- Department of Business, Qingdao Binhai University, Qingdao, China

To achieve China’s 2030 target for reducing greenhouse gases, the government has implemented a low-carbon pilot city policy. One goal of this policy is to promote the green transformation of local firms; as such, this paper focuses on how the policy influences green innovation among firms. The study analyzed data on the number of green patents held by industrial firms listed in Shanghai and Shenzhen Stock Exchanges in China for the 2007–2017 period. This enabled an investigation of green innovation activity after implementation of the low-carbon pilot city policy, using a Differences-in-Differences model. We found that the low-carbon pilot cities policy has a significant impact on applications for green patents. The relationship is stronger for private owned firms compared to State-owned firms. The direction of the effect was mainly due to green utility patent applications by private owned firms. State-owned firms have strong path dependence and are protected by local governments, so they are less constrained by low-carbon pilot city policies, which makes it difficult for them to improve the green innovation of State-owned firms. Firms in a monopoly position have more motivation to pursue green innovations than firms in competitive settings. Because green innovations have double positive externalities and require cooperation between multiple departments, they are associated with higher risk levels compared to nongreen innovations. It is difficult for firms in highly competitive industries to continuously invest many resources in green environmental R&D. This study provides important data supporting the basis of low-carbon pilot city policy implementation.

1 Introduction

The environmental pollution has become an essential threat to the global environment (Jt et al., 2022). Energy consumption is defined as one of the main determinants of environmental degradation (Yu et al., 2022b). Cities play an important role in China’s low carbon development, as urban and industrial development consumes large amounts of energy (Liu Y. et al., 2022). To ensure that China meets its 2030 targets for curbing greenhouse gas emissions, the central government launched low-carbon pilot projects in provinces, regions and cities in 2010. These projects were further expanded in 2012 and 2017, and currently cover 80 cities. These cities have issued low-carbon policy implementation plans based on their own industrial structure, resource endowments, and technological advantages. Most plans clearly promote low-carbon development through technological innovation. Being a low-carbon city means promoting overall low-carbon urban development, by improving energy efficiency, adjusting the energy structure, transforming high carbon industries to low carbon industry, and allocating more environmentally-friendly resources. Green technology innovation is a key force to realize this development model. The government has assigned great importance to pilot low-carbon provinces and cities, and continues to expand the scope of the pilot work. That shows the importance of the pilot policy in developing green and low-carbon environments in China. And many firms focus on emissions reduction activities such as green technologies and sustainable supply chain management, because they are receiving pressure from public and stakeholders (Yu et al., 2022c).

Scholars’ applications of the “Porter Hypothesis” are generally divided into macro and micro levels. Macro-level analyses consider the relationship between environmental regulation and industry productivity. Micro-level analyses consider the relationship between environmental regulation and a firm’s green performance. Different levels of data and these two levels of analyses can lead to different insights, and potentially inconsistent conclusions about environmental regulatory performance. A review of the literature exploring the relationship between low-carbon policy and technological innovation shows that studies about the impact of environmental policy on technological innovation and productivity are usually based on the “Porter Hypothesis,” that environmental regulations can affect enterprises’ production decisions in two ways. First, regulations increase pollution control costs, which may lead to short-term reductions in R&D or investments in other projects. However, companies diversify investments when facing environmental policies, which may include increasing R&D investments to upgrade existing technology (Xia et al., 2022). The second possible impact occurs when environmental policies produce an “Innovative Offset” effect, which yields economic benefits by improving enterprise productivity (Porter and Van der Linde, 1995). Under appropriate regulatory pressure, enterprises are motivated to engage in technological innovation, to improve energy use efficiency and reduce pollution emissions from production processes. Enterprises that conform with emission regulations gain both environmental and economic benefits.

To test the weak Porter hypothesis, existing studies have found that environmental regulations pressure companies to focus on research and development (R&D) expenditures (Milani, 2017; Wang et al., 2019). However, these expenditures reflect inputs to production activities, and do not directly reveal innovation results. Moreover, due to the path-dependent effect of green technology innovation, R&D expenditures do not alone define the types of innovation. Given this challenge, scholars began to use more refined and microscopic patent data to measure enterprise innovation (Popp, 2006; Dong et al., 2019). To address the question of whether environmental policy can induce green technology innovation, research has gradually shifted from the macro level to the more micro level of enterprises.

China’s sulfur dioxide (SO2) emission rights trading policy, which expanded beyond its pilot scope in 2007, as an entry point, and identified that such trading policies significantly induced green technology innovation in polluting industries (Zhang et al., 2019). The carbon emissions trading pilot policy also promoted low-carbon technology innovation at the enterprise level (Tan et al., 2022). However, due to different measurement methods of environmental regulation and the differences in selected samples, studies on these initiatives have reached inconsistent conclusions. Some studies have found that environmental policies advance improvements in the productivity of specific industries (Nesta et al., 2014; Albrizio et al., 2017); other scholars have reached the opposite conclusion (Liu et al., 2015). Some studies have highlighted a nonlinear relationship between environmental regulation and enterprise productivity (Yang et al., 2020; Zhang et al., 2020; Liu et al., 2021). Some papers have shown that voluntary environmental regulations, such as voluntary environmental information disclosure and environmental management system certification, can promote technological innovation in firms (Jiang et al., 2020). Some research shown that technological innovation can reduce environmental pollution (Liu S. et al., 2022; Yu C. M. et al., 2022).

The low-carbon pilot city policy implements an urban level environmental regulation policy to help meet China’s climate action target. The policy imposes weak constraints, relies on industry, and includes a policy mix. In the area of weak constraints, the country does not set targets for low-carbon cities, such as the peak time of carbon emissions or standard measures for products’ carbon emissions in different industries. Rather, local governments advance low-carbon policies based on their own resources. Other environmental regulatory policies express a clear purpose; in contrast, low-carbon pilot cities apply policy using an exploratory approach. This approach highlights the need to evaluate whether weakly restrictive policy encourages technological innovation. The low-carbon pilot city policy is mainly aimed at industries with high energy consumption and high emissions, including industrial, construction, transportation, energy supply, and waste management enterprises (Chen et al., 2021). The goal is to reduce urban greenhouse gas emissions.

Compared with other urban policies, the low-carbon city policy focuses on green technology innovation by enterprises. The policy encourages innovation in the economy, science and technology, education, and social development, by optimizing the allocation of innovative resources, increasing resources for innovation, and improving the level of the innovation environment (Zhang et al., 2021). The pilot smart city policy mainly focuses on reforming the mode of urban governance, created by changes in information technology. It is hoped that the form of urban development may also improve by applying smart equipment and smart technology that help a city achieve innovation in resource allocation, in emerging industries, and in related technologies and products (Zhang et al., 2017). The low-carbon city pilot policy has other policy characteristics. It involves formulating development plans for a low-carbon city, based on local economic development, technological and industrial advantages, and other characteristics. Based on these characteristics, pilot cities have formulated corresponding low-carbon city development programs, containing different types of policy tools, such as command and control, market-driven, and voluntary policies. Pilot cities have also introduced green finance policies, including industry subsidies, preferential loans, and special fiscal funds.

Research on low-carbon city policy generally falls into two main areas. Several studies have evaluated and analyzed the effectiveness of implementing the policy. Some studies have applied a double-difference model to investigate the impact of low-carbon city construction on green GDP of county-level cities. These have found that low-carbon city construction results in different economies of scale and regional characteristics (Albrizio et al., 2017). Some scholars have used the PSM-DID model to investigate the impact of low-carbon city pilot policy on the total factor productivity of enterprises (Chen et al., 2021).

These previous studies have mainly focused on the relationship between low-carbon city policy and city-level emission reductions, but have not considered green performance at a micro firm-level. Therefore, this study focused on the relationship between having a low-carbon city pilot policy and green innovation. Two key research questions were considered:

1. How does a low-carbon pilot policy impact green innovation performance?

2. What is the difference between macro- and micro-performance with respect to the impact of a low-carbon pilot policy on green innovation?

A key contribution of this study is identifying the relationship between weak constraint policies and firm green innovation. There is a positive relationship between having a low-carbon city pilot policy and the number of green patents by associated enterprises. This research provides more comprehensive insight into the relationship between environmental policy and innovation, providing a new type of evaluation of the “Porter Hypothesis."

2 Conceptual framework and hypothesis development

2.1 Low-carbon pilot city policy and green innovation

The low-carbon pilot city policy is intended to improve energy efficiency, converse energy, and reduce pollution emissions during production processes. It should also support a city’s industrial transformation and upgrades to a low-carbon setting, to reduce overall carbon intensity and total carbon emissions. The policy is intended to incentivize enterprises to develop low-carbon green technology innovations, consistent with “Porter’s hypothesis.” Hence, we hypothesize:

H1:. The low-carbon pilot city policy promotes green technological innovation by enterprises.

2.2 Low-carbon city policy, firm ownership, and green innovation

Environmental policies have different effects on green technology innovation based on the different ownership structures of the enterprises involved. State-owned enterprises (SOEs) and privately-owned enterprises have different characteristics and advantages with respect to green technology innovation. SOEs are usually large and have important responsibilities in contributing to the local economy. They also receive policy support, including fiscal subsidies, tax reductions, convenient financing, and other benefits (Jiang et al., 2020). This enables SOEs to conduct long-term innovation activity. SOEs are generally found in traditional industries and face strong path dependence, because R&D and production activities produce high pollution and emissions. Environmental policies may have weak and limited impacts on green innovation, because of the hidden relationship between SOEs and government.

In contrast, privately-owned enterprises face a more complex market competition environment, which impacts their R&D direction when facing environmental pressure. They can generally reduce the costs of environmental regulation by increasing productivity. Therefore, privately-owned enterprises usually show more flexibility and motivation toward innovation when faced with environmental policy. For example, one study found that policies in the wind power industry significantly impacted invention patents filed by private-owned enterprises, and have a significant advantage with respect to utility patents compared to SOEs (Wang and Mogi, 2017). Hence, we hypothesize the following:

H2:. Compared with SOEs, the low-carbon pilot city policy is more conducive to promoting green technological innovation in privately-owned enterprises.

2.3 Low-carbon city policy, market competition, and green innovation

Research about the relationship between market competition and technology progress can also be traced back to Porter’s Hypothesis. Porter argued that larger (and somewhat monopolistic) firms have a stronger intent to innovate, and are more motivated to engage in R&D. This aligns with Schumpeter’s opinion (Wang et al., 2022). Monopolies engage in more innovative activities (Wang and Mogi, 2017), and such technology progress can promote economic growth. Finding the optimal balance between social gains and monopolistic innovation is an important topic in regulatory economics. However, there is no consensus among researchers about the ideal relationship between market competition and innovation in economics and industrial settings: the relationship is sometimes negative and sometimes positive (Gilbert, 2006; Peroni and Ferreira, 2012). This issue was addressed in research from Arrow and Schumpeter (Song and Wang, 2018). The porter argues that enterprises facing high competition should focus their investments on R&D, while monopolistic enterprises have a lack of flexibility with respect to R&D. Some studies have found a threshold effect with respect to the relationship between market competition and innovation; enterprises take the initiative to invest in R&D when there is a high level of competition within a certain threshold range (Peroni and Ferreira, 2012).

Previous studies have not provided a definitive perspective on the relationship between competition and innovation, but green innovation is more specifically than otherwise. Whether enterprises invest in innovation depends on how the different interests involved divide up the benefits (Gilbert, 2006). In the short term, green innovation may consume significant resources in a competitive context, and enterprises need to balance profits and green development (Liu et al., 2021). The above literature indicates that market competition does affect green innovation, indirectly impacting firm performance and competitive advantage. Hence, we hypothesize:

H3:. The low-carbon pilot city policy has a more significant effect on green innovation by firms in industries where there is low competition.

2.4 Low-carbon city policy, financial agglomeration, and green innovation

Financial intermediaries are key factors influencing green innovation. Green innovation involves significant uncertainty due to immature technology, making it difficult to get loans. An enterprise can obtain a loan more easily for green innovations when there is active interest in financing environmental investments. Many scholars have confirmed that a booming financial environment can promote green innovation (Qu et al., 2020). Financial intermediaries can use technology to screen high-quality green innovation projects, and boost resource allocation efficiencies to focus on green innovation activities (Laeven et al., 2015). Financial development can alleviate information asymmetry associated with green innovation. The financial industry can also facilitate overall reductions in the number of polluting industries and boost green economic benefits; this is grounded in industrial structure evolution theory. Financial industries enhance knowledge dissemination, because they enable development by relevant service industries through an agglomeration effect (Yuan et al., 2019). Financial intermediaries can promote industrial structure upgrades by investing resources to encourage green industry development.

Financial agglomeration can further reassure enterprises and create a sound environment for green innovation. Agglomeration gathers different resources, such as labor and capital, to form a platform where knowledge can be exchanged between industries and enterprises, improving the green technology progress of the whole industry (Yuan et al., 2020). Many scholars have tested the relationship between financial agglomeration and innovation. One key study found that financial agglomeration was significantly correlated with green innovation in prefecture-level cities (Yuan et al., 2019). The discussion above indicates that financial agglomeration affects green innovation, and indirectly improves transfers with respect to industrial upgrades. Hence, we hypothesize:

H4:. The low-carbon pilot city policy has a more significant effect on firm-level green innovation than on the city’s high-level financial agglomeration.

3 Sample and variable description

3.1 Data and sample

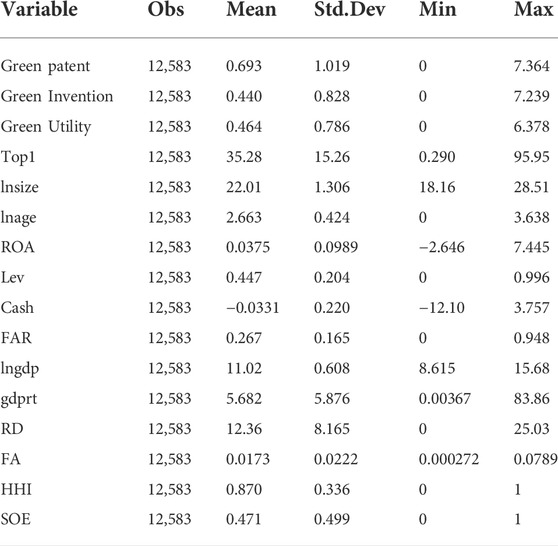

We tested the study hypotheses using firm and city-level data from the China Stock Market and Accounting Research Database (CSMAR) and China City Statistical Yearbook. A list of firms was used to construct an initial sample for the years 2007–2017. We used green patent applications to measure a firm’s level of green innovation. Patent data came from the China National Intellectual Property Administration (CNIPA). Green patents were selected based on the IPC Green Inventory of WIPO (World Intellectual Property Organization). There are three types of patents: invention, utility, and design patents. We focused on invention and utility patents to test this study’s hypotheses. To process the 2007–2017 data, we first filtered the data using the China Securities Regulatory Commission’s (CSRC) two-digit industry codes. We only included industrial firms, which applied for the largest number of green patents. We excluded delisting listed companies. Third, invalid data were excluded. The final total effective sample included 12,583 observations representing 1,240 firms. Table 1 provides the summary statistics.

3.2 Variables

3.2.1 Outcome variable

The outcome variable in this study was green innovation, and was measured using applications for green patents, invention patents, and utility patents. First, the number of patent applications from the listed companies was collected from the China National Intellectual Property Administration (CNIPA). The green patents were extracted using a green patent classification number from the 2010 “Green List of International Patent Classification” by WIPO. The green list is based on the classification of green patents under the UNFCC, and included seven broad categories.

3.2.2 Treatment variable

The status of a city as a pilot low-carbon policy city was set as the treatment variable for this study. Corporate green technology innovations, measured by patents, require a significant time cycle to complete. The first batch of pilot low-carbon cities may have had a limited initial implementation, and the second batch of pilot cities may have required similar amounts of time to achieve results in the form of new patents. As such, improved green performance by the first two batches of pilot cities may not be reflected in too short a reflective timeframe. Based on this, to accommodate the need for an adequate amount of time to pass to see impacts through patents, the review of the low-carbon pilot city policy focused only on the first two batches of low-carbon provinces and regions engaged in the pilot policy. Each firm in the study was coded as a one if the firm was in the first two groups of pilot low-carbon provinces, autonomous regions, and cities, or 0 if otherwise.

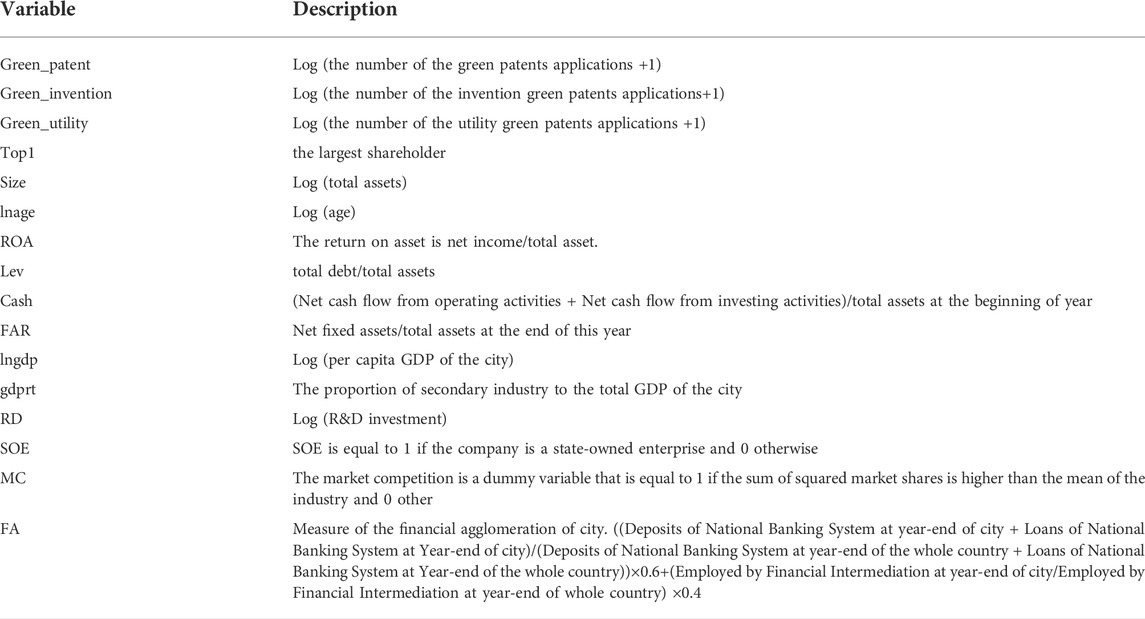

3.2.3 Control variables

Based on previous literature, Table 2 defines the control variables used in this study.

3.3 Research design

The difference-in-difference model is a commonly used and well-grounded method for modelling and evaluating the impact of policy implementation (Wang et al., 2019). The method first divides subjects into a treatment group and control group. The net effect of policy implementation is identified by assessing differences over time, before and after the policy implementation. The difference between the treatment group and the control group is defined by whether the policy was implemented or not. In this study, firms in the first two batches of pilot low-carbon provinces and cities served as the treatment group. Firms in other cities and provinces were in the control group. To test the causal effects of the low-carbon city policy on green innovation, we estimated the following difference-in-difference model:

Green innovation is measured by the number of green patents earned by firm

4 Results

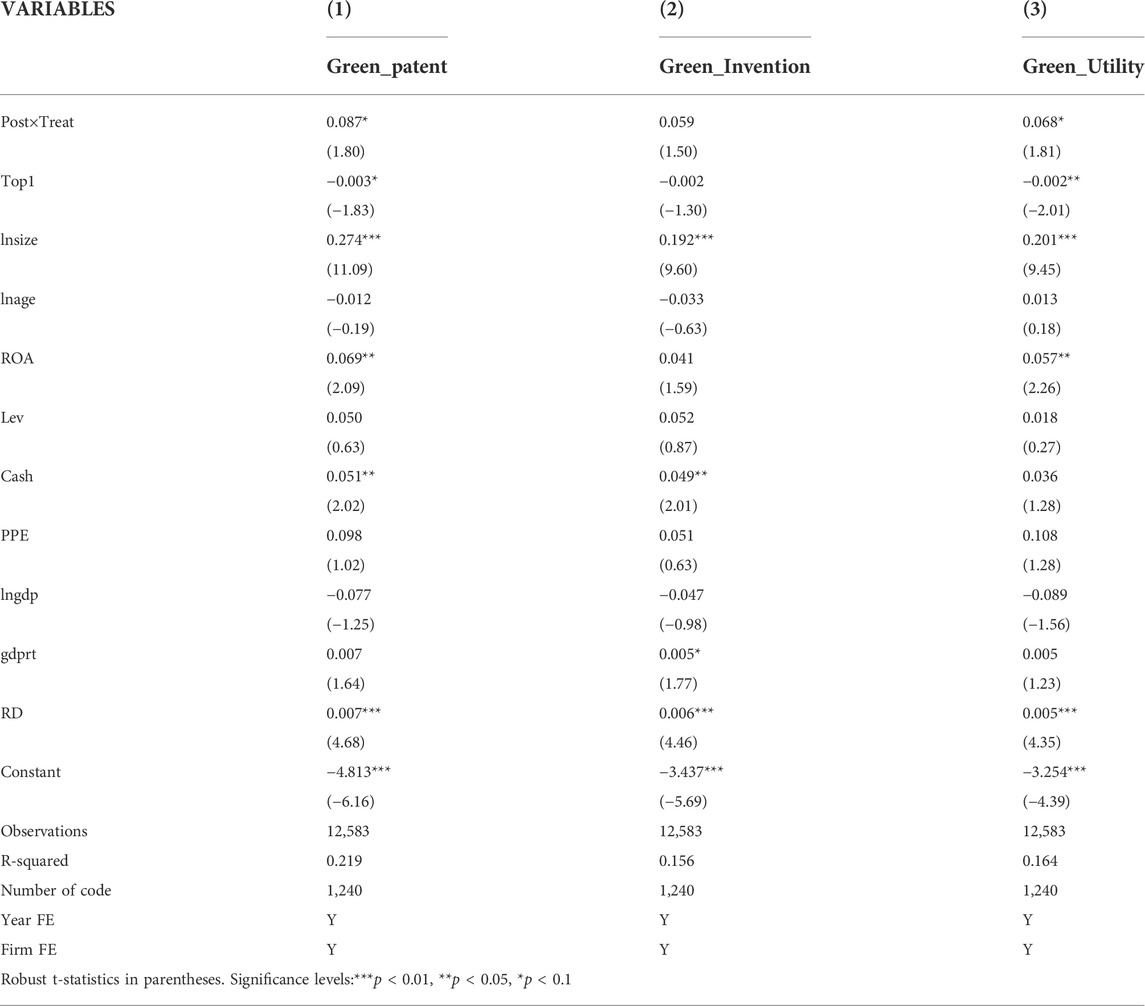

4.1 Impact of low-carbon city pilot policy on green innovation

Table 3 shows the regression results for Model (1), which assesses the impact of the low-carbon policy on green innovation. All regressions controlled for firm and year fixed effects, and used city-level cluster standard errors. In Column (1), the variable Treat×Post is 0.087, and is significant at a 10% significance level. This indicates that the logarithm of green patent application of firm increased 12.55% after the low-carbon city policy was implemented. In Column (3), the variable Treat Post is 0.068 is significant at the 10% level, suggesting that the logarithm of green utility patent applications increased 14.66% after implementation of the low-carbon city policy.

4.2 Robustness tests

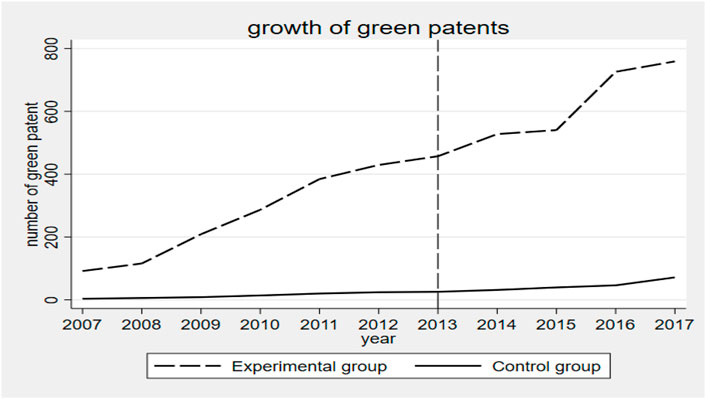

Several robustness tests were conducted to assess and verify results. First, Figure 1 shows the results of a parallel trend test. The horizontal axis is the year, and the vertical axis represents the number of green patent applications at the city level. The dotted line is the number of green patent applications by firms in pilot areas at the city level; the solid line represents the number of green patent applications of firms in non-pilot areas at the city level. The real vertical line is the year when the pilot policy was implemented. In Table 4, we used a dummy variable to measure green innovation. The variable is set at one if number of green patent applications is greater than zero, and 0 if otherwise. The result showed that the low-carbon pilot city policy did impact green utility patent applications. We evaluated the Return on investment (ROI) to determine which adopted which type of green innovation. Green utility patents have lower levels of risk compared to invention patents. Investments in utility patents are done both to relieve regulatory pressure and to improve firm performance (Liu et al., 2021).

5 Discussion

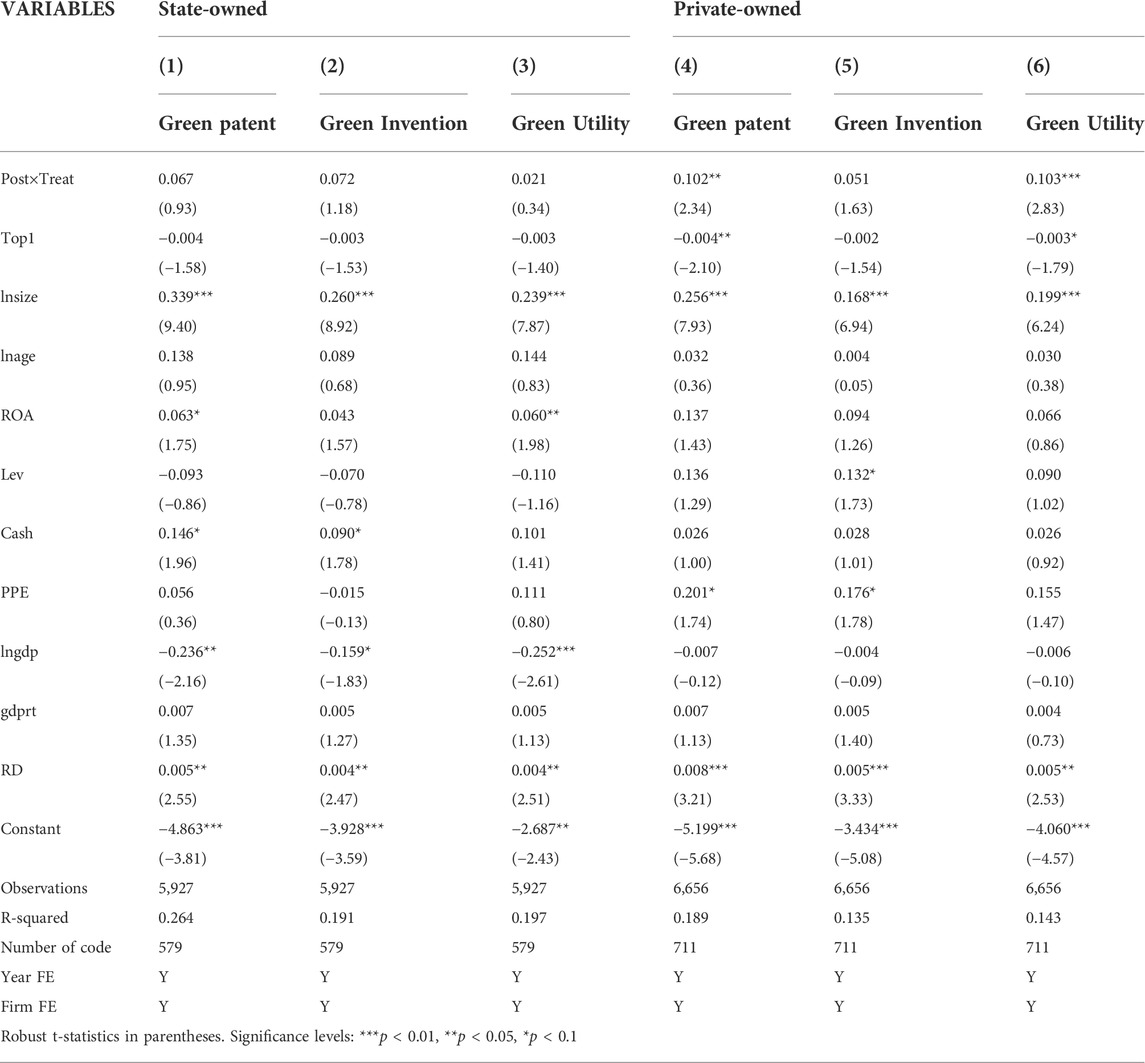

Impact of low-carbon city pilot policy and ownership on green innovation.

The regression results are shown in Table 4, and show the relationship between the low-carbon city policy and green innovation, controlling for firm and year fixed effects, and using clustered standard errors at the city level. The results show that the low-carbon pilot policy increased the green patent applications of privately-owned firms, with regression coefficients of 0.102 at a 5% statistical significance level. The results indicate that the logarithm of green patent applications from privately-owned firm increased 14.72% after the low-carbon cities policy was implemented. The results show that the low-carbon pilot policy increased the green utility patent applications of privately-owned firms, with regression coefficients of 0.103 at a 1% statistical significance level. This indicates that the logarithm of green patent applications from firms increased 22.20% after the low-carbon cities policy was implemented.

The results show that the low-carbon pilot policy only significantly improved the green innovation of privately-owned firms, but not state-owned firms. The direction of the effect was mainly due to green utility patent applications. The low-carbon pilot city policy did not significantly improve the green innovation of state-owned firms. As discussed above, this is because state-owned firms have a stronger path dependence, and because they are protected by local government, they are less constrained by environmental regulations.

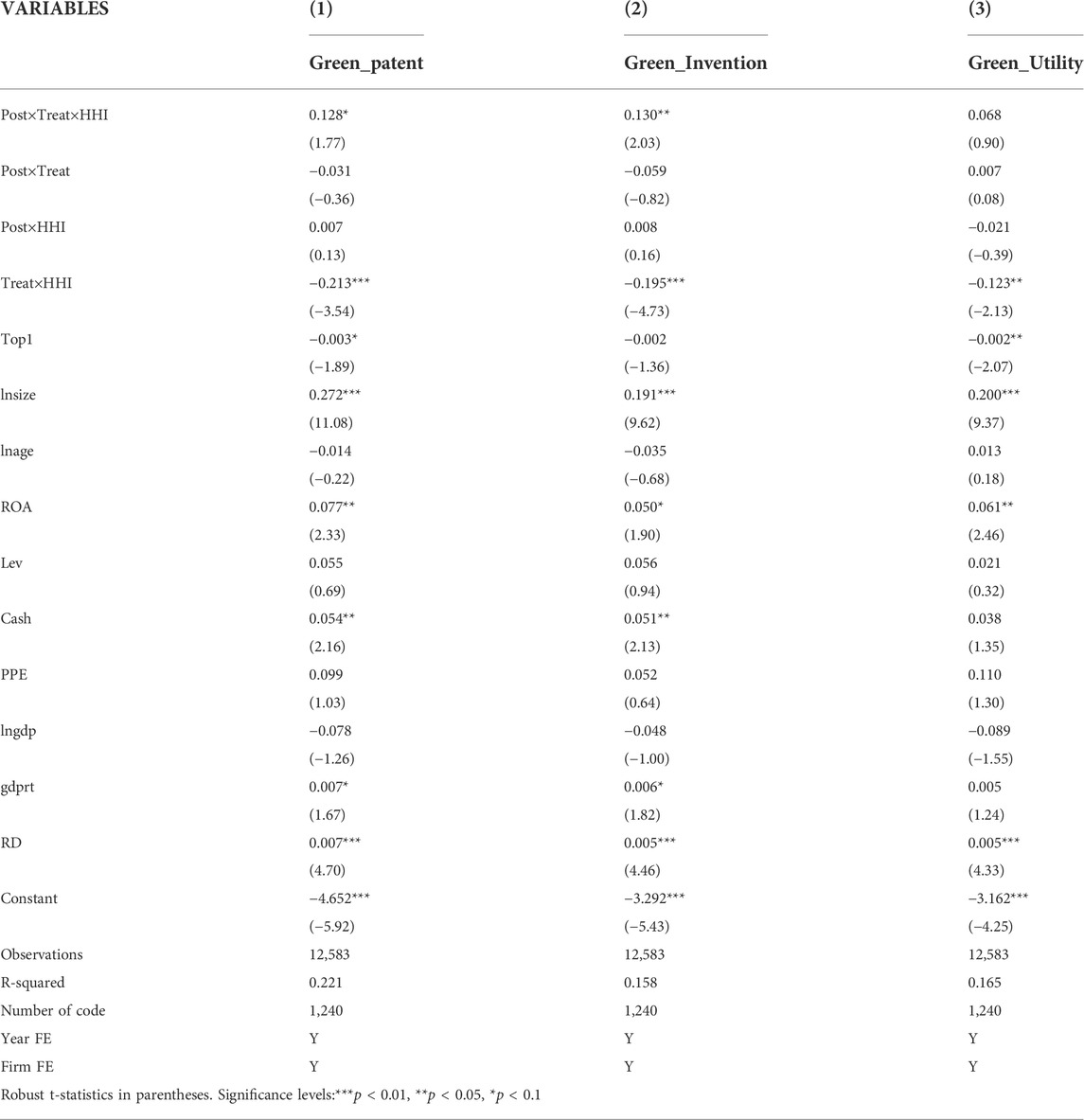

Table 5 shows the regression results illustrating the moderating role of market competition on the relationship between the low-carbon city policy on green innovation by firms. Market competition was measured using the Herfindahl-Hirschman-Index (HHI), based on the 2-digit standard industry classification (SIC) codes from listed A-share firms in the CSMAR Database. HHI was measured as the sum of squared market shares:

where Sikt is the market share of company I in industry k in the year t. Market share and firm sales were collected from the CSMAR database. The MC equals one if the HHI index is higher than the industry mean, and 0 if otherwise. The result shows that the coefficients Treat×Post×MC are 0.128 and 0.130, and are significant at a 10% and 5% significance level, respectively. The results indicate that the low-carbon city policy had a more significant effect on the green innovation of firms in industries that face lower levels of competition. In general, green innovations are associated with higher risk levels compared to nongreen innovations, because of the double positive externalities (Yang et al., 2022). Green innovations require cooperation between multiple departments. As such, enterprises in a concentrated market environment are generally more motivated to engage in green environmental R&D than those in competitive environments.

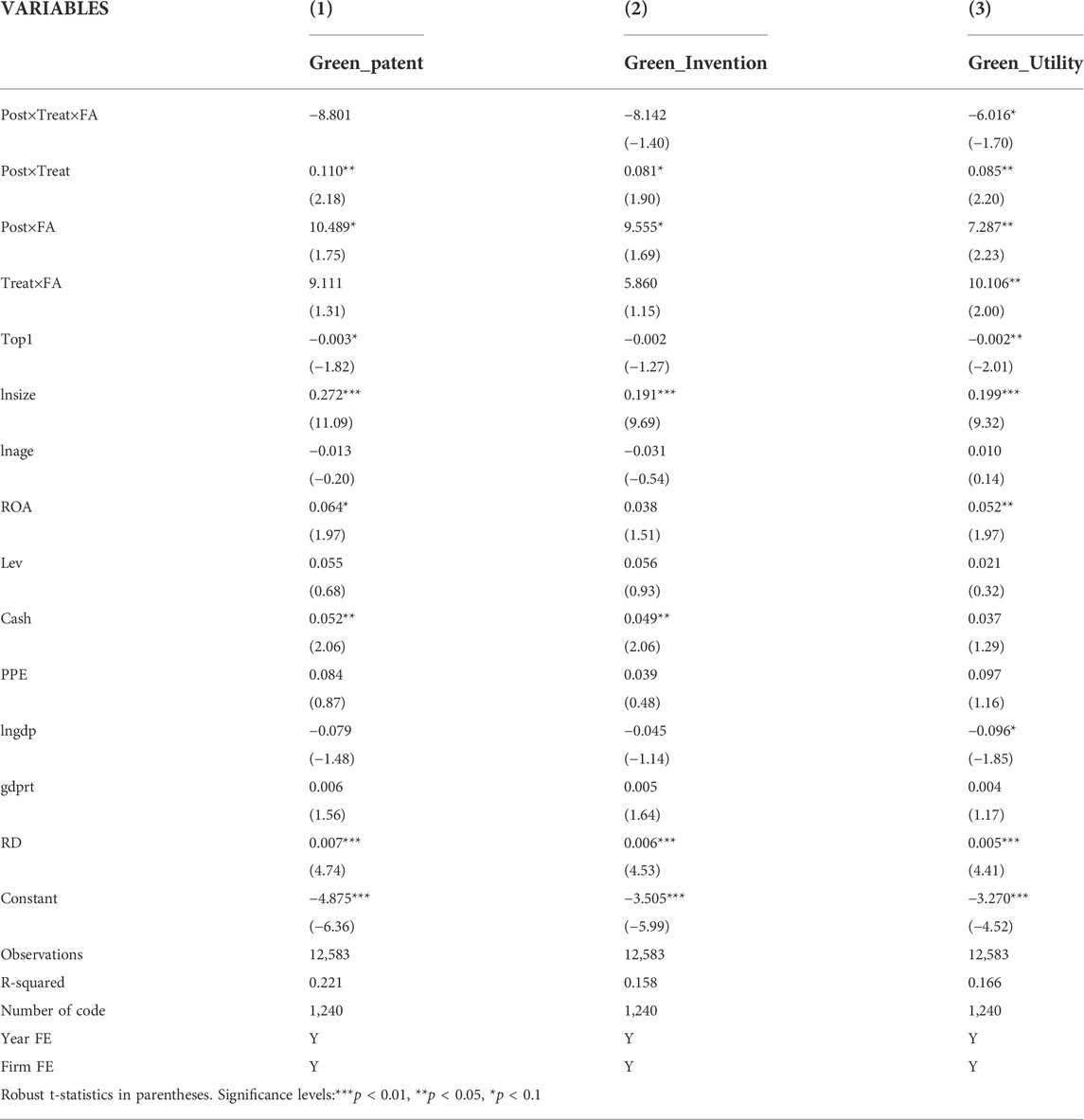

5.1 Impact of low-carbon city pilot policy and financial agglomeration on green innovation

The low-carbon pilot city policy encouraged green financial support for low-carbon transformation. Green financial policies can improve financing convenience for firms, ease the financial pressure involved in technology transformation, and promote green technology innovation. Cities with high financial agglomeration can better implement green financial policies, improve the convenience of financing for enterprises, and ease the financial pressure on firms in the course of technological transformation.

Table 6 shows the regression results assessing the moderating role of financial agglomeration on the relationship between the low-carbon city policy on the green innovation of enterprises. The result in Column 3) shows that the coefficient Treat × Post × FA was −6.016, and was statistically significant at a 10% level. The results show that financial agglomeration did not promote enterprises’ green technology innovation. Financial agglomeration did not improve the financing constraints of firms to promote green technology innovation.

6 Conclusion

This study tested the relationship between the low-carbon pilot city pilot and green innovation by firms. Using the green patent application data of listed firms for 2007–2017 and the DID methodological approach, we examined how the low-carbon city policy can promote green technology innovation, and transform urban development in a green and low-carbon direction. The results show that the low-carbon city policy somewhat stimulated the overall green technology innovation activities.

Of enterprises. The conclusion remained valid after a series of robustness tests, such as the parallel trend hypothesis, and the substitution of other indicators to measure green technology innovation. At the firm level, the pilot policy had a higher impact on the green technology innovation of privately-owned enterprises compared to SOEs, with privately-owned enterprises filing more green utility patents. Compared with highly competitive sectors, firms in sectors with low competition were more motivated to submit applications for green patents.

We conclude that the low-carbon city policy incentivizes green technology innovation, and that market forces support the development of a green economy. The research conclusions highlight the following policy implications for effectively promoting low-carbon city policies and green technology innovation by firms.

First, the low-carbon pilot city policy includes incentives that increase the number green patent applications, promoting green and low-carbon development in China. When considering city-level environmental governance policy, each pilot city can develop its own low-carbon development implementation plan, based on its actual economic and industrial environment. This is a policy tool with a high degree of freedom and weak binding forces. This paper’s research results show that the low-carbon pilot city policy plays a certain role in inducing green technology innovation. Policy makers can promote low-carbon cities across the country by drawing on these pilot experiences. This may contribute to China’s climate action target of achieving a carbon peak by 2030 and carbon neutrality by 2060. The pilot policy is characterized by imposing weak constraints. Therefore, the government should effectively oversee and guide the pilot cities in implementing the pilot program, to fully induce the green technology innovation of enterprises. This should ultimately achieve carbon emission reductions and economic development through green technology progress.

Second, our results show that privately-owned firms engage in more green innovation behavior under the low-carbon policy, because they face higher environmental pressures than SOEs. Firms in industries with low competition invest more resources in green environmental R&D than firms in highly competitive industries. We speculate that double externalities associated with green patents reduce the associated competitive advantage in domestic markets. Firms can export green goods overseas, where they can prevent competitors from benefitting from the double externalities. As such, corporate managers, especially those in industrial enterprises, should focus on green innovation under the low-carbon city policy, so that the firm can maintain a competitive advantage and improve their future international prospects.

Third, our testing showed that firms with different types of ownership respond differently to the low-carbon pilot city policy. Investors need to consider these differences when starting investment projects. Under the pilot policy, firm characteristics impact which firms react to the policy and invest in environmental innovations.

This paper examined the causal relationship between the low-carbon pilot city policy and green innovation by firms. Like all studies, it had some methodological limitations. First, the low-carbon city pilot policy was implemented in July 2010, and it is difficult to assess how other policies may also impact outcomes. Second, assessing the relationship between the financial environment and policy leads to somewhat limited conclusions, and the approach alone cannot directly prove the financial agglomeration effect on green technology innovation. This highlights the need to collect additional relevant data for further mining and testing. The low-carbon city pilot policy is still being continuously advanced, enabling additional tracking and analysis with more data in the future.

7 Limitations

This study may have some limitations, as follows. First, this paper uses the number of green patent application to measure green innovative behaviors. Although this method can reflect the green innovation choices of firms under different environmental, it is still not comprehensive. We will use more methods to measure green innovation behavior of firms under different perspectives.

Second, this article only examines green innovation behavior by listed firms. But it fails to consider Small and medium-sized enterprises (SMEs), them are small in scale and difficult to continuously invest resources in green innovation compared with listed companies. Face to environmental policies, there may be obvious differences in the green innovation choices of SMEs. In the further, we will collect green innovation information of SMEs to deepen subsequent research.

Finally, this study demonstrates the relationship between low-carbon policy and firm innovation behavior. But multiple policy affects firms’ green innovation behavior except low-carbon policies. Future research can use appropriate measurement methods to the synergistic effect of different policies and explore the role of low-carbon policy and others, and their impact mechanism on green innovation behavior.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding authors.

Author contributions

FP: Conceptualization, data collection, formal analysis, and methodology. FP and PW: Writing the original manuscript, writing—review and editing, administration.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Albrizio, S., Kozluk, T., and Zipperer, V. (2017). Environmental policies and productivity growth: Evidence across industries and firms. J. Environ. Econ. Manag. 81, 209–226. doi:10.1016/j.jeem.2016.06.002

Chen, H., Guo, W., Feng, X., Wei, W., Liu, H., Feng, Y., et al. (2021). The impact of low-carbon city pilot policy on the total factor productivity of listed enterprises in China. Resour. Conservation Recycl. 169, 105457. doi:10.1016/j.resconrec.2021.105457

Dong, Z., He, Y., and Wang, H. (2019). Dynamic effect retest of R&D subsidies policies of China's auto industry on directed technological change and environmental quality. J. Clean. Prod. 231, 196–206. doi:10.1016/j.jclepro.2019.05.188

Gilbert, R. (2006). Looking for mr. Schumpeter: Where are we in the competition--innovation debate? Innovation policy Econ. 6, 159–215. doi:10.1086/ipe.6.25056183

Jiang, Z., Wang, Z., and Zeng, Y. (2020). Can voluntary environmental regulation promote corporate technological innovation? Bus. Strategy Environ. 29 (2), 390–406. doi:10.1002/bse.2372

Jt, A., Yan, L. A., Wz, A., and Ly, B. (2022). Smog prediction based on the deep belief - BP neural network model (DBN-BP). Urban Clim. 44, 101078. doi:10.1016/j.uclim.2021.101078

Laeven, L., Levine, R., and Michalopoulos, S. (2015). Financial innovation and endogenous growth. J. Financial Intermediation 24 (1), 1–24. doi:10.1016/j.jfi.2014.04.001

Liu, L. W., Chen, C. X., Zhao, Y. F., and Zhao, E. D. (2015). China's carbon-emissions trading: Overview, challenges and future. Renew. Sustain. Energy Rev. 49, 254–266. doi:10.1016/j.rser.2015.04.076

Liu, S., Zhang, J. X., Niu, B., Liu, L., and He, X. J. (2022a). A novel hybrid multi-criteria group decision-making approach with intuitionistic fuzzy sets to design reverse supply chains for COVID-19 medical waste recycling channels. Comput. Industrial Eng. 169, 108228. doi:10.1016/j.cie.2022.108228

Liu, Y., Tian, J. W., Zheng, W. F., and Yin, L. R. (2022b). Spatial and temporal distribution characteristics of haze and pollution particles in China based on spatial statistics. Urban Clim. 41, 101031. doi:10.1016/j.uclim.2021.101031

Liu, Y., Wang, A., and Wu, Y. (2021). Environmental regulation and green innovation: Evidence from China’s new environmental protection law. J. Clean. Prod. 297, 126698. doi:10.1016/j.jclepro.2021.126698

Milani, S. (2017). The impact of environmental policy stringency on industrial R&D conditional on pollution intensity and relocation costs. Environ. Resour. Econ. (Dordr). 68 (3), 595–620. doi:10.1007/s10640-016-0034-2

Nesta, L., Vona, F., and Nicolli, F. (2014). Environmental policies, competition and innovation in renewable energy. J. Environ. Econ. Manag. 67 (3), 396–411. doi:10.1016/j.jeem.2014.01.001

Peroni, C., and Ferreira, I. S. G. (2012). Competition and innovation in Luxembourg. J. Ind. Compet. Trade 12 (1), 93–117. doi:10.1007/s10842-011-0101-x

Popp, D. (2006). International innovation and diffusion of air pollution control technologies: The effects of NOX and SO2 regulation in the US, Japan, and Germany. J. Environ. Econ. Manag. 51 (1), 46–71. doi:10.1016/j.jeem.2005.04.006

Porter, M. E., and Van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Qu, C., Shao, J., and Shi, Z. (2020). Does financial agglomeration promote the increase of energy efficiency in China? Energy Policy 146, 111810. doi:10.1016/j.enpol.2020.111810

Song, M. L., and Wang, S. H. (2018). Market competition, green technology progress and comparative advantages in China. Manag. Decis. 56 (1), 188–203. doi:10.1108/md-04-2017-0375

Tan, X. J., Liu, Y. S., Dong, H. M., and Zhang, Z. (2022). The effect of carbon emission trading scheme on energy efficiency: Evidence from China. Econ. Analysis Policy 75, 506–517. doi:10.1016/j.eap.2022.06.012

Wang, H., Chen, Z., Wu, X., and Nie, X. (2019). Can a carbon trading system promote the transformation of a low-carbon economy under the framework of the porter hypothesis?—empirical analysis based on the PSM-DID method. Energy Policy 129, 930–938. doi:10.1016/j.enpol.2019.03.007

Wang, H., Qi, S., Zhou, C., Zhou, J., and Huang, X. (2022). Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 331, 129834. doi:10.1016/j.jclepro.2021.129834

Wang, N., and Mogi, G. (2017). Deregulation, market competition, and innovation of utilities: Evidence from Japanese electric sector. Energy Policy 111, 403–413. doi:10.1016/j.enpol.2017.09.044

Xia, L., Gao, S., Wei, J., and Ding, Q. (2022). Government subsidy and corporate green innovation-Does board governance play a role? Energy Policy 161, 112720. doi:10.1016/j.enpol.2021.112720

Yang, G., Zha, D., Wang, X., and Chen, Q. (2020). Exploring the nonlinear association between environmental regulation and carbon intensity in China: The mediating effect of green technology. Ecol. Indic. 114, 106309. doi:10.1016/j.ecolind.2020.106309

Yang, S., Wang, W., Feng, D., and Lu, J. (2022). Impact of pilot environmental policy on urban eco-innovation. J. Clean. Prod. 341, 130858. doi:10.1016/j.jclepro.2022.130858

Yu, C. M., Chen, X. J., Li, N., Zhang, Y., Li, S. L., Chen, J. M., et al. (2022a). Ag3PO4-based photocatalysts and their application in organic-polluted wastewater treatment. Environ. Sci. Pollut. Res. 29 (13), 18423–18439. doi:10.1007/s11356-022-18591-7

Yu, Z., Ponce, P., Irshad, A. U. R., Tanveer, M., Ponce, K., and Khan, A. R. (2022b). Energy efficiency and jevons' paradox in OECD countries: Policy implications leading toward sustainable development. J. Pet. Explor. Prod. Technol. 12 (1), 1–14. doi:10.1007/s13202-022-01478-1

Yu, Z., Waqas, M., Tabish, M., Tanveer, M., Ul Haq, I., and Khan, S. A. R. (2022c). Sustainable supply chain management and green technologies: A bibliometric review of literature. Environ. Sci. Pollut. Res. 29, 58454–58470. doi:10.1007/s11356-022-21544-9

Yuan, H., Feng, Y., Lee, J., Liu, H., and Li, R. (2020). The spatial threshold effect and its regional boundary of financial agglomeration on green development: A case study in China. J. Clean. Prod. 244, 118670. doi:10.1016/j.jclepro.2019.118670

Yuan, H., Zhang, T., Feng, Y., Liu, Y., and Ye, X. (2019). Does financial agglomeration promote the green development in China? A spatial spillover perspective. J. Clean. Prod. 237, 117808. doi:10.1016/j.jclepro.2019.117808

Zhang, D. Y., Rong, Z., and Ji, Q. (2019). Green innovation and firm performance: Evidence from listed companies in China. Resour. Conservation Recycl. 144, 48–55. doi:10.1016/j.resconrec.2019.01.023

Zhang, G.-Y., Guan, R., and Wang, H.-J. (2020). The nNonlinear cCausal rRelationship bBetween eEnvironmental rRegulation and tTechnological iInnovation—eEvidence bBased on the gGeneralized pPropensity sScore mMatching mMethod. Sustainability 12 (1), 352. doi:10.3390/su12010352

Zhang, K., Ni, J., Yang, K., Liang, X., Ren, J., and Shen, X. S. (2017). Security and privacy in smart city applications: Challenges and solutions. IEEE Commun. Mag. 55 (1), 122–129. doi:10.1109/MCOM.2017.1600267CM

Keywords: low carbon city pilot policy, green innovation, differences-in-differences model, low carbon, listed company

Citation: Pei F and Wang P (2022) The impact of the low-carbon city pilot policy on green innovation in firms. Front. Environ. Sci. 10:987617. doi: 10.3389/fenvs.2022.987617

Received: 06 July 2022; Accepted: 31 August 2022;

Published: 22 September 2022.

Edited by:

Syed Abdul Rehman Khan, Xuzhou University of Technology, ChinaReviewed by:

Asif Basit, University of Malaya, MalaysiaMuhammad Tanveer, Imam Muhammad ibn Saud Islamic University, Saudi Arabia

Copyright © 2022 Pei and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Peilu Wang, MDI3MjFAcWRiaHUuZWR1LmNu

Fei Pei

Fei Pei Peilu Wang*

Peilu Wang*