94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 18 January 2023

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.984316

This article is part of the Research TopicEco-Innovation and Green Productivity for Sustainable Production and ConsumptionView all 47 articles

A correction has been applied to this article in:

Corrigendum: Adoption of digital money (e-wallet) in the post COVID-19 era: The moderating role of low distribution charges and low transit time in impulsive buying: A developing country perspective

Qing Wei1

Qing Wei1 Wendong Xiao2

Wendong Xiao2 Rana Muhammad Shahid Yaqub3*

Rana Muhammad Shahid Yaqub3* Muhammad Irfan4†

Muhammad Irfan4† Muhammad Murad3†

Muhammad Murad3† Muhammad Zafar Yaqub5

Muhammad Zafar Yaqub5Online purchasing is increasing because customers are shifting to digital wallets and digital money, as these services are provided by different microfinance and other commercial banking sectors, and different online brands are working in Pakistan to support environmental sustainability. The objective of this study was to demonstrate to what extent low distribution charges and low transit time is contributing to impulsive buying when customers can use digital money in Pakistan. The study was conducted using survey research. Importantly, 650 questionnaires were distributed to the respondents with a received response rate of 40%. The study found that digital money (e-wallet) is positively associated with impulsive buying. Moreover, the moderating role of distribution charges and low transit time has been significant in impulsive buying has been significant. This study concludes that low transit time and load distribution charges must be considered by online businesses and brands working in Pakistan to ensure productivity and capture a larger market share of impulsive buying in Pakistan. Also, the current study contributes a theoretical framework to the knowledge and literature related to impulsive buying. The scope of this study is limited to the online businesses and brands that are working to provide products and services to the Pakistani people with the help of digital money and digital transactions. Significantly, this study provides significant future directions that are important to consider for upcoming studies to focus on and contribute to effectively.

In the post-pandemic era, the trends of online purchasing have changed because people are shifting to digital wallets and digital money as these services are provided by different microfinance and other commercial banking sectors in Pakistan. This research is based on the gaps identified in the earlier literature. Indeed, the role of digital money is critical in online purchasing (Lee et al., 2022) but this study did not discuss the factors that are motivating the public to adopt e-wallets. On the other hand, the outbreak of the pandemic shifted people toward e-wallet purchasing, although the variables influencing people to adopt e-wallets were not discussed by Sari et al. (2021). Similarly, the role of low distribution charges and low transit time was not discussed in earlier studies (Rahayu & Prasetyatama, 2021; Shamim & Islam, 2022). Modern marketers are more concerned with electronic money and digital transactions for environmental sustainability and to reduce climate problems (Dodgson et al., 2015). However, as far as impulsive buying is concerned, the people of Pakistan are getting the opportunity to purchase from an online business while they interact with advertisements on social media related to the product or services. In this way, Febria & Oktavio (2020) highlight digital marketing and e-wallets as the influencing factors that are contributing to the impulsive buying of the people of Pakistan.

An e-wallet is a service for secure digital money transactions offered by different banks to improve the standard of living of people (Hidajat & Lutfiyah, 2022). Similarly, according to the study of Yong Lee et al. (2021), the usefulness of digital money or e-wallets refers to the manner in which people use digital money for routine life purchases. Moreover, Rahayu & Prasetyatama (2021) point out that e-wallet risk refers to the problems with using digital transactions for purchasing products and services in any market. Also, impulsive buying is when people have no idea or intention to purchase a product or service, yet they still make a purchase (Mainwaring et al., 2005; Lee et al., 2022). Additionally, low distribution charges refer to the money that people have to pay when they are purchasing any product and service from any business entity, as explained by Le & Lei (2018). Importantly, people are more concerned about the transit time of product or service delivery because they want to get the product as early as possible to satisfy their needs, as discussed in the studies of Jeong & Chung (2022) and Pholphirul et al. (2021). People are more concerned about their product and services and the delivery time not only in the case of impulsive buying but for other purchasing as well (Lummus et al., 2001; Hameed et al., 2018; Imran et al., 2019). The extensive use of e-wallets by customers in the modern era of advanced technology and online business platforms can reduce environmental problems (Tiwari et al., 2016). Not only does the government have a responsibility for environmental sustainability (Desch & Krishnamurthy, 2009), but, according to Nayyar & Arora (2019), marketers need to focus on sustainable marketing and run their businesses in an environmentally sustainable manner.

The objective of this study was to determine to what extent low distribution charges and low transit time is contributing to impulsive buying when people are provided with the opportunity of using digital money for environment sustainability in Pakistan. Paperless money is an emerging trend as businesses are shifting to digital transactions, and it helps in environmental sustainability and sustainable marketing because digital receipts are used as an alternative to paper receipts (Desch & Krishnamurthy, 2009; Rosenbaum, 2011; Tiwari et al., 2016; Gujrati, 2017). In this regard, the study by Febria & Oktavio (2020) was conducted to address the gap in the literature by determining the relationship between impulsive buying and digital money. Shamim and Islam, (2022) and Ahn & Kwon (2022) concluded that digital marketing plays an important role in impulsive buying. Furthermore, Liu et al. (2022) discussed the role of time pressure on impulsive buying. However, no particular study was conducted to determine the moderating role of low distribution charges and low transit time in impulsive buying, as demonstrated in the studies by Efendi et al. (2019) and Qingyang et al. (2018). Therefore, the theoretical framework of this study was designed with careful consideration by critically reviewing the earlier literature to address the moderation of low distribution charges and low transit time in the relationship between impulsive buying and digital money for sustainable marketing and a sustainable environment in Pakistan. In addition, impulsive buying is an emerging marketing technique quite useful for businesses (Farid & Ali, 2018; Sofi & Najar, 2018; Ahn et al., 2020; Xiao et al., 2020; Natswa, 2021). The scope of this study is limited to the online businesses and brands that are working to provide products and services to the Pakistani people with the help of digital money and digital transactions.

This study is significant because it is designed to provide important theoretical as well as practical implications that are related to the role of digital money and e-wallets in impulsive buying for environmentally sustainable business practices in Pakistan. Not only does this study provide an appropriate contribution to the literature with a significant theoretical framework, but it also provides practices for online businesses to develop different strategies for ensuring the best services for the impulsive buying of Pakistani people according to the goals of sustainable business development. Importantly, impulsive buying has increased with the modern tools of marketing and communication (Habib & Qayyum, 2018; Muthiya et al., 2021; Liu et al., 2022). Moreover, this study provided significant implications related to the low transit time and load distribution charges that must be considered by the online businesses and brands working in Pakistan to ensure productivity and capture a big market share of impulsive buying in Pakistan. This study is based on the novel idea that, as emerging economies are being digitalized, the awareness about e-wallet usefulness, distribution charges and transit time would facilitate businesses to generate more sales in their target markets. Lastly, this study provides significant future directions that are important to consider for upcoming studies to focus on and contribute to effectively.

The theoretical framework of this study is grounded in Hawkins Stern’s impulse buying theory. In this theory, Stern proposed that consumers indulge in impulsive buying behaviors under the influence of external forces (Zhang et al., 2007; Heath et al., 2020). He emphasized that marketers can convince customers to purchase more than they need (Habib & Qayyum, 2018; Ahmad et al., 2019; Miao et al., 2019; Gulfraz et al., 2022), and that price and distribution are fundamental factors leading customers to impulsive buying, as indicated by Sun & Wu (2011) and Shamim & Islam (2022). Further, Stern claimed other factors include motivation, promotions, advertising, outstanding displays, features, and service quality (Legaspi et al., 2016; Barakat, 2019). In addition to this theory, this study aims to evaluate the moderating role of low distribution charges and low transit time in the relationship between the adoption of e-wallets and impulsive buying as this gap was identified by Qingyang et al. (2018) and Efendi et al. (2019) in the context of online businesses. Indeed, as customers are utilizing digital wallets for purchasing (Mainwaring et al., 2005; Ridaryanto et al., 2019; Rahayu & Prasetyatama, 2021; Sari et al., 2021; Yong Lee et al., 2021; Hidajat & Lutfiyah, 2022), this study aims to contribute to the overall knowledge about impulse buying, and the practices followed by online businesses to influence customers to make impulsive purchases, while also following sustainable environmental business practices.

The e-wallet is considered one of the most effective COVID-19 era tools for customers of any community to purchase products and services (Febria & Oktavio, 2020; Lee et al., 2022) because it is secure and reliable (Hidajat & Lutfiyah, 2022). In the past, people usually carried money as cash, which could be problematic, for example, when facing the challenges of carrying a lot of cash while traveling (Mainwaring et al., 2005; Narang et al., 2017). Moreover, according to the study by Rosenbaum, (2011), having cash is not environmentally friendly, as, in return for it, paper-based receipts are provided to the customers that threaten environmental sustainability. However, in light of the study by Rahayu & Prasetyatama (2021), the changing dynamics of digital wallets since COVID-19 have provided an opportunity for people to convert their cash into digital money and carry it in a long-term safe and secure manner with proper protection. Initially, there were different challenges for people to put their money into digital accounts (Shamim & Islam, 2022), because it was not easily accessible for everyone due to the belief that it is not secure (Rahayu & Prasetyatama, 2021; Lee et al., 2022). Indeed, Hidajat & Lutfiyah (2022) demonstrate that due to privacy and security issues, digital money was not always protected by the concerned companies, which led people to be reluctant to use digital money. However, with the development of information communication technology over time, improved protection of digital money has provided the opportunity for people to get digital wallets and save money for purchasing (Farid & Ali, 2018; Ahn et al., 2020; Yong Lee et al., 2021). Similarly, information communication technology has provided the opportunity for online businesses to grow in their target markets (Hameed et al., 2018; Racela & Thoumrungroje, 2020; Wu et al., 2022), as people have been provided with the opportunity of using digital money and platforms for digital transactions. People began to purchase products from online services because it was the most reliable and simplest method in the mature market (Akram et al., 2018; Parmar & Chauhan, 2018; Hashmi et al., 2019; Lee et al., 2022) where people have the opportunity to obtain information related to the product and services before purchasing. According to Hidajat & Lutfiyah (2022) and Lee et al. (2022), the usefulness of digital wallets provides the opportunity for people to get involved in digital transactions not only between businesses but also for transferring money from one individual to another in the post COVID-19 era. Digital money was capitalized on by online businesses and brands after the outbreak of the pandemic (Febria & Oktavio, 2020; Zhao et al., 2021), because it was the best opportunity to access target markets, and it is easier and more acceptable for people to purchase products and services from online businesses after the pandemic (Muthiya et al., 2021; Liu et al., 2022; Shamim & Islam, 2022). The successful operations of Alibaba and its growth in its target market are the best examples of how the use of a digital wallet system enabled people to purchase products and services safely from their homes during lockdown and after the pandemic (Sari et al., 2021; Yulianto et al., 2021). In reality, Alibaba is leading business practices regarding digital receipts for customers as an alternative approach to the paper receipts used in traditional business practices (Desch & Krishnamurthy, 2009; Rosenbaum, 2011; Nayyar & Arora, 2019).

Hypothesis 1. There is a relationship between e-wallet usefulness and adopting e-wallets.

It is critical to understand the risks associated with digital wallets, because it is a hurdle to their adoption as a secure payment gateway (Sofi & Najar, 2018; Ahn et al., 2020; Febria & Oktavio, 2020). Importantly, following the pandemic, people are concerned about security and want a secure way to conduct transactions (Natswa, 2021). However, according to Hidajat & Lutfiyah (2022), after COVID-19, it has been observed that a digital wallet system is more appropriate for saving money on purchases, as it helps people to buy products and services when they have interacted with advertisements online. Further, customers are always concerned with impulsive buying (Miao et al., 2019) due to their direct dependence on digital wallet systems after the pandemic (Barakat, 2019). With impulsive buying, Shamim & Islam (2022) and Xiao et al. (2020) demonstrate that people have no intention to purchase products and services from online businesses, but they are triggered by the influence of different factors, one of which is the use of a digital wallet. On the one hand, if the people of any community were not provided with the opportunity of using a digital wallet system, it would be very difficult for them to impulse buy in the online business sector (Habib & Qayyum, 2018; Muthiya et al., 2021; Liu et al., 2022; Shamim & Islam, 2022). As a successful online business trend, it is critical to understand the role of digital money as it is useful in the post-pandemic era (Bunyamin et al., 2021), providing people with effective support and gateways to transfer money from one account to another to purchase products and services (Gulfraz et al., 2022). People who are purchasing from online brands are more concerned about digital wallets and secure payment systems, as discussed in the study by Thompson et al. (2014). However, with the success of eBay and Amazon, the digital wallet system is important because it allows people to purchase products and services from their homes without visiting a store to look at the products (Habib & Qayyum, 2018; Sofi & Najar, 2018; Hashmi et al., 2019; Bunyamin et al., 2021). Therefore, the trend of online businesses has increased because digital money is widely used by most members of the community who are directly or indirectly related to the purchase from the online businesses. Different studies on impulse buying found that the role of digital wallet system is important as it provides people with the opportunity for purchasing products and services (Bellini et al., 2017; Miao et al., 2019; Muthiya et al., 2021; Purwanto A. et al., 2021). On the other hand, if people in a community do not have access to digital wallets, as a result they have to visit physical stores in markets and purchase products and services during lockdowns, for example, due to covid-19-like pandemics (Febria & Oktavio, 2020; Rahayu & Prasetyatama, 2021; Sari et al., 2021; Lee et al., 2022). In addition to this, customers must replace cash money with digital money, and businesses should similarly replace paper receipts with digital receipts in an effort to make their business practices paperless and contribute to environmental sustainability (Rosenbaum, 2011; Song et al., 2013; Tiwari et al., 2016).

Hypothesis 2. There is a relationship between e-wallet risk and adopting an e-wallet.

Hypothesis 3. There is a relationship between adopting e-wallets and impulsive buying.

In online business activities in the post COVID-19 era, the role of low transit time and load distribution charges matter a lot to the customer (Yaqub et al., 2022) who is purchasing the product or services (Dhandra, 2020; Muthiya et al., 2021). This is because people are always concerned with the price and time of online shopping deliveries, as discussed in the studies by Yulianto et al. (2021) and Farid & Ali (2018). Also, low transit time and load distribution charges are a factor of competitive advantage for different businesses in their target markets, because if any business is providing products or services at a very low cost of distribution, their customers are more satisfied (Lummus et al., 2001; Akram et al., 2018; Khoi et al., 2018; Pholphirul et al., 2021; Jeong & Chung, 2022). Similarly, in impulse buying, one of the critical factors is the emergence of digital wallets after the pandemic (Zhao et al., 2021; Lee et al., 2022), because they allow people purchase products from any online brand (Thompson et al., 2014). Further, when people interacted with any advertisement online before the outbreak of the pandemic, they went to a physical store and read the information related to the product or service, as demonstrated in the study by Shamim & Islam (2022). In addition to this, customers are concerned about the distribution time of their purchased products because they want to satisfy their needs for impulsive buying (Bellini et al., 2017; Lee et al., 2022; H; Purwanto et al., 2020). It is a psychological factor that customers are more concerned about low distribution charges when they are willing to purchase any product or service from online businesses (Imran et al., 2019; Miao et al., 2019; Liu et al., 2022). On the one hand, Lee et al. (2022) found that customers are willing to purchase products online because they do not have time to visit stores, for example, due to medical emergencies, and if they are more informed about products and services. On the other hand, Sari et al. (2021) demonstrated that online customers are more concerned about the delivery of products and services at the right time with the right cost because they compare the delivery time and cost with other brands in the same product line in the same market in the post COVID-19 era. Therefore, it is critical for brands, particularly online brands, to consider the important role of low distribution charges to provide reliable services to the customer and develop a competitive advantage through factors such as brand loyalty (Akram et al., 2018; Hameed et al., 2018; Miao et al., 2019; Jeong & Chung, 2022). Additionally, low transit time must be considered by the brands and the management of a brand to ensure that customers are provided with products and services as early as possible, as recommended in the study by Hameed et al. (2018). In this way, Imran et al. (2019) point out that it would be better for brands to develop a competitive advantage and critical success factor in the target market. Indeed, online brands like Amazon that are providing products and services to customers should consider lowering the distribution charges (Lummus et al., 2001; Akram et al., 2018). The theoretical framework of the study highlights the visual relationship between variables of the study and the relationship of variables in hypotheses development (see Figure 1).

Hypothesis 4. There is a moderating role of low distribution charges in the relationship between adopting e-wallets and impulsive buying.

Hypothesis 5. There is a moderating role of low transit time in the relationship between adopting e-wallets and impulsive buying.

In this study, the relationship between the variables was tested with the help of quantitative data that were taken from the respondents on a five-point Likert scale questionnaire. However, the scale items for this study were adopted from previous studies to collect data from the respondents. The scale items for e-wallet usefulness were adapted from Ridaryanto et al. (2019). Secondly, the scale items for e-wallet risk were adapted from the study by Ridaryanto et al. (2019). Thirdly, the scale items for adopting e-wallets were taken from the study by Ridaryanto et al. (2019). Fourthly, the scale items for impulsive buying were adapted from the study by Legaspi et al. (2016). Additionally, the scale items for low transit time were adapted from the study by Maxham, (2001). Lastly, the scale items for low distribution charges were adapted from the study by Liang et al. (2020). Furthermore, these scale items for each variable were reviewed by expert researchers to check the facial validity of the questionnaire. With the approval of researchers, the questionnaire was finalized and prepared to collect the data from the target respondents.

In this study, data were collected from the respondents by obtaining their consent to complete the study questionnaire. However, a random sampling technique was used in this study to collect the data. In this regard, the questionnaire was printed and distributed to the respondents who were individuals with experience of online purchasing with the help of a digital wallet. Furthermore, the survey-based questionnaire is easy to conduct and appropriate to get the data because it is saves time and cost of research. In this way, 650 questionnaires were distributed to respondents with an expected response rate of 40% (based on the response rate of 40% of earlier studies related to marketing and consumer behavior). Moreover, the email address of the researcher was given to the respondents as a point of contact to address any questions they had when regarding completing the questionnaires. All queries from respondents were answered promptly to get the best data from them. The questionnaires were collected and, after analyzing them in detail, 310 questionnaires were considered appropriate for the data analysis of this study to assess the relationship between the different variables outlined in the theoretical framework of the study. Thus, the sample size for this study is 310, which is appropriate in the light of earlier research. Importantly, the respondents were thanked for their time and contribution to the study.

In this section of the study, the results of data analysis that were obtained by partial least square (PLS) calculations are presented. On the one hand, PLS Algorithm calculations were taken to check the convergent validity and discriminant validity for the scale items used in this study. However, on the other hand, the PLS Bootstrapping calculations were taken to determine the path coefficient and moderating relationship between the variables used in this study. In this way, the data analysis section of this study is discussed in detail.

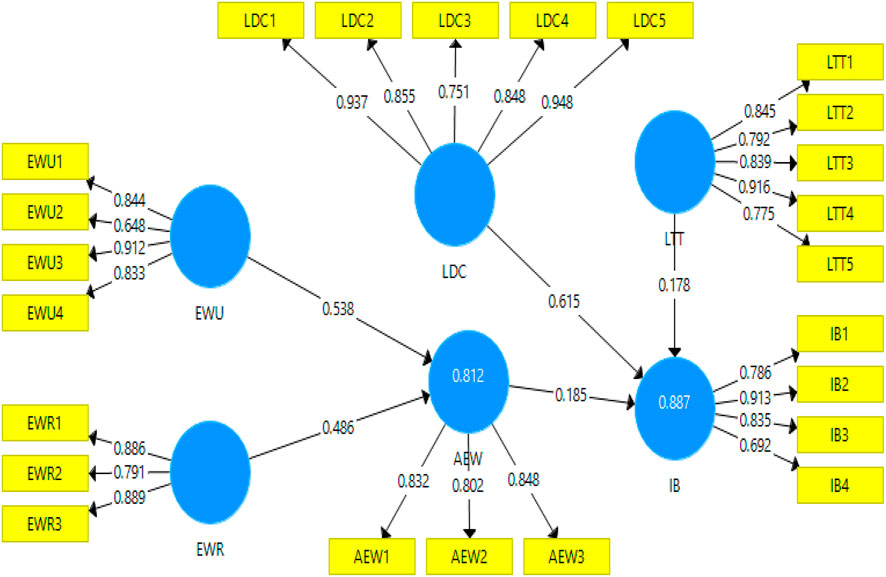

In this section of the study, the reliability and validity of the scale items were tested with PLS Algorithm calculations (see Figure 2). To begin with, the values of factor loadings were identified for each scale item used in the questionnaire study, and the results reveal that the value of factor loadings for each scale item is greater than the 0.60 recommended by Henseler & Fassott (2010). Similarly, the values of composite reliability (CR) and average variance extracted were tested, and according to the results the values of CR were not less than 0.70, and the values of AVE for each variable were greater than the 0.50 recommended by the study by Ramayah et al. (2018). The results available in Table 1 reveal the clear reliability and validity of the scale items used in this study.

FIGURE 2. Measurement model. EWU, E-wallet Usefulness; EWR, E-wallet Risk; AEW, Adopting E-wallet; IB, Impulsive Buying; LDC, Low Distribution Charges, and LTT, Low Transit Time.

This section of the study has the results of the discriminant validity test that was identified by the Heteritrait-Monotrait (HTMT) method by using PLS Algorithm calculations (see Table 2). The discriminant validity is tested to check the distinction between the scale items used in the variable of the study to collect the data from the respondents. HTMT is an advanced and reliable method adopted by the latest studies for testing discriminant validity (Ab Hamid et al., 2017). In this study, the results reveal that there is a clear discriminant validity between the scale items as the values of each variable were not greater than 0.90, as recommended by Hair Jr et al. (2017). Therefore, the study has clear discriminant validity for the scale items used in the questionnaire.

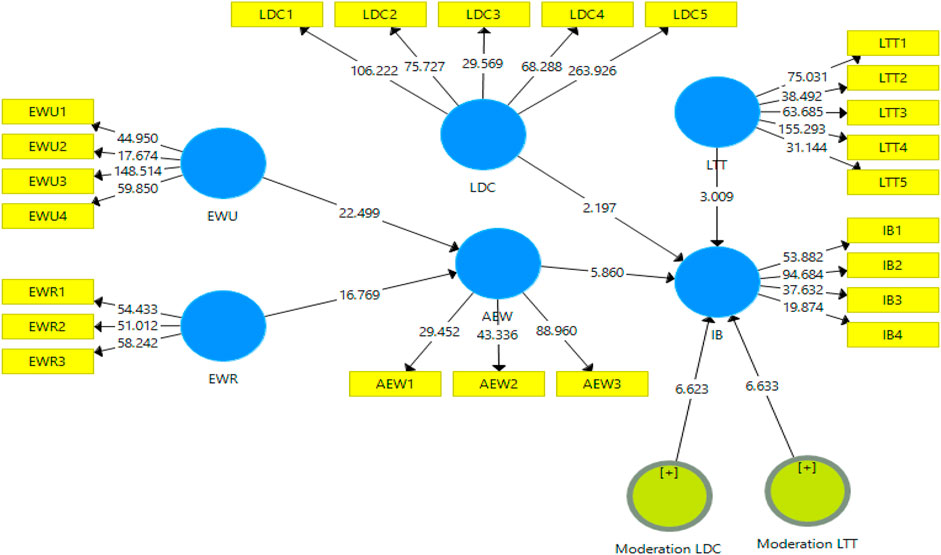

In this section of the study PLS structural equation modeling results were taken by PLS Bootstrapping calculations (Figure 3). To begin with, hypothesis one was tested and the results reveal a significant relationship between e-wallet usefulness and adopting e-wallets (β = 0.538, t = 22.499, and p = 0.000). Secondly, hypothesis two was tested and the results reveal a significant relationship between e-wallet risk and adopting e-wallets (β = 0.486, t = 16.769, and p = 0.000). Thirdly, hypothesis three was tested and the results reveal a significant relationship between adopting e-wallets and impulsive buying (β = 0.192, t = 5.860, and p = 0.000). The results of the hypotheses are shown in Table 3.

FIGURE 3. Structural model. EWU, E-wallet Usefulness; EWR, E-wallet Risk; AEW, Adopting E-wallet; IB, Impulsive Buying; LDC, Low Distribution Charges, and LTT, Low Transit Time.

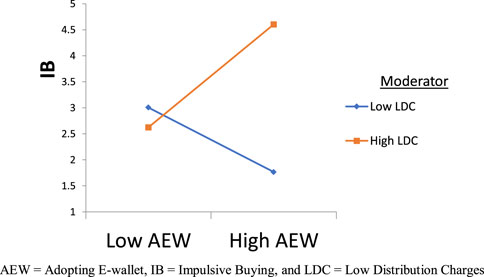

Fourthly, hypothesis four was tested and the results reveal the significant moderating role of low distribution charges in the relationship between adopting e-wallets and impulsive buying (β = 0.804, t = 6.623, and p = 0.000). Furthermore, it was revealed that low distribution charges strengthen the positive relationship between adopting e-wallets and impulsive buying (see Figure 4). These findings show that low distribution charges have a significant influence on the relationship between adopting e-wallets and impulsive buying.

FIGURE 4. Moderation LDC -> IB. AEW, Adopting E-wallet; IB, Impulsive Buying, and LDC, Low Distribution Charges.

Lastly, hypothesis five was tested and the results revealed the significant moderating role of low transit time on the relationship between adopting e-wallets and impulsive buying (β = 0.784, t = 6.633, and p = 0.000). In the same way, a low transit time strengthens the positive relationship between adopting an e-wallet and impulsive buying (see Figure 5). These findings show that a low transit time has a significant influence on the relationship between adopting e-wallets and impulsive buying.

FIGURE 5. Moderation LTT -> IB. AEW, Adopting E-wallet; IB, Impulsive Buying, and LTT, Low Transit Time

According to the results of H1 and H2, there is a significant role played by e-wallet usefulness and e-wallet risk in influencing the adoption of e-wallets. The findings of this study are in line with the findings of earlier studies (Ridaryanto et al., 2019; Rahayu & Prasetyatama, 2021). In modern times, digital money is considered one of the fundamental needs of human beings, as discussed by Hidajat & Lutfiyah (2022). Since digitalization has overtaken traditional types of transactions, e-money or digital wallets are therefore critical for people in the post-pandemic era (Hidajat & Lutfiyah, 2022). However, users are more concerned about the usefulness and associated risks of e-wallets, as the lockdowns led people to use digital wallets, as discussed by Sari et al. (2021). According to Yong Lee et al. (2021), if people are provided with a realistic and more advanced way of e-wallet risk elimination, then they would be more interested in adopting e-wallets or digital money for routine use in the post-pandemic era. According to the results of H3, there is a significant relationship between adopting e-wallets and impulsive buying. Similarly, the findings of this study line up with the findings of earlier studies (Mainwaring et al., 2005; Lee et al., 2022). Indeed, impulsive buying is influenced by many other invisible factors as well; however, the role of digital money transfers is also influencing impulsive buying (Legaspi et al., 2016; Muthiya et al., 2021). Customers in America are more likely to make purchases impulsively when buying through digital marketing because it gives them information related to the product and, after lockdown trends, they can still easily use digital wallets for purchasing (Shamim & Islam, 2022). The management of business organizations must provide the appropriate and reliable gateways of transactions to their customers, as it leads to impulsive buying (Habib & Qayyum, 2018; Zhao et al., 2021). Similarly, in the post-pandemic era, impulsive buying can be increased with the help of digital marketing and reliable tools for online purchasing, as discussed by the study by Ahn & Kwon (2022). The focus for brand management should be to improve digital transaction systems, as the transactional systems of Alibaba and Amazon are leading customers to buy impulsively (Legaspi et al., 2016; Qingyang et al., 2018; Dhandra, 2020).

According to the results of H4, there is a significant moderating role of low distribution charges in the relationship between adopting e-wallets and impulsive buying. The findings of this study are also aligned with the findings of earlier literature (Aw, 2019; Manss et al., 2020). Similarly, the results of H5 demonstrate that there is a significant moderating role of low transit time in the relationship between adopting e-wallets and impulsive buying. The results of this study validate the results of existing studies in literature (Ohnmacht & Scherer, 2010; Yulianto et al., 2021). Low distribution charges are considered a competitive advantage of business organizations in target markets during lockdown (Hidayatullah et al., 2019; Skordoulis et al., 2020; Mehmood & Hanaysha, 2022). Interestingly, after the COVID-19 lockdown, customers of online brands are more critical of the distribution and delivery charges of products, as discussed in the studies of Jeong & Chung (2022) and Hang et al. (2022). On the other hand, the logistics time is critical for customers, as most of the customers prioritize haste and expect the early delivery of products and services (Akram et al., 2018; Khoi et al., 2018; Miao et al., 2019; Jeong & Chung, 2022). In this way, according to the study by Oshodin & Omoregbe (2021), the focus of organizations must be to minimize the supply chain and logistics time to improve the competitive advantage in target markets because customers need to get product earlier in minimal time as they avoid visiting stores due to lockdown. Online businesses with the shortest time for logistics and product delivery are most acceptable to customers (Imran et al., 2019); therefore, the responsibility of the supply chain management department is to design activities and reduce transportation time and cost for customers (Lummus et al., 2001; Liang et al., 2020). Similarly, this study demonstrates the moderating role of low transit time and low distribution charges in purchasing products and services from ‘bricks and clicks’ businesses in Pakistan. In a nutshell, this study significantly highlights the impressive and critical moderating role of low distribution changes and low transit time in the satisfaction of customers and impulsive buying. In addition, this study determined the role of two moderators, contributing to the topic literature as well as practices of online businesses connected with e-wallet payment gateways. Therefore, the management of businesses must consider this critical role, and, with proper application, more opportunities could be provided to customers for impulsive buying from online businesses.

One of the prime objectives of this study was to provide significant theoretical implications for impulse buying and digital money for environmental and marketing sustainability in Pakistan. The study hypotheses discerned that, in the online business environment, there is a critical role for the digital wallet as a variable, as it provides a way for transactions between a brand and its customers. In earlier studies, the roles of low transit time and low distribution charges were not discussed as moderators in the relationship between the adoption of electronic wallets and impulsive buying in the context of Pakistan (Ridaryanto et al., 2019; Febria & Oktavio, 2020; Yong Lee et al., 2021; Hidajat & Lutfiyah, 2022). Therefore, this study has introduced the critical moderating role of low distribution charges and low transit time on the relationship between e-wallet adoption and impulsive buying. This theoretical framework and significant moderating hypotheses have enhanced the body of knowledge concerning these significant variables. On the other hand, no significant study has provided the relationship between e-wallet risk and adoption of e-wallets. Further, this study introduced that, for e-wallet adoption, the role of e-wallet usefulness and e-wallet risk is critical as it influences people choosing to adopt a digital money system. Therefore, this study added to the theory that with this customer attitude, businesses need to focus on the use of digital transactions and digital receipts that make business practices environmentally friendly. Indeed, this research contributed to the theory that there is a critical role for digital marketing in the transaction between the customer and impulse buying, but it must be done in a way to ensure that proper information related to the low transit time and low distribution charges are provided in advertisements, as this can trigger a customer’s decision to purchase product or services immediately. Additionally, this study contributes to the literature by defining the relationship between impulsive buying and electronic wallets that could facilitate future researchers in understanding these relationships.

This study also provides significant practical implications for online businesses in Pakistan related to marketing and impulsive purchasing, including sustainable business practices. Indeed, the trend of online marketing and online purchasing increases when people are provided with the opportunity of digital and electronic payment systems. In this regard, the digital wallet has changed the dynamics of traditional businesses, shifting the organization and its customers to purchasing online. Therefore, this study provides significant theoretical implications related to impulsive buying with the moderating role of low transit time and low distribution charges. To begin with, it is the responsibility of business management to ensure that marketing campaigns are providing relevant information about the low transit time of the delivery of the product and services. Moreover, it must be ensured that the cost advertised related to the product and services distribution must be lower than competitors because customers compare the cost of distribution with other competitors. It also helps businesses to gain a lower cost advantage in their target markets. Additionally, it is the responsibility of business management to ensure that an effective payment gateway is provided for the transaction of digital money and receipts to customers in return for products and services. Importantly, by providing these services, a business can develop a competitive advantage in their target market, particularly in mature markets. Similarly, it is the responsibility of business management to ensure the customer that the digital payment gateway is reliable and secure for the transaction of money and that it also leads to business and environmental sustainability. In this way, the customers’ sense of security and the usefulness of electronic wallets could be developed, making purchases more attractive and increasing the likelihood of impulsive buying with the help of effective digital marketing.

This study was conducted to determine the role of e-wallets in impulsive buying, and the moderating role of low distribution charges and low transit time in the business sector of online brands in Pakistan. However, this study has some limitations that need to be addressed by future studies. Firstly, this study tested the moderating role of low distribution changes and low transit time on the relationship between the adoption of e-wallets and impulsive buying, but future studies must consider the moderating role of digital marketing in the relationship between e-wallets and impulsive buying. Secondly, the literature review section also disclosed that information communication technology has influence on the adoption of e-wallets; therefore, future studies must consider the mediating role of information communication technology in the relationship between e-wallets and impulsive buying. Thirdly, the e-wallet loans trend is increasing as many microfinance sectors are providing opportunities for e-wallet loans; therefore, the mediating role of digital wallet loans on the relationship between e-wallets and impulsive buying should be tested in future research. In this regard, addressing these limitations would further improve the contribution to the literature as well as the practices of online businesses for impulsive buying of customers in Pakistan.

The original contributions presented in the study are included in the article/Supplementary Merial, further inquiries can be directed to the corresponding author

Ethics review and approval/written informed consent was not required as per local legislation and institutional requirements.

RMSY, MI, and MM conceptualized the idea of the research. MM, and WX collected the data. RMSY and MM did write the first draft of the manuscript. MI, MZY, and QW analyzed the data and prepared the final draft. All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

This research project was funded by Beijing Municipal Philosophy and Social Science Planning Office "Research on the Coordinated Development of Beijing-Tianjin-Hebei Financial Agglomeration and Industrial Structure Upgrading" (16YJB037) and Key Development Project of Department of Science and Technology (2015C03Bd051).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The reviewer MU declared a shared affiliation with the author MI to the handling editor at the time of review.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Ab Hamid, M. R., Sami, W., and Sidek, M. H. M. (2017). Discriminant validity assessment: Use of Fornell & Larcker criterion versus HTMT criterion. J. Phys. Conf. Ser. 890 (1), 012163. doi:10.1088/1742-6596/890/1/012163

Ahmad, M. B., Ali, H. F., Malik, M. S., Humayun, A. A., and Ahmad, S. (2019). Factors affecting impulsive buying behavior with mediating role of positive mood: An empirical study. Eur. Online J. Nat. Soc. Sci. 8 (1), 17.

Ahn, J., and Kwon, J. (2022). The role of trait and emotion in cruise customers’ impulsive buying behavior: An empirical study. J. Strategic Mark. 30 (3), 320–333. doi:10.1080/0965254x.2020.1810743

Ahn, J., Lee, S., and Kwon, J. (2020). Impulsive buying in hospitality and tourism journals. Ann. Tour. Res. 82, 102764. doi:10.1016/j.annals.2019.102764

Akram, U., Hui, P., Khan, M. K., Tanveer, Y., Mehmood, K., and Ahmad, W. (2018). How website quality affects online impulse buying: Moderating effects of sales promotion and credit card use. Asia Pac. J. Mark. Logist. 30, 235–256. doi:10.1108/apjml-04-2017-0073

Aw, E. C.-X. (2019). Understanding the webrooming phenomenon: Shopping motivation, channel-related benefits and costs. Int. J. Retail Distribution Manag. 47, 1074–1092. doi:10.1108/IJRDM-01-2019-0026

Barakat, M. A. (2019). A proposed model for factors affecting consumers’ impulsive buying tendency in shopping malls. J. Mark. Manag. 7 (1), 120–134.

Bellini, S., Cardinali, M. G., and Grandi, B. (2017). A structural equation model of impulse buying behaviour in grocery retailing. J. Retail. Consumer Serv. 36, 164–171. doi:10.1016/j.jretconser.2017.02.001

Bunyamin, B., Manda, H. M., and Hadidu, A. (2021). Analysis of lifestyle, price discount and product quality on impulsive buying in issue clothing store. J. Inov. Penelit. 2 (1), 213–220.

Desch, T. S., and Krishnamurthy, K. (2009). The growth of paperless money: Retail payments in the United States continue to evolve. Charlotte, United States: Richmond Fed Economic Brief.

Dhandra, T. K. (2020). Does self-esteem matter? A framework depicting role of self-esteem between dispositional mindfulness and impulsive buying. J. Retail. Consumer Serv. 55, 102135. doi:10.1016/j.jretconser.2020.102135

Dodgson, M., Gann, D., Wladawsky-Berger, I., Sultan, N., and George, G. (2015). Managing digital money. Acad. Manag. J. 58 (2), 325–333. doi:10.5465/amj.2015.4002

Efendi, R., Indartono, S., and Sukidjo, S. (2019). The mediation of economic literacy on the effect of self control on impulsive buying behaviour moderated by peers. Int. J. Econ. Financial Issues 9 (3), 98–104. doi:10.32479/ijefi.7738

Farid, D. S., and Ali, M. (2018). Effects of personality on impulsive buying behavior: Evidence from a developing country, Mark. Branding Res. 5, 31, doi:10.19237/MBR.2018.01.04

Febria, M., and Oktavio, A. (2020). Peran positive emotion sebagai intervening variable antara sales promotion dan impulsive buying behaviour pada pengguna e-wallet pengunjung Tunjungan Plaza Surabaya, J. Manaj. Pemasar. 14, 67, doi:10.9744/pemasaran.14.2.67─76

Gujrati, R. (2017). India’s march towards faceless, paperless, cashless economy. Int. J. Commer. Manag. Res. 3 (6), 73–77.

Gulfraz, M. B., Sufyan, M., Mustak, M., Salminen, J., and Srivastava, D. K. (2022). Understanding the impact of online customers’ shopping experience on online impulsive buying: A study on two leading E-commerce platforms. J. Retail. Consumer Serv. 68, 103000. doi:10.1016/j.jretconser.2022.103000

Habib, M. D., and Qayyum, A. (2018). Cognitive emotion theory and emotion-action tendency in online impulsive buying behavior. J. Manag. Sci. 5 (1), 86–99. doi:10.20547/jms.2014.1805105

Hair, J. F., Matthews, L. M., Matthews, R. L., and Sarstedt, M. (2017). PLS-SEM or CB-sem: Updated guidelines on which method to use. Int. J. Multivar. Data Analysis 1 (2), 107–123. doi:10.1504/ijmda.2017.10008574

Hameed, W.-U., Nadeem, S., Azeem, M., Aljumah, A. I., and Adeyemi, R. A. (2018). Determinants of e-logistic customer satisfaction: A mediating role of information and communication technology (ict). Int. J. Supply Chain Manag. (IJSCM) 7 (1), 105–111.

Hang, Y., Sarfraz, M., Khalid, R., Ozturk, I., and Tariq, J. (2022). Does corporate social responsibility and green product innovation boost organizational performance? A moderated mediation model of competitive advantage and green trust. London: Economic Research-Ekonomska Istraživanja, 1–21.

Hashmi, H., Attiq, S., and Rasheed, F. (2019). Factors affecting online impulsive buying behavior: A stimulus organism response model approach. Mark. Forces 14 (1).

Heath, C., Sommerfield, A., and von Ungern-Sternberg, B. S. (2020). Resilience strategies to manage psychological distress among healthcare workers during the COVID-19 pandemic: A narrative review. Anaesthesia 75 (10), 1364–1371. doi:10.1111/anae.15180

Henseler, J., and Fassott, G. (2010). “Testing moderating effects in PLS path models: An illustration of available procedures,” in Handbook of partial least squares (Springer), 713–735.

Hidajat, T., and Lutfiyah, N. (2022). E-WALLET: Make users more consumptive? ECONBANK J. Econ. Bank. 4 (1), 15–22. doi:10.35829/econbank.v4i1.163

Hidayatullah, S., Firdiansjah, A., Patalo, R. G., and Waris, A. (2019). The effect of entrepreneurial marketing and competitive advantage on marketing performance. Int. J. Sci. Technol. Res. 8 (1), 297–1301.

Imran, M., Hamid, S., Aziz, A., and Hameed, W. (2019). The contributing factors towards e-logistic customer satisfaction: A mediating role of information technology. Uncertain. Supply Chain Manag. 7 (1), 63–72. doi:10.5267/j.uscm.2018.5.002

Jeong, S. W., and Chung, J. E. (2022). Enhancing competitive advantage and financial performance of consumer-goods SMEs in export markets: How do social capital and marketing innovation matter? Asia Pac. J. Mark. Logist. doi:10.1108/apjml-05-2021-0301

Khoi, N. H., Tuu, H. H., and Olsen, S. O. (2018). The role of perceived values in explaining Vietnamese consumers’ attitude and intention to adopt mobile commerce. Asia Pac. J. Mark. Logist. 30, 1112–1134. doi:10.1108/apjml-11-2017-0301

Le, P. B., and Lei, H. (2018). The effects of innovation speed and quality on differentiation and low-cost competitive advantage: The case of Chinese firms. Chin. Manag. Stud. doi:10.1108/CMS-10-2016-0195

Lee, Y. Y., Gan, C. L., and Liew, T. W. (2022). Do E-wallets trigger impulse purchases? An analysis of Malaysian gen-Y and gen-Z consumers. J. Mark. Anal., 1–18. doi:10.1057/s41270-022-00164-9

Legaspi, J. L., Galgana, I. L. O., and Hormachuelos, C. (2016). “Impulsive buying behavior of millennials on online shopping,” in Proceeding of the 4th National Business and Management Conference Held at Ateneo de Davao University, 513–534.

Liang, R., Wang, J., Huang, M., and Jiang, Z.-Z. (2020). Truthful auctions for e-market logistics services procurement with quantity discounts. Transp. Res. Part B Methodol. 133, 165–180. doi:10.1016/j.trb.2020.01.002

Liu, X. S., Shi, Y., Xue, N. I., and Shen, H. (2022). The impact of time pressure on impulsive buying: The moderating role of consumption type. Tour. Manag. 91, 104505. doi:10.1016/j.tourman.2022.104505

Lummus, R. R., Krumwiede, D. W., and Vokurka, R. J. (2001). The relationship of logistics to supply chain management: Developing a common industry definition. Industrial Manag. Data Syst. 101, 426–432. doi:10.1108/02635570110406730

Mainwaring, S. D., Anderson, K., and Chang, M. F. (2005). “What’s in your wallet? Implications for global e-wallet design,” in CHI’05 Extended Abstracts on Human Factors in Computing Systems, 1613–1616.

Manss, R., Kurze, K., and Bornschein, R. (2020). What drives competitive webrooming? The roles of channel and retailer aspects. Int. Rev. Retail, Distribution Consumer Res. 30 (3), 233–265. doi:10.1080/09593969.2019.1687104

Maxham, J. G. (2001). Service recovery’s influence on consumer satisfaction, positive word-of-mouth, and purchase intentions. J. Bus. Res. 54 (1), 11–24. doi:10.1016/s0148-2963(00)00114-4

Mehmood, K. K., and Hanaysha, J. R. (2022). Impact of corporate social responsibility, green intellectual capital, and green innovation on competitive advantage: Building contingency model. Int. J. Hum. Cap. Inf. Technol. Prof. (IJHCITP) 13 (1), 1–14. doi:10.4018/ijhcitp.293232

Miao, M., Jalees, T., Qabool, S., and Zaman, S. I. (2019). The effects of personality, culture and store stimuli on impulsive buying behavior: Evidence from emerging market of Pakistan. Asia Pac. J. Mark. Logist. 32, 188–204. doi:10.1108/apjml-09-2018-0377

Muthiya, A. I., Pradana, M., Wijaksana, T. I., Utami, F. N., and Artadita, S. (2021). Self-monitoring and trust as essential factors on impulsive purchase of hand sanitizer products in Indonesian COVID-19 situation. Webology 18 (2), 1081–1094. doi:10.14704/web/v18i2/web18376

Narang, R., Sharma, R., and Tiwari, S. (2017). A study on antecedents leading to impulse buying in an evolving cashless indian economy. TRANS Asian J. Mark. Manag. Res. (TAJMMR) 6 (12), 5–21.

Natswa, S. L. (2021). Buy-now-pay-later (BNPL): Generation Z’s dilemma on impulsive buying and overconsumption intention. BISTIC Business Innovation Sustainability and Technology International Conference (BISTIC 2021), 130–137.

Nayyar, N., and Arora, S. (2019). “Paperless technology–A solution to global warming,” in Proceeding of the 2019 2nd International Conference on Power Energy (Greater Noida, India: Environment and Intelligent Control PEEIC), 486–488.

Ohnmacht, T., and Scherer, M. (2010). More comfort, shorter travel time, or low fares? Comparing rail transit preferences of commuters, holiday and leisure travelers, business travelers, and shoppers in Switzerland. Transp. Res. Rec. 2143 (1), 100–107. doi:10.3141/2143-13

Oshodin, E. A., and Omoregbe, O. (2021). Supply chain management, competitive advantage and organizational performance in the Nigerian manufacturing sector. Oradea J. Bus. Econ. 6 (2), 57–68. doi:10.47535/1991ojbe129

Parmar, G., and Chauhan, J. (2018). Factors affecting online impulse buying behaviour. Int. J. Educ. Manag. Stud. 8 (2), 328–331.

Pholphirul, P., Rukumnuaykit, P., Charoenrat, T., Kwanyou, A., and Srijamdee, K. (2021). Service marketing strategies and performances of tourism and hospitality enterprises: Implications from a small border province in Thailand. Asia Pac. J. Mark. Logist. 34, 887–905. doi:10.1108/apjml-01-2021-0064

Purwanto, A., Ardiyanto, J., and Sudargini, Y. (2021). Intention factors of halal food purchase among student consumers: An explanatory sequential mixed methods study. J. Industrial Eng. Manag. Res. 2 (2), 21–34.

Purwanto, H., Fauzi, M., Wijayanti, R., Al Awwaly, K. U., Jayanto, I., Purwanto, A., et al. (2020). Developing model of halal food purchase intention among Indonesian non-muslim consumers: An explanatory sequential mixed methods research. Syst. Rev. Pharm. 11 (10), 396, doi:10.31838/srp.2020.10.63

Qingyang, L., Yuxuan, X., and Sijia, C. (2018). “Y-generation digital natives’ impulsive buying behavior,” in Proceeding of the 2018 3rd Technology Innovation Management and Engineering Science International Conference (Bangkok, Thailand: TIMES-ICON). 1–5.

Racela, O. C., and Thoumrungroje, A. (2020). Enhancing export performance through proactive export market development capabilities and ICT utilization. J. Glob. Mark. 33 (1), 46–63. doi:10.1080/08911762.2018.1549302

Rahayu, I., and Prasetyatama, G. (2021). Determinants of the intention to continue using e–wallet during the Covid–19 pandemic. J. Contemp. Account. 3 (2), 53–63. doi:10.20885/jca.vol3.iss2.art1

Ramayah, T., Cheah, J., Chuah, F., Ting, H., and Memon, M. A. (2018). Partial least squares structural equation modeling (PLS-SEM) using smartPLS 3.0. Kuala Lumpur: Pearson.

Ridaryanto, R. K., Firmansyah, R. K., and Am, S. (2019). Factors affecting the use of E-wallet in JABODETABEK area. Int. J. Adv. Trends Comput. Sci. Eng. 8 (6), 3645–3651. doi:10.30534/ijatcse/2019/149862019

Rosenbaum, M. J. (2011). A paper chase in a paperless world: Regulating informal value transfer systems. Colum. J. Transnat’l L. 50, 169.

Sari, R. K., Utama, S. P., and Zairina, A. (2021). The effect of online shopping and E-wallet on consumer impulse buying. APMBA (Asia Pac. Manag. Bus. Appl. 9 (3), 231–242. doi:10.21776/ub.apmba.2021.009.03.3

Shamim, K., and Islam, T. (2022). Digital influencer marketing: How message credibility and media credibility affect trust and impulsive buying. J. Glob. Scholars Mark. Sci. 32, 601–626. doi:10.1080/21639159.2022.2052342

Skordoulis, M., Ntanos, S., Kyriakopoulos, G. L., Arabatzis, G., Galatsidas, S., and Chalikias, M. (2020). Environmental innovation, open innovation dynamics and competitive advantage of medium and large-sized firms. J. Open Innovation Technol. Mark. Complex. 6 (4), 195. doi:10.3390/joitmc6040195

Sofi, S. A., and Najar, S. A. (2018). Impact of personality influencers on psychological paradigms: An empirical-discourse of big five framework and impulsive buying behaviour. Eur. Res. Manag. Bus. Econ. 24 (2), 71–81. doi:10.1016/j.iedeen.2017.12.002

Song, P., Huang, D., Yang, Q., and Zhang, Y. (2013). Research on financial coordinated supervision platform and supervision strategy for online payment under paperless trade. Int. J. Serv. Technol. Manag. 11, 19–239. doi:10.1504/ijstm.2013.055635

Sun, T., and Wu, G. (2011). Trait predictors of online impulsive buying tendency: A hierarchical approach. J. Mark. Theory Pract. 19 (3), 337–346. doi:10.2753/mtp1069-6679190307

Thompson, F. M., Newman, A., and Liu, M. (2014). The moderating effect of individual level collectivist values on brand loyalty. J. Bus. Res. 67 (11), 2437–2446. doi:10.1016/j.jbusres.2014.02.011

Tiwari, U., Diwan, T. D., and Sahu, N. (2016). Save green, go green through paperless. Int. J. Recent Trends Eng. Res. (IJRTER) 3 (1).

Wu, D., Yang, X., Yang, W., Lu, C., and Li, M. (2022). Effects of teacher-and school-level ict training on teachers’ use of digital educational resources in rural schools in China: A multilevel moderation model. Int. J. Educ. Res. 111, 101910. doi:10.1016/j.ijer.2021.101910

Xiao, H., Zhang, Z., and Zhang, L. (2020). A diary study of impulsive buying during the COVID-19 pandemic. Curr. Psychol. 41, 5745–5757. doi:10.1007/s12144-020-01220-2

Yaqub, R. M. S., Azhar, M. S., Hameed, W. U. L., and Murad, M. (2022). Role of web design, E-payment and E-traceability with mediating role of consumer behavior to develop customer satisfaction for emerging bricks and clicks business model trends in south Punjab. Rev. Educ. Adm. Law 5 (2), 123–135. doi:10.47067/real.v5i2.224

Yong Lee, Y., Lay Gan, C., and Wei Liew, T. (2021). in Impulse Buying’s Antecedents and Consequences: Malaysian E-wallet Users PerceptionsProceeding of the 2021 5th International Conference on Software and E-Business (ICSEB).

Yulianto, Y., Sisko, A., and Hendriana, E. (2021). The stimulus of impulse buying behavior on E-commerce shopping festival: A moderated-mediated analysis. J. Bus. Manag. Rev. 2 (10), 692–714. doi:10.47153/jbmr210.2152021

Zhang, X., Prybutok, V. R., and Strutton, D. (2007). Modeling influences on impulse purchasing behaviors during online marketing transactions. J. Mark. Theory Pract. 15 (1), 79–89. doi:10.2753/mtp1069-6679150106

Keywords: adopting e-wallet, low distribution chagres, low transit time, impulsive buying, environmental sustainability

Citation: Wei Q, Xiao W, Yaqub RMS, Irfan M, Murad M and Yaqub MZ (2023) Adoption of digital money (e-wallet) in the post COVID-19 era: The moderating role of low distribution charges and low transit time in impulsive buying: A developing country perspective. Front. Environ. Sci. 10:984316. doi: 10.3389/fenvs.2022.984316

Received: 01 July 2022; Accepted: 19 December 2022;

Published: 18 January 2023.

Edited by:

Cem Işık, Anadolu University, TürkiyeReviewed by:

Tehreem Fatima, The University of Lahore, PakistanCopyright © 2023 Wei, Xiao, Yaqub, Irfan, Murad and Yaqub. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Rana Muhammad Shahid Yaqub, c2hhaGlkLnlhcXViQGl1Yi5lZHUucGs=

†ORCID: Muhammad Irfan, orcid.org/0000-0003-2578-6292; Muhammad Murad, orcid.org/0000-0003-3021-9997

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.