- 1School of Finance and Economics, Qinghai University, Xining, China

- 2School of Business and Economics, United International University, Dhaka, Bangladesh

Introduction: The study’s motivation is to investigate the role of environmental and financial disclosure, IT adoption, and good governance on firms’ sustainability from 1990–2019. A sample of 75 financial institutions enlisted in Bangladesh’s capital market was considered for relevant data collection.

Methodology: Secondary data sources were used for data accumulation, including annual reports of target FIs, economic review reports, and central banks publication. Several econometrical techniques have been implemented to document the empirical nexus and the elasticities of explained variables on firm performance.

Findings: In terms of baseline assessment, the study revealed a positive and statistically significant association between a firm’s sustainability and target explanatory variables. Furthermore, the study extended the empirical valuation by implementing a system-GMM and documented a positive linkage between financial and environmental disclosure, IT adaptation, good governance, and the firm’s performance sustainability.

Discussion: These study findings suggest that information symmetry, investor protection, and access to financial services foster and stabilize the firms’ performance. Concerning corporate governance’s mediating effect, the study established a mediating role with positive influences on financial performance augmentation. On the policy ground, the study postulated that financial policymakers should address fairness and integrity in disclosing information to the public. Enforcement has to be initiated to ensure good governance.

1 Background of the study

One of the primary issues that harm the principal–agent interaction is the asymmetry of information, which has been cited as one of the most significant contributors to aggravating the conflict of interest. Regarding firms’ operational concerns and performance stability, lesser disturbance will prompt a better ambiance for growth; it is generally accepted that they have a good understanding of the business. The principals or owners of the company depend on the information that has been revealed to know how well the company is operating, particularly how well it is meeting its main purpose, which is maximizing wealth (Shanthi et al., 2015). It is not enough for information to be correct; it must also be current for it to be of any use to the person making a choice (Mugo, 2009; Andriamahery & Qamruzzaman, 2022a). Therefore, disclosure may be seen as the supply of timely and pertinent information to ensure complete transparency and an accurate image of the activities taken by the corporation in areas such as governance and financial performance.

In recent literature, a growing amount of research and discussion has been devoted to determining whether or not there is a connection between the responsible and socially sustainable conduct of businesses and their financial performance in the long run (Lassala et al., 2017; Ganlin et al., 2021; Alam, 2022). Due to the extensive globalization that markets have undergone and the growing demand of stakeholders for social commitment and transparency from businesses, social, environmental, and economic actions with sustainability criteria have been implemented (Adams, 2002; Moneva & Eduardo, 2008). Firms’ performance may be influenced by general corporate practices and disclose pertinent information, which will be generated from a company’s practice of social and economic integration. Additionally, the modern business environment is both dynamic and complicated. Shareholders have been put in danger of having their profits manipulated due to a lack of complete information on the firm’s operations, as has been seen in recent years with an increase in the number of scandals, frauds, suspensions, and even delisting. As a consequence of high-profile business failures in recent years, the topic of corporate governance has started to assume an ever-increasing prominent role in the public arena, and it is anticipated that the trend for corporate governance practices will be ingrained extensively. The focus has shifted from the traditional “shareholders only” approach to corporate governance to a broader corporate governance model that identifies the issues and priorities of stakeholders. Poor corporate governance can negatively impact economies and the stability of financial systems and also have tangible, serious social and environmental consequences (Dusuki & Bouheraoua, 2011; Alam et al., 2022).

The study considered environmental disclosure, the quality of financial disclosure, IT adoption, and good governance in a firm’s performance equation. After the financial crises in 2002 and 2008, companies worldwide became more conscious of providing more information to investors and consumers, particularly dealing with financial information. The literature has suggested that financial disclosure has demonstrated transparency and symmetry in information management, which prompts companies’ superior performance with the firm’s value proposition (Musleh Alsartawi, 2018). Over the last several decades, people’s awareness of environmental concerns has dramatically expanded, and they prefer to see firms’ contribution to restoring environmental balance (Ham et al., 2016). In 2015, the United Nations issued a resolution entitled “Sustainability Development Goals” (SDGs) as a response to several environmental challenges; since then, environmental concerns have emerged as major concerns for businesses, organizations in the public sector, and the worldwide community. The public now exerts greater pressure on businesses to be accountable for their environmental impact than in the past (Burgwal & Vieira, 2014). Therefore, for businesses to get legitimacy from the many stakeholders, they be transparent about their environmental responsibilities. It is not acceptable to let the presence of commercial enterprises affect the quality of the natural environment in the surrounding area. Due to the continual demand from stakeholders, businesses must formulate and implant environmental protection strategies, disclose environmental information, and actively involve environmental quality improvement. Environmental protection requirements arose due to the firms’ operational sustainability (Albertini, 2014). Making information about the environment public was pioneered in various media types, such as annual and sustainability reports. Furthermore, the quality of environmental disclosure is affected by firm size, leverage position, and corporate governance (Akrout & Othman, 2016; Handoyo, 2018).

The significance of good corporate governance (CG, hereafter) in determining how well a company carries out its responsibilities and makes the most of its assets is generally recognized in every area of the world (Crifo et al., 2019) along with tracking how well the company performs (Dony et al., 2019). The successful completion of the business’s goals and an increase in its performance’s effectiveness may be aided by corporate governance, which provides helpful information to the organization. CG is a procedure that may be described as supervising and managing businesses using several legal and other criteria. GG contains a collection of concepts and methods that deal with the interaction between management and stakeholders by providing corporate services such as transparency in a business transaction, legal compliance, protection of shareholders’ interests, and the organization’s ethical ideals. There are a lot of different methods that are used to assess corporate governance in each company. A few of these mechanisms include the size of the board of directors, the make-up of the board, the audit committee, and the standing of the CEO (Al-Homaidi et al., 2019).

The current study used Bangladesh as a case study to examine the relationship between explanatory and explained variables. The following factors have guided the selection of the sample economy: first, a firm’s actual information disclosure significantly affects performance, especially on a mark-based assessment. It suggests that the stock price behavior is due to investors’ attitudes toward the firm based on publicly available information. Second, disclosing operational modernization and access to customers’ services have a critical effect on a firm’s sustainability, indicating the customer’s confidence and preference for getting and availing the services, which are significantly guided by technological assistance. Additionally, financial institutions have increased their investment for IT inclusion in their processes to offer better services and retain their position in the market, especially in the last 20 years. Thus, this study examines the potential role of IT adaptation and diffusion effects on performance standards. Third, the sustainable growth of financial sectors is critically important for sustainable development but should come at the additional cost of environmental degradation. Thus, in recent times, environmental disclosure has become an alternative way to assess the firm’s contribution to the economy, potentially affecting overall firm performance.

The novelty of the study lies in the following aspects: first, considering the existing literature, many studies have been initiated focusing on financial institutions’ performance in different economies; however, the empirical assessment dealing with the financial institutions’ performance in Bangladesh has yet to be extensively investigated. The present study has initiated the empirical assessment to establish a bridge in the existing literature with fresh insight. Second, on the comprehensive assessment, the study implemented an empirical model with aggregated aspects and industry-focused investigation. The motivation to execute the empirical model with industry-specific assessment is to get a comparative picture. Third, the study extended the empirical assessment with the incorporation of interactive terms dealing with the assessment of the mediating role of corporate governance on the financial performance of financial institutions in Bangladesh.

2 Theoretical assessment

According to the stakeholder theory, the primary objective of a company should be to advance the interests of its many stakeholders. The perception that companies have a positive reputation and image is constructed by stakeholders who believe the company has high environmental disclosure standards. Stakeholders have the right to get information on activities that affect the environment to assist them in making decisions. Najihah et al. (2020) demonstrated that companies try to improve their image to gain stakeholders’ legitimacy and approval. This leads to an increase in the amount of money invested in the company, which, in turn, leads to an increase in the stock return. As a result, it is anticipated that companies that have improved their environmental performance and efforts will have a greater stock return.

Disclosure of financial information is an unavoidable need for companies’ prosperity since these establishments depend on providing truthful and up-to-date data to assist investors in making decisions and influencing new investors (Lipunga, 2014; Nuhiu et al., 2017; Murshed et al., 2022). When a company’s performance is strong, according to the signaling hypothesis, it is more likely to release detailed information to the market than when it is hiding negative news. This is done to prevent the company’s share price from being undervalued and operates on the presumption that managers want to indicate that they are efficient and working to maximize shareholders’ wealth. Managers might use different channels to communicate these signals to investors (Musleh Al-Sartawi et al., 2016).

In 1932, Adolf Berle and Gardiner developed the first corporate governance theory, which is still at the apex of theoretical discussion. In their book, Modigliani and Miller (1958) presented their capital structure theory. In addition, they advanced the notion that if there were no corporation taxes, the value of a levered business (based on taxes) would be the same as the value of an unlevered firm if the two firms were identical. This theory is called the MM1 preposition hypothesis in certain circles. Furthermore, they also put up the MM2 offer, in which they made use of the concept of taxing corporations, a situation in which a highly indebted firm can obtain a tax shield (benefit).

According to the signaling concept, a good company would purposefully signal the market. Consequently, the market is said to be able to discriminate between excellent and weak businesses. An effective signal can be recognized and caught by the market to function properly. The company’s quality is shown by CG, which, in turn, will provide a signal by providing the financial statements and the information on corporate governance that the company achieved in a certain amount of time. The signal that a trustworthy company provides is considered good news. However, the signal given by a corporation that cannot be trusted is considered bad news.

3 Literature review

3.1 Corporate governance and firm performance

Regulators, shareholders, investors, and society have been forced to realize the importance of effective corporate governance, the only remedy for economic calamities in the 19th century due to a string of financial scandals and the collapse of large business houses. This understanding led scholars worldwide to focus their efforts on establishing the nature of the link between corporate governance and company performance. Numerous individuals were motivated to identify the various techniques that companies may consider to develop an effective corporate governance system and determine the impact of this mechanism on a company’s financial performance. The role of corporate governance in effective decision-making and organizational strategical success has been extensively assessed in the literature. Considering the nexus between corporate governance and a firm’s performance, existing literature suggests three lines of thought. First, many researchers have postulated a positive, statistically significant association between CG and firms’ performances (Mia et al., 2014; Dony et al., 2019; Susanti et al., 2019; Ahmed et al., 2020; Murshed et al., 2021). Existing literature records have advocated that good governance practices ensure the availability of quality information and transparency in the managerial decision-making process and allow employees access to management information, thus allowing performance enhancement in the long run (Crifo et al., 2019; Gangi et al., 2019). Corporate governance is a rapidly evolving subject area that has been forced into necessitating the restoration of investor confidence in capital markets. It refers to the rules, procedures, and processes that govern and manage an organization. The literature argues that good governance is critical for a company’s success (Alix Valenti et al., 2011). Agrawal and Knoeber (1996) assert that firms with good corporate governance rules could acquire financial resources for investment at a reduced cost, resulting in increased company value, particularly since investors prefer to do business with companies that adhere to sound governance standards. Moreover, good governance practices act as incentives for potential investors and encourage future investment, which eventually supports performance sustainability (Han Widiatmika & Sri Darma, 2018). In a similar line of study that is the nexus between CG and firms’ performance sustainability, Munir et al. (2019) investigated Pakistan. They documented that good CG is a critical attribute for operational sustainability through organizational transparency, accountability, independence, and fairness.

An empirical test was conducted by Beasley (1996) to investigate the impact of the number of independent directors on the board of members on the incidence of financial crimes. A study found that a significant reduction in the possibility of fraud in financial statements occurs whenever a large number of independent directors serve on the board of directors. According to Dalton et al. (1999), it is essential to have independent directors as opposed to executive directors. Furthermore, the study revealed that independent directors have more access than executive directors to the resources and information supplied by third parties. Greater corporate governance, on the whole, contributes to an improvement in financial performance by lowering the risk that investors are exposed to and, as a result, assists in the recruitment of more investors (Manigandan et al., 2022; Spanos, 2005). Businesses can make the most of the available resources and predict that they will also have exceptional financial performance because have good corporate governance systems.

The second line of evidence suggests an adverse association between CG and financial performance (Appiah et al., 2017; Benadetta Munyiva et al., 2020). Patel et al. (2018) investigated the link between corporate governance and a firm’s performance and exposed that company performance decreases as directors’ ownership increases. Study findings indicate a negative relationship, particularly due to non-executive directors’ inability to perform efficiently, effectively, and independently in the existing local and cultural context.

3.2 IT adaptation and firm’s performance

In particular, information and communication technology (ICT) has brought about a fundamental shift in how banks generally work and provide customer service in the banking industry. To catch up with the pace of global development, improve the quality of customer service delivery, and lower the cost of transactions, banks have made significant investments in ICT and have widely adopted ICT networks to deliver a wide variety of value-added products and services. This has been carried out to deliver various value-added products and services, and the expansion of information and communications technology has significantly influenced the development of more adaptable and user-friendly financial services. It is a commonly held belief among business leaders, those who influence policy, and people who research that the significance of new technologies and breakthroughs for economic development and competitiveness is unquestionable. However, not every new technological development or innovative idea succeeds. In light of the vast number of technological possibilities and financial innovations, which businesses have the potential impact on growth? Knowing which types of innovative activities and technologies are most clearly associated with increased competitiveness and growth is desirable. Alternatively, the success of new technologies and creative activities more or less probable is even more, significant than having that understanding (Koellinger, 2008; Andriamahery & Qamruzzaman, 2022b) when discussing topics such as technology, innovation, and other associated ideas, not always the case that performance is a one-way path. Successful companies may have easier access to funding, making it simpler to finance a greater number of investments and innovations (Abel & Blanchard, 1983; Hubbard & Kashyap, 1992). In addition, investments in technology and innovation may benefit firms’ absorptive capacity (Cohen & Levinthal, 1989; Muneeb et al., 2022) and the availability of complementary resources such as skilled labor (Bresnahan et al., 2002), and learning-by-doing effects may occur. In the case of Vietnam, Le and Pham (2022) explored the impact of ICT development and banking profitability from 2009 to 2020 with a sample of 39 bank-based financial institutions. Study findings documented that ICT investment was positively connected to a firm’s profitability; moreover, the study postulated that ICT advancements improve the banks’ performance as they transition from analog to digital systems. In the case of e-business, Koellinger (2008) established a skeptical attitude favoring technological innovation and IT integration in the business process.

The study revealed that firms that rely on innovations not made possible by the internet are less likely to see growth compared to companies that rely on innovations made possible by the internet. To sum up, the literature suggested that innovation is not always associated with improved profitability which was a discovery. The fact that the responses of firms engaged in cutthroat competition are heavily dependent on the connection between innovative ideas and financial success makes it far more difficult to create the relationship. One of the most basic obstacles an inventor must face is stopping other companies from replicating a creative procedure or product. No firm on the market, not even the one that was the first to introduce a new invention to its sector, will be able to outcompete its competitors if they all adopt the same procedure and begin manufacturing the same product. This is due to the fact that all firms will use the same process, including the first firm to market items based on the concept (Teece, 2006). In that case, the time for each company that contributed to the innovation to enjoy extra benefits from their investment in the innovation is reduced. The issue is sometimes referred to as the appropriate dilemma (Geroski, 1995; Li & Qamruzzaman, 2022; Zhuo & Qamruzzaman, 2022).

3.3 Environmental disclosure and firm’s performance

The inconclusive, earlier empirical findings and the link between environmental performance and financial success have led to inconsistent outcomes owing to the three different schools of thought that have lately emerged (Horváthová, 2010). According to Palmer et al. (1995) and Walley and Whitehead (1994), the neoclassical school of economic thought believes that environmental legislation results in increased business expenses. On the other hand, the conventional neoclassical hypothesis maintains that an improvement in environmental performance would increase expenses. This perspective is founded on the idea that efforts to reduce pollution and enhance environmental quality have diminished marginal net benefits. Nevertheless, the third school of assumption contradicts the other two schools of thought by establishing a link between environmental success and financial performance that is formed like an inverted-U association (Lankoski, 2000; Wagner, 2001). The connection between these two schools of thought is referred to as a “traditionalist” relationship in the negative sense and a “revisionist” relationship in the positive sense. According to this point of view, there will be a positive association between environmental performance and financial success up to the level of environmental performance at which economic advantages will be at their highest level (Ayesha et al., 2022; Azam et al., 2022; Gregory, 2022).

A group of researchers has confirmed the adverse influence of environmental disclosure on a firm’s performance; for instance, Klassen and McLaughlin (1996), Jones and Rubin (2001), and Stanwick and Stanwick (2000) explored whether there was a correlation between environmental disclosure and the financial success of 469 large firms listed on the Forbes 500 list in 1994. Study findings show that firms rated well in terms of their financial success had a higher number of instances of environmental policies and environmental pledges than businesses that were ranked badly in terms of their financial performance. In addition, companies with medium financial success had the highest frequencies of firm environmental policies and commitment. Meng et al. (2013) examined the relationship between economic performance and the ED for 792 Chinese enterprises in 2006, 784 Chinese businesses in 2007, and 792 Chinese businesses in 2008. The empirical data demonstrated that the relationship between ED and firm performance is multiplicative and that ownership is a crucial institutional characteristic that impacts ED in China, from voluntarism to regulation. Their studies also demonstrated that the evaluation of corporate ED is related to financial performance and must exercise prudence concerning ownership type, which may vary from voluntarism to regulation.

For Indonesian manufacturing firms, the study by Arafat et al. (2012) revealed that environmental quality has positively augmented the firm’s performance. However, the impact of environmental disclosure on financial performance was statistically insignificant, while concurrently having a big impact on a company’s financial success are factors such as its environmental performance and transparency. These findings make it abundantly clear that businesses in developing nations will become more concerned with environmental sustainability and long-term profitability as time goes on. As a component of the environmental information disclosure, the environmental financial and non-financial information is made public. The environmental expenditures, investments, and provisions were all put into monetary terms in the financial report that dealt with the environment (Andriamahery & Qamruzzaman, 2022a; Xia et al., 2022). The literature exposed the link between environmental information disclosure and business performance and discovered that a high degree of environmental information disclosure might be helpful to a company’s financial success (Gjergji et al., 2021) (Neu et al., 1998; Prencipe, 2004; Cormier et al., 2011). It is realistic to predict that firms would incorporate environmental awareness into their operations to take advantage of the potential financial advantages. This would be as follows: as a consequence, adopting an environmental policy will affect the choices made by the management of the firms, eventually leading to an improvement in the companies’ financial performance (Stanwick & Stanwick, 2000; Qamruzzaman & Wei, 2018).

3.4 Financial disclosure quality and firm’s performance

It has been shown that elevating the level of financial transparency a company presents positively impacts the business’s overall success and is advantageous to the organization as a whole. Performance may be defined in terms of the business’s profit margin, rate, or return on assets; alternatively, it may be assessed in terms of a rise in the company’s stock value (Andrimahery and Qamruzzaman, 2022b; Liang & Qamruzzaman, 2022; Ma & Qamruzzaman, 2022). Alternatively, this performance may be measured in terms of the increase in the company’s overall value. In the great majority of situations, it has been proven in the accounting literature that earnings, timely disclosures, and disclosures in addition to annual reports have an important link with one another, that is, to have a correlation (Shi & Qamruzzaman, 2022; Xia et al., 2022).

In recent years, financial disclosure (FD hereafter) has emerged as one of the most important tools for communicating information to those in charge of making decisions. This viewpoint is gaining support among a growing number of companies in a variety of countries all around the world. The dramatic increase in the number of individuals using the internet and the volume of information that is made available to the general public has substantially impacted the operation of various economic and legal institutions throughout the globe (Aqel & Ahmad, 2014; Miao & Qamruzzaman, 2021; Yingjun et al., 2021). By disclosing symmetric information to shareholders and stakeholders, FD promotes transparency, which contributes to a reduction in the agency problem. This may be performed by demonstrating the management team’s commitment to openness and accountability throughout the operation of the business. Businesses could boost the demand for their shares and, as a result, lead to improvement in their long-term profitability if they provided a greater quantity of financial information to the public. The nexus between financial disclosure and financial performance was positive and statistically significant (Al-Mohannadi & Syam, 2007; Jullobol & Sartmool, 2015; Musleh Alsartawi, 2018). However, investors’ ability to accurately evaluate the true performance of the companies may be hampered as a result of the vast amounts of information that have been published.

To maintain a healthy corporate governance system, companies must comply with the requirement that they promptly provide understandable and comparable information. This material should focus on the challenges associated with finances, management, and organization ownership (Richardson & Welker, 2001; Dai et al., 2022; JinRu & Qamruzzaman, 2022). In addition, the adoption of FD is considered in the context of the economics of financial disclosure as a method of minimizing agency difficulties. This is carried out as a means of mitigating agency problems. It has been stated that the successful implementation of FD is dependent not only on the dominant form of corporate governance in the nation but also on the supporting infrastructures that exist within it (Musleh Alsartawi, 2018)

4 Data, variables, and methodology

4.1 Definition of variables

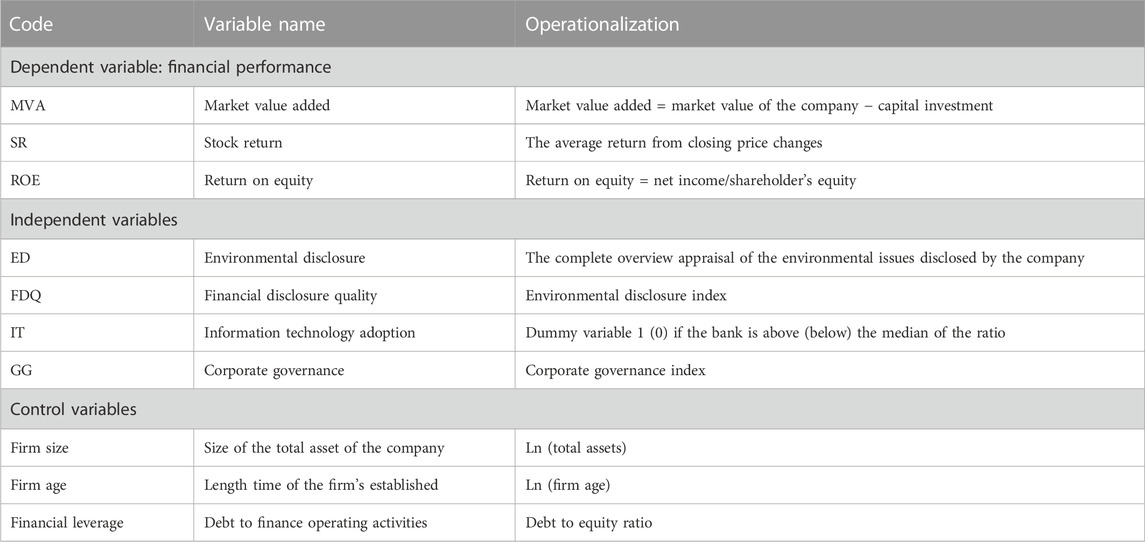

The motivation of the study is to gauge the impact of financial disclosure, environmental disclosure (ED), good governance (GG), and IT adoption on firms’ performance sustainability by taking the financial sectors in Bangladesh.

Several proxies have measured financial performance following the existing literature as an explained variable. The present study has considered two proxies extensively used in the literature in measuring the firms’ financial performance. First, the market value added, also known as MVA, is the difference between the current market value of a company and the total amount of capital that has been contributed to the company by its shareholders and bondholders. MVA can be calculated as a reflection of the performance of management:

Market value added = market value of the company − capital investment.

Second, the return on equity (ROE) calculates the percentage of a company’s net income that was distributed to shareholders compared to the total amount of equity held by shareholders. ROE is a metric that may determine how profitable a firm is since it shows how much profit a company earns with the shareholders’ investment. The return on equity is expressed as a percentage and found by using the following formula:

Return on equity = net income/shareholder’s equity.

Stock return (SR) is considered a proxy for measuring the firms’ performance based on market fraction. The following formula is implemented to drive the stock return with the closing stock price.

SR= (closing stock price (t)/closing stock price 0) − 1.

The key explanatory variables of the study are as follows: first, IT adoption: We measure IT adoption as a dummy, taking the value of 1(0) if the bank is above (below) the median of the ratio of tech and communication expenses to total operating expenses for 2020, and these firms are henceforth denoted “high (low) IT-adopters” (Dadoukis et al., 2021; Liang & Qamruzzaman, 2022; Muneeb et al., 2022).

Financial disclosure quality (FDQ): following the existing literature (Abeysekera et al., 2021), the present study has constructed the financial disclosure quality indexed by accounting for accrual, persistence, predictability, and smoothness. In financial reporting, “earnings quality” may be broken into four categories. We evaluated the quality of each component of earnings using a scale that ranged from 1 to 10, with one being the least desired and 10 representing the ideal outcome. The quality, predictability, and smoothness of accruals are each assessed on an upward scale, with higher values indicating greater earning quality. A correlation between higher values and more predictability is also suggested, implying that the greater the consistent earnings, the lower the quality of the profits. The quality continues to deteriorate as the scale moves downward. This study calculated the Financial Disclosure Quality (FDQ) using the standardized, average aggregate score of the four assessed aspects (Dechow & Dichev, 2002; Li et al., 2014). This was carried out to ensure accuracy. There is no one approach to integrating the four earnings aspects that everyone recognizes and accepts.

The accrual earning quality has been derived by executing the following equation:

where

The persistence equation is as follows:

where Earnj,t is firm j’s net income before extraordinary items in year t, Earnj, t−1 is firm j’s net income before extraordinary items in year t-1, and c is the residual. Through the use of the technique of persistent regression [49, 50], it is possible to deduce the predictability of profits by analyzing the variance in the residual value. Greater variations in the residual, as assessed by the square root of that variance, signal a lower degree of persistence. This is because the square root of that variance measures persistence.

The component of productivity and smoothness can be derived with the expectation of the following equation:

where PREDj,t is the earnings predictability of firm j in year t, and σ2 (cˆ j, t) is the estimated residual variance of firm j in year t, calculated from the following equation:

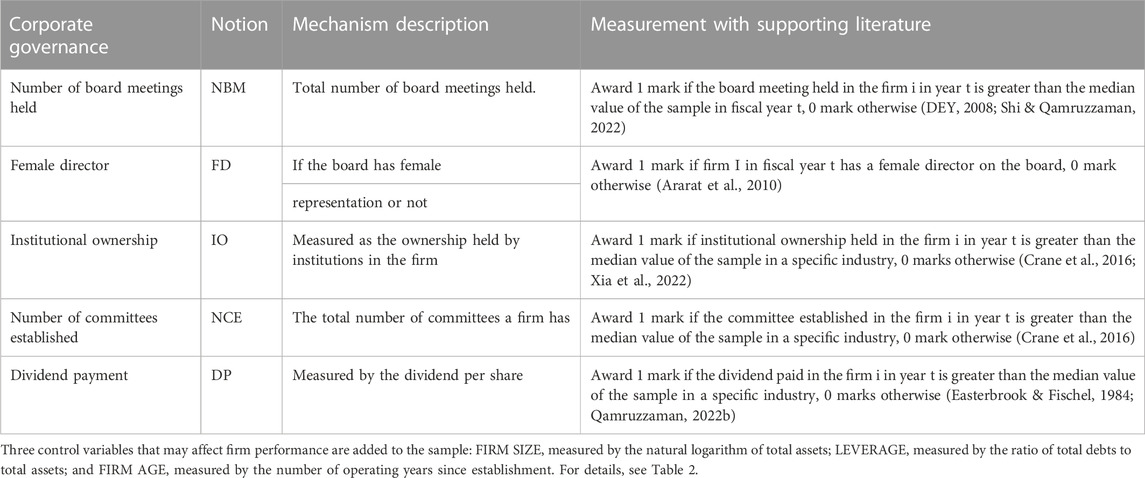

Corporate governance: The term CG was originally used in the 1800s by Alabdullah et al. (2014) to bridge the gap between the management of the company and the owner-principal due to unacceptable managerial practices that might damage the firm. As a result, the CG idea was developed to account for the interrelationships between board members, management branch managers, audit committees, shareholders, and other interested parties. CG can be defined as the effective implementation of ethical guidelines and practices in the organization through control machinima (Alabdullah et al., 2014; Liang & Qamruzzaman, 2022). CG is a set of rules and methods that govern the relationship between management and stakeholders. It accomplishes this by providing corporate functions such as transaction transparency, legal compliance, shareholder protection, and business ethics. The impact of CG on a firm’s performance varies with the appropriate selection of measurement, implying that appropriate proxy detection can produce diverse outcomes in empirical assessment (Al-Homaidi et al., 2019). Managers and authorities across the globe are using CG as a proxy for workers because of global financial problems (Sun et al., 2011). Following the existing literature (Nam & Lum, 2006; Siagian et al., 2007), we constructed a corporate governance index using the corporate governance checklist (Table 1).

4.2 The hypothesis of the study

1. Environmental disclosure positively fosters firms’ financial performance.

2. Quality of financial disclosure prompts firms’ financial performance.

3. IT adoption increases the possibilities of firms’ performance sustainability.

4. Corporate governance is positively connected to firms’ financial performance.

4.3 Regression models

To assess the aforementioned hypotheses of the study, the following regression models are to be implemented, where financial performance is measured by MVA, SR, and ROE with independent variables, namely, FD, ED, IT adoption (IT), and GG, along with a list of control variables: firm size (FZ), leverage (LEV), and firm age (AGE).

Model 1–03: without mediating effects

Model. 04–06: with mediating effects

5 Model estimation and discussion

5.1 Descriptive statistics and multicollinearity assessment

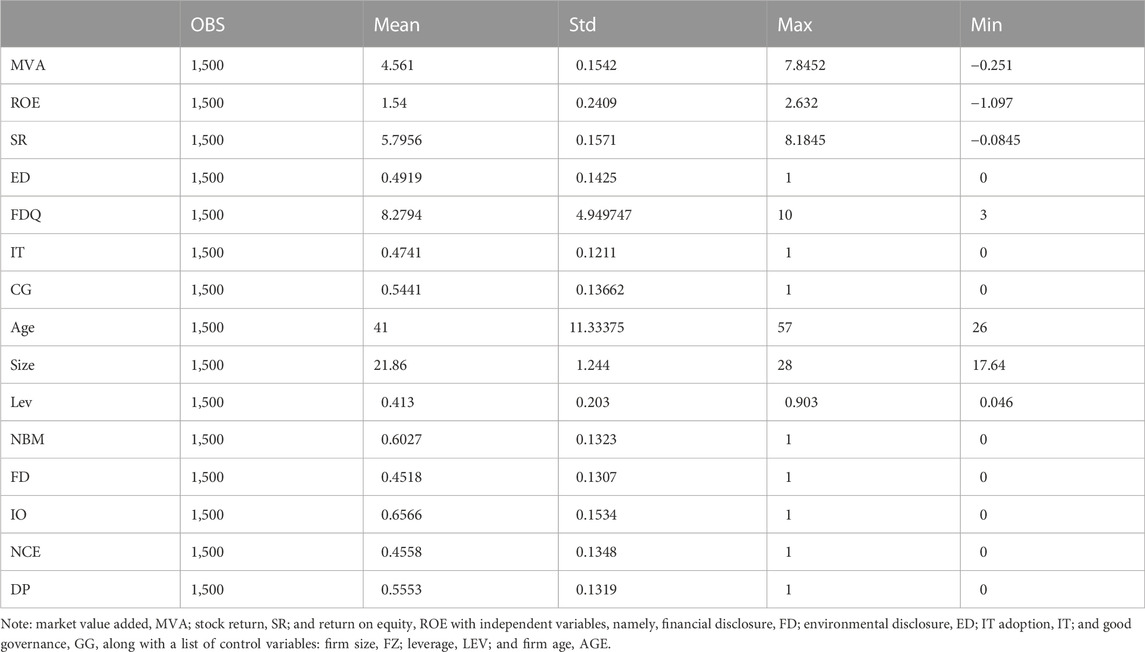

Table 3 exhibits the descriptive statistics of research variables. Referring to the measures of financial performance, the mean value of MAV is 4.561 per share with a standard deviation of 0.1542, the average ROE is 1.541 percent with a standard deviation of 0.2409, and for SR, the mean value is 5.7956 percent with a standard deviation of 0.1571. The mean value of environmental disclosure is 0.4919 with a standard deviation of 0.1425, the mean value of the financial disclosure quality index is 8.2749, and the standard deviation is 4.949. The average value of IT adoption is 0.4747 with a standard deviation of 0.1211. The corporate governance index’s average value is 0.5441, and the standard deviation is 0.1366.

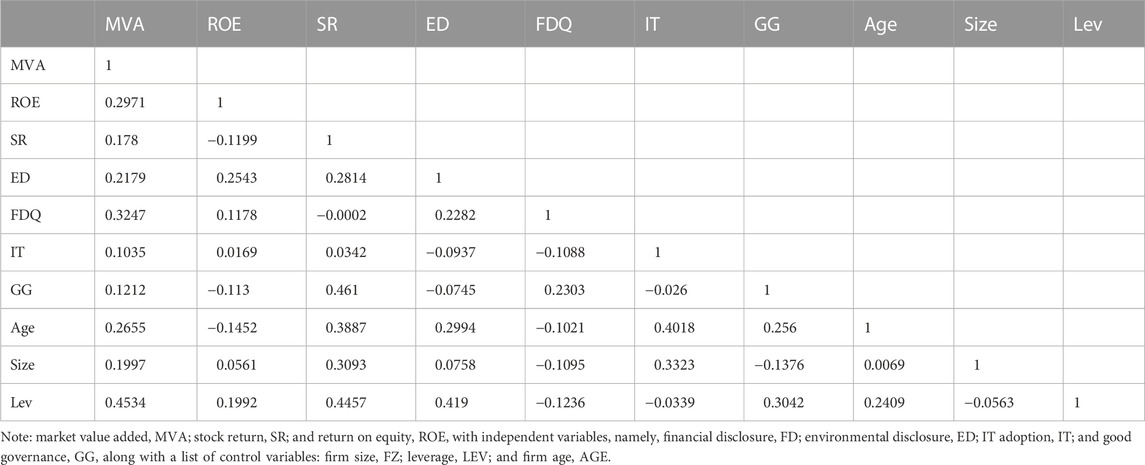

To explore the possible multicollinearity among the research variables, the study has implemented the pairwise correlation, and the results are presented in Table 4. According to the coefficient of correlation, it is shown that the issue of multicollinearity is not available. The coefficient value is less than the threshold, which is 0.80.

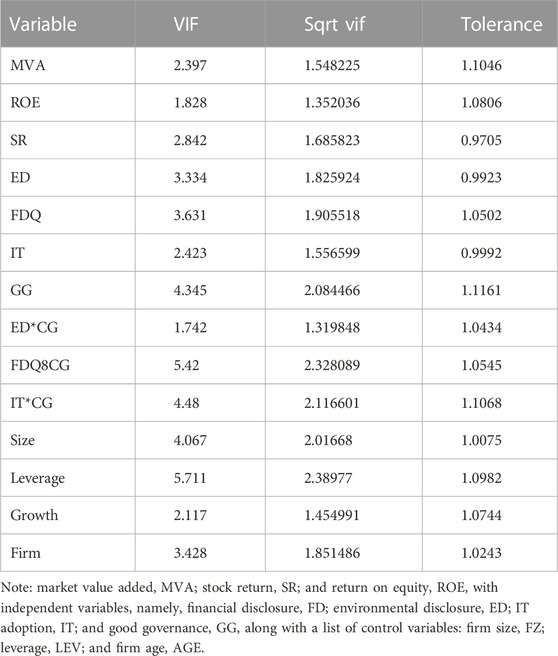

In addition, we conducted individual VIF studies for each incident. We found that none of the readings in any of them surpassed the threshold of 10. This was the case regardless of the situation (Shan, 2013). Results of VIF displayed in Table 5.

5.2 The effects of corporate governance, IT adoption, environmental disclosure, and financial disclosure quality on performance—market value added

The effects of technological adoption on firms’ performance have been revealed to be positive and statistically significant for the full sample (a coefficient of 0.1609), banking institutions (a coefficient of 0.1668), and the insurance industry (a coefficient of 0.021). Considering the coefficients, it is apparent that information technology adoption has produced a friendly environment in augmenting financial performance. In particular, the effect of IT adoption is more significant in the banking industry than in insurance institutions. The study documented a positive and significant linkage between the effects of environmental disclosure on performance. More specifically, a 10% improvement in environmental disclosure accelerates the firms’ market value performance by 0.168% for full-sample assessment, 0.293% for banking industry assessment, and 0.961% for insurance. A study advocated that environmental reporting for the insurance industry has a greater impact on firms’ performance than the banking industry. The study established that the quality of financial disclosure positively accelerated the firms’ performance; that is, financial transparency with the precision of financial information results in increase in the firms’ value. In particular, a 10% improvement in the financial disclosure quality can improve financial performance by 0.351% for the overall assessment, 0.477% for the banking industry, and 0.769% for the insurance industry. Studies suggest that presenting financial information and access to all increase the organizational reputation and eventually support accelerating institutional performance. Our finding is supported by the existing literature (Al-Sartawi, 2018; Zhuo & Qamruzzaman, 2022). Disclosure of financial information is an unavoidable need for companies’ prosperity since these establishments depend on providing truthful and up-to-date data to assist investors in making decisions and influencing new investors (Lipunga, 2014; Li & Qamruzzaman, 2022).

The coefficient of corporate governance on MVA revealed positive and statistically significant for the full-sample assessment (a coefficient of 0.0764), the banking industry (a coefficient of 0.0799), and the insurance industry (a coefficient of 0.0549). According to the assessment, effective governance in the organization ensures sustainability in financial performance, which is supported by the existing literature (Balasubramanian et al., 2010; Muhammad Sadiq et al., 2016; Hussain et al., 2019). Corporate governance ensures not only the trust of shareholders but also that of other stakeholders, such as 1) the government, 2) workers, 3) suppliers, and 4) consumers, by ensuring that the leaders of organizations are held responsible for the decisions they make. Shareholders are one example of a stakeholder group. Companies with inadequate governance have a larger propensity for worse operational performance and value, higher input costs, lower labor productivity, and lower equity return and value (Zaharia & Zaharia, 2012). On the other side, good corporate governance guarantees shareholders will obtain the maximum returns possible on their investments. This, in turn, contributes to an increase in total wealth and the economy’s growth as a whole (Creţu, 2012; Qamruzzaman, 2022a).

The results of mediating effects of good governance on firms’ performance are displayed in Supplementary Appendix Table S7. According to the coefficients of the interactive term (IT*CG, ED*CG, FDQ*CG), the study revealed a positive and statistically significant linkage between them, indicating the mediating role of corporate governance.

5.3 The effects of corporate governance, IT adoption, environmental disclosure, and financial disclosure quality on performance—ROE

Supplementary Appendix Table S8 exhibits the results of the financial performance measured by ROE. According to the target model coefficients, it is revealed that IT adoption, ED, FDQ, and CG-positive support increases the value of the firm, which ROE measures. The study finding is in line with that of existing literature (Shin, 2001; Beccalli, 2007; Kharuddin et al., 2010; Sabherwal & Jeyaraj, 2015). Referring to empirical model estimation with a full sample, the overall industry performance has revealed a positive association with IT adoption (a coefficient of 0.0711), environmental disclosure (a coefficient of 0.0871), the quality of financial disclosure (a coefficient of 0.1382), and corporate governance (a coefficient of 0.092). Furthermore, taking account of model estimation with the banking industry, the study revealed that the financial performance, that is, ROE, increases due to investment in IT integration (a coefficient of 0.0396), prompt disclosure dealing with environmental activities (a coefficient of 0.0472), the transparency in financial information accessibility (a coefficient of 0.0525), and the presence of effective corporate governance (a coefficient of 0.0404). The study revealed that IT adoption (a coefficient of 0.0712), ED (a coefficient of 0.0026), FDQ (a coefficient of 0.0326), and CG (a coefficient of 0.0722) act as catalysts in improving the financial performance in the insurance industry. On a comparative note, the insurance industry’s financial performance has been revealed to be more significant than the banking industry’s performance. In contrast, environmental disclosure and the quality of financial disclosure have been established as critical to improving the financial performance in the banking industry.

The next study implemented the empirical assessment with the mediating role of corporate governance on financial performance, measured by ROE. The results of mediating effects assessments are displayed in Supplementary Appendix Table S9. According to the coefficients of the interactive term, the study exposed positive and statistically significant effects running from (IT*CG) and (FD*CG) to the financial performance of the banking industry and the negative association documented for (EDQ*IT). Regarding insurance industry assessment, corporate governance’s mediating effects have been positive and statistically significant, which is valid for all interactive-term investigations.

5.4 The effects of corporate governance, IT adoption, environmental disclosure, and financial disclosure quality on performance—stock return

In the following, financial performance is measured by taking into account the stock return, which is measured by the average monthly closing price. The results of the empirical estimation are displayed in Supplementary Appendix Table S10. According to the effects of explanatory variables on stock return, the study established a positive tie between IT adoption and stock return in the banking industry (a coefficient of 0.0528) and insurance industry (a coefficient of 0.0796), indicating that investment in IT boosts the firms’ performance. The literature supports our study’s finding of a positive linkage between IT adoption and stock return (Dewan et al., 2007; Lui et al., 2022; Squillace et al., 2022). One of the likely reasons for this is that the investments that consumers make in information technology are analogous to the expenditures that businesses make in that area. The likelihood of an increase in sales is thus rendered null and void because customers may use information technology to save costs while searching for low-cost goods or services and selecting alternative suppliers. Put another way, investments in information technology are necessary to keep up with the changes in the market; yet, these expenditures are not sufficient on their own to go ahead with these changes in the market. Because of this, a fall in the price that consumers pay for products or services may lead to a decline in profitability, although a decrease in input costs may increase overall levels of productivity.

The nexus of environmental disclosure and stock return was positive and statistically significant in the banking industry (a coefficient of 0.0822) and the insurance industry (a coefficient of 0.0403). The magnitudes of environmental disclosure were more significant for the banking industry than the insurance industry. Our study findings aligned with the existing literature (Rostami et al., 2016; Cahyani Putri, 2019; Suhadak et al., 2019; Alsahlawi et al., 2021). Better governance that includes an increase in financial and operational openness is one way, so the argument goes that the organization may attain a lower risk of adverse selection. Traders provide higher liquidity to the stocks of organizations with strong governance because these companies have fewer problems with adverse selection.

The study established that the quality of financial disclosure positively assists in increasing the stock return in the financial market. According to the study coefficient, a 1% development in the quality of financial disclosure will result from the acceleration of stock return in the banking industry by 0.207% and in the insurance industry by 0.202%. The elasticity of FDQ is almost equally likely. The literature supports the positive linkage between the quality of financial disclosure and stock return (Gao et al., 2016). However, it contrasts with the study findings of Hussein and Nounou (2021).

Corporate governance impact on stock return revealed a positive and statistically significant association. Referring to the coefficients, a 1% improvement in corporate governance practices can augment the stock performance by inducing the stock return of the banking sector by 0.124% and the insurance industry by 0.1299%, respectively. Study findings are supported by the studies of Amelia et al. (2021), Wicaksono and Wahyudi (2022), and Indijanto et al. (2022). Corporate governance encompasses “all those components which affect the organization’s decision making” (Wicaksono & Wahyudi, 2022). It considers not only the control rights of shareholders but also the control rights and insolvency powers of those who hold the loans. In addition to that, it considers the commitment to the workforce, the suppliers, and the consumers in addition to the statutory and regulatory requirements. The extent of the degree of competition in the sector of the economy in which the firm operates has a sizeable effect on the decisions that are made by the company.

The next study implemented the empirical assessment with the mediating role of corporate governance on financial performance, which is measured by stock return. The results of mediating effects assessments are displayed in Supplementary Appendix Table S11. According to the coefficients of interactive term, the study exposed positive and statistically significant effects running from (IT*CG) and (FD*CG) to the financial performance of the banking industry and the negative association documented for (EDQ*IT). Referring to the insurance industry assessment, the mediating effects of corporate governance have been exposed as positive and statistically significant, which is valid for all interactive term investigations.

5.5 Robustness assessment of empirical output with system-GMM estimation

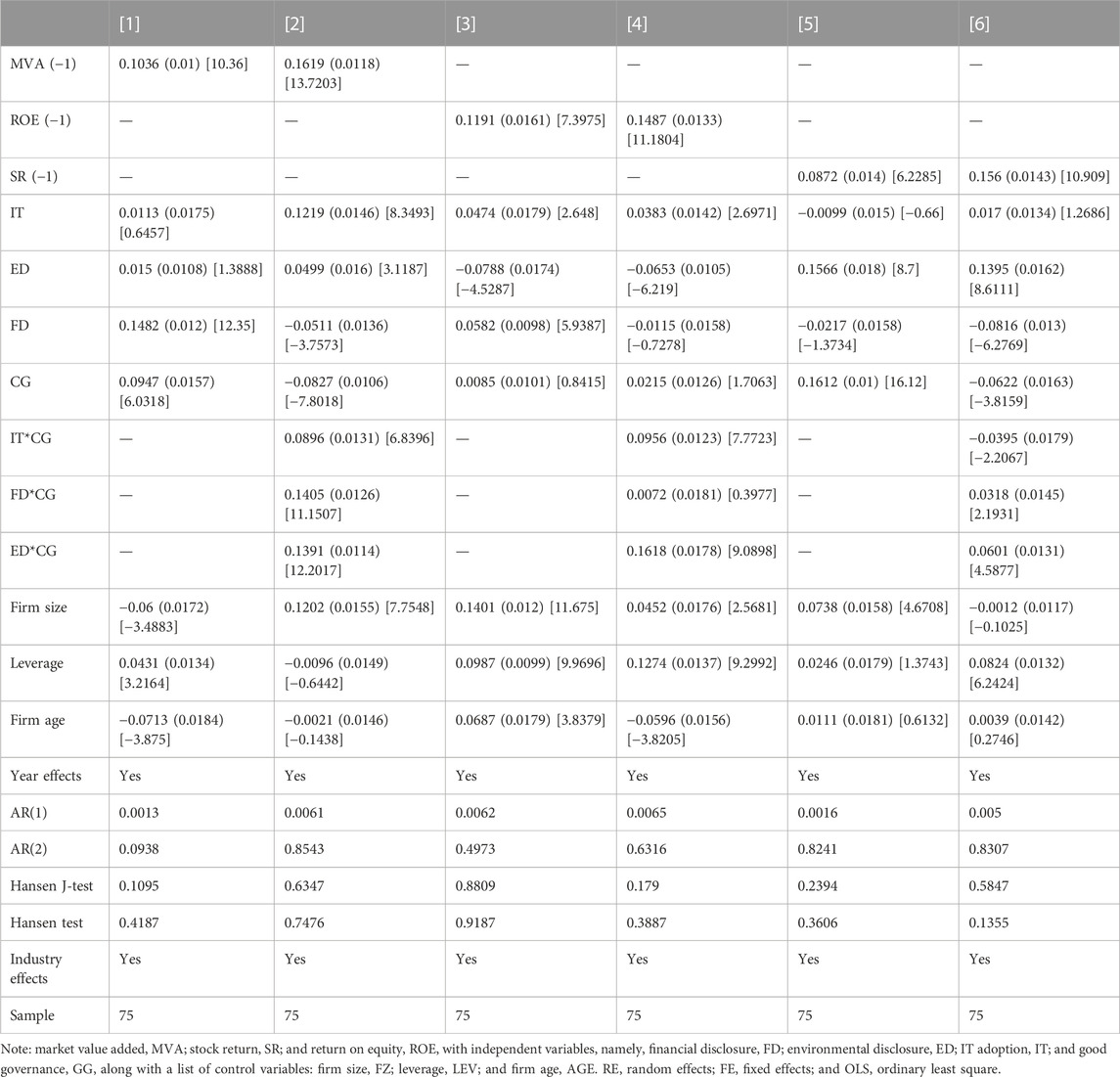

The study extended the empirical assessment by implementing the system-GMM framework with the motivation of robustness assessment. The results of the system-GMM assessment are reported in Table 6. The empirical model output was displayed in columns [1], [3], and [5] without interactive terms, and columns [2], [4], and [6] revealed empirical model output with the interactive term. Referring to the output displayed in columns [1], [3], and [5], the impact of TI adoption, environmental disclosure, the quality of financial disclosure, and corporate governance established a positive and statistically significant connection to financial performance. Furthermore, the interactive term, dealing with the assessment of moderating effects of corporate governance on firms’ performance, according to the coefficient displayed in columns [2], [4], and [6], the positive and significant effects revealed and confirmed the mediating role of corporate governance in the empirical assessment.

6 Discussion

The study documented a positive and statistically significant association between corporate governance and the financial performance of the financial institutions, indicating that operational efficiency and transparency enhance the organization’s reputation and market competitiveness and change the investors’ perception on a positive note, eventually augmenting the performance of the firms’. Our findings align with existing literature (Alves & Mendes, 2004; Kula, 2005; Siagian et al., 2007; Boshnak, 2021; Ahmet et al., 2022). The study by Baek et al. (2004) established that the possibility of a conflict of interest between the principles of the organization and the agents of the organization might be mitigated, eventually resulting in an increase in the value of the business under efficient governance practice and ownership structure. Furthermore, according to Tomar and Bino (2012), the concept of “corporate governance” refers to the act of putting in place the structure, processes, and mechanisms that guarantee the company is being directed and managed in a manner that increases the firm’s potential for long-term shareholder value by holding managers accountable and improving the company’s overall performance. In other words, the interests of managers and shareholders may be brought into harmony via the implementation of such a framework by resolving the all-too-familiar “agency dilemma,” which arises when ownership and management are kept separate.

IT adoption has been positively and statistically significant to the firm’s sustainability, indicating the catalyst role of IT development in thriving financial performance. According to IT adoption elasticity in a firm’s sustainability measures, a study advocated that a 10% technological development progress will result in performance acceleration. Our study findings are in line with existing literature (see, for instance, Horobet et al., 2021; Ghose and Maji, 2022), The information technology revolution has screwed up the conventional method of conducting business in the banking industry by making it possible for banks to break out of their comfort zones and the value creation chain. This has resulted in the old method being rendered obsolete. Because of this, the delivery of customer support may now be divided into several businesses. Therefore, as an example, the vast majority of banks that operate on the internet also offer insurance and securities in addition to banking goods. However, not all the items they distribute are manufactured by their organization (Hernando & Nieto, 2007).

Furthermore, it would seem that information technology opens up previously unimaginable prospects for the banking industry in terms of how they may arrange the creation, distribution, and marketing of financial products over the internet. While it presents the banking industry with new opportunities, it also ushers in a slew of difficult challenges, such as the development of novel IT applications, the erosion of traditional market demarcations, the breaking down of traditional industry barriers, the emergence of new competitors, and the introduction of novel business models (Saatcioglu et al., 2001; Liao & Cheung, 2003). Le and Ngo (2020) provide evidence that the use of cutting-edge technology significantly contributes to improving a company’s financial performance. The fact that the deployment of new software and online banking enhances the management of credit risk (Campanella et al., 2017), decreases the information cost access (Petria et al., 2015), and lowers the operational cost may be an explanation for the beneficial effect (Liberti & Petersen, 2018). The outcomes of this study were just published in the peer-reviewed journal Credit Risk Management (Dong et al., 2020).

According to the elasticity of environmental disclosure and firm performance, the study established a negative tie to stock return, demonstrating that a higher degree of environmental disclosure by firms translates to a lower stock return for enterprises listed in Bangladesh. Our finding is supported by the literature offered in the study of Alsahlawi et al. (2021), Brammer et al. (2006), and Hsu et al. (2017). One possible explanation for the adverse finding is that although environmental, social, and governance (ESG) policies might be value-relevant for investors and other stakeholders, these practices are not properly incorporated into stock returns. A further justification for the conclusion may be found in the argument about the risk factors. According to Mǎnescu (2011), the returns of businesses with low environmental factors are higher, primarily because these returns include a non-sustainability risk premium. It has been hypothesized that environmental, social, and governance factors might represent systemic risk. This is consistent with the increased knowledge of the potential for non-sustainability and the accessibility of information. As a result, the negative link between the environmental disclosure score and stock returns may result from the incentive offered for the risk of non-sustainability. This is a consequence of the fact that the disclosure score takes into account environmental factors. That is to say, companies that have a larger ED show less risk, and as a result, the stock returns will be lower in the event that they are invested in such companies. On the other hand, the study unveiled the positive effects of ED on a firm’s performance which ROA and ROE measures. Our study findings are in line with those of the existing literature (Maji and Kalita, 2022).

7 Practical implication

The presence of effective corporate governance practices accelerated the growth of the firms, implying the active presentation of firms’ strategies along with the way of execution by offering the intended direction of future development. Regardless of the interest of the target group’s connection to the firms, accountability and transparency improve the organizational reputation and accelerate the growth of financial indicators. Furthermore, nowadays, most of the company’s shareholders have shown an interest in being elected to the board of directors to assume responsibility for the organization’s market position concerning its economic standing. As a direct consequence of the failure of several large organizations located worldwide, there has been a resurgence of focus on the performance and behavior of an organization’s board of directors. The board of directors of the company, who are often among the most senior members of management, bears the whole weight of responsibility for the business’s overall strategic direction. Effective corporate governance is analogous to having a very significant foundation, and it plays a part in the success of business ventures entrepreneurs run. Institutional investors favor companies with strong corporate governance structures, such as board independence, audit committees, and CEO duality, according to Baxter (2007). This is because these factors tend to reduce earnings management, which is a positive sign of the quality of financial disclosure. Institutional investors have several objectives, one of which is to ensure the truthfulness and transparency of financial disclosure and their conformity with the norms and standards of financial reporting. These norms and standards may include the International Accounting Standards (IAS).

The widespread use of the internet and the rise of the economy based on information contribute to the ever-increasing challenges we face today. The banking industry, on the other hand, needs to have a solid understanding of the nature of the changes that are occurring in their environment, specifically changes in terms of IT, innovation, and demographics, to properly deal with the challenge that is posed by IT. If one lacks this understanding, it may be impossible to transition into the information technology field successfully. In the modern-day, financial institutions that are well-prepared and have a strong grasp of the phenomenon of electronic banking will be in a better position to make intelligent decisions about how to convert IT and make the most of the potential of electronic banking. Establishing core competencies in today’s highly competitive market may aid the banking sector in rearranging their products and service distribution to their customers. The shift from conventional banking to electronic banking will enable the sector to retain its competitive advantages and reach a state of unity.

8 Conclusion and policy recommendation

The motivation of this study is to assess the role of IT adoption, environmental disclosure, the quality of financial disclosure, and corporate governance on firms’ financial performance, measured by MVA, ROE, and SR. The study considered a pool of 75 financial institutions with 30 representing the bank-based financial institutions and 45 representing the insurance industry. The pertinent data have been extracted from the publically annual report and stock data from Dhaka Stock Exchange for 2000–2019.

According to the empirical assessment, a study documented a positive and statistically significant link between explanatory variables and the measurement of financial performance. Furthermore, the moderating effects of corporate governance have been revealed with a positive indication. The study also implemented the system-GMM estimation in confirming the robustness by ensuring the association derived earlier with the target model.

The following suggestions are posted in future development on the concluding note that the study suggested: first, information asymmetry should be minimized and offer easy access to organizational information because accountability and transparency in the organization immensely guide firms’ reputations and investors’ commitment to the firms. Second, financial institutions in Bangladesh must encourage accepting technological innovation in their operational process to enable their financial services to be easily accessible through operational efficiency. Moreover, IT integration allows firms’ to ensure accountability, and effective corporate governance supports the process of symmetry in information circulation. The eventual effects can be observed in the acceleration of financial performance. Thus, it is suggested that government incentives and policy support be offered in addition to capital investment so that the financial institutions have exploited the market opportunity. Third, protecting investors’ interests is one of the critical factors contributing both positively and negatively. It suggests that investors’ confidence might stabilize with good governance. Therefore, it is postulated that the management of FIs in Bangladesh should approach with positive intent, and governmental role in appropriate composition for management operation, in the long run, can support the firm’s sustainability with persistent performance and investor’s confidence.

The present study has the following limitations, which can be addressed in future research. First, the present study ignored the non-banking financial institutions in empirical assessment; therefore, a future study can be formulated with the inclusion of NBFIs of Bangladesh. Second, a future study can be initiated with the inclusion of diversified measures of financial performance such as net profit and earnings per share (EPS)

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

MQ: Introduction: Methodology: Empirical model estimation; JL: Conceptualization, Discussion; First draft preparation, Final Preparation.

Funding

This study received Research Funding by Institute for Advanced Research Publication Grant of United International University, Ref. No.: IAR-2023-Pub-003.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/fenvs-2023-1002357/full#supplementary-material

References

Abel, A. B., and Blanchard, O. J. (1983). The present value of profits and cyclical movements in investment (0898-2937). pennysylvania: Wharton univerity.

Abeysekera, I., Li, F., and Lu, Y. (2021). Financial disclosure quality and sustainability disclosure quality. A case in China. PLOS ONE 16 (5), e0250884. doi:10.1371/journal.pone.0250884

Adams, C. A. (2002). Internal organisational factors influencing corporate social and ethical reporting. Account. Auditing Account. J. 15 (2), 223–250. doi:10.1108/09513570210418905

Agrawal, A., and Knoeber, C. R. (1996). Firm performance and mechanisms to control agency problems between managers and shareholders. J. Financial Quantitative Analysis 31 (3), 377–397. doi:10.2307/2331397

Ahmed, E. R., Alabdullah, T. T. Y., Thottoli, M. M., and Maryanti, E. (2020). Does corporate governance predict firm profitability? An empirical study in Oman. Int. J. Account. Bus. Soc. 28 (1), 161–177. doi:10.21776/ub.ijabs.2020.28.1.7

Ahmet, Ş., Halil, E. İ., and Burcu, B. (2022). How important is corporate governance features and the lags on audit reports in firm performance: The case of Turkey. Stud. Bus. Econ. 17 (1), 218–237. doi:10.2478/sbe-2022-0015

Akrout, M. M., and Othman, H. B. (2016). Ownership structure and environmental disclosure in mena emerging countries. Corp. Ownersh. Control 13 (4), 381–388. doi:10.22495/cocv13i4c2p9

Al-Homaidi, E. A., Almaqtari, F. A., Ahmad, A., and Tabash, M. (2019). Impact of corporate governance mechanisms on financial performance of hotel companies: Empirical evidence from India. Afr. J. Hosp. Tour. Leis. 8 (2), 1–21. doi:10.1080/23322039.2019.1616521

Al-Mohannadi, M., and Syam, W. (2007). The effect of accounting disclosure at published annual financial reports on stock prices an applied study of industrial shareholding Jordanian companies. Stud. Manag. Sci. 34 (2).

Al-Sartawi, A. M. M. (2018). Online financial disclosure, board characteristics and performance of islamic banks. J. Econ. Coop. Dev. 39 (3), 93–114. doi:10.1002/1099-0925

Alabdullah, T. T. Y., Yahya, S., and Ramayah, T. (2014). Corporate governance mechanisms and Jordanian companies' financial performance. Asian Soc. Sci. 10 (22), 247. doi:10.5539/ass.v10n22p247

Alam, M. S., Alam, M. N., Murshed, M., Mahmood, H., and Alam, R. (2022). Pathways to securing environmentally sustainable economic growth through efficient use of energy: A bootstrapped ARDL analysis. Environ. Sci. Pollut. Res. 29 (33), 50025–50039. doi:10.1007/s11356-022-19410-9

Alam, M. S. (2022). Is trade, energy consumption and economic growth threat to environmental quality in Bahrain–evidence from VECM and ARDL bound test approach. Int. J. Emerg. Serv. 11 (3), 396–408. doi:10.1108/IJES-12-2021-0084

Albertini, E. (2014). A descriptive analysis of environmental disclosure: A longitudinal study of French companies. J. Bus. Ethics 121 (2), 233–254. doi:10.1007/s10551-013-1698-y

Alix Valenti, M., Luce, R., and Mayfield, C. (2011). The effects of firm performance on corporate governance. Manag. Res. Rev. 34 (3), 266–283. doi:10.1108/01409171111116295

Alsahlawi, A. M., Chebbi, K., and Ammer, M. A. (2021). The impact of environmental sustainability disclosure on stock return of Saudi listed firms: The moderating role of financial constraints. Int. J. Financial Stud. 9 (1), 4. doi:10.3390/ijfs9010004

Alves, C., and Mendes, V. (2004). Corporate governance policy and company performance: The Portuguese case. Corp. Gov. An Int. Rev. 12 (3), 290–301. doi:10.1111/j.1467-8683.2004.00370.x

Amelia, D. F., Adam, M., Isnurhadi, I., and Widiyanti, M. (2021). Market performance and corporate governance in banking sector Indonesia stock exchange. Int. J. Bus. Econ. Manag. 4 (1), 1–7. doi:10.31295/ijbem.v4n1.400

Andriamahery, A., and Qamruzzaman, M. (2022a). Do access to finance, technical know-how, and financial literacy offer women empowerment through women’s entrepreneurial development? [Original research]. Front. Psychol. 12, 776844. doi:10.3389/fpsyg.2021.776844

Andriamahery, A., and Qamruzzaman, M. (2022b). A symmetry and asymmetry investigation of the nexus between environmental sustainability, renewable energy, energy innovation, and trade: Evidence from environmental kuznets curve hypothesis in selected MENA countries. Front. Energy Res. 9. doi:10.3389/fenrg.2021.778202

Appiah, K. O., Awunyo-Vitor, D., and Awuah-Nyarko, S. (2017). Corporate governance and financial performance of listed banks: Evidence form emerging market. Int. J. Econ. Account. 8 (1), 29–42. doi:10.1504/ijea.2017.084858

Aqel, A. A., and Ahmad, M. M. (2014). High-fidelity simulation effects on CPR knowledge, skills, acquisition, and retention in nursing students. Worldviews Evidence-Based Nurs. 11 (6), 394–400. doi:10.1111/wvn.12063

Arafat, M. Y., Warokka, A., and Dewi, S. R. (2012). Does environmental performance really matter? A lesson from the debate of environmental disclosure and firm performance. J. Organ. Manag. Stud. 2012 (2012), 15. doi:10.5171/2012.213910

Ararat, M., Aksu, M. H., and Tansel Cetin, A. (2010). The impact of board diversity on boards' monitoring intensity and firm performance: Evidence from the istanbul stock exchange. Available at SSRN 1572283.

Ayesha, S., Zartashia, M., Muneeb, M. A., and Md, Q. (2022). Nepotism effects on job satisfaction and withdrawal behavior: An empirical analysis of social, ethical and economic factors from Pakistan. J. Asian Finance, Econ. Bus. 9 (3), 311–318. doi:10.13106/JAFEB.2022.VOL9.NO3.0311

Azam, M. Q., Hashmi, N. I., Hawaldar, I. T., Alam, M. S., and Baig, M. A. (2022). The COVID-19 pandemic and overconfidence bias: The case of cyclical and defensive sectors. Risks 10 (3), 56. doi:10.3390/risks10030056

Baek, J.-S., Kang, J.-K., and Suh Park, K. (2004). Corporate governance and firm value: Evidence from the Korean financial crisis. J. financial Econ. 71 (2), 265–313. doi:10.1016/S0304-405X(03)00167-3

Balasubramanian, N., Black, B. S., and Khanna, V. (2010). The relation between firm-level corporate governance and market value: A case study of India. Emerg. Mark. Rev. 11 (4), 319–340. doi:10.1016/j.ememar.2010.05.001

Baxter, P. J. (2007). Audit committees and financial reporting quality. University of Southern Queensland.

Beasley, M. S. (1996). An empirical analysis of the relation between the board of director composition and financial statement fraud. Account. Rev. 71 (4), 443–465.

Beccalli, E. (2007). Does IT investment improve bank performance? Evidence from europe. J. Bank. Finance 31 (7), 2205–2230. doi:10.1016/j.jbankfin.2006.10.022

Benadetta Munyiva, K., Ambrose, K., and Robert, O. (2020). Moderating role of firm size on corporate governance and financial performance of microfinance institutions in Kenya. Afr. J. Emerg. Issues 2 (1).

Boshnak, H. A. (2021). Corporate governance mechanisms and firm performance in Saudi Arabia. Int. J. Financial Res. 12 (3), 446. doi:10.5430/ijfr.v12n3p446

Brammer, S., Brooks, C., and Pavelin, S. (2006). Corporate social performance and stock returns: UK evidence from disaggregate measures. Financ. Manag. 35 (3), 97–116. doi:10.1111/j.1755-053X.2006.tb00149.x

Bresnahan, T. F., Brynjolfsson, E., and Hitt, L. M. (2002). Information technology, workplace organization, and the demand for skilled labor: Firm-level evidence. Q. J. Econ. 117 (1), 339–376. doi:10.1162/003355302753399526

Burgwal, D. v. d., and Vieira, R. J. O. (2014). Determinantes da divulgação ambiental em companhias abertas holandesas. Revista Contabilidade Finanças 25, 60–78. doi:10.1590/s1519-70772014000100006

Cahyani Putri, W. (2019). The effect of good corporate governance, firm size and financial leverage on income smoothing and its implication on stock return. Sci. J. Reflect. Econ. Account. Manag. Bus. 2 (1), 91–100. doi:10.37481/sjr.v2i1.54

Campanella, F., Della Peruta, M. R., and Del Giudice, M. (2017). The effects of technological innovation on the banking sector. J. Knowl. Econ. 8 (1), 356–368. doi:10.1007/s13132-015-0326-8

Cohen, W. M., and Levinthal, D. A. (1989). Innovation and learning: The two faces of R & D. Econ. J. 99 (397), 569–596. doi:10.2307/2233763

Cormier, D., Ledoux, M. J., and Magnan, M. (2011). The informational contribution of social and environmental disclosures for investors. Manag. Decis. 49 (8), 1276–1304. doi:10.1108/00251741111163124

Crane, A. D., Michenaud, S., and Weston, J. P. (2016). The effect of institutional ownership on payout policy: Evidence from index thresholds. Rev. Financial Stud. 29 (6), 1377–1408. doi:10.1093/rfs/hhw012

Creţu, R.-F. (2012). Corporate governance and corporate diversification strategies. Rev. Manag. Comp. Internațional 13 (4), 621–633.

Crifo, P., Escrig-Olmedo, E., and Mottis, N. (2019). Corporate governance as a key driver of corporate sustainability in France: The role of board members and investor relations. J. Bus. Ethics 159 (4), 1127–1146. doi:10.1007/s10551-018-3866-6

Dadoukis, A., Fiaschetti, M., and Fusi, G. (2021). IT adoption and bank performance during the Covid-19 pandemic. Econ. Lett. 204, 109904. doi:10.1016/j.econlet.2021.109904

Dai, M., Qamruzzaman, M., and Hamadelneel Adow, A. (2022). An assessment of the impact of natural resource price and global economic policy uncertainty on financial asset performance: Evidence from bitcoin. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.897496

Dalton, D. R., Daily, C. M., Johnson, J. L., and Ellstrand, A. E. (1999). Number of directors and financial performance: A meta-analysis. Acad. Manag. J. 42 (6), 674–686. doi:10.5465/256988

Dechow, P. M., and Dichev, I. D. (2002). The quality of accruals and earnings: The role of accrual estimation errors. Account. Rev. 77, 35–59. doi:10.2308/accr.2002.77.s-1.35

Dewan, S., Shi, C., and Gurbaxani, V. (2007). Investigating the risk–return relationship of information technology investment: Firm-level empirical analysis. Manag. Sci. 53 (12), 1829–1842. doi:10.1287/mnsc.1070.0739

Dey, A. (2008). Corporate governance and agency conflicts. J. Account. Res. 46 (5), 1143–1181. doi:10.1111/j.1475-679X.2008.00301.x

Dong, J., Yin, L., Liu, X., Hu, M., Li, X., and Liu, L. (2020). Impact of internet finance on the performance of commercial banks in China. Int. Rev. Financial Analysis 72, 101579. doi:10.1016/j.irfa.2020.101579

Dony, N., Joseph, C., and James, B. J. (2019). “Corporate governance attributes and firm’s value,” in Ethics and sustainability in accounting and finance. Editor K. T. Çalıyurt (Singapore: Springer), Vol. I, 227–245. doi:10.1007/978-981-13-3203-6_13

Dusuki, A. W., and Bouheraoua, S. (2011). The framework of Maqasid al-Shari'ah and its implication for Islamic finance. ICR J. 2 (2), 316–336. doi:10.52282/icr.v2i2.651

Easterbrook, F. H., and Fischel, D. R. (1984). Mandatory disclosure and the protection of investors. Va. Law Rev. 70 (4), 669–715. doi:10.2307/1073082

Gangi, F., Meles, A., D'Angelo, E., and Daniele, L. M. (2019). Sustainable development and corporate governance in the financial system: Are environmentally friendly banks less risky? Corp. Soc. Responsib. Environ. Manag. 26 (3), 529–547. doi:10.1002/csr.1699

Ganlin, P., Qamruzzaman, M., Mehta, A. M., Naqvi, F. N., and Karim, S. (2021). Innovative finance, technological adaptation and SMEs sustainability: The mediating role of government support during COVID-19 pandemic. Sustainability 13 (16), 9218–9227. doi:10.3390/su13169218

Gao, F., Dong, Y., Ni, C., and Fu, R. (2016). Determinants and economic consequences of non-financial disclosure quality. Eur. Account. Rev. 25 (2), 287–317. doi:10.1080/09638180.2015.1013049

Geroski, P. (1995). “Markets for technology: Knowledge, innovation and appropriability,” in Handbook of the economics innovation and technological change. Editor P. Stoneman (Oxford: Blackwell Publishers).

Ghose, B., and Maji, S. G. (2022). Internet banking intensity and bank profitability: Evidence from emerging Indian economy. Manag. Finance 48, 1607–1626. ahead-of-print(ahead-of-print). doi:10.1108/MF-09-2021-0434

Gjergji, R., Vena, L., Sciascia, S., and Cortesi, A. (2021). The effects of environmental, social and governance disclosure on the cost of capital in small and medium enterprises: The role of family business status. Bus. Strategy Environ. 30 (1), 683–693. doi:10.1002/bse.2647

Gregory, R. P. (2022). The effect of atmospheric greenhouse gases on firm value and firm size distribution. J. Clean. Prod. 358, 131751. doi:10.1016/j.jclepro.2022.131751

Ham, M., Mrčela, D., and Horvat, M. (2016). Insights for measuring environmental awareness. Ekonomski vjesnik Rev. Contemp. Entrepreneursh. Bus. Econ. Issues 29 (1), 159–176.

Han Widiatmika, P., and Sri Darma, G. (2018). Good corporate governance, job motivation, organization culture which impact company financial performance. J. Manaj. Bisnis 15 (3), 82–99. doi:10.38043/jmb.v15i3.608

Handoyo, S. (2018). The development of Indonesia environmental performance and environmental compliance. J. Account. Auditing Bus. 1 (1), 74–80. doi:10.24198/jaab.v1i1.15656

Hernando, I., and Nieto, M. J. (2007). Is the internet delivery channel changing banks’ performance? The case of Spanish banks. J. Bank. Finance 31 (4), 1083–1099. doi:10.1016/j.jbankfin.2006.10.011

Horobet, A., Radulescu, M., Belascu, L., and Dita, S. M. (2021). Determinants of bank profitability in CEE countries: Evidence from GMM panel data estimates. J. Risk Financial Manag. 14 (7), 307. doi:10.3390/jrfm14070307

Horváthová, E. (2010). Does environmental performance affect financial performance? A meta-analysis. Ecol. Econ. 70 (1), 52–59. doi:10.1016/j.ecolecon.2010.04.004

Hsu, H. (2017). “Environmental information disclosure and firm performance,” in Proceeings of the 2017 International Conference on Economics, Finance and Statistics (ICEFS 2017), Hong Kong, January 14-15, 2017.

Hubbard, R. G., and Kashyap, A. K. (1992). Internal net worth and the investment process: An application to U.S. Agriculture. J. Political Econ. 100 (3), 506–534. doi:10.1086/261827

Hussain, S., Ahmad, T., and Hassan, S. (2019). Corporate governance and firm performance using GMM. Int. J. Inf. Bus. Manag. 11 (2), 300–316.

Hussein, A., and Nounou, G. (2021). The impact of internet financial reporting on Egyptian company’s performance. J. Financial Report. Account. 20, 841–865. ahead-of-print(ahead-of-print). doi:10.1108/JFRA-10-2020-0293

Indijanto, H. S., Bambang, P., and Tri, W. (2022). The role of corporate governance and financial condition on stock returns in Indonesia. J. Asian Finance, Econ. Bus. 9 (4), 325–332. doi:10.13106/JAFEB.2022.VOL9.NO4.0325

JinRu, L., and Qamruzzaman, M. (2022). Nexus between environmental innovation, energy efficiency, and environmental sustainability in G7: What is the role of institutional quality? [Original research]. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.860244

Jones, K., and Rubin, P. H. (2001). Effects of harmful environmental events on reputations of firms. Adv. Financial Econ. 6, 161–182. doi:10.1016/S1569-3732(01)06007-8

Jullobol, N., and Sartmool, S. (2015). The effect of firm performance on voluntary disclosure in annual reports: A case study of technology industry in the stock exchange of Thailand. RMUTT Glob. Bus. Econ. Rev. 10 (2).

Kharuddin, S., Ashhari, Z. M., and Nassir, A. M. (2010). Information system and firms' performance: The case of Malaysian small medium enterprises. Int. Bus. Res. 3 (4), 28. doi:10.5539/ibr.v3n4p28

Klassen, R. D., and McLaughlin, C. P. (1996). The impact of environmental management on firm performance. Manag. Sci. 42 (8), 1199–1214. doi:10.1287/mnsc.42.8.1199

Koellinger, P. (2008). The relationship between technology, innovation, and firm performance—empirical evidence from e-business in Europe. Res. Policy 37 (8), 1317–1328. doi:10.1016/j.respol.2008.04.024

Kula, V. (2005). The impact of the roles, structure and process of boards on firm performance: Evidence from Turkey. Corp. Gov. An Int. Rev. 13 (2), 265–276. doi:10.1111/j.1467-8683.2005.00421.x

Lankoski, L. (2000). Determinants of environmental profit: An analysis of the firm-level relationship between environmental performance and economic performance. Finland: Helsinki University of Technology.

Lassala, C., Apetrei, A., and Sapena, J. (2017). Sustainability matter and financial performance of companies. Sustainability 9 (9), 1498. doi:10.3390/su9091498

Le, T. D. Q., and Ngo, T. (2020). The determinants of bank profitability: A cross-country analysis. Cent. Bank. Rev. 20 (2), 65–73. doi:10.1016/j.cbrev.2020.04.001

Le, T. L. V., and Pham, D. K. (2022). “The ICT impact on bank performance: The case of Vietnam,” in Advances in computational intelligence and communication technology. Editors X.-Z. Gao, S. Tiwari, M. C. Trivedi, P. K. Singh, and K. K. Mishra (Berlin, Germany: Springer).

Li, F., Abeysekera, I., and Ma, S. (2014). The effect of financial status on earnings quality of Chinese-listed firms. J. Asia-Pacific Bus. 15 (1), 4–26. doi:10.1080/10599231.2014.872963