94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 16 August 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.981013

This article is part of the Research TopicFinancial and Trade Globalization, Greener Technologies and Energy TransitionView all 46 articles

In the carbon neutrality strategy, understanding the effects of green finance on green technology innovation is conductive to promoting the green transformation of the economy. Based on the micro-level and provincial panel data of Shanghai and Shenzhen A-share listed companies from 2012 to 2019, this study explored the impact of green financial development on the enterprises’ green technology innovation. Both mediating effect and moderating effect models were employed to determine the impact of green finance on green technological innovation. It was found that green finance significantly improved the enterprises’ green technology innovation, despite sufficient incentives for “quantity” and relatively insufficient motivation for “quality”. The mechanistic tests demonstrated that the green finance could encourage enterprises to improve green technology innovation by alleviating corporate financing constraints. The green innovation effect of green finance was gradually increased when the regional intellectual property protection was improved. The heterogeneity test indicated that the incentive effect of green financial development on green technology innovation was more evident in state-owned enterprises, enterprises with good internal control quality, and enterprises in the growth period. If only enterprises in the recession stage received green financial support, a “green innovation bubble” might occur. The research conclusions enrich the theories on the driving factors of enterprise green innovation and provide empirical evidence for enhancing the competitiveness of enterprise green innovation and achieving carbon neutrality.

As the world’s largest developing country, China is in an industrial upswing and has inevitably become a major emitter of total carbon emissions (Jahanger et al., 2021; Jahanger et al., 2022b). According to the World Resources Institute, China has led the world in annual carbon dioxide emissions since 2005 (Yang et al., 2021; Jahanger et al., 2022a; Jiang et al., 2022). In 2020, the carbon dioxide emission in China accounted for 98.94 billion tons, still ranking first in the world. Environmental degradation caused by high carbon emissions poses a serious threat to China’s economic development and carbon neutrality goals (Yang et al., 2020; Usman and Jahanger, 2021; Ke et al., 2022). Technological innovation is generally considered an effective reason for the reduction of carbon dioxide emissions, as it improves energy efficiency and contributes to cleaner production (Usman et al., 2021; Balsalobre-Lorente et al., 2022). In this context, green technology innovation is expected to be an effective tool to deal with the environmental crisis (Kamal et al., 2021; Usman and Hammar, 2021). Technological innovation, especially green technology innovation, is of great significance to achieve a win-win situation for economic development and environmental protection.

Green innovation refers to technological innovation that can reduce pollution, avoid energy consumption and improve the ecological environment (Braun and Wield, 1994). Compared with the conventional technology innovation, green technology innovation is characterized by long cycle time, slow return, difficult evaluation and high risk. Those characteristics makes it difficult for endogenous financing to support enterprises in a range of green innovation activities, which lead enterprise turn to external financing methods such as equity financing and debt financing. However, due to the high cost of external financing, many external investors and bank credit hold a cautious and conservative investment attitude towards green innovation in the imperfect capital market, resulting in a high external financing constraint for green innovation activities. Previous studies support that financial development can broaden financing channels, reduce information asymmetry between investment and financing agents, and ultimately alleviate financing constraints (Disatnik and Steinhart, 2015). Financial development can help enterprises finance green projects by promoting green enterprises to enhance scale effect, structure effect and technology effect. A favorable financial environment can provide loans to environmental enterprises at very low prices (Usman and Balsalobre-Lorente, 2022; Usman et al., 2022), thus guiding capital into green and low-carbon industries and promoting green technological progress. In addition, the existing literature shows that traditional financial institutions choose investment projects based on profitability criteria alone and ignore resource and environmental factors, which makes it difficult to support corporate green projects. Traditional financial institutions, represented by banks, mostly take profit and risk control as their guidelines, leading to the phenomenon of favoring the rich over the poor and financial exclusion time to time (Qian et al., 2020). Traditional financial institutions may have some drawbacks in supporting enterprises’ green technology innovation activities. In addition, the existing literature so far also confirms the driving role of environmental regulations (Jia et al., 2022; Ma et al., 2022; Qu et al., 2022), firm characteristics (Li et al., 2017), and government subsidies (Hu D. et al., 2021) on corporate green innovation. However, the green finance perspective is rarely covered. This study attempts to address these gaps by exploring the relationship between green finance and corporate green innovation. Therefore, the purpose of this study is to empirically test the role and mechanism of green finance in green technology innovation.

The enterprises listed on Shanghai Stock Exchange and Shenzhen Stock Exchange are selected as samples. The sampling period is 2011–2019. This paper adopts the panel data fixed-effects model for empirical analysis. The results show that: firstly, green finance has a significant driving effect on corporate green technological innovation; secondly, green finance enhances corporate green technological innovation by alleviating corporate financing constraints; thirdly, the driving effect of green finance on corporate green technological innovation is stronger in regions with strong intellectual property protection. Fourthly, the driving effect of green finance on green innovation is more significant in the sample of state-owned enterprises, the sample of enterprises with high-quality internal control, and the sample of enterprises in the growth stage. The positive effect of green finance on green innovation quality does not appear in the sample group of private enterprises.

The contribution of this research is reflected in the following four aspects. Firstly, this paper provides empirical evidence that green finance can promote green technology innovation in Chinese companies. Most of the existing literature focuses only on the relationship between green finance and economic development (Yin and Xu, 2022) or green finance and environmental quality (Zhou X. G. et al., 2020), but the research about the impact of green finance on corporate green technology innovation is relatively scarce. Green technology innovation is an effective tool to achieve a win-win situation for both economic development and environmental protection. Thus, it is significant to explore the impact of green finance and corporate green technology innovation. Secondly, the coupling coordination degree of regional environmental regulation and financial development is used to construct green finance development indicators. In previous studies, most measures of green finance were based on the capital supply side (Li and Hu, 2014) or the measured development level of green finance using a single green financial instrument (Zhang et al., 2022). Due to technical factors (e.g., statistical caliber) and institutional factors (e.g., incentive distortion), the above measures are difficult to accurately measure the development level of green finance. Starting from the essence of green finance, the coupling coordination degree model is used to construct the development index of green finance, in order to accurately describe the economic consequences of green finance. Thirdly, this paper incorporates green finance, financing constraints and green technological innovation into a unified analytical framework. It is found that green finance enhances corporate green technological innovation by alleviating financing constraints. Another study also found that intellectual property protection positively moderates the relationship between green finance and green technology innovation. It is deconstructed the inner logic of green finance and green innovation. Fourthly, there is a lack of in-depth research on the heterogeneous effects of green finance and corporate green innovation. This paper clarifies that the impact varies across enterprises with different attributes in the nature of ownership, internal controls and corporate life cycle. It is found that the innovation-driving effect of green finance is stronger in state-owned enterprises, enterprises with high-quality internal controls, and enterprises in the growth stage. This is a useful supplement to the theory of how green finance affects the activities of green technology innovation.

The rest of the paper is arranged as follows. Literature and Research Hypotheses Section reviews the related literature and puts forward the research hypotheses. Research Design Section presents the research design. The next two Results and Discussions Sections describe and analyze the empirical results, respectively. Conclusions and Policy Implications Section provides the conclusion and policy implications.

Most of the studies have assessed whether green finance can lead to green technology innovation in enterprises stays at the level of theoretical analysis. For example, Wang L. et al. (2021) analyzed the mechanism of green finance that promotes enterprises’ innovation from both internal and external aspects. They found that green finance can realize the exchange of capital or information among green economic subjects through external and internal incentives and ability to promote enterprises’ innovation. Ma et al. (2020) believed that financing problem is the main factor restricting green technology innovation through theoretical analysis. They proposed a financial service system to build effective green technology innovation from the perspective of financial institutions and governments. In addition, some scholars used the green finance reform pilot area policy in China as a quasi-natural experiment, and studied its impacts on enterprises’ green innovation (Li and Liu, 2021). They found that green finance promotes green innovation by increasing corporate long-term borrowing and improving corporate debt structure. Several studies analyzed the impact of implementing the green credit policy on enterprises’ green technology innovation. They found that green credit guidelines can promote corporate green technology innovation on the whole. Green credit guidelines mainly limited green technology innovation through the reduction of debt financing, rather than financing constraints. (Hu G. et al., 2021; Hong et al., 2021).

As the development of global green finance has shown a new trend, more and more countries are committed to carbon neutrality. Green development has become the inherent demand for high-quality economic development and modernization. Green technological innovation plays a crucial role in tackling resource and environmental issues, transforming economic development mode, and realizing high-quality economic development. Most existing studies focus on the driving factors of green innovation from the environmental regulations, government, market and micro-enterprise perspectives. Firstly, from the perspective of environmental regulations, the “Porter hypothesis” is the main base for environmental regulations. Porter pointed out that appropriate environmental regulations can promote the technological innovation of enterprises (Porter, 1991), as confirmed by many researchers. They found that appropriate environmental regulations improve green innovation. With the improvement of market mechanisms, and particularly by increasing the environmental awareness of companies and public, voluntary environmental regulations have the most noticeable incentive linear effect on green innovation (Shao et al., 2020; Zhang et al., 2020). Secondly, the perspective of government mainly analyzed government subsidies and local government quality. Some studies have provided evidence that government subsidies can effectively reduce the capital risks in the process of technological innovation activities and improve the green technological innovation abilities of enterprises (Tian and Liu, 2021). Local government can stimulate the enterprises’ enthusiasm for green technology innovation by providing direct funding and tax incentives (Guo et al., 2018). The third one is the market perspective, mainly focusing on the market demand. Some studies have indicated that both public’s environmental awareness and consumers’ green concept can affect the green innovation of enterprises (Doran and Ryan, 2012). The forth one is the micro-enterprise perspective, Li et al. (2017) pointed out that the enterprises’ profitability positively affects the innovation level of green products. Companies with higher profitability maintain sufficient liquid resources to support green product innovation. Liu and Wang (2021) found that corporate executives with military experience have more vital policy perceptions and respond more actively to national policies. When facing environmental policy pressure, they will take the initiative to cultivate enterprises’ green innovation ability and improve their green image. Yuan and Cao (2022) analyzed the impact of corporate social responsibility fulfillment on green innovation, and confirmed its positive role in obtaining specific social capital and promoting green innovation.

Based on the literature review, the research on the relationship between enterprises’ green finance and technological innovation is still in its infancy. Technological progress, especially green technological progress, plays a decisive role in green growth. Currently, whether green finance can leverage enterprises to achieve green technological innovation and complete economic transformation and upgrading remains an important issue.

The new Schumpeter growth model clearly states that financial development promotes technological progress and economic growth in the long-run. The developed financial system promotes the enterprises’ technological innovation by reducing the evaluation agency’s cost, providing flexible capital sources, and spreading the risks of innovation activities (Xing et al., 2020). Enterprises’ green technology innovation activities need continuous and stable financial support, and internal financing is generally difficult to meet the financial needs of green innovation activities. Financial institutions have become a key factor affecting enterprises’ innovation activities as a key external financing channel. “Greening” is the most prominent feature that distinguishes green finance from traditional finance. Green finance considers the potential environmental effects (potential returns, risks and costs related to the environment) in the investment and financing decision-making process. Therefore, the green technology innovation projects that are difficult to obtain financing under the traditional financial system can receive financial support from the green financial system and improve the possibility of enterprises to carry out green technology innovation activities (Wang and Wang, 2021). In addition, green finance is a financial service that provides financial support for energy conservation and environmental protection projects. Through financial guidance, it leverages social capital to flow to green industrial projects, stimulate enterprise vitality and promote enterprises to actively carry out green innovation projects. Green finance is the foundation of green technology innovation and the blood of green technology innovation system. Hence, the first hypothesis is as follows.

H1: The development of green finance can improve green technology innovation in enterprises.

The R&D innovation of enterprises needs to continuously introduce new technologies, new equipment and high-quality human resources. For most enterprises, internal financing is difficult to meet the capital needs of R&D activities, and external financing is needed to ensure the smooth progress of R&D projects. A large number of studies confirmed that external financing constraints seriously restrict the technological innovation of enterprises (Guariglia and Liu, 2014). The high cost, long cycle and high uncertainty of green technology innovation make it particularly affected by external financing constraints (Yu et al., 2021).

From the perspective of the effect and path of green finance, green finance alleviates the financing constraints of enterprises by playing two functions, namely, resource allocation and risk control, so as to improve the level of green technology innovation of enterprises. Resource allocation mainly includes the following two scenarios. Firstly, green finance directly provides preferential loans for innovation projects of environment-friendly enterprises (Xing et al., 2020). Green finance alleviates the financing constraints in the process of enterprise green innovation to encourage enterprises’ green innovation activities and improve the level of enterprise green technology innovation. Secondly, green finance policies limit the financing needs of “High-Pollution, High-Energy-Consumption” enterprises. Enterprises actively involve green innovation activities to ease the financial barriers in the production process (Yu et al., 2021). For risk control, due to the large initial investment of green technology innovation, high investment risk, and long investment term. Traditional financial institutions with liquidity preference have low investment willingness. Through long-term risk-sharing financial system, green finance effectively reduces liquidity risk, alleviates financing constraints faced by green technology innovation, and then improves the level of green technology innovation of enterprises. In addition, green finance helps the capital market to select high-quality projects, thereby effectively reducing transaction costs, and reasonably avoiding the risks of green technology innovation projects. These effects not only improve the market’s willingness to invest, but also mobilize more savings to participate in enterprises’ green technology innovation projects, and promote green technology progress (Soundarrajan and Vivek, 2016). Then, the second hypothesis is proposed as follows.

H2: The development of green finance promotes enterprises’ green technology innovation by relieving financing constraints.

Green innovation needs strong intellectual property protection. In recent years, the competition among enterprises has gradually become fierce due to the rapid development of the green industry. It has become a sharp weapon for enterprises to seize the market by attacking competitors through intellectual property litigation. Encouraging enterprises to perform green technological innovation and green industries development need a sound intellectual property rights protection system to protect innovation achievements from the source. The Guidelines on Building a Market-oriented Green Technology Innovation System, issued in January 2019, clearly states that the intellectual property protection system should be improved. Intellectual property protection should be strengthened in all links of green technology development, demonstration, promotion, application, and industrialization. Regarding intellectual property protection, Chinese President Xi Jinping expresses that “innovation is the primary driving force for development, and protecting intellectual property is protecting innovation”. In addition, previous studies confirm the incentive effect of intellectual property protection on enterprises’ technological innovation. Adequate intellectual property protection motivates enterprises to increase R&D and innovation investments (Hsu et al., 2013; Fang et al., 2017). Therefore, the third hypothesis is as follows.

H3: In regions with strong intellectual property protection, green finance has a strong positive effect on green technology innovation of enterprises.

The enterprises listed on Shanghai Stock Exchange and Shenzhen Stock Exchange are selected as samples. The sampling period is 2011–2019. The selection process was in accordance with three principles. First, companies in finance and insurance were excluded. Second, companies with missing data were eliminated to ensure data reliability. Third, companies with ST, *ST, and PT were excluded. The enterprise characteristic data and enterprise patent data were obtained from the China Research Data Service Platform (CNRDS). The World Intellectual Property Organization (WIPO) issued the green patent standard for the enterprise green invention patent. Data on the development of green finance come from the National Bureau of Statistics, China Finance Yearbook, and China Environmental Statistics Yearbook. All the continuous variable data were processed with winsorization at 1 and 99% quantiles to avoid the influence of extreme outliers.

Based on H1, the Model 1) was constructed to assess the impact of green finance on enterprises’ green technology innovation.

In Model (1), The subscript i represents the enterprise, j represents the province and t represents the year. Variable INNO represents the green technology innovation level of enterprise, measured by the number of green patent applications of the enterprise. Specifically, the total number of green patent applications INNO1 was used to measure the number of green technology innovations of enterprises, and the number of green invention patent applications INNO2 was used as a comparative indicator to measure the quality of green technology innovation of enterprises. Variable GF refers to the green finance development level of province, measured by combining the degrees of environmental regulation and financial development. Variable Control was a set of control variables, including enterprise size (Size), asset-liability ratio (Lev), enterprise age (Age), growth rate of operating income (Growth), return on total assets (ROA), ownership concentration (First), board size (Board), proportion of independent directors (Indb), cash ratio (Cash), and regional economic development level (Fz). eit denotes the random error term. The fixed effects of the time, individual firm, and province (the firm location) are controlled to make the regression result robust, ß1 shows the impact of green finance development on enterprise green technology innovation. According to the above assumptions, the prediction coefficient of this paper ß1 is significantly positive.

There are two popular indicators to measure green innovation: one is the number of green patent applications, and the other is the number of green patents granted (Chen et al., 2022; Zhao and Wang, 2022). Compared with the patent grant data, the patent applications data is more reliable, timely, and stable. Patent application data perform better than granted patent data in reflecting a firm’s innovation output level (Ernst, 2001). By using Xie’s research method (Xie et al., 2022), the total number of green patent applications and green invention patent applications are proxy variables for the number of green technology innovations (INNO1) and the quality of green technology innovation (INNO2), respectively.

The current measurement of green finance development starts from quantitative and qualitative perspectives. Quantitative analyses have two categories. The first category is the comprehensive index method, which combines green credit, green bond, green insurance, carbon finance, and other indicators into a comprehensive index to measure the development level of regional green finance through principal component analysis or entropy weight method (Zhou X. et al., 2020; Lee and Lee, 2022). The second category involves the green bond issuance or green credit ratio as a proxy variable to measure the regional green finance development (Zhu et al., 2021). The qualitative analysis discusses the impact of green financial policies on economic growth, and the resource allocation effect of green credit (Song et al., 2021; Yao et al., 2021). However, the incremental data of green finance has some limitations, such as fuzzy flow direction (Corfee-Morlot et al., 2016). In addition, China’s green bond and insurance markets started late, the issuance scale of green bonds is relatively low, and the supply of green insurance products is insufficient. As a result, the relevant statistical data of regions are missing to some extent, and the above measurement methods are inaccurate for regional green finance development.

Green finance was initially referred to as environmental finance, essentially credit rationing based on environmental constraints (Zeng et al., 2022). The “comprehensive report of the G20” in 2016 explains that “green finance refers to investment and financing activities that generate environmental benefits to support sustainable development”. Hence, green finance is an Innovative Financial System Combining Market with Policy. Regarding this analysis and following Xie (2021) approach and Wang S. et al. (2021) coupling coordination degree model, this paper considered the coupling coordination degree of regional environmental regulation and financial development as a proxy variable for regional green finance development level. The provincial-level data were used in this study due to the data availability. The specific methods are as follows.

1) The first step determines the environmental regulation and financial development indicators to obtain their sequence values u1 and u2 after standardized processing. Environmental regulation is measured by the ratio of a completed investment in industrial pollution control to regional GDP, and financial development is measured by the deposit-loan ratio of each region. (2) The second step uses the coupling coordination degree model to determine the development level of green finance. The greater the D value of coupling coordination degree, the higher the regional green finance development. The specific model is as follows:

where

Other essential factors affecting green technology innovation need to be controlled. The choice of control variables is reflected in the relevant research (Cai et al., 2021; Qu et al., 2022), as follows: 1) Enterprise size (Size): The natural logarithm of one plus the total assets amount of the enterprise was used to represent the enterprise size (Chen et al., 2021). When the enterprise is large, the asset size is large, and the financing constraint is small. Moreover, large-scale enterprises choose to participate more in innovation activities (Lv et al., 2021); 2) Enterprise age (Age): Enterprise age is the natural logarithm of the company’s years since its establishment; 3) Asset-liability ratio (Lev): Asset-liability ratio is measured by the ratio of total liability to total assets. Moderate debt management allows firms to have more capital for R&D innovation; 4) Enterprise growth (Growth): Enterprise growth (Growth) is the rate of operating revenue; 5) Return on total assets (ROA): Return on total assets represents the profitability of enterprises. The company with higher profitability has stronger innovation willingness and innovation ability (Huang et al., 2021); 6) Board size (Board): Board size is the natural logarithm of board members; 7) Proportion of independent directors (Indb): The proportion of independent directors (Indb) is the number of independent directors to the number of directors. Independent board of directors can perform advisory and supervisory duties due to reputation effect (Tang et al., 2013); 8) Ownership concentration (First): Ownership concentration is the proportion of the largest shareholder; 9) Cash ratio (Cash): The cash ratio (Cash) is ratio of cash and cash equivalents to current liabilities. As innovation needs sufficient financial support, this index is chosen to measure the cash level of enterprises; 10) Regional economic development level (Fz): Regional economic development level is usually measured by the natural logarithm of GDP per capita. Regions with high levels of economic development have a sound institutional environment, which has a positive impact on enterprise innovation (Zhang et al., 2017).

Table 1 shows the basic statistical characteristics of major variables. The results demonstrated that the logarithmic mean values of green innovations quantity (INNO1) and green innovation quality (INNO2) were 0.319 and 0.227, respectively. The median number of green patent applications was 0. According to Table 1, the overall innovation of enterprises was low, and apparently, most enterprises did not apply for green patents, leading to a lack of green innovation. The maximum and minimum values of green finance development (GF) were 0.6 and 0.234, respectively, showing remarkable differences in the green finance development among regions.

Table 2 presents the Pearson correlation coefficients of the variables. The results showed that the explained variable (GF) was correlated with all the control variables, indicating that the choice of control variables is plausible. Furthermore, as the correlation coefficients of all variables were less than 0.8, severe multicollinearity did not exist in our regression analyses.

Table 3 shows the estimated fixed effects of regional green finance development on enterprise green technology innovation. Columns 1) and 2) of Table 3 show the regression result after controlling the enterprise, time, and region, as well as excluding other relevant control variables. According to Columns 1) and 2) of Table 3, all the coefficients of the explanatory variable GF were positive and statistically significant at 1% level, indicating that regional green finance development improves the enterprises’ green technology innovation. After including relevant control variables, the green finance development had a stable positive effect on the quantity and quality of enterprises’ green technology innovation. This positive effect implies that green finance development can improve both quantity and quality of the enterprises’ green technology innovation. Hence, hypothesis H1 is verified. In addition, Columns 3) and 4) of Table 3 show that the regression coefficient of GF are positive and statistically significant at 1% level. The GF coefficient in Column 3) was greater than that in Column 4) (0.403 > 0.282), indicating that the development of regional green finance has sufficient incentive for “quantity” and relatively insufficient incentive for “quality” during the process of enterprise green technology innovation.

Regarding the regression results of the control variables, the coefficients of SIZE in Columns 3) and 4) were positive and statistically significant at 1% level. This result indicates that large enterprises have strong green innovation capacity and promote enterprises’ sustainable development through green technology innovation and other ways. The coefficient of ownership concentration (First) was negative and statistically significant, indicating that the higher the ownership concentration is, the more unfavorable it is for enterprises to carry out green technology innovation. According to column (4), the coefficient of regional economic development (Fz) was positive and statistically significant at 10% level. This positive effect indicates that the economically developed areas have intense market competition, the awareness of environmental protection and environmental regulation is strong, and the loan standard of “differential treatment” of green finance is prominent. Companies focus more on “substantive innovation” and quality improvement of green technology innovation to reduce pollution control costs and avoid falling into financing difficulties or even elimination.

Considering the left-truncation feature of patent data, the dual Tobit model was used to further verify the impact of green finance development on the level of green technology innovation of enterprises. In addition, a virtual variable was constructed according to whether the number of green patent applications was 0, and Logit model and Probit models were used for robustness test. Table 4 represents the results of the three regression models. The regression results were basically consistent with Table 3 after regressing different models.

In the development process of green finance, green credit is more complete than other green financial products and has become the main component of green finance. According to the China Banking and Insurance Regulatory Commission data, the balance of green credit in both local and foreign currencies reached 15.9 trillion Yuan by the end of 2021. Following Dong and Nian (2020), this paper took the development of green credit (GC) in each province as the measurable indicator of green finance development. Green credit was measured by the ratio of the interest expenditure of the top six high energy-consuming industries in the region to the interest expenditure of industrial industry. The lower the ratio, the higher the development level of green finance in the region. The estimation results are shown in Columns 1) and 2) of Table 5, respectively. It was found that the impact of the green credit (GC) on green technology innovation of enterprises was still significantly positive at the 1% level. In addition, considering the high risk of the innovation and the long period of time, there may be reverse causality between green financial development and enterprise green technology innovation. Referring to the research of He and Tian (2013), the number of green patent applications in “T + 1” and “T + 2” is selected as the proxy variables of green technology innovation level. The results are shown from Columns 3) to 6) of Table 5. It was observed that the coefficient of GF and the significance of GF were basically consistent with the regression results in Table 3.

Since the statistical standard of patent application was changed in 2017, this research re-estimates the regression without the data of 2017. Table 6 shows the regression results. It was found that the explanatory (green finance GF) had a significant impact on the explained variable (green technology innovation INNO), and the magnitude and the direction of impact were, by and large, consistent with the Model (1), Therefore, it is demonstrated that the selection of variables is reasonable, and the regression results of the models are robust and reliable.

The aforementioned robustness test Sample Excluding the Data of 2017 Section treated the explained variables in periods of “T +1” and “T +2” to eliminate the endogeneity problem caused by the reverse causality of “where the level of green technology innovation is higher, the development of green finance is better” as much as possible. There are still endogeneity biases such as omitted variables. This paper uses instrumental variables to weaken the endogenous problem. Following Chong et al. (2013), this study manually sorts out the data of bordering provinces of all provinces, and uses the mean level of the green finance development of all bordering provinces in the same year as the green finance’ instrumental variable. On the one hand, the economic development level of bordering provinces is similar, so the development level of green finance in these provinces is similar. On the other hand, the development level of green finance in bordering provinces is difficult to affect the green innovation of local enterprises through financing channels (Li et al., 2020). Therefore, the instrumental variable satisfies the two constraints of correlation and exogeneity. Table 7 shows the regression results of instrumental variables. The coefficient of green finance development (GF) was positive even after considering the possible endogenous problems between regional green finance development and enterprise green technology innovation. This result indicates that regional green finance development significantly improves the level of enterprise green technology innovation, which is consistent with the previous results. The results of the robustness tests and the treatment of endogenous problems indicate that the core conclusion of this paper is robust.

Stepwise regression test proposed by Baron and Kenny (1986) is commonly used to test mediating effect. To test H2, Models 3) and 4) were constructed on the basis of Model (1).

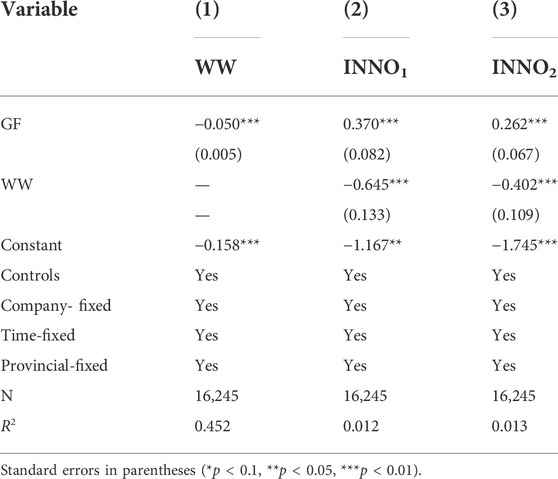

In Model (3), the explained variable WW was financing constraint. This study follows Whited and Wu (2006) used the WW index as the proxy variable of financing constraint. The higher the WW index, the higher the degree of financing constraint. According to the regression idea of mediating effect, if the coefficient of ß1 in Eq. 3 is significantly negative, then regression of Eq. 4 can be carried out. If a1 in Eq. 4 is not significant and a2 is significant, it indicates that the financing constraint is a complete intermediary variable between green financial development and enterprise green technology innovation. If both a1 and a2 are significantly not 0, it indicates that financing constraints are partial intermediary variables between green financial development and enterprise green technology innovation. Table 8 shows the regression results. According to Column 1) of Table 8, the ß1 in Eq. 3 was negative and statistically significant at 1% level, it indicates that the development of green finance alleviates financing constraints. Based on Columns 2) and 3) in Table 8, a1 and a2 in Eq. 4 are positive and negative, respectively, and statistically significant at 1% level. This result indicates that financing constraints play a partial intermediary effect in the incentive process of green finance development and enterprises’ green technological innovation. Thus, the development of green finance helps enterprises obtain more available funds by alleviating the enterprises’ financing constraints, and then increasing the quantity and quality of enterprises’ green technology innovation. Hypothesis H2 is verified.

TABLE 8. Regression results of green finance development, financing constraints, and enterprise green technology innovation level.

Due to the limitation of length of an article, the robustness test of this part is omitted. If necessary, it can be obtained from the author.

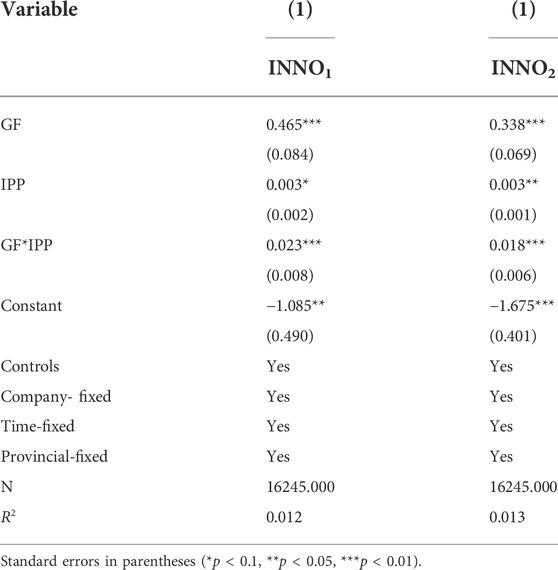

From the perspective of external intellectual property protection, this paper examines the different effects of green finance on enterprise green technology innovation under different intellectual property protection environments. To test H3, a panel data regression model 5) was constructed. The specific model is as follows:

where IPP is the level of intellectual property protection in each province. This study follows Zhang and Lu (2012) to use the intellectual property protection index disclosed in China Provincial Marketization Index Report as a proxy for the intellectual property protection in each province. The moderating effect of intellectual property protection on the relationship between green finance and enterprises’ green technology innovation is shown in Table 9. From Table 9, it can be observed that intellectual property protection positively regulates the relationship between green finance and enterprises’ green technology innovation, indicating that when the level of intellectual property protection in each province is higher, the relationship between the two is more obvious. Hence, hypothesis H3 is verified.

TABLE 9. Regression results of the green finance development, intellectual property protection, and enterprise green technology innovation level.

Due to the limitation of length of an article, the robustness test of this part is omitted. If necessary, it can be obtained from the author.

The above empirical results verify the role of regional green finance development in promoting green technology innovation and its mechanism. At present, numerous studies show that the firm’s characteristics also affect the firm’s innovation behavior. Therefore, this paper selects variables that may affect enterprise innovation behavior via the internal characteristics of enterprises, such as the nature of equity and internal control. Additionally, this paper considers the differences in innovation activities in different life cycle stages of enterprises to analyze the heterogeneity from the perspective of the enterprise life cycle.

The estimation results of each group are shown in Table 10. According to the nature of property rights, enterprises are divided into state-owned enterprises (SOE) and non-state-owned enterprises (NSE). The parameter estimation results are shown in Columns 1) and 2) of Table 10. The promotion effect of green finance development on the quantity and quality of enterprises’ green technology innovation is more significant in the sample group of state-owned enterprises. However, the promotion effect of substantive green innovation is difficult to be reflected in the sample group of private enterprises.

Internal control is an internal governance process in which all staff, including senior management, participate in achieving the business and financial goals of the enterprise. This kind of control is an important governance mechanism for the company. The quality of internal control relates to the enterprises’ operation and risk management. A large number of studies show that a high-quality internal control creates a good innovation environment, improves management’s innovation consciousness, reduces agency cost, alleviates information asymmetry, promotes enterprises to strengthen corporate social responsibility (CSR) performance and improves an enterprise’s innovation performance (Ntim and Soobaroyen, 2013; Wang et al., 2022). This research evaluated the green innovation-driven effect of green finance by dividing the samples into two groups according to whether the internal control of enterprises was greater than the median of the sample. The internal control index of DIB listed enterprises was adopted as the indicator to evaluate the effectiveness of internal control of enterprises (Li, 2020), and DIB internal control index was used to take the logarithmic measure. The greater the index value, the higher the quality of internal control. Columns 3) and 4) of Table 10 represent the regression results. The coefficient of the explanatory variable GF was positive and statistically significant in the group with high-quality internal control, while it was insignificant in the organization with low-quality internal control. The results showed that green finance could only affect green innovation in high-quality internal control enterprises rather than low-quality internal control enterprises.

Change in the enterprises’ life cycle affects the internal characteristics and external market environment. The change in internal characteristics and external market environment is embodied in the differences in strategic choice, governance capacity, financial needs, and competitive environment, which leads to the heterogeneity of innovation activities in different life cycle stages. Therefore, this study follows Dickinson to use the cash flow combination method (Dickinson, 2011). The enterprise life cycle has three stages of “growth-mature-regression” to examine the difference between green finance development’s driving with enterprise green innovation during the enterprise life cycle. The regression results are presented in Table 10. The GF coefficient was positive in Columns 5)–(7), and this value and its significance level in Column 5) were greater than in Column (6). These results confirm the enterprises’ stronger green innovation ability in the growth stage. In comparison, the GF coefficient in Column 7) was close to 10% statistical significance level, and the coefficient of green innovation quality (Inno2) was statistically insignificant. This finding suggests that the innovation-driven effect of green finance development is the most obvious in the growing enterprises, followed by the mature ones. Green finance can only produce a “green innovation bubble” in the regression enterprises.

The direct effect of green finance is one of our interests in this paper. The baseline results suggest that green finance can significantly promote green technology innovation. However, the development of regional green finance has sufficient incentive for “quantity” and relatively insufficient incentive for “quality” during the process of enterprise’ green technology innovation. This is consistent with the finding of Wang and Wang (2021).These different effects have the following reasons: 1) green innovation started in China lately and the green innovation ability is low; 2) the green invention patents are usually breakthrough innovations with more incredible difficulty, more investment and long investment cycle; 3) To obtain economic benefits such as subsidies or loan concessions provided by policies, enterprises often carry out “strategic innovation”, that is, short-term pursuit of green technology innovation quantity and ignore the quality of green innovation.

Furthermore, it is observed that the green finance can improve enterprises’ green technology innovation through relieving enterprise financing constraint paths. Compared with other technological innovation, green technology innovation needs more investment in R&D funds, resulting in higher external financing constraints for green innovation activities. Financial institutions create more green credit, green bonds, green insurance and other green financial products. It can guide social capital to invest in green industry, so as to alleviate the capital bottleneck and insufficient financing during the process of green innovation. This can stimulate enterprise vitality, increase R&D investment, and promote the improvement of green technology innovation level (Han, 2020). Goetz (2019) also confirmed that green credit can reduce the long-term debt financing cost of enterprises based on the data of American enterprises, thus promoting the green technology research and development of enterprises.

In addition, the research results show that local intellectual property protection positively moderates the relationship between green finance and green technological innovation of enterprises. Enterprise’s innovation activities have externalities. When the non-exclusive characteristics of enterprise’s innovation results are highlighted, enterprises will be pessimistic about the future innovation income, which leads to a decline in enterprises’ innovation motivation. From the perspective of externality theory, strengthening intellectual property protection not only ensures the exclusiveness of enterprise innovation achievements, but also reduces the risk of technology spillover and effectively promotes enterprises to increase R&D investment and improve innovation output (Yu and Wang, 2021).

Finally, the heterogeneity analysis shows that the green innovation driving effect of green finance is more prominent in the sample group of state-owned enterprises. The promoting effect of green finance on the quality of green innovation is not obvious in the sample group of private enterprises. These effects have many reasons. Firstly, green finance is still in the stage of development, and the information disclosure mechanism is not mature enough (Zhang et al., 2011). State-owned enterprises with relatively sound information, and green finance plays a more significant role in supporting green innovation. Secondly, as the pillar of the national economy, state-owned enterprises are more affected by policies than private enterprises and face more tremendous pressure from public opinion and government regulation. “Green bleaching” and “green washing” behavior of state-owned enterprises would be under control, and more substantial innovation would be carried out. State-owned enterprises have non-precipitation redundant resources and provide diversified promotion paths to managers, which improves the enterprises’ willingness and ability to improve green innovation. Thirdly, compared with state-owned enterprises, private enterprises have more prominent financing constraints. To attract “support”, they prefer strategic innovation to substantive innovation, making it difficult to improve the quality of innovation in the short-term.

In the group with high-quality internal control, the positive effect of green finance on green innovation quantity and green innovation quality passed the significance test for the studied period, while this effect did not appear in the group with low-quality internal control. This result implies that good internal control quality effectively plays a supervisory role, thus alleviating agency problems. This finding helps corporate executives to establish a sense of social responsibility for long-term development and improve their awareness of green innovation to enhance the enterprises’ green technology innovation.

The results in Columns 5)–7) of Table 9 suggest that the innovation-driven effect of green finance is the most obvious in the growing enterprises, followed by the mature ones. Green finance can only produce a “green innovation bubble” in the regression enterprises. This is consistent with the findings of Yu et al. (2018).Generally, the enterprises’ cash inflow continues to increase in the growth stage, their financing ability improves, and managers have a strong risk-taking spirit and risk tolerance. Additionally, their main goal is to develop new technologies and products to increase their market share, achieve rapid expansion, and improve profit levels. In the mature stage, the profit level is relatively stable, and the operational and financial risks reduce significantly. The managers’ main goal is to “prioritize stability while pursuing progress”. In addition, managers are prone to the innovation inertia of “meet comfortable with the status quo”, and the enterprises’ resilience and innovation vitality are no longer the past. During the recession stage, their economic benefits decrease significantly, their cash flow continues to shrink, and they cannot provide a large amount of funds for substantive innovation in the short-term. Instead, only strategic innovations compensate for environmental production costs, leading to the apparent shortage of green innovation, especially in terms of quality.

Developing green industry and promoting green technology innovation are the keyways to realize the decoupling between economic development, environmental pollution and resource consumption. The enterprises listed on Shanghai Stock Exchange and Shenzhen Stock Exchange are selected as samples, this paper uses panel econometric data to explore the impact of regional green finance development on the level of green technology innovation of enterprises, and further discusses the mechanism and path of action. The following conclusions are drawn.

First, the green finance can significantly improve enterprises’ green technology innovation, but there is sufficient incentive for the quantity of green technology innovation, despite poor motivation to the quality of green technology. Second, the test results of mechanism analysis show that green finance can improve enterprises’ green technology innovation through relieving enterprise financing constraints paths. The protection of local intellectual property positively moderates the relationship between green finance and enterprises’ green technology innovation. This is consistent with the conclusion of Bao et al. (2020). Third, heterogeneity analysis shows that the improvement effect of green finance on the enterprises’ green technology innovation is more significant in the sample group of state-owned enterprises. The positive effect of green finance on green innovation quality did not appeared in the sample group of private enterprises. In the group with high-quality internal control, the positive effect of green finance on green innovation quantity and green innovation quality passed the significance test for the studied period, while this effect did not appear in the group with low-quality internal control. The enterprises’ life cycle has three stages: growth-maturation-recession. According to the results, the innovation-driven effect of green finance was the most obvious in the growing enterprises, followed by the mature ones. Green finance could only produce a “green innovation bubble” in the regression enterprises.

According to the findings, this paper represents the following policy implications.

From the perspective of constructing a green financial system, the government should develop an appropriate incentive and restraint mechanism, foster the relationship of the banking department with the finance and taxation department, and establish a long-term mechanism for green finance development. In this way, the government can noticeably improve and rapidly construct a green financial service system. In addition, decision makers should encourage the financial institutions to carry out financial innovation around prolonging the term and revitalizing assets. They also should formulate some policies to develop and improve green financial products, which meet the needs of green technology innovation. Moreover, they should actively attract private capital, leverage it to invest in green projects, make up the funding gap with green finance, and fulfill the needs of enterprises and projects with green financing.

From the perspective of green technology innovation, it is necessary to establish a unified evaluation system and identification standards for green technology projects. This action ensures the fairness, scientific, and feasibility of green technology enterprise evaluation, eliminates “greenwashing” and other green fraud projects of enterprises, and promotes the sustainable development of green technology innovation. In addition, the government should formulate a patent protection mechanism for green technology innovation, strengthen law enforcement against infringement, protect the legitimate rights and interests of innovators, and build solid intellectual property protection for green innovation.

Furthermore, governments and regulators should customize incentive policies based on firm heterogeneity and the nature of green innovation projects. On the one hand, government should increase investment in research and development (R&D) and improve the utilization rate of funds, tax incentives and tax reductions should be used to encourage pollution control enterprises to carry out green technology innovation. It is worth noting that incentive policies should be consistent with the difficulty, depth, and potential environmental effects of green innovation projects. Our findings show that the promotion effect of green finance development on enterprise green technology innovation is more significant in the sample group of state-owned enterprises. The innovation driving effect of green finance development is the strongest in the growth period, followed by the maturation stage, and the weakest in the recession stage. Therefore, state-owned enterprises and enterprises in the growth stage should make full use of the green finance driving effect and acquire diversified financing channels via resource allocation and risk control functions of green finance to ensure the continuous development of green technology innovation activities. Private and mature enterprises should face up to their lack of innovation, formulate reasonable incentive policies or organize related training courses to mobilize the green innovation consciousness of enterprise managers. The employees’ green innovation vitality initiatives need stimulation and improvement. From the perspective of the financing constraints faced by private enterprises, the problem is more serious. The government should provide some guidance and incentive such as incubation, guarantee and discount government loans to reduce the financing cost and risk premium of green technology enterprises, and open the channel of financing cost of green finance to promote green innovation. For enterprises in the recession period, the government should set up a special fund for green finance or give corresponding innovation subsidies to encourage enterprises in transformation and upgrading through green technology innovation.

From the perspective of enterprises, they should raise the awareness of intellectual property protection and actively declare green innovation achievements. In addition, enterprises should issue internal rules and regulations, clarify the responsibilities of each main department in the system of green technology innovation, and establish a standardized and long-term internal control and constraint mechanism.

Finally, providing an information-sharing platform ensures a benign interaction among the government, enterprises, and financial institutions, through joint efforts of various parties. Forming a complementary and win-win development pattern of green finance and technological innovation gives full play to the driving effect of green innovation, so as to realize green development, social green transformation, and sustainable economic development.

This research has several limitations that suggest future research opportunities. First, we did not classify green technology innovation. Future consideration will be given to divide green technology innovation into 1) technological innovation in fossil fuels and 2) technological innovation in renewables. On this basis, we conduct more in-depth and detailed research, so as to produce more and more valuable results. Second, the mediating effect of green finance on green innovation takes fewer variables into account, and the channels of green finance on green innovation are rich. We can also explore the mediating effect of debt structure. The above aspects should be considered in the directions to be explored in the future research.

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

All the authors contributed extensively to the work presented in this paper. Conceptualization, ZL; methodology, SJ and ZL; software, SJ; validation, XL; resources, HX; data curation, HS; writing-original draft preparation, SJ. All authors have read and agreed to the published version of the manuscript.

This research was funded by National Natural Science Foundation of China, grant number 71903114.

The authors would like to express their gratitude to EditSprings (https://www.editsprings.cn) for the expert linguistic services provided.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Balsalobre-Lorente, D., Ibanez-Luzon, L., Usman, M., and Shahbaz, M. (2022). The environmental Kuznets curve, based on the economic complexity, and the pollution haven hypothesis in PIIGS countries. Renew. Energy 185, 1441–1455. doi:10.1016/j.renene.2021.10.059

Bao, Z., Shi, Y., and Zhong, Z. (2020). Chinese IPR protection strategy and innovation incentives —“Protecting”or “injuring”? Stud. Sci. Sci. 38, 843–851. doi:10.16192/j.cnki.1003-2053.2020.05.009

Baron, R. M., and Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 51, 1173–1182. doi:10.1037/0022-3514.51.6.1173

Braun, E., and Wield, D. (1994). Regulation as a means for the social control of technology. Technol. Anal. Strateg. Manag. 6 (3), 259–272. doi:10.1080/09537329408524171

Cai, A., Zheng, S., Cai, L., Yang, H., and Comite, U. (2021). How does green technology innovation affect carbon emissions? A spatial econometric analysis of China’s provincial panel data. Front. Environ. Sci. 9, 813811. doi:10.3389/fenvs.2021.813811

Chen, Y., Chen, M., and Li, T. (2021). China’s CO2 emissions reduction potential: a novel inverse DEA model with frontier changes and comparable value. Energy Strategy Rev. 38, 100762. doi:10.1016/j.esr.2021.100762

Chen, Z., Niu, X., Gao, X., and H, C. (2022). How does environmental regulation affect green innovation? A perspective from the heterogeneity in environmental regulations and pollutants. Front. Energy Res. 10, 885525. doi:10.3389/fenrg.2022.885525

Chong, T. T. L., Lu, L., and Ongena, S. (2013). Does banking competition alleviate or worsen credit constraints faced by small- and medium-sized enterprises? Evidence from China. J. Bank. Financ. 37 (9), 3412–3424. doi:10.1016/j.jbankfin.2013.05.006

Corfee-Morlot, J., Rydge, J., Gencsu, I., and Bhattacharya, A. (2016). The sustainable infrastructure imperative: financing for better growth and development. SB. Bus. Wkly. doi:10.13140/RG.2.2.12364.00640

Dickinson, V. (2011). Cash flow patterns as a proxy for firm life cycle. Acc. Rev. 86 (6), 1969–1994. doi:10.2308/accr-10130

Disatnik, D., and Steinhart, Y. (2015). Need for cognitive closure, risk aversion, uncertainty changes, and their effects on investment decisions. J. Mark. Res. 52 (3), 349–359. doi:10.1509/jmr.13.0529

Dong, X., and Nian, W. (2020). Research on the spatial correlation of Green finance's support to regional economy. J. Ind. Technol. Econ. 39, 62–69.

Doran, J., and Ryan, G. (2012). Regulation and firm perception, eco-innovation and firm performance. Eur. J. Innov. Manag. 15 (4), 421–441. doi:10.1108/14601061211272367

Ernst, H. (2001). Patent applications and subsequent changes of performance: evidence from time-series cross-section analyses on the firm level. Res. Pol. 30, 143–157. doi:10.1016/s0048-7333(99)00098-0

Fang, L., Lerner, J., and Wu, C. (2017). Intellectual property rights protection, ownership, and innovation: Evidence from China. Rev. Financ. Stud. 30 (7), 2446–2477. doi:10.1093/rfs/hhx023

Goetz, M. (2019). Financing conditions and toxic emissions. SAFE Working Paper. doi:10.2139/ssrn.3411137

Guariglia, A., and Liu, P. (2014). To what extent do financing constraints affect Chinese firms' innovation activities? Int. Rev. Financ. Anal. 36, 223–240. doi:10.1016/j.irfa.2014.01.005

Guo, Y., Xia, X., Zhang, S., and Zhang, D. (2018). Environmental regulation, government R&D funding and green technology innovation: evidence from China provincial data. Sustainability 10 (4), 940. doi:10.3390/su10040940

Han, K. (2020). Research on the relationship between green finance development. Price Theory Pract. 04, 144–147+178. doi:10.19851/j.cnki.CN11-1010/F.2020.04.127

He, J., and Tian, X. (2013). The dark side of analyst coverage: the case of innovation. J. Financ. Econ. 109 (3), 856–878. doi:10.1016/j.jfineco.2013.04.001

Hong, M., Li, Z., and Drakeford, B. (2021). Do the green credit guidelines affect corporate green technology innovation? Empirical research from China. Int. J. Env. Res. Pub. Health. 18 (4), 1682. doi:10.3390/ijerph18041682

Hsu, P. H., Wang, C., and Wu, C. (2013). Banking systems, innovations, intellectual property protections, and financial markets: evidence from China. J. Bus. Res. 66 (12), 2390–2396. doi:10.1016/j.jbusres.2013.05.025

Hu, D., Qiu, L., She, M., and Wang, Y. (2021a). Sustaining the sustainable development: How do firms turn government green subsidies into financial performance through green innovation? Bus. Strateg. Environ. 30 (5), 2271–2292. doi:10.1002/bse.2746

Hu, G., Wang, X., and Wang, Y. (2021b). Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ. 98, 105134. doi:10.1016/j.eneco.2021.105134

Huang, M., Li, M., and Liao, Z. (2021). Do politically connected CEOs promote Chinese listed industrial firms’ green innovation? The mediating role of external governance environments. J. Clean. Prod. 278, 123634. doi:10.1016/j.jclepro.2020.123634

Jahanger, A., Usman, M., and Ahmad, P. (2022a). A step towards sustainable path: the effect of globalization on China's carbon productivity from panel threshold approach. Environ. Sci. Pollut. Res. 29 (6), 8353–8368. doi:10.1007/s11356-021-16317-9

Jahanger, A., Usman, M., and Balsalobre-Lorente, D. (2021). Autocracy, democracy, globalization, and environmental pollution in developing world: Fresh evidence from STIRPAT model. J. Public Aff., e2753. doi:10.1002/pa.2753

Jahanger, A., Usman, M., Murshed, M., Mahmood, H., and Balsalobre-Lorente, D. (2022b). The linkages between natural resources, human capital, globalization, economic growth, financial development, and ecological footprint: the moderating role of technological innovations. Resour. Policy 76, 102569. doi:10.1016/j.resourpol.2022.102569

Jia, L., Hu, X., Zhao, Z., He, B., and Liu, W. (2022). How environmental regulation, digital development and technological innovation affect China’s green economy performance: evidence from dynamic thresholds and system GMM panel data approaches. Energies 15 (3), 884. doi:10.3390/en15030884

Jiang, T. Y., Yu, Y., Jahanger, A., and Balsalobre-Lorente, D. (2022). Structural emissions reduction of China's power and heating industry under the goal of "double carbon": a perspective from input-output analysis. Sustain. Prod. Consum. 31, 346–356. doi:10.1016/j.spc.2022.03.003

Kamal, M., Usman, M., Jahanger, A., and Balsalobre-Lorente, D. (2021). Revisiting the role of fiscal policy, financial development, and foreign direct investment in reducing environmental pollution during globalization mode: evidence from linear and nonlinear panel data approaches. Energies 14 (21), 6968. doi:10.3390/en14216968

Ke, J. M., Jahanger, A., Yang, B., Usman, M., and Ren, F. (2022). Digitalization, financial development, trade, and carbon emissions; implication of pollution haven hypothesis during globalization mode. Front. Environ. Sci. 10, 873880. doi:10.3389/fenvs.2022.873880

Lee, C. C., and Lee, C. C. (2022). How does green finance affect green total factor productivity? Evidence from China. Energy Econ. 107, 105863. doi:10.1016/j.eneco.2022.105863

Li, C., Yan, X., Song, M., and Yang, W. (2020). Fintech and corporate. Innovation ——evidence from Chinese NEEQ-listed companies. China Ind. Econ. 1, 81–98. doi:10.19581/j.cnki.ciejournal.2020.01.006

Li, D., Zheng, M., Cao, C., Chen, X., Ren, S., and Huang, M. (2017). The impact of legitimacy pressure and corporate profitability on green innovation: evidence from China top 100. J. Clean. Prod. 141, 41–49. doi:10.1016/j.jclepro.2016.08.123

Li, R., and Liu, l. (2021). Green finance and enterprises' green innovation. Wuhan. Univ. J. 74 (06), 126–140. doi:10.14086/j.cnki.wujss.2021.06.012

Li, W., and Hu, M. (2014). An overview of the environmental finance policies in China: retrofitting an integrated mechanism for environmental management. Front. Environ. Sci. Eng. 8 (3), 316–328. doi:10.1007/s11783-014-0625-5

Li, X. (2020). The effectiveness of internal control and innovation performance: an intermediary effect based on corporate social responsibility. PLoS One 15 (6), e0234506. doi:10.1371/journal.pone.0234506

Liu, Z., and Wang, H. (2021). The influence of top managers' military. Experience on enterprise green innovation. Soft. Sci. 35, 74–80. doi:10.13956/j.ss.1001-8409.2021.12.12

Lv, C., Shao, C., and Lee, C.-C. (2021). Green technology innovation and financial development: do environmental regulation and innovation output matter? Energy Econ. 98, 105237. doi:10.1016/j.eneco.2021.105237

Ma, J., An, G., and Liu, J. (2020). Constructing financial service system supporting green technology innovation. Financ. Theor. Pract. 5, 1–8.

Ma, N., Liu, P., Xiao, Y., Tang, H., and Zhang, J. (2022). Can green technological innovation reduce hazardous air pollutants?-an empirical test based on 283 cities in China. Int. J. Environ. Res. Public Health 19 (3), 1611. doi:10.3390/ijerph19031611

Ntim, C. G., and Soobaroyen, T. (2013). Corporate governance and performance in socially responsible corporations: new empirical insights from a neo-institutional framework. Corp. Gov. Int. Rev. 21 (5), 468–494. doi:10.1111/corg.12026

Porter, M. E. (1991). America's green strategy. Sci. Am. 264 (4), 168. doi:10.1038/scientificamerican0491-168

Qian, H., Tao, Y., Cao, S., and Cao, Y. (2020). Theoretical and empirical analysis on the development of digital finance and economic growth in China. J. Quanti. Tech. Econ. 37, 06. doi:10.13653/j.cnki.jqte.2020.06.002

Qu, F., Xu, L., and Chen, Y. (2022). Can market-based environmental regulation promote green technology innovation? Evidence from China. Front. Environ. Sci. 9, 823536. doi:10.3389/fenvs.2021.823536

Shao, S., Hu, Z., Cao, J., Yang, L., and Guan, D. (2020). Environmental regulation and enterprise innovation: a review. Bus. Strateg. Environ. 29 (3), 1465–1478. doi:10.1002/bse.2446

Song, M., Xie, Q., and Shen, Z. (2021). Impact of green credit on high-efficiency utilization of energy in China considering environmental constraints. Energy Policy 153, 112267. doi:10.1016/j.enpol.2021.112267

Soundarrajan, P., and Vivek, N. (2016). Green finance for sustainable green economic growth in India. Agric. Econ. 62 (1), 35–44. doi:10.17221/174/2014-agricecon

Tang, X., Du, J., and Hou, Q. (2013). The effectiveness of the mandatory disclosure of independent directors' opinions: empirical evidence from China. J. Account. Public Policy 32 (3), 89–125. doi:10.1016/j.jaccpubpol.2013.02.006

Tian, H., and Liu, S. (2021). The effect of government subsidies government subsidies on green technology innovation capability. Syst. Eng. 39, 34–43.

Usman, M., and Balsalobre-Lorente, D. (2022). Environmental concern in the era of industrialization: can financial development, renewable energy and natural resources alleviate some load? Energy Policy 162, 112780. doi:10.1016/j.enpol.2022.112780

Usman, M., and Hammar, N. (2021). Dynamic relationship between technological innovations, financial development, renewable energy, and ecological footprint: fresh insights based on the STIRPAT model for asia pacific economic cooperation countries. Environ. Sci. Pollut. Res. 28 (12), 15519–15536. doi:10.1007/s11356-020-11640-z

Usman, M., and Jahanger, A. (2021). Heterogeneous effects of remittances and institutional quality in reducing environmental deficit in the presence of ekc hypothesis: a global study with the application of panel quantile regression. Environ. Sci. Pollut. Res. 28 (28), 37292–37310. doi:10.1007/s11356-021-13216-x

Usman, M., Jahanger, A., Makhdum, M., Balsalobre-Lorente, D., and Bashir, A. (2022). How do financial development, energy consumption, natural resources, and globalization affect arctic countries' economic growth and environmental quality? An advanced panel data simulation. Energy 241, 122515. doi:10.1016/j.energy.2021.122515

Usman, M., Khalid, K., and Mehdi, M. A. (2021). What determines environmental deficit in asia? Embossing the role of renewable and non-renewable energy utilization. Renew. Energy 168, 1165–1176. doi:10.1016/j.renene.2021.01.012

Wang, L., Xu, J., and Li, C. (2021a). The mechanism and stage evolution of green financial policy promoting enterprise innovation. Soft. Sci. 35 (12), 81–87. doi:10.13956/j.ss.1001-8409.2021.12.13

Wang, P., Bu, H., and Liu, F. (2022). Internal control and enterprise green innovation. Energies 15 (6), 2193. doi:10.3390/en15062193

Wang, S., Kong, W., Ren, L., Zhi, D., and Dai, B. (2021b). Research on misuses and modification of coupling coordination degree model in China. J. Nat. Resour. 36, 793–810. doi:10.31497/zrzyxb.20210319

Wang, X., and Wang, Y. (2021). Research on the green innovation promoted by green credit policies. Manage. World. 37, 173–188+111. doi:10.19744/j.cnki.11-1235/f.2021.0085

Whited, T. M., and Wu, G. (2006). Financial constraints risk. Rev. Financ. Stud. 19, 531–559. doi:10.1093/rfs/hhj012

Xie, Q. (2021). Environmental regulation, green financial development and technological innovation of firms. Sci. Res. Manage. 42, 65–72. doi:10.19571/j.cnki.1000-2995.2021.06.009

Xie, Z., Wang, J., and Zhao, G. (2022). Impact of green innovation on firm value: evidence from listed companies in China’s heavy pollution industries. Front. Energy Res. 9, 806926. doi:10.3389/fenrg.2021.806926

Xing, C., Zhang, Y., and Wang, Y. (2020). Do banks value green management in China? The perspective of the green credit policy. Financ. Res. Lett. 35, 101601. doi:10.1016/j.frl.2020.101601

Yang, B., Jahanger, A., and Khan, M. A. (2020). Does the inflow of remittances and energy consumption increase CO2 emissions in the era of globalization? A global perspective. Air Qual. Atmos. Health 13, 1313–1328. doi:10.1007/s11869-020-00885-9

Yang, B., Jahanger, A., Usman, M., and Khan, M. A. (2021). The dynamic linkage between globalization, financial development, energy utilization, and environmental sustainability in GCC countries. Environ. Sci. Pollut. Res. 28 (13), 16568–16588. doi:10.1007/s11356-020-11576-4

Yao, S., Pan, Y., Sensoy, A., Uddin, G. S., and Cheng, F. (2021). Green credit policy and firm performance: what we learn from China. Energy Econ. 101, 105415. doi:10.1016/j.eneco.2021.105415

Yin, X. L., and Xu, Z. R. (2022). An empirical analysis of the coupling and coordinative development of China's green finance and economic growth. Resour. Policy 75, 102476. doi:10.1016/j.resourpol.2021.102476

Yu, C., Wu, X., Zhang, D., Chen, S., and Zhao, J. (2021). Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 153, 112255. doi:10.1016/j.enpol.2021.112255

Yu, Q., Xu, W., and Liu, Y. (2018). R&D investment, cooperation and innovation output of science &technology SMEs based on life cycle. Soft. Sci. 32, 83–86. doi:10.13956/j.ss.1001-8409.2018.06.19

Yu, Y., and Wang, Y. (2021). The intellectual property protection and the enterprise innovation activities. Soft. Sci. 35 (09), 47–52+67. doi:10.13956/j.ss.1001-8409.2021.09.07

Yuan, B., and Cao, X. (2022). Do corporate social responsibility practices contribute to green innovation? The mediating role of green dynamic capability. Technol. Soc. 68, 101868. doi:10.1016/j.techsoc.2022.101868

Zeng, Y., Wang, F., and Wu, J. (2022). The impact of green finance on urban haze pollution in China: a technological innovation perspective. Energies 15 (3), 801. doi:10.3390/en15030801

Zhang, B., Yang, Y., and Bi, J. (2011). Tracking the implementation of green credit policy in China: top-down perspective and bottom-up reform. J. Environ. Manage. 92 (4), 1321–1327. doi:10.1016/j.jenvman.2010.12.019

Zhang, J., Kang, L., Li, H., Ballesteros-Perez, P., Skitmore, M., and Zuo, J. (2020). The impact of environmental regulations on urban Green innovation efficiency: The case of Xi'an. Sustain. Cities Soc. 57, 102123. doi:10.1016/j.scs.2020.102123

Zhang, J., and Lu, Z. (2012). The protection of intellectual property rights, R&D investment and enterprises profits. J. Renmin Univ. China 26, 88–98.

Zhang, S. S., Wang, Z. Q., Zhao, X. D., and Zhang, M. (2017). Effects of institutional support on innovation and performance: roles of dysfunctional competition. Industrial Manag. Data Syst. 117 (1), 50–67. doi:10.1108/imds-10-2015-0408

Zhang, Z. F., Duan, H. Y., Shan, S. S., Liu, Q. Z., and Geng, W. H. (2022). The impact of green credit on the green innovation level of heavy-polluting enterprises-evidence from China. Int. J. Environ. Res. Public Health 19 (2), 650. doi:10.3390/ijerph19020650

Zhao, L., and Wang, Y. (2022). Financial ecological environment, financing constraints, and green innovation of manufacturing enterprises: empirical evidence from China. Front. Environ. Sci. 10, 891380. doi:10.3389/fenvs.2022.891830

Zhou, X. G., Tang, X. M., and Zhang, R. (2020b). Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Environ. Sci. Pollut. Res. 27 (16), 19915–19932. doi:10.1007/s11356-020-08383-2

Zhou, X., Tang, X., and Zhang, R. (2020a). Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Environ. Sci. Pollut. Res. 27 (16), 19915–19932. doi:10.1007/s11356-020-08383-2

Keywords: green finance, green technology innovation, financing constraints, intellectual property protection, heterogeneity

Citation: Jiang S, Liu X, Liu Z, Shi H and Xu H (2022) Does green finance promote enterprises’ green technology innovation in China?. Front. Environ. Sci. 10:981013. doi: 10.3389/fenvs.2022.981013

Received: 29 June 2022; Accepted: 26 July 2022;

Published: 16 August 2022.

Edited by:

Magdalena Radulescu, University of Pitesti, RomaniaCopyright © 2022 Jiang, Liu, Liu, Shi and Xu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zhonglu Liu, emhvbmdsdWxpdUAxNjMuY29t

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers