95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 10 February 2023

Sec. Environmental Economics and Management

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1103394

This article is part of the Research Topic Corporate Environmental Management, Climate Change and Sustainable Development View all 21 articles

Yuyang Zhang1

Yuyang Zhang1 Liping Dong2*

Liping Dong2*Foreign experience is a mechanism through which personal cognitions can be shaped into idiosyncratic characteristics. Under the unique institutional background of China, the purpose of this paper is to examine whether CEOs’ foreign experience will affect the performance of CSR and whether the influences of CEOs’ foreign experience on CSR vary from the categories of foreign experience or from the governance environments. We find that firms with returnee CEOs show better CSR performance. Moreover, the longer the CEO’s foreign experience, the better is the CSR performance. Our results are robust to endogeneity concerns, inclusion of additional control, and alternative measures of key variables. Further analyses indicate that foreign working and integrated experiences have important impacts on CSR performance; and the positive effect of foreign experience on CSR is more pronounced for firms located in better legal environment and for those audited by reputable auditor. Our findings highlight foreign experience of CEO as an important driver of CSR performance.

Corporate social responsibility (CSR) refers to the managerial responsibility that a firm should take for the welfare of stakeholders in their business operations. The concept of CSR is based on the idea of sustainable development. In addition to financial objectives, corporate business operations must be aligned with social development and environmental concerns (McWilliams and Siegel, 2001; Ali et al., 2022a). As Carroll (1979) states, CSR includes economic, ethical, legal, and communal expectations that society has of organizations. By integrating social and environmental requirements into long-term corporate strategies, firms that engage in CSR activities are preferred in the capital market and under severe industry competition (Ferrell et al., 2016; Liang and Renneboog, 2017; Chen J. et al., 2020). Accordingly, CSR has received considerable attention from scholars and practitioners, especially since the recent global environmental issues, resource scarcity, increased unemployment, and financial scandals (García and Sanz, 2018; Gonçalves et al., 2020).

Our paper builds on two streams of previous literature. The first is research on the determinants of CSR performance. In order to achieve sustainable development, firms have incentives to fulfill their social responsibilities. Prior studies document several factors that affect performance of CSR including external environments (Adnan et al., 2018; Ali et al., 2019; Ucar and Staer, 2020), institutional investors (Dyck et al., 2019; Nofsinger et al., 2019; Chen T. et al., 2020), media attention (Byun and Oh, 2018), ownership structure (Ali et al., 2019; Chen and Cheng, 2020; Chi et al., 2020), board characteristics (Cho et al., 2017; Muttakin et al., 2018), and managerial characteristics (Hegde and Mishra, 2019; Chen J. et al., 2020; Ali et al., 2022b).

Another stream of research is on the economic consequences of hiring returnee talents. In recent years, economic globalization and convenient transportation have promoted the international flow of talents (Wen et al., 2020). Previous studies indicate that managerial heterogeneity stemming from foreign experience impacts on corporate governance (Giannetti et al., 2015; Iliev and Roth, 2018), corporate performance (Estélyi and Nisar, 2016; Le and Kroll, 2017), and corporate decision-makings, like innovation (Yuan and Wen, 2018), tax avoidance (Wen et al., 2020), CEO compensation (Conyon et al., 2019), and earnings management (Du et al., 2017).

Overall, a large body of previous studies examine both internal governance mechanisms and external institutional factors affecting CSR performance. Meanwhile, prior literature have long been exploring economic consequences of managerial characteristics. Notwithstanding, the impact of managerial foreign experience on CSR is still an issue that needs empirical test. Our study aims to fill the research gap by introducing two essential issues: (1) Does a CEO’s foreign experience improve the firm’s performance of CSR; (2) Are there heterogeneous influences of a CEO’s foreign experience on CSR for different categories of foreign experience or for different governance environments.

The unique institutional background of China provides us the appropriate environment for examination. Compared with developed countries where CEOs have gained foreign experience, China lacks the perfection of institutions and capital markets (Peng and Zhou, 2005), offering a different institutional environment to investigate the impact of CEOs’ foreign experience on Chinese corporate behaviors. Meanwhile, China is at the stage of transformation from high-speed development to high-quality development. Talent is a strategic driving force for Chinese economy. However, talent with foreign experience is still scarce in the Chinese labor market despite the economic development and the implementation of brain gain policies (Giannetti et al., 2015; Yuan and Wen, 2018). The supply of talent with foreign experience cannot fully meet the needs of all Chinese enterprises, leading to heterogeneity between regions and companies regarding the recruitment of returnee senior executives.

To test the impact of CEOs’ foreign experience on CSR performance, we manually collect data of CEOs’ foreign experience from corporate annual reports and related internet websites. The important aspects of CEOs’ foreign experience include the duration, category and the host country or region of foreign experience. Further, our paper employs two variables as the proxy for CEOs’ foreign experience. One is a dummy variable indicating whether a CEO had foreign experience. The other is a continuous variable measuring the duration of a CEO’s foreign experience. As for the performance of CSR, we use RKS’s CSR ratings that is widely used in related previous studies. To control for the unobservable firm-specific heterogeneity, firm-fixed effects models are adopted for evaluations. Consistent with our predictions, our study finds that a CEO’s foreign experience significantly improves the CSR performance. Moreover, there is a positive and significant relationship between the duration of a CEO’s foreign experience and the performance of CSR. We conduct a series of analytical tests to verify the robustness of the results. Additionally, the positive impact of foreign experience on CSR is mainly derived from foreign working and integrated experiences rather than foreign educational experience. The effect of a CEO’s foreign experience on CSR is strengthened by legally protective environments and high-quality external auditing.

Our research makes the following contributions to existing literature. First, we supplement the growing literature on the determinants of CSR by presenting the significant effect of CEOs’ foreign experience on the performance of CSR. Previous studies demonstrate the role of corporate external and internal factors on facilitating CSR performance. However, little is known about how foreign experience of CEOs drives CSR practices. Our analysis provides the theoretical frameworks and empirical evidence to address the above issue. Second, our results highlight the importance of hiring and retaining senior executives with foreign experience capable of improving the performance of CSR and enabling firms to acquire a better social reputation. Therefore, our paper expands the stream of study on the economic consequence of senior executives’ early experiences. Finally, given the increased importance of talent and the development of talent markets, Chinese central and provincial governments recently implemented a series of preferential policies to introduce overseas talent. By exploring the influence of CEOs’ foreign experience on corporate social behaviors, our study provides firm-level empirical evidence on the validity of China’s brain gain policies.

The remainder of the paper is organized as follows. Section 2 discusses the related theory and develops testable hypotheses. Section 3 describes our research design including the sample selection, data, measures of key variables, and applied regression models. Empirical results are presented in Section 4. To examine the validity of our results, we conduct several robustness tests in Section 5. Further analyses for the heterogeneous effects of foreign experience on CSR are discussed in Section 6. Section 7 presents the conclusion of the paper.

Since Hambrick and Mason (1984) put forward the upper echelons theory, the literature regarding the relationship between senior executives and corporate behaviors has gradually attracted attention. According to the upper echelons theory, it is difficult for senior executives to fully understand all the information related to enterprise decision-making due to the cognitive limitations of senior executives and uncertainties of corporate environments. The existing cognitive structure of senior executives impacts their understanding of relevant information, affecting corporate decision-making. The characteristics of senior executives play an important role in forming their cognitive structure. Existing literature investigates the effects of senior executives’ gender (Khaw et al., 2016; Adhikari et al., 2019; Luo et al., 2020), age (Paul and Shrivatava, 2016; Kunze and Menges, 2017; Li et al., 2017; Zhu et al., 2021), family status (Zellweger et al., 2013; Hegde and Mishra, 2019; Vandekerkhof et al., 2019), foreign background (Giannetti et al., 2015; Fu et al., 2017; Yuan and Wen, 2018; Conyon et al., 2019; Wen et al., 2020), educational background (King et al., 2016; Wang and Yin, 2018; Mun et al., 2020), ability (Mishra, 2014; Jung and Subramanian, 2017; Uygur, 2018), and other characteristics (Custódio and Metzger, 2014; Beneish et al., 2017; Cheung et al., 2017; Sunder et al., 2017) on corporate activities and decision-making.

Given that CSR activities reflect managerial behaviors that improve the welfare of customs, employee, environment, society and other stakeholders, beyond the interests of shareholders or without legal requirements (McWilliams and Siegel, 2001), senior executives have discretions in the engagement of CSR activities. Based on the concept of upper echelons theory, managerial cognitive structure impacts on such discretionary decisions and therefore exerts a crucial influence on the establishment of CSR strategy (Petrenko et al., 2016).

As a comparison of prior literature examining the effects of executive psychological features and personal values, for instance, narcissism (Petrenko et al., 2016; Al-Shammari et al., 2019), hubris (Tang et al., 2015; Tang et al., 2018) and political ideologies (Chin et al., 2013), on CSR practices, we focus on CEOs’ foreign experience as a determinant of CSR performance. As the executive leader of corporate top management teams, CEOs’ foreign experience molds their unique cognitive structure, affects their identification and judgment of useful information for decision-making. Thus, it plays an important role in corporate performance or strategic choice. Bhagwati and Hamada (1974) propose that well-educated labor force and professionals from developing countries tend to flow to developed countries. Yuan and Wen (2018) believe that CEOs from developing countries are more likely to choose developed countries to complete their foreign experience. In this vein, we posit that a CEO’s foreign experience obtained from developed countries can affect the performance of CSR in the following ways.

First, CEOs with foreign experience generally acquire high-quality knowledge or skill training, laying a solid professional foundation and accumulating rich management experience for their follow-up domestic work. Compared with local CEOs without foreign experience, returnee CEOs tend to have a stronger ability to identify and process key information, and more skillfully recognize the corporate status and developmental trends. Besides, foreign experience leads CEOs to a confrontation with different systems of value or with different institutions, which furthers CEOs to have a global mindset and therefore to more consider stakeholders. When stakeholders have higher requirements on the performance of CSR, CEOs with foreign experience have a deeper understanding of the demands of stakeholders, thereby promoting CSR performance.

Additionally, with the development of capital markets in developed countries, publicity and education related to CSR have been established, and corresponding legal systems or national strategies have been promulgated. During their stay in developed countries, for work or education, CEOs obtain the cognition on fulfillment of CSR and comprehend its positive consequences on firms. Therefore, foreign experience in developed countries enhances the importance of CSR in a CEO’s cognition and makes corporate strategies stakeholder-orientated. Compared with the relatively sound CSR environments in developed countries (Campbell, 2007), Chinese firms generally have low awareness of social responsibility (Yin and Zhang, 2012). Therefore, foreign experience helps CEOs acknowledge the concept of CSR and significantly enhance CSR fulfillment after their return to China.

Meanwhile, while working or studying abroad, CEOs understand the normalization and authority of contracts in foreign markets and the serious litigation risks and reputation-destroying costs incurred by violating contracts or damaging stakeholders’ interests. The favorable legal and regulatory environment in developed countries makes CEOs with a foreign experience more cautious and risk-averse (Yuan and Wen, 2018). This trait continues to affect even after CEOs have returned to their homeland. Prior studies indicate that returnee senior executives can implement more effective corporate governance and risk control mechanisms (Giannetti et al., 2015; Yuan and Wen, 2018). Predictably, CEOs with foreign experience are more willing to fulfill CSR activities for the sake of protecting stakeholders’ legitimate rights and proactively avoiding risks caused by the lack of CSR engagements.

Finally, compared with the relatively laggard CSR management practices of Chinese enterprises, firms in developed countries have rich experience fulfilling CSR. While working or studying abroad, CEOs familiarize themselves with management practices and understand advanced operation modes of foreign enterprises. Importantly, CEOs would have more opportunity to participate in the fulfilling of CSR in foreign enterprises. Upon their return to China, CEOs can apply relevant experiences to management activities and improve the CSR performance of Chinese enterprises. Therefore, we develop the following baseline hypothesis.

Hypothesis 1. Firms that have CEOs with foreign experience will show greater CSR performance than firms that have CEOs without foreign experience.To further examine the effect of CEOs’ foreign experiences, we investigate how the duration of a CEO’s foreign experience affects a firm’s CSR performance, to provide additional evidence for the relationship between CEOs’ foreign experience and CSR. Based on the upper echelons theory, CEOs’ characteristics formed by their past experiences can explain the variances in corporate behaviors. Foreign experience can strengthen CEOs’ ability to identify and process key information, recognize the concept of CSR, avoid the risk of lack of CSR, and enrich their experience of CSR engagement. Moreover, the acquisition of foreign experience is a process by which CEOs continuously adapt to different institutional environments and gradually realize that effective institutions have significant governance effects on firms’ behaviors. Importantly, the longer the process lasts, the greater the impact of the characteristics shaped by foreign experiences on CEOs’ subsequent career and decision-making. Therefore, with the increase in CEOs’ foreign experience, the influence of foreign institutional environments is gradually more profound, strengthening the positive impact on CSR performance. Accordingly, we propose the following hypothesis.

Hypothesis 2. The longer the CEOs’ foreign experience, the better the CSR performance of the Chinese firms they serve.

Our sample companies were chosen from Chinese firms listed on the Shanghai Stock Exchange and Shenzhen Stock Exchange between 2011 and 2014. We end the sample at 2014 because Ministry of Finance of China revised or added a number of accounting standards in 2014, which will affect the comparability of financial reports of listed companies in the following years. The CSR data is obtained from CSR Ratings of Rankins (hereafter denoted as RKS). Based on the resumes of CEOs disclosed in corporate annual reports and Sina finance (finance.sina.com.cn) as a complementary information source, we manually collected data regarding the foreign experience of CEOs, including the duration, category and the country or region of foreign experience. Corporate financial and governance data are separately obtained from the China Stock Market and Accounting Research (CSMAR) and the China Center for Economic Research (CCER) databases. The data on the regional legal environment of the sample firms are taken from the marketization index of Chinese provinces published by Wang et al. (2017). The country-level data of institutional characteristics of CEOs’ foreign experience are obtained from Worldwide Governance Indicators compiled by the World Bank and from Djankov et al. (2008).

Financial companies are excluded from our sample due to their unique regulatory environments and different financial statement formats (Vafeas, 2000; Peasnell et al., 2005; Firth et al., 2007). We excluded firms for which necessary data was not available. Noteworthily, not all listed companies are included in RKS’s CSR ratings database since social responsibility reports are not compulsorily required by China securities regulatory commission. Finally, 2,165 firm-year observations (involving 674 firms) are adopted. To mitigate the bias from outliers, we winsorized all continuous variables at the 1st and 99th percentiles.

Following previous studies (Lau et al., 2016; Liao et al., 2018; Luo and Liu, 2020; Kong et al., 2021), we adopt RKS’s CSR ratings as the proxy for CSR (RKS_CSR). RKS is an authoritative third-party rating agency for CSR in China, committed to providing reliable, time-series and firm-level information regarding CSR ratings for corporate investors, consumers, and the public. RKS’s CSR ratings are weighed estimated by four dimensions of CSR quality, including macrocosm (30%), content (45%), technique (15%), and industry (10%). Specifically, macrocosm refers to the strategy on CSR, content focuses on the implementation of CSR, technique represents the information disclosure of CSR and industry involves the industry-specific criteria for rating CSR engagement (Zhang et al., 2018). High value of RKS’s CSR ratings (RKS_CSR) indicates high quality of CSR. To verify robustness, we use the CSR scores from Hexun.com covering corporate responsibility for shareholders, employees, suppliers/customers/consumers, environments and society, as an alternative proxy for CSR.

We measure CEOs’ foreign experience by whether they have foreign experience (CEOFE_D) and by the duration of their foreign experience (CEOFE_L). CEOFE_D takes a value of one if the CEO of the sample firm was working or studying in countries or regions outside the Chinese mainland, and zero otherwise. CEOFE_L equals the natural logarithm of one plus the total year duration of the CEO’s foreign experience. Following Giannetti et al. (2015), we do not view it as foreign working experience if the CEO held a position in foreign subsidiaries or agencies of Chinese companies. We consider that the foreign educational experience is the CEOs’ studying experience to obtain a master’s or doctoral degree in foreign countries or regions.

According to existing literature (Lau et al., 2016; Liao et al., 2018; Hegde and Mishra, 2019; Luo and Liu, 2020; Kong et al., 2021), our study considers the following variables including firm size (SIZE), the return of assets (ROA), market-to-book ratio (MTB), firm leverage (LEV), cash holding (OCF), property, plant, and equipment (PPE), ownership concentration (BLOCK), ownership restriction by the second-largest shareholder (RESTRAIN), board size (BOARD), board independence (ID), the duality of CEO and board chairman (DUAL), and whether the observation is a state-owned enterprise (STATE) to control other factors that affect CSR activities.

We examine the relationship between CEOs’ foreign experience and CSR by adopting the following models (1) and (2). To control for the unobservable firm-specific heterogeneity, we include firm-fixed effects in the following models.

where, subscript i and t represent firm and year, respectively. RKS_CSR is a dependent variable measuring firm-level quality of CSR, CEOFE_D and CEOFE_L are independent variables indicating whether the CEO has any foreign experience and the duration of the foreign experience, respectively. According to the hypotheses, we predict that the coefficients of CEOFE_D and CEOFE_L (α1 and β1) are positive. Control is a set of control variables that are associated with CSR. Year and Firm are the year and firm fixed effects, respectively. To mitigate heteroscedasticity and cluster problems, we adopt robust standard errors by clustering at the firm-level. Detailed definitions of variables are reported in Table 1.

Panel A of Table 2 exhibits the results of the descriptive statistics for key variables. During the research period, the mean value of the CSR score (RKS_CSR) of the sample companies increased from 33.8235 to 39.3698 (not reported). Results of the standard deviation of RKS_CSR show that CSR performance is different across firms. Additionally, results indicate that 3.74% of observations employ CEOs with foreign experience (CEOFE_D), suggesting that Chinese listed companies are short of CEO talent with foreign experience. The mean value of foreign experience duration (CEOFE_L) for returnee CEOs is 1.3828. Regarding firm performance, the average ROA (MTB) of sample firms is 4.21% (1.8390). Regarding ownership structure, the average largest shareholder holds 39.2943% of total outstanding shares (BLOCK), which is approximately 16 times the mean percentage ownership of the second-largest shareholders (RESTRAIN). These figures suggest that Chinese ownership structures are highly concentrated, such that the largest shareholder can dominate listed companies. Regarding board governance, the average (median) board has 9.7460 (9.0000) members (not reported). Independent directors account for about one-third of total board members (ID). This figure suggests that Chinese companies adopt the minimum level of independent directors required by the China Securities Regulatory Commission. Of the sample companies, 16.12% hire CEOs who also serve as chairpersons of the board (DUAL). Besides, the government or state agency controls approximately 63.79% of listed companies (STATE).

Panel B and C of Table 2 report the results of univariate analysis. First, we compare the mean of RKS_CSR between firms with and without returnee CEOs (CEOFE_D) in Panel B of Table 2. The results show that the values in the subsample for those without returnee CEOs are higher than those for the subsample with returnee CEOs, but the difference is insignificant. Furthermore, we present the mean differences on RKS_CSR according to the duration of CEOs’ foreign experience (CEOFE_L) in Panel C of Table 2. By adopting the mean value of CEOFE_L (1.3828, representing 3.5802 years) for returnee CEOs as the cut-off, we find that the mean RKS_CSR is significantly higher (at the 10% level) for firms hiring CEOs with longer foreign experience compared to that for firms hiring returnee CEOs with shorter foreign experience.

Table 3 reveals the country or region and category distribution of CEOs’ foreign experience. In sum, there are 81 CEOs with foreign experience during the sample period, of which 20, 51, and 10 CEOs have a foreign working, educational and integrated experience, respectively. Therefore, studying abroad is a primary mode for CEOs of Chinese listed companies to obtain foreign experience. Typically, the United States and the United Kingdom are major countries where CEOs gain foreign experience.

Table 4 reports the results of the pairwise correlation matrix among variables used in the baseline regression analyses. We show the correlation coefficients in bold if they are significantly different from zero at the 5% or 1% level. We find that the correlations among most independent variables (except for CEOFE_D and CEOFE_L) are low, and serious multicollinearity problems are less likely to exist.

As mentioned, Hypothesis one and two imply a positive relationship between CEOs’ foreign experience and performance of CSR. We execute regression analyses of models (1) and (2) using the entire sample to validate the idea. We adopt RKS’s CSR ratings (RKS_CSR) as the dependent variable, and the important explanatory variables are whether CEOs have foreign experience (CEOFE_D) and the duration of CEOs’ foreign experience (CEOFE_L).

Table 5 presents the regression results. We find that CEOFE_D and CEOFE_L have positive and significant coefficients in the regressions of RKS_CSR. The results are consistent with our hypotheses that CEOs with foreign experience enhance the CSR performance, and that the longer their foreign experience, the more improved the CSR performance. The findings suggest that foreign experience helps CEOs understand the demands of stakeholders and the importance of CSR fulfillment, which are beneficial to the improvement of CSR performance of Chinese domestic firms they served. Moreover, as the length of CEOs’ foreign experience increases, influence of foreign institutional environments on CEOs’ cognition of CSR engagement becomes profound and it facilitates the improvement of CSR performance.

The findings are qualitatively similar with those reported in Zhang et al. (2018) and Bertrand et al. (2021). Compared with Zhang et al. (2018) which focus on the impact of returnee directors, we address the foreign experience of CEOs who exert a directly crucial influence on the CSR activities, and consider the duration of foreign experience of CEOs which is ignored by most prior literature. Differ from Bertrand et al. (2021) adopting a sample of local firms across multiple developed countries, our paper concerns about the issue in China. A single-country setting has relatively small variations in cultural and institutional aspects that are advantageous in avoiding unobserved factors contaminating the result. We also extend the study by confirming that managerial foreign experience indeed matter for CSR performance in emerging market.

Regarding economic importance, the coefficient of CEOFE_D is 0.1070, suggesting that CEOs with foreign experience increase the performance of CSR by 10.70%. Considering the mean value of RKS_CSR is 3.5655, the effect of CEOs’ foreign experience on CSR accounts for 3.00% of the sample mean values of RKS_CSR. Besides, the estimated coefficient of CEOFE_L is 0.0565, and the standard deviation of CEOFE_L (RKS_CSR) for the whole sample is 0.2776 (0.2976). Therefore, one standard deviation increase in CEOFE_L enhances the performance of CSR by 0.0527 standard deviations (0.0565✕0.2776/0.2976). The results indicate that the explanatory power of CEOs’ foreign experience on CSR performance is economically significant.

Like those in prior studies of CSR (Lins et al., 2017; Kao et al., 2018; Chen T. et al., 2020), Table 5 shows the low R-squared (less than 0.4) due to the use of cross-sectional sample. Moreover, since the application of various fixed effects that may mitigate the influence of time-invariant corporate characteristics, the estimated coefficients of most of control variables are insignificant (Kong et al., 2021). We find that only firm size (SIZE) holds a positive and significant coefficient, showing that firms with large assets are likely to be associated with the high performance of CSR. This result is consistent with previous studies (Dang et al., 2022) that larger firms have a stronger incentive to engage in CSR to uphold their reputation. Meanwhile, this finding implies that larger firms can afford the cost of engagement of CSR due to their larger resource availability and lesser relative costs (Wickert et al., 2016; Ting, 2021).

Overall, we consider multiply features of CEOs’ foreign experience and present single-country evidence which suggests that managerial idiosyncratic characteristics can shape CSR performance.

Due to the omitted variables or reverse causality, the analysis results could be biased by endogenous problems.

We adopt instrumental variables (IV) regression analyses to mitigate endogeneity arising from unobservable factors that correlate with CEOs’ foreign experience. We employ the Chinese university rating where CEOs obtained their bachelor’s degree, the age of CEOs, and the average values of CEOFE_D (CEOFE_L) by industry and year as instrumental variables. First, students from highly rate Chinese universities are preferred when they apply abroad. Therefore, the high rating of Chinese universities attended by CEOs in their undergraduate years is a competitive advantage for further studies or working abroad. Following Giannetti et al. (2015), we sort Chinese universities into three (EDU3) or four (EDU4, as robustness) ratings based on the ranking presented in Netbig.com, and predict that EDU3 (or EDU4) is positively related to CEOFE_D and CEOFE_L. Second, the age of CEOs (AGE) affects their decision to go abroad. People of different ages in China have experienced different economic development or political backgrounds, thereby having different opportunities or preferences for going abroad. Third, following Lennox et al. (2012); Faccio et al. (2016), we use the average foreign experience of CEOs in the same industry and year (CEOFE_DIY and CEOFE_LIY) as an instrument.

Table 6 reports the IV regression results. Columns (1) and (3) show the first-stage regression results by regressing CEOs’ foreign experience (CEOFE_D or CEOFE_L) on instrumental variables and all control variables. We find that the instrumental variables have consistent coefficients with our predictions. The ratings of universities where CEOs obtained their bachelor’s degree (EDU3) is positively and significantly related to the CEOs’ foreign experience. It suggests that a highly rated university in the undergraduate period provides CEOs with competitive educational background and increases the possibility of CEOs’ going abroad and the duration of foreign experience. The results do not qualitatively change if we adopt EDU4 as an instrumental variable instead of EDU3. Columns (2) and (4) exhibit the second-stage regression results by adopting the performance of CSR (RKS_CSR) as a dependent variable. We employ instrumented CEOFE_D or CEOFE_L, derived from the first-stage regression as a key independent variable. We find that the coefficients of instrumented CEOFE_D and CEOFE_L are positive and significant at the 1% level. Besides, endogeneity test statistics, including robust score chi2 and robust regression F in the first-stage regressions, are significant at the 1% level, suggesting that variables of CEOs’ foreign experience (CEOFE_D and CEOFE_L) are endogenous. Score chi2 in the test of over-identifying restrictions is insignificant, indicating that our specification models are well identified. In summary, the results reinforce our main evidence that CEOs’ foreign experience improves the performance of CSR even when we mitigate the endogenous problems.

Additionally, the effect of CEOs’ foreign experience on CSR could be affected by the issue of reverse causality. That is, firms that perform better in CSR activities are more willing to hire CEOs with foreign experience, or such firms are more attractive for CEOs with foreign experience. To solve this issue, we substitute CEOs’ foreign experience with country-level institutional environments. When CEOs study or work abroad, sound institutional environments in foreign countries or regions increasingly shape their characteristics and values, thus playing a positive role in improving the CSR performance in their subsequent organizations. More importantly, the soundness of country and region-level institutional environments are not affected by the quality of CSR activities. Therefore, in this study, we replace the variables of CEOs’ foreign experience with characteristics of institutional environments in the country or region where the CEO obtained foreign experience to control the endogenous problems caused by the reverse causality.

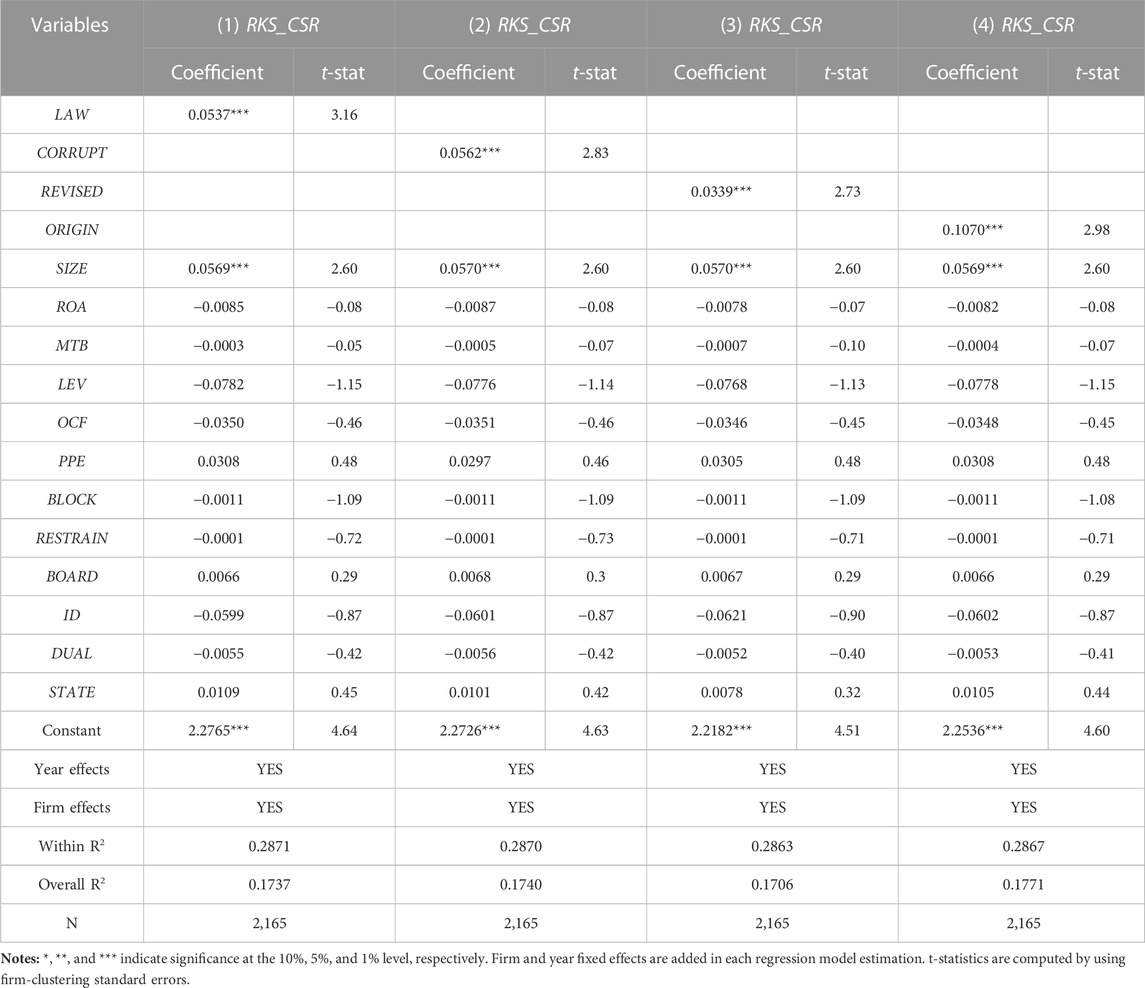

We adopt four country- or region-level indices regarding institutional environments of foreign countries or regions, including the rule of law (LAW), control of corruption (CORRUPT), revised anti-director index (REVISED), and whether the country or region has an English law origin (ORIGIN). The higher the value of indices, the better the institutional environments. Table 7 shows the results. We find that the estimated coefficients of the four country- or region-level variables of institutional environments are significantly positive at the 1% level, indicating that the soundness of institutional environments in the country or region where CEOs acquired their foreign experience can shape their characteristics, regulate their subsequent career behaviors and thereby enhance the performance of CSR. The results also suggest that the effect of CEOs’ foreign experience on CSR is still valid even when we consider the endogeneity problem caused by reverse causality.

TABLE 7. CEO’s foreign experience and CSR (Effects of country or region-level institutional factors).

Probably, firms with returnee CEOs simultaneously appoint board of directors with foreign experience as corporate elites and dutiful supervisors (Rivas, 2012). According to Giannetti et al. (2015), directors of company boards with foreign experience facilitate the adoption of advanced corporate governance practices and effectively perform monitoring functions. Therefore, they improve firm performance. To mitigate the concern that the directors’ foreign experience could drive the relationship between CEOs’ foreign experience and CSR, we include an additional control variable indicating the foreign experience of the board of directors (DIRFE) in models (1) and (2). Table 8 presents the regression results by considering the foreign experience of directors. Columns (1) and (2) include DIRFE as a control variable, and columns (3) and (4) include DIRFE and its interaction term with CEOFE_D or CEOFE_L. We find that coefficients of CEOs’ foreign experience variables (CEOFE_D and CEOFE_L), in columns (1) and (2), are positive and significant at 5% or better. However, the coefficient of the directors’ foreign experience variable (DIRFE) is insignificant. Columns (3) and (4) show that interaction terms of DIRFE and CEOFE_D (CEOFE_L) are statistically positive and significant. The results suggest that the impact of CEOs with foreign experience on CSR is still consistent with our hypothesis when considering directors with foreign experience. We do not find evidence that directors’ foreign experience improves the performance of CSR. However, the positive relationship between a CEO’s foreign experience and CSR is more pronounced in firms with directors with foreign experience.

We address robustness by adopting different measures of CSR and CEOs’ foreign experience.

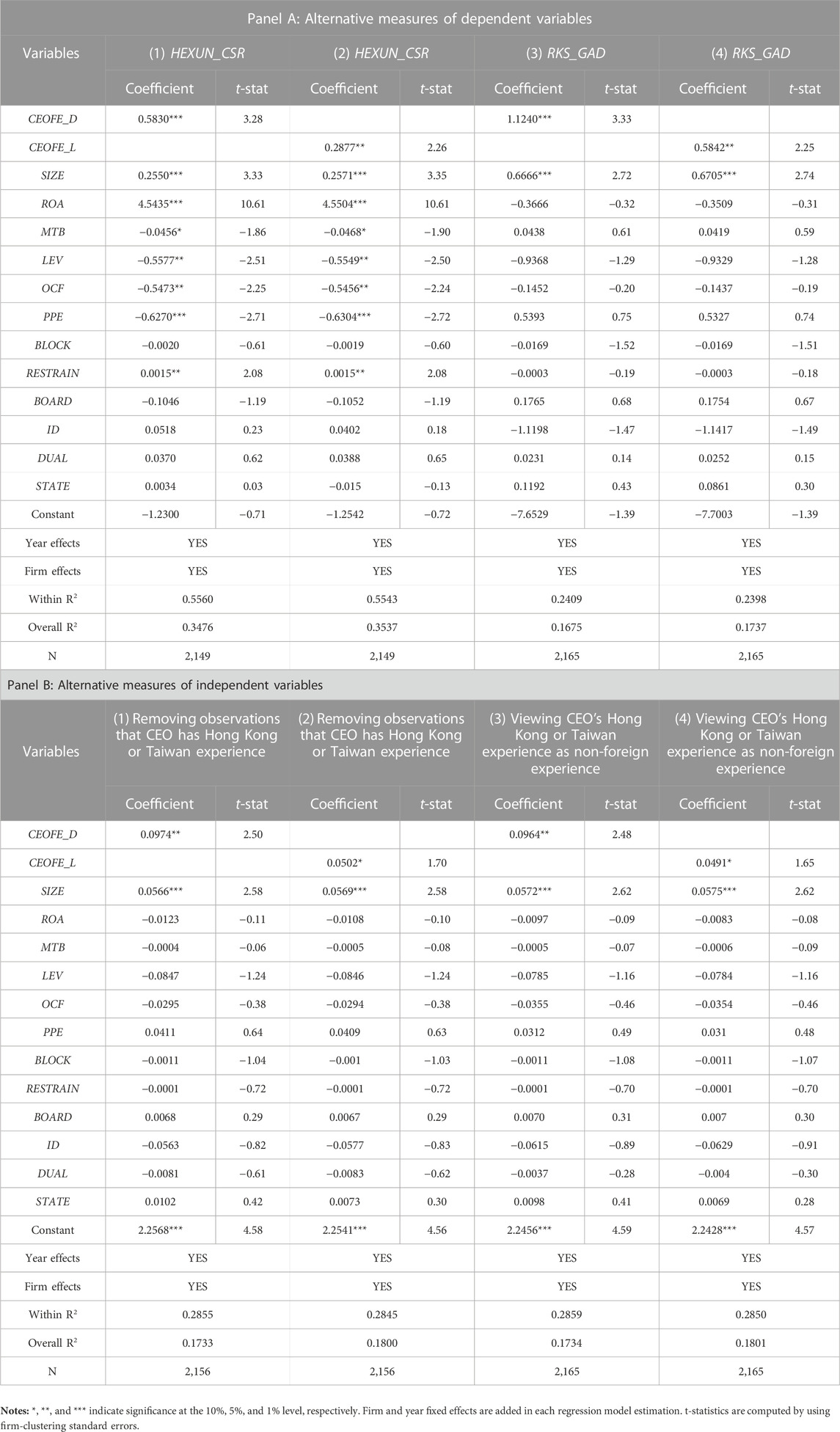

First, RKS discloses grades of CSR in addition to the score of CSR. Each firm-year is graded from AAA + to C (19 grades in total) based on its RKS_CSR. We assign a value of 19 (1) to AAA+ (C) grade indicating the highest (lowest) quality of CSR (RKS_GAD). Second, Hexun.com provides an evaluation of CSR performance for listed companies from five dimensions, including the responsibility of shareholders, employees, suppliers/customs/consumers, environment, and society. By assigning a different weight for each dimension, Hexun.com provides an aggregate CSR score (HEXUN_CSR) for Chinese listed companies. Panel A of Table 9 reports regression results by using RKS_GAD and HEXUN_CSR as an alternative dependent variable. We find consistent results that CEO’s foreign experience (CEOFE_D and CEOFE_L) is positively and significantly related to alternative proxies for CSR performance (RKS_GAD or HEXUN_CSR).

TABLE 9. CEO’s foreign experience and CSR (Alternative measures of dependent and independent variables).

Additionally, Panel B of Table 9 exhibits the results by re-considering the definition of CEOs’ foreign experience. Hong Kong Special Administrative Region and Taiwan have an economic, cultural, and political close relationship with Chinese mainland. In columns (1) and (2), we remove observations where CEOs have Hong Kong or Taiwan experience, whereas, in columns (3) and (4), we view CEOs’ Hong Kong or Taiwan experience as non-foreign experience. Results show robust evidence that CEOs’ foreign experience (CEOFE_D and CEOFE_L) enhances CSR performance (RKS_CSR).

We investigate the heterogeneous influence of different categories of CEOs’ foreign experience on CSR, dividing their foreign experience into foreign working, educational and integrated experience. Panels A and B of Table 10 report regression results by using CEOFE_D and CEOFE_L, respectively. Column (1) focuses on the effect of CEOs’ foreign working experience on CSR. Column (2) examines the effect of CEOs’ foreign educational experience on CSR. Column (3) tests the effect of CEOs’ foreign integrated experience on CSR. Thus, in each columns the remaining two parameters are not included, respectively.

Results in Panel A of Table 10 show that coefficients of CEOFE_D in columns (1) and (3) are positive and significant, whereas the coefficient of CEOFE_D in column (2) is insignificant. The results suggest that, compared to CEOs’ foreign educational experience, their foreign working and integrated experiences enhance CSR performance significantly. In Panel B of Table 10, we find the same qualitative results by adopting CEOFE_L as an independent variable. The results suggest that the governance effect of CEOs’ foreign experience on performance of CSR mainly is derived from CEOs’ foreign working or integrated experience, rather than foreign educational experience. Sound institutional environments, like legal protection, governance mechanism, or market supervision in foreign countries or regions where CEOs obtained their foreign experience improve CEOs’ ethical concept and management philosophy in their career. It is more likely that CEOs care about the firm’s long-term development and enhance the performance of CSR if they were sent to foreign countries or regions with better institutional characteristics. Therefore, compared to CEOs’ foreign educational experience, their foreign working experience impacts CSR more profoundly and directly (Conyon et al., 2019). Besides, CEOs’ foreign educational experience affects CSR performance only when CEOs have foreign working experience simultaneously (also called as foreign integrated experience).

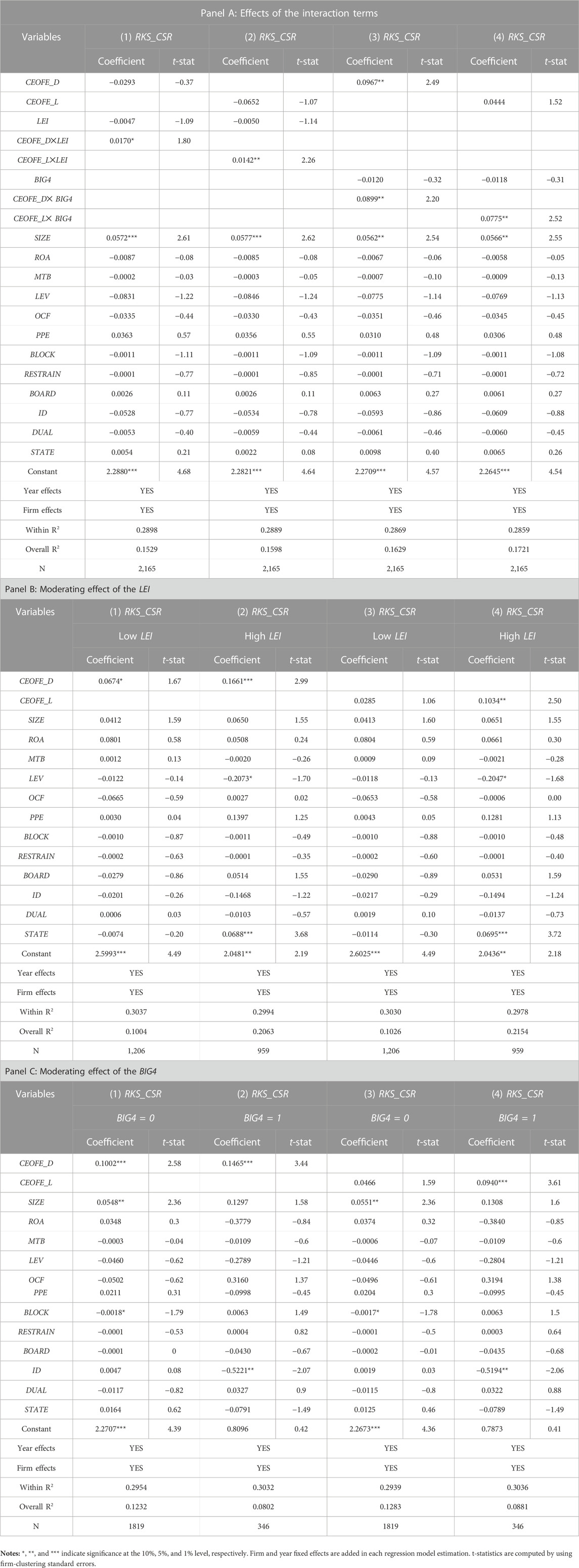

We further analyze CEOs’ foreign experience and CSR by considering several external governance factors. First, to examine the effect of the provincial legal environment on the relationship between CEOs’ foreign experience and CSR, we include the legal environment index (LEI), indicating the quality of institutional regulations in the province where the sample firm is located. Besides, as a mechanism of corporate governance, external auditing monitors and advises firm operations. Therefore, auditing quality potentially affects the effect of CEOs’ foreign experience on the performance of CSR. We adopt a dummy variable that equals one if the observation hires a Big 4 (including Deloitte, Ernst and Young, KPMG, and PricewaterhouseCoopers) auditor, and zero otherwise (BIG4).

We report, in Panel A of Table 11, the regression results by including the interaction terms between CEOs’ foreign experience and LEI or BIG4 and their coefficients are positive and significant at the 10% level or better. It suggests that CEOs’ foreign experience plays a governance role on CSR performance in firms with good external governance mechanisms. Specifically, the effect of CEOs’ foreign experience on CSR is more pronounced for firms located in provinces with sound legal environments or for those audited by a Big four auditor. As a robustness check, we split our sample into two sub-samples according to the median value of LEI in Panel B of Table 11 and the value of BIG4 in Panel C of Table 11, respectively. Coefficients of CEOs’ foreign experience are positive and significant in sub-samples with a high-quality provincial legal environment or external auditing. Notably, the magnitudes of coefficients of CEOs’ foreign experience in firms with high-quality legal environment and external auditing are even larger than those in firms with low-quality legal and auditing governance. Taken together, the evidence indicates that CEOs’ foreign experience exerts a positive effect on CSR especially for firms with better external governance. High-quality provincial legal environment and external auditing provide a sound governance setting under which CEOs’ foreign experience effectively enhances the performance of CSR.

TABLE 11. CEO’s foreign experience and CSR (Moderating effects of provincial legal environment and auditing quality).

Our paper investigates the impact of CEOs’ foreign experience on the performance of CSR by using recent data of Chinese listed companies. The recent Chinese institutional environment offers an appropriate research setting to consider the effect of foreign background of senior executives on corporate behaviors. We manually collect comprehensive data of CEOs’ foreign experience in Chinese listed firms from 2011 to 2014. Results show that firms hiring CEOs with foreign experience have significantly increased CSR performance. Additionally, the longer the CEO’s foreign experience, the better the firm’s CSR performance. The results are consistent with our hypotheses that foreign experience enhances CEOs’ capacity to recognize critical information, provides CEOs with increased cognition of CSR, and improves the performance of CSR. The results are robust to endogenous tests, additional control for directors’ foreign experience, and alternative measures of key variables. Furthermore, we differentiate the categories of foreign experiences. Compared to CEOs’ foreign educational experience, CEOs’ foreign working and integrated experience are significantly associated with better CSR performance. Evidence of heterogeneity tests shows that the positive impact of CEOs’ foreign experience on CSR performance is more pronounced for firms in provinces with better legal environments and for those audited by a Big four auditor.

Our study contributes to the literature that CEOs’ foreign experience is significantly associated with better performance of CSR and offers a new research perspective of the economic consequences of CEOs’ foreign experience. The results have several implications for Chinese listed companies and their stakeholders. Specifically, our research demonstrates the positive relationship between CEOs’ foreign experience and CSR performance. This finding is beneficial to firms that are keen on hunting returnee talents and supports the implementation of China’s brain gain policies. Meanwhile, we find that CEOs’ foreign working experience improves CSR performance implying that foreign working experience is a vital criterion for corporate recruitment of returnees compared to foreign educational experience. For results of heterogeneity, they inspire stakeholders to concern about the compatibility between internal governance mechanisms (employing returnee CEOs) and external governance factors (legal environment and auditing quality).

Publicly available datasets were analyzed in this study. This data can be found here: https://cn.gtadata.com/.

YZ: Conceptualization, Data curation; Methodology; Writing original draft. LD: Reviewing and editing the paper; Funding acquisition. All authors have given approval to the final version of the manuscript.

This work was supported by the Beijing Social Science Fund Project (grant number: 18GLB015); the Basic Scientific Research Fund of Beijing University of Posts and Telecommunications (grant number: 2019XKRK02).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Adhikari, B. K., Agrawal, A., and Malm, J. (2019). Do women managers keep firms out of trouble? Evidence from corporate litigation and policies. J. Account. Econ. 67 (1), 202–225. doi:10.1016/j.jacceco.2018.09.004

Adnan, S. M., Hay, D., and Staden, C. J. (2018). The influence of culture and corporate governance on corporate social responsibility disclosure: A cross country analysis. J. Clean. Prod. 198 (10), 820–832. doi:10.1016/j.jclepro.2018.07.057

Al-Shammari, M., Rasheed, A., and Al-Shammari, H. (2019). CEO narcissism and corporate social responsibility: Does CEO narcissism affect CSR focus? J. Bus. Res. 104, 106–117. doi:10.1016/j.jbusres.2019.07.005

Ali, S., Jiang, J., Ahmad, M., Usman, O., and Ahmed, Z. (2022a). A path towards carbon mitigation amidst economic policy uncertainty in BRICS: An advanced Panel analysis. Environ. Sci. Pollut. Res. 29, 62579–62591. doi:10.1007/s11356-022-20004-8

Ali, S., Jiang, J., Rehman, R. u., and Khan, M. K. (2022b). Tournament incentives and environmental performance: The role of green innovation. Environ. Sci. Pollut. Res. doi:10.1007/s11356-022-23406-w

Ali, S., Zhang, J., Usman, M., Khan, F. U., Ikram, A., and Anwar, B. (2019). Sub-national institutional contingencies and corporate social responsibility performance: Evidence from China. Sustainability 11 (19), 5478. doi:10.3390/su11195478

Beneish, M. D., Marshall, C. D., and Yang, J. (2017). Explaining CEO retention in misreporting firms. J. Financial Econ. 123 (3), 512–535. doi:10.1016/j.jfineco.2016.12.004

Bertrand, O., Betschinger, M., and Moschieri, C. (2021). Are firms with foreign CEOs better citizens? A study of the impact of CEO foreignness on corporate social performance. J. Int. Bus. Stud. 52, 525–543. doi:10.1057/s41267-020-00381-3

Bhagwati, J., and Hamada, K. (1974). The brain drain, international integration of markets for professionals and unemployment. J. Dev. Econ. 1 (1), 19–42. doi:10.1016/0304-3878(74)90020-0

Byun, S. K., and Oh, J. M. (2018). Local corporate social responsibility, media coverage, and shareholder value. J. Bank. Finance 87, 68–86. doi:10.1016/j.jbankfin.2017.09.010

Campbell, J. L. (2007). Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Acad. Manag. Rev. 32 (3), 946–967. doi:10.5465/amr.2007.25275684

Carroll, A. B. (1979). A three-dimensional conceptual model of corporate performance. Acad. Manag. Rev. 4 (4), 497–505. doi:10.5465/amr.1979.4498296

Chen, J., Liu, X., Song, W., and Zhou, S. (2020). General managerial skills and corporate social responsibility. J. Empir. Finance 55, 43–59. doi:10.1016/j.jempfin.2019.10.007

Chen, T., Dong, H., and Lin, C. (2020). Institutional shareholders and corporate social responsibility. J. Financial Econ. 135 (2), 483–504. doi:10.1016/j.jfineco.2019.06.007

Chen, Y., and Cheng, H. Y. (2020). Public family businesses and corporate social responsibility assurance: The role of mimetic pressures. J. Account. Public Policy 39 (3), 106734. doi:10.1016/j.jaccpubpol.2020.106734

Cheung, K. T. S., Naidu, D., Navissi, F., and Ranjeeni, K. (2017). Valuing talent: Do CEOs’ ability and discretion unambiguously increase firm performance. J. Corp. Finance 42, 15–35. doi:10.1016/j.jcorpfin.2016.11.006

Chi, W., Wu, S., and Zheng, Z. (2020). Determinants and consequences of voluntary corporate social responsibility disclosure: Evidence from private firms. Br. Account. Rev. 52, 100939. doi:10.1016/j.bar.2020.100939

Chin, M. K., Hambrick, D. C., and Treviño, L. K. (2013). Political ideologies of CEOs: The influence of executives' values on corporate social responsibility. Adm. Sci. Q. 58 (2), 197–232. doi:10.1177/0001839213486984

Cho, C. H., Jung, J. H., Kwak, B., and Yoo, C. (2017). Professors on the board: Do they contribute to society outside the classroom? J. Bus. Ethics 141 (2), 393–409. doi:10.1007/s10551-015-2718-x

Conyon, M. J., Haß, L. H., Vergauwe, S., and Zhang, Z. (2019). Foreign experience and CEO compensation. J. Corp. Finance 57 (4), 102–121. doi:10.1016/j.jcorpfin.2017.12.016

Custódio, C., and Metzger, D. (2014). Financial expert CEOs: CEO’s work experience and firm’s financial policies. J. Financial Econ. 114 (1), 125–154. doi:10.1016/j.jfineco.2014.06.002

Dang, V. Q. T., Otchere, I., and So, E. P. K. (2022). Does the nature of political connection matter for corporate social responsibility engagement? Evidence from China. Emerg. Mark. Rev. 52, 100907. https://www.sciencedirect.com/science/article/pii/S1566014122000243. doi:10.1016/j.ememar.2022.100907

Djankov, S., La Porta, R., Lopez-de-Silanes, F., and Shleifer, A. (2008). The law and economics of self-dealing. J. Financial Econ. 88 (3), 430–465. doi:10.1016/j.jfineco.2007.02.007

Du, X., Jian, W., and Lai, S. (2017). Do foreign directors mitigate earnings management? Evidence from China. Int. J. Account. 52 (2), 142–177. doi:10.1016/j.intacc.2017.04.002

Dyck, A., Lins, K. V., Roth, L., and Wagner, H. F. (2019). Do institutional investors drive corporate social responsibility? International evidence. J. Financial Econ. 131 (3), 693–714. doi:10.1016/j.jfineco.2018.08.013

Estélyi, K. S., and Nisar, T. M. (2016). Diverse boards: Why do firms get foreign nationals on their boards? J. Corp. Finance 39 (4), 174–192. doi:10.1016/j.jcorpfin.2016.02.006

Faccio, M., Marchica, M., and Mura, R. (2016). CEO gender, corporate risk-taking, and the efficiency of capital allocation. J. Corp. Finance 39 (4), 193–209. doi:10.1016/j.jcorpfin.2016.02.008

Ferrell, A., Liang, H., and Renneboog, L. (2016). Socially responsible firms. J. Financial Econ. 122 (3), 585–606. doi:10.1016/j.jfineco.2015.12.003

Firth, M., Fung, P. M. Y., and Rui, O. M. (2007). Ownership, two-tier board structure, and the informativeness of earnings–Evidence from China. J. Account. Public Policy 26 (4), 463–496. doi:10.1016/j.jaccpubpol.2007.05.004

Fu, X., Hou, J., and Sanfilippo, M. (2017). Highly skilled returnees and the internationalization of EMNEs: Firm level evidence from China. Int. Bus. Rev. 26 (3), 579–591. doi:10.1016/j.ibusrev.2016.11.007

García, J. L. S., and Sanz, J. M. D. (2018). Climate change, ethics and sustainability: An innovative approach. J. Innovation Knowl. 3 (2), 70–75. doi:10.1016/j.jik.2017.12.002

Giannetti, M., Liao, G., and Yu, X. (2015). The brain gain of corporate boards: Evidence from China. J. Finance 70 (4), 1629–1682. doi:10.1111/jofi.12198

Gonçalves, T., Gaio, C., and Costa, E. (2020). Committed vs opportunistic corporate and social responsibility reporting. J. Bus. Res. 115, 417–427. doi:10.1016/j.jbusres.2020.01.008

Hambrick, D. C., and Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 9 (2), 193–206. doi:10.5465/amr.1984.4277628

Hegde, S. P., and Mishra, D. R. (2019). Married CEOs and corporate social responsibility. J. Corp. Finance 58, 226–246. doi:10.1016/j.jcorpfin.2019.05.003

Iliev, P., and Roth, L. (2018). Learning from directors’ foreign board experiences. J. Corp. Finance 51, 1–19. doi:10.1016/j.jcorpfin.2018.04.004

Jung, H. W., and Subramanian, A. (2017). CEO talent, CEO compensation, and product market competition. J. Financial Econ. 125 (1), 48–71. doi:10.1016/j.jfineco.2017.04.005

Kao, E. H., Yeh, C. C., Wang, L. H., and Fung, H. G. (2018). The relationship between CSR and performance: Evidence in China. Pacific-Basin Finance J. 51, 155–170. https://www.sciencedirect.com/science/article/pii/S0927538X18302294. doi:10.1016/j.pacfin.2018.04.006

Khaw, K. L. H., Liao, J., Tripe, D., and Wongchoti, U. (2016). Gender diversity, state control, and corporate risk-taking: Evidence from China. Pacific-Basin Finance J. 39, 141–158. doi:10.1016/j.pacfin.2016.06.002

King, T., Srivastav, A., and Williams, J. (2016). What's in an education? Implications of CEO education for bank performance. J. Corp. Finance 37, 287–308. doi:10.1016/j.jcorpfin.2016.01.003

Kong, D., Cheng, X., and Jiang, X. (2021). Effects of political promotion on local firms’ social responsibility in China. Econ. Model. 95, 418–429. https://www.sciencedirect.com/science/article/pii/S0264999319309812. doi:10.1016/j.econmod.2020.03.009

Kunze, F., and Menges, J. I. (2017). Younger supervisors, older subordinates: An organizational-level study of age differences, emotions, and performance. J. Organ. Behav. 38 (4), 461–486. doi:10.1002/job.2129

Lau, C., Lu, Y., and Liang, Q. (2016). Corporate social responsibility in China: A corporate governance approach. J. Bus. Ethics 136, 73–87. doi:10.1007/s10551-014-2513-0

Le, S., and Kroll, M. (2017). CEO international experience: Effects on strategic change and firm performance. J. Int. Bus. Stud. 48 (5), 573–595. doi:10.1057/s41267-017-0080-1

Lennox, C. S., Francis, J. R., and Wang, Z. (2012). Selection models in accounting research. Account. Rev. 87 (2), 589–616. doi:10.2308/accr-10195

Li, X., Low, A., and Makhija, A. K. (2017). Career concerns and the busy life of the young CEO. J. Corp. Finance 47, 88–109. doi:10.1016/j.jcorpfin.2017.09.006

Liang, H., and Renneboog, L. (2017). On the foundations of corporate social responsibility. J. Finance 72 (2), 853–910. doi:10.1111/jofi.12487

Liao, L., Lin, T., and Zhang, Y. (2018). Corporate board and corporate social responsibility assurance: Evidence from China. J. Bus. Ethics 150, 211–225. doi:10.1007/s10551-016-3176-9

Lins, K. V., Servaes, H., and Tamayo, A. (2017). Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. J. Finance 72, 1785–1824. https://onlinelibrary.wiley.com/doi/10.1111/jofi.12505.

Luo, J., and Liu, Q. (2020). Corporate social responsibility disclosure in China: Do managerial professional connections and social attention matter? Emerg. Mark. Rev. 43, 100679. doi:10.1016/j.ememar.2020.100679

Luo, J., Peng, C., and Zhang, X. (2020). The impact of CFO gender on corporate fraud: Evidence from China. Pacific-Basin Finance J. 63, 101404. doi:10.1016/j.pacfin.2020.101404

McWilliams, A., and Siegel, D. (2001). Corporate social responsibility: A theory of the firm perspective. Acad. Manag. Rev. 26 (1), 117–127. doi:10.5465/amr.2001.4011987

Mishra, D. R. (2014). The dark side of CEO ability: CEO general managerial skills and cost of equity capital. J. Corp. Finance 29, 390–409. doi:10.1016/j.jcorpfin.2014.10.003

Mun, S., Han, S. H., and Seo, D. (2020). The impact of CEO educational background on corporate cash holdings and value of excess cash. Pacific-Basin Finance J. 61, 101339. doi:10.1016/j.pacfin.2020.101339

Muttakin, M. B., Khan, A., and Mihret, D. G. (2018). The effect of board capital and CEO power on corporate social responsibility disclosures. J. Bus. Ethics 150 (1), 41–56. doi:10.1007/s10551-016-3105-y

Nofsinger, J. R., Sulaeman, J., and Varma, A. (2019). Institutional investors and corporate social responsibility. J. Corp. Finance 58, 700–725. doi:10.1016/j.jcorpfin.2019.07.012

Paul, J., and Shrivatava, A. (2016). Do young managers in a developing country have stronger entrepreneurial intentions? Theory and debate. Int. Bus. Rev. 25 (6), 1197–1210. doi:10.1016/j.ibusrev.2016.03.003

Peasnell, K., Pope, P., and Young, S. (2005). Board monitoring and earnings management: Do outside directors influence abnormal accruals. J. Bus. Finance Account. 32 (7-8), 1311–1346. doi:10.1111/j.0306-686X.2005.00630.x

Peng, M., and Zhou, J. (2005). How network strategies and institutional transitions evolve in asia. Asia-Pacific J. Manag. 22 (4), 321–336. doi:10.1007/s10490-005-4113-0

Petrenko, O. V., Aime, F., Ridge, J., and Hill, A. (2016). Corporate social responsibility or CEO narcissism? CSR motivations and organizational performance. Strategic Manag. J. 37 (2), 262–279. doi:10.1002/smj.2348

Rivas, J. L. (2012). Board versus tmt international experience: A study of their joint effects. Cross Cult. Manag. Int. J. 19 (4), 546–562. doi:10.1108/13527601211270011

Sunder, J., Sunder, S. V., and Zhang, J. (2017). Pilot CEOs and corporate innovation. J. Financial Econ. 123 (1), 209–224. doi:10.1016/j.jfineco.2016.11.002

Tang, Y., Mack, D. Z., and Chen, G. (2018). The differential effects of CEO narcissism and hubris on corporate social responsibility. Strategic Manag. J. 39 (5), 1370–1387. doi:10.1002/smj.2761

Tang, Y., Qian, C., Chen, G., and Shen, R. (2015). How CEO hubris affects corporate social (ir) responsibility. Strategic Manag. J. 36 (9), 1338–1357. doi:10.1002/smj.2286

Ting, P. H. (2021). Do large firms just talk corporate social responsibility? - the evidence from CSR report disclosure. Finance Res. Lett. 38, 101476. https://www.sciencedirect.com/science/article/abs/pii/S1544612319301722. doi:10.1016/j.frl.2020.101476

Ucar, E., and Staer, A. (2020). Local corruption and corporate social responsibility. J. Bus. Res. 116, 266–282. doi:10.1016/j.jbusres.2020.05.012

Uygur, O. (2018). CEO ability and corporate opacity. Glob. Finance J. 35, 72–81. doi:10.1016/j.gfj.2017.05.002

Vafeas, N. (2000). Board structure and the informativeness of earnings. J. Account. Public Policy 19 (2), 139–160. doi:10.1016/S0278-4254(00)00006-5

Vandekerkhof, P., Steijvers, T., Hendriks, W., and Voordeckers, W. (2019). The effect of nonfamily managers on decision-making quality in family firm TMTs: The role of intra-TMT power asymmetries. J. Fam. Bus. Strategy 10 (3), 100272. doi:10.1016/j.jfbs.2019.01.002

Wang, X., Fan, G., and Yu, J. (2017). The provincial marketization index in China (2016). Beijing: Social Science Literature Press, 214–225.

Wang, Y., and Yin, S. (2018). CEO educational background and acquisition targets selection. J. Corp. Finance 52, 238–259. doi:10.1016/j.jcorpfin.2018.08.013

Wen, W., Cui, H., and Ke, Y. (2020). Directors with foreign experience and corporate tax avoidance. J. Corp. Finance 62, 101624. doi:10.1016/j.jcorpfin.2020.101624

Wickert, C., Scherer, A. G., and Spence, L. J. (2016). Walking and talking corporate social responsibility: Implications of firm size and organizational cost. J. Manag. Stud. 53 (7), 1169–1196. https://onlinelibrary.wiley.com/doi/full/10.1111/joms.12209.

Yin, J., and Zhang, Y. (2012). Institutional dynamics and corporate social responsibility (CSR) in an emerging country context: Evidence from China. J. Bus. Ethics 111, 301–316. doi:10.1007/s10551-012-1243-4

Yuan, R., and Wen, W. (2018). Managerial foreign experience and corporate innovation. J. Corp. Finance 48 (1), 752–770. doi:10.1016/j.jcorpfin.2017.12.015

Zellweger, T. M., Nason, R. S., Nordqvist, M., and Brush, C. G. (2013). Why do family firms strive for nonfinancial goals? An organizational identity perspective. Entrepreneursh. Theory Pract. 37 (2), 229–248. doi:10.1111/j.1540-6520.2011.00466.x

Zhang, J., Kong, D., and Wu, J. (2018). Doing good business by hiring directors with foreign experience. J. Bus. Ethics 153 (3), 859–876. doi:10.1007/s10551-016-3416-z

Keywords: CEOs’ foreign experience, corporate social responsibility, cognition, upper echelons theory, brain gain

Citation: Zhang Y and Dong L (2023) Foreign experience of CEO and corporate social responsibility: Evidence from China. Front. Environ. Sci. 11:1103394. doi: 10.3389/fenvs.2023.1103394

Received: 20 November 2022; Accepted: 31 January 2023;

Published: 10 February 2023.

Edited by:

Zhenghui Li, Guangzhou University, ChinaReviewed by:

Shahid Ali, Nanjing University of Information Science and Technology, ChinaCopyright © 2023 Zhang and Dong. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Liping Dong, ZG9uZ2xpcGluZzAxMjBAMTYzLmNvbQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.