher audit fees. Based on this rationale, we propose the following hypothesis:

H3: Companies with higher ESG disclosure scores in the dimensions of environment, society, and corporate governance will experience higher audit fees.

2.4 Mediating variable: operational risk

The literature extensively examines the relationship between corporate non-financial information disclosure and business risk as well as audit risk assessment (Zhang, 2015). However, the association between corporate environmental, social, and governance (ESG) disclosure and the mitigation of business risk remains contentious, yielding mixed findings. Xiao et al. (2021) propose a potential link between ESG disclosure and reduced audit fees through the mitigation of business risk. Nevertheless, it is important to note that ESG information disclosure by Chinese companies is still in its early stages, lacking standardized practices and third-party certification. Moreover, the prevalent practice of “report first, manage later” in China further complicates effective implementation of ESG disclosures by companies. Additionally, management may manipulate non-financial information, which often lacks transparency and verifiability, thereby increasing business risk for companies engaging in ESG disclosures (Merkl-Davies and Brennan, 2007). Consequently, companies that disclose ESG information may face higher risks and increased business risk compared to those that do not disclose ESG information. Drawing upon the “strong pockets” theory, auditors are motivated and capable of incorporating business risks associated with ESG disclosures into their risk assessments, thereby heightening audit risk.

Within the capital market context, numerous companies with high ESG disclosure scores fail to fulfill their ESG responsibilities, primarily due to existing profit incentives. The multi-objective hypothesis posits that firms are more inclined to fulfill ESG responsibilities when such fulfillment maximizes returns, or when high-scoring ESG disclosures are driven by management opportunism aimed at safeguarding reputation (Chen et al., 2016). Investigating corporate donation behavior, Gao et al. (2012) find that this behavior more closely resembles a “green scarf” rather than a “red scarf.” Specifically, a higher ESG disclosure score is associated with a greater likelihood of engaging in earnings management, potentially eroding stakeholders’ trust in the company and straining the company-stakeholder relationship (Barnett, 2007), consequently amplifying business risk. Considering these factors, auditors may enhance risk assessments and undertake additional audit procedures for companies with high ESG disclosure scores to mitigate the risk of audit opinion purchasing practices. Based on this, we propose the following Hypothesis 4:

H4: Operational risk mediates the relationship between audit fees and companies with higher ESG disclosure scores.

2.5 Moderating variable: media attention

The media serves as an external platform that facilitates the dissemination of reliable and efficient information to the market, playing a crucial role as a bridge between companies and the public. It helps to address information frictions, break down barriers, reduce information asymmetry, and enhance corporate transparency (Hammami and Zadeh, 2019; Yang and Zhang, 2021; Li et al., 2023). In this context, the media also plays a significant role in the dissemination of ESG information.

Companies with higher ESG disclosure scores can benefit from increased media attention. This increased attention provides auditors with more opportunities to gather audit evidence, reducing their reliance on information provided solely by the company. As a result, information and audit risks are lowered. Moreover, media scrutiny serves as an informal oversight mechanism that influences corporate behavior and restrains management opportunism.

In companies with higher ESG disclosure scores, media attention can decrease the likelihood of negative corporate actions, such as unethical practices, and reduce the tendency for earnings management. Consequently, this can result in lower audit risks. As a direct consequence, audit fees may be reduced. Based on these considerations, we propose the following hypothesis:

H5: Media attention moderates the positive relationship between company ESG disclosure scores and audit fees, suggesting that higher media attention leads to reduced audit fees for companies with higher ESG disclosure scores.

3 Research design and methodology

3.1 Sample selection and data sources

The Bloomberg Information Database (Bloomberg) introduced corporate ESG disclosure scores in 2011. This study examines the relationship between corporate ESG disclosure and audit fees using data from non-financial A-share listed companies in China from 2011 to 2020. To ensure the quality of the sample, a four-step screening process was conducted. Firstly, financially listed companies were excluded, followed by the exclusion of companies with ST (Special Treatment) and *ST (Double Special Treatment) status. Thirdly, companies listed in the current year were eliminated. Fourthly, samples with more than 1% missing data were excluded. Data on corporate ESG disclosure, disclosure scores for environmental (E), social responsibility (S), and corporate governance (G), media attention data from the China Research Data Service Platform, and other data from the Guotaian database were collected. In total, 22,659 observations were analyzed for the presence or absence of corporate ESG disclosure, and 8,298 observations were analyzed for corporate ESG disclosure scores. To mitigate the impact of outliers, the variables were adjusted to the 1% level.

3.2 Model specification

To control for potential influences on audit fees, we adopt a TWFE (time and entity fixed effects) approach to account for unobservable heterogeneity across firms over time. By incorporating these fixed effects, our objective is to isolate the specific effects of ESG disclosure and leakage scores on audit fees.

In our model, we include ESG-related variables such as ESG disclosure, ESG score, and E/S/G (environmental, social responsibility, and corporate governance) disclosure score. This inclusion is motivated by the increasing importance of ESG considerations in the business world. Stakeholders, including investors, customers, and regulators, demand greater transparency and accountability from companies regarding their ESG performance. Consequently, companies are incentivized to disclose more ESG information in order to differentiate themselves in the market and establish trust with stakeholders.

Simultaneously, we introduce control variables into the model to account for factors that may independently affect audit fees, irrespective of ESG disclosures. These variables may encompass financial performance measures, company size, and industry characteristics, among others. By controlling for these variables, we enhance our ability to isolate the specific impact of ESG disclosure on audit fees. Additionally, we consider industry-level, time-level, and provincial-level controls to capture variations across industries, time periods, and regions. These controls eliminate the influence of unique characteristics or contextual factors that may affect audit fees, thereby ensuring that our analysis accurately captures the specific impact of ESG disclosures within a given industry, time period, and geography. Consequently, models (1), (2), and (3) are explicitly designed to test hypotheses 1 to 3.

In the above equations, lnfeeit represents audit fees, while esgpub, esg, and e/s/g indicate the presence or absence of corporate ESG disclosure, corporate ESG disclosure scores, and corporate E, S, and G disclosure scores in three distinct dimensions, respectively. Control denotes the selected control variables. t and i represent different companies and companies across different years, respectively. Additionally, Ind signifies the industry variable used to control for differences at the industry level, Year represents the time variable used to account for the effects of time factors on enterprises, Province denotes the province variable used to exclude the influence of unbalanced development between regions, and ϵit is the random error term.

In Eq. 1, a positive value for α1 implies that firms disclosing ESG information have higher audit fees, which supports hypothesis 1. Conversely, a negative value for α1 would suggest that hypothesis 1 is not supported. The same interpretation applies to Eqs 2, 3, where a positive α1 value would indicate support for the respective hypothesis, while a negative α1 value would indicate otherwise.

To test hypothesis 4, a stepwise approach was employed, following the method developed by Baron and Kenny (1986) and Judd and Kenny (1981). The study developed the following model, using the corporate ESG disclosure score as an illustration:

To investigate hypothesis 4, the study examined the product of β1 in Eq. 4 and β3 in Eq. 5. A positive value of this product would indicate the presence of operational risk as a mediating factor in the relationship between corporate ESG disclosure and audit fees. If β2 is equal to 0, the mediating effect is considered fully mediating. However, if β2 is not equal to 0, the mediating effect is considered partially mediating. This analysis helps assess the role of operational risk in influencing the relationship between corporate ESG disclosure and audit fees.

To test hypothesis 5, the study employed the commonly used interaction term approach developed by Lu and Han (2007). In this approach, the study designed an interaction term between corporate ESG disclosure and the degree of digital transformation, which was modeled as follows:

Upon careful analysis of the data, the results of the regression analysis may indicate various scenarios. Firstly, a positive correlation between the variable β1 and the variable β3 would suggest that the moderating variable has a positive effect on the relationship between corporate ESG disclosure and audit fees. Alternatively, if β1 is positively correlated with the ESG disclosure variable but negatively correlated with the moderating variable β3, it suggests that the moderating variable may have a dampening effect on the relationship. These findings imply that the moderating variable can either facilitate or impede the relationship between corporate ESG disclosure and audit fees, depending on the nature of its correlation with the relevant variables. It highlights the importance of considering the interactive effects and provides insights into how the relationship may be influenced by the moderating variable.

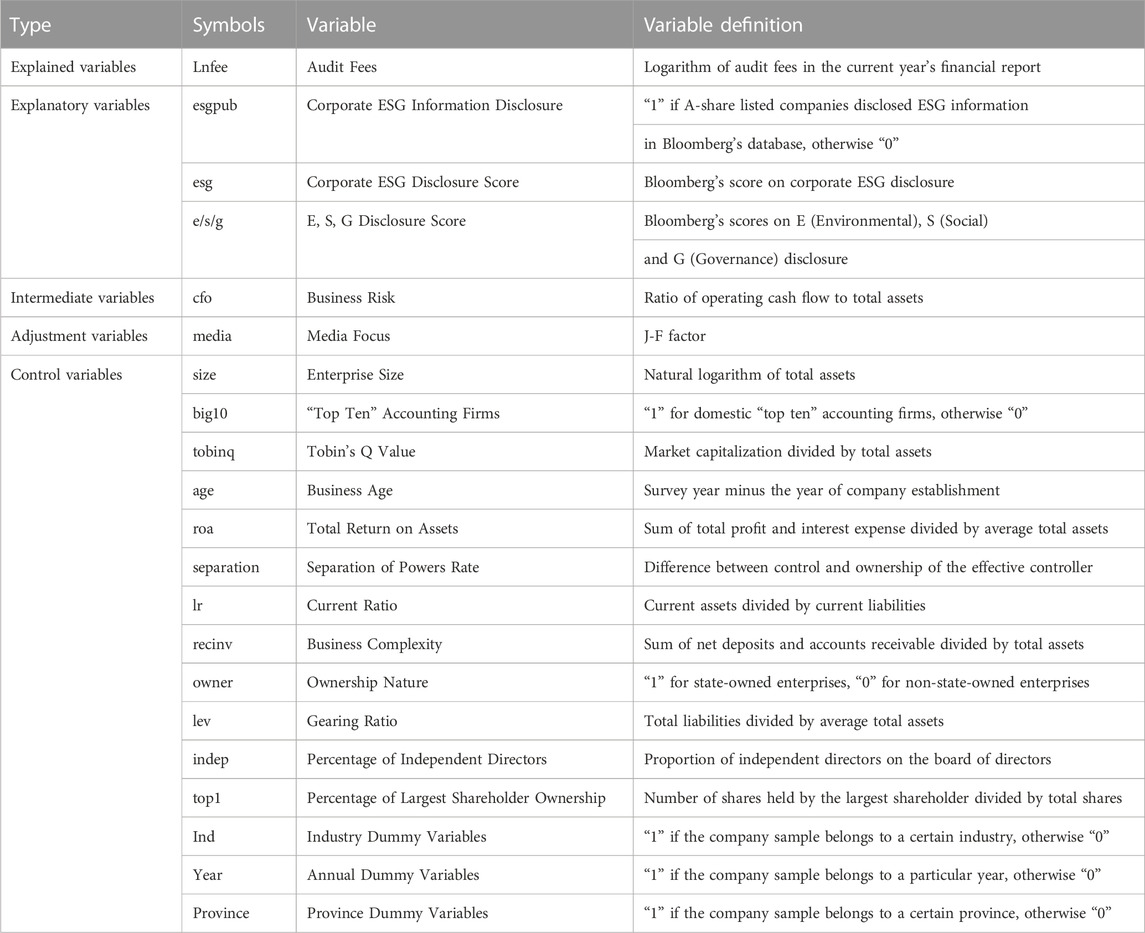

3.3 Variable definitions

3.3.1 Explained variables

The logarithmic transformation of audit fees, denoted as Lnfee, is used as the measurement for assessing audit fees in the existing academic literature. This approach has been supported by prior research, including Simunic (1980) and Li et al. (2019).

3.3.2 Explanatory variables

In this study, we employ Bloomberg’s ESG disclosure score as a proxy for measuring corporate ESG disclosure. This measurement approach draws upon the works of Fazzini and Dalmaso (2016) and Minutolo et al. (2019). The ESG disclosure score is derived from the Bloomberg database and encompasses the following criteria. First, the presence or absence of corporate ESG information disclosure (esgpub) is determined based on the availability of such information in the Bloomberg database. A-share listed companies with available ESG information are classified as “Corporate ESG information disclosed” and assigned a value of “1”, while those without ESG information are labeled as “Corporate ESG information not disclosed” and assigned a value of “0”. Second, corporate ESG disclosure scores (esg) are derived from the Bloomberg database, which provides disclosure scores for the three dimensions of E, S and G. These disclosure scores are utilized to assess the level of ESG disclosure by corporations.

3.3.3 Mediating variables

Operating risk (cfo) is assessed using the methodology proposed by Wei et al. (2021). Cash flow from operating activities as a percentage of total assets is employed as a metric to gauge operating risk. This approach is based on the rationale that cash flow from operating activities provides a reliable indication of a company’s ability to generate cash flows from its core business operations, which is a key determinant of its operating risk.

3.3.4 Moderating variables

To measure media attention, we adopt the Janis-Fadner coefficient (J-F), as proposed by Janis and Fader (1965), introduced by Deephouse (1996), and applied to the study of corporate legitimacy by Aerts and Cormier (2009). Our specific methodology for calculating the J-F coefficient as a proxy for media attention is presented in Eq. 7. This approach allows us to monitor public opinion pressure and gain insights into the dynamics of media attention.

In this study, the J-F is used to quantify media attention. The J-F coefficient is computed based on the number of positive (e) and negative (c) media coverage of a given firm, as well as the total number of coverage (t).

The J-F coefficient ranges from −1 to 1, where a higher positive value indicates greater positive coverage of the firm. It is important to note that the media attention analyzed in this paper focuses on the relationship between corporate ESG disclosure and audit fees, particularly in cases where a firm receives more positive media coverage.

3.3.5 Control variables

In the present study, the selection of control variables is based on a careful review of previous literature and the specific research focus. The chosen control variables encompass indicators of firm size and audit quality, such as the “big10″ designation for the top 10 accounting firms. Larger firms with better audit quality generally command higher fees. Additionally, solvency indicators such as the gearing ratio and current ratio, Tobin’s Q value, profitability indicators such as the percentage of independent directors and return on total assets, as well as indicators of corporate age, business complexity, separation of powers, shareholding of the largest shareholder, nature of ownership, corporate size, and other corporate business indicators are considered.

It is important to note that audit fees are influenced not only by firm-specific factors but also by the objective situation and risk of the enterprise itself. Therefore, variables that reflect the enterprise’s situation are included in the analysis.

Specifically, three dummy variables (industry, year, and province) are included to control for differences in industry-level factors, unobserved time-related variables, and uneven regional development. The definitions of the specific variables used in the analysis are presented in Table 1. Through this comprehensive and meticulous approach, the study aims to enhance the accuracy and robustness of the empirical results.

4 Empirical results

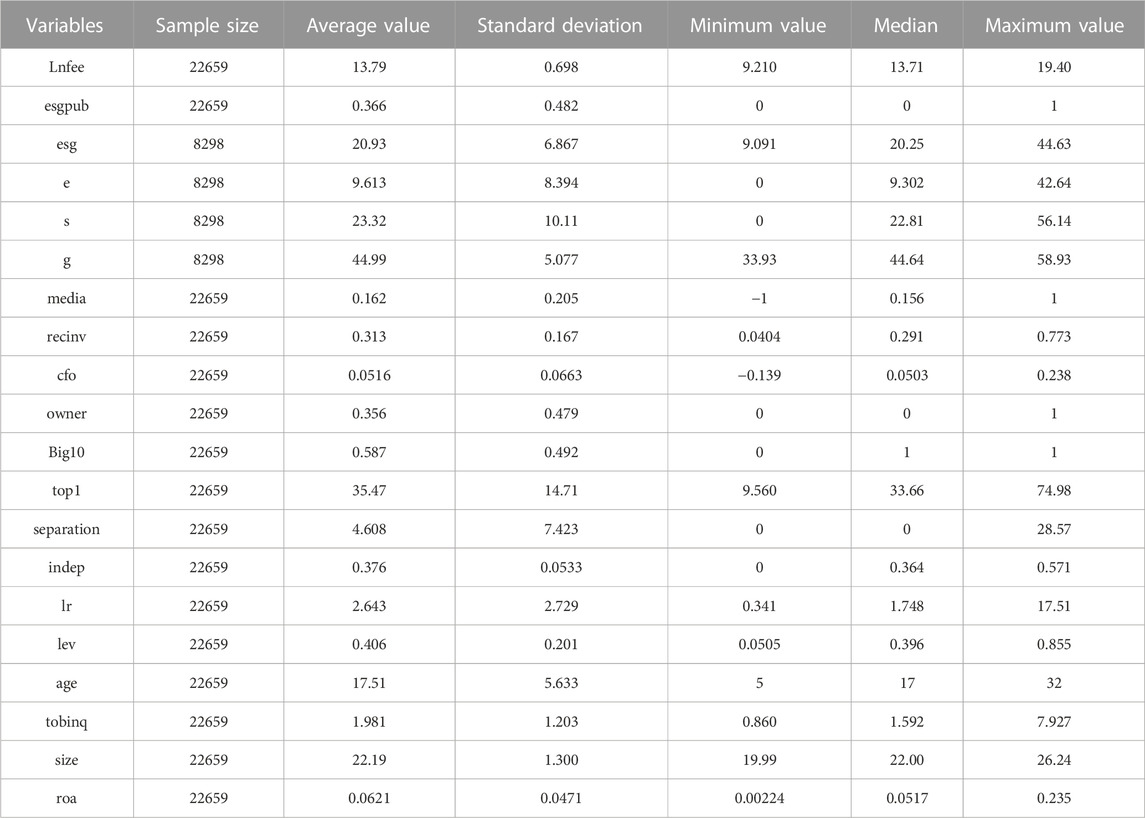

4.1 Descriptive statistics

Table 2 presents descriptive statistics providing valuable insights into the investigated variables. The variable representing audit fees (Lnfee) exhibits a normal distribution, with a mean of 13.79 and a median of 13.71, indicating that a majority of audit fees fall within a relatively narrow range.

The variable denoting corporate ESG information disclosure (esgpub) shows a mean of 0.366 and a median of 0, suggesting that only 36.6% of A-share listed companies in China disclose ESG information. These findings underscore the significance of promoting corporate ESG information disclosure to enhance sustainability practices among companies.

The mean of the enterprise ESG information disclosure score (esg) is 20.93, with a median of 20.25 and a standard deviation of 6.867. The normal distribution observed for this variable indicates that, on average, companies demonstrate moderate levels of ESG information disclosure. However, the substantial variation in disclosure scores between companies highlights the absence of standardized disclosure policies. It implies that companies in China attach varying degrees of importance to ESG information, leaving room for improvement in actively embracing responsibility for green and sustainable development.

Similarly, the descriptive statistics for the corporate environmental (E), social responsibility (S), and corporate governance (G) information disclosure scores (e, s, g) align with the ESG information disclosure scores (esg). These findings indicate notable discrepancies between the disclosure scores of different companies within the sample, reflecting the diverse approaches companies take toward disclosing ESG-related information.

The descriptive statistics for the control variables, as well as the mediating variable of operational risk (cfo) and the moderating variable of media attention (media), also exhibit a normal distribution. These results suggest that these variables are suitable for further analysis.

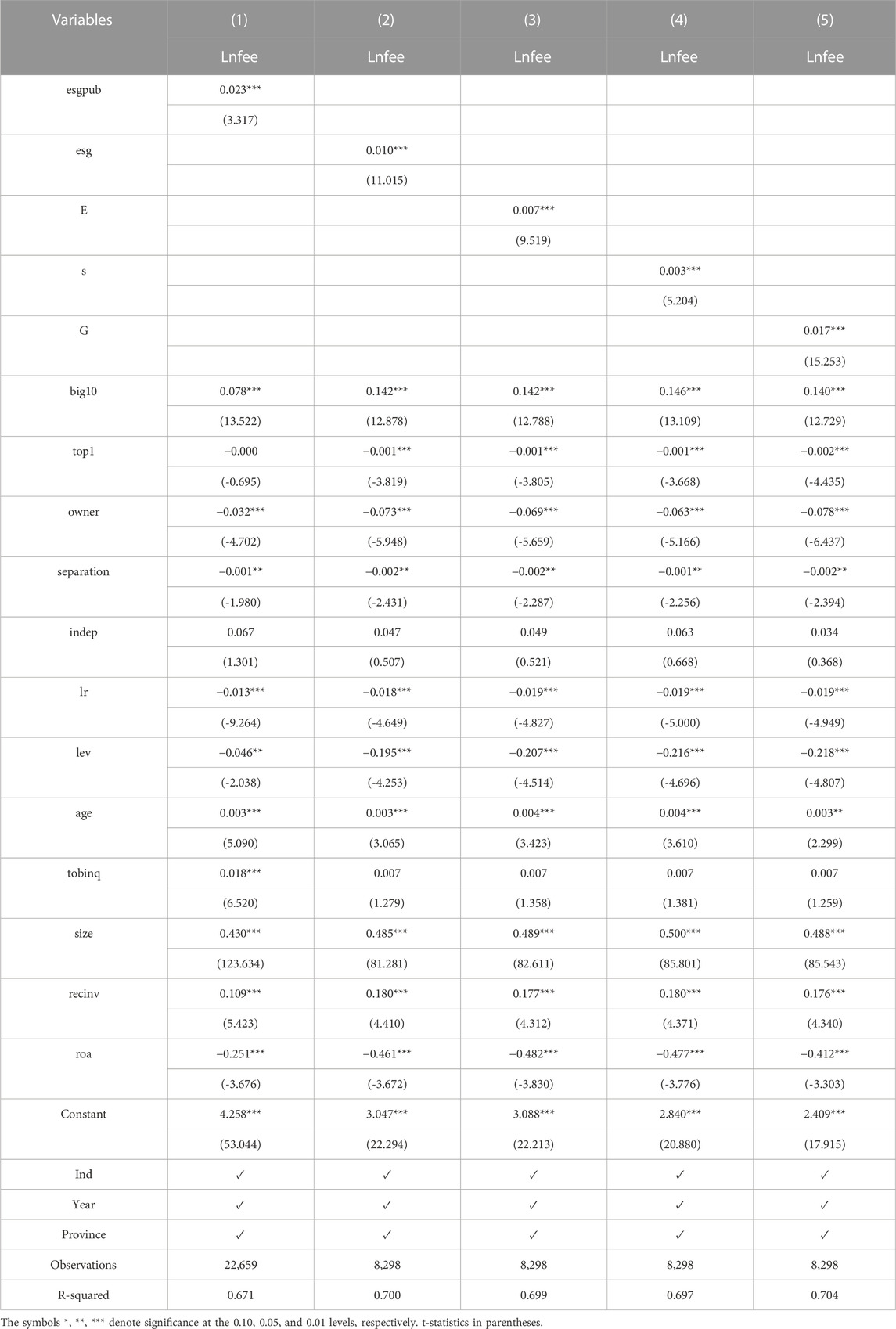

4.2 Regression analysis

4.2.1 Main hypotheses

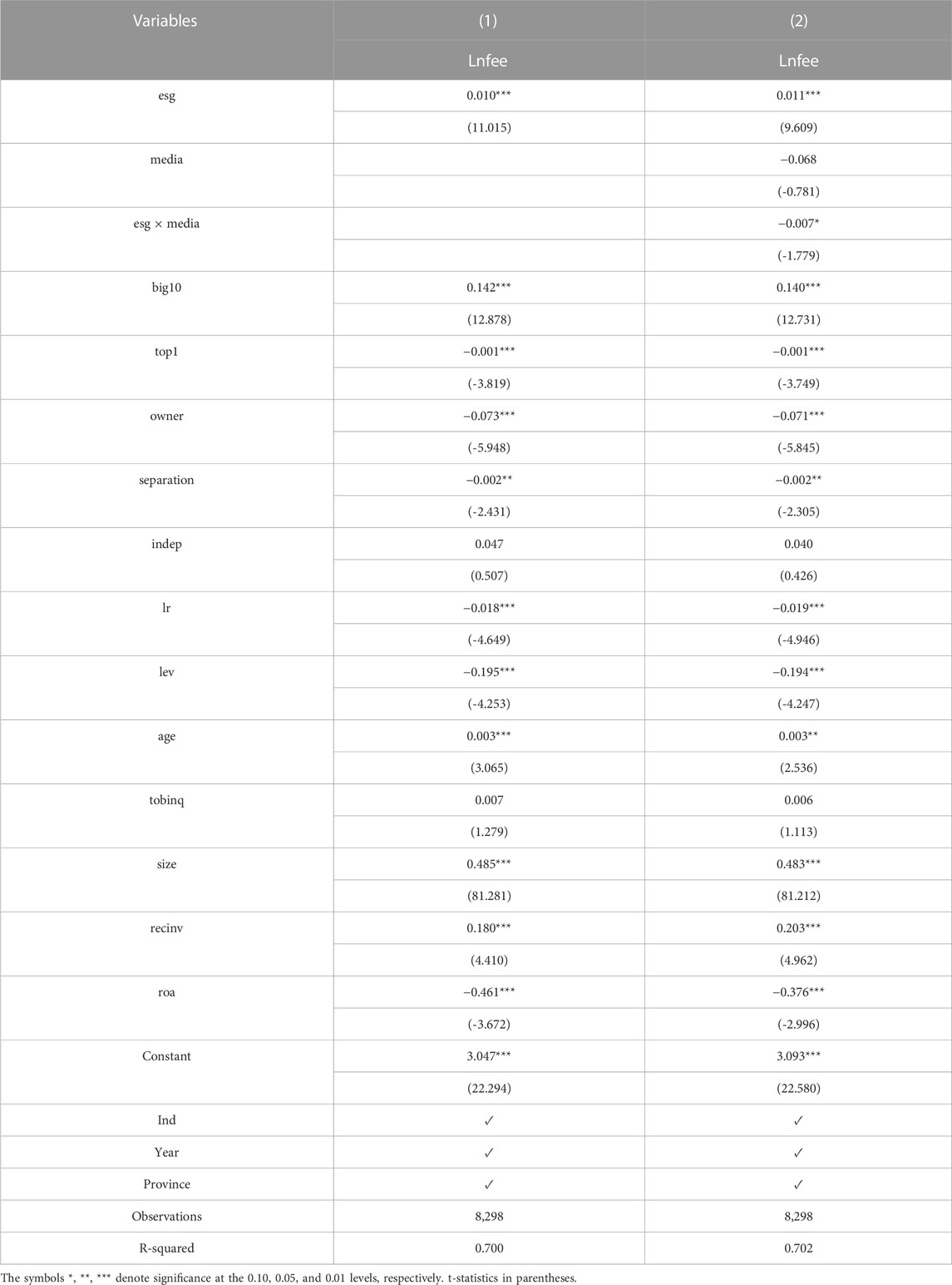

In order to investigate the association between ESG disclosure and audit fees, this study examined the regression coefficients of ESG information disclosure (esgpub), corporate ESG disclosure scores (esg), and audit fees (Lnfee), as shown in Table 3.

In the first column of Table 3, the regression coefficient between ESG information disclosure and audit fees is 0.023 (significant at the 1% level), indicating that companies disclosing ESG information tend to have higher audit fees compared to those that do not disclose ESG information. This suggests that auditors need to review, consider, and verify the disclosed ESG information as part of their assessment of “other information”. The increased workload and audit risk associated with ESG disclosures contribute to higher audit fees. Additionally, the complexity introduced by ESG matters and strategic management systems further amplifies audit risk, leading to higher fees. Thus, the H1 is supported.

The second column of Table 3 shows a regression coefficient of 0.010 (significant at the 1% level) between corporate ESG disclosure scores and audit fees. This indicates that higher ESG disclosure scores are associated with higher audit fees. The increased communication and data analysis required between auditors and companies with high disclosure scores, to ensure the consistency and reliability of financial statements and ESG information, contribute to higher fees. Moreover, high disclosure scores may reflect opportunistic behaviors, such as “greenwashing”, which increase audit risk and costs. Hence, the H2 is supported.

Columns 3, 4, and 5 of Table 3 present the regression coefficients between disclosure scores (e, s, g) in the dimensions of environmental (E), social responsibility (S), and corporate governance (G), and audit fees. The results indicate a positive and significant relationship (at the 1% level) between high disclosure scores in these dimensions and audit fees. Auditors consider the impact of corporate environmental, social responsibility, and corporate governance disclosures on financial information, leading to increased workload and risk, thereby resulting in higher audit fees. Thus, the H3 is supported.

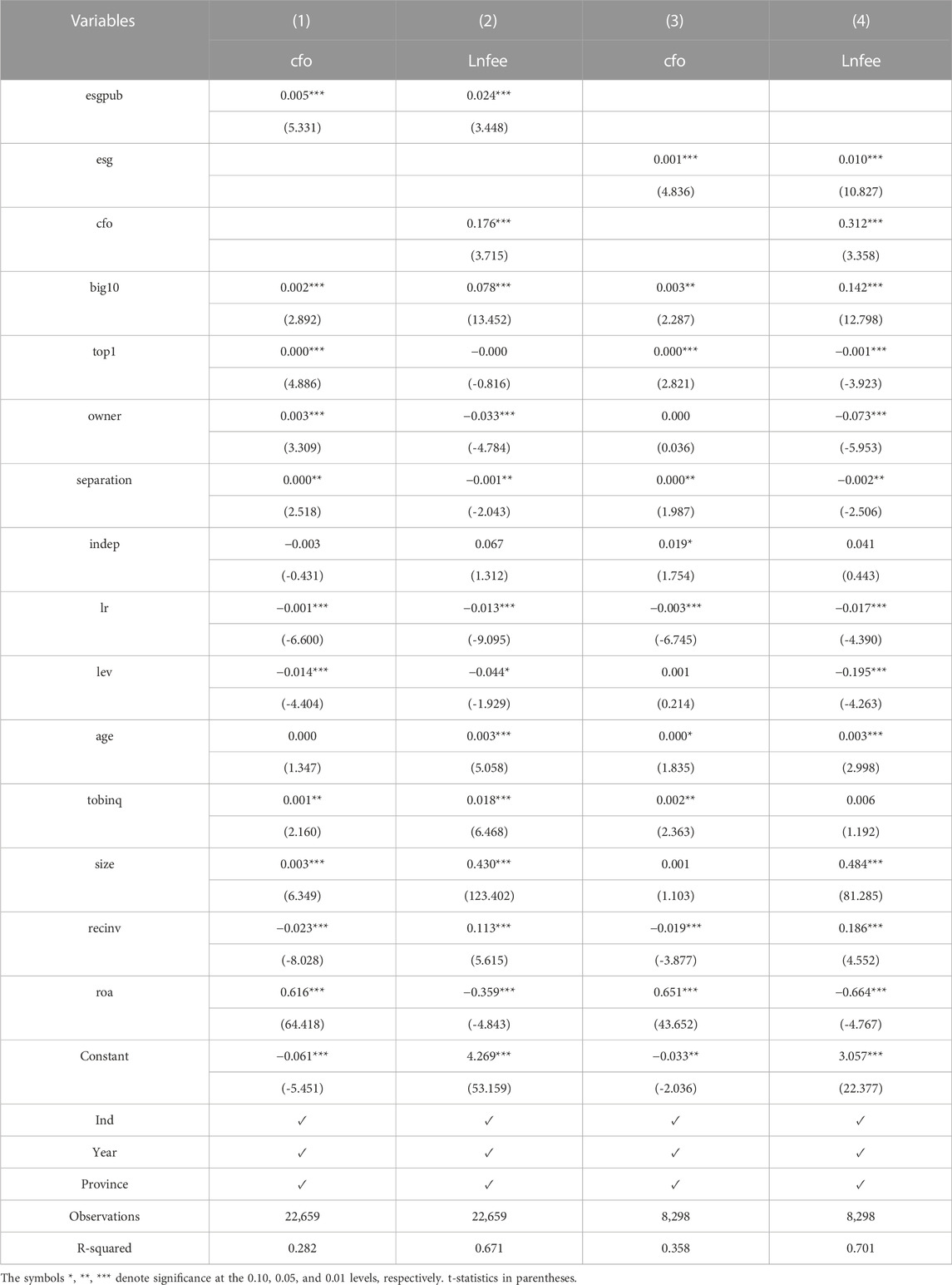

4.2.2 Mediation analysis

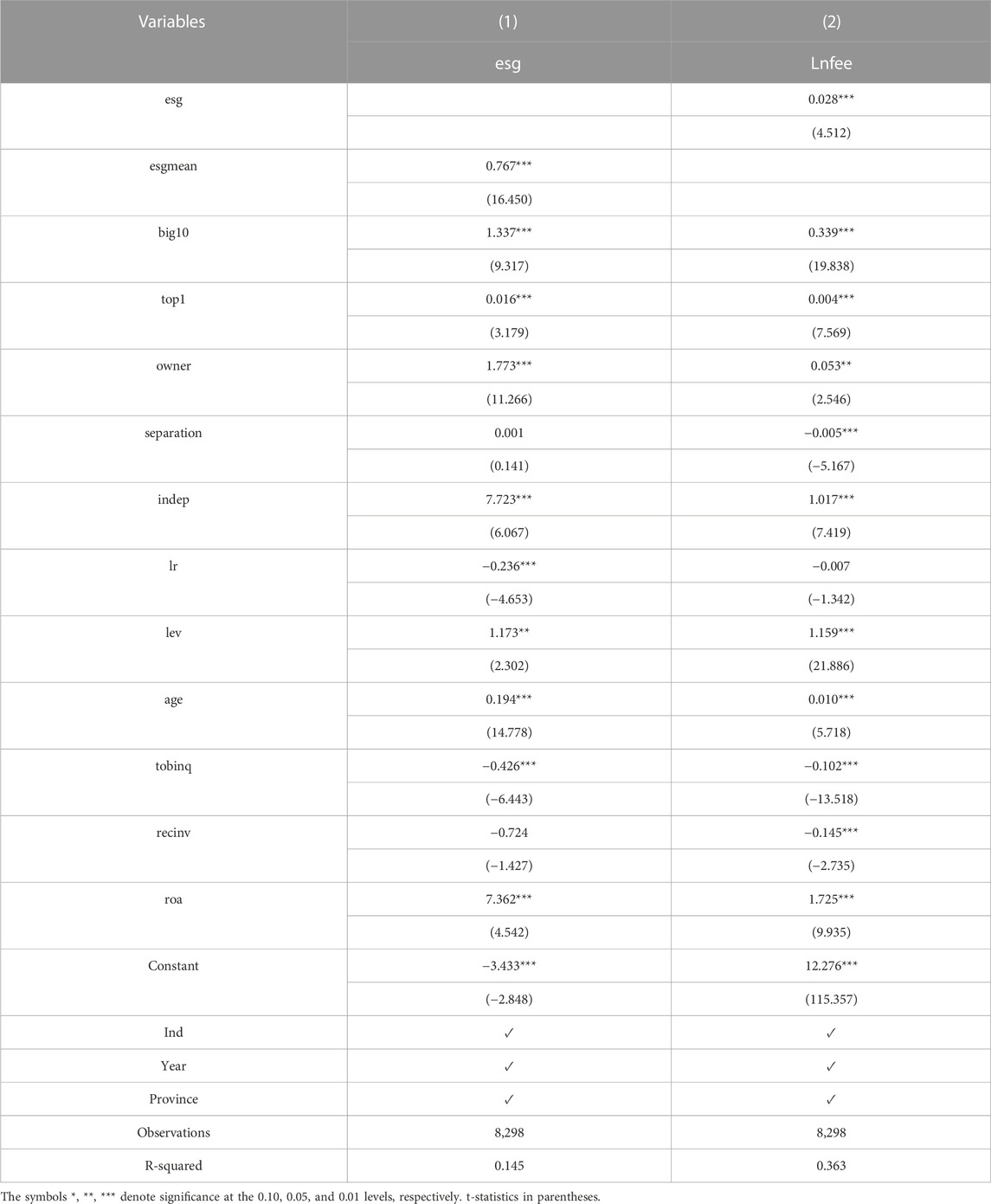

In order to examine the mediating role of operational risk between corporate ESG information disclosure and audit fees, we conducted a regression analysis, and the results are presented in Table 4.

The regression analysis in the first two columns of Table 4 reveals a statistically significant regression coefficient of 0.005 between ESG disclosure (esgpub) and operational risk (cfo) at the 1% significance level. Similarly, the regression coefficient between operational risk (cfo) and audit fees (Lnfee) is 0.176, also statistically significant at the 1% level. These findings indicate that operational risk acts as a mediator between ESG disclosure and audit fees. One possible explanation for these results is that companies disclosing ESG information face higher risks due to irregular disclosure practices or potential motivations for earnings management, leading to an increase in operational risk. Auditors may incorporate these business risks into their risk assessments, in line with the “strong pockets” theory, thereby increasing audit risk and subsequently audit fees based on the risk premium theory.

The third and fourth columns of Table 4 demonstrate a statistically significant regression coefficient of 0.001 between corporate ESG disclosure score (esg) and operational risk (cfo) at the1% level of significance. Additionally, the regression coefficient between operational risk (cfo) and audit fees (Lnfee) is 0.010, also statistically significant at the 1% level. These results indicate that companies with higher ESG disclosure scores experience elevated operational risks, which contribute to higher audit fees. One possible explanation for this finding is that firms with higher ESG disclosure scores may employ earnings management techniques to enhance their scores, consequently leading to an increase in operational risk. In response to companies with higher ESG disclosure scores, auditors may intensify risk assessments and execute additional audit procedures to avoid issuing inappropriate audit opinions. Thus, our findings support H4, suggesting that in the early stages of ESG implementation in China, ESG information disclosure and scoring are perceived as incremental risks to audits rather than improving operational risks.

4.2.3 Moderation analysis

The first two columns of Table 5 demonstrate a statistically significant positive association between the corporate ESG disclosure score (esg) and audit fees (Lnfee) at the 1.

One possible explanation for this result is that news media attention can increase the auditor’s access to audit evidence, decrease reliance on corporate ESG information, and reduce information and audit risk. Additionally, companies with higher corporate ESG disclosure scores may benefit from increased corporate transparency, reduced irregularities, and decreased potential for earnings management due to media attention. This leads to a reduction in audit risk and ultimately results in a reduction in audit fees, thereby validating H5.

4.3 Robustness tests

4.3.1 Sensitivity analysis

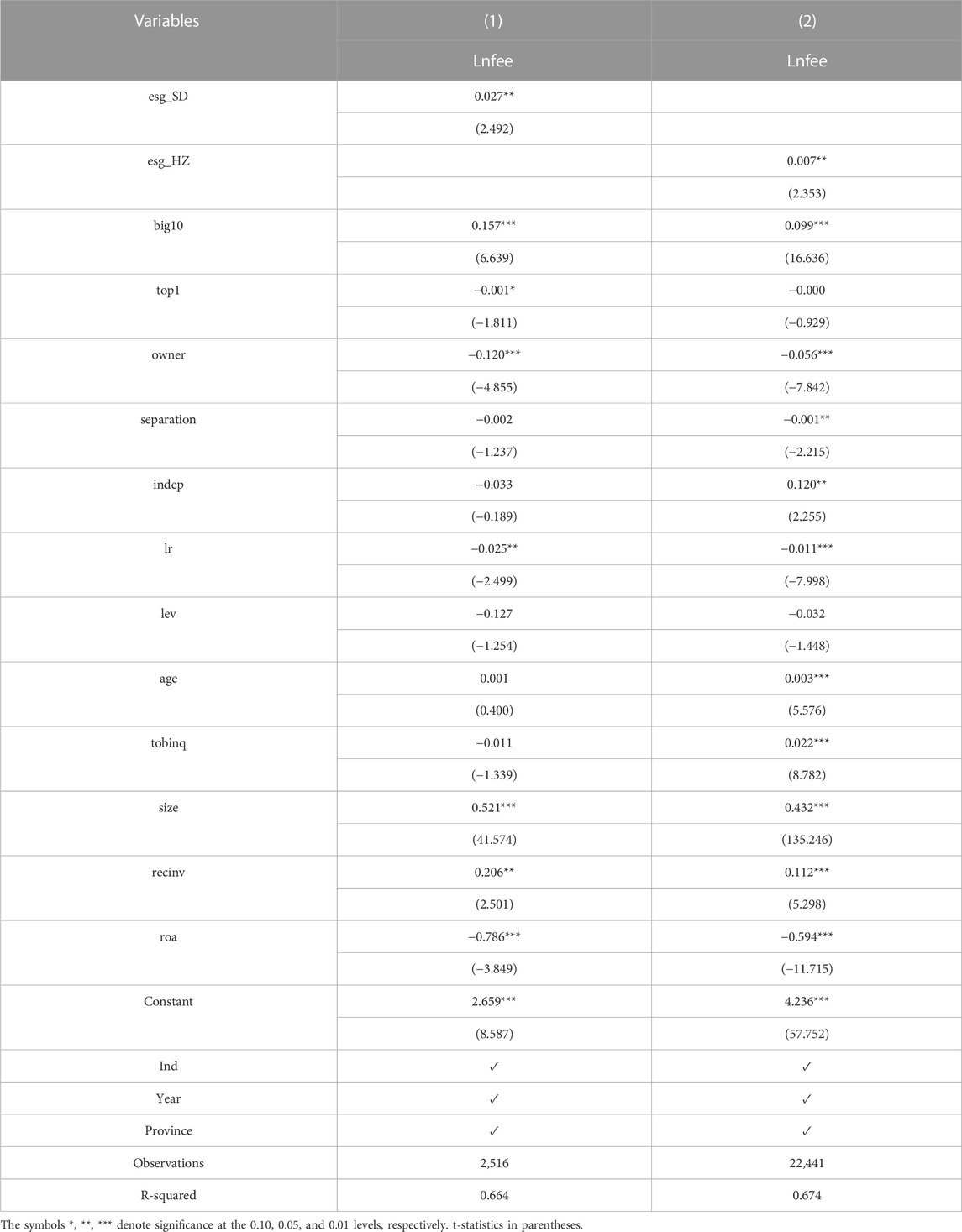

Using country-specific ESG rating databases is more suitable for studying domestic stock markets than relying on ESG rating data from international companies. To address this issue, this study adopts the approach of Xiao et al. (2021), introducing SynTao Green Finance (esgSD) as a local institution providing corporate ESG databases in China. Additionally, this study draws on the method of Li et al. (2022), using Huazheng ESG rating (esgHZ) and two selected variables as proxy indicators for ESG disclosure. The main objective of this paper is to explore whether there is a consistent positive correlation between corporate ESG disclosure scores (ESG) and audit fees (Lnfee) through regression analysis. The results are presented in Table 6.

In column (1) of Table 6, the regression results demonstrate that, based on the SynTao Green Finance database, even after controlling for other variables (such as industry, year, and province), there is a significant positive correlation between the company’s ESG disclosure score (esgSD) and audit fees (Lnfee). Moreover, the regression results from the SynTao Green Finance database align with those from the Bloomberg database, indicating that a higher ESG disclosure score is associated with higher audit fees. These findings provide support for the hypothesis of this study. In column (2), the results obtained from the Huazheng database are consistent with those from the SynTao Green Finance database, further bolstering the robustness of the research assumptions.

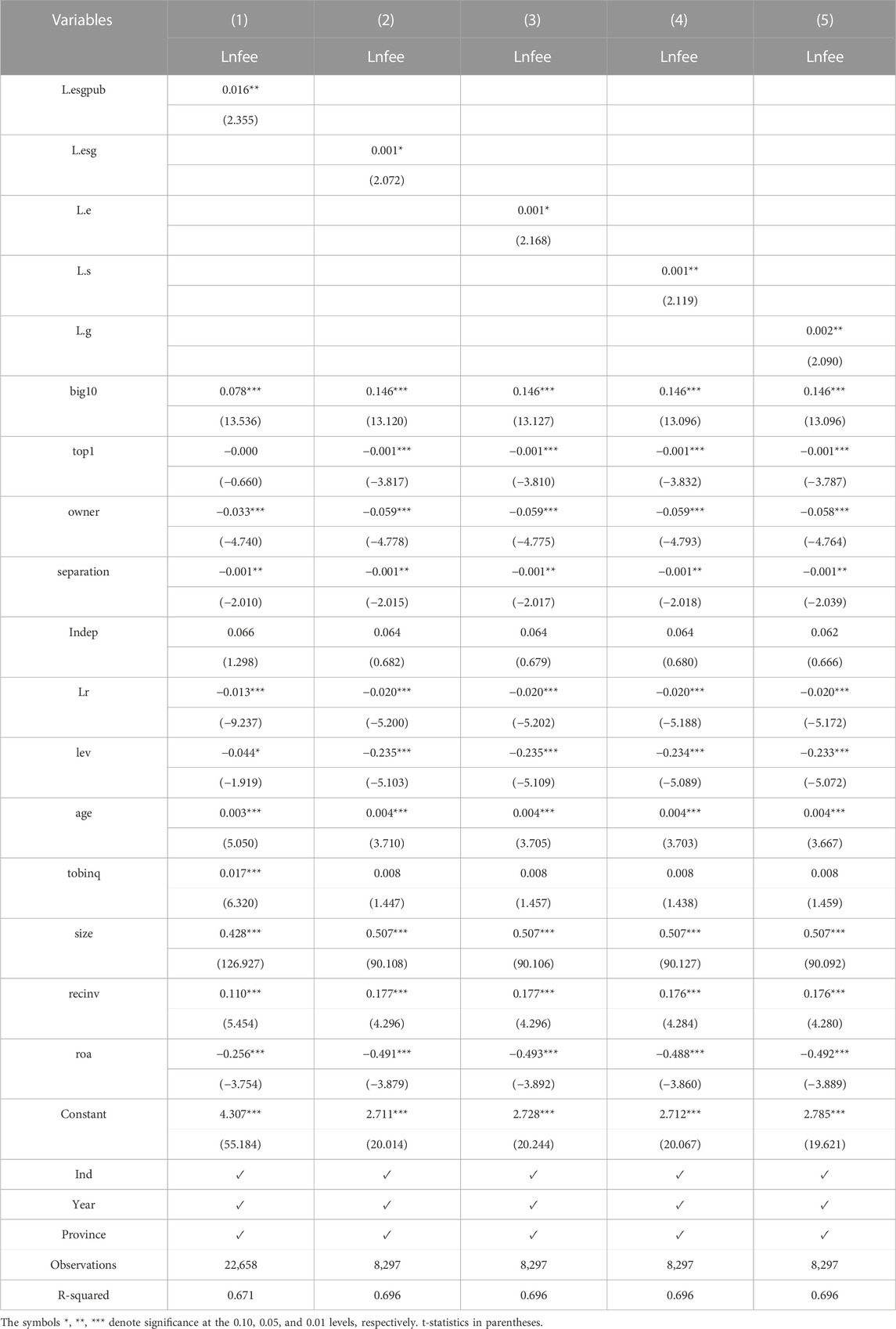

4.3.2 One-period Lag analysis

We have investigated the relationship between corporate ESG disclosure and audit fees, while considering the potential impact of previous year’s scoring results and current year’s performance. To analyze this relationship, we performed a one-period lagged regression, examining the association between corporate ESG disclosure, ESG disclosure scores, disclosure scores of any dimension, and lagged audit fees. The results presented in Table 7 indicate that the lagged one-period regression results are statistically significant, supporting the hypotheses put forth in this study. These findings demonstrate the robustness of the relationship between corporate ESG disclosure and audit fees, even after controlling for potential confounding variables such as prior year scoring results and current year performance.

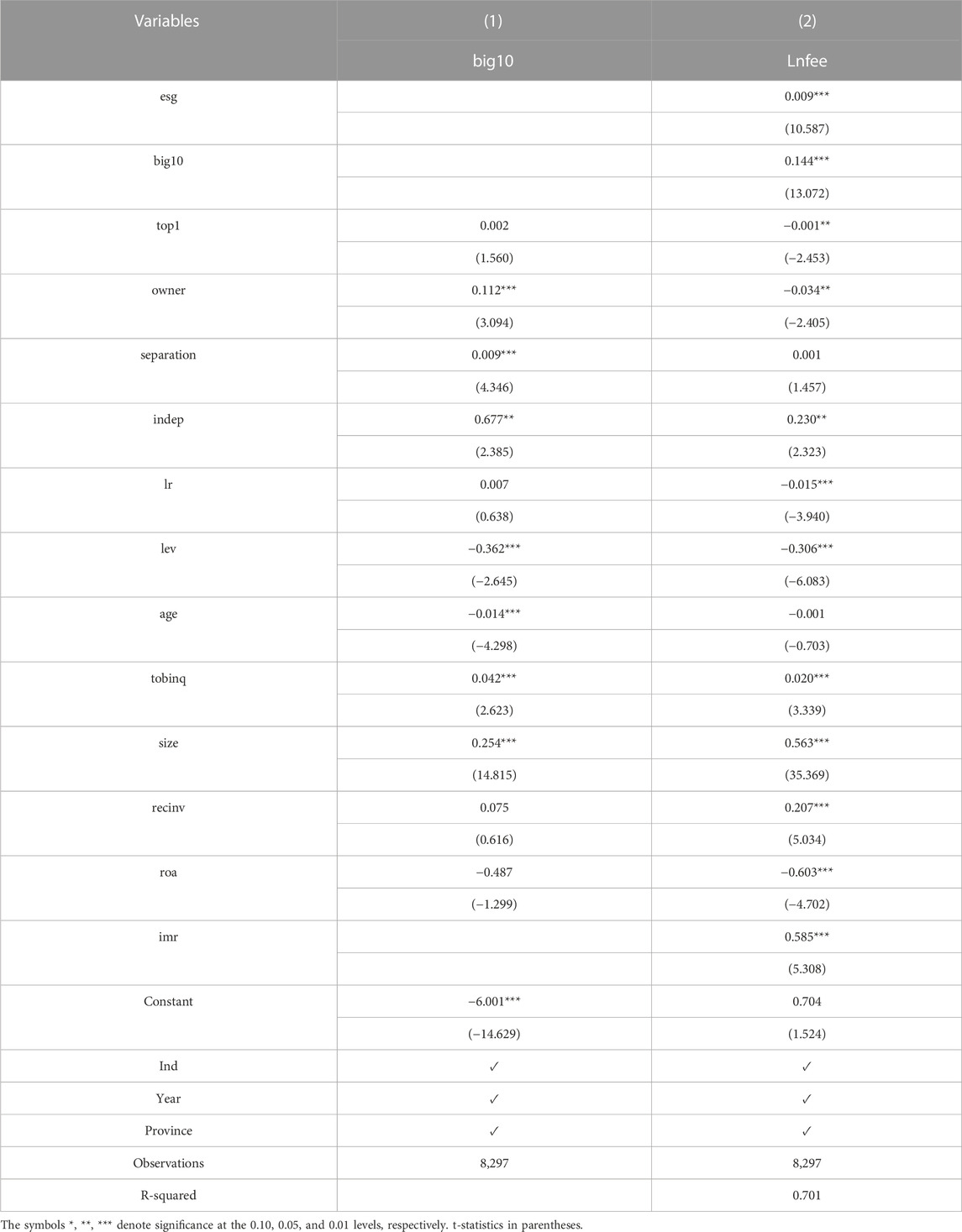

4.3.3 Instrumental variable analysis

We addressed the issue of endogeneity by employing an instrumental variable approach based on the studies conducted by Eliwa et al. (2019). In this approach, we used the industry mean of the Bloomberg ESG score as the instrumental variable, which is highly correlated with the corporate ESG disclosure score (esg) and satisfies the correlation hypothesis. Additionally, since the industry mean of Bloomberg ESG disclosure score (esgmean) only affects audit fees through the path of ESG disclosure score, it meets the exogeneity hypothesis. The regression results, using the instrumental variable method, are presented in Table 8. The coefficient between the instrumental variable (esgmean) and the corporate ESG disclosure score (esg) is statistically significant at the 1% level, with a value of 0.767, indicating the presence of a cohort effect among industries and peer competition behavior in relation to the corporate ESG disclosure score (esg). Specifically, firms within the same industry tend to imitate or surpass each other in attaining higher ESG scores.

In the second stage of our analysis, we estimated the results after addressing the endogeneity problem through the use of instrumental variables (esgmean). Our findings show a significant and positive coefficient of 0.028 between the ESG disclosure score (esg) and audit fee (Lnfee) after the “treatment,” indicating that the regression results remain robust even after addressing the endogeneity issue. Moreover, the coefficient between esg and Lnfee at the 1% significance level is consistent with the regression prior to the “treatment.” These results validate the reliability and validity of our research.

4.3.4 Sample selection bias analysis

This paper addresses the potential endogeneity issue between corporate ESG disclosure scores (esg) and audit fees (Lnfee) that may arise due to self-selection biases. Specifically, firms with higher audit fees may be influenced by their characteristics, such as larger size and a more complex business environment, rather than the impact of corporate ESG disclosure. Additionally, larger firms tend to be audited by larger auditor firms, which creates a self-selection issue. To mitigate this problem, we utilize a Heckman two-stage model applicable to resolve the endogeneity issue arising from sample selection bias (Heckman, 1976).

The first stage of our analysis involves performing a Probit regression on Eq. 8 to calculate the inverse Mills ratio (IMR) value. We then add the IMR value to Eq. 2 in the second stage, and the results are presented in Table 9. Our findings reveal that the coefficient of corporate ESG disclosure score (esg) and audit fee (Lnfee) is 0.009 after adding the IMR value and is significant at the 1% level of significance. It suggests that our study results remain robust and validate the hypothesis of this paper. Thus, our approach successfully addresses the self-selection issue and provides reliable estimates of the relationship between corporate ESG disclosure scores and audit fees.

4.4 Heterogeneity analysis

In the early stages of ESG practices in China, corporate ESG disclosure plays a crucial role in identifying deficiencies in sustainable development capabilities and encourages firms to enhance their ESG infrastructure. However, the current system of ESG disclosure in China needs revision due to existing institutional frameworks. ESG practices and disclosures in China are primarily voluntary and lack legal obligations. Therefore, this study aims to examine the specific effects of disclosure nature and the policy impact of the new Environmental Protection Law on their relationship through group regression analysis.

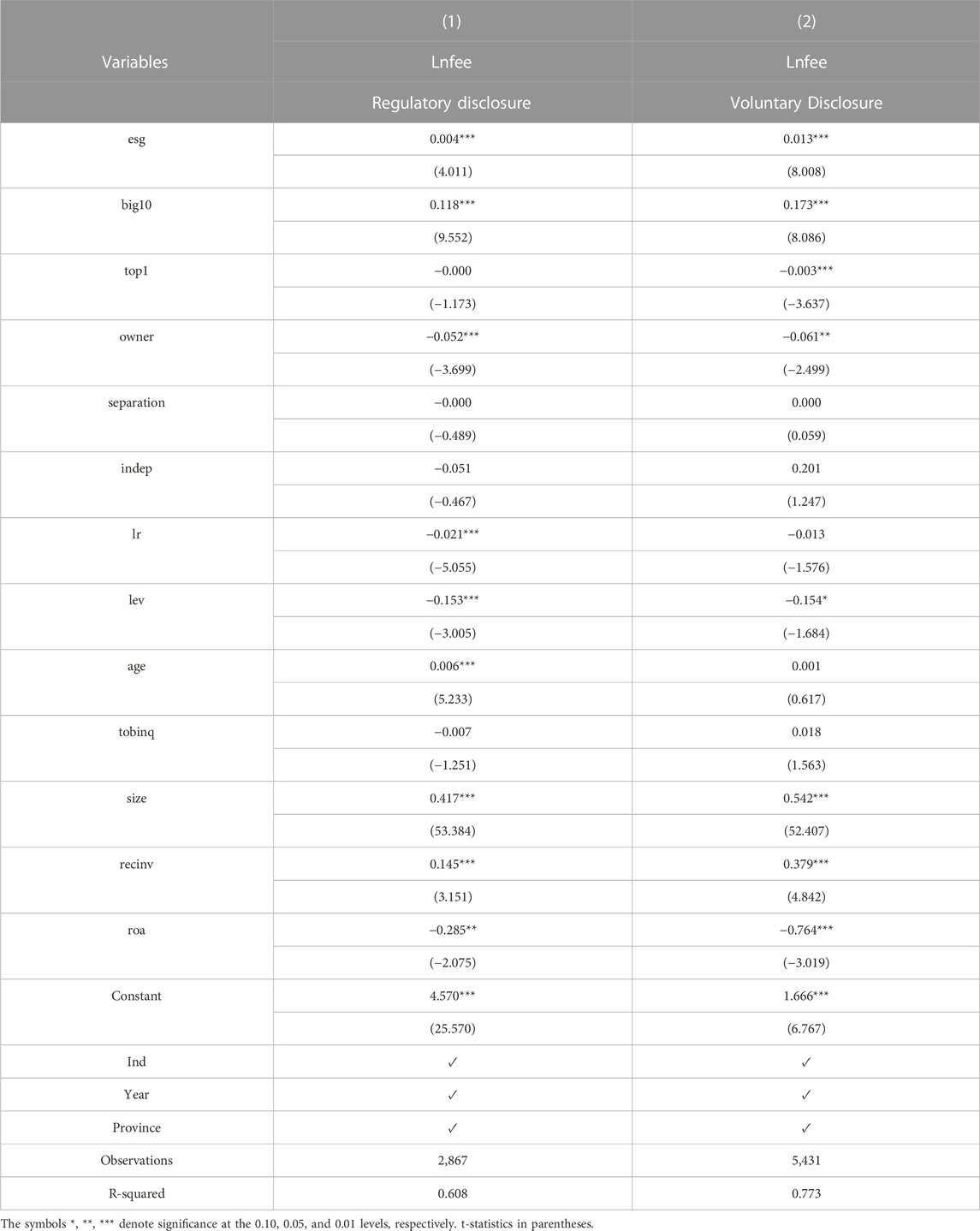

4.4.1 Nature of ESG disclosure

In 2008, the Shenzhen Stock Exchange and the Shanghai Stock Exchange (SSE) mandated the disclosure of social responsibility information for specific companies while encouraging others to disclose it voluntarily. In 2022, China issued its first set of “Corporate ESG Disclosure Guidelines”. Although most countries do not require disclosing information related to ESG activities, most companies provide ESG information in their social responsibility reports. However, companies that voluntarily disclose information and those that are required to do so may have different attitudes towards incremental ESG information as ESG disclosure policies continue to improve, leading to changes in audit fees. This study performs group regressions on a sample of companies based on the nature of their corporate disclosures in social responsibility reports. Results show a significant positive correlation (at the 1% level) between ESG disclosure score (esg) and audit fee (Lnfee) among companies that are required to disclose. At the same time, the exact correlation is also significant (at the 1% level) among companies that voluntarily disclose. The coefficients are found to be comparable between the two groups. The study concludes that among companies that voluntarily disclose ESG information, a higher ESG score is associated with a higher audit fee, possibly due to self-selection or surplus management by such firms (Table 10). It is because voluntarily disclosing firms have more significant incentives to improve their corporate reputation by conveying positive signals of ESG information to stakeholders, which can confer a competitive advantage compared to firms subject to mandatory disclosure.

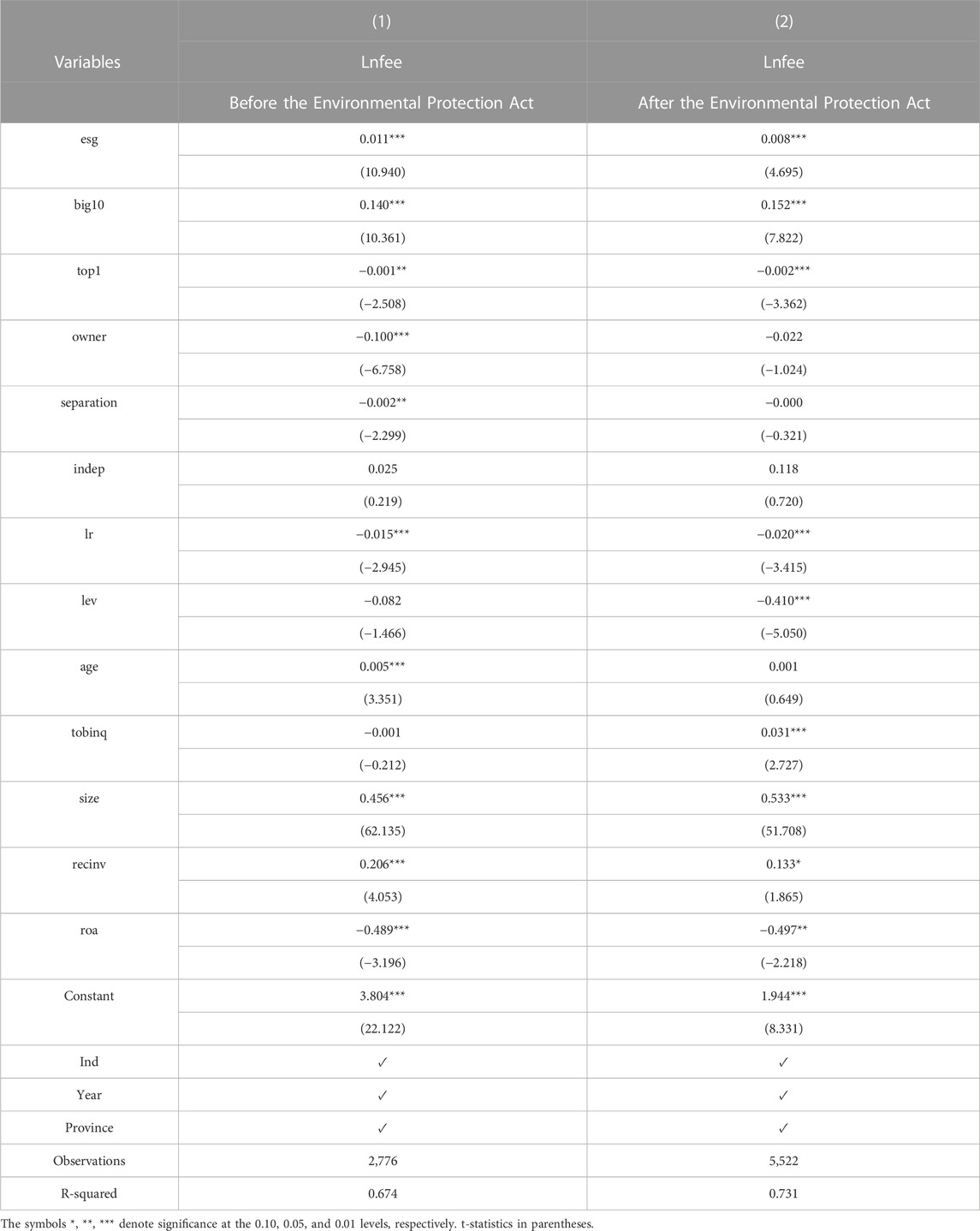

4.4.2 Policy effects of the new environmental protection law

The enactment of the new Environmental Protection Law on January 1, 2015, has been widely acknowledged as the most stringent environmental protection law in history, demonstrating the resolve of the regulatory system to manage environmental concerns. As a fundamental pillar of this law, its impact on the relationship between ESG disclosure scores and audit fees of companies cannot be overlooked. Against this backdrop, this study conducted a regression analysis of a sample data set, stratified by the pre- and post-implementation of the new Environmental Protection Law. The results presented in Table 11 indicate that the correlation coefficient between corporate ESG disclosure score (esg) and audit fee (Lnfee) before the implementation of the new Environmental Protection Law was 0.011, which is statistically significant at the 1% level. However, after the implementation of the new Environmental Protection Law, this correlation coefficient decreased to 0.008, which remains statistically significant at the 1% level. A difference-in-coefficients test was conducted, which yielded an empirical p-value of 0.063, suggesting comparable coefficients. This finding suggests that the positive effect of corporate ESG disclosure score (esg) on audit fees (Lnfee) has weakened following the implementation of the new Environmental Protection Law. The possible reasons for this outcome may include the heightened requirements for corporate environmental compliance under the new law, leading to a higher level of information disclosure, and the reduction of surplus management due to the constraints of the new Environmental Protection Law, resulting in a decrease in audit risks associated with phenomena such as “greenwashing” and “bleaching”.

5 Conclusion and implications for practice

In conclusion, our comprehensive analysis of the relationship between corporate ESG information disclosure and audit fees in China has yielded significant research findings. We have observed that ESG information disclosure levels vary among Chinese companies, with a general trend of relatively low disclosure. Notably, companies voluntarily disclosing ESG information and achieving higher ESG disclosure scores face higher audit fees, indicating that voluntary disclosure serves as a signal of commitment to ESG practices and attracts increased scrutiny from auditors.

Furthermore, auditors in China currently perceive ESG disclosure as a cumulative risk, underscoring the need for greater integration of ESG considerations into audit processes. Media attention also plays a moderating role, influencing the relationship between corporate ESG disclosure scores and audit fees. This highlights the impact of media scrutiny on the costs associated with ESG-related audits.

The implementation of the new Environmental Protection Law in China has had a dampening effect on the positive relationship between corporate ESG disclosure scores and audit fees. This outcome can be attributed to heightened environmental compliance requirements, which have led to increased information disclosure and reduced audit risks associated with practices such as “greenwashing” and “bleaching.”

Drawing from our research findings, we propose several recommendations for various stakeholders. Government and regulators should prioritize strengthening the ESG information disclosure framework by establishing robust standards and regulatory mechanisms to ensure transparency and reliability in corporate ESG disclosures. Corporate management should actively prioritize ESG information disclosure, while also working towards reducing surplus management practices and enhancing transparency and accountability in their ESG reporting processes. Auditors should incorporate ESG considerations into their audit procedures and deepen their understanding of the risks and opportunities associated with ESG disclosure. Additionally, media outlets should strive for accurate and balanced reporting to enhance stakeholder understanding and trust in corporate ESG practices. Lastly, ESG investors should adopt a holistic approach when evaluating companies, considering multiple factors beyond just audit fees and ESG disclosure scores.

Implementing these recommendations will strengthen China’s ESG ecosystem, promote sustainable business practices, and enhance stakeholder confidence. Our research contributes valuable insights to the existing literature on ESG and audit fees, providing guidance for policymakers, auditors, companies, and investors navigating China’s evolving ESG landscape.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

KZ, JW, and XL contributed to conception, design of the study, organized the database, and performed the statistical analysis. KZ and JW wrote the first draft of the manuscript. All authors contributed to the article and approved the submitted version.

Funding

This research was funded by the National Social Science Foundation of China (grant number 22BJY117) and China Postdoctoral Science Foundation (grant number 2021M692027).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aerts, W., and Cormier, D. (2009). Media legitimacy and corporate environmental communication. Account. Organ. Soc. 34 (1), 1–27. doi:10.1016/j.aos.2008.02.005

Ali, C. B., and Lesage, C. (2013). Audit pricing and nature of controlling shareholders: Evidence from France. China J. Account. Res. 6 (1), 21–34. doi:10.1016/j.cjar.2012.08.002

Barnett, M. L. (2007). Stakeholder influence capacity and the variability of financial returns to corporate social responsibility. Acad. Manag. Rev. 32 (3), 794–816. doi:10.5465/amr.2007.25275520

Baron, R. M., and Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personality Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Berg, F., Koelbel, J. F., and Rigobon, R. (2022). Aggregate confusion: The divergence of ESG ratings. Rev. Finance 26 (6), 1315–1344. doi:10.1093/rof/rfac033

Brammer, S. J., and Pavelin, S. (2006). Corporate reputation and social performance: The importance of fit. J. Manag. Stud. 43 (3), 435–455. doi:10.1111/j.1467-6486.2006.00597.x

Chen, Z., and Xie, G. (2022). ESG disclosure and financial performance: Moderating role of ESG investors. Int. Rev. Financial Analysis 83, 102291. doi:10.1016/j.irfa.2022.102291

Chen, J., Yang, X., and Zhang, Z. (2016). Environmental uncertainty, corporate social responsibility and audit fees. Audit Research 04, 61–66.

Christensen, D. M., Serafeim, G., and Sikochi, A. (2021). Why is corporate virtue in the eye of the beholder? The case of ESG ratings. Account. Rev. 97 (1), 147–175. doi:10.2308/tar-2019-0506

Deephouse, D. L. (1996). Does isomorphism legitimate? Acad. Manag. J. 39 (4), 1024–1039. doi:10.5465/256722

Desalegn, G., and Tangl, A. (2022). Forecasting green financial innovation and its implications for financial performance in Ethiopian Financial Institutions: Evidence from ARIMA and ARDL model. Natl. Account. Rev. 4 (2), 95–111. doi:10.3934/NAR.2022006

Eliwa, Y., Aboud, A., and Saleh, A. (2019). ESG practices and the cost of debt: Evidence from EU countries. Crit. Perspect. Account. 79, 102097. doi:10.1016/j.cpa.2019.102097

Fazzini, M., and Dalmaso, L. (2016). The value relevance of “assured” environmental disclosure: The Italian experience. Sustain. Account. Manag. Policy J. 7 (2), 225–245. doi:10.1108/sampj-10-2014-0060

Galant, A., and Cadez, S. (2017). Corporate social responsibility and financial performance relationship: a review of measurement approaches. Econ. Res. -Ekon. 30 (1), 676–693. doi:10.1080/1331677X.2017.1313122

Gao, Y., Chen, Y., and Zhang, Y. (2012). “Red scarf” or “green scarf”: A study on the motivation of private enterprises’ charitable donations. Manag. World 08, 106–114.

Griffin, P. A., Lont, D. H., and Sun, Y. (2010). Agency problems and audit fees: Further tests of the free cash flow hypothesis. Account. Finance 50 (2), 321–350. doi:10.1111/j.1467-629x.2009.00327.x

Hammami, A., and Zadeh, M. H. (2019). Audit quality, media coverage, environmental, social, and governance disclosure and firm investment efficiency Evidence from Canada. Int. J. Account. Inf. Manag. 59 (15). doi:10.1108/IJAIM-03-2019-0041

Heckman, J. J. (1976). The common structure of statistical models of truncation, sample selection and limited dependent variables and a simple estimator for such models. Ann. Econ. Soc. Meas. 5 (4), 475–492.

Huang, S., Huang, K. T., and Zhou, Z. (2022). The studies on Chinese traditional culture and corporate environmental responsibility: Literature review and its implications. Natl. Account. Rev. 4 (1), 1–15. doi:10.3934/NAR.2022001

Janis, I. L., and Fader, R. (1965). “The coefficient of imbalance,” in Language of politics. Editors H. Lasswell, and N. Leites, 153–169.

Jensen, M. C., and Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financial Econ. 3 (76), 305–360. doi:10.1016/0304-405x(76)90026-x

Judd, C. M., and Kenny, D. A. (1981). Process analysis: Estimating mediation in treatment evaluations. Eval. Rev. 5 (5), 602–619. doi:10.1177/0193841x8100500502

Li, C., and Wang, X. (2022). Local peer effects of corporate social responsibility. J. Corp. Finance 73, 102187. doi:10.1016/j.jcorpfin.2022.102187

Li, S., and Xu, T. (2022). Advances in environmental-social responsibility-corporate governance research. Dyn. Econ. 8, 133–146.

Li, B., Wang, B., Qing, X., Zhang, Y., Chen, S., Yang, H., et al. (2019). Hemodynamic effects of enhanced external counterpulsation on cerebral arteries: A multiscale study. Audit Res. 18 (01), 91–99. doi:10.1186/s12938-019-0710-x

Li, Z., Liao, G., and Albitar, K. (2020). Does corporate environmental responsibility engagement affect firm value? The mediating role of corporate innovation. Bus. Strategy Environ. 29 (3), 1045–1055. doi:10.1002/bse.2416

Li, Z., Shao, Y., Li, Z., and Li, M. (2022). ESG disclosure, media monitoring and corporate financing constraints. Sci. Decis. Mak. 7, 1–26.

Li, Z., Huang, Z., and Su, Y. (2023). New media environment, environmental regulation and corporate green technology innovation: Evidence from China. Energy Econ. 119, 106545. doi:10.1016/j.eneco.2023.106545

Lu, X., and Han, L. (2007). Mediator variables, moderator variables and covariates—concepts, statistical tests and comparisons. Psychol. Sci. 04, 934–936.

Luo, D. (2022). ESG, liquidity, and stock returns. J. Int. Financial Mark. Institutions Money 78, 101526. doi:10.1016/j.intfin.2022.101526

Ma, X. (2019). Barriers and prospects of ESG investment walking China. Financial Mark. Res. 6, 71–74.

Marcel, D. T. A. M. (2019). The determinant of economic growth evidence from Benin: Time series analysis from 1970 to 2017. Financial Mark. Institutions Risks 3 (1), 63–74. doi:10.21272/fmir.3(1).63-74.2019

Merkl-Davies, D. M., and Brennan, N. M. (2007). Discretionary disclosure strategies in corporate narratives: Incremental information or impression management? J. Account. Literature 27, 116–196.

Minutolo, M. C., Kristjanpoller, W. D., and Stakeley, J. (2019). Exploring environmental, social, and governance disclosure effects on the S&P 500 financial performance. Bus. Strategy Environ. 28 (6), 1083–1095. doi:10.1002/bse.2303

Okafor, A., Adeleye, B. N., and Adusei, M. (2021). Corporate social responsibility and financial performance: Evidence from US tech firms. J. Clean. Prod. 292, 126078. doi:10.1016/j.jclepro.2021.126078

Qiu, M., and Yin, H. (2019). Corporate ESG performance and financing cost in the context of ecological civilization construction. Quantitative Econ. Tech. Econ. Res. 36 (03), 108–123.

Raghunandan, A., and Rajgopal, S. (2022). Do ESG funds make stakeholder-friendly investments? Rev. Account. Stud. 27 (3), 822–863. doi:10.1007/s11142-022-09693-1

Saygili, E., Arslan, S., and Birkan, A. O. (2022). ESG practices and corporate financial performance: Evidence from Borsa Istanbul. Borsa Istanb. Rev. 22 (3), 525–533. doi:10.1016/j.bir.2021.07.001

Simunic, D. (1980). The pricing of audit services theory and evidence. J. Account. Res. 18 (1), 161–190. doi:10.2307/2490397

Şimşek, H., and Öztürk, G. (2021). Evaluation of the relationship between environmental accounting and business performance: the case of Istanbul province. Green Finance 3 (1), 46–58. doi:10.3934/GF.2021004

Thomas, J., Yao, W., Zhang, F., and Zhu, W. (2022). Meet, beat, and pollute. Rev. Account. Stud. 27 (3), 1038–1078. doi:10.1007/s11142-022-09694-0

Verrecchia, R. E. (1990). Information quality and discretionary disclosure. J. Account. Econ. 12 (4), 365–380. doi:10.1016/0165-4101(90)90021-u

Wei, C., Liu, C., and Sun, H. (2021). Vertical concurrent executives, nature of property rights and audit fees. Audit Econ. Res. 36 (02), 52–62.

Xiao, F., Lan, F., Shi, W., Xiong, H., and Shen, H. (2021). Do esg ratings of listed companies affect audit fees? – a quasi-natural experiment based on esg rating events. Audit Res. 3, 41–50.

Yang, G. C., and Zhang, L. N. (2021). What makes industrial policy more effective? – Evidence based on massive media coverage data and R&D manipulation phenomenon. Econ. Q. 21 (06), 2173–2194.

Zhang, J. (2015). A study on the economic consequences of corporate social responsibility information disclosure-from the perspective of influencing audit fees. J. Shandong Univ. Finance Econ. 27 (06), 96–106.

Keywords: audit fees, ESG disclosure, operational risk, media attention, corporate governance

Citation: Zhang K, Liu X and Wang J (2023) Exploring the relationship between corporate ESG information disclosure and audit fees: evidence from non-financial A-share listed companies in China. Front. Environ. Sci. 11:1196728. doi: 10.3389/fenvs.2023.1196728

Received: 30 March 2023; Accepted: 17 July 2023;

Published: 31 July 2023.

Edited by:

Mobeen Ur Rehman, Shaheed Zulfikar Ali Bhutto Institute of Science and Technology (SZABIST), United Arab EmiratesReviewed by:

Alam Rehman, National University of Modern Languages, PakistanDi Gao, Southwestern University of Finance and Economics, China

Zhenghui Li, Guangzhou University, China

Copyright © 2023 Zhang, Liu and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jingjing Wang, MDgxMDI1MDI1QHNodS5lZHUuY24=

Kaimeng Zhang

Kaimeng Zhang Xihe Liu1

Xihe Liu1 Jingjing Wang

Jingjing Wang