94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 13 February 2023

Sec. Environmental Economics and Management

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1126692

This article is part of the Research Topic Advances in Co-benefits of Climate Change Mitigation View all 12 articles

Using the data of listed companies in the Chinese capital market from 2014 to 2020, this paper studies the impact of the CEO’s green ecological experience on corporate green innovation and further analyzes the moderating effects of tax credit rating and tax burden. The results show that 1) the CEO’s green ecological experience can enhance corporate green innovation, 2) China’s tax credit rating positively moderates the impact of the CEO’s green ecological experience on corporate green innovation, and 3) corporate tax burden will negatively moderate the impact of the CEO’s green ecological experience on corporate green innovation.

The acceleration of industrialization and urbanization in the world has caused numerous environmental issues. For instance, global warming has been one of the severe consequences, which challenges the global environment and threatens the coastal dweller. So far, many countries have taken actions to decelerate the trend of environmental disruption by reducing carbon emissions. For instance, by developing information and communication technology (ICT), both high-income and middle-income countries have decreased carbon emissions (Sun et al., 2023). However, the climate policy uncertainty will block R&D input, decreasing cash flows (Ren et al., 2023a). Most people are also transferring their attentions from less effective development to protecting the environment. Yousaf et al. (2022) claim that various laws and policies are focused on protecting the environment. These policies may regulate corporate operation and force them to allocate more resources to green innovation in a more sustainable way. Furthermore, as the COVID-19 pandemic has huge economic impacts globally, many countries are trying to promote economic recovery through economic policies, and these economic policy uncertainties are positive for the overall market (Wang et al., 2023b). From the productivity perspective, Bucea-Manea-Tonis et al. (2021) state that green innovation has a positive impact on people’s health and thus increases their productivity. Additionally, in the fast-paced world, knowledge, innovation, and technology are becoming more crucial (Tullani et al., 2018). It is required for the corporations to increase their competence by focusing on R&D and launching more eco-friendly products to attract consumers. Furthermore, many stakeholders like to search for CEOs’ and executives’ backgrounds to determine their educational level, habits, and abilities since these may be related to corporate operation. For instance, the CEO’s green ecological experience influences the positive environmental deviance and the CEO’s foreign experience enhances the green innovation (Walls and Hoffman, 2013; Quan et al., 2023). Moreover, a “U” shape relationship is shown between the company executive political connections and the corporate pollution (Wang et al., 2022). In addition to these, taxes may also be one of the influencing factors since the tax payment directly relates to the cash-holding level. A higher tax burden may force enterprises to ignore the R&D, creating financial constraints for corporations and thus influencing green innovation (Wang et al., 2023a). However, these negative impacts can be controlled by some actions from governments, for instance, adjusting environmental tax rates to the optimal level and controlling the uncertainty of oil price to enhance resource integration and increase the green technology (Wang and Yu, 2021; Ren et al., 2023b). Additionally, governments can put forward dynamic climate policies to overcome energy price fluctuations (Ren et al., 2023c). Also, the digital finance will foster urban innovation (Ren et al., 2023a). These may be helpful for green innovation development. In conclusion, corporate green innovation may be restricted by many factors and it protects the environment and motivates corporations to obtain advantages in competition for sustained development.

Corporate green innovation has been studied by many scholars. To the best of our knowledge, the existing literature mainly focuses on the study of the external influence and internal mechanism of green innovation, including the input, expenditure, and efficiency of green innovation. Research studies on green innovation have ignored the role of the CEO’s experience in the business operation activities of enterprises and they rarely involve the mechanism of factors directly related to the corporate cash flow and corporate management, such as tax credit rating and tax burden.

This paper will study the impact of the CEO’s green ecological experience on corporate green innovation and further explore the moderating role of corporate tax credit rating and tax burden. The innovations and contributions of this study may include the following: 1) It studies the impact of the CEO’s green ecological experience on corporate green innovation, which enriches the research literature on corporate green innovation. 2) It explores the moderating effects of tax credit rating and tax burden on the impact of the CEO’s green experience on corporate green innovation. 3) This study also inspires CEOs to strengthen the study of green knowledge, guiding enterprises to control their tax level reasonably, which results in a Chinese example for other countries to develop corporate green innovation.

Scholars propose different definition of green innovation from different perspectives. Lai and Zhan (2021) define green innovation as green and technological innovation, which reflects the environmental responsibility of technological innovation. Additionally, Zhu et al. (2018) define green innovation as innovative and valuable innovation that can protect the environment and save resources, which includes three characteristics, namely, resource conservation, environment protection, and sustainable development. In addition to technology, process, and product innovation, Dai and Liu (2009) also propose system innovation, which refers to organizational innovation and management innovation of enterprises. Li (2015) and Sun et al. (2022) propose that green innovation would bring spillover externalities from which competitors and stakeholders would benefit. However, Rennings and Rammer (2011) believe that external policies are beneficial to promote corporate green innovation, which is beneficial to improve corporate performance, create a good atmosphere, and improve corporate competitiveness.

The existing research on systematic innovations about the connotation of green innovation mainly focuses on external factors and internal mechanisms. From the perspective of external factors, these include policies and market factors, for example, fintech can improve the green innovation performance of enterprises, and resource mismatching plays the role of a mediator in this process (Liu et al., 2022b); government subsidies, policy pressures, and external incentives can also encourage enterprises to conduct green innovation-related R&D (Tian and Pan, 2015; Chen et al., 2022). From the perspective of the internal mechanism of enterprises, the organizational strategies and green organizational identities will positively affect green innovation and thus enhance the green development (Wang et al., 2014; Yousaf et al., 2022). In terms of corporate strategy, Hart and Dowell (2011) point out five factors affecting corporate green innovation strategy. These are conventional green capabilities based on investments in products and production processes, employee participation and training for environmental issues, green organization capability across internal functions, formal environmental management systems and procedures, and strategic planning considering environmental issues, and these prove to have a positive impact on corporate green innovation. Scarpellini et al. (2020) state that green innovation may enhance environmental management capabilities and form an innovation circle.

In addition, scholars also conduct research studies from three perspectives: input, output, and efficiency of green innovation. In terms of green innovation input, Ghisetti and Rennings (2014) point out that green innovation can improve environmental performance, build a good image of enterprises, enhance the competitiveness of enterprises, and as an internal driving factor, influence enterprises to invest in the green innovation practice. Bucea-Manea-Tonis et al. (2021) claim that green innovation increases employee productivity and enhances corporate performance. The output of corporate green innovation can be measured by the green patent output, and venture capital has a positive impact on the green patent output of new energy enterprises (Qi et al., 2017). Furthermore, Tullani et al. (2018) state that green innovation increases consumer intention. In terms of the influencing factors of green innovation efficiency, Chen (2016) points out that the optimization of the technology level and property rights structure can improve the green total factor productivity. Liu et al. (2022a) and Zeng et al. (2022) point out that the heterogeneity of the intelligent background of an enterprise’s management team has positively influenced the green innovation practice of an enterprise. Self-regulation and green marketing will also impact the green capacity of the corporation (Demirel and Kesidou, 2019).

The CEO’s experience has been a hot topic for corporation research studies. Hambrick and Mason (1984) believe that CEOs can form different traits through their past education and work experiences, which to some extent affect their psychological structures such as attention tendency, cognitive ability, and values, and ultimately affect the corporate behavior, decision-making, and performance. For these reasons, CEO traits may be considered when mentioning innovation decisions as innovation is full of risks, is unpredictable, and requires continuous improvement (Holmstrom, 1989; Wang and Yu 2021). For the process of shaping a green experience, growing up with a mother and increasing outdoor time will help children to shape their environmental attitude as they will focus more on the nature value (Evans et al., 2018; DeVille et al., 2021). However, education matters, not the child’s attitude (Evans et al., 2018). After shaping their green attitude, CEOs who have environmentally conscious values would be more concerned about the nature and pay more attention to the demands of stakeholders on environmental issues (Wolf, 2014). Environmental protection values and green ecological experience will prompt CEOs to choose the decision plan consistent with their ecological values after weighing the feasibility of alternative plans (Zeng et al., 2022).

Scholars commonly research tax for macro and micro perspectives. From the macro perspective, taxation is believed to influence the national economic growth and has profoundly effective influence on the economy (Lee and Gordon, 2005; Baker et al., 2021). Higher tax rates may increase tax evasion, but they are effective in guaranteeing social insurance (Affes, 2020; Kindermann and Krueger, 2022) while decreasing tax rate is beneficial to enhance the macroeconomy, attracting more enterprises and gaining increasing outputs (Conefrey and Fitz Gerald, 2011; Shevlin et al., 2019). Furthermore, tax rates can be measured by tax administration; Basri et al. (2021) claim that improving tax administration is equal to raising the tax rate to eight percent. From the micro perspective, Guo et al. (2021) find that the percentage of decreasing sales resulting in tax deductions are less than the percentage of increasing sales resulting in tax enhancements, which proves that the tax expenditures are sticky. Furthermore, different from general cognition, low corporate tax rates have no relationship with foreign direct investments (Jensen, 2012). For individual characteristics, it is mentioned that tax morale declines when the incomes are higher (Grundmann and Graf Lambsdorff, 2017).

To sum up, when studying green innovation, it is found that scholars mainly focus on the factors affecting green innovation in the external aspects of external resource input, future development, environmental performance, scientific and technological progress, and employee productivity. For the internal perspective, the previous literature mainly focuses on the environmental management and corporate strategy, which refer to the macro level. However, when testing the green innovation of enterprises from the perspectives of input, output, and efficiency, the research from the perspective of investment in green innovation ignores the external financing factors and the capital of enterprises. The influence on managerial characteristics should not be ignored (Zhang and Shi, 2022) when studying green innovation. In addition to that, scholars rarely refer to the moderating effect of taxation on the impact of green innovation. This study uses the CEO’s green ecological experience, tax credit rating, and tax burden as variables to study the impact of the CEO’s green ecological experience on corporate green innovation and further analyzes the moderating effect of tax credit rating and tax burden.

CEOs with green ecological experiences are more accustomed to being close to nature. They sincerely care about nature and try to reduce the impact on the environment. From the perspective of the enterprise, the natural affinity of the CEO is conducive to improving the overall awareness of the enterprise to protect the environment. Moreover, it is conducive for the enterprise to respond to the global green policy and mainly focus on the green innovation R&D to improve the overall technical performance and ability of the enterprise, which will establish a superior social image and implement stakeholder interests.

Reducing tax rate provides working capital to guarantee that enterprises carry out green innovation as enterprises have high incentives to use tax savings for green innovation (He and Xiao, 2022). In addition, tax credit rating saves taxes and fees, improves corporate reputation, and creates a better financing environment for enterprises. It creates conditions for the increase in corporate working capital and encourages enterprises to carry out green innovation.

Based on the aforementioned discussion, this study argues that the green ecological experience of CEOs will affect the overall concern of the enterprises for the nature. Enterprises will be more motivated to invest more green innovation capital and reduce environmental pollution caused by the operation. In addition, since the tax credit rating reflects the standardization of the companies and the corporate tax burden reflects the costs of the enterprises, all these may directly or indirectly affect the impact of the CEOs on the green innovation of the enterprise. So, this study proposes the research framework shown in Figure 1.

Zhang and Shi (2022) define the academic experience as the experiences of working in relevant academic positions. Taking this methodology, green experience can be measured by participating in green and environment-related education. The relevant education is judged based on whether the education majors belong to the majors of pulp and paper making, environment, environmental engineering, and environmental science. According to the natural connection theory, CEOs with high-quality ecological environment experiences will establish a complete and strong nature connection by themselves and thus generate a strong sense of belonging to ecological nature and form values centered on the ecological environment (Evans et al., 2018). Therefore, they have a potential consciousness of environmental protection, stronger willingness and emotion for environmental protection, and a stronger motivation to preserve nature (Deville et al., 2021). According to Hambrick and Mason (1984), the characteristics of CEOs play a significant role in making corporate decisions and influencing corporate performance.

It is seen that the green ecological experience of the CEO is conducive for the enterprise to pay attention to the demands of its stakeholders, improving its sensitivity to policies related to sustainable development. In addition, it is significant for enterprises to pay attention to sustainable development issues and formulate corresponding corporate policies. The green ecological experience of the CEO will also impact the decision of the enterprise on green innovation and thus affect the management process. Furthermore, CEOs having green ecological experience will own the sense of natural belonging and tend to invest more green innovation R&D to protect the environment when making corporate decisions. Therefore, H1 is proposed in this paper.

H1. The CEO’s green ecological experience will positively affect the corporate green innovation.

Since 2014, the Chinese taxation department has been evaluating enterprises as “A, B, C, D” levels (with the addition of “M” in 2018), which is significant for the standardized tax collection process to improve the integrity of taxpayers. Tax credit rating is “flexible tax collection and administration” with “universality” and “softness” (Sun and Lei, 2019). The taxation department implements incentive rewards for “A-level” taxpayers, which is conducive to improving the credit of enterprises, thus easing the financing constraints of enterprises (Sun and Lei, 2019). From the perspective of tax compliance, “A-level” tax credit ratings are conducive to offset the tax burden raised by the tax compliance of enterprises, reducing the tax burden of enterprises (Guo, 2022). In addition, “A-level” taxpayers can significantly increase their R&D input by improving their financing capacity through tax incentives (Zhang, 2021). From the internal perspective of enterprises, tax credit ratings can effectively reduce the level of excessive cash holdings of enterprises, which are beneficial for corporate governance (Sun, 2022). Tax credit ratings may also promote enterprise innovation through marketing and management (Sun and Lei, 2019).

It is seen that tax credit ratings start from the standardization of the tax payment process, guarantee that enterprises benefit from the legal tax payment, and impact on improving the fluent capital. The specific impacts are as follows: from the perspective of enterprises, “A-level” enterprises have better social reputation, enjoy various channels, higher financing amount, and improve the fluent cash flow compared with “non-A-level” enterprises. Meanwhile, due to the “tax shield” effect, “A-level” enterprises can reduce their own tax burden (Sun et al., 2019; Zhang, 2021; Guo, 2022; Sun, 2022).

To conclude, tax credit ratings can improve the smooth cash flow by improving the standardization of the tax payment process and external financing to enable enterprises to invest funds in R&D. Then, CEOs with the green ecological experience may pay more attention to the overall impact of green innovation on enterprises and invest more funds in green innovation to meet the demands of environment-friendly enterprises. In view of these statements, this study proposes H2.

H2. Compared with “non-A-level” enterprises, “A-level” enterprises can positively moderate the effect of the CEO’s green ecological experience on the enterprise’s green innovation.

Tax burden is a factor considered in the production and operation of enterprises which will affect the green innovation input through the cash flow. For the national level, tax burden plays an “inverted U-shaped” role in Chinese economic growth (Lu and Li, 2019). For enterprises, Liu and Huang (2018) state that the increasing tax burden led to the marginal deviation of production factors from the optimal level of society. When ignoring the government transfer, the tax burden will have a “crowding-out effect” and inhibit the economic growth of enterprises (Xiao et al., 2021). Therefore, tax burden is crucial to measure the proportion of the working capital in the process of business operations.

Due to the adverse impact of high tax burden on enterprises, enterprises will take tax burden into consideration when making decisions related to green innovation. With the increase in tax burden, the relevant cash flow held by enterprises will decrease, and the capital pressure of enterprises will increase. As a consequence, the overall capital will not be guaranteed. Although CEOs with green ecological experience may focus primarily on the environment when making decisions related to environmental protection, they may transfer the focus to the development of main business and ignore R&D activities. Given these considerations, CEOs with green ecological experience may not spend excessive capital on R&D activities. In view of these, this study proposes H3:

H3. If ceteris paribus, the tax burden will reversely moderate the positive impact of the CEO’s green ecological experience on corporate green innovation.

The data in this study are mainly from the following three sources: 1) the information about tax credit ratings is from the official website of the Chinese taxation department (www.chinatax.gov.cn); 2) the relevant data about enterprise green innovation are from Chinese Research Data Service Platform (CNRDS); and 3) the financial data about enterprises are from the China Stock Market and Accounting Research database (CSMAR).

The tax credit rating policy was published in 2014 and listed “A-level” taxpayers in 2015. This study takes A-stock market enterprises from 2014 to 2020 as the research sample, referring to the methodology of Guo (2022) and Sun et al. (2019) and removes statistics according to the following steps to ensure the representativeness of the samples: 1) financial industry samples, 2) ST and ST* samples, 3) data missing samples, and 4) samples with the ratio of liability to asset greater than one and negative net assets. At the same time, all samples are processed with 1% and 99% winsorization to prevent the interference of the abnormal data. After processing, 20,585 data were obtained.

The commonly used indicators to measure the performance of green innovation are green total factor productivity ratio, the number of green patents granted, and the number of green patent applications (Chen et al., 2022; Zhang et al., 2022). This study adopts the methodology of Chen et al. (2022) and Zhang et al. (2022) and uses the number of green patent applications to measure green innovation. The specific reasons are as follows: first, the authorization of green patents needs to be reviewed by relevant departments and can only be identified as enterprise patents when meeting the conditions. Therefore, the number of authorized green patents to measure the innovation level of enterprises is delayed (Chen et al., 2022). Second, it is difficult to extract the green environmental protection data of enterprises, and there is a lack of data between consistent years (Zhang et al., 2022), so it is not suitable to adopt the green total factor productivity ratio. In addition, green patent application cannot be imitated and the application conditions are strict, so it can reflect the green innovation ability of enterprises. This study adopts the methodology of Zhang et al. (2022), using the number of green innovation patents applied by the companies in the current year in the database as the proxy variable of the green innovation capacity of the enterprise. Specifically, the number of green innovation patents applied = the number of green patents applied by the enterprise independently + the number of green patents applied by the enterprise jointly. After calculating that, one is added to the number, and the statistics are processed with the natural logarithm to the regression model.

Referring to Zhang and Shi (2022), this study focuses on a CEO who has studied a relevant green major to determine whether he/she has a green ecological environment experience. If a CEO has a green ecological environment experience, the value is 1; otherwise, it is 0.

Since the Chinese taxation department only discloses the “A-level tax” taxpayers, this study adopts the methodology of Guo (2022), which takes the tax credit rating as the explanatory variable and divides enterprises into two categories: “A-level” and “non-A-level.” If the tax credit rating is “A-level,” the value is 1; otherwise, it is 0.

This study adopts the methodology of Xiao et al. (2021) and Guo (2022) and uses the percentage of “tax paid by the enterprise/enterprise business income” to represent enterprise tax burden. In the equation, tax paid by the enterprise = business and additional tax + income tax expense.

The previous literature has proved that the characteristics of an enterprise can affect the choice of green innovation. Considering the timeliness of research studies, this study selects the control variables from the characteristic and nature of enterprises by referring to Chen et al. (2022), Zhang et al. (2022), Sun et al. (2022), and Guo (2022). For characteristics, this study selects the indicators of the company size (Size), ratio of liability to asset (LEV), and return on assets (ROA). As for the nature of the enterprise, this study selects the indicators of equity concentration (Cncon), proportion of independent directors (IDR), board size (Boardsize), and includes the property rights (ROE). The definitions are listed in Table 1.

Based on the aforementioned theoretical analysis and hypotheses, this study constructs the following three empirical models to test hypotheses H1, H2, and H3, respectively:

Table 2 shows the descriptive statistical results. It can be seen that the mean value of Greeninnovation of enterprises is 0.487 and the standard deviation is 0.890, indicating that there is little difference in the overall level of green innovation among companies. The mean credit rating (Treat) is 0.65, indicating that more than half of the sample is “A-level.” In addition, the minimum value of Burden is −0.0194, the maximum value is 0.228, and the average value is 0.0338, which means that the average tax burden of the company in the sample is about 3.4%, while the existence of negative tax burden indicates that there is tax retention or rebate. The average value of Greenexperience is 0.214, indicating that about 20% of the CEOs have a green ecological experience.

According to the Pearson correlation coefficient matrix, it can be found that green innovation is positively correlated with the CEO’s green ecological experience at the significance level of 1%, which preliminarily indicates that the CEO’s green ecological experience has a significant promoting effect on green innovation. However, green innovation is positively correlated with the tax credit rating and the CEO’s green ecological experience at the significance level of 1%. This preliminarily indicates that tax credit ratings have a significant positive effect on green innovation and green ecological experience, while tax burden and green innovation are negatively correlated at the significance level of 1%, indicating that tax burden has an adverse effect on green innovation. In addition, Size, LEV, Boardsize, and ROE of property rights are significantly positively correlated with Greeninnovation. It is worth mentioning that IDR, Cncon, and Greeninnovation have no statistical correlation between the proportion of independent directors and Greeninnovation. The relevant results are shown in Table 3.

As shown in Table 4, column (1) is the result without adding control variables, column (2) is the result after adding control variables without the fixed year effect, and column (3) is the result after adding control variables with the fixed year effect. It can be found that the regression coefficients of the CEO’s green ecological experience are 1.230, 1.200, and 1.196 successively, all of which are significant at the 1% significance level and the coefficients are positive. This shows that the CEO’s green ecological experience can positively impact the corporate green innovation. According to column (3), the regression coefficient of Greenexperience in the case of controlling years is 1.196, which indicates that CEOs with green ecological experience enhance 230.69% (e^1.196-1) % on green innovation. According to the comparison between column (1), (2), and (3), after adding control variables, the regression coefficient of the CEO’s green ecological experience is still relatively stable, which can verify the validity of H1.

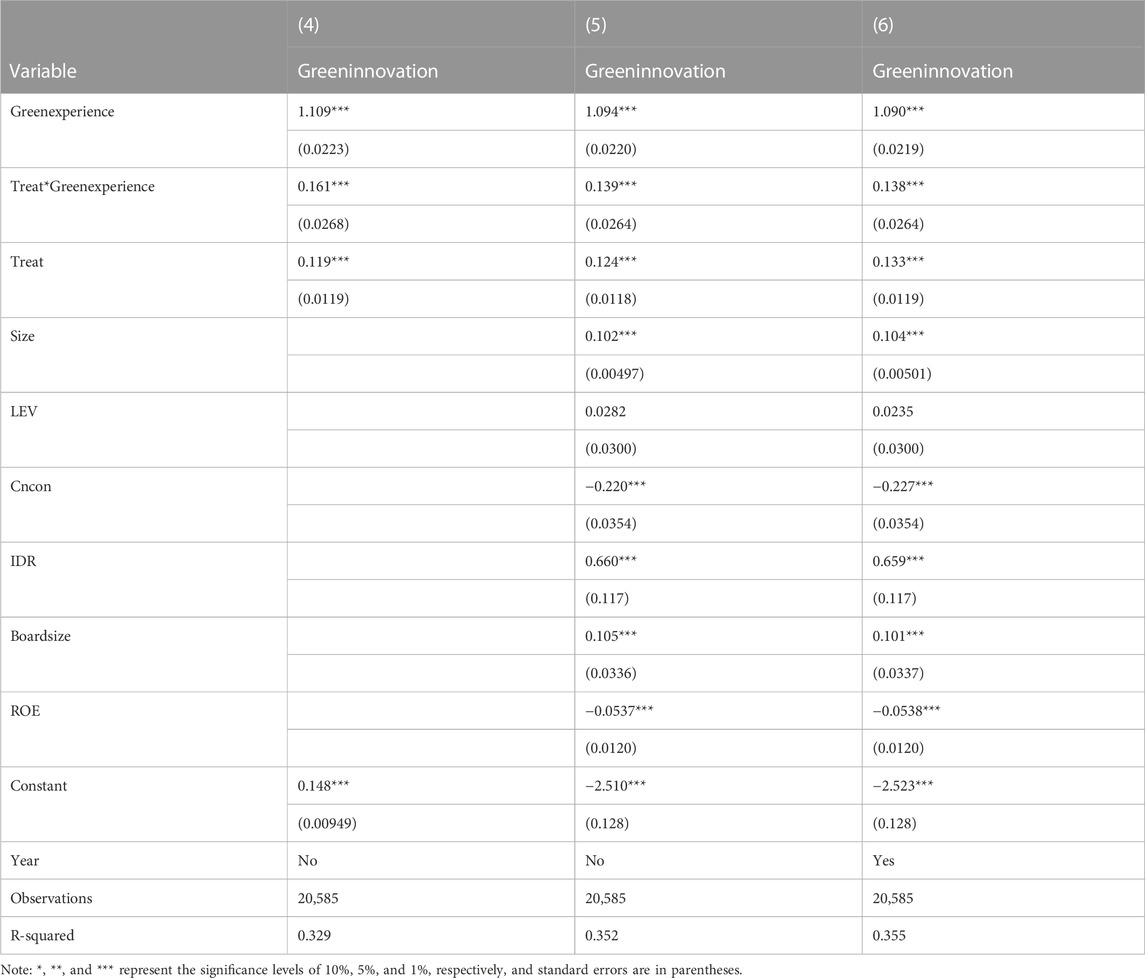

The regression results are shown in Table 5. Column (4) shows the moderating effect of the tax credit rating on the CEO’s green ecological experience and corporate green innovation without adding control variables, column (5) shows the results after adding control variables without the fixed year effect, and column (6) shows results after adding control variables with the fixed year effect. Regardless of whether control variables are added or fixed for the year effect, the regression coefficients of the CEO’s green ecological experience are positive and significant at the 1% significance level, and the coefficients of interaction terms are also positive and significant at the 1% significance level. It can be found that the coefficients of the interaction terms are 0.161, 0.139, and 0.138, respectively, indicating that when the tax credit rating of the enterprise is “A-level,” the tax credit rating of the enterprise will positively moderate the relationship between CEO’s green ecological experience and corporate green innovation. The reasons may be as follows: first, tax administration is emphasized by many developing countries (Baker et al., 2021), and tax credit rating is one of the evaluating criteria for enterprises to comply with the regulation. “A-level” enterprises show adaptability to restrictions and constraints, using their own tax self-inspection system to regulate the process and effectively respond for taxable preferential policies (Guo, 2022). For this reason, it can enjoy the tax return by the Chinese tax department. Second, based on the CEO’s improvement of corporate green innovation, “A-level” enterprises have comprehensive management mechanisms. By paying taxes on time, they have more standardized management mechanisms for using funds. The tax incentive and financing funds to “A-level” enterprises reduce the financial constraints and are conducive to the enterprise to invest sufficient capital into green innovation to achieve sustainable development (Guo, 2022; Wang et al., 2023a).

TABLE 5. Moderating effects of tax credit ratings on CEO’s green ecological experience and green innovation.

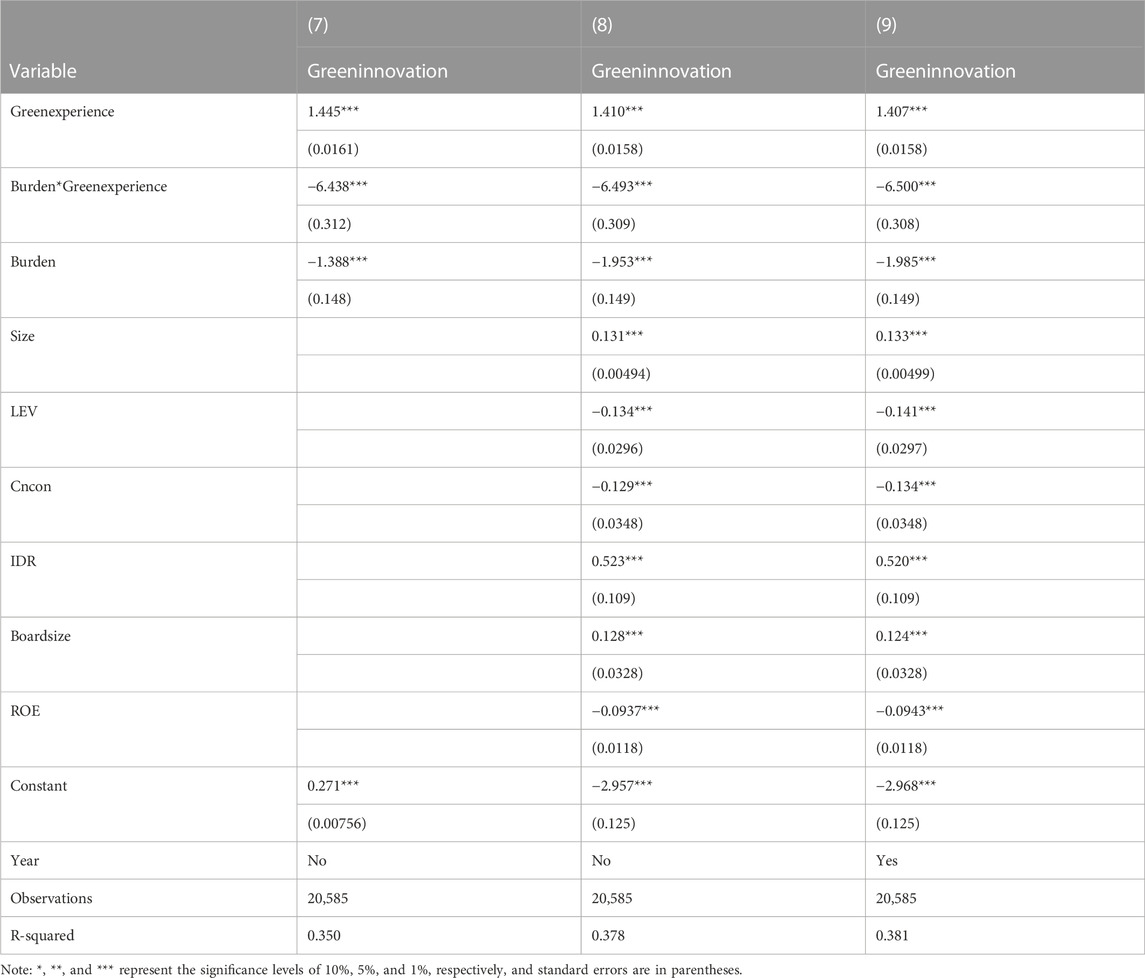

Regression results are shown in Table 6. Column (7) shows the moderating effect of tax burden on the CEO’s green ecological experience and corporate green innovation without adding control variables, column (8) shows the result after adding control variables without the fixed year effect, and column (9) shows the result after adding control variables with the fixed year effect. It is found that the coefficients of the CEO’s green ecological experience are 1.445, 1.410, and 1.407, respectively, and all are statistically significant at the 1% level. In addition, the coefficients of the interaction Burden*Greenexperience are −6.348, −6.493, and −6.500, respectively, which are all negative coefficients and are significant at the 1% significance level, indicating that tax burden negatively moderates the impacts of the CEO’s green ecological experience on the enterprise’s green innovation, which also verifies H3. For this reason, this study argues that first, innovation requires enterprises to dedicate abundant funds to support R&D continuously (Zeng et al., 2022). Tax burden inflicts financing pressure on the enterprises, which forces enterprises to consider economic benefits while ignoring the environmental conflicts caused by enterprises and thus ignoring the development of green innovation. Therefore, high tax burden will reversely moderate the impact of the CEO’s green ecological experience on green innovation. Furthermore, tax burden will influence the cash flow of the enterprises as the result revenue of green innovation cannot directly offset the dedication (Voegtlin and Scherer, 2017). Although the cash flow can be obtained through loaning, financing, and other means, it undoubtedly increases the burden of enterprises. Moreover, although CEOs with green ecological experience have closed natural connection and may have a long-term vision of protecting the environment, they may still insist on the development of the enterprise as it is related to their performances. Therefore, under high tax burden, they may neglect the future environmental benefits and thus neglect the green innovation due to the high uncertainty and complexity of green innovation (Wang and Yu, 2021).

TABLE 6. Moderating effects of tax burden on CEO’s green ecological experience and green innovation.

To verify the reliability of the aforementioned regression results, this study adopts the selection of subsamples and endogeneity tests to carry out the robustness test.

As the tax burden is one of the factors influencing enterprise green innovation, the macro tax burden of Chinese industries presents a distribution structure of “the middle stream stands the largest percentage, and the upstream and downstream industries take a relatively small proportion.” Based on the value chain theory, this study adopts the definition of the middle downstream industries of the value chain by Yao et al. (2022) and selects the upstream and downstream industries, respectively, according to different tax burden rates of the industries. The regression results are shown in Table 7.

It can be found that the coefficients of the CEO’s green ecological experience in columns (10), (11), (12), and (13) are 1.091, 1.087, 1.393, and 1.389, respectively, all of which are significant at the significance level of 1%. This indicates that H1 is robust. In addition, the interaction term Treat*Greenexperience coefficient in the following results is also significant at the significance level of 1%, and the coefficient is positive regardless of the fixed year effect, which also proves H2. Similarly, the coefficient of Burden*Greenexperience is negative, which is significant at the significance level of 1%. This indicates that H3 is a robust result.

To solve the endogeneity problem caused by missing variables, this study adopts the fixed individual control effect to test the endogeneity. The regression results are shown in Table 8. Columns (15) and (17) used the fixed individual and year effect, while columns (14) and (16) used the fixed individual effect. In the four scenarios, the positive impact of the CEO’s green ecological experience on green innovation is significant at the significance level of 1%, the interaction coefficient between the tax credit rating and CEO’s green ecological experience is positive, and it is significant at the 10% significance level, while the interaction term between tax burden and CEO’s green ecological experience is negative and significant at the 1% significance level, which indicates that there is no endogeneity problem caused by missing variables, and the result is still robust.

This study uses SYS-GMM method proposed by Blundell and Bond (1998) to verify the results. Table 9 shows the SYS-GMM regression results. It is seen that the p-value of AR (1) in columns (18) and (19) are both below 0.1. The p-value of AR (2) is above 0.1, which means the disturbance terms are not correlated. Additionally, the p-values of Hansen test columns (18) and (19) are all above 0.1 and below 0.25. For this analysis, the results are valid. In column (19), Burden*Greenexperience is significant at the significance level of 1%. In column (18), Treat is significant at the level of 5%. Treat*Greenexperience and Burden are significant at the significance level of 10%. According to the regression results, it is seen as robust.

This study takes the A-stock market enterprise from 2014 to 2020 as the research sample. From the perspective of green innovation, it explores whether the CEO’s green ecological experience can positively affect green innovation and explores the moderating effect of tax credit rating and tax burden. The results show that the CEO’s green ecological experience can improve corporate green innovation. The reason may be that the leadership characteristics of the CEO and the stronger affinity for nature lead enterprises to be more inclined to take measures to protect the environment (Hambrick and Mason, 1984; Evans et al., 2018; Deville et al., 2021). In addition, the “A-level” enterprises have high allowance and enjoy tax incentives to invest more in scientific research funds for corporate green innovation through effective financing means and reducing the cost of the corporate working capital (Sun and Lei, 2019; Guo, 2022; Sun, 2022). Because of that, tax credit ratings can positively moderate the relationship between the CEO’s green ecological experience and green innovation. This result is put forward based on the fact that the tax credit rating is beneficial to corporate social reputation, enterprises’ financing level, and cash-holding level (Sun and Lei, 2019; Guo, 2022). Furthermore, tax burden may reversely moderate the relationship between CEO’s green ecological experience and green innovation. The reason is that tax burden causes financial restraints for enterprises as the revenue may be received in the long-term and cannot be directly return (Voegtlin and Scherer, 2017; Wang et al., 2023a). Due to the high complexity of green innovation, enterprises may take the green innovation decision into account seriously (Wang and Yu, 2021).

The implications of this study for the government and enterprises are as follows.

First of all, when the enterprises need to innovate the corresponding national green policies and global guidelines, CEOs with green ecological experience will create the affinity for the environment through the influence of CEOs on employees and implement long-term strategies to achieve sustainable development and improve the corporate image. Furthermore, enterprises should strengthen the awareness of green development, create a culture of environmental protection, and enhance the sense of closeness between employees and nature to achieve long-term and sustainable development of enterprises. Furthermore, enterprises should be fully aware of the role of taxes during the corporate operation. In the process of tax payment, enterprises should pay corporate tax in accordance with the formal procedures on time and in sufficient quantity to get an “A-level” tax credit rating so that they can improve their reputation and gain more external financing. By taking these actions, enterprises can invest more funds in green innovation to correspond to the national green policies, strengthen the corporate image globally, meet the global requirement, and achieve green and high-efficiency development. Additionally, CEOs with the ecological experience should effectively manage the process of tax payment. This is to increase the tax credit rating level and control a moderate tax burden for the enterprise. As the tax credit rating level rises and the tax burden is controlled, the enterprise enjoys more tax incentive and is willing to devote more funds for future R&D voluntarily. This will improve the corporate image and corporate social responsibility. Finally, the government needs to maintain a reasonable tax rate. On one hand, a reasonable tax burden rate is a sufficient condition for enterprises to maintain a high working capital. On the other hand, a reasonable tax burden rate is conducive to the long-term development of enterprises and conducive for enterprises to voluntarily undertake tax obligations. In addition, the government can increase the reward for green innovation patents and vigorously support enterprises to carry out green innovation while maintaining a reasonable tax burden rate, which provides incentives for enterprises and helps them use surplus funds for green innovation. Moreover, the government should carry out education and publicity on environmental protection so that enterprises can realize the benefits of green innovation and actively carry out R&D.

The limitations of this study are as follows: 1) corporate green innovation is composed of many aspects. This study uses the applied green patents as indicators, but it does not include all dimensions of green innovation, so it may need to be measured comprehensively. In the future, more comprehensive indicators can be used to measure green innovation. 2) This study only focuses on Chinese samples and fails to explore the developed countries and emerging entities; further research studies may be taken to test if the conclusions are suitable for those areas.

The data analyzed in this study are subject to the following licenses/restrictions: Data will be availability on requirement. Requests to access these datasets should be directed to cGhpbGlwdzMxNzhAMTYzLmNvbQ==.

All authors contributed to the study conception and design. Material preparation, data collection, and analysis were performed by YL, LW, and SL. The first draft of the manuscript was written by YL, and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript. More specific contribution details are as follows: YL: validation, resources, software, data curation, writing—original draft, formal analysis, review and editing, and visualization. LW: conceptualization, methodology, supervision, project administration, and writing—review and editing. SL: writing—review and editing, investigation, and visualization. VB: critical review, conceptualization, manuscript revisions, and language improvement.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Affes, W. (2020). The impact of tax rates on tax evasion: A macroeconomic study. Account. Manag. Inf. Syst. 19 (2), 252–282. doi:10.24818/jamis.2020.02003

Baker, S. R., Johnson, S. R., and Kueng, L. (2021). Shopping for lower sales tax rates. Am. Econ. J. Macroecon. 13 (3), 209–250. doi:10.1257/mac.20190026

Basri, M. C., Felix, M., Hanna, R., and Olken, B. A. (2021). Tax administration versus tax rates: Evidence from corporate taxation in Indonesia. Am. Econ. Rev. 111 (12), 3827–3871. doi:10.1257/aer.20201237

Blundell, R., and Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. J. Econ. 87 (1), 115–143. doi:10.1016/S0304-4076(98)00009-8

Bucea-Manea-Tonis, R., Prokop, V., Ilic, D., Gurgu, E., Bucea-Manea-Tonis, R., Braicu, C., et al. (2021). The relationship between eco-innovation and smart working as support for sustainable management. Sustain. (Basel, Switz.) 13 (3), 1437. doi:10.3390/su13031437

Chen, C. (2016). China’s industrial green total factor productivity and its determinants-an empirical study based on ML index and dynamic panel data model. Stat. Res. 33 (03), 53–62. doi:10.19343/j.cnki.11-1302/c.2016.03.007

Chen, L., Zhang, L., and Wang, H. (2022). Research on the influence of government subsidies on green innovation of new energy enterprises. Friends Account. 11, 150–157. doi:10.3969/j.issn.1004-5937.2022.11.022

Conefrey, T., and Fitz Gerald, J. D. (2011). The macro-economic impact of changing the rate of corporation tax. Econ. Model. 28 (3), 991–999. doi:10.1016/j.econmod.2010.11.009

Dai, H., and Liu, X. (2009). Some comments on research of environmental innovation. Stud. Sci. Sci. 27 (11), 1601–1610. doi:10.16192/j.cnki.1003-2053.2009.11.020

Demirel, P., and Kesidou, E. (2019). Sustainability-oriented capabilities for eco-innovation: Meeting the regulatory, technology, and market demands. Bus. Strategy Environ. 28 (5), 847–857. doi:10.1002/bse.2286

DeVille, N. V., Tomasso, L. P., Stoddard, O. P., Wilt, G. E., Horton, T. H., Wolf, K. L., et al. (2021). Time spent in nature is associated with increased pro-environmental attitudes and behaviors. Int. J. Environ. Res. Public Health 18 (14), 7498. doi:10.3390/ijerph18147498

Evans, G. W., Otto, S., and Kaiser, F. G. (2018). Childhood origins of young adult environmental behavior. Psychol. Sci. 29 (5), 679–687. doi:10.1177/0956797617741894

Ghisetti, C., and Rennings, K. (2014). Environmental innovations and profitability: How does it pay to be green? An empirical analysis on the German innovation survey. J. Clean. Prod. 75, 106–117. doi:10.1016/j.jclepro.2014.03.097

Grundmann, S., and Graf Lambsdorff, J. (2017). How income and tax rates provoke cheating – an experimental investigation of tax morale. J. Econ. Psychol. 63, 27–42. doi:10.1016/j.joep.2017.10.003

Guo, F., Gan, S., Yang, W., and Kuang, P. (2021). Are sales and taxes “sticky”? Empirical evidence of the impact of tax enforcement on tax revenue growth in China. Appl. Econ. Lett. 28 (8), 663–667. doi:10.1080/13504851.2020.1770675

Guo, L. (2022). The impact of tax credit rating on corporate tax burden. J. Zhongnan Univ. Econ. Law 01, 86–97. doi:10.19639/j.cnki.issn1003-5230.2022.0011

Hambrick, D. C., and Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 9 (2), 193–206. doi:10.5465/amr.1984.4277628

Hart, S. L., and Dowell, G. (2011). Invited editorial: A natural-resource-based view of the firm. J. Manag. 37 (5), 1464–1479. doi:10.1177/0149206310390219

He, H., and Xiao, L. M. (2022). Tax reduction and fee reduction, green innovation and high-quality development -- based on the research of Chinese manufacturing enterprises. Fujian Trib. 02, 86–98.

Holmstrom, B. (1989). Agency costs and innovation. J. Econ. Behav. Organ. 12, 305–327. doi:10.1016/0167-2681(89)90025-5

Jensen, N. M. (2012). Fiscal policy and the firm: Do low corporate tax rates attract multinational corporations? Comp. Polit. Stud. 45 (8), 1004–1026. doi:10.1177/0010414011428594

Kindermann, F., and Krueger, D. (2022). High marginal tax rates on the top 1 percent? Lessons from a life-cycle model with idiosyncratic income risk. Am. Econ. J. Macroecon. 14 (2), 319–366. doi:10.1257/mac.20150170

Lai, X., and Zhan, W. (2021). The connotation and influencing factors of green technology innovation. Sci. Technol. Industry 21 (10), 320–327. doi:10.3969/j.issn.1671-1807.2021.10.054

Lee, Y., and Gordon, R. H. (2005). Tax structure and economic growth. J. Public Econ. 89 (5–6), 1027–1043. doi:10.1016/j.jpubeco.2004.07.002

Li, X. (2015). Analysis and outlook of the related researches on green innovation. R&D Manag. 27 (02), 1–11. doi:10.13581/j.cnki.rdm.2015.02.001

Liu, J., Liu, Y., and Liu, S. (2022a). The impact of functional background heterogeneity of senior management team on green innovation. J. Nat. Sci. Hunan Normal Univ. 12, 164. doi:10.3390/bs12060164

Liu, J., Zhang, C., and Tian, W. (2022b). Fintech, resource mismatch and urban green innovation. J. Finance Econ. 06, 68–78. doi:10.19622/j.cnki.cn36-1005/f.2022.06.008

Liu, Q., and Huang, J. (2018). How does firm taxation influence the resource allocation efficiency? World Econ. 41 (01), 78–100. doi:10.19985/j.cnki.cassjwe.2018.01.005

Lu, Q., and Li, Z. (2019). The “inverted U-shaped” curve relationship between the macro tax burden rate and economic growth: Based on the theoretical analysis and empirical research of the supply-side structural reform. J. Guangxi Univ. Finance Econ. 32 (01), 13–35.

Qi, S., Zhang, Q., and Wang, B. (2017). Market-oriented incentives to the innovation of new energy companies-evidence from venture capital and companies’ patents. China Ind. Econ. 12, 95–112. doi:10.19581/j.cnki.ciejournal.20171214.009

Quan, X., Ke, Y., Qian, Y., and Zhang, Y. (2023). CEO foreign experience and green innovation: Evidence from China. J. Bus. Ethics 182 (2), 535–557. doi:10.1007/s10551-021-04977-z

Ren, X., Li, J., He, F., and Lucey, B. (2023a). Impact of climate policy uncertainty on traditional energy and green markets: Evidence from time-varying granger tests. Renew. Sustain. Energy Rev. 173, 113058. doi:10.1016/j.rser.2022.113058

Ren, X., Liu, Z., Jin, C., and Lin, R. (2023c). Oil price uncertainty and enterprise total factor productivity: Evidence from China. Int. Rev. Econ. Finance 83, 201–218. doi:10.1016/j.iref.2022.08.024

Ren, X., Zeng, G., and Gozgor, G. (2023b). How does digital finance affect industrial structure upgrading? Evidence from Chinese prefecture-level cities. J. Environ. Manag. 330, 117125. doi:10.1016/j.jenvman.2022.117125

Rennings, K., and Rammer, C. (2011). The impact of regulation-driven environmental innovation on innovation success and firm performance. Industry Innovation 18 (3), 255–283. doi:10.1080/13662716.2011.561027

Scarpellini, S., Valero-Gil, J., Moneva, J. M., and Andreaus, M. (2020). Environmental management capabilities for a “circular eco-innovation. Bus. Strategy Environ. 29 (5), 1850–1864. doi:10.1002/bse.2472

Shevlin, T., Shivakumar, L., and Urcan, O. (2019). Macroeconomic effects of corporate tax policy. J. Account. Econ. 68 (1), 101233. doi:10.1016/j.jacceco.2019.03.004

Sun, H., and Lei, G. (2019). The impact of tax-paying credit rating system on of enterprises technological innovation. Public Finance Res. 12, 87–101. doi:10.19477/j.cnki.11-1077/f.2019.12.008

Sun, R. (2022). Tax credit rating mechanism and level of excess cash holdings. Mark. Manag. Rev. 01, 151–153. doi:10.19932/j.cnki.22-1256/F.2022.01.151

Sun, X., Xiao, S., Ren, X., and Xu, B. (2023). Time-varying impact of information and communication technology on carbon emissions. Energy Econ. 118, 106492. doi:10.1016/j.eneco.2022.106492

Sun, X., Zhai, S., and Yu, S. (2019). Can flexible tax enforcement ease corporate financing constraints-evidence from a natural experiment on tax-paying credit rating disclosure. China Ind. Econ. 03, 81–99. doi:10.19581/j.cnki.ciejournal.2019.03.015

Sun, Y., Yu, H., and Sun, L. (2022). External financing and enterprise green technology innovation: Based on signaling effect of government subsidies. J. Shandong Univ. Finance Econ. (04), 101–110. doi:10.3969/j.issn.1008-2670.2022.04.010

Tian, H., and Pan, C. (2015). Study on the impact of corporate environmental ethics on green innovation performance. J. Xi 'an Jiaot. Univ. Soc. Sci. 35 (03), 32–39. doi:10.15896/j.xjtuskxb.201503005

Tullani, H., Saha, R., and Dahiya, R. (2018). Green innovation and ethical responsibility: Do they improve customer’s green purchase intentions? Int. J. Sustain. Entrepreneursh. Corp. Soc. Responsib. 3 (1), 35–52. doi:10.4018/IJSECSR.2018010103

Voegtlin, C., and Scherer, A. G. (2017). Responsible innovation and the innovation of responsibility: Governing sustainable development in a globalized world. IDEAS Work. Pap. Ser. RePEc 143 (2), 227–243. doi:10.1007/s10551-015-2769-z

Walls, J. L., and Hoffman, A. J. (2013). Exceptional boards: Environmental experience and positive deviance from institutional norms. J. Organ. Behav. 34 (2), 253–271. doi:10.1002/job.1813

Wang, C., Chen, P., Hao, Y., and Dagestani, A. A. (2023a). Tax incentives and green innovation—the mediating role of financing constraints and the moderating role of subsidies. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.1067534

Wang, X., Li, J., Ren, X., Bu, R., and Jawadi, F. (2023b). Economic policy uncertainty and dynamic correlations in energy markets: Assessment and solutions. Energy Econ. 117, 106475. doi:10.1016/j.eneco.2022.106475

Wang, X., Qin, S., and Wang, K. (2014). The exploration of corporate green technology innovation drive green development. J. Tech. Econ. Manag. (08), 26–29. doi:10.3969/j.issn.1004-292X.2014.08.006

Wang, Y., and Yu, L. (2021). Can the current environmental tax rate promote green technology innovation? evidence from China’s resource-based industries. J. Clean. Prod. 278, 123443. doi:10.1016/j.jclepro.2020.123443

Wang, Z., Fu, H., and Ren, X. (2022). The impact of political connections on firm pollution: New evidence based on heterogeneous environmental regulation. Petroleum Sci. In press. doi:10.1016/j.petsci.2022.10.019

Wolf, J. (2014). The relationship between sustainable supply chain management, stakeholder pressure and corporate sustainability performance. J. Bus. Ethics 119 (3), 317–328. doi:10.1007/s10551-012-1603-0

Xiao, Z., Zheng, G., and Cai, G. (2021). Tax burden of enterprise, investment squeezing and economic growth. Account. Res. 06, 19–29. doi:10.3969/j.issn.1003-2886.2021.06.002

Yousaf, Z., Radulescu, M., Sinisi, C., Nassani, A. A., and Haffar, M. (2022). How do firms achieve green innovation? Investigating the influential factors among the energy sector. Energies (Basel) 15 (7), 2549. doi:10.3390/en15072549

Zeng, C., Luo, M., and He, X. (2022). On executives’ high-quality ecological environment experience and corporate green innovation. J. Guangdong Univ. Finance Econ. 37 (03), 82–97.

Zhang, N., Sun, J., and Wu, C. (2022). The impact of internal control on green innovation of environmental protection enterprises. Commer. Account. 01, 55–58. doi:10.3969/j.issn.1002-5812.2022.01.014

Zhang, S., and Shi, H. (2022). CEO's academic experience and firms' green technological innovation. Sci. Technol. Manag. Res. 42 (03), 135–144. doi:10.3969/j.issn.1000-7695.2022.3.017

Zhang, Y. (2021). Can ratepaying integrity promote firms’ R&D investment Evidence from the disclosure of China’s listed companies’ rate paying credit rating. J. Shanxi Univ. Finance Econ. 43 (09), 70–85. doi:10.13781/j.cnki.1007-9556.2021.09.006

Keywords: capital market, green innovation, CEO’s green ecology experience, tax credit rating, tax burden

Citation: Wang L, Li Y, Lu S and Boasson V (2023) The impact of the CEO’s green ecological experience on corporate green innovation—The moderating effect of corporate tax credit rating and tax burden. Front. Environ. Sci. 11:1126692. doi: 10.3389/fenvs.2023.1126692

Received: 18 December 2022; Accepted: 26 January 2023;

Published: 13 February 2023.

Edited by:

Xiaohang Ren, Central South University, ChinaCopyright © 2023 Wang, Li, Lu and Boasson. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lixia Wang, cGhpbGlwdzMxNzhAMTYzLmNvbQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.