- 1Department Economics, University of Ulsan, Ulsan, Republic of Korea

- 2Department Financial Management, Guangdong Baiyun University, Guangzhou, China

Under the guidance of a high-quality development strategy, upholding the long-term concept of green development is the foundation allowing polluting companies to resist external environmental threats and retain their legitimate business statuses. However, the top managers of companies do not always hold long-term perspectives. To this end, we investigate the impact of management myopia on green technological innovation and its mechanism of action for heavy polluters using zero-inflated Poisson regression analysis for 2007–2020 for A-share listed heavy polluters. The empirical results show that the logarithmic value of green technological innovation decreases 1.251 units for each 1-unit increase in the management myopia level demonstrated by heavily polluting enterprises. Moreover, these results are more significant in heavily polluting enterprises with high management shareholding and those that receive more government subsidies. However, managerial myopia is suppressed in heavily polluting firms with many independent directors and institutional investors. A further study found that managerial myopia had the most significant negative impact on green technological innovation for heavy polluters in the central region, and each 1-unit increase in the managerial myopia level decreased the firm’s green technology innovation level by 3.577 units. The findings of this paper have important implications for heavily polluting firms seeking to improve their senior management appointments and governance structures, promote green technology and technological innovation, and achieve high-quality corporate development.

1 Introduction

China’s large population, relative shortage of resources per capita and rapid economic development has led to excessive resource consumption and environmental pollution. China’s current level of economic development is not sustainable (Anwar et al., 2022a). Therefore, transforming the development objectives from quantity to quality, from scale expansion to structural upgrading, and from factor-driven to innovation-driven has become a pivotal issue to be solved for China to promote high-quality economic development. Technological innovation can play an important role in promoting sustainable development (Anwar, Malik, and Ahmad, 2021; Liu Xin, 2022; Anwar et al., 2022b; Wen et al., 2022). Green technology innovation is becoming an important emerging field in the new era of global industrial revolution and technological competition. Green technological innovations take the realization of green growth as the core pursuit. Green technological innovations focus on innovations to provide new products, processes, services, and market solutions. Green technological innovations reduce natural consumption and ecological and environmental damage. They improve resource allocation efficiency, providing powerful support and a realization path for China to achieve high-quality economic development. As laws regulating corporate production emissions become stringent, the environmental protection requirements placed on companies will incentivize ecological and technological innovations around the product life cycle and firms will seek to gain a competitive stage in the marketplace.

Heavy polluters face many complex difficulties when attempting to achieve green transformation. Among these challenges are the high investment cost and high-risk characteristics of green technology innovations, leading to heavily polluting enterprises to increase their green transformation capability (Ahuja, Lampert, and Tandon, 2008; Wang, Zeng, and Li, 2022). The existence of resource overdependence in industries leads to the emergence of green transformation bottlenecks. Applying green innovational technologies to processes or products by heavily polluting enterprises does not necessarily result in corresponding compensation from beneficiary customers or society (Jaffe, Newell, and Stavins, 2005; Xie, Huo, and Zou, 2019). In other words, heavy polluters may be in a stage of practical creation but may not be green (Fang, Gao, and Lai, 2020). Based on the “dual externalities” of green technology itself (that is, technology spillover effect and environmental externality), heavy polluters face risks from inside and outside the enterprises when attempting to apply green technological innovations. As strategic decision-makers and executors, top managers directly affect the amount of risk enterprises take. Therefore, the cognition of green technology innovation strategies by high-level managers of heavily polluting firms is a research issue of significant relevance. This issue is related to the ability of heavy polluters to enhance their legitimacy, realize consistent economic benefits, and maintain a position of competitiveness (Li et al., 2020a).

According to upper echelons theory, enterprises’ strategic choices and decisions are affected not only by purely economic and technological factors but also by the cognition and ideology of imperfect rational strategy makers (Hambrick and Mason, 1984). Organizational behavior reflects senior managers’ traits, and their characteristics can effectively predict organizational outcomes (strategic choices and performance). These traits include elements such as cognition, experience, and values. Therefore, to understand why an organization takes specific strategic actions, it is helpful to understand the traits of senior managers. For example, having a CEO with extensive marketing and sales experience and a high tolerance for uncertainty related to a good growth business strategy, and having a CEO with extensive financial and accounting experience and a low tolerance for uncertainty are related to an excellent mature business strategy (Gupta and Govindarajan 1984; Huang et al., 2022). If top managers are open to change, the firm will adopt pioneering strategies to promote organizational innovations (Oreg and Berson, 2019). In addition, psychological factors related to senior managers’ cognitive base and values such as tenure, education (Liu et al., 2022b), gender (Dan and Qi, 2017; Expósito, Sanchis-Llopis, and Sanchis-Llopis, 2021), perception of environmental responsibility (Wang et al., 2021), and CEO overconfidence (Xia et al., 2023) can also influence corporate green technological innovations. However, demographic indicators are less conclusive and accurate than psychological indicators, and there is a significant correlation between demographic factors and organizational outcomes (strategic choice and performance) in the upper echelons theory research (Ali et al., 2022). However, these studies have neglected to investigate the impact of green technological innovations on heavy polluters through the lens of the short-term time orientation of top managers.

Individuals who hold a short-term time orientation, or exhibit temporal myopia, are more concerned with immediate benefits and values, are less concerned with long-term development, and will not consider long-term benefits if they conflict with the long-term. Considering only short-term benefits is suitable for rapid development and quick realization of value, but not for long-term growth (Hofstede and Hofstede, 2001). Top managers are under tremendous pressure in the capital market. In the event of poor business performance or failure to meet performance targets, top managers will face the risk of dismissal and salary reduction. For top managers of heavy polluters, the choices of implementing green technology innovational strategies with “double positive externalities” may, on the one hand, expose them to more significant risks and challenges. However, on the other hand, it may have higher strategic value in terms of legitimacy and sustainable competitiveness. This dilemma makes it difficult for top-level managers to establish a clear innovation path (Lampikoski et al., 2014). Therefore, when balancing optimal long-term profitable projects and suboptimal short-term profitable projects, top managers may choose suboptimal short-term options to ensure salary enhancement and job security (Siegrist et al., 2020), generating managerial myopia. In this context, it is worthwhile to explore in depth what impact the heavy polluters’ managerial myopia will have on corporate green technological innovations.

Because of the significant differences in the institutional environment between heavy polluters and other firms in implementing green technological innovations, this paper examines the impact of managerial myopia on green technological innovations in Chinese A-share listed heavy polluters. For data availability, we only consider listed heavy polluters, which may cause selection bias, but we believe that our results hold at least for larger heavy polluters. We explore the differences in managerial myopia’s impact on heavy polluters’ green technology innovations under different subsample groups. To check the soundness of the findings, we used various methods, such as changing explanatory variables, adding control variables, and transforming the regression model.

The possible contributions of this paper are as follows. 1) The first contribution is to broaden the research domain on the ramifications of managerial myopia theory on business organizations. Prior studies have mainly focused on strategic inertia (Seo, Kang, and Baek, 2020), strategic shift (Herrmann and Nadkarni, 2014; Oreg and Berson, 2019), firm performance (Javed, Ihsan, and Ullah, 2021), and conventional innovation (Seo, Kang, and Baek, 2020). However, few studies have explored the impacts of managerial myopia on green technological innovations in heavily polluting firms. We enrich the influences of managerial myopia on green technological innovations in heavy-polluting enterprises to explore the mechanism between them. 2) The second contribution of this paper is to increase the research on managerial myopia theory research in enterprises. Previous scholars’ measurement of managerial myopia mainly focused on questionnaire ratings (Marginson and McAulay, 2008; Wang and Bansal, 2012), financial indicators (Chintrakarn et al., 2016), manager compensation incentive plans (Bolton, Scheinkman, and Xiong, 2006; Edmans, Fang, and Lewellen, 2017), take-over pressure (Stein, 1988; Zhao et al., 2012) and other methods. The methods are either based on observable ex post behaviors or are influenced by numerous objective circumstances instead of measuring managers’ innate and stable time cognition characteristics. However, Nan, Fujing, and Haonan (2021) took the MD&A of the annual reports of China’s A-share listed companies as the object and determined the Chinese word set of “short-term horizon” through text analysis and machine learning methods based on Brochet, Loumioti, and Serafeim (2015). Then, they used the dictionary method to construct the index of Chinese managerial myopia. We use this new index to measure the management myopia of heavily polluting enterprises, which is also different from the approach taken by previous scholars. At present, the empirical evidence regarding this Chinese managerial myopia indicator is relatively scarce, and our study effectively complements the empirical evidence on manager myopia. 3) The third contribution of this paper is to improve the analytical framework of the drivers of green technological innovations in heavily polluting firms at the executives’ trait level, the corporate governance level, and the extrinsic incentive level. The prevailing literature centers around the impact of each independent aspect on green technological innovations but only involves some of the three levels simultaneously. We first investigate managerial myopia’s impact on heavy polluters’ green technological innovation at management trait level. After that, we analyze the mechanisms through which managerial myopia affects green technological innovations at the level of top managers’ incentives, the concentration ratio of owners, and government grants in different subsamples of heavy polluters, with the aim of forming a comprehensive study of the effect of managerial myopia on heavy polluters’ green technological innovations at the organizational and external levels. The article is a comprehensive study of the effects of managerial myopia on heavy polluters’ green technological innovations at different levels within and outside the organization.

The remainder of the article is organized as followings. Section 2 provides the theoretical analysis and research hypotheses; Section 3 provides information on the sample, data, and methods; Section 4 presents the regression results; Section 5 includes the endogeneity test and robustness analysis; further analysis is provided in Part VI; the Section 6 is the discussion; and the last part is the conclusion.

2 Theoretical analysis and hypotheses

2.1 Time-oriented management

Time orientation originates from social psychology and is the tendency to emphasize or favor a specific time frame in the domain of an individual’s attitudes, actions, and perspectives, i.e., an individual’s psychologically inclined perceptual expression of the past, present, or future (Lewin, 1942; Bluedorn, 2000; Shipp, Edwards, and Lambert, 2009). Time orientation is a relatively stable cognitive temporal bias (Keough, Zimbardo, and Boyd, 1999). This long-lasting individual difference predicts different individual behaviors, such as information processing, planning, and decision-making (Kivetz and Tyler, 2007). Past-time orientation individuals still need to accomplish tasks (Specter and Ferrari, 2000). Individuals with a preference for present-time orientation prefer smaller but more timely rewards under reward conditions (Steinberg et al., 2009) and are more rational (Picone, Sloan, and Taylor, 2004). In contrast, individuals with future-time orientation are willing to plan rationally for what they want to do in the future (Howlett, Kees, and Kemp, 2008). Thus, time orientation is integral to an individual’s self-cognition.

Time-oriented management is applied from a strategic perspective, i.e., their subjective preferences for the past, present, and future in strategic decision-making (Bluedorn and Martin, 2008; Lumpkin and Brigham, 2011). The cognitive limitations of senior managers in the temporal dimension of decision-making (Miller, 2002), or managers’ preference for the present over the future (Lin et al., 2019), are referred to as top managers’ temporal short-termism orientation or managerial myopia. Managerial myopia tends to be centered on current benefits that can be met immediately rather than upon the future growth of the enterprises (Stein, 1989; Laverty, 1996), and this myopic preference is counterproductive to enterprises in the longer term (Mullins, 1991; Marginson and McAulay, 2008). The top managers are widely subject to myopic temporal cognitive biases in maximizing their economic interest in the firm, are prone to ignoring the firm’s long-term value, and are more focused on current outcomes.

2.2 Influences of green technological innovations on enterprises

Green technological innovations are essential for society and organizations (Chen, 2008; Chen, Chang, and Wu, 2012; Yang et al., 2018), and they can reduce carbon emissions in high pollution environments (Sun et al., 2022). Thus, green technological innovations are critical elements in environmental management (Takalo and Tooranloo, 2021; Habiba, Xinbang, and Anwar, 2022). Green technology innovations may guide organizations to achieve sustained competitiveness (Hur, Kim, and Park, 2013) and are essential tools for firms to boost market share and maintain longer-term viability. External incentives and internal motivation are the main impetus behind the development of green technological innovations. External incentives mainly come from external stimuli such as government environmental regulations (Lee and Tang, 2018; Shapiro et al., 2018; Borsatto et al., 2021), institutional investors (Shleifer and Vishny, 1986; Holderness et al., 1988; Luong et al., 2017; García-Sánchez et al., 2020) and government grants (Görg and Strobl, 2007; Meuleman and De Maeseneire, 2012; Zúñiga-Vicente et al., 2014). In contrast, internal motivations mainly come from top managers’ characteristics (Zhang et al., 2017), governance structure (Belloc, 2013; Sueyoshi and Yuan, 2015), and other internal corporate environments. Organizational factors can significantly affect firms’ willingness to innovate by implementing green technology. Existing studies have mostly focused on the links between companies’ innovation and top managers’ demographic characteristics, such as age (Flood et al., 1997; Barker et al., 2002; Acemoglu, Akcigit, and Celik, 2022), gender (Mirchandani, 1999; Yao, 2015; Lyngsie and Foss, 2017; Wu et al., 2021; Foss et al., 2022), degree (Bantel and Jackson, 1989; Barker et al., 2002; Harel, Schwartz, and Kaufmann, 2021; Singh et al., 2022), and tenure (Daellenbach, McCarthy, and Schoenecker, 1999; Cucculelli, 2018; Li and Yang, 2019; Loukil and Yousfi, 2022; Messeni Petruzzelli et al., 2022), which can affect firm innovation differently. However, few studies focused their attention on the effect of the management team’s short-term orientation, i.e., managerial myopia, on green technological innovations in heavily polluting enterprises.

2.3 Managerial myopia and heavy polluters’ green technological innovations

Managerial myopia represents the individual traits of top managers regarding perceptions of time. Top managers’ perceptions and attributes impact their behaviors and strategic decisions, influencing organizational behavior and outcomes (Hambrick and Mason, 1984). Upper echelons theory states that managers with myopia are more likely to prioritize short-term financial performance and stock price over long-term company interests; therefore, when managerial myopia is present, in the adoption of green technological innovations by heavily polluting firms, business decisions will be based on current performance considerations Therefore, while making strategic judgments, myopic managers are more likely to opt for projects with a short duration and large rewards (Narayanan, 1985; Stein, 1988; Holmström, 1999). The hallmarks of traditional innovation activities are present in green technical innovations, such as inputs coming before returns (Maritan, 2001), uncertain outputs, and benefits that cannot be realized quickly (Pindyck, 1982; Zaheer, Albert, and Zaheer, 1999). In addition, green technological innovations have the “double positive externality” of science and technology spillover effects and environmental performance. Therefore, myopic managers will use their resources and personal authority to selectively avoid green technology innovational behaviors to avoid the problems of a long innovation cycle, high R&D expenses, high R&D risks, and uncertain investment returns. Thus, we put forth the first hypothesis, as follows.

H1:. Managerial myopia in heavy polluters negatively correlates with green technological innovations.The influence of managerial myopia of heavy polluters on green technological innovations is related to the indigenous and extraneous drivers of heavy polluters. If assumption H1 holds, we intend to discuss green technological innovations further, acting as executive incentives, equity concentration, institutional investors, and government grants, and the association between managerial myopia and green technological innovations in heavily polluting firms.

2.3.1 Management equity incentives

A conflict of objectives, interests, and information asymmetry exists between principals and agents due to the split of owners and controls of the companies. The operators attempt to maximize personal interests, thus giving rise to agency problems (Jensen and Meckling, 1976). As an incentive and constraint mechanism, management shareholding aligns the unique benefits of managers to the general benefits of shareowners, especially long-term benefits, so that shareholder value becomes a guideline for management’s decision-making behavior. No consensus has been achieved on the potential impact of management shareholding on corporates’ innovation, and the following two main views have emerged: the convergence of interest effect and the entrenchment effect. The former suggests that firms with higher managerial shareholding can significantly improve their innovational efficiency and thus increase their innovational output (Francis and Smith, 1995). Managerial shareholding has an “incentive compatibility” in innovational management, and the aftermath is more conspicuous in corporations with lower proxying costs. Thus, increasing executive shareholding can better align the interests of management and outside shareholders, creating a “convergence of interests” effect that increases business value (Jensen and Meckling, 1976). In contrast, the entrenchment effect means that higher managerial shareholdings will strengthen top managers’ effective control over the enterprise. Placing excessive emphasis on their interests creates a risk-averse mentality and a preference for stable income. Top managers will create “entrenchment” regarding innovational activities and reduce the accomplishments of R&D (Czarnitzki and Kraft, 2004), exacerbating interagency conflicts and ultimately reducing enterprise worthiness (Panda and Leepsa, 2017). As an incentive mechanism in a mature market economy, the effectiveness of management shareholding is mainly dependent on the improvement and matching of corporate governance structures. However, the governance structures of most Chinese companies is imperfect and unregulated, and the powers and responsibilities of the board of directors, supervisory board, and managers are unclear (Xudong, 2021). Therefore, higher managerial shareholding can lead to excessive incentives and induce agency problems (Zheng, Xiangyi, and Shujing, 2017), causing companies focus more on short-term gains and neglect social responsibility (Haimei, Xiaojing, and Wanfa, 2014). Managerial shareholding has a negative effect on corporate innovation (Zhou et al., 2021). As a result, the following hypothesis is presented.

H2:. The higher the management shareholding, the more negative the relationship between managerial myopia and green technological innovations in heavy polluters.

2.3.2 The concentration of equity

The equity attention is a quantitative indicator of the concentration or dispersion of shareholders, as shown by their different shareholding ratios. It is the primary indicator of the state of a company’s equity distribution and an essential indicator of a company’s stability strength. There has been a clear divergence in the literature regarding the effect of equity concentration on corporate innovations. Some scholars believe that equity concentration positively affects innovations. The company’s shareholding structure affects how the organization manages resource allocation and what drives the management team to support the innovation process (AlHares et al., 2020). Hosono, Tomiyama, and Miyagawa (2004), through a study of the Japanese machinery manufacturing industry, found that corporate innovation performance gradually increases as the control of significant shareholders increases. The concentration of equity from improved management of large shareholders can generate effective monitoring mechanisms, which are essential for corporate innovation (Belloc, 2012). Other scholars believe that equity concentration negatively influences companies’ innovations because a significant increase in available resources will stimulate the selfish profit motive of major shareholders.

The wealth transfer and opportunistic behavior of large shareholders will crowd out the firm’s limited strategic innovation resources and create insufficient innovation investment. In addition, the excessive intervention of major shareholders may cause firms to deviate from a stable technological trajectory and cause managerial resentment and resistance, inhibiting innovation (Burkart, Gromb, and Panunzi, 1997). Furthermore, it reduces firms’ willingness to innovate by implementing green technology (Xu and Wang, 2020). In general, when the concentration of equity reaches a high level, although it can alleviate the proxy conflicts between owners and management, there are issues with dual proxies between significant and minor shareowners. (Sauerwald and Peng, 2013), Which hurts the company’s innovation capability (Sukumar et al., 2020). In constrast, when the owners are more diversified, the decision-making ability of the majority shareholder is constrained. This reduces tunneling behavior and benefits enterprises’ innovations (Minetti, Murro, and Paiella, 2015). As a result, we propose the following hypothesis.

H3:. The bigger the first largest shareholder is, the more negative the relationship between managerial myopia and green technological innovations in heavy polluters.

2.3.3 Independent directors

The principal-agent hypothesis claims that independent directors are the key to board governance. Their value mainly lies in the fact that their independence can alleviate potential interest conflicts among the directors and stockholders (Fama and Jensen, 1983). They play an internal supervisory role and are an essential part of internal corporate governance. Lim (2022) believes that in corporate governance, independent directors do not focus on maximizing the shareholding interests and instead guard the consumers, communities, and other relevant interest groups. When external stakeholders aim to preserve the environment and save resources, independent directors will require businesses to strengthen green technological innovations and fulfill their social responsibilities. When independent directors are larger, they play a more influential part in corporate governance, and their suggestions are less likely to be ignored by the management. Their internal supervision of the administration is more effective, which can reduce the managers’ rejection of green technology innovation projects due to lack of ambition and ensure the independence and fairness of corporate decision-making. Lu and Wang (2018) took large companies in industries lacking competition and technology as samples to investigate the function of independent directors in corporate innovations. The results also supported the finding that independent directors have a positive effect on innovational activities. The resource dependence theory emphasizes the resource dependence characteristics of independent directors. The theory holds that introducing independent directors can improve the board’s decision-making quality regarding technological innovations. Due to their different knowledge backgrounds and technical experience, independent directors can expand the board of directors’ visions by raising the internal directors, which is conducive to discovering promising innovation opportunities. By introducing independent directors connected with the external environment, an enterprise can effectively address the challenges of operation uncertainty. Independent directors can help the company to resolve various crises to a large extent and increase the survival possibility of the enterprise organization by allocating more resources to innovation activities and creating social relations conducive to technological innovation (Pearce and Zahra, 1991). Therefore, we propose the following hypothesis.

H4:. The smaller the number of independent directors is, the more negative the relationship between managerial myopia and green technological innovations in heavy polluters.

2.3.4 Institutional investors

The link between institutional investors and corporate technological innovation has been investigated in depth. In summary, the following two distinct views have been expressed: 1) the superiority of institutional investors and 2) the myopia of institutional investors. Scholars who hold the view of the superiority of institutional investors believe that a higher shareholding of institutional investors in a company will result in more investment returns, as institutional investors will be deeply involved in the -term business decision-making and promote innovations (Holderness et al., 1988; Kochhar and Parthiban, 1996). With more comprehensive market information and internal channels, institutional investors have incomparable information advantages over ordinary ones. In addition, when institutional investors hold a high percentage of shares, they are like being “locked in” to the firm and may encourage innovation to exit the firm without suffering losses (Jensen, 1993). Regardless of the purpose, institutional investors promote technological innovation in firms (Hansen and Hill, 1991; Wahal and McConnell, 2000; Aghion et al., 2009a). Scholars who hold the view regarding myopia of institutional investors argue that institutional investors need specific information. The pursuit of short-term gains leaves firm managers with neither the ability nor the incentive to implement technological innovation strategies (Porter, 1992). Moreover, institutional investors can use their information advantage to keep abreast of market changes and to change portfolios. When a company’s performance declines in the short term, institutional investors can promptly adjust their holding positions and reduce their shares in the company. This short-sighted behavior will not be conducive to firms undertaking R&D projects with long time horizons (David et al., 2006). In addition, for reasons of commercial confidentiality, companies seldom disclose information about their R&D activities. Institutional investors need to follow up on innovation activities and understand the details of the activities, thus increasing their sensitivity to innovation activities. Accordingly, we hypothesized the following.

H5:. The lower the institutional investors’ shareholding, the more negative the relationship between managerial myopia and green technological innovations in heavy polluters.

2.3.5 Government grants

Compared with traditional innovation, green science and technology should focus on promoting ecological and environmental benefits while achieving corporate efficiency. Government subsidies, whether they catalyze enterprise environmental technology and innovations or not, actually reflect a relationship between the public sector and enterprises (Liu, 2022b). There are two opposing views about this relationship, as follows: the “promotion hypothesis” and the “suppression hypothesis.” Zhang et al. (2014) found that government grants are conducive to selling and promoting green products. When firms receive external financing from government grants, they have a greater incentive to innovate green technologies. Government grants inject fiscal and tax funds into firms, alleviating the financing constraints firms face in the innovation process (Jaffe and Palmer, 1997; Bronzini and Iachini, 2014). In parallel, government grants play a “certification effect” on firms’ innovational projects, which can release positive signals and guidance to the capital markets (Kleer, 2010; Meuleman and De Maeseneire, 2012; Montmartin and Herrera, 2015; Li et al., 2019). Thus, government grants guarantee firms’ effective investment in innovation.

In contrast, the “suppression hypothesis” argues that the entry of government capital in the form of subsidies essentially triggers moral hazard in firms and that government subsidies are less discriminatory and that companies are prone to “greater failure due to government subsidies” (Howell, 2017). Large government grants weaken policymakers’ incentives to create value, take risks, and “crowd out” innovation inputs (David, Hall, and Toole, 2000; Cai et al., 2016; Jiangfeng, Qinghua, and Xinxin, 2020). In addition, Thomson and Paul, (2013), based on data from several OECD countries, found that government grants do not contribute to the increase of R&D investment and do not affect firms’ innovational performance. Thus, we make the following assumption.

H6:. The more the government grants there are, the more negative the relationship between managerial myopia and green technological innovations in heavy polluters.

3 Samples, statistics and methods

3.1 Samples and statistics

This study investigates the impact of managerial myopia on green technology innovation in heavily polluting firms using data from A-share listed heavily polluting firms from 2007 to 2020. Our choice of data is based on the following reasons. First, 2007 was an essential year in the international convergence of Chinese accounting standards, and the new Enterprise Accounting Standards (EAS) were implemented this year. To avoid the impact of the difference in accounting standards before and after 2007, we chose the sample time interval of 2007–2020. Second, we identify heavily polluting enterprises by combining the “Management List of Environmental Protection Verification Industries for Listed Companies” formulated by the Chinese Ministry of Environmental Protection in 2008, the criteria for defining heavily polluting industries by previous scholars (Ailing et al., 2019; Ye, Caizhen, and Yi, 2019; Jinglin et al., 2021; Yipan and He, 2021), and the availability of data. The heavy polluters cover 23 industries, such like thermal power, iron and steel, cement, etc.

The explained variable green patent applications were obtained from the Chinese Research Data Services Platform (CNRDS). The core explanatory variable managerial myopia data comes from the WinGo Data Platform (http://www.wingodata.com). Moreover, the control variable data were collected from China Stock Market & Accounting Research Database (CSMAR).

In this paper, we screened the data as follows: 1) the samples with delisted samples were excluded; 2) the samples with incomplete data were excluded; 3) the relevant continuous variables in the model were winsorized by the upper and lower 1% to avoid the influence of outliers. According to the above criteria, we finally obtained 3767 firm-year observations.

3.2 Empirical design and variables definition

Because the number of green invention patent applications in heavily polluting firms is counting data and there are many zero values, we consider the zero-inflated Poisson regression (ZIP) model for testing. The model is as follows:

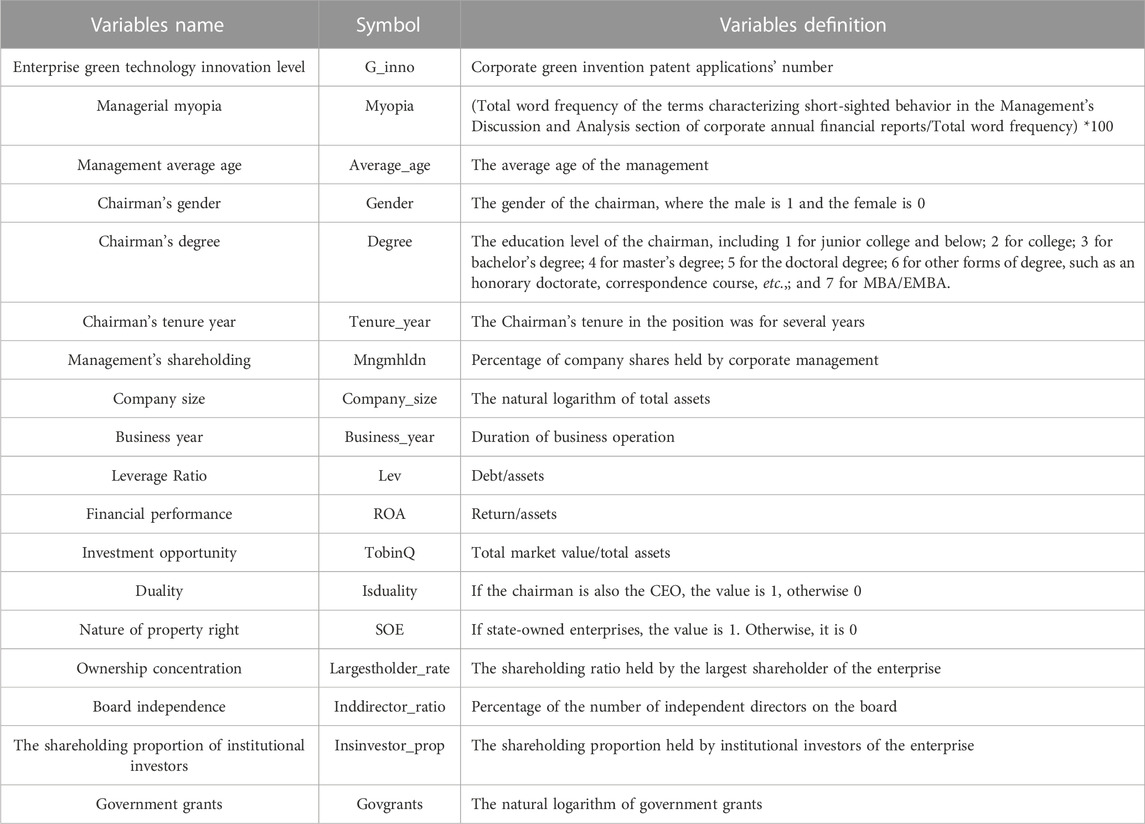

The explicit definitions of the variables in a model are as follows.

1) G_inno. We use the green invention patent applications to measure enterprises’ green technological innovations level based on the methods of Huang, Li, and Liao (2021) and Ren et al. (2021). The types of green patents include green inventions, green utility models, and green design patents. Among them, green invention patents are more inventive and technical. In contrast, green utility models and design patents contain less innovation and only protect the products’ shape, structure, and appearance. Therefore, we only consider green invention patents in the baseline regression. In the robustness test, we use the amount of green utility model patent applications and the sum of green patent applications to measure the level of green technology innovation of enterprises to ensure the reliability of the findings.

2) Myopia. Currently, the measurement of managerial myopia is a problematic area of research, and there are three main measures in the existing literature. First, some scholars use the amount of R&D investment or the ratio of R&D investment to total operating revenue to measure the myopia levels of managers (Balsmeier and Buchwald, 2015; Garel, 2017; Denis, 2019). Second, managerial myopia is measured using demographic characteristics such as age (Madyan, Kurniawan, and Firdausi 2019; Antia, Pantzalis, and Park 2021) and tenure (Levesque et al., 2014; Li et al., 2021). Third, some researchers use the frequency of myopia-related keywords in the annual management discussion and analysis (MD&A) to measure the myopia level of managers in companies (Nan, Fujing, and Haonan, 2021). This paper draws on the third approach to construct variables that measure the myopia level of corporate managers, and robustness tests are conducted based on the first approach.

3) Other control variables. According to a previous study (Hameed, Counsell, and Swift, 2012; Brochet, Loumioti, and Serafeim, 2015; Jaffe et al., 2015; Amore and Bennedsen, 2016; Cobo-Benita et al., 2016; Asensio-López, Cabeza-García, and González-Álvarez, 2018; Dionisio and Raupp de Vargas, 2020; Filatotchev, Aguilera, and Wright, 2020; You et al., 2020; Nan, Fujing, and Haonan, 2021; Xu et al., 2023), this paper controls for a range of factors that influence corporate green technological innovations at the following four levels: management characteristics, corporate/organization characteristics, governance characteristics and external environment. First, at the level of management characteristics, we choose the average age of the management (Average_age), the gender of the chairman (Gender), the degree of the chairman (Degree) and his or her tenure of office (Tenure_year), and the management shareholdings (Mngmhldn). Second, at the level of organizational characteristics, we select company size (Company_size), business year (Business_year), leverage ratio (Lev), investment opportunities (TobinQ), returns on total assets (ROA), CEO duality (Isduality), and whether the company is a state-owned enterprise (SOE). Third, at the level of governance structure characteristics, we choose the first largest shareholder rate (Largestholder_rate) and board independence ratio (Inddirectisratio) is selected. Finally, at the level of the external environment, institutional investors’ shareholding proportion (Insinvestor_prop) and government grants (Govgrants) are designated as control variables. In addition, we controlled for the year and individual double fixed effects.

The above variables are defined in Table 1.

4 Results

4.1 Descriptive statistics and correlation analysis

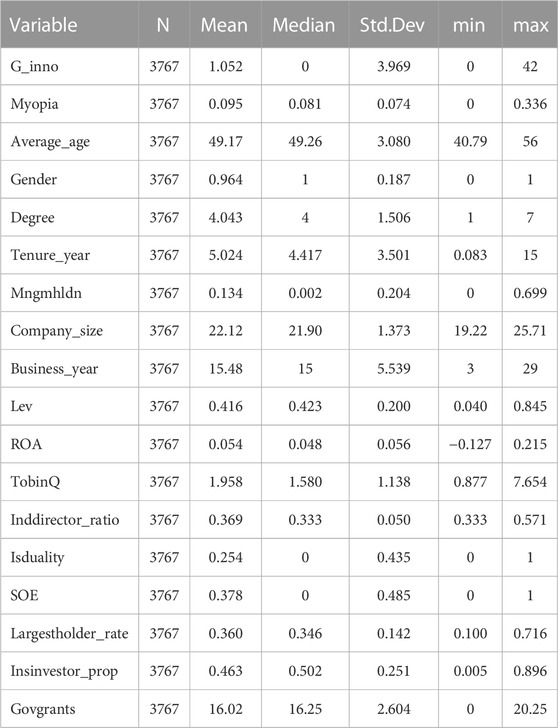

The descriptive statistics results for all variables are reported in Table 2, including the number of observations, mean, median, standard deviation, minimum and maximum values of each variable. Among them, the mean value of the explained variable G_inno is 1.052, the median is 0, and the standard deviation is 3.969, which shows that there are still large differences in green technological innovation among different polluters. The maximum value of variable G_inno is 42, and the minimum is 0, indicating a considerable variation in green technological innovations among the heavy polluters in the sample. The core explanatory variable Myopia has a mean of 0.095, a median of 0.081, and a standard deviation of 0.074, indicating sufficient variability in the indicator of managers’ myopic behavior. In addition, the means and standard deviations of the control variables were within acceptable limits.

After correlation analysis (see Table 3), the correlation coefficient between Myopia and G_inno was found to be −0.028, negatively correlated at the significance level of 10%, preliminary supporting the previously proposed Hypothesis 1.

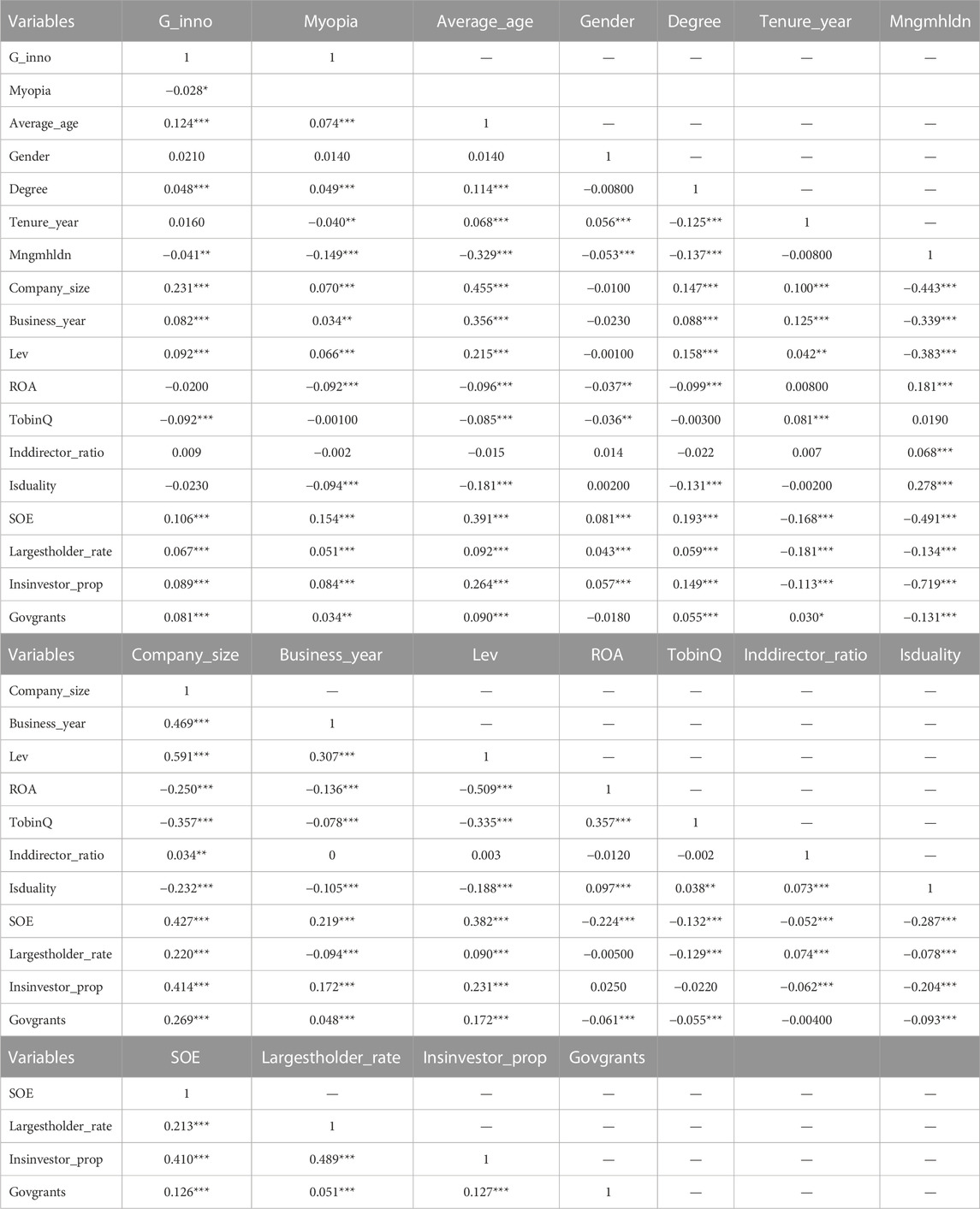

4.2 Benchmark regression results

The benchmark regression results are shown in Table 4. The first column is a one-way regression of G_inno and Myopia only; the coefficient for Myopia is negative and passes the 1% statistical significance test (beta = −1.209, t value = 0.239). Column (2) is a regression of G_inno and the set of control variables only. We find that executing background characteristics, such as Gender, Degree, and Tenure_year, are significantly and positively correlated with G_inno. In company financial characteristics, Company_size is significantly and positively correlated with G_inno, while Business_year and Lev are significantly and negatively correlated with G_inno. In corporate governance structure, Inddirector_ratio and Largestholder_rate have negative coefficients and pass the 10% significance test, while Isduality is significantly and positively related to G_inno. Similar to ownership, SOE is significantly and positively correlated with G_inno. Finally, in extrinsic incentives, institutional shareholding ratio (Insinvestor_prop) and government grants (Govgrants) are significantly and positively correlated with G_inno. Column (3) is a regression of all variables, and the importance of the Myopia variable coefficient did not vary. It indicates that managerial myopia (Myopia) still shows a significant negative relationship with heavy polluters’ green technological innovations (G_inno) after controlling for control variables (beta = −1.251, t value = 0.255). The results show that the logarithmic value of green technological innovation decreases 1.251 units for each 1-unit increase in the managerial myopia of seriously polluting enterprises. Hypothesis 1 is verified, which means that managerial myopia in heavily polluting firms does lead firms to reduce their green technological innovations. Our finding is consistent with the results of Bebchuk and Stole (1993), Laverty (2004), Asker, Farre-Mensa, and Ljungqvist (2010), Liu (2022a).

5 Robustness tests

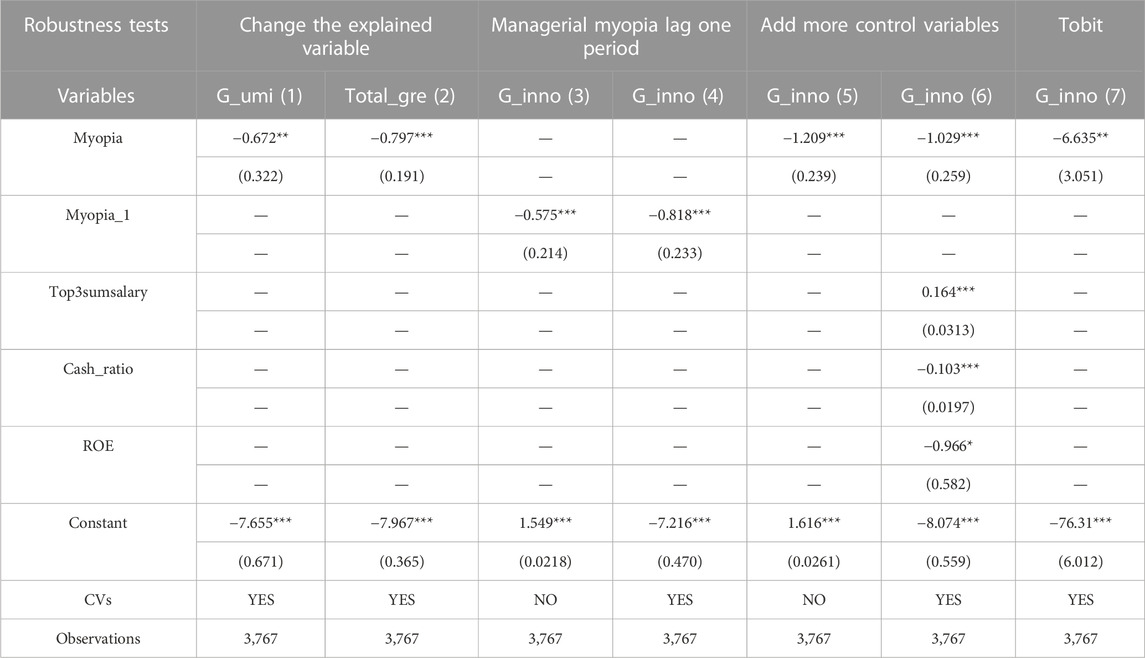

To ensure the reliability of the above regression results, we conduct robustness tests in the following five aspects (see Table 5).

5.1 Change the explained variable

Green patents include the following two different types: green invention patents and green utility model patents. In the benchmark regression, we use the number of green invention patent applications (G_inno) as the explained variable. To ensure the robustness of the results, we adopt the quantity of green utility model patent applications (G_umi) and the total number of green patent applications (Total_gre) to measure the green technological innovation level. Detailed outcomes are shown in the table below (see Table 5). In column (1), we substituted the green utility model applications for the green technological innovations by companies. The myopia coefficient is −0.672 (p<5%). Moreover, column (2) represents the enterprises’ green technological innovations by the sum of green patent applications. The myopia coefficient is −0.797 (p<1%). The results show that managerial myopia and corporate green technological innovations are still negatively correlated after replacing the proxy variables. This shows that the benchmark results are robust.

5.2 Lagged core explanatory variable

We run regressions using one-period lagged myopia (Myopia_1) and corporate green technological innovations to ensure that the possible presence of reverse causality does not endogenously influence our results. From the theoretical analysis, this study mainly tests the effect of managerial myopia on green technological innovations in heavily polluting firms. Managerial myopia causes senior managers to care more about short-term interests. Moreover, green technological innovations in heavily polluting enterprises have double positive externalities. Therefore, senior managers may choose something other than green technological innovations when making investment decisions, thus hindering the implementation of green technological innovations in heavily polluting firms. In contrast, green technology innovations are an investment in the future potential development and legitimacy of heavy polluters, so green technology innovations will impact the investment decisions of superior managers, whose decision-making behavior is a manifestation of their time orientation. Therefore, we believe that robustness tests using a one-period lagged core explanatory variable may reduce endogeneity due to reverse causality. The results in columns (3) and (4) in Table 5 show that one-period lagged myopia and corporation green technological innovations remain significantly and negatively correlated. The coefficients of myopia are −0.575 and −0.818, respectively. The results support the conclusion that managerial myopia has a particularly detrimental effect on firms’ green technological innovations, which is coherent with the baseline regression results.

5.3 Add more control variables

To alleviate the impact of missing control variables, we further introduce the following additional control variables for the robustness test: 1) the natural logarithm of the total compensation of the top three executives (Top3sum salary), which represents the compensation incentive of managers; 2) returns on equity (ROE), which represents the utilization efficiency of the company’s capital invested by shareholders; 3) the growth rate of the company’s main operating income, which represents growth opportunities; and 4) the cash ratio, which represents the company’s cash holdings. We added them into the model for regression estimation. Columns (5) and (6) in Table 5 shows the new regression results. The coefficients of managers’ myopia on the green technological innovations of heavily polluting enterprises are −1.209 and −1.029, respectively, and the regression results are significant at the 1% confidence level (t values are 0.239 and 0.259, respectively). The finding indicates that the inverse effect of managerial myopia on serious polluters’ green technological innovations remained even after we added more control variables.

5.4 Change the regression model

Taking many zero values of the explained variables into consideration, we regressed the above equation using the Tobit model. As seen in the last column of Table 5, the myopia coefficient is −6.635 and significant at the 5% confidence level (t value = 3.051). The results demonstrate that managerial myopia and heavy polluters’ green technological innovations are still significantly negatively related, and Hypothesis 1 remains unchanged.

6 Further research

6.1 Further validation of managerial incentives

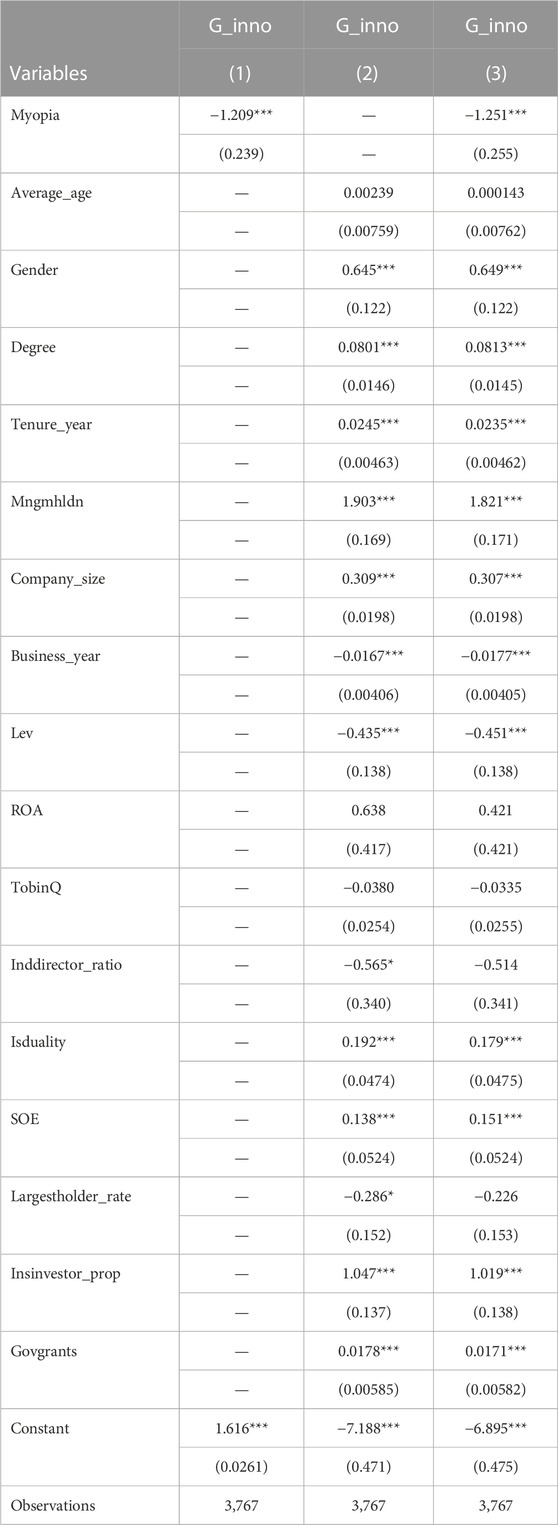

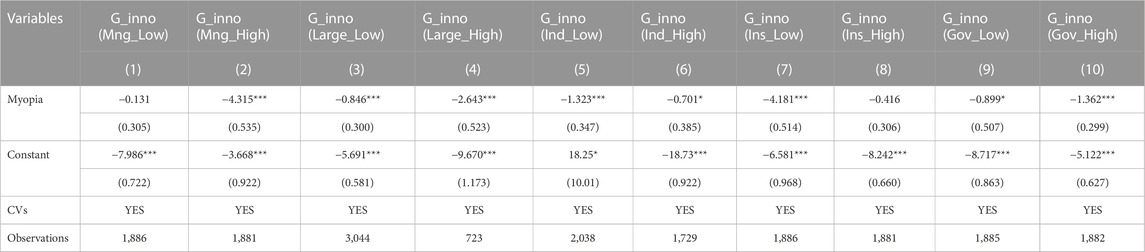

To further verify the endogenous incentives mechanism of managers, we investigate the following two aspects: the managerial motivation dimension and managerial external constraints (see Table 6).

6.1.1 Managerial Motivation dimension

To verify the role of management incentives play in the relationship between management myopia and corporate green technological innovations in heavily polluting enterprises, we divided the sample into two subsamples, high and low, using the median of the management shareholding ratio as the boundary. We conducted group regressions using the model above. The findings are shown in Table 6. Column (1) shows the regression outcomes for the low management shareholding, the myopia coefficient is −0.131, and the result is not significant (t value = 0.305). Column (2) displays the regression results for the high subsample, the myopia coefficient is −4.315, and the result is significant at the 1% confidence level (t value = 0.535). By comparing the coefficient of myopia in the two groups, we can see that the managerial myopia performance on corporate green technological innovations in highly polluting enterprises is more significant for management teams with higher management shareholdings.

In contrast, the effect of managerial myopia on corporate green technological innovations disappears for management teams with low management shareholdings. This result suggests that the higher the management shareholding ratios are, the more pronounced the myopic behavior of managers, and Hypothesis 2 holds. This result is also consistent with the findings of Haimei et al, (2014) that higher management shareholding leads to excessive incentives, making firms more focused on short-term gains rather than promoting practical innovation.

6.1.2 Corporate Governance structure dimension

Next, we consider the moderating role that corporate governance structures play between managerial myopia and green technological innovations in heavily polluting firms. We partition the sample into high and low groups by taking the median of the first largest shareholder ratio and the independent directors’ ratio, respectively, and then run group regressions using the above model.

Columns (3) and (4) in Table 6 show the outputs of the regressions. Column (3) shows the regression results for the low first largest shareholder ratio and the high ratio in column (4). The myopia coefficient in the low group is −0.846 and significant at the 1% confidence level (t value = 0.300). Similarly, the myopia coefficient in the high group is −2.643 and significant at the 1% confidence level (t value = 0.523). The influence of managerial myopia on heavy polluters’ green technological innovations is still significantly negative for both subsamples. However, the absolute value of myopia’s coefficient is more prominent in the high-concentration ratio group. The results indicate that the first largest shareholder ratio does not suppress managerial myopia’s negative effect on green technological innovations, and Hypothesis 3 does not hold. For the first largest shareholder, green technology innovation requires long-term, continuous capital and human investment with long payback periods, and their control self-interest grabbing will be hindered as a result, so the higher the shareholding of the first largest shareholder, the more reluctant they are to invest in innovation (Hope et al., 2017).

For columns (5) and (6), the group regression results for the independent directors’ ratio are listed. By comparing the significance of the myopia coefficients in the high and low groups, we find that managerial myopia has a significantly weaker impact on corporate green technological innovations for seriously polluting enterprises with a higher independent director’s ratio. The myopia coefficient is −0.701 and is significant at the 10% confidence level (t value = 0.385). In contrast, for firms with a lower independent director’s ratio, managerial myopia significantly negatively affects corporate ecotechnological innovations. The myopia coefficient in the low group is −1.323 and is significant at the 1% confidence level (t value = 0.347). This result indicates that the more independent directors that participate, the greater the enhancement of the firm’s supervision, and managers will reduce their myopic behavior to avoid the detection of their myopic behavior, and Hypothesis 4 holds. Independent directors are outside directors who have fewer interest conflicts than inside directors and are better able to objectively evaluate managers’ strategies and performance (Boivie et al., 2021). Increasing the proportion of independent directors can better ensure the supervision of managers’ innovation behaviors (Wang et al., 2020) and limit managers’ myopic behaviors.

6.2 Further validation of managerial external constraints

To further identify the external constraint mechanism for managers, we investigate the following two aspects separately.

6.2.1 Institutional Investor dimension

We still regress the subsamples by classifying the sample into high and low subsamples, using the median of institutional investors ratio as the boundary. Columns (7) and (8) in table 6 show the results of the subsamples of institutional investors’ low and high shareholding ratios, respectively. The myopia coefficients are −4.181 (t value = 0.514) and −0.416 (t value = 0.306). We determine the significance of myopia coefficients by comparing the high and low groups and find that the managerial myopia response to corporate green technological innovations is obviously weaker in the higher institutional investor ratio group. In contrast, for heavy polluters with a lower institutional-investor ratio, managerial myopia strongly negatively affects green technological innovations. This result means that the involvement of many institutions strengthens the heavy polluters’ external monitoring, and managers will reduce their innovational intolerance to avoid the external detection of their short-sighted behavior, and Hypothesis 5 holds. Institutional investors are larger and have a stronger monitoring role than general investors and can actively participate in corporate governance, alleviate managerial agency problems, reduce myopic behavior within the firm (Bushee, 1998), and thus promote green technology innovation.

6.2.2 Governance Grants dimension

The last two columns in Table 6 reveal the regression results for the two subsamples, bounded by the median government grants. Column (9) shows the regression results for the lower government grants. The coefficient of myopia is −0.899 and is significant at the 10% confidence level (t value = 0.507). Column (10) shows the results for the higher government grants, and the myopia coefficient is −1.362 and is significant under the 1% significance level (t value = 0.299). By comparing the significance of myopia coefficients in the two groups, this study finds that the influence of managerial myopia on corporate green technology innovations is significantly smaller for the group with fewer government grants. In contrast, the group with more government allowances, managerial myopia has a clear negative effect on green technological innovations. The result indicates that large government grants do not improve heavy polluters’ green technological innovations motivation but rather exacerbate the managers’ myopic investment behaviors, and Hypothesis 6 holds. The green innovation is characterized by high risk, high uncertainty and strong externalities, and companies tend to abandon green innovation projects when they face financing problems (Aghion et al., 2009b). Government grants can have an “incentive effect” and a “signaling effect” regarding green innovation. However, excessive subsidies will only strengthen enterprises’ dependence on public resources, which will eventually reduce enterprises’ initiatives to engage in green innovation and inhibit green innovation (Xuyun et al., 2019).

6.3 Managerial myopia, geographic location, and green technology innovation

Enterprise innovation undoubtedly needs a good innovation environment and sufficient financial support intimately interfaced with the enterprises’ geographical location. Regarding the innovation environment, the economic development of remote areas needs to catch up, the number of enterprises is smaller, and the financial system is relatively closed. Local protectionism is serious. Therefore, the market competition atmosphere could be more robust, and enterprises need more innovation vitality. Stocks in remote areas attract little attention from analysts (Loughran and Schultz, 2005). Second, R&D spillovers form group innovation activities within a specific geographic region occur. For these reasons, the social network created by proximity to geographic space facilitates R&D learning of neighboring firms, and the capital flow between neighboring firms enables collaborative innovation. R&D spillovers also promote the clustering of industries within a particular geographic area, which attracts many R&D personnel who would usually stay in their original locations. Lychagin et al. (2016) confirm the importance of geographic location when exploring the mechanism of R&D spillovers. For financial support, the information transparency of firms varies across geographic locations, and firms in remote areas face a more closed information environment, which creates more complex and timelier environment for external investors to acquire information. Thus, firms face more substantial external financing constraints. The allocation of credit funds by banks and equity investments by institutional investors prefer geographically located firms (Almazan et al., 2010).

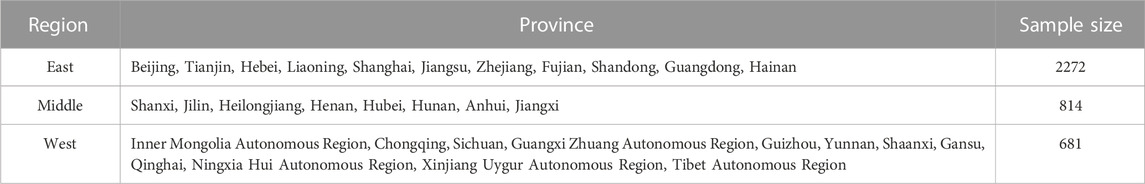

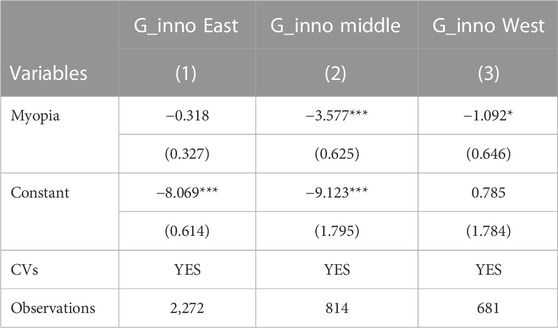

We ran the regressions according to the geographical location (province) of the heavily polluting firms as three subsample groups, east, middle, and west regions, where the cutoffs of the east, middle and west follow the division criteria of the Chinese National Bureau of Statistics. Table 7 shows the specific regional distribution criteria. The regression results are specified as follows (see Table 8). In Table 8, columns (1), (2), and (3) show the sample groups geographically located in the eastern, central, and western regions, respectively. The myopia coefficient in the eastern region is −0.318 (t value = 0.327), that in the central part is −3.577 (t value = 0.625), and that in the western area is −1.092 (t value = 0.646). Managerial myopia and enterprises’ green technological innovations are negatively correlated in the different areas, with the significance in the order of middle-west-east. The results indicate that the managerial myopia of heavy polluters in the middle region has the most pronounced inhibitory effect on green and technological innovations, next to those found in the western and eastern areas.

TABLE 8. Regression results for managerial myopia, geographic location, and green technology innovation.

The central region is facing a difficult situation of east-west attack. Because the middle part is in the plain area, its eight provinces dominate the agricultural industry. The agricultural sector is weak, and the manufacturing industry in the east has not achieved the “gradient effect” of the middle transfer. The economic development environment in the central region is characterized by “economic depression.” In addition, the eastern and western areas have strong development policies from the state, which further passively squeezes the middle part. Therefore, due to the geographical location of the central region, adverse external environmental effects to the development of enterprises in its territory occur, which also explains to a certain extent why the managerial myopia of heavy polluters in the middle region strongly influences green technological innovations.

7 Discussion

Whether heavy polluters follow the current trend of high-quality development of Chinese economy and are willing to invest in green technological innovations to achieve transformation and upgrading is directly related to the senior management’s time perspective. Managers’ natural and stable short-sightedness (Nan, Fujing, and Haonan, 2021) influences their decision-making. There are few research findings on managerial myopia and green technological innovations in heavily polluting firms. The mechanism by which managerial myopia affects green and technological innovations in highly polluting firms is still being determined. Analyzing the connection between managerial myopia and green technological innovations in heavily polluting companies will promote the development of green technological innovations and help improve the existing corporate governance of heavily polluted firms.

The main research found a significant negative trend among managerial myopia and green technological innovations in listed heavy polluters. Our findings are consistent with those of previous authors (Bebchuk and Stole, 1993; Laverty, 2004; Asker, Farre-Mensa, and Ljungqvist, 2010; Liu et al., 2022a). As senior managers are the ones at the helm of companies, their lack of a long-term vision for development is not conducive to high-risk and long-cycle green technological innovations.

By further exploring the internal and external mechanisms, we find that the higher the management shareholding and the more the government grants the company receives, the more negative the observed association between managerial myopia and green technological innovations in heavily polluting firms. Previous studies have confirmed that higher executive equity incentives are not conducive to enterprise activities that realize innovation (Bens et al., 2003; Coles, Daniel, and Naveen, 2006; Li et al., 2020b). When the proportion of equity held by executives is too high, it may trigger the executives to engage in opportunistic behavior, which leads to problems such as using public office for personal gain and on-the-job consumption, which negatively affect corporate green technology innovation. Similarly, excessive government subsidies hurt firms’ technological innovation (Strobl, 2013; Busom, 2000; David, Hall, and Toole, 2000). The previous conclusions agree with our findings. For polluting firms, access to government subsidies may be more accessible and less financially constrained than market financing, and excessive government subsidies instead hurt firm innovation (Howell, 2017).

In contrast, we find that if independent directors and institutional investors own significant stakes, the inverse association between management myopia and green technological innovations is less powerful. Previous studies have demonstrated that increased independence of the board could positively influence businesses to engage in innovating activities (Balsmeier, Fleming, and Manso, 2017; Lu and Wang, 2018) and increase the institutional investors’ shareholding, which may give rise to innovations (Aghion et al., 2009b, Lerner and Wulf, 2007, Gao et al., 2019). These previous conclusions are also consistent with our findings. Notably, equity concentration does not moderate the negative relationship between managerial myopia and green technological innovations.

In addition, we also analyzed the different roles of moderation by geographical location. The negative relationship between managerial myopia and green technology innovations is most significant for heavy polluters in the middle region, followed by those in the western and eastern areas. This may result from a complex interaction of environmental regulations, firm characteristics, and regional hinge effects (Zhu et al., 2014).

Our sample only selected heavily polluting listed corporations in Chinese A-shares and did not consider non-listed heavy polluters; therefore, the sample selection may limit our findings. Moreover, managerial myopia’s impact on corporate innovational strategies is complex and diversified. This paper only digs into the implications of managerial myopia on green technological innovations. Future research can also continue to be more perspectives to investigate managerial myopia’s mechanisms regarding the strategic decision of enterprises to engage in green technology innovations, forming more valuable supplements to the research related to enterprise green technological innovations and providing more referable guidance for enterprises’ production practice.

8 Conclusion

Ecology and low-carbon transformation, upgrading, and sustainable development have become critical paths for Chinese enterprises to develop with high quality. Heavily polluting enterprises should follow the trend and actively contribute to realizing the “double carbon” goal of the country. Based on the upper echelons and time orientation theoretical framework, the study empirically investigated how managerial myopia affects green technological innovations in heavily polluting enterprises over the period 2007 to 2020. The findings showed that managerial myopia clearly negatively impacted green technological innovations in heavily polluting firms, and the results pass the endogeneity test of lagged variables. The findings persisted despite conducting several robustness tests, such as adding control variables and replacing green technological innovating indicators.

Taking heterogeneity analysis further, it is shown that increasing management equity incentives promote management myopia and the adverse effects of corporate green technological innovations. Moreover, increasing the number of independent directors and institutional investors, which corresponds to increasing the supervision of the company both internally and externally, can effectively curb the negative relationship between them. In contrast, the equity concentration does not moderate the relationship between them. In addition, we found that the adverse effect of managerial myopia on green technological innovations is more prevalent among heavy polluters in the central region.

Based on the above findings, the following policy insights are obtained from this paper. First, enterprises are an indispensable micro part of achieving sustainable economic development under a high-quality development strategy. The time perspective of senior managers directly influences enterprises’ green technology innovation decisions. The findings of this paper provide empirical evidence that enterprises should pay attention to the time perspective of their senior managers in addition to their demographic characteristics when selecting and training them. Second, this paper confirms that strengthening internal and external corporate supervision can curb managerial myopia. Enterprises should improve their corporate governance mechanisms and give full play to their internal and external supervision mechanisms to enhance their governance capabilities. Third, the influence of geographical location must be appreciated. The central region government should effectively combine market mechanisms with the enterprises it is helping to achieve sustainable development.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

YW: Writing—review and editing, conceptualization, methodology, project administration; ZL: Writing—review and editing, conceptualization, methodology; YW: Writing—original draft, conceptualization, methodology; YW: Writing—review and editing, formal analysis; YW: Writing—review and editing; ZL: Writing—review and editing.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acemoglu, Daron, Akcigit, Ufuk, and Murat, Alp Celik (2022). Radical and incremental innovation: The roles of firms, managers, and innovators. Am. Econ. J. Macroecon. 14 (3), 199–249. doi:10.1257/mac.20170410

Aghion, Philippe, Blundell, Richard, Griffith, Rachel, Peter, Howitt, and Prantl, Susanne (2009a). The effects of entry on incumbent innovation and productivity. Rev. Econ. Statistics 91 (1), 20–32. doi:10.1162/rest.91.1.20

Aghion, Philippe, Veugelers, Reinhilde, and Serre, Clément (2009b). Cold start for the green innovation machine. Breugel, Netherlands: Bruegel policy contribution.

Ahuja, Gautam, Morris Lampert, Curba, and Tandon, Vivek (2008). 1 moving beyond schumpeter: Management research on the determinants of technological innovation. Acad. Manag. Ann. 2 (1), 1–98. doi:10.5465/19416520802211446

Ailing, P. A. N., Liu, Xin, Qin, Jinlong, and Shen, Yu (2019). Can green M&A of heavy polluting enterprises achieve substantial transformation under the pressure of media. China Ind. Econ. (2), 174–192. doi:10.19581/j.cnki.ciejournal.20190131.005

AlHares, Aws, Elamer, Ahmed A., Alshbili, Ibrahem, and Moustafa, Maha W. (2020). Board structure and corporate R&D intensity: Evidence from forbes global 2000. Int. J. Account. Inf. Manag. 28, 445–463. doi:10.1108/ijaim-11-2019-0127

Ali, Rizwan, Ramiz Ur, Rehman, Suleman, Sana, and Collins, Gyakari Ntim (2022). CEO attributes, investment decisions, and firm performance: New insights from upper echelons theory. Manag. Decis. Econ. 43 (2), 398–417. doi:10.1002/mde.3389

Almazan, Andres, De Motta, Adolfo, Titman, Sheridan, and Uysal, Vahap (2010). Financial structure, acquisition opportunities, and firm locations. J. Finance 65 (2), 529–563. doi:10.1111/j.1540-6261.2009.01543.x

Amore, Mario Daniele, and Bennedsen, Morten (2016). Corporate governance and green innovation. J. Environ. Econ. Manag. 75, 54–72. doi:10.1016/j.jeem.2015.11.003

Antia, Murad, Pantzalis, Christos, and JungPark, Chul (2021). Does CEO myopia impede growth opportunities? Rev. Quantitative Finance Account. 56 (4), 1503–1535. doi:10.1007/s11156-020-00934-5

Anwar, Ahsan, Chaudhary, Amatul R., and Malik., Summaira (2022a). Modeling the macroeconomic determinants of environmental degradation in E-7 countries: The role of technological innovation and institutional quality. J. Public Aff. 28, e2834. doi:10.1002/pa.2834

Anwar, Ahsan, Malik, Summaira, and Ahmad, Paiman (2022b). Cogitating the role of technological innovation and institutional quality in formulating the sustainable development goal policies for E7 countries: Evidence from quantile regression. Glob. Bus. Rev., 097215092110726. doi:10.1177/09721509211072657

Anwar, Ahsan, Malik, Summaira, and Ahmad, Paiman (2021). Cogitating the role of technological innovation and institutional quality on environmental degradation in G-7 countries. Int. J. Green Econ. 15 (3), 213–232. doi:10.1504/ijge.2021.120871

Asensio-López, Diego, Cabeza-García, Laura, and González-Álvarez, Nuria (2018). Corporate governance and innovation: A theoretical review. Eur. J. Manag. Bus. Econ. 28 (3), 266–284. doi:10.1108/ejmbe-05-2018-0056

Asker, John, Farre-Mensa, Joan, and Alexander, Ljungqvist (2010). Does the stock market harm investment incentives? Available at https://ssrn.com/abstract=1640379.

Bluedorn, Allen C. (2000). “Time and organizational culture,” in Handbook of organizational culture and climate. Editors N. M. Ashkanasy, C. P. Wilderom, and M. F. Peterson Available at https://books.google.com/books?id=AUt1i9ZEa48C&printsec=frontcover&hl=zh-CN#v=onepage&q&f=false.

Balsmeier, Benjamin, and Buchwald, Achim (2015). Who promotes more innovations? Inside versus outside hired CEOs. Industrial Corp. Change 24 (5), 1013–1045. doi:10.1093/icc/dtu020

Balsmeier, Benjamin, Lee, Fleming, and Manso, Gustavo (2017). Independent boards and innovation. J. Financial Econ. 123 (3), 536–557. doi:10.1016/j.jfineco.2016.12.005

Bantel, Karen A., and Jackson, Susan E. (1989). Top management and innovations in banking: Does the composition of the top team make a difference? Strategic Manag. J. 10 (S1), 107–124. doi:10.1002/smj.4250100709

Barker, , Vincent, L., and Mueller, George C. (2002). CEO characteristics and firm R&D spending. Manag. Sci. 48 (6), 782–801. doi:10.1287/mnsc.48.6.782.187

Bebchuk, Lucian Arye, and Stole, Lars A. (1993). Do short-term objectives lead to under-or overinvestment in long-term projects? J. Finance 48 (2), 719–729. doi:10.2307/2328920

Belloc, Filippo (2012). Corporate governance and innovation: A survey. J. Econ. Surv. 26 (5), 835–864. doi:10.1111/j.1467-6419.2011.00681.x

Belloc, Filippo (2013). Law, finance and innovation: The dark side of shareholder protection. Camb. J. Econ. 37 (4), 863–888. doi:10.1093/cje/bes068

Bens, Daniel A., Nagar, Venky, DouglasSkinner, J., and Wong, M. H. Franco (2003). Employee stock options, EPS dilution, and stock repurchases. J. Account. Econ. 36 (1-3), 51–90. doi:10.1016/j.jacceco.2003.10.006

Bluedorn, Allen C., and Martin, Gwen (2008). The time frames of entrepreneurs. J. Bus. Ventur. 23 (1), 1–20. doi:10.1016/j.jbusvent.2006.05.005

Boivie, Steven, Withers, Michael C., ScottGraffin, D., and Corley, Kevin G. (2021). Corporate directors' implicit theories of the roles and duties of boards. Strategic Manag. J. 42 (9), 1662–1695. doi:10.1002/smj.3320

Bolton, Patrick, Jose, Scheinkman, and Xiong, Wei (2006). Executive compensation and short-termist behaviour in speculative markets. Rev. Econ. Stud. 73 (3), 577–610. doi:10.1111/j.1467-937x.2006.00388.x

Borsatto, Jaluza, Maria, Lima Silva, and Bazani, Camila Lima (2021). Green innovation and environmental regulations: A systematic review of international academic works. Environ. Sci. Pollut. Res. 28 (45), 63751–63768. doi:10.1007/s11356-020-11379-7

Brochet, Francois, Loumioti, Maria, and George, Serafeim (2015). Speaking of the short-term: Disclosure horizon and managerial myopia. Rev. Account. Stud. 20 (3), 1122–1163. doi:10.1007/s11142-015-9329-8

Bronzini, Raffaello, and Iachini, Eleonora (2014). Are incentives for R&D effective? Evidence from a regression discontinuity approach. Am. Econ. J. Econ. Policy 6 (4), 100–134. doi:10.1257/pol.6.4.100

Burkart, Mike, Gromb, Denis, and Panunzi, Fausto (1997). Large shareholders, monitoring, and the value of the firm. Q. J. Econ. 112 (3), 693–728. doi:10.1162/003355397555325

Bushee, Brian J. (1998). The influence of institutional investors on myopic R&D investment behavior. Account. Rev., 305–333.

Busom, Isabel (2000). An empirical evaluation of the effects of R&D subsidies. Econ. innovation new Technol. 9 (2), 111–148. doi:10.1080/10438590000000006

Cai, Xiqian, Lu, Yi, Wu, Mingqin, and Yu, Linhui (2016). Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J. Dev. Econ. 123, 73–85. doi:10.1016/j.jdeveco.2016.08.003

Chen, Yu-Shan (2008). The driver of green innovation and green image–green core competence. J. Bus. ethics 81 (3), 531–543. doi:10.1007/s10551-007-9522-1

Chen, Yu-Shan, Chang, Ching. Hsun, and Wu, Feng. Shang (2012). Origins of green innovations: The differences between proactive and reactive green innovations. Manag. Decis. 50, 368–398. doi:10.1108/00251741211216197

Chintrakarn, Pandej, Jiraporn, Pornsit, Sameh Sakr, , and Lee, Sang Mook (2016). Do co-opted directors mitigate managerial myopia? Evidence from R&D investments. Finance Res. Lett. 17, 285–289. doi:10.1016/j.frl.2016.03.025

Cobo-Benita, , Ramón, José, Rodríguez-Segura, Enrique, Ortiz-Marcos, Isabel, and Ballesteros-Sánchez, Luis (2016). Innovation projects performance: Analyzing the impact of organizational characteristics. J. Bus. Res. 69 (4), 1357–1360. doi:10.1016/j.jbusres.2015.10.107

Coles, Jeffrey L., Daniel, Naveen D., and Naveen, Lalitha (2006). Managerial incentives and risk-taking. J. financial Econ. 79 (2), 431–468. doi:10.1016/j.jfineco.2004.09.004

Cucculelli, Marco (2018). Firm age and the probability of product innovation. Do CEO tenure and product tenure matter? J. Evol. Econ. 28 (1), 153–179. doi:10.1007/s00191-017-0542-4

Czarnitzki, Dirk, and Kraft, Kornelius (2004). Firm leadership and innovative performance: Evidence from seven EU countries. Small Bus. Econ. 22 (5), 325–332. doi:10.1023/b:sbej.0000022209.72378.fe

Daellenbach, Urs S., AnneMcCarthy, M., and Schoenecker, Timothy S. (1999). Commitment to innovation: The impact of top management team characteristics. R&d Manag. 29 (3), 199–208. doi:10.1111/1467-9310.00130

Dan, Tian, and Qi, Yu (2017). The influence of background characteristics of top managers on corporate green innovation. Res. Financial Econ. Issues (6), 108–113.

David, Parthiban, Yoshikawa, Toru, MuraliChari, D. R., and Rasheed, Abdul A. (2006). Strategic investments in Japanese corporations: Do foreign portfolio owners foster underinvestment or appropriate investment? Strategic Manag. J. 27 (6), 591–600. doi:10.1002/smj.523

David, Paul A., BronwynHall, H., and Toole, Andrew A. (2000). Is public R&D a complement or substitute for private R&D? A review of the econometric evidence. Res. policy 29 (4-5), 497–529. doi:10.1016/s0048-7333(99)00087-6

Denis, David J. (2019). Is managerial myopia a persistent governance problem? J. Appl. Corp. Finance 31 (3), 74–80. doi:10.1111/jacf.12361

Dionisio, Marcelo, and Raupp de Vargas, Eduardo (2020). Corporate social innovation: A systematic literature review. Int. Bus. Rev. 29 (2), 101641. doi:10.1016/j.ibusrev.2019.101641

Edmans, Alex, Fang, Vivian W., and Lewellen, Katharina A. (2017). Equity vesting and investment. Rev. Financial Stud. 30 (7), 2229–2271. doi:10.1093/rfs/hhx018

Expósito, Alfonso, Sanchis-Llopis, Amparo, and Sanchis-Llopis, Juan A. (2021). CEO gender and SMEs innovativeness: Evidence for Spanish businesses. Int. Entrepreneursh. Manag. J., 1–38. doi:10.1007/s11365-021-00758-2

Fama, , Eugene, F., and Jensen, Michael C. (1983). Separation of ownership and control. J. law Econ. 26 (2), 301–325. doi:10.1086/467037

Fang, Jiayu, Gao, Chao, and Lai, Mingyong (2020). Environmental regulation and firm innovation: Evidence from national specially monitored firms program in China. J. Clean. Prod. 271, 122599. doi:10.1016/j.jclepro.2020.122599

Filatotchev, Igor, Aguilera, Ruth V., and Wright., Mike (2020). From governance of innovation to innovations in governance. Acad. Manag. Perspect. 34 (2), 173–181. doi:10.5465/amp.2017.0011

Flood, Patrick C., Fong, Cher-Min, Smith, Ken G., O'Regan, Phillip, Moore, Sarah, and Morley, Michael (1997). Top management teams and pioneering: A resource-based view. Int. J. Hum. Resour. Manag. 8 (3), 291–306. doi:10.1080/095851997341658

Foss, Nicolai, Lee, Peggy M., Murtinu, Samuele, and Scalera, Vittoria G. (2022). The XX factor: Female managers and innovation in a cross-country setting. Leadersh. Q. 33 (3), 101537. doi:10.1016/j.leaqua.2021.101537

Francis, Jennifer, and Smith, Abbie (1995). Agency costs and innovation some empirical evidence. J. Account. Econ. 19 (2-3), 383–409. doi:10.1016/0165-4101(94)00389-m

Gao, Kaijuan, Shen, Hanxiao, Gao, Xi, and Chan, Kam C. (2019). The power of sharing: Evidence from institutional investor cross-ownership and corporate innovation. Int. Rev. Econ. Finance 63, 284–296. doi:10.1016/j.iref.2019.01.008

García-Sánchez, , Isabel-María, , and García-Sánchez, Alejandra (2020). Corporate social responsibility during COVID-19 pandemic. J. Open Innovation Technol. Mark. Complex. 6 (4), 126. doi:10.3390/joitmc6040126

Garel, Alexandre (2017). Myopic market pricing and managerial myopia. J. Bus. Finance Account. 44 (9-10), 1194–1213. doi:10.1111/jbfa.12262

Görg, Holger, and Strobl, Eric (2007). The effect of R&D subsidies on private R&D. Economica 74 (294), 215–234. doi:10.1111/j.1468-0335.2006.00547.x

Gupta, Anil K., and Govindarajan, Vijay (1984). Business unit strategy, managerial characteristics, and business unit effectiveness at strategy implementation. Acad. Manag. J. 27 (1), 25–41. doi:10.2307/255955

Habiba, Umme, Cao, Xinbang, and Anwar, Ahsan (2022). Do green technology innovations, financial development, and renewable energy use help to curb carbon emissions? Renew. Energy 193, 1082–1093. doi:10.1016/j.renene.2022.05.084

Haimei, Wang, Lv, Xiaojing, and Lin, Wanfa (2014). The effect of foreign equity participation, executive ownership, InstitutionalOwnership on corporate social ResponsibilityBased on the empirical test ofA-share public companies in China. Account. Res. (8), 81–87.

Hambrick, Donald C., and Mason, Phyllis A. (1984). Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 9 (2), 193–206. doi:10.5465/amr.1984.4277628