- 1School of Economics and Management, University of Chinese Academy of Sciences, Beijing, China

- 2Sino-Danish College, University of Chinese Academy of Sciences, Beijing, China

Digitalization and sustainability, as emerging trends, have long attracted both academic and industrial focuses, yet the topic has not been sufficiently investigated at the micro-firm level. Selecting Chinese listed companies from 2010 to 2021 as the research sample and adopting the two-way fixed effects model, the impact of firms’ digital transformation on their green innovation as well as the channels and mechanisms involved are investigated. The empirical results show that, firstly, the digital transformation of firms can significantly promote the quality and quantity of their green innovation. Secondly, internal control is a mediating path for digital transformation to promote green innovation, while financing constraints suppress the above effects, and top management team’s environmental attention positively moderates the promotion of green innovation by corporate digital transformation. Thirdly, the promotion effects are more pronounced in firms that are state-owned, large-scale, ecologically cost-free, and relatively highly financing constrained. The findings suggest that digital transformation has advantages in revealing the “Solow paradox” that persists in the digital era, and the synergistic development of digitalization and greening at the firm level is realistic and feasible.

1 Introduction

In the 1970 s, the global ecological environment problems brought about by industrialization became increasingly prominent, and the threat of “the limits to growth" (Meadows, 1972) received extensive academic attention. In this protracted debate, the concept of sustainable development (SD) has become an important milestone and has gradually become an ongoing global initiative. Following the Millennium Development Goals (MDGs), 17 Sustainable Development Goals (SDGs) were adopted at the 2015 UN Sustainable Development Summit, and these globally shared goals and sustainability efforts have played an important role in promoting global sustainable development (ElMassah and Mohieldin, 2020a).

In the overall global effort toward sustainable development, technological change is both the source and solution of many environmental problems related to human activities (Hekkert et al., 2007; ElMassah and Mohieldin, 2020b; Sun and Guo, 2022). On the one hand, digitization can be a disruptive force and negatively affect sustainable development. For instance, 4% of global CO2 emissions can be attributed to digitization, while global data centers as infrastructure for digital transformation consume about 1% of total global electricity consumption (Masanet et al., 2020). On the other hand, rapid digitalization has also been shown to be associated with less carbon emissions, lower haze concentrations, higher air quality, and a more comprehensive energy system transition (e.g., Wang J. et al., 2022).

Sustainable development and digitalization together are noted as emerging megatrends and lead to paradigm changes in economic and social systems. Government departments and leading companies have begun to focus on integrating environmental sustainability into the digital revolution. However, digitalization, despite the many benefits it can bring to sustainable development, has not yet been fully discussed in academia (George et al., 2020). Existing studies mainly focus on national, regional, and industry levels, while the large lack of data from the firm level hinders the systematic assessment of these impacts (Ghobakhloo et al., 2021).

To fill this gap, this paper aims to establish a dialogue between digitalization and sustainability at the micro-enterprise level. In this vein, the “digital transformation” and “green innovation” of companies become viable indicators to build this bridge. On the one hand, “digital transformation” is an organizational change triggered and shaped by the widespread proliferation of digital technologies and has become a central driver of technological innovation (Berger et al., 2019). Given the consensus on the “digital imperative”, the transition to digitalization has become a key strategic decision and an inevitable choice for companies in modern management and information systems upgrading (Bharadwaj et al., 2013). On the other hand, innovation is considered as a vehicle for achieving sustainable development, thus discussing innovation through the lens of sustainability has become an important trend in the field of innovation (Freeman, 1996). “Green innovation”, which reflects both ecological and productivity elements and has significant “dual externalities”, is an ideal indicator of micro-firms’ practice of sustainable development (Sun and Guo, 2022).

A few studies on this micro topic have confirmed that firms’ digital transformation can promote their green innovation, and further, factors such as human and financial investment in innovation, government subsidies and taxes, firms’ information processing and knowledge integration capabilities, and firms’ internal and external costs are considered as intermediate mechanisms by which digital transformation affects their green innovation (e.g., Feng et al., 2022; Sun and Guo, 2022; Xue et al., 2022), and this facilitative effect is heterogeneous across firms. As can be seen, the existing literature partially points out the intermediate mechanisms by which digital transformation affects green innovation, while the moderating role is largely neglected. Therefore, we hope to further explore the channels and mechanisms to provide more micro-level evidence for business managers and policymakers.

Another benefit of this study is that this paper helps to provide evidence to unravel the Solow paradox at the micro-firm level. Solow paradox, also known as the productivity paradox, states that computers are everywhere but are not reflected in productivity (Solow, 1987) and has been widely debated in academia (e.g., Acemoglu et al., 2014). In the digital era, Solow paradox manifests itself in the disproportion between societal investment in digital technologies and the productivity gains resulting from their progress. Possible explanations for this phenomenon have been proposed, with some arguing that the digitization process is still in its early stages and its potential has not yet been fully realized, and others arguing that the social goals undertaken by IDT, such as improving the ecological environment, are not reflected in the statistical indicators, making the output of digitalization underestimated. Therefore, this paper examines the role of digital transformation of micro firms on their green innovation, which would add a footnote to the Solow paradox if positive externalities of digital transformation do exist.

This paper then focuses on the following questions: 1) Can the digital transformation of firms promote their green innovation? 2) If the facilitation effects exist, what are the potential channels and mechanisms involved? 3) Are the effects heterogeneous for firms with different characteristics and features? Furthermore, by examining the above questions, this paper will provide evidence for the unraveling of the Solow paradox in the digital era at the micro-firm level. China is chosen as the research context for this study. As the second largest digital economy after the United States, China is leading the synergistic development of digitization and greening to consolidate its leadership in the digital domain. We examine data for A-share listed companies from 2010 to 2021 and find that firms’ digital transformation can promote their green innovation, with internal control and financing constraints as intermediate mechanisms, where the former plays a mediating role while the latter plays a suppressing role. The executive team’s environmental attention positively moderates the promotion of green innovation by digital transformation. Moreover, digital transformation promotes better performance of green innovation characterized by double externalities, suggesting that the positive consequences of digital transformation may be reflected beyond productivity, adding new evidence to the Solow paradox.

The possible marginal contributions of this paper are: first, this paper establishes the interaction between digital transformation and sustainable development at the enterprise level from the perspective of green innovation, and the empirical results further support the findings of Sun and Guo (2022), bridging the gap in microscopic research in this area and providing an exegesis for the Solow paradox in the digital era. Second, this paper expands the understanding of the interaction channels and mechanisms between digital transformation and green innovation from the perspective of micro-structured subjects, reveals the path to realize the compatibility between digital and green transformation at the enterprise level, and paves the way for opening the “black box” of digital transformation and green innovation of enterprises. Third, the digital transformation of enterprises with different characteristics and in different contexts elicits heterogeneous green innovation outcomes, and this paper highlights these heterogeneities and examines them through effective empirical means, which further enriches the relevant research.

The rest of the paper is organized as follows: in Section 2, we formulate four hypotheses based on a review of the existing literature and details of the study design, including data sources, sample selection, variable definitions, regression model settings, and descriptive statistics of the variables; in Section 3, the results of our work are presented, including basic regressions, intermediate and moderating effects, endogeneity issues and robustness tests, and heterogeneity analysis. Section 4 discusses the conclusions and implications.

2 Materials and methods

2.1 Theoretical analysis and research hypothesis

2.1.1 Corporate digital transformation and green innovation

Green innovation is considered as technological innovation involving energy saving, pollution prevention, waste recycling, green product design or corporate environmental management (Chen et al., 2006), which can significantly reduce the negative environmental impact in addition to adding value to the firm and its stakeholders. The goal of green innovation is not only to reduce the environmental burden, but to pursue better environmental benefits. The “first mover advantage” that early movers in green innovation may enjoy is tempting, such as demanding higher prices for green products, projecting a green corporate image, and gaining a sustainable competitive advantage (Hart, 1995). Therefore, green innovation is gradually rising as a corporate strategy and is considered as an effective means for firms to gain sustainable competitive advantage in a whole new arena (Taklo et al., 2020).

The importance of green innovation has been widely emphasized in academic studies (e.g., Kunapatarawong and Martínez-Ros, 2016), with the natural resource base view, institutional theory, and stakeholder theory serving as its theoretical cornerstones. Scholars believe that the internal drivers of green innovation mainly include the green orientation of firms, green technological capabilities, green culture and environmental ethics, etc. (e.g., Sharma and Vredenburg, 1998; King and Lenox, 2002), while external factors are reflected in environmental climate, environmental regulation, economic and institutional pressures, government subsidies, green financial policies, stakeholder pressure, etc. (e.g., Wang et al., 2021; Zhang et al., 2019; Chen et al., 2012).

Despite the numerous incentives, there are still many challenges for corporate green innovation. On the one hand, green innovation is characterized by high R&D costs, high risks, and long cost recovery time (e.g., Martínez-Ros and Kunapatarawong, 2019), which may negatively impact short-term economic benefits. Organizations can be skeptical about taking green innovation actions when there is insufficient understanding of green initiatives within the organization, lack of an appropriate organizational culture, or inefficient government support. On the other hand, compared to general technological innovation, green innovation has significant double externalities (Rennings et al., 2006), i.e., the technological efforts of green innovators may be “free-riding” by others, and the social costs of environmental pollution are much higher than the costs borne by polluters. As a result, green innovators may not fully reap the benefits of their innovations, which may inhibit firms’ willingness to engage in green innovation.

In this context, digital transformation, spearheaded by the application of digital technologies, may provide support to break the green innovation puzzle. Digital transformation is considered as the process that combines next-generation information and communication technologies to trigger significant changes and drive improvements in the attributes of organizational operations, products, management, business models, production processes, etc. In line with the Sustainable Development Goals (SDGs), reducing pollution emissions and implementing green innovations are laudable, and these actions require significant additional management efforts, including redesigning complex processes within companies and developing green capabilities (Kock et al., 2011). Digital transformation of companies requires redefining and redesigning strategic orientations and business processes, and if efforts are made to embed environmental responsibility in this process, it is expected to not only make green innovation less costly and more efficient, but also positively respond to the concerns of internal and external stakeholders and provide them with a considerable level of satisfaction (Miles, 2019).

Currently, digital transformation has become an inevitable requirement for many industries and firms to respond to the call for sustainable development and promote green innovation, as well as an important guarantee for achieving a win-win situation for economic and environmental development (Acemoglu et al., 2012). The digital transformation of firms has brought about the widespread use of digital technologies, which has led to lower information and transaction costs, accelerated the deep integration and sharing of internal and external information and resources, and further alleviated the information asymmetry problem of enterprises. On this basis, the division of labor and green R and D resource allocation of enterprises are also optimized, which empowers innovation activities and further promotes green innovation in enterprises (Li and Shen, 2021; Feng et al., 2022).

The existing normative literature on the relationship between digital transformation and green innovation is relatively limited and focuses on the national, regional, and industry levels. A small number of studies on micro-firms confirm that the application of one of the Frontier technologies, such as manufacturing intelligence, blockchain, and big data, can promote green innovation in enterprises. Moreover, several scholars have also confirmed that digital transformation of firms has a positive impact on their green innovation activities, which helps to enhance their competitive advantage (El-Kassar and Singh, 2018). Regarding the effect of digital transformation on the quantity and quality of green innovation, some studies argue that to seek policy support or financial subsidies with observable innovation output, enterprises may be more inclined to pursue rapid growth in “quantity” of innovation in the short term at the expense of “quality”. However, Xiao and Zeng (2022) believe that digital transformation can help mitigate such short-term behavior and facilitate enterprises to strike a balance between “quality” and “quantity” in the pursuit of green innovation. This paper argues that digital transformation, as a systematic and holistic project, contributes to the “quality and quantity” of green innovation and proposes Hypothesis 1.

Hypothesis 1:. Digital transformation of enterprises can significantly improve the quality and quantity of their green innovation.

2.1.2 Corporate digitalization, internal control, and green innovation

Internal control is the process of establishing systems, regulations, and control methods in an enterprise to achieve a set of economic and operational objectives, with the aim of improving operational efficiency and achieving corporate strategy (Jensen, 1993). High-quality internal control is the basis for ensuring that business processes are compliant and efficient. According to enterprise risk management theory, internal control is an important guarantee for the implementation of corporate innovation strategies, and its role in promoting corporate innovation has been confirmed by numerous studies (e.g., Hoskisson et al., 2002). In addition, it has been noted that firms’ green innovation activities are vulnerable to their level of internal controls (Gordon and Wilford, 2012) and that exposure to poorer governance has a negative impact on green patents (Amore and Bennedsen, 2016).

Digital transformation has brought about the popular application of a new generation of information technology such as artificial intelligence, blockchain, cloud computing and big data, which has greatly improved the digital coverage of key areas and links of enterprise activities, as well as provided technical guarantee and implementation support for the iteration and reshaping of the enterprise internal control system. First, the continuous deepening of digital transformation has introduced the digital model with the characteristics of high efficiency, intelligence and precision into the internal control system of enterprises. The intervention of the digital system has largely reduced the potential risks of fraud and errors brought about by manual operations, making the execution of internal control much more efficient and effective, and reducing supervision costs while improving management efficiency. Second, digital transformation effectively remedies internal control deficiencies, enhances internal control, and improves corporate governance (Skaife et al., 2013), as well as enables greater precision in internal decision making and increased risk assessment and response capabilities. Firms are allowed to pry digital controls to enhance monitoring and supervision of all aspects of green innovation activities (Wang P. et al., 2022), and to pre-empt and mitigate risk potential in green R and D (Gordon & Wilford, 2012), which further stimulates green innovation. Third, good internal controls are strongly associated with better information quality, which can improve information transparency and reduce information asymmetry. External investors have easier access to internal information, which in turn affects the ability of firms to obtain financial support and low-cost financing.

Therefore, when digital transformation leads to improved internal controls, corporate executives tend to be more proactive in taking actions to fulfill social responsibility, such as increasing environmental investment or implementing green innovations to cater to the environmental concerns of their stakeholders. Based on the above analysis, this paper proposes Hypothesis 2.

Hypothesis 2:. Digital transformation of enterprises promotes green innovation by improving their internal controls.

2.1.3 Corporate digitalization, financing constraints, and green innovation

In the case of market imperfections such as information asymmetry and agency problems, firms face financial frictions when seeking external financing support, and the phenomenon that external financing is more costly than internal financing is known as financing constraints (Whited and Wu, 2006). Financing constraints are thought to be highly correlated with firms’ innovation decisions, innovation capabilities, and innovation outcomes. According to free cash flow theory, tighter financing constraints result in less free cash flow within the firm, alleviating agency problems and prompting firms to make investment decisions that are in the long-term interest, such as boosting R and D investment and developing new products, which has a positive impact on innovation performance. This view is also supported by innovation theory, which suggests that resource constraints force firms to improve the efficiency of their available resources and make optimal investment decisions, thus helping to improve their innovation performance. Conversely, an alternative view is that financing constraints tend to hamper innovation. Resource constraints may limit the advancement of sustainable development, especially given the long payback period, high investment risks and “double externalities” that characterize green innovation, and studies have argued that financing difficulties, as well as perceived financing barriers, can discourage firms from investing in green technologies and green projects.

The influencing factors of financing constraints are mainly studied from the perspectives of government and market. In the context of digital upgrading becoming an unavoidable strategic choice for firms to achieve high-quality development, there are high expectations for digital transformation to ease financing constraints. First, in the Chinese context, the government actively supports firms’ digital upgrading initiatives and has introduced a series of policies to provide financial support, which directly enhances firms’ ability to access credit financing and alleviates their internal capital pressure (Hinings et al., 2018). Second, digital transformation strengthens enterprises’ information processing capabilities and reduces information asymmetry, facilitating interconnection and signaling between enterprises and credit institutions, which in turn alleviates credit resource mismatch and empowers enterprises with financing advantages. Third, digital transformation involves companies leveraging digital technologies to reinvent and reengineer their processes, organizational structures, and business models, thereby enabling them to reduce operational risk, seize growth opportunities and achieve better financial performance, which makes it less of a barrier for companies to seek external financing.

However, the existence of the Solow paradox may make the reality less “ideal”. Asongu and Moulin (2016) show that the role of ICTs in facilitating the availability of finance is very limited. On the one hand, digital transformation often implies significant internal resource investment and additional financing needs, which can exacerbate business risks in the short term, while external investors may demand higher returns to address potential risks, resulting in higher financing costs for firms. On the other hand, digital transformation of firms is a systematic change of technology, organization and process, and there is a time lag for its positive effects to appear, especially when “going digital” becomes a trend and enterprises are scrambling to jump on the bandwagon, there will be a “black hole” period with only inputs but no obvious outputs, when the financing constraints faced by enterprises may subsequently increase.

Taken together, the analysis above shows that scholars’ views on how digital transformation of firms affects financing constraints and how financing constraints influence green innovation are contradictory. It is affirmed that financing constraints do play an important role in the path of digital transformation affecting green innovation, while the mechanism and direction are not yet fully clear. This paper thus considers financing constraints as an intermediate mechanism by which firms’ digital transformation affects their green innovation and proposes Hypothesis 3.

Hypothesis 3:. Financing constraints play an intermediate role in the process of digital transformation of enterprises affecting their green innovation.

2.1.4 Corporate digitalization, TMT environmental attention, and green innovation

The upper echelons theory emphasizes the dominance and centrality of the executive team within a firm and suggests that an organization’s strategies and behaviors can be viewed as a mapping of the value preferences and psychological perceptions of its top managers (Hambrick and Mason, 1984). Tushman and O’Reilly (2007) believe that only the top management team (TMT) can repeatedly and intentionally coordinate and allocate the assets and resources of the enterprise, as well as put potentially conflicting strategic agendas into action. Furthermore, the attention-based view argues that cognitive factors such as attention, in addition to the personal characteristics of executives, also have an impact on a firm’s strategic decisions (Ocasio, 1997). Attention is considered a key ability to sense, identify, and create opportunities (Helfat and Peteraf, 2014), and with top managers’ attention being a scarce resource, understanding how the attention of the senior management team is allocated and managed can help explain corporate behavior and decisions (Hambrick and Mason, 1984; Ocasio, 1997).

Studies have concluded that the environmental attention of top managers leads the strategic orientation of firms in terms of environmental protection and green innovation. When top management teams devote more time and effort to ecology-related topics, they are more likely to identify potential opportunities in green innovation, such as government environmental incentives, pricing power for green products, and possible competitive advantages. Therefore, these enterprises possess a stronger willingness for green innovation and tend to develop forward-looking environmental strategies that proactively address environmental issues. Accordingly, some proactive actions may be taken, including developing green products to meet consumer demand, enhancing R and D collaboration on green innovation to share risks, and soliciting government support to offset the cost of green innovation. In contrast, executives who pay less attention to environmental issues or have a negative attitude toward environmental protection may choose to meet only the minimum requirements of relevant environmental regulations (Cordano and Frieze, 2000). During the migration to digitalization, senior management teams with low environmental attention may not purposely allocate resources to green innovation activities, in which case the facilitative effect of digital transformation on green innovation may be significantly diminished. Accordingly, this paper proposes Hypothesis 4:

Hypothesis 4:. The role of corporate digitalization in green innovation is more prominent when TMT environmental attention is high.

2.2 Study design

2.2.1 Sample selection and data sources

Our sample combines multiple data sets. We obtained data of A-share listed companies from 2010 to 2021 from China Stock Market and Accounting Research Database (CSMAR). Green patent data is collected from China Research Data Service Platform (CNRDS); Corporate digital transformation and TMT environment attention data are in-scribed through text mining of annual reports of listed companies; Internal control data comes from DIB Internal Control and Risk management database (DIB). Referring to the mainstream literature practice, the raw data are cleaned as follows: 1) samples from the financial industry are excluded; 2) ST and PT companies are excluded; 3) samples with missing regression variables are excluded; 4) observations that do not comply with general accounting standards are excluded, and finally 20,408 sets of observations are obtained. To avoid the impact of extreme values on the regression results, all micro-level continuous variables are winsorized at the 1% level.

2.2.2 Definition of main variables

2.2.2.1 Dependent variables

Green innovation (LNInv, LNInvUti). Patent data are output indicators in innovation activities, and green patents have the inherent advantage of measuring green innovation, such as being widely available and continuously documented across industries and time scales. Given that the patent approval process is cumbersome and time-consuming, and the number of applications is more time-sensitive than the number of grants, this paper selects the number of green patent applications as a proxy variable for green innovation. Specifically, the number of green invention patent applications is used to measure the quality of green innovation (LNInv), and the sum of the number of green invention patent and green utility model patent applications is used to measure the number of green innovation (LNInvUti) (Xiao and Zeng, 2022). The number of green patents is added by one and logarithmically processed due to the right-skewed distribution of the data.

2.2.2.2 Independent variable

Digital transformation (DIG). Drawing on the ideas of Yuan et al. (2021), this paper portrays the level of digital transformation of listed companies based on text analysis methods. Firstly, a dictionary of enterprise digital transformation terms is constructed based on the texts of digital economy-related policies, and 197 key words are obtained by retaining the words that appeared more than 5 times; secondly, text analysis is conducted on the MD&A section of annual reports of listed companies based on machine learning methods, and the frequency of 197 words appeared in the annual reports is counted; finally, the sum of the obtained word frequencies is divided by the length of the MD&A discourse of the annual report of the year and multiplied by 100 (Sun and Guo, 2022), which became the evaluation index of the degree of digital transformation of enterprises (DIG). The higher the index, the higher the degree of digital transformation of the enterprise.

2.2.2.3 Intermediate variables

Internal control (INCON). With reference to existing studies, the “DIB-Chinese listed companies internal control index” is used to reflect the level of internal control of enterprises (Shen et al., 2012). The index is designed based on 11 indicators under the five major objectives of internal control and corrected for internal control deficiencies, with good comprehensiveness and reliability. The larger the index, the higher the quality of internal control.

Financing constraint (SA). This paper adopts the SA index method proposed by Hadlock and Pierce (2010) to measure financing constraints. The SA index is built on two variables with little time variation and strong exogeneity, namely firm size and firm age, and is calculated as follows: SA = -0.737 × Size +0.043 × Size^2–0.04 × Age, where Size is the natural logarithm of the firm’s total assets. In this paper, we use the absolute value of SA index to represent the degree of financing constraint, and the larger the absolute value, the higher the degree of financing constraint.

2.2.2.4 Moderating variable

TMT Environmental attention (EA). The attention-based view holds that attention is mapped onto the lexical language used, that frequently used lexical information reflects attentional focus, and that the frequency of lexical use changes as attention and perception of things change (Sapir, 1944). Therefore, the text data released by listed companies provide a relatively reasonable data source for identifying their TMT attention allocation. According to the China Listed Companies Association, only about 30% of Chinese listed companies have disclosed their social responsibility reports for 2021, and the disclosure behavior itself may imply that these companies have a relatively high level of environmental concern. To avoid sample selection bias, this paper selects the MD&A section of listed companies’ annual reports as the material for textual analysis.

The textual analysis method is used to measure TMT environmental attention. Specifically, we sort and summarize the words related to ecology and environmental protection in 500 annual reports, and then supplement their close synonyms with the Chinese Synonyms Dictionary, after which 200 annual reports are randomly selected for verification and 79 keywords are defined. Further, the frequency of TMT environmental attention keywords in the MD&A part of the annual report is counted, and their ratio to the total word frequency of the MD and A text is taken as the TMT environmental attention proxy variable (EA).

2.2.2.5 Control variables

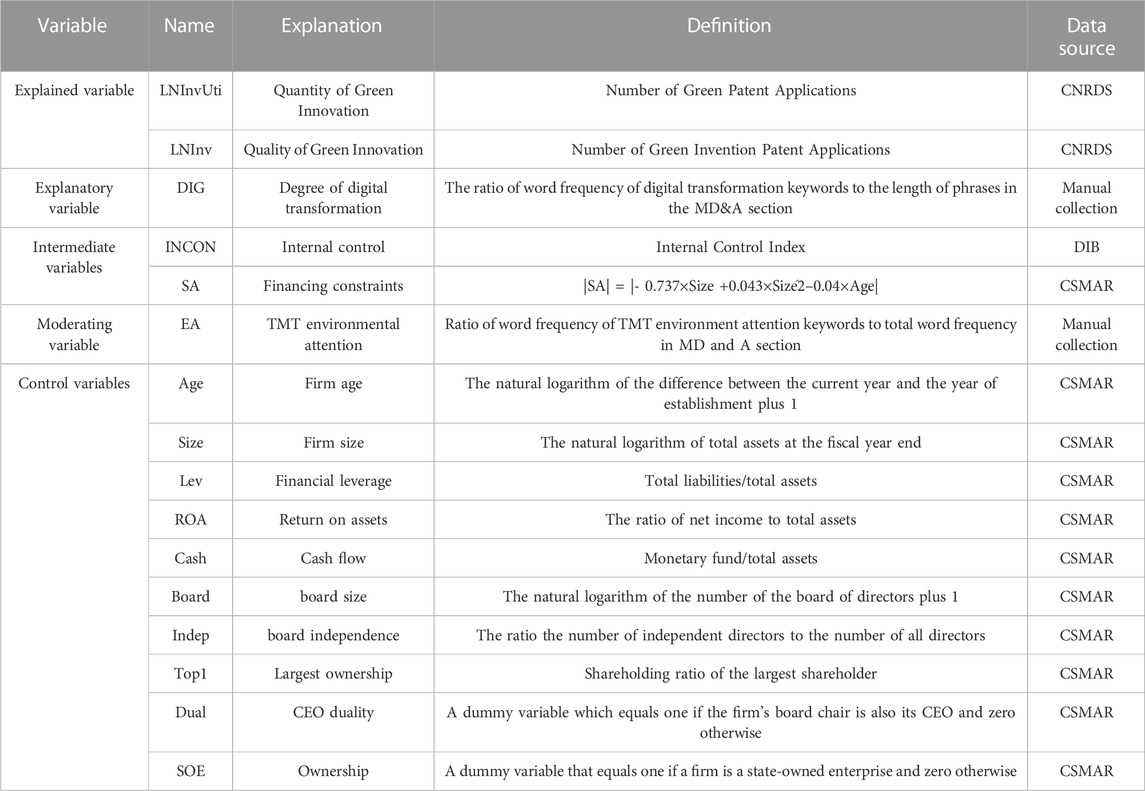

Drawing on previous studies (e.g., Wu et al., 2021; Sun and Guo, 2022), this paper introduces a series of control variables in the regressions, including firm age (Age), firm size (Size), financial leverage (Lev), firm performance (ROA), cash flow (Cash), board size (Board), board independence (Indep), equity concentration (Top1), CEO duality (Dual) and ownership (SOE). In addition, industry (IND) and year (Year) dummy variables are also introduced. The definition and construction of these variables are shown in detail in Table 1.

2.2.3 Empirical model design

2.2.3.1 Basic regression model

First, we use a fixed effects (FE) panel regression to test H1, i.e., whether the digital transformation of firms can promote their green innovation. The fixed effects regression is chosen over the random effects regression based on the Hausman test, which is not detailed here to save space, and the OLS model is:

Where i and t stand for enterprise and year respectively.

2.2.3.2 Intermediate effects model

Second, H2 and H3 consider internal control and financing constraints as intermediate variables in the digital transformation of firms affecting their green innovation, and we build the following regressions:

Where

2.2.3.3 Moderating effects model

Third, H4 proposed TMT environmental attention (EA) as a moderating factor, tested as follows:

Where

3 Results

3.1 Correlation analysis

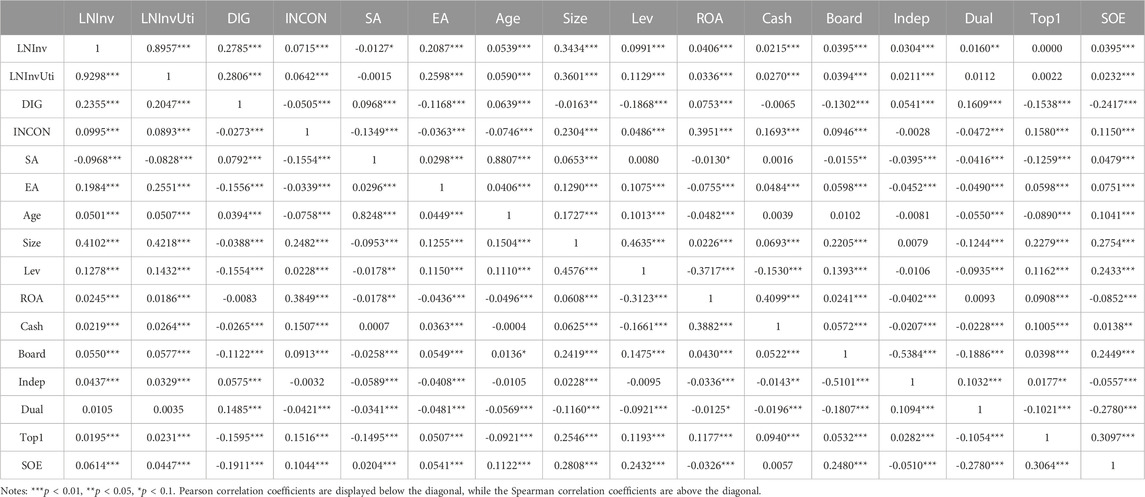

Table 2 reports the variable correlation coefficient matrix. DIG shows a significant positive correlation with LNInv and LNInvUti, which is consistent with. Hypothesis 1 and suggests that the benchmark model is reasonable. DIG is significantly and negatively correlated with Size, Lev, Board and SOE, indicating that smaller, less indebted, smaller board size and non-state-owned enterprises are more likely to implement digital transformation. Correlations between other variables are also plausible. For example, there is a significant positive correlation between Size and Cash, indicating that larger enterprises have stronger cash flow. INCON is significantly and positively correlated with ROA, indicating that firms with better profitability have higher levels of internal control. The multicollinearity test is adopted, and the average VIF value is 1.720, less than the threshold value of 10, which proves that there is no serious multicollinearity problem among the independent variables in the model.

3.2 Descriptive statistics

Table 3 reports the descriptive statistics of the variables. The means of green innovation quality (LNInv) and green innovation quantity (LNInvUti) are 0.7358 and 1.0663, respectively, and the standard deviations are larger than the means, indicating that the level of green innovation varies widely among the sample companies. The mean value of DIG is 0.8810, which is greater than its median value of 0.5114, indicating that more than half of the sample enterprises’ digital transformation degree does not reach the mean value, reflecting the limited or relatively low digital transformation degree of Chinese A-share listed companies in general; the standard deviation of DIG (0.9747) is higher than its mean value (0.8810), which indicates that there may be prominent individual or category differences in the degree of digital transformation of the sample companies.

3.3 Benchmark regression results

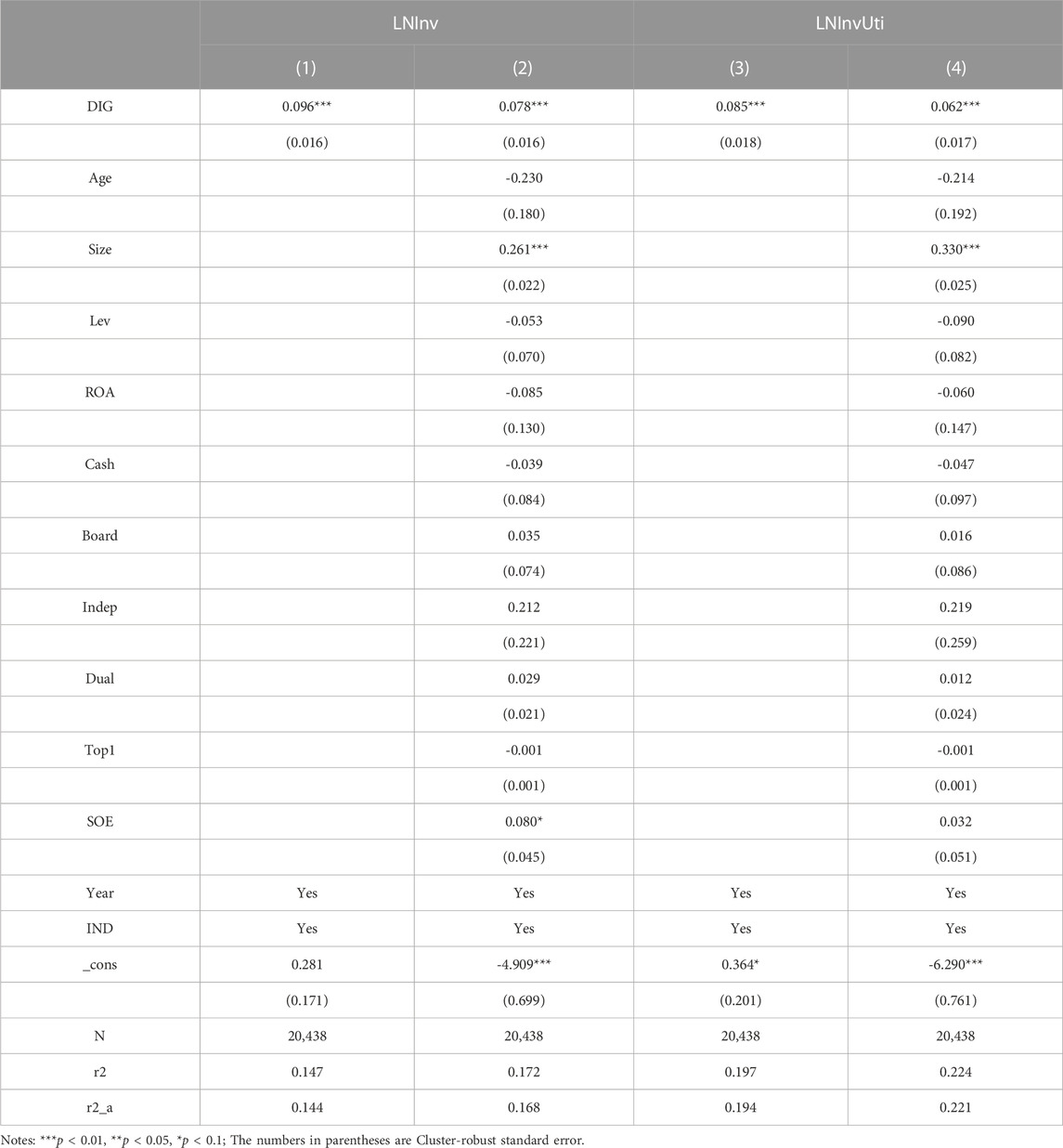

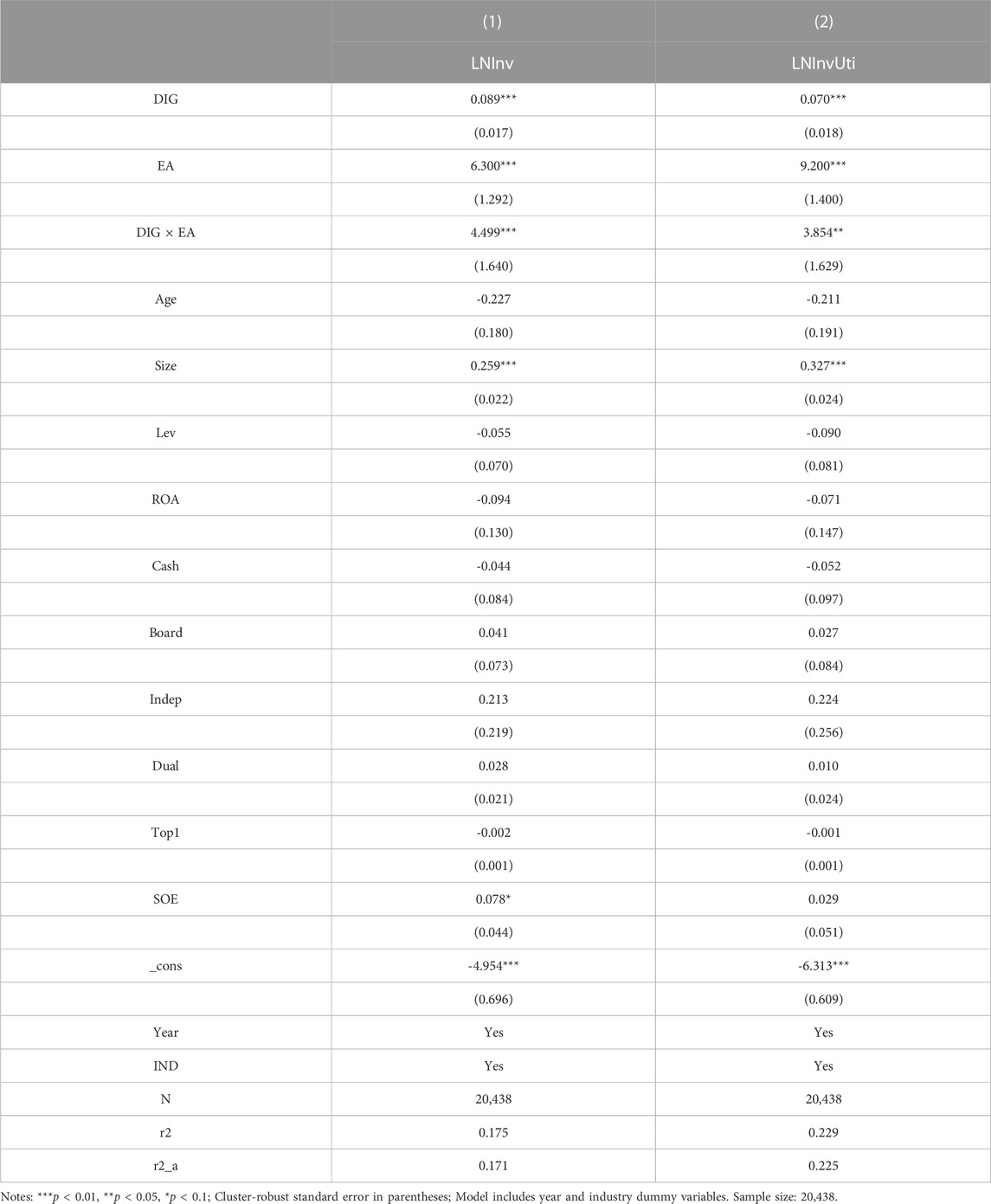

Table 4 reports the results of the benchmark regressions. When the fixed effects of industry and year are controlled, corporate digital transformation has a significant positive effect on both the quality of green innovation (LNInv) (

3.4 Examination of the intermediate effect of internal control

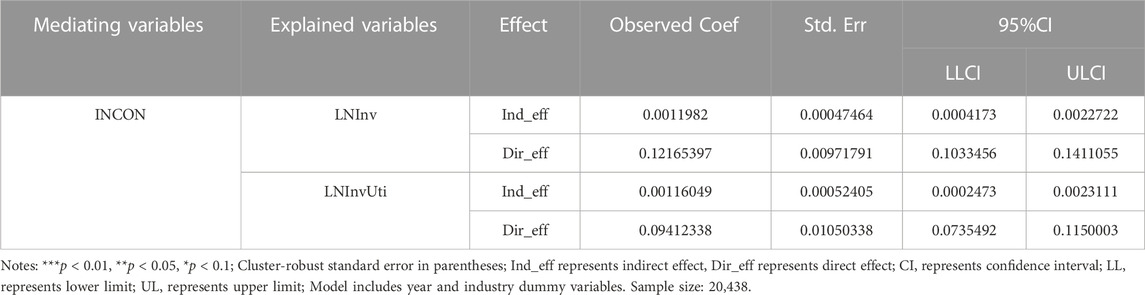

We test the mediating effect of internal control by Bootstrap method with 5000 repetitions of sampling, and the results are shown in Table 5. At 95% confidence level, the confidence interval of both indirect paths of DIG and LNInv/LNInvUti do not contain zero, which proves the existence of the mediating effect. The direct effects of digital transformation on the quality of green innovation and quantity of green innovation are 0.12165397 (p < 0.01), 0.09412338 (p < 0.01), respectively. The coefficients of the mediating effect of internal control (INCON) are 0.0011982 (p < 0.05) and 0.00116049 (p < 0.05), and the percentages of the mediating effect are 0.975% and 1.218%, respectively. The empirical results confirm that internal control (INCON) is a functional channel in the process of digital transformation (DIG) for green innovation, validating H2 and answering question 2): corporate digital transformation promotes green innovation by improving the quality of a firm’s internal control. In other words, digital transformation of enterprises leverages digital technology to accelerate the standardization and speed up the flow of information, improving the efficiency and agility of all aspects of internal control, effectively preventing and mitigating enterprise risks, and exerting a certain “governance effect”, i.e., contributing to the improvement of the quality of internal control. Moreover, higher quality of internal controls increases the transparency of corporate information and exposes companies to greater internal and external scrutiny, which further motivates firms to actively shoulder social responsibility and engage in green innovation activities. Thus, internal controls play a mediating role in the digital transformation of companies to promote their green innovation.

3.5 Examination of the intermediate effect of financing constraints

As mentioned earlier, digital transformation requires firms to redirect and reallocate the investment of financial resources, which will affect their green innovation. Following the suggestion of Jiang (2022), this paper adopts the following steps to test the indirect effects of financing constraints. First, the impact of financing constraints on corporate green innovation is examined, and the results are shown in Table 6. The regression results of financing constraints on the dependent variables (quality and quantity of green innovation) in columns 1) 2) are both significantly negative at the 1% confidence level, i.e., a higher degree of financing constraints inhibits green innovation of enterprises. This result is inextricably linked to the characteristics of green innovation activities such as high investment, long payback period and unpredictable benefits, whose innovation results have the attributes of public goods and can be easily imitated and replicated. When firms are rich in liquidity and redundant resources, they are more inclined to invest in green innovation to gain a differentiated and sustainable competitive advantage; while when financing constraints are high, funds will be prioritized into agendas directly related to the firm’s production and operations to cope with current uncertainties, while investments in green innovation activities related to long-term sustainability will be curtailed.

Second, the paper further examines the impact of digital transformation on financing constraints. As shown in columns 3) 4), the regression results of digital transformation on the degree of financing constraints are significantly positive at the 1% confidence level, and the results are still robust when lagging DIG by one period, suggesting that digital transformation exposes firms to a higher degree of financing constraints rather than the “alleviating effect” advocated by some scholars (e.g., Xue et al., 2022). The “Solow paradox” clarifies this result. Firstly, there is a time lag in the effectiveness of digital transformation, and its potential has not been fully realized. In particular, the current digital transformation of the sample firms is generally low, information asymmetry is not significantly reduced, and there is no immediate “profitability effect” in terms of firm performance or growth, and financial institutions often have difficulty in effectively overcoming adverse selection caused by information asymmetry. Secondly, the application of new technologies requires a corresponding “organizational” transformation, which requires a “painful” period of friction, debugging, and integration, during which the implementation of digital transformation may be characterized by increased organizational redundancy rather than output or profitability. Thirdly, digital transformation generates additional financing needs for firms, crowding out their limited funds, which in turn may lead to higher interest costs, thus pushing up the financing constraints of firms. Finally, when digital transformation becomes a “must” and firms rush to this track, it may result in a redistribution of market share rather than a “bigger cake”, and the incentive of credit sector to grant “special allowances” is therefore gone. Moreover, the regression results of the control variables show that smaller firms with less adequate cash flow face a higher degree of financing constraints, which supports the scholars’ view that large firms rely more on internal funds for innovation while SMEs rely more on exogenous financing and are more likely to face financing constraints (Lei et al., 2022).

Third, financing constraints are added to the regressions, and the results are presented in columns 5) 6). The direct effect coefficients of DIG on the quality and quantity of green innovation are 0.086 (p < 0.01) and 0.070 (p < 0.01), respectively, which are larger than its total effect of 0.078 (p < 0.01) and 0.062 (p < 0.01) (see columns 2) 4) of Table 4). In addition, the product of the indirect effect coefficient γ1 (0.007, p < 0.01) and the coefficient μ2 (-1.260 and -1.298, p < 0.01) is negative, in the opposite direction of the direct effect μ1. According to MacKinnon (2000), the indirect effect of financing constraints on digital transformation and green innovation is the “suppressing effect”, which means that financing constraints suppress the effect of digital transformation on green innovation to a certain extent. Specifically, the effect of digital transformation on green innovation is weakened by raising the level of financing constraints. Once the financing constraint is controlled for, the difference in the regression coefficients of digital transformation on green innovation widens. The measured share of the suppressing effect of financing constraints in the path of digital transformation on the quality and quantity of green innovation is 6.370% and 7.587%, respectively. Therefore, H3 passes the test and answers question 2): digital transformation exposes firms to higher financing constraints, and higher levels of financing constraints hinder firms’ green innovation efforts, thus showing an overall weakening of the impact of digital transformation on green innovation, a result that reflects the lingering power of the Solow paradox, despite the promising potential and prospects of digital transformation. The positive externalities of digital transformation may be reflected in better environmental performance and higher levels of green innovation, but they do not address the financing constraint.

We note that this empirical finding that digital transformation pushes up firms’ financing constraints is not consistent with some existing studies (e.g., Xue et al., 2022), and we dissect the reasons for this may lie in measurement errors and miscalculations. First, various measures of the level of digital transformation, such as the proportion of digitization-related intangible assets, the share of IT personnel, IT investment and telecommunication expenditures, and the frequency of digital transformation words, are widely used in a large number of literatures, and scholars have obtained different datasets based on different measures, which in turn have produced different empirical results. Second, financing constraints themselves are difficult to quantify, scholars have used some variables as indicators to measure the degree of corporate financing constraints, and representative indices include FC index, KZ index, SA index and WW index, etc., and the differences of different indices may yield different calculation results. Finally, this paper selects the SA index, which is constructed only by two strongly exogenous variables, namely, firm size and age, to measure financing constraints. However, the SA index calculates a negative value, which has been ignored by some literature, misinterpreting positive effects as negative ones. In this paper, text mining method is used to measure DIG, and the absolute value of SA index is used to represent the degree of financing constraint, which has high credibility. In summary, different measurement approaches may lead to different conclusions, and we believe that the impact of digital transformation on the financing constraints faced by firms is an interesting topic worthy of further exploration and discussion.

3.6 Examination of the moderating effect of TMT environmental attention

Table 7 reports the results of the regression analysis of model 3), with the quality and quantity of green innovation as dependent variables, the coefficients of the cross product term DIG × EA (Interaction term between digital transformation and TMT environmental attention) are 4.499 (p < 0.01) and 3.854 (p < 0.05), respectively, and are in the same direction as the coefficients of DIG in columns 2) and 4) in Table 4, indicating that TMT environmental attention positively moderates the facilitation of digital transformation on green innovation. The regression results of model 3) are consistent with. Hypothesis 4, which enriches the interpretation of question 2) and further supports the findings of existing studies (e.g., Sun and Guo, 2022). Cognitive factors such as attention have been shown to play an important role in strategic decision making and resource allocation in companies. In particular, the environmental attention of the executive team directs corporate environmental and green actions, and our findings suggest that the role of digital transformation in promoting green innovation is more significant when TMT environmental attention is higher. That is, executive teams with higher environmental attention are more likely to perceive and capture environmental opportunities and tend to allocate more resources to green innovation activities during the digital transformation process, thus achieving better performance in terms of both quality and quantity of green innovation.

3.7 Robustness analysis and endogeneity problem

3.7.1 Re-measurement of digital transformation

Considering that different measurement methods may bring errors, this paper constructs a new digital transformation indicator DIG2 based on the idea of Wu et al. (2021), and then further decomposes the indicator according to two levels, “underlying technology” and “practical application”, and notates them as DIG_ba and DIG_ap, respectively. These indicators are regressed separately according to model 1) and the results are shown in Table 8. After replacing the digital transformation measure and breaking down the dimensions, the coefficient of model 1) remains significantly positive. Specifically, before adding the control variables, the regression coefficients of DIG2 on LNInv, LNInvUti are 0.077 and 0.069 (columns 1) and 5)), respectively; after adding the control variables, the above coefficients are 0.055 and 0.040 (columns 2) and 6)), respectively, both of which are significantly positive at the 1% level. The regression coefficients of digital transformation underlying technology (DIG_ba) on the quality and quantity of green innovation are 0.064 and 0.063 (columns 3) and 7)), respectively, both of which are significantly positive at the 1% level, indicating that the underlying technology of digital transformation (DIG_ba) contributes equally to the quality and quantity of green innovation. The regression coefficients of digital technology application (DIG_ap) on green innovation quality and quantity are 0.036 and 0.019 (columns 4) and 8)), which are significantly positive at the 1% and 10% levels, respectively, indicating that digital technology application (DIG_ap) has a greater contribution to green innovation quality. These results confirm the robustness of the findings of this paper.

3.7.2 Two-stage least squares

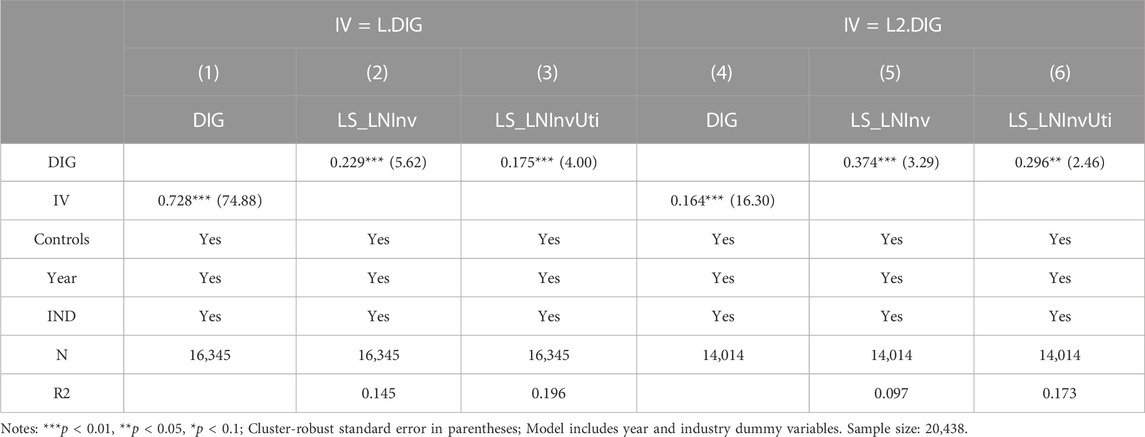

The green innovation of enterprises may have prompted the increase of R&D investment and the application of new technologies, which stimulated the improvement of digital transformation level, so the endogeneity problem of reverse causality may exist. Therefore, this paper further uses the two-stage least squares (2SLS) method to mitigate the endogeneity problem. The independent variables are lagged, and the estimated results are shown in Table 9. The first-stage regression coefficients are significantly positive at the 1% level (columns 1) and 4)), and the lagged variables satisfy the correlation condition. Columns 2) and 5) report the results of the second-stage regression of the lagged variables on the quality of green innovation (LNInv), where the regression coefficient of DIG is significantly positive at the 1% level, and columns 3) and 6) report the results of the second-stage regression of the lagged variables on the quantity of green innovation (LNInvUti), where the regression coefficient of DIG is significantly positive at the 1% and 5% levels, respectively. The above results fully demonstrate that the main findings of this paper remain robust and reliable after considering the lagged effect.

3.7.3 Addition of control variables

To mitigate the impact of other potential channels on corporate green innovation, more variables are included in the control variables.

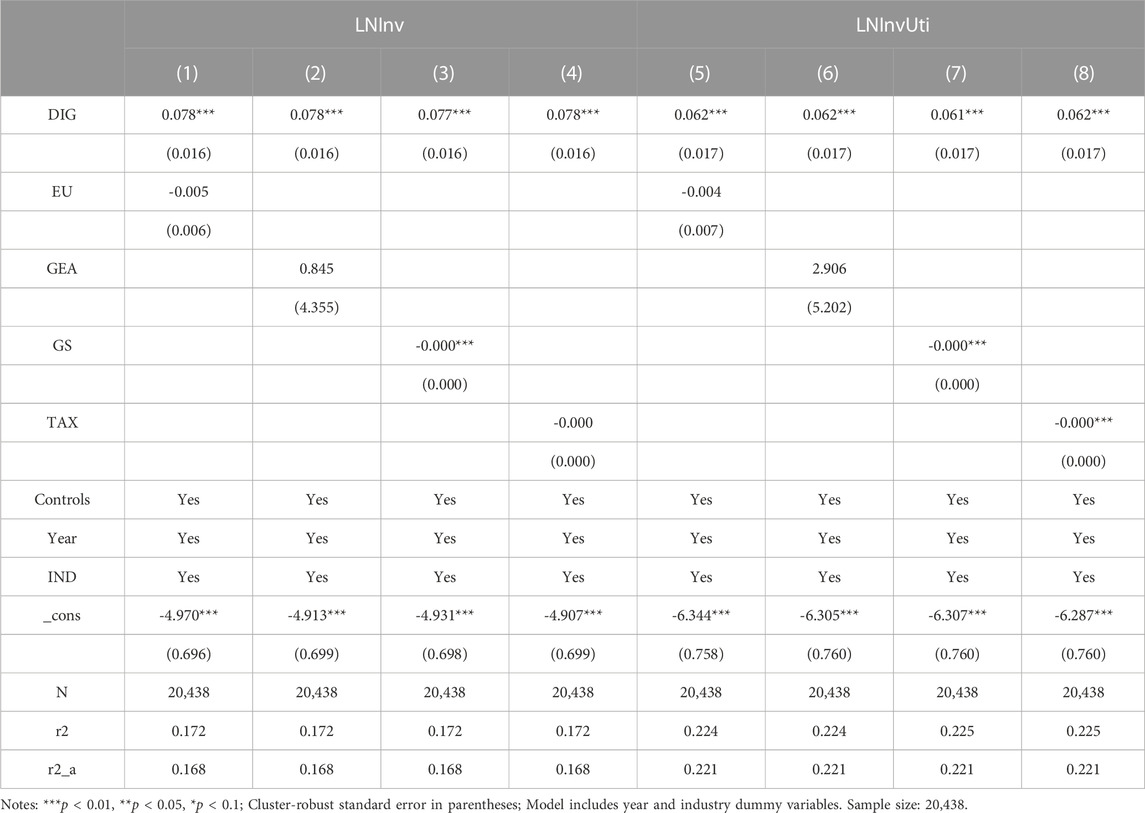

External Environmental Uncertainty (EU). When faced with a highly uncertain external environment, firms may choose to “stay put” and wait for the right opportunity to invest in green innovation, or they may “take a chance” to gain a competitive advantage or external support. Therefore, this paper treats environmental uncertainty (EU) as a control variable, where the EU indicator is constructed by referring to the study of Ghosh and Olsen (2009). The impact of external environmental changes on firms eventually leads to fluctuations in sales revenue or operating performance, so the latter is used to characterize the former (EU), and the measurement process is as follows: 1) The abnormal sales revenue of each sample company for the past 5 years is estimated separately using the following formula: Sale = φ0+φ1Year+ε, where Sale is the sales revenue, Year is the annual variable, and the current year is taken as 5, four if last year, and so on, the annual variable is regressed to exclude the change of sales revenue brought by the stable growth of the company, and the residual result obtained from the regression is the abnormal sales revenue; 2) the standard deviation of abnormal sales revenue in the past 5 years is divided by the average value of sales revenue in the past 5 years to obtain the unadjusted environmental uncertainty of the industry; 3) the result of the second step is divided by the industry environmental uncertainty (the median of the non-industry-adjusted environmental uncertainty of all firms in the same industry in the same year) to obtain the industry-adjusted environmental uncertainty (EU). The higher the value, the higher the environmental uncertainty faced by the firm. After including EU in the control variables, the regression results are reported in columns 1) and 5) of Table 10, where the regression coefficient of DIG remains significantly positive.

Government Ecological Attention (GEA). Local governments with higher ecological attention are likely to actively introduce policies that favour green innovation, releasing positive signals that prompt local enterprises to undertake green innovation activities. Adopting a text mining approach, we measure the ratio of ecological keyword frequencies to all word frequencies in government work reports as a proxy for the government’s ecological attention (GEA) and added it to the control variables. Columns 2) and 6) of Table 10 report the relevant regression results. After controlling for GEA, the regression coefficient of digital transformation (DIG) remains significantly positive.

Government Environmental Subsidies (GS). Studies have shown that policymakers can promote private R&D investments through subsidies. On the one hand, government environmental subsidies can, to some extent, alleviate the financial pressure and compensate for the high costs and risks associated with green innovation in the private sector, and on the other hand, the government may incentivize firms to reduce emissions or enhance green innovation through environmental subsidies. Therefore, the data of government subsidies obtained by listed companies due to their environmental actions are calculated, and government environmental subsidies (GS) are included in the control variables. The results in columns 3) and 7) of Table 10 demonstrate that the regression coefficient of digital transformation remains significantly positive after controlling government environmental subsidies (GS).

Tax Incentives (TAX). Fiscal policy incentives play an important role in the development and diffusion of green innovation, and tax incentives are one of the main instruments of fiscal policy incentives in addition to direct subsidies. Government R&D tax incentives may promote green innovation by firms through direct stimulation or leveraging effects. In this paper, we add tax incentives received by firms (TAX) to the control variables, and as shown in columns 4) and 8) of Table 10, the regression coefficient of digital transformation remains significantly positive when controlling for tax incentives (TAX).

In summary, after multiple robustness and endogeneity treatments, the core findings of this paper remain highly consistent.

3.8 Heterogeneity analysis

In the previous test, this paper examines the impact of corporate digital transformation on green innovation using the full sample, and the results show that corporate digital transformation can significantly improve the quality and quantity of green innovation. However, it is worth noting that the above effects may be asymmetric under different external environments and different corporate attributes. Further, the sample firms are tested by group based on the nature of enterprise ownership, enterprise size, ecological expenditures and financing constraints.

3.8.1 Heterogeneity analysis of property rights of enterprises

The impact of digital transformation on green innovation may differ among enterprises with different property rights, so the sample enterprises are grouped according to property rights, and the test results are shown in Table 11. In both groups, the promoting effect of corporate digital transformation on green innovation quality (LNInv) has passed the 1% statistical significance test (Columns 1) and 2)). The p-value of the difference between groups is 0.048, indicating that the coefficients are comparable. The coefficient of digital transformation in the group of state-owned enterprises (SOEs) is 0.131, which is higher than that of non-state-owned enterprises (non-SOEs) at 0.047, which means that the promotion effect of digital transformation on the quality of green innovation in SOEs is more significant than that in non-SOEs. Columns 3) and 4) show the regression results of corporate digital transformation on the quantity of green innovation (LNInvUti). Although the coefficient is positive and significant, however, the difference in its coefficient between groups is not significant (p = 0.188) and not comparable, indicating that there is a facilitative effect of corporate digital transformation on green innovation quantity, and there is no significant difference in this effect between state-owned and non-state-owned enterprises.

The reasons for this result are multiple. On the one hand, green innovation quality implies higher technological capacity and correspondingly more investment in R&D resources, while SOEs have natural advantages in terms of strength endowment and resources accessibility due to the endorsement of state credibility, and the government also encourages and guides SOEs to actively implement digital transformation, which in turn facilitates their green innovation. On the other hand, SOEs are held to higher expectations in terms of social responsibility commitment. In the process of digital transformation, SOEs are more motivated to undertake green innovation with high investment and positive externality characteristics in response to the call for green transformation development, and thus their performance in terms of green innovation quality is better than that of non-SOEs. In contrast, the threshold for increasing the quantity of green innovation is relatively low, the required resource investment is relatively small, and firms of different ownership that undergo digital transformation can more easily increase their green innovation quantity output. In conclusion, SOEs have stronger strength and incentives to drive green innovation and thus actively undertake social responsibility, as evidenced by higher green innovation quality compared to non-SOEs; while there is no significant difference between SOEs and non-SOEs in terms of green innovation quantity promoted by digital transformation.

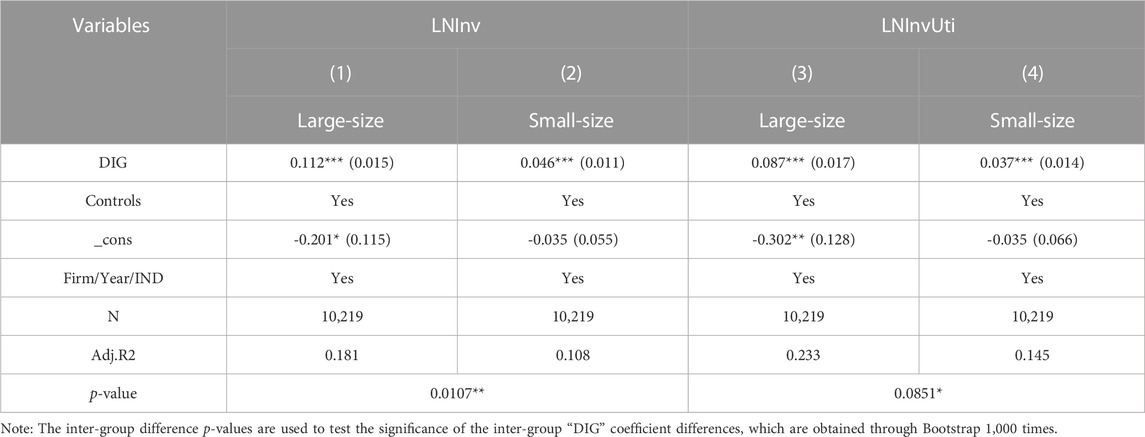

3.8.2 Heterogeneity analysis of firm size

To examine the impact of digital transformation on green innovation in enterprises of different sizes, the sample firms are grouped according to the median of their size, and the results are presented in Table 12. In both groups, the coefficients of digital transformation on the quality of green innovation (LNInv) and the quantity of green innovation (LNInvUti) are significantly positive at the 1% level with comparable values (p = 0.0107 and 0.0851, respectively). Specifically, compared with smaller enterprises, digital transformation has a more significant effect on the quality and quantity of green innovation in larger enterprises. On the one hand, this result may be due to the fact that larger enterprises tend to have stronger financial strength and risk resistance, and they have more strength and motivation to actively engage in digital upgrading and thus empower green innovation; on the other hand, large size also implies higher industry status, with significant advantages in seeking external resource support and leading industry development, large enterprises are therefore more likely to take the initiative to seize the opportunities of digital transformation, actively implement green innovation, shape the green image of enterprises and meet the expectations of stakeholders.

3.8.3 Heterogeneity analysis of ecological expenditures

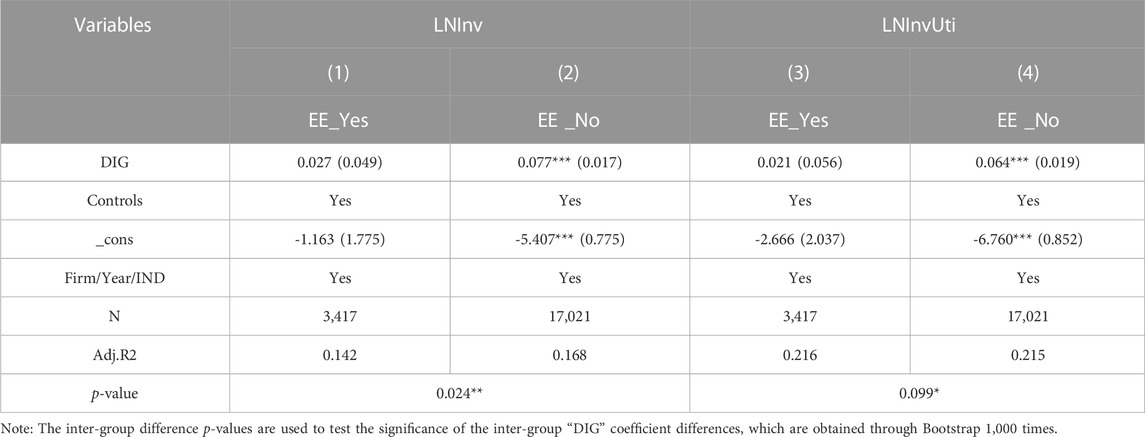

Proactive eco-environmental pollution control and environmental protection investment is also one of the initiatives for enterprises to actively assume environmental responsibility and implement sustainable development strategies. On the one hand, eco-expenditures reflect the subjects’ environmental awareness to some extent, and it is inferred that these enterprises may have the willingness to actively carry out green innovation activities; on the other hand, ecological expenditures imply that funds are tied up, which may crowd out funds for green innovation, so firms with eco-expenditures may be associated with lower levels of green innovation. In this paper, the sample firms are divided into two groups for group testing based on the presence or absence of ecological expenditures, and the results are shown in Table 13.

In the group with ecological expenditures, the effect of digital transformation on both green innovation quality (LNInv) and green innovation quantity (LNInvUti) was not significant (columns 1) and 3)); while in the group of firms without ecological expenditures, digital transformation significantly contributed to the improvement of green innovation quality (LNInv) and green innovation quantity (LNInvUti) (columns 2) and 4)). This indicates that firms almost always face resource constraints, and it is often difficult to achieve both “terminal treatment” and “green innovation” at the same time. In the process of digital transformation, when firms invest more resources in direct terminal treatment, digital transformation no longer has a positive effect on green innovation.

3.8.4 Heterogeneity analysis of financing constraints

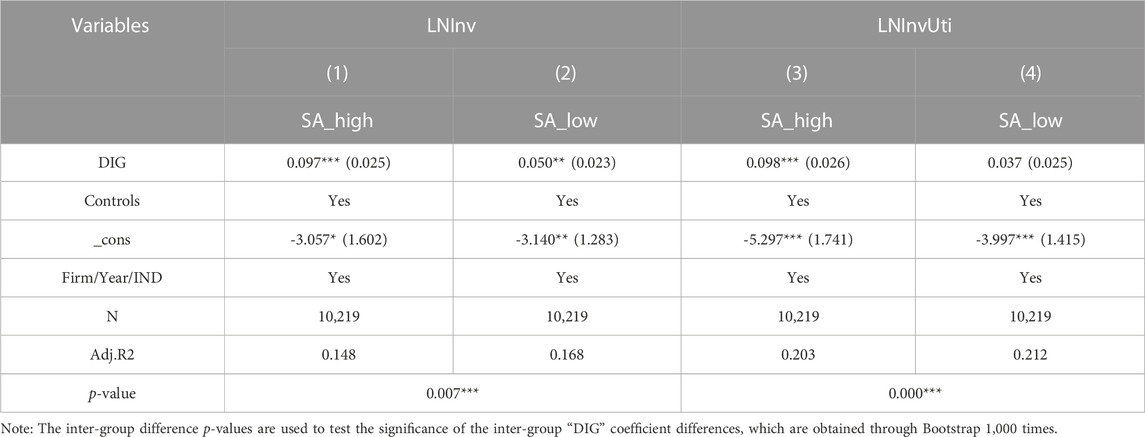

In this paper, we find that financing constraints suppress the promotion of digital transformation of enterprises for green innovation, and furthermore, we wonder whether there are differences in the aforementioned impact paths when enterprises face different levels of financing constraints. The sample firms are divided into two groups according to the median of financing constraints, and the regression results are shown in Table 14. As can be seen, the coefficients are comparable between the groups at the 1% level (p-values are 0.007 and 0.000, respectively). From columns 1) 2), digital transformation promotes green innovation quality (LNInv) in both the groups with high and low financing constraints, and this boosting effect is more pronounced in the group facing higher financing constraints. According to columns 3) and 4), digital transformation has a significant enhancement effect on the quantity of green innovation (LNInvUti) in the group with high financing constraints, while this effect is not significant in the group with low financing constraints. This result supports the idea of innovation theory that when firms face higher levels of financing constraints, limited financial resources leave firms with fewer options and instead stimulate their creativity. Under such circumstances, firms are more motivated to maximize their available resources, make the best investment decisions, and actively seize potential opportunities for green innovation, which leads to better performance in terms of quality and quantity of green innovation.

4 Discussion

To establish an interaction on the synergistic development of digitalization and greening at the micro level, this paper examines the impact of firms’ digital transformation on their green innovation by constructing a two-way fixed-effect model, and explores the role of internal control, financing constraints and TMT environmental attention in this impact path. The main findings are as follows: 1) Digital transformation of firms has a significant positive impact on promoting both the quality and quantity of their green innovation, and this finding still holds after multiple robustness tests, which provides a theoretical basis for achieving the synergistic development of digital transformation and green sustainability at the firm level; 2) Digital transformation can improve the level of internal control of firms, thus positively influencing the quality and quantity of green innovation; digital transformation may raise the financing constraint faced by firms, thus suppressing the promotion effect of digital transformation on green innovation; the effect of digital transformation on green innovation is more pronounced when TMT environmental attention is high; 3) Heterogeneity analysis shows that the impact of digital transformation on green innovation is more effective among state-owned enterprises, large-scale enterprises, enterprises without ecological expenditures, and enterprises with higher financing constraints.

4.1 Theoretical contributions

This study makes several theoretical contributions to the existing literature. Firstly, this study echoes the call of the academia to establish an interaction between the two tides of digitalization and sustainable development (Luo et al., 2022), builds a bridge between the interaction of digital transformation and green innovation at the micro-firm level, provides a systematic review of the literature on the topic, and further expands the determinants of green innovation in firms. Secondly, this paper helps to open the “black box” of the process of digital transformation empowering green innovation (Sun and Guo, 2022), finding that internal control is the mediating path of digital transformation promoting green innovation, while financing constraints suppress the impact, besides, TMT’s environmental attention positively moderates the contribution of corporate digital transformation to green innovation. The study of these channels and mechanisms enriches existing theoretical studies on the impact of digital transformation and provides new perspectives. Thirdly, this paper uses Chinese listed companies as the research sample to analyze the heterogeneity and dissect the potential causes in terms of ownership, firm size, ecological expenditures, and financing constraints, enriching the existing research.

In addition, this study also provides empirical evidence to reveal the Solow paradox in the era of digital economy from a microscopic perspective. On the one hand, we find that digital transformation of firms can promote green innovation characterized by double externalities, i.e., although digital transformation does not initially aim to reduce environmental burdens, it does generate positive environmental benefits, suggesting that digital transformation generates benefits beyond productivity, adding micro-level evidence to the Solow paradox in the digital era. On the other hand, digital technologies are expected to fundamentally reshape business strategies, business processes, corporate capabilities, products and services, as well as expand relationships among focal companies in business networks (Bharadwaj et al., 2013), however, the manifestation of these effects requires a long period of exploration, debugging and integration. Overall, most enterprises are still in the initial stage of digital transformation, and the potential positive effects of digital transformation have not yet been fully revealed, as evidenced by the fact that the initial investment in digital transformation is much higher than its visible benefits; meanwhile, the high failure rate of digital transformation makes the future benefits highly uncertain. In this context, the credit sector demands higher risk premiums, which exposes firms to a higher degree of financing constraints when seeking external financial support for their digital initiatives. At this stage, IT inputs are not significantly reflected in productivity, and higher inputs and relatively lower outputs make external financing more costly for firms, which may in turn discourage firms’ willingness to undertake digital transformation, and firms remain plagued by the Solow paradox.

4.2 Managerial implications

This paper provides some enlightenment for policy making. Firstly, the government should strengthen the construction of digital infrastructure, create the foundation conditions for the wide application of digital technology and the value mining of data elements, consolidate the empowerment base for enterprises to grasp digital opportunities and implement digital transformation. Secondly, the government should flexibly adopt measures such as government subsidies and tax incentives to increase financial support for enterprises’ digital upgrading actions, and financial institutions should be supervised to moderately lower the financing threshold to mobilize enterprises’ willingness to shift to digitalization and greening. Thirdly, the government should recognize the positive externalities of corporate digital transformation and create a supportive macro environment through multi-level institutional arrangements. The asymmetry of the benefits of green innovation brought by digital transformation is noteworthy, and more preferential treatment for non-state enterprises and SMEs should be considered in the formulation of relevant support policies to improve the overall efficiency of green innovation.

Business entities can also draw inspiration from this paper. First, enterprises should raise the awareness of digital transformation opportunities, take the initiative to assess the gap between strategic objectives and the current situation, actively employ external supportive conditions and environment to take digital actions, promote the deep integration of cutting-edge technologies and business, thus improving their digital transformation level. Second, enterprises should be keenly aware of the positive impacts of digital transformation, such as efficiency gains, cost reductions, reduced information asymmetry, and improved quality of internal controls, and release these positive signals externally to respond to stakeholder concerns and project a corporate image that espouses sustainability and creates conditions for securing external resources. Third, the allocation of attention by the executive team on environmental issues has a significant impact on the quality and quantity performance of green innovation. As green development is expected to shape a firm’s green image and gain a sustainable competitive advantage, enterprises should keep track of the latest trends and relevant policy support of the government on environmental protection, and ensure that their executive teams allocate sufficient attention to environmental issues through various means.

5 Conclusion

Digitalization-led green sustainability is attracting widespread attention. Focusing on China’s practice of promoting synergistic digitalization and greening, this paper examines the potential impact of corporate digital transformation on contributing to sustainable development through the lens of green innovation. The findings further support the study by Sun and Guo (2022), which clarifies the advantageous role of digital transformation in elucidating the “Solow paradox” in the digital economy and reveals compatible paths for corporate digital transformation and green innovation. Our study provides inspiration for policy makers, academics, and practitioners, broadens feasible pathways for common global challenges and opportunities, and provides empirical references for different countries and regions in developing synergistic strategies for digital transformation and green sustainability.

Several limitations deserve mention. First, the measurement of corporate digital transformation is a long-standing challenge (Yuan et al., 2021). This paper uses a textual analysis approach to portray it and further distinguish it from perspectives of underlying technologies and practical applications, however, such a division is still relatively rough and subjective, and more efforts are needed in future research. Second, green innovation is a comprehensive concept that contains different dimensions such as green product innovation and green process innovation (Chen et al., 2006), green innovation input and green innovation output (e.g., Zhao et al., 2021), green technology innovation and green management innovation (e.g., Shu et al., 2014), etc. This paper uses green patent outputs to portray green innovation, and future research could delineate green innovation in more detail and further investigate the heterogeneous impact that digital transformation may have on it. Third, there may be multiple pathways through which a firm’s digital transformation affects its green innovation. This study explores the role played by internal control and financing constraints, and the study of the channels and mechanisms involved still needs to be further expanded. Finally, this study takes China as the research context, while firms in different countries and regions are at different stages of the digital revolution, it is worthwhile to examine in depth whether the promotion effect of corporate digital transformation on green innovation is prevalent, what are the boundary conditions for the occurrence of this impact, and what kind of heterogeneity exists among firms with different characteristics, etc.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

YS and MH conceived the study; YS and MH collected the data; MH developed the analyses with input from YS; all authors contributed to writing and revisions. All authors approved this final manuscript.

Funding

This research was financially supported by the National Natural Science Foundation of China (Number 72073125) and the Fundamental Research Funds for the Central Universities (Number E2E40805X2).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acemoglu, D., Aghion, P., Bursztyn, L., and Hemous, D. (2012). The environment and directed technical change. Am. Econ. Rev. 102 (1), 131–166. [online]. doi:10.1257/aer.102.1.131

Acemoglu, D., Autor, D., Dorn, D., Hanson, G. H., and Price, B. (2014). Return of the solow paradox? IT, productivity, and employment in US manufacturing. Am. Econ. Rev. 104 (5), 394–399. doi:10.1257/aer.104.5.394

Amore, M. D., and Bennedsen, M. (2016). Corporate governance and green innovation. J. Environ. Econ. Manag. 75, 54–72. doi:10.1016/j.jeem.2015.11.003

Asongu, S. A., and Moulin, B. (2016). The role of ICT in reducing information asymmetry for financial access. Res. Int. Bus. Finance 38, 202–213. doi:10.1016/j.ribaf.2016.04.011

Berger, E. S. C., von Briel, F., Davidsson, P., and Kuckertz, A. (2019). Digital or not – the future of entrepreneurship and innovation. J. Bus. Res. 125, 436–442. doi:10.1016/j.jbusres.2019.12.020

Bharadwaj, A., El Sawy, O. A., Pavlou, P. A., and Venkatraman, N. (2013). Digital business strategy: Toward a next generation of insights. MIS Q. 37 (2), 471–482. doi:10.25300/misq/2013/37:2.3

Chen, Y.-S., Lai, S.-B., and Wen, C.-T. (2006). The influence of green innovation performance on corporate advantage in taiwan. J. Bus. Ethics 67 (4), 331–339. doi:10.1007/s10551-006-9025-5

Chen, Y., Chang, C., and Wu, F. (2012). Origins of green innovations: The differences between proactive and reactive green innovations. Manag. Decis. 50 (3), 368–398. doi:10.1108/00251741211216197

Cordano, M., and Frieze, I. H. (2000). Pollution reduction preferences of U.S. Environmental managers: Applying ajzen’S theory of planned behavior. Acad. Manag. J. 43 (4), 627–641. doi:10.5465/1556358

El-Kassar, A.-N., and Singh, S. K. (2018). Green innovation and organizational performance: The influence of big data and the moderating role of management commitment and HR practices. Technol. Forecast. Soc. Change 144, 483–498. doi:10.1016/j.techfore.2017.12.016

ElMassah, S., and Mohieldin, M. (2020a2020). Corrigendum to ‘digital transformation and localizing the sustainable development goals (SDGs). Ecol. Econ. 169, 106490. doi:10.1016/j.ecolecon.2020.106604

ElMassah, S., and Mohieldin, M. (2020b). Digital transformation and localizing the sustainable development goals (SDGs). Ecol. Econ. 169, 106490. doi:10.1016/j.ecolecon.2019.106490

Feng, H., Wang, F., Song, G., and Liu, L. (2022). Digital transformation on enterprise green innovation: Effect and transmission mechanism. Int. J. Environ. Res. Public Health 19 (17), 10614. doi:10.3390/ijerph191710614

Freeman, C. (1996). The greening of technology and models of innovation. Technol. Forecast. Soc. Change 53 (1), 27–39. doi:10.1016/0040-1625(96)00060-1

George, G., Merrill, R. K., and Schillebeeckx, S. J. D. (2020). Digital sustainability and entrepreneurship: How digital innovations are helping tackle climate change and sustainable development. Entrepreneursh. Theory Pract. 45 (5), 999–1027. doi:10.1177/1042258719899425

Ghobakhloo, M., Iranmanesh, M., Grybauskas, A., Vilkas, M., and Petraitė, M. (2021). Industry 4.0, innovation, and sustainable development: A systematic review and a roadmap to sustainable innovation. Bus. Strategy Environ. 30, 1–21. doi:10.1002/bse.2867

Ghosh, D., and Olsen, L. (2009). Environmental uncertainty and managers’ use of discretionary accruals. Account. Organ. Soc. 34 (2), 188–205. doi:10.1016/j.aos.2008.07.001

Gordon, L. A., and Wilford, A. L. (2012). An analysis of multiple consecutive years of material weaknesses in internal control. Account. Rev. 87 (6), 2027–2060. Accessed 30 Sept. 2021. doi:10.2308/accr-50211

Hambrick, D. C., and Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 9 (2), 193–206. doi:10.5465/amr.1984.4277628

Hart, S. L. (1995). A natural-resource-based view of the firm. Acad. Manag. Rev. 20 (4), 986–1014. doi:10.2307/258963

Hekkert, M. P., Suurs, R. A. A., Negro, S. O., Kuhlmann, S., and Smits, R. E. H. M. (2007). Functions of innovation systems: A new approach for analysing technological change. Technol. Forecast. Soc. Change 74 (4), 413–432. doi:10.1016/j.techfore.2006.03.002

Helfat, C. E., and Peteraf, M. A. (2014). Managerial cognitive capabilities and the microfoundations of dynamic capabilities. Strategic Manag. J. 36 (6), 831–850. doi:10.1002/smj.2247

Hinings, B., Gegenhuber, T., and Greenwood, R. (2018). Digital innovation and transformation: An institutional perspective. Inf. Organ. 28 (1), 52–61. doi:10.1016/j.infoandorg.2018.02.004

Hoskisson, R. E., Hitt, M. A., Johnson, R. A., and Grossman, W. (2002). Conflicting voices: The effects of institutional ownership heterogeneity and internal governance on corporate innovation strategies. Acad. Manag. J. 45 (4), 697–716. doi:10.5465/3069305

Jensen, M. C. (1993). The modern industrial revolution, exit, and the failure of internal control systems. J. Finance 48 (3), 831–880. doi:10.1111/j.1540-6261.1993.tb04022.x

Jiang, T. (2022). Mediating and moderating effects in empirical studies of causal inference. China Ind. Econ., 100–120. doi:10.19581/j.cnki.ciejournal.2022.05.005

King, A., and Lenox, M. (2002). Exploring the locus of profitable pollution reduction. Manag. Sci. 48 (2), 289–299. [online]. doi:10.1287/mnsc.48.2.289.258