- School of Business, Qingdao University, Qingdao, China

The link between corporate digitization and green innovation is now receiving attention from all spheres of life in light of the rapidly developing digital economy and the goal of sustainable development. This study explores how corporate digitalization affects green innovation, its mediating mechanism, and moderating effects by integrating resource-based theory, attention-based view, and institutional theory. We utilize the panel data of Chinese Shanghai and Shenzhen A-share manufacturing corporation data from 2011 to 2020 as samples and use the fixed effect model in linear regression of panel data for regression analysis. Research findings: 1) corporate digitalization fosters not only green innovation directly but also promotes green innovation by enhancing human capital. 2) Executive team environmental attention encourages the beneficial correlation between human capital and green innovation. 3) Media attention promotes the favorable relationship between corporate digitalization and green innovation. 4) Heterogeneity analysis revealed that the corporate digitalization effect on green innovation is more significant when firms are more prominent in high-tech industries. The findings encourage corporations to strengthen their digital strategy, infrastructure, and applications. In addition, they can also inspire green innovation to enable companies to develop sustainably.

1 Introduction

In the past few years, manufacturing corporates in China have been caught in the dilemma of low quality, low efficiency, and severe ecological damage while using resources for rapid development (Ji and Zhang, 2019). We must therefore draw attention to the waste and pollution problems in the manufacturing industry. The UN proposed the Sustainable Development Goal in 2021. To address the issues of global climate change, pollution, and waste, it took into account economic, social, and environmental concerns (Sinha et al., 2021). More and more academic research is being done from the standpoint of environmental science under the setting of the sustainable development goal (Sukma and Leelasantitham, 2022a). For instance, from the macro-level perspective, Hoseinzadeh et al. (2022a, 2022b) applied the PRISMI PLUS Toolkit to the city of Spain and the island of Procida with a comprehensive analysis of energy, economic and environmental. They demonstrated the approach to integrating renewable energy (solar and wind energy). This is crucial for the region’s sustainable development and energy independence, as well as for reaching the decarbonization goal. Fayazi Rad et al. (2022) applied the advanced hydrogen production device to the road infrastructure sector in Iran, which reduced carbon dioxide emissions and increased sustainability. Similarly; Hoseinzadeh and Astiaso Garcia (2022) explored renewable energy systems using solar and wind energy with great potential on Italian islands for economic and environmental benefits and sustainable development. From the viewpoint of environmental science and the microscale level of enterprises, studying how corporate behavior favorably impacts the economy, society, and environment has become crucial to advancing the sustainable development goal (Sukma and Leelasantitham, 2022b). Green innovation is a critical component of accomplishing the goal of sustainable development (Song and Yu, 2018). Corporate green innovation may promote sustainable growth, minimize adverse environmental effects, and increase environmental and economic advantages (Hojnik and Ruzzier, 2016). Therefore, from a micro perspective, corporations must seek out green innovation to promote sustainable development goals.

Meanwhile, digital technology is advancing rapidly and integrating with traditional businesses. These organizational environmental elements have a consequence on how companies change. Corporations must adhere to digital development and update their technologies, allowing them to drive green innovation and digitally enable stable, sustainable improvement (Wen et al., 2021; Sukma and Leelasantitham, 2022b). It is practical to look at how corporate digitalization affects green innovation to promote corporate development.

Several researchers have already researched the connection between corporate digitization and green innovation. The environment may benefit from corporate digitalization (Danish, 2019). Big data technologies can simulate green innovation’s process and predict its course, which can positively affect green innovation practices (El-Kassar and Singh, 2019; Li and Shen, 2021) and enable companies to gain green competitiveness (Tian et al., 2022). Digitalization increases information transparency, which fosters shared commitment and trust, significantly boosts innovation, and enables sustainable development (Dong et al., 2021; Sukma and Leelasantitham, 2022a). Corporate digitalization can increase the number and quality of green innovations (Rao et al., 2022). But as the study goes on, some researchers have discovered the phenomena known as the “digital paradox” because of the growth of digital technology (Gebauer et al., 2020), which instead increases energy consumption and pollution (Avom et al., 2020). Several researchers have presented a non-linear perspective on the impacts of corporate digitalization on green innovation. The “data-driven” effect of corporations promotes the upgrading of green innovation strategies, while corporate digitalization can inhibit green innovation due to the “curse of competence” and digital overload (Hajli, 2015; Dong and Netten, 2017; Gebauer et al., 2020; Cao et al., 2021; Li and Shen, 2021). There is disagreement over how corporate digitalization affects green innovation. Therefore, it is crucial to ascertain if corporate digitalization can foster green innovation.

Most current research concentrates on the direct relationships between corporate digitalization and green innovation. However, they still have not fully reveal how corporate digitalization affects green innovation internally. Corporate digitalization is only a means of green innovation (Bartel et al., 2007). Corporate environmental programs intimately tie to stakeholders who influence or engage in environmental actions (Ioanna et al., 2022). The stakeholders of green innovation in enterprises are shareholders, managers, and employees (Mitchell et al., 1997). Stakeholders’ behavior affects the effectiveness of IT projects and the quality of IT systems; whether corporate digitalization (such as IT technology) can successfully foster green innovation depends on people’s background knowledge and experience (Sukma and Leelasantitham, 2022b). Thus, human capital is the nucleus resource of green innovation. Advanced digital resources for green innovation may be learned, absorbed, and used by human capital at a greater level. Following the resource-based theory, this study explores the mediating mechanism between corporate digitalization and green innovation from the human capital standpoint.

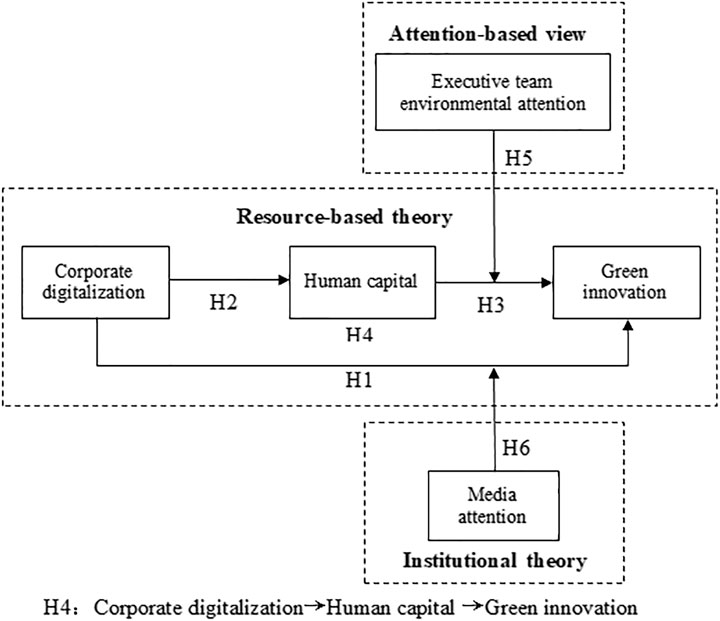

Most previous research has considered the moderating effect of corporate digitalization and green innovation from a single internal or external perspective (Wei and Sun, 2021; Cardinali and De Giovanni, 2022), while we account for moderating effects from dual perspectives of corporations’ internal and external environmental attention in this empirical study. Within the enterprise, the executive team’s level of environmental awareness determines how much green innovation a company engages in, and it affects how resources are allocated for corporate green innovation (Wang L. et al., 2022). So we select executive team environmental attention as an internal environmental factor to explore its moderating effect on human capital and green innovation. The attention-based view combined with institutional theory provides a better understanding of how firms develop a competitive advantage (Ocasio, 2011). According to institutional theory, businesses must pursue green innovation initiatives to meet external institutional demand and boost organizational legitimacy. Prior research has concentrated on how coercive forces (such as government environmental rules) affect green innovation (Wu et al., 2022) while ignoring the impact of non-coercive pressures. Outside the enterprises, the media, as a non-coercive pressure, plays a guiding role in the topics concerned by corporates and the public. Media attention to environmental behavior can guide companies to use resources and technology for green innovation (Wang and Zhang, 2021). So we choose media attention as an external environmental factor to assess the moderating effects of media attention on corporate digitalization and green innovation.

Then, the following queries merit consideration:

Q1: What correlation exists between green innovation and corporate digitalization? Will it be heterogeneous among different corporations?

Q2: Can human capital serve as a mediating mechanism in corporate digitalization and green innovation?

Q3: From dual perspectives of internal and external environmental attention, what moderating effect does executive team environmental attention have on human capital and green innovation? And how can media attention play a moderating impact between corporate digitalization and green innovation?

To address the issues above, first, we analyze Q1 and Q2 per the resource-based theory and Q3 in accord with the attention-based view and institutional theory. Second, we utilize the fixed effect model in the linear regression of panel data to conduct an empirical test using the panel data of A-share manufacturing businesses in China from 2011 to 2020 as samples. After that, the robustness test is carried out, and the endogenous problem is alleviated. In further research, heterogeneity analysis is carried out according to enterprise size and technological attributes.

The following are the main contributions: first, we empirically verify the micro mechanism of corporate digitalization and green innovation using the realistic background of green development and the digital economy. Second, from the view of human capital, we have unlocked the mediating role of corporate digitalization promoting green innovation, which offers suggestions for fully utilizing the environmental benefit potential of corporate digitalization. Third, we examine the moderating effect in light of dual internal and external environmental attention. We include executive team environmental attention as an internal factor in the “corporate digitalization-human capital-green innovation” research framework. Media attention is an external factor in the “corporate digitalization-green innovation” research framework. As a result, it provides a more situational empirical analysis of the relationship between green innovation and corporate digitalization.

2 Theoretical analysis and research hypotheses

2.1 The impact of corporate digitalization on green innovation

Corporate digitization is a strategic act. It uses digital resources to formulate and execute corporate actions to achieve digitalization at all levels of manufacturing, sales service, and management (Bharadwaj et al., 2013; Nambisan et al., 2019).

The resource-based theory states that corporations can achieve superior performance and a competitive edge by utilizing priceless, uncommon, unique, and irreplaceable resources (Wernerfelt, 1984; Barney, 1991). Thus, Valuable and unique digital resources within a corporation may provide it with a competitive edge. The company’s internal resources may also be combined with digital resources for green innovation. The following are the primary aspects that corporate digitalization has affected green innovation.

In R&D and manufacturing, companies use digital technologies such as blockchain to collect and analyze financial market information to provide financing support for R&D and manufacturing of green innovations. Corporate digitalization enables reallocating and optimizing resources and efficiently uses resources in manufacturing business processes, generating green energy-saving technologies (Chuang and Huang, 2018; Cardinali and De Giovanni, 2022). Advanced sensors, artificial intelligence, and other digital technologies enable to monitor of the manufacturing process autonomously, in real-time, and precisely. These also optimize the procedure for high loss and low output, thus achieving green process innovation (Müller and Voigt, 2018; Li et al., 2022). Big data analytics and other digital technologies can access and analyze enormous volumes of data, identify obstacles to green innovation, and evaluate possible advantages through insight.

Corporate digitalization in sales can obtain high-quality information and improve information processing to meet consumers’ green needs. This study by Johnson et al. (2017) claimed that green customer preferences could be gathered and analyzed using digital resources. Therefore, the development of corporate digitalization can quickly gain insight into green information in the market, close the distance with customers and conduct real-time communication to promote green innovation (Hajli, 2015; Dong and Netten, 2017). Additionally, corporate digitization supports green innovation by enabling businesses to swiftly respond to changing environmental conditions and get dynamic knowledge about external ecological governance and other issues. Consequently, we put up the following hypotheses.

Hypothesis 1:. Corporate digitalization will foster green innovation.

2.2 The impact of corporate digitalization on human capital

Human capital combines workers’ experience, talents, and physical strength and has economic value (Youndt et al., 2004; Subramaniam and Youndt, 2005). In this study, human capital refers to stakeholders’ skills, knowledge, and experience, which can guide enterprises to realize strategic decisions. According to most academics, corporate digitalization benefits the human capital of businesses.

Corporate digitalization can optimize its human resource structure to enhance the human capital level. In the process of external recruitment, corporate digitalization requires the intellectual development of enterprises. Advanced equipment with cutting-edge technology will replace the low-skilled workforce, thus increasing the demand for highly qualified workers. Therefore, corporates can use digital technologies to break the limitation of information time and space, place recruitment information precisely, establish a job seeker information database, and conduct precise recruitment to optimize human capital structure and accumulate human capital (Gilch and Sieweke, 2021). In the internal performance appraisal process, digital resources dynamically detect employees’ work and provide reasonable performance incentives according to their abilities. The excellent performance evaluation system is conducive to attracting higher levels of talent and adjusting the human capital structure (Baptista et al., 2020; Schuetz and Venkatesh, 2020), thus improving the human capital level of the company.

Corporate digitalization can also enhance the quality of their human resources to enhance the human capital level. Employees need to learn and use digital technologies to cope with the unconventional tasks such as R&D and production that emerge from the digital development of companies (Kozanoglu and Abedin, 2021; Cetindamar et al., 2022). Employees then utilize common digital platforms and digital technologies to interact and cooperate with individuals in the same business or even across industries, making it simpler to get new information and experience both within and outside the workplace (Leonardi, 2021; Cetindamar et al., 2022), thereby improving human capital. The following hypotheses are offered based on the analysis above.

Hypothesis 2:. Corporate digitalization will improve corporates human capital level.

2.3 The impact of human capital on green innovation

New or enhanced goods, procedures, management, and services make up a green innovation. It can minimize the adverse environmental effects while simultaneously adding value to customers and businesses (Hojnik and Ruzzier, 2016). Green innovation bases its attention on innovation and places a greater emphasis on environmental conservation and green value. People are the core carrier of all production factors (Marchiori et al., 2022), but the significant determinants of green innovation are the knowledge, technology, skill, and experience integrated into human capital. Developing an innovation strategy as part of a talent plan is essential for encouraging green innovation. Some academics contend that a corporates’ ability to green innovation is influenced by its amount of human capital (Adomako and Nguyen, 2020; Gerhart and Feng, 2021; Munawar et al., 2022). The following factors dominate how corporate human capital affects green innovation:

In corporate manufacturing, when updating environmental protection equipment and improving production and management practices, the experience and knowledge possessed by human capital can replace the need for natural resources and reduce environmental degradation and resource waste (Yao et al., 2019; Ahmed et al., 2020). In sales services, companies with higher human capital have more robust analytical capabilities and extensive information sources (King and Tucci, 2002). This enables them to understand customers’ environmental consumption needs on time and have the ability to predict future ecological consumption needs (Munawar et al., 2022) to encourage green innovation among corporations. Additionally, research suggests that people are more likely to support the advancement and use of green technology if their human capital is better, their personal qualities are higher, and so on (Yong et al., 2019; Mansoor et al., 2021; Asiaei et al., 2022), and resist the consumption pattern that is not conducive to environmental sustainability (Yao et al., 2019). We put out the following hypotheses in light of the study above.

Hypothesis 3:. The increase in corporate human capital level will encourage green innovation.

2.4 The mediating role of human capital

The resource-based view asserts that human capital is a valuable asset. Human capital refers to stakeholders’ skills, knowledge, and experience. Referring to the research of Ioanna et al. (2022), we use priority to map and analyze the stakeholders of corporate green innovation in Figure 1. First, the CEO, managers, and shareholders have the highest priority since they will implement the company’s strategy. Second, the R&D department, manufacturing department, customer service department, and functional department staff are responsible for making decisions, so they have medium priority. Finally, the enterprise’s external stakeholders—consumers, suppliers, the government, and the general public—impact its strategic conduct. Still, they have no decision-making or execution authority and have the lowest priority. The following mainly analyzes the mediating role of human capital owned by internal stakeholders in enterprise between corporate digitalization and green innovation.

In recruitment and selection, corporates use digital technologies to establish a job search information database to understand the environmental protection concepts of job seekers (Deng et al., 2022) and select employees with solid environmental awareness to enhance corporate green human capital. In internal learning and training, corporate digitalization can use the Intranet to establish an environmental knowledge management system, and provide employees with environmental protection training, to enhance human capital’s ability to acquire, analyze and integrate environmental experience, which is beneficial for green innovation (Antunes and Pinheiro, 2020; Cardinali and De Giovanni, 2022). In addition, digital elements precisely match external environmental changes with internal data processing to achieve “linkage empowerment”. The relationship network formed by the “internal and external linkage” of digital resources can enhance the interaction with strategic partners and stakeholders, strengthen cooperative relationships, and promote organizational learning of green knowledge (Deng et al., 2022), then encouraging green innovation. Researchers put out the following hypotheses in light of the study above.

Hypothesis 4:. Corporate digitization promotes green innovation by improving the human capital level.

2.5 The moderating effect of executive team environmental attention

As per the attention-based view (ABV), corporate managers’ attention determines organizational behavior (Ocasio, 1997). When the executive team pays attention to external environmental information, it determines whether the event is an opportunity or a challenge for their corporates based on their experience and takes further actions to achieve the corporate’s strategy (Ocasio, 1997; Boone et al., 2019). Corporate green innovation behavior results from the guidance of the executive team’s environmental attention. The empirical research of Wang L. et al. (2022) also argued that corporate green innovation strategies result from the guidance of the executive team’s environmental attention. Most previous studies took the executive team’s environmental attention as a driving factor for corporate green innovation but ignored its moderating effect.

Corporate human capital’s successful implementation of green innovation activities is closely related to the executive team’s environmental attention. The process of attention to action is the moderating effect of the executive team’s environmental attention on human capital and green innovation. With being intensely environmentally conscious, the executive pays more attention to the environmental system, media coverage, and public awareness, and they can better understand the environment’s information (Peng and Liu, 2016). As a result, they make more significant efforts to implement green innovation inside corporations. They are fully aware of the significance of environmental concerns and how to relate them to business development. The executive team will devote more human resources to green innovation because of this choice, which will also impact corporate resource allocation. Considering this, here are some hypotheses that we put forth.

Hypothesis 5:. The executive team’s environmental attention promotes the positive relationship between human capital and green innovation.

2.6 The moderating effect of media attention

According to institutional theory, organizations need to increase organizational legitimacy in response to external institutional pressures. Studies have demonstrated that when environmental awareness grows, informal institutional pressure (such as media attention) encourages corporations to implement green innovations and achieve environmental legitimacy (Wang and Zhang, 2021; He et al., 2022). Thus, corporations with more media attention can strengthen their digital strategies and use digital resources and technologies to implement green innovation.

On the one hand, the media provides public information about corporate digitization and green innovation. As the general public becomes more environmentally conscious, investors will use the information on corporate green investments reported in the media as a reference, and consumers will be more willing to purchase environmental products stimulated by advertisements (Nyilasy et al., 2014; Zahid et al., 2018). To enhance their environmental legitimacy, companies use media information to understand the relevant green needs of their stakeholders and use corporate digitalization to encourage green innovation based on the relevant ecological dynamics. On the other hand, as an informal supervision mechanism outside the corporate (Chang et al., 2020), the media promotes a positive connection between corporate digitalization and green innovation. Media attention can expose corporate environmental violations (Chang et al., 2020; Wang and Zhang, 2021). The social pressure created by media exposure of corporate environmental violations can affect the image and reputation of a corporate (Wang F. et al., 2022). Therefore, corporates will balance economic and environmental benefits to maintain their reputation, build a green image (Cheng and Liu, 2018), and encourage green innovation through corporate digitalization. The following hypotheses have been put forth based on the study mentioned above.

Hypothesis 6:. Media attention promotes the positive relationship between corporate digitalization and green innovation.

Based on the above hypotheses, our Research conceptual model is shown in Figure 2.

3 Research design

3.1 Sample and data

The research sample used in this work was the data of Chinese Shanghai and Shenzhen A-shares manufacturing enterprises from 2011 to 2020. We screened the initial data as follows: 1) dismissed ST, *ST, and other specially treated enterprises during the observation period, and 2) dismissed the samples with missing values for the main variables. Finally, we obtained the balance panel data of 405 companies with 4,050 observations.

We choose the sample for the following considerations: First, A-share companies refer to ordinary shares listed in Chinese Shanghai and Shenzhen and are subscribed to and traded in RMB. Chinese stocks also have B-shares, H-shares, N-shares, etc., which are foreign stocks and need more sample data. We selected Chinese Shanghai and Shenzhen A-shares listed companies based on the data’s accuracy and the research sample’s integrity. Second, large-scale manufacturing is the major contributor to excessive resource consumption and environmental damage. Using manufacturing corporations as research samples, we can propose specific implications for minimizing environmental damage. Third, per the Listing Rules of the Shanghai Stock Exchange (Revised in 2019), “ST (Special Treatment)" will be added to the Stock’s name if a listed firm encounters financial losses for two consecutive years or if its net assets are less than the face value of the Stock. When a company loses money for three consecutive years or has suffered financial losses for less than 3 years, "*ST” will be appended to the Stock’s name, indicating that delisting may occur at any time. Thus, we dismiss ST and *ST companies since they apply to bankruptcy accounting rather than standard accounting rules and might raise suspicions of financial fraud.

Data sources: Corporate digitalization data came from the China Financial Research Center platform; corporate green innovation data came from CNRDS databases; human capital data came from the Wind database; media attention data came from the financial news of Chinese listed companies in CNRDS databases; executive team environmental attention data came from Wingo financial text data platform; all other related data came from CSMAR databases.

3.2 Main variables description

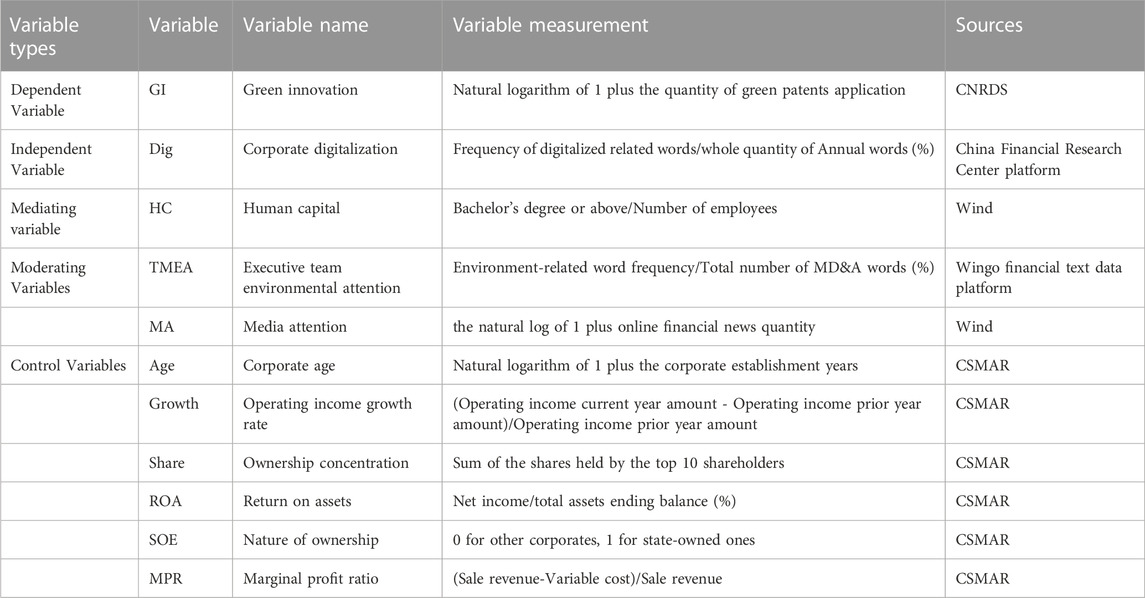

3.2.1 Dependent variable: Green innovation

According to studies by Johnstone et al. (2010) and Li et al. (2017), the quantity of green patent applications of enterprises reflects green innovation. We gauge green innovation (GI) by utilizing the number of green patent applications plus one and taking the natural logarithm. Adding one is to avoid the circumstance that the quantity is zero and cannot take a natural logarithm. Table 2 displays the variable’s construction and sources.

3.2.2 Independent variable: Corporate digitalization

Since annual reports can reflect the development direction and strategic decisions of corporates (Donovan et al., 2021), most scholars use text analysis to estimate the number of digital keywords in annual reports to measure corporate digitalization (Hossnofsky and Junge, 2019; Ricci et al., 2020; Li and Shen, 2021; Wen et al., 2022). Following the studies of the previous academics, we measure corporate digitization (Dig) by the ratio of a digitalization-related word number in annual reports to the overall word number. Table 2 displays the variable’s construction and sources.

3.3.3 Mediating variable: Human capital

Employee skills and knowledge levels will increase as business human capital increases. Employee education levels correlate with their skill and knowledge levels. Improved education levels correlate with higher employee quality. As a result, they will learn, assimilate, and apply digital materials more sensitive (Bartel et al., 2007; Zhang et al., 2022). Referring to the research of Wiersema and Bantel (1992), the researchers evaluate human capital (HC) in this study by the percentage of employees with bachelor’s degrees or higher in the enterprise.

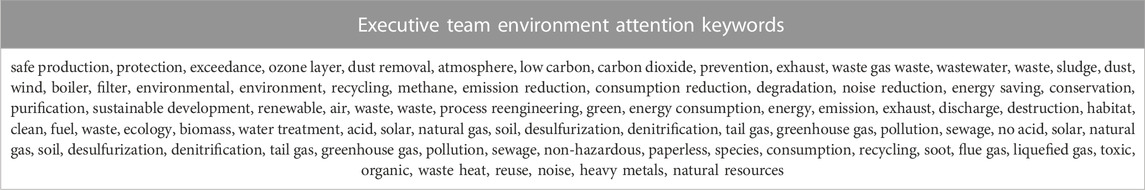

3.3.4 Moderating variables: Executive team environmental attention and media attention

Attention will be reflected in the vocabulary used by individuals. Frequently used vocabulary information can reflect the focus of individual attention (Sapir, 1944). Therefore, the pertinent environmental keywords in annual reports will show senior executives’ attention. First, we adopt environmental attention keywords list of Wu and Hua (2021), as shown in Table 1. Second, relying on the research of Wang L. et al. (2022) and Wu and Hua (2021), we count the environmental attention keywords in the managerial discussion and analysis (MD&A) section through the Wingo financial text data platform. Then we utilize the proportion of executive team environment attention keywords in MD&A to the entire words number as a measure for executive team environmental attention (TMEA).

Similar to research by Wang F. et al. (2022) and Cheng and Liu (2018), the number of pertinent news reports usually measures media attention. With the Internet’s rapid expansion, online reporting has become the primary media attention channel. To gauge media attention (MA), this study employs online financial news quantity plus one and takes the natural logarithm.

3.3.5 Control variables

Following prior studies by (Chuang and Huang, 2018; Cardinali and De Giovanni, 2022; Li et al., 2022), the control variables in this research are Age, Growth, Share, return on assets (ROA), nature of ownership (SOE), and marginal profit ratio (MPR). Table 2 displays the Variable’s construction and sources.

3.4 Regression models

Panel linear regression models involve mixed regression models, fixed effect models, and random effect models. The fundamental premise of the mixed regression model is the absence of an individual effect. However, there might be a unique situation in corporate development because each enterprise has a specific geographical, social, and economic context. In a panel regression model, there are two forms of individual effects: the random effect and the fixed effect. The Hausman test should be conducted to verify whether the data apply to the fixed effect model or the random effect model. Because the general Hausman test statistics are not robust in heteroscedasticity, we conduct the robust Hausman test employing Stata17.0 (Wooldridge, 2010). The outcome exhibits that p = 0.0074, that is, p < 0.01, disproving the null assumption of a random effect. So the fixed effect model is accepted. Then, we add the annual dummy variable to examine whether there is a yearly effect. The test outcome of the combined significance of annual dummy variables demonstrates that F (9, 404) = 8.46, Prob > F = 0.000, clearly rejecting the null hypothesis of “no time impact”, and the model exists as an annual effect. Therefore, we choose the two-way fixed effect for individuals and time model and heteroscedasticity-robust standard errors during parameter estimation to prevent heteroscedasticity issues.

This study presents corporate human capital (HC) as a mediating variable to examine whether corporate digitalization can affect green innovation through corporate human capital. There was control over the yearly fixed effect and the individual fixed effect based on the theoretical analysis previously presented to assess the mechanism of corporate digitalization’s influence on green innovation. Consistent with the analysis principle of the mediation effect (Baron and Kenny, 1986), the two-way fixed effect model in linear regression of panel data, the measurement model is developed:

To further examine the moderating effect, this study introduces the interaction terms of human capital and executive team environmental attention, and the interaction terms of corporate digitalization and media attention, and builds the following model:

Among them,

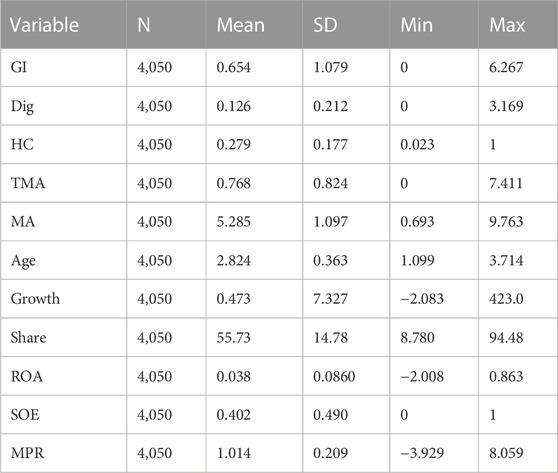

3.5 Descriptive statistics

Table 3 displays the findings of the descriptive statistics. The minimum and highest values of green innovation (GI) are 0 and 6.267, showing a disparity in various corporates’ green innovation. Corporate digitalization (Dig) ranges from 0% to 3.169%, with a mean value of only 0.126% and a standard error is 0.177%, demonstrating that there are significant variances and that corporate digitization is often at a low degree. Human capital (HC) has a mean value of 0.279 and the minimum value of 0.023, which shows that there is also a difference in human capital levels among companies. The fraction of environmental issues in MD&A is relatively low, and there is a big difference between firms, according to the mean value of executive team environmental attention (TMEA), which is 0.768, and the minimum value, which is 0. The overall mean of media attention (MA) is 5.285, and the standard deviation is 1.097, showing a lot of variance in media attention giving to different firms. Additionally, the age of the sample firms ranges from 1.099 to 3.714 and the proportion of top 10 shareholders ranges from 8.78% to 94.48%, falling within an appropriate range. Operating income is increasing at a rate greater than 0.1, demonstrating that the company has a good growth trend. The sample companies’ average growth rate is 0.43, suggesting that they are generally in a solid growth phase. ROA greater than 0 signifies a good return on assets, and the mean value of the sample companies is 0.038, showing that the average profitability of the companies is high. MPR greater than 0 indicates that increasing product sales increase corporate revenue. The average MPR of the sample companies is 1.014, meaning a satisfactory average marginal profit margin. The outcomes of the descriptive statistics reflect that the data selection is appropriate.

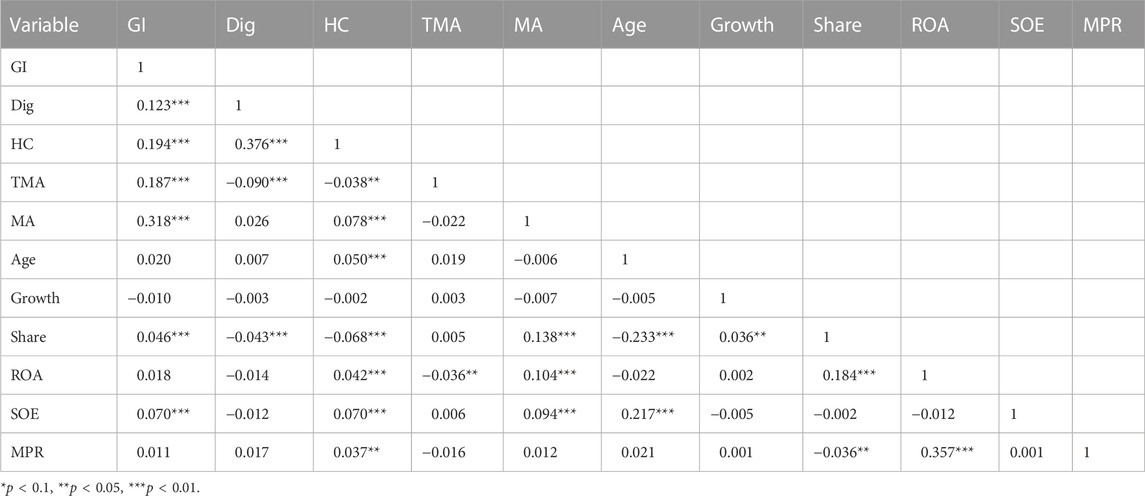

3.6 Correlation analysis

We conducted a simple OLS regression for correlation analysis, and Table 4 displays the findings. Corporate digitalization and green innovation’s Pearson correlation coefficient fulfilled the 1% statistical test. Additionally, human capital, executive team environmental attention, media attention, and green innovation are positively correlated. The results indicate that corporates with higher digitalization, higher human capital levels, more executive team environmental attention, and more media attention will be more conducive to green innovation. The VIF is 1.21 at the maximum after the variance inflation factor test, demonstrating no multicollinearity. Therefore, our variable selection is reasonable.

4 Discussion

In this section, the outcomes of models (1)–(5) using the two-way fixed effect model with heteroscedasticity-robust standard errors are derived and contrasted with the results of several experts’ earlier studies. Second, the robustness test (such as replacing variables measurement and estimated models) is conducted, and the endogenous problem is alleviated. Additionally, the fixed effect model is utilized to explore the heterogeneity of corporate scale and technology features. Finally, the study’s theoretical and practical enlightenment is provided.

4.1 Regression analysis

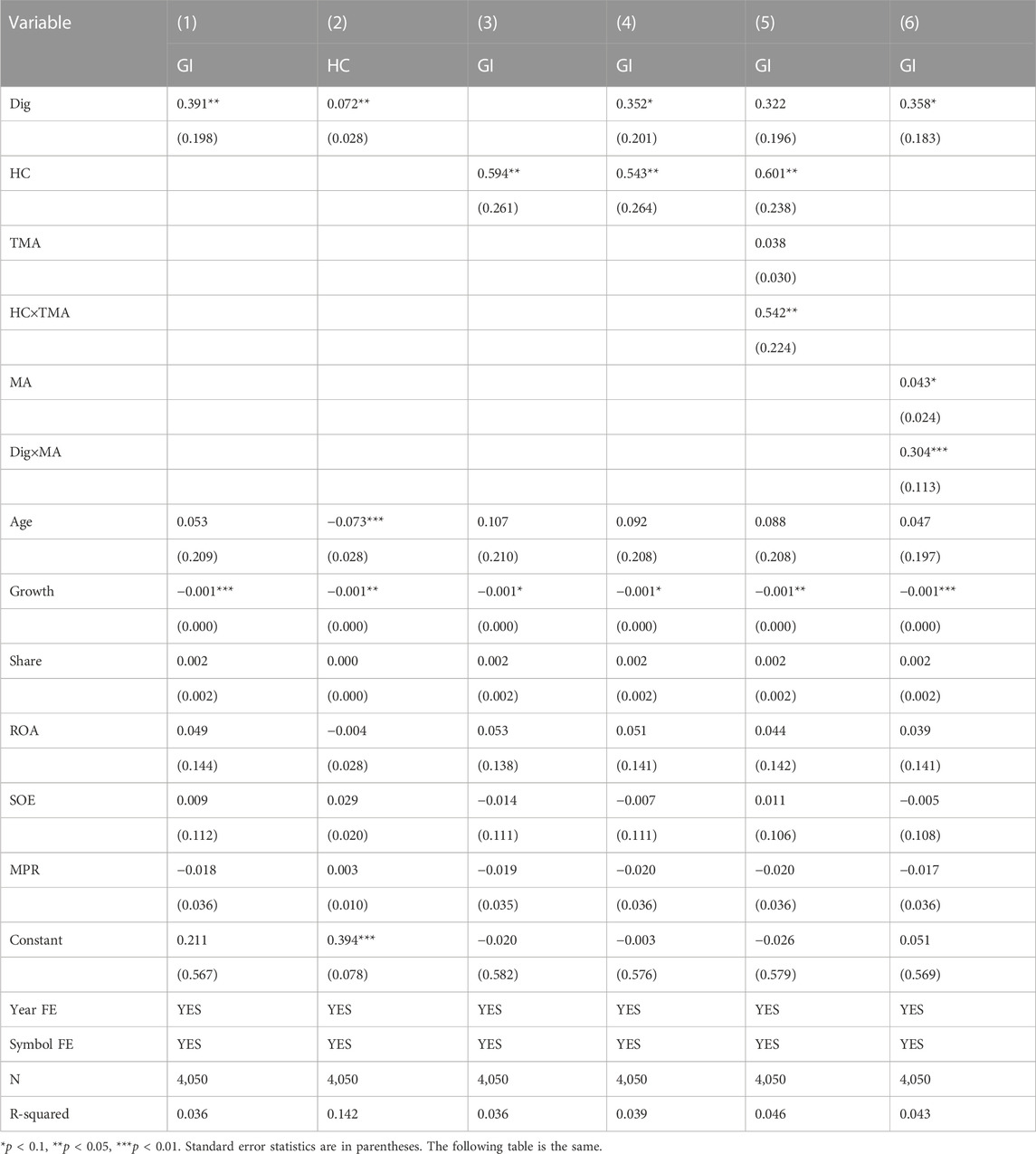

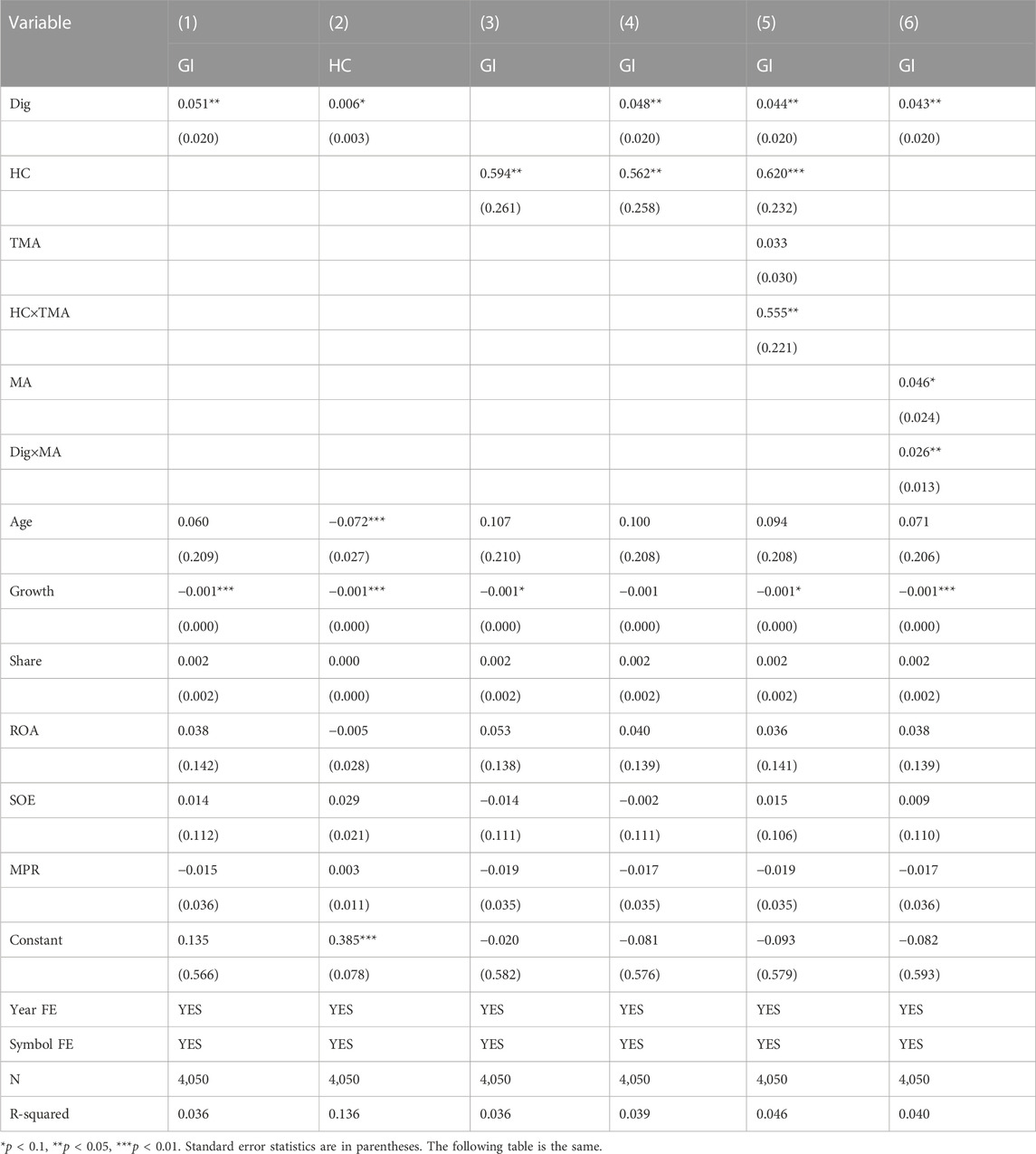

Table 5 displays the outcomes of corporate digitalization on green innovation and mediating function of human capital. Column 1) of Table 5 evaluates the impact of corporate digitalization on green innovation. With a correlation value of 0.391, the findings demonstrate that corporate digitalization and green innovation are statistically relevant at the 5% level, indicating corporate digitalization fosters green innovation, which confirmed the findings of Danish. (2019), Li and Shen (2021), Tian et al. (2022), and Rao et al. (2022), so H1 has been verified. However, this goes against the conclusion reached by Avom et al. (2020). The correlation between corporate digitalization and human capital is relevant at the 5% level, as displayed in column 2) of Table 5, with a correlation value of 0.072, affirmed that corporate digitization promotes the enhancement of human capital level, indicating that H2 has been verified. As is evident from column 3) in Table 5, human capital and green innovation are relevant at a 5% level, and the coefficient value is 0.594, showing increasing the level of human capital encourages green innovation, and H3 has been verified. These results also confirm Munawar et al. (2022), Yao et al. (2019), and Asiaei et al. (2022).

This study further verifies the mediating role of human capital between green innovation and enterprise digitalization. According to column 4) in Table 5, corporate digitalization and green innovation are highly associated at the 10% level, while human capital and green innovation are related at the 5% level. It is preliminarily shown that human capital mediates the connection between corporate digitalization and green innovation to some extent, so H4 is preliminarily verified.

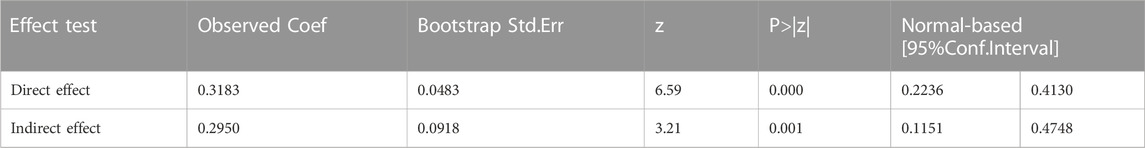

To further verify the mediating effect, Bootstrap method regression was used with 1,000 sampling times (Preacher and Hayes, 2008), and as shown in Table 6, there is no 0 within the 95% confidence interval. Further analysis reveals that human capital has a partial mediation function in corporate digitalization and green innovation. The results also confirm the finding of Ren et al. (2022).

A regression test is carried out following model 4) to investigate the moderating role of executive team environmental attention on the interaction between human capital and green innovation. The outcomes are in Table 5’s column 5). The model findings reveal that the interaction term between human capital and executive team environmental attention is associated at the 5% level, which verifies H5. A regression test is performed according to model 5) to assess the moderating impact of media attention within corporate digitalization and green innovation. The statistics are displayed in column 6) of Table 5. The interaction effect between corporate digitalization and media attention is positive at the 1% level. It suggests that media attention is favorably moderating the link between corporate digitalization and green innovation, supporting H6.

4.2 Robustness test

4.2.1 Replace the dependent variable indicator

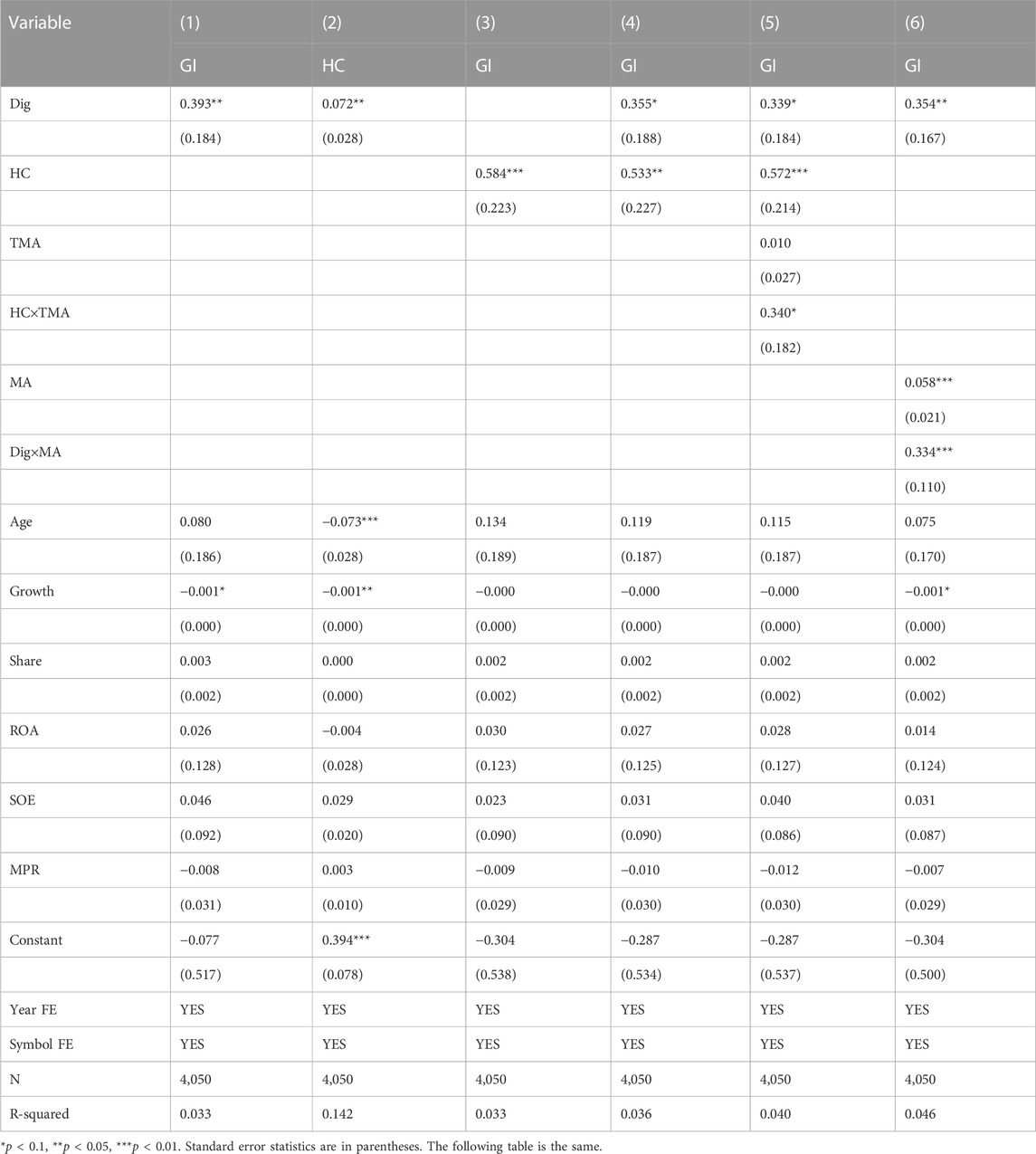

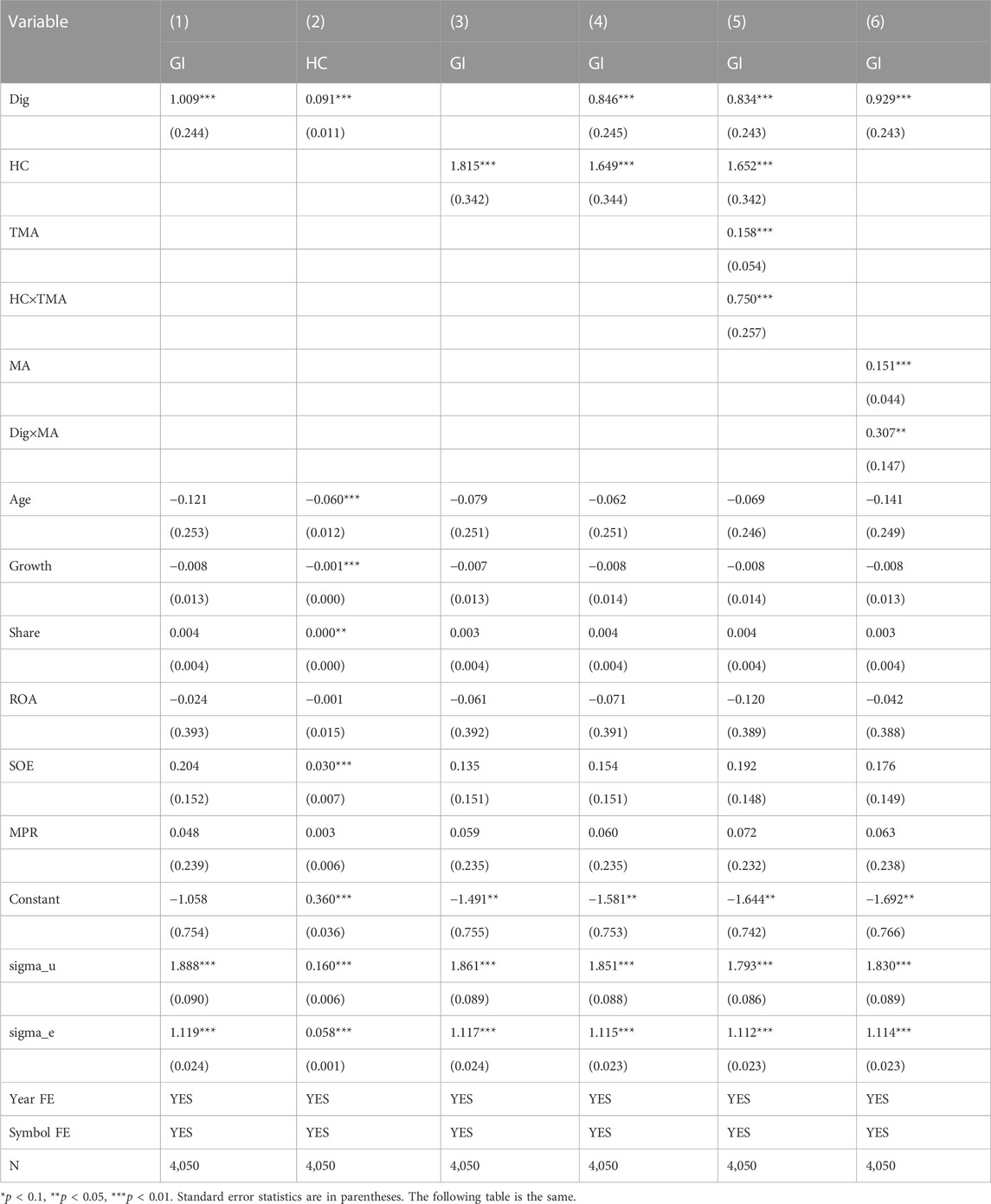

Since green invention patents are more innovative and creative (Tong et al., 2014), green invention patents may more accurately represent corporate green innovation. In the robustness test, we use green invention patents quantity plus one and take the natural logarithm to evaluate green innovation. Table 7 displays the outcomes, and it is clear that the regression outcomes are in line with those of prior regressions, making the outcomes of this study robust.

4.2.2 Replace the independent variable indicator

Grounded on the study of Wen et al. (2022), this research adopts the aggregate quantity of corporate digitalization-related terms in annual reports plus one and takes the natural logarithm to evaluate corporate digitization. Table 8 displays the outcomes of the two-way fixed effects model. The findings are in line with those of the prior study, as seen from the table, making the conclusions in this work robust.

4.2.3 Model replacement

Green innovation in this article is the number of green patent applications, but the quantity of green patents has an amount of 0 values in the actual data of selected firms. Therefore, this paper further employs the Tobit regression model for robustness testing. Table 9 presents the findings, and it is clear that the Tobit model outcomes coincide with the previous two-way fixed effects regression results mentioned above.

4.2.4 Endogenous test

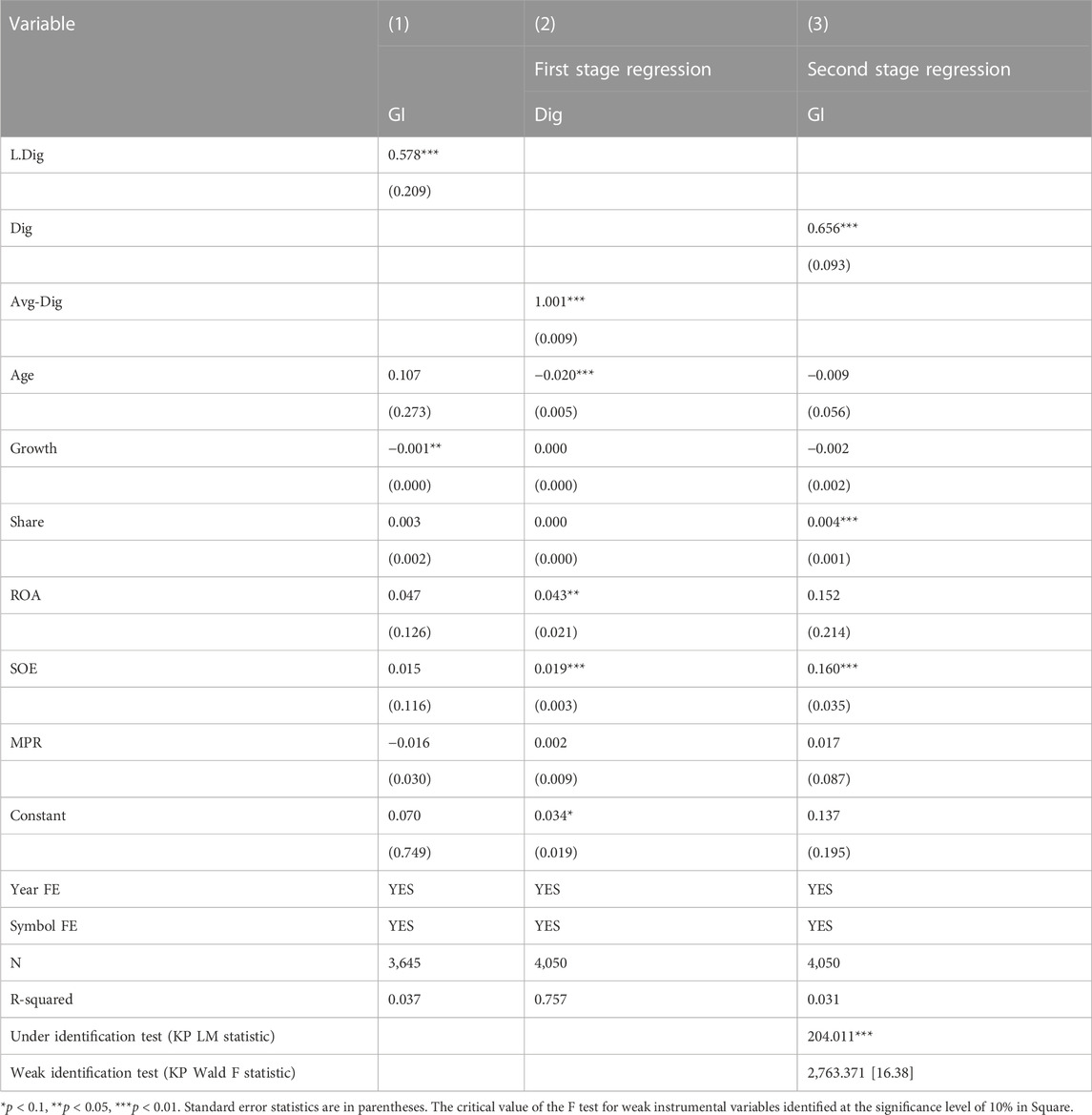

The two-way fixed effects model and robust standard errors are utilized in the testing, but the possible presence of two-way causality can cause bias in the study results. To address the possible endogeneity problem, we use two approaches. First, the independent variables lagging one stage behind are used for regression with green innovation of corporates, as indicated in column 1) of Table 10. Corporate digitalization lagging one period still has a correlation with green innovation at the 1% level. Second, relying on the research of Li and Shen (2021), the average value of corporate digitalization in the same city and industry is selected as the instrumental variable and assigned Avg-Dig. The mean value of corporate digitalization (Dig) within the same city and industry links to corporate digitization, but it has no direct bearing on corporate green innovation. Therefore, the instrumental variable ensures the relevance and externality of the instrumental variable. The Kleibergen-Paap rk LM statistic is relevant at the 1% level, which denies the null hypothesis that the instrumental variable is not adequately identified. The Kleibergen-Paap rk Wald F statistic is larger than the F statistic at the 10% significance level proposed by Stock et al. (2002), with weak instrumental variables being the null hypothesis denied. The instrumental variables employed for this work are, in aggregate, appropriate and reliable. Columns 2) and 3) of Table 10 display the two-stage least squares regression for the instrumental variables, and the outcomes remain robust.

4.3 Heterogeneity analysis

The inconsistent corporate traits may contribute to the variation in the effects of corporate digitalization on green innovation, given contradictory findings in previous studies by other scholars. Therefore, this paper further conducts grouping regression for sample firms according to corporate size and technological attributes.

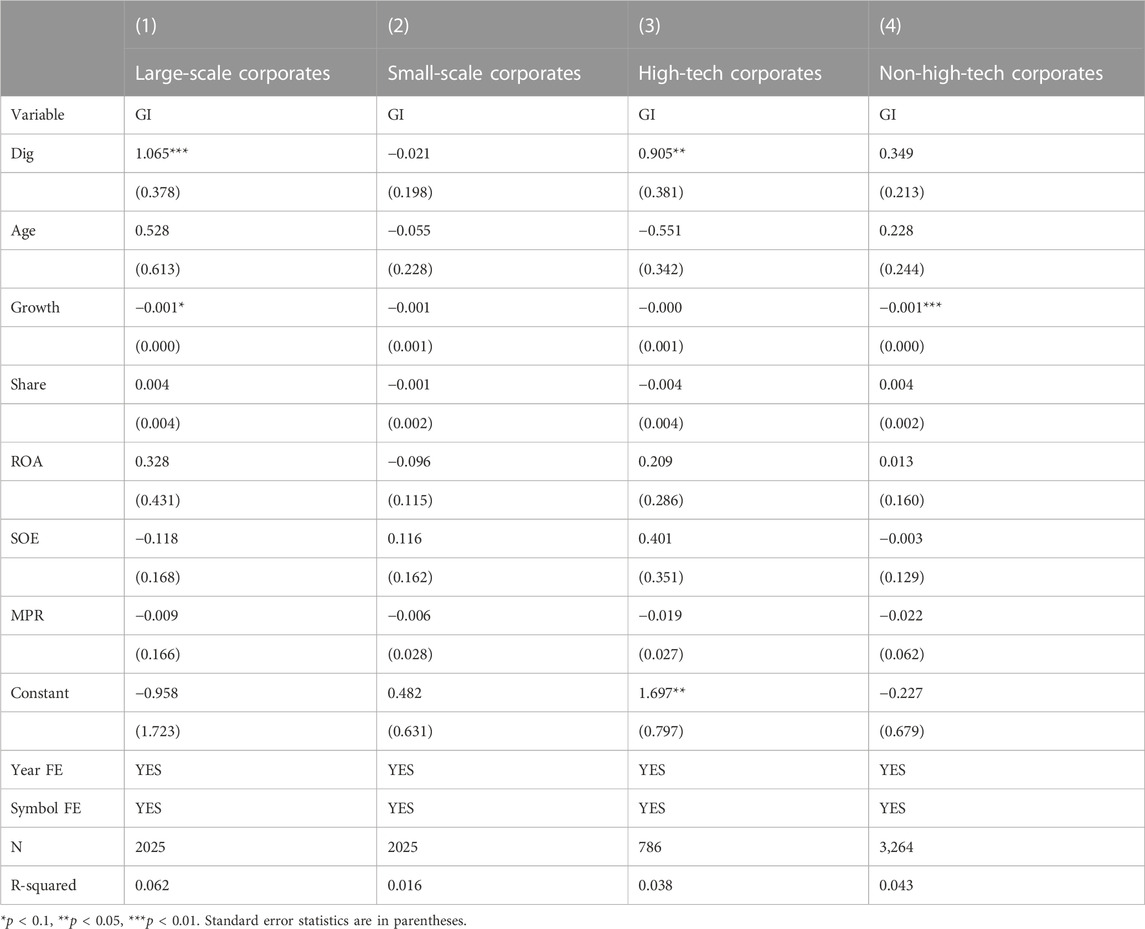

In this paper, we grouped firms according to the median assets of all sample firms. Firms with assets more than the median assets of the sample firms are grouped into large-scale firms, while the rest are small and medium-scale firms. The regression coefficient in the group of large-scale enterprises is considerably relevant at the 1% level, while the group of small-scale firms is not, by the grouping statistics in columns 1) and 2) of Table 11. The cause may be that large-scale corporations with resources and capabilities are conducive to carrying out digital transformation activities and have higher risk-taking and resource allocation capabilities, which will accelerate green innovation. Therefore, the consequence of corporate digitalization on green innovation is more obvious in large-scale enterprise groups compared to small and medium-scale enterprises.

In this paper, we classify enterprises into high-tech and non-high-tech corporations based on whether they qualify as high-tech corporates. The outcomes are in Table 11’s columns 3) and 4). The statistical test of corporate digitalization on green innovation is relevant at the 5% level in the high-tech corporate group, while the non-high-tech corporate group is not significant. The reason may be that high-tech corporations have a stronger innovation foundation and capability, and their digitalization level is also higher, and they can smoothly embed corporate digitalization into organizational decision-making and production process for green innovation. Given this, green innovation of high-tech firms is more significantly affected by corporate digitalization than non-high-tech ones.

4.4 Theoretical implications

The following are the main contributions of this work. First, empirical studies of corporate digitalization on green innovation at the micro-scale are not numerous and do not yield consistent findings given the reality of the digital economy and corporate environmental development. This paper empirically verifies the beneficial influence of corporate digitalization on green innovation at the micro level of corporates, which enriches the micro research on green innovation in the setting of the digital era. Second, prior research has concentrated on the direct impacts of corporate digitalization and green innovation (El-Kassar and Singh, 2019; Li and Shen, 2021), but human capital is the core resource of production factors, and digital resources need to be shared, absorbed, and transformed into human capital by employees to promote green innovation better. This research reveals the mediating role in the evolutionary path from corporate digitalization to green innovation from the human capital perspective. Third, most previous research has considered the moderating effect of corporate digitalization and green innovation from a single internal or external perspective (Wei and Sun, 2021; Cardinali and De Giovanni, 2022). In this study, we choose boundary conditions from internal and external perspectives, such as executive teams’ environmental attention and media attention. Then we respectively identify their moderating mechanisms in “corporate digitalization--human capital--green innovation” and “corporate digitalization--green innovation”, which provide a more contextualized perspective for a comprehensive examination of corporate digitalization and green innovation.

4.5 Practical implications

The research’s results suggest the following practical implications. First, the government should actively guide corporate in digital transformation and green development. According to the differences in corporate scale and technological attributes, the government should promptly introduce different relevant support policies, such as subsidies, tax relief, simplification of administrative approval, and improvement of environmental regulations. These measures can reduce the hindrance and risk of corporates in digital transformation and green development. Second, corporates should strengthen digital strategy, enhance digital infrastructure construction and application, improve environmental awareness, and promote green R&D and manufacturing and green sales services by relying on digital technology to realize effective sharing of green information and resources inside and outside corporates. According to the view of human capital, corporates should make use of digitalization to improve the level of human capital, such as fully introducing professionals in the field of digital technology, using various digital platforms for employee training, and encouraging employees to use information management systems for knowledge share. In addition, corporates should pay attention to matching people and jobs, actively carry out green practices and training, and utilize human capital to support green innovation. Third, the executive team should strengthen their attention to the environment, keep abreast of internal and external green information, and allocate internal and external resources reasonably to promote green innovation. Employees should support the executive team in making decisions that are conducive to the sustainable growth of the corporates. Fourth, the media should increase their coverage of corporate environmental practices and keep their reports factual, timely, and accurate to convey information to the public. Corporations should accept media attention and establish an excellent communication mechanism with the media. It will not only enable the media to perform an effective monitoring function but help corporates to develop a positive green image and maintain their reputation in front of the general public.

4.6 Limitations and future directions

However, this work does have some limitations. Firstly, this paper only uses digitization-related word frequency to measure the overall situation of corporate digitization. It is not yet a good reflection of the investment and level of digitization in business processes such as manufacturing and sales services. In the future, the measurement of corporate digitization can be further refined in terms of specific details. Second, these research samples are limited to manufacturing corporates, and in the future, we can explore whether the model has consistent findings and inherent mechanisms for different types of corporates. Finally, the dimensions of green innovation can be further refined in the future, for instance, social-based innovation and self-interest innovation, to enrich relevant research and get more targeted practical implications.

5 Conclusion

The study of corporate digitalization and green innovation is the focus of current academic concern and also has important practical significance for digital economy development and corporate sustainability. This study explores the effect of corporate digitalization on green innovation and the function of human capital as an intermediary. It further discusses the moderating effects of two environmental attention, specifically the internal factors—executive team environmental attention, and the external factors—media attention. An empirical test was employed using the fixed effect model based on the panel data of A-share manufacturing companies in Chinese Shanghai and Shenzhen from 2011 to 2020. These are the conclusions: 1) Corporate digitalization can greatly enhance corporate green innovation. After the robustness and endogeneity tests, the findings are still valid. 2) Based on the influence mechanism, corporate digitalization can foster green innovation by enhancing corporates’ human capital. 3) The executive team’s environmental attention inspires a favorable interaction between human capital and green innovation, and media attention plays the same function in corporate digitalization and green innovation. 4) Further research reveals that the consequence of corporate digitalization on green innovation is more significant for large-scale and high-tech enterprises. This research expands on existing micro-research on green innovation in the context of the digital age. It identifies the mediating role in the evolutionary path from corporate digitalization to green innovation in a more contextualized perspective. Additionally, the study provides practical guidance for businesses, the executive team, and the media, along with positive recommendations to the government to support sustainable growth and corporate digital development.

Data availability statement

Publicly available datasets were used in this work. The specific panel data of this study has been uploaded to the Supplementary Material section.

Author contributions

JL, LW, and FN wrote, edited, and modified the work. LW analyzed the data, created and edited the charts. JL, LW, and FN revised the manuscript. All authors contributed to the work and approved it for publication.

Funding

This work is funded by the National Social Science Foundation of China (No.22BJY227), Natural Science Foundation of Shandong Province (No. ZR2020MG034) and Social Science Foundation of Shandong Province (No. 21CSDJ09).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2023.1137271/full#supplementary-material

References

Adomako, S., and Nguyen, N. P. (2020). Human resource slack, sustainable innovation, and environmental performance of small and medium-sized enterprises in sub-Saharan Africa. Bus. Strateg. Environ. 29, 2984–2994. doi:10.1002/bse.2552

Ahmed, Z., Asghar, M. M., Malik, M. N., and Nawaz, K. (2020). Moving towards a sustainable environment: The dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Resour. Policy 67, 101677. doi:10.1016/j.resourpol.2020.101677

Antunes, H. de J. G., and Pinheiro, P. G. (2020). Linking knowledge management, organizational learning and memory. J. Innov. Knowl. 5, 140–149. doi:10.1016/j.jik.2019.04.002

Asiaei, K., O’Connor, N. G., Barani, O., and Joshi, M. (2022). Green intellectual capital and ambidextrous green innovation: The impact on environmental performance. Bus. Strateg. Environ. 32, 369–386. doi:10.1002/bse.3136

Avom, D., Nkengfack, H., Fotio, H. K., and Totouom, A. (2020). ICT and environmental quality in Sub-Saharan Africa: Effects and transmission channels. Technol. Forecast. Soc. Change 155, 120028. doi:10.1016/j.techfore.2020.120028

Baptista, J., Stein, M. K., Klein, S., Watson-Manheim, M. B., and Lee, J. (2020). Digital work and organisational transformation: Emergent Digital/Human work configurations in modern organisations. J. Strateg. Inf. Syst. 29, 101618. doi:10.1016/j.jsis.2020.101618

Barney, J. (1991). Firm resources and sustained competitive advantage. J. Manage. 17, 99–120. doi:10.1177/014920639101700108

Baron, R. M., and Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 51, 1173–1182. doi:10.1037/0022-3514.51.6.1173

Bartel, A., Ichniowski, C., and Shaw, K. (2007). How does information technology affect productivity? Plant-Level comparisons of product innovation, process improvement, and worker skills. Q. J. Econ. 122, 1721–1758. doi:10.1162/qjec.2007.122.4.1721

Bharadwaj, A., El Sawy, O. A., Pavlou, P. A., Venkatraman, N., University, O. S. C., Boston, U., et al. (2013). Digital business strategy: Toward a next generation of insights. MIS Q. 37, 471–482. doi:10.25300/MISQ/2013/37:2.3

Boone, C., Lokshin, B., Guenter, H., and Belderbos, R. (2019). Top management team nationality diversity, corporate entrepreneurship, and innovation in multinational firms. Strateg. Manag. J. 40, 277–302. doi:10.1002/smj.2976

Cao, S., Nie, L., Sun, H., Sun, W., and Taghizadeh-Hesary, F. (2021). Digital finance, green technological innovation and energy-environmental performance: Evidence from China’s regional economies. J. Clean. Prod. 327, 129458. doi:10.1016/j.jclepro.2021.129458

Cardinali, P. G., and De Giovanni, P. (2022). Responsible digitalization through digital technologies and green practices. Corp. Soc. Responsib. Environ. Manag. 29, 984–995. doi:10.1002/csr.2249

Cetindamar, D., Abedin, B., and Shirahada, K. (2022). The role of employees in digital transformation: A preliminary study on how employees’ digital literacy impacts use of digital technologies. IEEE Trans. Eng. Manag., 1–12. doi:10.1109/TEM.2021.3087724

Chang, Y., He, Y., Jin, X., Li, T., and Shih, C. M. (2020). Media coverage of environmental pollution and the investment of polluting companies. Asia-Pacific J. Financ. Stud. 49, 750–771. doi:10.1111/ajfs.12315

Cheng, J., and Liu, Y. (2018). The effects of public attention on the environmental performance of high-polluting firms: Based on big data from web search in China. J. Clean. Prod. 186, 335–341. doi:10.1016/j.jclepro.2018.03.146

Chuang, S.-P., and Huang, S.-J. (2018). The effect of environmental corporate social responsibility on environmental performance and business competitiveness: The mediation of green information technology capital. J. Bus. Ethics 150, 991–1009. doi:10.1007/s10551-016-3167-x

Danish, K. (2019). Effects of information and communication technology and real income on CO2 emissions: The experience of countries along Belt and Road. Telemat. Inf. 45, 101300. doi:10.1016/j.tele.2019.101300

Deng, H., Duan, S. X., and Wibowo, S. (2022). Digital technology driven knowledge sharing for job performance. J. Knowl. Manag. 27, 404–425. doi:10.1108/JKM-08-2021-0637

Dong, J. Q., Karhade, P. P., Rai, A., and Xu, S. X. (2021). How firms make information technology investment decisions: Toward a behavioral agency theory. J. Manag. Inf. Syst. 38, 29–58. doi:10.1080/07421222.2021.1870382

Dong, J. Q., and Netten, J. (2017). Information technology and external search in the open innovation age: New findings from Germany. Technol. Forecast. Soc. Change 120, 223–231. doi:10.1016/j.techfore.2016.12.021

Donovan, J., Jennings, J., Koharki, K., and Lee, J. (2021). Measuring credit risk using qualitative disclosure. Rev. Acc. Stud. 26, 815–863. doi:10.1007/s11142-020-09575-4

El-Kassar, A. N., and Singh, S. K. (2019). Green innovation and organizational performance: The influence of big data and the moderating role of management commitment and HR practices. Technol. Forecast. Soc. Change 144, 483–498. doi:10.1016/j.techfore.2017.12.016

Fayazi Rad, L., Amini, M., Ahmadi, A., and Hoseinzadeh, S. (2022). Environmental and economic assessments of hydrogen utilization in the transportation sector of Iran. Chem. Eng. Technol. 1–13. doi:10.1002/ceat.202100500

Gebauer, H., Fleisch, E., Lamprecht, C., and Wortmann, F. (2020). Growth paths for overcoming the digitalization paradox. Bus. Horiz. 63, 313–323. doi:10.1016/j.bushor.2020.01.005

Gerhart, B., and Feng, J. (2021). The resource-based view of the firm, human resources, and human capital: Progress and prospects. J. Manage. 47, 1796–1819. doi:10.1177/0149206320978799

Gilch, P. M., and Sieweke, J. (2021). Recruiting digital talent: The strategic role of recruitment in organisations’ digital transformation. Ger. J. Hum. Resour. Manag. 35, 53–82. doi:10.1177/2397002220952734

Hajli, N. (2015). Social commerce constructs and consumer’s intention to buy. Int. J. Inf. Manage. 35, 183–191. doi:10.1016/j.ijinfomgt.2014.12.005

He, Z., Cao, C., and Feng, C. (2022). Media attention, environmental information disclosure and corporate green technology innovations in China’s heavily polluting industries. Emerg. Mark. Financ. Trade 58, 3939–3952. doi:10.1080/1540496X.2022.2075259

Hojnik, J., and Ruzzier, M. (2016). The driving forces of process eco-innovation and its impact on performance: Insights from Slovenia. J. Clean. Prod. 133, 812–825. doi:10.1016/j.jclepro.2016.06.002

Hoseinzadeh, S., and Astiaso Garcia, D. (2022). Techno-economic assessment of hybrid energy flexibility systems for islands’ decarbonization: A case study in Italy. Sustain. Energy Technol. Assessments 51, 101929. doi:10.1016/j.seta.2021.101929

Hoseinzadeh, S., Groppi, D., Sferra, A. S., Di Matteo, U., and Astiaso Garcia, D. (2022a). The PRISMI plus toolkit application to a grid-connected mediterranean island. Energies 15, 8652. doi:10.3390/en15228652

Hoseinzadeh, S., Nastasi, B., Groppi, D., and Astiaso Garcia, D. (2022b). Exploring the penetration of renewable energy at increasing the boundaries of the urban energy system – the PRISMI plus toolkit application to Monachil, Spain. Sustain. Energy Technol. Assessments 54, 102908. doi:10.1016/j.seta.2022.102908

Hossnofsky, V., and Junge, S. (2019). Does the market reward digitalization efforts? Evidence from securities analysts’ investment recommendations. J. Bus. Econ. 89, 965–994. doi:10.1007/s11573-019-00949-y

Huang, S. Z., Chau, K. Y., Chien, F., and Shen, H. (2020). The impact of startups’ dual learning on their green innovation capability: The effects of business executives’ environmental awareness and environmental regulations. Sustainability 12, 6526. doi:10.3390/su12166526

Ioanna, N., Pipina, K., Despina, C., Ioannis, S., and Dionysis, A. (2022). Stakeholder mapping and analysis for climate change adaptation in Greece. Euro-Mediterranean J. Environ. Integr. 7, 339–346. doi:10.1007/s41207-022-00317-3

Ji, Q., and Zhang, D. (2019). How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 128, 114–124. doi:10.1016/j.enpol.2018.12.047

Johnson, J. S., Friend, S. B., and Lee, H. S. (2017). Big data facilitation, utilization, and monetization: Exploring the 3Vs in a new product development process. J. Prod. Innov. Manag. 34, 640–658. doi:10.1111/jpim.12397

Johnstone, N., Haščič, I., and Popp, D. (2010). Renewable energy policies and technological innovation: Evidence based on patent counts. Environ. Resour. Econ. 45, 133–155. doi:10.1007/s10640-009-9309-1

King, A. A., and Tucci, C. L. (2002). Incumbent entry into new market niches: The role of experience and managerial choice in the creation of dynamic capabilities. Manage. Sci. 48, 171–186. doi:10.1287/mnsc.48.2.171.253

Kozanoglu, D. C., and Abedin, B. (2021). Understanding the role of employees in digital transformation: Conceptualization of digital literacy of employees as a multi-dimensional organizational affordance. J. Enterp. Inf. Manag. 34, 1649–1672. doi:10.1108/JEIM-01-2020-0010

Leonardi, P. M. (2021). COVID-19 and the new technologies of organizing: Digital exhaust, digital footprints, and artificial intelligence in the wake of remote work. J. Manag. Stud. 58, 249–253. doi:10.1111/joms.12648

Li, D., and Shen, W. (2021). Can corporate digitalization promote green innovation? The moderating roles of internal control and institutional ownership. Sustainability 13, 13983. doi:10.3390/su132413983

Li, D., Zheng, M., Cao, C., Chen, X., Ren, S., and Huang, M. (2017). The impact of legitimacy pressure and corporate profitability on green innovation: Evidence from China top 100. J. Clean. Prod. 141, 41–49. doi:10.1016/j.jclepro.2016.08.123

Li, H., Tang, H., Zhou, W., and Wan, X. (2022). Impact of enterprise digitalization on green innovation performance under the perspective of production and operation. Front. Public Heal. 10, 971971. doi:10.3389/fpubh.2022.971971

Mansoor, A., Jahan, S., and Riaz, M. (2021). Does green intellectual capital spur corporate environmental performance through green workforce? J. Intellect. Cap. 22, 823–839. doi:10.1108/JIC-06-2020-0181

Marchiori, D. M., Rodrigues, R. G., Popadiuk, S., and Mainardes, E. W. (2022). The relationship between human capital, information technology capability, innovativeness and organizational performance: An integrated approach. Technol. Forecast. Soc. Change 177, 121526. doi:10.1016/j.techfore.2022.121526

Mitchell, R. K., Agle, B. R., and Wood, D. J. (1997). Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Acad. Manag. Rev. 22, 853–886. doi:10.5465/AMR.1997.9711022105

Müller, J. M., and Voigt, K. I. (2018). Sustainable industrial value creation in SMEs: A comparison between industry 4.0 and made in China 2025. Int. J. Precis. Eng. Manuf. - Green Technol. 5, 659–670. doi:10.1007/s40684-018-0056-z

Munawar, S., Yousaf, D. H. Q., Ahmed, M., and Rehman, D. S. (2022). Effects of green human resource management on green innovation through green human capital, environmental knowledge, and managerial environmental concern. J. Hosp. Tour. Manag. 52, 141–150. doi:10.1016/j.jhtm.2022.06.009

Nambisan, S., Wright, M., and Feldman, M. (2019). The digital transformation of innovation and entrepreneurship: Progress, challenges and key themes. Res. Policy 48, 103773. doi:10.1016/j.respol.2019.03.018

Nyilasy, G., Gangadharbatla, H., and Paladino, A. (2014). Perceived greenwashing: The interactive effects of green advertising and corporate environmental performance on consumer reactions. J. Bus. ethics 125, 693–707. doi:10.1007/s10551-013-1944-3

Ocasio, W. (1997). Towards an attention-based view of the firm. Strateg. Manag. J. 18, 187–206. doi:10.1002/(SICI)1097-0266(199707)18:1+<187:AID-SMJ936>3.0.CO;2-K

Peng, X., and Liu, Y. (2016). Behind eco-innovation: Managerial environmental awareness and external resource acquisition. J. Clean. Prod. 139, 347–360. doi:10.1016/j.jclepro.2016.08.051

Preacher, K. J., and Hayes, A. F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 40, 879–891. doi:10.3758/BRM.40.3.879

Rao, S., Pan, Y., He, J., and Shangguan, X. (2022). Digital finance and corporate green innovation: Quantity or quality? Environ. Sci. Pollut. Res. 29, 56772–56791. doi:10.1007/s11356-022-19785-9

Ren, S., Hao, Y., and Wu, H. (2022). Digitalization and environment governance: Does internet development reduce environmental pollution? J. Environ. Plan. Manag., 1–30. doi:10.1080/09640568.2022.2033959

Ricci, F., Scafarto, V., Ferri, S., and Tron, A. (2020). Value relevance of digitalization: The moderating role of corporate sustainability. An empirical study of Italian listed companies. J. Clean. Prod. 276, 123282. doi:10.1016/j.jclepro.2020.123282

Schuetz, S., and Venkatesh, V. (2020). Research perspectives: The rise of human machines: How cognitive computing systems challenge assumptions of user-system interaction. J. Assoc. Inf. Syst. 21, 460–482. doi:10.17705/1jais.00608

Sinha, A., Mishra, S., Sharif, A., and Yarovaya, L. (2021). Does green financing help to improve environmental and social responsibility? Designing SDG framework through advanced quantile modelling. J. Environ. Manage. 292, 112751. doi:10.1016/j.jenvman.2021.112751

Song, W., and Yu, H. (2018). Green innovation strategy and green innovation: The roles of green creativity and green organizational identity. Corp. Soc. Responsib. Environ. Manag. 25, 135–150. doi:10.1002/csr.1445

Stock, J. H., Wright, J. H., and Yogo, M. (2002). A survey of weak instruments and weak identification in generalized method of moments. J. Bus. Econ. Stat. 20, 518–529. doi:10.1198/073500102288618658

Subramaniam, M., and Youndt, M. A. (2005). The influence of intellectual capital on the types of innovative capabilities. Acad. Manag. J. 48, 450–463. doi:10.5465/AMJ.2005.17407911

Sukma, N., and Leelasantitham, A. (2022a). A community sustainability ecosystem modeling for water supply business in Thailand. Front. Environ. Sci. 10, 940955. doi:10.3389/fenvs.2022.940955

Sukma, N., and Leelasantitham, A. (2022b). From conceptual model to conceptual framework: A sustainable business framework for community water supply businesses. Front. Environ. Sci. 10, 1013153. doi:10.3389/fenvs.2022.1013153

Tian, H., Li, Y., and Zhang, Y. (2022). Digital and intelligent empowerment: Can big data capability drive green process innovation of manufacturing enterprises? J. Clean. Prod. 377, 134261. doi:10.1016/j.jclepro.2022.134261

Tong, T. W., He, W., He, Z. L., and Lu, J. (2014). Patent regime shift and firm innovation: Evidence from the second amendment to China’s patent law. Acad. Manag. Proc. 2014, 14174. doi:10.5465/ambpp.2014.14174abstract

Wang, F., Sun, Z., and Feng, H. (2022a). Can media attention promote green innovation of Chinese enterprises? Regulatory effect of environmental regulation and green finance. Sustainability 14, 11091. doi:10.3390/su141711091

Wang, K., and Zhang, X. (2021). The effect of media coverage on disciplining firms’ pollution behaviors: Evidence from Chinese heavy polluting listed companies. J. Clean. Prod. 280, 123035. doi:10.1016/j.jclepro.2020.123035

Wang, L., Zeng, T., and Li, C. (2022b). Behavior decision of top management team and enterprise green technology innovation. J. Clean. Prod. 367, 133120. doi:10.1016/j.jclepro.2022.133120

Wei, Z., and Sun, L. (2021). How to leverage manufacturing digitalization for green process innovation: An information processing perspective. Ind. Manag. Data Syst. 121, 1026–1044. doi:10.1108/IMDS-08-2020-0459

Wen, H., Lee, C. C., and Song, Z. (2021). Digitalization and environment: How does ICT affect enterprise environmental performance? Environ. Sci. Pollut. Res. 28, 54826–54841. doi:10.1007/s11356-021-14474-5

Wen, H., Zhong, Q., and Lee, C. C. (2022). Digitalization, competition strategy and corporate innovation: Evidence from Chinese manufacturing listed companies. Int. Rev. Financ. Anal. 82, 102166. doi:10.1016/j.irfa.2022.102166

Wernerfelt, B. (1984). A resource-based view of the firm. Strateg. Manag. J. 5, 171–180. doi:10.1002/smj.4250050207

Wiersema, M. F., and Bantel, K. A. (1992). Top management team demography and corporate strategic change. Acad. Manag. J. 35, 91–121. doi:10.5465/256474

Wooldridge, J. M. (2010). Econometric analysis of cross section and panel data. Cambridge, MA: MIT press.

Wu, G., Xu, Q., Niu, X., and Tao, L. (2022). How does government policy improve green technology innovation: An empirical study in China. Front. Environ. Sci. 9, 799794. doi:10.3389/FENVS.2021.799794

Wu, J., and Hua, X. (2021). Top management team attention and firm green innovation strategy: Empirical evidence from listed Chinese manufacturing companies. First Sci. Sci. Manag. S.and Trans. 42, 122–142.

Yao, Y., Ivanovski, K., Inekwe, J., and Smyth, R. (2019). Human capital and energy consumption: Evidence from OECD countries. Energy Econ. 84, 104534. doi:10.1016/j.eneco.2019.104534

Yong, J. Y., Yusliza, M.-Y., Ramayah, T., and Fawehinmi, O. (2019). Nexus between green intellectual capital and green human resource management. J. Clean. Prod. 215, 364–374. doi:10.1016/j.jclepro.2018.12.306

Youndt, M. A., Subramaniam, M., and Snell, S. A. (2004). Intellectual capital profiles: An examination of investments and returns. J. Manag. Stud. 41, 335–361. doi:10.1111/j.1467-6486.2004.00435.x

Zahid, M. M., Ali, B., Ahmad, M. S., Thurasamy, R., and Amin, N. (2018). Factors affecting purchase intention and social media publicity of green products: The mediating role of concern for consequences. Corp. Soc. Responsib. Environ. Manag. 25, 225–236. doi:10.1002/csr.1450

Keywords: corporate digitalization, green innovation, human capital, executive team environmental attention, media attention

Citation: Li J, Wang L and Nutakor F (2023) Empirical research on the influence of corporate digitalization on green innovation. Front. Environ. Sci. 11:1137271. doi: 10.3389/fenvs.2023.1137271

Received: 04 January 2023; Accepted: 08 February 2023;

Published: 21 February 2023.

Edited by:

Grigorios L. Kyriakopoulos, National Technical University of Athens, GreeceReviewed by:

Narongsak Sukma, Mahanakorn University of Technology, ThailandSiamak Hoseinzadeh, Sapienza University of Rome, Italy

Ioannis Sebos, National Technical University of Athens, Greece

Copyright © 2023 Li, Wang and Nutakor. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Le Wang, d2FuZ2xleWkxN0AxNjMuY29t

Jinke Li

Jinke Li Le Wang

Le Wang Felix Nutakor

Felix Nutakor