- 1School of Business Administration, Guizhou University of Finance and Economics, Guiyang, China

- 2National Tax Institute of STA, Yangzhou, China

- 3Business School, Jiangsu Normal University, Xuzhou, China

Under the emissions trading policy, two typical carbon allowance allocation rules of grandfathering and benchmarking are widely adopted in the present carbon markets. Based on the mathematical modeling method, this paper explores which allocation rule is more viable for manufacturers’ low-carbon activities including abatement investment and remanufacturing activities. Meanwhile, the effects on total profit, total carbon emissions, consumer surplus, and social welfare are discussed through numerical analysis. The results show that benchmarking is more viable for abatement investment activities of manufacturers than grandfathering. Additionally, benchmarking is always more viable for remanufacturing activities of manufacturers only in a situation with a higher consumer low-carbon preference. Otherwise, which allocation rule is more beneficial for remanufacturing activities mainly depends on the abatement cost coefficient. Correspondingly, the higher the consumer low-carbon preference or the lower the abatement cost, the more viable the benchmarking is to achieve each performance target (e.g., total profit, emissions control, consumer surplus, and social welfare). Based on these findings, this paper also recommends managerial insights for manufacturers and policy implications for policy-makers.

1 Introduction

The outbreak of coronavirus disease 2019 (COVID-19) has induced a certain effect on the environment. Climate warming will be an even more rigorous issue and also widely concerning since the total greenhouse gas emissions (especially carbon dioxide) may exceed the level before the event considering the resumption of large-scale industrial production (Wang and Su, 2020). This calls for a cautious and opportune response from the global community to improve this situation (Li et al., 2022). Consequently, many countries have promulgated several carbon emission policies, such as mandatory carbon emission capacity, emission trading, carbon tax, and low-carbon offset (Song and Leng, 2012; Zhang et al., 2021). Among them, the emissions trading policy is more efficient in emission control and is widely adopted and implemented (Luo et al., 2016; Qiu et al., 2017; Huang et al., 2022). Under the emissions trading policy, enterprises could obtain initial carbon allowances from the government with or without payment and purchase or sell carbon credits in the carbon markets if necessary (Toptal et al., 2014; Xu et al., 2017).

As a vital foundation for designing the emissions trading policy, carbon allowances are mainly allocated free of charge to reduce resistance of enterprises and ensure easy implementation at the initial stage (Liao et al., 2015; Chang et al., 2017). For instance, at least 90% of carbon allowances are allocated free of charge in Shenzhen’s emissions trading system (Yang W.et al., 2020). So far, there are two typical free allocation rules of grandfathering and benchmarking in the present carbon markets. Under grandfathering, the amount of free carbon allowances is fixed and determined by the historical carbon emissions of enterprises in the base year. Under benchmarking, the free allocated carbon allowances are associated with the industry benchmark emission intensity and total output (Neuhoff et al., 2006; Zetterberg, 2014; Ji et al., 2017). Concretely, the industry benchmark emission intensity is determined by the government at the beginning of the compliance period, and total carbon allowances are equal to the benchmark emission intensity times the enterprise’s total output by the end of the current period (Yang W.et al., 2020). As we all know, the largest carbon market in the world—EU Emissions Trading System (EU-ETS)—and China’s pilot carbon markets mainly adopt grandfathering and benchmarking. It is also one of the main motivations to carry out research focusing on these two allocation rules in this paper.

The manufacturing industry, as an essential part of society, is the main emitter of carbon dioxide. Rapid growth in manufacturing has drawn more attention to improving environmental quality (Farouq et al., 2021). Thus, in response to the emissions trading policy, low-carbon technology investments have been incorporated into operational planning by manufacturers (Yang W.et al., 2020). Some studies have shown that environmental quality can be effectively improved through technological changes (Huang et al., 2019; Yang L.et al., 2021). In practice, some manufacturers (e.g., Gree and Haier) have continuously developed and introduced abatement technologies, which undoubtedly makes significant contributions to the low-carbon upgrade of the industry and society (Meng et al., 2021). In 2021, Gree officially launched the photovoltaic (storage) direct-current air conditioning system, and it is estimated that this technology can reduce the carbon emissions of air conditioners by 85.7%. Moreover, as one of the effective ways to restore the value of waste products, remanufacturing is regarded as an essential means to achieve energy saving and carbon abatement. Large global manufacturers such as BMW, IBM, and Kodak are involved in remanufacturing activities and obtain considerable economic and environmental benefits (Ilgin and Gupta, 2011; Li et al., 2013). The emissions trading policy is believed to benefit low-carbon activities of manufacturers (Wang et al., 2017; Yang et al., 2018), but the performance of the different allocation rules is still unclear.

Previous studies on carbon allowance allocation rules mainly concentrated on the macro-level and single low-carbon activity. However, in reality, the macro-emission target must eventually be decomposed to the manufacturer’s micro-operation level. For instance, in 2019, the “Regulation (EU) 2019/631 of the European Parliament and of the Council” issued by the European Union set CO2 emission performance standards for new passenger cars and new light commercial vehicles, which indicates that automakers are given clear abatement targets. Moreover, manufacturers may simultaneously carry out several low-carbon operation activities to better achieve specific emission reduction targets. Taking Gree as an example, in addition to technological investments, it has also built some green recycling and remanufacturing bases and is committed to transforming production modes. Furthermore, manufacturers are more active in fulfilling social responsibilities, rather than focusing only on their own interests. The “2019 China Corporate Social Responsibility 500 Excellent Evaluation Report” shows that the manufacturing industry accounts for 41.25% of the shortlisted enterprises. Therefore, this paper considers a monopolistic manufacturer whose low-carbon activities include abatement investments and remanufacturing. Based on the emissions trading policy with two different carbon allowance allocation rules, some research questions will be answered in this paper: 1) how does the emissions trading policy affect manufacturers’ abatement investments and remanufacturing integration decisions? 2) Which allocation rule (e.g., grandfathering and benchmarking) will better induce low-carbon activities (e.g., abatement investment and/or remanufacturing decisions) and achieve specific performance targets (e.g. total profit, total carbon emissions, consumer surplus, and social welfare)? 3) How do different situations (e.g., a higher/lower abatement cost and consumer low-carbon preference) affect the performance of each allocation rule?

To address these issues, this paper develops two nonlinear mathematical models under the emissions trading policy and explores the effects of two typical free allocation rules of grandfathering and benchmarking on abatement investment and manufacturing/remanufacturing decisions. Through theoretical analysis, which allocation rule is more viable for the manufacturer’s low-carbon activities is mainly discussed. Meanwhile, based on multiple performance targets (e.g., total profit, total carbon emissions, consumer surplus, and social welfare), this paper explores the policy-maker’s selection strategy of allocation rules and the effects of some crucial parameters (e.g., consumer sensitivity coefficient and abatement cost coefficient) on the results. Some managerial insights and policy implications are expected to be provided for low-carbon activities of manufacturers and policy design of policy-makers, respectively.

The remainder of this paper is organized as follows. Section 2reviews some relevant literature. Section 3 presents materials and research methods, including problem description and assumption statement, and mathematical model construction and analysis. Section 4 elaborates the comparative analysis of several performance targets under different allocation rules through numerical analysis. Finally, Section 5provides conclusions and future research.

2 Literature review

The relevant literature can be divided into the following two main streams: 1) the literature exploring the effect of carbon emission policies on production decisions with remanufacturing and/or abatement investment decisions and 2) the literature on different free carbon allowance allocation rules under the emissions trading policy.

In the first stream of the literature, several carbon emission policies are involved, such as mandatory carbon emission capacity and carbon tax (Liu et al., 2015; Dou et al., 2019; Shuang et al., 2019; Hu et al., 2020). Moreover, a large part of the literature is devoted to studying the effect of the emissions trading policy on remanufacturing decisions. For instance, Chai et al. (2018) identified several conditions that would benefit manufacturers with remanufacturing activities under the emissions trading policy. Yang L. et al. (2020) explored the impact of the emissions trading policy on the remanufacturing decision, total profit, and total carbon emissions under different recycling channels. Paying attention to the effect on recycling modes, Yang C. et al. (2021) found that the emissions trading policy can always reduce carbon emissions. Considering the uncertainty of the quality of recycled products, Zhao et al. (2021) studied the remanufacturing decision under the emissions trading policy and stated that manufacturers with dynamic carbon emissions have higher profits and fewer carbon emissions than those with fixed carbon emissions. Bai et al. (2022) further explored the effect of the emissions trading policy on remanufacturing activities and total carbon emissions with limited demand distribution information.

A few scholars recently studied the comprehensive issue of remanufacturing and abatement investment decisions under different carbon emission policies. Among them, substantial literature focuses on the impact of the carbon tax policy. For instance, considering monopolistic and competitive scenarios, Ding et al. (2020) investigated remanufacturing and emission reduction decisions under the carbon tax and take-back legislation. Alegoz et al. (2021) concentrated on pure and hybrid manufacturing/remanufacturing systems and carried out a comparative analysis of production and abatement decisions under a carbon tax policy. Wang and Wang (2021) proposed a differentiated carbon tax regulation across new and remanufactured products and explored the effect on manufacturing/remanufacturing and emission reduction decisions. However, the existing relevant literature is rarely involved in the emissions trading policy. Yuan et al. (2020) studied the pricing and emission reduction decisions of a remanufacturing supply chain system with dual-sale channels under the emissions trading policy.

It can be found that the aforementioned papers involving the emissions trading policy neglect alternative carbon allowance allocation rules. So far, most existing studies analyze the effect or performance of different carbon allowance allocation rules from a macro-perspective, such as Wu and Li (2020), Peng et al. (2021), and Tian et al. (2022), but few papers focus on relevant issues from a micro-perspective. Zhang et al. (2015) carried out a comparative analysis of pricing and emission reduction strategies under different allocation rules of grandfathering, benchmarking, and auction. Chang et al. (2017) mainly studied a two-stage manufacturing/remanufacturing decision issue considering grandfathering and benchmarking. Ji et al. (2017) investigated the effect of different allocation rules on retail and emission reduction decisions, total revenue, and social welfare. Yang L.et al. (2020) constructed a mathematical model to make optimal green technology investment and pricing decisions and analyzed the effect of grandfathering and benchmarking on operational decisions and total carbon emissions. Although the aforementioned papers regarding grandfathering and benchmarking are relevant to our study, very few literature studies addresses remanufacturing activity, and none of them considers the integrated issue of remanufacturing and abatement investment.

To sum up, our main contributions lie in the following three aspects: first, this paper contributes to the abatement investment and remanufacturing integration decisions under the emissions trading policy. Second, from the perspective of enterprise micro-operation, we explore the different effects of grandfathering and benchmarking on the aforementioned integrated emission control decisions, which is to verify which allocation rule is more viable for the manufacturer’s abatement investment and/or remanufacturing decisions. The third contribution is in addressing the policy-maker’s selection strategy of allocation rules based on multiple performance targets (e.g., total profit, total carbon emissions, consumer surplus, and social welfare) and exploring the effect of some crucial parameters (e.g., consumer sensitivity coefficient and abatement cost coefficient) on the results.

3 Materials and research methods

3.1 Problem description and symbol instruction

This study considers a monopolistic manufacturer engaged in the production and sales of both new and remanufactured products in a single period. With the popularity of environmental protection concepts, consumers tend to pay higher prices for low-carbon products. Moreover, as the advocate of low-carbon development, the government guides the manufacturer to carry out low-carbon activities by implementing the emissions trading policy. Free carbon allowances are allocated to the manufacturer by grandfathering or benchmarking. In our model, in addition to remanufacturing, the manufacturer could launch abatement investment activity to control carbon emissions. Thus, the manufacturer needs to jointly determine the abatement investment level and manufacturing/remanufacturing quantities to maximize its profit. For lucidity and simplicity, decision variables and relevant parameters involved in the models are shown in Table 1.

3.2 Assumptions

The following assumptions are provided to help understand our models:

Assumption 1. Consumers are heterogeneous in their willingness-to-pay for new products (σ) and remanufactured products (βσ), where ß represents the consumer preference degree for remanufactured products and 0<β<1. Then, assuming that consumers are willing to pay a higher price for the low-carbon product, the actual utility of purchasing a new product and a remanufactured product for rational consumers is

Assumption 2. Similar to Zhou et al. (2017), Ding et al. (2020), and Wang and Wang (2021), this paper also does not consider other manufacturing and remanufacturing costs in the models, which would help express the core issues. Thus, following Chen et al. (2020) and Chen and Chen (2021), the added values of new and remanufactured products are defined as

Assumption 3. The abatement activity can be regarded as a one-time investment, and the corresponding cost positively correlates with the abatement investment level. Following Qin et al. (2019), Ding et al. (2020), and Wang and Wang (2021), the abatement cost is assumed to be a quadratic function

Assumption 4. Under the emissions trading policy, two typical allocation rules of grandfathering and benchmarking are considered. Under grandfathering, the amount of free carbon allowances is mainly affected by the manufacturer’s historical carbon emissions in the base year and, thus, is unchanged in a single period. However, total carbon allowances under benchmarking vary with the total output of both product types and are equal to the industry benchmark emissions intensity δ times the manufacturer’s total output in the current period. Similar settings can be found in the studies by Ji et al. (2017) and Yang L.et al. (2020). The industry benchmark emission intensity means the government’s emission control requirements for a certain industry. The higher the industry benchmark emission intensity, the lower the emission control requirements.

3.3 Profit maximization mathematical models for the manufacturer

In order to explore the effect of different allocation rules on the manufacturer’s low-carbon activities, this subsection elaborates the construction of a mathematical model of profit maximization from a micro-operation level under two different conditions: the grandfathering allocation rule and the benchmarking allocation rule. Under the grandfathering case, total free carbon allowances for the manufacturer are assumed to be the constant E0 and have no relation to the total output in the current period. However, as mentioned previously, total free carbon allowances under the benchmarking case are dynamic and are equal to the industry benchmark emission intensity δ times the total output in the current period. Furthermore, a comparative analysis is presented to clarify which allocation rule is more variable for remanufacturing and/or abatement investment decisions.

3.3.1 Grandfathering case

Under grandfathering, the manufacturer obtains free carbon allowances on the basis of historical carbon emissions in the base year after carbon verification (Sadegheih, 2011). Then, in addition to the carbon allowances allocated by the policy-maker and bought from carbon markets, the manufacturer could achieve carbon savings through low-carbon activities such as remanufacturing and abatement investments. Thus, according to the aforementioned problem description and assumptions, the manufacturer’s profit function under grandfathering is as follows:

where the first and second terms represent the sales revenue of new and remanufactured products, respectively; the third term represents the cost or benefits from emission trading; and the last term denotes the manufacturer’s total abatement cost.

Lemma 1. For a given τ, the manufacturer’s profit function πm under grandfathering is jointly concave with respect to qn and qr, and optimal manufacturing and remanufacturing quantities can be expressed as

Lemma 2. Under the condition of abatement investment and production integration decisions, the manufacturer’s profit function πm under grandfathering is jointly concave with respect to τ, qn, and qr, and the optimal abatement investment level and manufacturing and remanufacturing quantities can be expressed as follows, where

Proof. See Appendix A.According to lemma 1 and lemma 2, the manufacturer’s abatement investment and production decisions are not affected by the initial carbon allowances but are mainly affected by the carbon price determined by carbon markets. Thus, under grandfathering, the policy-maker cannot promote low-carbon investments and adjust production quantities in a single period by determining the amount of free carbon allowances. Meanwhile, grandfathering is even less effective in controlling the manufacturer’s total carbon emissions, which is consistent with the results of most existing studies.

Proposition 1. Under grandfathering: (1)

Proposition 2. Under grandfathering: (1)

3.3.2 Benchmarking case

Under benchmarking, the manufacturer obtains total free carbon allowances based on the industry benchmark emission intensity and total output after carbon verification (Yang L.et al., 2020). To maximize the profit, the manufacturer needs to determine the abatement investment level and manufacturing/remanufacturing quantities in a single period. Therefore, according to the aforementioned problem description and assumptions, the manufacturer’s profit function under benchmarking is as follows:

where δ(qn + qr) represents total free carbon allowances obtained by the manufacturer under benchmarking.

Lemma 3. For a given τ, the manufacturer’s profit function πm under benchmarking is jointly concave with respect to qn and qr, and optimal manufacturing and remanufacturing quantities can be expressed as

Lemma 4. Under the condition of abatement investment and production integration decisions, the manufacturer’s profit function πm under benchmarking is jointly concave with respect to τ, qn, and qr, and the optimal abatement investment level and manufacturing and remanufacturing quantities can be expressed as follows, where

Proof. See Appendix A.According to lemma 3 and lemma 4, the manufacturer’s abatement investment and production decisions under benchmarking are affected by the industry emission benchmark coefficient and carbon price. Thus, under benchmarking, the policy-maker can promote the abatement investment level and adjust production quantities in a single period by determining the industry emission benchmark coefficient. Consequently, benchmarking can achieve a controlling effect on the manufacturer’s total carbon emissions.

Proposition 3. Under the benchmarking: (1)

3.3.3 Comparative analysis

First,

Corollary 1. For a given τ, there always exist (1)

Corollary 2. Under the condition of abatement investment and production integration decisions, there always exists

Corollary 3. Under the condition of abatement investment and production integration decisions, there always exist (1)

Corollary 4. Under the condition of abatement investment and production integration decisions, there always exist:

(1)

(2)

4 Numerical analysis and discussion

This section further explores the effect on different performance targets, such as total profit, total carbon emissions, consumer surplus, and social welfare, through numerical analysis. First, 0<β<1, which indicates that consumers have a lower willingness-to-pay for remanufactured products, so we considered β = 0.65. To reflect carbon savings of active remanufacturing, the unit new product’s carbon emissions are set clearly higher (en = 0.6), and that of the unit remanufactured product is lower (er = 0.3). Then, combining the data obtained from investigating actual remanufacturers in China and actual practice, the other parameters involved in the model are set as follows: pe = 0.6, E0 = 0.55, and μ = 0.2. Finally, specific results will be presented in the following figures.

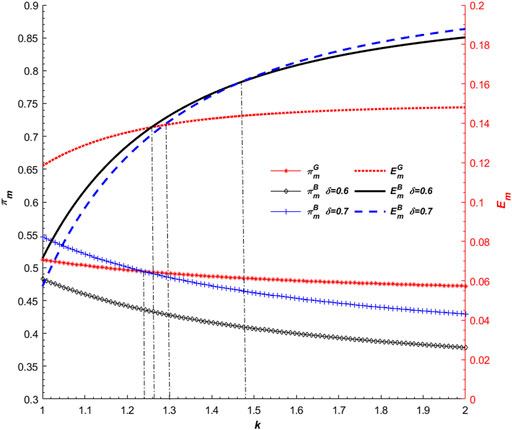

4.1 Effects on total profit and total carbon emissions

First, this subsection shows the value of λ = 0.5 and mainly discusses the effect on the manufacturer’s total profit and total carbon emissions. As shown in Figure 1, under each allocation rule, the manufacturer’s total profit decreases with the increase of the abatement cost coefficient k, which is mainly because manufacturing/remanufacturing quantities decrease as k increases. Moreover, the total profit positively correlates with the industry emission benchmark coefficient δ under benchmarking. Thus, when initial carbon allowances E0 remain unchanged under grandfathering, benchmarking gradually shows more advantages in the total profit as δ increases. However, as k increases, the advantage (or disadvantage) in the total profit under benchmarking will become weaker (or more apparent) than under grandfathering.

Furthermore, Figure 1 shows that the manufacturer’s total carbon emissions increase with the increase of the abatement cost coefficient k under each allocation rule. This is mainly because a higher abatement cost coefficient would result in a lower abatement investment level. More interestingly, the correlation between the total carbon emissions and the industry emission benchmark coefficient under benchmarking depends on the abatement cost coefficient. Specifically, the total carbon emissions have a negative correlation with δ when k is low (k<1.48) and a positive correlation with δ when k is high (k>1.48). A possible explanation is that, when k is relatively low, a higher abatement investment level will lead to lower total carbon emissions. This indicates that although the increasing δ can always bring a higher total profit to the manufacturer, it is at the cost of higher carbon emissions when k is high. Therefore, a looser benchmarking allocation rule would be beneficial to both the total profit and the environment only when the abatement cost is low. Otherwise, the policy-maker should weigh the total profit and the environment further to determine the industry emission benchmark coefficient. In addition, which allocation rule is more beneficial to the environment also depends on the abatement cost coefficient. As k increases, the advantage (or disadvantage) in emission control under benchmarking will also become weaker (or more apparent) than under grandfathering. Consequentially, both in terms of the total profit and the environment, benchmarking is more beneficial when the abatement cost is lower. Otherwise, grandfathering would be more viable.

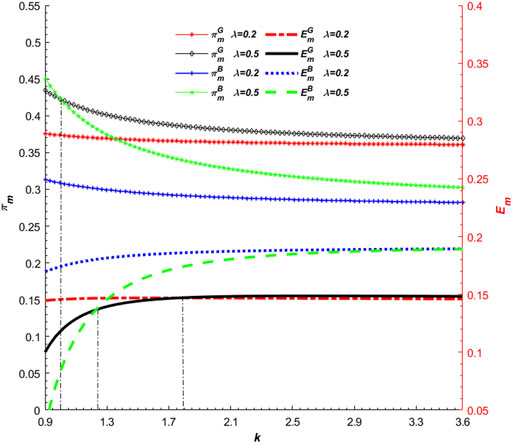

Then, this subsection shows the value of δ = 0.5 and explores the effect on the manufacturer’s total profit and total carbon emissions. As shown in Figure 2, the manufacturer’s total profit under each allocation rule positively correlates with the consumer low-carbon preference coefficient λ. However, the higher the abatement cost coefficient k, the weaker the advantage in the total profit caused by the higher λ. Moreover, compared with grandfathering, the equal change in λ would bring a larger increment in the total profit under benchmarking. This is mainly because the increasing λ can not only enhance the product demand but also increase initial free carbon allowances, which could improve the emission trading revenue or reduce emission trading cost. More importantly, Figure 2 shows that the increasing λ would further weaken the disadvantage or enhance the advantage in the total profit under benchmarking. Otherwise, grandfathering is more beneficial to the total profit when the consumer low-carbon preference is relatively weak.

Furthermore, under each allocation rule, a higher consumer low-carbon preference coefficient λ would abnormally lead to lower total carbon emissions only when the abatement cost coefficient k is lower than a certain threshold. Relatively speaking, the threshold of k mentioned previously under benchmarking (k = 3.6) is much greater than that under grandfathering (k = 1.78). It shows that benchmarking can better ensure that the increasing λ is beneficial to both the profit and the environment. However, under grandfathering, the greater total profit caused by a higher λ is more often at the cost of heavy carbon emissions. Finally, when the consumer low-carbon preference is relatively weak, grandfathering is more viable to the environment. Otherwise, which allocation rule is more beneficial to the environment also depends on the abatement cost coefficient. As mentioned previously, a lower abatement cost is more conducive to show the advantage of benchmarking in the environment. This also indicates that the increasing λ is more beneficial to reflect the advantage of benchmarking in the environment. In summary, when the consumer low-carbon preference coefficient is relatively strong, benchmarking is more beneficial for manufacturers to perform better both in terms of the total profit and the environment. Otherwise, grandfathering would be more viable.

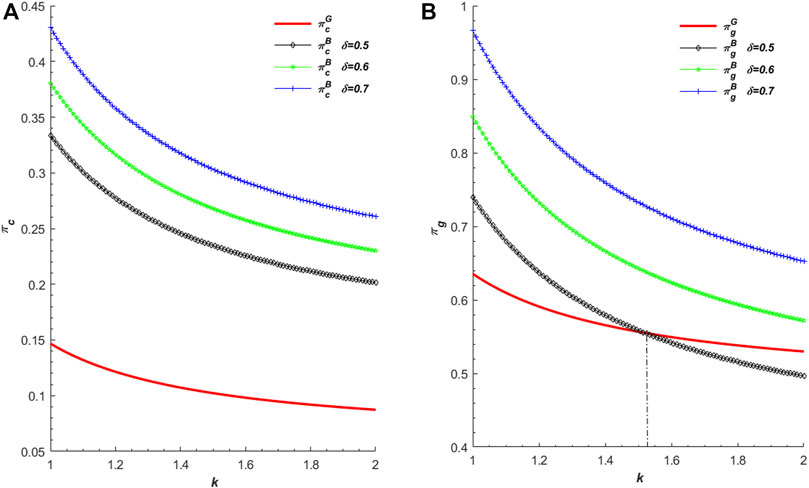

4.2 Effects on consumer surplus and social welfare

This subsection mainly elaborates the effect on consumer surplus and social welfare. Following Ding et al. (2020) and Wang and Wang (2021), the consumer surplus is shown as follows:

Next, we set λ = 0.5, and the results are shown in Figure 3. Figure 3A shows that the consumer surplus under benchmarking shows a positive correlation with the industry emission benchmark coefficient δ. Consequently, which allocation rule is more beneficial to consumer surplus mainly depends on the industry emission benchmark coefficient. Moreover, as shown in Figures 3A,B, higher δ would ultimately induce higher social welfare due to the higher total profit and consumer surplus. Similarly, which allocation rule is more beneficial to social welfare also mainly depends on the industry emission benchmark coefficient. However, when δ is unchanged, a higher abatement cost coefficient k would make the disadvantage (or advantage) of grandfathering in social welfare even weaker (or even stronger). This is mainly because, as mentioned previously, grandfathering is more beneficial to the total profit and the environment when the abatement cost is lower. Finally, taking δ = 0.6 as an example, it can be found that benchmarking is not necessarily more beneficial to the manufacturer’s total profit and the environment but always shows more apparent advantages in consumer surplus and social welfare. Therefore, from the perspective of consumers and policy-makers, benchmarking may be more conducive to achieving the corresponding performance target.

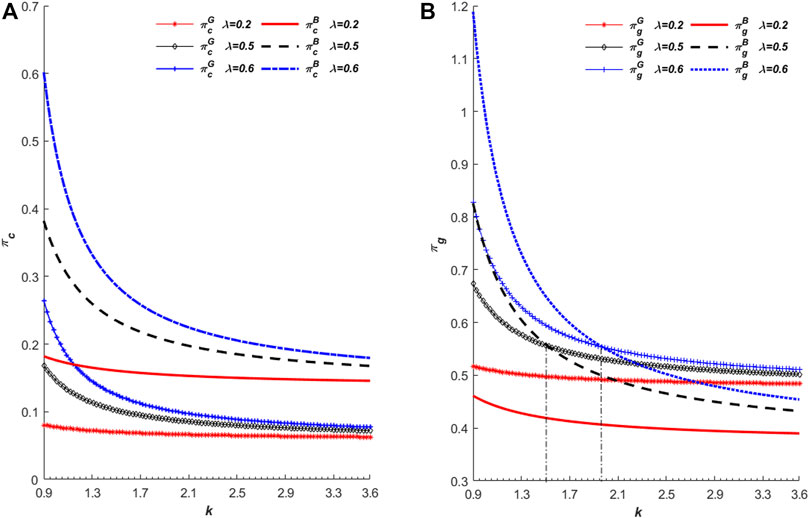

Finally, we set δ = 0.5, and the results are shown in Figure 4. It can be observed that, under the aforementioned two allocation rules, both consumer surplus and social welfare show positive correlations with the consumer low-carbon preference coefficient λ. However, as the higher abatement cost coefficient k increases, the corresponding increments in consumer surplus and social welfare caused by increasing λ would reduce. In addition, from the perspective of consumers, benchmarking always shows apparent advantages compared with grandfathering, as shown in Figure 4A. A possible explanation is that benchmarking can better improve the market share of low-carbon products as shown in corollary 3. From the perspective of policy-makers, which allocation rule is more viable for social welfare mainly depends on λ and k. Specifically, grandfathering shows an apparent advantage in social welfare when λ is low (λ = 0.2). When λ is high (λ = 0.5 or 0.6), grandfathering is more advantageous only when k exceeds a certain threshold. More interestingly, the threshold value of k (k = 1.92) with a higher consumer low-carbon preference coefficient (λ = 0.6) is greater than that (k = 1.46) with lower consumer low-carbon preference coefficient (λ = 0.5), which is mainly because, as mentioned previously, a higher λ is more beneficial to reflect the advantages of benchmarking in the total profit and the environment. Correspondingly, a higher k is more beneficial to reflect the advantages of grandfathering in the total profit and the environment. Eventually, taking social welfare as a performance target, the stronger consumer low-carbon preference or the lower abatement cost may weaken the disadvantage or enhance the advantage of benchmarking. Conversely, the policy-maker may be more inclined to adopt the grandfathering allocation rule in a situation with weaker consumer low-carbon preference or higher abatement cost.

5 Conclusion

Focusing on different carbon allowance allocation rules of grandfathering and benchmarking under the emissions trading policy, this study mainly explored a monopolistic manufacturer’s abatement investment and manufacturing/remanufacturing decisions in a single period by maximizing the total profit. Meanwhile, the effects of grandfathering and benchmarking on decision variables and performance targets (e.g., total profit, total carbon emissions, consumer surplus, and social welfare) are analyzed through theoretical and numerical analyses. Finally, some managerial insights and policy implications are provided for the manufacturer’s low-carbon activities and the policy-makers’ policy design, respectively.

First, under grandfathering, the policy-maker cannot adjust manufacturers’ abatement investment and manufacturing/remanufacturing decisions by the administrative measure. However, benchmarking could affect manufacturers’ low-carbon operations through administrative measures (e.g., the industry emission benchmark coefficient) and economic measures (e.g., the carbon price). In addition, under benchmarking, the increasing industry emission benchmark coefficient can always promote manufacturers’ abatement investment levels. It should be noted that only in a situation with stronger consumer low-carbon preference can the rising industry emission benchmark coefficient also always increase manufacturers’ remanufacturing quantities. Eventually, the higher the industry emission benchmark coefficient, the greater the total profit, consumer surplus, and social welfare. The difference is that the correlation between the industry emission benchmark coefficient and the environment mainly depends on the abatement cost coefficient. Only when the abatement cost is relatively low will the industry emission benchmark coefficient be higher and the total carbon emissions be lower. Otherwise, the increment in the total profit caused by the increasing industry emission benchmark coefficient would be at the cost of heavy emissions. Therefore, for policy-makers to better achieve the environmental performance target, a higher industry emission benchmark coefficient should be provided for manufacturers with lower abatement costs; on the contrary, a tightened allocation rule of benchmarking should be implemented. For manufacturers, it is more helpful to achieve a win–win goal of economic and environmental benefits by reducing the abatement cost under benchmarking.

Second, under a given abatement investment level, benchmarking is more viable for manufacturers’ remanufacturing activities than grandfathering. Additionally, the harsher the remanufacturing environment (e.g., higher carbon price and lower willingness-to-pay for remanufactured products), the more apparent the advantage in promoting remanufacturing activities under benchmarking. Furthermore, under the condition of integrating abatement investment and manufacturing/remanufacturing decisions, benchmarking is more viable for manufacturers’ abatement investment activities than grandfathering. Meanwhile, a stronger consumer low-carbon preference or lower abatement cost would make this advantage more apparent. Similarly, only in a situation with a stronger consumer low-carbon preference is benchmarking more viable for manufacturers’ remanufacturing activities. Correspondingly, the higher the consumer low-carbon preference or the lower the abatement cost, the more favorable benchmarking is to achieve each performance target (e.g., total profit, emission control, consumer surplus, and social welfare). Therefore, for policy-makers, benchmarking should be implemented to better promote manufacturers’ abatement investment activities. More importantly, in a situation with a stronger consumer low-carbon preference or lower abatement cost, benchmarking may be more beneficial to manufacturers’ remanufacturing activities and each performance target. Otherwise, grandfathering would be more viable. For manufacturers, under each allocation rule, the lower emission reduction cost or the stronger low-carbon preference will help them reasonably respond to changes in the market environment or policy environment and better achieve a win–win goal of economic and environmental benefits.

Finally, our study can be extended in a few ways for future research. For instance, the issue studied in this work can be extended to two-period or multi-period, and the volatility in the carbon price will be considered. Additionally, the policy-maker’s decision-making process can be embedded, and more carbon allowance allocation rules should be modeled.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author contributions

ZW and YW contributed to conceptualization, methodology, and writing—original draft. ZW contributed to funding acquisition, writing—review and editing, and supervision. FW and YW contributed to literature sorting, formal analysis, and software.

Funding

The authors are grateful for the financial support provided by the Planning Project of Philosophy and Social Sciences in Guizhou Province (grant number 20GZYB55).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Appendix A:

Proof of Lemma 1. According to Eq. 1, the first derivation of the manufacturer’s profit πm with respect to qn and qr is shown as follows:

Then, the manufacturer’s optimal manufacturing and remanufacturing quantities are

Therefore, lemma 1 is proved.

Proof of Lemma 2. According to Eq. 1, the first derivation of the manufacturer’s profit πm with respect to τ is shown as follows:

Substituting

In order to ensure that decision variables are not negative, then

Therefore, lemma 2 is proved.

Proof of Proposition 1. According to expressions of

Since

Moreover, since

, then

Thus,

Since

Therefore, proposition 1 is proved.

Proof of Proposition 2. According to expressions of

Since

Since

, then,

Thus,

If

If

Therefore, proposition 2 is proved.

Proof of Lemma 3. According to Eq. 1, the first derivation of the manufacturer’s profit πm with respect to qn and qr is shown as follows:

Then, the manufacturer’s optimal manufacturing and remanufacturing quantities are

Therefore, lemma 3 is proved.

Proof of Lemma 4. According to Eq. 2, the first derivation of the manufacturer’s profit πm with respect to τ is shown as follows:

Substituting

Similarly, in order to ensure that decision variables are not negative, then

Therefore, lemma 4 is proved.

Proof of Proposition 3. According to expressions of

Since

Since

If

If

Therefore, proposition 3 is proved.

Proof of Corollary 1. According to expressions of

Obviously,

Therefore, corollary 1 is proved.

Proof of Corollary 2. According to expressions of

Therefore, corollary 2 is proved.

Proof of Corollary 3. According to expressions of

Thus, we have

Referring to the proof process of proposition 3, we can easily obtain:

If

Then, we have

Therefore, corollary 3 is proved.

Proof of Corollary 4. According to expressions of

Thus, we have

Thus, we have

Thus, if

Thus, if

Thus, we have

Therefore, corollary 4 is proved.

References

Alegoz, M., Kaya, O., and Bayindir, Z. P. (2021). A comparison of pure manufacturing and hybrid manufacturing-remanufacturing systems under carbon tax policy. Eur. J. Oper. Res. 294, 161–173. doi:10.1016/j.ejor.2021.01.018

Bai, Q., Xu, J., and Zhang, Y. (2022). The distributionally robust optimization model for a remanufacturing system under cap-and-trade policy: A newsvendor approach. Ann. Oper. Res. 309 (2), 731–760. doi:10.1007/s10479-020-03642-4

Chai, Q., Xiao, Z., Lai, K., and Zhou, G. (2018). Can carbon cap and trade mechanism be beneficial for remanufacturing? Int. J. Prod. Econ. 203, 311–321. doi:10.1016/j.ijpe.2018.07.004

Chang, X., Li, Y., Zhao, Y., Liu, W., and Wu, J. (2017). Effects of carbon permits allocation methods on remanufacturing production decisions. J. Clean. Prod. 152, 281–294. doi:10.1016/j.jclepro.2017.02.175

Chen, W., and Chen, C. (2021). Production decision of remanufacturing firms with carbon quota repurchase Financing. J. Syst. Manage. 30 (5), 916–925. doi:10.3969/j.issn1005-2542.2021.05.007

Chen, Y., Li, B., Bai, Q., Xu, J., and Wang, Z. (2020). Research on production and emission reduction investment decisions of the remanufacturing enterprise under carbon trading environment. Control Decis. 35 (3), 186–194. doi:10.13195/j.kzyjc.2018.0446

Ding, J. F., Chen, W. D., and Wang, W. B. (2020). Production and carbon emission reduction decisions for remanufacturing firms under carbon tax and take-back legislation. Comput. Ind. Eng. 143, 106419. doi:10.1016/j.cie.2020.106419

Dong, G., Liang, L., Wei, L., Xie, J., and Yang, G. (2021). Optimization model of trade credit and asset-based securitization financing in carbon emission reduction supply chain. Ann. Oper. Res. doi:10.1007/s10479-021-04011-5

Dou, G. W., Guo, H. N., Zhang, Q. Y., and Li, X. D. (2019). A two-period carbon tax regulation for manufacturing and remanufacturing production planning. Comput. Ind. Eng. 128, 502–513. doi:10.1016/j.cie.2018.12.064

Farouq, I. S., Sambo, N. U., Ahmad, A. U., Jakada, A. H., and Danmaraya, I. A. (2021). Does financial globalization uncertainty affect CO2 emissions? Empirical evidence from some selected SSA countries. Quant. Financ. Econ. 5 (2), 247–263. doi:10.3934/QFE.2021011

Hu, X., Yang, Z., Sun, J., and Zhang, Y. (2020). Carbon tax or cap-and-trade: Which is more viable for Chinese remanufacturing industry? J. Clean. Prod. 243, 118606. doi:10.1016/j.jclepro.2019.118606

Huang, Z., Dong, H., and Jia, S. (2022). Equilibrium pricing for carbon emission in response to the target of carbon emission peaking. Energy Econ. 112, 106160. doi:10.1016/j.eneco.2022.106160

Huang, Z., Liao, G., and Li, Z. (2019). Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. Change 144, 148–156. doi:10.1016/j.techfore.2019.04.023

Ilgin, M. A., and Gupta, S. M. (2011). Performance improvement potential of sensor embedded products in environmental supply chains. Resour. Conserv. Recycl. 55 (6), 580–592. doi:10.1016/j.resconrec.2010.05.001

Ji, J., Zhang, Z., and Yang, L. (2017). Comparisons of initial carbon allowance allocation rules in an O2O retail supply chain with the cap-and-trade regulation. Int. J. Prod. Econ. 187, 68–84. doi:10.1016/j.ijpe.2017.02.011

Li, S., Yu, Y., Jahanger, A., Usman, M., and Ning, Y. (2022). The impact of green investment, technological innovation, and globalization on CO2 emissions: Evidence from MINT countries. Front. Environ. Sci. 10, 868704. doi:10.3389/fenvs.2022.868704

Li, X., Li, Y., and Saghafian, S. (2013). A hybrid manufacturing/remanufacturing system with random remanufacturing yield and market-driven product acquisition. IEEE Trans. Eng. Manag. 60 (2), 424–437. doi:10.1109/TEM.2012.2215873

Liao, Z., Zhu, X., and Shi, J. (2015). Case study on initial allocation of Shanghai carbon emission trading based on Shapley value. J. Clean. Prod. 103 (15), 338–344. doi:10.1016/j.jclepro.2014.06.045

Liu, B., Holmbom, M., Segerstedt, A., and Chen, W. (2015). Effects of carbon emission regulations on remanufacturing decisions with limited information of demand distribution. Int. J. Prod. Res. 53 (2), 532–548. doi:10.1080/00207543.2014.957875

Luo, Z., Chen, X., and Wang, X. (2016). The role of co-opetition in low carbon manufacturing. Eur. J. Oper. Res. 253, 392–403. doi:10.1016/j.ejor.2016.02.030

Meng, Q., Li, M., Liu, W., Li, Z., and Zhang, J. (2021). Pricing policies of dual-channel green supply chain: Considering government subsidies and consumersʹ dual preferences. Sustain. Prod. Consum. 26, 1021–1030. doi:10.1016/j.spc.2021.01.012

Neuhoff, K., Martinez, K. K., and Sato, M. (2006). Allocation, incentives and distortions: The impact of EU-ETS emissions allowance allocations to the electricity sector. Clim. Policy 6 (1), 73–91. doi:10.1080/14693062.2006.9685589

Peng, H., Qi, S., and Cui, J. (2021). The environmental and economic effects of the carbon emissions trading scheme in China: The role of alternative allowance allocation. Sustain. Prod. Consum. 28, 105–115. doi:10.1016/j.spc.2021.03.031

Qin, J., Han, Y., Wei, G., and Xia, L. (2019). The value of advance payment financing to carbon emission reduction and production in a supply chain with game theory analysis. Int. J. Prod. Res. 58 (1), 200–219. doi:10.1080/00207543.2019.1671626

Qiu, Y., Qiao, J., and Pardalos, P. M. (2017). A branch-and-price algorithm for production routing problems with carbon cap-and-trade. Omega 68, 49–61. doi:10.1016/j.omega.2016.06.001

Reimann, M., Xiong, Y., and Zhou, Y. (2019). Managing a closed-loop supply chain with process innovation for remanufacturing. Eur. J. Oper. Res. 276, 510–518. doi:10.1016/j.ejor.2019.01.028

Sadegheih, A. (2011). Optimal design methodologies under the carbon emission trading program using MIP, GA, SA, and TS. Renew. Sustain. Energy Rev. 15 (1), 504–513. doi:10.1016/j.rser.2010.07.035

Shuang, Y., Diabat, A., and Liao, Y. (2019). A stochastic reverse logistics production routing model with emissions control policy selection. Int. J. Prod. Econ. 213, 201–216. doi:10.1016/j.ijpe.2019.03.006

Song, J., and Leng, M. (2012). “Analysis of the single-period problem under carbon emissions policies,” in Handbook of newsvendor problems: Models, extensions and applications; the bookings institution. Editor T. M. Choi (New York, USA: Springer).

Tian, M., Hu, Y., Wang, H., and Li, C. (2022). Regional allowance allocation in China based on equity and efficiency towards achieving the carbon neutrality target: A composite indicator approach. J. Clean. Prod. 342, 130914. doi:10.1016/j.jclepro.2022.130914

Toptal, A., Özlü, H., and Konur, D. (2014). Joint decisions on inventory replenishment and emission reduction investment under different emission regulations. Int. J. Prod. Res. 52 (1), 243–269. doi:10.1080/00207543.2013.836615

Wang, Q., and Su, M. (2020). A preliminary assessment of the impact of COVID-19 on environment-A case study of China. Sci. Total Environ. 728, 138915. doi:10.1016/j.scitotenv.2020.138915

Wang, Y., Chen, W., and Liu, B. (2017). Manufacturing/remanufacturing decisions for a capital-constrained manufacturer considering carbon emission cap and trade. J. Clean. Prod. 140, 1118–1128. doi:10.1016/j.jclepro.2016.10.058

Wang, Y., and Wang, F. (2021). Production and emissions reduction decisions considering the differentiated carbon tax regulation across new and remanufactured products and consumer preference. Urban Clim. 40, 100992. doi:10.1016/j.uclim.2021.100992

Wu, Q., and Li, C. (2020). How quota allocation affects the unified ETS of China: A simulation with dynamic CGE model. Environ. Sci. Pollut. Res. 27 (2), 1835–1851. doi:10.1007/s11356-019-06588-8

Xu, J., Chen, Y., and Bai, Q. (2017). A two-echelon sustainable supply chain coordination under cap-and-trade regulation. J. Clean. Prod. 135 (1), 42–56. doi:10.1016/j.jclepro.2016.06.047

Yang, C., Li, T., and Albitar, K. (2021). Does energy efficiency affect ambient PM2.5? The moderating role of energy investment. Front. Environ. Sci. 9, 707751. doi:10.3389/fenvs.2021.707751

Yang, L., Hao, C., and Hu, Y. (2021). Outsourcing or not? The OEM's better collecting mode under cap-and-trade regulation. J. Syst. Sci. Syst. Eng. 30 (2), 151–177. doi:10.1007/s11518-020-5475-z

Yang, L., Hu, Y., and Huang, L. (2020). Collecting mode selection in a remanufacturing supply chain under cap-and-trade regulation. Eur. J. Oper. Res. 287 (2), 480–496. doi:10.1016/j.ejor.2020.04.006

Yang, L., Ji, J., Wang, M., and Wang, Z. (2018). The manufacturer's joint decisions of channel selections and carbon emission reductions under the cap-and-trade regulation. J. Clean. Prod. 193, 506–523. doi:10.1016/j.jclepro.2018.05.038

Yang, W., Pan, Y., Ma, J., Yang, T., and Ke, X. (2020). Effects of allowance allocation rules on green technology investment and product pricing under the cap-and-trade mechanism. Energy Policy 139, 111333–111411. doi:10.1016/j.enpol.2020.111333

Yenipazarli, A. (2016). Managing new and remanufactured products to mitigate environmental damage under emissions regulation. Eur. J. Oper. Res. 249, 117–130. doi:10.1016/j.ejor.2015.08.020

Yuan, K., Wu, G., Dong, H., He, B., and Wang, D. (2020). Differential pricing and emission reduction in remanufacturing supply chains with dual-sale channels under CCT-mechanism. Sustainability 12 (19), 8150. doi:10.3390/su12198150

Zetterberg, L. (2014). Benchmarking in the European union emissions trading system: Abatement incentives. Energy Econ. 43, 218–224. doi:10.1016/j.eneco.2014.03.002

Zhang, G., Cheng, P., Sun, H., Shi, Y., and Kadiane, A. (2021). Carbon reduction decisions under progressive carbon tax regulations: A new dual-channel supply chain network equilibrium model. Sustain. Prod. Consum. 27, 1077–1092. doi:10.1016/j.spc.2021.02.029

Zhang, Y., Wang, A., and Tan, W. (2015). The impact of China's carbon allowance allocation rules on the product prices and emission reduction behaviors of ETS-covered enterprises. Energy Policy 86, 176–185. doi:10.1016/j.enpol.2015.07.004

Zhao, P., Deng, Q., Zhou, J., Han, W., Gong, G., and Jiang, C. (2021). Optimal production decisions for remanufacturing end-of-life products under quality uncertainty and a carbon cap-and-trade policy. Comput. Ind. Eng. 162, 107646. doi:10.1016/j.cie.2021.107646

Keywords: grandfathering, benchmarking, emissions trading policy, abatement investment decision, manufacturing/remanufacturing decisions

Citation: Wang Z, Wang F and Wang Y (2022) Grandfathering or benchmarking: Which is more viable for the manufacturer’s low-carbon activities?. Front. Environ. Sci. 10:991827. doi: 10.3389/fenvs.2022.991827

Received: 12 July 2022; Accepted: 26 October 2022;

Published: 11 November 2022.

Edited by:

Ghassan H. Mardini, Qatar University, QatarReviewed by:

Hao Dong, Lingnan College, Sun Yat-sen University, ChinaÁngel Acevedo-Duque, Autonomous University of Chile, Chile

Copyright © 2022 Wang, Wang and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yongjian Wang, d3lqMDEwNEBqc251LmVkdS5jbg==

Zhanjie Wang1

Zhanjie Wang1 Yongjian Wang

Yongjian Wang