- 1Economics and Management College, China University of Geosciences, Wuhan, China

- 2Economics and Environment Research Center, China University of Geosciences, Wuhan, China

The trade-off between environment and economy has been one of the hot topics discussed in academia, but there are many disputes among them. Based on the micro data of Chinese listed companies from 2016 to 2020, this paper uses the shock of the Environmental Protection Tax Law (EPTL) in 2018 as a quasi-natural experiment. Our Differences-in-Differences (DID) method is used to study the impact of the environmental governance pressure caused by the EPTL on firms’ total factor productivity (TFP). The conclusions suggest that: 1) The EPTL has significantly improved heavily polluting enterprises’ TFP, and this finding remains stable after a range of robustness checks. 2) The subgroup analysis shows that. The smaller the size of the administrative expenses paid by the enterprises, the larger the effect of the EPTL on firms’ TFP; the positive effect of the EPTL on the TFP of heavily polluting enterprises is not pronounced in the sample of small-scale enterprises; when the degree of financial slack is small, the effect of the EPTL on firms’ TFP is greater; the effect of the EPTL is greater when the enterprises are located in provincial capital and municipalities. 3) Meanwhile, we also find that promoting firm value and stimulating green innovation may be the potential mechanisms of the EPTL affecting firms’ TFP. This paper provides experience summary for the firms’ high-quality development under the background of government environmental governance.

1 Introduction

The economic growth model characterized by “high pollution, high consumption, and low efficiency” has resulted in numerous environmental burdens on China’s pursuit of high-quality economic development (Khan et al., 2021; Li et al., 2022; Jiang et al., 2023). These environmental problems not only constrain total factor productivity (TFP), but also pose a significant threat to people’s health and wellbeing, leading to enormous medical costs (He et al., 2016; Tang et al., 2021). As the main body of social production activities, how to restrain the enterprises’ pollution behavior to improve the ecological environment has become a critical issue to be solved (Yang et al., 2021; Tang et al., 2022). In response to these challenges, China’s government has placed significant emphasis on environmental governance since 2012, and has implemented a range of legal frameworks to address ecological issues (Hao et al., 2018). The TFP is often considered a key indicator of technological improvement, improving TFP to promote high-quality economic growth has become the main way for China to build its competitive advantage (Sun, 2022). Consequently, designing environmental policies that can enhance firms’ TFP has become a critical practical issue that the Chinese government must consider (Cai and Ye, 2020; Wang et al., 2021).

In essence, the efficient allocation of resources is crucial in ensuring sustainable economic growth in the long term (Zhou et al., 2020). As the primary entity of a market economy, enterprises play a pivotal role in allocating various production factors to achieve higher levels of production efficiency (Bas and Paunov, 2021). According to the “compliance cost hypothesis”, the environmental measures implemented by the government force enterprises to reallocate existing resources and shift part of resources from traditional production to pollution control and environmental protection activities, which breaks enterprises’ original production deployment and squeezed out innovation and other investments, thus producing a “crowding out effect” on the firms’ TFP (Hancevic, 2016; Tang et al., 2020). Porter and Van der Linde, (1995) put forward a completely opposite view to the “compliance cost hypothesis”, namely, the “Porter hypothesis”. The hypothesis suggests that appropriate environmental policies can promote enterprises’ technological innovation, thus offsetting environmental costs and gaining competitive advantages, and ultimately improving firms’ TFP (Franco and Marin, 2017). Nevertheless, some scholars argue that the impact of environmental regulation on firms’ TFP is the result of the interplay between the “compliance cost hypothesis” and the “Porter hypothesis” (Becker, 2011; Johnstone et al., 2017; Peng et al., 2021). By combing the existing literature, we find that the economic effects of the environmental policies have also been in dispute, the existing studies have come to differentiated conclusions due to different research objects, different research methods and different variable measurement methods, etc., (Del Gatto et al., 2011; Peng et al., 2020).

Since the relationship between environmental regulation and TFP is not clear, it is necessary to further study this relationship (Ghosal et al., 2019; Hille & Mobius, 2019). To promote ecological civilization, on 1 January 2018, China’s EPTL was officially implemented, and several environmental laws and regulations jointly constructed China’s environmental legal system. The EPTL can guide and promote the enterprises to change their production mode, and regulate enterprises’ pollution behavior by internalizing the negative externalities of environmental pollution. As it combines the strictness of mandatory regulation and the flexibility of market-based regulation, the EPTL has attracted the attention of many scholars once it was issued (Wang et al., 2021). However, it is unknown whether the EPTL can achieve economic dividends while improving environmental performance. Based on this, this article discusses the influence of the EPTL on firms’ TFP, thereby supplementing the research on the micro-economic effects of the EPTL.

The economic, value, and green innovation effects of environmental regulation are a widely researched topic in academia. The implementation of the EPTL in 2018 provides a rare opportunity for checking the “Porter effect” of environmental regulation. This article constructs a Differences-in-Differences (DID) model based on the implementation of the EPTL in 2018. The findings of this paper are multiple, our DID model suggests that: 1) Specifically, the EPTL raises the TFP of heavily polluting enterprises by 3.4%. 2) The higher-scale administrative expenses and higher financial slack will weaken the “Porter effect” of the EPTL. For small-scale enterprises, the EPTL is not effective. The EPTL has a greater effect on heavily polluting enterprises located in provincial capitals and municipalities. 3) We find that the EPTL is not only conducive to improving the firms’ TFP, but also improving the financial performance and green innovation of enterprises, thus, our paper provides a feasible direction for the next research on the EPTL. This paper confirms the “Porter effect” of the EPTL, which provides a more refined reference for the high-quality development.

Our paper has the following innovations. First, our research examines the effect of central government macro-environmental legislation on firms’ TFP, which can be seen not only as a retest of the “Porter hypothesis”, but also an expansion of the micro effects of the EPTL. Therefore, this paper enriches the recent studies on “Porter hypothesis” (Dong and Zheng, 2022; Pan et al., 2022). Second, different from most previous research on TFP at the macro level, such as national level (Wu et al., 2020), province level (Gao et al., 2021), city level (Xie et al., 2021; Wang et al., 2022), and industry level (Franco and Marin, 2017; Yang and Shen, 2023), etc. Our study focuses on micro-level TFP, and overcomes issues of imprecise estimated results caused by inadequate sample size at the macro-level. Third, we discuss the heterogeneity of environmental protection tax laws affecting firms’ TFP from both macro and micro perspectives, thus providing viable paths for firms in different conditions to improve their productivity. Meanwhile, we also find that the EPTL improves heavily polluting firms’ financial performance and green innovation, thus exploring the potential mechanisms of the EPTL affecting firms’ TFP from the value channel and innovation channel. Finally, our research extends the understanding of the micro-economic effects of China’s EPTL, and offers practical guidelines for firms to enhance their production efficiency, financial performance, and environmental performance under the pressure of external regulation. Our paper also provides a feasible program for firms to achieve high-quality development.

2 Institutional context and research hypothesis

2.1 Institutional context

Areas with more serious environmental pollution may face the dilemma of not being able to attract high-level talents and new technology industries, leading to economic stagnation or even recession. How to promote the construction of legal system to effectively improve the ecological environment is an important issue facing the Chinese government. Based on the international universal rules and the legislative experience of other countries, the government has released a series of environmental protection laws, regulations and behavior guidelines, forming a relatively complete environmental regulation system (Chang et al., 2015; Yu et al., 2021; Jiang et al., 2022). At present, China has entered a critical period of the high-quality economic development and ecological civilization construction, and a series of “hard and soft” environmental policies are issued to promote green development (Tang et al., 2018). Unlike the developed western countries with more mature institutional systems, China’s formal institutional system is not yet perfect (Allen et al., 2005), and the legislation in the field of environmental protection also starts late. For a long time, China’s environmental legislation still has the problems of low quality legislation, insufficient supporting measures, and unsatisfactory implementation effect, especially in a number of environmental areas there are still legislative gaps. In recent years, with the central government paying more attention to environmental protection and the people’s preference for a good ecological environment gradually increasing, China’s environmental legislation has entered a new stage. Especially since the 18th Party Congress, China’s environmental legal system has made historic progress, of which the EPTL is one of the most typical representatives. The environmental protection tax comes from the sewage charging system. With the further advancement of environmental governance in China, the disadvantages of the sewage charging system have gradually emerged, such as its legal effect is relatively low, the rigidity of law enforcement is insufficient, and there are many intervention factors, etc. Therefore, to improve the overall environmental protection awareness of the whole society, it is crucial to carry out environmental protection tax reform (Liu et al., 2022).

In order to improve the green tax system and regulate the enterprises’ pollution governance behavior. From 2014 to 2015, the government work reports required that the legislation of environmental protection tax should be put on the agenda. In December 2015, the EPTL of the People’s Republic of China (Draft) was submitted to the State Council. On 25 December 2016, the EPTL was determined to be officially implemented from 1 January 2018, marking the official transition of China from the sewage charging system to the environmental protection tax system. The EPTL consists of 5 chapters and 28 items, many of which are directly related to the tax payment when enterprises discharge pollutants, which may affect enterprises’ production efficiency. For example, Article 13 of the EPTL stipulates that when the concentration of pollutants discharged by enterprises is lower than the national and local standards, the tax proportion can be reduced appropriately, which reflects the incentive means of the EPTL. Another example, such as Article 26 of the EPTL, stipulates that enterprises that do not discharge pollutants directly into the environment as required will bear ecological losses and will be held legally responsible in serious cases, which reflects the enforceability of the EPTL.

In order to ensure the smooth transition from the sewage charging system to the environmental protection tax system, the EPTL is consistent with the sewage charging system in many aspects, such as the collection object, collection scope, tax calculation method, etc. Meanwhile, to better play the positive incentive role of the EPTL, there are many differences between the EPTL and the sewage charging system. For example, compared to the sewage charging system, the EPTL is a national-level environmental law with stronger legal effect, and there are major improvements in many aspects such as emission reduction preferences and tax rates. The EPTL has further improved the legal system of China’s ecological environmental protection (Zheng and He, 2022).

2.2 Research hypothesis

The famous “Porter hypothesis” holds that the clear and flexible environmental policies can trigger the firms’ “innovation compensation effect”, thereby optimizing the efficiency of resource allocation and making the production process more efficient (Cheng and Kong, 2022). The “innovation compensation effect” can partially or even completely compensate for the adverse impact of environmental regulation on enterprises (e.g., compliance cost), making enterprises occupy a favorable position in the fierce market competition and obtain economic benefits (Lee et al., 2011), thus helping to improve firms’ TFP. On the other hand, the “market-oriented” regulatory instruments can provide more freedom for enterprises’ production activities due to its high degree of flexibility, and promote corporate reform of green production technology and carry out green production. Green innovation can simplify the production process and establish a “green” image for the enterprises, this external advantage is also an important guarantee for enterprises to improve the TFP (Jeong et al., 2014). The EPTL originated from the sewage charging system, which not only has the flexibility of market-oriented environmental regulation. At the same time, as an important environmental legal system, it also has the strictness of mandatory regulation. The positive relationship between strict and suitable environmental regulation and firms’ TFP can be derived from many studies (e.g., Moffette et al., 2021; Yamazaki, 2022). Therefore, we propose:

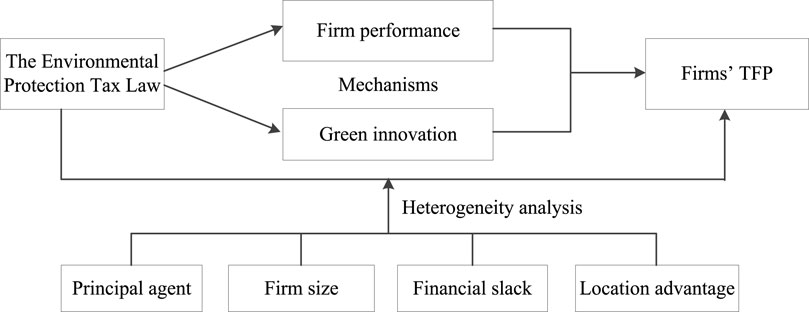

Hypothesis. China’s EPTL notablely improves the heavily polluting enterprises’ TFP.Figure 1 depicts the framework diagram of this paper. The influence of the EPTL on firms’ TFP is our main concern. Further, we explore the possible channels through which the EPTL affect firms’ TFP. More deeply, this paper discusses the effects of the EPTL in different situations.

3 Research design

3.1 Sample selection and data source

On 1 January 2018, the EPTL was officially implemented. In 2015, the TFP was first written into the State Council’s “Government Work Report”, this top design once again proves the importance of improving TFP. Considering that the improvement of firms’ TFP usually has a certain lag, in order to make the window period before and after the policy implementation consistent, this article selects 2016–2020 as the time interval. This is exactly the same as the beginning and ending time of China’s 13th “Five Year Plan”. Referring to the relevant literature (e.g., Hu et al., 2021; Zhang et al., 2022), this paper selects heavily polluting enterprises as the experimental group. After the implementation of the EPTL, heavily polluting enterprises are under stronger regulatory pressure, while the non-heavily polluting firms are subject to less constraining effects due to their lower pollution level. Except that the green innovation comes from CNRDS database, other variable information comes from the CSMAR database.

Following the conventions of existing empirical research, we further process the research sample as follows: 1) Remove relevant listed companies related to financial industries such as banks, securities, insurance, etc. 2) Excluding the sample with special circumstances such as ST and PT. 3) Excluding cross-listed companies. 4) Eliminating companies with asset liability ratio greater than 100%. 5) Excluding firms listed in the current year. Finally, in this paper, a total of 12,801 observations were obtained after screening.

3.2 Variable definitions

3.2.1 Dependent variables

Firms’ total factor productivity (TFP). The core problem of economic operation is efficiency and the key to improving efficiency is to achieve productivity improvement. The TFP is considered to be the main power source of long-term sustainable development. In the early research, the academic circle usually measured TFP at the macro or meso level (Albrizio et al., 2017; Xia and Xu, 2020) and. Later, with the deepening of research and the micro data became more available, the micro firms’ TFP gradually attracted the researchers’ attention. At present, the methods of calculating the TFP can be divided into 5 categories: 1) Non-parametric methods, such as data envelopment analysis (DEA), exponential methods, etc. 2) Parametric methods, such as stochastic Frontier analysis. 3) Ordinary least square method (OLS). 4) Fixed effects method. 5) Semi-parametric approach, such as OP method (Olley and Pakes, 1996) and LP method (Levinsohn and Petrin, 2003). Considering the great advantage of OP method in mitigating endogeneity and selection bias, we select the TFP estimated by the OP model as the main dependent variable. Many authoritative documents also use OP model to calculate firms’ TFP in China (e.g., Brandt et al., 2012; Zhang et al., 2018; He et al., 2020). Also, we use the TFP calculated by LP method, OLS method and fixed effects model as the robustness tests.

The OP method proposed by Olley and Pakes effectively avoids the endogeneity and selection bias problems of traditional methods (Olley and Pakes, 1996). Specifically, the regression model for the OP method to estimate firms’ TFP is as follows:

In the above equation, i denotes the firm, t denotes the year, Yit denotes the firm’s gross operating income, Kit refers to the firm’s net fixed assets, Iit is the total investment, Lit is the labor input, Ageit denotes firm’s listing age, Stateit is the firm’s ownership (1 for state-owned firms and 0 for non-state-owned firms), Exitit denotes whether the firm is involved in export activities (1 for participation in export activities, 0 otherwise), Yearm, Industryk and Provincen represent the year, industry and province dummy variables, respectively, and εit is the random error term. Running the above equation, we can obtain εit, which is exactly the firms’ TFP estimated by the OP method.

3.2.2 Independent variable

Timet*Treati. Timet*Treati is a dummy variable whose coefficient indicates the effect of the EPTL. If the focal enterprise belongs to the heavily polluting industry and the year is 2018 or later, Timet*Treati equals 1, and 0 otherwise.

3.2.3 Control variables

To eliminate other important factors that may bias the estimation results as much as possible, referring to Ai et al. (2020), Wu and Wang (2022), the control variables selected mainly include corporate financial features and corporate governance features. Corporate financial features include: Firm size (Size), that is, the natural logarithm of the total assets of the enterprise; asset liability ratio (Lev), that is, the proportion of total liabilities to total assets; enterprise growth (Growth), measured by the growth rate of operating revenue; free cash flow (Cash), measured as the ratio of net cash flow from operating activities to total assets. Corporate governance features include: Ownership structure (Soe), dummy variable, 1 indicates state-owned enterprises, 0 means non-state-owned enterprises; duality (Dual), 1 for duality of CEO and chair of the board, 0 otherwise; equity concentration (Top1), shareholding ratio of the largest shareholder; the proportion of independent directors (Indir); board size (Board), i.e., the number of all directors on the board.

3.3 Research model

This paper examines the economic effect of environmental regulation by introducing the EPTL implemented in 2018. The DID model is the most commonly used method for evaluating policy effects in economics. Referring to Greenstone and Hanna (2014), we develop the following DID model to mitigate the endogeneity:

Among them, where TFPit represents the TFP of firm i in year t; Treati is a dummy variable, when the enterprise belongs to the heavily polluting industry, it takes 1, otherwise it is 0; Timet is also a dummy variable, when the year belongs to 2018 and later, Timet is 1, otherwise it is 0; i, t represent the enterprise and the year, respectively; Controlit represents the corporate financial features and governance features; μi and νt represent the enterprise and time fixed effects; εit is the error term. β1 is the coefficient of independent variable.

4 Empirical results

4.1 Descriptive statistics

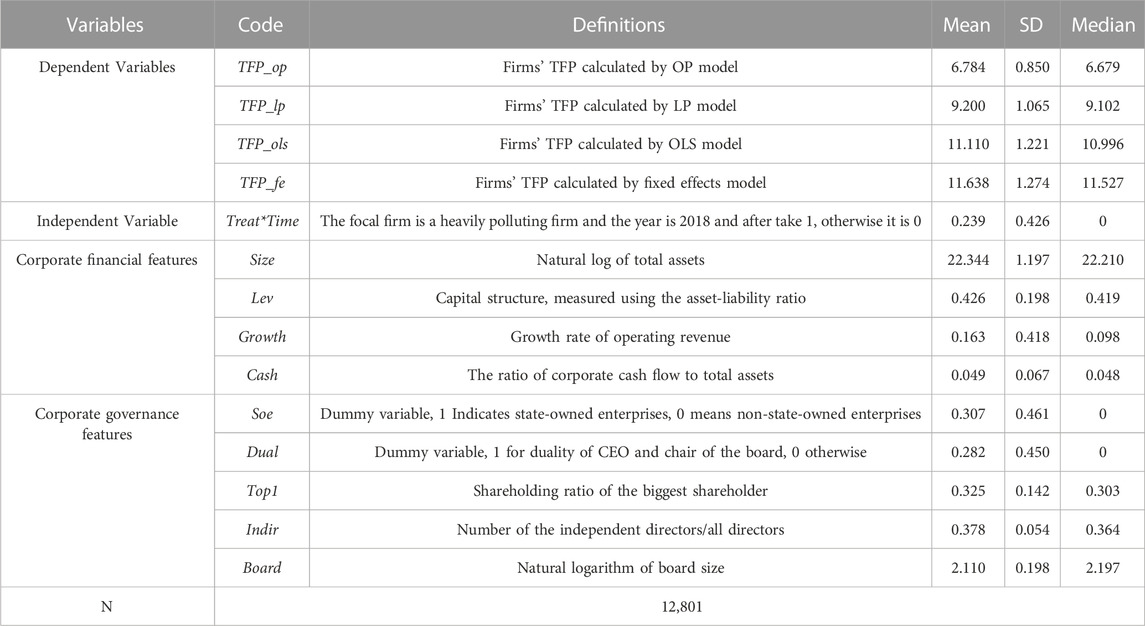

Table 1 shows that the mean and median values of firms’ TFP calculated by various methods do not differ much from each other and the standard errors are small, indicating that the firms’ TFP is generally evenly distributed.

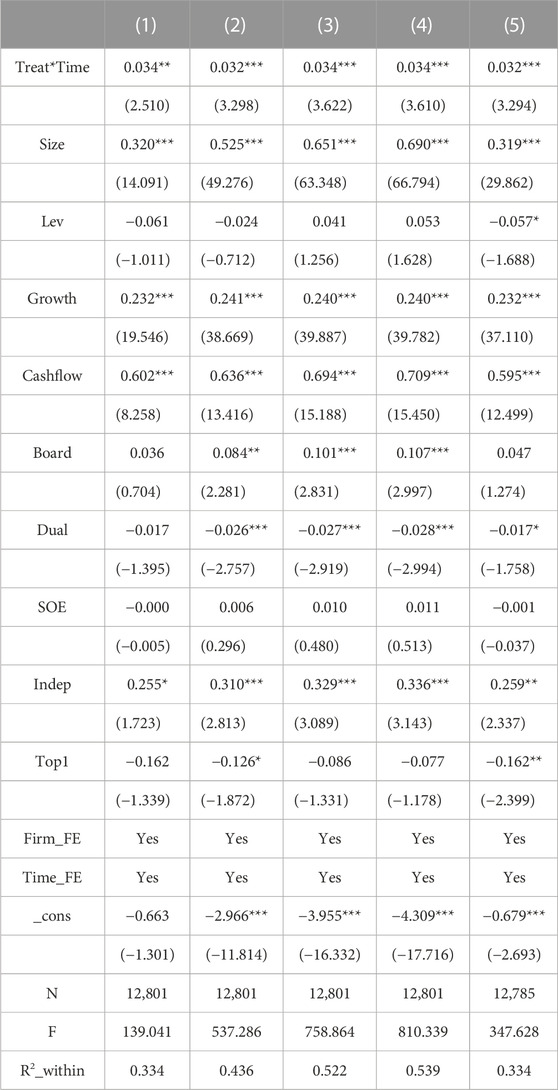

4.2 Baseline results

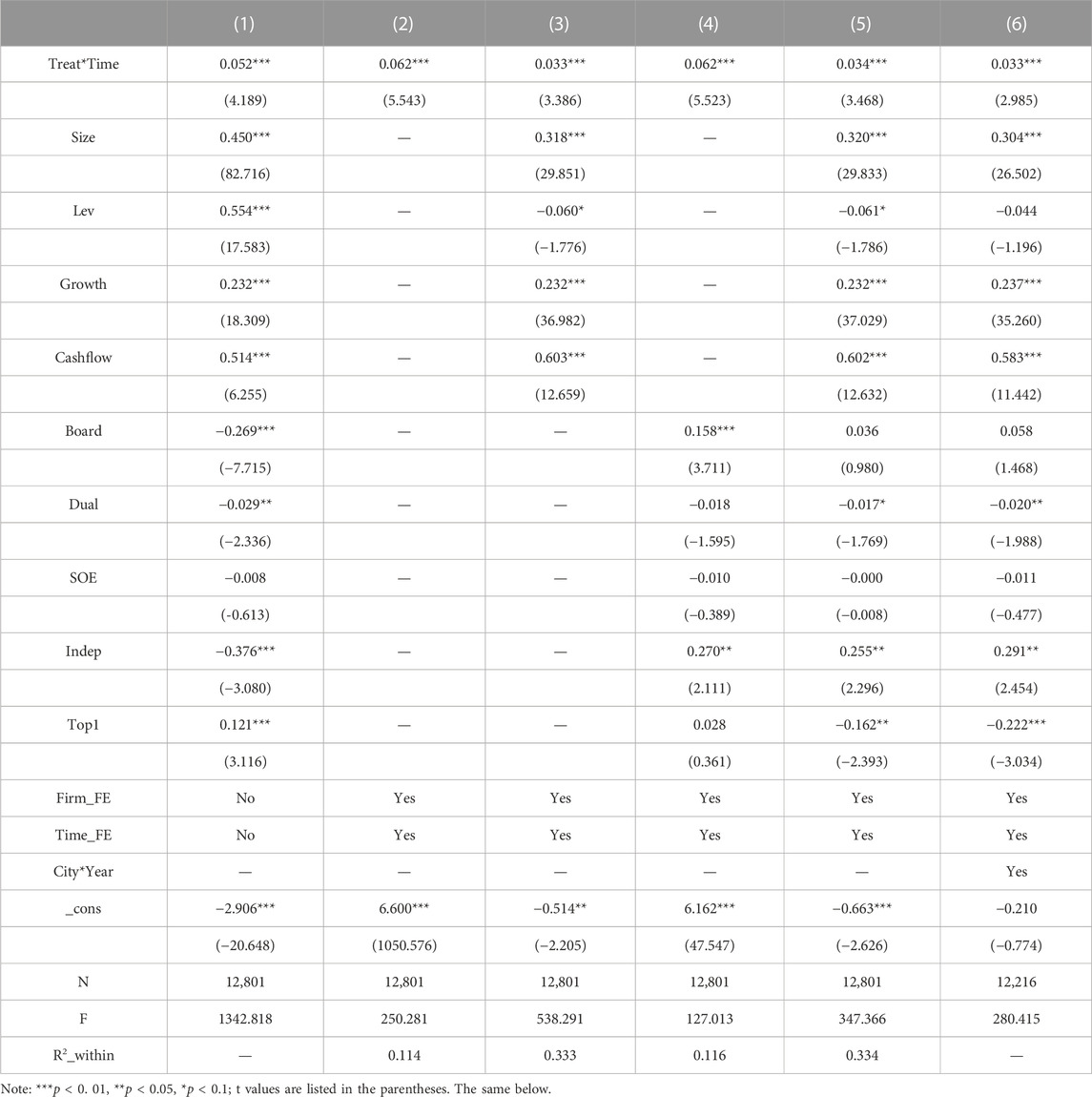

Table 2 illustrates the causal effect of the EPTL on firms’ TFP. Column 1) shows the result of OLS regression. The column 2) shows the result without adding the financial features and governance features to the model. When we incorporate the financial features into the regression, the coefficient and significance of the independent variable are substantially reduced and the result is exhibited in the column 3). Similarly, the column 4) presents the regression result with governance features as the control variables. The column 5) illustrates the result of incorporating all financial features and governance features into the regression model. Column 6) of Table 2, our paper further controls the interactive fixed effect of city and year to control the urban features that do not change with time. In general, the EPTL has increased the TFP of heavily polluting enterprises by 3.4%, and the research results verify the “Porter effect” under the Chinese context, thus supporting our Hypothesis.

4.3 Robustness checks

4.3.1 Parallel trend test

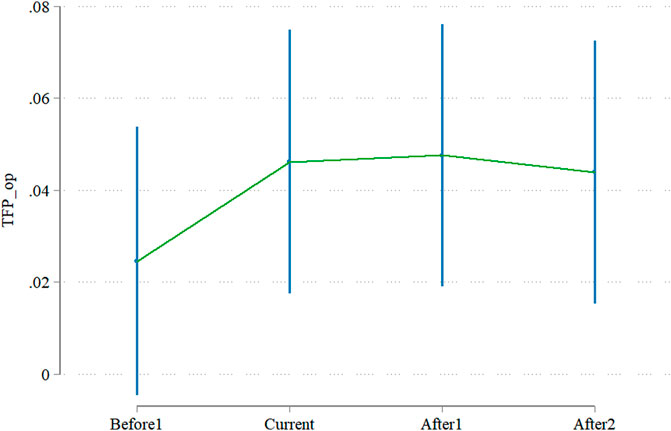

The experimental group and the control group should maintain the parallel trend before the implementation of the policy (Bertrand et al., 2004). In order to verify whether this assumption is tenable, referring to Beck et al. (2010); Sun et al. (2020), this paper uses the event study method to conduct a more robust empirical test. In Figure 2, Before1 indicates the year before the implementation of the EPTL, i.e., 2017. And its corresponding coefficient and t-value are 0.023 and 1.539, respectively, which fail to pass the significance test, indicating that the DID model can pass the parallel trend test. Current and After1-After2 denote 2018 and 2019–2020, respectively, and the coefficients are both significantly positive at the 1% level, indicating that the heavily polluting enterprises’ TFP has significantly increased after the implementation of the EPTL. Therefore, the parallel trend test confirms the economic effect of the EPTL, which provides strong support for the effectiveness of the “Porter hypothesis”.

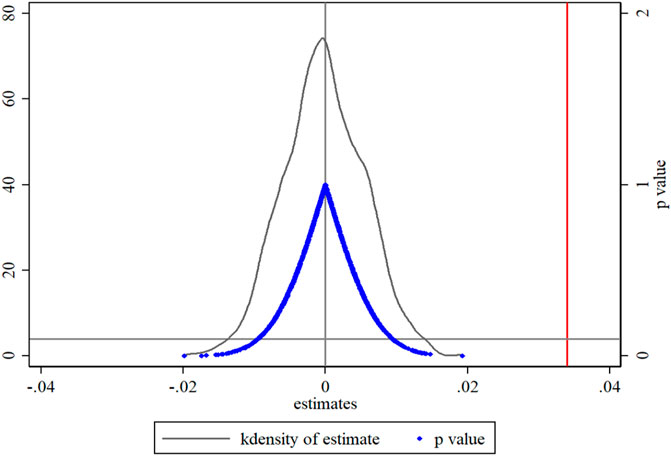

4.3.2 Placebo test

To further exclude the influence of other environmental policies in the same period on the baseline results. Referring to Bradley et al. (2017), as this paper uses unbalanced panel data, we randomly select the experimental group from the whole sample, and keep the proportion of the experimental group and the implementation time of the EPTL unchanged. Then carry out regression test according to the benchmark regression model to obtain the regression p-value and kernel density estimation, and repeat the above steps for 1,000 times. Figure 3 shows the placebo test, plotting the probability density distribution of the regression coefficients and the corresponding p values. We can find that most of the estimated coefficients are concentrated around 0 and approximately follow the normal distribution, and most of the p values are greater than 0.1. Meanwhile, the real estimated value (from column (5) of Table 2) in this paper is significant outliers in the placebo test. This shows that the TFP improvement of heavily polluting enterprises caused by the EPTL has not been seriously disturbed by other environmental policies.

4.3.3 Other robustness tests

In addition, this paper also performs other robustness tests to demonstrate the robustness of the baseline regression results. Table 3 shows the results of other robustness tests. In the column (1), we employ the firm level of clustering robust standard errors. Compared with the benchmark regression, the significance of the independent variable is reduced from 1% to 5%. In columns (2), (3), (4) of Table 3, we use firms’ TFP calculated by the LP method, OLS model and fixed effects model as the dependent variables, respectively, and the coefficients of the independent variables are all significantly positive at the 1% level. In order to overcome the problem of sample selection bias, we employ the sample after propensity score matching (PSM) to conduct the regression test again, and the result is showed in column (5) of Table 3.

5 Further analysis

5.1 Heterogeneity analysis

In fact, due to the complexity of economic system, the impact of the EPTL on firms’ TFP may exhibit differences under different conditions. In this part, our paper will examine the effect difference of the EPTL from the firm level and the regional level.

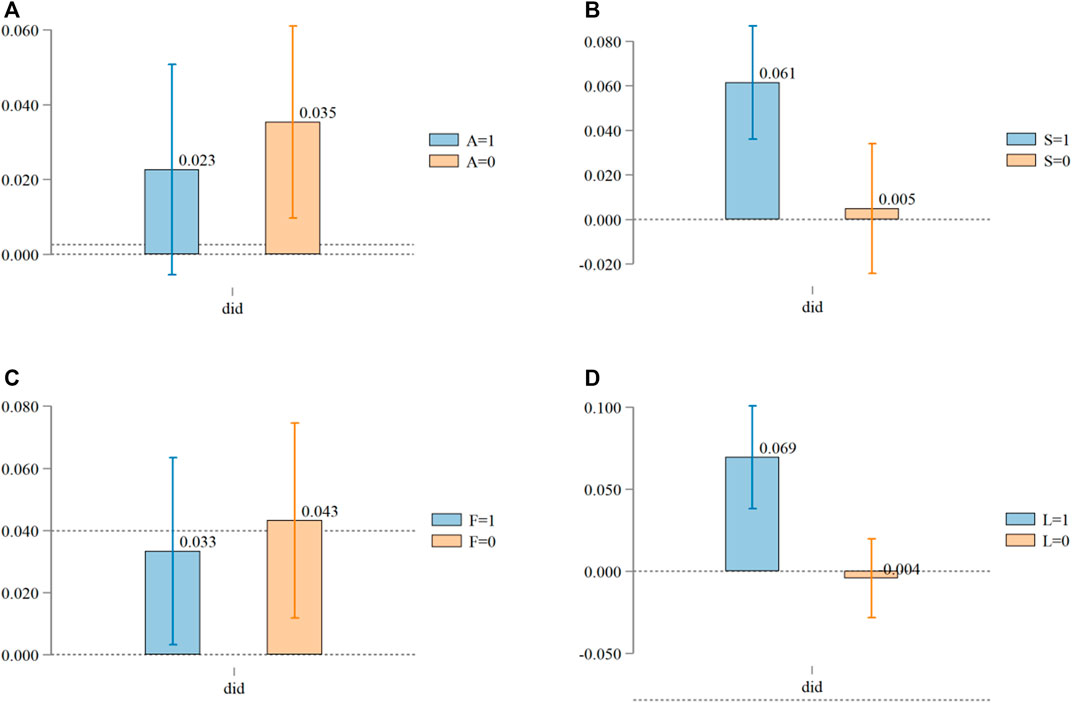

5.1.1 Principal agent differences

The principal-agent theory shows that in the firm, because of the information asymmetry that often exists between the agents and the firm’s shareholders, the agents may take advantage of the information advantage to engage in activities that damage the firm’s performance. In other words, the agents may sacrifice the interests of shareholders to maximize their own interests, and such opportunistic behavior is more likely to harm firm’s productivity. Given this scenario, we expect that the impact of the EPTL on firms’ TFP may be greater among firms with lower principal-agent costs.

Referring to Chae et al. (2009), we measure the principal-agent cost by using the proportion of administrative expenses to the enterprises’ total operating income. The larger the proportion, the more serious of the principal-agent problem in the enterprise. This article uses the median of administrative expenses rate as the dividing point, and the sample is divided into higher principal-agent cost group (A = 1) and lower principal-agent cost group (A = 0). Figure 4A shows the regression result of the group with higher principal-agent cost (coefficient = 0.023, t = 1.581), the regression coefficient of the independent variable is not significant. And for the group with lower principal-agent cost (coefficient = 0.035, t = 2.707), the regression coefficient of the independent variable is significantly positive at the 1% level. The possible explanation is that the principal-agent cost is high, the managers of heavily polluting enterprises may take negative actions to deal with environmental regulation policies from the perspective of maximizing their own interests, thus discouraging positive activities such as corporate innovation, which is ultimately harmful to production efficiency. Consequently, the positive effect of the EPTL on heavily polluting firms’ TFP is more significant in firms with lower principal-agent cost.

5.1.2 The heterogeneity of firm size

Large-scale enterprises are the core and pillar of national economic development, and they have obvious advantages over other enterprises in R&D investment, market share, financing cost, internationalization degree, etc. In addition, the competitive means of large-scale enterprises are more diversified, and the higher level of technological innovation also provides an important guarantee for them to improve production efficiency. Therefore, firms with different sizes may choose differentiated coping strategies when faced with environmental regulatory measures, and we expect the policy effect of the EPTL is more pronounced in the sample of large-scale firms.

This paper takes the median of firm size as the dividing point, and divides the sample into large-scale enterprises (S = 1) and small-scale enterprises (S = 0). The empirical results are exhibited in Figure 4B, compared with small-scale enterprises (coefficient = 0.005, t = 0.325), the EPTL significantly promotes the TFP of large-scale heavily polluting enterprises (coefficient = 0.061, t = 4.752). It is not difficult to imagine that large-scale enterprises have significant scale advantages, they are usually the leading enterprises in the industry or region, and their financing costs are often low. They can obtain more policy support from the government, making large-scale enterprises more capable of coping with the adverse shocks of environmental regulation.

5.1.3 The heterogeneity of financial slack

There are different conclusions about whether financial slack is beneficial or harmful to the enterprises. Financial slack means that a large number of idle resources are not fully utilized within the enterprise, and is generally considered to be the result of long-term inefficient operation and mismanagement of the enterprise. Therefore, financial slack may exacerbate principal-agent problems and inhibit firm performance, resulting in efficiency losses (Marlin and Geiger, 2015). In addition, although financial slack can reduce the adverse shock of fierce external market competition on the firms, it also tends to make the managers become arrogant and blindly confident. What’s more, managers may use financial slack to maximize their own welfare, thus reducing the R&D investment (Keupp and Gassmann, 2013; Shaikh, O’Brien, and Peters, 2018), and adversely affecting the production efficiency of firms. Therefore, we expect that the impact of the EPTL on firms’ TFP will be greater in the group with lower financial slack.

To test the above conjecture, referring to Vanacker et al. (2017), this paper uses the ratio of the sum of cash and cash equivalents to the total assets of the enterprises to measure financial slack. According to the median of financial slack, the sample is divided into high financial slack group (F = 1) and low financial slack group (F = 0). The empirical results are shown in Figure 4C, we find that the EPTL significantly improves the TFP of heavily polluting enterprises, whether for the group with high financial slack (coefficient = 0.033, t = 2.171) or the group with low financial slack (coefficient = 0.043, t = 2.700). However, for enterprises with high financial slack, the EPTL has a greater impact on the TFP of heavily polluting enterprises. Therefore, a greater degree of financial slack for companies will weaken the positive effect of the EPTL on firms’ TFP.

5.1.4 Location advantage difference

The imbalance of regional economic development has become an obstacle to high-quality economic development in China, therefore, it is inevitable that the firms’ TFP in different cities will be different. The provincial capitals and municipalities are often the “locomotive” of regional economic development, which can not only get more attention and resource preference from higher-level governments, but also have incomparable advantages in policy preferences, industrial layout, human capital and transportation. Therefore, we speculate that the EPTL has a greater impact on the TFP of firms located in municipalities and provincial capitals.

This article divides the cities of the enterprise headquarters into the provincial capital cities, municipalities (L = 1) and other cities (L = 0), and we find that nearly half of the sample is located in the provincial capital cities and municipalities. The corresponding empirical results are illustrated in Figure 4D. Compared with heavily polluting enterprises located in other cities (coefficient = −0.004, t = −0.343), the EPTL has a greater impact on the TFP of heavily polluting enterprises in provincial capital cities and municipalities (coefficient = 0.069, t = 4.358), which is similar to the research results of Yang et al. (2021). The main reason is that, the marketization and resource allocation efficiency of the provincial capital and municipalities are often higher, which can attract more productive enterprises to settle. The many advantages owned by the provincial capital and municipalities will provide convenience for enterprises to improve TFP.

5.2 Potential mechanisms

This part further explores the possible channels of the EPTL affecting firms’ TFP. The mediating effects model proposed by Baron and Kenny (1986) is more applicable to psychological studies, but it is not reliable in economics due to the problems such as endogeneity bias and poor identification of some mechanisms. Therefore, referring to Baron (2022), this paper tests the potential mechanisms by observing the effect of the EPTL on mediating variables.

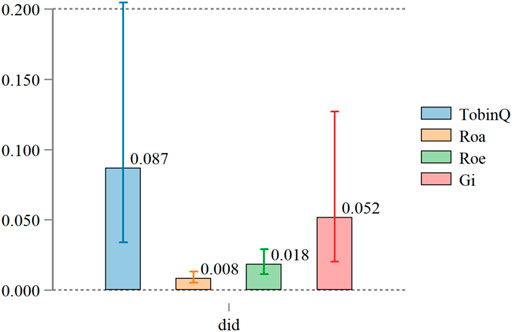

5.2.1 Increasing firm performance

As the main body of micro-economic activities, firms must face the trade-off between environmental costs and firm performance. According to the traditional economic theory, when the government implements environmental regulation measures and requires enterprises to increase investment in environmental protection and adopt green production mode. The external regulatory pressure forces enterprises to reallocate existing resources and shift part of their investment from traditional production to pollution control and environmental protection activities, which leads to “compliance cost” and reduces enterprises’ profitability (Ramanathan et al., 2018). However, the “Porter hypothesis” presents a very different view from the traditional economic theory. The classic “Porter hypothesis” holds that environmental regulation can trigger the “innovation compensation effect” and “first mover advantage” of the enterprises, partially or even completely compensate for the adverse effects of environmental regulation on enterprises (e.g., additional production costs), and then promote firm value (Yu et al., 2017; Peng et al., 2021). Ultimately, the improvement of firm value will bring higher production efficiency. Thus, environmental regulation may enhance or reduce firm value, and then affect firms’ TFP.

There are many ways to measure firm value in academic circle, referring to Hao et al. (2022), this article selects TobinQ as an indicator for measuring firm value. Since the long-term income represented by TobinQ is more in line with firms’ long-term profit and loss under the pressure of environmental regulation, and TobinQ is widely used in the relevant research of firm value (e.g., Rassier and Earnhart, 2015; Kong et al., 2020). At the same time, we employ return on total assets (Roa) and return on net assets (Roe) as the robustness tests. Figure 5 shows the micro value effect of the EPTL. Figure 5 exhibits the regression result of TobinQ as the dependent variable (coefficient = 0.087, t = 2.152). Not surprisingly, the result indicates that the EPTL is conducive to improving the performance of heavily polluting enterprises. Also, in Figure 5, we use Roa and Roe as the dependent variables respectively, and the coefficients of the independent variables are all significantly positive. The empirical results suggest that the EPTL can enhance firm performance, and numerous studies have confirmed the positive relationship between environmental regulation and firm value (e.g., Kong et al., 2014; Lee et al., 2017).

5.2.2 Promoting green innovation

The relationship between environmental governance and green innovation has always been the focus of controversy in academic circles, and has also been discussed by a large number of academic studies at home and abroad. More studies support the positive relationship between the two. For example, according to “Porter hypothesis”, appropriate environmental regulation can stimulate green innovation of enterprises, and eventually the “innovation compensation effect” brought by green innovation can partially or even fully offset the “compliance cost” of environmental regulation, thus making enterprises more competitive (Cui et al., 2022). In order to achieve the long-term goal of sustainable development, enterprises must improve their green technology innovation capability, accelerate the transformation of the original polluting production mode, and properly deal with environmental issues in order to improve their profits and market competitiveness.

R&D investment is a sunk cost, which cannot truly reflect the innovation ability of the enterprises. Referring to Hu et al. (2021), we use the number of green patent applications (Gi) to measure the green innovation ability of enterprises. To strengthen the credibility of the baseline regression results, we use Gi as the dependent variable to explore whether the EPTL triggers the “innovation compensation effect”. As shown in Figure 5, we find that the EPTL significantly enhances the green innovation level of heavily polluting firms (coefficient = 0.052, t = 2.104). This not only argues the robustness of the benchmark results from the side, but also shows that under the mild environmental governance pressure, heavily polluting firms are more willing to adopt positive environmental governance behaviors rather than responding to governance pressure by the negative means such as “greenwashing”.

6 Conclusion and implications

As an important part of the formal system, the economic effect of environmental regulation is highly controversial. Whether it is the self-defined comprehensive environmental regulation indicators or the macro environmental policies as the quasi-natural experiments, the effect of environmental regulation on firms’ TFP is not clear. This article takes the implementation of the EPTL as an external policy shock, based on the analysis framework of the “Porter hypothesis”, we employ the DID model to test the influence of the EPTL on firms’ TFP. We find that: 1) The EPTL has significantly improved the TFP of heavily polluting enterprises. After 2019, this positive impact has a slight decline. 2) Meanwhile, the EPTL also improves the financial performance and green innovation of heavily polluting enterprises. 3) Heterogeneity analysis illustrates that the impact of the EPTL on heavily polluting enterprises’ TFP is not significant in the samples of enterprises with higher agency costs and small-scale enterprises. Financial slack may weaken the positive effect of the EPTL on firms’ TFP. For enterprises located in the provincial capital and municipalities, the EPTL shows positive effect. As an effective means to reconcile the contradiction between environmental governance and economic development, our study systematically investigates the relationship between the EPTL and firms’ TFP.

Based on the main conclusions we have obtained, this article proposes the following policy recommendations:

Firstly, considering the economic effect of the EPTL is small. We recommend the central government should continue to strictly implement the EPTL and take a combination of various environmental supervision measures to control environmental pollution, and bring legal, economic, administrative and other methods into environmental governance. In addition to environmental policies, it is also necessary to pay attention to relevant systems that are complementary to environmental policies. For example, the government should formulate a sound relevant legal system to provide investors with a good market legal environment to enhance investor confidence. The government may provide financial assistance and tax incentives to encourage enterprises to adopt more environmentally-friendly production methods and technologies, thereby reducing pollution emissions and resource waste, while enhancing production efficiency and enterprise competitiveness.

Secondly, based on the results of the mechanism analysis. The government can increase its support for green innovation and encourage companies to engage in such innovation, fully leveraging the supportive role of green innovation on firms’ TFP. At the same time, by implementing industrial policies, science and technology innovation funds, and other measures, it can promote companies to strengthen technological innovation and enhance their competitiveness in the market. Companies should carefully evaluate various risks and adopt corresponding measures to prevent and control them, providing a guarantee for the healthy and stable development of the enterprise. Companies can improve their profitability by optimizing their business model, improving operational efficiency, and reducing production costs. To continuously enhance firm value, companies can explore novel business models and reinforce supply chain management, while incessantly optimizing and adjusting its operational strategies, to adapt to the ever-changing market and consumer demands.

Lastly, differentiated environmental measures can be considered. Encourage enterprises to reduce their administrative costs in order to maximize the positive impact of EPTL on firms’ TFP. Companies may consider introducing external monitoring mechanisms to weaken the principal-agent problems and opportunistic behaviors that exist within the company. We suggest that the government allocate existing resources reasonably and give more preferential measures to small and medium-sized enterprises and enterprises headquartered in small cities when formulating environmental regulation policies. For example, small and medium-sized enterprises are the main force of economic development, and most of them are located in small cities with underdeveloped economy. The government can appropriately increase subsidies for such enterprises and reduce their credit costs to alleviate financing pressure.

In fact, there are still some limitations in our research results. First of all, there are many methods to measure firms’ TFP, and the existing research has not reached a unified consensus. Although this paper uses the most commonly used methods in academia to estimate firms’ TFP, Ackerberg et al. (2015) argue that the OP and LP methods to estimate firms’ TFP suffer from functional dependence, which cannot be effectively estimated. Therefore, future research can use ACF method to further verify our empirical results. Secondly, this paper does not focus on the mechanisms that the EPTL affects firms’ TFP. Future research can explore other novel mechanisms besides the common mechanisms such as enterprise innovation ability and resource allocation efficiency. Finally, the value effect and green innovation effect of the EPTL has not been discussed in detail in this paper, and future research can be further expanded on this basis.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

SY designs the research, puts forward the idea and provides the funding. CW writes the original article, collects the data. KL and JL review the article. All the authors contribute to the manuscript. All authors contributed to the article and approved the submitted version.

Funding

This work was supported by the National Social Science Foundation of China (Grant No: 20FGLB038).

Acknowledgments

Thanks to the editors and reviewers for their valuable comments on this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ackerberg, D. A., Caves, K., and Frazer, G. (2015). Identification properties of recent production function estimators. Econometrica 83 (6), 2411–2451. doi:10.3982/ecta13408

Ai, H. S., Hu, S. L., Li, K., and Shao, S. (2020). Environmental regulation, total factor productivity, and enterprise duration: Evidence from China. Bus. Strategy Environ. 29 (6), 2284–2296. doi:10.1002/bse.2502

Albrizio, S., Kozluk, T., and Zipperer, V. (2017). Environmental policies and productivity growth: Evidence across industries and firms. J. Environ. Econ. Manag. 81, 209–226. doi:10.1016/j.jeem.2016.06.002

Allen, F., Qian, J., and Qian, M. (2005). Law, finance, and economic growth in China. J. financial Econ. 77 (1), 57–116. doi:10.1016/j.jfineco.2004.06.010

Baron, E. J. (2022). School spending and student outcomes: Evidence from revenue limit elections in Wisconsin. Am. Econ. J. Econ. Policy 14 (1), 1–39. doi:10.1257/pol.20200226

Baron, R. M., and Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. personality Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Bas, M., and Paunov, C. (2021). Disentangling trade reform impacts on firm market and production decisions. Eur. Econ. Rev. 135, 103726. doi:10.1016/j.euroecorev.2021.103726

Beck, T., Levine, R., and Levkov, A. (2010). Big bad banks? The winners and losers from bank deregulation in the United States. J. Finance 65 (5), 1637–1667. doi:10.1111/j.1540-6261.2010.01589.x

Becker, R. A. (2011). Local environmental regulation and plant-level productivity. Ecol. Econ. 70 (12), 2516–2522. doi:10.1016/j.ecolecon.2011.08.019

Bertrand, M., Duflo, E., and Mullainathan, S. (2004). How much should we trust differences-in-differences estimates? Q. J. Econ. 119 (1), 249–275. doi:10.1162/003355304772839588

Bradley, D., Kim, I., and Tian, X. (2017). Do unions affect innovation? Manag. Sci. 63 (7), 2251–2271. doi:10.1287/mnsc.2015.2414

Brandt, L., Van Biesebroeck, J., and Zhang, Y. F. (2012). Creative accounting or creative destruction? Firm-Level productivity growth in Chinese manufacturing. J. Dev. Econ. 97 (2), 339–351. 2. doi:10.1016/j.jdeveco.2011.02.002

Cai, W. G., and Ye, P. Y. (2020). How does environmental regulation influence enterprises' total factor productivity? A quasi-natural experiment based on China's new environmental protection law. J. Clean. Prod. 276, 124105. doi:10.1016/j.jclepro.2020.124105

Chae, J., Kim, S., and Lee, E. J. (2009). How corporate governance affects payout policy under agency problems and external financing constraints. J. Bank. Finance 33 (11), 2093–2101. doi:10.1016/j.jbankfin.2009.05.003

Chang, L., Li, W., and Lu, X. (2015). Government engagement, environmental policy, and environmental performance: Evidence from the most polluting Chinese listed firms. Bus. Strategy Environ. 24 (1), 1–19. doi:10.1002/bse.1802

Cheng, Z., and Kong, S. (2022). The effect of environmental regulation on green total-factor productivity in China's industry. Environ. Impact Assess. Rev. 94, 106757. doi:10.1016/j.eiar.2022.106757

Cui, J. B., Dai, J., Wang, Z. X., and Zhao, X. D. (2022). Does environmental regulation induce green innovation? A panel study of Chinese listed firms. Technol. Forecast. Soc. Change 176, 121492. doi:10.1016/j.techfore.2022.121492

Del Gatto, M., Di Liberto, A., and Petraglia, C. (2011). Measuring productivity. J. Econ. Surv. 25 (5), 952–1008. doi:10.1111/j.1467-6419.2009.00620.x

Dong, F., and Zheng, L. (2022). The impact of market-incentive environmental regulation on the development of the new energy vehicle industry: A quasi-natural experiment based on China's dual-credit policy. Environ. Sci. Pollut. Res. 29 (4), 5863–5880. doi:10.1007/s11356-021-16036-1

Franco, C., and Marin, G. (2017). The effect of within-sector, upstream and downstream environmental taxes on innovation and productivity. Environ. Resour. Econ. 66 (2), 261–291. doi:10.1007/s10640-015-9948-3

Gao, Y., Zhang, M., and Zheng, J. (2021). Accounting and determinants analysis of China's provincial total factor productivity considering carbon emissions. China Econ. Rev. 65, 101576. doi:10.1016/j.chieco.2020.101576

Ghosal, V., Stephan, A., and Weiss, J. F. (2019). Decentralized environmental regulations and plant-level productivity. Bus. Strategy Environ. 28 (6), 998–1011. doi:10.1002/bse.2297

Greenstone, M., and Hanna, R. (2014). Environmental regulations, air and water pollution, and infant mortality in India. Am. Econ. Rev. 104 (10), 3038–3072. doi:10.1257/aer.104.10.3038

Hancevic, P. I. (2016). Environmental regulation and productivity: The case of electricity generation under the CAAA-1990. Energy Econ. 60, 131–143. doi:10.1016/j.eneco.2016.09.022

Hao, X. Y., Chen, F. L., and Chen, Z. F. (2022). Does green innovation increase enterprise value? Bus. Strategy Environ. 31 (3), 1232–1247. doi:10.1002/bse.2952

Hao, Y., Deng, Y., Lu, Z.-N., and Chen, H. (2018). Is environmental regulation effective in China? Evidence from city-level panel data. J. Clean. Prod. 188, 966–976. doi:10.1016/j.jclepro.2018.04.003

He, G. J., Fan, M. Y., and Zhou, M. G. (2016). The effect of air pollution on mortality in China: Evidence from the 2008 Beijing Olympic Games. J. Environ. Econ. Manag. 79, 18–39. doi:10.1016/j.jeem.2016.04.004

He, G. J., Wang, S. D., and Zhang, B. (2020). Watering down environmental regulation in China. Q. J. Econ. 135 (4), 2135–2185. doi:10.1093/qje/qjaa024

Hille, E., and Mobius, P. (2019). Environmental policy, innovation, and productivity growth: Controlling the effects of regulation and endogeneity. Environ. Resour. Econ. 73 (4), 1315–1355. doi:10.1007/s10640-018-0300-6

Hu, G. Q., Wang, X. Q., and Wang, Y. (2021). Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ. 98, 105134. doi:10.1016/j.eneco.2021.105134

Jeong, E., Jang, S., Day, J., and Ha, S. J. (2014). The impact of eco-friendly practices on green image and customer attitudes: An investigation in a cafe setting. Int. J. Hosp. Manag. 41, 10–20. doi:10.1016/j.ijhm.2014.03.002

Jiang, H. D., Liu, L. J., Dong, K. Y., and Fu, Y. W. (2022). How will sectoral coverage in the carbon trading system affect the total oil consumption in China? A CGE-based analysis. Energy Econ. 110, 105996. doi:10.1016/j.eneco.2022.105996

Jiang, H. D., Purohit, P., Liang, Q. M., Liu, L. J., and Zhang, Y. F. (2023). Improving the regional deployment of carbon mitigation efforts by incorporating air-quality co-benefits: A multi-provincial analysis of China. Ecol. Econ. 204, 107675. doi:10.1016/j.ecolecon.2022.107675

Johnstone, N., Managi, S., Rodriguez, M. C., Hascic, I., Fujii, H., and Souchier, M. (2017). Environmental policy design, innovation and efficiency gains in electricity generation. Energy Econ. 63, 106–115. doi:10.1016/j.eneco.2017.01.014

Keupp, M. M., and Gassmann, O. (2013). Resource constraints as triggers of radical innovation: Longitudinal evidence from the manufacturing sector. Res. Policy 42 (8), 1457–1468. doi:10.1016/j.respol.2013.04.006

Khan, Z., Ali, S., Dong, K., and Li, R. Y. M. (2021). How does fiscal decentralization affect CO2 emissions? The roles of institutions and human capital. Energy Econ. 94, 105060. doi:10.1016/j.eneco.2020.105060

Kong, D. M., Liu, S. S., and Dai, Y. H. (2014). Environmental policy, company environment protection, and stock market performance: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 21 (2), 100–112. doi:10.1002/csr.1306

Kong, Y. S., Famba, T., Chituku-Dzimiro, G., Sun, H. P., and Kurauone, O. (2020). Corporate governance mechanisms, ownership and firm value: Evidence from listed Chinese firms. Int. J. Financial Stud. 8 (2), 20. doi:10.3390/ijfs8020020

Lee, J., Veloso, F. M., and Hounshell, D. A. (2011). Linking induced technological change, and environmental regulation: Evidence from patenting in the US auto industry. Res. Policy 40 (9), 1240–1252. doi:10.1016/j.respol.2011.06.006

Lee, K. H., Park, B. J., Song, H., and Yook, K. H. (2017). The value relevance of environmental audits: Evidence from Japan. Bus. Strategy Environ. 26 (5), 609–625. doi:10.1002/bse.1940

Levinsohn, J., and Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 70 (2), 317–341. doi:10.1111/1467-937x.00246

Li, X. S., Shu, Y. X., and Jin, X. (2022). Environmental regulation, carbon emissions and green total factor productivity: A case study of China. Environ. Dev. Sustain. 24 (2), 2577–2597. doi:10.1007/s10668-021-01546-2

Liu, G., Yang, Z., Zhang, F., and Zhang, N. (2022). Environmental tax reform and environmental investment: A quasi-natural experiment based on China's environmental protection tax law. Energy Econ. 109, 106000. doi:10.1016/j.eneco.2022.106000

Marlin, D., and Geiger, S. W. (2015). The organizational slack and performance relationship: A configurational approach. Manag. Decis. 53 (10), 2339–2355. doi:10.1108/md-03-2015-0100

Moffette, F., Skidmore, M., and Gibbs, H. K. (2021). Environmental policies that shape productivity: Evidence from cattle ranching in the Amazon. J. Environ. Econ. Manag. 109, 102490. doi:10.1016/j.jeem.2021.102490

Olley, S., and Pakes, A. (1996). The dynamics of productivity in the telecommunications equipment industry. Econometrica 64, 1263–1297. doi:10.2307/2171831

Pan, X., Pu, C., Yuan, S., and Xu, H. (2022). Effect of Chinese pilots carbon emission trading scheme on enterprises' total factor productivity: The moderating role of government participation and carbon trading market efficiency. J. Environ. Manag. 316, 115228. doi:10.1016/j.jenvman.2022.115228

Peng, J. C., Xiao, J. Z., Zhang, L., and Wang, T. (2020). The impact of China's 'Atmosphere Ten Articles' policy on total factor productivity of energy exploitation: Empirical evidence using synthetic control methods. Resour. Policy 65, 101544. doi:10.1016/j.resourpol.2019.101544

Peng, J. Y., Xie, R., Ma, C. B., and Fu, Y. (2021). Market-based environmental regulation and total factor productivity: Evidence from Chinese enterprises. Econ. Model. 95, 394–407. doi:10.1016/j.econmod.2020.03.006

Porter, M. E., and Van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Ramanathan, R., Ramanathan, U., and Bentley, Y. (2018). The debate on flexibility of environmental regulations, innovation capabilities and financial performance–A novel use of DEA. Omega 75, 131–138. doi:10.1016/j.omega.2017.02.006

Rassier, D. G., and Earnhart, D. (2015). Effects of environmental regulation on actual and expected profitability. Ecol. Econ. 112, 129–140. doi:10.1016/j.ecolecon.2015.02.011

Shaikh, I. A., O'Brien, J. P., and Peters, L. (2018). Inside directors and the underinvestment of financial slack towards R and D-intensity in high-technology firms. J. Bus. Res. 82, 192–201. doi:10.1016/j.jbusres.2017.09.014

Sun, C. W., Zhan, Y. H., and Du, G. (2020). Can value-added tax incentives of new energy industry increase firm's profitability? Evidence from financial data of China's listed companies. Energy Econ. 86, 104654. doi:10.1016/j.eneco.2019.104654

Sun, Y. C. (2022). Environmental regulation, agricultural green technology innovation, and agricultural green total factor productivity. Front. Environ. Sci. 10, 2025. doi:10.3389/fenvs.2022.955954

Tang, H. L., Liu, J. M., and Wu, J. G. (2020). The impact of command-and-control environmental regulation on enterprise total factor productivity: A quasi-natural experiment based on China's "two control zone" policy. J. Clean. Prod. 254, 120011. doi:10.1016/j.jclepro.2020.120011

Tang, P. C., Jiang, Q. S., and Mi, L. L. (2021). One-vote veto: The threshold effect of environmental pollution in China?s economic promotion tournament. Ecol. Econ. 185, 107069. doi:10.1016/j.ecolecon.2021.107069

Tang, P. C., Liu, X., Hong, Y., and Yang, S. W. (2022). “Moving beyond economic criteria: Exploring the social impact of green innovation from the stakeholder management perspective,” in Corporate social responsibility and environmental management (New Jersey, United States: Wiley Online Library).

Tang, P. C., Yang, S. W., Shen, J., and Fu, S. K. (2018). Does China's low-carbon pilot programme really take off? Evidence from land transfer of energy-intensive industry. Energy Policy 114, 482–491. doi:10.1016/j.enpol.2017.12.032

Vanacker, T., Collewaert, V., and Zahra, S. A. (2017). Slack resources, firm performance, and the institutional context: Evidence from privately held European firms. Strategic Manag. J. 38 (6), 1305–1326. doi:10.1002/smj.2583

Wang, H. S., Yang, G. Q., Xiao, O. Y., and Qin, J. Y. (2021). Does central environmental inspection improves enterprise total factor productivity? The mediating effect of management efficiency and technological innovation. Environ. Sci. Pollut. Res. 28 (17), 21950–21963. doi:10.1007/s11356-020-12241-6

Wang, K.-L., Pang, S.-Q., Zhang, F.-Q., Miao, Z., and Sun, H.-P. (2022). The impact assessment of smart city policy on urban green total-factor productivity: Evidence from China. Environ. Impact Assess. Rev. 94, 106756. doi:10.1016/j.eiar.2022.106756

Wu, H. T., Ren, S. Y., Yan, G. Y., and Hao, Y. (2020). Does China's outward direct investment improve green total factor productivity in the "belt and road" countries? Evidence from dynamic threshold panel model analysis. J. Environ. Manag. 275, 111295. doi:10.1016/j.jenvman.2020.111295

Wu, Q., and Wang, Y. (2022). How does carbon emission price stimulate enterprises' total factor productivity? Insights from China's emission trading scheme pilots. Energy Econ. 109, 105990. doi:10.1016/j.eneco.2022.105990

Xia, F., and Xu, J. (2020). Green total factor productivity: A re-examination of quality of growth for provinces in China. China Econ. Rev. 62, 101454.

Xie, R., Fu, W., Yao, S. L., and Zhang, Q. (2021). Effects of financial agglomeration on green total factor productivity in Chinese cities: Insights from an empirical spatial Durbin model. Energy Econ. 101, 105449. doi:10.1016/j.eneco.2021.105449

Yamazaki, A. (2022). Environmental taxes and productivity: Lessons from Canadian manufacturing. J. Public Econ. 205, 104560. doi:10.1016/j.jpubeco.2021.104560

Yang, S. W., Wang, C., Zhang, H., Lu, T. S., and Yi, Y. (2021). Environmental regulation, firms' bargaining power, and firms' total factor productivity: Evidence from China. Environ. Sci. Pollut. Res. 29 (6), 9341–9353. doi:10.1007/s11356-021-16116-2

Yang, Z. H., and Shen, Y. (2023). The impact of intelligent manufacturing on industrial green total factor productivity and its multiple mechanisms. Front. Environ. Sci. 10, 2600. doi:10.3389/fenvs.2022.1058664

Yu, H., Liao, L., Qu, S., Fang, D., Luo, L., and Xiong, G. (2021). Environmental regulation and corporate tax avoidance: A quasi-natural experiments study based on China's new environmental protection law. J. Environ. Manag. 296, 113160. doi:10.1016/j.jenvman.2021.113160

Yu, W., Ramanathan, R., and Nath, P. (2017). Environmental pressures and performance: An analysis of the roles of environmental innovation strategy and marketing capability. Technol. Forecast. Soc. Change 117, 160–169. doi:10.1016/j.techfore.2016.12.005

Zhang, A. X., Deng, R. R., and Wu, Y. F. (2022). Does the green credit policy reduce the carbon emission intensity of heavily polluting industries? -Evidence from China's industrial sectors. J. Environ. Manag. 311, 114815. doi:10.1016/j.jenvman.2022.114815

Zhang, P., Deschenes, O., Meng, K., and Zhang, J. (2018). Temperature effects on productivity and factor reallocation: Evidence from a half million Chinese manufacturing plants. J. Environ. Econ. Manag. 88, 1–17. doi:10.1016/j.jeem.2017.11.001

Zheng, H., and He, Y. (2022). How do the China pollution discharge fee policy and the environmental protection tax law affect firm performance during the transitional period? Environ. Sci. Pollut. Res, 1–17.

Keywords: the environmental protection tax law, total factor productivity, value effect, economic effect, heavily polluting enterprises, OP method

Citation: Yang S, Wang C, Lyu K and Li J (2023) Environmental protection tax law and total factor productivity of listed firms: promotion or inhibition?. Front. Environ. Sci. 11:1152771. doi: 10.3389/fenvs.2023.1152771

Received: 28 January 2023; Accepted: 27 April 2023;

Published: 11 May 2023.

Edited by:

Zhenghui Li, Guangzhou University, ChinaReviewed by:

Hong-Dian Jiang, China University of Geosciences, ChinaMaham Furqan, Oregon State University, United States

Copyright © 2023 Yang, Wang, Lyu and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Chao Wang, MTg3OTAxMDg4MzlAMTYzLmNvbQ==

Shuwang Yang1,2

Shuwang Yang1,2 Chao Wang

Chao Wang