- School of Public Finance and Taxation, Dongbei University of Finance and Economics, Dalian, China

Environmental, social, and corporate governance (ESG) performance is an analytical framework for measuring the contribution of enterprises to sustainable development and fulfillment of social responsibility. The introduction of an environmental protection tax in China in 2018, which imposes tax on the pollution emission of enterprises, helps enterprises improve their ESG performance and raise their environmental awareness, thus effectively promoting their green technological innovation to achieve sustainable development. This study examines the effect of China’s environmental protection tax on corporate ESG performance and green technology innovation. The findings showed that the environmental protection tax in China can vastly improve the ESG performance and green technological innovation, with the ESG performance exhibiting a partial mediating effect in promoting corporate green technological innovation. The mediating effect in enhancing ESG performance and green technological innovation varies with the nature of firms’ property rights and regions.

Introduction

Rapid economic growth has caused serious damage to global resources and the ecological environment. Environmental, social and corporate governance (ESG) was first introduced in the “Who Cares Wins” initiative released by the UN Global Compact in 2004. In 2006, the UN Principles for Responsible Investment (UNPRI) incorporated ESG into investment decisions, with the aim of promoting sustainable corporate development and enabling investors to focus more on the performance of companies in terms of environmental friendliness, social responsibility, and corporate governance, rather than on their financial performance. With the widespread recognition of ESG in society, third-party organizations in various countries have devised their own ESG rating systems to measure enterprises’ ESG performance in three dimensions: environmental, social, and corporate governance responsibilities.

China introduced the environmental protection tax on January 1, 2018, the first tax to address environmental protection in China. China’s environmental protection tax is levied on air pollutants, water pollutants, solid waste, and noise. Taxes for air and water pollutants are determined by the people’s governments of each province, municipalities directly under the Central Government, and autonomous regions in China. These are based on the tax range specified in the Environmental Protection Tax Law of the People’s Republic of China: the tax for solid waste is RMB5–1,000 per ton1 and noise is taxed at RMB350–1,200 per month2 based on six noise levels. The Chinese environmental protection tax directly levies taxes on taxable pollutants emitted by enterprises with the aim of reducing the emission of pollutants by transforming the external environmental costs of enterprises into their internal production costs. At the policy level, the environmental protection tax has a “double dividend” effect, as it can reduce the emission of pollutants by enterprises and effectively improve environmental quality, thus realizing an environmental dividend. Although the environmental protection tax will increase the costs of the enterprises, the technological innovation of the enterprises will have an innovative compensation effect which will improve their productivity and boost their financial performance. The improvement of enterprise production efficiency and transformation of green production will also have a sound effect on the green development of the economy and realize the social dividend of the environmental protection tax. To save the cost of the tax and gain sound political affinity, enterprises will optimize their production process by green transformation, which may improve the environmental and social performance of companies. Therefore, China’s environmental protection tax may help firms improve ESG performance (Chen et al., 2022).

However, there are few studies on the impact of China’s environmental protection tax on corporate ESG performance. Based on this background, this study selected the data of A-shares listed enterprises from 2016 to 2020 as the research sample. Additionally, a difference-in-differences model was used to test the effect of the environmental protection tax on corporate ESG performance and green technological innovation. We conducted various robustness tests, including alternative variables, placebo test, and random sample censoring. The findings showed that the environmental protection tax in China can vastly improve the ESG performance and green technological innovation. We also found that China’s environmental protection tax had a partial mediating effect on improving corporate green technological innovation through corporate ESG performance.

Literature review and research hypothesis

Literature review

Environmental tax and double dividend

Pigou argued that the root cause of negative externalities for firms was the gap between private and social costs, and that tax policy could correct negative externalities and improve overall social welfare. Tullock (1967) was the first to propose the multiple dividends effects of environmental taxes, and Pearce (1991) was the first to use the term “double dividend,” arguing that environmental taxes can help improve environmental quality while promoting economic development and social equity. The environmental dividend of environmental taxes has been generally recognized in academic circles, while the social dividend has remained a controversial topic. For example, Baumol and Oates. (1988)argued that environmental taxes helped reduce carbon emissions. In a study of the Indian cement industry, Sabuj (2010) found that environmental regulation could improve energy use efficiency and reduce pollution emissions. A study of environmental taxes implemented in Finland and Malaysia by He, (2019)found that both environmental and social dividends could be realized in the long run. Chinese scholars also argued that the “environmental dividend” and “social dividend” could be achieved within a certain tax rate range (He, 2021; Sun et al., 2021). However, Liu and Zhou (2010) argued that environmental taxes had a negative impact on employment and economic growth. Similarly, Dai et al. (2021)found that environmental regulations affected trade. Adopting a CGE model to test, Carbon taxation could achieve a “double dividend” and encourage investment (Orlov and Grethe, 2012).

Environmental protection tax and firm performance

Neoclassical economic theory suggests that environmental protection tax increases the tax burden of enterprises: when revenue remains unchanged, the operating income is reduced and the business and financial performance is impaired. Gary (1987) found that environmental regulations increased firms’ costs and reduced their financial performance. Barbera (1990) argued that firms’ rising pollution abatement costs would result in reduced productivity in some industries. “The Porter hypothesis” is a break with traditional economics. To maximize profits, firms have to reduce the tax burden arising from the environmental protection tax by engaging in technological innovation or improving productivity. Thus, “The Porter hypothesis” suggests that appropriate environmental regulations improve the productivity and product quality of enterprises and enhance their financial performance. Berman and Bui (2001) confirmed this view through a study of oil refining in Los Angeles. Lin (2013) confirmed that under environmental regulation, technological innovation helped firms reduce emissions and sell their products, and that appropriate environmental regulation could also achieve the “triple effect” of environment, firm financial performance, and economic growth. Sun et al. (2021) found that the promotion of green technological innovation helped improve the utilization of natural resources, and green technological innovation helped reduce production costs. Measuring the competitiveness of enterprises in three dimensions (i.e., enterprises’ operational capacity, development capacity, and external linkage capacity), Bi and Yu, (2019) concluded that environmental taxes had a positive effect on the competitiveness of enterprises. Wei and Hu (2021) argued that administrative and market-based environmental policies had a positive effect on the long-term performance of firms with their salient contribution to corporate social responsibility.

Environmental tax and green technological innovation

Weitzman (1974) was the first to theoretically argue that tax instruments have a stronger effect on technological innovation than administrative orders alone. Acemoglu et al. (2012) found that tax policies and research subsidies are helpful for green technological innovation and emission reduction. The relationship between political affiliation and corporate innovation performance was analyzed by Yang and Yu (2014), showing that political affiliation serves to enhance the outcomes of corporate patent efforts. Bi et al. (2019) found that environmental taxes could promote green investments by firms and was conducive to environmental governance and improvement. According to Schumpeter’s innovation theory, R&D investment can promote the enhancement of firms’ technological innovation and competitiveness. Bai and Chen. (2022) theoretically confirmed that environmental regulation stimulated firms’ intrinsic motivation for environmental governance and had a catalytic effect on firms’ innovation investment and improvement of governance technology. In their study of the shift from the pollutant discharge fee to environmental protection tax in China in 2018, Yu et al. (2021) found that the shift had a significant promotion effect on the green transformation of heavy-polluting enterprises, albeit with differences among enterprises with various characteristics. Huang et al. (2022) also argued that the environmental protection tax could promote technological innovation of enterprises, but the degree of impact varied for enterprises of different property rights and different sizes.

ESG performance and corporate behavior

With the increasing emphasis on environmental protection, a growing number of scholars are linking corporate ESG performance to corporate behavior. Fatemi et al. (2017) found that sound corporate ESG performance could enhance corporate financial performance. However, Ruhaya et al. (2018) suggested the converse. Bowenand and Gond. (2013) stated that social responsibility motivated businessmen to make decisions based on social values and government wishes. Tan and Zhu, (2022) argued that sound ESG performance of firms could reduce financing constraints, helping them to attract investment and engage in technological innovation. Tian (2020) adopted a game theory approach and found that the role of social responsibility on the performance of corporate technological innovation was more salient in regions with lower environmental tax rates. Using a large cross-sectional dataset, Li et al. (2018) found ESG discourse has a positive impact on firm value. Francesco et al. (2021) also argued that ESG pillars could help improve firms’ behavior, particularly highlighting the impact of the governance pillar.

Research hypothesis

Environmental protection tax and corporate ESG performance

Environmental protection tax in the broad sense refers to the emission of pollutants, resource use, and management, that is, all taxes related to resource use and resource bonding. The environmental protection tax in the narrow sense refers only to the tax that came into effect in China in 2018. The environmental protection tax analyzed in this study is limited to the concept of environmental protection tax in the narrow sense.

China’s environmental protection tax takes the emissions of pollutants from enterprises as the basis for taxation and aims to achieve environmental protection. The introduction of an environmental protection tax reflects the Chinese government’s intention for green development, and guides the society in enhancing environmental protection awareness, attracting greater attention to environmental protection to achieve sustainable social development. In order to reduce the costs of environmental protection tax, enterprises optimize their production process, improve their utilization rate of resources, reduce energy consumption, and choose more environmentally friendly packaging, which indirectly reduces the emission of pollutants. In the production process, enterprises directly reduce the emission of pollutants by improving the pollution treatment process and the end treatment technology, which improves their environmental performance. The stakeholder theory holds that the development of enterprises is related to the quality of their response to stakeholder demands. The implementation of environmental protection tax enables society to pay greater attention to the environmental protection actions and sustainable development strategies of enterprises, thus enhancing consumers’ willingness to purchase the products of enterprises with sound environmental protection behaviors and a strong sense of social responsibility. Companies also improve their social performance to gain a closer political affinity. However, the adjustment of corporate strategies and change in business awareness of corporate shareholders requires time. Thus environmental protection tax may not have a significant impact on corporate governance performance of companies in the short term. However, the implementation of environmental protection tax in China can improve corporate ESG performance in terms of the combined effect. Based on the above analysis, this study proposed Hypothesis 1 as follows:

H1: China’s environmental protection tax improves the ESG performance of firms.

Environmental protection tax and green technological innovation

China’s environmental protection tax is one of the key tools used by the government to manage the environment. The “Porter hypothesis” suggests that appropriate environmental regulation is conducive to corporate green technological innovation. China’s environmental protection tax is an incentive-based environmental management system. Although the environmental protection tax has a dampening effect on the operating profit of enterprises, it stimulates enterprises to achieve green innovation. The environmental protection tax follows the ancient “polluter pays” principle, and the amount of tax costs borne by enterprises hinges on the amount of pollutants emitted. The development of green products, including those that are recyclable and reusable, and production of goods that are more in line with sustainable development reduces the pressure of production on the environment, leading to the compensatory effect of innovation, thus increasing firms’ enthusiasm for green technological innovation. In addition, the environmental protection tax introduced in China in 2018 produced stronger enforcement with less administrative intervention from local governments than the previous administrative fees. Owing to the mandatory nature of the tax and the monitoring of pollution emissions by environmental protection departments, enterprises have less bargaining power with the government, which also reduces the government’s rent-seeking behavior (Lv and Cao, 2019). Therefore, the institutional advantages of China’s environmental protection tax induces rational firms to improve their green technological innovation capabilities and reduce the potential environmental protection tax costs. Therefore, Hypothesis 2 is proposed.

H2: China’s environmental protection tax significantly promotes firms’ green technological innovation.

The mediating effect of corporate ESG performance on green technological innovation

Green technological innovation refers to the use of green products, green technologies, and green processes to achieve the alignment of the economic, social, and ecological performance of enterprises. Green technological innovation not only refers to the improvement of production processes, but also includes the research and development (R&D) of green products and the use of new tools or new methods. The green technological innovation of enterprises is closely related to R&D investment, and Song and Du. (2017) found that the investment of R&D funds has a positive effect on green technological innovation. The improvement of corporate ESG performance can effectively reduce the financing constraints of enterprises and attract more institutional investors following corporate ESG performance, which is conducive to corporate green technological innovation. Good environmental performance of firms is in line with the rising environmental awareness of society and promotes political affinity. To maintain sound environmental performance, enterprises need to improve their green technological innovation capabilities by continuously improving their production processes, pollution treatment technologies, and resource utilization. Sound social performance of enterprises improves the relationship between enterprises and stakeholders. By taking more social responsibility, enterprises can more easily obtain technical support and government procurement, reduce the information asymmetry of external investors, and gain access to more investment to advance their green technological innovation. The management teams of companies with better corporate governance performance tend to have a more precise understanding of national policies and pay greater attention to environmental protection, as well as to long-term corporate development and value enhancement. Green technology innovation not only promotes the green transition of enterprises, but also has a better promotion effect on the improvement of enterprise value. Therefore, the improvement of corporate ESG performance contributes to the improvement of corporate green technological innovation capability. Thus, Hypothesis 3 is proposed.

H3: Corporate ESG performance has a mediating effect on the relationship between environmental protection tax and corporate green technological innovation in China.

Research design

Model setting

The environmental protection tax introduced in China in 2018 is viewed as a quasi-natural experiment exogenous to the economic system, and the difference-in-differences model is considered a relatively mature method to test the net effect of policy adjustments. This study constructed a difference-in-differences model.

In Eq. 1, i and t represent the firm and year. GTI, representing the green technology innovation, is the explained variable. We searched the number of green patent applications of enterprises on the Chinese Research Data Services (CNRDS) based on the green technology classification list provided by the OECD and World Intellectual Property Office (WIPO), and selected the logarithm as the mediating variable (GTI) by adding 1 to the number of applications.

The core explanatory variable is the dummy variable

Referring to Yu et al.’s (2021) and Bai and Chen, (2022) selection of variables, we use the control variables Xi,t, including firm size (Size), leverage ratio (Lev), return on assets (Roa), regional economic level (Gdp), nature of equity (state), firm year (Age), and the degree of equity concentration (share). λi is the individual fixed effect, μt is the time fixed effect, and Ɛi,t is the random error.

To test whether corporate ESG performance has a mediating effect on the role of environmental protection tax in promoting corporate green technology innovation, the mediating effect is incorporated into the difference-in-differences model and the following models are constructed.

ESG represents corporate ESG performance, which is the mediating variable. The mediating effects of environmental (E), social (S), and corporate governance (G) dimensions on the relationship between the environmental protection tax and corporate green technological innovation in China was also examined and the other variables are defined in the same way as in Eq. 1.

Data source

This study selected heavy polluters as the treatment group and non-heavy polluters as the control group. Based on the definition of heavily polluting industries in the Guidelines for Environmental Information Disclosure by Listed Companies (Consultation Draft) issued by the Ministry of Ecology and Environment of the People’s Republic of China and the Guidelines for the Industry Classification of Listed Companies (2012 Revision) issued by the China Securities Regulatory Commission, this study selected 16 heavily polluting industries such as steel, cement, coal, and metallurgy as the treatment group samples, and the cultural and entertainment, transportation, wholesale, retail and leasing services as the control group samples.

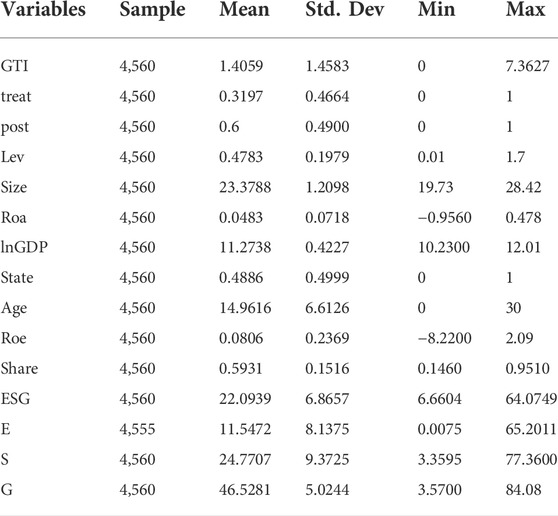

Our initial sample consisted of the A-shares listed companies of China from 2016 to 2020, excluding the samples containing ST, ST*, and missing key data during the sample period, and excluding the special enterprise samples such as financial and insurance industries and comprehensive enterprises. We used Bloomberg database ESG scores of A-share listed companies to measure corporate ESG performance. All the control variables were from the WIND database. To avoid the influence of extreme values on the empirical results, observations below the 1st and above the 99th percentile of the continuous variable data were excluded, and the final sample data of 4560 were obtained. Table 1 shows the descriptive statistics results of the main variables.

Empirical results

Basic regression results

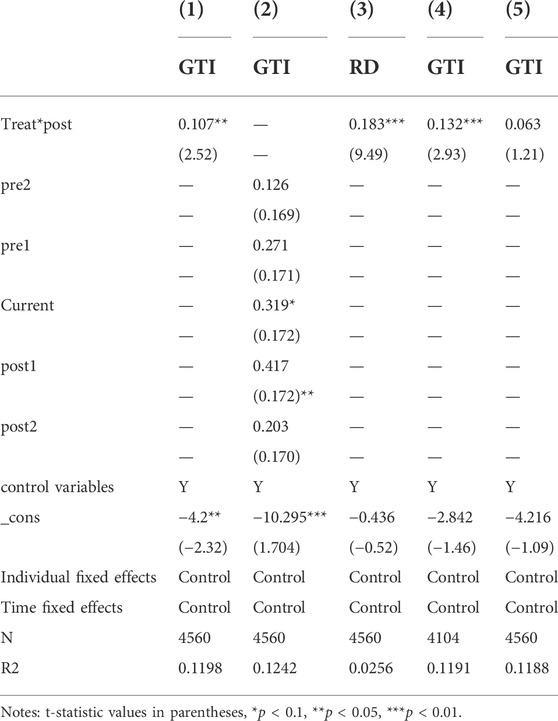

The results of the regression for treat*post is shown in Column 1 (Table 2), which shows the results of Model 1; the regression coefficient is significant at the 5% level. This result indicates that the implementation of an environmental protection tax in China effectively promotes the improvement of green technological innovation in Chinese enterprises. In other words, the green technological innovation of heavy polluting enterprises is more effective than that of non-heavy polluting enterprises (Yu et al., 2021; Huang et al., 2022).

The use of a DID model must satisfy the parallel trend assumption. Thus, to verify whether the parallel trend hypothesis holds, the following dynamic effect model of the impact of environmental protection tax on corporate green technological innovation in China is constructed thus:

where pre2, pre1, current, post1, and post2 are the cross multiplication terms of the time dummy variables and the heavily polluting polluters from 2016 to 2020, respectively. The specific results are shown in Column 2 (Table 2), revealing that the results for pre2 and pre1 do not reach the 10% level of significance. Thus, there was no significance gap in China before the implementation of the environmental protection tax policy. In other words, the control and experimental groups satisfy the parallel trend hypothesis, and the DID model is adopted.

To further test whether the above results are all robust, we conducted the following tests. First, to reduce the error of variable selection, we measured enterprise green technological innovation (GTI) by replacing the number of green patent applications with the ratio of environmental protection input (RD) in Column 3. Second, to exclude the bias of sample selection, 10% of the original sample was randomly censored and DID regression was performed again, as shown in Column 4. Third, to exclude the interference of other policies on the empirical results, this study conducted a placebo test, assuming that the implementation time of environmental protection tax policy was 2019, in Column 5. The results of Columns 3 and 4 show that the coefficients of treat*post are positive at 1% level of significance, supporting our main findings. The result shown in Column 5 does not reach significance, which indirectly confirms that firms are able to implement green technological innovation because of the environmental protection tax rather than the other policies.

Mediating effects

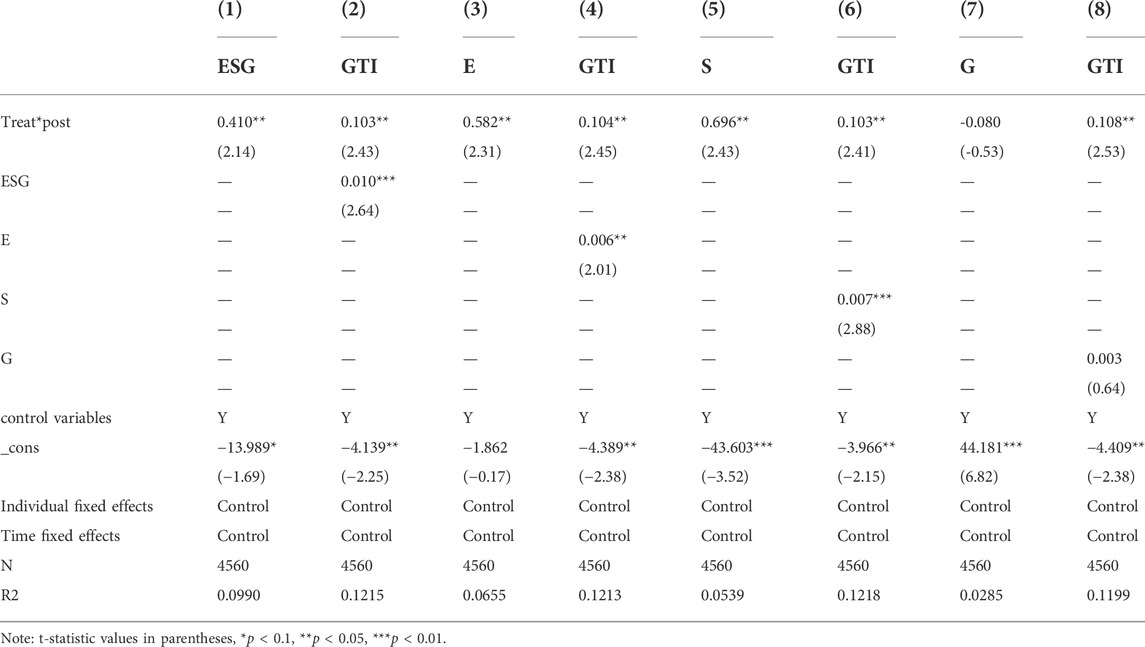

To analyze the mediating effect of ESG performance on the relationship between environmental protection tax and green technological innovation in China, a DID analysis was performed on models 2 and 3. Table 3 presents the regression results. As shown in Column 1, the treat*post coefficient is significant at the 5% level, indicating that the implementation of China’s environmental protection tax can improve the overall ESG performance of enterprises. This result is similar to that of Chen et al. (2022). The regression coefficient of treat*post in Column 2 is 0.103, significant at the 5% level, while the regression coefficient of ESG in Column 2 is 0.010, significant at the 1% level, indicating that ESG performance has a partial mediating effect. As ESG consists of three dimensions (i.e., environmental (E), social (S), and corporate governance (G)), we conducted a regression analysis of E, S, and G on models 2 and 3 to analyze the impact of China’s environmental protection tax on E, S, and G and the mediating effect of E, S, and G on corporate green technology innovation. The results, shown in Columns 3, 5, and 7 of the table, indicate that the environmental protection tax can improve the environmental and social performance of firms, but has no significant effect on improving the corporate governance performance of firms. In other words, China’s environmental protection tax can enhance corporate ESG performance, but this is mainly due to enhanced environmental performance and social performance of firms. From the regression results in Columns 4, 6, and 8 of the table, it can be deduced that environment and society play a partial mediating role in corporate green technological innovation, and have no significant effect on corporate governance. Thus, the mediating effect of ESG performance on corporate green technological innovation is the result of the company’s environmental and social performance.

Heterogeneity analysis

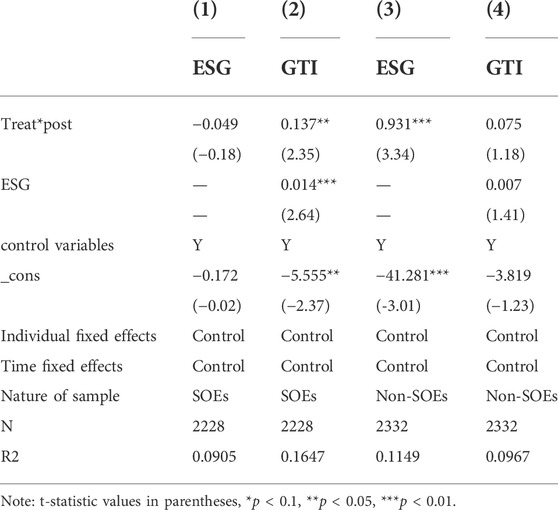

The regression analysis was performed by grouping by the nature of enterprise property rights (Table 4). The coefficient of treat*post in Column 1 is non-significant, while the coefficient of treat*post in Column 3 is significant at the 1% level, indicating that China’s environmental protection tax improves the ESG performance of non-state-owned enterprises (non-SOEs). The results in Columns 2 and 4 indicate that China’s environmental protection tax promotes green technological innovation in SOEs, which is contrary to Huang et al. (2022). This is probably because SOEs, with less financial pressure, advantageous resource endowment, closer relationship with government departments, and stronger government bargaining power, do not need to obtain external investment and government policies by improving corporate ESG performance. In addition, SOEs have had a greater social responsibility and better relationship with stakeholders since their inception and raised their environmental standards before the implementation of China’s environmental protection tax. Thus, the implementation of China’s environmental protection tax has no significant effect on the ESG performance of SOEs. However, SOEs have easier access to financial and technical support, and thus the Chinese environmental protection tax has a significant impact on improving green technological innovation in SOEs. Contrariwise, non-SOEs are more motivated to improve their ESG performance to secure better government relations, attract more investment, and reduce financing constraints. However, access to financing has a lag effect; as most non-SOEs have a weak foundation, they are thus unable to immediately improve their green technological innovation capability.

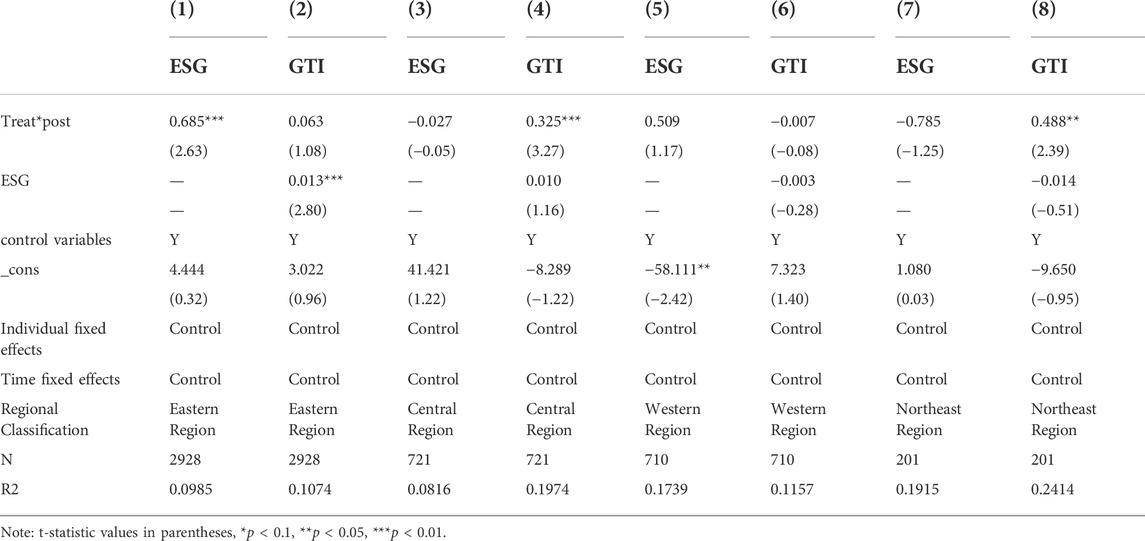

The China Statistical Yearbook divides China into four regions3: central, eastern, western, and northeastern. The regression analysis is done for models 2 and 3 (Table 5). The regression coefficients of ESG performance in eastern China are significant at the 1% level, while the regression coefficients of GTI are non-significant, indicating that the environmental protection tax improves the ESG performance of enterprises in the eastern region, and ESG performance has a complete mediation effect in improving the green technological innovation of enterprises. For central and northeastern China, environmental protection tax can enhance firms’ green technological innovation, but has no significant effect on the ESG performance of firms in central, western, and northeastern China. A possible reason is that the general tax standard is higher in eastern China and enterprises bear high tax costs. Enterprises aim to reduce financing constraints and attract investment by improving ESG performance; they also have an incentive to reduce tax costs by improving their green technological innovation capabilities. In addition, the eastern region has a higher concentration of talents, a higher degree of marketization, and a more mature financing mechanism than other regions, implying a more powerful driver for technological innovation. This result is consistent with that of Lu and Dang (2014). Therefore, the ESG performance of enterprises in eastern China has a complete mediation effect on the relationship between environmental protection tax and corporate green technological innovation.

Conclusion and policy suggestions

With increasing awareness of environmental protection, analyses of long-term corporate value and development potential are no longer limited to financial indicators, and experts and scholars are increasingly incorporating ESG concepts into investment practices. Therefore, studying the intrinsic relationship and operational mechanism of environmental protection tax, green technological innovation, and corporate ESG performance can help improve corporate ESG performance, attract favorable investors, and enhance corporate green technological innovation capability. Based on this, the sample data of A-share Chinese listed companies from 2016 to 2020 was used to establish a difference-in-differences model to test the impact of the introduction of the environmental protection tax in China on corporate green technological innovation and ESG performance. Additionally, the role of corporate ESG performance in environmental protection tax and corporate green technological innovation was verified, and a heterogeneity analysis was conducted. We find that China’s environmental protection tax has a significant effect on the improvement of corporate green technological innovation and ESG performance, and the improvement of ESG performance is observed in two aspects, namely, environmental performance and social performance. In addition, China’s environmental protection tax has a partial mediation effect on improving corporate green technological innovation through corporate ESG performance; that is, corporate ESG performance is partially mediated by environmental performance and social performance of the three dimensions, with no significant effect on corporate governance. Moreover, China’s environmental protection tax has different effects on firms with different types of property rights and in different regions. The environmental protection tax aims to improve the technological innovation capacity of SOEs and enterprises in central, eastern, and northeastern regions, but it can only improve the ESG performance of non-SOEs and enterprises in eastern region. Finally, the ESG performance of enterprises in the eastern region has a complete mediation effect. Based on the analysis results, the following policy insights are derived:

First, appropriately raise the tax standards. The cost of environmental management varies across regions, and thus differential taxation standards needs to be implemented in different regions. With the continuous development of China’s economic level and the maturity of environmental protection technology, tax standards need to be raised in some regions at an appropriate time. Therefore, given the improvement of China’s economy and environmental technology, the rate for environmental protection tax must be appropriately increased in some regions. However, the increase must be in line with the actual requirements of China’s economic development, and be gradual: the tax rate for pollutants with more serious pollution hazards must be the first to be raised, followed by other pollutants, based on the economic growth.

Second, gradually expand the scope of taxation. The purpose of the environmental protection tax in China is to reduce the pollution of the environment and improve the ecological environment by taxing pollutants. However, some of the pollution is still not included in the scope of taxation. Thus, the effect of environmental protection tax on green technological innovation and ESG performance in some regions or industries is not salient. For example, while volatile organic compounds include 12 major categories, only some of the volatile organic compounds in air pollution are taxed, such as benzene, toluene, and formaldehyde. Thus, all volatile organic compounds should be gradually included in the taxation scope in the future. In addition, noise pollution only includes industrial noise, but construction and aircraft noise, which have a greater impact on residents, should also be included in the scope of taxation. China’s environmental protection tax should not be limited to the current four categories of pollutants, but should also gradually include light pollution, household waste, and thermal pollution into the scope of environmental protection tax.

Third, industry disparities should be reflected in China’s environmental protection tax. Owing to the differences in technology base, pollution level, and major pollutants of each industry, differential taxation is implemented by industry. This avoids regional tax competition and improves the targeting and flexibility of the environmental protection tax. According to the survey by the Ministry of Environment of China, sulfur dioxide and nitrogen oxides are the main pollutants. However, currently, differential taxes for different pollutants are adopted in less than half of the cities in China. Thus, in the future, slightly higher tax rates should be set for sulfur dioxide and nitrogen oxides in air pollutants and chemical aerobics in water pollutants based on the industry tax gap. Solid waste is currently taxed in four classes by category and a differential tax rate should be set for each type of waste by quantity in the future. Such a differential tax rate by industry and different emissions helps guide society toward the green concept and enterprises toward enhancing environmental efficiency, fulfilling social responsibility, and improving ESG performance.

The main contribution of this study is that we focus on corporate ESG performance from the perspective of China’s environmental protection tax, and study the intermediary effect of ESG performance between environmental protection tax and green technology innovation of enterprises. A signification limitation of our study is its use of A-share listed firms in China for the data of ESG performance, ignoring the small and medium-size enterprises. In future research, we will establish an ESG index evaluation system and use data from multiple countries.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

JL led the conceptual design of the manuscript, SL wrote the initial drafts and built the model, all authors reviewed the manuscript and provided comments and feedback.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Coal gangue: RMB5/tonne; tailings: RMB15/tonne; hazardous waste: RMB1000/tonne, including smelting slag, fly ash, slag, other solid waste (e.g., semi-solid, liquid waste).

2A monthly tax of RMB350 is levied on industrial noise exceeding the standard by 1–3 decibels; a monthly tax of RMB700 is levied on industrial noise exceeding the standard by 4–6 decibels; a monthly tax of RMB1,400 is levied on industrial noise exceeding the standard by 7–9 decibels; a monthly tax of RMB2,800 is levied on industrial noise exceeding the standard by 10–12 decibels; a monthly tax of RMB5,600 is levied on industrial noise exceeding the standard by 13–15 decibels; and a monthly tax of RMB11,200 is levied on industrial noise exceeding the standard by 16 + decibels.

3The eastern region includes 10 provinces (cities): Beijing, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan; the central region includes 6 provinces: Shanxi, Anhui, Jiangxi, Henan, Hubei, and Hunan; the western region includes 12 provinces (regions, cities): Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, and Xinjiang; and the northeast region includes Liaoning, Jilin, and Heilongjiang.

References

Acemoglu, D., Aghion, P., Bursztyn, L., and Hemous, D. (2012). The environment and directed technical change. Am. Econ. Rev. 102, 131–166. doi:10.1257/aer.102.1.131

Bai, Y., and Chen, S. (2022). Empirical study on the impact of environmental regulation on enterprise environmental investment. Environ. Resour. Ecol. J. 6 (02). doi:10.23977/EREJ.2022.060207

Barbera, A., McConnell, V. D., and McConnell, V. (1990). The impact of environmental regulations on industry productivity: Direct and indirect effects. J. Environ. Econ. Manage. 18 (1), 50–65. doi:10.1016/0095-0696(90)90051-y

Baumol, W., and Oates, W. (1971). The use of standards and prices for protection of the environment. Swed. J. Econ. 7, 42–54. doi:10.2307/3439132

Berman, E., and Bui, L. (2001). Environmental regulation and productivity: Evidence from oil refineries. Rev. Econ. Stat. 88 (3), 498–510. doi:10.1162/00346530152480144

Bi, Q., and Yu, C. (2019). Environmental tax and enterprise technological innovation: Promotion or suppression? Sci. Res. Manag. 12, 116–125. doi:10.19571/j.cnki.1000-2995.2019.12.012

Bowen, H., and Gond, J. (2013). Social responsibilities of the businessman. Iowa City Iowa: University of Iowa Press.

Chen, G., Wei, B., and Dai, L. (2022). Can ESG-responsible investing attract sovereign wealth funds’ investments? Evidence from Chinese listed firms. Front. Environ. Sci. 10, 935466. doi:10.3389/fenvs.2022.935466

Dai, Z., Zhang, Y., and Zhang, R. (2021). The impact of environmental regulations on trade flows: A focus on environmental goods listed in APEC and OECD. Front. Psychol. 11, 773749. doi:10.3389/fpsyg.2021.773749

Fatemi, A., Glaum, M., and Kaiser, S. (2017). ESG performance and firm value the moderating role of disclosure. Glob. Finance J. 38, 45–64. doi:10.1016/j.gfj.2017.03.001

Francesco, P., Nicola, C., Wu, J., and Riccardo, T. (2021). How do ESG pillars impact firms’ marketing performance? A configurational analysis in the pharmaceutical sector. J. Bus. Industrial Mark. 37 (8), 1594–1606. doi:10.1108/jbim-07-2020-0356

Gary, W. (1987). The cost of regulation: OSHA, EPA and the productivity slowdown. Am. Econ. Rev. 77 (5), 998–1006. Available at: http://www.jstor.org/stable/1810223.

He, P., Ya, Q., Long, C., Yuan, Y., and Chen, X. (2019). Nexus between environmental tax, economic growth, energy consumption, and carbon dioxide emissions: Evidence from China, Finland, and Malaysia based on a panel-ARDL approach. Emerg. Mark. Finance Trade 57, 698–712. doi:10.1080/1540496X.2019.1658068

He, L., Wang, B., Xu, W., Cui, Q., Chen, H., Wang, B., et al. (2021). Could China’s long-term low-carbon energy transformation achieve the double dividend effect for the economy and environment? Environ. Sci. Pollut. Res. 29, 20128–20144. doi:10.1007/S11356-021-17202-1

Huang, S., Lin, H., Zhou, H., Ji, H., and Zhu, N. (2022). The influence of the policy of replacing environmental protection fees with taxes on enterprise green innovation—evidence from China’s heavily polluting industries. Sustainability 11, 6850. doi:10.3390/SU14116850

Li, Y., Gong, M., Zhang, X., and Gao, X. (2018). The impact of environmental social and governance disclosure on firm value the role of CEO power. Br. Account. Rev. 50, 60–75. doi:10.1016/j.bar.2017.09.007

Lin, L. (2013). Enforcement of pollution levies in China. J. Public Econ. 98 (2), 32–43. doi:10.1016/j.jpubeco.2012.11.004

Liu, Y., and Zhou, Z. (2010). Dividend hypothesis: A literature review. Finance Trade Econ. 06, 60–65. doi:10.19795/j.cnki.cn11-1166/f.2010.06.009

Lu, T., and Dang, Y. (2014). Corporate governance and innovation: Differences among industry categories. Econ. Res. J. 49 (6), 115–128. Available at: https://www.cnki.com.cn/Article/CJFDTotal-JJYJ201406009.htm.

Lv, L., and Cao, M. (2019). Reform of tax collection and management system from the perspective cooperation-Taking environmental protection tax as an example. J. China Univ. Geosciences Soc. Sci. Ed. 19 (06), 40–50. doi:10.16493/j.cnki.42-1627/c.2019.06.004

Orlov, A., and Grethe, H. (2012). Carbon taxation and market structure: A CGE analysis for Russia. Energy Policy 51, 696–707. doi:10.1016/j.enpol.2012.09.012

Pearce, D. (1991). A sustainable world: Who cares, who pays? RSA J. 139 (5420), 493–505. Available at: http://www.jstor.org/stable/41378097.

Ruhaya, A., Md Mahmudul, A., Jamaliah, S., and Mohamed, Z. (2018). The impacts of environmental, social, and governance factors on firm performance. Management of Environmental Quality. Int. J. 29 (02), 182–194. doi:10.1108/meq-03-2017-0033

Sabuj, K. (2010). Do undesirable output and environmental regulation matter in energy efficiency analysis? Evidence from Indian cement industry. Energy Policy 10, 6076–6083. doi:10.1016/j.enpol.2010.05.063

Song, W., and Du, H. Y. (2017). Independent research, technology spillovers and China’s green technology innovation. Res. Finance Econ. Issues 08, 98–105. doi:10.3969/j.issn.1000-176X.2017.08.014

Sun, Y., Zhi, Y., and Zhao, Y. (2021). Indirect effects of carbon taxes on water conservation A water footprint analysis for China. J. Environ. Manag. 279, 111747. doi:10.1016/j.jenvman.2020.111747

Tan, Y., and Zhu, Z. (2022). The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers' environmental awareness. Technol. Soc. 68, 101906. doi:10.1016/J.TECHSOC.2022.101906

Tian, C. (2020). The master-slave game analysis of environmental tax affecting enterprises’ green technological innovation. Finance Trade Econ. Res. 09, 95–104. doi:10.19654/j.cnki.cjwtyj.2020.09.011

Wei, Y., and Hu, C. (2021). On the relationship between environmental policy, corporate social responsibility and corporate performance. J. East China Univ. Sci. Technol. Soc. Sci. Ed. 03, 125–133. doi:10.3969/j.issn.1008-7672.2021.03.010

Yang, Z., and Yu, F. (2014). The mechanism research of political tie’s impact on business innovation. Nankai Econ. Stud. 6, 32–43. doi:10.14116/j.nkes.2014.06.003

Yu, L., Zhang, W., and Bi, Q. (2021). Can the reform of environmental protection fee-to-tax promote the green transformation of high-polluting enterprises? —evidence from quasi-natural experiments implemented in accordance with the environmental protection tax Law. China population. Resour. Environ. 5, 109–118. doi:10.12062/cpre.20200703

Keywords: environmental protection tax, green technological innovation, mediating effects, ESG, taxable pollutants

Citation: Li J and Li S (2022) Environmental protection tax, corporate ESG performance, and green technological innovation. Front. Environ. Sci. 10:982132. doi: 10.3389/fenvs.2022.982132

Received: 30 June 2022; Accepted: 08 August 2022;

Published: 31 August 2022.

Edited by:

Shigeyuki Hamori, Kobe University, JapanReviewed by:

Guifu Chen, Xiamen University, ChinaYun Ding, University of International Business and Economics, China

Copyright © 2022 Li and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shiyu Li, c2FsbHlyYWluMjAyMkAxMjYuY29t

Jing Li

Jing Li Shiyu Li

Shiyu Li