- 1School of Finance and Taxation, Xinjiang University of Finance and Economics, Urumqi, China

- 2Doctoral School of Entrepreneurship and Business, Budapest Business School, Budapest, Hungary

- 3Graduate School of Management of Technology, Pukyong National University, Busan, Republic of Korea

- 4College of Tropical Crops, Yunnan Agricultural University, Puer, China

Based on the data of explicit debt and implicit debt of local governments in China from 2012 to 2020, this paper theoretically analyzes and empirically tests the spatial correlation effect of fiscal decentralization and intergovernmental competition on local government debt risk. It’s found that local government debt risk has obvious inertia effect in time and positive spatial correlation effect in space, and local fiscal spending decentralization and intergovernmental competition have a significant positive impact on the local government debt risk, as well as a positive spatial spillover effect. The research of this paper has very important policy implications for perfecting China’s decentralization system, standardizing the competition among governments, and preventing and defusing local government debt risks.

1 Introduction

At present, China’s economy is in a period of deceleration, and most of China’s local government finances are in a state of slow growth or even deterioration due to the impact of unexpected events such as the Sino-US trade war and the COVID-19 epidemic. In 2020, China’s local government revenue grew by 0.93% compared with the same period last year, the lowest growth rate since 2001. The average annual growth rate of local fiscal revenue from 2001 to 2020 is 14.72%, of which the average annual growth rates of local fiscal revenue in the eastern, central, western and northeastern regions are 17.25%, 15.57%, 16.20% and 9.85%, respectively. There are 14 provinces with negative local revenue growth in 2020, namely Hubei, Tianjin, Heilongjiang, Xinjiang, Beijing, Guangxi, Jilin, Shanxi, Chongqing, Shanghai, Shaanxi, Ningxia, Tibet, and Inner Mongolia. In order to mitigate the impact of the COVID-19 epidemic and the impact of the trade war, Chinese local governments have increased the scale of bond issuance to stabilize economic growth expectations. For example, in 2020 Chinese local governments issued 6.44 trillion bonds, up 47.71 per cent from a year earlier. On the one hand, fiscal revenue declines and the ability to repay debt declines, on the other hand, local governments increase the scale of bond issuance to stabilize growth and further increase the potential debt service burden in the future, which will further increase the debt risk of local governments.

The 1994 Budget Law states that “local governments shall not issue local government bonds”. The new Budget Law adopted in 2014 stipulates that “part of the funds necessary for construction investment in the budget may be raised by issuing local government bonds within the limits determined by the State Council,” establishing the legal status of local governments to issue debt on their own. Since the financial crisis in 2008, in order to hedge against economic downside risks, local governments in China have raised a large amount of debt through public bond issuance or local government financing platforms, which is an important cause of the current debt risk. Although China’s local government debt has played an important role in promoting local economic development, with the rapid expansion of China’s local government debt, the risk of local government debt in China has gradually increased and will cause immeasurable harm to the national economy. Therefore, clarifying the scale of local government debt, the causes of its formation, its mechanism of action and its impact is an important research topic facing the academia at present, which has important theoretical and practical significance for proposing countermeasures to resolve local debt risks and maintaining stable financial and macroeconomic development. Therefore, this paper attempts to find out the cause, mechanism and influence of local government debt risk.

The possible marginal contribution of this paper lies in: firstly, the risk of local government debt in China is discussed within the framework of fiscal decentralization and competitive behavior among local governments, and the mechanism of the role of fiscal decentralization and intergovernmental competition in affecting local government debt risk is theoretically analyzed by distilling three key institutional factors of fiscal revenue competition, fiscal expenditure competition, and investment competition among local governments in China. Secondly, by establishing a dynamic spatial panel model and a spatial autoregressive model of heterogeneity coefficients, an empirical analysis of the spatial impact effects of fiscal decentralization and intergovernmental competition on local government debt risk is conducted to provide a reference basis for future decisions to prevent and resolve local government debt risk by adjusting the vertical central and local fiscal relationship and the horizontal competition between local governments.

This paper finds that decentralization of local fiscal expenditure and intergovernmental competition in the province have promoted the risk of government debt, fiscal expenditure decentralization and intergovernmental competition between local and neighboring provinces have spatial positive correlation with local government debt risk. Based on the above empirical findings, this paper argues that the regulation of local government explicit and implicit debts should be strengthened from the goal of reducing local government debt risk, improving the fiscal management system that matches the authority and expenditure responsibilities between the central and local governments, and regulating the competitive behavior among local governments to cope with the new changes in stabilizing growth and preventing risks.

The rest of this paper is organized as follows. Section 2 analyses the influence mechanism of fiscal decentralization and intergovernmental competition on local government debt risk and proposes the research hypotheses. Section 3 sets up the econometric model and explains indicator selection and the data sources. Section 4 focuses on the impact of inter-governmental competition on local government debt risk under decentralization based on the estimation results of the model. Finally, Section 5 summarizes the full text and puts forward corresponding policy suggestions.

2 Theoretical analysis and research hypotheses

2.1 Fiscal decentralization and local government debt risk

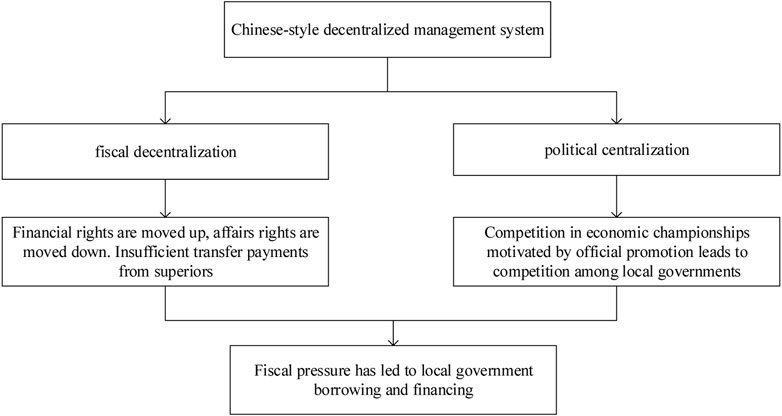

This paper maps the mechanism of action around the relationship between fiscal decentralization, intergovernmental competition and local government debt risk, as shown in Figure 1.

The traditional fiscal federation theory represented by Tiebout (1956), Buchanan, 1960 and Oates, 1969 proposes that because the local government understands the preferences of the residents in the area better than the central government, decentralization can ensure that the local government can provide public goods more efficiently than the central government. Qian and Weingast (1997) believe that because government officials pursue the maximization of their political interests, the higher the degree of fiscal decentralization of local governments, the stronger the motivation of local government officials to expand government investment through debt financing to achieve their own interests. Fiscal decentralization consists primarily of devolving revenue sources and expenditure functions to lower tiers of government. By bringing the government closer to the people, fiscal decentralization is expected to boost public sector efficiency, as well as accountability and transparency in service delivery and policy-making (DE Mello, 2000).

Whether in developed countries, developing countries, or countries in transition, fiscal decentralization is accompanied by political federalism. However, China deduces fiscal federalism under the vertical political management system, and the core connotation of Chinese decentralization is the close combination of economic decentralization and vertical political management system (Blanchard & Shleifer, 2001; Jin et al., 2005). Under the pressure of promotion of officials caused by political centralization and the pressure of local economic development caused by fiscal decentralization, the local government faces a huge financial gap so that the local government has to break through the government budget restrictions by borrowing directly and indirectly (Neyapti, 2010).

In 1994, China’s tax-sharing reform divided the income between the central and local governments, and the financial power was concentrated in the central government. However, there is little change between the central and local governments in the division of affairs and expenditures, and local governments still have a great responsibility for expenditures, thus resulting in a mismatch between affairs and financial powers and financial constraints on local governments (Pradhan, 2002). Fiscal vertical imbalance is not conducive to the sustainability of local public finance, while the comprehensive impact of transfer payment on fiscal sustainability is positive (Li and Du, 2021). Overall, local government revenues have declined while fiscal expenditure responsibilities have expanded, thus putting local governments under tremendous fiscal expenditure pressure (DE Mello, 2000). As a result, the mismatch between affairs and financial powers has forced local governments to borrow to make up for the shortfall in revenue and expenditure.

Hypothesis 1. Local fiscal expenditure decentralization has a driving effect on local government debt risk, and fiscal expenditure decentralization in one region can produce positive spatial spillover effect on local government debt risk in spatially adjacent or economically similar regions.

2.2 Intergovernmental competition and local government debt risk

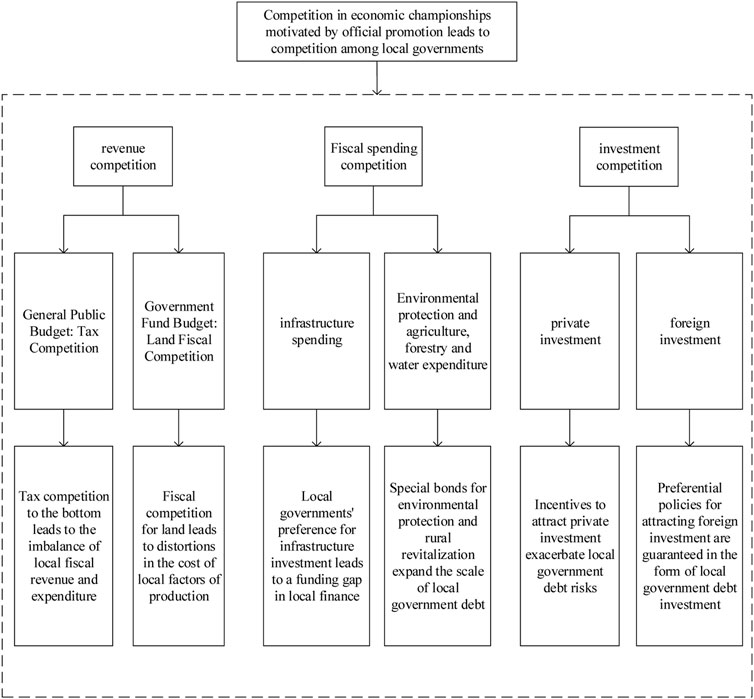

This paper maps the mechanism of action around the relationship between intergovernmental competition and local government debt risk, as shown in Figure 2.

FIGURE 2. The mechanism of the role of inter-governmental competition on local government debt risk.

Breton (1998) introduced the concept of competitive government, arguing that competition between local governments and the central government, and between local governments and local governments using taxation, healthcare, education, pensions, and environmental policies to attract mobility factors such as labor and capital to the region and thus enhance their competitiveness will facilitate the effective provision of local public goods. The excessive performance competition among Chinese local governments directly leads to the distortion of the allocation of land, taxation and other factors. China’s local governments have pushed up the risk of local government debt by competing for over-investment in infrastructure (Guo, 2009).

In terms of local government revenue competition, local governments tend to drive regional economic growth through tax competition and land finance competition. Tax bottom-to-bottom competition is a competitive tool used by local governments to attract investment, but if local governments rely excessively on attracting investment through tax incentives, it will lead to an imbalance in regional fiscal balance and eventually local governments will have to raise debt (Ihori and Yang, 2009; Borck et al., 2015; Kopczewska et al., 2016). Fiscal decentralization results in stronger intergovernmental competition and lower tax rates (Crowley and Sobel, 2011). There are two paths of land finance competition among local governments: first, local governments offer residential and commercial land at high prices to obtain high governmental fund revenues, thereby increasing local government revenues; second, local governments offer industrial land at low prices to attract corporate investment, thereby increasing the level of regional industrialization (Qun et al., 2015). Under fiscal decentralization and economic target assessment, local governments choose to balance payment by remising more land, which will result in an increase in the land remise scale and price (Hong et al., 2016).

In terms of fiscal spending competition, under the GDP-oriented performance appraisal system, local government officials prefer to invest funds in productive construction projects such as infrastructure construction and municipal works, so as to achieve the purpose of rapidly improving the economic development level of their jurisdictions in the short term (Bird and Tassonyi, 2001). The behavior of local governments in expanding economic construction expenditures has a significant “herd effect” among local governments. This investment preference of local governments leads to a shortage of funds, and ultimately, local governments have to rely on debt borrowing.

In terms of investment competition, local governments to attract private investment, foreign direct investment (FDI) in loans and other aspects of the implementation of a series of preferential investment initiatives, and these preferential policies to local governments to raise debt investment in the form of pre-security (Pan et al., 2017; Lv et al., 2020).

Hypothesis 2. Competition for fiscal revenue, competition for fiscal expenditure, and competition for investment among local governments in the region have a driving effect on local government debt risk, and competition for fiscal revenue, competition for fiscal expenditure, and competition for investment in one region can produce positive spatial spillover effect on local government debt risk in spatially adjacent or economically similar regions.

3 Empirical strategy

3.1 Model setting

3.1.1 Dynamic panel model

Local government debt risk is a dynamic process, and the current local government debt risk is not only influenced by the current bond issuance but may also be related to debt factors in past periods. In order to reduce the endogeneity problem of the econometric model and scientifically analyze the dynamic effects of fiscal decentralization and intergovernmental competition on local government debt risk, we consider adding the lagged term of local government debt risk as an instrumental variable and revise the econometric model to a dynamic panel model with a one-period lag.

In formula (1), the effects of fiscal decentralization (

3.1.2 Dynamic spatial durbin model

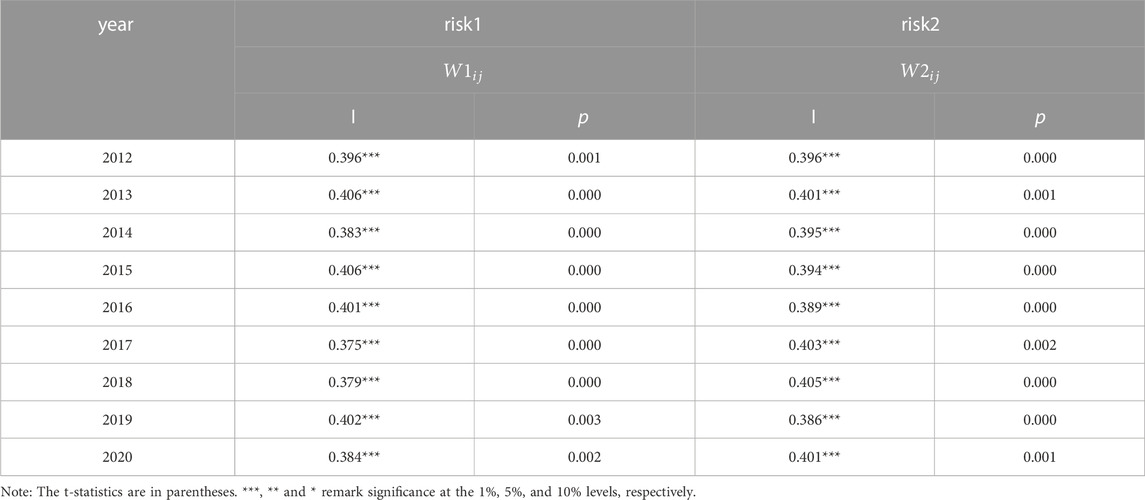

Under the current fiscal decentralization system arrangement, local governments are bound to consider the responses and possible implementation strategies of neighboring regions when formulating fiscal revenue and expenditure policies as a reference for their own fiscal implementation activities. In this paper, the global spatial Moran’s I index is used to determine the spatial correlation of local government debt risk during the observation period. The global spatial Moran’s I index is mainly used to examine whether the distribution of the entire spatial sequence

In formula (2):

This paper draws on LeSage and Pace (2009) and Elhorst (2014) to develop a dynamic spatial Durbin model (SDM) for estimating (Allers and Elhorst, 2005; Elhorst and Fréret, 2009; Lee and Yu, 2010; Coll and Toneva, 2019). In formula (5),

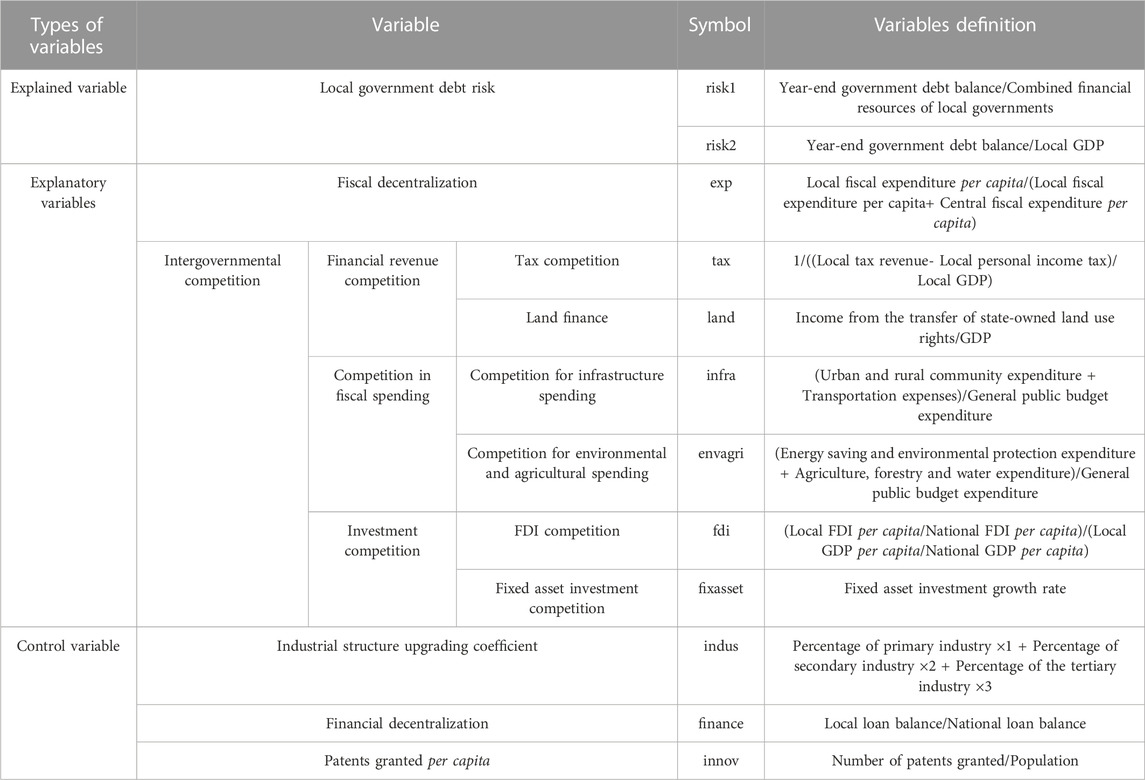

3.2 Variable selection

At present, the conventional international debt risk measure is the debt ratio (

3.3 Data sources

In this paper, balanced panel data of a total of 270 observations from 30 provinces (Tibet, Hong Kong, Macau and Taiwan are not included) from 2012 to 2020 are selected as the study sample. The main reason for choosing 2012 as the starting year is that in 2012, the Audit Office organized a comprehensive audit of governmental debts by the national auditing agencies, from which we obtained local government debt data, ensuring continuous and uniform caliber of local government debt data. The indicator data in this paper are mainly obtained from the China Statistical Yearbook, China Financial Yearbook, China Population and Employment Statistical Yearbook, China Regional Economic Statistical Yearbook, financial account reports, statistical yearbooks and statistical bulletins of each local government for the relevant years from 2012 to 2020. In addition, this paper deflates the value volume indicator using the price index with 2012 as the base period to avoid the possible effects of price fluctuations on the empirical results. Among them, the FDI data is obtained by converting the exchange rate into RMB in the current year and then deflating it using the fixed asset investment price index, and the exchange rate median data is obtained from the website of the State Administration of Foreign Exchange. The data of local-government financial vehicles (LGFVs) bonds are obtained from the Wind database.

4 Empirical results

4.1 Results for the dynamic panel models

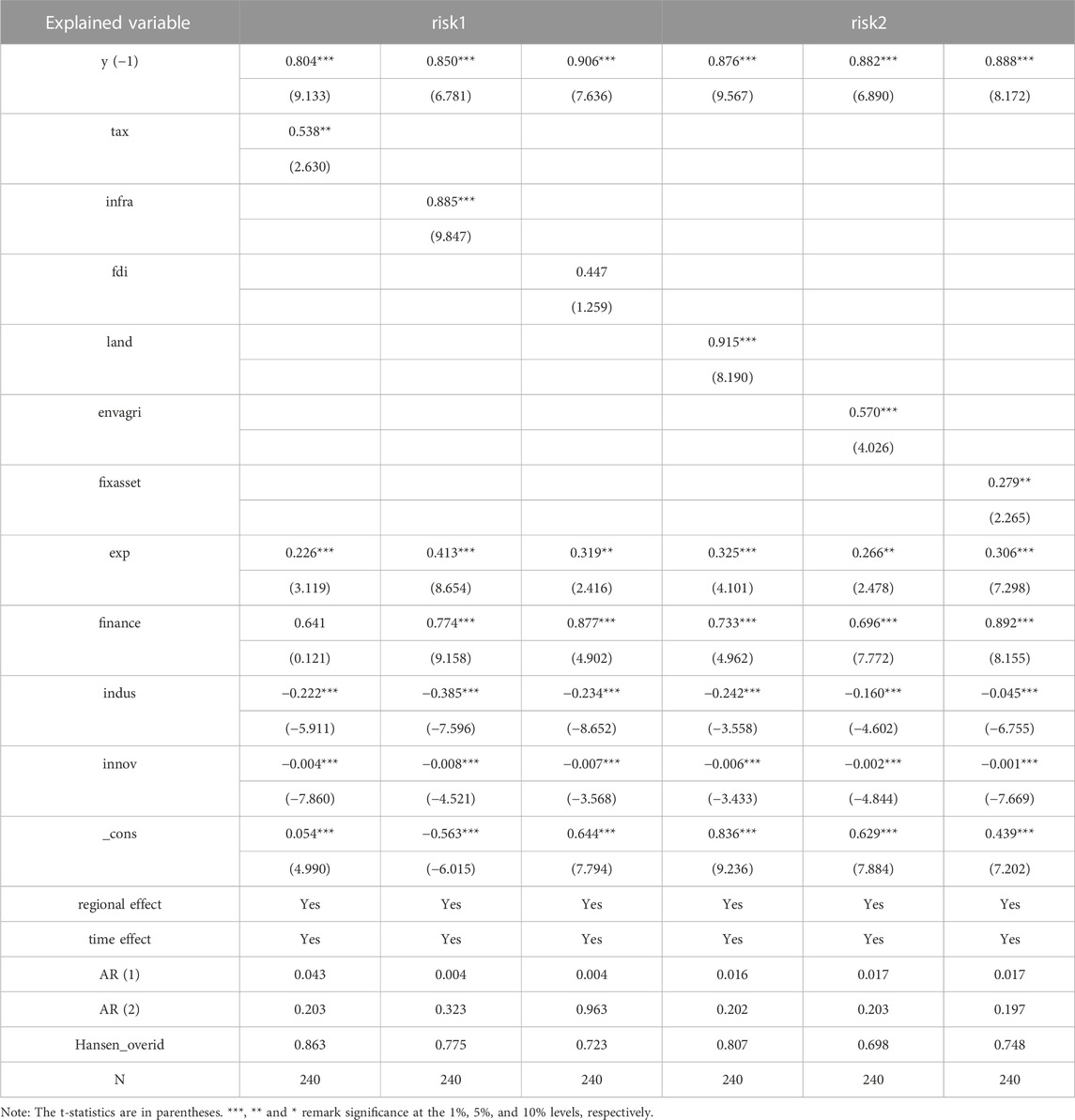

In this paper, the lagged t-2 periods of the explanatory variables are used as instrumental variables, and the two-stage systematic generalized moments estimation regression results show that there is significant first-order serial correlation and no second-order serial correlation in the residual terms of the model, and the Hansen over-identification test indicates that the instrumental variables selection and lagged 2 periods are appropriate and there is no over-identification problem. The coefficient of the lagged term of local government debt risk under the regression model estimation in Table 2 is significant at the 1% level, indicating that the inclusion of the lagged term of the explanatory variables in the model is essential and there is a significant lagged effect of local government debt risk.

The dynamic panel model estimation results indicate that fiscal decentralization, tax competition, land finance competition, infrastructure construction expenditure competition, environmental protection, agriculture, forestry and water expenditure competition, and fixed asset investment competition have significant driving effects on local government debt risk. The effects of industrial structure and the level of independent innovation on local government debt risk are significantly negative and both pass the 1% significance test, indicating that the more developed the tertiary industry and the level of independent innovation are, the lower the risk of local government debt. The effect of financial decentralization on local government debt risk shows a significant positive effect, indicating that the higher the financial decentralization, the higher the risk of local government debt in the region.

4.2 Results for the spatial SDM panel models

4.2.1 Spatial correlation test

Based on the establishment of the economic distance weight matrix and according to the formula of Moran’s I, this paper measures the Moran’s I index value of local government debt risk level from 2012 to 2020, as shown in Table 3. According to Table 3, it can be seen that the Moran’s I indexes in the observation period are positive and pass the 1% significance level test, indicating that the local government debt risk shows a significant spatial correlation trend in the two spatial weight matrices set. Therefore, the spatial effects of fiscal decentralization and intergovernmental competition on local government debt risk should be emphasized when constructing the model in order to improve the credibility and accuracy of the parameter estimation results.

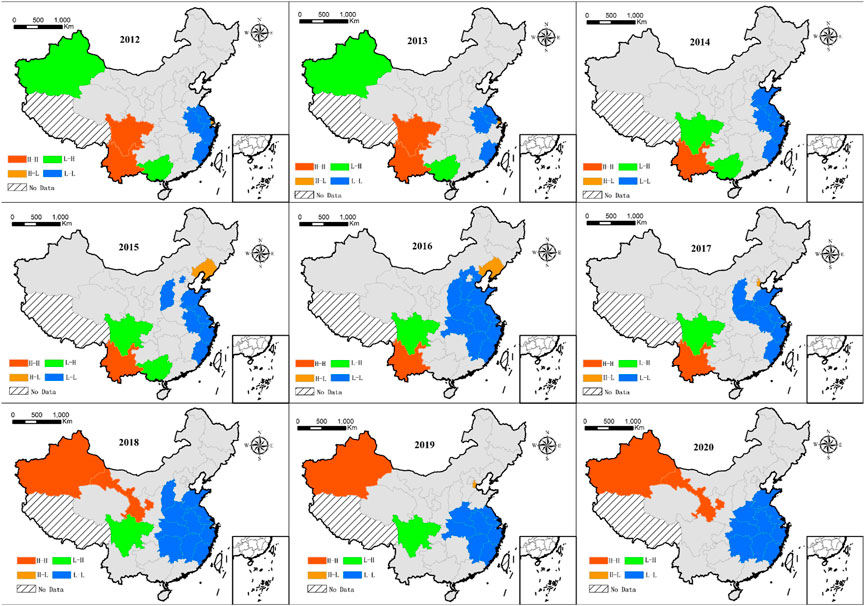

In Figure 3, Local Indicator of Spatial Autocorrelation (LISA) maps of risk1 under the

4.2.2 The test of model

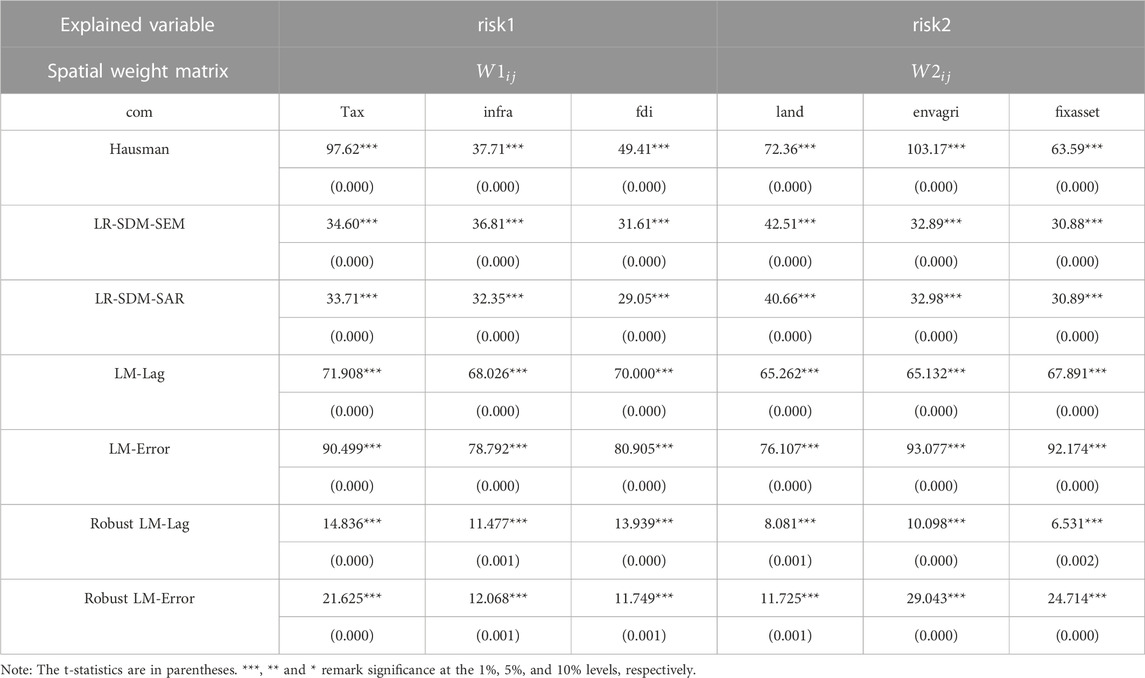

As shown in Table 4, firstly, the results of LR spatial lag test under two weight matrices show that SDM refuses to degenerate into SLM or SEM. Therefore, the SDM employed in this paper is robust. Secondly, the LM-lag, robust LM-lag, LM-error and robust LM-error are significant at the level of 1%, which indicates that the spatial econometric model should be chosen for empirical research. Thirdly, the results of Hausman test reject the null hypothesis at the 1% significance level, so it was decided to build a fixed-effects model. Finally, based on the above analysis and testing, it was determined to construct a spatial Durbin model with fixed effects.

4.2.3 Analysis of spatial effect

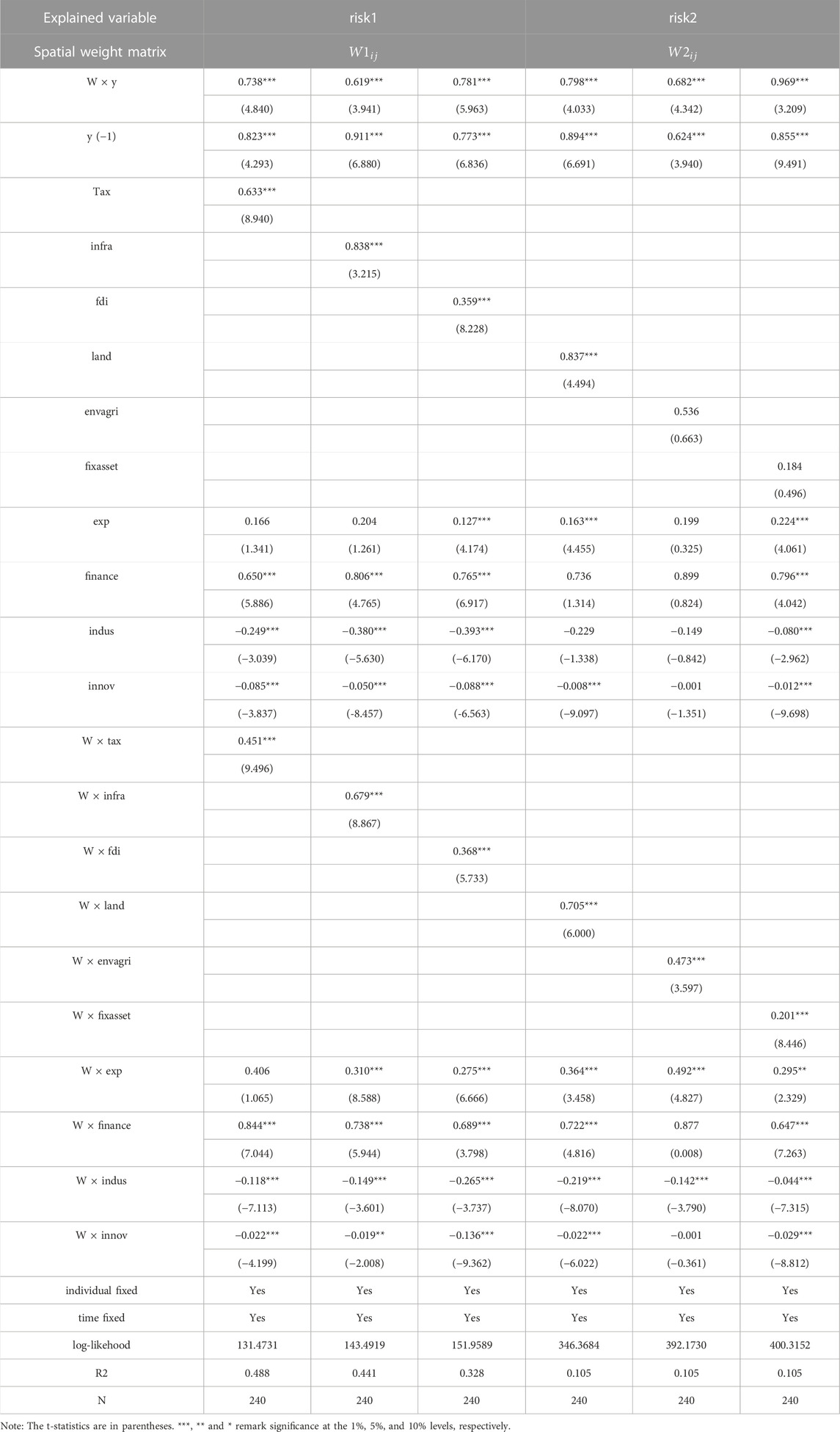

This paper focuses on the estimation results of the dynamic SDM with a fixed effect where the explanatory variable is risk1 and the spatial weight matrix is a first-order inverse distance matrix. As seen in Table 5, in general, the effect of the same factor on local government debt risk is generally consistent across the spatial weight matrix estimation results. The parameter estimates of the lagged period of local government debt risk in the dynamic SDM are all significantly positive, indicating that there is a significant inertia effect of local government debt risk in time, and local government debt risk in the previous period has an isotropic effect on local government debt risk in the current period. The parameter estimates of the spatial lag term of local government debt risk in each model are significantly positive, indicating that there is a positive spatial correlation effect of local government debt risk in space, a large number of regions with higher local government debt risk are also bound to cluster around the regions with higher local government debt risk, and the debt raising behavior of local governments is imitative and competitive. There is a spillover effect of debt risk in neighboring regions, the higher the risk of government debt in this region will affect the higher risk of local government debt in neighboring regions.

The coefficient of fiscal spending decentralization on local government debt risk is significantly positive, which means that fiscal spending decentralization has a significant driving effect on local government debt risk. The coefficients of intergovernmental competition on local government debt risk in tax competition, land finance competition, expenditure competition, and investment competition are all significantly positive, i.e., intergovernmental competition shows a significant contribution to local government debt risk through fiscal revenue competition, fiscal expenditure competition, and investment competition. Industrial structure and autonomous innovation show a significant negative effect on local government debt risk, and financial decentralization shows a significant positive effect on local government debt risk.

4.2.4 Decomposition of spatial spillover effect

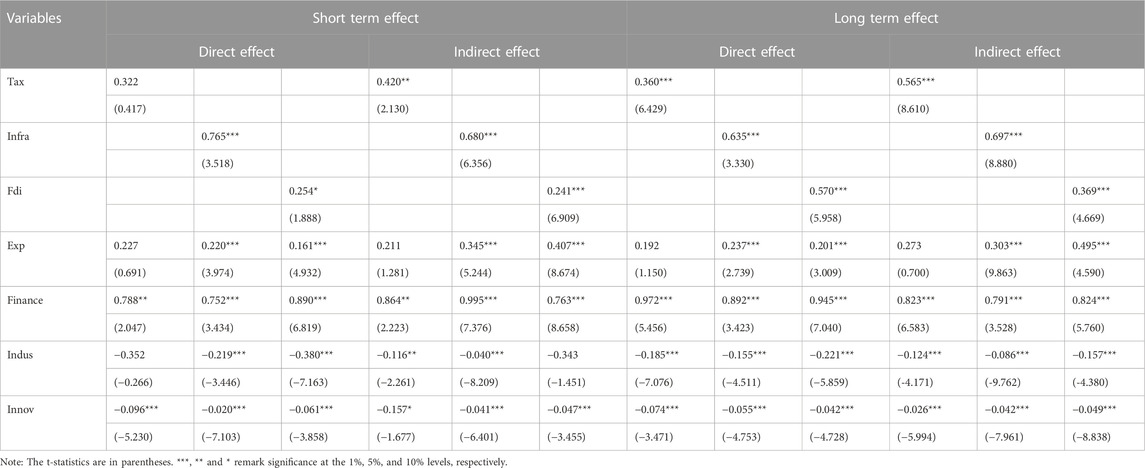

Since the spatial econometric model contains spatial lagged terms of the explanatory variables and explained variables, the total effect of an explanatory variable on the explained variable is not equal to the magnitude of its coefficient, so the spatial spillover effect cannot be directly judged as significant or not based on the significance of the coefficient of the spatial econometric model. LeSage and Pace (2009) analyze the effects of changes in explanatory variables through a partial differential approach and classify these effects into direct, indirect, and total effects. The direct effect indicates the magnitude of the effect of the independent variable in a region on that dependent variable, and the direct effect is equal to the sum of the spatial Durbin model coefficient and the feedback effect. Indirect effects, also known as spatial spillover effects, are used to measure the effect of an explanatory variable in a neighboring region on the explanatory variable in the region. This paper further measures the direct and indirect effects of fiscal decentralization and intergovernmental competition on local government debt risk based on the point estimates of the dynamic spatial Durbin model in Table 5. Table 6 reports the results of short- and long-term direct and indirect effect estimates for the explained variable of risk1, spatial weight matrix of first-order inverse distance matrix, and dynamic SDM with fixed effects.

Both the direct and indirect effects of fiscal spending decentralization on local government debt risk are significantly positive, indicating that there is a positive spatial correlation between inter-regional fiscal spending on local government debt risk, and this homogeneous competitive relationship leads to a significant imitation effect of government spending behavior between regions. The results obtained in this paper are consistent with the results of the Ouyang and Li (2021) empirical evidence. Ouyang and Li (2021) examine the effects of fiscal decentralization on the default risk of Chinese local government debts based on data from both urban construction investment bonds and local government bonds, find that fiscal expenditure decentralization tends to increases the default risk of local government debts. Both the direct and indirect effects of tax competition on local government debt risk are significantly positive, indicating that inter-regional tax competition exhibits a significant positive spatial correlation. Local governments adopt tax incentives to attract enterprises to invest locally on a priority basis, but tax competition has led to a growing gap between local government revenues and expenditures, pushing up the risk of local government debt. Both the direct and indirect effects of land finance on local government debt risk are significantly positive, indicating that there is a significant positive spatial correlation between inter-regional land finance competition on local government debt risk. With high land prices and strong land collateral capacity, local governments have a strong impulse to raise debt. The rise in local land prices will also be transmitted to neighboring areas, and the risk of local government debt in neighboring areas will further expand. The direct and indirect effects of infrastructure construction and environmental, agriculture, forestry and water conservancy expenditures on local government debt risk are both significantly positive, indicating that infrastructure construction and environmental, agriculture, forestry and water expenditures exhibit significant positive spatial correlation effects. Both the direct and indirect effects of FDI competition and fixed asset investment competition on local government debt risk are positive, indicating that investment competition exhibits a significant positive spatial correlation effect on local government debt risk. The results obtained in this paper are in agreement with the findings of the Qu et al. (2022). Qu et al. (2022) find that investment-driven economic growth has led to a surge in local government debt in the past decade, with GDP growth falling behind its competitors, a local government tends to issue debt more aggressively.

The direct and indirect effects of financial decentralization on local government debt risk are both positive, indicating that financial decentralization shows a significant positive spatial correlation effect on local government debt risk. The local-government financial vehicles (LGFVs) are more likely to obtain loans from local financial institutions than private enterprises, thus increasing the risk of local government debt. If the local-government financial vehicles (LGFVs) in the region raises more debt, the local-government financial vehicles (LGFVs) in neighboring regions will also compete for credit support from banks and other financial institutions, leading to the local financial decentralization showing a driving effect on government debt risk in neighboring regions. The vertical fiscal imbalance caused by fiscal decentralization is not conducive to the rationalization and advancement of industrial structure (Lin and Zhou 2021). Both the direct and indirect effects of industrial structure on local government debt risk are negative, indicating that industrial structure exhibits a significant negative correlation effect in space. The upgrading of local industrial structure will promote economic development and reduce the risk of local government debt, and the upgrading of local industrial structure will lead to the simultaneous up-grading of industrial structure in the surrounding areas, thus reducing the risk of government debt in the surrounding areas. Government debt reduces firms’ R&D expenditures and lowers firms’ number of new patents. One plausible explanation is that government debt raises firms’ capital costs, which limits innovation activities (Fan et al., 2022). Both the direct and indirect effects of innovation on local government debt risk are significantly negative, indicating that innovation exhibits a significant negative spatial correlation effect on local government debt risk. Enhancing innovation in the region makes local economic development more de-pendent on technological innovation rather than government investment, and innovation will reduce the risk of local government debt in the region.

5 Conclusion

Strengthening local government debt management in China is of great significance to prevent and resolve the financial crisis and stabilize the sustainable and healthy development of the local economy. This paper explains the influence mechanism of fiscal decentralization and intergovernmental competition on local government debt risk from three aspects: fiscal revenue competition, fiscal expenditure competition, and investment competition, and on this basis, using local government debt data from 2012 to 2020, we empirically test the spatial correlation effect of fiscal decentralization and intergovernmental competition on local government debt risk. This paper finds that, firstly, there is an obvious inertia effect of local government debt risk in time, and the local government debt risk in the previous period has an isotropic effect on the local government debt risk in the current period; there is a positive spatial correlation effect of local government debt risk in space, and the local government debt raising behavior is imitative and competitive. Secondly, local fiscal spending decentralization and intergovernmental competition have a significant positive impact on the local government debt risk, as well as a positive spatial spillover effect. Thirdly, financial decentralization has a significant positive impact on the local government debt risk, as well as a positive spatial spillover effect; industrial structure upgrading and science and technology innovation have a significant negative impact on the local government debt risk, as well as a negative spatial spillover effect. According to the above conclusions, this paper puts forward the following three policy implications.

First, for local government debt risk prevention, we should pay attention not only to the total amount and risk of immediate debt, but also to long-term potential risks. Strengthen the information disclosure and rating system of local government bonds, and play the role of supervision of local government bond issuance and use by market players. Replacement of local government stock bonds with excessively high interest rates and raising of additional bonds in accordance with market-based principles. Improve the efficiency of debt use, so that debt funds are really used on the “cutting edge”. Develop green bonds, expand the scale of green bonds, and play the application of green bonds in green transportation, green agriculture, pollution prevention and control, etc. Accelerate the transformation and upgrading of local financing platforms, break the rigid payment of urban investment bonds, and improve the market-based debt default disposal mechanism.

Second, optimize the central general transfer payments and special transfer payments in the distribution system between regions to maintain a balanced regional development. Optimize the tax sharing mechanism and reduce the dependence of localities on central transfer payments. In terms of local expenditure on people’s livelihood, the use of funds directly from the central government has been steadily increased.

Third, the local government is not simply a competitive zero-sum game relationship, but a competitive win-win relationship. In terms of fiscal revenue competition, local governments should moderately implement policies to reduce taxes and fees, both to ensure the vitality of enterprises and to prevent fiscal risks. In terms of fiscal spending competition, local governments should strengthen their support for new infrastructure construction, science and technology, and education.

Fourth, local governments should achieve differentiated competition in the industrial structure between regions, extending upstream and downstream in the industrial chain to form a vertical complementary co-development, to avoid homogeneous competition caused by horizontal competition in industrial structure. Rationalize the allocation of financial resources among regions and strengthen the supervision of non-standard financing business of local government financing vehicles (LGFVs).

This study performs a preliminary exploration into the impact of fiscal decentralization and intergovernmental competition on the local government debt risk, but much remains to be known. First, this study adopts macro data at the provincial level, which are admittedly too rough. Because the degrees of fiscal decentralization, intergovernmental competition and government debt risk in different cities in the same province are obviously heterogeneous, future research can use city-level data to carry out further detailed research from a more microscopic perspective. Second, because of the data limitations, the time span chosen in this study is from 2012 to 2020, and the latest local government debt risk cannot be analyzed. In future research, we will seek breakthroughs in these aspects.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

XH: Conceptualization, methodology, formal analysis, software, funding acquisition and writing—original draft. SB: Writing—original draft, supervision, software, writing—review and editing. YY: Investigation, data curation, writing—original draft and conclusion modification.

Funding

This work was supported by Xinjiang University of Finance and Economics 2022 University-level postgraduate research innovation projects (XJUFE 2022B10).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Allers, M. A., and Elhorst, J. P. (2005). Tax mimicking and yardstick competition among local governments in The Netherlands. Int. tax public finance 12 (4), 493–513. doi:10.1007/s10797-005-1500-x

Bird, R. M., and Tassonyi, A. T. (2001). Constraints on provincial and municipal borrowing in Canada: Markets, rules, and norms. Can. Public Adm. 44 (1), 84–109. doi:10.1111/j.1754-7121.2001.tb02045.x

Blanchard, O., and Shleifer, A. (2001). Federalism with and without political centralization: China versus Russia. IMF staff Pap. 48 (1), 171–179.

Borck, R., Fossen, F. M., Freier, R., and Martin, T. (2015). Race to the debt trap?—spatial econometric evidence on debt in German municipalities. Regional Sci. Urban Econ. 53, 20–37. doi:10.1016/j.regsciurbeco.2015.04.003

Breton, A. (1998). Competitive governments: An economic theory of politics and public finance. Cambridge: Cambridge University Press.

Coll, M. T. B., and Toneva, M. I. (2019). The importance of spatial effects in municipal debt: La importancia de los efectos espaciales en la deuda municipal. Rev. Contabilidad-Spanish Accounting Review 22 (1), 61–72. doi:10.6018/rc-sar.22.1.354311

Crowley, G. R., and Sobel, R. S. (2011). Does fiscal decentralization constrain leviathan? New evidence from local property tax competition. Public Choice 149 (1), 5–30. doi:10.1007/s11127-011-9826-7

De Mello, L. R. (2000). Fiscal decentralization and intergovernmental fiscal relations: A cross-country analysis. World Dev. 28 (2), 365–380. doi:10.1016/s0305-750x(99)00123-0

Elhorst, J. P., and Fréret, S. (2009). Evidence of political yardstick competition in France using a two-regime spatial Durbin model with fixed effects. J. Regional Sci. 49 (5), 931–951. doi:10.1111/j.1467-9787.2009.00613.x

Elhorst, J. P. (2014). Spatial econometrics from cross-sectional data to spatial panels. Berlin, Germany: Springer.

Fan, J., Liu, Y., Zhang, Q., and Zhao, P. (2022). Does government debt impede firm innovation? Evidence from the rise of LGFVs in China. J. Bank. Finance 138, 106475. doi:10.1016/j.jbankfin.2022.106475

Guo, G. (2009). China's local political budget cycles. Am. J. Political Sci. 53 (3), 621–632. doi:10.1111/j.1540-5907.2009.00390.x

Hong, Z., Yi, Z., and Tiantian, C. (2016). Land remise income and remise price during China’s transitional period from the perspective of fiscal decentralization and economic assessment. Land Use Policy 50, 293–300. doi:10.1016/j.landusepol.2015.10.008

Ihori, T., and Yang, C. C. (2009). Interregional tax competition and intraregional political competition: The optimal provision of public goods under representative democracy. J. Urban Econ. 66 (3), 210–217. doi:10.1016/j.jue.2009.08.001

Jin, H., Qian, Y., and Weingast, B. R. (2005). Regional decentralization and fiscal incentives: Federalism, Chinese style. J. public Econ. 89 (9-10), 1719–1742. doi:10.1016/j.jpubeco.2004.11.008

Kopczewska, K., Kudła, J., Walczyk, K., Kruszewski, R., and Kocia, A. (2016). Spillover effects of taxes on government debt: A spatial panel approach. Policy Stud. 37 (3), 274–293. doi:10.1080/01442872.2016.1146246

Lee, L. F., and Yu, J. (2010). A spatial dynamic panel data model with both time and individual fixed effects. Econ. Theory 26 (2), 564–597. doi:10.1017/s0266466609100099

LeSage, J., and Pace, R. K. (2009). Introduction to spatial econometrics. Boca Raton, Fla: Chapman and Hall/CRC.

Li, T., and Du, T. (2021). Vertical fiscal imbalance, transfer payments, and fiscal sustainability of local governments in China. Int. Rev. Econ. Finance 74, 392–404. doi:10.1016/j.iref.2021.03.019

Lin, B., and Zhou, Y. (2021). How does vertical fiscal imbalance affect the upgrading of industrial structure? Empirical evidence from China. Technological Forecasting and Social Change 170, 120886.

Lv, B., Liu, Y., and Li, Y. (2020). Fiscal incentives, competition, and investment in China. China Econ. Rev. 59, 101371. doi:10.1016/j.chieco.2019.101371

Neyapti, B. (2010). Fiscal decentralization and deficits: International evidence. Eur. J. political Econ. 26 (2), 155–166. doi:10.1016/j.ejpoleco.2010.01.001

Oates, W. E. (1969). The effects of property taxes and local public spending on property values: An empirical study of tax capitalization and the Tiebout hypothesis. J. political Econ. 77 (6), 957–971. doi:10.1086/259584

Ouyang, A. Y., and Li, R. (2021). Fiscal decentralization and the default risk of Chinese local government debts. Contemp. Econ. Policy 39 (3), 641–667. doi:10.1111/coep.12531

Pan, F., Zhang, F., Zhu, S., and Wójcik, D. (2017). Developing by borrowing? Inter-jurisdictional competition, land finance and local debt accumulation in China. Urban Stud. 54 (4), 897–916. doi:10.1177/0042098015624838

Pradhan, H. K. (2002). Local government finance and bond market financing: India. Jamshedpur, India: Xavier Labour Relations Institute.

Qian, Y., and Weingast, B. R. (1997). Federalism as a commitment to preserving market incentives. J. Econ. Perspect. 11 (4), 83–92. doi:10.1257/jep.11.4.83

Qu, X., Xu, Z., Yu, J., and Zhu, J. (2022). Understanding local government debt in China: A regional competition perspective. Regional Sci. Urban Econ. 98, 103859. doi:10.1016/j.regsciurbeco.2022.103859

Qun, W., Yongle, L., and Siqi, Y. (2015). The incentives of China's urban land finance. Land Use Policy 42, 432–442. doi:10.1016/j.landusepol.2014.08.015

Keywords: local government debt risk, fiscal decentralization, intergovernmental competition, spatial effect, dynamic spatial durbin model

Citation: Huo X, Bi S and Yin Y (2023) The impact of fiscal decentralization and intergovernmental competition on the local government debt risk: Evidence from China. Front. Environ. Sci. 11:1103822. doi: 10.3389/fenvs.2023.1103822

Received: 22 November 2022; Accepted: 13 January 2023;

Published: 01 February 2023.

Edited by:

Zeeshan Khan, Curtin University Sarawak, MalaysiaReviewed by:

Salman Wahab, Qingdao University, ChinaMuhammad Tufail, Xi’an Jiaotong University, China

Copyright © 2023 Huo, Bi and Yin. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yushi Yin, eWlueXVzaGk3QGdtYWlsLmNvbQ==; Xuling Huo, eHVsaW5naHVvQDE2My5jb20=

Xuling Huo

Xuling Huo Shulei Bi2

Shulei Bi2