94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 18 August 2023

Sec. Environmental Economics and Management

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1084605

Tianhe Jiang1

Tianhe Jiang1 Jun Han2*

Jun Han2*Industrial structure adjustment is one of the key impetuses for China’s transition to high-quality economic development, influencing urban‒rural income equity through resource reallocation. This paper presents a theoretical analysis of the impact of industrial structure adjustment and economic development quality on the urban‒rural income gap. A spatial dynamic model is adopted to analyse the influence of the industrial structure adjustment range, adjustment quality and economic development quality on the urban‒rural income gap. The results based on full sample analysis suggest that the influence of the industrial structure adjustment range on the urban‒rural income gap is not significant, while the quality of industrial structure adjustment is significantly positively correlated with the urban‒rural income gap; the quality of economic development suppresses the income gap between urban and rural areas. The findings from regional analysis indicate that industrial structure adjustment and the quality of economic development have significantly heterogeneous effects in the eastern, central and western regions. Further analysis reveals threshold effects for both industrial structure adjustment and economic development quality on the urban‒rural income gap. Given this, policy implications for a fairer development transition are noted based on an interpretation of the empirical results.

China’s economic system has gradually transformed from a planned economy to a market economy over the 40 years since the reform and opening began. Successive incentive and competition mechanisms in the blooming market environment have largely improved the civilian economy and the total distributable income. Meanwhile, the equal income distribution system of Mao’s era has been subverted by the current institution, which sets work rewards as the cornerstone, valuing individual contributions and factors as well as technology. However, this flexible system with macroeconomic utility has exacerbated income inequality in China. From the perspective of regional development, income inequality is rooted in China’s urban‒rural dual structure. Due to the separation of urban and rural areas and barriers to their integration, typically, industrial sectors are concentrated in urban areas, agricultural areas almost monopolize the agricultural sector, and rural economic development and residents’ income lag far behind those in urban areas. Statistically, the Gini coefficient of China has remained stubbornly higher than the international warning line of 0.4 since the 1990s, and the ratio of per capita disposable income of urban residents to that of rural residents increased from 1.82:1 in 1980 to 2.64:1 in 2019 (Morduch and Sicular, 2002; Wan et al., 2006; Zhang and Eriksson, 2010).

Since the postwar economic restoration, income distribution inequality under economic transition has become a striking and controversial issue globally. Based on the analysis of early developed countries, Kuznets pointed out that, along with economic development and related structural changes, the gap in residents’ income takes an “inverted U” course (Murphy et al., 1989; Calderón and Chong, 2004). Conversely, many works on new economic development theories emphasize urban‒rural income inequity (Chusseau et al., 2008; Fang et al., 2008; Aiyar and Ebeke, 2020), which can be attributed to the accumulation of specialized human capital (Bresnahan et al., 2002), the knowledge spillover effect (Bronzini and Piselli, 2009) and the influence of technological progress (Caselli, 1999; Fang et al., 2008). The assertion of new economic development theory about the relationship between economic development and the urban‒rural income gap hardly explains why economic growth leads to the “inverted U” shape in which the urban‒rural income gap first expands and then narrows (Esteban et al., 2007). Therefore, this study analyses the relationship between the urban‒rural income gap and economic development, taking industrial restructuring and high-quality economic development into consideration. This approach is helpful to further understand the reallocation of urban‒rural resources and provide knowledge for optimizing China’s urban‒rural income gap, thus enriching the practical value of new economic development theory. Through the above analysis, we find that industrial structure adjustment and high-quality economic development complement each other. It is necessary to analyse the impact of industrial structure adjustment and the quality of economic development on the urban‒rural income gap to avoid the middle-income trap and provide policy recommendations for promoting the coordinated development of urban and rural areas.

This paper studies the impact of industrial structure adjustment and economic development quality on the urban‒rural income gap from the following aspects. First, the industrial structure adjustment is decomposed into adjustment range and adjustment quality. Second, the definition of the quality of economic development in the existing research is considered in terms of the efficiency of the green economy, and the selection of the index system is not comprehensive enough to fully reflect all the indicators of the quality of economic development. Third, as China’s economy enters a new stage of high-quality development with industrial restructuring as an important driving force, there is a lack of research on the impact of this adjustment as an intermediate mechanism or a combination of the two on the income gap between urban and rural areas. To address these three gaps, we designed this study to provide relevant knowledge and enrich the literature.

Patterns of economic transformation provide a comprehensive understanding of the relationship between industrial structure and the income gap. Positive shifts within industrial structure facilitate the efficient movement of productive factors from low-productivity sectors to high-productivity sectors. Such optimal reallocation of productive factors expedites the emergence of new industries and propels the structural advancement of economic development (Hsieh and Klenow, 2009). However, during the evolution of the industrial structure, a substitution of industries occurs as emerging industries in the growth stage coexist with traditional “sunset” industries. Consequently, the sluggish economic development resulting from stagnant output growth leads to a “structural slowdown” in economic progress. Therefore, throughout the course of industrial structure evolution, the economic development process may undergo two extended and intertwined phases of “structural acceleration” and “structural deceleration”.

Within a dual economic structure that includes urban and rural regions, economic development instigates changes in labor remuneration for human capital, resulting in a divergent pattern between developed urban economies and underdeveloped rural economies (Banerjee and Duflo, 2003; Fang et al., 2008). The impact of human capital on the income gap between urban and rural areas can be primarily attributed to two factors. Firstly, differences in educational attainment between urban and rural residents contribute to income disparities (Spitz, 2006; Rubin and Segal, 2015). Secondly, when labor quality remains constant, variations in the distribution of existing resources can also give rise to income disparities between urban and rural areas. Lewis further highlights that developing countries encounter the challenge of dual economic structures, characterized by the coexistence of traditional agricultural sectors and modern industrial sectors (Goldberg and Nina, 2007). Within such contexts, rural economic progression generally trails behind urban development, resulting in modest increases in farmers’ incomes and presenting a sizable short-term challenge in significantly improving the income gap between urban and rural areas.

In recent years, researchers have delved into discussions regarding the impact of industrial restructuring on urban-rural income inequality (Du Caju et al., 2010; Mehta and Sun, 2011; Ju et al., 2016). Certain experts posit that the adjustment of the industrial structure contributes to a reduction in the income gap between urban and rural areas. This viewpoint suggests that such restructuring leads to increased labor demand in urban regions, accompanied by higher wages (Benito, 2000; Verhoogen, 2008), which in turn attracts rural-to-urban migration. This migration helps alleviate labor-land imbalances in rural areas and subsequently enhances agricultural production efficiency (Liu, 2005; Shin, 2012). On the other hand, other scholars contest the notion that industrial structuring directly narrows urban-rural income inequality (Ahluwalia, 1976; Benjamin et al., 2011), asserting that the ingrained urban-rural dual economic system, with its cultural and technical barriers, limits employment opportunities for rural laborers, thereby resulting in unstable income sources for this segment of the workforce (Calderón and Chong, 2004; Goto and Endo, 2014).

Scholars mainly study the relationship between the quality of economic development and the income gap between urban and rural areas from the perspective of economic development and economic transformation, and such research is roughly divided into two research streams. One stream examines whether there is an “inverted U-shaped” feature between economic development and the urban‒rural income gap (Ahluwalia, 1976; Deininger and Squire, 1998). For example, Anand and Kanbur (1993) and Goto and Endo (2014) think that the evidence for the existence of the “inverted U-shaped” curve between economic development and the income gap is insufficient. However, some existing empirical studies show that there is a “U-shaped” or cubic function relationship between economic development and the income gap (Verhoogen, 2008; Marrero and Rodríguez, 2013). Another view is that whether economic development and the urban‒rural income gap promote each other or inhibit each other is not clear. For example, Zheng et al. (2014) believe that rapid economic development has laid a material foundation for the improvement of the income gap, enabling local governments to effectively coordinate the allocation of resources and promote the coordinated and sustainable development of urban and rural areas and regions (Schenkman and Bousquat, 2021). Economic development further improves the social security system, which is conducive to the fair allocation of social resources. Bronzini and Piselli (2009) believe that the direct result of rapid economic development is that society can create more material wealth and bring more financial revenue to the government. At this time, the spatial spillover effect brought by increasing investment in infrastructure can bring more jobs to low-income groups and indirectly narrow the gap between urban and rural areas.

Upon thorough review of the literature, it is evident that existing research predominantly focuses on pairwise analysis concerning the correlation between the income gap, industrial structure, and high-quality economic development. Nonetheless, a clear gap exists in direct research that comprehensively scrutinizes the relationship between the income gap and high-quality economic development. Additionally, a dearth of analysis exists with regards to the interconnectedness of these three factors from the vantage point of industrial structure adjustment. To address these gaps, this article intends to make marginal contributions in the following realms: 1) Examining the influence of high-quality economic development on the urban-rural income gap by adopting spatial econometric models; 2) Analyzing the underlying mechanisms through which high-quality economic development impacts the urban-rural income gap, considering both the magnitude and quality of industrial structure adjustment; 3) Assessing potential disparities in the impact of high-quality economic development on the urban-rural income gap across diverse regions characterized by varying levels of economic development.

The urban‒rural income gap, as a predicted variable, is usually measured by the Gini index, Theil index or income ratio of urban and rural residents. The Gini coefficient can compare only the income gap of the whole population in a country or region, thus easily ignoring the interests of the low-income class, and it is difficult to use the coefficient to explain the characteristics of the income gap. The Gini coefficient, as a measure of the incomes of urban and rural residents, easily ignores the important influencing factor of the urban and rural population structure. The Theil index not only considers the population structure but also considers the relative changes in residents’ incomes and provides the realistic background of the urban‒rural dual economic structure, so it is more in line with the current situation of the income gap between high- and low-income groups on the macrolevel of measuring urban–rural income. It is also more sensitive in calculating the income gap (Shao et al., 2016; Birch and Marshall, 2018). Therefore, it is more scientific to choose the Theil index of the urban‒rural income gap.

Generally, the quality of economic development indicates whether a country or region can achieve more efficient production, a more coordinated economic structure, more stable economic operation, improved welfare distribution, and enhanced sustainability of economic development than before by accumulating economic development on a certain scale and of certain quantity, thus keeping the economy in a comprehensive and sustained growth state in the long term (Eiadat et al., 2008). Therefore, we believe that high-quality economic development is effective economic development achieved by a country or region on the basis of quantity and scale growth, relying on technological progress, improving resource allocation efficiency and production efficiency, etc. Such growth is characterized by high efficiency, stability, rational structure and green economic development. Therefore, we glean from Luo et al. (2021), Peng et al. (2021) and other scholars the following five aspects for improving the quality of economic development.

(1) The efficiency of economic development. The efficiency of economic development refers to the economic benefits that can be obtained at a certain economic cost. It reflects the relationship between input and output. A high efficiency of economic development means that the same input can bring more output, or the same output consumes less input. This dimension is mainly used to reflect the promotion of regional technological progress, the improvement of organizational management and the reform of systems of economic development. The improvement of economic development efficiency can promote the efficiency of resource allocation and investment, promote intensive production in a region, and enable the expansion of the production possibilities Frontier. Its constituent indicators mainly comprise capital productivity, labour productivity and total factor productivity (TFP).

(2) The stability of economic development. The stability of economic development reflects whether the economy can maintain sustained and stable growth; specifically, it evaluates whether a country or region has achieved the goals of price stability and full employment. On the one hand, stable economic development can prevent overproduction caused by excessive, ineffective investment when the economy is overheated. It can also avoid the welfare loss caused by the dilution effect of a high inflation rate on residents’ wealth. On the other hand, stable economic development can also effectively avoid many problems, such as high unemployment, low investment and social instability, during economic recessions. Its constituent indicators mainly comprise economic development volatility, consumer price index and urban registered unemployment rate.

(3) The optimization of the economic structure. The optimization of the economic structure reflects whether the regional economic structure tends to be rational and balanced in the process of economic development. Because the economic structure is a multilevel complex composed of many related systems, a rational economic structure can improve the use efficiency and allocation efficiency of elements; promote the flow of capital, technology, labour and other factors to more efficient departments; enable more reasonable and efficient resource use; alleviate the pressure of resource and ecological environment problems on economic development; promote coordinated development between urban and rural areas, departments and industries; and provide sustainable power for the quality of economic development. Its constituent indicators mainly include the ratio of the added value of secondary industry to GDP, the ratio of the added value of tertiary industry to GDP, and the ratio of the output value of high-tech industry to the total industrial output value.

(4) The sharing of economic development. The sharing of economic development measures the increase and distribution of social welfare brought about by development in a country or region and reflects whether the achievement of regional economic development can effectively improve the welfare of the residents, whether the benefits of development can be shared by the residents, and whether social development is well coordinated. The ultimate goal of regional economic development is not only to realize the continuous growth of the economy overall but also to pay attention to individual survival and sustainable development. On the one hand, improved sharing can promote economic development by raising residents’ income level and increasing savings and consumption; on the other hand, it can increase individuals’ sense of belonging to and identification with society. Its constituent indicators mainly comprise the Engel coefficient of urban residents, the Engel coefficient of rural residents, medical beds per thousand people, public transport vehicles per ten thousand people and road area per capita.

(5) The development of the green economy. Green economic development theory is different from the traditional economic development concept. A green economy is an economy that follows the principle of green development, which not only includes factors such as resource input and environmental pollution cost in the traditional economy but also considers the undesired outputs of resource use and environmental pollution in its calculations. The problem of green economic development can be solved by improving the efficiency of the economic system. Its constituent indicators mainly comprise energy consumption per unit of GDP, industrial wastewater discharge per unit of GDP, industrial waste gas discharge per unit of GDP and industrial solid waste discharge per unit of GDP.

In Table 1, Capital Productivity = GDP/capital stock, Labour productivity = GDP/employees, and total factor productivity (TFP) is measured based on the ML index method (DEA-Malmquist‒Luenberger). The input indicators include capital, labour and resources (expressed by energy consumption), the expected output is GDP, and the undesired output is wastewater discharge, SO2, solid waste output, total exhaust gas emissions, and total smoke (dust) emissions. Capital stock is calculated as

Because the index units in Table 1 are not uniform, first, the calculation indexes in Table 1 are averaged and made dimensionless. Second, the widely used principal component analysis method is used to select eigenvalues greater than 1 as the principal component index. Finally, the variance contribution rate of the principal component of each index is used as the weight, linear weighting is carried out, and a comprehensive index of the economic development quality of 30 provinces in China is obtained.

The adjustment range of the industrial structure is the range of change in the development process of the three major industries; it has a decisive influence on the development of the national economy, and its range is related to the healthy development and growth speed of the regional economic structure (Sharon et al., 2020; Zheng et al., 2014). According to Findeisen and Sudekum. (2008), the adjustment range of industrial structure (adj) is found by measuring the intensity of the change in the total employment in industrial enterprises in the region.

The quality of industrial structure adjustment is an important element of the process of industrial evolution from low-level to high-level and is also a necessary factor in the process of high-quality economic development. It is the shift of productive factors from low productivity sectors to high productivity or high technical complexity sectors (Acemoglu and Zilibotti, 2001). Therefore, the quality of industrial structure adjustment essentially has two meanings: first, the change in the proportional relationship of input factors; and second, the improvement in labour productivity. The measurement method is as follows:

The principle for selecting the control variables is mainly based on the possible impact on the urban‒rural income gap and is also an uncontrollable factor of the urban‒rural income gap (Shin, 2012; Díez-Minguela et al., 2018; Aiyar and Ebeke, 2020; Sharon et al., 2020). Based on existing research, considering the availability of data and the representativeness of indicators, the influential economic and institutional indicators are selected as the important variables that affect the urban‒rural income gap. The control variables selected in this paper are as follows: 1) Urbanization (urb), 2) government expenditure (gov), 3) economic openness (ope), 4) unemployment rate (une), 5) traffic convenience (roa), 6) education level (edu), and 7) employment by ownership type (own).

Based on the availability of data and statistical calibre, this paper uses panel data on 30 provinces (autonomous regions and municipalities) from 2000 to 2019. Due to the serious lack of data in Tibet, this region was eliminated. Data sources include the statistical yearbooks of provincial units, the Statistical Yearbook of China’s Population and Employment, etc. Some provinces are missing statistical data, so we supplement the data using interpolation. The statistical characteristics of each variable after processing are shown in Table 2.

Based on the above analysis, we first established the following basic model:

Thi represents the Theil index for measuring the income gap between urban and rural areas in period t and region i, eco represents the quality of economic development, ind represents the adjustment of the industrial structure (adjustment range and adjustment quality), and x represents the set of control variables.

In formulas 5, 6 Y and X represent dependent variables and independent variables, respectively.

Because the adjustment of the regional industrial structure and economic development is a continuous process, the resulting income gap depends not only on current factors but also on previous factors; that is, the income gap may have dynamic effects. This paper uses a dynamic spatial panel model to test the impact of industrial structure adjustment and economic development quality on the income gap as follows:

Traditional econometric models may ignore the deviation caused by spatial factors. An important basis for distinguishing traditional econometric models from spatial econometric models is the spatial correlation test. Moran’s I test can not only eliminate the errors caused by spatial factors to a certain extent but also indicate whether there is correlation between spatial entities within a certain range.

Table 3 gives the Moran’s I test results of the urban‒rural income gap from 2000 to 2019. The urban‒rural income gap has been significant since 2005. Generally, the income gap between different regions does not show completely random characteristics, thus indicating that there is a very obvious positive spatial correlation between the urban‒rural income gap.

Before parameter estimation, it is impossible to judge the spatial dependence characteristics of variables empirically. First, it is necessary to judge and select the models to determine which ones meet the actual requirements. According to the criterion proposed by Anselin and Florax (1995), the result shows that the LM-test value of the SAR model is significantly better than that of the SEM under the economic weight matrix and that while R-LMERR is significant, R-LMLAG is not. Therefore, the spatial autoregressive method was chosen to analyse the panel data empirically1.

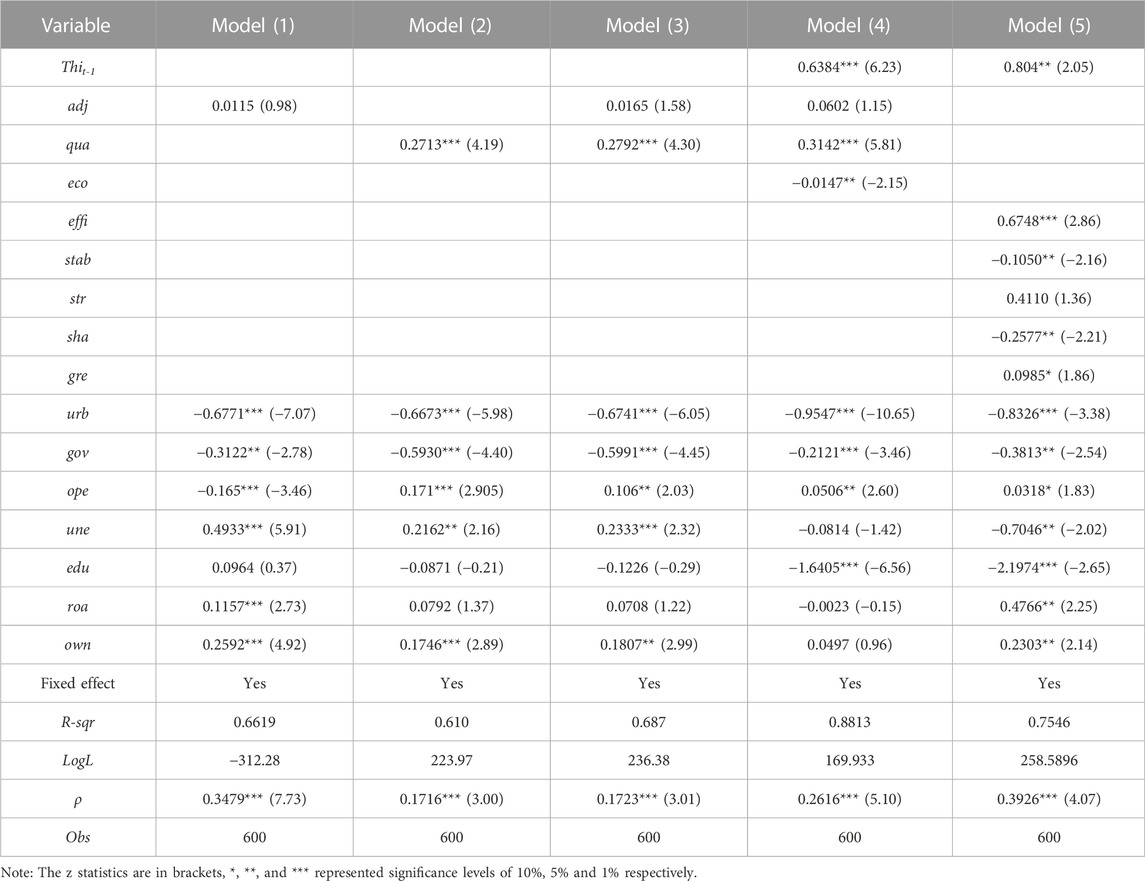

We analysed the estimation results of industrial structure adjustment and economic development quality on the income gap between urban and rural areas nationwide. To ensure the robustness of the regression results, in Table 4, we further choose to regress the core explanatory variables separately. Models (1) and (2) investigate the effects of industrial structure adjustment magnitude and adjustment quality, respectively, on the urban‒rural income gap, and model (3) considers the joint effects of industrial structure adjustment amplitude and adjustment quality on the urban‒rural income gap. Model (4) considers the dynamic effect of the income gap under a one-stage lag. In addition, because there are many individual subindicators that affect the quality of economic development and there is a lack of comprehensive information that reflects such quality, this paper also considers adding the secondary indicators that constitute the quality of economic development to the regression model. To more accurately reflect the impact of economic development components on the urban‒rural income gap (model (5).

TABLE 4. Test results of industrial structure adjustment and economic development quality on urban-rural income gap.

First, according to the estimation results of industrial structure adjustment and economic development quality on urban and rural income in Table 4, the lag period is still positive (0.6384), which indicates that the income gap between urban and rural residents has strong path dependence and is still difficult to change in the short term. In addition, according to the regression under both nondynamic and dynamic effect models in Table 4, the adjustment of the industrial structure has no significant effect on the income gap between urban and rural areas at the indicated significance level, but the quality of industrial structure adjustment not only promotes the increase in disposable income in urban and rural areas but also widens the income gap between urban and rural areas [Table 4, Model (2) and (Model (4)]. We interpret this as follows: The adjustment of the industrial structure tends towards secondary and tertiary industries, which are mainly concentrated in cities. This is in line with the development of cities, which encourages an industrial policy centred on cities, while the government pays less attention to the development of nonurban industries, resulting in an unbalanced development situation between urban and rural industries (Chen, 2003; Ezcurra, 2009). This explains how the continuous improvement of the quality of industrial structure adjustment, with the increasingly fine division of labour in society, deepens the proprietary degree of human capital, which directly affects the income gap between urban and rural areas. For example, the upgrading of the industrial structure raises the requirements for the quality of labour and the education level of workers, but it always causes a disadvantage for rural low-skilled workers in the employment market. In the face of various difficulties related to, for example, with employment and salary (Zhang and Eriksson, 2010), unemployment will inevitably occur in different situations and widen the income gap between urban and rural areas.

In addition to the long-standing dual management system of urban and rural economies and society, even though the disposable income of rural and urban residents is increasing, cities are more likely to use policy patterns to obtain surplus from migrant workers during the process of economic development. Compared with rural workers’ contributions, their wage increases are insufficient. The two are not equivalent, and the superposition effect of income inequality brought by urban and rural areas will continue to further widen the income gap (Chakravarty and Majumder, 2001). Second, it is found that the quality of economic development has a significant inhibitory effect on the income gap between urban and rural areas (−0.0147). According to the comprehensive list of indicators of economic development quality in Table 1, the quality of economic development is a comprehensive evaluation of regional economic development, and its ultimate goal is to improve people’s livelihood and quality of life. Therefore, with profound changes in the mode of economic development, with the increasing new demands of the public and governments at all levels for the quality of economic development, economic development plays an increasingly obvious role in solving the problem of achieving sufficient balance in the development process, social security system and income redistribution and promoting economic development and social stability, which are also important effects of narrowing the income gap between urban and rural residents. Finally, according to the regression results of secondary indicators of economic development quality [Table 4, Model (5)], the efficiency of economic development significantly promotes the income gap between urban and rural areas (with an estimated effect of 0.6748). This paper explains that over the past few decades, China’s economic development has consistently focused on improving the speed or efficiency of economic development. In attracting investment and developing industry, the primary considerations are often output value, profits and taxes, while quality of life issues such as environmental protection are ignored; in turn, this leads to the widening of the social income gap. Through the stability of economic development and economic development, the joint regression showed that both of these factors significantly suppressed the income gap between urban and rural areas (−0.105 and −0.2577). In fact, the stability of the economy determines residents’ optimistic attitudes towards future economic development caused by current cash holdings and future economic fluctuations. Obviously, the more stable economic development is the more effective it is at ensuring the rationality and fairness of residents’ wealth and income distribution and reducing the income gap. The sharing of economic development is the result of economic development, and guarantees are an important tool for adjusting income distribution. Also, the higher the sharing of economic development and the better the social welfare, the greater the benefits are for low-income groups. Therefore, the sharing of economic development has obvious significance for controlling the income gap between urban and rural areas.

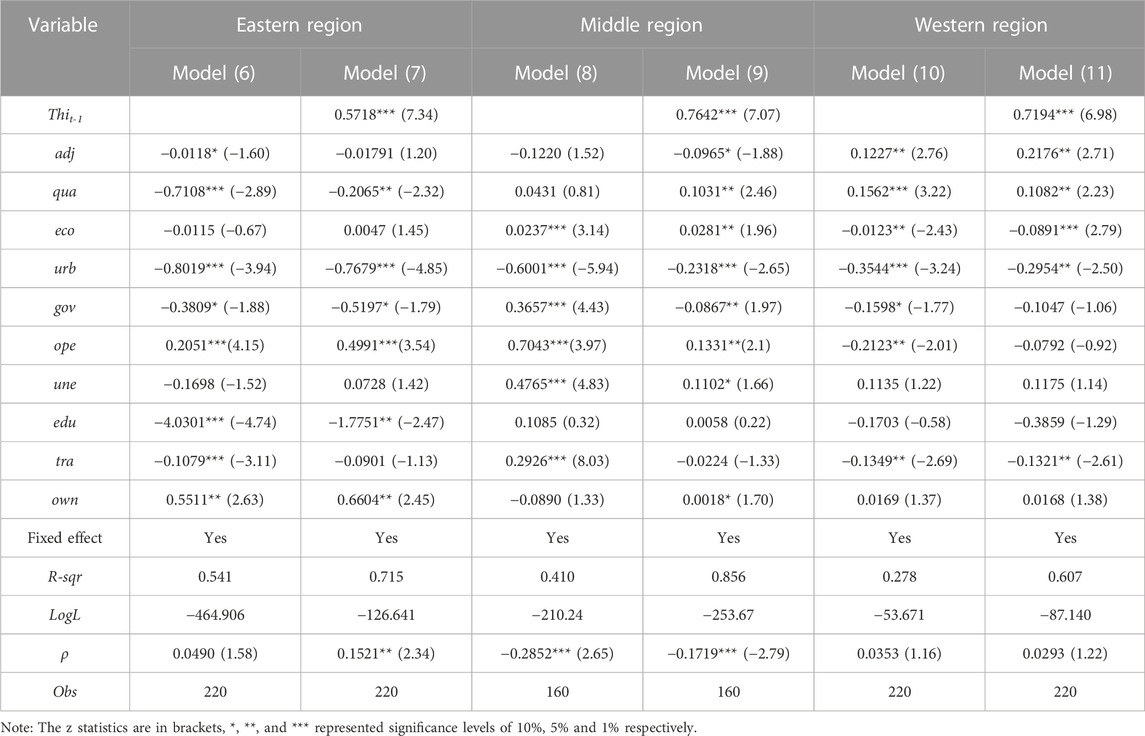

Because of geographical, environmental, human capital and other factors, there are great differences in regional economic development, including higher economic development in eastern coastal provinces than in central and western regions that are relatively backwards. These differences in development level cause not only certain differences in industrial structure adjustment and economic development quality but also income inequality between urban and rural areas in the eastern, central and western regions. Therefore, we divide the study area into eastern, central and western areas according to level of economic development2. In the analysis of the impact of the heterogeneity of regional economic development on the income gap between urban and rural residents in different regions (Table 5), to avoid endogeneity problems, the lagged term and nonlagged term are selected for estimation in different regions.

TABLE 5. Test results of industrial structure adjustment and economic development quality on urban and rural income gap in different regions.

By studying the influence of industrial structure adjustment on the urban‒rural income gap in different regions, we find that the adjustment range of the industrial structure and the quality of economic development in the eastern region have no significant influence on the urban‒rural income gap. However, the quality of industrial structure adjustment significantly reduces the income gap between urban and rural areas (−0.2065). A possible explanation for this is that the eastern region has a good economic foundation and a high degree of marketization (Chen et al., 2020; Han and Jiang, 2022). The urban‒rural division or urban‒rural dual structure is less obvious there than that in the central and western regions. The development of tertiary industry, especially the modern service industry in the eastern region, has absorbed a large amount of surplus rural labour, increased the nonagricultural income of rural residents and narrowed the income gap between urban and rural areas. In the central and western regions, the quality of industrial structure adjustment causes the income gap between urban and rural areas to widen in the lagged estimate. Unlike the eastern region, where the industrial structure is in the late stage of industrialization, the central and western regions are still in the middle or even early stage of industrialization (Ezcurra, 2009), and their industrial structure level is not high, so they are still facing the challenges of arduous and urgent economic development. In addition, we also found that the adjustment of the industrial structure in the western region significantly widens the income gap between urban and rural areas (0.2176). This shows that the adjustment range of the industrial structure has different effects on the income gap between urban and rural areas in different periods of regional economic development, especially in the later period of urbanization in economically developed areas. In economically underdeveloped areas, because the economy is in a stage of rapid growth, the absorption of a large number of industries and the expansion of employment have increased the overall income of residents and narrowed the income gap between urban and rural residents. However, in the early stage of economic development in underdeveloped western areas, the income gap caused by the strict division of urban and rural systems and unequal development opportunities cannot be reversed in the short term and will inevitably lead to the widening of the income gap between urban and rural areas.

We find that the quality of economic development in eastern China has no significant impact on the urban‒rural income gap. The main reasons for this are that the social and economic development in the eastern region is more balanced, the industries are diversified, there are more channels for farmers to increase their income, and the social welfare level and income distribution have become increasingly reasonable. Compared with the midwest, the urban‒rural division is not obvious. In the central region, the quality of economic development is remarkably good (0.0281), although this widens the income gap between urban and rural areas. Both growth pole theory and unbalanced development theory show that in the early stage of economic development or industrialization, differences in regional development and unbalanced distribution of resources will inevitably trend toward a widening and then narrowing of the gap between urban and rural areas. The central region is still in the middle stage of industrialization and urbanization, and the income gap between urban and rural areas there is bound to expand first and then converge. The quality of economic development in western China significantly restrains the income gap between urban and rural areas (−0.0891). In contrast to that in the eastern and central regions, the quality of economic development in the western region has always been relatively low. The long-term income source of farmers in the western region is mainly family-managed farming. However, with the state’s continuous investment in the western region in recent years, the opportunities for economic development there has greatly improved (Luo et al., 2021). A large number of surplus labourers have moved to cities and towns to seek employment, and the income structure of family agriculture has begun to change. Wage income has gradually become the main source of income increases for workers in the western region. The income growth of rural manual labourers is faster than that of urban employees, which is another key reason the income gap between urban and rural areas in the western region has narrowed.

We note that there may be some errors in the model’s structure and variable selection, which may affect the reliability of the regression results. Therefore, to further test the robustness of industrial structure adjustment and economic development quality on the urban‒rural income gap, the Theil index of urban and rural income is replaced by the Theil index of urban and rural residents’ consumption (Cthi) and the per capita income ratio of urban and rural residents (

Table 6 estimates the results of the robustness test by using the full sample and subregional sample. We use the full sample and find that the one-stage lag of the explained variables and the regression direction of the core explained variables are basically consistent with the results mentioned above. The regression results using the core explanatory variables Dthi and Cthi are slightly different from those of the core explanatory variables in Tables 3–5, but they do not affect the explanation of the above regression results, so the explanation is not repeated here.

According to the above spatial model analysis, we find that the adjustment of the industrial structure has no significant impact on the income gap between urban and rural areas anywhere in China, particularly in the eastern and central regions. In the central region, the quality of industrial structure adjustment has no significant impact on the income gap between urban and rural areas. The quality of economic development also shows different levels of significance in the eastern, central and western regions (Han and Jiang, 2022). Therefore, we suspect that one or more thresholds in the range of industrial structure adjustment and in economic development quality must be broken for the income gap between urban and rural areas to narrow. To further verify the existence of the threshold effect, a threshold regression model is used to test this conjecture. We use a first-order threshold model to determine whether a threshold value exists. Similarly, on the basis of a single threshold model, considering the differences in natural conditions and economic and social characteristics in different regions, there may be multiple threshold effects in the adjustment range of industrial structure and the quality of economic development. The following panel threshold regression model is thus established.

where I (⋅) represents the indicator function. When I (⋅) is false, it takes a value of 0; otherwise, it takes a value of 1. The threshold variables

According to the above threshold effect test results (Table 7), we find that there is a single threshold between the quality of industrial structure adjustment (4.4758) and the amplitude of industrial structure adjustment (2.4140) at a confidence level of 5%. The quality of economic development has two threshold effects (0.1679 and 0.4694). To ensure unbiased regression results, the maximum likelihood estimation method (MLE) is used to estimate the impact of the threshold on the urban‒rural income gap, and the estimation results are shown in Table 8.

According to the regression parameter estimation of the threshold effect, we find (Table 8) that when the significance level of industrial structure adjustment is lower than 4.4758 and 2.414, there is no significant impact on the urban‒rural income gap, and only after they cross their respective thresholds will they have a significant impact on the urban‒rural income gap. In this regard, this paper explains that as an important means of government macrocontrol, industrial policy is policy oriented (Ezcurra, 2009; Luo et al., 2021); therefore, in the process of industrial restructuring, it will inevitably cause unemployment problems in different situations, especially for the manual labour force, which is always in an inferior position in the job market. In the process of industrial structure adjustment, various difficulties in adaptation and employment will arise. Additionally, although industrial structure adjustment will bring “employment gains” in the short term, it will widen the income gap between urban and rural residents. However, in the long run, the adjustment of the industrial structure has not only changed the traditional pattern of agricultural development but also introduced new industries, such as service industries, into underdeveloped areas. This has strengthened the mobility of urban and rural human capital in underdeveloped areas, which is also a requirement for the development of the market economy and ultimately helps increase the disposable income of manual labourers and narrow the income gap between urban and rural areas.

Table 8 also shows that there is a second-order threshold effect of the quality of economic development. This effect does not significantly impact the income gap between urban and rural areas below 0.1679 but enlarges the income gap between urban and rural areas in the threshold interval (0.1679 and 0.4694) and restrains the income gap between such areas when the quality of economic development crosses above the second-order threshold. We demonstrate this using Kuznets’s “inverted U-shape” theory of income distribution as follows: At present, the quality of China’s economic development is still in the initial stage of the “inverted U-shape”. In the short term, the income distribution gap will widen. When the economy develops to a certain level, the income distribution gap will gradually narrow.

Using the panel data of 30 provincial units in China from 2000 to 2019, in this paper, we construct a comprehensive index of economic development quality from five aspects, namely, economic development efficiency, stability, structural optimization, social welfare and green economic development. We also construct two variables, namely, the industrial structure adjustment amplitude and the adjustment quality. The effects of industrial structure adjustment and economic development quality on the income gap between urban and rural areas are investigated. The findings are as follows. First, the quality of industrial structure adjustment has significantly widened the income gap between urban and rural areas in the full sample. The quality of economic development narrows the income gap between urban and rural areas. Second, in the regional study, it was found that the adjustment of the industrial structure widened the income gap between urban and rural areas in western China. The quality of the industrial structure adjustment has restrained the income gap between urban and rural areas from expanding in eastern China but widened the income gap between urban and rural areas in central and western China. Through research on the quality of economic development, we find that high-quality economic development enlarges the income gap between urban and rural areas in central China but restrains that income gap in western China. Finally, further analysis shows that the adjustment range and quality of the industrial structure have a first-order threshold effect on the urban‒rural income gap, which widens after crossing the first-order threshold. The regression of the economic development quality threshold shows that there is a significant second-order threshold effect on the quality of economic development, which significantly expands the income gap between urban and rural areas between the first-order threshold and second-order threshold.

Based on the analysis and results, this paper suggests the following macro-level policy implications which might be helpful for adjusting China’s industry structure and the relationship between supply and demand, breaking down the regional barriers to development, and enhancing the technological innovation of manufacturing sector. In specific, while considering the speed of economic development, policymakers should give more attention to the quality of economic development than they do at present in order to simultaneously pursue both the speed and quality of economic development; furthermore, they should take the improvement of labour productivity as the fundamental means to increase income, adjust the “speed” and “quality” of economic development to enhance people’s livelihood security, and jointly drive the growth of urban and rural residents’ incomes. Second, Chinese government should take the industrial structure adjustment as a coordinator to solve narrow income gap. In light of the great regional differences in China, each region should formulate practical industrial development policies according to its current industrial development level. In those rural areas with good basic conditions, local urbanization with industry upgrading is supposed to promoted to enrich farmers. And in those resource-poor countryside, detailed policies should be issued to accelerate the transfer of surplus rural labour to urban tertiary industry.

While this study seeks to provide an in-depth exploration of the topics at hand, it is worthwhile noting its limitations, the recognition of which has furthered our understanding of the subject enough to propose scope for future research. To begin with, our examination is primarily limited to the role of industrial structure adjustment on the income disparity between urban and rural geographical contexts, whilst disregarding the potential impacts of other variables. This circumscribed perspective may alter the applicability and reach of the resulting policy recommendations derived from our study. Secondly, our analysis is confined to deciphering the relationship between industrial structure adjustment, the quality of economic development, and the urban-rural income discrepancy, thereby excluding other potential cause-and-effect paradigms. This analysis may overlook additional crucial relationships that, if addressed, could contribute significantly to the literature. Thirdly, ensuring the feasibility of the study necessitated bypassing in-depth micro-level data, possibly sidelining an array of detailed insights that could be unearthed from such granular information. Consequently, the omission of this potentially rich subset of data precludes a more extensive dissection of the matter at hand and thereby modestly hobbles the findings’ comprehensive implications. Given these constraints, it is recommended that ensuing research considers shifting the spotlight to the analysis of income disparity from individual and family viewpoints for a more profound and nuanced understanding of this critical socio-economic issue. A deeper dive into the micro-level data will significantly buttress the nuances and scope of the investigation, paving the way for an all-encompassing comprehension of income disparity and its interconnected spheres of influence.

The original contributions presented in the study are included in the article/Supplementary Materials, further inquiries can be directed to the corresponding author.

JH and TJ: Conceptualization. JH: methodology, data collection and curation, software. JH and TJ: writing—original draft preparation, writing—review and editing. All authors contributed to the article and approved the submitted version.

Nanjing University of Posts and Telecommunications Humanities and Social Sciences Research Fund Project (NYY222059; NYY222040).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

1Due to space limitations, SAR and SEM test results are not provided. These can be obtained from the author upon request.

2The National Bureau of Statistics divides China’s economic zones into eastern, central, western and northeastern regions, and it is not meaningful to separate the northeastern region into three economic zones. Thus, in this paper, China’s economic zones are divided into central, eastern and western economic zones. The eastern region consists of Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong and Hainan, for a total of 11 provinces (municipalities directly under the central government). The central region consists of eight provinces, including Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei and Hunan. The western region includes Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia and Xinjiang, for a total of 11 provinces (autonomous regions and municipalities).

Acemoglu, D., and Zilibotti, F. (2001). Productivity differences. Q. J. Econ. 116 (2), 563–606. doi:10.1162/00335530151144104

Ahluwalia, M. S. (1976). Inequality, poverty and development. J. Dev. Econ. 3 (4), 307–342. doi:10.1016/0304-3878(76)90027-4

Aiyar, S., and Ebeke, C. (2020). Inequality of opportunity, inequality of income and economic growth. World Dev. 136 (10), 105115. doi:10.1016/j.worlddev.2020.105115

Anand, S., and Kanbur, R. (1993). The Kuznets Process and the inequality development relationship. J. Dev. Econ. 40 (1), 25–52. doi:10.1016/0304-3878(93)90103-t

Anselin, L., and Florax, R. J. (1995). “Small sample properties of tests for spatial dependence in regression models: some further results,” in New directions in spatial econometrics. Berlin, Heidelberg: Springer Berlin Heidelberg, 21–74. doi:10.1016/j.worlddev.2020.105115

Banerjee, A. V., and Duflo, E. (2003). Inequality and growth: what can the data say? J. Econ. Growth 8 (3), 267–299. doi:10.1023/A:1026205114860

Benito, A. (2000). Inter-industry wage differentials in great britain. Oxf. Bull. Econ. Statistics 62, 727–746. doi:10.1111/1468-0084.0620s1727

Benjamin, D., Brandt, L., and Giles, J. (2011). Did higher inequality impede growth in rural China? Econ. J. 121 (5), 1281–1309. doi:10.1111/j.1468-0297.2011.02452.x

Birch, E., and Marshall, D. (2018). Revisiting the earned income gap for Indigenous and non-Indigenous Australian workers: evidence from a selection bias corrected model J. Ind. Relat. 60 (1), 3–29.

Bresnahan, T. F., Brynjolfsson, E., and Hitt, L. M. (2002). Information technology, workplace organization, and the demand for skilled labor: firm-level evidence. Q. J. Econ. 117 (1), 339–376. doi:10.1162/003355302753399526

Bronzini, R., and Piselli, P. (2009). Determinants of long-run regional productivity with geographical spillovers: the role of R&D, human capital and public infrastructure. Regional Sci. &Urban Econ. 39 (2), 187–199. doi:10.1016/j.regsciurbeco.2008.07.002

Calderón, C., and Chong, A. (2004). Volume and quality of infrastructure and the distribution of income: an empirical investigation. Rev. Income Wealth 50 (1), 87–106. doi:10.1111/j.0034-6586.2004.00113.x

Caselli, F. (1999). Technological revolutions. Am. Econ. Rev. 89 (1), 78–102. doi:10.1257/aer.89.1.78

Chakravarty, S. R., and Majumder, A. (2001). Inequality, polarisation and welfare: theory and applications. Aust. Econ. Pap. 40 (1), 1–13. doi:10.1111/1467-8454.00108

Chen, B. L. (2003). An inverted-U relationship between inequality and long-run growth. Econ. Lett. 78 (2), 205–212. doi:10.1016/S0165-1765(02)00221-5

Chen, L. M., Ye, W. Z., Huo, C. J., and James, K. (2020). Environmental regulations, the industrial structure, and high-quality regional economic development: evidence from China. Land 9 (12), 517–522. doi:10.3390/land9120517

Chusseau, N., Dumont, M., and Hellier, J. (2008). Explaining rising inequality: skill-biased technical change and north-south trade. J. Econ. Surv. 22 (3), 409–457. doi:10.1111/j.1467-6419.2007.00537.x

Deininger, K., and Squire, L. (1998). New ways of looking at old issues: inequality and growth. J. Dev. Econ. 57 (2), 259–287. doi:10.1016/s0304-3878(98)00099-6

Díez-Minguela, A., Martinez-Galarraga, J., Sanchis-Llopis, M. T., and Tirado-Fabregat, D. A. (2018). The origins of economic growth and regional income inequality in Latin europe, 1870–1950. J. Interdiscip. Hist. 49 (1), 93–116. doi:10.1162/jinh_a_01233

Du Caju, P., Lamo, A., Poelhekke, S., Katay, G., and Nicolitsas, D. (2010). Inter-industry wage defferentials in Eu countries: what do cross-country time warying data add to the picture? J. Eur. Econ. Assoc. 8 (2-3), 478–486. doi:10.1162/jeea.2010.8.2-3.478

Eiadat, Y., Kelly, A., Roche, F., and Eyadat, H. (2008). Green and competitive? An empirical test of the mediating role of environmental innovation strategy. J. World Bus. 43 (2), 131–145. doi:10.1016/j.jwb.2007.11.012

Esteban, J., Cradin, C., and Debraj, R. (2007). An Extension of a Measure of Polarization, with an application to the income distribution of five OECD countries. J. Econ. Inequal. 5 (1), 1–19. doi:10.1007/s10888-006-9032-x

Ezcurra, R. (2009). Does income polarization affect economic growth? The case of the European regions. Reg. Stud. 43 (2), 267–285. doi:10.1080/00343400701808899

Fang, C., Huang, L., and Wang, M. (2008). Technology spillover and wage inequality. Econ. Model. 25 (1), 137–147. doi:10.1016/j.econmod.2007.05.002

Findeisen, S., and Südekum, J. (2008). Industry churning and the evolution of cities: evidence for Germany. J. Urban Econ. 64 (2), 326–339. doi:10.1016/j.jue.2008.02.003

Goldberg, P, K., and Nina, P. (2007). Distributional effects of globalization in developing countries. J. Econ. Literature 45 (1), 39–82. doi:10.1257/jel.45.1.39

Goto, K., and Endo, T. (2014). Labor-intensive industries in middle-income countries: traps, challenges, and the local garment market in Thailand. J. Asia Pac. Econ. 19 (2), 369–386. doi:10.1080/13547860.2014.880283

Han, J., and Jiang, S, C. (2022). Which is important? — The economy or people’s livelihood. Econ. Research-Ekonomska Istraživanja 36, 1–20. doi:10.1080/1331677X.2022.2150256

Hsieh, C. T., and Klenow, P. J. (2009). Misallocation and manufacturing TFP in China and India. Q. J. Econ. 124 (4), 1403–1448. doi:10.1162/qjec.2009.124.4.1403

Ju, Q. J., Ni, J. L., Ni, D. B., and Wu, Y. (2016). Land acquisition, labor allocation, and income growth of farm households. Emerg. Mark. Finance Trade 52 (8), 1744–1761. doi:10.1080/1540496x.2016.1181860

Liu, Z. (2005). Institution and inequality: the hukou system in China. J. Comp. Econ. 33 (1), 133–157. doi:10.1016/j.jce.2004.11.001

Luo, S., Shi, Y., Sun, Y., Zhao, Z., and Zhou, G. (2021). Can FDI and ODI two-way flows improve the quality of economic growth? Empirical evidence from China. Appl. Econ. 53, 5028–5050. doi:10.1080/00036846.2021.1914318

Marrero, G. A., and Rodríguez, J. G. (2013). Inequality of opportunity and growth. J. Dev. Econ. 104, 107–122.

Mehta, A., and Sun, W. (2011). Inter-industry wage differentials and worker heterogeneity: evidence from Indonesia and the asian financial crisis. SSRN Electron. J. 2011. doi:10.2139/ssrn.1910425

Morduch, J., and Sicular, T. (2002). Rethinking inequality decomposition, with evidence from rural China. Econ. J. 112 (4), 93–106. doi:10.1111/1468-0297.0j674

Murphy, K. M., Shleifer, A., and Vishny, R. (1989). Income distribution, market size, and industrialization. Q. J. Econ. 104 (3), 537–564. doi:10.2307/2937810

Peng, W., Yin, Y., Kuang, C., Wen, Z., and Kuang, J. (2021). Spatial spillover effect of green innovation on economic development quality in China: evidence from a panel data of 270 prefecture-level and above cities. Sustain. Cities Soc. 69, 102863. doi:10.1016/j.scs.2021.102863

Rubin, A., and Segal, D. (2015). The effects of economic growth on income inequality in the US. J. Macroecon. 45, 258–273. doi:10.1016/j.jmacro.2015.05.007

Shao, C. Y., Meng, X. H., Cui, S. C., Wang, J. R., and Li, C. C. (2016). Income-related health inequality of migrant workers in China and its decomposition: an analysis based on the 2012 China Labor-force Dynamics Survey data[J]. J. Chin. Med. Assoc. 79 (10), 531–537.

Schenkman, S., and Bousquat, A. (2021). From income inequality to social inequity: impact on health levels in an international efficiency comparison panel. BMC Public Health 21 (1), 688. doi:10.1186/s12889-021-10395-7

Sharon, G. M., Koh Grace, H. Y., and Bomhoff, E. J. (2020). The income inequality, financial depth and economic growth nexus in China. World Econ. 43 (2), 412–427. doi:10.1111/twec.12825

Shin, I. (2012). Income inequality and economic growth. Econ. Model. 29 (5), 2049–2057. doi:10.1016/j.econmod.2012.02.011

Spitz, O. A. (2006). Technical change, job tasks, and rising educational demands: looking outside the wage structure. J. Labor Econ. 24 (2), 235–270. doi:10.1086/499972

Verhoogen, E. A. (2008). Trade, quality upgrading, and wage inequality in the Mexican manufacturing sector. Q. J. Econ. 123 (2), 489–530. doi:10.1162/qjec.2008.123.2.489

Wan, H. G., Lu, M., and Chen, Z. (2006). The inequality-growth nexus in the short and long run: empirical evidence from China. J. Comp. Econ. 34 (4), 654–667. doi:10.1016/j.jce.2006.08.004

Zhang, J., Wu, G., and Zhang, J. (2004). The estimation of China’s provincial capital stock: 1952-2000. Econ. Res. J. 10, 35–44.

Zhang, Y., and Eriksson, T. (2010). Inequality of opportunity and income inequality in nine Chinese provinces, 1989-2006. China Econ. Rev. 21 (4), 607–616. doi:10.1016/j.chieco.2010.06.008

Keywords: industrial structure adjustment, quality of economic development, urban-rural income gap, regional economic development, China

Citation: Jiang T and Han J (2023) The effect of industrial structure adjustment and economic development quality on transitional China’s urban‒rural income inequity. Front. Environ. Sci. 11:1084605. doi: 10.3389/fenvs.2023.1084605

Received: 30 October 2022; Accepted: 07 August 2023;

Published: 18 August 2023.

Edited by:

Faik Bilgili, Erciyes University, TürkiyeReviewed by:

Deodat E. Adenutsi, Ho Technical University, GhanaCopyright © 2023 Jiang and Han. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jun Han, bmpoYW5qdW5Abmp1cHQuZWR1LmNu

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.