94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

POLICY BRIEF article

Front. Environ. Sci., 03 October 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.999145

This article is part of the Research TopicResource Efficiency and Environmental Impact AssessmentView all 21 articles

In recent years, climate change is getting more and more attention all around the world. China is a major participant in global climate governance. Enterprises play an important role in climate change governance, and the development of ESG concept is highly unified with the realization of global climate change governance and the “peaking carbon emission and carbon neutrality” goal in China. However, the development of ESG in China still faces many challenges. Based on the existing literature, data and policy documents, we analyze the current situation and existing problems of ESG development in China. Moreover, we propose ESG development policy recommendations that are suitable for China’s national conditions. Finally, in the context of environmental protection and resource conservation, our study will help enterprises achieve sustainable development.

In recent years, global climate change issue has become increasingly serious. The occurrence of climate change-related phenomena such as extreme weather, ice-sheet melting and sea-level rise have caused huge damage to the ecological environment and brought severe challenges to human society. Countries around the world have attached greater importance to climate change issues and global climate governance has attracted more and more attention. China is an important participant, contributor, and leader in global climate governance. Meanwhile, China was also one of the first signatories of the United Nations Framework Convention on Climate Change, making significant contributions to the Kyoto Protocol and the Paris Agreement and their implementation rules (Hu, 2021).

In the context of global climate change, facing the increasingly severe environmental problems and scarcity of resources, China has pledged to peak carbon emission by 2030 and achieve carbon neutrality by 2060 (The Central People’s Government of the People’s Republic of China, 2020a). In order to achieve this target, Chinese government has proposed a “1 + N” policy framework, including implementation plans and supporting measures for key areas and sectors to reduce their carbon emissions (The Central People’s Government of the People’s Republic of China, 2020b). Furthermore, the Ministry of Ecology and Environment issued the Administrative Measures for Legal Disclosure of Enterprise Environmental Information, which included carbon dioxide emissions in the scope of information disclosure for the first time (The Ministry of Ecology and Environment of the People’s Republic of China, 2021). Environmental, social and corporate governance (ESG) is a necessary way for companies to contribute to the national “peaking carbon emissions and carbon neutrality” target. To build a well-developed ESG policy system and to make ESG become the main standard for investments and productions will also contribute to the improvement of corporate value.

The ESG concept originated in the 1970s (Moskowitz, 1972). And the term ESG was first widely used in 2004 in the “Who Cares Wins” report, which was a joint initiative of financial institutions invited by the United Nations (UN Environment Programme-Finance Initiative, 2004). ESG is the abbreviation of environmental, social and governance. “E” in ESG represents the environmental and resource impacts of corporate activities, including carbon emissions, pollution emissions, and the use of natural resources such as energy and water. “S” focuses on corporate social responsibility (CSR), mainly including employee welfare, supply chain management, product responsibility, and social welfare. “G” means corporate governance, including the composition and power norms of the senior executives, risk management and internal control, investor relations, executive compensation, corruption, and others (Qiu and Yin, 2019). ESG concept is consistent with the United Nations Sustainable Development Goals (SDG). It is an important basis for socially responsible investment, and a wide-accepted criterion for international community to evaluate whether companies are in line with the level of green and sustainable development (China Banking and Insurance News, 2022). ESG directly reflects the modernization of national governance system and governance capacity at the micro and medium level enterprises. And it encourages enterprises and industries to build more scientific and comprehensive development modes.

The development of ESG has been relatively mature in many western countries; but in China, it is still at the beginning stage. Under the background of realizing the ambitious carbon neutrality target, China has a broad development space to establish the ESG concept with Chinese characteristics, but there are also many problems and challenges. Promoting the concept of ESG in China will not only help control the greenhouse gas emissions in different sectors, especially the high-emission sectors, but also effectively enhance the development of carbon market. Furthermore, inclusion of ESG concepts in the financial system and company development strategies will help accelerate the green and low-carbon transformation of industries. Ultimately, efforts from Chinese companies on green and sustainable businesses can contribute to global climate change mitigation.

ESG takes the holistic view that sustainability extends beyond just environmental issues. It is best characterized as a framework that helps stakeholders understand how an organization is managing risks and opportunities related to environmental, social, and governance criteria (Kyle, 2022). The concept of environmental in ESG is very consistent with the concept of environmental protection and resource conservation and the “peaking carbon emission and carbon neutrality” goal in China. Meanwhile, enterprises are not only an important guarantee for China’s economic development, but also environmental pollution and resource consumption. At this stage, China actively promotes enterprises to publish ESG development reports, which helps ensure that the State formulates more precise emission reduction policies according to different industries and regions, and better realizes the sustainable development of Chinese enterprises.

This paper summarizes existing literature, data reports and policy documents related to ESG, and analyze the current situation and problems of ESG development in China. It helps us to grasp the specific situation of China’s ESG practice development comprehensively and accurately. The remainder of this paper is organized as below. Section 2 reviews relative research on ESG. And we analyze the current situation and problems of ESG development in China. Section 3 proposes some policy recommendations on how to promote the development of ESG in China and draws the research conclusions.

Research on ESG started in and is mainly about western countries, while in China such research is limited. Previous research mainly focuses on the impact of ESG on enterprise performance and investment efficiency.

Researchers have not reached a unified conclusion on the relationship between ESG and enterprise performance. On the one hand, many researchers believe that there is a positive correlation between them. Friede et al. (2015) used microdata from 2,200 academics and investors to analyze the relationship between ESG and financial performance. They found that it was a significant positive relationship between ESG and financial performance. Ghoul et al. (2017) studied countries with different development levels of market economy system; they found that there was a significant positive correlation between ESG and enterprises in countries with the imperfect market economy system. For the environment aspect of ESG, Yang and Zhou (2004) found that the environmental performance of enterprises can promote the formulation of effective environmental management plans to control pollution prevention and control and resource use, increase the efficiency of resource use and improve the environmental protection effect. This can improve the competitive advantage of enterprises to a certain extent. For the social aspect of ESG, Li and Xiao (2009) found that enterprises with good social performance can create greater profits to a certain extent. From the corporate governance aspect of ESG, Li et al. (2019) found that companies with good governance have better performance.

On the other hand, some researchers hold the opposite view. Brammer and Pavelin (2006) found a negative relationship between ESG and enterprise performance, which means the higher the enterprise ESG score is, the worse the enterprise performance is. Sassen et al. (2016) use European companies as a case study. They found the improvement of ESG level has a negative impact on enterprise performance.

Researchers also have different views on the relationship between ESG and investment efficiency. Bhandari and Javakhadze (2017) used the ESG score of 15,670 samples in KLD database. They found that there is a positive relationship between ESG performance and investment efficiency from 1992 to 2014. On the contrary, Muslu et al. (2015) believe that the voluntary disclosure of non-financial information of from listed companies can help reduce the risk of bias investors. Healy and Palepu (2001) argued that managers will use disinformation disclosure to get more investment to boost earnings. Shen et al. (2010) found that the more information about environmental indicators disclosure of high polluting listed enterprises, the lower their financing costs to a certain extent.

The research on ESG in China is still in the stage of theoretical accumulation due to the limitation of ESG practices and data availability. It is very important to further promote ESG research and analysis, in order to provide valuable supports for decision making and enterprise strategic planning from a scientific point of view.

The Chinese government attaches great importance to the development of ESG in recent years. Since 2017, the Chinese government has issued a series of policy documents, ranging from voluntary disclosure to mandatory restrictions on disclosure of environmental information. A list of formal policy documents related to ESG in China is included in Supplementary Table S1. In general, Chinese government has proposed increasingly strict regulations on companies’ ESG disclosure in the past 5 years. Policy documents before 2020 all came from the securities regulatory authorities. Since 2020, the Ministry of Ecology and Environment has begun to make substantive requirements for environmental information disclosure of enterprises. This means that the relationship between environmental and natural resource management issues and enterprise production is gradually reflected in government planning. However, China still lacks a complete ESG policy system, and the existing ESG evaluation has not received widespread social attention.

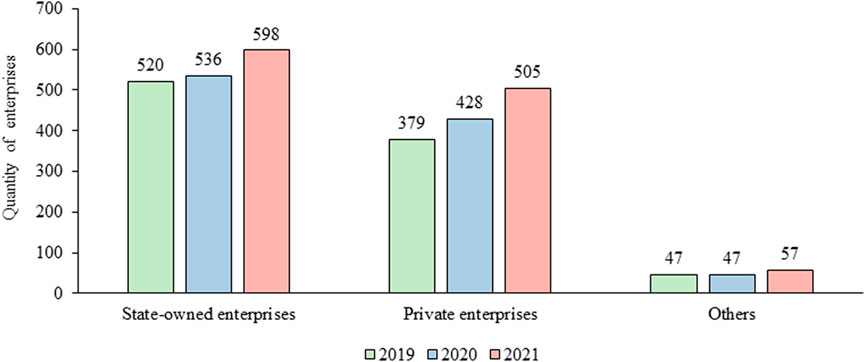

At present, China’s ESG disclosure mainly comes from A-share listed companies, followed by large enterprises, while the number of small and medium-sized companies is very limited. According to the newly published “China ESG Development Report 2021”, the amount of information disclosure varies with the nature of enterprises (Wang, 2022). As shown in Figure 1, the number of A-share listings has grown from 946 in 2019 to 1,130 in 2021. The overall disclosure rate of listed companies slightly increased from 26.22% to 26.92%, respectively. Among the 300 listed companies in CSI 300 Index, in which only large corporates were included, 266 issued CSR reports, accounting for 88.67%, which was much higher than the disclosure rate of small and medium-sized enterprises. However, only 66 Chinese companies provided comprehensive ESG report in 2021, only 1.5% of the total (Breuer et al., 2022; Kays, 2022).

FIGURE 1. The ESG-related reports for 2021 listed companies in 2019–2021 (Wang, 2022).

The equity nature of companies also plays a role in their ESG disclosure. As shown in Figure 2; Table 1, the number of ESG-related reports issued by state-owned companies was much higher than that of other types of companies, and the number of ESG-related reports increased year by year, with a disclosure rate of 48.67% in 2021. Which means nearly half of the state-owned companies have published ESG-related reports. Unlike state-owned companies, only 18.07% of the private companies provided ESG-related reports in 2021. Fortunately, the number of companies disclosing ESG information has grown rapidly by 33.25% from 2019 to 2021, compared to 9.23% and 21.27% for state-owned enterprises and other types of enterprises, respectively.

FIGURE 2. The release of ESG-related reports of A-share listed companies with different equity types in China in 2019–2021 (Wang, 2022).

TABLE 1. The proportion of ESG reports issued by 2021 companies in 2019–2021 (Adopted from Wang, 2022).

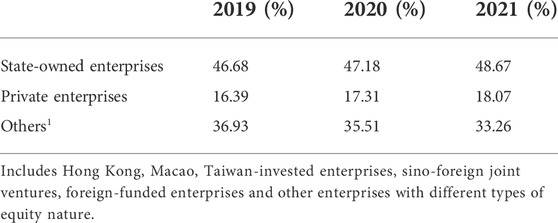

In China, among the three dimensions of ESG, corporate governance dimension is the most frequently disclosed content, and the environmental dimension is reported by fewest companies. As shown in Figure 3, in terms of different corporate disclosures, among the 300 listed large corporates in CSI 300 Index, the disclosure rate for “Director remuneration” is 92%, while the rate for “Anticompetitive conduct” is only 4%.

FIGURE 3. Chinese CSI 300 Index companies ESG-related report common indicators of disclosure rate in 2021 (Wang, 2022).

On average, the disclosure rate of environmental indicators was the lowest (36.33%); the disclosure rate of social indicators was 38.67%, and the disclosure of corporate governance was the highest (47.02%).

Enterprises actively disclose environmental information according to law, which can effectively enhance long-term competitiveness. Fortunately, both the Chinese government and enterprises attach great importance to the disclosure of enterprise environmental information. The level of enterprise environmental information disclosure is rising year by year. Typically, under the constraint of resources and environment, the environmental information disclosure level of the heavy pollution industry increased from 34 points in 2015 to 50 points in 2020 (Li, 2022).

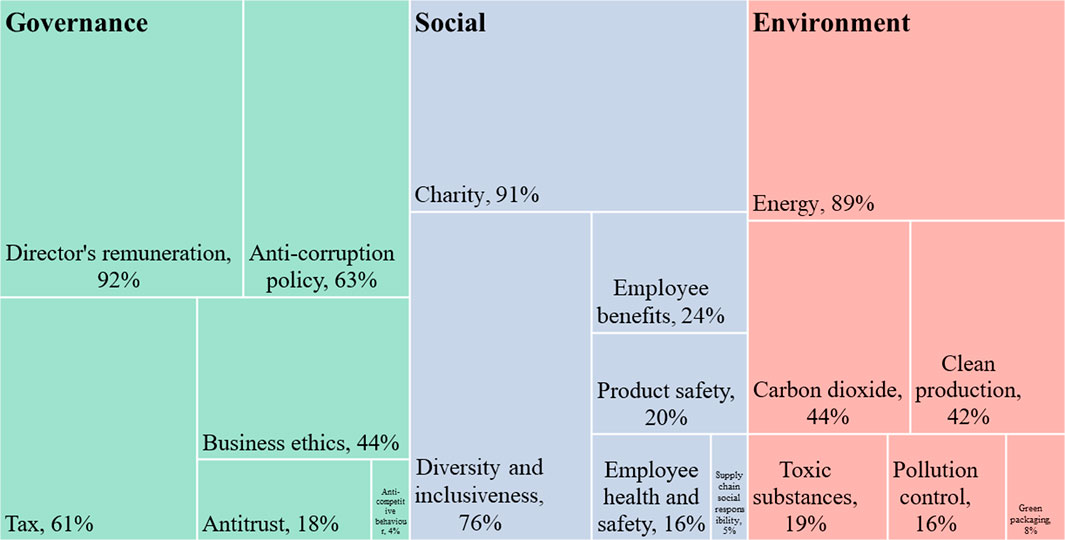

In recent years, China’s ESG disclosure standards are based on the Shanghai and Shenzhen stock exchanges CSR, while the TCFD standard, a measure of climate change, is seldom used. Figure 4 shows the disclosure standards used by listed companies in 2019–2021. These companies used 10 different standards. Especially, TF securities in China specially disclosed the environmental information disclosure report. Its behavior lays a good foundation for enterprises to achieve sustainable development. The most adopted CSR guidelines are issued by the Shanghai Stock Exchange and the Shenzhen Stock Exchange. Several international standards were also used by many companies, such as the GRI standard which ranked third. GRI standard is relatively loose, giving enterprises a greater degree of freedom to disclose.

FIGURE 4. The disclosure standards used for reference by 2021 listed companies in 2019–2021 (Wang, 2022).

Based on the analysis of the quantity, content, and standard of ESG disclosure in China, the following problems are noted. First, ESG disclosure in China is dominated by listed companies and other large enterprises, while small and medium companies’ participation is lacking. Second, China does not have mandatory requirements on the content of ESG disclosure. Many companies will not voluntarily disclose ESG-related information, which creates data availability problem and hinders companies’ ESG performance tracking. Although some enterprises have taken the initiative to disclose ESG reports, most of the reports are mainly descriptive and the quality of ESG reports varies (Wang and Zhang, 2022). Moreover, some indicators measuring corporate sustainability are rarely involved. Last but not the least, China currently lacks nationally agreed ESG disclosure standards. Most of the standards adopted by enterprises are CSR guidelines that emphasize social responsibility. Standards that cover comprehensive ESG topics are not dominantly used, and current standards do not incorporate China’s peak carbon emissions and carbon neutrality goals.

ESG rating has become the mainstream trend of international market development. At present, the most authoritative rating agencies in China are Syo Tao Green Finance, China Alliance of Social Value Investment, Harvest Fund, International Institute for Green Finance, Central University of Finance and Economics, Sino-Securities Index Information Service (Shanghai) Co. Ltd., Rankins CSR Ratings and Asset Management Association of China. The main functions of these rating agencies include standard-setting, disclosure requirements, data collection and rating. The evaluation system of these rating agencies mainly formulated with reference to the standards published by international organizations or stock exchanges. Industry information and data are derived from questionnaires sent to enterprises. Supplementary Table S2 included the introduction and official websites of main ESG ranking agencies in China.

First, the development of ESG rating agencies in China is still in the beginning stage. The social and market acceptance of many rating agencies and their reports is relatively low (Wang and Zhang, 2022). Second, the evaluation process of different rating agencies is not transparent, the indicator setting, and the evaluation method are subjective. Therefore, the evaluation of enterprise ESG level may be biased. Sometimes, different rating agencies give diametrically opposite evaluations to the same company Third, current ESG evaluation system in China is adopted from developed countries, with little consideration of China’s environmental, social and economic characteristics. These problems are caused by multiple reasons. For example, unlike the traditional financial data, ESG data does not have neutrality; the rating subjects and topic coverage vary among different ESG rating methods; the various levels and weight of indicators are subjective. Furthermore, the lack of real-time monitoring, information asymmetry and other external factors also hinder the development of ESG rating in China.

The application of ESG investment strategy in China’s capital market has just started. Many investment institutions are in the theoretic development stage of ESG strategy. In terms of investment willingness, by the end of 2018, a total of 18 institutions in China had joined the United Nations Principle of Responsible Investment (UNPRI), including 13 investment managers and five other institutions. Compared with the United States (414), the United Kingdom (339), and other countries with better financial market system, there are still some gaps. In terms of investment practice, there are only a few of ESG-related funds and other asset management products in China. By the end of 2018, of the total 7,851 public funds, only one fund explicitly invested in ESG stocks, and the net assets of the fund was only 845.8 million yuan. If a broad scope of ESG, including topics such as “sustainable development” and “green”, is considered, the number of related funds is only 10, with the net assets of only 8.359 billion yuan (Ma, 2019). The situation of ESG investment became better after 2018. According to incomplete statistics by the China Finance and Green Gold Institute, by September 2020, there were 114 ESG-related public offering fund products in China’s fund market, and the total assets reached 114.4 billion yuan (Asset Management Association of China, 2020). However, compared to Europe and the United States, China still need more efforts to create better environment for the development of ESG investment.

The main factor restricting ESG is that companies have less ESG information disclosure, and it is difficult to obtain company ESG performance information. Specifically, at this stage, few listed companies in China actively disclose ESG reports, and investors are difficult to obtain sufficient information and data to make a relatively comprehensive ESG assessment of listed companies. Moreover, the ESG evaluation system used in China mainly refers to the mature ESG evaluation system in European and American markets, which usually do not consider China’s characteristics, and the ESG evaluation system in China has not been unified and widely accepted. In this case, different investors often have different opinions on ESG of listed companies, resulting in many contradictions, which is not conducive to the long-term development of ESG in China.

Based on the analysis above, the quality of ESG information disclosure in China at this stage is uneven, and enterprises’ disclosure in the environmental (E) dimension is very few. At present, China lacks an influential evaluation system that conforms to China’s situation and widely accepted by enterprises. ESG-related financial products are limited in number and small in investment scale. Therefore, the following policy recommendations are proposed.

Firstly, the Chinese government should create an environment that is more conducive to the development of ESG. To ensure that companies develop on the direction of the ESG concept, Chinese government should propose more policies and regulations related to the ESG development concept and provide subsidies, tax cuts and other favorable policies for companies with good ESG performance. Furthermore, the government can integrate government agencies with different functions and strengthen organizational cooperation among agencies and institutes to accelerate the development of ESG in China. In addition, the government needs to carry out more publicity, so that companies and investors have a deeper understanding of the concept and the importance of ESG.

Secondly, it is crucial to establish a comprehensive ESG information disclosure system. ESG information disclosure is the basis of ESG rating. The Chinese government should speed up the formulation of unified ESG information disclosure standards. Also, it is necessary to make reasonable use of the compulsory function of government in China to encourage companies to formulate development plans that consist with the ESG concept and strictly supervise the effective and truthful disclosure of company ESG information. Moreover, the government can also enhance the development of third-party ESG organizations, which provides professional supportive service to companies to help them improve ESG governance system and information disclosure quality.

Finally, an ESG evaluation system based on China’s reality should be built. On the basis of fully considering the actual situations of China, relevant government agencies should cooperate with private institutions to build a comprehensive government-enterprise ESG evaluation and management framework with unified ESG evaluation criteria. The government should encourage the development of domestic ESG rating agencies and carry out ESG pilot projects in high carbon emission industries (China Securities Journal, 2022). Furthermore, it is necessary to construct China’s ESG rating database. To improve the ESG rating accuracy, the database should also include in-time updates and adjustments according to policy changes.

In summary, the relationship between international and domestic ESG evaluation standards is accurately mastered. On the one hand, the definition of the most advanced ESG evaluation standards in the world has been profoundly clarified. On the other hand, in the context of China’s national conditions, an ESG evaluation system that is suitable for China’s development should be constructed. Meanwhile, enterprises, as participants in achieving the “peaking carbon emission and carbon neutrality” goal, have fully played their important role.

The study has certain theoretical and practical significance for the development of ESG in China. Theoretically, the study comprehensively analyzes the current situation and existing problems of China’s ESG disclosure, rating and investments. It can enrich the relevant research scope of ESG to a certain extent. In practice, for enterprises, it helps them pay more attention to the latest ESG related information and adjust the development direction of enterprises in time. Therefore, it can help improve the value and competitiveness of enterprises. By analyzing the current situation and existing problems of China’s ESG, we are able to provide the Chinese government with a favorable guarantee that ESG will be optimized and improved. This will lay a good foundation for constructing the system framework of an ESG with Chinese characteristics.

Under the background of environmental protection and resource conservation, ESG is the direction of improving the quality and efficiency of corporate activities based on their core competitiveness. It can also lead companies to become important contributors to China’s “peaking carbon emissions and carbon neutrality” target. The Chinese government should create an environment that is friendly to ESG development, establish a comprehensive ESG information disclosure system, and build a government-enterprise ESG management framework which is suitable for China’s specific situations. These actions can promote the development of ESG for Chinese companies, help China to form a friendly pattern of resource conservation and environmental protection, and contribute to the global green, low-carbon and sustainable development.

BJ: Formal analysis, Writing—review and editing, Data curation, Writing—original draft. XS: Formal analysis, Writing—review and editing, Data curation, Writing—original draft, Visualization. YM: Formal analysis, Writing—review and editing, Visualization.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.999145/full#supplementary-material

Asset Management Association of China (2020). The origin, development and driving factors of ESG investment concept. Available at: https://www.amac.org.cn/businessservices_2025/ywfw_esg/esgyj/yjxsjg/202011/P020201106643543589201.pdf.

Bhandari, A., and Javakhadze, D. (2017). Corporate social responsibility and capital allocation efficiency. J. Corp. Finance 43, 354–377. doi:10.1016/j.jcorpfin.2017.01.012

Brammer, S., and Pavelin, S. (2006). Voluntary environmental disclosures by large UK companies. J. Bus. Finan. Acc. 33 (7-8), 1168–1188. doi:10.1111/j.1468-5957.2006.00598.x

Breuer, M., Hombach, K., and Müller, M. A. (2022). When you talk, I remain silent: Spillover effects of peers' mandatory disclosures on firms' voluntary disclosures. Acc. Rev. 97 (4), 155–186. doi:10.2308/TAR-2019-0433

China Banking and Insurance News (2022). The goal of ESG: Sustainable development. Available at: http://www.cbimc.cn/content/2022-02/08/content_456573.html.

China Securities Journal (2022). Ministry of Ecology and Environment of the People's Republic of China: to create a conducive policy environment for ESG development. Available at: https://www.cs.com.cn/xwzx/hg/202206/t20220629_6280703.html (Accessed July 10, 2022).

Friede, G., Busch, T., and Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Finance Invest. 5 (4), 210–233. doi:10.1080/20430795.2015.1118917

Ghoul, S. E., Guedhami, O., and Kim, Y. (2017). Country-level institutions, firm value, and the role of corporate social responsibility initiatives. J. Int. Bus. Stud. 48 (3), 360–385. doi:10.1057/jibs.2016.4

Healy, P. M., and Palepu, K. G. (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. J. Account. Econ. 31 (1-3), 405–440. doi:10.1016/S0165-4101(01)00018-0

Hu, A., Chen, H., Liang, J., Liu, C., Li, F., and Mu, C. (2021). Cell-based therapeutics for the treatment of hematologic diseases inside the bone marrow. J. Control. Release 21 (03), 1–13. doi:10.1016/j.jconrel.2021.09.018

Kays, A. (2022). Voluntary disclosure responses to mandated disclosure: Evidence from Australian corporate tax transparency. Acc. Rev. 97 (4), 317–344. doi:10.2308/TAR-2018-0262

Kyle, P. (2022). What is ESG (environmental, social, and governance)? Available at: https://corporatefinanceinstitute.com/resources/knowledge/other/esg-environmental-social-governance/(Accessed August 17, 2022).

Li, W., Hao, C., Cui, G., Zheng, M., and Meng, Q. (2019). Forty years of corporate governance research: A review and agenda. Foreign Econ. manage. 41 (12), 161–185. doi:10.16538/j.cnki.fem.2019.12.008

Li, W., and Xiao, H. (2009). CSR research based on the perspective from better allocation of social resources—criticizing neoclassical economics' views on CSR. China Ind. Econ. 4, 116–126. doi:10.19581/j.cnki.ciejournal.2009.04.012

Li, Z. (2022). Why is it significant for enterprises to disclose environmental information? Environ. Econ. 2022 (06), 22–23.

Ma, X. (2019). The development trend of ESG investment in China. Res. Gen. Virtual Econ. 10 (02), 33–38.

Muslu, V., Radhakrishnan, S., Subramanyam, K. R., and Lim, D. (2015). Forward-looking MD & A disclosures and the information environment. Manage. Sci. 61 (5), 931–948. doi:10.1287/mnsc.2014.1921

Qiu, M., and Yin, H. (2019). An analysis of enterprises' financing cost with ESG performance under the background of ecological civilization construction. J. Quant. Tech. Econ. 36 (03), 108–123. doi:10.13653/j.cnki.jqte.2019.03.007

Sassen, R., Hinze, A. K., and Hardeck, I. (2016). Impact of ESG factors on firm risk in Europe. J. Bus. Econ. 86 (8), 867–904. doi:10.1007/s11573-016-0819-3

Shen, H., You, J., and Liu, J. (2010). On the environmental inspection for refinancing, environmental disclosure and the cost of equity capital. J. Financ. Res. 12, 159–172.

The Central People’s Government of the People’s Republic of China (2020a). Xi jinping proposed an important speech at general debate of the 75th united Nations general assembly. Available at: http://www.gov.cn/xinwen/2020-09/22/content_5546168.htm.

The Central People’s Government of the People’s Republic of China (2020b). Xi jinping: China will put in place a “1+N” policy framework for carbon peak and carbon neutrality. Available at: http://www.gov.cn/xinwen/2021-10/12/content_5642050.htm (Accessed July 11, 2022).

The Ministry of Ecology and Environment of the People’s Republic of China (2021). Administrative measures for legal disclosure of enterprise environmental information. Available at: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk02/202112/t20211221_964837.html.

UN Environment Programme – Finance Initiative (2004). Who Cares wins-the global compact connecting financial markets to a changing world. Available at: https://www.ifc.org/wps/wcm/connect/topics_ext_content/ifc_external_corporate_site/sustainability-at-ifc/publications/(Accessed July 10, 2022).

Wang, D. (2022). China ESG development report 2021. Beijing: Economic & Management Publishing House.

Wang, K., and Zhang, Z. (2022). The status quo, comparison and prospect of ESG rating at home and abroad. Financ. Acc. Mon. 02, 137–143. doi:10.19641/j.cnki.42-1290/f.2022.02.019

Keywords: environmental, social and corporate governance, carbon neutrality, peak carbon emission, climate change, enterprise

Citation: Ju B, Shi X and Mei Y (2022) The current state and prospects of China’s environmental, social, and governance policies. Front. Environ. Sci. 10:999145. doi: 10.3389/fenvs.2022.999145

Received: 20 July 2022; Accepted: 16 September 2022;

Published: 03 October 2022.

Edited by:

Yin Long, The University of Tokyo, JapanCopyright © 2022 Ju, Shi and Mei. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiaonan Shi, c2hpeGlhb25hbkBpZ2EuYWMuY24=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.