- 1Institute of Industrial Economics, Jiangxi University of Finance and Economics, Nanchang, China

- 2Department of Economics, Jinan University, Guangzhou, China

Examining the factors that influence rural households’ wealth facilitates enhancing poor households’ happiness, improving their overall welfare, and narrowing the wealth gap between different households. Thus, this study analyzed data from the China Family Panel Survey (CFPS) using multiple linear regression and propensity score matching methods to examine the impact of natural disasters on rural household wealth. Our findings showed that natural disasters have a significant negative impact on rural household wealth, with a medium-to long-term effect. Additionally, the heterogeneity analysis indicated that natural disasters have a greater effect on the wealth of larger households and households with high-consumption levels. Mechanism results suggest that natural disasters affect rural household wealth by reducing household income and harming individual’s physical and mental health.

1 Introduction

Natural disasters, such as hurricanes, earthquakes, droughts, mudslides, and floods, not only worsen the living conditions of a region’s inhabitants, but also result in huge expenses for the government, businesses, and individual residents, directly or indirectly reducing the local population’s wealth growth rate. Economic inequality includes both income and wealth inequality. In most countries, current wealth inequality is much higher than income inequality, averaging more than 0.6 and the share of wealth held by minorities continues to expand (Yang and Gan, 2020). The Credit Suisse Global Wealth Report 2021 stated that the global wealth gap has continued its sharp rise, with the richest 1% owning nearly half (45%) of the wealth. Data from the Wind database showed Chinese residents’ 2021 per capita disposable income to be 35,128 RMB, slightly above the global average. Nearly 900 million people in China (approximately 60% of the country’s total population) belong to the lower-middle-income group. Among them, the proportion of rural residents in the low- and middle-income groups is over 90%. Eliminating the wealth gap and narrowing the gap between the low- and high-income groups is a key point. Examining the determinants of rural households’ wealth levels and exploring the focus points for wealth growth of the middle- and low-income groups facilitate improving farmers’ welfare and narrowing the wealth gaps between income groups, which could enhance the happiness of low-income families and improve the overall welfare of society.

With its vast territory and diverse terrain, China is more seriously affected by natural disasters than other regions. The Ministry of Emergency Management of China reported that, in 2021, natural disasters in China affected 107 million people, damaged or directly caused the collapse of 2,143,100 houses, affected up to 11,739 thousand hectares of crops, and caused direct economic losses of up to 334.02 billion yuan.1 It is clear that natural disasters in China cover a wide area, are devastating, and inflict serious losses that significantly impact the economic behavior of the country’s residents. In China’s rural areas, most residents still largely depend on crops for their economic resources. Thus, the impact of natural disasters on the wealth of rural Chinese house-holds is particularly profound.

Given that natural hazards affect residents’ work and lives in different ways, many studies have examined the impact of natural disasters on individual and household economic behavior. Existing research found that natural disasters affect individuals’ well-being (Rehdanz et al., 2015), investor sentiment (Hirshleifer and Shumway, 2003; Kamstra et al., 2003; Kaplanski and Levy, 2010), migration (Saldaña-Zorrilla and Sandberg, 2009; Warner and Afifi, 2014; Cattaneo and Peri, 2016; Pajaron and Vasquez, 2020), risk preferences (Bourdeau-Brien and Kryzanowski, 2020), mental health (Shultz, 2014; Graham et al., 2019; Zhang et al., 2022), and children’s development (Rabassa et al., 2012; Deuchert and Felfe, 2015). Furthermore, studies have examined the impact of natural disasters on household income inequality (Yamamura, 2015; Abdullah et al., 2016; Keerthiratne and Tol, 2017), household savings (Filipski et al., 2019), household debt (Gallagher and Hartley, 2017), household consumption (Arndt et al., 2004; Wahdat, et al., 2021), and other household behaviors. Natural disasters cause direct or indirect economic losses to households. Therefore, several studies have investigated the impact of natural disasters on household income (Bayudan-Dacuycuy and Lim, 2013; Bui et al., 2014; Arouri et al., 2015). Arouri et al. (2015) found that natural disasters can dampen household income growth. However, other studies revealed that natural disasters do not affect the population’s income, which may be because government transfers to the affected areas compensate for the population’s income loss (Tatyana, 2017). Household wealth is a more comprehensive reflection of a household’s economic situation (Pollack, et al., 2007). Therefore, examining the impact of natural disasters on household wealth can provide a more comprehensive understanding of natural disasters’ impact on households’ economic status.

Existing literature that examines natural disasters’ effects on household wealth is relatively scarce. We did not find any studies that examined the effects of natural disasters on household wealth in rural China. Hence, this study examined the effects of natural disasters on rural household wealth based on data from the 2014, 2016, and 2018 CFPS. This study contributes to the existing literature by: 1) enriching knowledge of the factors that influence household wealth and providing empirical evidence that identifies natural disasters’ effects on household financial behavior; 2) examining the heterogeneity of natural disasters’ effects on rural households’ wealth for different size households and different consumption levels, to enhance understanding of natural disasters’ heterogeneous effects on rural households’ wealth; 3) clarifying the mechanism through which natural disasters affect rural households’ wealth by reducing residents’ income and health status, which provides policy insights for the government to mitigate rural households’ wealth loss caused by natural disasters, and thereby enhance social welfare.

2 Theoretical analysis and research hypotheses

Natural disasters are characterized by suddenness, urgency, clustering, and concomitance. Therefore, natural disasters, while negatively affecting families in the area, also cause serious damage to the local infrastructure, resulting in the regional economy’s collapse and even social disruption. Therefore, natural disasters usually bring unpredictable negative exogenous shocks to individuals or households, affecting normal life and the macroeconomy’s stable operation. Previous studies found that natural disasters cause casualties and significant physical damage (Toya and Skidmore, 2007), and affect foreign direct investment (Neise et al., 2022) and government debt (Borensztein et al., 2009; Lis and Nickel, 2010; Melecky and Raddatz, 2015; Klomp, 2017).

Many studies also found that natural disasters significantly negatively impact economic development (Cavallo et al., 2013; Abbas Khan et al., 2019; Qureshi et al., 2019; Deng et al., 2022), making it difficult for individuals to maintain normal economic activities in a poor external environment, thereby indirectly affecting household wealth accumulation. More importantly, natural disasters also directly affect household wealth. Most farming households rely on agricultural production for income; however, natural disasters may destroy crops and cause significant losses to farming households (Huigen and Jens, 2006; Huang, et al., 2022). Additionally, natural disasters may destroy houses and the means of production (Jia et al., 2018), causing direct wealth losses to households. Natural disasters also cause panic and price increases, which increases household expenditures. Increased economic losses and expenditures, in turn, hinder rural households’ wealth accumulation. Based on these factors, we proposed the following hypothesis.

hypothesis 1. Natural disasters may harm rural household wealth.Natural disasters might impact rural household wealth through harming population health. For example, previous studies have found that natural disasters, such as typhoons, mudslides, and hailstorms, may adversely affect the physical health of individuals, sometimes causing death (Kahn, 2005; Han et al., 2021), and may also negatively affect individuals’ mental health (Graham et al., 2019; Zhang et al., 2022). Residents need to spend time and money to improve ill health. However, the penetration of agricultural mechanization is low in rural China; most areas are planted and harvested through manual labor. When agricultural workers’ health deteriorates, crop cultivation is reduced. Additionally, individuals with disaster related disabilities cannot engage in agricultural production, thus reducing household income. Individuals with deteriorating health conditions may also need to increase their health care expenditures or sell their fixed assets to pay for high medical expenses, thus reducing household wealth. Based on these factors, we proposed the following hypothesis.

Hypothesis 2. Natural disasters may harm population health, and thus affect rural households’ wealth.Natural disasters might impact rural household wealth though their effect on household income. Natural disasters can destroy crops, homes, and arable land, reducing household property income. Natural disasters may also damage irrigation facilities and transportation infrastructure, thus affecting crop yields and crop sales, which indirectly affects household incomes. Additionally, natural disasters may damage farmers’ means of production, which is time-consuming and costly to repair or purchase, affecting the normal agricultural production cycle. Many studies have shown that natural disasters significantly negatively impact the population’s income (Bayudan-Dacuycuy and Lim, 2013; Bui et al., 2014; Arouri et al., 2015), which is an important sources of household wealth accumulation. Decreased household income inevitably affects household wealth accumulation. Given these factors, we proposed the following hypothesis.

Hypothesis 3. Natural disasters may reduce the household income and thus affect rural households’ wealth.

3 Materials and methods

3.1 Data sources

This study used data from the 2014, 2016, and 2018 CFPS, which conducted a detailed study of individuals, households, and communities in 25 provinces/municipalities/autonomous regions in China, including Beijing, Sichuan, Shanghai, Guangdong, and Jiangsu. Its wide sample coverage and scientific sampling method helped to ensure a representative sample by collecting both individual information, such as birthdates, gender, marital status, household registration, and health status, and household information, such as household wealth, consumption, and size. This allowed us to examine the impact of natural disasters on rural residents’ household wealth by excluding data from cities. We also excluded samples with missing values, resulting in a sample comprising 6,144 households and 15,063 individuals.

3.2 Variable definitions and descriptive statistics

3.2.1 Household wealth

The dependent variable was household net wealth. Referring to existing relevant studies (Hurst and Lusardi, 2004; Piketty and Zucman, 2014), we used household net assets to measure household net wealth, including financial assets, such as stocks, bonds, and funds, and non-financial assets, such as real estate and buildings. Our study does not include household appliances, automobiles, IV, washing machine or wealth that is difficult to quantify in numerical terms, and we don’t include the government’s transfer payment (the pension that an individual can receive after retirement) in the future. We summed the total household assets and deducted them from the total household liabilities to determine each household’s net wealth.

3.2.2 Natural disasters

The core explanatory variables in this study were natural disasters. Drawing on existing research (Zhang et al., 2022), we constructed two core explanatory variables based on the 2014 CFPS questionnaire, which asked individuals, “Has your village experienced the following natural disasters in the past four years?” The options included nine types of natural disasters, such as drought, flood, forest fire, hail, typhoon, mudslide, agricultural, and forestry pests and diseases, earthquake, and infectious diseases. Based on these questions, we constructed the first core explanatory variable (Disaster_d), a dummy variable that indicates whether an individual experienced natural disaster. If the individual’s village experienced any kind of natural disaster in the past four years, Disaster_d was coded 1; otherwise, it was coded 0. The second core explanatory variable was natural disaster intensity (Disaster_n), which used the number of natural disasters experienced by the individual’s village as a proxy variable, where a greater number of natural disasters in the past four years indicated a greater natural disaster intensity.

3.2.3 Relevant variable descriptive statistics

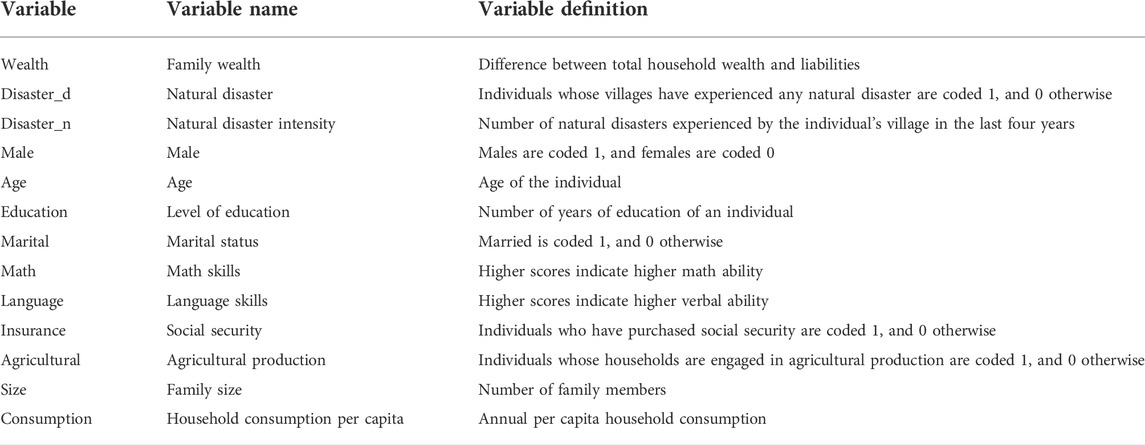

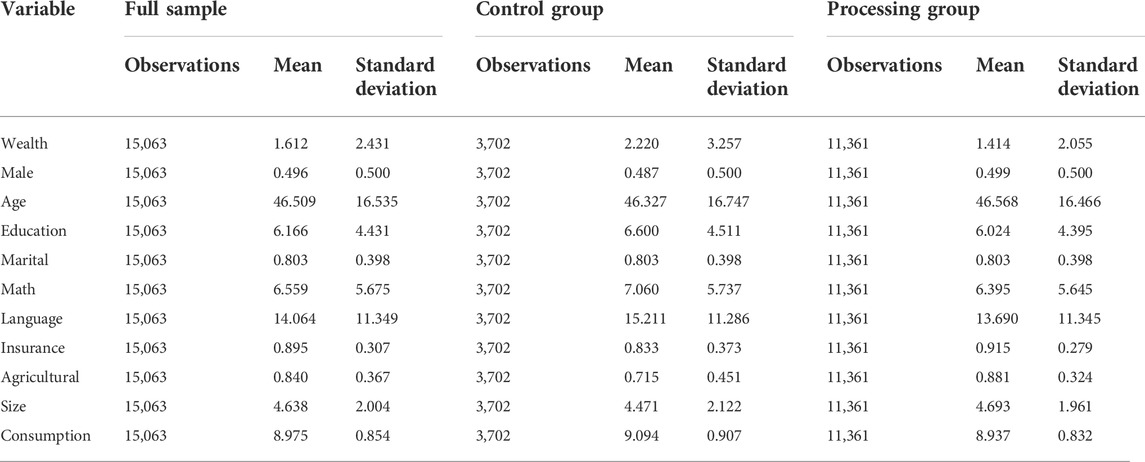

To alleviate the endogeneity problem caused by omitted variables, we controlled for a series of variables. Individual-level control variables included gender, age, education, marital status, cognitive ability, and social security. Household-level control variables included whether a household member was engaged in agricultural production, household size, and household consumption. Considering that households’ annual per capita consumption is relatively large, we used logarithmic processing of household consumption. Table 1 shows the variable definitions.

Descriptive statistics for household wealth, natural disasters, and the control variables are shown in Table 2. Mean household wealth was 16,120 RMB, indicating that rural households have low net wealth. Mean household wealth for the control group was 22,220 RMB, with a mean of 14,140 RMB for households that experienced at least one natural disaster was. Therefore, on average, households that experienced natural disasters had lower levels of wealth accumulation than households that did not. These results suggest that natural disasters may harm rural households’ level of wealth.

3.3 Econometric models

This study used a multiple linear regression model to examine the impact of natural disasters on household wealth.2 The model is as follows.

4 Results

4.1 Regression results

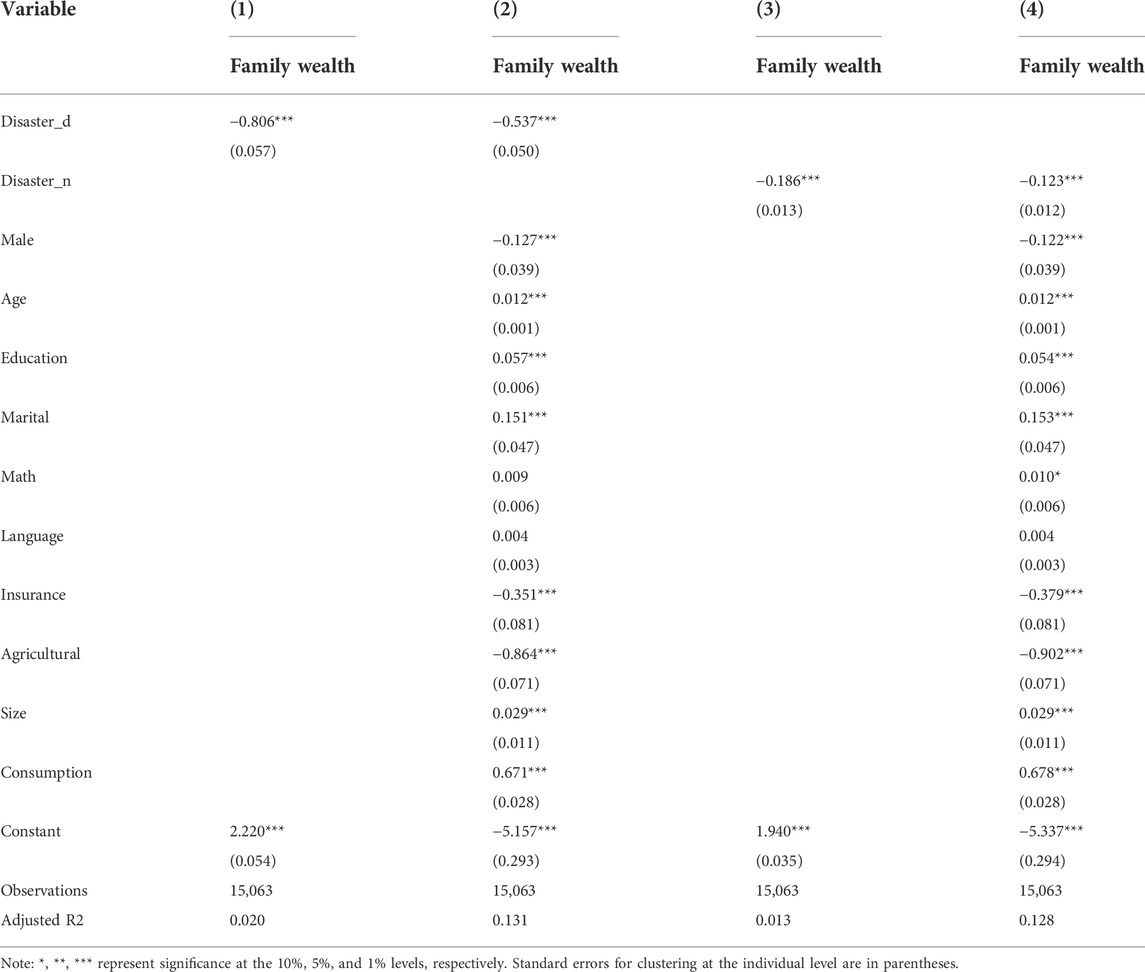

Table 3 reports the estimated impact of natural disasters on household wealth. Columns 1) and 3) show the results without controlling for gender, age, and other control variables; the estimated coefficients of natural disasters’ impact and intensity on household wealth, were −0.806 and −0.186, respectively. Both were negatively significant at the 1% significance level, indicating that natural disasters have a significant negative impact on household wealth. Table 3, columns 2) and 4) include the control variables; the estimated coefficients of natural disaster impact and intensity on household wealth remain negatively significant, further indicating that natural disasters have a significant negative impact on household wealth. The above results are consistent with Hypothesis 1. Analyzing the estimated coefficients for the control variables revealed that agricultural production, social insurance, and gender estimated coefficients were all adversely significant at the 1% level of significance. The estimated coefficients of age, education, marital status, household size, and household consumption on household wealth were also significant, indicating that these factors significantly impact household wealth.

4.2 Robustness tests

4.2.1 Estimation using the propensity score matching method

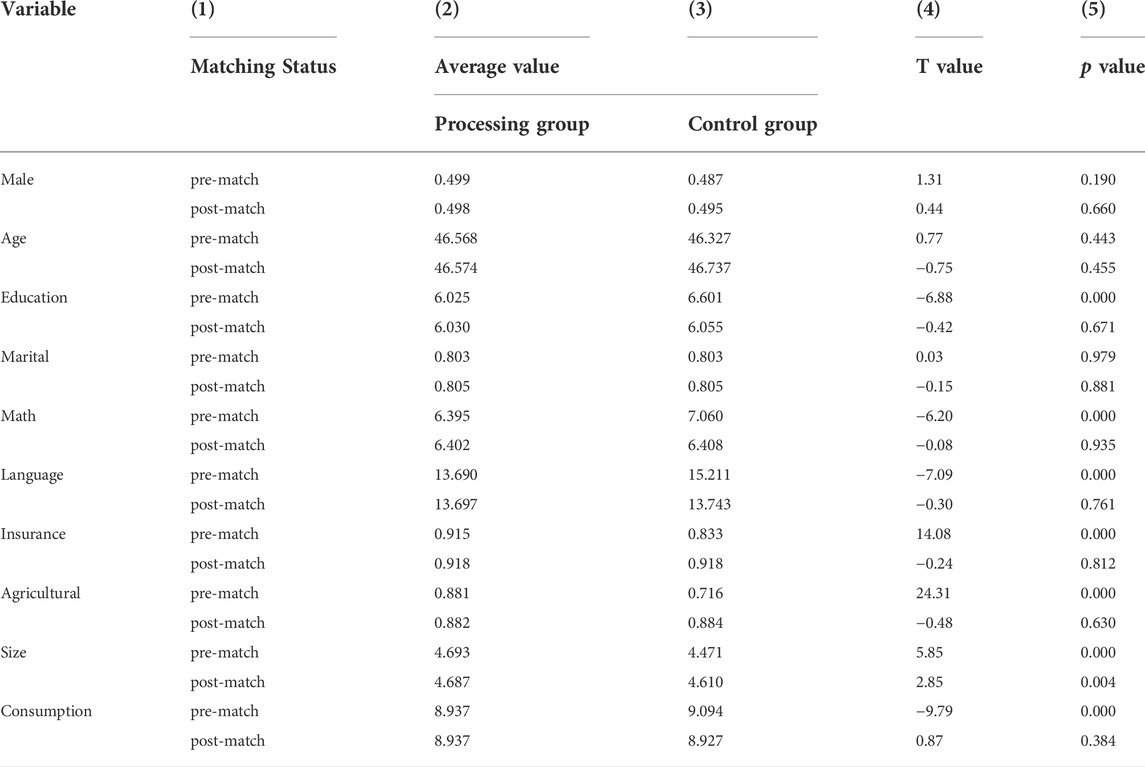

Individuals choose their own place of residence according to the natural environment or the occurrence of historical natural disasters. This may introduce a sample self-selection problem. Referring to existing research (Zhang et al., 2022), we used propensity score matching (PSM) to alleviate this source of bias. Before using PSM, it was necessary to test the common support assumption and whether the balance test was satisfied. The equilibrium test showed no significant differences in individual or household characteristics between the treatment group (individuals affected by natural disasters) and the control group (individuals not affected by natural disasters) after matching. Satisfying the common support assumption implies that the propensity scores of the treatment and control groups are mostly in the same range after matching, ensuring that there is a large enough sample to estimate the impact of natural disasters on household wealth.

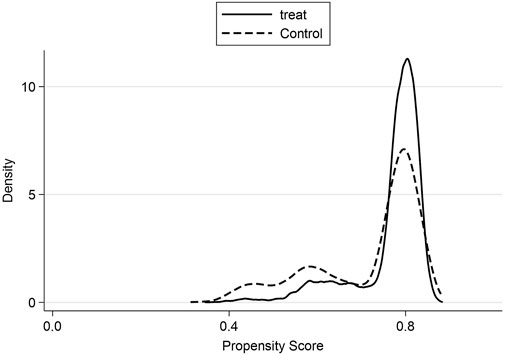

The balance test results in Table 4 show that all control variables except for family size support the original hypothesis of no systematic difference between the control and treatment groups after matching, indicating that the data satisfy the balance test. In addition, the propensity scores’ probability density plots before and after matching (Figures 1,2) showed that 172 samples were lost after matching; the propensity score values of both the treatment and control groups intersected and were in the same range after matching. This illustrates the effectiveness of using propensity score matching.

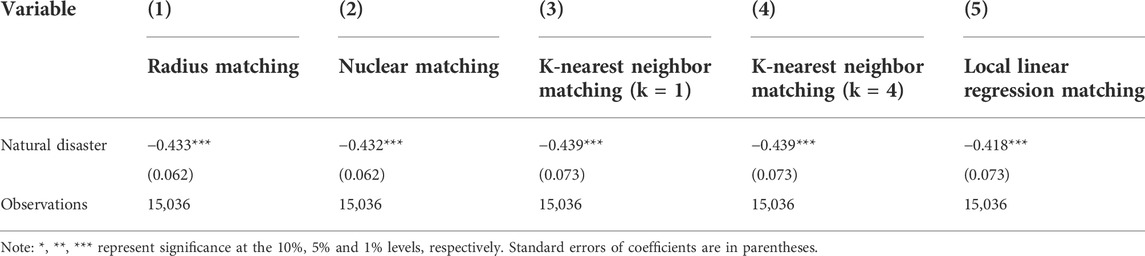

Drawing on existing research (Zhang et al., 2022), we examined the impact of experiencing a natural disaster on household wealth using five different matching methods, including radius matching, kernel matching, K-nearest neighbor matching (K = 1 and K = 4), and spline matching. Table 5 shows the impact of natural disasters on household wealth obtained using the propensity score matching method. Analyzing the natural disaster coefficients shows that regardless of matching method, the estimated coefficients of natural disasters’ impact on rural household wealth were negative and significant, which is consistent with the above estimation results, further indicating that natural disasters have a significant negative impact on rural household wealth.

4.2.2 Substitution of the explanatory variables

In the above model, the dependent variable, family wealth, was continuous. We then established a dummy variable: if family wealth is greater than the average value of the net wealth of all families in the data, the family is considered to have a relatively high level of wealth, and is coded 1; otherwise, it is coded 0. We then used a probit model to examine the impact of natural disasters on household wealth. As shown by the estimation results in Table 6, the estimated coefficients of natural disaster occurrence and intensity on household wealth were negatively significant. In addition, columns 3) and 4) of Table 6 report the marginal effects of the impact of natural disasters on household wealth. Both the natural disaster occurrence and intensity marginal effects on the impact of household wealth were negatively significant. These results further illustrate the robustness of the finding that natural disasters significantly negatively affect rural household wealth.

4.3 Heterogeneity analysis

4.3.1 Heterogeneity in the impact of households at different levels of consumption

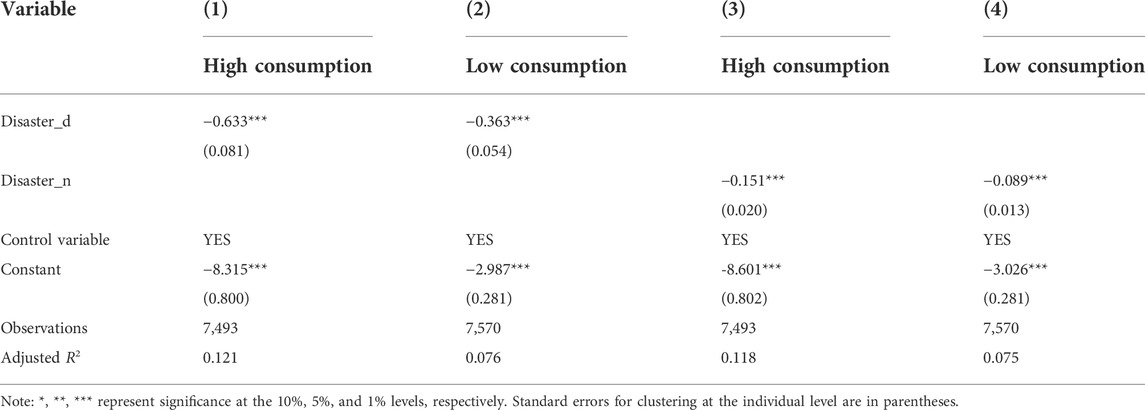

To examine the heterogeneity of natural disasters’ impact on the wealth of households with different consumption levels, we divided the sample into high- and low-consumption households and used a multiple linear regression model to examine the impact of natural disasters on high- and low-consumption households’ wealth. Households were considered high consumption if their consumption level was greater than the mean consumption value of all sample households, and vice versa for low-consumption households. The estimation results in Table 7 show that the effect of natural disasters on the wealth of high- and low-consumption households is negatively significant. This indicates that natural disasters harm the wealth of both low- and high-consumption households. The absolute value of the estimated coefficient of natural disasters’ impact on high-consuming households was greater than that of low-consuming households, indicating a larger impact on high-consuming households.

TABLE 7. Heterogeneity in the impact of natural disasters on households at different levels of consumption.

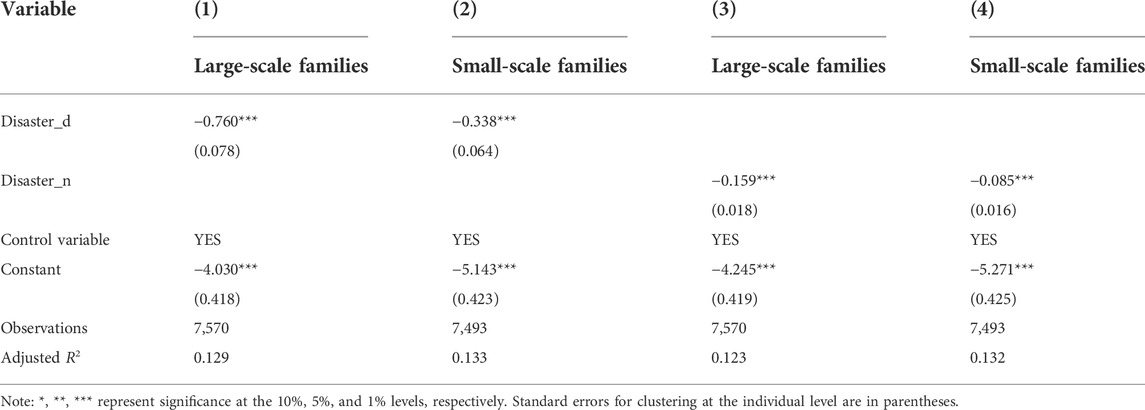

4.3.2 Heterogeneity in the impact of different household sizes

To examine the impact of natural disasters on the wealth of different sized households, we divided the sample into larger and smaller households, where a household was considered large if it was larger than the average of all household sizes, and small if the opposite was true. We then used a multiple linear regression model to examine the impact of natural disasters on the wealth of large- and small-scale households. As shown in Table 8, the estimated effect of natural disasters on both large-scale and small-scale households was negatively significant, indicating that natural disasters have a significant negative effect on both large-scale and small-scale households. Comparing the wealth effects on large-scale and small-scale households showed that the estimated coefficient absolute value of the natural disasters’ impact on large-scale household wealth was greater than that on small-scale households.

4.4 Mechanism of action test

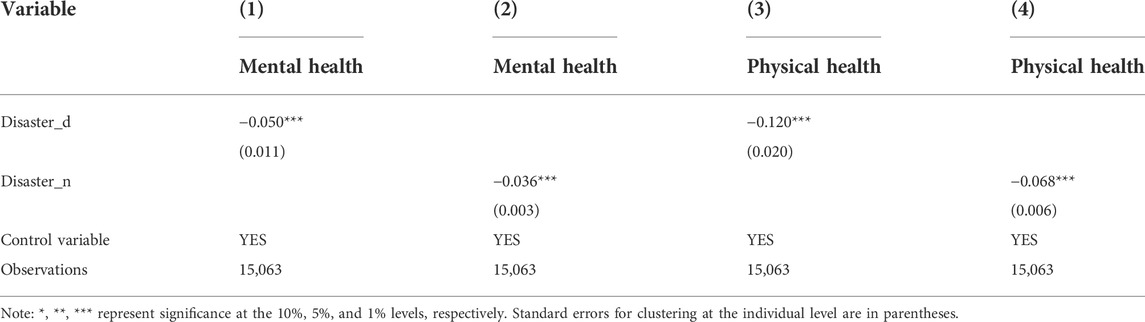

4.4.1 Impact of natural disasters on the physical and mental health of the population

To test Hypothesis 2, we examined natural disasters’ effects on individuals’ physical and mental health. The CFPS asked individuals, “How healthy do you think you are?” with possible responses, 1. Unhealthy, 2. Fair, 3. Relatively healthy, 4. Good healthy, and 5. Excellent healthy. Each response was assigned an integer value from 1 to 5, with higher scores indicating better physical health. Following existing studies (Gu et al., 2020; Zhang et al., 2022), we measured individuals’ mental health based on the 2014 Flow Center Depression Scale (CES-D). The CFPS CES-D scale included six questions about mental health.3 We used factor analysis method measure mental health. The Kaiser–Meyer–Olkin (KMO) test values were greater than 0.8, and Bartlett’s spherical test results all rejected the original hypothesis of no correlation between variables at the 1% significance level. Cronbach’s alpha was 0.856. These results indicate that it is reasonable to use factor analysis to measure individuals’ mental health, where higher scores reflect better mental health.

We used the ordinary least square to investigate the impact of natural disasters on individual mental health. Given the physical health is an ordinal variable, we employed the oprobit model to estimate the impact of natural disasters on population physical health. Results are shown in Table 9. The estimates show that natural disasters’ effects on individuals’ physical and mental health were negatively significant. These results are consistent with Hypothesis 2, indicating that natural disasters can affect household wealth by harming individuals’ physical and mental health.

4.4.2 Impact of natural disasters on individual incomes

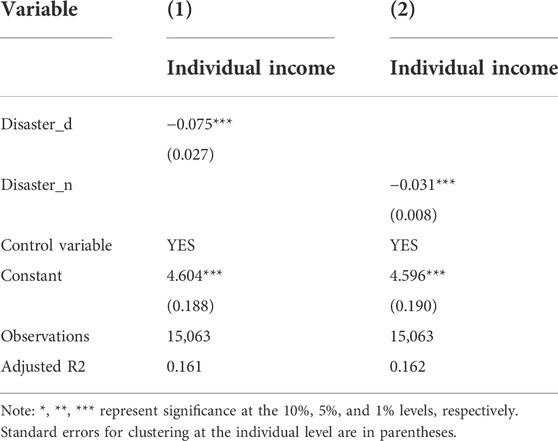

To test Hypothesis 3, we used the ordinary least square to examine the impact of natural disasters on individual annual income. The specific question about the household income is “In the past one year, what was your household’s total income, which include operational income, property income, wage income, and financial support or government subsidies from others.” The estimation results are shown on Table 10. The estimated coefficients of natural disasters’ impact and intensity on individual income were −0.075 and −0.031, respectively, which are negatively significant at the 1% significance level. This indicates that natural disasters have a significant negative impact on residents’ income, which validates Hypothesis 3, and further indicates that natural disasters affect rural household wealth by reducing the population’s income.

4.5 Further analysis

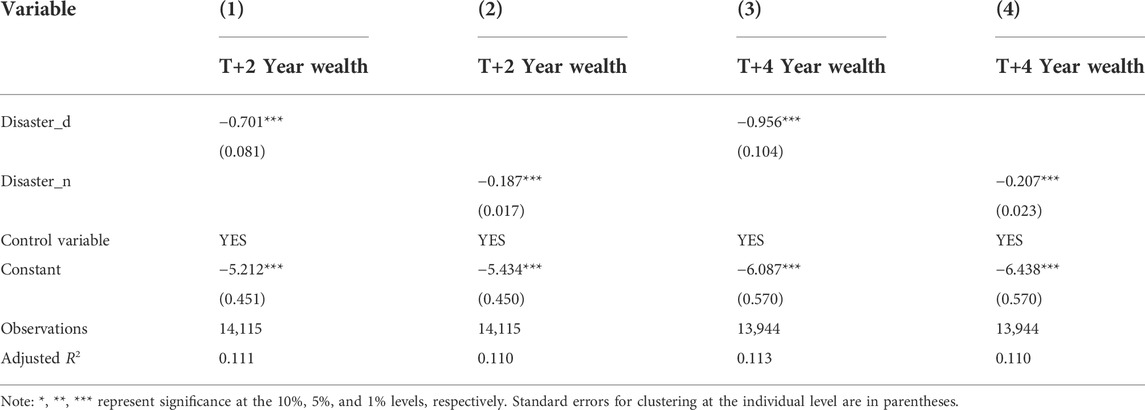

To examine the medium- and long-term impacts of natural disasters on household wealth, we matched the household wealth variables in rural China in 2016 and 2018 with the CFPS in 2014, and used multiple linear regression to examine the medium- and long-term impacts. Table 11 shows that the estimated coefficients of natural disasters’ impact on household wealth levels after two and four years were negatively significant, indicating that natural disasters have both a short-term impact on rural household wealth and a medium-to long-term impact.

5 Discussion

Numerous studies have examined the impact of natural disasters on individual or household income (Bui et al., 2014; Arouri et al., 2015; Park and Wang, 2017). However, studies on the impact of natural disasters on household wealth are rare. Fang et al. (2019) examined the impact of natural disasters on inclusive wealth based on macro data for G20 countries from 1990 to 2010, but the study was conducted from a macro perspective and did not examine the impact of natural disasters on household wealth. However, other studies examined the impact of natural disasters on household wealth. For example, Howell and Elliott (2019) examined the impact of natural disasters on the relative wealth of households (wealth gap) based on Panel Study of Income Dynamics (PSID) data. Unlike these studies, the present study did not explore the causal relationship between natural disaster experience and household relative wealth, but instead focused on the short-term and mid-to long-term effects of natural disasters on household absolute wealth. Our findings suggest that natural disasters have a significant negative impact on household wealth, which is consistent with the findings of Arouri et al. (2015).

Starting from household differences, we examined the heterogeneity of natural disasters on household wealth with different consumption and different family sizes. This is beneficial to understanding the heterogeneous impact of natural disasters on household wealth. The findings show that natural disasters have a greater impact on households with higher levels of consumption. This may be because households with higher consumption levels may have relatively higher asset levels, and may own more productive equipment and fixed assets. In contrast, natural disasters such as typhoons, mudslides, and hailstorms, may damage buildings; therefore, this household group is more vulnerable to natural disasters. In addition, natural disasters may reduce residents’ income, and it is difficult for individuals to change high-consumption habits when their income is reduced. Some households may rely on their pre-disaster savings or the sale of fixed assets to maintain high consumption. Thus, natural disasters affect high-consuming households more than low-consuming households. In addition, the heterogeneity analysis results suggest that natural disasters’ impact on the wealth of larger households is also greater. This may be because larger rural households may expand their acreage and purchase more means of production to revive their livelihoods compared to smaller rural households. However, these households also take greater risks, and when natural disasters occur, they may be more vulnerable to the effects and may suffer more wealth losses. Thus, natural disasters have a greater impact on the wealth of larger households than on smaller ones.

This study theoretically analyzed the role of residents’ income and health status in natural disasters’ effects on household economic status, and conducted a corresponding mechanism test, providing empirical evidence for understanding the mechanism by which natural disasters affect household wealth. The mechanism analysis results suggest that natural disasters may reduce household income and decrease individual physical and mental health. This result is consistent with the findings of Kokai et al. (2004), Udomratn (2008), and Zhang et al. (2022). The mechanism analysis also examined the effect of natural disasters on household income, and showed that natural disasters can significantly negatively affect income, which is consistent with the findings obtained by Arouri et al. (2015) and Pleninger (2022).

Further analysis revealed that natural disasters not only impact household wealth in the short term, but have significant medium-to long-term effects as well. This could be because natural disasters reduce residents’ income and harm their health status. The health status of residents is not necessarily reversible. When individuals’ health status deteriorates, it may be difficult to recover and may even worsen, which inevitably affects their long-term income. It can also increase household medical expenditures, making it difficult for a family to accumulate wealth long after a natural disaster, and resulting in a significant loss of family wealth. Natural disasters can also destroy crops and the means of production on which households depend. Poorer households may lack funds to purchase appropriate agricultural means of production. They may also face credit constraints that prevent borrowing funds, making it difficult to regain their previous production scale, which affects the household’s long-term income. Thus, natural disasters may affect household wealth levels in the near term, and also household wealth accumulation in the medium-to long-term.

This study has limitations. First, in constructing the model, individual and household-level control variables were included as much as possible. However, it was not possible to control for every variable that may affect household wealth. Second, the net household wealth measure is underestimated because some high-wealth net worth households were unwilling to disclose their true household wealth. Future research can improve the models by obtaining the true wealth of high-income households. Third, we examined the relationship between natural disasters and rural households’ absolute wealth, and indirectly analyzed natural disasters’ effects on household wealth inequality. Future research could explore the effect of natural disasters on the relative gap in household wealth to analyze the direct effect of natural disasters on household wealth inequality.

The following policy implications can be drawn from the study findings. First, natural disasters have a significant negative impact on rural households’ wealth. Therefore, it is necessary to focus on providing social security and policy assistance to the affected groups to reduce household wealth loss, help affected farmers accumulate wealth, and reduce the wealth gap between the affected and wealthy groups. Second, it is important to improve natural disaster prevention and response; strengthen monitoring and early warning systems; increase research on the effects of natural disasters, such as catastrophic weather, floods, and earthquakes; and improve the rural infrastructure to substantially reduce household wealth loss. Third, the government should increase its disaster prevention and mitigation efforts to enhance rural households’ ability to cope with natural disasters, which can effectively reduce residents’ wealth loss when natural disasters occur. Fourth, our findings show that natural disasters affect household wealth by reducing residents’ income and harming individual’s health. Therefore, the government should focus on rural households’ physical and mental health, and provide economic support by increasing their income. This will prevent individuals from falling into the poverty trap because of health problems.

6 Conclusion

As the widening wealth gap has become more prominent worldwide, many scholars have examined and analyzed the impact of natural disasters on households’ economic status and welfare. Based on 15,063 observations from the CFPS database, we examined the causal relationship between natural disasters and rural household wealth, leading to our study’s core conclusions: 1) natural disasters have a significant negative effect on rural household wealth, and this effect remains over the long run; 2) natural disasters have a greater negative effect on the wealth of high consumption and larger households; and 3) natural disasters affect rural household wealth by reducing residents’ income and harming individual’s physical and mental health.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

Conceptualization, SW and RZ; methodology, SW, RZ, and DF; software, SW and RZ; validation, SW, RZ, CW, and DF; formal analysis, SW and RZ; investigation, SW, CW, and DF; resources, RZ; data curation, SW and DF; writing—original draft preparation, SW, RZ, CW, and DF; writing—review and editing, SW and CW visualization, RZ and DF; supervision, SW, CW, and RZ; project administration, SW, RZ, and DF. All authors have read and agreed to the published version of the manuscript.

Acknowledgments

We would like to thank Editage (www.editage.cn) for English language editing.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Link to data source: https://www.mem.gov.cn/xw/yjglbgzdt/202201/t20220123_407204.shtml.

2This paper does not examine the impact of natural disasters on household wealth using a panel fixed effects model, as data related to natural disasters are not included for 2016 as well as 2018.

3The six questions were 1) In the last month, how often did you feel emotionally depressed, de-pressed, and unable to do anything to cheer you up? 2) In the last month, how often did you feel nervous? 3) In the last month, how often did you feel restless and had difficulty staying calm? 4) In the last month, how often did you feel that there is no hope for the future? 5) In the last month, how often did you find it difficult to do anything? 6) In the last month, how often did you think life is meaningless?.

References

Abbas Khan, K., Zaman, K., Shoukry, A. M., Sharkawy, A., Gani, S., Sasmoko, , et al. (2019). Natural disasters and economic losses: Controlling external migration, energy and environmental resources, water demand, and financial development for global prosperity. Environ. Sci. Pollut. Res. 26 (14), 14287–14299. doi:10.1007/s11356-019-04755-5

Abdullah, A. N. M., Zander, K. K., Myers, B., Stacey, N., and Garnett, S. T. (2016). A short-term decrease in household income inequality in the Sundarbans, Bangladesh, following Cyclone Aila. Nat. Hazards (Dordr). 83 (2), 1103–1123. doi:10.1007/s11069-016-2358-1

Arndt, J., Solomon, S., Sheldon, K., Kasser, T., and Sheldon, K. M. (2004). The urge to splurge: a terror management account of materialism and consumer behavior. J. Consum. Psychol. 14 (3), 198–212. doi:10.1207/s15327663jcp1403_2

Arouri, M., Nguyen, C., and Youssef, A. B. (2015). Natural disasters, household welfare, and resilience: evidence from rural vietnam. World Dev. 70, 59–77. doi:10.1016/j.worlddev.2014.12.017

Bayudan-Dacuycuy, C., and Lim, J. A. (2013). Family size, household shocks and chronic and transient poverty in the Philippines. J. Asian Econ. 29, 101–112. doi:10.1016/j.asieco.2013.10.001

Borensztein, E., Cavallo, E., and Valenzuela, P. (2009). Debt sustainability under catastrophic risk: The case for government budget insurance. Risk Manag. Insur. Rev. 12 (2), 273–294. doi:10.1111/j.1540-6296.2009.01168.x

Bourdeau-Brien, M., and Kryzanowski, L. (2020). Natural disasters and risk aversion. J. Econ. Behav. Organ. 177, 818–835. doi:10.1016/j.jebo.2020.07.007

Bui, A. T., Dungey, M., Nguyen, C. V., and Pham, T. P. (2014). The impact of natural disasters on household income, expenditure, poverty and inequality: evidence from vietnam. Appl. Econ. 46 (15), 1751–1766. doi:10.1080/00036846.2014.884706

Cattaneo, C., and Peri, G. (2016). The migration response to increasing temperatures. J. Dev. Econ. 122, 127–146. doi:10.1016/j.jdeveco.2016.05.004

Cavallo, E., Galiani, S., Noy, I., and Pantano, J. (2013). Catastrophic natural disasters and economic growth. Rev. Econ. Stat. 95 (5), 1549–1561. doi:10.1162/REST_a_00413

Deng, X., Wang, G., Yan, H., Zheng, J., and Li, X. (2022). Spatial–temporal pattern and influencing factors of drought impacts on agriculture in China. Front. Environ. Sci. 10, 820615. doi:10.3389/fenvs.2022.820615

Deuchert, E., and Felfe, C. (2015). The tempest: short- and long-term consequences of a natural disaster for children's development. Eur. Econ. Rev. 80, 280–294. doi:10.1016/j.euroecorev.2015.09.004

Fang, J., Lau, C. K. M., Lu, Z., Wu, W., and Zhu, L. (2019). Natural disasters, climate change, and their impact on inclusive wealth in G20 countries. Environ. Sci. Pollut. Res. 26 (2), 1455–1463. doi:10.1007/s11356-018-3634-2

Filipski, M. J., Jin, L., Zhang, X., and Chen, K. Z. (2019). Living like there's no tomorrow: The psychological effects of an earthquake on savings and spending behavior. Eur. Econ. Rev. 116, 107–128. doi:10.1016/j.euroecorev.2019.04.004

Gallagher, J., and Hartley, D. (2017). Household finance after a natural disaster: the case of hurricane katrina. Am. Econ. J. Econ. Policy 9 (3), 199–228. doi:10.1257/pol.20140273

Graham, H., White, P., Cotton, J., and Mcmanus, S. (2019). Flood- and weather-damaged homes and mental health: an analysis using england's mental health survey. Int. J. Environ. Res. Public Health 16 (18), 3256. doi:10.3390/ijerph16183256

Gu, H., Yan, W., Elahi, E., and Cao, Y. (2020). Air pollution risks human mental health: an implication of two-stages least squares estimation of interaction effects. Environ. Sci. Pollut. Res. 27 (2), 2036–2043. doi:10.1007/s11356-019-06612-x

Han, Y., Wei, J., and Zhao, Y. (2021). Long-term effects of housing damage on survivors' health in rural China: Evidence from a survey 10 Years after the 2008 Wenchuan earthquake. Soc. Sci. Med. 270, 113641. doi:10.1016/j.socscimed.2020.113641

Hirshleifer, D., and Shumway, T. (2003). Good day sunshine: Stock returns and the weather. J. Finance 58 (3), 1009–1032. doi:10.1111/1540-6261.00556

Howell, J., and Elliott, J. R. (2019). Damages done: the longitudinal impacts of natural hazards on wealth inequality in the United States. Soc. Probl. 66 (3), 448–467. doi:10.1093/socpro/spy016

Huang, D., Chen, Y., Chen, P., and Zheng, Q. (2022). The protein losses of three major cereal crops by natural disasters in China from 1988 to 2020. Front. Environ. Sci. 10, 884754. doi:10.3389/fenvs.2022.884754

Huigen, M. G. A., and Jens, I. C. (2006). Socio-economic impact of super typhoon harurot in san mariano, isabela, the Philippines. World Dev. 34 (12), 2116–2136. doi:10.1016/j.worlddev.2006.03.006

Hurst, E., and Lusardi, A. (2004). Liquidity constraints, household wealth, and entrepreneurship. SSRN J. 112 (2), 319–347. doi:10.2139/ssrn.414780

Jia, H., Chen, F., Pan, D., and Zhang, C. (2018). The impact of earthquake on poverty: Learning from the 12 may 2008 wenchuan earthquake. Sustainability 10 (12), 4704–4715. doi:10.3390/su10124704

Kahn, M. E. (2005). The death toll from natural disasters: the role of income, geography, and institutions. SSRN J. 87 (2), 271–284. doi:10.2139/ssrn.391741

Kamstra, M. J., Kramer, L. A., and Levi, M. (2003). Winter blues: A SAD stock market cycle. Am. Econ. Rev. 93 (1), 324–343. doi:10.1257/000282803321455322

Kaplanski, G., and Levy, H. (2010). Sentiment and stock prices: The case of aviation disasters. J. Financ. econ. 95 (2), 174–201. doi:10.1016/j.jfineco.2009.10.002

Keerthiratne, S., and Tol, R. (2017). Impact of natural disasters on income inequality in Sri Lanka. World Dev. 105, 217–230. doi:10.1016/j.worlddev.2018.01.001

Klomp, J. (2017). Flooded with debt. J. Int. Money Finance 73, 93–103. doi:10.1016/j.jimonfin.2017.01.006

Kokai, M., Fujii, S., Shinfuku, N., and Edwards, G. (2004). Natural disaster and mental health in Asia. Psychiatry Clin. Neurosci. 58 (2), 110–116. doi:10.1111/j.1440-1819.2003.01203.x

Lis, E. M., and Nickel, C. (2010). The impact of extreme weather events on budget balances. Int. Tax. Public Finance 17 (4), 378–399. doi:10.1007/s10797-010-9144-x

Melecky, M., and Raddatz, C. (2015). Fiscal responses after catastrophes and the enabling role of financial development. World Bank. Econ. Rev. 29 (1), 129–149. doi:10.1093/wber/lht041

Neise, T., Sohns, F., Breul, M., Revilla, D., and Javierc, C. (2022). The effect of natural disasters on FDI attraction: a sector-based analysis over time and space. Nat. Hazards (Dordr). 110 (2), 999–1023. doi:10.1007/s11069-021-04976-3

Pajaron, M. C., and Vasquez, G. N. A. (2020). Weathering the storm: weather shocks and international labor migration from the Philippines. J. Popul. Econ. 33 (4), 1419–1461. doi:10.1007/s00148-020-00779-1

Park, A., and Wang, S. (2017). Benefiting from disaster? Public and private responses to the wenchuan earthquake. World Dev. 94, 38–50. doi:10.1016/j.worlddev.2016.12.038

Piketty, T., and Zucman, G. (2014). Capital is back: Wealth-income ratios in rich countries 1700-2010. Q. J. Econ. 129 (3), 1255–1310. doi:10.1093/qje/qju018

Pleninger, R. (2022). Impact of natural disasters on the income distribution. World Dev. 157, 105936. doi:10.1016/j.worlddev.2022.105936

Pollack, C. E., Chideya, S., Cubbin, C., Williams, B., Dekker, M., and Braveman, P. (2007). Should health studies measure wealth?: A systematic review. Am. J. Prev. Med. 33 (3), 250–264. doi:10.1016/j.amepre.2007.04.033

Qureshi, M. I., Yusoff, R. M., Hishan, S. S., Alam, A. F., Zaman, K., and Rasli, A. M. (2019). Natural disasters and Malaysian economic growth: policy reforms for disasters management. Environ. Sci. Pollut. Res. 26 (15), 15496–15509. doi:10.1007/s11356-019-04866-z

Rabassa, M., Skoufias, E., and Jacoby, H. G. (2012). Weather and child health in rural Nigeria. J. Afr. Econ. 23 (4), 464–492. doi:10.1093/jae/eju005

Rehdanz, K., Welsch, H., Narita, D., and Okubo, T. (2015). Well-being effects of a major natural disaster: the case of fukushima. J. Econ. Behav. Organ. 116 (8), 500–517. doi:10.1016/j.jebo.2015.05.014

Saldaña-Zorrilla, S. O., and Sandberg, K. (2009). Spatial econometric model of natural disaster impacts on human migration in vulnerable regions of Mexico. Disasters 33 (4), 591–607. doi:10.1111/j.1467-7717.2008.01089.x

Shultz, J. M. (2014). Perspectives on disaster public health and disaster behavioral health integration. Disaster Health 2 (2), 69–74. doi:10.4161/dish.24861

Tatyana, D. (2017). The fiscal cost of hurricanes: Disaster aid versus social insurance. Am. Econ. J. Econ. Policy 9 (3), 168–198. doi:10.1257/pol.20140296

Toya, H., and Skidmore, M. (2007). Economic development and the impacts of natural disasters. Econ. Lett. 94 (1), 20–25. doi:10.1016/j.econlet.2006.06.020

Udomratn, P. (2008). Mental health and the psychosocial consequences of natural disasters in Asia. Int. Rev. Psychiatry 20 (5), 441–444. doi:10.1080/09540260802397487

Wahdat, A. Z., Gunderson, M. A., and Lusk, J. L. (2021). Farm producers' household consumption and individual risk behavior after natural disasters. Agric. Resour. Econ. Rev. 50 (1), 127–149. doi:10.1017/age.2021.2

Warner, K., and Afifi, T. (2014). Where the rain falls: Evidence from 8 countries on how vulnerable households use migration to manage the risk of rainfall variability and food insecurity. Clim. Dev. 6 (1), 1–17. doi:10.1080/17565529.2013.835707

Yamamura, E. (2015). The impact of natural disasters on income inequality: Analysis using panel data during the period 1970 to 2004. Int. Econ. J. 29 (3), 359–374. doi:10.1080/10168737.2015.1020323

Yang, X., and Gan, L. (2020). Bequest motive, household portfolio choice, and wealth inequality in urban China. China Econ. Rev. 60, 101399. doi:10.1016/j.chieco.2019.101399

Keywords: natural disasters, household wealth, income, physical health, mental health

Citation: Wu S, Zhang R, Wang C and Feng D (2022) The impact of natural disasters on rural household wealth: Micro evidence from China. Front. Environ. Sci. 10:993722. doi: 10.3389/fenvs.2022.993722

Received: 14 July 2022; Accepted: 29 August 2022;

Published: 14 September 2022.

Edited by:

Rupakumar Kolli, Indian Institute of Tropical Meteorology, IndiaReviewed by:

Tao Ding, Northeast Electric Power University, ChinaRui Cheng, Anhui University of Finance and Economics, China

Copyright © 2022 Wu, Zhang, Wang and Feng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Rui Zhang, bmp1ZXRpbW9AMTYzLmNvbQ==

Shaoyong Wu

Shaoyong Wu Rui Zhang

Rui Zhang Chuncao Wang1

Chuncao Wang1 Dawei Feng

Dawei Feng