- 1School of Statistics, Lanzhou University of Finance and Economics, Lanzhou, China

- 2Gansu Provincial Key Laboratory of Digital Economy and Social Computing Science, Lanzhou, China

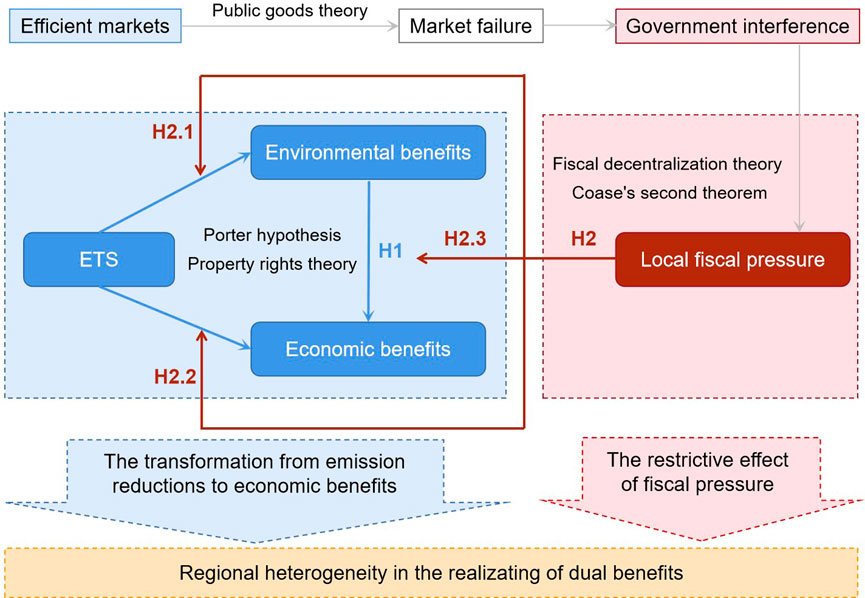

Compared with developed economies, China implements the Emission Trading Scheme (ETS) within a fundamentally distinct political-economic-institutional context. This study aims to investigate the internal mechanisms and external constraints of emission trading scheme in achieving the dual benefits of environmental preservation and economic advancement within the institutional context of fiscal decentralization. We demonstrate that the transmission from emission reduction to economic returns inherently facilitates the realization of dual benefits, and further propose a restrictive effect of local fiscal pressure on the effectiveness of the emission trading scheme. Using panel data of 284 prefectural-level cities from 2003 to 2017, we conduct a quasi-experiment based on China’s emission trading scheme pilot policy in 2007. The results indicate three primary conclusions: First, the implementation of emission trading scheme in China generally yields dual environmental-economic benefits, with emission reduction serving as a transmission channel for realizing economic gains. Second, high fiscal pressure on local governments not only directly undermines policy effects but also indirectly affects the transmission channel. Finally, the dual benefits have been realized in eastern China, but not yet in the central and western regions. This study contributes to the research on market-oriented environmental governance under fiscal decentralization. The theoretical logic of this study can be applied to a wide range of market-based mechanisms for green factors trading, providing valuable insights for countries facing similar challenges.

1 Introduction

Traditional administrative-ordered environmental regulations have an immediate effect but impede enterprises’ initiatives to reduce emissions, distorting market order (De Mulder, 2011). China is gradually shifting its environmental policies from administrative mandates to market-oriented ones, such as the Emission Trading Scheme (ETS) proposed by Dales (1968), which can effectively address environmental issues while simultaneously reducing the overall social costs of pollution control through market forces. However, it is still controversial whether the implementation of ETS in China can achieve dual benefits for both the environment and economy through “efficient markets.”

Relying solely on market mechanisms to address environmental problems may encounter market failure due to the characteristics of public goods in the environment. Decentralized governments play a pivotal role in environmental governance (Oates, 2001). The evolutionary history of fiscal decentralization in China has resulted in a fiscal system that exhibits the characteristics of relatively low proportions of local revenue but high expenditure responsibilities (Bai et al., 2019), thereby engendering mounting fiscal pressures on local governments. Despite the abundance of literature on the relationship between fiscal decentralization and environmental governance, there is a lack of research exploring whether local fiscal pressures under fiscal decentralization pose a threat to market-based means of environmental governance, such as ETS. Compared with developed economies, China’s implementation of ETS occurs within a completely different political-economic institutional context (Jiang et al., 2016). Fiscal decentralization represents an institutional arrangement that must be considered when evaluating the effectiveness of China’s ETS policy.

This study aims to explore the internal mechanisms and external constraints of ETS in achieving dual benefits within the institutional context of fiscal decentralization. What is the interrelationship between the economic and environmental effects of ETS? How does this relationship facilitate the realization of dual environmental and economic benefits? Will local fiscal pressures under fiscal decentralization impede the effectiveness of ETS? To address these inquiries, drawing on the Porter hypothesis and property rights theory, we demonstrate that the transmission mechanism from emission reduction to economic return inherently fosters the realization of dual benefits. Furthermore, we propose a restrictive effect of local fiscal pressure on the effectiveness of ETS with the theoretical foundations in fiscal decentralization theory and Coase’s second theorem.

Our first hypothesis posits that emission reduction serves as a transmission channel for realizing economic benefits within the ETS framework. The market-oriented ETS can stimulate enterprise innovation, and the resulting benefits of such innovation may offset or even surpass compliance costs associated with pollution treatment under the strong Porter hypothesis. In such circumstances, enterprises tend to promote their green production processes and reduce emissions to maximize profits. To theoretically validate our first hypothesis, we conduct a theoretical derivation from a micro-enterprise perspective. To empirically test this hypothesis, we take China’s ETS pilot policy in 2007 as a quasi-experiment. Using panel data from 284 prefectural-level cities in China spanning from 2003 to 2017, we employ the difference-in-differences (DID) method to investigate the policy’s effects on emission reduction and profit growth. Additionally, we incorporate a mediating effect model to examine an internal mechanism for dual benefits, that is, transmission from emission reduction to economic return. To alleviate the potential endogeneity of reverse causality between emission reduction and profit growth, we adopt two strategies: firstly, considering that future profits are unlikely to alter emissions generated in the past, we utilize industrial profits from the subsequent period instead of the current one as our dependent variable; secondly, we employ two instrumental variables (IVs), namely, the domestic garbage disposal rate and green space per capita, which can reflect a city’s environmental management focus and commitment but are unlikely to impact industrial enterprise profits. Besides, we also employ staggered DID, Sobel test, and Bootstrap test to enhance the robustness of the mediating effect as much as possible.

Our second hypothesis posits that local fiscal pressure undermines the effectiveness of ETS, specifically including impacts on the environmental effect, the economic effect, and the transmission from emission reduction to profit promotion. Fiscal decentralization empowers local governments but also exacerbates their fiscal pressures, which curtails the financial expenditure of local governments to effectively manage emissions trading. When local governments under high fiscal pressure are captured by capital interests, potential rent-seeking corruption may affect excess emission fines and transaction costs (Fan et al., 2009). Furthermore, based on the theoretical derivation of Hypothesis 1, we illustrate how local fiscal pressure influences the economic effect and the transmission from emission reduction to profit promotion, specifically through the changes in initial quotas and excess emission fines. To empirically test this hypothesis, we use a triple-difference framework to examine the impact of local fiscal pressure on policy effectiveness. Additionally, we conduct grouped regressions separated by the median of fiscal pressure and further test differences in coefficients.

The results of this study offer three main conclusions. First, the implementation of ETS in China generally yields dual environmental-economic benefits and emission reduction is one transmission channel to realize economic benefits, implying a synergistic effect instead of a trade-off. Second, high fiscal pressure on local governments not only directly damages policy effects but also indirectly affects the transmission channel, which reveals the significance of a “promising government” in market-based environmental governance. Finally, the dual benefits have been realized in eastern China but not yet in the central and western regions, which can be explained by the constraint of fiscal pressure and the transmission efficiency from emission reductions to economic benefits.

The contributions of this article are mainly reflected in the following aspects:

First, from a novel perspective, we contextualize the evaluation of market-based environmental policies within China’s fiscal decentralization system and investigate the dual environmental-economic effects of ETS under local fiscal pressure for the first time. Building upon the theoretical foundations of fiscal decentralization and Coase’s second theorem, we propose that local fiscal pressure poses an external constraint on the effectiveness of ETS, thereby contributing to the literature on market-oriented environmental governance in a decentralized fiscal system. Distinguished from previous research that focused solely on the direct impact of administrative actions by local governments on the environment under fiscal decentralization, this paper emphasizes how to influence the operational effectiveness of ETS market mechanisms, revealing the significance of “promising governments” in market-based environmental governance.

Second, we demonstrate an internal mechanism of ETS to inherently promote dual benefits, that is, the transmission from emission reduction to economic return. Although policy evaluation of ETS has attracted wide attention, only a few studies discuss the dual environmental and economic effects of ETS and just separately examine the outcomes of the environment and economy. In fact, further elucidation of the interrelationship between environmental and economic effects is necessary to clarify how ETS achieves dual benefits. Our viewpoint is reinforced by Yu et al.’s (2022) study with micro-empirical evidence that the firms regulated by ETS improve the return on assets by cutting emissions. With the theoretical foundations in the Porter hypothesis and property rights theory, we theoretically deduce and demonstrate the transmission mechanism, which distinguishes our study from previous research.

Finally, this article offers two perspectives based on the theoretical hypotheses posited in this study to account for the regional variation in the policy effects: the impact of fiscal pressure and the conversion of emission reductions into economic benefits. Although regional heterogeneity analysis is common in policy evaluation, most articles merely describe the characteristics of regional differences but rarely explain the reasons. In contrast, we provide an account for the regional variation based on the theoretical hypotheses posited in this study. Methodologically, in addition to the grouped regressions based on regions adopted in previous studies, we employ a triple-difference model that incorporates regional dummy variables to examine heterogeneity. This approach can avoid identification interference caused by differences in control variable coefficients across groups.

While the policy focus of this paper lies on pollutant emission in China, the theoretical logic can be applied to a wide range of market-based mechanisms for green factors trading such as carbon emissions trading, energy use rights trading, and natural resources trading, which can effectively address issues related to climate change, energy scarcity, and natural resources’ depletion. The reason for choosing the 2007 ETS pilot policy in this study is that it represents an earlier implementation of a green factor trading mechanism in China, thereby minimizing potential interference from subsequent policies. This study also provides valuable insights for countries facing similar challenges.

The remaining sections of this article are structured as follows: Section 2 introduces the background of the ETS policy and fiscal decentralization in China. Section 3 reviews relevant literature and presents the theoretical analysis. Section 4 describes the empirical strategy used in this study. Section 5 presents the results and discussion, including the dual environmental-economic effects of the policy and the inner link between them, the impact of fiscal pressure on the effectiveness of the policy, and regional heterogeneity analysis. Section 6 concludes and puts forward policy implications.

2 Background on China’s ETS policy and fiscal decentralization

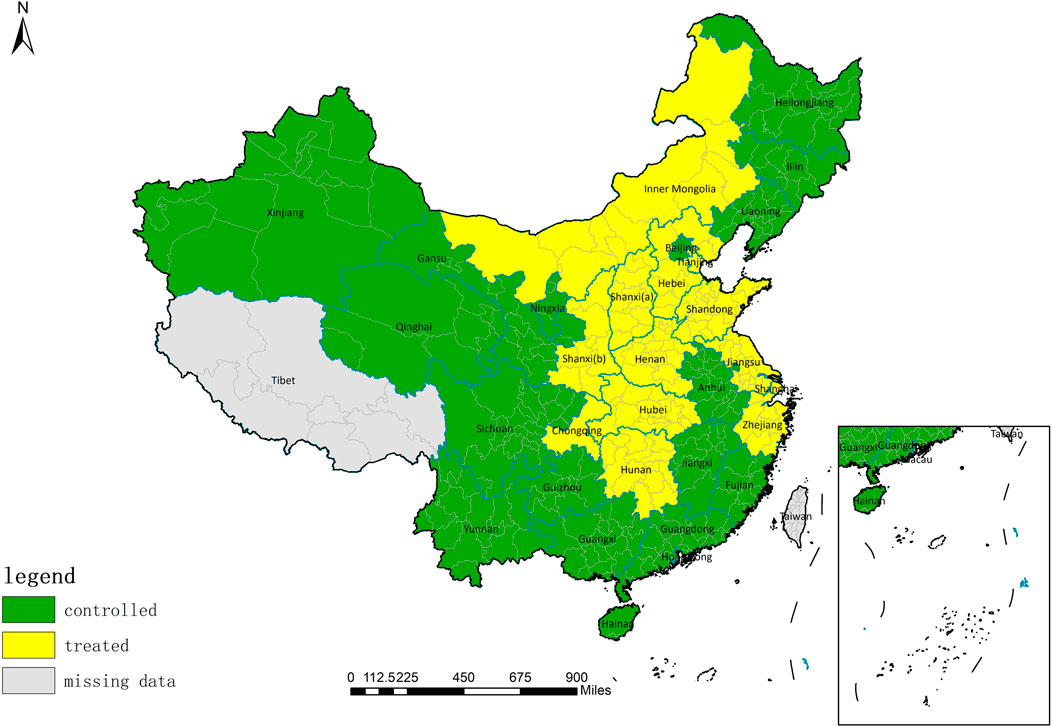

China initiated the sulfur dioxide (SO2) ETS pilot policy in 2002. In 2007, Tianjin, Jiangsu, Zhejiang, Shanxi (a), Shanxi (b), Hubei, Hunan, Inner Mongolia, Hebei, Chongqing, and Henan were approved as ETS pilots. Subsequently, local governments successively introduced relevant policies. To standardize related management and further promote continuous and effective emission reductions, the State Council issued the “Guiding Opinions on Further Promoting the Pilot Work of Paid Use and Trading of Emission Rights1” (hereinafter referred to as Guiding Opinions) in 2014. The Ministry of Finance, together with the former Ministry of Environmental Protection and the National Development and Reform Commission (NDRC), issued the “Interim Measures for the Management of Revenue from the transfer of Pollutant Emission Rights2” in 2015. Currently, 28 provinces (autonomous regions or municipalities) have carried out the work of emission rights trading (Tibet, Guangxi, and Jilin have not yet begun). By the end of 2021, the total amount of paid use and trading of emission rights in China was 24.5 billion yuan. The transaction volume of pilot areas accounted for 83% of the total volume of the country, of which the secondary market contribution rate was 85%3.

The evolutionary background of fiscal decentralization in China makes its fiscal system exhibit the characteristics of a relatively low proportion of local revenue but a high degree of expenditure responsibility (Bai et al., 2019). During the period of planned economy in China, with highly centralized finance, the central government bore a heavy burden while local governments lacked initiative and responsibility for over two decades since 1953. From 1980 to 1993, China underwent a transitional period from a planned economy to a free and open socialist market economy. To incentivize local government initiatives, China implemented the local financial package system during this time, which entrusts local governments with responsibility for annual budget utilization after central government approval. In 1994, the tax-sharing reform was implemented, which established a reasonable division of powers and responsibilities between central and local governments in terms of taxation. This resulted in a significant increase in the central government’s share of fiscal revenue. In 2002, the income tax sharing reform further concentrated central finance revenue by shifting from territorial-based taxation to shared tax types between central and local governments (Xi et al., 2017). Hereafter, the highly centralized distribution of fiscal revenue, coupled with the “new normal” of slower economic growth in China, has impeded the growth rate of local fiscal revenue (Xia et al., 2022). Consequently, the conflict between limited funds for local fiscal revenue and rigid pressure on fiscal expenditure has intensified (Bao and Guan, 2019), leading to increasing fiscal pressure on local governments.

3 Literature review and theoretical analysis

3.1 Literature review

3.1.1 Environmental regulation, ETS, and the dual benefits

In the traditional concept, environmental regulations impose additional costs on enterprises and potentially undermine economic growth, indicating a trade-off between the environment and the economy (Goodstein, 1996). However, the Porter hypothesis challenges the conventional wisdom by suggesting that well-designed environmental regulations, despite increasing costs, can stimulate innovation in enterprises to improve productivity and partially or completely offset compliance costs (Porter and van der Linde, 1995; Bosquet, 2000). It establishes a theoretical foundation for subsequent scholars to study the economic impacts of environmental regulations. Actually, Pearce. (1991) was the first to introduce the concept of a double dividend of the environmental tax policy, namely, pollution reduction and economic promotion.

ETS is an application of property rights theory to environmental problems (Coase, 1960), which internalizes externality problems generated by public products by establishing a market mechanism. The literature on evaluating the effects of ETS originally focused on the United States (US) and the European Union (EU) where SO2 emissions trading and Carbon ETS were first implemented, respectively. Scholars have examined ETS from various perspectives, including abatement and environmental effect (Schleich and Betz, 2004; Anderson and Di Maria, 2011), cost-effectiveness and economic incentives (Rico, 1995; Neuhoff et al., 2006), the economic and environmental performances (Segura et al., 2018), etc. Nevertheless, the implementation of ETS in China differs from that in the US or EU in terms of market size and coverage, enforcement mechanisms and penalties, quota allocation, etc. (Yan et al., 2020). Studies on Chinese ETS policy are mainly conducted from three perspectives: (1) ex-ante analyses utilizing simulation models, such as the Computable General Equilibrium (CGE) model (Li et al., 2014; Cheng et al., 2016); (2) designs of trading mechanisms to enhance market liquidity and efficiency (Munnings et al., 2016; Zhao et al., 2016); (3) ex-post evaluation of policy effects using econometric methods (Xuan et al., 2020; Yan et al., 2020; Liu et al., 2021).

Scholars keep trying to verify whether ETS is a well-designed environmental regulatory tool supporting the Porter hypothesis (Jaffe and Palmer, 1997; Tang et al., 2020; Tan and Lin, 2022; Dechezleprêtre et al., 2023). However, empirical studies have yielded divergent conclusions regarding whether China’s implementation of ETS has resulted in dual benefits for both the environment and the economy. Some studies cast doubt on achieving dual benefits from various perspectives, such as output promotion and employment increase (Hou et al., 2020; Zhang, 2020; Tan and Lin, 2022). Tan and Lin (2022) discovered that the carbon emission trading policy in China exhibits a discernible reduction effect on emissions, but an insignificant economic impact on output. They emphasized the necessity of external technological breakthroughs to achieve dual benefits. Hou et al. (2020) empirically tested that the policy was effective for regulating environmental pollution but ineffective for promoting the economy, utilizing gross domestic product (GDP) and per capita GDP as economic performance. Zhang (2020) concluded that the “blue dividend” (economic effect) was realized by significantly improving the employment level; however, no evidence of the “green dividend” (environmental effect) was discovered. Nevertheless, some empirical articles come to opposite conclusions. Ren et al. (2020) and Huang et al. (2021) identified the dual benefits of reducing SO2 emissions while simultaneously increasing industrial output. Yang et al. (2020) empirically tested the double dividends of Carbon ETS in China, based on the economic outcomes of expanding employment. Yu et al. (2022) provided empirical evidence at the micro-enterprise level that China’s carbon ETS reduces carbon intensity while improving return on assets.

3.1.2 Fiscal decentralization, local fiscal pressure, and environmental governance

As for whether fiscal decentralization contributes to environmental governance, the existing literature can be broadly categorized into three perspectives:

The first category of standpoint deems that fiscal decentralization fosters environmental governance (Oates, 2001; Jacobsen et al., 2012; Khan et al., 2021), and its theoretical underpinning is rooted in the first generation of fiscal decentralization theory. Decentralized governments play a crucial role in environmental governance by establishing and enforcing environmental standards and regulations (Oates, 2001). Local governments are typically better equipped to manage and enforce pollution control within their jurisdiction, and local pollution has implications for the allocation of expenditure and tax responsibilities across all levels of government (Alm and Banzhaf, 2012). Some scholars make explanations by the hypothesis of a “race to the top,” that is, local governments compete to show their environmental governance performance by raising environmental standards and transferring pollutants to other areas to improve the environmental quality in their jurisdiction (Levinson, 2003; Khan et al., 2021).

The second kind of view, based on the second generation of fiscal decentralization theory, posits that fiscal decentralization is detrimental to environmental governance and aggravates environmental pollution (Sigman, 2005; Kunce and Shogren, 2007; Zhang et al., 2011; Deng and Xu, 2013; Huang, 2017; Khan et al., 2021). The decentralization-induced local competition may lead to inefficiencies in addressing practical environmental problems (Levinson, 2003), particularly in developing countries (Alm and Banzhaf, 2012). Based on the environmental externality hypothesis, decentralization may cause a “free rider” problem in local governments’ environmental governance due to the cross-regional spillover effect of environmental pollution (Silva and Caplan, 1997). Contrary to the “race to the top” paradigm, the hypothesis of a “race to the bottom” suggests that local governments may lower environmental standards to attract enterprises and capital for economic development, which can lead to environmental degradation (Khan et al., 2021). Besides, some scholars argue that China’s fiscal decentralization system makes the fiscal expenditure structure of local governments favor productive construction over public services (Fu and Zhang, 2007).

The third perspective emphasizes a nonlinear relationship between fiscal decentralization and environmental governance (Chen and Chang, 2020; Cheng et al., 2020). Chen and Chang (2020) empirically tested an inverted U-shaped relationship between fiscal decentralization and pollutants in China. Cheng et al. (2020) explicated a nonlinear impact of fiscal decentralization on carbon emissions by examining various degrees of autonomy and levels of fiscal expenditure.

Although fiscal decentralization enhances the central government’s macroeconomic control and fiscal flexibility, it also imposes significant fiscal pressure on local governments (Lin and Zhou, 2021). Bao and Guan (2019) pointed out that fiscal pressure undermined the environmental governance efficiency of local governments. Bai et al. (2019) discovered that fiscal pressure distorted tax competition among local governments, leading to the shielding of high-tax polluting enterprises by local governments to expand their tax base and increase revenue. Xi et al. (2017) illustrated this distortion from the perspective of changes in the composition of the value-added tax. Kou and Han (2021) observed that the positive impact of vertical environmental protection pressure on local environmental management was weakened by increasing local fiscal pressure.

3.1.3 Research gap

Prior literature offers us extensive experience and a foundational basis for study; however, there is still room for improvement and expansion in the following two aspects:

On one hand, although policy evaluation of ETS has garnered significant attention, only a limited number of studies have discussed the dual environmental and economic effects of ETS. These studies tend to separately examine the outcomes on the environment and economy to illustrate the respective benefits. To fully understand how the dual benefits are realized, it is crucial to further investigate the interrelation between environmental and economic effects. Yu et al. (2022) empirically tested that A-share listed firms regulated by ETS in China were able to improve their return on assets by cutting emissions. However, given the typically superior financial performance of listed firms compared to unlisted enterprises, there may be a risk of sample selection bias. Therefore, it is crucial to theoretically derive and demonstrate the transmission from emission reduction to economic returns.

On the other hand, in contrast to developed economies, China’s implementation of ETS is situated within a fundamentally distinct political-economic-institutional context (Jiang et al., 2016). Fiscal decentralization represents a type of institutional arrangement. Although previous literature has already provided evidence of the relationship between fiscal decentralization and environmental governance, positive or negative, we have not yet found any article that combines ETS and fiscal decentralization to analyze the effects of market-oriented environmental regulations in the context of fiscal decentralization. Furthermore, while fiscal decentralization empowers local governments, it also exacerbates their fiscal pressures. However, just a few articles focus on local fiscal pressure under the decentralization system.

3.2 Theoretical analysis

3.2.1 The internal relationship of the dual effects

Figure 1 displays the analysis framework of this study.

According to the property rights theory (Coase, 1960), emission rights can be regarded as a special commodity granted by the government and traded among enterprises in a free market (Dales, 1968). Under a given emission quota, the costs of enterprises with higher emissions increase because of pollution treatment and the purchase of excess emission rights (Yu et al., 2020). In contrast, enterprises that emit less and protect the environment can realize economic benefits by selling or storing surplus emission rights (Ji et al., 2017; Narassimhan et al., 2018).

Based on the Porter hypothesis (Porter and van der Linde, 1995), environmental regulations can stimulate enterprise innovation, and the benefits of innovation may offset or even surpass the additional regulatory costs under the strong version of this hypothesis (Jaffe and Palmer, 1997). According to the narrow Porter hypothesis (Jaffe and Palmer, 1997), the market-oriented ETS is more likely to encourage enterprise innovation than command-and-control environmental regulations. Under an ETS, enterprises are motivated to optimize profits by promoting green production processes and reducing emissions (Yu et al., 2020).

To clearly illustrate the impacts of ETS on emissions and the economy, we conduct theoretical derivation from the micro-enterprise perspective. Enterprises can reduce emissions through a “scale effect” or a “technique effect.” The former involves controlling the scale of production to generate fewer emissions, as pollutants are positively correlated with output (Jouvet et al., 2005). The latter comprises two kinds of technology: the “front-end technology” improves the efficiency of energy utilization, leading to less pollution during production at a given output level; the “tail-end technology” realizes a certain amount of decontamination after production but before emission (Dong and Yang, 2021).

In terms of the “front-end technology” for emissions reduction, referring to Zhang (2020), Eq. 1 represents the functional relationship between production-generated pollutants and output.

where

The “tail-end technology” will increase enterprises’ additional expenditures for decontamination:

where

We categorize enterprises into two groups: enterprises whose actual emissions are below the quota (L enterprises) and enterprises that emit more than the quota (H enterprises). The two groups of enterprises produce identical products with equivalent structures of production cost

where

To illustrate the effect of ETS on profits, we make

Definitely,

To detect how enterprises’ profits change in response to changes in emission reduction under the circumstance of emissions trading, we further take the derivative of maximum profits with respect to the amount of decontamination

According to Eqs 8, 9, regardless of the actual emissions above or below the quota, the result of derivation is

To sum up, the implementation of ETS can result in increased profits for industrial enterprises with lower emissions. Furthermore, emission reduction efforts can drive profit growth for enterprises as long as the trading price exceeds their unit variable decontamination cost. Therefore, we propose our first hypothesis.

Hypothesis 1. ETS can promote industrial profits by reducing industrial emissions.

3.2.2 The impact of local fiscal pressure on the effectiveness of ETS

From a macro perspective of the entire society, cumulative social welfare is equal to the profits generated by all enterprises minus the losses caused by environmental pollution and regulatory and transactional costs. Coase’s first theorem states that in a market with zero transaction costs, resources will be automatically allocated to the state of Pareto optimality by the market mechanism regardless of initial rights arrangements. Actually, due to factors such as information asymmetry, the transaction costs incurred by buyers and sellers are not negligible. As Coase’s second theorem suggests, the initial allocation of legal rights can significantly impact resource allocation efficiency once transaction costs are taken into account (Coase, 1937). In this case, prohibitively high transaction costs result in the emitter’s actual income being lower than its marginal cost of reducing emissions, which renders the ETS ineffective (Montero, 1998). It can be seen that the efficiency of ETS depends on factors such as initial allocation, transaction costs, and trading prices.

Apart from the fact that market forces essentially determine trading prices, neither the initial allocation nor transaction costs can get rid of government intervention. The initial quota is determined by the government based on supervision and audit, while institutional structures exert an impact on transaction costs. Fiscal decentralization, as an institutional arrangement, empowers local governments but also increases their fiscal pressure. When faced with mounting fiscal pressures, local governments may be more inclined to engage in a “race to the bottom” or experience a decline in their capacity for “racing to the top.”

On one hand, fiscal pressure restricts the ability of local governments to manage emissions trading effectively, which means the capacity of “racing to the top” decreases. The ability of local governments to perform their duties affects the monitoring, accounting, and regulation of emissions, the quota allocation management in the trading market, and the reporting and disclosure of emissions by enterprises. Stable fiscal strength offers local governments the fund guarantee to fulfill their responsibility for environmental management (Liang and Langbein, 2015). Facing a substantial gap between fiscal revenue and expenditure, local governments have insufficient financial resources to provide regulatory staffing, materials and equipment, as well as support for environmental governance (Xi et al., 2017).

On the other hand, high levels of financial pressure force local governments to make a trade-off between economic development and environmental protection, which means the likelihood of “racing to the bottom” increases. Local governments under fiscal pressure may be vulnerable to capture by capital interests, resulting in rent-seeking corruption (Fan et al., 2009). Fiscally constrained governments may seek to close their fiscal gaps by selling emissions permits, which creates a fiscal externality in the permit market (Andersen and Greaker, 2018). Besides, Chinese-style fiscal decentralization makes the central government largely determine local official promotions (Bowman Cutter and DeShazo, 2007), resulting that local officials concern more about economic development and tend to expand investments in industries with a high return on GDP (Shen et al., 2020). Moreover, compared to environmental protection, economic development can generate more tax revenue for local governments, thereby alleviating fiscal pressure to some extent (Bai et al., 2019). Thus, we put forward Hypothesis 2.

Hypothesis 2. Local fiscal pressure restricts the effectiveness of ETS.

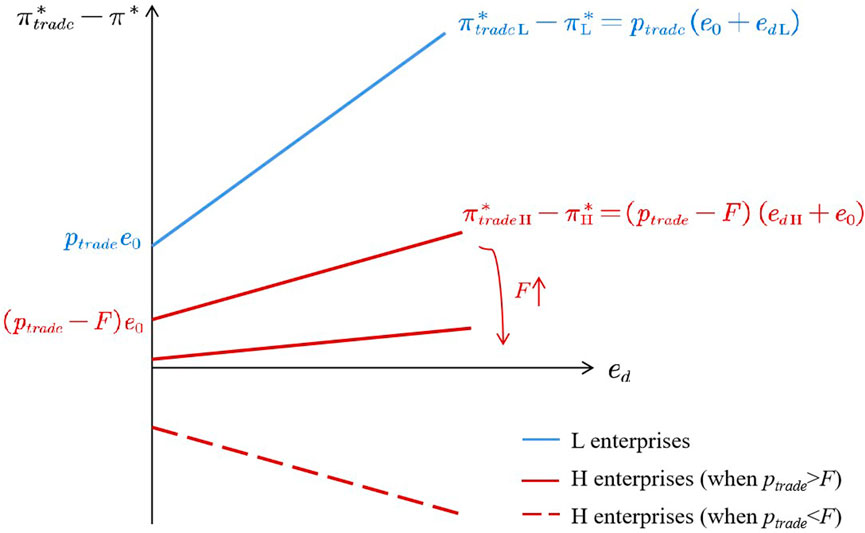

Hypothesis 2.1. Local fiscal pressure harms the abatement effect of ETS.According to Eqs 6, 7, the profitability differential between the inclusion and exclusion of ETS is contingent upon the trading price

Hypothesis 2.2. Local fiscal pressure has a negative impact on the economic effect of ETS.The slopes of the lines in Figure 2 can tell us how local fiscal pressure affects the transmission from emission reduction to profit promotion. For H enterprises, the slope includes a portion coming from the penalty

Hypothesis 2.3. Local fiscal pressure impairs the transmission from emission reduction to profit promotion.

4 Materials and methods

4.1 Econometric model specification

Eliminating the impact of unobservable confounders is one of the greatest challenges to correctly diagnosing a policy effect. DID can infer causality using observational data and mitigate the endogeneity problem. Thus, we adopt the DID strategy, treating the ETS pilot policy as a quasi-experiment and separating the samples into the treated group and the controlled group.

The method framework is as follows: the classical DID model is adopted to evaluate the abatement effect and the economic effect of the policy; the mediating effect model is employed to test the transmission role of emission reduction; the triple-difference framework and subsample regressions are used to investigate the impact of local fiscal pressure and the regional heterogeneity of policy effects.

4.1.1 DID model

where subscripts

To accurately identify the causal effect in the DID framework, the parallel trend hypothesis must be satisfied. Referencing prior research (Greenstone and Hanna, 2014; Xuan et al., 2020; Liu et al., 2021), we conduct Eq. 12 which can not only test the parallel trend but also make a dynamic analysis of the policy effect.

where

4.1.2 Mediating effect model

The mediating effect model (Baron and Kenny, 1986) is applied to investigate the transmission role of emission reduction between ETS implementation and economic returns. First, Eq. 11 is employed to identify the total effect (

4.1.3 Triple-difference model

To determine whether the fiscal pressure (

To further scrutinize the disparity in policy effects among regions, the total sample is subcategorized into the eastern, central, and western regions5. The triple-difference specification with two region dummy variables is presented as Eq. 15. Due to three region categories, two region dummy variables (

4.2 Variables and data

4.2.1 Sample and data

The research samples consist of 284 cities from 30 provinces of inland China (excluding Taiwan, Macau, Hong Kong, and Tibet due to a lack of data). The research period is set from 2003 to 2017 for the following reasons. First, the 2014 Guiding Opinions set the target that the pilot work would be basically completed by 2017. Secondly, on 1 January 2018, China officially implemented the environmental protection tax, of which the taxable pollutants such as SO2 and nitrogen oxides (NOX) are duplicated with the objects of emission rights trading. Besides, missing data prevents us from extending the research period further. Specifically, the data of total fixed assets, total current assets, and total profits of industrial enterprises above the designated size (IEADS) in 2018, and the data of industrial emissions (industrial SO2, NOX, and soot) and energy consumption (electricity consumption for industrial) before 2003 are missing. Nevertheless, this study covers long enough periods before and after the implementation of the policy.

This study includes pilot areas approved in both 2002 and 2007 as the treatment group and regards 2007 as the external shock time of the quasi-experiment. The 2002 SO2 ETS pilot policy6 was mainly implemented in the electricity industry with no trading platform, and a very limited number of transactions occurred (Huang et al., 2021). However, the 2007 ETS pilot policy, constructing trading platforms and covering the industries of power, cement, steel, petrochemical, glass, etc., are considered more effective (Ren et al., 2020; Huang et al., 2021). The latter is also instructive for the pilot areas that were approved before but made no substantial progress. Besides, the omission of the pilot areas approved in 2002 may lead to bias in the results, so these areas are also taken into account as the treatment group. Eventually, the treatment group includes Shanghai, Tianjin, Chongqing, Shandong, Shanxi (a), Jiangsu, Henan, Zhejiang, Hubei, Hunan, Hebei, Shanxi (b), and Inner Mongolia autonomous (see Figure 3). 126 cities are classified into the treatment group7.

FIGURE 3. The geographical distribution of the ETS pilots in China. Data source: 1:1,000,000 national basic geographic database of the National Catalogue Service for Geographic Information.

The basic data source is the China City Statistical Yearbook (2004–2018) and statistical yearbooks of various provinces and cities, with a few missing indicators in different years or cities. In the placebo test part, PM2.5 data is derived from the Atmospheric Composition Analysis Group of Dalhousie University, and weather data is from China Surface Climatological Data Set V3.0.

4.2.2 Core variables

The dependent variables in this article are denoted by

The core explanatory variables are the policy variable (

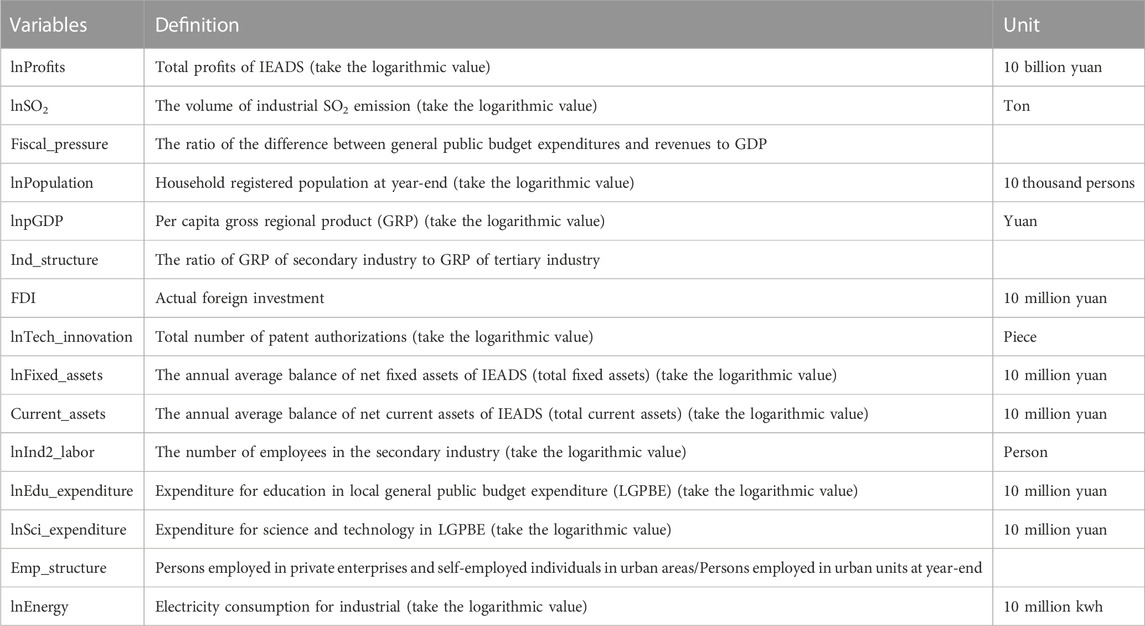

4.2.3 Control variables

Control variables for estimating environmental effects are selected based on the IPAT model (Ehrlich and Holdren, 1971), which indicates that population (P), affluence (A), and technology (T) are the primary impacts (I) on the environment. Therefore, population (Population), per capita gross regional product (pGDP), and technology innovation (Tech_innovation) are included. In addition, industrial structure (Ind_structure) is added, considering that the economic structure is also the primary factor. Besides, foreign direct investment (FDI) has a diffusion effect on improving technology and environmental management experience (Wang et al., 2021).

Control variables for estimating economic effects are considered from the following aspects: First, to make profits, fixed assets (Fixed_assets) such as houses, factories, and large machinery and equipment are necessary capital inputs. Net current assets (Current_assets) reflect the liquidity constraints that could severely limit production input (Wang et al., 2019). Second, labor forces can influence both production output and factor cost in quantity and quality. Therefore, the number of employees in the secondary industry (Ind2_labor) and the structure of employees (Emp_structure) are included to represent the quantity of the labor force, and the local general public budget expenditure on education (Edu_expenditure) is added to represent the quality of the labor force. Third, technology innovation (Tech_innovation) and local general public budget expenditure on science and technology (Sci_expenditure) are selected for controlling the level of technological development and the degree of emphasis. Besides, energy consumption (Energy) is added for the reason that industrial output is sensitive to it (Huang et al., 2021); industrial structure (Ind_structure) and foreign investment (FDI) are controlled due to their impacts on the flows of capital and labor.

The definitions of relevant variables are depicted in Table 1.

5 Results and discussion

5.1 The dual environmental and economic effects of ETS

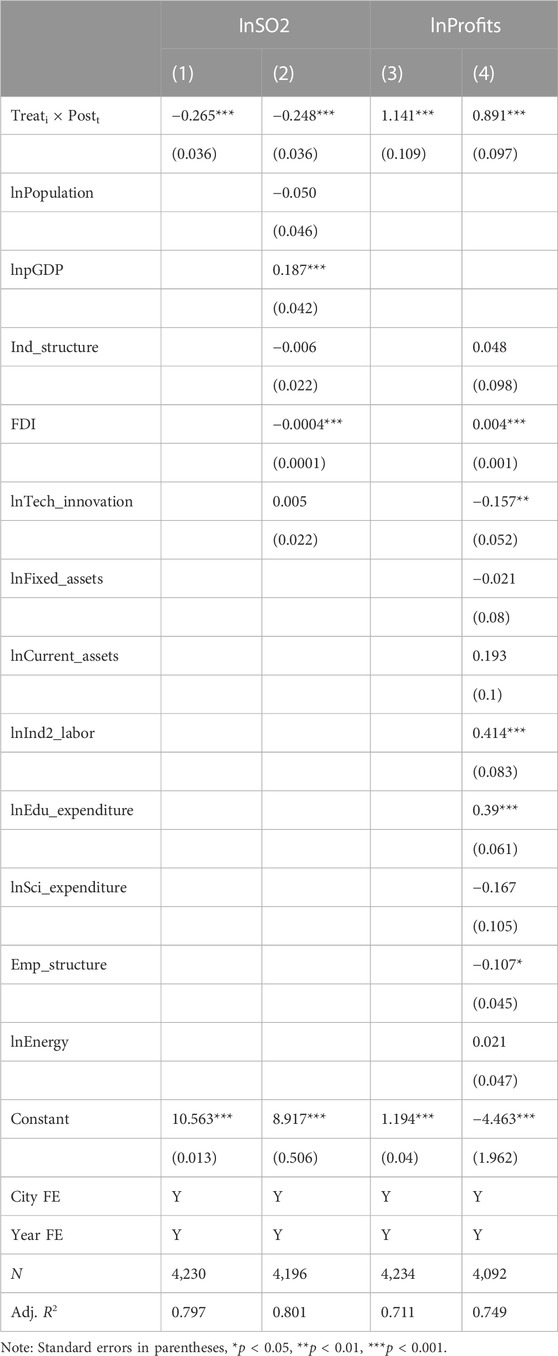

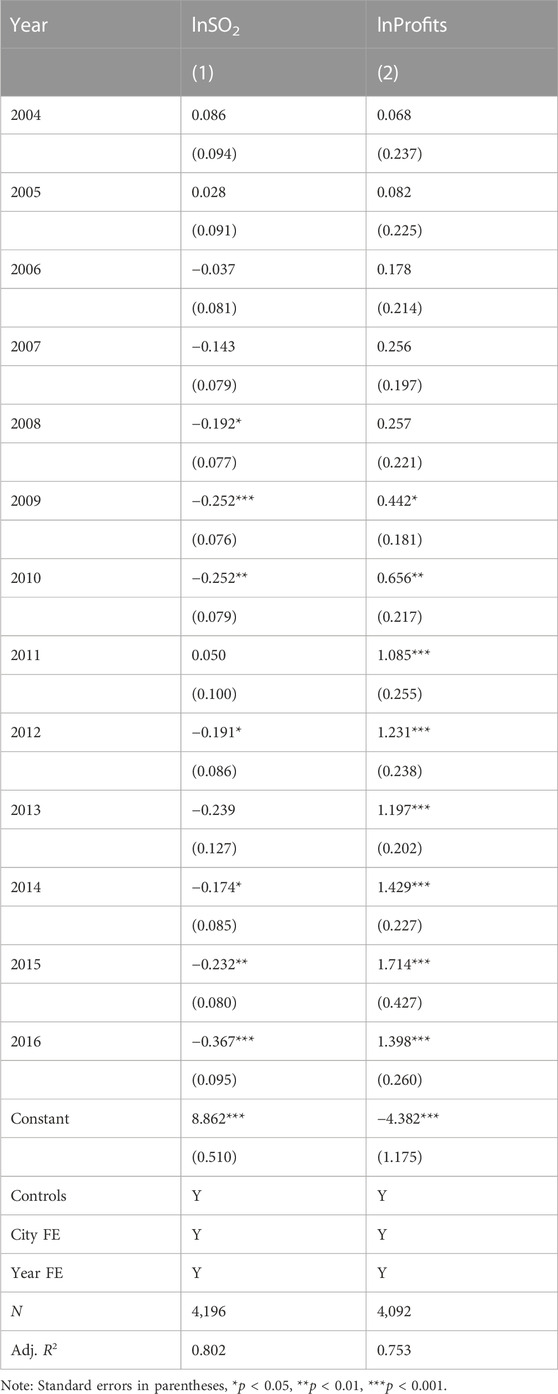

The baseline regression results of the policy effects on emissions reduction and profit growth are shown in Table 2. Columns (1) and (3) depict the estimated results with only the city-fixed effect and the year-fixed effect controlled, eliminating the impacts of individual heterogeneity and time variation. Columns (2) and (4) add all the control variables in Eqs 10, 11, which control for the city-fixed effect and year-fixed effect. The coefficients on the interaction term

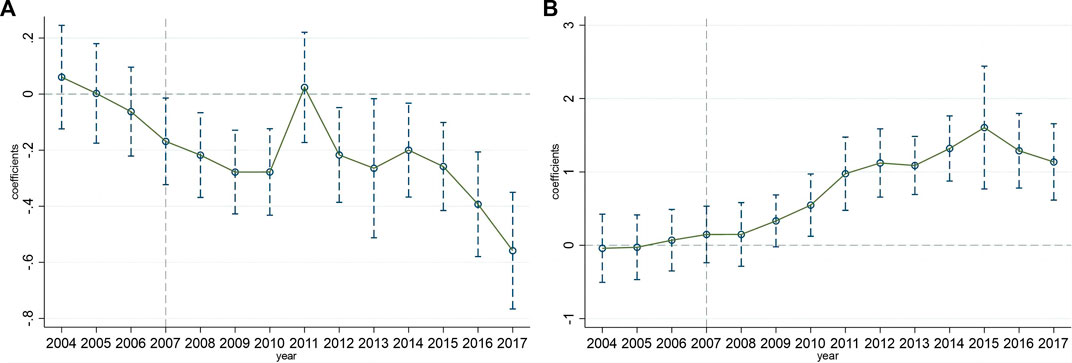

According to the parallel trend hypothesis, the interaction term coefficients before policy implementation should be insignificant, which is supported in Table 3 and Figure 4. Dynamic analysis reveals varying degrees of hysteresis impact on curbing SO2 emissions and promoting profit growth. In 2011, there was a rebound in the abatement effect of the policy. One possible explanation is that to recover and develop the economy after the 2008 financial crisis, China actively took measures to support the development of production in 2009. Under the fiscal decentralization system, local governments affected by economic performance assessment standards may sacrifice the environment to pursue economic development, which results in a rise in industrial emissions. The policy effect on industrial profits did not reach statistical significance until 2009 and maintained a relatively stable positive impact since then, denoting a hysteretic but positively cumulative dynamic effect on bolstering industrial profit growth. The impact of ETS on reducing emissions depends on the enforcement of local governments within a total emissions control framework, while its economic benefits stem from emitters’ gradual adjustments driven by profit maximization. As a result, economic effects generally have a longer latency than environmental effects before the policy takes effect (Sueyoshi and Yuan, 2017).

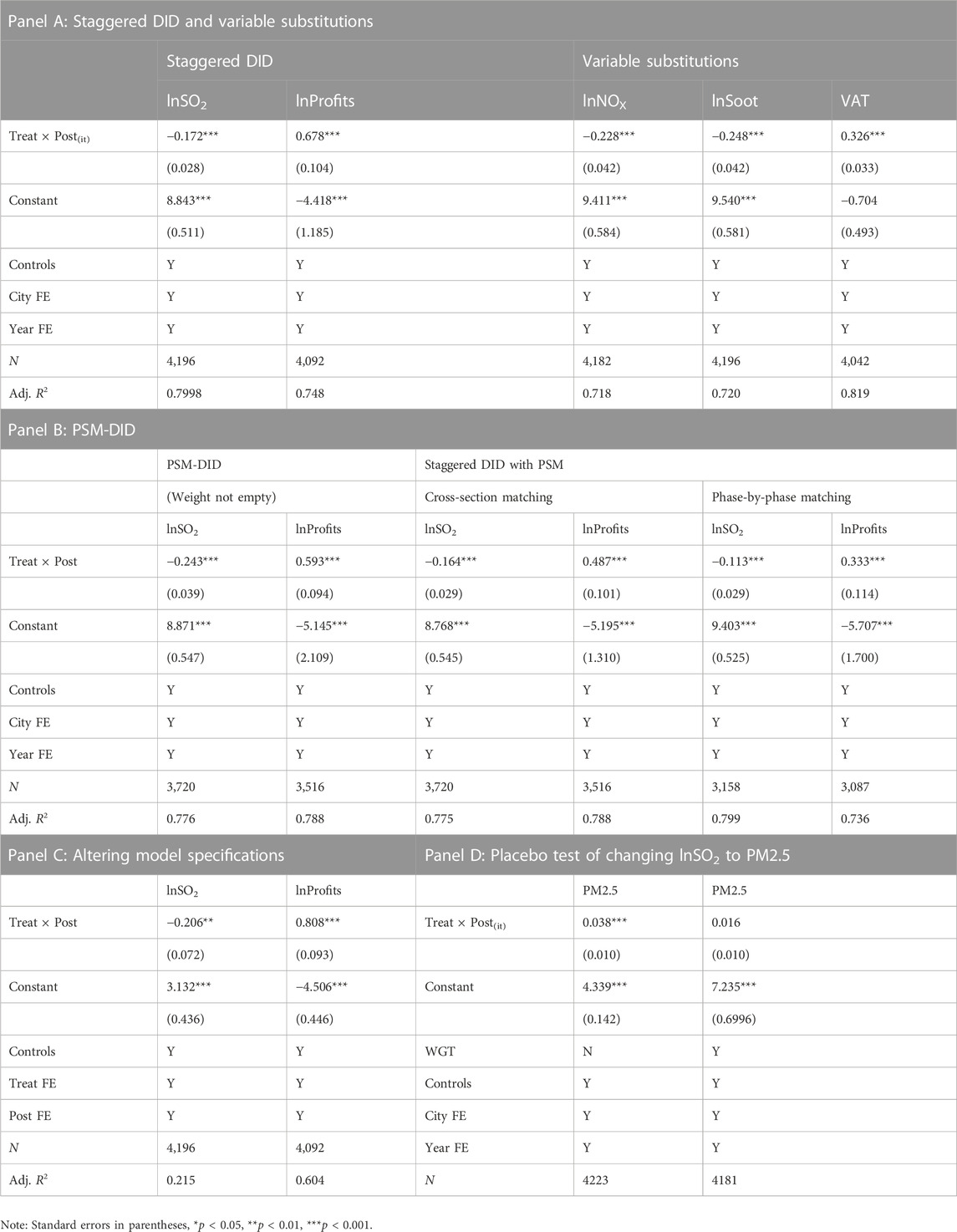

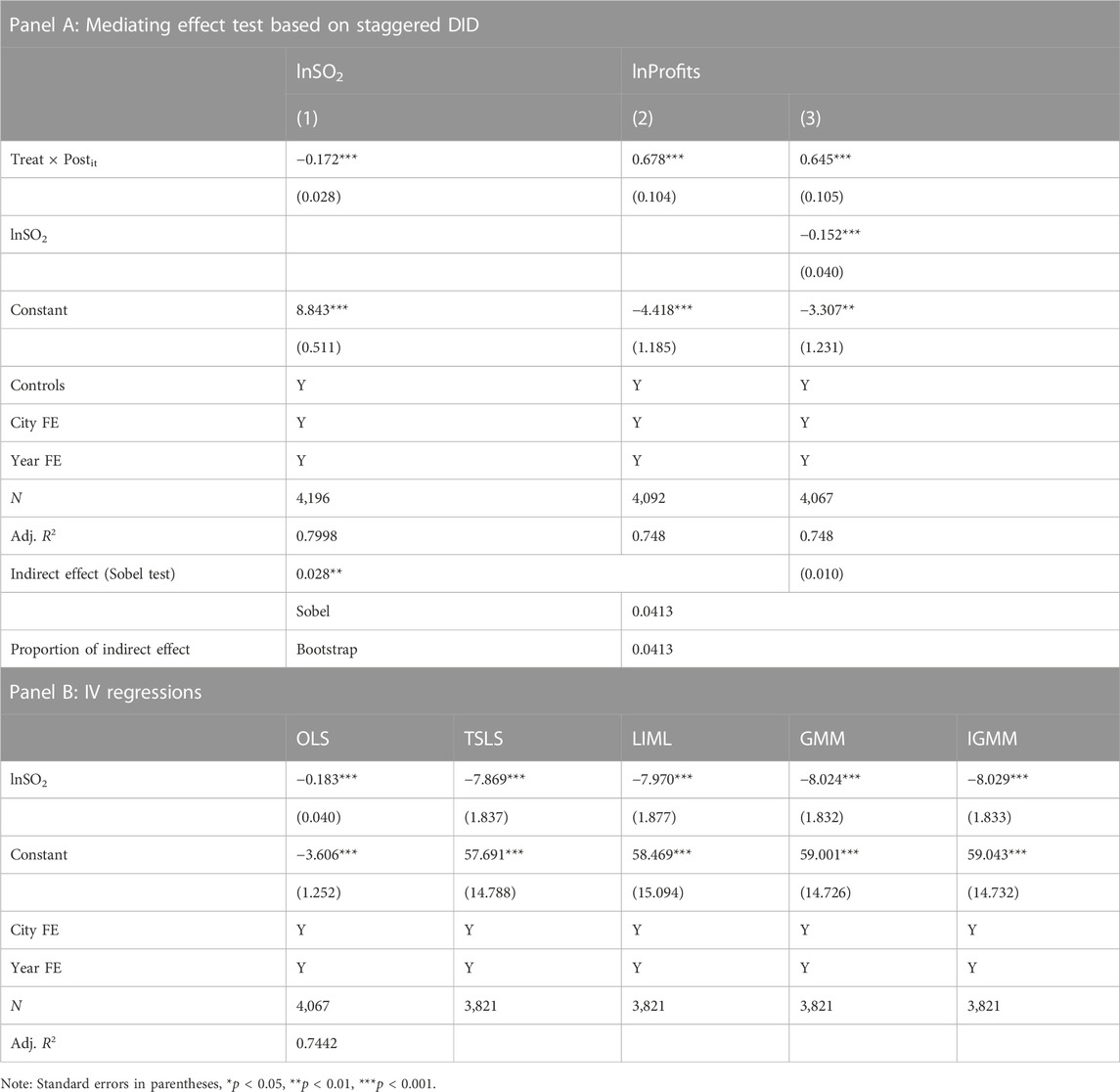

Table 4 shows the results of robustness tests: (1) The staggered DID is conducted to address the problem that the execution time of ETS varies across pilot areas (shown in the first two columns of Panel A). We searched the websites of the Ecology and Environment Departments (Bureaus) of each province (municipality) for ETS-related information and obtained the execution time in each pilot area. If the policy was executed before 2007 (only in Shandong and Jiangsu), we unanimously set 2007 as the start date of the policy. Considering that staggered DID may lead to biased estimates, we just apply it to robustness tests (for details see Supplementary Information S1; Supplementary Tables S1; Supplementary Figures S1 in Supplementary Material). (2) We make variable substitutions to support robustness. Specifically, industrial SO2 emissions are replaced with the emissions of industrial NOX (lnNOX) and soot (lnSoot), and industrial profits are substituted with the value-added tax (VAT) payable by IEADS (shown in the last three columns of Panel A). (3) The propensity score matching (PSM) approach is adopted to alleviate the problem of self-selection. ETS pilot areas are typically selected based on the regional economic development level, pollution level, and industrial structure (Han et al., 2019; Huang et al., 2021). However, PSM is appropriate for cross-sectional data, whereas the DID framework necessitates panel data. Most existing studies address this issue by treating the panel data as cross-sectional data and matching directly, which leads to another concern of time mismatch. Performing a phase-by-phase matching on each cross-section of panel data can solve the problem of time mismatch (Böckerman and Ilmakunnas, 2009), but the control group is unstable. Due to the reasons above, we just take PSM-DID as robustness tests and conduct both cross-sectional and phase-by-phase matching (shown in Panel B, for details see (Supplementary Tables S2–S6; Supplementary Figures S2–S4 in Supplementary Material). (4) We alter econometric model specifications, controlling

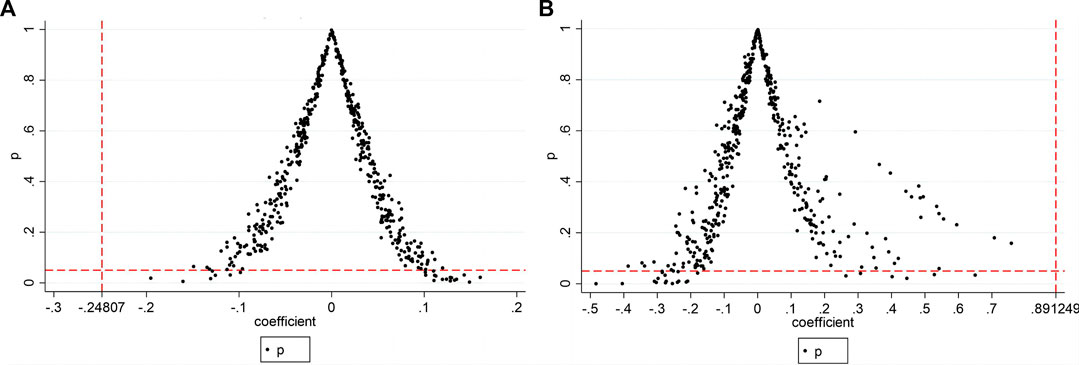

Besides, two placebo tests are conducted as follows: (1) To avoid the impact of parallel policies, such as the Action Plan of Air Pollution Prevention and Control and the Carbon ETS, we substitute industrial SO2 emissions with PM2.5. On the one hand, the primary target of Carbon ETS is the greenhouse gases (GHG) that have the same sources and a coexistence effect with PM2.5 (Driscoll et al., 2015; Liu et al., 2021). If PM2.5 does not decrease during our research period, we can assume that the parallel policies have little disturbance on the policy effect. On the other hand, according to the dynamic analysis in Table 3, the 2007 ETS policy had already come into effect before the proposal of the two parallel policies8. Panel D of Table 4 presents the results on PM2.5. Considering that PM2.5 is easily influenced by weather, green space coverage, and the level of urban transportation infrastructure, these variables (denoted by WGT 9) are controlled for (2) To avoid other random factors and obtain a credible causal effect, we randomly choose 126 cities as the pseudo-treatment group, repeating 500 times (see Figure 5). The estimated result for the pseudo-treatment group demonstrates that the average coefficients of the policy effects on

5.2 The internal relationship between the environmental and economic effects of ETS

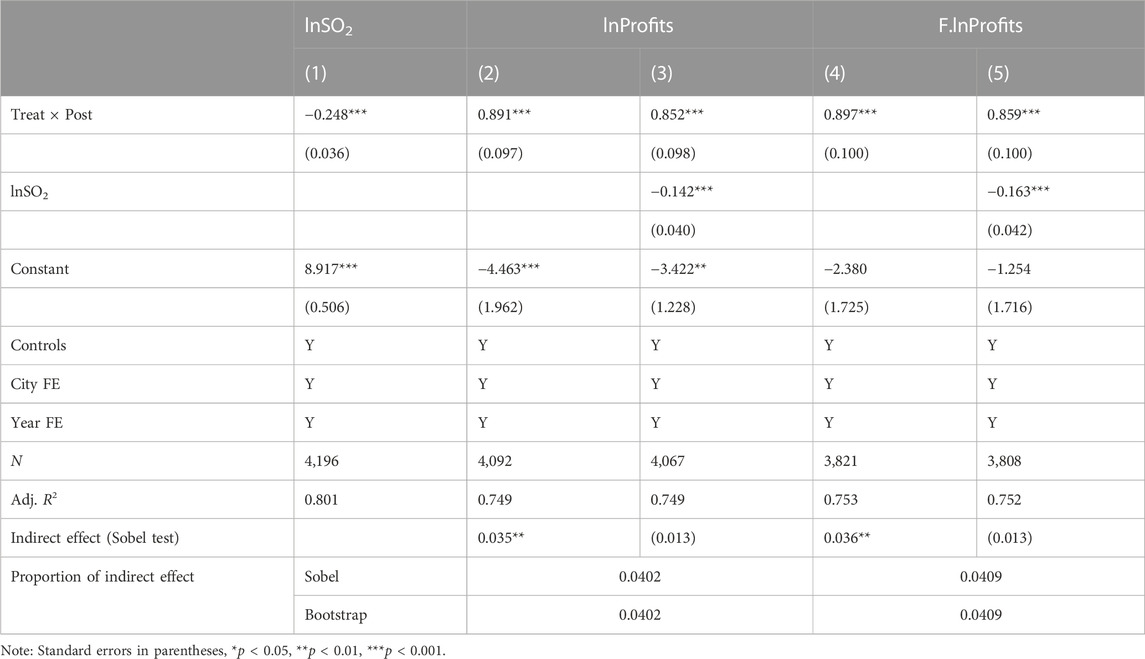

The preceding part provides empirical evidence that the implementation of ETS in China is generally conducive to emission reduction and profit promotion. In this part, we explore the inner relationship between the environmental effect and the economic effect to reveal the intrinsic mechanism for achieving dual dividends. Table 5 presents the results of mediating effect test. Columns (1) and (2) reiterate the results from columns (2) and (4) of Table 2 and column (3) shows the regression result of Eq. 13 As depicted in the first three columns, the total effect (

To ensure robustness, we conduct the mediating effect test based on staggered DID (see Panel A of Table 6). Additionally, to avoid the interference of different sets of control variables in the regressions of

For the endogeneity, we use DID method, fixed effects, and PSM method to alleviate it to some extent. However, the endogeneity of reverse causality between emission reduction and profit growth may still exist. Rising profits provide industrial enterprises with economic strength to cut emissions. We adopt two strategies: First, considering that future profits can hardly change the emissions generated previously, we use the next period of industrial profits instead of the current period one as the explained variable, and the results are shown in columns (4) and (5) of Table 5. Second, we take the domestic garbage disposal rate and green space per capita as IVs to mitigate the endogeneity of the reverse causality. Because the selected IVs can reflect a city’s attention and commitment to environmental management but are almost unable to affect the profits of industrial enterprises. Panel B of Table 6 demonstrates that the results of various estimation methods of IV regressions are consistent with ordinary least squares (OLS), to some extent, supporting the causal inference from emission reductions to profit growth. Besides two-stage least squares (TSLS), we undertake IV regressions with the limited information maximum likelihood (LIML) method, which is insensitive to weak instrumental variables, even though the selected IVs pass the weak instrument tests; taking heteroscedasticity and autocorrelation into account, we employ the generalized method of moments (GMM) and iterative GMM (IGMM). The validity test of instrumental variables and weak instrument robust tests are provided in the Supplementary Material (see Supplementary Tables S12, S13).

Overall, based on the empirical evidence of the ETS pilot policy in China, emission reduction is one transmission channel to realize economic benefits in the scenario of emissions trading, which fundamentally explains the internal mechanism of realizing the dual benefits, emphasizing the synergistic effect instead of a trade-off between the environment and economy.

5.3 The impact of local fiscal pressure on the effectiveness of ETS

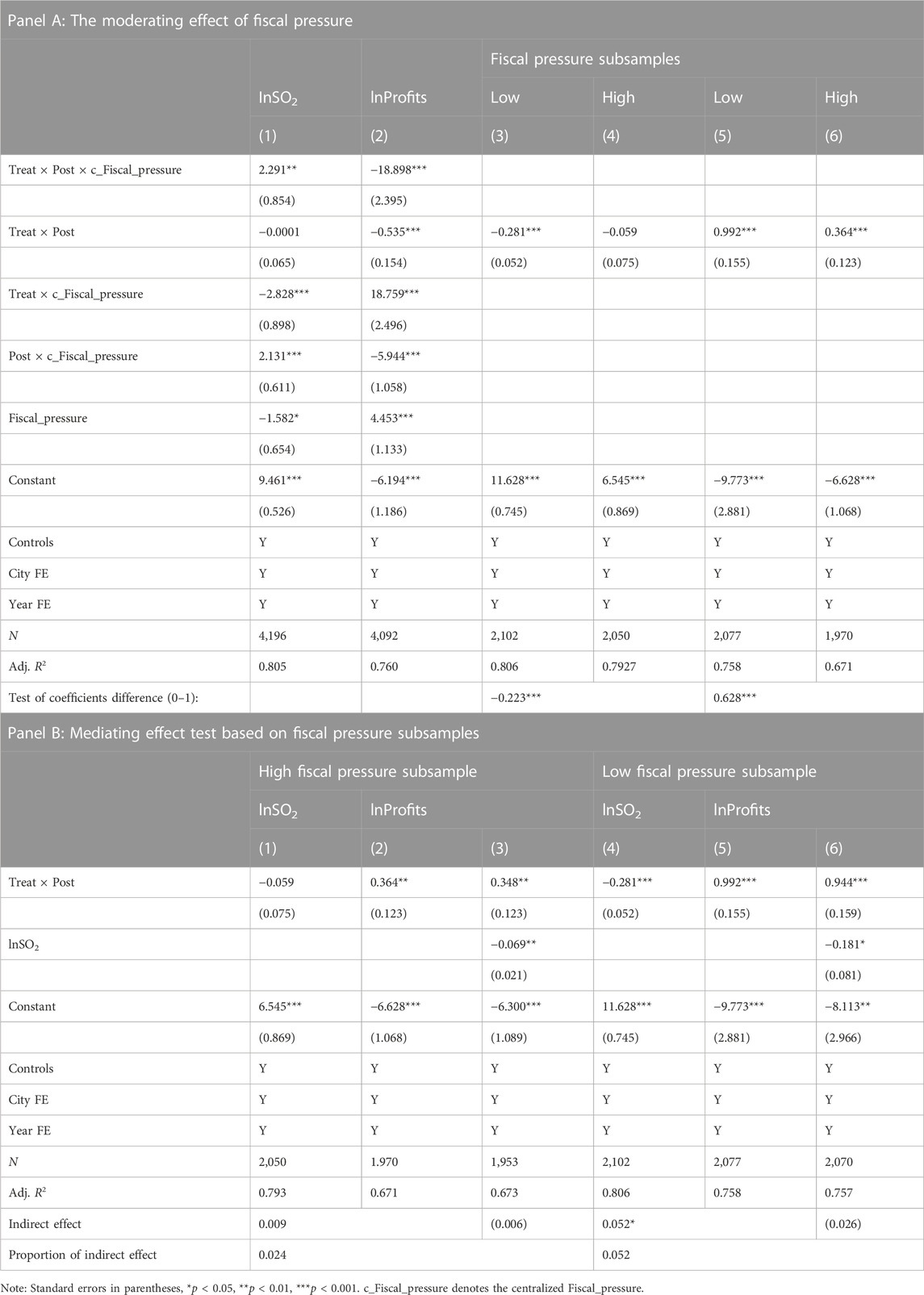

In this part, we set environmental policy analysis in the context of China’s fiscal decentralization system and examine the effectiveness of the ETS pilot policy under local fiscal pressure. Panel A of Table 7 depicts the impact of fiscal pressure on policy effects. In columns (1) and (2), the coefficients of the triple-interaction terms (2.291 and −18.898) are significant with opposite signs to the original double-interaction coefficients in Table 2 (−0.248 and 0.891), indicating that local fiscal pressure poses a negative impact on the effectiveness of the policy. Columns (3)–(6) present the results of subsamples of low and high fiscal pressure separated by the median of

Additionally, we investigate whether local fiscal pressure has an impact on the transmission role of emission reduction. Panel B of Table 7 depicts the mediating effect tests based on subsamples of fiscal pressure. In columns (1)–(3), the high fiscal pressure subsample shows neither a significant abatement effect nor a mediating effect. While in columns (4)–(6), the indirect effect of the low fiscal pressure subsample accounts for a higher proportion (5.2%) than that of the entire sample (4.02%), implying that lower levels of the pressure are conducive to greater transmission from emission reduction into economic benefits. The last two lines show the main results of the Sobel test, indicating the indirect effect of the high fiscal pressure subsample is insignificant, but that of another subsample is significant (with a value of 0.052 and a p-value less than 0.05) (for details see Supplementary Tables S14 in Supplementary Material). The indirect impact varies in response to divergent fiscal pressures. Higher fiscal pressure limits the capacity of local governments to effectively manage emissions trading. When local governments are captured by capital interests, potential rent-seeking corruption may result in increasing excess emission fines and transaction costs (Fan et al., 2009), as theoretically illustrated in Section 3.2.2. Thus, local fiscal pressure impairs the transmission from emission reduction to profit promotion and Hypothesis 2.3 holds.

In brief, fiscal pressure not only directly damages policy effectiveness but also indirectly affects the transmission channel for achieving dual dividends. Hypothesis 2 holds. High fiscal pressure restricts the ability of local governments to execute ETS, such as emissions monitoring, environmental regulation, and quota allocation management, which eventually undermines the abatement effect. When there is a market failure in environmental issues, local governments with high fiscal pressure are difficult to make an appropriate intervention.

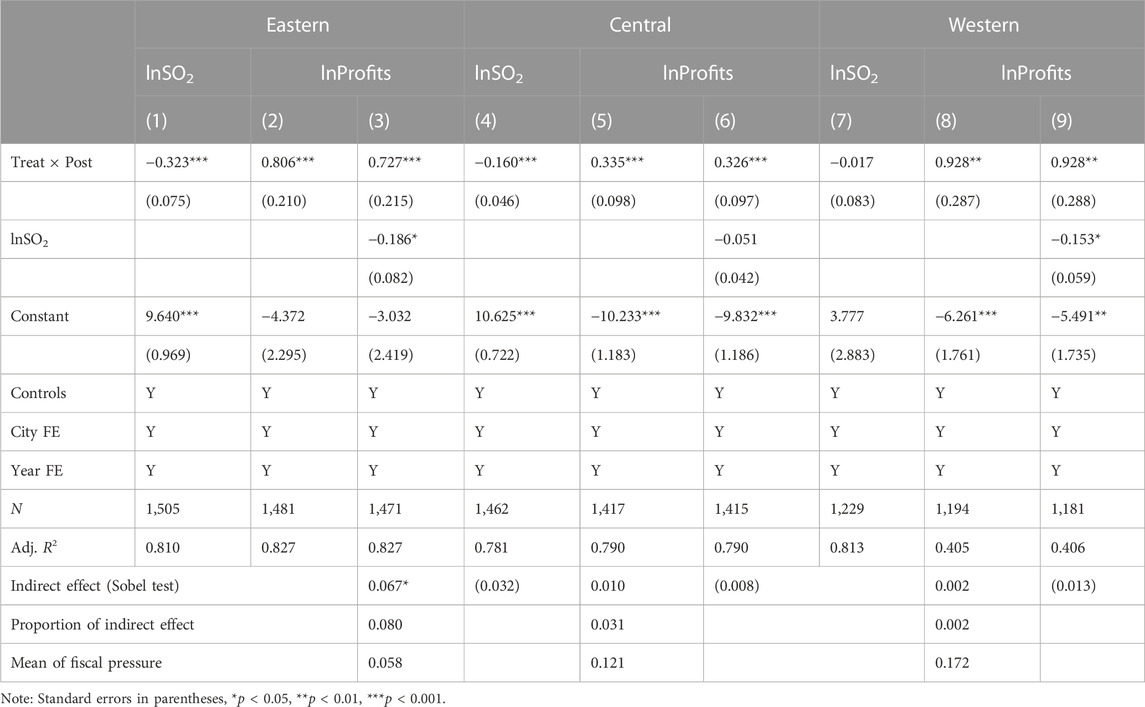

5.4 Regional heterogeneity analysis

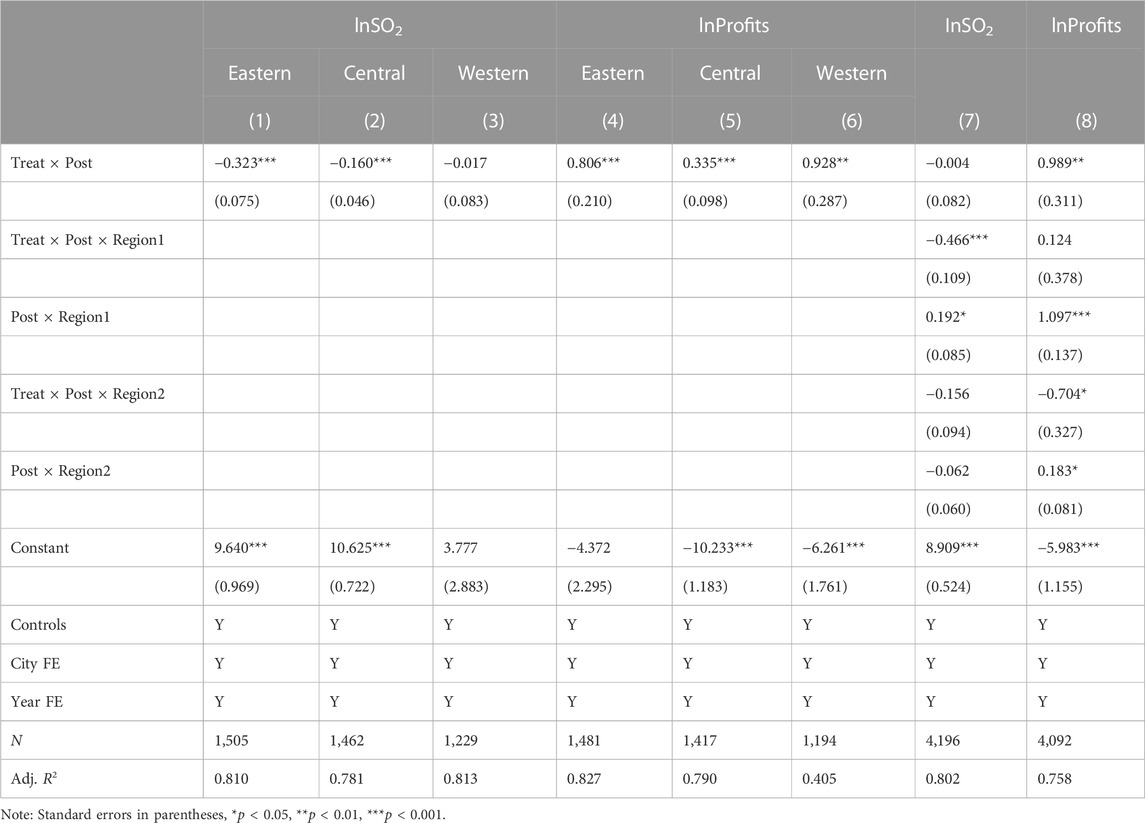

China develops unevenly across its vast territory (Chen et al., 2020), resulting in a diverse range of regional development patterns and implementation procedures of policies. Consequently, it is necessary and meaningful to probe the regional heterogeneity of the policy effects. In Table 8, the first six columns display the results based on regional subsamples. In terms of the abatement effect revealed in columns (1)–(3), the coefficients of

To analyze the dynamic effects of the policy in different regions, we employ Eq. 12 for regional subsamples (see Supplementary Table S15 in Supplementary Material). The abatement effect first appeared in the eastern region in 2007, one year later in the central region. Since 2011, the policy effects on promoting profit growth have appeared in the eastern and central regions. Generally, the economic effect emerged later than the environmental effect, which is consistent with our preceding result at the national level. There is no meaningful evidence of policy effects in the western region. To sum up, the implementation effects of the ETS pilot policy vary among regions in China. The eastern region has achieved the dual benefits of environmental protection and economic development, whereas the central and western regions have not shown “efficient markets.”

We want to further explain why the policy effect varies among regions. According to our previous analyses, it can be explained by different levels of fiscal constraint and diverse transmission efficiency from emission reduction to economic benefits. The mediating test based on regional subsamples is presented in Table 9. The indirect effect is only significant in the eastern region, which accounts for 8% of the total effect, higher than the percentage of the national level. Bootstrap test still stands in the eastern subsample (see Supplementary Table S17 in Supplementary Material). Besides, we compare the average levels of fiscal pressure in the three regions (at the last line of Table 9, details in Supplementary Tables S16). The order of fiscal pressure among regions, from lowest to highest, follows the sequence of east, central and western regions, which is consistent with the decline sequence in the abatement effect. Therefore, we perceive that the dual benefits have not been realized in the central and western regions due to not only lower abatement effects but also lower transmission efficiency from emission reduction to profit growth. Moreover, higher levels of fiscal pressure in the two regions restrict the effectiveness of the policy. On the one hand, compared to the eastern region, the ETS markets in the western and central regions are relatively underdeveloped with an incomplete trading mechanism. On the other hand, local governments facing increasingly severe fiscal pressures have limited capital expenditures on emission trading management, potentially leading to the prioritization of economic development and even rent-seeking corruption over efforts towards environmental preservation. As a result of the combination of the two aspects above, not only does ETS have a limited effect on regional emission reduction, but also the transmission mechanism from emission reduction to profit realization fails to function, thereby impeding the attainment of dual benefits.

5.5 Discussion

Based on the results of this paper, our research objectives can be addressed. First, this article provides empirical evidence that China’s ETS pilot policy is conducive to emission reduction and profit promotion at a national average level, which is consistent with relevant research (Ren et al., 2020; Huang et al., 2021). The result confirms that the implementation of ETS in China performs an “efficient market” in both environmental protection and economic development. An additional finding is that the economic effect appeared later than the abatement effect because the former requires a gradual adjustment process.

Second, we explore the internal relationship between the economic and environmental effects of ETS to elucidate how the dual benefits are realized, filling an existing research gap. The result indicates that emission reduction serves as a transmission channel for achieving economic benefits, which is in line with our theoretical analysis. Our findings fundamentally explicate the internal mechanism of realizing the dual benefits, emphasizing the synergistic effect instead of a trade-off between them. Yu et al. (2022) provided micro-empirical evidence that China’s A-share listed firms improved their return on assets by cutting emissions after the implementation of ETS. Distinguished from their studies, we theoretically deduce the transmission from emission reduction to economic return and test the mechanism at the city level. Examining policy effects at the city level aligns with our focus on assessing local fiscal pressures in this study.

Third, since environmental problems may encounter market failure, we take “promising governments” into consideration for assessing the effect of ETS for the first time. We find local fiscal pressure not only directly undermines policy effectiveness but also indirectly hinders the transmission channel for achieving dual dividends. Higher levels of fiscal pressure constrain the capacity of local governments to effectively manage emissions trading, compelling local governments to make a trade-off between economic development and environmental protection. Compared to environmental governance, economic development can generate more tax revenue, thereby alleviating the fiscal pressure on local governments to some extent (Bai et al., 2019). Besides, local governments facing high fiscal pressure may struggle to intervene effectively in cases of market failure, ultimately leading to an unsatisfactory implementation of environmental policies.

Although previous studies have examined the heterogeneity effects of the policy from perspectives of environmental enforcement (Ren et al., 2020) and city characteristics such as industrialization and administrative level (Huang et al., 2021), further empirical evidence and explanation are required to elucidate the divergent environmental and economic impacts of ETS across different regions. Our findings indicate that the implementation of ETS in eastern China has achieved the dual benefits of emission reduction and profit growth. However, there is insufficient evidence to support this claim for the central and western regions. Additionally, we elucidate the regional heterogeneity by the fiscal pressure constraint and the shift from emission reduction to economic benefits. The implementation of ETS in the central and western regions does not exhibit an “efficient market” of synergistic effects between the environment and economy. Meanwhile, the high fiscal pressure in these two regions may prompt local governments to abandon “racing to the top” for a “racing to the bottom” in environmental governance.

6 Conclusion and policy implications

6.1 Conclusion

China is transitioning its environmental governance patterns and increasingly prioritizing the market-based ETS. In contrast to developed economies, China’s implementation of ETS occurs within a fundamentally different political-economic-institutional context. Fiscal decentralization grants local governments with authority but also amplifies their fiscal pressures. The evaluation of ETS policy in China should be situated within the institutional context of fiscal decentralization.

From a novel perspective, we integrate market-based ETS with the institutional background of fiscal decentralization to investigate the internal mechanisms and external constraints of ETS in achieving dual environmental-economic benefits under local fiscal pressure. We demonstrate that the transmission mechanism from emission reduction to economic return inherently promotes the realization of dual benefits, and propose a restrictive effect of local fiscal pressure on the effectiveness of ETS. The theoretical logic in this study can be applied to a wide range of market-based mechanisms for trading green factors, including carbon emissions, energy use rights, and natural resources. Our study provides valuable insights for China to effectively coordinate “efficient markets” and “promising governments” in environmental governance, while also serving as a reference point for other countries with similar backgrounds.

The empirical results yield three primary conclusions. First, the implementation of ETS in China generally shows an “efficient market” for both environmental protection and economic development with emission reduction serving as a transmission channel to achieve economic benefits. As more emission reductions are translated into economic gains, greater dual benefits are realized, fundamentally elucidating the internal mechanism behind achieving such dual benefits. Second, high fiscal pressure on local governments not only directly impairs policy effectiveness but also indirectly hinders the transmission channel for achieving dual dividends, which highlights the importance of “promising governments” in market-based environmental governance. Finally, the implementation of ETS has brought dual benefits to eastern China but not to the central and western regions, which can be explained from the perspectives of various levels of local fiscal pressure and differing transmission efficiencies in converting emission reductions into economic benefits.

6.2 Policy implications

To fully coordinate “efficient markets” and “promising governments” in environmental governance and improve the effectiveness of ETS, this paper proposes the following policy implications:

(1) The policy of ETS pilots is an essential exploration of environmental governance in China, having made certain achievements but still requiring great improvement. Local governments are responsible for implementing national strategies, exploring local experiences, and guiding grassroots practices. They should adhere to the combination of national top-level design and local exploration. It is urgent to accelerate the establishment of a diversified system for assessing political performance and guide local governments to attach importance to the supply of environmental public goods.

(2) The predicament of high fiscal pressure on local governments, especially the institutional fiscal pressure under fiscal decentralization, needs to be addressed. On the one hand, the fiscal powers and expenditure responsibilities of governments at all levels should be properly divided, and the relationship between market participation and government supervision should be further coordinated. On the other hand, to reduce institutional fiscal pressure, a stable financial security system for local governments should be built to narrow the gap between revenue and expenditure through transfer payments and tax rebates. The local financial departments should raise the fiscal fund allotment for the management of emission rights trading, including the relevant expenditures in the unified arrangement of the financial budget.

(3) Enterprises should be encouraged to drive up profits through emission reduction, which leads to a positive cycle. In order to incentivize enterprises to voluntarily reduce emissions, a market mechanism combined with appropriate government intervention should be employed to further widen the gap between costs of emitting and the benefits of abatement. To accomplish reduction goals at given output levels, enterprises can apply operating leverage reasonably and effectively, allocating the capital investment and cost structure of emission reduction technology from a long-term perspective. Since economic benefits come later than the abatement effect, industrial enterprises need to be effectively guided to smoothly pass through the period of stagnant profit growth.

6.3 Limitations and further research

The conclusion of this paper is convincing, nevertheless, there exist certain limitations that necessitate further research to address. On the one hand, given that pollutants may be transmitted between adjacent cities and redistributed based on cross-city parent-subsidiary company relationships, it is necessary to consider both the spillover effect of policy implementation and pollution transfer. Solving this problem necessitates access to pollution data from enterprises, which can be procured through the China Industrial Enterprise Pollution Database (CIEPD). However, the operational status of industrial enterprises in CIEPD is discontinuous and does not provide information on subsidiary companies or their geographical locations. If listed companies are taken as samples, the types and units of pollutants disclosed are not uniform. As big data continues to be widely used, this problem may be solved in the future. On the other hand, to illustrate how local fiscal pressure affects the effectiveness of ETS, we theoretically analyze the possible pathways (quota allocation, excess emission fines, and transaction costs). We highlight the importance of addressing institutional fiscal pressure. Nevertheless, further research is necessary to provide more empirical evidence and specific measures for mitigating institutional fiscal pressure.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

YS contributed to study design, data analysis, and draft writing. YS and XG contributed to data curation and visualization. YS, HH, and QC contributed to revisions and proofreading. HH contributed to funding acquisition, project administration, and resources. All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

This study was supported by the National Social Science Fund of China (No. 18BTJ001 and No. 20XTJ005) and the Central Government Funds for Guiding Local Science and Technology Development (No. GSK215115).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2023.1095321/full#supplementary-material

Abbreviations

ETS, Emission Trading Scheme; DID, difference-in-differences; IV, instrumental variables; SO2, sulfur dioxide; NDRC, National Development and Reform Commission; GDP, gross domestic product; CGE, Computable General Equilibrium; NOX, nitrogen oxide; IEADS, industrial enterprises above designated size; GRP, gross regional product; LGPBE, local general public budget expenditure; PSM, propensity score matching; GHG, greenhouse gases; TSLS, two-stage least squares; LIML, limited information maximum likelihood; GMM, generalized method of moments; IGMM, iterative generalized method of moments; CIEPD, China Industrial Enterprise Pollution Database.

Footnotes

1http://www.gov.cn/zhengce/content/2014-08/25/content_9050.htm (in Chinese).

2http://www.gov.cn/zhengce/2016-05/25/content_5076588.htm (in Chinese).

3https://www.eco.gov.cn/news_info/56610.html (in Chinese).

4Assumptions: (1) All enterprises own the same amount of emission quota e0 (2). Equilibrium between production and marketing is obtained. Thus, all products manufactured can be sold out. Although production and sales levels can affect profits through changes in inventory cost, this article focuses on the impact of emission change on profits. (3) L enterprises sell surplus emission rights on the emission trading market, whereas H enterprises purchase excess emission permits. (4) Enterprises are rational economic agents pursuing maximized profits.

5According to the NDRC, the eastern region includes Beijing, Tianjin, Shanghai, Hebei, Jiangsu, Zhejiang, Shandong, Liaoning, Fujian, Guangdong, and Hainan; the central region refers to Shanxi, Henan, Hubei, Hunan, Jilin, Heilongjiang, Anhui, and Jiangxi; the western region includes Inner Mongolia, Shanxi (b), Chongqing, Yunnan, Guangxi, Sichuan, Guizhou, Tibet, Gansu, Qinghai, Ningxia, and Xinjiang.

6Shandong, Shanxi (a), Jiangsu, Henan, Tianjin, Shanghai, and Liuzhou were approved as pilot areas in the 2002 SO2 ETS pilot policy.

7The city of Liuzhou, approved in 2002 in Guangxi province, as an exception, was not included in the treatment group because of missing data, which is reasonable considering that the Guangxi province was not the pilot area and Liuzhou is neither a capital city nor a municipality.

8The Action Plan was released in 2013. The Carbon ETS was proposed in 2011 and initiated in 2013.

9Weather includes wind speed, rainfall, humidity, sunshine and temperature, based on data from China Surface Climatological Data Set V3.0. Green space per capita is calculated by the area of parks green land divided by the household registered population at year-end, and the level of urban transportation infrastructure is calculated by the number of buses per 10 thousand people, with relevant data obtained from the China City Statistical Yearbook.

References

Alm, J., and Banzhaf, H. S. (2012). Designing economic instruments for the environment in a decentralized fiscal system. J. Econ. Surv. 26, 177–202. doi:10.1111/j.1467-6419.2010.00632.x

Andersen, J. J., and Greaker, M. (2018). Emission trading with fiscal externalities: The case for a common carbon tax for the non-ETS emissions in the EU. Environ. Resour. Econ. 71, 803–823. doi:10.1007/s10640-017-0184-x

Anderson, B., and Di Maria, C. (2011). Abatement and allocation in the pilot phase of the EU ETS. Environ. Resour. Econ. 48, 83–103. doi:10.1007/s10640-010-9399-9

Bai, J., Lu, J., and Li, S. (2019). Fiscal pressure, tax competition and environmental pollution. Environ. Resour. Econ. 73, 431–447. doi:10.1007/s10640-018-0269-1

Bao, G., and Guan, B. (2019). Does fiscal pressure reduce the environmental governance efficiency of local governments? (in Chinese). China Popul. Resour. Environ. 29, 38–48. doi:10.12062/cpre.20181102

Baron, R. M., and Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 51, 1173–1182. doi:10.1037//0022-3514.51.6.1173

Böckerman, P., and Ilmakunnas, P. (2009). Unemployment and self-assessed health: Evidence from panel data. Health Econ. 18, 161–179. doi:10.1002/hec.1361

Bosquet, B. (2000). Environmental tax reform: Does it work? A survey of the empirical evidence. Ecol. Econ. 34, 19–32. doi:10.1016/S0921-8009(00)00173-7

Bowman Cutter, W., and DeShazo, J. R. (2007). The environmental consequences of decentralizing the decision to decentralize. J. Environ. Econ. Manag. 53, 32–53. doi:10.1016/j.jeem.2006.02.007

Chen, S., Shi, A., and Wang, X. (2020). Carbon emission curbing effects and influencing mechanisms of China’s Emission Trading Scheme: The mediating roles of technique effect, composition effect and allocation effect. J. Clean. Prod. 264, 121700. doi:10.1016/j.jclepro.2020.121700

Chen, X., and Chang, C. P. (2020). Fiscal decentralization, environmental regulation, and pollution: A spatial investigation. Environ. Sci. Pollut. Res. 27, 31946–31968. doi:10.1007/s11356-020-09522-5

Cheng, B., Dai, H., Wang, P., Xie, Y., Chen, L., Zhao, D., et al. (2016). Impacts of low-carbon power policy on carbon mitigation in Guangdong Province, China. Energy Policy 88, 515–527. doi:10.1016/j.enpol.2015.11.006

Cheng, S., Fan, W., Chen, J., Meng, F., Liu, G., Song, M., et al. (2020). The impact of fiscal decentralization on CO2 emissions in China. Energy 192, 116685. doi:10.1016/j.energy.2019.116685

Coase, R. H. (1937). The nature of the firm. Economica 4, 386–405. doi:10.1111/j.1468-0335.1937.tb00002.x

Coase, R. H. (1960). “The problem of social cost,” in Classic papers in natural resource economics. Editor C. Gopalakrishnan (London: Palgrave Macmillan UK), 87–137. doi:10.1057/9780230523210_6

Dales, J. H. (1968). Pollution property and prices: An essay in policy-making and economics. Toronto: University of Toronto Press.

De Mulder, J. (2011). The protocol on strategic environmental assessment: A matter of good governance. Rev. Eur. Community & Int. Environ. Law 20, 232–247. doi:10.1111/j.1467-9388.2012.00731.x

Dechezleprêtre, A., Nachtigall, D., and Venmans, F. (2023). The joint impact of the European Union emissions trading system on carbon emissions and economic performance. J. Environ. Econ. Manag. 118, 102758. doi:10.1016/j.jeem.2022.102758

Deng, Y., and Xu, H. (2013). Foreign direct investment, local government competition and environmental pollution: Empirical analysis on fiscal decentralization. China Popul. Resour. Environ. 23, 155–163. Available at: https://kns.cnki.net/kcms2/article/abstract?v=3uoqIhG8C44YLTlOAiTRKgchrJ08w1e7xAZywCwkEELZHdYJoe4FE7v5brg xF1coA9eQA0w QAZfW23-S_XdB7mKaOVzRuCuN&uniplatform=NZKPT (Accessed April 24, 2023).

Dong, P., and Yang, Y. (2021). Air pollution, emission trading and improvement of regional environmental quality. J. Huazhong Agric. Univ. Soc. Sci. Ed. 101, 190–191. doi:10.13300/j.cnki.hnwkxb.2021.06.011

Driscoll, C. T., Buonocore, J. J., Levy, J. I., Lambert, K. F., Burtraw, D., Reid, S. B., et al. (2015). US power plant carbon standards and clean air and health co-benefits. Nat. Clim. Change 5, 535–540. doi:10.1038/nclimate2598

Ehrlich, P. R., and Holdren, J. P. (1971). Impact of population growth. Obstetrical Gynecol. Surv. 26, 769–771. doi:10.1097/00006254-197111000-00014

Fan, C. S., Lin, C., and Treisman, D. (2009). Political decentralization and corruption: Evidence from around the world. J. Public Econ. 93, 14–34. doi:10.1016/j.jpubeco.2008.09.001

Feng, R., Lin, P., Hou, C., and Jia, S. (2022). Study of the effect of China’s emissions trading scheme on promoting regional industrial carbon emission reduction. Front. Environ. Sci. 10, 947925. doi:10.3389/fenvs.2022.947925

Fu, Y., and Zhang, Y. (2007). Chinese decentralization and fiscal expenditure structure bias: The cost of competition for growth (in Chinese). J. Manag. World 4, 12–22. doi:10.19744/j.cnki.11-1235/f.2007.03.002

Goodstein, E. (1996). Jobs and the environment: An overview. Environ. Manag. 20, 313–321. doi:10.1007/BF01203840

Greenstone, M., and Hanna, R. (2014). Environmental regulations, air and water pollution, and infant mortality in India. Am. Econ. Rev. 104, 3038–3072. doi:10.1257/aer.104.10.3038

Han, W., Zhoupeng, C., Xingyi, W., and Xin, N. (2019). Can a carbon trading system promote the transformation of a low-carbon economy under the framework of the porter hypothesis? -Empirical analysis based on the PSM-DID method. Energy policy 129, 930–938. doi:10.1016/j.enpol.2019.03.007

Hou, B., Wang, B., Du, M., and Zhang, N. (2020). Does the SO2 emissions trading scheme encourage green total factor productivity? An empirical assessment on China’s cities. Environ. Sci. Pollut. Res. 27, 6375–6388. doi:10.1007/s11356-019-07273-6

Huang, J., Shen, J., Miao, L., and Zhang, W. (2021). The effects of emission trading scheme on industrial output and air pollution emissions under city heterogeneity in China. J. Clean. Prod. 315, 128260. doi:10.1016/j.jclepro.2021.128260

Huang, S. (2017). A study of impacts of fiscal decentralization on smog pollution. J. World Econ. 40, 127–152. doi:10.19985/j.cnki.cassjwe.2017.02.007

Jacobsen, G. D., Kotchen, M. J., and Vandenbergh, M. P. (2012). The behavioral response to voluntary provision of an environmental public good: Evidence from residential electricity demand. Eur. Econ. Rev. 56, 946–960. doi:10.1016/j.euroecorev.2012.02.008

Jaffe, A. B., and Palmer, K. (1997). Environmental regulation and innovation: A panel data study. Rev. Econ. Statistics 79, 610–619. doi:10.1162/003465397557196

Ji, J., Zhang, Z., and Yang, L. (2017). Comparisons of initial carbon allowance allocation rules in an O2O retail supply chain with the cap-and-trade regulation. Int. J. Prod. Econ. 187, 68–84. doi:10.1016/j.ijpe.2017.02.011

Jia, J., Guo, Q., and Ning, J. (2011). Fiscal decentralization, government governance structure and county-level financial challenges. J. Manag. World 2011, 30–39. doi:10.19744/j.cnki.11-1235/f.2011.01.006

Jiang, J., Xie, D., Ye, B., Shen, B., and Chen, Z. (2016). Research on China’s cap-and-trade carbon emission trading scheme: Overview and outlook. Appl. Energy 178, 902–917. doi:10.1016/j.apenergy.2016.06.100

Jouvet, P. A., Michel, P., and Rotillon, G. (2005). Optimal growth with pollution: How to use pollution permits? J. Econ. Dyn. Control 29, 1597–1609. doi:10.1016/j.jedc.2004.09.004

Khan, Z., Ali, S., Dong, K., and Li, R. Y. M. (2021). How does fiscal decentralization affect CO2 emissions? The roles of institutions and human capital. Energy Econ. 94, 105060. doi:10.1016/j.eneco.2020.105060

Kou, P., and Han, Y. (2021). Vertical environmental protection pressure, fiscal pressure, and local environmental regulations: Evidence from China’s industrial sulfur dioxide treatment. Environ. Sci. Pollut. Res. 28, 60095–60110. doi:10.1007/s11356-021-14947-7

Kunce, M., and Shogren, J. F. (2007). Destructive interjurisdictional competition: Firm, capital and labor mobility in a model of direct emission control. Ecol. Econ. 60, 543–549. doi:10.1016/j.ecolecon.2005.04.024

Levinson, A. (2003). Environmental regulatory competition: A status report and some new evidence. Natl. Tax J. 56, 91–106. doi:10.17310/ntj.2003.1.06

Li, J. F., Wang, X., Zhang, Y. X., and Kou, Q. (2014). The economic impact of carbon pricing with regulated electricity prices in China—an application of a computable general equilibrium approach. Energy Policy 75, 46–56. doi:10.1016/j.enpol.2014.07.021

Liang, J., and Langbein, L. (2015). Performance management, high-powered incentives, and environmental policies in China. Int. Public Manag. J. 18, 346–385. doi:10.1080/10967494.2015.1043167

Lin, B., and Zhou, Y. (2021). How does vertical fiscal imbalance affect the upgrading of industrial structure? Empirical evidence from China. Technol. Forecast. Soc. Change 170, 120886. doi:10.1016/j.techfore.2021.120886

Liu, J. Y., Woodward, R. T., and Zhang, Y. J. (2021). Has carbon emissions trading reduced PM2.5 in China? Environ. Sci. Technol. 55, 6631–6643. doi:10.1021/acs.est.1c00248

Montero, J. P. (1998). Marketable pollution permits with uncertainty and transaction costs. Resour. Energy Econ. 20, 27–50. doi:10.1016/S0928-7655(97)00010-9

Munnings, C., Morgenstern, R. D., Wang, Z., and Liu, X. (2016). Assessing the design of three carbon trading pilot programs in China. Energy Policy 96, 688–699. doi:10.1016/j.enpol.2016.06.015

Narassimhan, E., Gallagher, K. S., Koester, S., and Alejo, J. R. (2018). Carbon pricing in practice: A review of existing emissions trading systems. Clim. Policy 18, 967–991. doi:10.1080/14693062.2018.1467827

Neuhoff, K., Keats, K., and Sato, M. (2006). Allocation, incentives and distortions: The impact of EU ETS emissions allowance allocations to the electricity sector. Clim. Policy - Clim. POLICY 6, 73–91. doi:10.1080/14693062.2006.9685589

Oates, W. (2001). A reconsideration of environmental federalism resources for the future. Available at: https://econpapers.repec.org/paper/agsrffdps/10460.htm (Accessed October 10, 2022).

Pearce, D. (1991). The role of carbon taxes in adjusting to global warming. Econ. J. 101, 938. doi:10.2307/2233865