- 1College of Economics and Management, Xinjiang University, Urumqi, China

- 2Center for Innovation Management Research of Xinjiang, Urumqi, China

With the promotion of carbon-peak and carbon-neutral strategies and the increase in green awareness, green development is gradually gaining attention, and the green supply chain management (GSCM) derived from traditional supply chain management is gradually becoming a path to promote green development. At the same time, enterprise, as an important source of pollution, how to consider social responsibility, such as environmental protection, in the process of ensuring efficiency improvement has become an important issue. To study the impact of green supply chain management on enterprise value and its path of action, this paper examines the impact of green supply chain management on enterprise value, explores the moderating effect of the risk-taking level, and further analyzes the dual moderating effect played by technological innovation capability and supply chain concentration. Based on the micro data of 131 Chinese listed enterprises from 2014 to 2021, a panel-regression model is used to illustrate how green supply chain management affects enterprise value, and the results show that: 1) green supply chain management can promote enterprise value; 2) the level of risk-taking strengthens the promoting effect of green supply chain management on enterprise value enhancement; and 3) the technological innovation capability negatively regulates the moderating effect of risk-taking, while the supply chain concentration positively regulates the moderating effect of risk-taking. The research results of this paper enrich the path of the effect of implementing of green supply chain management on enterprise value enhancement, i.e., the process of green supply chain management to enhance enterprise value is regulated by the level of enterprise risk-taking, while technological innovation capability and supply chain concentration will also regulate the level of enterprise risk-taking and thus promote enterprise value enhancement. This research not only extends the research perspective and enriches the existing research, but also provides a theoretical basis for enterprises to implement green supply chain management to promote value enhancement and improve the level of green supply chain management implementation and the green development of enterprises.

1 Introduction

In the past forty decades, China’s industrialization has developed rapidly and achieved a leap from the early stage of industrialization to the late stage of industrialization and has become the world’s largest newly industrialized country and the second largest economy (Aslam et al., 2021), with achievements that have attracted worldwide attention. However, the problems of high emissions and pollution brought by economic development should not be underestimated (Chen, 2015). For example, air pollution due to PM2.5, soil pollution due to heavy metals and the continuous emission of carbon dioxide into the atmosphere during production and living activities have accelerated the process of global warming and caused a series of ecological problems and extreme weather (Mannucci and Franchini, 2017; Qin et al., 2021; An and Zhu, 2022), which not only affect human survival but also gradually affect the healthy economic development (Feng et al., 2021; Wei et al., 2023).

In the context of the destruction of ecological environment, the continued impact of COVID-19, and the increasingly severe situation at home and abroad, China’s economic development is transforming from high-speed growth to green and high-quality growth, and enterprises are transforming from pursuing profits to pursuing benefits and how to achieve the coordinated development of economic capacity enhancement and ecological environmental protection has become an important issue (Sun et al., 2022).

In October 2020, Xi Jinping proposed unswervingly implementing the concept of green development and follow the path of green development. In October 2022, Xi Jinping proposed to promote green development and the harmonious coexistence of humans and nature. In addition, various countries and organizations have been enacting laws and regulations to protect the ecological environment (Wang et al., 2018). For example, the signing of the Paris Climate Agreement and the implementation of China’s green credit policy (Zhang et al., 2022), carbon neutral strategy, carbon peak strategy, and Made in China 2025 (Xu, 2022). Because the concept of “green” is linked with “sustainability,” or “eco” (Ezuma et al., 2022), thus these assertions and regulations have led to the green development approach represented by green supply chains, sustainability transitions (Sarkis et al., 2020), corporate initiatives for environmental responsibility (Li et al., 2020; Liao et al., 2021; Li et al., 2022), etc., which has received wide attention from various social parties (Tseng et al., 2019; Becerra et al., 2021; Pal et al., 2023). This includes government, public (Baldini et al., 2018), investors, and competitors (Cao et al., 2019). Along with the increasing public awareness of environmental protection and the introduction of government laws and regulations, enterprises, as one of the main sources of environmental pollution and also an important pillar of economic development (Panigrahi et al., 2018), have to reduce pollutant emissions and enhance green development through sustainable transformation, green technological advancement, green supply chain management (GSCM) and other green development approaches (Abu Seman et al., 2019).

GSCM is a comprehensive environmental management tool that has a greater potential to solve environmental problems, promote healthy business development of enterprises (Sheng et al., 2022), optimize resource efficiency and reduce environmental problems. The implementation of GSCM can lay the foundation for the development and realization of a green economy from a microscopic perspective, GSCM is becoming an inevitable choice to promote ecological civilization and solve environmental problems (Cao and Zhang, 2022). Therefore, in the context of the increasingly severe development situation of enterprises and the urgent need for green development, the creation of a green industrial chain and supply chain becomes a necessary condition for the improvement of enterprise competitiveness.

But under what circumstances will companies proactively implement and operate well with GSCM as a strategy, what impact will the implementation of GSCM have on corporate value, and in what ways will that impact be realized? These questions are yet to be explored in depth. For example, we should recognize that in the development of business operation, the level of risk-taking is also an extremely important point that affects the business decision process, the level of corporate risk-taking refers to the ability or level of risk that a company can take in the course of its business, specifically including operational risk and financial risk, only when the level of risk-taking is high, enterprises will make decisions such as GSCM to promote value enhancement and at the same time, technological innovation capability (TIC) and supply chain concentration (SCC) will affect the level of risk taking. Specifically, TIC is a new technology or capability that is modified or developed by an enterprise to achieve a certain goal or meet the needs of a certain activity, especially at this stage of China’s economic transformation, the ability to innovate in technology is particularly important (Wang et al., 2021). The relationship between technology and economics has been the focus of much research (Liu et al., 2022a), many studies have mentioned that technological innovation activities have the characteristics of high investment and high risk (Lu et al., 2020; Liu et al., 2022b; Mao et al., 2022), and it is difficult to generate effective returns in the short term (Aghion et al., 2013), therefore, the higher the TIC, the more it can indicate the current technological innovation activities of the enterprise, the more it is not conducive to the stability of the enterprise’s capital, which will enhance the enterprise’s risk-taking level. SCC is an important indicator of the stability of the supply chain network in which an enterprise is located, including customer concentration and supplier concentration. The higher the concentration of the supply chain, the more stable the relationship between the enterprise and its suppliers and sellers, which to a certain extent can enhance the risk-taking level of the enterprise.

Therefore, this paper will take the level of risk-taking of a company as a research perspective to explore how GSCM affects corporate value when the level of risk-taking of a company varies. The significance of this study is that, firstly, from the theoretical point of view, this study deepens the research on the impact of GSCM on enterprise value, and further enriches and expands the research on the impact of GSCM on enterprise value from the perspective of enterprises’ risk-taking level. Secondly, from the practical point of view, the research results of this paper can provide certain inspiration for enterprises to implement GSCM, and also to implement the green development approach represented by GSCM.

Based on this, this research explores how GSCM affects firm value when firms have different levels of risk-taking, and helps firms to further understand and implement GSCM. Specifically, the contribution points of this paper, 1) using micro-firm data rather than data from questionnaires to argue for a facilitating effect of GSCM on firm value; 2) finding that the higher the level of corporate risk-taking, the more the implementation of GSCM can promote firm value; 3) the lower the TIC and the higher the SCC, the higher the level of risk-taking, the more significantly GSCM can influence the enhancement of firm value. The research in this paper helps to supplement the research on GSCM and enterprise value in depth and can further provide theoretical support and empirical evidence for the implementation of GSCM in enterprises.

The remaining structure of this paper is organized as follows. Based on previous studies, Section 2 provides the literature review about GSCM. Section 3 presents a theoretical analysis and hypotheses on the impact of GSCM on firm value and its possible paths of action. Section 4 includes the models, data and their sources used in the paper. Section 5 empirically tests the direct, moderating and dual moderating effects of GSCM on firm value. Section 6 summarizes the paper’s research, and Section 7 discusses the policy recommendations. Finally, Section 8 points to future research directions.

2 Literature review

2.1 Supply chain management and green supply chain management

Since the 21st century, competition has shifted from inter-organizational to inter-supply chain, and effective supply chain management practices have become a way to maintain a competitive advantage and improve business performance (Li et al., 2006). In the context of increasing economic globalization and the continued impact of the COVID-19, supply chain networks and their partnerships are facing many challenges and there is a risk of disruption (Wang and Yang, 2022). The outbreak, represented by COVID-19, has had a significant impact on all processes of each supply chain (Moosavi et al., 2022). As a result, we found that the traditional supply chain development model is more brittle and unable to meet the growing needs of companies (Sarkis et al., 2020).

Since the traditional supply chain management ignores the negative impact that the supply chain may cause to the environment in the process of operation and optimization (Gurel et al., 2015), GSCM or Environmental Supply Chain Management (ESCM) is based on traditional supply chain management, and focuses more on the efficiency of resource utilization and the environmental impact of enterprises in the supply chain, including suppliers, manufacturers, sellers, and end customers (Rabbi et al., 2020; Li and Zhou, 2022). Rodríguez-González et al. (2022) explored the impact of circular economy on corporate financial performance and found that circular economy contributes to GSCM practices and thus to corporate financial performance.

2.2 Sustainable supply chain management

With the increase of economic development, social progress and environmental protection awareness, the consideration of green sustainability and recyclability of supply chains in supply chain networks has gradually received wide attention from researchers. In order to achieve economic, social, and environmental sustainability, Panigrahi et al. (2018) provide a review and analysis of the theory of sustainable supply chains from economic, environmental and social perspectives. Salehi-Amiri et al. (2021) designed a sustainable closed-loop supply chain for the walnut industry. Yontar and Ersöz (2020) argue that the purpose of developing a green and sustainable supply chain is to provide, improve or enhance environmental and economic value for the various stakeholders in the chain. Zhu and Wu (2022) studied the impact of supply chain sustainability on supply chain performance, and found that supply chain sustainability can contribute to supply chain performance improvement, and supply chain sustainability plays a mediating role in the process of supply chain resilience affecting supply chain performance. Gholian-Jouybari et al. (2023) designed a sustainable supply chain for agri-food products by considering the concept of marketing.

2.3 Closed-loop supply chain and reverse logistics

With economic, social and environmental influences, business operations and decision makers are also considering closed-loop supply chains. Compared to traditional supply chains, closed-loop supply chains have more advantages, such as considering both forward and backward logistics (reverse logistics) (Liao et al., 2020), controlling waste emissions in the logistics cycle, etc., which can reduce the environmental damage and negative impacts of companies’ supply chain activities (Chiu et al., 2021), it ensures that many industries are green and sustainable (Salehi-Amiri et al., 2021). Mirzagoltabar et al. (2021) proposed two new heuristic algorithms to study multi-objective dual-channel closed-loop supply chains considering the case of demand and price uncertainty and justified and tested them with the lighting industry. Asghari et al. (2022) studied the decision making problem of pricing and advertising in a closed-loop supply chain network. Xu et al. (2022b) incorporates overconfidence and competitive preferences into a closed-loop supply chain study and proposes a series of Stackelberg models with multiple dominant models, exploring how the chain of behavioural preferences jointly affects the pricing, profit, utility and social benefit decisions of both parties under different dominant models.

Reverse logistics is not only part of the closed-loop supply chain, it is also one of the most important processes in the green supply chain management framework (Rao and Holt, 2005). Through recycling, reuse and waste reduction scarce resources can be used efficiently and pollutant emissions can be reduce. Richnák and Gubová (2021) provides practical recommendations for the development of green and reverse logistics in Slovakian companies based on summarising and sorting out the research on green and reverse logistics. Ma et al. (2022) studied the impact of blockchain technology plays a role in the process of product recovery and distribution. Li and Chen (2022) designed a reverse logistics network for third party logistics under uncertainty disruption based on a risk-averse model. Based on blockchain technology, Wu (2022) proposes a commodity traceability solution that can effectively reduce waste generation and can provide for the sustainable development of green reverse logistics.

2.4 Green supply chain management and enterprise value

Enterprises are micro subjects of economic development, and important subjects of supply chain nodes. The role of GSCM in the development of enterprise operation is gradually becoming obvious. In the study of GSCM and firm value, Longoni and Cagliano (2018), Li et al. (2019), Ahmed et al. (2020) and Samad et al. (2021) concluded that GSCM can promote firm value. Min and Galle (2001) found that green procurement increases firms’ costs and inhibits improvement in their financial performance. Ni and Sun (2019) argued that GSCM might have a specific impact on firm value under certain conditions. To deeply explore the relationship between the two, Feng et al. (2018) and Abdallah and Al-Ghwayeen (2019) analyzed the mediating role played by environmental performance and operational performance in the process of GSCM affecting corporate financial performance. Zhang et al. (2019a) explored the role of social control in GSCM practices for corporate value enhancement based on social exchange theory. Sheu and Chen (2012) used a three-stage game theory model to analyze the role of government financial intervention in GSCM affecting firm value as a facilitator. Agyabeng-Mensah et al. (2020) argued that implementing green human resource management and supply chain environmental cooperation may contribute to the impact of internal GSCM practices on firm value. Fasan et al. (2021) studied the impact of the implementation of GSCM on the financial performance of companies in the context of the ongoing impact of the COVID-19, and he concluded that GSCM is there is an effective risk management tool that can buffer the COVID-19 adverse effects on firms. Salandri et al. (2022) studied the effect of green practices on operational performance when firms have different levels of agility and concluded that green practices, represented by green packaging, promote operational performance when firms are more agile. Wang and Li (2021) tested the effect of the institutional environment to positively regulate GSCM on firm value. Dong et al. (2021) empirically tested the differential impact of GSCM on clean technology innovation incentives of local and foreign firms from the perspective of firm identity. Xie and Zhu (2022) introduced dual knowledge search and green social capital to construct a third-order mediated adjustment model and explored the deep-rooted mechanism of the effect of GSCM practices on the relationship between green innovation and firm performance.

In summary, there is a large amount of literature in the field of GSCM research. This includes perspectives on sustainable supply chains, closed-loop supply chains and reverse logistics, GSCM and others. Among the studies on GSCM and enterprise value, some literature clearly states that GSCM can enhance enterprise value, while others are vague. Most studies use questionnaires to obtain data on enterprise GSCM and do not use micro data to analyse the relationship between GSCM and enterprise value. In some of the studies there are articles that explore the relationship between the two in depth from the perspectives of social control, institutional environment and human resources, however, we found no relevant literature examining the value enhancement of GSCM to companies from the perspective of enterprises’ risk-taking level.

Therefore, the purpose of this paper is: to explore the impact of the implementation of GSCM on enterprise value, and to analyze in depth how GSCM affects enterprise value when enterprises face different levels of risk from a risk perspective. And further explores how different TIC and SCC affect the level of corporate risk-taking to influence the enhancing effect of GSCM on corporate value enhancement.

The main approach of this paper is: based on the data of 131 Chinese listed companies from 2014–2021, using panel regression, moderation and double moderation models, the role of enterprise implementation of GSCM on value enhancement is analyzed. It further analyzes how the level of risk-taking level faced by firms affects GSCM practices for corporate value when the level of risk-taking varies. It also analyzes how the implementation of GSCM by enterprises affects enterprise value when the impact of TIC and SCC on enterprise risk-taking level varies.

3 Theoretical analysis and research hypothesis

3.1 Theoretical analysis

The core idea of supply chain management theory is the collaborative operation of the supply chain, that is, how to work with suppliers, sellers, manufacturers and other subjects to achieve reasonable utilization of limited resources. The implementation of supply chain management can form a dependency relationship between different enterprises, which can promote smoother information communication and more convenient collaboration among the node enterprises in the chain, reduce the occurrence of bullwhip effect and various additional costs caused by information asymmetry (Jain, 2022), thus reducing the business risk and improving the enterprise value.

Stakeholder theory is a leading theoretical framework in sustainable economic and social development (Sajjad et al., 2020). It argues that no company can develop without the input and participation of various stakeholders (Dias et al., 2018). This coincides with the concept of supply chain management, which also emphasizes that the business situation of one enterprise in the chain is affected, and the business situation of other enterprises in the chain is also affected. Taking the core enterprise in the supply chain as an example, if the core enterprise has a stable relationship with its suppliers and sellers, it can better promote the development and economic interests of related enterprises.

Risk management theory suggests that in a risky environment, firms identify, measure and analyze risks and proactively, choose the most effective way to reduce the impact of risks on business operations. For example, financial distress and technological innovation activities carried out by firms, because the development of technological innovation activities requires continuous investment of resources (Lu et al., 2020) and the external environment is constantly changing, which is very likely to cause an increase in business risks, so under certain circumstances, operators and decision makers will suspend technological innovation activities in order to avoid risks (Wang and Rao, 2021).

3.2 Research hypothesis

3.2.1 Direct effect

Implementing GSCM by enterprises can enhance the value of enterprises. Specifically, 1) implementing GSCM can enhance the value of enterprises by reducing costs and improving resource utilization efficiency (Yildiz Çankaya and Sezen, 2018; Novitasari et al., 2022). Implementing of supply chain management affects the realization of the effective connection between supply and demand of each node enterprise in the supply chain, and the good operation of the supply chain can avoid information distortion (Neeley and Leonardi, 2018), reduce the inventory retention time (Andiappan et al., 2022), and reduce the frequency of the bullwhip effect (Xue et al., 2020), thus making more effective use of inventory resources and reducing transaction costs and inventory costs. Implementing GSCM means that the damage caused to the environment in the process of production, distribution, and even recycling is minimized (Ghobakhloo et al., 2013; Mohamed Abdul Ghani et al., 2017; Wang et al., 2020; Ali et al., 2022), which can minimize the cost of recycling and pollution reduction based on a traditional supply chain and thus enhance the value of enterprises (Karimi et al., 2021). 2) Implementing GSCM by enterprises can enhance corporate performance by improving corporate competitiveness. Meanwhile, the international community is paying increasing attention to the development of environmental protection, and various countries and regions have set green standards and requirements for import and export products. By implementing GSCM, local enterprises can integrate greening into the whole process of production and sales of goods, improve their corporate image, enhance the trust of suppliers and consumers, improve their market position and product competitiveness, and thus expand their market share and enhance their corporate value. 3) Implementing GSCM is important in promoting the green transformation of enterprises. Implementing GSCM enables enterprises to consider environmental and resource elements, coordinate the relationship between the environment and development, effectively solve increasingly serious environmental pollution and social problems, and meet the long-term interests of human development while satisfying economic development. Moreover, it is an important step that promotes the green transformation of enterprises and supports an ecological civilization and achieves the dual carbon goal (Agrawal et al., 2022). Based on the above analysis, this paper proposes the following:

H1. Implementing GSCM by enterprises can promote value enhancement.

3.2.2 Indirect effect

3.2.2.1 The moderating effect of the risk-taking level

The level of risk-taking is the ability of an enterprise to withstand the threat of potential losses in its production and business activities, reflecting the tendency of the enterprise to chase high profits and be able to pay a certain price for it. In terms of the financial crisis theory, if an enterprise only pursues high profits from projects, investments, and decisions without considering the level of risk it can bear, it undoubtedly exposes the enterprise’s capital flow to great uncertainty in the process of operation and increases the possibility of financial distress (Zhou and Zhao, 2021). Therefore, the financial situation and the level of risk-taking of the enterprise influence each other. Enterprises with a low probability of financial distress will have a high level of risk-taking, at this time, they intend to make strategic decisions such as GSCM. Additionally, when an enterprise implements GSCM, it will increase the economic cost, which to some extent will increase the probability of financial distress in the enterprises and thus reduce the level of risk-taking. Therefore, enterprises will be better served to conduct GSCM for value enhancement when the risk-taking level of enterprises is high. Based on the above analysis, this paper proposes the hypothesis that:

H2. The risk-taking level has a positive moderating effect on the relationship between GSCM and enterprise value improvement. That is, in enterprises with high risk-taking ability, GSCM has a more significant impact on the improvement in enterprise value.

3.2.2.2 The impact of TIC on corporate risk-taking level

Technological innovation can inhibit the level of risk-taking. Many studies have mentioned that technological innovation is characterized by high risk and high levels of investment, which may introduce huge operational and financial risks to enterprises (Lu et al., 2020; Mao et al., 2022). Especially in the case of an uncertain external business environment and complex technological innovation, firms will avoid technological innovation as much as possible to reduce the operational risk (Wang and Rao, 2021). At the same time, technological innovation requires continuous capital injection, and the investment experiences difficulty generating good returns in the short term (Aghion et al., 2013), which can exacerbate financial distress and thus affect the level of risk-taking. Based on this, this paper proposes the following hypothesis:

H2a. TIC affects the level of corporate risk-taking and thus affects the impact of GSCM on improving corporate value. That is to say, the lower the TIC of enterprises, the smaller the probability of financial distress, which can promote the level of corporate risk-taking, thereby significantly affecting the relationship between GSCM and enterprise value.

3.2.2.3 The impact of SCC on enterprise risk-taking level

SCC can positively affect the risk-taking level of enterprises (Dai and Zhu, 2020). According to supply chain management theory and stakeholder theory, implementing supply chain management can form a dependency relationship between different enterprises, which can promote smoother communication and easier collaboration among the nodes in the chain, reduce the bullwhip effect and various additional costs caused by information asymmetry, and thus reduce the frequency of financial distress and improve the level of risk-taking. In addition, according to the supply chain stability theory and transaction cost theory, the higher SCC, the more stable the proportion of core enterprises purchasing from upstream enterprises and selling to downstream enterprises, which indicates the higher the stability of the current supply chain network, which can reduce the market cost and transaction cost of finding or developing new partners, reduce the probability of financial distress, improve the risk-taking of enterprises, and ensure the healthy operation of enterprises. Based on the above analysis, this paper proposes the hypothesis that:

H2b. SCC can affect the moderating effect of the enterprise’s risk-taking level; that is, in enterprises with higher SCC, the possibility of financial distress is lower and the risk-taking level is higher, which can significantly affect the relationship between GSCM and enterprise value.

4 Research design

4.1 Model design

To examine the impact of GSCM on enterprise value, this paper constructs Model (l):

To test the moderating effect of the risk-taking level on the relationship between GSCM and enterprise value, this paper builds Model (2), which is constructed by adding moderating variables and the cross-product term of moderating variables and independent variables based on Model (1).

In the above model, Qit denotes the enterprise value of the ith firm in sample period t; GSCMit is the GSCM score of the ith firm in sample period t; RISKit is the enterprise risk-taking level of the ith firm in sample period t; controls are each control variables selected in this paper: the firm’s operating year (AGE); the firm size (SIZE); equity concentration (EC); board size (BOA); degree of industry competition (LER); regional economic development (GDP) and firm (ID). In Model (1), if α1 is positive, it indicates that implementing GSCM can promote enterprise value. Model (2), on the other hand, measures the moderating role of corporate risk-taking capacity between GSCM and value enhancement, and if β3 is positive, it means that an increase in the risk-taking level can strengthen the role of GSCM in promoting corporate value enhancement (Jiang, 2022).

To further test the dual moderating effect of TIC and SCC on firms’ risk-taking level, the dual moderating effect analysis was conducted using grouped regressions, drawing on a study by Xiao et al. (2021). Grouping the samples according to the median can avoid the regression bias caused by excessive sample size differences between the two groups. Therefore, in this paper, the samples are divided into two groups based on the median of TIC and SCC, respectively, in the double moderation effect analysis to determine the effect of an enterprise’s implementation of GSCM on value enhancement when their TIC and SCC have different effects on their risk-taking level.

4.2 Variables selection

4.2.1 Explained variable

Enterprise value (Q): Financial performance is useful for directly expressing good or bad business conditions and providing security for long-term business operations, and Tobin’s Q is an important indicator of a firm’s market value and business performance situation (Xu et al., 2022a; Qi and Wang, 2022). Therefore, this paper chooses Tobin’s Q value (Q) to characterize the firm’s value. The calculation formula is: Q = market value/(total assets at the end of the period − net intangible assets − net goodwill).

4.2.2 Explanatory variable

Green supply chain management (GSCM): This paper mainly selects the CITI index in GSCM disclosed by the Center for Public Environmental Studies (IPE) to measure the GSCM score of enterprises. The CITI index is mainly a dynamic evaluation of enterprises’ performance in supply chain environmental management from the perspectives of environmental compliance, energy saving and emission reduction, and information disclosure based on the information publicly disclosed by the government and enterprises. The index can objectively and systematically reflect enterprises’ willingness and ability to manage environmental pollution problems of upstream and downstream manufacturers (Dong et al., 2021).

4.2.3 Moderating variables

Risk-taking level (RISK): From the perspective of corporate finance, this paper draws on the research of (Abinzano et al., 2020) and selects the Z score to measure the financial risk faced by enterprises and their ability to withstand risks. The greater the Z value is, the more stable the financial situation is and the lower the probability of financial risk.

Technological innovation capability (TIC): The proportion of R&D investment in operating income is used to measure the TIC of enterprises (Gu et al., 2018). The greater the ratio, the higher the TIC of enterprises.

Supply chain concentration (SCC): This paper uses the average of the ratio of the top five suppliers’ purchases to the total annual purchases and the top five customers’ sales to the total annual sales, which are disclosed in the annual reports to reflect the degree of SCC (Patatoukas, 2011; Fang et al., 2017). The higher the SCC, the better the stability of the supply chain.

4.2.4 Control variables

Company operating year (AGE): this is measured by the difference between the company’s operating year and the year of establishment. In general, the longer the business time, the better the accumulation of funds, technology, credit, and other conditions, and the more conducive and capable of promoting enterprises to conduct activities. Firm size (SIZE): this selects the logarithm of the company’s total assets to characterize them. Larger enterprises can optimize the efficiency of resource allocation and reduce the probability of risk (Cuerva et al., 2014). Equity concentration (EC): this is measured by the sum of the shareholding ratios of the top ten major shareholders. Board size (BOA): this is represented by the number of board members. Industry competitiveness (LER): this is the industry Lerner index used to measure the degree of competition in the industry. Regional economic development (GDP) is the GDP index of each province (last year = 100) used for measurement. Different enterprises in different provinces and local economic development impact enterprises differently. At the same time, considering that the individual differences of different enterprises may affect the regression results, this paper also controls the enterprise individual variable (ID).

4.3 Data source and processing

This paper includes data samples from enterprises and cities, specifically.

The independent variable GSCM data comes from the CITI score in the GSCM section of the IPE website, which started in 2014 and dynamically evaluates the performance of enterprises in supply chain environmental management from the perspectives of environmental compliance, energy saving and emission reduction and information disclosure with the help of publicly available information from the government and enterprises. This paper follows the sample of Chinese listed enterprises in the GSCM score disclosed by IPE from 2014–2021, and excludes the sample of financial industry, the sample of enterprises with ST and PT, the sample of enterprises listed in the current year, and the enterprises with serious missing data samples in order to avoid estimation bias as much as possible, and finally gets 131 enterprises with 316 valid observations. In order to maintain the consistency of the data sample, all other data are counted and screened based on 131 enterprises from 2014–2021.

The SCC data in the control variables were obtained from the corporate annual reports disclosed by each enterprise in the sample. The GDP data in the control variables are obtained from the statistical yearbooks of the cities where each enterprise in the study sample is located.

All other data are obtained from the China Stock Market & Accounting Research Database (CSMAR), which is a research-oriented and accurate database in the field of China’s economy and finance with reference to the standards of authoritative databases such as CRSP and COMPUSTAT and is developed with the actual national conditions of China. It has covered 18 series of macroeconomics, industry economics, listed companies, stocks, funds, etc., and is widely used in existing research.

5 Finding and analysis

5.1 Descriptive statistic

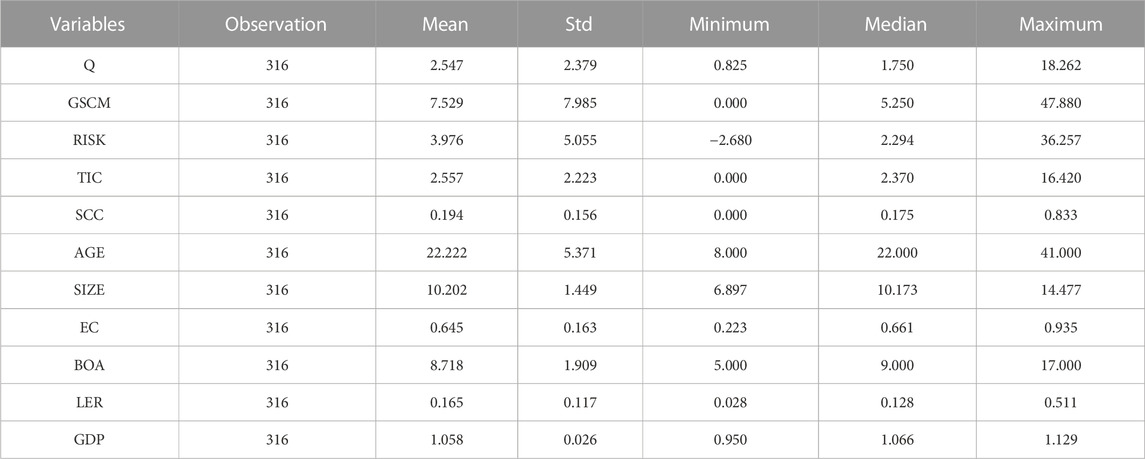

Table 1 shows the descriptive statistical results of the relevant variables. The minimum value of Q is 0.825, the maximum value is 18.262, the median is 1.750, and the mean is 2.547. This means that different enterprises have great differences in operating conditions. The minimum value of GSCM is 0, the maximum value is 47.880, the median is 5.250, and the mean value is 7.529, indicating that the degree of implementation of GSCM varies among companies, and most enterprises implement GSCM to a lower degree. The minimum value of RISK is −2.680, the maximum value is 36.257, the median is 2.294, and the mean value is 3.976, indicating a large gap between whether the enterprise faces financial distress. The risk management ability of most enterprises is relatively poor, and the probability of financial distress is relatively high. The variance inflation factor test found that the mean value of the VIF is 1.11, which is far lower than the critical value of 10, indicating that the research results are not affected by multicollinearity.

5.2 Baseline regression

5.2.1 Stepwise regression

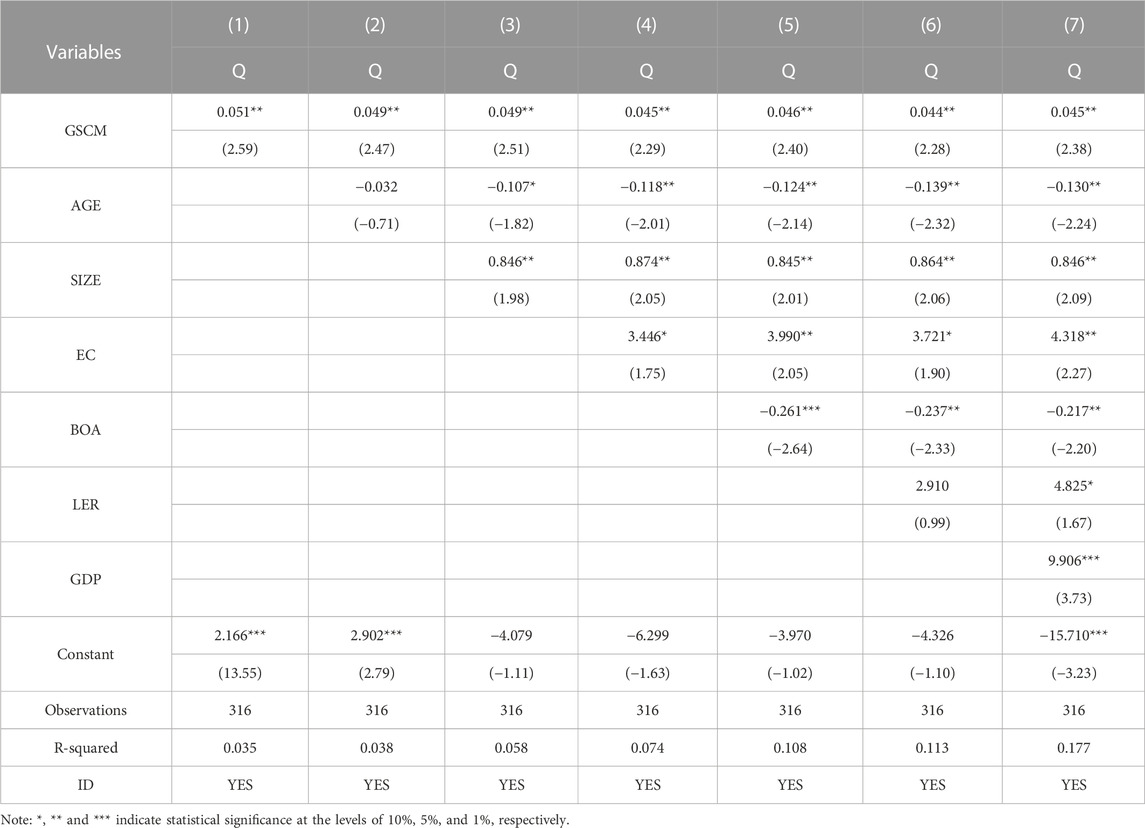

In this paper, the regression test was carried out by gradually adding variables. Table 2 reports the regression results of the impact of GSCM on enterprise value improvement. The regression results show that with the addition of variables, R2 increases, the coefficient symbols of each variable remain unchanged, and the coefficient of the independent variable GSCM gradually stabilized at about 0.045, which means that the enterprise value increases by 0.045 percentage points for every unit increase in the score of GSCM. Hypothesis H1 is thus verified.

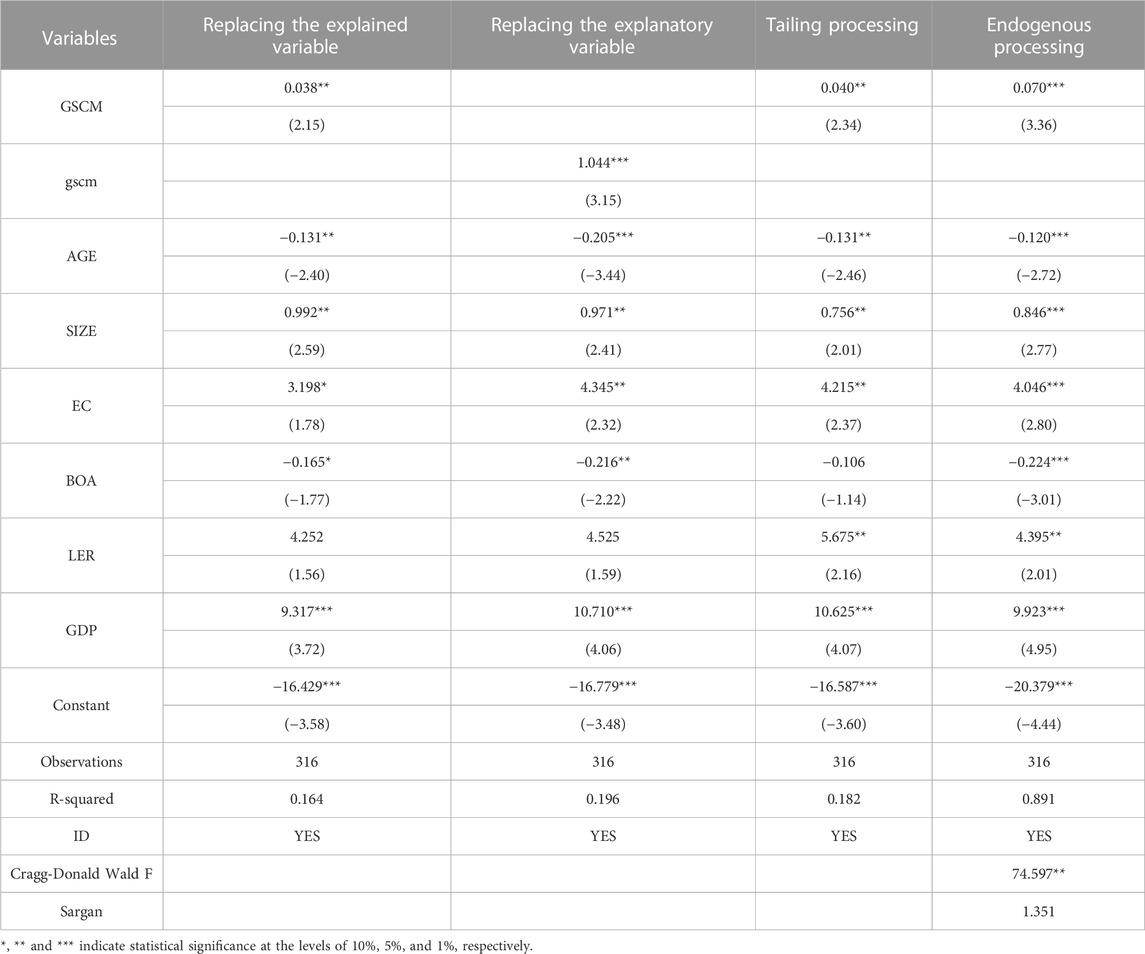

5.2.2 Robustness tests

Replacing variables: 1) First, we can replace the explained variable. Using the market value/total assets calculation method at the end of the period, we can replace the original calculation formula and recalculate the Tobin’s Q value (QC). The regression results of Table 3 show that implementing GSCM after replacing the explanatory variables significantly improves enterprise value, assuming that H1 is established. 2) Second, we can replace the explanatory variable. Considering that the GSCM scores of different enterprises are inconsistent, this paper performs 0/1 processing on the data of GSCM based on the original data, that is, the GSCM score of i enterprise in t year is not 0, and it is assigned to 1, while the GSCM score is 0, and it is assigned to 0. The results in Table 3 show that H1 still holds after the explanatory variables are replaced.

Tailing processing: Since there may be extreme values in the original data that affect the regression results of the samples, this paper performs a 1% degree of bilateral tail reduction on the variables based on the original data. The regression results are shown in Table 3, and the conclusion is still valid.

Endogenous processing: To avoid potential endogenous problems that interfere with the regression results, this paper draws on the research of Xie et al. (2016) and selects the average level of GSCM scores of various industries and provinces where enterprises are located as instrumental variables, and conducts endogenous tests through the 2SLS method. The regression results show that the weak instrumental variable (Cragg-Donald Wald F test) significantly rejects the original hypothesis at the 5% level, and the over-identification test (Sargan test) cannot reject the original hypothesis, indicating that all instrumental variables are exogenous, and after considering the endogenous problem, implementing GSCM can still play a positive role in promoting enterprise value.

5.2.3 Heterogeneity analysis

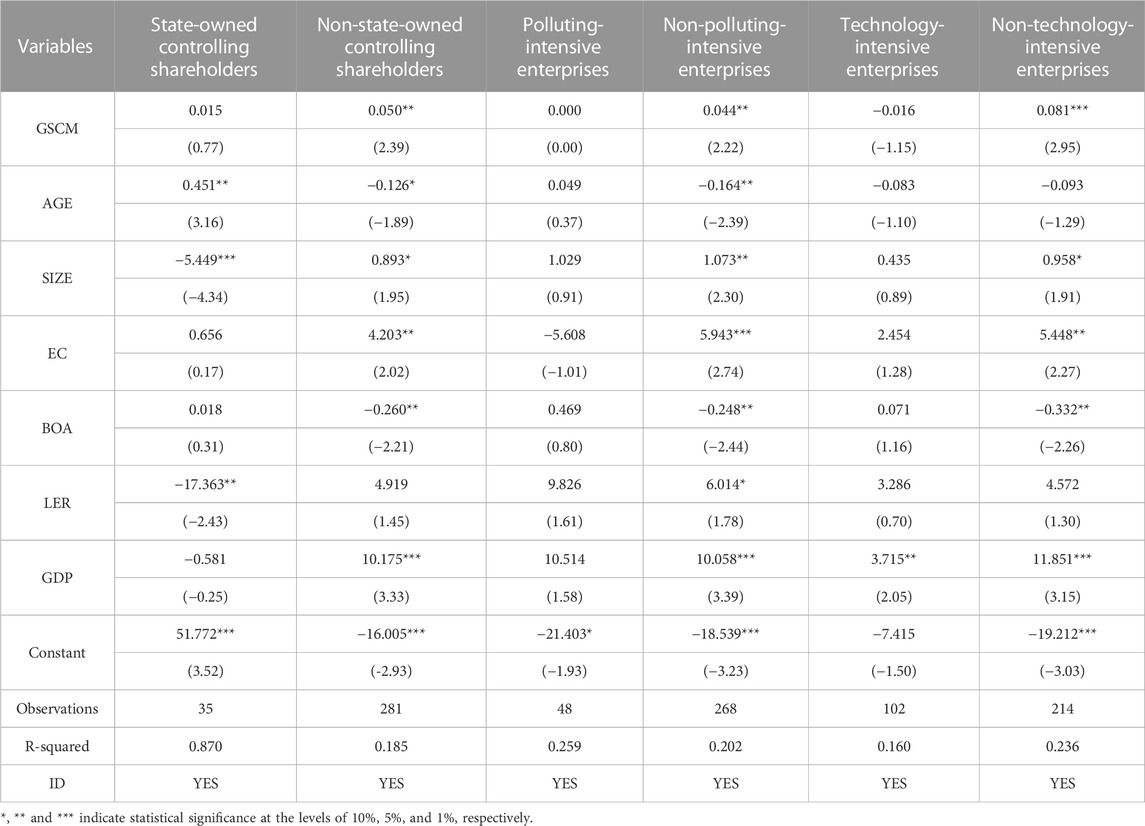

The nature of the controlling shareholder: The decision and use of various enterprise resources are dominated by the controller (controlling shareholder). Therefore, the nature of the controlling shareholder is different, and the effect of enterprise operation and governance is also different. Based on the research of Zhang et al. (2019b), this paper divides the controlling shareholders into state-owned controlling shareholders (SOCS) and non-state-owned controlling shareholders (NSOCS) and analyzes the promotion effect of GSCM on enterprise value in enterprises with different controlling shareholders. The test results are shown in Table 4. It can be seen from Table 4 that for the enterprises of NSOCS, the coefficient of GSCM is significant at the 5% level, which means that GSCM can promote the value of the enterprise under the influence of NSOCS. On the other hand, the coefficient of GSCM of SOCS is insignificant, indicating that the impact of GSCM on the value of enterprises of SOCS is not obvious. The possible reasons for this are that enterprises influenced by SOCS are more likely to have unclear ownership, poor self-motivation, etc., resulting in the absence of managers, inefficient management and governance, etc., and affecting business and governance. When the business of enterprises of NSOCS is in good condition, shareholders can obtain greater vested interests and further lay a good foundation for realizing self-worth. Therefore, compared with SOCS, NSOCS can better play their leading role, promote enterprises to conduct GSCM, and promote enterprise value.

Type of enterprise: Different types of enterprises face different development conditions on the background of economic structure transformation and the dual carbon strategy. 1) Polluting-intensive enterprises (PIE) and non-polluting-intensive enterprises (NPIE). PIE face more severe transformation goals and policy regulations in the current context. According to the research of Liu and Liu (2015), enterprises with industry codes C19, C22, C26, C29, C30, C31, and D44 in the sample are defined as PIE, and enterprises in other industries are defined as NPIE. The results of the heterogeneity analysis are shown in Table 4. The results show that the coefficient of GSCM of NPIE is significant at the 5% level, which means that GSCM can promote the value of NPIE. The coefficient of GSCM of PIE is insignificant, indicating that implementing GSCM has no obvious impact on the value improvement in PIE. The possible reason for this is that PIE have a certain particularity in that implementing green processes costs more. At the same time, implementing of GSCM is not only the implementation of PIE, but also needs the implementation of other enterprises. However, the operators of other enterprises think that improving the environment and implementing greenization is the responsibility of PIE, and this sentiment reduces the sensitivity of enterprises on the chain to implementing GSCM. 2) Technology-intensive enterprises (TIE) and non-technology-intensive enterprises (NTIE). According to the CSRC’s 2012 industry classification standard, firms with industry codes C27, C34, C35, C36, C37, C38, C39, and M74 are defined as TIE, and the rests are NTIE. The regression results of Table 4 show that the coefficient of GSCM of NTIE is significant at the 1% level, which means that GSCM can promote the value of enterprises of NTIE. The GSCM coefficient of TIE is insignificant, indicating that implementing GSCM has no obvious impact on the value improvement in TIE. The possible reasons for this are as follows: compared with TIE, NTIE have poor technical capabilities, and the green and sustainable development of supply chain management requires enterprises to have certain technical capabilities and conditions. At the same time, digital technology has played a greater role during the COVID-19 epidemic. Therefore, implementing GSCM in enterprises with poor technical ability will help them improve their technical level and promote their ability to transform technological and other capabilities into value improvement. Therefore, implementing GSCM in NTIE will play a more significant role in promoting enterprise value.

5.3 Further analysis

5.3.1 The moderating effect test of enterprise risk-taking level

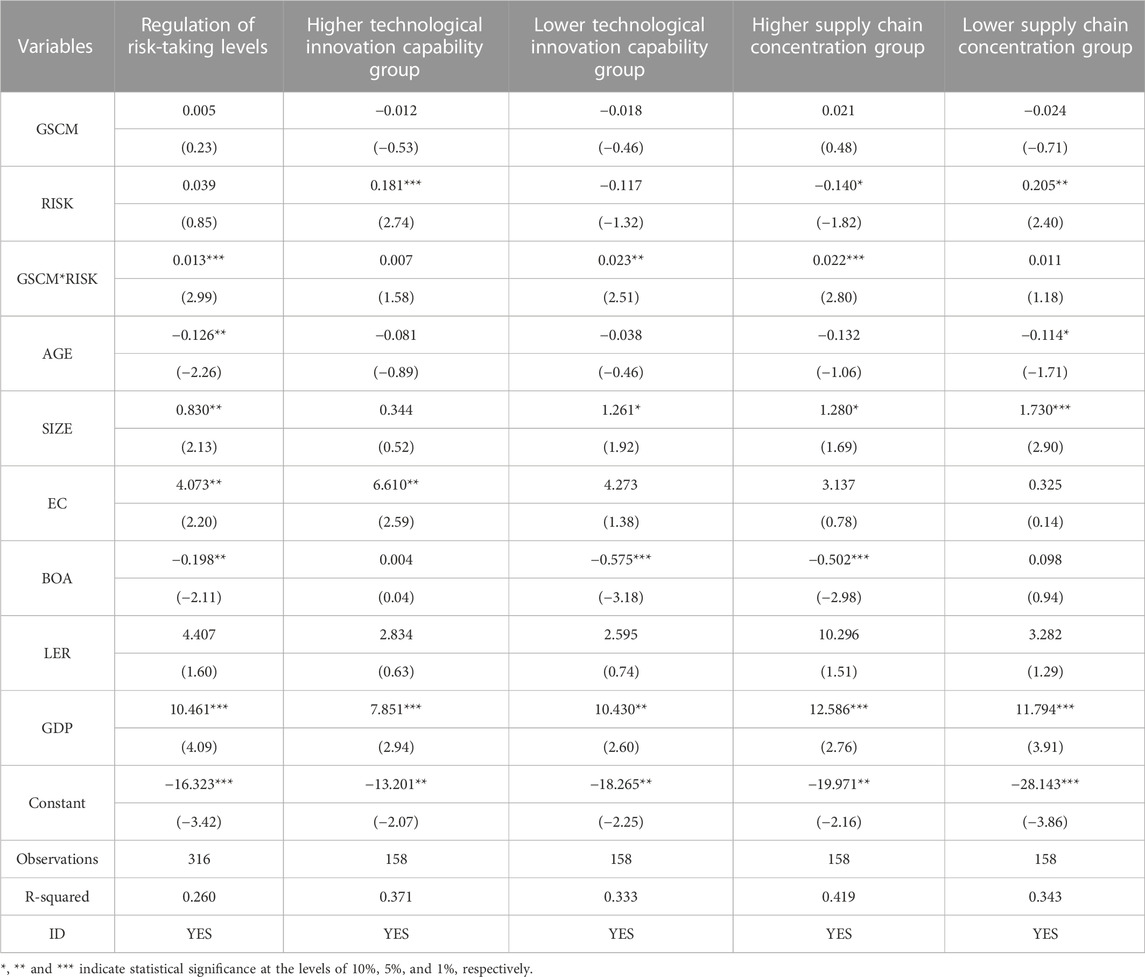

The regression results in Table 5 show that the interaction term coefficient between GSCM and corporate risk-taking is 0.013 and significant at the 1% level, indicating that when the risk-taking level is higher, implementing GSCM can better promote an improvement in corporate value. It is not difficult to understand that, as mentioned earlier, the implementation of GSCM by enterprises will reduce the risk-taking level of enterprises and increase the possibility of enterprises facing financial difficulties. Only when the enterprise’s risk-taking level is higher, it can show that the enterprise does not have the possibility of facing higher financial distress under the current business condition, and the enterprise will have the intention to implement GSCM. Therefore, the higher the risk-taking level of the enterprise, the more it can indicate that the current enterprise does not have financial distress, and the more it can support the enterprise to carry out GSCM. That is, when the enterprise risk-taking level is higher, the positive promotion effect of implementing GSCM on enterprise value enhancement is obvious.

5.3.2 Test on the dual moderating effect of TIC and SCC

The regression results of the dual moderating effects of Table 5 show the following: 1) When the TIC of enterprises is low, the moderating effect of the risk-taking level is more significant. This is because enterprises conducting technological innovation work spend a lot of manpower and material resources, which increases the probability of corporate financial difficulties and financial constraints, debt risk, etc., and implementing GSCM also requires enterprises to continuously inject funds; when the financial risks faced by enterprises are too large, it is not conducive for enterprises to conduct GSCM. Therefore, the lower the TIC of enterprises, the more significant the role of the risk-taking level in promoting enterprise value using GSCM. Hypothesis H2a thus holds. 2) When the SCC is higher, the risk-taking level plays a more significant role in implementing GSCM to promote enterprise value. SCC is measured by the average of the sum of the proportion of the top five customers and suppliers in the overall sales and procurement. The higher the SCC value, the stronger the relationship between enterprises, and the more conducive it is for enterprises to establish a stable supply and sales network and reduce procurement and sales risks and costs to increase the abundance of funds to conduct GSCM and turn it into enterprise value. Therefore, the higher the SCC value, the more significant the role of the risk-taking level in GSCM promoting enterprise value. Hypothesis H2b thus holds.

6 Discussion and conclusion

6.1 Discussion

In the existing research, most articles analyze how GSCM improves corporate value, but analyzing mechanisms and paths and discussing the relationship between the two is not comprehensive. The implementation of GSCM requires enterprises to inject funds continuously, and enterprises’ financial level reflects the enterprises’ risk-taking ability to a certain extent. At the same time, the risk-taking level of enterprises is affected by the degree of technological innovation and the stability of the supply and sales network. Therefore, this paper first examines the impact of GSCM on enterprise value and analyzes the regulatory role of the risk-taking level in promoting enterprise value by GSCM, further discussing the dual-level regulatory role of TIC and SCC. The innovation of this paper lies in. 1) Enriching the research on the impact of GSCM on enterprise value. 2) From the perspective of corporate risk-taking level, this paper studies the role of the risk-taking level in GSCM to enhance enterprise value. 3) This paper further explores how the level of risk-taking affects the role of GSCM in promoting enterprise value when the TIC and SCC adjust the level of risk-taking.

6.2 Conclusion

This paper uses the data of 131 Chinese listed companies from 2014 to 2021 to empirically test the impact of implementing GSCM on improving enterprise value. At the same time, to clarify the path of implementing GSCM affecting the improvement in enterprise value, this paper also explores the regulatory role of the risk-taking level, further analyzes the dual regulatory role of TIC and SCC and draws the following conclusion. 1) Enterprises carrying out GSCM can promote an improvement in enterprise value. 2) The nature of the controlling shareholders of enterprises is different, the type of enterprise is different, and the role of GSCM in enhancing corporate value is different. When the enterprise is NSOCS, NPIE and NTIE types, implementing GSCM significantly promotes enterprise value. 3) The level of corporate risk-taking can positively regulate the role of GSCM in enhancing enterprise value; that is, the higher the level of risk-taking, the more GSCM can promote enterprise value. 4) The level of corporate risk-taking is moderated by TIC and SCC. When the TIC is low or the SCC is high, the level of risk-taking plays a more significant role in promoting corporate value via GSCM.

7 Practical enlightenment

Implementing GSCM can promote an improvement in enterprise value. To achieve this goal, we should focus on the following.

(1) Starting from the government, through guidance, encouragement, and other measures to promote GSCM—we should cultivate new economic growth points and promote the acceleration of the green, intelligent, and high-end transformation and upgrading of traditional industries to form new competitive advantages and thus realize the win–win situation of ecological protection and promote the greening of enterprises. The research results reveal that when enterprises have a good level of risk-taking, the role of the GSCM in promoting enterprise value is more obvious. In addition, improving the enterprise’s TIC is not conducive to the enterprise’s risk-taking level, but implementing greenization and ecologicalization will inevitably require an injection of capital, technological, and other costs. This requires government departments to issue special support policies to strengthen support for enterprises with good finances and talent; at the same time, market resources must be guided to achieve rational allocation and ensure an improvement in the TIC of enterprises and the stability of capital and cash flow.

(2) Starting from enterprises, we should deepen the management and operation awareness of the coexistence of ecological protection and economic benefits, actively incorporate greening and sustainability into the scope of enterprise management and supply chain collaboration and internalize the cognition and practice of GSCM in the ideological culture and operation management. The different types of shareholders and the different types of enterprises will affect the implementation of GSCM. This requires enterprises to adjust measures to local conditions when implementing GSCM and not blindly follow the trend so as not to cause greater management and operational risks. The higher the SCC, the better the moderating effect of the risk-taking level. On the one hand, the higher the SCC, the better the supply chain network’s stability. At this time, enterprises can implement the concept of environmental protection in the process of product manufacturing and sales using cooperation and interaction with upstream and downstream enterprises to enhance the overall greening of the chain and enhance enterprise value and performance. On the other hand, the better the stability of the supply chain, the better the positive regulatory effect of the risk-taking level is. At this time, different enterprises can establish the concept and channel of cooperation and strive to build a mutually beneficial supply and sales system. Product manufacturing and raw material supply enterprises can continuously improve their product quality, and commodity sales enterprises can improve their sales methods. While improving their competitiveness, they can increase the demand and support of other enterprises for their own enterprises, improve the stability of supply and sales networks, and reduce the probability of financial risks to improve their performance when implementing GSCM.

8 Research limitations and future research directions

This paper has found that the level of risk-taking can positively promote the role of GSCM in terms of enterprise value enhancement, and TIC and SCC also influence the level of risk-taking, but there are certain shortcomings.

Firstly, due to data limitations, the CITI index disclosed by IPE is selected to measure the GSCM level of companies in this paper, but the index only evaluates some specific companies, and the overall sample size is small. Future research could: 1) A universal evaluation index system can be constructed based on the evaluation criteria of IPE to meet the purpose of evaluating the GSCM scores of all companies. 2) Further, the statistical method can be used to argue the role of GSCM implementation on enterprise value based on the evaluation scores, so that the research conclusions can be more convincing to promote and facilitate the implementation of GSCM in enterprises.

Secondly, the benefits of implementing GSCM for enterprises are not only reflected in value enhancement, but future research can also analyze the benefits brought by the implementation of GSCM for enterprises from the perspective of enterprise competitiveness, inventory cost, and green development.

Finally, the lack of other regulating factors in the theoretical analysis and research process, future research could also find, study and argue how the implementation of GSCM affects enterprise value enhancement from the perspective of customers and suppliers, to enrich the research of GSCM and promote the implementation of GSCM in enterprises, to achieve a win-win situation of economic benefits and environmental protection.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

Conceptualization, LZ and YD; methodology, LZ and YD; software, LZ and YD; validation, LZ; formal analysis, LZ and YD; resources, LZ and YD; data curation, LZ and YD; writing—original draft preparation, LZ and YD; writing—review and editing, LZ, YD, and HW; visualization, LZ and YD; supervision, LZ, YD, and HW; project administration, YD and HW; funding acquisition, YD and HW. All authors have read and agreed to the published version of the manuscript.

Funding

This article is supported by the Research Projects on National Social Science Foundation of China under Grant number 20BGL015, The Shanghai Cooperation Organization (SCO) Science and Technology Partnership Program and International Science and Technology Partnership Program and International Science and Technology Cooperation Program under Grant number 2019E01009 and the Silk Road Innovation Project of Xinjiang University under Grant number SL2022010, SL2022015.

Acknowledgments

Thanks to Mel Dudley and Christopher Adam Dacosta for taking the time to proofread and correct the language of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abdallah, A. B., and Al-Ghwayeen, W. S. (2019). Green supply chain management and business performance: The mediating roles of environmental and operational performances. Bus. Process Manag. J. 26, 489–512. doi:10.1108/BPMJ-03-2018-0091

Abinzano, I., Gonzalez-Urteaga, A., Muga, L., and Sanchez, S. (2020). Performance of default-risk measures: The sample matters. J. Bank. Finance 120, 105959. doi:10.1016/j.jbankfin.2020.105959

Abu Seman, N. A., Govindan, K., Mardani, A., Zakuan, N., Mat Saman, M. Z., Hooker, R. E., et al. (2019). The mediating effect of green innovation on the relationship between green supply chain management and environmental performance. J. Clean. Prod. 229, 115–127. doi:10.1016/j.jclepro.2019.03.211

Aghion, P., Van Reenen, J., and Zingales, L. (2013). Innovation and institutional ownership. Am. Econ. Rev. 103, 277–304. doi:10.1257/aer.103.1.277

Agrawal, V., Mohanty, R. P., Agarwal, S., Dixit, J. K., and Agrawal, A. M. (2022). Analyzing critical success factors for sustainable green supply chain management. Environ. Dev. Sustain doi:10.1007/s10668-022-02396-2

Agyabeng-Mensah, Y., Ahenkorah, E., Afum, E., Nana Agyemang, A., Agnikpe, C., and Rogers, F. (2020). Examining the influence of internal green supply chain practices, green human resource management and supply chain environmental cooperation on firm performance. Supply Chain Manag. An Int. J. 25, 585–599. doi:10.1108/SCM-11-2019-0405

Ahmed, W., Najmi, A., and Khan, F. (2020). Examining the impact of institutional pressures and green supply chain management practices on firm performance. Manag. Environ. Qual. An Int. J. 31, 1261–1283. doi:10.1108/MEQ-06-2019-0115

Ali, Q. M., Nisar, Q. A., Abidin, R. Z., Qammar, R., and Abbass, K. (2022). Greening the workforce in higher educational institutions: The pursuance of environmental performance. Environ. Sci. Pollut. Res. doi:10.1007/s11356-022-19888-3

An, R., and Zhu, G. (2022). Clustering of economic efficiency of urban energy carbon emissions based on decoupling theory. Energy Rep. 8, 9569–9575. doi:10.1016/j.egyr.2022.07.063

Andiappan, V., Foo, D. C. Y., and Tan, R. R. (2022). Automated targeting for green supply chain planning considering inventory storage losses, production and set-up time. J. Industrial Prod. Eng. 39, 341–352. doi:10.1080/21681015.2021.1991015

Asghari, M., Afshari, H., Mirzapour Al-e-hashem, S. M. J., Fathollahi-Fard, A. M., and Dulebenets, M. A. (2022). Pricing and advertising decisions in a direct-sales closed-loop supply chain. Comput. Industrial Eng. 171, 108439. doi:10.1016/j.cie.2022.108439

Aslam, B., Hu, J., Shahab, S., Ahmad, A., Saleem, M., Syed, S., et al. (2021). The nexus of industrialization, GDP per capita and CO2 emission in China. Environ. Technol. innovation 23, 101674. doi:10.1016/j.eti.2021.101674

Baldini, M., Maso, L. D., Liberatore, G., Mazzi, F., and Terzani, S. (2018). Role of country- and firm-level determinants in environmental, social, and governance disclosure. J. Bus. Ethics 150, 79–98. doi:10.1007/s10551-016-3139-1

Becerra, P., Mula, J., and Sanchis, R. (2021). Green supply chain quantitative models for sustainable inventory management: A review. J. Clean. Prod. 328, 129544. doi:10.1016/j.jclepro.2021.129544

Cao, J., Liang, H., and Zhan, X. (2019). Peer effects of corporate social responsibility. Manag. Sci. 65, 5487–5503. doi:10.1287/mnsc.2018.3100

Cao, X., and Zhang, Y. (2022). Environmental regulation, foreign investment, and green innovation: A case study from China. Environ. Sci. Pollut. Res. 29, 90046–90057. doi:10.1007/s11356-022-22722-5

Chen, S. (2015). Environmental pollution emissions, regional productivity growth and ecological economic development in China. China Econ. Rev. 35, 171–182. doi:10.1016/j.chieco.2014.08.005

Chiu, C.-Y., Cheng, C.-Y., and Wu, T.-Y. (2021). Integrated operational model of green closed-loop supply chain. Sustainability 13, 6041. doi:10.3390/su13116041

Cuerva, M. C., Triguero-Cano, Á., and Córcoles, D. (2014). Drivers of green and non-green innovation: Empirical evidence in low-tech SMEs. J. Clean. Prod. 68, 104–113. doi:10.1016/j.jclepro.2013.10.049

Dai, S., and Zhu, Z. (2020). Environmental uncertainty, supply chain concentration and corporate risk-taking. Finance Account. Newsl. 2020, 95–98. doi:10.16144/j.cnki.issn1002-8072.2020.21.020

Dias, A., Rodrigues, L. L., Craig, R., and Neves, M. E. (2018). Corporate social responsibility disclosure in small and medium-sized entities and large companies. Soc. Responsib. J. 15, 137–154. doi:10.1108/SRJ-05-2017-0090

Dong, Z., Tan, Y., and Cao, Z. (2021). Does green supply chain management stimulate clean technology innovation? -An empirical analysis based on identification and classification tests. J. East China Normal Univ. (Philosophy Soc. Sci. Ed.) 53, 136–149+183. doi:10.16382/j.cnki.1000-5579.2021.04.013

Ezuma, R. E. M. R., Matthew, N. K., Ezuma, R. E. M. R., and Matthew, N. K. (2022). The perspectives of stakeholders on the effectiveness of green financing schemes in Malaysia. GF 4, 450–473. doi:10.3934/GF.2022022

Fang, H., Zhang, Y., and Wang, P. (2017). Legal environment, supply chain concentration and comparability of corporate accounting information. Account. Res. 2017, 33–40+96.

Fasan, M., Soerger Zaro, E., Soerger Zaro, C., Porco, B., and Tiscini, R. (2021). An empirical analysis: Did green supply chain management alleviate the effects of COVID-19? Bus. Strategy Environ. 30, 2702–2712. doi:10.1002/bse.2772

Feng, M., Yu, W., Wang, X., Wong, C. Y., Xu, M., and Xiao, Z. (2018). Green supply chain management and financial performance: The mediating roles of operational and environmental performance. Bus. Strategy Environ. 27, 811–824. doi:10.1002/bse.2033

Feng, Y., Chen, H., Chen, Z., Wang, Y., and Wei, W. (2021). Has environmental information disclosure eased the economic inhibition of air pollution? J. Clean. Prod. 284, 125412. doi:10.1016/j.jclepro.2020.125412

Ghobakhloo, M., Tang, S. H., Zulkifli, N., and Mohd Ariffin, M. K. A. (2013). An integrated framework of green supply chain management implementation. Int. J. Innovation, Manag. Technol. 4, 86–89.

Gholian-Jouybari, F., Hashemi-Amiri, O., Mosallanezhad, B., and Hajiaghaei-Keshteli, M. (2023). Metaheuristic algorithms for a sustainable agri-food supply chain considering marketing practices under uncertainty. Expert Syst. Appl. 213, 118880. doi:10.1016/j.eswa.2022.118880

Gu, X., Chen, Y., and Pan, S. (2018). Economic policy uncertainty and innovation-an empirical analysis based on listed companies in China. Econ. Res. 53, 109–123.

Gurel, O., Acar, A. Z., Onden, I., and Gumus, I. (2015). Determinants of the green supplier selection. Procedia - Soc. Behav. Sci. 181, 131–139. doi:10.1016/j.sbspro.2015.04.874

Jain, A. (2022). Sharing demand information with retailer under upstream competition. Manag. Sci. 68, 4983–5001. doi:10.1287/mnsc.2021.4116

Jiang, T. (2022). Mediating and moderating effects in empirical studies of causal inference. China Ind. Econ. 2022, 100–120. doi:10.19581/j.cnki.ciejournal.2022.05.005

Karimi, S. K., Naini, S. G. J., and Sadjadi, S. J. (2021). An integration of environmental awareness into flexible supply chains: A trade-off between costs and environmental pollution. Environ. Sci. Pollut. Res. 2021, 1–11. doi:10.1007/s11356-021-13454-z

Li, G., Li, L., Choi, T. M., and Sethi, S. P. (2019). Green supply chain management in Chinese firms: Innovative measures and the moderating role of quick response technology. J. Operations Manag. 66, 958–988. doi:10.1002/joom.1061

Li, M., and Zhou, Y. (2022). Analysis of supply chain optimization method and management intelligent decision under green economy. Wirel. Commun. Mob. Comput. 2022, 1–9. doi:10.1155/2022/4502430

Li, R., and Chen, X. (2022). Reverse logistics network design under disruption risk for third-party logistics providers. Sustainability 14, 14936. doi:10.3390/su142214936

Li, S., Ragu-Nathan, B., Ragu-Nathan, T. S., and Subba Rao, S. (2006). The impact of supply chain management practices on competitive advantage and organizational performance. Omega 34, 107–124. doi:10.1016/j.omega.2004.08.002

Li, Z., Liao, G., and Albitar, K. (2020). Does corporate environmental responsibility engagement affect firm value? The mediating role of corporate innovation. Bus. Strategy Environ. 29, 1045–1055. doi:10.1002/bse.2416

Li, Z., Zou, F., and Mo, B. (2022). Does mandatory CSR disclosure affect enterprise total factor productivity? Econ. Research-Ekonomska Istraživanja 35, 4902–4921. doi:10.1080/1331677X.2021.2019596

Liao, G., Hou, P., Shen, X., and Albitar, K. (2021). The impact of economic policy uncertainty on stock returns: The role of corporate environmental responsibility engagement. Int. J. Finance Econ. 26, 4386–4392. doi:10.1002/ijfe.2020

Liao, Y., Kaviyani-Charati, M., Hajiaghaei-Keshteli, M., and Diabat, A. (2020). Designing a closed-loop supply chain network for citrus fruits crates considering environmental and economic issues. J. Manuf. Syst. 55, 199–220. doi:10.1016/j.jmsy.2020.02.001

Liu, P., Zhao, Y., Zhu, J., Yang, C., Liu, P., Zhao, Y., et al. (2022a). Technological industry agglomeration, green innovation efficiency, and development quality of city cluster. GF 4, 411–435. doi:10.3934/GF.2022020

Liu, Y., Failler, P., and Ding, Y. (2022b). Enterprise financialization and technological innovation: Mechanism and heterogeneity. PLOS ONE 17, e0275461. doi:10.1371/journal.pone.0275461

Liu, Y., and Liu, M. (2015). Does haze affect the surplus management of heavy polluters? -An examination based on the political cost hypothesis. Account. Res. 2015, 26–33+94.

Longoni, A., and Cagliano, R. (2018). Inclusive environmental disclosure practices and firm performance: The role of green supply chain management. Int. J. Operations Prod. Manag. 38, 1815–1835. doi:10.1108/IJOPM-12-2016-0728

Lu, Q., Wang, H., and Liu, W. (2020). Managerial power, technological innovation and audit risk premium. China Soft Sci. 2020, 137–144+164.

Ma, D., Qin, H., and Hu, J. (2022). Achieving triple sustainability in closed-loop supply chain: The optimal combination of online platform sales format and blockchain-enabled recycling. Comput. Industrial Eng. 174, 108763. doi:10.1016/j.cie.2022.108763

Mannucci, P., and Franchini, M. (2017). Health effects of ambient air pollution in developing countries. IJERPH 14, 1048. doi:10.3390/ijerph14091048

Mao, J., Zhang, R., and Guan, C. (2022). Digital economy, fiscal decentralization and corporate innovation. J. Southwest Univ. Natl. Humanit. Soc. Sci. Ed. 43, 118–129.

Min, H., and Galle, W. P. (2001). Green purchasing practices of US firms. Int. J. Operations Prod. Manag. 21, 1222–1238. doi:10.1108/EUM0000000005923

Mirzagoltabar, H., Shirazi, B., Mahdavi, I., and Arshadi Khamseh, A. (2021). Sustainable dual-channel closed-loop supply chain network with new products for the lighting industry. Comput. Industrial Eng. 162, 107781. doi:10.1016/j.cie.2021.107781

Mohamed Abdul Ghani, N. M. A., Egilmez, G., Kucukvar, M., Bhutta, S., and Khurrum, M. (2017). From green buildings to green supply chains: An integrated input-output life cycle assessment and optimization framework for carbon footprint reduction policy making. Manag. Environ. Qual. An Int. J. 28, 532–548. doi:10.1108/MEQ-12-2015-0211

Moosavi, J., Fathollahi-Fard, A. M., and Dulebenets, M. A. (2022). Supply chain disruption during the COVID-19 pandemic: Recognizing potential disruption management strategies. Int. J. Disaster Risk Reduct. 75, 102983. doi:10.1016/j.ijdrr.2022.102983

Neeley, T. B., and Leonardi, P. M. (2018). Enacting knowledge strategy through social media: Passable trust and the paradox of nonwork interactions. Strategic Manag. J. 39, 922–946. doi:10.1002/smj.2739

Ni, W., and Sun, H. (2019). Does construct multidimensionality matter? A nuanced examination of the relationship among supply chain integration, green supply chain management, and business performance. Sustainability 11, 5455. doi:10.3390/su11195455

Novitasari, M., Wijaya, A. L., Agustin, N. M., Gunardi, A., and Dana, L.-P. (2022). Corporate social responsibility and firm performance: Green supply chain management as a mediating variable. Corp. Soc. Responsib. Environ. Manag. 30, 267–276. doi:10.1002/csr.2353

Pal, B., Sarkar, A., and Sarkar, B. (2023). Optimal decisions in a dual-channel competitive green supply chain management under promotional effort. Expert Syst. Appl. 211, 118315. doi:10.1016/j.eswa.2022.118315

Panigrahi, S. S., Bahinipati, B., and Jain, V. (2018). Sustainable supply chain management: A review of literature and implications for future research. Manag. Environ. Qual. An Int. J. 30, 1001–1049. doi:10.1108/MEQ-01-2018-0003

Patatoukas, P. N. (2011). Customer-base concentration: Implications for firm performance and capital markets. Account. Rev. 87, 363–392. doi:10.2308/accr-10198

Qi, X., and Wang, Q. (2022). Exploratory innovation, redundant resources and financial performance of small and medium-sized enterprises. Friends Account. 2022, 66–72.

Qin, G., Niu, Z., Yu, J., Li, Z., Ma, J., and Xiang, P. (2021). Soil heavy metal pollution and food safety in China: Effects, sources and removing technology. Chemosphere 267, 129205. doi:10.1016/j.chemosphere.2020.129205

Rabbi, M., Ali, S. M., Kabir, G., Mahtab, Z., and Paul, S. K. (2020). Green supply chain performance prediction using a bayesian belief network. Sustainability 12, 1101. doi:10.3390/su12031101

Rao, P., and Holt, D. (2005). Do green supply chains lead to competitiveness and economic performance? Int. J. Operations Prod. Manag. 25, 898–916. doi:10.1108/01443570510613956

Richnák, P., and Gubová, K. (2021). Green and reverse logistics in conditions of sustainable development in enterprises in Slovakia. Sustainability 13, 581. doi:10.3390/su13020581

Rodríguez-González, R. M., Maldonado-Guzmán, G., Madrid-Guijarro, A., and Garza-Reyes, J. A. (2022). Does circular economy affect financial performance? The mediating role of sustainable supply chain management in the automotive industry. J. Clean. Prod. 379, 134670. doi:10.1016/j.jclepro.2022.134670

Sajjad, A., Eweje, G., and Tappin, D. (2020). Managerial perspectives on drivers for and barriers to sustainable supply chain management implementation: Evidence from New Zealand. Bus. Strategy Environ. 29, 592–604. doi:10.1002/bse.2389

Salandri, L., Cascio Rizzo, G. L., Cozzolino, A., and De Giovanni, P. (2022). Green practices and operational performance: The moderating role of agility. J. Clean. Prod. 375, 134091. doi:10.1016/j.jclepro.2022.134091

Salehi-Amiri, A., Zahedi, A., Akbapour, N., and Hajiaghaei-Keshteli, M. (2021). Designing a sustainable closed-loop supply chain network for walnut industry. Renew. Sustain. Energy Rev. 141, 110821. doi:10.1016/j.rser.2021.110821

Samad, S., Nilashi, M., Almulihi, A., Alrizq, M., Alghamdi, A., Mohd, S., et al. (2021). Green supply chain management practices and impact on firm performance: The moderating effect of collaborative capability. Technol. Soc. 67, 101766. doi:10.1016/j.techsoc.2021.101766

Sarkis, J., Cohen, M. J., Dewick, P., and Schröder, P. (2020). A brave new world: Lessons from the COVID-19 pandemic for transitioning to sustainable supply and production. Resour. Conservation Recycl. 159, 104894. doi:10.1016/j.resconrec.2020.104894

Sheng, X., Chen, L., Yuan, X., Tang, Y., Yuan, Q., Chen, R., et al. (2022). Green supply chain management for a more sustainable manufacturing industry in China: A critical review. Environ. Dev. Sustain 25, 1151–1183. doi:10.1007/s10668-022-02109-9

Sheu, J.-B., and Chen, Y. J. (2012). Impact of government financial intervention on competition among green supply chains. Int. J. Prod. Econ. 138, 201–213. doi:10.1016/j.ijpe.2012.03.024

Sun, J., Sarfraz, M., Khawaja, K. F., and Abdullah, M. I. (2022). Sustainable supply chain strategy and sustainable competitive advantage: A mediated and moderated model. Front. Public Health 10, 895482. doi:10.3389/fpubh.2022.895482

Tseng, M.-L., Islam, M. S., Karia, N., Fauzi, F. A., and Afrin, S. (2019). A literature review on green supply chain management: Trends and future challenges. Resour. Conservation Recycl. 141, 145–162. doi:10.1016/j.resconrec.2018.10.009

Wang, C., Zhang, Q., and Zhang, W. (2020). Corporate social responsibility, Green supply chain management and firm performance: The moderating role of big-data analytics capability. Res. Transp. Bus. Manag. 37, 100557. doi:10.1016/J.RTBM.2020.100557

Wang, M.-X., Zhao, H.-H., Cui, J.-X., Fan, D., Lv, B., Wang, G., et al. (2018). Evaluating green development level of nine cities within the Pearl River Delta, China. J. Clean. Prod. 174, 315–323. doi:10.1016/j.jclepro.2017.10.328

Wang, M., Li, L., Lan, H., Wang, M., Li, L., and Lan, H. (2021). The measurement and analysis of technological innovation diffusion in China’s manufacturing industry. NAR 3, 452–471. doi:10.3934/NAR.2021024

Wang, M., and Yang, Y. (2022). An empirical analysis of the supply chain flexibility using blockchain technology. Front. Psychol. 13, 1004007. doi:10.3389/fpsyg.2022.1004007

Wang, S., and Li, S. (2021). Study on the relationship between green supply chain management, institutional environment and environmental benefits of retail enterprises. Bus. Econ. Res. 2021, 35–38.

Wang, X., and Rao, S. (2021). Group operation, controlling shareholder equity pledge and corporate innovation. Nanfang Finance 2021, 49–58.

Wei, L., Lin, B., Zheng, Z., Wu, W., and Zhou, Y. (2023). Does fiscal expenditure promote green technological innovation in China? Evidence from Chinese cities. Environ. Impact Assess. Rev. 98, 106945. doi:10.1016/j.eiar.2022.106945

Wu, J. (2022). Sustainable development of green reverse logistics based on blockchain. Energy Rep. 8, 11547–11553. doi:10.1016/j.egyr.2022.08.219

Xiao, X., Lin, S., Li, Q., and Zhuang, M. (2021). A study of the impact of knowledge distance and institutional distance on innovation catch-up of firms in emerging economies - the dual moderating role of firm characteristics. Manag. Rev. 33, 115–129. doi:10.14120/j.cnki.cn11-5057/f.2021.10.011

Xie, D., Zheng, D., and Cui, C. (2016). Are controlling shareholders’ equity pledges a potential “landmine”? -A study based on the perspective of stock price collapse risk. Manag. World 2016, 128–140+188. doi:10.19744/j.cnki.11-1235/f.2016.05.011

Xie, X., and Zhu, Q. (2022). Innovative fulcrums or conservative shackles: How can green supply chain management practices leverage corporate performance? China Manag. Sci. 30, 131–143. doi:10.16381/j.cnki.issn1003-207x.2019.0999

Xu, G., Zhuo, Y., Zhang, Y., and Zhang, J. (2022a). Does ESG disclosure increase firm value? Financ. Account. Newsl. 2022, 33–37. doi:10.16144/j.cnki.issn1002-8072.2022.04.029

Xu, H., Gao, K., Chi, Y., Chen, Y., and Peng, R. (2022b). Interactive impacts of overconfidence and competitive preference on closed-loop supply chain performance. Mathematics 10, 4334. doi:10.3390/math10224334

Xu, L. (2022). Towards green innovation by China’s industrial policy: Evidence from made in China 2025. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.924250

Xue, X., Dou, J., and Shang, Y. (2020). Blockchain-driven supply chain decentralized operations – information sharing perspective. Bus. Process Manag. J. 27, 184–203. doi:10.1108/BPMJ-12-2019-0518

Yildiz Çankaya, S., and Sezen, B. (2018). Effects of green supply chain management practices on sustainability performance. J. Manuf. Technol. Manag. 30, 98–121. doi:10.1108/JMTM-03-2018-0099

Yontar, E., and Ersöz, S. (2020). Investigation of food supply chain sustainability performance for Turkey’s food sector. Front. Sustain. Food Syst. 4. doi:10.3389/fsufs.2020.00068

Zhang, M., Tse, Y. K., Dai, J., and Chan, H. K. (2019a). Examining green supply chain management and financial performance: Roles of social control and environmental dynamism. IEEE Trans. Eng. Manag. 66, 20–34. doi:10.1109/TEM.2017.2752006

Zhang, W., Liu, Y., Zhang, F., and Dou, H. (2022). Green credit policy and corporate stock price crash risk: Evidence from China. Front. Psychol. 13. doi:10.3389/fpsyg.2022.891284

Zhang, Y., Liu, L., and Yin, Z. (2019b). Shareholding structure characteristics and efficiency of mixed ownership firms. Account. Econ. Res. 33, 92–107. doi:10.16314/j.cnki.31-2074/f.2019.03.007

Zhou, C., and Zhao, X. (2021). Do government tax cuts help enhance corporate risk-taking: Empirical evidence from Chinese listed companies. J. Jiangxi Univ. Finance Econ. 2021, 29–42. doi:10.13676/j.cnki.cn36-1224/f.2021.01.005

Keywords: green supply chain management, risk-taking, enterprise value, technological innovation capability, supply chain concentration

Citation: Zhang L, Dou Y and Wang H (2023) Green supply chain management, risk-taking, and corporate value—Dual regulation effect based on technological innovation capability and supply chain concentration. Front. Environ. Sci. 11:1096349. doi: 10.3389/fenvs.2023.1096349

Received: 12 November 2022; Accepted: 27 January 2023;

Published: 06 February 2023.

Edited by:

Zhenghui Li, Guangzhou University, ChinaReviewed by:

Maxim A. Dulebenets, Florida Agricultural and Mechanical University, United StatesGaoke Liao, Guangzhou University, China

Ming Lang Tseng, Asia University, Taiwan

Sema Yılmaz Genç, Yıldız Technical University, Türkiye

Copyright © 2023 Zhang, Dou and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hailing Wang, aGFpbGluZ3dhbmdAeGp1LmVkdS5jbg==

†These authors have contributed equally to this work

Lingfu Zhang

Lingfu Zhang Yongfang Dou1,2†

Yongfang Dou1,2†