95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 20 October 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.985620

This article is part of the Research Topic Green Energy Technologies for Environmental Sustainability: Drivers, Challenges, and Future Aspects View all 27 articles

The development of digital inclusive finance in China can help alleviate the problems of the “three rural areas” and contribute to rural revitalization. The impact of digital inclusive finance on rural revitalization is examined by multiple linear regression, mediated effect model, and threshold effect model in a sample of 30 provinces in China from 2011 to 2020. It is found that (1) the digital inclusive finance index and its sub-indicators - the breadth of digital financial coverage and depth of digital financial use - can promote rural revitalization in China, but the digitalization degree of its sub-indicators does not have a significant linear effect on rural revitalization, but a “U” shaped relationship of first inhibiting and then promoting, with 2017 as the boundary. (2) The regional heterogeneity test reveals that the promotion effect of the digital financial inclusion index and its sub-indicators of digital financial coverage breadth and digital financial usage depth on rural revitalization is more significant in the eastern coastal and central inland provinces, and insignificant in the western remote areas. (3) The mediating effect test finds that digital inclusive finance in China can contribute to rural revitalization by promoting economic growth in rural areas and narrowing the income gap between urban and rural areas. (4) The threshold effect test reveals that there is a single threshold effect of digital inclusive finance and its three sub-indicators on rural revitalization in China. When the digital inclusive finance index and the three sub-dimensions are below the threshold value, they have a facilitating effect on rural revitalization, and after crossing the threshold value, their facilitating effect on rural revitalization becomes more significant. Based on the empirical analysis results, this paper puts forward suggestions for improving the development mechanism of digital inclusive finance, formulating differentiated financial support policies and strengthening financial supervision according to regional differences, and establishing a long-term mechanism for rural revitalization, to promote China’s rural revitalization.

Since the beginning of the 21st century, how to build a well-off society has become the top priority of China’s economic and social development. The 17th and 18th Communist Party of China National Congress both put forward requirements and made strategic plans for the work of agriculture, rural areas and famers based on the strategic goal of building a well-off society in all aspects (Chen, 2019). On this basis, the report of the 19th Communist Party of China National Congress clearly put forward for the first time the implementation of rural revitalization strategy. It also profoundly elaborated what the road of socialist rural revitalization with Chinese characteristics is and how to take such road, which is a major strategic decision made by the Party Central Committee with an aim to build a well-off society, realize basic modernization, and comprehensively build a modern socialist country (Liu et al., 2020). It can be said that the rural revitalization strategy is the general strategy to promote the modernization of China’s agriculture and rural areas and the general sense of China’s the problems of agriculture, rural areas and farmers in the future (Zeng et al., 2021).

This paper aims to study the important part of digital inclusive finance in China’s rural revitalization during 2011–2020, as well as to explore what role rural economic growth and the unbalanced development between urban and rural areas play in this process. Consequently, this article selects the panel data of 30 provinces in China from 2011 to 2020 and comprehensively examines the role of digital inclusive finance and its three sub-dimensions in rural revitalization, and further investigate the mediating role of rural economic growth and unbalanced development between urban and rural areas in this process.

Compared with the existing literature, the innovations of this paper includes three aspects: 1) This paper empirically tests the role of digital financial inclusion in the rural revitalization strategy from the overall digital financial inclusion index and its three sub-indicators respectively. And from the perspective of provincial discrepancies in China, the role of digital inclusive finance in rural revitalization is furthermore discussed. 2) From the perspective of rural economic growth and the unbalanced development between urban and rural areas in this process, this article empirically tests the role of digital inclusive finance in promoting rural revitalization, which is of important signification for China to further promote the rural revitalization strategy. (3) The non-linear relationship of the model is demonstrated by testing the threshold impact of digital financial inclusion according to traditional linear regression.

The rest of this paper consists of four parts. The second part includes the literature review and research hypothesis. The third part includes the model setting, data sources and selection of indicators. The fourth part shows the results of the empirical evidence. The fifth part concentrates on the results and countermeasure suggestions.

Currently, the promotion effect of financial development on rural revitalization has been empirically supported by scholars. For example, Zhuo, Yubo et al. (2021) found that financial development significantly promoted rural revitalization and there was a threshold effect, and the promotion effect increased with the increase of rural per capita disposable income (Zhuo et al., 2021). Zhang Dehua (2020) similarly found that financial development positively promoted rural revitalization. And increasing credit allocation to rural enterprises and farmers significantly promotes rural revitalization (Zhang, 2020). Under the impetus of urbanization, the flow of rural financial factors to urban areas has led to the problem of insufficient financial distributionsingle product variety, and small coverage in rural areas, which eventually lead to lagging financial development in rural areas (Su et al., 2019). The continuous iterative innovation of financial technology, represented by computer database analysis technology, has improved the achieve of inclusive finance, and providing technical feasibility for the dissolution of the defects of traditional finance. As China enters the 5G era, digital inclusive finance is developing rapidly in China and has become an important force to help the rural revitalization strategy (Peng and Tao, 2022).

Scholars have expanded their theory of rural finance based on Goldsmith and Shaw’s theory of financial development (Kennedy et al., 1960; Goldsmith, 1990). Influenced by Keynesianism and Nackles’ “vicious circle theory of poverty,” the theory of agricultural credit subsidies has become an important guiding theory to address the problems of rural economic growth and capital demand. The theory believes that the problem of insufficient supply of capital in rural areas is widespread, and in order to improve the efficiency of agricultural production and effectively alleviate regional poverty, it is necessary to establish special government subsidized funds and non-profit inclusive financial institutions to solve China’s “Three Rural Issues” (Fu et al., 2020). Since the 1980s, the theory of China’s rural financial system has been fully developed, which relies entirely on market mechanisms and emphasizes that interest rate easing could boost financial intermediaries in rural areas. (Wensheng, 2020). After the 1990s, scholars found that social and non-market factors were essential for establishing efficient financial markets. The theory of imperfect competition accelerates the innovation level of the microfinance model, which helps to improve the service level of rural financial market. It also cultivates a fertile theoretical ground for the spread of digital financial inclusion.

Digital inclusive finance is a product of the deep integration of digital information technology, such as big data and blockchain, with traditional inclusive finance. Some scholars believe that the development of digital inclusive finance can significantly promote rural revitalization in several ways. First, the development of digital inclusive finance effectively alleviates agricultural financial exclusion and enhances the accessibility of rural loans (Corrado and Corrado, 2017; Liu et al., 2021a), while digital inclusive finance, with the help of technology, helps optimize the adjustment of industrial institutions in rural areas as well as the development of new industries and new business models in rural areas, thus promoting the prosperity of rural industries (Liu et al., 2021b). Second, digital inclusive finance can give full play to the guiding function of financial resources and promote the combination of inclusive finance with rural environmental protection and green and healthy development, thereby giving financial support to green agricultural projects and promoting rural ecological livability (Yang and Fu, 2019). Third, digital inclusive finance can change the traditional credit evaluation system with digital technology, realize the common construction and sharing of farmers’ information, and improve the appearance of rural villages, while digital inclusive finance can enrich the financial knowledge of farmers and promote the civilization of rural villages. Fourth, digital inclusive finance can help build a rural governance system, provide an information-sharing platform for all participating subjects, promote digital means of governance, and facilitate effective rural governance. Fifth, compared with traditional finance, digital inclusive finance can better meet the needs of rural residents for credit, investment, and insurance and enhance the wealth management ability of villagers. At the same time, based on big data algorithms, it can precisely target the capital management needs of farmers and provide them with personalized and customized financial services (Liu and Ruan, 2018), thus giving full play to the positive significance of financial support for farmers’ prosperity and promoting their affluent lives. Another view is that the initial development of digital inclusive finance does not promote rural revitalization. As it takes a certain process from the generation of new technology to its acceptance by people, especially in the case of information asymmetry, farmers usually accept new technologies based on the principle of minimizing risks. This response may lead to the misalignment of supply and demand and make promotion and acceptance more difficult. Meanwhile, as an emerging concept, digital inclusive finance often requires more time and effort for farmers owing to their lack of corresponding basic knowledge, which will have a crowding-out effect on the resources originally invested and limit the development of rural revitalization to a certain extent (Kondo et al., 2008). By constructing the evaluation system of “two highs, three degrees, three winds, three governance and three riches” for rural revitalization, Ge Heping and Qian Yu found that the influence of digital inclusive finance on rural revitalization shows a U-shaped relationship. Specifically, before the inflection point, digital inclusive finance will inhibit the development of rural revitalization to a certain extent, and after the inflection point, digital inclusive finance will significantly promote rural revitalization. The influence of digital inclusive finance on rural revitalization has a significant spatial spillover effect (Ge and Qian, 2021). Using the Peking University’s Digital Inclusive Finance Development Index, Li Jigang and Ma Jun empirically found that digital inclusive finance can promote rural revitalization and has a single threshold effect. In particular, there is a promotion effect when the level of digital inclusive finance development is below the threshold, but this promotion effect is more significant when such level of development is above the threshold (Li and Ma, 2021). Xie Di and Su Bo found that digital inclusive finance can promote rural revitalization, and the heterogeneity test results indicated a difference in the promotion utility between the east, central, and western regions (Xie and Su, 2021). In summary, although scholars generally agree that digital inclusive finance development can promote rural revitalization strategy in the long run, the relationship between the two is somewhat controversial in the short term. Therefore, we propose the following hypotheses.

H1a. : Digital financial inclusion development can significantly contribute to rural revitalization.

H1b. : Digital financial inclusion will inhibit rural revitalization to a certain extent in the short term but promote it in the long term.Agricultural capital is the core issue of agricultural economic development, and the Pareto law of finance implies that only the top customers are the source of profit. Accordingly, the optimal business strategy of financial institutions is to concentrate on serving the top customers, such that the remaining end customers often face the problem of difficult financing (Ma et al., 2022). Owing to cost–profit considerations, financial institutions generally shy away from remote areas, and so the development of digital inclusive finance can provide convenient and effective services for customers in rural areas. In addition, the main purpose of digital inclusive finance is to expand the breadth and depth of the scope of financial services, take deep root in remote areas and more places in need, and make it convenient for rural remote areas to enjoy special financial services by enriching targeted financial products and increasing the number of service outlets. By increasing rural savings and accumulating rural capital, we promote the growth of investment in rural areas, which in turn drives their economic growth.The development of digital inclusive finance will also enhance farmers’ income from multiple perspectives and narrow the income gap between urban and rural areas (Beck et al., 2007; Dai and Yang, 2021; Ji et al., 2021; Yu et al., 2021). First, the development of digital inclusive finance has the advantage of being rooted in the local area and is uniquely positioned to collect information in rural areas, lead the development of rural industries, and compete with traditional financial institutions. The agricultural support funds it provides for rural areas can enhance the technological content and intensification of agricultural industries, revitalize idle land in rural areas, promote the upgrading of rural industrial institutions, and drive the income growth of farmers. Second, the establishment of a more extensive and in-depth financial service system will help broaden the capital management channels of rural residents, and the securities, funds, trusts, and insurance institutions rooted in rural areas can break through the single financial management channel of cash collection and savings, meet the diversified financial needs of rural residents, and promote the growth of farmers’ income (Ge et al., 2022). Finally, the development of digital inclusive finance will help enhance the risk management ability of farmers. Agricultural production is seasonal and unstable and vulnerable to natural disasters and commodity price fluctuations. Furthermore, risks are more likely to accumulate and lack corresponding apportionment mechanisms in rural areas where the development of inclusive finance is backward. The emergence of rural inclusive finance can provide financial derivatives services for farmers to reduce possible price fluctuations through risk hedging. At the same time, the development of rural insurance institutions ensures the stability of rural industrial development in the event of natural disasters and market risks and reduces the loss of rural residents’ income to a greater extent. Yu’s study on the impact of digital inclusive finance on rural consumption upgrading in China found that digital inclusive finance promotes the consumption upgrading of rural residents through three channels, namely, income and wealth effects, liquidity constraints, and payment methods, which in turn promote rural revitalization (Yu and Wang, 2021). Meanwhile, through a study of 28 Chinese provinces from 2006 to 2016, Liu found that inclusive finance can promote farmers’ income but industrial structure upgrading plays a mediating mechanism in it (Liu et al., 2021c). On the basis of the above analysis, we propose the following hypotheses.

H2. : Digital financial inclusion helps rural economic development, which in turn promotes rural revitalization

H3. : Digital inclusive finance helps narrow the income gap between urban and rural areas, thus promoting rural revitalization

The measurement of the development level of rural revitalization covers a total of 31 development indicators drawn mainly from the EPS database. China Energy Statistical Yearbook, China Agricultural Machinery Industry Yearbook, China Education Statistical Yearbook, China Social Statistical Yearbook, and China Rural Statistical Yearbook are searched to complete the missing values, and the interpolation method is used to complete the missing data of very specific indicators for individual years and regions. The digital inclusive finance index (2011–2010) released by the Digital Inclusive Finance Index Group of Peking University is mainly used. Covering the period of 2011–2020, the index includes 33 indicators in three categories: breadth of digital financial coverage, depth of digital financial use, and digitalization of inclusive finance.

In this paper, starting from the connotation of rural revitalization, the index system of rural revitalization development level draws on the research results of the comprehensive evaluation of rural revitalization strategy since the 19th National Congress and constructs a scientific and effective evaluation system from five dimensions: prosperous industry, ecological livability, civilized countryside, effective governance, and affluent living (see Table 1). The index system mainly includes 5 primary indicators, 15 secondary indicators, and 31 tertiary indicators. Among them, the prosperity of the industry reflects the construction of the rural modern industrial system and the development of industrial integration. Seven three-level indicators related to agricultural development fully reflect the status of industrial revitalization. Ecological livability reflects whether the rural development route is green and environmentally friendly and whether it is people-oriented to effectively improve the living environment, and reflects ecological revitalization. The rural culture reflects the construction of rural culture, education, and health care, and reflects the revitalization of civilization. Effective governance reflects whether the rural social governance system is sound and whether the governance results are effective, reflecting organizational revitalization. The affluence of life reflects the richness of farmers’ material life and reflects the degree of human revitalization. The improvement of material life is the fundamental purpose of the rural revitalization strategy. At the same time, only when farmers enjoy the benefits of rural revitalization will the whole society be more willing to engage in agricultural production, and rural revitalization will have a source of power for continuous advancement. The five dimensions interact and influence each other to form an organic whole of rural revitalization. This study uses the entropy weight method to measure the rural revitalization development indicators. For the sake of comparability, the data are standardized to eliminate the differences between different quantitative scales.

Peking University’s Digital Finance Research Center cooperated with Ant Financial to compile the Digital Inclusive Finance Index, which covers the total index at provincial, municipal, and some county levels and contains three sub-indices: breadth of digital finance coverage, depth of digital finance usage and degree of digitalization. In 2019, Peking University released the 2011–2018 Digital Inclusive Finance Index, and in April 2021, the university’s Digital Finance Research Center released the Peking University Digital Inclusive Finance Index (2011–2020), which provides data support for this thesis (Yao and Yang, 2022). This study uses the provincial data of this index as the core explanatory variables. Referring to the related study by Han Huiyuan et al. (2021), it divides the digital inclusive finance index, breadth of digital inclusive finance coverage (DIF_B), depth of digital inclusive finance use (DIF_D), and degree of digitalization (DIG) by 200 (Han and Gu, 2021).

According to the previous analysis, this study selects the rural GDP per capita to measure the level of rural economic development. The total value of China’s economic growth is generally expressed by GDP, but since the relevant statistical yearbook does not have the statistical caliber of rural GDP, based on the existing literature, we use the gross value of the primary industry and the value added of the township industry to estimate the rural GDP per capita divided by. To reduce the absolute value of the data and eliminate the problem of heteroskedasticity, we take the logarithm of the rural GDP per capita in this paper. The Theil index is chosen to measure the urban–rural income gap. The Gini coefficient is a basic tool to measure the urban–rural income gap, but it is only sensitive to the income changes of the middle class. It is difficult to distinguish whether the Gini coefficient expands because the income of all classes generally increases or the income of the low-income class is lower and the income of the high-income class is higher due to the further widening of the gap between the rich and poor. Based on the comparative analysis of this paper, compared with the Gini coefficient, the Theil index not only takes into full account the influence of population but is also more sensitive to the changes in the income of different strata. It can likewise well reflect the income changes of different strata and the changes in the ratio of urban and rural population. Therefore, this study selects the Theil index to measure the urban–rural income gap.

Referring to Lv and Zhao’s research, the moderating variables in this paper are Diff, GS, GB, and GD. Diff = DIG*DIG is a squared term of the degree of digitalization. GS denotes the product of the first-order lag term of the inclusive financial index in time (

In this study, the degree of openness to the outside world (Open) and the old age dependency ratio (Old) are selected as the control variables. The degree of openness to the outside world is expressed as the proportion of total imports and exports to the GDP per capita of the region (Zhou et al., 2018). The old age dependency ratio is expressed as the ratio of the old part of the non-working-age population to the working-age population multiplied by 100. It is used to indicate how many old people need to be covered for every 100 working-age population (Wu et al., 2021), referring to Wu Lianxia et al. (2021). Table 2 presents the descriptive statistics of the relevant variables.

According to the research objectives, this study constructs benchmark regressions (Eqs 1–4) to investigate the impact of digital financial inclusion development on rural revitalization.

In Eqs 1–4, RV represents the explained variable rural revitalization, and the specific accounting method is shown below. DIF denotes the Digital Inclusion Financial Development Index. DIF_B denotes the breadth of digital inclusion financial coverage. DIF_D denotes the depth of digital inclusion financial use. DIG denotes the degree of digitalization.

Considering the role of rural economic development and urban-rural income disparity in the process of digital inclusive finance for rural revitalization, this paper establishes the following mediating effect model, taking the total digital inclusive finance index as an example here, and the mediating effect model of its three sub-indicators is similar to this, which will not be further elaborated here.

In this paper, we adopt the stepwise regression method of intermediary effect test, whose general steps are: if

Considering the possible nonlinear relationship between digital inclusive finance and rural revitalization, this paper refers to Hansen’s (1999) research method for threshold effect regression study paper also considering that the threshold value needs to be determined by testing, the following single threshold model is set and the actual threshold value is finally determined.

In Eq. 9, Q is the threshold variable;

Table 3 presents the results of the baseline regression of digital inclusive finance on rural revitalization. Model (1) shows the regression results of the digital inclusive finance index on rural revitalization. The results reveal that the regression coefficient of the index is 3.793 and significant at the 1% level, indicating that the development of digital inclusive finance can significantly promote rural revitalization. Model (2) shows the regression results of the breadth of digital inclusive finance use (DIF_B) on rural revitalization; the regression coefficient is 3.288 and significant at the 1% level, indicating that the increase of account coverage of digital inclusive finance can significantly promote rural revitalization. The possible reason for this is the enhanced reach of finance via the emergence of Internet finance represented by Alipay. It also reduces the cost of technology, improves the efficiency of financial innovation, and solves the problem of the “last mile” of rural financial reform faced by the county economy. Model (3) is the regression result of the depth of digital inclusive financial use (DIF_D) on rural revitalization; the regression coefficient is 2.368 and significant at the 1% level, indicating that diversified financial fund management and financing channels, such as money fund business, credit business, insurance business, and investment business, can significantly promote rural revitalization. Model (4) shows the regression results of digital degree on rural revitalization; its regression coefficient is 0.336, which does not pass the significance test. The possible reason is that the digital degree is measured in digital forms, such as Anthem, Sesame Credit, and user QR code, which take time to gain popularity in rural areas.

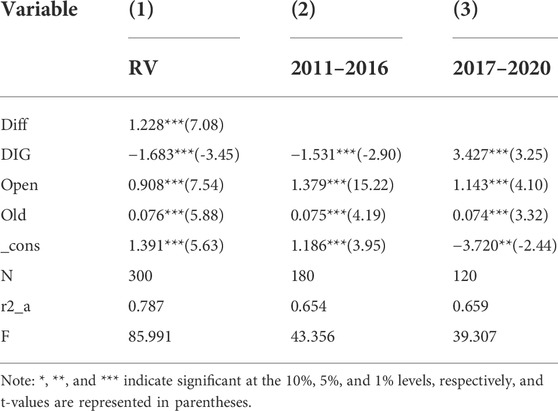

To clarify the reasons for the insignificant regression coefficient of the digitalization index, combined with the previous theoretical analysis, we believe that the degree of digitalization of digital inclusive finance has a certain time cost for rural revitalization. That is, as new digital financial services such as Ant Hana and Sesame Credit are emerging technologies, it takes time from generation to popularization, especially under the problems of backward information conditions and weak infrastructure in rural areas. In China, there may be a misalignment between supply and demand in digital finance, leading to difficulties in its promotion to and acceptance by users in the early stage. Therefore, we believe that the digitalization degree of digital inclusive finance has a nonlinear effect on rural revitalization. Under certain conditions, the digitalization degree of digital inclusive finance will inhibit rural revitalization and, beyond the critical value, promote rural revitalization. On the basis of the above analysis, we add the squared term of digital inclusive financial digitalization degree based on the original model as well as test the effect of digitalization degree on rural revitalization in stages with 2017 as the time node. The regression results are shown in Table 4.

TABLE 4. Regression results of non-linear effects of digitalization degree and rural revitalization.

As shown in Table 4, the regression coefficient of the squared term of the degree of digitalization (Diff) in Model (1) is 11.228 and significant at the 1% level. Moreover, the regression coefficient of the degree of digitalization is -1.683 and significant at the 1% level, indicating a nonlinear effect of the degree of digitalization on rural revitalization. Model (2) shows the regression results of the degree of digitalization on rural revitalization from 2011 to 2016, where the regression coefficient of the degree of digitalization is −1.531 and significant at the 1% level, indicating that the degree of digitalization would constrain the development of rural revitalization to some extent until 2017. Model (3) shows the regression results of the degree of digitalization on rural revitalization from 2017 to 2020, in which the regression coefficient of the degree of digitalization is 3.427 and significantly positive at the 1% level. This result indicates that from 2017 to the present, the increase in the degree of digitalization of digital inclusive finance can significantly promote the development of rural revitalization. Taken together, we find that the degree of digitalization shows a nonlinear effect on rural revitalization, with 2017 as the critical point for the effect of the degree of digitalization on rural revitalization. The degree of digitalization would also constrain rural revitalization to some extent before 2017, but the advancement of digitalization after 17 years will promote the development of rural revitalization. The possible reason for this outcome is that General Secretary Xi Jinping first proposed the rural revitalization strategy in the report of the 19th Party Congress in 2017, which elevated rural revitalization to the level of a global strategy (Bai et al., 2021). In addition, the work of technology enterprises represented by Taobao to root in the countryside and help rural residents eliminate poverty and get rich has achieved remarkable results. As the Ali Research Institute stated in the China Taobao Village Research Report (2017) released in 2017, 2,118 Taobao villages and 242 Taobao towns were formed nationwide in 2017, which improved the income of residents and accelerated the process of rural revitalization (Xiang and Hu, 2019).

From the perspective of empirical methodology, the econometric model in this study may have an insurmountable “endogeneity” problem, and the rural revitalization strategy and digital financial inclusion may be influenced by a series of unobservable factors, such as farmers’ expectations of the future and personal consumption preferences, which will lead to bias in the estimation of the regression coefficients of digital financial inclusion (Li et al., 2020; Liu et al., 2021d). To avoid possible endogeneity problems in the measurement, we construct GS, GB, and GD indicators for instrumental variable estimation, drawing on the study of Xingjian Yi and Zhou Li (2018) (Yi and Zhou, 2018). Table 5 reports the regression results based on the variational approach. The results clearly show that the estimated coefficients of the instrumental variables in the first stage are significant and non-zero. The estimation results indicate that the promotion effect of digital inclusive finance on rural revitalization remains significant after the endogeneity is fully considered. Therefore, the regression results in the previous section basically satisfy the robustness requirements.

There is a nonlinear effect of the impact of digitalization on rural revitalization in the previous paper. Given this result, do the digital inclusion financial index, breadth of digital inclusion financial coverage, and depth of digital inclusion use also have different effects depending on the time period? To verify the stability of the empirical results, this study takes 2017 as the node and conducts a regression analysis with reference to the previous regression approach. The results are shown in Table 6.

Models (1) and (2) in Table 6 reflect the results of the test of digital inclusive finance index on rural revitalization by time period. From the results, it can be seen that digital inclusive finance can significantly promote rural revitalization in different time periods, proving the stability of the promotion effect of digital inclusive finance index on rural revitalization. Models (3) and (4) reflect the regression results of the breadth of digital inclusive financial coverage on rural revitalization by time period. The results show that such breadth can significantly promote rural revitalization in different time periods, and the coefficients of the breadth of digital inclusive financial coverage in models (3) and (4) are close to each other, which further confirms the stability of the empirical results. Models (5) and (6) reflect the regression results of the depth of digital financial inclusion use on rural revitalization by time period. It can be seen that the depth of digital financial inclusion use can significantly promote rural revitalization in different time periods. In summary, after the regression results are analyzed by time period, the robustness of the above regression results is proven.

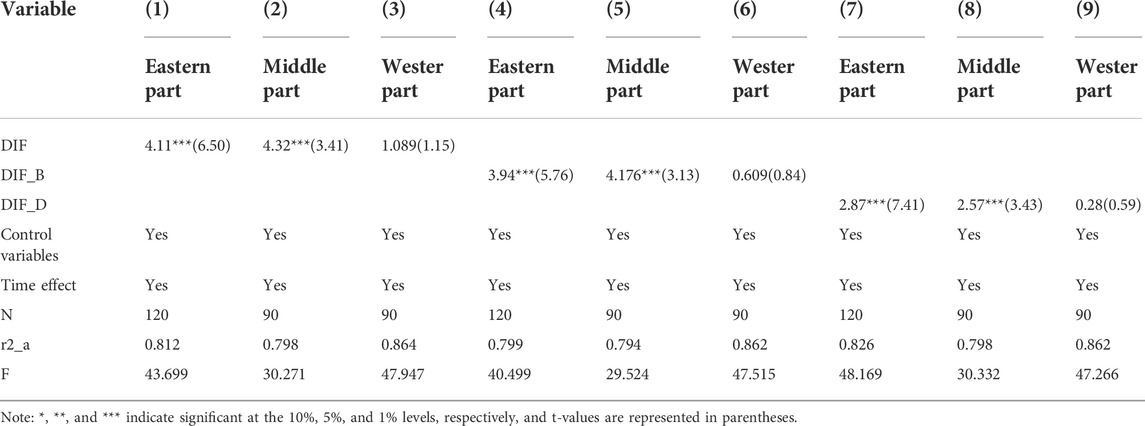

For a country with a dual economy and a highly uneven regional economic development like China, are there certain regional differences in the impact of digital inclusive finance development on rural revitalization? For this reason, we refer to the division of scholars into provincial regions and divide the full sample into three subsamples, namely, eastern coastal region, central inland region, and western remote region, for regressions. For the readability of the experimental results and owing to space limitation, we omit the time effect and control variables. The regression results are shown in Table 7.

TABLE 7. Regression results of regional heterogeneity of digital inclusive finance and rural revitalization.

Table 7 shows the regression results of the regional heterogeneity of digital inclusive finance on rural revitalization. Overall, the promotion effect of digital inclusive finance on rural revitalization is shown to be more significant in the eastern coastal and central inland regions but not in the western remote region. Specifically, models (1)–(3) show the regression results of the digital inclusive finance index on rural revitalization. The regression coefficients of the eastern coastal and central inland regions are 4.11 and 4.32, respectively, and both significant at the 1% level, indicating that for the total digital inclusive finance index, its promotion effect on rural revitalization is most significant in the central inland region, followed by the eastern coastal region. The regression coefficient for the western region does not pass the significance test. Models (4)–(6) represent the regression results of the breadth of digital financial inclusion coverage on rural revitalization. The regression coefficients of the eastern and central regions are 3.94 and 4.176, respectively, and both are significant at the 1% level, indicating that for the breadth of digital financial inclusion coverage, its contribution to rural revitalization is most significant in the central region, followed by the coastal region. The regression coefficient of the western region does not pass the significance test. Models (7)–(9) show the regression results of the depth of digital inclusive finance usage on rural revitalization. The regression coefficients of the eastern and central regions are 2.87 and 2.57, respectively, and both are significant at the 1% level, indicating that for the depth of digital inclusive financial use, its promotion effect on rural revitalization is most significant in the eastern region, followed by the central region. The regression coefficient of the western region does not pass the significance test.

The above analysis shows that the promotion effect of total index and coverage breadth of digital inclusive finance on rural revitalization is most effective in the central region, and the promotion effect in the coastal region is less than that in the central region but still significant. The depth of digital inclusive financial use is most significant in the coastal region, and the promotion effect in the central region is not as effective as that in the coastal region but still very significant. The promotion effects of digital inclusive finance index, coverage breadth, and usage depth on rural revitalization are not significant in the western region. The possible reasons for this finding are as follows. First, compared with the western region, financial development in the central inland and eastern coastal provinces is more mature as there is a more mature financial environment and relatively mature financial personnel, which cultivate a good financial fertile ground for the emergence and popularization of digital inclusive finance. However, the development of digital inclusive finance has been affected to a certain extent by the relatively weak financial foundation in the remote western regions of China. The average education level and knowledge of financial knowledge in coastal and inland provinces are also higher than those in remote western regions, and people’s mastery of financial knowledge helps them reduce financial rejection of digital inclusive finance, thus helping digital inclusive finance promote widely and deeply in eastern and central regions.

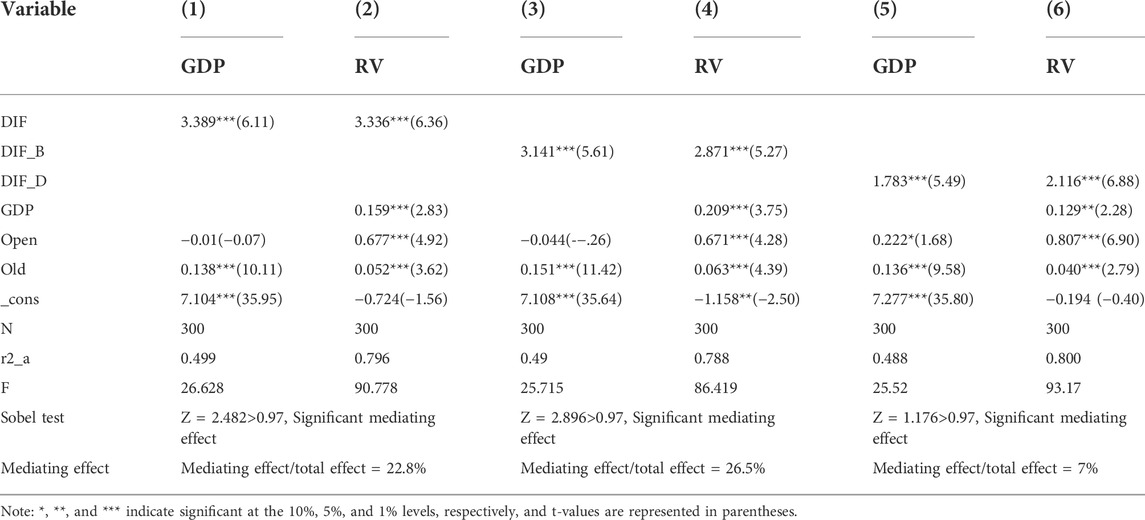

To verify the mediating effect of rural economic development, this study used the three indicators of digital inclusive financial development index, breadth of digital inclusive financial coverage, and depth of use as explanatory variables and included rural economic development as a mediating variable in the analysis framework. The regression results of the mediating effect of rural economic development are shown in Table 8. Considering that the regression results of the degree of digitalization on rural revitalization are not significant, this study does not include the degree of digitalization in the scope of the study when testing the mediating effect. The regression results of digital financial inclusion and the three sub-dimensions (breadth of digital finance coverage, depth of digital finance usage and degree of digitalization) on rural revitalization have been reported in Table 3 and are not repeated here. Model (1) reports the regression results of digital inclusive finance on rural economic development, and model (2) tests whether rural economic development plays a partial mediating role in digital inclusive finance and rural revitalization. Model (3) reports the regression results of digital inclusive finance coverage breadth on rural economic development, and model (4) tests whether rural economic development plays a partial mediating role in digital inclusive finance coverage breadth and rural revitalization. Model (5) reports the regression results of the depth of digital inclusive financial use on rural economic development, and model (6) examines whether rural economic development plays a partial mediating role in the depth of digital inclusive financial use and rural revitalization. The regression results show a significant mediating effect of rural economic growth as a mediating variable in the process of digital inclusive finance index contributing to rural revitalization. The proportion of this mediating effect in the total effect is 22.8%. Similarly, in the process of digital inclusive financial index coverage contributing to rural revitalization, there is a significant mediating effect of rural economic growth as a mediating variable, and the proportion of this mediating effect in the total effect is 26.5%. In the process of the depth of digital inclusive financial use contributing to rural revitalization, there is a significant mediating effect of rural economic growth as a mediating variable, and the proportion of this mediating effect in the total effect is 7%.

TABLE 8. Digital inclusive finance and rural revitalization: a test of the mediating effect of regional economic growth.

These regression results suggest that rural economic growth plays a crucial role in the process of digital inclusive finance contributing to rural revitalization. Specifically, the development of digital inclusive finance can drive regional employment and entrepreneurship, boost demand, and stimulate consumption. Meanwhile, the development of digital inclusive finance can form a certain financial agglomeration effect, improve the efficiency of capital allocation, and drive the growth of the rural real economy. In a comprehensive view, the econometric test based on the mediating effect clearly reveals the link of “digital inclusive financial development–rural economic growth–rural revitalization” in the rural revitalization strategy of China.

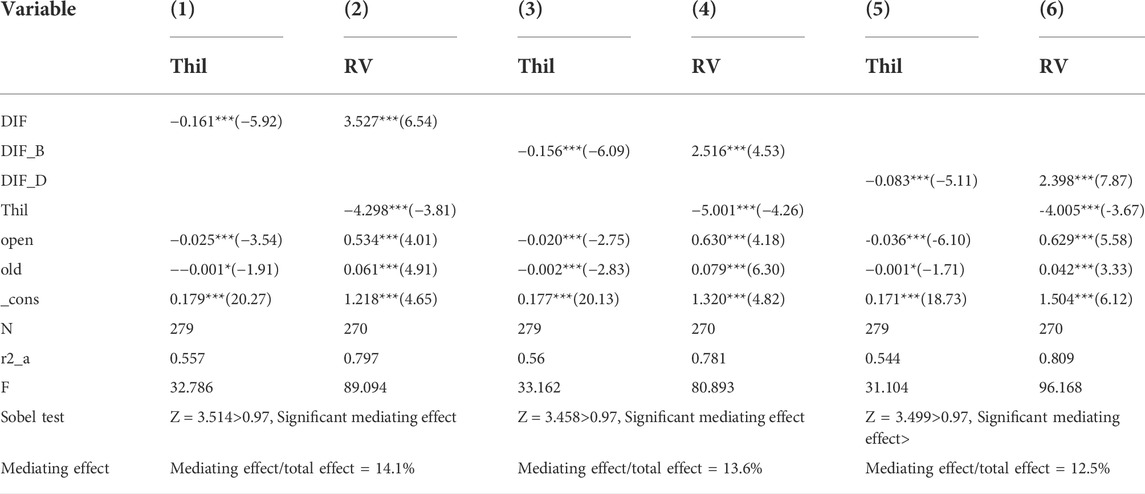

To verify the mediating effect of the urban–rural income gap, this study uses the three indicators of digital inclusive financial development index, digital inclusive financial coverage breadth, and usage depth as explanatory variables and expresses urban–rural income gap through the Theil index. In addition, it includes urban–rural income gap as a mediating variable in the analysis framework. The regression results of the mediating effect of urban–rural income gap are shown in Table 9. Considering that the regression results of digitalization degree on rural revitalization are not significant, digitalization degree was not included in the scope of this study when testing the mediating effect. The regression results of digital financial inclusion and the three sub-dimensions (breadth of digital finance coverage, depth of digital finance usage and degree of digitalization) on rural revitalization have been reported in Table 3 and are not repeated here. Model (1) reports the regression results of digital inclusive finance on urban–rural income gap (Theil), and model (2) tests whether urban–rural income gap (Theil) plays a partial mediating role in digital inclusive finance and rural revitalization. Model (3) reports the regression results of digital inclusive financial coverage breadth on urban–rural income gap (Theil), and model (4) tests whether urban–rural income gap (Theil) plays a partial mediating role in digital inclusive financial coverage breadth and rural revitalization. Model (5) reports the regression results of depth of digital inclusive financial use on urban–rural income gap (Theil), and model (6) tests whether urban–rural income gap (Theil) plays a partial mediating role in the depth of digital inclusive financial use and rural revitalization. The regression results suggests that there is a significant mediating effect with the urban–rural income gap as the mediating variable in the process of digital inclusive finance index contributing to rural revitalization, and the proportion of this mediating effect in the total effect is 14.1%. Similarly, in the process of digital inclusive finance index coverage breadth contributing to rural revitalization, there is a significant mediating effect of urban–rural income gap as a mediating variable, and the proportion of this mediating effect in the total effect is 13.6%. In the process of the depth of digital inclusive financial use contributing to rural revitalization, there is a significant mediating effect of urban–rural income gap as a mediating variable, and the proportion of this mediating effect in the total effect is 12.5%.

TABLE 9. Digital inclusive finance and rural revitalization: a test of the mediating effect of the urban-rural income gap.

These regression results indicate that the narrowing of the urban–rural income gap plays a crucial role in the process of digital inclusive finance contributing to rural revitalization. In a comprehensive view, the econometric test based on the mediating effect clearly reveals that there is a link of “digital inclusive finance development–urban-rural income gap narrowing–rural revitalization” in the rural revitalization strategy of China.

The regression results of the panel data model confirmed the results from the previous paper that digital inclusive finance index, breadth of digital inclusive finance coverage, and depth of use contributes positively to rural revitalization. However, these findings assume that the impact of digital inclusive finance is linear and thus ignore the possible variability of its impact at different development stages of digital inclusive finance. Although the previous paper confirmed the existence of a temporal nonlinear effect of the degree of digital inclusive finance digitalization on rural revitalization, is this nonlinear effect related to the degree of digital inclusive finance development? The previous study did not provide an answer. Therefore, the next paper will further test the characteristics of whether a threshold effect exists between digital inclusive finance and rural revitalization by using the digital inclusive finance development index as the threshold variable. The current study refers to the treatment of Wang (2015) to determine whether the threshold effect exists and whether it is significant, and the specific regression results are shown in Table 10. As can be seen from the table, the digital inclusive finance index and its three sub-indicators pass the single threshold effect test at the 1% level but not the double and triple threshold tests (i.e., there is a single threshold effect for each dimensional index).

The results of the threshold estimates are reported in Table 11. The estimates of the threshold and confidence intervals indicate that the 95% confidence interval range is narrow and the threshold regression results are more significant.

By estimating the threshold effects and threshold values, this study empirically tested the threshold effects of the total digital inclusive finance index and each sub-dimension using a panel threshold regression model. The regression results are shown in Table 12.

Table 12 reports the estimation results of the threshold regression, from which it can be seen that there is a significant positive relationship between digital inclusive finance and rural revitalization, indicating that digital inclusive finance promotes rural revitalization to a certain extent. Specifically, when the explanatory variable is digital inclusive finance, the elasticity coefficient is 0.697 when the total digital inclusive finance index is lower than γ1. When the total digital inclusive finance index is higher than γ1, the elasticity coefficient is 1.408. Obviously, the strength of the effect of digital inclusive finance on rural revitalization is different in different intervals, showing the characteristic of threshold effect. As the digital inclusive finance index crosses the threshold value, its role in promoting rural revitalization becomes more significant. When the explanatory variables are coverage breadth, usage depth, and degree of digitalization, the estimated coefficients of each categorical index show similar trends with the transformation of the zone system, and the regression coefficients on rural revitalization gradually become larger when each categorical index crosses the threshold value.

Digital inclusion is a new industry formed by the integration and development of Internet and inclusive finance and is an important driving force to help revitalize the countryside. This study systematically constructs an evaluation index system for rural revitalization from five aspects and measures the development level of rural revitalization in 30 provinces in China from 2011 to 2020 using the entropy weight method. With data from the Digital Inclusive Finance Index of Peking University from 2011 to 2020 to match with the rural revitalization index, the effect of the Digital Inclusive Finance Development Index on rural revitalization was empirically tested. The regression results of the sub-indicators show a linear positive relationship between the breadth of coverage and depth of use on rural revitalization as well as a U-shaped relationship between the degree of digitalization and rural revitalization with 2017 as the cut-off point. Furthermore, the degree of digitalization before 2017 would limit rural revitalization to a certain extent. After 2017, the degree of digitalization significantly promoted the development of rural revitalization. (2) The results of the regional heterogeneity test show that the promotion effect of the Digital inclusive finance index, coverage breadth, and usage depth on rural revitalization is more significant in the eastern coastal and central inland provinces while the effect on the western remote areas does not pass the significance test. (3) The results of the mechanism of action test indicate that digital inclusive finance, breadth of coverage, and depth of use can contribute to rural revitalization by promoting economic growth in rural areas and narrowing the income gap between urban and rural areas. (4) Digital inclusive finance index and the three sub-dimensions have a single threshold effect on rural revitalization. When the digital inclusive finance index and the three sub-dimensions are below the threshold value, they have a positive promotion effect on rural revitalization, and after crossing the threshold value, their promotion effect on rural revitalization is more significant. Based on this, this paper proposes the following recommendations.

First, we should improve the development mechanism of digital inclusive finance and help revitalize rural finance. We should actively promote the digitalization of the countryside and the development of rural digital industries. At the same time, we should strengthen financial support in the construction of rural information technology, enhance the construction of network communication facilities in rural areas, and improve the infrastructure to support the development of digital inclusive finance. Second, we need to adapt to local conditions and activate the endogenous power of rural development. In view of the different roles of digital inclusive financial development in rural revitalization in the eastern, central, and western regions, differentiated financial support policies should be formulated according to local conditions and time. Regions with weak economic foundation should focus on popular education, try to solve the problem of the lack of rural capital, and attract people returning to their hometowns to start their own businesses. Regions with better economic development should tilt the development of digital inclusive finance to innovation and entrepreneurship, actively upgrade the rural industrial structure, develop ecological tourism agriculture, change the mode of increasing farmers’ income, and activate the endogenous power of rural revitalization. Finally, financial supervision should be strengthened and a long-term mechanism for rural revitalization be established. A sound agricultural risk guarantee mechanism should be established to alleviate the plight of rural residents returning to poverty due to disasters, while a sound digital inclusive finance risk supervision mechanism should be established to integrate Internet resources and improve risk warning, prevention, and control and treatment through data risk ranking.

The limitation of this study is that in the construction of the evaluation system of rural revitalization and development, due to the difficulty of obtaining some data, it may not be able to comprehensively and systematically reflect the situation of rural revitalization and development. Secondly, the empirical part of this paper uses the data from 2011 to 2020, the period is only 10 years, the sample size is relatively small, and only short-term analysis can be carried out. Therefore, in the future, researchers can consider analyzing the long-term impact of digital financial inclusion on rural revitalization, and can also conduct similar studies with other countries as research objects.

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding authors.

Conceptualization, WL and MX; Methodology, MX; Software, MX; Validation, MX, and JF; Formal analysis, MX; Survey, MX and JF; Data statute, MX; Writing-original manuscript preparation, MX; Writing-review and editing, WL, JF, and BX; Visualization, JF; Supervision, WL and BX; Project management, WL; Funding acquisition, WL.

This research was funded by 2020 “Young Backbone Teacher Training Program” of Henan Higher Education Institution, grant number 2020GGJS092.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Bai, B., Chen, F., and Zhou, G. (2021). Functions of village classification based on POI data and social practice in rural revitalization. Arab. J. Geosci. 14 (17), 1690–1714. doi:10.1007/s12517-021-08001-6

Beck, T., Demirgüç-Kunt, A., and Levine, R. (2007). Finance, inequality and the poor. J. Econ. GrowthBost. 12 (1), 27–49. doi:10.1007/s10887-007-9010-6

Chen, X. (2019). The core of China’s rural revitalization: Exerting the functions of rural area. China Agric. Econ. Rev. 12, 1–13. doi:10.1108/CAER-02-2019-0025

Corrado, G., and Corrado, L. (2017). Inclusive finance for inclusive growth and development. Curr. Opin. Environ. Sustain. 24, 19–23. doi:10.1016/j.cosust.2017.01.013

Dai, A., and Yang, Z. (2021). A study on the factors of farmers' income gap under financial capital considering the strategy of rural revitalization. Basic. Clin. Pharmacol. Toxicol. 128, 185. 111 RIVER ST, HOBOKEN 07030-5774, NJ USA: WILEY.

Fu, Q., Wu, J., Zhao, R., and Yang, Z. (2020). Poverty alleviation effect of inclusive finance: A case study of the coastal regions of north China. J. Coast. Res. 107 (SI), 419–424. doi:10.2112/JCR-SI107-094.1

Ge, H. P., and Qian, Y. (2021). The impact mechanism and empirical test of digital inclusive financial services on rural revi-talization. Mod. Econ. Explor. 40 (05), 118–126. doi:10.13891/j.cnki.mer.2021.05.014

Ge, H., Tang, L., Zhou, X., Tang, D., and Boamah, V. (2022). Research on the effect of rural inclusive financial ecological environment on rural household income in China. Int. J. Environ. Res. Public Health 19 (4), 2486. doi:10.3390/ijerph19042486

Goldsmith (1990). Financial structure and financial development [M]. Shanghai: Shanghai Sanlian Bookstore.

Han, H., and Gu, X. (2021). Linkage between inclusive digital finance and high-tech enterprise innovation performance: Role of debt and equity financing. Front. Psychol. 12, 814408. doi:10.3389/fpsyg.2021.814408

Ji, X., Wang, K., Xu, H., and Li, M. (2021). Has digital financial inclusion narrowed the urban-rural income gap: The role of entrepreneurship in China. Sustainability 13 (15), 8292. doi:10.3390/su13158292

Kennedy, C., Gurley, J. G., Shaw, E. S., and Enthoven, A. C. (1960). Money in a theory of finance. Econ. J. 70 (279), 568. doi:10.2307/2228813

Kondo, T., Orbeta, A., Dingcong, C., and Infantado, C. (2008). Impact of microfinance on rural households in the Philippines. IDS Bull. 39 (1), 51–70. doi:10.1111/j.1759-5436.2008.tb00432.x

Li, H., Guo, T., Nijkamp, P., Xie, X., and Liu, J. (2020). Farmers’ livelihood adaptability in rural tourism destinations: An evaluation study of rural revitalization in China. Sustainability 12 (22), 9544. doi:10.3390/su12229544

Li, J. G., and Ma, J. (2021). Empirical evidence on the relationship between digital inclusive financial development and rural revitalization. Statistics Decis. Mak. 37 (10), 138–141. doi:10.13546/j.cnki.tjyjc.2021.10.030

Liu, G., Fang, H., Gong, X., and Wang, F. (2021). Inclusive finance, industrial structure upgrading and farmers’ income: Empirical analysis based on provincial panel data in China. Plos one 16 (10), e0258860. doi:10.1371/journal.pone.0258860

Liu, J., and Ruan, W. (2018). Analysis on the role and effect of inclusive finance in the development of green ecological industry under the background of poverty alleviation. Ekoloji 27 (106), 1013–1020.

Liu, S., Gao, L., Latif, K., Dar, A. A., Zia-Ur-Rehman, M., and Baig, S. A. (2021). The behavioral role of digital economy adaptation in sustainable financial literacy and financial inclusion. Front. Psychol. 12, 742118. doi:10.3389/fpsyg.2021.742118

Liu, Y., Liu, C., and Zhou, M. (2021). Does digital inclusive finance promote agricultural production for rural households in China? Research based on the Chinese family database (CFD). China Agric. Econ. Rev. 13, 475–494. doi:10.1108/CAER-06-2020-0141

Liu, Y., Luan, L., Wu, W., Zhang, Z., and Hsu, Y. (2021). Can digital financial inclusion promote China's economic growth? Int. Rev. Financial Analysis 78, 101889. doi:10.1016/j.irfa.2021.101889

Liu, Y., Zhang, Y., and Yang, Y. (2020). China’s rural revitalization and development: Theory, technology and management. J. Geogr. Sci. 30 (12), 1923–1942. doi:10.1007/s11442-020-1819-3

Lv, Y. Q., and Zhao, B. (2020). Research on digital finance and rural economic development. Wuhan: Wuhan Fi-nance, 79–84.

Ma, M., Lin, J., and Sexton, R. J. (2022). The transition from small to large farms in developing economies: A welfare analysis. Am. J. Agric. Econ. 104 (1), 111–133. doi:10.1111/ajae.12195

Peng, Y., and Tao, C. (2022). Can digital transformation promote enterprise performance?—from the perspective of public policy and innovation. J. Innovation Knowl. 7 (3), 100198. doi:10.1016/j.jik.2022.100198

Su, T., Yu, Y., Chen, Y., and Zhang, J. (2019). The experience, dilemma, and solutions of sustainable development of inclusive finance in rural China: Based on the perspective of synergy. Sustainability 11 (21), 5984. doi:10.3390/su11215984

Wensheng, D. (2020). Rural financial information service platform under smart financial environment. IEEE Access 8, 199944–199952. doi:10.1109/ACCESS.2020.3033279

Wu, L., Huang, Z., and Pan, Z. (2021). The spatiality and driving forces of population ageing in China. Plos one 16 (1), e0243559. doi:10.1371/journal.pone.0243559

Xiang, L., and Hu, L. Y. (2019). Study on the influence of livelihood risk perception on farmers' willingness to participate in e-commerce poverty alleviation and intergenerational differences. Agric. Technol. Econom-ics 38 (05), 85–98. doi:10.13246/j.cnki.jae.2019.05.008

Xie, D., and Su, B. (2021). Digital inclusive finance helps rural revitalization development:A theoretical analysis and em-pirical test. Shandong Soc. Sci. 35 (04), 121–127. doi:10.14112/j.cnki.37-1053/c.2021.04.019

Yang, Y., and Fu, C. (2019). Inclusive financial development and multidimensional poverty reduction: An empirical assessment from rural China. Sustainability 11 (7), 1900. doi:10.3390/su11071900

Yao, L., and Yang, X. (2022). Can digital finance boost SME innovation by easing financing constraints?: Evidence from Chinese GEM-listed companies. Plos one 17 (3), e0264647. doi:10.1371/journal.pone.0264647

Yi, X. J., and Zhou, L. (2018). Does the development of digital inclusive finance significantly affect residential consumption - micro evidence from Chinese households. Financial Res. 11, 47–67.

Yu, C., Jia, N., Li, W., and Wu, R. (2021). Digital inclusive finance and rural consumption structure–evidence from Peking University digital inclusive financial index and China household finance survey. China Agric. Econ. Rev. 14, 165–183. doi:10.1108/CAER-10-2020-0255

Yu, N., and Wang, Y. (2021). Can digital inclusive finance narrow the Chinese urban–rural income gap? The perspective of the regional urban–rural income structure. Sustainability 13 (11), 6427. doi:10.3390/su13116427

Zeng, X., Zhao, Y., and Cheng, Z. (2021). Development and research of rural renewable energy management and ecological management information system under the background of beautiful rural revitalization strategy. Sustain. Comput. Inf. Syst. 30, 100553. doi:10.1016/j.suscom.2021.100553

Zhang, D. (2020). The innovation research of contract farming financing mode under the block chain technology. J. Clean. Prod. 270, 122194. doi:10.1016/j.jclepro.2020.122194

Zhou, G., Gong, K., Luo, S., and Xu, G. (2018). Inclusive finance, human capital and regional economic growth in China. Sustainability 10 (4), 1194. doi:10.3390/su10041194

Keywords: digital inclusive finance, rural revitalization, urban-rural income gap, threshold effect, mediation effect

Citation: Xiong M, Fan J, Li W and Sheng Xian BT (2022) Can China’s digital inclusive finance help rural revitalization? A perspective based on rural economic development and income disparity. Front. Environ. Sci. 10:985620. doi: 10.3389/fenvs.2022.985620

Received: 04 July 2022; Accepted: 10 October 2022;

Published: 20 October 2022.

Edited by:

Magdalena Radulescu, University of Pitesti, RomaniaReviewed by:

Muhammad Sohail Amjad Makhdum, Government College University Faisalabad, PakistanCopyright © 2022 Xiong, Fan, Li and Sheng Xian. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wenqi Li, bGl3ZW5xaTEwMjNAMTYzLmNvbQ==; Brian Teo Sheng Xian, YnJpYW5fdGVvQG1zdS5lZHUubXk=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.