- Department of Accounting and Information Systems, Qatar University, Doha, Qatar

The purpose of this article is to assess the quality of the sustainability reporting indicators used by oil and gas companies (OGCs) in Gulf Cooperation Council (GCC) countries. This study utilizes the International Petroleum Industry Environmental Conservation Association (IPIECA) guidance as a new robust methodology to assess the quality of sustainability reporting, which is considered a comprehensive benchmark that directly relates to the oil and gas sector. This study conducts a content analysis of the sustainability reports published by OGCs in GCC countries for the 2016–2018 period. The results reveal that the quality of the sustainability indicators disclosed by companies is largely unsuitable. The results also show that companies fail to report detailed information on environmental indicators as the most important category for OGCs. The findings demonstrate that most OGCs in Qatar pay more attention to sustainable reporting indicators than the OGCs in other GCC countries. This study successfully addresses many previously outstanding issues regarding the quality of the sustainability reporting indicators used by OGCs in GCC countries. Hence, the findings paint a clear picture of the situation so that regulators, policymakers, and managers can correct the existing shortcomings in the quality of sustainability reporting and promote sustainability reporting guidance best practices.

1 Introduction

We assess the quality of the sustainability reports published by oil and gas companies located in the oil-richest countries, namely Gulf Cooperation Council (GCC) countries. The last decade has witnessed increasing recognition of sustainability issues among companies, governments, and international organizations (Kolk 2003; Barkemeyer et al., 2009). Consequently, corporations have begun competing in terms of reporting on their sustainability practices (Kolk, 2010). A sustainability report is an institutional report presenting the performance of the organization’s economic activities, social responsibility, ethical culture, environmental protection, and governance performance (Heemskerk et al., 2002). Sustainability reporting provides information to different stakeholders that can help them make decisions. Companies need to focus on these issues not only to compete in the global market (Kaspereit and Lopatta 2016) but also to satisfy the local community’s needs (Michelon and Parbonetti 2012; Malik 2015; Cardoni et al., 2019). Thus, sustainability reporting can minimize the gap between companies and the community by providing sufficient information. Although the petroleum sector is one of the most important sectors in the current era, its operations have serious consequences for society and the environment (Alazzani and Wan-Hussin 2013; George et al., 2016). Despite yielding much-needed resources, exploiting oil and gas is a double-edged sword. On the one hand, oil and gas are the main drivers of global development and progress (Haderer 2013). On the other hand, each stage of their lifecycles—including exploration, drilling, production, marketing, and end use by consumers—has a significant impact on the environment and society (Orazalin et al., 2019). These resources also play important political and economic roles that affect policymakers’ decisions. Thus, the companies that operate in this vital industry have important environmental and social responsibilities and face considerable local and international pressure to produce high-quality sustainability reports (Aerts and Cormier 2009; Fernandez-Feijoo et al., 2014).

The study is timely and concentrates on a topic that indeed requires much attention. There is a dearth of research on Middle East oil and gas company’s sustainability reporting and therefore, the contribution of this study makes considering such gap areas is tremendous. Thus, the value of this study is in tow folds. First the focus on GCC is really important and a valuable contribution to sustainability reporting. Second the study deconstructs the sustainability reports to analyze the key question, “ what is the level of sustainability reporting by OGCs among GCC countries?”. The focus on OGCs’ sustainability reporting in GCC stems from several reasons. First, OGCs that are members of the GCC depend heavily on oil and gas as the main drivers of their economies. Second, one-third of the world’s proven oil reserves are in GCC countries (Raouf and Luomi 2015). Third, those companies manage upstream and downstream activities of the petroleum industry, with approximately 77 percent of the world’s petroleum resources (Chen 2007). In addition, the OGCs hold the majority of their respective countries’ oil reserves and are the largest producers of crude oil in the world (Pirog 2007). For example, Saudi Arabia is the second-largest oil producer in the world (El-Chaarani 2019).

Another motivation for assessing the sustainability reporting of the OGCs in the GCC is that sustainability information reporting by OGCs could differ between multinational OGCs and their national counterparts, owing to the different priorities and interests of the companies. For example, the first priority of national companies is to serve the community, and thus, they pay heed to sustainability issues. Multinational OGCs report sustainability information in order to build and maintain their credibility, first and foremost with shareholders and then with their other stakeholders. This is because they face considerable pressure from international shareholders to do so (Liu et al., 2014). By contrast, national OGCsare motivated to first obtain credibility from within the community they operate in and then pay heed to the demands of other stakeholders.

We also pursue this line of research because there is a scarcity of studies on the practices of sustainability reporting by OGCs (Lertzman et al., 2013). Previous studies have focused on multinational OGCs or private companies (Spangler and Pompper 2011; Alazzani and Wan-Hussin 2013; Samuel et al., 2013; Raufflet et al., 2014) and have not conducted critical analyses of sustainability reporting by national OGCs, either globally or in the GCC countries. This study is also motivated by the growing empirical literature (e.g., Frynas 2005; Frynas 2010; Raufflet et al., 2014; Comyns and Figge 2015; Talbot and Boiral 2015; Chaiyapa et al., 2016; Shvarts et al., 2016; Gaudencio et al., 2018; Orazalin and Mahmood 2018) that explores sustainability practices in OGCs. Thus, we believe that this is the first integrated analysis and comprehensive study of the quality of the sustainability reporting indicators of OGCs in GCC countries and disclosure of the same.

The GCC is an economic and political alliance of six Middle Eastern countries: Saudi Arabia, Oman, the United Arab Emirates (UAE), Kuwait, Qatar, and Bahrain. These countries share similar characteristics in terms of their political regimes (monarchy), cultures and traditions, religion (Islam), ethnicity (Arab), and even their economies, which includes their high dependence on oil revenue (Benbouziane and Benmar 2010). Thus, as oil and gas are among the most important and productive exports for the GCC countries, this study focuses mainly on the OGCs in these six countries. These companies have been largely ignored in previous studies, likely because most of them are not publicly listed. As researchers, we identify the importance of addressing this issue to bridge the gap in the research in this area.

Our key question is: What is the level of sustainability reporting by OGCs within the GCC countries? To answer this question, we assess the sustainability reporting of the OGCs within the GCC countries against the guidance for sustainability reporting by OGCs provided by the International Petroleum Industry Environmental Conservation Association (IPIECA). We have also chosen to study the oil and gas sector because it is a major contributor to the GCC countries’ economies. Additionally, oil and gas in the GCC countries accounted for nearly 33 percent of the world’s proven oil reserves in 2013 (Raouf and Luomi 2015).

This paper contributes to the literature by assessing the quality of the sustainability reporting of the NOGCs in the GCC. We focus on these companies in this group because their unique characteristics differentiate them from other OGCs elsewhere. For instance, most of these companies are large, government-owned, required to follow specific rules and regulations, overseen by the government, and answerable to society. In addition to the exclusive rights that they hold to the development and exploration of oil resources within their home countries, OGCs also can decide on their degree of participation in specific activities. Further, in many cases, their motivations might include maintaining energy security, economic development, job creation, and wealth redistribution (Pirog 2007). Additionally, sustainability reporting may differ for the OGCs, because their stakeholders have different requirements and expectations regarding the same (Freundlieb and Teuteberg 2013; Miska et al., 2013). Thus, OGCs have to provide sustainability reports that satisfy their stakeholders’ interests. Such reporting is part of their sustainable development objectives.

Another contribution of this research is methodological. By assessing the quality of sustainability reporting, this study goes beyond the work of prior studies by using the IPIECA guidance to assess the quality of sustainability reporting. We argue for and integrate the IPIECA guidance in this study as it can provide a comprehensive benchmark for the practices of sustainability reporting in OGCs (Rodriguez 2019). Additionally, the consensual agreement among three organizations (IPIECA, API, and the International Association of Oil and Gas Producers [OGP]) creates comprehensive guidance for sustainability reporting for these companies. The IPIECA indicators were designed to be suitable for measuring sustainability in the oil and gas sector. Thus, IPIECA indicators are directly related to OGCs. Shortall et al. (2015) indicated that selecting the appropriate sustainable indicators is a means of measuring sustainability. We elaborate on this further in Section 3. Thus, we select this guidance to assess the quality of the sustainability reporting by the OGCs in the GCC countries, and our results show that the quality of their sustainability reporting is moderate. We also find that the environmental indicator is the most commonly reported factor, whereas the social and economic indicators are the least frequently reported factors by the OGCs in the GCC countries.

The remainder of this study is organized as follows. Section 2 presents the literature review. Section 3 describes the methodology used in the study. Section 4 presents the descriptive results and the discussion. Section 5 concludes the paper.

2 Literature review

Publishing a sustainability report gives companies a platform through which to provide their stakeholders with information about how the company addresses its strategic plans and initiatives concerning sustainability. At a minimum, sustainability reports should contain information about the economic, social, and environmental aspects and performance of a company. Further, these three aspects of sustainability reporting by necessity contain quantitative and qualitative information (Daub 2007) and strive toward improved effectiveness and efficiency (KPMG 2002; as cited in Asif et al., 2013a).

Stakeholder theory, along with institutional theory and legitimacy theory, dominates in social and environmental research (Gray et al., 1996; 2009; Spence et al., 2010). In this paper, we follow this stream of research by using a combination of strategic and institutional legitimacy theory and stakeholder theory to assess the context in which oil and gas companies operate (Comyns 2016). The stakeholder perspective considers that companies issue sustainability reports as a way of responding to stakeholder informational needs and stakeholder pressure (Deegan and Blomquist 2006). Strategic legitimacy views the attainment of legitimacy from a managerial perspective, arguing that companies strategically produce reports to gain or maintain legitimacy (Deegan, 2006). The main concept of legitimacy theory constitutes society’s acceptance of the behaviors of the organization (Suchman, 1995).

The oil and gas sector has placed itself within the agenda of sustainability development and reporting, particularly since the publication of sustainability reporting guidelines like those devised by the Global Reporting Initiative (GRI) and IPIECA. Oil and gas is one of the key goods importing and exporting internationally. According to the World Bank, oil and gas products are the foremost items traded world wide, amounting to approximately USD 2 billion in daily trades (Tordo et al., 2011). The same paper reported that 90 percent of the world’s oil and gas reserves and 75 percent of oil and gas production are controlled by national oil companies (NOCs). With the current trends of paying attention to sustainability issues, governments often issue objectives, policies, and a variety of regulations related to sustainability issues in the petroleum sector. NOCs need to follow these policies and objectives as well as the global initiatives and guidelines. Sometimes the choice of which objectives and regulations to adhere to is based on the particular objectives that policymakers want to realize and their relative priorities (Tordo et al., 2011).

Sustainability reporting has been studied from different perspectives. Some studies have focused on the theoretical background of sustainability reporting (Connelly et al., 2011; Onn and Woodley 2014; Rezaee 2016). Other studies refer to the development of an applicable framework for implementing sustainability practices (e.g., Asif et al., 2013b), a methodology for measuring the quality of sustainability reporting (Freundlieb et al., 2014; Michelon et al., 2015), investigating the impact of external issues such the uncertainty of economic policy (Li and Zhong, 2020), and supply chain sustainability goals (Ahmad W. N. K. et al., 2016). A few studies, such as those of Abdalla and Siti-Nabiha (2015), Chaiyapa et al. (2016), Fragouli and Jumabayev (2015), and Orazalin et al. (2019), have studied perceptions of factors that motivate improved disclosure on sustainability practices, while others have assessed sustainability reporting in different industrial sectors. Some of these studies, such as those of Frost et al. (2005), Kolk (2008), Alonso-Almeida et al. (2014), Ahmad and Hossain (2015), Ehnert et al. (2016), Raucci and Tarquinio (2015), Rudari and Johnson (2015), Nobanee and Ellili (2016), and Santos et al. (2016), have also covered the sustainability reporting of all listed companies in different industrial sectors. Kolk et al. (2001) analyzed these practices in the largest companies. The current studies also, such us Li et al. (2021) which asserted about the importance of CSR mandatory disclosure and it is significantly impact of total productivity. Further, this study also found mediating effect of R&D and innovation expenditures. Another study conducted by which develop a comprehensive corporate environmental responsibility engagement measurement, then study this issue with the firm value as well as explore the mediating effect of firm innovation on this relationship based on a sample of 496 China’s A-share listed companies from 2008 to 2016. They found negative effect on firm value, and corporate innovation promotes firm value of firms with corporate environmental responsibility more than firms without corporate environmental responsibility.

A number of authors have discussed multinational OGCs’ sustainability reporting (e.g., Frynas 2005; 2010; Dong and Burritt 2010; Spangler and Pompper 2011; Alazzani and Wan-Hussin 2013; Samuel et al., 2013; Raufflet et al., 2014). However, despite the fact that 75 percent of oil production is controlled by national OGCs, only a few studies have analyzed the sustainability reporting practices used by these particular companies. Examples include Lertzman et al. (2013), who covered only one national OGC in Latin America; Eljayash et al. (2012), who referred to environmental reporting by Middle Eastern companies; and Kirat (2015), who covered this issue for Qatar. Notably, numerous studies have discussed sustainability reporting for various sectors, with the oil and gas industry being the most common. This is an indicator of the importance of sustainability reporting by OGCs as well as their significance in maintaining a clean environment, supporting their communities, and enhancing their countries’ respective economies. We will start our review for environment component as it is considered the main factor in the sustainability report; thus, the following sub-section will elaborate on environmental reporting.

2.1 Environmental reporting by oil and gas companies

The first stand of this review is about environmental reporting. This issue is the foremost investigated in the literature in this area with regard to OGCs (Ranangen and Zobel 2014). This is natural because issues pertaining to the environment in the oil and gas sector are deemed as sensitive. The energy sector, such as the oil and gas industry, has been known to cause irreparable damage to the environment through air pollution, ecological impacts, landform changes, and global environmental problems (Hilson and Murck 2000; Spalding-Fecher 2003). Thus, it is important to focus on environmental reporting. We begin this section by reviewing the studies that have covered OGCs’ environmental reporting. Alazzani and Wan-Hussin (2013) evaluated environmental practices in eight multinational OGCs using the guidelines of sustainability reporting issued in 2006 by the GRI as a benchmark. The researchers found that OGCs exert reasonable efforts to follow the GRI guidelines regarding the environmental indicator. Along the same lines, Kolk et al. (2001) found that oil companies listed among the Fortune Global 250 report more information on environmental issues when compared to other sectors, and they focus more on climate change issues. Alciatore et al. (2006) remarked that OGCs disclose more information on environmental performance when the regulatory pressures increase and when there is a threat to the legitimacy of oil companies’ continued operation. Eljayash et al. (2012), evaluated environmental disclosure by OGCs in the Middle East and North Africa. They used an index to assess the extent and quality of environmental disclosure. They found that there was a significant difference in environmental reporting among the companies; however, the level of the disclosure was low when compared with that of developed countries.

Shvarts et al. (2016) performed an analysis of Russian OGCs’ environmental transparency and responsibility and reported a significant difference in the level of environmental responsibility and transparency. Dong and Burritt (2010) examined the extent and quality of social and environmental reporting practices in the Australian oil and gas industry against general and industry benchmarks. They noted that Australian OGCs have poor disclosures in terms of the extent of information they provide on social and environmental issues, and the companies failed to disclose detailed information regarding the level of participation by employees and the companies’ actual achievements with regard to the quantification of targets and outputs. However, the researchers did find that the companies’ disclosures on human resources-related information was appropriate.

Greenhouse gas (GHG) emissions constitute an important environmental indicator. The World Energy Council reported that in 2014, energy companies alone accounted for 35 percent of global GHG emissions (Talbot and Boiral 2015). Evaluating the quality of GHG emissions reporting, Comyns (2016) analyzed how the pressures of institutional organizations can influence multinational OGCs’ reporting practices on GHG emissions. She found better quality and more extensive reporting under the EU Emissions Trading Scheme. Along similar lines, Comyns and Figge (2015) studied the data of Global Fortune 500 Index companies and found that their GHG emissions reporting quality did not significantly improve between 1998 and 2010. They also noted that the quality reporting differed under each of the seven categories of quality, and they attributed this result to information typology. Similarly, analyses of GHG emissions reporting have been conducted for other companies, including those in Brazil (Castanheira et al., 2014) and in Europe (Liesen et al., 2015), as well as Fortune 500 companies (Talbot and Boiral 2015). Generally, the studies remarked that GHG emissions reporting is still not as prevalent as it should be given the pervasiveness of OGCs’ GHG emissions generation.

What can be drawn from presenting previous studies is that they tried to determine the level of disclosure of environmental issues in oil and gas companies. We believe that these studies lacking use appropriate guidance that can be used as a benchmark to assess environmental disclosure. Therefore, we believe that our current study attempted to bridge this research gap, by focusing on using the IPIECA guidance, which served very well to assess the extent of reporting on the environmental indictor in those companies. Another gap of these studies is the neglecting other two main indicators of sustainability reporting, which are health and safety indicator and social and economic indicator. So, our study addresses all the three indicators of sustainability reporting.

2.2 Sustainability reporting by oil and gas companies

The second strand of review deals with the studies that assess the level of disclosure of sustainability. Several studies have assessed the three indicators of sustainability reporting for multinational OGCs. Most of these studies focused on the largest OGCs in the world. In the following, we highlight two streams of research. The first is about the methodology used in evaluating sustainability reporting and the second stream is about the level of disclosure. The methodology studies such as Raufflet et al. (2014) used the dichotomous method to examine the world’s leading OGCs’ CSR practices. They found that the extent of reporting for environmental indicators was the highest (earning a score of 81 percent), followed by social and health and safety information. Likewise, Roca and Searcy (2012) conducted content analyses on 13 Canadian OGCs’ CSR reports for 2008. Using the triple bottom line categories listed under the GRI indicators as the benchmark. They found that funding, donations, and GHG emissions are the most frequently reported items by the OGCs, with the average score being 74 percent. They also found that 46 percent of the Canadian OGCs included the GRI-specified indicators in their reports. The studies related to level of disclosure such as; Ahmad W. N. K. W. et al. (2016) which found inconsistencies in the sustainability information reporting among the world’s largest OGCs. However, they did note that the majority of these companies (60 percent) disclosed considerable amounts of environmental information, followed by social information. Spence (2011) assessed CSR initiatives in Mexican OGCs. He concluded that the high reputational cost traditionally associated with paying adequate attention to environmental and social issues has caused OGCs to spend more on CSR activities to alleviate any negative environmental and social effects arising from their operations.

Kirat (2015) analyzed the level of CSR in OGCs located in Qatar, a GCC country. His results suggested that OGCs in Qatar engage in CSR activities by focusing on the environment, sports, education, and health, but they neglect other important activities such as labor rights, human rights, work conditions, and anti-corruption and anti-bribery measures. He stated that CSR is making rapid inroads into the Qatar oil and gas industry, and these initiatives should now rise to the next level, where the focus should be on developing—and then institutionalizing—policies and strategies.

From the above literature, we can draw that there are essential limitations in the methods that have been used in assessing the level of sustainability reporting, as well as the inappropriate benchmark used. This limitation may lead to inaccurate results. Thus, we think that the current study is more broadly and systematically in the way of focusing on all OGCs in GCC countries using IPIECA guidance, and applied more advance method, three levels of disclosure (0,1, and 2).

3 Methodology

To answer the research question and achieve the objective of the study, which is assessing the quality of sustainability reporting in OGCs, we first describe the sustainability reporting index used in this paper. Several organizations around the world have issued sustainability reporting guidelines at the international level, including the GRI (2002, 2006, 2013), industry-specific reporting guidelines (e.g., API, 2004; IPIECA, 2011), and the GHG Protocol (WRI and WBCSD, 2004).

One standardized sustainability reporting framework is the Oil and Gas Industry Guidance on Voluntary Sustainability Reporting published by IPIECA. It was issued jointly with the API and the OGP. This guidance was updated in 2011 and 2015. According to the first set of IPIECA guidelines published in 2002, the objective of IPIECA is to provide globally consistent and accepted sustainability reporting guidance. This sustainability reporting framework is globally recognized as the most widely used tool for OGCs because it is considered to be a framework that includes indicators, standard disclosures, reporting protocols, and principles that are directly related to the oil and gas sector. IPIECA is the only global guidance involving both upstream and downstream sectors (Petraglia 2011). IPIECA guidance also is applicable to integrated companies such as national OGCs that have a full value chain. Most national OGCs are integrated companies because they are involved in upstream and downstream segments (Spangler and Pompper 2011). Furthermore, the IPIECA guidance also includes specifications for the oil and gas sector, while the GRI framework may be applied to different industrial sectors (Murphy et al., 2016). IPIECA intends to assist the oil and gas industry by developing, sharing, and promoting appropriate practices in and knowledge of sustainability reporting. Additionally, the United Nations Environment Programme (UNEP) promotes the use of IPIECA’s guidelines. The UNEP uses it as a communication channel to disseminate best practices in sustainability reporting. In other words, it is important to note that sustainability reporting initiatives receive support from the UN (Jenkins and Yakovleva 2006; Jones et al., 2007; Boasson 2009; Emeseh 2009; Tuodolo 2009).

The latest edition of this guidance developed by IPIECA was published in 2015 and consists of three main indicators: the environment; health and safety; and social and economic issues. Each of these indicators includes several sub-indicators and items, comprising a total of 34 items in the guidance. The first refers to the environment, which comprises three sub-indicators: climate change and energy, ecosystem services, and local environmental impact. The second is health and safety, which is subdivided into three sub-indicators: health and environmental risks; workforce protection; and process safety and asset integrity. The last refers to social and economic issues, which comprises five sub-indicators: community and society, human rights, local content, business ethics and transparency, and labor practices. This study uses the 2015 edition of IPIECA’s reporting guidelines to assess the quality of the sustainability reporting conducted by OGCs in the GCC countries.

Voluntary reporting, such sustainability reporting, is assessed using different methodologies. Some studies have conducted content analyses of CSR performance by using the dichotomous method, which takes the value of 1 if the item is present and 0 otherwise. Examples include the work of Cooke (1989), Meek et al. (1995), and Asif et al. (2013a). While studies such as those carried out by Deegan and Gordon (1996) and Haniffa and Cooke (2005) have conducted content analyses using sentences and words, others, such as those by Arcay and Vazquez (2005) and Eng and Mak (2003), have assigned points to each item of the index based on the importance of that item to the users. The content of the information in the report alone is not a sufficient condition to assess its quality and extensiveness (Toms 2002). Assessing quality reporting could be based on the nature and meaning of reporting in addition to the stakeholders’ messages (Tregidga et al., 2012). Thus, measuring the quantitative and qualitative aspects of the information gives an idea of the quality and extensiveness of the report (Hossain et al., 2005). Hrasky (2012) noted that companies that rely more on charts and graphs in their sustainability reports convey more information on their actual impacts and accomplishments.

The qualitative and quantitative reporting assessed in prior studies used different methods. Cheng and Courtenay (2006) used the dichotomous method for examining the qualitative and quantitative information. Likewise, Beck et al. (2010) assessed the quality reporting by using the content and the volume of the information along with classifying the items into categories and subcategories, while Clarkson et al. (2008), Clarkson et al. (2013), and Plumlee et al. (2015) evaluated the quality of environmental reporting by examining the type and nature of the information. The type of information was classified into soft or hard (quantitative or qualitative), while the nature of the information was categorized as positive, neutral, or negative. Another study conducted by Michelon et al. (2015) assessed the quality of CSR reporting using three dimensions: information content, types of tools used to describe the information, and managerial orientation.

A variety of studies have examined the quality of reporting via different levels of measured qualitative and quantitative information. For example, Al-Janadi et al. (2012) used three levels; Darrell and Schwartz (1997), Guthrie et al. (1999), and Cormier and Magnan (1999) referred to four levels; Van Staden and Hooks (2007) applied five levels; and Gamble et al. (1996) and Raar (2002) used seven levels. Hassan (2010) suggested that using a ranking system with too many points could diminish the measurement’s reliability, as increasing the number of points raises the chances of subjective judgments of measurement.

Therefore, our study uses three levels of disclosure (2, 1, and 0) to ensure the measurement tool’s reliability. Level 2 is assigned to an item if the company discloses common items and supplemental items with qualitative or quantitative information for that item supported by graphics, charts, or tables based on the guidance. Level 1 is assigned to an item if the organization discloses only some of the common items with quantitative or qualitative information, and level 0 is assigned to an item if that item is not disclosed. Level 2 is assigned if the company provide details about the item, not only general but also the firms provide either details or quantity measurement. We do content analyses by reading the report carefully and look for every item according to the guidelines, then we scored base on the above criteria, not disclosing we score 0, general disclosure we score 1, and detail disclosure we score 2. The sustainability index score for each company is calculated according to the company’s average score over 3 years. Thus, the total score of the 34 items of the index is 68 (34*2). If a company scores 68, it means that it reported 100 percent of all items in the index. ((68/68) *100), while, if a company score for example 45, it will obtained 66.18 percent ((45/68) * 100). This method of disclosure overcomes the shortcomings of the dichotomous method due to the ignorance of the extent to which each item was disclosed because it gives a score of 1 if the item is disclosed and 0 otherwise. Additionally, our chosen method avoids the weaknesses of other methods that assess the information disclosure of the items by sentences or words. In such methods, if the selected words are repeated frequently, the effectiveness of the quality reporting suffers.

We opt to analyze the sustainability reports for a period of 3 years from 2016 to 2018. We select this period to ensure that the most recent edition (the 2015 edition) of IPIECA’s guidelines can be applied. Initially, all 51 OGCs in the GCC countries were to be considered for this research. However, the study omits 34 companies from the sample owing to the unavailability of their sustainability reports for the study period. Thus, the final sample selection in this study consists of 17 OGCs that published at least one sustainability report during the study period. The 17 OGCs include three companies from Kuwait, one from Bahrain, six from Qatar, three from Saudi Arabia, one from Oman, and three from the UAE. The information of five companies was collected also by external researcher to make the accuracy of the findings and contributes to the validation of the result.

4 Results and discussion

This section describes the results of this study assessing the quality of sustainability reporting for OGCs in the GCC countries.

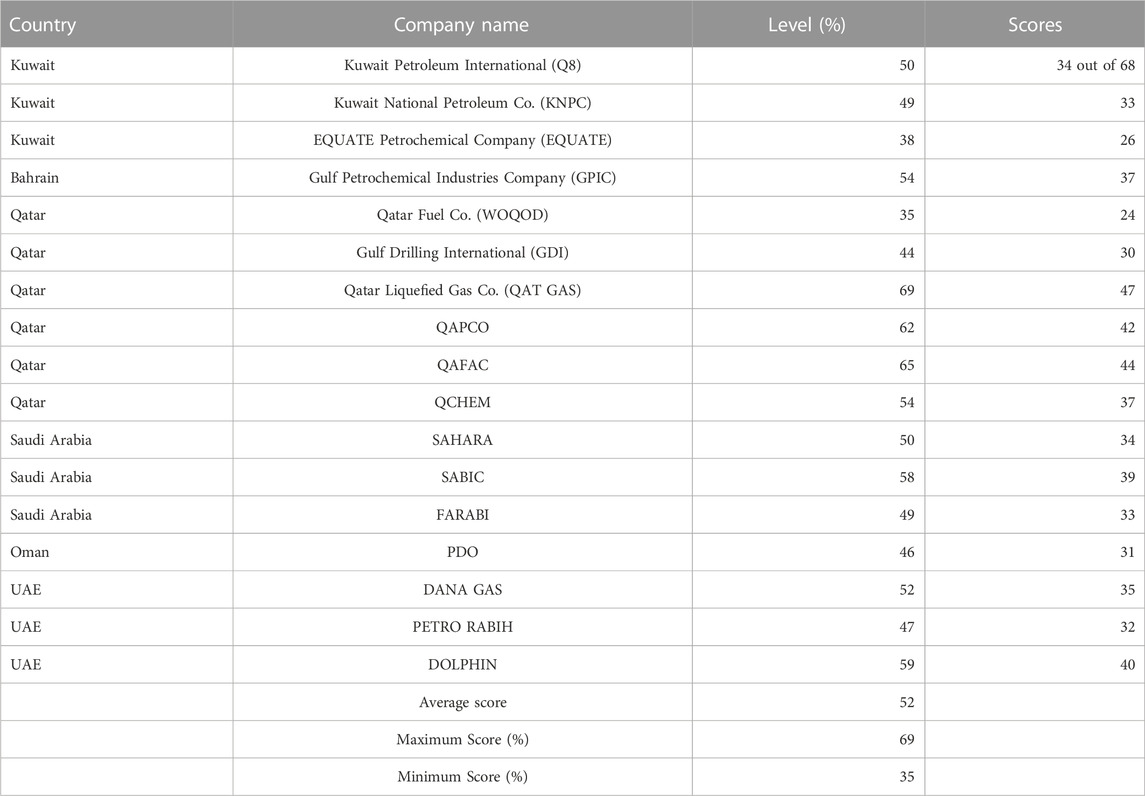

Table 1 summarizes the descriptive statistics for the sustainability reports across companies and countries. The overall average score based on the IPIECA 2015 guidelines for the entire sample of OGC reports is 35 (52 percent). This means that the OGCs in GCC countries disclosed moderate information about their sustainability practices. This can be compared with the findings of prior studies on international OGCs, such as the work of Raufflet et al. (2014) and Ahmad W. N. K. W. et al. (2016), which noted that world-class OGCs report sufficient CSR information, with an average of more than 80 percent. Other studies have found low levels of disclosure. For example, Orazalin and Mahmood (2018) found that Russian OGCs report a low level of sustainability disclosure, with an average of 20 percent, whereas Gaudencio et al. (2018) found that Brazilian OGCs scored 41 percent on their sustainability reporting.

Table 1, Panel A, provides information on the quality of companies’ sustainability reporting. The results show that the QAT GAS company obtained the highest score 47 (69 percent), followed by QAFAC, which scored 44 (65 percent). However, EQUATE scored the lowest score 26 (38 percent). One explanation for such a low score is that this company is not involved in the full streams of segments. Comparing the results of the GCC countries shows that the OGCs in Qatar tend to disclose the highest level of information on their sustainability practices, with an average score of 56 percent, followed by the OGC in Bahrain (54 percent). Kuwaiti companies scored the lowest average score (45.60 percent). Comparing the results from one company to another shows that there is a significant variation in the sustainability reporting. For example, in Kuwait, Q8 scored 50 percent, while EQUATE scored only 38 percent. This result is supported by the findings of Shvarts et al. (2016), who found a significant difference in the environmental reporting done by Russian OGCs. Another explanation for the variation in reporting levels may be that certain countries actively promote sustainability reporting whereas others do not.

The sustainability reports of the OGCs in the UAE show varied scores. For instance, DOLPHIN obtained a score of 59 percent, whereas PETRO RABIH obtained 47 percent. The average scores in other countries, such Kuwait and Saudi Arabia, also show varied scores. This study includes only one company from Oman, PDO, which is the country’s main government-owned petroleum company. The results show that PDO scored 46 percent, which is considered low when compared to some of the companies from Qatar, Kuwait, and the UAE. Among the Saudi petroleum companies, three companies provided sustainability reports during our study period, with an average score of 52 percent. It is noted that the largest oil and gas company in the world, which is Saudi ARAMCO, did not disclose a sustainability report in the 3-year study period, which means that the government in Saudi Arabia might not encourage OGCs to provide information on their sustainability practices.

Table 1, provides information on the quality of the countries’ sustainability reporting. In general, the total score of the reporting across countries shows that there is not much significant variation in their practices. However, Qatar ranked first with an average of 55 percent (37 scores), followed by Bahrain with 54 percent. Oman and Kuwait ranked the lowest with 46 percent. On the one hand, the insignificant differences might be attributed to the six countries’ shared characteristics, such as their institutional settings, corporate cultures, and dependence on oil revenues. On the other hand, Qatar’s ranking might indicate that its OGCs are more committed to sustainability reporting. For example, the four pillars of Qatar’s National Vision 2030 relate to sustainability. They are: human development, economic development, environmental development, and social development. These pillars are also considered to be the core elements of sustainability reporting. Accordingly, the Qatar government established various centers for sustainability development, such as one under the Ministry of Environment in 2013.

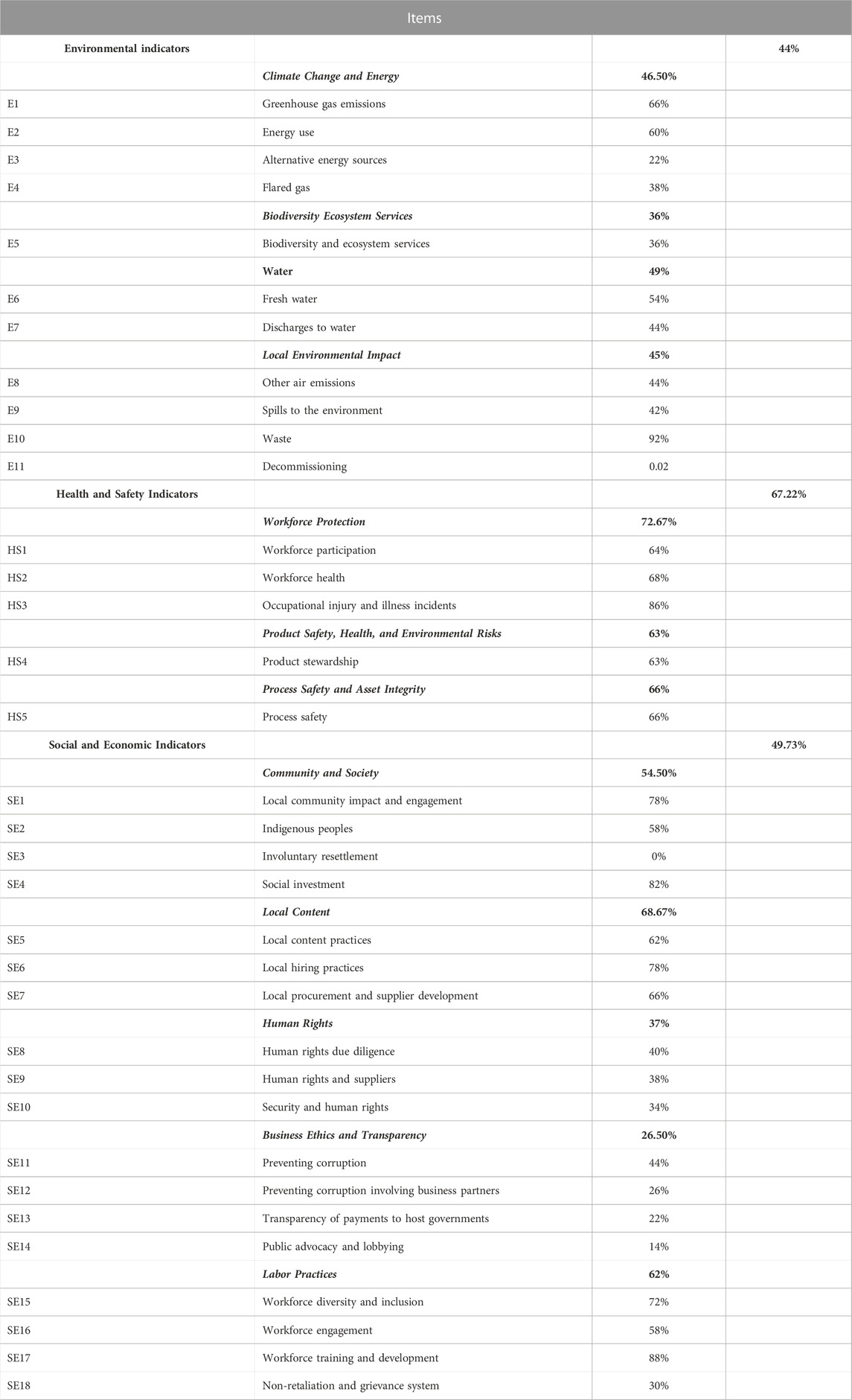

Table 2 summarizes the results pertaining to the three main sections on sustainability reporting. To gain a better understanding, we analyze the subcategories mentioned previously: environmental indicators, health and safety indicators, and social and economic indicators. The requirements for providing information on these subcategories depend on the varying degree of practicing OGCs to the quality of sustainability reporting. We find that OGCs in GCC countries report the least information on the environment (43.50 percent), followed by social and economic information (49 percent). The highest percentage is observed for the health and safety information subcategory (66 percent). This result is consistent with the study of Orazalin et al. (2019), which found that oil and gas companies in Russia report more economic information than environmental information. This result implies that OGCs in GCC countries fail to pay attention to the most important indicator of sustainability in OGCs, which is the environment. This result is consistent with the study of Dong and Burritt (2010), which reported that OGCs in Australia poorly disseminate detailed information on environmental and social issues. The lowest score for environment-related information, despite the sensitivity of the industry to environmental issues, reveals that OGCs in GCC countries may not focus on the implementation of environmental initiatives and may not be willing to disclose the relevant information due to the lack of pressure from stakeholders and consumers. This interpretation is supported by the belief that stakeholder pressure is reflected in high levels of sustainability information reporting (Cowen et al., 1987; Raucci and Tarquinio 2015). Another implication of the results may be that OGCs report more on government-regulated items, such as waste and GHG emissions, and report minimal information on items that face no regulatory oversight, such as ecosystem services, alternative energy sources, and flared gas.

Comparing the average score of the environmental sections with prior studies reveals that there are differences from one study to another. These differences are based on the methodology of assessment used, the economic development of the countries, the existence of regulation, the size of the company, and the company type (local or multinational/government-owned or private). For example, Orazalin et al.’s (2019) study found that the average score of the environmental section in Russian OGCs is 20.83 percent, while Raufflet et al. (2014) found that the average score of the environmental indicator in international oil and gas companies is 81 percent. Another study conducted by Guenther et al. (2007) found that the average score of environmental information for 19 international OGCs is 42 percent. The results of most prior studies on environmental reporting are low and consistent with the results of the current study, with the exception of the results of Raufflet et al.’s (2014) study, which contradicted those of our own. However, this contradiction might be due to the sample selection differences. For example, their study selected international OGC companies which were evaluated as A+ by the GRI in 2011, which means that they selected the highest level of international OGCs in terms of their sustainability practices.

Delving more deeply into the items included within the environmental indicator, we find that oil spills into the environment, with a score of 41 percent, tends to be one of the most underreported items by OGCs. This result is consistent with the finding of Shvarts et al. (2016), who found that only 3 out of 19 OGCs in Russia report on oil spill contingency plans. Spilling oil and any other fluids into the environment during the operational transport of oil and gas causes environmental pollution and affects sensitive ecosystems and people’s livelihoods (Pereira and Mudge 2004; Orbell et al., 2007). Thus, OGCs must be vigilant to prevent spills and report on the quantity of oil or any other fluid spilled into the environment, as well as the impact and response action for that spill. The result also shows that flared gas is one of the least frequently reported items by OGCs, with a score of 38 percent. This means that most of the companies do not report sufficient information on the hydrocarbon gases flared into the atmosphere from their operations. This low level of reporting on oil spills and flared gas may due to the absence of government regulation in GCC countries. This argument is supported by Spence (2011), who stated that the failure of governments to implement regulations on the environment is one of the main factors contributing to OGCs’ harm to the environment. In his report on flaring, Gervet (2007) stated that GCC countries emit high levels of flared gases despite having made progress in decreasing the amount of flared gases. Some countries, such as Qatar, have made significant strides toward reducing flared gases due to commitment from the highest level of government to improving the country’s environmental impact management (Rozhkova 2011). This is an achievement unique to Qatar, and it has proven challenging to replicate elsewhere.

With regard to the health and safety indicators, the results in Table 2 show that this section scored the highest, with an overall score of 66 percent. This result is consistent with the findings of Raufflet et al. (2014), Dong and Burritt (2010), and Cardoni et al. (2019), who found higher levels of reporting information on health and safety when compared with other sections of sustainability reports. We assess the individual health and safety items and find that the most frequently reported item by the OGCs is occupational injury and illness incidents, with a score of 86 percent, whereas the least frequently reported item is product stewardship, with a score of 63 percent. This result indicates that OGCs pay considerable attention to and are more concerned with programs on workforce health, likely owing to the high degree of danger associated with these companies’ operations, and due to the challenging locations of OGCs’ operations, there is a high risk to human safety (Murphy et al., 2017). Thus, this high risk leads international organizations that are interested in human rights to focus on the nature of health and safety in these companies. Therefore, OGCs try to report more information on health and safety in order to avoid criticism and prevent the threat of boycotts and media campaigns from these international organizations.

The results for the reporting on social and economic items show a low score of 49 percent. The OGCs in GCC countries earn the lowest score on involuntary resettlement (0 percent), followed by public advocacy and lobbying (14 percent). This result is consistent with the findings of Cardoni et al. (2019). The lowest scoring subsection in the social and economic category is business ethics and transparency, with an average score of 26 percent. This low score indicates that most of the OGCs are government-owned companies, and there is no regulation requiring these companies to report information on preventing corruption or on the transparency of their payments to the government. Another explanation is that OGCs in GCC countries may be indifferent to the interests of society because most of them are national companies and their operations are local. This explanation is supported by Murphy et al.’s (2017) argument that international OGCs look out for the best interests of the societies in the foreign countries in which they work due to the nature of their operations in diverse communities and remote regions.

5 Conclusion and policy implications

This study’s objective was to assess and understand the quality of sustainability reporting among OGCs in GCC countries. By assessing the quality of sustainability reports using the IPIECA guidelines, the results highlight that the quality of the sustainability reporting is moderate, with an average score of 35 (52 percent). We also find that reports on most environmental indicators, such as ecosystem services, climate change and energy, and local environmental impact, are lacking and show a low degree of reporting quality, followed by the social and economic indicators. However, this study finds that the quality of reporting varies from one company to another. For example, Qatar Gas Company scored 69 percent on the quality of its sustainability reporting, whereas EQUATE scored the lowest at 38 percent.

Business ethics and anti-corruption programs are important for companies to enhance their transparency and sustainability. The results show that the OGCs provided poor quality information on their business ethics and transparency. This low level of disclosure may be due to the lack of transparency regulations and anti-corruption policies and procedures in these countries. This finding is supported by Frynas (2010), who observed that the world’s leading OGCs have a poor track record on reporting issues related to anti-corruption. Thus, it is advisable for GCC governments to issue regulations that encourage OGCs to create and implement anti-corruption policies.

The findings of the study conclude that there is a moderate level of awareness about the quality of sustainability reporting among OGCs in GCC countries and the catalytic role of sustainability reporting in providing a clear picture of their social, economic, and environmental performances. Furthermore, efficient sustainability reporting is vital in the decision-making process, especially in OGCs (Morhardt et al., 2002; Ramos et al., 2013). The findings also provide insight into the practice of sustainability reporting among OGCs. The first insight is that OGCs do not pay considerable attention to environmental issues in their sustainability reports despite the industry’s environmental sensitivity. The second is that while OGCs are concerned to some extent with health and safety, they are not particularly concerned with social and economic issues, which indicates the failure of these companies to consider the best interests of the communities in which they work.

This study provide further implication related sustainable development in oil and gas companies. This sector is the main component of the economies of the countries of the region. Thus, these countries added in their visions the sustainability development as the main pillar of their visions. Even though, the energy has a positive role in the development of this region. However, the combustion of fossil energy sources deteriorates the environmental quality by increasing carbon and ecological footprint. Thus, this study provided implication by helping these countries to mitigating the ecological effect and suggesting to enhance the energy efficiency strategies.

In conclusion, this article contributes to the literature by assessing the level of sustainability reporting among OGCs in GCC countries, which is a topic that has been largely ignored in previous studies. This study has implications for policymakers, regulators, and company management in the GCC countries, in that it is crucial for the companies to improve their sustainability reporting practices, particularly in the areas of risk management for product safety, health and environmental risks, spills into the environment, and corruption prevention. Moreover, the low level of reporting for some important sustainability elements, such as spills of oil or other materials into the environment—which have the potential to pollute not only bodies of water but also to harm human, bird, and aquatic life—and human rights have important implications for government authorities. Furthermore, of the 51 OGCs in the GCC countries, only 17 companies issued sustainability reports during our study period. Thus, these countries’ governments need to issue regulations both requiring and encouraging OGCs to report and adopt sustainability reporting best practices. However, given that our paper is based on an analysis of the available sustainability reports of only 17 OGCs in a 3-year period, our conclusions should be considered as preliminary.

Our findings on the practices of sustainability reporting in the energy sector leads us to conclude that sustainability reporting still needs to improve in order to meet best practices. More academic work is required to bridge the gaps between sustainability policy and practice in the energy industry. This is especially true of the OGCs because of the dearth of studies in this area. The endorsement and implementation of mandatory regulations may also play an essential role in enhancing the quality of sustainability disclosure.

Several interesting topics related to sustainability reporting in oil and gas offer potential avenues of study for future research. For example, the analysis of sustainability reporting can be extended to include other countries in the Middle East and North Africa in order to make a more complete comparison of differences in politics, government, culture, and economic development. Certain variables that may have an impact on the quality of sustainability reporting, such as the size of the company, its financial performance and culture, and economic development, can also be investigated. Furthermore, a future study can focus on case studies. This type of research can provide the assurance of the actual practices of sustainability in comparison with what companies disclose in their sustainability report.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

YA write most of the parts of the paper including analyzing the data from the sustainability Reports, CSR Reports. and write the methodology section with the discussion of the results and the conclusion. Furthermore, He write the LR. AA enhanced the LR section and the discussion section.

Acknowledgments

The authors acknowledge that their study relies on the companies’ sustainability report in collecting the data, thus there is no any ethical issue towards anybody now or in future.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abdalla, Y. A., and Siti-Nabiha, A. K. (2015). Pressures for sustainability practices in an oil and gas company: Evidence from Sudan. Qual. Res. Account. Manag. 12 (3), 256–286. doi:10.1108/qram-04-2014-0038

Aerts, W., and Cormier, D. (2009). Media legitimacy and corporate environmental communication. Account. Organ. Soc. 34 (1), 1–27. doi:10.1016/j.aos.2008.02.005

Ahmad, N. N. N., and Hossain, D. M. (2015). Climate change and global warming discourses and disclosures in the corporate annual reports: A study on the Malaysian companies. Procedia-social Behav. Sci. 172, 246–253. doi:10.1016/j.sbspro.2015.01.361

Ahmad, W. N. K., de Brito, M. P., Tavasszy, L. A., Gunasekaran, A., and Pati, N. (2016). Sustainable supply chain management in the oil and gas industry: A review of corporate sustainability reporting practices. Benchmarking An Int. J. 23 (6), 1423–1444. doi:10.1108/bij-08-2013-0088

Ahmad, W. N. K. W., Rezaei, J., de Brito, M. P., and Tavasszy, L. A. (2016). The influence of external factors on supply chain sustainability goals of the oil and gas industry. Resour. Policy 49, 302–314. doi:10.1016/j.resourpol.2016.06.006

Al-Janadi, Y., Rahman, R. A., and Omar, N. H. (2012). The level of voluntary disclosure practices among public listed companies in Saudi Arabia and the UAE: Using a modified voluntary disclosure index. Int. J. Discl. Gov. 9 (2), 181–201. doi:10.1057/jdg.2011.19

Alazzani, A., and Wan-Hussin, W. N. (2013). Global reporting initiative's environmental reporting: A study of oil and gas companies. Ecol. Indic. 32, 19–24. doi:10.1016/j.ecolind.2013.02.019

Alciatore, M. L., Dee, C. C., Freedman, M., and Jaggi, B. (2006). Environmental disclosures in the oil and gas industry. Adv. Environ. Account. Manag. 3, 49–75.

Alonso Almeida, M., Llach, J., and Marimon, F. (2014). A closer look at the ‘global reporting initiative sustainability reporting as a tool to implement environmental and social policies: A worldwide sector analysis. Corp. Soc. Responsib. Environ. Manag. 21 (6), 318–335. doi:10.1002/csr.1318

American Petroleum Institute—API (2004). Manual of Petroleum Measurement Standards. Available at: https://www.api.org/publications-standards-and-statistics/standards/standards-addenda-and-errata/standards-addenda-and-errata/∼/media/a2af8a6e504e478389b286779472edaf.ashx.

Arcay, M. R. B., and Vazquez, M. F. M. (2005). Corporate characteristics, governance rules and the extent of voluntary disclosure in Spain. Adv. Account. 21, 299–331. doi:10.1016/s0882-6110(05)21013-1

Asif, M., Searcy, C., Santos, P. d., and Kensah, D. (2013a). A review of Dutch corporate sustainable development reports. Corp. Soc. Responsib. Environ. Manag. 20 (6), 321–339. doi:10.1002/csr.1284

Asif, M., Searcy, C., Zutshi, A., and Fisscher, O. A. (2013b). An integrated management systems approach to corporate social responsibility. J. Clean. Prod. 56, 7–17. doi:10.1016/j.jclepro.2011.10.034

Barkemeyer, R., Figge, F., Holt, D., and Hahn, T. (2009). What the papers say: Trends in sustainability: A comparative analysis of 115 leading national newspapers worldwide. J. Corp. Citizensh. (33), 69–86.

Beck, A. C., Campbell, D., and Shrives, P. J. (2010). Content analysis in environmental reporting research: Enrichment and rehearsal of the method in a British–German context. Br. Account. Rev. 42 (3), 207–222. doi:10.1016/j.bar.2010.05.002

Benbouziane, M., and Benamar, A. (2010). Could GCC countries achieve an optimal currency area? Middle East Dev. J. 2 (02), 203–227. doi:10.1142/s179381201000023x

Boasson, E. (2009). On the management success of regulative failure: Standardised CSR instruments and the oil industry's climate performance. Corp. Gov. Int. J. Bus. Soc. 9 (3), 313–325. doi:10.1108/14720700910964361

Cardoni, A., Kiseleva, E., and Terzani, S. (2019). Evaluating the intra-industry comparability of sustainability reports: The case of the oil and gas industry. Sustainability 11 (4), 1093. doi:10.3390/su11041093

Castanheira, É. G., Grisoli, R., Freire, F., Pecora, V., and Coelho, S. T. (2014). Environmental sustainability of biodiesel in Brazil. Energy Policy 65, 680–691. doi:10.1016/j.enpol.2013.09.062

Chaiyapa, W., Esteban, M., and Kameyama, Y. (2016). Sectoral approaches establishment for climate change mitigation in Thailand upstream oil and gas industry. Energy Policy 94, 204–213. doi:10.1016/j.enpol.2016.04.007

Chen, M. E. (2007). National oil companies and corporate citizenship: A survey of transnational policy and practice. Houston, TX: The James A. Baker III Institute for Public Policy of Rice University. Available at Stanford University: http://large.stanford.edu/publications/power/references/baker/studies/noc/docs/NOC_CC_Chen.pdf (Accessed July 14, 2018).

Cheng, E. C., and Courtenay, S. M. (2006). Board composition, regulatory regime and voluntary disclosure. Int. J. Account. 41 (3), 290–292. doi:10.1016/j.intacc.2006.07.002

Clarkson, P. M., Fang, X., Li, Y., and Richardson, G. (2013). The relevance of environmental disclosures: Are such disclosures incrementally informative? J. Account. Public Policy 32 (5), 410–431. doi:10.1016/j.jaccpubpol.2013.06.008

Clarkson, P. M., Li, Y., Richardson, G. D., and Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 33 (4), 303–327. doi:10.1016/j.aos.2007.05.003

Comyns, B. (2016). Determinants of GHG reporting: An analysis of global oil and gas companies. J. Bus. Ethics 136 (2), 349–369. doi:10.1007/s10551-014-2517-9

Comyns, B., and Figge, F. (2015). Greenhouse gas reporting quality in the oil and gas industry: A longitudinal study using the typology of “search”, “experience” and “credence” information. Account. Auditing Account. J. 28 (3), 403–433. doi:10.1108/aaaj-10-2013-1498

Connelly, B. L., Ketchen, D. J., and Slater, S. F. (2011). Toward a “theoretical toolbox” for sustainability research in marketing. J. Acad. Mark. Sci. 39 (1), 86–100. doi:10.1007/s11747-010-0199-0

Cooke, T. E. (1989). Voluntary corporate disclosure by Swedish companies. J. Int. Financial Manag. Account. 1 (2), 171–195. doi:10.1111/j.1467-646x.1989.tb00009.x

Cormier, D., and Magnan, M. (1999). Corporate environmental disclosure strategies: Determinants, costs and benefits. J. Account. Auditing Finance 14 (4), 429–451. doi:10.1177/0148558x9901400403

Cowen, S. S., Ferreri, L. B., and Parker, L. D. (1987). The impact of corporate characteristics on social responsibility disclosure: A typology and frequency-based analysis. Account. Organ. Soc. 12 (2), 111–122. doi:10.1016/0361-3682(87)90001-8

Darrell, W., and Schwartz, B. N. (1997). Environmental disclosures and public policy pressure. J. Account. Public Policy 16 (2), 125–154. doi:10.1016/s0278-4254(96)00015-4

Daub, C.-H. (2007). Assessing the quality of sustainability reporting: An alternative methodological approach. J. Clean. Prod. 15 (1), 75–85. doi:10.1016/j.jclepro.2005.08.013

Deegan, C. (2006). “Legitimacy theory,” in Methodological issues in accounting research: Theories, methods and issues (Spiramus Press Ltd), 161–181.

Deegan, C., and Blomquist, C. (2006). Stakeholder influence on corporate reporting: An exploration of the interaction between WWF-Australia and the Australian minerals industry. Account. Organ. Soc. 31 (4–5), 343–372. doi:10.1016/j.aos.2005.04.001

Deegan, C., and Gordon, B. (1996). A study of the environmental disclosure practices of Australian corporations. Account. Bus. Res. 26 (3), 187–199. doi:10.1080/00014788.1996.9729510

Dong, S., and Burritt, R. (2010). Cross-sectional benchmarking of social and environmental reporting practice in the Australian oil and gas industry. Sustain. Dev. 18 (2), 108–118. doi:10.1002/sd.450

Ehnert, I., Parsa, S., Roper, I., Wagner, M., and Muller-Camen, M. (2016). Reporting on sustainability and HRM: A comparative study of sustainability reporting practices by the world's largest companies. Int. J. Hum. Resour. Manag. 27 (1), 88–108. doi:10.1080/09585192.2015.1024157

El-Chaarani, H. (2019). The impact of oil prices on the financial performance of banking sector in Middle East region. Int. J. Energy Econ. Policy 9 (5), 148–156. doi:10.32479/ijeep.8075

Eljayash, K. M., James, K., and Kong, E. (2012). The quantity and quality of environmental disclosure in annual report of national oil and gas companies in Middle East and North Africa. Int. J. Econ. Finance 4 (10), 201–217. doi:10.5539/ijef.v4n10p201

Emeseh, E. (2009). Social responsibility in practice in the oil producing Niger delta: Assessing corporations and government’s actions. J. Sustain. Dev. Afr. 11 (2), 113–125.

Eng, L. L., and Mak, Y. T. (2003). Corporate governance and voluntary disclosure. J. Account. public policy 22 (4), 325–345. doi:10.1016/s0278-4254(03)00037-1

Fernandez-Feijoo, B., Romero, S., and Ruiz, S. (2014). Effect of stakeholders’ pressure on transparency of sustainability reports within the GRI framework. J. Bus. ethics 122 (1), 53–63. doi:10.1007/s10551-013-1748-5

Fragouli, E., and Jumabayev, K. (2015). Sustainable development of corporate social responsibility in the oil and gas industry: The case of Kazakhstan. Int. J. Inf. Bus. Manag. 7 (3), 135.

Freundlieb, M., Gräuler, M., and Teuteberg, F. (2014). A conceptual framework for the quality evaluation of sustainability reports. Manag. Res. Rev. 37 (1), 19–44. doi:10.1108/mrr-04-2012-0087

Freundlieb, M., and Teuteberg, F. (2013). Corporate social responsibility reporting-a transnational analysis of online corporate social responsibility reports by market–listed companies: Contents and their evolution. Int. J. Innovation Sustain. Dev. 7 (1), 1–26. doi:10.1504/ijisd.2013.052117

Frost, G., Jones, S., Loftus, J., and Laan, S. (2005). A survey of sustainability reporting practices of Australian reporting entities. Aust. Account. Rev. 15 (35), 89–96. doi:10.1111/j.1835-2561.2005.tb00256.x

Frynas, J. G. (2010). Corporate social responsibility and societal governance: Lessons from transparency in the oil and gas sector. J. Bus. ethics 93 (2), 163–179. doi:10.1007/s10551-010-0559-1

Frynas, J. G. (2005). The false developmental promise of corporate social responsibility: Evidence from multinational oil companies. Int. Aff. 81 (3), 581–598. doi:10.1111/j.1468-2346.2005.00470.x

Gamble, G. O., Hsu, K., Jackson, C., and Tollerson, C. D. (1996). Environmental disclosures in annual reports: An international perspective. Int. J. Account. 31 (3), 293–331. doi:10.1016/s0020-7063(96)90022-9

Gaudencio, L. M., de OliveiraCuri, R. W., Santana, C., Silva1, J., and Meira, C. (2018). Oil and gas companies operating in Brazil adhere to GRI-G4 essential sustainability indicators: A critical review. Environ. Dev. Sustain. 22, 1123–1144. doi:10.1007/s10668-018-0239-3

George, R. A., Siti-Nabiha, A., Jalaludin, D., and Abdalla, Y. A. (2016). Barriers to and enablers of sustainability integration in the performance management systems of an oil and gas company. J. Clean. Prod. 136 (A), 197–212. doi:10.1016/j.jclepro.2016.01.097

Gervet, B. (2007). Gas flaring emission contributes to global warming. Lulea, Sweden: Renewable Energy Research Group, Lulea University of Technology. Available at Researchgate website: https://www.researchgate.net/profile/Bo_Nordell/publication/267850638_Gas_Flaring_Emission_Contributes_to_Global_Warming/links/54609aaf0cf2c1a63bfe3756.pdf (Accessed Mar 20, 2018).

Gray, R. H., Owen, D., and Adams, C. (1996). Accounting & accountability: Changes and challenges in corporate social and environmental reporting. Upper Saddle River, NJ: Prentice-Hall.

Gray, R. H., Owen, D., and Adams, C. (2009). “Some theories for social accounting?: A review essay and a tentative pedagogic categorisation of theorisations around social accounting,” in Sustainability, environmental performance and disclosures (Emerald Group Publishing Limited), 1–54. doi:10.1108/S1479-3598(2010)0000004005

GRI (2002, 2006, 2013). Sustainability Reporting Guidelines. Amsterdam: Global Reporting Initiative.

Guenther, E., Hoppe, H., and Poser, C. (2007). Environmental corporate social responsibility of firms in the mining and oil and gas industries: Current status quo of reporting following GRI guidelines. Greener Manag. Int. 53.

Guthrie, J., Petty, R., Ferrier, F., and Wells, R. (1999). There is no accounting for intellectual capital in Australia: A review of annual reporting practices and the internal measurement of intangibles. Amsterdam: OECD Symposium on Measuring and Reporting of Intellectual Capital, 9–11.

Haderer, M. (2013). I need to know: An introduction to the oil industry and OPEC. Vienna: Ueberreuter Print GmbH.

Haniffa, R. M., and Cooke, T. E. (2005). The impact of culture and governance on corporate social reporting. J. Account. public policy 24 (5), 391–430. doi:10.1016/j.jaccpubpol.2005.06.001

Hassan, N. (2010). Corporate social responsibility disclosure: An examination of framework of determinants and consequences. Durham, England: Durham University.

Heemskerk, B., Pistorio, P., and Scicluna, M. (2002). Sustainable development reporting: Striking the balance. Earthprint, Stevenage: World Business Council for Sustainable Development.

Hilson, G., and Murck, B. (2000). Sustainable development in the mining industry: Clarifying the corporate perspective. Resour. policy 26 (4), 227–238. doi:10.1016/s0301-4207(00)00041-6

Hossain, M., Ahmed, K., and Godfrey, J. M. (2005). Investment opportunity set and voluntary disclosure of prospective information: A simultaneous equations approach. J. Bus. Finance Account. 32 (5-6), 871–907. doi:10.1111/j.0306-686x.2005.00616.x

Hrasky, S. (2012). Visual disclosure strategies adopted by more and less sustainability-driven companies. Account. Forum 36 (3), 154–165. doi:10.1016/j.accfor.2012.02.001

IPIECA (2011). Local content strategy: A guidance document for the oil and gas industry. London: IPIECA.

IPIECA (2015). Oil and gas industry guidance on voluntary sustainability reporting: Using environmental, health & safety Social and economic performance. London: IPIECA.

Jenkins, H., and Yakovleva, N. (2006). Corporate social responsibility in the mining industry: Exploring trends in social and environmental disclosure. J. Clean. Prod. 14 (3), 271–284. doi:10.1016/j.jclepro.2004.10.004

Jones, S., Frost, G., Loftus, J., and Laan, S. (2007). An empirical examination of the market returns and financial performance of entities engaged in sustainability reporting. Aust. Account. Rev. 17 (41), 78–87. doi:10.1111/j.1835-2561.2007.tb00456.x

Kaspereit, T., and Lopatta, K. (2016). The value relevance of SAM's corporate sustainability ranking and GRI sustainability reporting in the European stock markets. Bus. Ethics A Eur. Rev. 25 (1), 1–24. doi:10.1111/beer.12079

Kirat, M. (2015). Corporate social responsibility in the oil and gas industry in Qatar perceptions and practices. Public Relat. Rev. 41 (4), 438–446. doi:10.1016/j.pubrev.2015.07.001

Kolk, A. (2008). Sustainability, accountability and corporate governance: Exploring multinationals' reporting practices. Bus. Strategy Environ. 17 (1), 1–15. doi:10.1002/bse.511

Kolk, A. (2003). Trends in sustainability reporting by the Fortune global 250. Bus. Strategy Environ. 12 (5), 279–291. doi:10.1002/bse.370

Kolk, A., Walhain, S., and Van de Wateringen, S. (2001). Environmental reporting by the Fortune global 250: Exploring the influence of nationality and sector. Bus. strategy Environ. 10 (1), 15–28. doi:10.1002/1099-0836(200101/02)10:1<15:aid-bse275>3.0.co;2-y

Lertzman, D., Garcia, P., and Vredenburg, H. (2013). Corporate social responsibility in Latin America’s petroleum industry: A national oil company’s strategy for sustainable development. Int. J. Bus. Innovation Res. 7 (2), 185–208. doi:10.1504/ijbir.2013.052578

Li, Z., and Zhong, J. (2020). Impact of economic policy uncertainty shocks on China's financial conditions. Finance Res. Lett. 35, 101303. doi:10.1016/j.frl.2019.101303

Li, Z., Zou, F., and Mo, B. (2021). Does mandatory CSR disclosure affect enterprise total factor productivity? Econ. Res.-Ekon. Istraz. 35(1), 1–20. doi:10.1080/1331677X.2021.2019596

Liesen, A., Hoepner, A. G., Patten, D. M., and Figge, F. (2015). Does stakeholder pressure influence corporate GHG emissions reporting? Empirical evidence from Europe. Account. Auditing Account. J. 28 (7), 1047–1074. doi:10.1108/aaaj-12-2013-1547

Liu, X., Garcia, P., and Vredenburg, H. (2014). CSR adoption strategies of Chinese state oil companies: Effects of global competition and cooperation. Soc. Responsib. J. 10 (1), 38–52. doi:10.1108/srj-11-2012-0147

Malik, M. (2015). Value-enhancing capabilities of CSR: A brief review of contemporary literature. J. Bus. Ethics 127 (2), 419–438. doi:10.1007/s10551-014-2051-9

Meek, G. K., Roberts, C. B., and Gray, S. J. (1995). Factors influencing voluntary annual report disclosures by US, UK and continental European multinational corporations. J. Int. Bus. Stud. 26 (3), 555–572. doi:10.1057/palgrave.jibs.8490186

Michelon, G., and Parbonetti, A. (2012). The effect of corporate governance on sustainability disclosure. J. Manag. Gov. 16 (3), 477–509. doi:10.1007/s10997-010-9160-3

Michelon, G., Pilonato, S., and Ricceri, F. (2015). CSR reporting practices and the quality of disclosure: An empirical analysis. Crit. Perspect. Account. 33, 59–78. doi:10.1016/j.cpa.2014.10.003

Miska, C., Stahl, G. K., and Mendenhall, M. E. (2013). Intercultural competencies as antecedents of responsible global leadership. Eur. J. Int. Manag. 7 (5), 550–569. doi:10.1504/ejim.2013.056477

Morhardt, J. E., Baird, S., and Freeman, K. (2002). Scoring corporate environmental and sustainability reports using GRI 2000, ISO 14031 and other criteria. Corp. Soc. Responsib. Environ. Manag. 9 (4), 215–233. doi:10.1002/csr.26

Murphy, H., Collacott, R., Campbell, J. A., and Padilla, A. (2017). “Consistent with study by. Social performance indicators in the update of the oil and gas industry guidance on sustainability reporting,” in SPE asia pacific health, safety, security, environment and social responsibility conference. Kuala lumpure (Malaysia: Society of Petroleum Engineers), 4–6.

Murphy, H., Tyson, L., Røed, H., and Janus, B. (2016). “Third edition of the oil and gas industry guidance on voluntary sustainability reporting,” in SPE international conference and exhibition on health, safety, security, environment, and social responsibility (Stavanger, Norway: Society of Petroleum Engineers), 11–13l.

Nobanee, H., and Ellili, N. (2016). Corporate sustainability disclosure in annual reports: Evidence from UAE banks: Islamic versus conventional. Renew. Sustain. Energy Rev. 55, 1336–1341. doi:10.1016/j.rser.2015.07.084

Onn, A. H., and Woodley, A. (2014). A discourse analysis on how the sustainability agenda is defined within the mining industry. J. Clean. Prod. 84, 116–127. doi:10.1016/j.jclepro.2014.03.086

Orazalin, N., and Mahmood, M. (2018). Economic, environmental, and social performance indicators of sustainability reporting: Evidence from the Russian oil and gas industry. Energy Policy 121, 70–79. doi:10.1016/j.enpol.2018.06.015

Orazalin, N., Mahmood, M., and Narbaev, T. (2019). The impact of sustainability performance indicators on financial stability: Evidence from the Russian oil and gas industry. Environ. Sci. Pollut. Res. 26 (8), 8157–8168. doi:10.1007/s11356-019-04325-9

Orbell, J. D., Dao, H. V., Kapadia, J., Ngeh, L. N., Bigger, S. W., Healy, M., et al. (2007). An investigation into the removal of oil from rock utilising magnetic particle technology. Mar. Pollut. Bull. 54 (12), 1958–1961. doi:10.1016/j.marpolbul.2007.09.025

Pereira, M. G., and Mudge, S. M. (2004). Cleaning oiled shores: Laboratory experiments testing the potential use of vegetable oil biodiesels. Chemosphere 54 (3), 297–304. doi:10.1016/s0045-6535(03)00665-9

Petraglia, J. (2011). Manual for IPIECA oil and gas industry downstream series. AECOM, business wire. New York: ABI/INFORM Collection ProQuest.

Pirog, R. L. (2007). The role of national oil companies in the international oil market. Washington, DC: Congressional Research Service Report RL34137Library of Congress.

Plumlee, M., Brown, D., Hayes, R. M., and Marshall, R. S. (2015). Voluntary environmental disclosure quality and firm value: Further evidence. J. Account. Public Policy 34 (4), 336–361. doi:10.1016/j.jaccpubpol.2015.04.004

Raar, J. (2002). Environmental initiatives: Towards triple-bottom line reporting. Corp. Commun. An Int. J. 7 (3), 169–183. doi:10.1108/13563280210436781

Ramos, T. B., Cecílio, T., Douglas, C. H., and Caeiro, S. (2013). Corporate sustainability reporting and the relations with evaluation and management frameworks: The Portuguese case. J. Clean. Prod. 52, 317–328.

Ranangen, H., and Zobel, T. (2014). Revisiting the ‘how’of corporate social responsibility in extractive industries and forestry. J. Clean. Prod. 84, 299–312. doi:10.1016/j.jclepro.2014.02.020

Raucci, D., and Tarquinio, L. (2015). A study of the economic and non-financial performance indicators in corporate sustainability reports. J. Sustain. Dev. 8 (6), 216–230. doi:10.5539/jsd.v8n6p216

Raufflet, E., Cruz, L. B., and Bres, L. (2014)., An assessment of corporate social responsibility practices in the mining and oil and gas industriesJ. Clean. Prod. 84. December, 256–270. doi:10.1016/j.jclepro.2014.01.0771

Rezaee, Z. (2016). Business sustainability research: A theoretical and integrated perspective. J. Account. Literature 36, 48–64. doi:10.1016/j.acclit.2016.05.003

Roca, L. C., and Searcy, C. (2012). An analysis of indicators disclosed in corporate sustainability reports. J. Clean. Prod. 20 (1), 103–118. doi:10.1016/j.jclepro.2011.08.002

Rodriguez, F. D. (2019). Managing environmental and social impacts of the petroleum sector: Using environmental and social assessment towards more sustainable development. Washington, United States: Word Bank Group. Available at: https://pdfs.semanticscholar.org/504d/d052abe710544bbe7bd74cbe902c4cf3b2ae.pdf (Accessed December 14, 2019).

Rozhkova (2011). International practices in policy and regulation of flaring and venting in upstream operations, lessons from international experience. Washington, DC: GGFR. Available at: http://siteresources.worldbank.org/INTGGFR/Resources/578035-1164215415623/3188029-1324042883839/1_International_Practices_in_Policy_and_Regulation_of_Flaring_and_Venting_in_Upstream_Operations.pdf (Accessed November 26, 2018).

Rudari, L., and Johnson, M. E. (2015). Sustainability reporting practices of group III US air carriers. Int. J. Aviat. Aeronautics, Aerosp. 2 (2), 1–19. Article 5. doi:10.15394/ijaaa.2015.1066

Samuel, V. B., Agamuthu, P., and Hashim, M. (2013). Indicators for assessment of sustainable production: A case study of the petrochemical industry in Malaysia. Ecol. Indic. 24, 392–402. doi:10.1016/j.ecolind.2012.07.017

Santos, S., Rodrigues, L. L., and Branco, M. C. (2016). Online sustainability communication practices of European seaports. J. Clean. Prod. 112, 2935–2942. doi:10.1016/j.jclepro.2015.10.011

Shortall, R., Brynhildur, D., and Guðni, A. (2015). Development of a sustainability assessment framework for geothermal energy projects. Energy Sustain. Dev. 27, 28–45. doi:10.1016/j.esd.2015.02.004

Shvarts, E. A., Pakhalov, A. M., and Knizhnikov, A. Y. (2016). Assessment of environmental responsibility of oil and gas companies in Russia: The rating method. J. Clean. Prod. 127, 143–151. doi:10.1016/j.jclepro.2016.04.021

Spalding-Fecher, R. (2003). Indicators of sustainability for the energy sector: A South African case study. Energy Sustain. Dev. 7 (1), 35–49. doi:10.1016/s0973-0826(08)60347-6

Spangler, I. S., and Pompper, D. (2011). Corporate social responsibility and the oil industry: Theory and perspective fuel a longitudinal view. Public Relat. Rev. 37 (3), 217–225. doi:10.1016/j.pubrev.2011.03.013

Spence, C., Husillos, J., and Correa-Ruiz, C. (2010). Cargo cult science and the death of politics: A critical review of social and environmental accounting research. Crit. Perspect. Account. 21 (1), 76–89. doi:10.1016/j.cpa.2008.09.008

Spence, D. B. (2011). Corporate social responsibility in the oil and gas industry: The importance of reputational risk. Chicago-Kent Law Rev. 86 (1), 59–85.

Suchman, M. C. (1995). Managing legitimacy: Strategic and institutional approaches. Acad. Manage. Rev. 20 (3), 571–610.

Talbot, D., and Boiral, O. (2015). GHG reporting and impression management: An assessment of sustainability reports from the energy sector. J. Bus. Ethics 147 (2), 367–383. doi:10.1007/s10551-015-2979-4

Toms, J. (2002). Firm resources, quality signals and the determinants of corporate environmental reputation: Some UK evidence. Br. Account. Rev. 34 (3), 257–282. doi:10.1006/bare.2002.0211

Tordo, S., Tracy, B., and Arfaa, N. (2011). National oil companies and value creation. Washington DC: World Bank Publications. No. 218.

Tregidga, H., Milne, M., and Lehman, G. (2012). Analyzing the quality, meaning and accountability of organizational reporting and communication: Directions for future research. Account. Forum 36 (3), 223–230. doi:10.1016/j.accfor.2012.07.001

Tuodolo, F. (2009). Corporate social responsibility: Between civil society and the oil industry in the developing world. ACME An Int. E-Journal Crit. Geogr. 8 (3), 530–541.

Van Staden, C. J., and Hooks, J. (2007). A comprehensive comparison of corporate environmental reporting and responsiveness. Br. Account. Rev. 39 (3), 197–210. doi:10.1016/j.bar.2007.05.004

World Resources Institute (WRI) and World Business Council for Sustainable Development (WBCSD) (2004). The Greenhouse Gas Protocol, A Corporate Accounting and Reporting Standard. Available at: https://www.wbcsd.org/contentwbc/download/2670/33469/1.

Keywords: GCC countries, sustainability reporting indicators, oil and gas companies, IPIECA, environmental disclosure

Citation: Aljanadi Y and Alazzani A (2023) Sustainability reporting indicators used by oil and gas companies in GCC countries: IPIECA guidance approach. Front. Environ. Sci. 11:1069152. doi: 10.3389/fenvs.2023.1069152