95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 16 January 2023

Sec. Environmental Economics and Management

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1071658

This article is part of the Research Topic Environmental Risk and Corporate Behaviour View all 30 articles

Global warming not only affects biodiversity, but also threatens human health and wellbeing. As the main source of greenhouse gas emissions, enterprises play a critical role in carbon emissions reduction. However, only a small number of enterprises have disclosed their “low-carbon transition roadmap”, primarily due to the lack of immediate payoffs of green investment, which is disadvantageous to achieve net-zero emissions. First, through case analysis of carbon governance in typical countries around the world, we identify effective emissions reduction measures that firms can learn from. Next, this paper summarizes the multi-dimensional impact framework of corporate carbon emissions reduction. Last, we propose a carbon emissions reduction roadmap for companies from four aspects: companies should 1) actively engage in the carbon emissions trading system, 2) increase the application of green technology, 3) enhance corporate governance structure, and 4) ensure sufficient cash flow for low-carbon transition. This study contributes to the framework of corporate sustainable transition, providing practical references for balancing corporate environmental footprint and value growth.

Excessive greenhouse gas emissions are caused by human activities and will lead to global warming throughout both inland and ocean systems (Draper and Weissburg, 2019). Global warming results in land drought (Li et al., 2021), wetland degradation (Zhang et al., 2021), sea-level rise (Hieronymus, 2019), and an increase in the acidity of seawater (Orr et al., 2005; IPCC, 2014). Global warming not only influences the range of species and responses to seasonal events, but also impacts the interactions within and between species (Elert and Fink, 2018), and even leads to changes in biodiversity (Kardol et al., 2011; Chang et al., 2019), species variation (Shao et al., 2019) and death of animals (Muhlfeld et al., 2018).

As the main contributor to global warming and environmental pollution, enterprises play a critical role in carbon emissions reduction (Chen et al., 2022; Jiao et al., 2022; Zhang et al., 2022; Zhao et al., 2022). Therefore, enterprises should take on more responsibilities for reducing carbon emissions (Besio and Pronzini, 2014; Haney, 2017). However, corporate low-carbon activities lack immediate payoffs of green investment. In the short term, a large reduction of cheaper traditional fossil energy may increase the operation cost and enhance financial risks (Tian et al., 2022). The cost increase is a disincentive for enterprises to achieve net-zero emissions. To avoid an operation cost increase, some companies are unwilling to conduct carbon emissions reduction activities while ignoring the carbon performance in the whole supply chain. For example, the 2050 net zero target set by the Airports Council International Europe (ACI Europe) only covers buildings and land operations, excluding aircraft emissions-which account for 98% of corporate carbon emissions (Rogelj et al., 2021). In addition, some companies use greenwashing to improve the self-image of the funds from investment institutions and shareholders (Liu et al., 2021). However, by relying on false propaganda to create a good environmental image, enterprises will fail to achieve the substantial goal of carbon emissions reduction. Another risk for enterprises is that the exposure to corporate greenwashing led to a lost trust of investors and consumers (Nyilasy et al., 2014; Post et al., 2015). Furthermore, the trust loss causes irreparable damage to the corporate reputation and value.

Then how can enterprises achieve the goal of carbon reduction? From the previous literature, government environmental regulation is an external factor that affects corporate carbon emissions reduction. More and more research has found that the pressure from the government is an important driving force for corporate carbon emissions reduction activities (de Aguiar and Bebbington, 2014; Baboukardos, 2017; Herold and Lee, 2019; Wang et al., 2019; Tian et al., 2022). The external pressure exerted by environmental regulations on enterprises can effectively overcome organizational inertia and form a complementary relationship with the corporate internal governance mechanism (Ambec & Barla, 2002), transforming external pressure into an incentive factor to promote corporate carbon emissions reduction. In addition, the “Porter Hypothesis” believes that appropriate environmental regulation can force enterprises to invest in green technology innovation and form long-term benefits that exceed the cost of environmental legitimacy (Porter and Van der Linde, 1995). With advanced green technologies applied to the production process, enterprises can reduce dependence on the traditional heavy-polluting production methods and effectively avoid extra environmental regulation costs (Berrone et al., 2013).

Previous research focuses on the impact of a single factor on corporate carbon emissions reduction. They overlooked the corporate pro-environmental activities for carbon emissions reduction controlled by a variety of internal and external elements. There are interactions among various factors, which indirectly impact corporate carbon emissions reduction. This paper first summarizes the carbon governance experiences of typical countries (or regions) all over the world and identifies advanced practices of incentivizing enterprises to reduce carbon emissions. Then, based on Institutional Theory, Stakeholder Theory, Natural Resource Based View (NRBV), and theory on Low-carbon Strategy Cost Management, we construct a noval four-dimensional framework for corporate carbon emission reduction. Finally, a corporate carbon emission reduction roadmap is proposed accordingly. Notably, the roadmap for corporate carbon emission reduction is generated from four aspects, including 1) actively participating in the carbon emission trading system; 2) increasing the application of green technology; 3) improving the corporate governance structure; and 4) ensuring sufficient cash flow for low-carbon transformation.

This study has two contributions to the corporate sustainability literature. First, we propose a four-dimensional analysis framework for corporate carbon emission reduction activities. Multiple perspectives explore the critical factors of corporate carbon emissions reduction and provide some suggestions for policymakers aiming to achieve net-zero emissions. Second, we screen out the corporate carbon emissions reduction measures from the carbon governance experience of typical countries (or regions), and draw a “corporate carbon emissions reduction roadmap”. Our findings will give suggestions for enterprises to promote post-epidemic activities through bottom-up pro-environmental behaviours and green recovery plans (Wan et al., 2021).

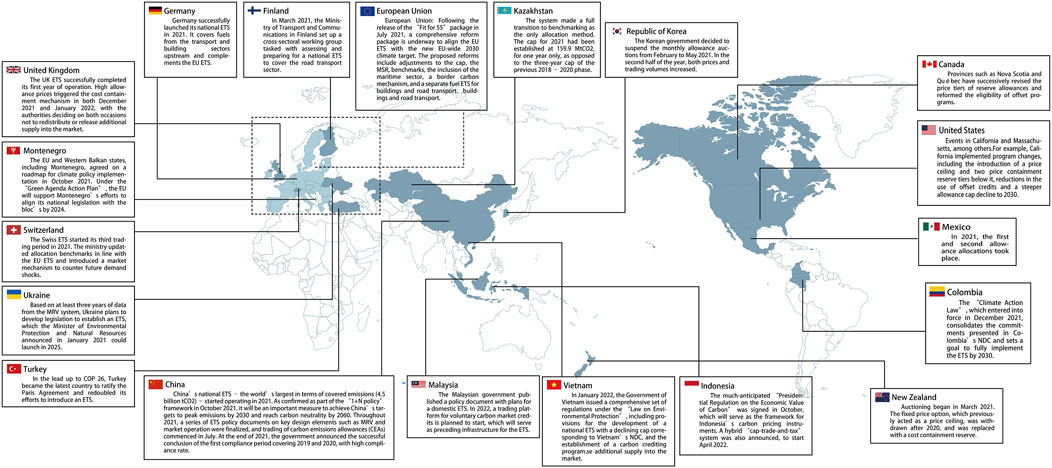

Since the United Nations Framework Convention on Climate Change (UNFCCC) was formed in March 1994, many countries start to pay more attention to international cooperation in mitigating climate change. The “Kyoto Protocol” (announced in December 1997) and the “Paris Agreement” (announced in December 2015) have become climate change policies with more participating countries around the world. On 10 November 2021, as the country with the largest total carbon emission and the largest carbon emission per capita, China and the US issued the “China-US Joint Glasgow Declaration on Enhancing Climate Action in the 2020s” during the United Nations Climate Change Conference in Glasgow. The declaration promises to further strengthen cooperation and take action in reducing carbon emissions and eliminating global illegal deforestation. These two countries (China and US) will work together to achieve the net-zero goal which was outlined in the Paris Agreement. To achieve the long-term goal of carbon neutrality, countries all over the world must rapidly adjust their policy frameworks to reduce carbon emissions. In this context, emissions trading will be crucial. The Emissions Trading System (ETS) will be an important tool to drive decarbonization. The ETS is a cap-and-trade mechanism based on allocations, as well as a trading mechanism that combines the state and the enterprises. We collected data from countries that are currently mature ETS, countries with developing ETS, as well as countries that are drafting system rules for ETS developments (ICAP., 2022), and disclosure in Figure 1. We found that the EU’s carbon emissions trading mechanism is the most mature, and most of the remaining countries are still in the initial phase.

FIGURE 1. Distribution of Emissions Trading Systems around the world Source from: ICAP Status Report 2022.

Since lots of countries join the United Nations Framework Convention on Climate Change (UNFCCC), these countries have faced huge pressure on carbon emissions reduction goals. A reduction in regional carbon emissions or carbon emissions per capita is considered an effective carbon reduction. We collected annual total carbon emissions and carbon emissions per capita of China, France, Germany, United Kingdom and United States during the period 1995 to 2020 from the Carbon Emission Accounts and Datasets (see Figure 2). We found that the United States and China are the countries with the largest carbon emissions. The total annual carbon emissions in the United States between 1995 and 2020 are about 5,000 million tons. China has experienced rapid industrialization and urbanization in the last few decades. In 2020, total carbon emissions have increased nearly four times compared to 1995, up to 10,000 million tons. Germany, the United Kingdom and France have fewer total emissions, and the overall trend is on a steady decline. The United States is the country with the highest carbon emissions per capita. Although total carbon emission has declined in recent years, the carbon emissions per capita is still as high as 13.53 tons in 2020. In the last 25 years, the carbon emissions per capita of Germany, United Kingdom and France are on a slow decrease, while carbon emissions per capita in China have increased. Moreover, China’s carbon emissions per capita increased rapidly from 2002 to 2011, surpassing France and United Kingdom in 2009 and 2015, respectively. In general, France, Germany and other EU countries, United Kingdom and United States have great achievement of carbon emissions reduction. The rest of this section will summarize corporate carbon emission reduction plans based on the carbon governance experiences of typical countries (or regions).

FIGURE 2. Comparison of countries’ carbon emissions from 1995 to 2020 (A). Comparison of total carbon emissions; (B). Comparison of carbon emissions per capita).

The EU is the main advocate and promoter of the global “Low Carbon Economy” and carbon emissions reduction. The EU has made important contributions to global carbon emissions reduction by implementing a series of carbon emission policies. The European Commission first launched the European Climate Change Programme (ECCP) in 2000 after the Kyoto Protocol made an 8% of carbon reduction commitment. In 2005, the EU is the first one to establish the European Union Emissions Trading System (EUETS), which successfully introduced the ETS market mechanism into carbon emission governance. The ETS is now well mature and is the first carbon emissions trading system established around the world. The ETS market covers electricity, cement, steel, ceramics, glass, paper, aviation and other industry, laying the foundation for carbon neutrality. The EU has also promulgated strategic policies such as the “2050 Energy Roadmap” and the “European Green Deal” in order to build a competitive low carbon economy and simulate future emission reduction pathways through increased carbon capture storage and the use of renewable energy (Xiao et al., 2022).

EU implements the carbon emissions reduction policy as follows: First, the EU encourages different sectors to work together to achieve a low carbon economy, by promoting renewable energy on a wider scale, including specific industries such as power plants, industrial energy equipment, heating and cooling systems, smart grids and durable energy-saving products, construction, services, public transportation. Second, the EU increases funding for green technology innovation by implementing the NER300 program, which is one of the largest funding projects all over the world. The fund is mainly from the sale of 3 gigatons of carbon emissions right in the third phase of the ETS, as well as private investment and state financing across the EU, mainly to finance the research and development of companies or organizations in renewable energy, carbon dioxide capture and energy storage.

The United States has not yet formed a unified carbon market, but has introduced a few carbon emissions reduction initiatives, such as Regional Greenhouse Gas Initiative (RGGI), Western Climate Initiative (WCI) and the mandatory Greenhouse Gas Reporting Program (GHGRP). In 2005, seven states in the northeastern United States and the mid-Atlantic signed the Regional Greenhouse Gas Initiative (RGGI) aiming to reduce greenhouse gas emissions. The US also sets an annual limit for reducing regional carbon dioxide emissions and formulates individual emissions budgets for each state. In 2007, seven states in the western United States and four provinces in Canada signed the Western Climate Initiative (WCI). The WCI sets a common emission cap for energy sources, storage allocations and emission reduction compensation. US Environmental Protection Agency established a mandatory Greenhouse Gas Reporting Program (GHGRP) in 2009. The GHGRP program requires 31 industrial sectors to disclose carbon emission information, which involves 85% of the country’s emission sources. Through these carbon emission programs, we can more comprehensively and accurately understand the status of greenhouse gas emissions in the United States. Recently, the US government issued the “Executive Order for tackling the Climate Crisis at home and abroad” and “Clean Future Act”, which aim to promote energy transition through green energy innovation, implementing green and clean energy solutions, increasing investment in clean energy, and using green finance to optimize market resource allocation. With the development of clean energy, the United States aims to accelerate low-carbon development in various industries.

The United States has formed a way to promote corporate carbon emissions reduction actively by the use of financial means and ETS market mechanisms. The US government attaches great importance to innovating carbon reduction technologies through government-enterprise cooperation by using government policies. The purposes are to guide ETS market development, increase the enthusiasm of the ETS market, enhance green innovation and maintain the international competitive advantage. To ensure the implementation of the policy, the US government has adopted taxation, subsidies, finance and other measures to affect the corporate cost of production and operation. The US encourages enterprises to voluntarily carry out innovative activities to develop carbon emissions reduction technologies through the ETS market and to promote carbon emissions reduction in a “bottom-up” voluntary emission reduction model.

The United Kingdom is an advocate and leader of a low-carbon economy, with economic growth of 78% and carbon emissions reductions of 44% between 1990 and 2019. The United Kingdom low carbon policy mainly includes 1) low carbon legislation, 2) low carbon strategy, and 3) fiscal and tax subsidies. Firstly, low carbon legislation. In 2008, the Climate Change Act (CCA) was formed, every 5 years as a stage, and the United Kingdom has different carbon budget levels at different stages. The bill clearly puts forward long-term low carbon development goals, and legally stipulates enterprises’ carbon emission constraints. Next is the low carbon strategy. British issued the energy white paper “Our energy future - creating a low-carbon economy” in 2003. This is the first time the concept of a “low carbon economy” was proposed and it aims to solve the emission problems by reducing the use of oil, natural gas and coal energy. United Kingdom issued “The United Kingdom Low Carbon Transition Plan” in July 2009, which claims the low carbon industry as a new growth point of the United Kingdom economy. Last, fiscal and tax subsidies. In 2001, the United Kingdom established the “Carbon Fund”. The “Carbon Fund” from climate change taxes and landfill taxes aims to help enterprises to develop low-carbon technologies. United Kingdom Carbon Trust established in 2001, which is to “accelerate the transition to a low carbon economy by working with businesses and the public sector to reduce carbon emissions and develop commercialized low carbon technologies”. The Green Investment Bank (GIB) was established in the United Kingdom in 2012, as the world’s first publicly funded bank to finance low-carbon projects, with the aim of mobilizing private capital into the green energy sector.

In addition to promulgating a series of policies and regulations, in 2020, the United Kingdom has also formulated a comprehensive support policy for enterprises in terms of capital, technology and talent. The “Ten Point Plan” has mobilized 12 billion pounds of government investment for green innovation. At the same time, the “Ten Point Plan” encourages private sector investment and unleashes the creativity of capital to generate and develop new green technology. The United Kingdom helps investors to obtain funding for green projects by building London as a global green financial centre. In terms of technical support, enterprises have greatly reduced the cost of low-carbon technologies by acquiring the latest advanced equipment supported by the government. In terms of talent support, the United Kingdom also trains workers in green job skills through the “Lifetime Skills Guarantee” project to meet the job requirements of emerging green industries.

The four-dimensional framework for corporate carbon emissions reduction includes Institutional Theory, Stakeholder Theory, Natural Resource Based View (NRBV), and Low-carbon Strategy Cost Management (Geels, 2014; Haley, 2014; Penna and Geels, 2015). Enterprises face pressure from various entities in the economic network (such as board directors, shareholders, and suppliers) and social and political networks (such as the government, environmental regulatory authorities, and other NGOs). Enterprises are responding to these pressures by implementing a variety of emission reduction strategies (Figure 3), including.

• Mandatory laws, market-oriented and voluntary environmental regulations, for example, emissions trading systems, emissions taxes, subsidies for emission reduction, and policies for pollution emission limitation (Magat, 1978; Milliman and Prince, 1989; Milliman and Prince, 1992);

• Internal governance structure and external governance mechanism, board directors, CEO, institutional investors, the law and the media (Kock et al., 2012; Haque 2017; Zhang et al., 2021; Liu et al., 2022; Ludwig and Sassen, 2022);

• Green innovation strategies such as R&D investments or green technological development (Tidd et al., 2005; Sohag et al., 2015);

• Cash flow pressure such as higher environmental costs and increased investment in environmental protection technologies (Su et al., 2020; Alam et al., 2022; Tao et al., 2022).

First, Institutional Theory explains the role of policies and regulations in corporate carbon emission reduction (Greenwood and Hinings, 2017). Pigou. (1920) was the first to put forward the problem of pollution externality, and proposed Pigouivaintax to solve the internalization of pollution cost. Coase (1960) proposed to solve the problem of externality by marketing and property right. Then, based on the Coase theory, Dales (1968) introduced the concept of property rights into the field of environmental pollution control, he first proposed the concept of the Emissions Trading System (ETS). Subsequent research found that mandatory laws, market-oriented and voluntary environmental regulations promulgated by the government or regions will effectively reduce corporate carbon emissions. For example, emissions trading systems, emissions taxes, subsidies for emission reduction, and policies for pollution emission limitation (Magat, 1978; Milliman and Prince, 1989; Milliman and Prince, 1992). In addition, the implementation of market-based climate policies represented by the emission trading system (ETS) can motivate companies listed in the Chinese A-share industrial sector to gain financial profits by reducing carbon emissions (Yu et al., 2022).

Second, the external pressure exerted by environmental regulations on enterprises can effectively overcome organizational inertia and form a complementary relationship with the internal governance mechanism of enterprises (Ambec and Barla, 2002), transforming external pressure into an incentive factor to promote corporate carbon emission reduction. Previous research found that firm size, oversight by corporate social responsibility committees, and regular disclosure of sustainability reports can help reduce carbon emissions from South African firms (Córdova et al., 2018). However, political relations, enterprise scale, industry category and regional differences affect the carbon emission reduction initiative of Chinese enterprises (Jiang et al., 2021). At the same time, due to the difficulty of coordinating the interests of all parties in the issue of carbon externalities, corporate governance is regarded as another way to deal with climate risks (Azar et al., 2021; Goud, 2022). According to the Stakeholder Theory, stakeholders of an organization are those who can influence or be influenced by the overall objectives (Freeman, 1984). Board directors play a critical role in managing resources in corporate operations (Hillman and Dalziel, 2003), and a positive role in corporate governance and avoiding environmental risks (de Villiers et al., 2011; Shaukat et al., 2016). Previous research found that board independence (Liao et al., 2015; Post et al., 2015), board gender diversity (Glass et al., 2016; Atif et al., 2021), and Chief Executive Officer (CEO)’s experience and personality (Walls and Berrone, 2017; Arena et al., 2018) may affect the corporate carbon emissions reduction activities. Recent studies have also found that the board’s environmental orientation is helpful to increase environmental-related investment and effectively reduce carbon emissions (Dixon-Fowler et al., 2017; Moussa et al., 2020; Tian et al., 2021). In addition, shareholders and other stakeholders need to pay more attention to the disclosure of corporate carbon information (Matsumura et al., 2014). At present, most countries do not force all companies to disclose carbon emission information, resulting in weak constraints on corporate carbon emissions by shareholders, institutional investors or the media.

Third, the “Porter Hypothesis” believes that appropriate environmental regulation can help force enterprises to innovate in green technology and form long-term benefits that exceed the cost of environmental regulation (Porter and Van der Linde, 1995). Enterprises that apply advanced green technology to the production process can reduce dependence on traditional heavy-polluting production methods and effectively avoid environmental supervision costs (Berrone et al., 2013). The forced effect of environmental regulations on corproate green innovation are from external pressure of stakeholders and the incentive factors within enterprises (Cole et al., 2013; Lee and Min, 2015; Ahmed et al., 2016; Shi et al., 2022). Xu et al. (2016) found that investors assign lower valuations to companies that were punished for environmental protection, and higher valuations to companies that commited on green development. Therefore, in terms of internal incentives, green innovation can enhance the perceptions of stakeholders in enterprises green transition and reduce the negative expectations of stakeholders on the pollution of the environment by enterprises (Buysse & Verbeke, 2003). According to the Natural Resource Based View (NRBV), enterprises increase investment in long-term research and development (R&D) for environmentally friendly products, processes and technologies, rather than focusing on short-term profit, R&D expenditure will be beneficial to enhance corporate environmental performance and sustainable competitiveness (Hart, 1995). Tian et al. (2020) document that green innovation significantly enhances corporates’ green technology and environmental performance. In addition, corporate green innovation is helpful to reduce energy consumption and waste in production (Alam et al., 2019), and will enhance energy and production efficiency, ultimately reducing the carbon emission intensity of the supply chain.

Fourth, in response to stricter environmental regulations, companies have to internalize various costs of carbon emission reduction, such as disclosure costs, compliance and management costs, and additional capital expenditures for technology upgrades to reduce emissions. The United Kingdom petrochemical industry reduced emissions by 88% between 1990 and 2019, mainly due to the closure of petrochemical plants, switching fuels to natural gas and electricity, and green technology upgrades to improve energy efficiency (Geels, 2022). Even with immediate results, the changes induced by the low-carbon transition increase a company’s operating leverage, which further translates into higher uncertainty in firms’ future cashflows (Oestreich and Tsiakas, 2015). Low-carbon Strategy Cost Management specifically includes the ex-ante cost accounting for the prevention of environmental pollution, the interim cost accounting for environmental maintenance and the ex-post cost accounting for environmental pollution control. Expanding the scope and period of environmental cost accounting will help the entire industry chain to manage environmental costs and maintain corporate cashflows. Corporate cash flow affects carbon emissions reduction in two ways. First sufficient cash flow of a company is the foundation for energy transition from traditional fossil energy to renewable energy. Energy transition and renewable energy consumption will reduce carbon emissions. Especially after the 2019 coronavirus pandemic, clean energy supply chains were disrupted, which bring greater challenges to corporates’ low-carbon transformation (Tian et al., 2022). With the shortage of low-carbon energy supply and rising costs, enterprises need more abundant cash flow to ensure low-carbon transition (Su et al., 2020; Alam et al., 2022). Second, corporate green innovation generally requires long-term R & D investment and sufficient cash flow of enterprises to promote green innovation and new technology applications. Cash flow and green innovation are important for energy consumption reduction, energy efficiency, and ultimately reduce corporate carbon emissions.

From the experience of Carbon Governance in typical countries (or regions) around the world, we find that the laws and regulations that keep pace with the times, the unified carbon accounting and carbon management methods, the mature management institutions, and carbon financial products are the main methods for carbon emissions reduction. At the same time, enterprises are facing the pressure of carbon emission reduction in economic and social fields. Then, how can enterprises carry out substantial carbon reduction activities? We have drawn a corporate carbon emissions reduction roadmap based on the four-dimensional framework for corporate carbon emissions reduction (Figure 4).

In the carbon emissions trading system, the government can allocate initial emission reduction responsibilities to companies with high energy consumption, high pollution and high emission. Enterprises with excess emissions need to purchase carbon emission rights through the carbon trading system. Companies reduce carbon dioxide emissions through various measures and sell their excess carbon emission allowances through carbon exchanges.

Corporations take the initiative to participate in this market transaction activities with carbon emission rights, which can bring two benefits for enterprises. First, companies used to reduce carbon emissions just to fulfil their social responsibilities. After carbon emissions trading is implemented, surplus emission allowances can be traded. The more the balance, the greater the benefit of the companies, which can directly reduce the energy cost. Second, for some companies with excess emissions, the economic losses caused by excess emissions are not obvious, however, with the carbon emissions trading system, excess emissions will bring higher production costs to enterprises. The corporate production costs linked with carbon emission will directly reduce high-polluting and energy-intensive products while increasing investment will strengthen carbon emissions reduction.

The Board director plays a critical role in corporate carbon emissions reduction activities by supervising corporate activities and managing and providing resources to help implement carbon emission policy. Some companies still lack attention to carbon neutrality goals. Some other companies have awareness of carbon neutrality goals but without any guidance on how to act, as there are no clear low-carbon transition measures. Therefore, enterprises need to exert the ability of the board directors to integrate resources and strengthen carbon emissions reduction activities. Furthermore, enterprises should strengthen the monitoring, statistics, accounting and analysis capabilities of energy consumption and carbon emissions, and actively carry out carbon quantification.

In addition, enterprises should continuously strengthen the level of employees’ low-carbon management and carbon asset trading through employee training. Enterprises should make more communication with the government, the public and financial investment institutions through environmental protection information disclosure, and contin uously enhance the company’s environmental protection image, thereby increasing the corporate value.

Green technology means that the enhancement of green innovation is critical to achieving carbon emissions reduction and improving energy efficiency through technological upgrading, reducing dependence on fossil energy, and increasing the utilization rate of renewable energy. Enterprises should encourage the application of green technology and control the carbon emissions of the whole industry chain. The traditional fuels used by enterprises include coal, coke, blue carbon, fuel oil, gasoline and diesel, liquefied gas, natural gas, coke oven gas, and coal bed methane. The important step in carbon emissions reduction is the production process, however, there are still many processes of fuel purchase and storage, processing and conversion, and use that need to improve. For example, to reduce the loss of organic components in fuel consumption, boilers should meet the design requirements and other combustion equipment to reduce energy waste.

The increase in green technology, such as China’s carbon emissions trading system, can enhance corporate carbon emissions reduction and obtain profits. The emission trading market will encourage energy-saving and low-carbon energy projects listed in Chinese Certified Emission Reduction (CCER) and participate in carbon trading. The cost of CCER projects will bring some funding for enterprises by selling carbon emission right, therefore, emission trading not only promotes the development of energy-saving and low-carbon energy, but also increase the companies’ cash flow and capital structure.

Under the conditions of a market economy, corporate cash flow determines the survival and development ability of the enterprises. Sufficient cash flow ensures that enterprises have more confidence in renewable energy consumption under the impact of uncertain events. For example, the supply chain of renewable energy has been cut off due to the COVID-19 pandemic, resulting in the price of renewable energy being risen. Enterprises that consume renewable energy will reduce the use of fossil fuels in the production process, phase out outdated production capacity, and reduce carbon emissions. In the long run, this will reduce corporate compliance costs and the use of carbon allowances. The extra carbon allowances can trade in the emission trading system, which will bring financial benefit and value growth. As corporate profits increase, more funds will be used for R&D investment, which will improve green technologies and reduce carbon emissions. The circular process will form a green and healthy corporate carbon emissions reduction plan.

Enterprises should incorporate environmental protection costs into enterprise cost management, and speed up the cash flow of the enterprise by establishing an appropriate inventory mechanism and credit policy. The main purpose is how to speed up the turnover of enterprise inventory and the recovery of accounts receivable, as well as how to reduce inventory occupation cash and bad debt losses, so that enterprises can maintain a reasonable level of cashflows.

Carbon neutrality is a systematic and comprehensive transformation carried out by countries at the economic and social levels. Enterprises should systematically invest upgrade technology research and development, operation management, investment and financing, to change the energy structure and carry out green transformation.

This paper summarizes the multi-dimensional effect of factors on Corporate carbon emissions reduction through literature reviews and emission data. The influencing factors mainly focus on environmental regulation, green innovation, corporate governance and cash flow. A basic carbon emissions reduction roadmap is proposed for enterprises, including four aspects: carbon emissions trading system, green technology and innovation, improving the corporate governance structure and ensuring sufficient cash flow.

With the experience of carbon governance around the world, carbon emissions reduction requires multi-party collaboration and continuous operation. Enterprises should strengthen their awareness of carbon asset management and take the initiative to engage in the emission trading system. The government and financial institutions should also suppurate the corporates’ low-carbon behaviour, and more efficient cooperation will ultimately help to achieve the goal of net-zero emissions.

To achieve the goal of net-zero emissions, enterprises should actively engage in carbon emissions trading systems, the global carbon trading system also needs to optimize firm performance. Carbon emissions trading systems in various countries are generally faced with three challenges: One is the lack of policy design. The regulation system of the total amount and production capacity are not consistent. The reform of energy supply systems and other emission trading systems is not the most efficient, which makes carbon emissions reduction more challenging. Second, the government lacks the capability to supervise. From the experience of the existing carbon emissions trading system, the government’s capability is critical and plays an important role in carbon emissions reduction. The cooperation between governments and emission-reduction companies needs to enhance effective measures to ensure the operation of the policy. Most national carbon emissions trading systems still use “top-down” allocation systems and trading rules, which will make the long-term investment participants encounter bottlenecks. Therefore, it is necessary to design an appropriate carbon emissions trading system to stimulate enterprises’ vitality to participate in carbon emissions trading systems. Lastly, it is necessary to stimulate the corporate internal motivation to actively participate in carbon emissions trading, which will create an incentive for companies to invest in net-zero emissions.

Governments around the world should also take the initiative to establish an effective carbon pricing mechanism. On the one hand, governments should rationally allocate quotas and set prices for “emission-controlled enterprises” in carbon emissions trading systems. Emission-controlled enterprises include petrochemical, chemical, building materials, steel, non-ferrous, paper, electric power, aviation and other industries. Setting carbon emission quotas for enterprises will strengthen enterprise carbon asset management and encourage enterprises to actively reduce emissions. On the other hand, carbon prices should play a guiding role in corporate and consumer activities. Compared with the carbon emissions reduction of production activities, consumer behaviour is more difficult to control and calculate. Companies should take the initiative to engage the carbon emission system and realize the importance of carbon emissions reduction. This is a gradual transition from production to consumption, which will eventually persuade consumers to adopt low-carbon behaviour. Therefore, it is crucial to encourage companies to take the initiative to engage in the carbon emissions trading system, and then subsequently, influence consumers’ low-carbon behaviour. It is particularly important to formulate reasonable carbon pricing.

Banks and other financial institutions need to upgrade the carbon financial product system as soon as possible and develop diversified carbon financial derivatives. The carbon financial markets around the world are emerging and developing, and the carbon financial products include carbon futures, carbon options, carbon forwards, and carbon swaps. However, the long-term extensive economic structure restricts the development of carbon finance, resulting in low financing efficiency in the carbon financial market. Most enterprises need to change their business model and eliminate outdated production. In the case of companies’ shortage of funds, bank loans are the main way to ensure the cash flow of normal operation of enterprises. The carbon financial trading market generally has problems of insufficient liquidity and low trading activity. Due to the small scale of the carbon financial market and the single product variety, enterprises tend to be conservative in emission reduction and lack carbon financial trading willingness.

The original contributions presented in the study are included in the article/supplementary material further inquiries can be directed to the corresponding author.

YW: methodology, validation, supervision, writing original draft preparation. GY: software, formal analysis. YZ: writing review and editing. QW: writing review and editing. All authors have read and agreed to the published version of the manuscript.

This research was funded by the National Social Science Found of China (Grant Number: 20BTJ030).

The authors would like to thank Professor Jinfang Tian Research Center for Statistics and Interdisciplinary Science from Shandong University of Finance and Economics for his support for this research, and thank the reviewers for their constructive and valuable comments to this study.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Ahmed, A., Uddin, G. S., and Sohag, K. (2016). Biomass energy, technological progress and the environmental kuznets curve: Evidence from selected European countries. Biomass Bioenergy 90, 202–208. doi:10.1016/j.biombioe.2016.04.004

Alam, M. S., Atif, M., Chien-Chi, C., and Soytas, U. (2019). Does corporate RandD investment affect firm environmental performance? Evidence from G-6 countries. Energy Econ. 78, 401–411. doi:10.1016/j.eneco.2018.11.031

Alam, M. S., Md Safiullah, M., and Islam, M. S. (2022). Cash-rich firms and carbon emissions. Int. Rev. Financial Analysis 81, 102106. doi:10.1016/j.irfa.2022.102106

Ambec, S., and Barla, P. (2002). A theoretical foundation of the Porter hypothesis. Econ. Lett. 75 (3), 355–360. doi:10.1016/S0165-1765(02)00005-8

Arena, C., Michelon, G., and Trojanowski, G. (2018). Big egos can be green: A study of CEO hubris and environmental innovation. Br. J. Manag. 29, 316–336. doi:10.1111/1467-8551.12250

Atif, M., Hossain, M., Alam, M. S., and Goergen, M. (2021). Does board gender diversity affect renewable energy consumption? J. Corp. Finance 66, 101665. doi:10.1016/j.jcorpfin.2020.101665

Azar, J., Duro, M., Kadach, I., and Ormazabal, G. (2021). The big three and corporate carbon emissions around the world. J. Financ. Econ. 142 (2), 674–696. doi:10.1016/j.jfineco.2021.05.007

Baboukardos, D. (2017). Market valuation of greenhouse gas emissions under a mandatory reporting regime: Evidence from the UK. Account. Forum 41, 221–233. doi:10.1016/j.accfor.2017.02.003

Berrone, P., Fosfuri, A., Gelabert, L., and Gomez-Mejia, L. R. (2013). Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 34 (8), 891–909. doi:10.1002/smj.2041

Besio, C., and Pronzini, A. (2014). Morality, ethics, and values outside and inside organizations: An example of the discourse on climate change. J. Bus. Ethics 19, 287–300. doi:10.1007/s10551-013-1641-2

Buysse, K., and Verbeke, A. (2003). Proactive environmental strategies: A stakeholder management perspective. Strateg. Manag. J. 24 (5), 453–470. doi:10.1002/smj.299

Chang, L., Wang, B., Yan, X., Ma, L., Reddy, G. V. P., and Wu, D. (2019). Warming limits daytime but not nighttime activity of epigeic microarthropods in Songnen grasslands. Appl. Soil. Ecol. 141, 79–83. doi:10.1016/j.apsoil.2019.05.012

Chen, S., Mao, H., and Sun, J. (2022). Low-carbon City Construction and corporate carbon reduction performance: Evidence from a quasi-natural experiment in China. J. Bus. Ethics 180, 125–143. doi:10.1007/s10551-021-04886-1

Cole, M. A., Elliott, R. J., Okubo, T., and Zhou, Y. (2013). The carbon dioxide emissions of firms: A spatial analysis. J. Environ. Econ. Manage 65, 290–309. doi:10.1016/j.jeem.2012.07.002

Córdova, C., Zorio-Grima, A., and Merello, P. (2018). Carbon emissions by South American companies: Driving factors for reporting decisions and emissions reduction. Sustainability 10 (7), 2411. doi:10.3390/su10072411

Dales, J. H. (1968). Pollution, property, and prices: An essay in policy-making and economics. Cheltenham, United Kingdom: Edward Elgar Pub.

de Aguiar, T. R. S., and Bebbington, J. (2014). Disclosure on climate change: Analysing the UK ETS effects. Account. Forum 38, 227–240. doi:10.1016/j.accfor.2014.10.002

de Villiers, C., Naiker, V., and Van Staden, C. J. (2011). The effect of board characteristics on firm environmental performance. J. Manage. 37, 1636–1663. doi:10.1177/0149206311411506

Dixon-Fowler, H. R., Ellstrand, A. E., and Johnson, J. L. (2017). The role of board environmental committees in corporate environmental performance. J. Bus. Ethics 140, 423–438. doi:10.1007/s10551-015-2664-7

Draper, A. M., and Weissburg, M. J. (2019). Impacts of global warming and elevated CO2 on sensory behavior in predator-prey interactions: A review and synthesis. Front. Ecol. Evol. 7, 00072. doi:10.3389/fevo.2019.00072

Elert, V. E., and Fink, P. (2018). Global warming: Testing for direct and indirect effects of temperature at the interface of primary producers and herbivores is required. Front. Ecol. Evol. 6, 00087. doi:10.3389/fevo.2018.00087

Geels, F. W. (2022). Conflicts between economic and low-carbon reorientation processes: Insights from a contextual analysis of evolving company strategies in the United Kingdom petrochemical industry (1970–2021). Energy Res. Soc. Sci. 91, 102729. doi:10.1016/j.erss.2022.102729

Geels, F. W. (2014). Reconceptualising the co-evolution of firms-in-industries and their environments: Developing an inter-disciplinary Triple Embeddedness Framework. Res. Policy 43 (2), 261–277. doi:10.1016/j.respol.2013.10.006

Glass, C., Cook, A., and Ingersoll, A. R. (2016). Do women leaders promote sustainability? Analyzing the effect of corporate governance composition on environmental performance. Bus. Strategy Environ. 25, 495–511. doi:10.1002/bse.1879

Goud, N. N. (2022). Corporate governance: Does it matter management of carbon emission performance? An empirical analyses of Indian companies. J. Clean. Prod. 379, 134485. doi:10.1016/j.jclepro.2022.134485

Greenwood, R., and Hinings, C. R. (2017). Understanding strategic change: The contribution of archetypes. Acad. Manage. J. 36, 1052–1081. doi:10.5465/256645

Haley, B. (2014). Promoting low-carbon transitions from a two-world regime: Hydro and wind in Québec, Canada. Energy Policy 73, 777–788. doi:10.1016/j.enpol.2014.05.015

Haney, A. B. (2017). Threat interpretation and innovation in the context of climate change: An ethical perspective. J. Bus. Ethics 143, 261–276. doi:10.1007/s10551-015-2591-7

Haque, F. (2017). The effects of board characteristics and sustainable compensation policy on carbon performance of UK firms. Br. Account. Rev. 49 (3), 347–364. doi:10.1016/j.bar.2017.01.001

Hart, S. L. (1995). A natural-resource-based view of the firm. Acad. Manage. Rev. 20, 986–1014. doi:10.2307/258963

Herold, D. M., and Lee, K. (2019). The influence of internal and external pressures on carbon management practices and disclosure strategies. Australas. J. Env. Man. 26, 63–81. doi:10.1080/14486563.2018.1522604

Hieronymus, M. (2019). An update on the thermosteric sea level rise commitment to global warming. Environ. Res. Lett. 14, 054018. doi:10.1088/1748-9326/ab1c31

Hillman, A. J., and Dalziel, T. (2003). Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Acad. Manage. Rev. 28, 383–396. doi:10.2307/30040728

IPCC (2014). “Climate change 2014: Synthesis report,” in Contribution of working groups I, II and III to the fifth assessment report of the intergovernmental panel on climate change (Geneva: IPCC).

Jiang, Y., Luo, T., Wu, Z., and Xue, X. (2021). The driving factors in the corporate proactivity of carbon emissions abatement: Empirical evidence from China. J. Clean. Prod. 288, 125549. doi:10.1016/j.jclepro.2020.125549

Jiao, Z., Xing, Z., Zhang, G., Ma, X., and Wang, H. (2022). Comparing decoupling and driving forces of CO2 emissions in China and India. Front. Environ. Sci. 273, 847062. doi:10.3389/fenvs.2022.847062

Kardol, P., Reynolds, W. N., Norby, R. J., and Classen, A. T. (2011). Climate change effects on soil microarthropod abundance and community structure. Appl. Soil. Ecol. 47, 37–44. doi:10.1016/j.apsoil.2010.11.001

Kock, C. J., Santalo, J., and Diestre, L. (2012). Corporate governance and the environment: What type of governance creates greener companies? J. Manag. Stud. 49 (3), 492–514. doi:10.1111/j.1467-6486.2010.00993.x

Lee, K. H., and Min, B. (2015). Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 108, 534–542. doi:10.1016/j.jclepro.2015.05.114

Li, H., Li, Z., Chen, Y., Xiang, Y., Liu, Y., Kayumba, P. M., et al. (2021). Drylands face potential threat of robust drought in the CMIP6 SSPs scenarios. Environ. Res. Lett. 16, 114004. doi:10.1088/1748-9326/ac2bce

Liao, L., Luo, L., and Tang, Q. (2015). Gender diversity, board independence, environmental committee and greenhouse gas disclosure. Br. Account. Rev. 47, 409–424. doi:10.1016/j.bar.2014.01.002

Liu, H., Wang, Y., Xue, R., Linnenluecke, M., and Cai, C. W. (2021). Green commitment and stock price crash risk. Financ. Res. Lett. 47, 102646. doi:10.1016/j.frl.2021.102646

Liu, H. Y., Jiang, J., Xue, R., Meng, X. F., and Hu, S. Y. (2022). Corporate environmental governance scheme and investment efficiency over the course of COVID-19. Financ. Res. Lett. 47, 102726–102728. doi:10.1016/j.frl.2022.102726

Ludwig, P., and Sassen, R. (2022). Which internal corporate governance mechanisms drive corporate sustainability? J. Environ. 301, 113780. doi:10.1016/j.jenvman.2021.113780

Magat, W. A. (1978). Pollution control and technological advance: A dynamic model of the firm. J. Environ. Econ. Manage. 5, 1–25. doi:10.1016/0095-0696(78)90002-5

Matsumura, E. M., Prakash, R., and Vera-Muñoz, S. C. (2014). Firm-value effects of carbon emissions and carbon disclosures. Acc. Rev. 89, 695–724. doi:10.2308/accr-50629

Milliman, S. R., and Prince, R. (1989). Firm incentives to promote technological change in pollution control. J. Environ. Econ. Manage. 17, 247–265. doi:10.1016/0095-0696(89)90019-3

Milliman, S. R., and Prince, R. (1992). Firm incentives to promote technological change in pollution control:Reply. J. Environ. Econ. Manage. 22, 292–296. doi:10.1016/0095-0696(92)90035-U

Moussa, T., Allam, A., Elbanna, S., and Bani-Mustafa, A. (2020). Can board environmental orientation improve US firms' carbon performance? The mediating role of carbon strategy. Bus. Strategy Environ. 29, 72–86. doi:10.1002/bse.2351

Muhlfeld, C. C., Dauwalter, D. C., Kovach, P. R., Kershner, L. J., Williams, E. J., and Epifanio, J. (2018). Trout in hot water: A call for global action. Science 6391, 866–867. doi:10.1126/science.aat8455

Nyilasy, G., Gangadharbatla, H., and Paladino, A. (2014). Perceived greenwashing: The interactive effects of green advertising and corporate environmental performance on consumer reactions. J. Bus. Ethics. 125, 693–707. doi:10.1007/s10551-013-1944-3

Oestreich, A. M., and Tsiakas, I. (2015). Carbon emissions and stock returns: Evidence from the EU emissions trading scheme. J. Bank. Financ. 58, 294–308. doi:10.1016/j.jbankfin.2015.05.005

Orr, J. C., Fabry, V. J., Aumont, O., Bopp, L., Doney, S. C., Feely, R. A., et al. (2005). Anthropogenic ocean acidification over the twenty-first century and its impact on calcifying organisms. Nature 437, 681–686. doi:10.1038/nature04095

Penna, C. C., and Geels, F. W. (2015). Climate change and the slow reorientation of the American car industry (1979–2012): An application and extension of the Dialectic Issue LifeCycle (DILC) model. Res. Policy 44 (5), 1029–1048. doi:10.1016/j.respol.2014.11.010

Porter, M. E., and Van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Post, C., Rahman, N., and McQuillen, C. (2015). From board composition to corporate environmental performance through sustainability-themed alliances. J. Bus. Ethics 130, 423–435. doi:10.1007/s10551-014-2231-7

Rogelj, J., Geden, O., Cowie, A., and Reisinger, A. (2021). Net-zero emissions targets are vague: Three ways to fix. Nature 591, 365–368. doi:10.1038/d41586-021-00662-3

Shao, J. J., Yuan, T. F., Li, Z., Li, N., Liu, H. Y., Bai, S. H., et al. (2019). Plant evolutionary history mainly explains the variance in biomass responses to climate warming at a global scale. New Phytol. 222, 1338–1351. doi:10.1111/nph.15695

Shaukat, A., Qiu, Y., and Trojanowski, G. (2016). Board attributes, corporate social responsibility strategy, and corporate environmental and social performance. J. Bus. Ethics 135, 569–585. doi:10.1007/s10551-014-2460-9

Shi, Q. L., Shan, Y. L., Zhong, C., Cao, Y., and Xue, R. (2022). How would GVCs participation affect carbon intensity in the “Belt and Road Initiative” countries? Energy Econ. 111, 106075. doi:10.1016/j.eneco.2022.106075

Sohag, K., Begum, R. A., Abdullah, S. M. S., and Jaafar, M. (2015). Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy 90, 1497–1507. doi:10.1016/j.energy.2015.06.101

Su, X., Zhou, S. S., Xue, R., and Tian, J. F. (2020). Does economic policy uncertainty raise corporate precautionary cash holdings? Evidence from China. Acc. Financ. 60, 4567–4592. doi:10.1111/acfi.12674

Tao, H., Zhuang, S., Xue, R., Cao, W., Tian, J., and Shan, Y. (2022). Environmental finance: An interdisciplinary review. Technol. Forecast. Soc. Change 179, 121639. doi:10.1016/j.techfore.2022.121639

Tian, J. F., Cao, W., Cheng, Q., Huang, Y. K., and Hu, S. Y. (2021). Corporate competing culture and environmental investment. Front. Psychol. 12, 774173. doi:10.3389/fpsyg.2021.774173

Tian, J. F., Pan, C., Xue, R., Yang, X. T., Wang, C., Ji, X. Z., et al. (2020). Corporate innovation and environmental investment: The moderating role of institutional environment. Adv. Clim. Change Res. 11, 85–91. doi:10.1016/j.accre.2020.05.003

Tian, J. F., Yu, L. G., Xue, R., Zhuang, S., and Shan, Y. L. (2022a). Global low-carbon energy transition in the post-COVID-19 era. Appl. Energy 307, 118205. doi:10.1016/j.apenergy.2021.118205

Tian, J., Zhang, S., Wei, X., Zhuang, S., and Zhang, M. (2022b). The impact of government environmental attention on public health: Implications for corporate sustainable development. Front. Environ. Sci. 1258, 973477. doi:10.3389/fenvs.2022.973477

Tidd, J., Bessant, J., and Pavitt, K. (2005). Managing innovation: Integrating technological, market and organizational change. Chichester, England: John Wiley and Sons.

Walls, J. L., and Berrone, P. (2017). The power of one to make a difference: How informal and formal CEO power affect environmental sustainability. J. Bus. Ethics 145, 293–308. doi:10.1007/s10551-015-2902-z

Wan, D. X., Xue, R., Linnenluecke, M., Tian, J. F., and Shan, Y. L. (2021). The impact of investor attention during COVID-19 on investment in clean energy versus fossil fuel firms. Financ. Res. Lett. 43, 101955. doi:10.1016/j.frl.2021.101955

Wang, F., Sun, J., and Liu, Y. (2019). Institutional pressure, ultimate ownership, and corporate carbon reduction engagement: Evidence from China. J. Bus. Res. 104, 14–26. doi:10.1016/j.jbusres.2019.07.003

Xiao, L., Guan, Y. R., Guo, Y. Q., Xue, R., Li, J. S., and Shan, Y. L. (2022). Emission accounting and drivers in 2004 EU accession countries. Appl. Energy 314, 118964. doi:10.1016/j.apenergy.2022.118964

Xu, X. D., Zeng, S. X., Zou, H. L., and Shi, J. J. (2016). The impact of corporate environmental violation on shareholders' wealth: A perspective taken from media coverage. Bus. Strategy Environ. 25 (2), 73–91. doi:10.1002/bse.1858

Yu, P., Hao, R., Cai, Z., Sun, Y., and Zhang, X. (2022). Does emission trading system achieve the win-win of carbon emission reduction and financial performance improvement? —evidence from Chinese A-share listed firms in industrial sector. J. Clean. Prod. 333, 130121. doi:10.1016/j.jclepro.2021.130121

Zhang, D., Zhang, Z., Ji, Q., Lucey, B., and Liu, J. (2021b). Board characteristics, external governance and the use of renewable energy: International evidence. J. Int. Financ. Mark. Inst. Money 72, 101317. doi:10.1016/j.intfin.2021.101317

Zhang, H., Sun, X., Liu, D., Wu, H. T., and Chen, H. (2021a). Air warming and drainage influences soil microarthropod communities. Front. Ecol. Evol. 9, 731735. doi:10.3389/fevo.2021.731735

Zhang, W., Zhang, C., Wei, S., Zhang, Q., Rehman, A., and Shah, A. (2022). Characteristics and evolution of China’s carbon emission reduction measures: Leading towards environmental sustainability. Front. Environ. Sci. 674, 924887. doi:10.3389/fenvs.2022.924887

Keywords: global warming, carbon governance, low-carbon transition, emissions reduction roadmap, sustainable development

Citation: Wang Y, Yao G, Zuo Y and Wu Q (2023) Implications of global carbon governance for corporate carbon emissions reduction. Front. Environ. Sci. 11:1071658. doi: 10.3389/fenvs.2023.1071658

Received: 16 October 2022; Accepted: 02 January 2023;

Published: 16 January 2023.

Edited by:

Shiyang Hu, Chongqing University, ChinaReviewed by:

Kun Huang, Huazhong University of Science and Technology, ChinaCopyright © 2023 Wang, Yao, Zuo and Wu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Qichun Wu, YXhsaWUud3VAbXEuZWR1LmF1

†These authors have contributed equally to this work and share first authorship

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.