- Business School of Ningbo University, Ningbo University, Ningbo, China

This article focuses the research sample on Chinese State-Owned Enterprises (SOEs), using the Beyond-logarithmic Stochastic Frontier Production Function and the ordinary fixed effect model to examine, and evaluates the influence of mixed ownership reform on the innovation of SOEs from the perspective of incentive and constraint mechanisms. Our study investigates the impact of the corporate governance, policy burden, and environmental regulation. The main conclusions are as follows. First, mixed ownership reform can enhance the innovation capability of SOEs. Second, mixed ownership reform stimulates innovation of SOEs by optimizing corporate governance and reducing policy constraints on enterprises which regulate enterprise decision-making behavior. Third, the environmental regulation also affects SOEs’ innovation. This study can provide a reference for the government to further deepen the reform, optimize the living environment of SOEs, improve environmental regulations and promote the sustainable development of economy.

1 Introduction

The low efficiency of production and innovation is the current problem faced by SOEs. SOEs’ productivity is a quarter lower on average than non-SOEs when controlling for the sector, according to IMF’s report (2017). The growing body of academic literature and recent trends increasingly emphasizes the importance to establish a response to improve SOEs’ innovation (Lo et al., 2022; Castelnovo, 2022; Wang and Deng, 2021). Moreover, SOEs play a particularly key role in the economy of developing countries such as China, Brazil, and Russia, where the state-owned sector controls the national economy and is dominant in strategic industries (Gershman et al., 2016). SOEs with high innovation capacity pursue abundant opportunities to push social innovation and economic growth (Wang and Deng, 2021; Li and Guan, 2022). Therefore, improvement of SOEs’ innovation is inevitable to achieve an economic sustainability agenda.

The institutional reform of SOEs is needed under Sustainable Development Goals (SDG) to deal with agency problems, and ways to deal with policy burdens and soft-budget constraints. IMF’s report (2017) points, mixed-ownership reform, in which private capital is allowed to invest in government-run enterprises, is still unclear whether the mixed-ownership model is effective to improve SOEs’ efficiency. Zhang et al. (2020) analyze that mixed ownership reform could significantly impact on innovation performance improvement of SOEs. Mixed ownership reform may facilitate the pursuit of innovation strategy of SOEs (Li et al., 2020). To date, understanding of how and when innovation of SOEs can benefit from the mixed ownership reform has been less. Thus, this study investigates whether mixed ownership reform can help SOEs to achieve innovation improvement.

Although mixed ownership reform has been implemented for over years in China, a well-developed mechanism to elaborate improvement of SOEs’ innovation remains lacking (Li and Xia, 2008; Naughton, 2017). Economists, led by Schumpeter (1934), point out that the ability of firms to innovate is the driving force for their sustainable development, and that the incentives and constraints of the economic system are important factors in determining whether firms innovate or not (Baumol, 2002). The established literature argues that SOEs’ innovative outcomes depend on excellent leadership and accommodative policy environment, meaning corporate governance and policy burden (Tang et al., 2011; Aghion et al., 2013; Wang and Chen, 2017). The study uses the incentives and constraints view to elaborate on the role of corporate governance and policy burden in relation to mixed ownership reform and SOEs’ innovation.

First, the internal incentives mechanism of SOEs are required (Wang and Deng, 2021). The problems of unclear property rights and lack of managers in SOEs are the key reasons for the low innovation capacity of SOEs. Mixed ownership reform will help enterprises improve corporate governance, reduce managers’ ethical risks, and encourage enterprises to carry out innovative activities by the higher proportion of non-state-owned shares (Tang et al., 2011). Wang and Sun (2018) suggest that establishing reasonable incentives is an important part of improving innovation efficiency of SOEs, for example, companies should be encouraged to develop reasonable compensation incentives to alleviate the risk-averse mentality of executives and increase managers’ enthusiasm for innovation. Lo et al. (2022) emphasize the novelty of highlighting the importance of organizational controls in the reform of SOEs. Second, reducing the external constraint behavior of SOEs. The behavior of SOEs will be guided by government intervention, and SOEs bearing policy burden will face budgetary and decision-making constraints, which in turn leads to low innovation motivation and innovation efficiency of enterprises. The main view indicates that non-state-owned shareholders have a positive influence on the innovation activities of enterprises by diminishing political pressure (Li and Yu, 2015; Wang and Chen, 2017). A previous study (Yuan et al., 2015) suggests that political connection affects enterprise innovation by reducing market competition and promoting overinvestment, leading to weak technological innovation, resource fragmentation and crowding-out effect. Existing research lacking empirical evidence on how corporate governance affects SOEs’ innovation and policy burden influences SOEs’ innovation (Naughton, 2017). Therefore, the study aims to explore the effect of corporate governance and policy burden on SOEs’ innovation and the both as mediators between mixed ownership reform and improvement of SOEs’ innovation.

To achieve the SDG in China, environmental regulation is also gaining attention. Such environmental regulations can fruitfully meet the country’s commitments regarding cleaner production and overall sustainable development (Shahzad et al., 2022). A prior study (Hojnik and Ruzzier, 2016) observes that environmental regulation guides firms to increase their use of clean energy and technology development, which is conducive to enhancing enterprise innovation. The article of Cui et al. (2022) addresses the “weak” version of the Porter hypothesis, which states that environmental regulation induces innovation. Although many scholars (Shahzad et al., 2022; Xu et al., 2022) have begun to study the impact of environmental regulation on green innovation as well as green finance, there are still few studies that integrating environmental regulation into the research system on the impact of mixed ownership reforms on SOEs’ innovation. Specifically, SOEs that use fossil energy tend to be more sensitive to environmental regulations. It thus becomes possible for SOEs to earn higher technological innovation level (Zhong and Zhao, 2012).

In terms of measuring technological innovation, on the one hand, existing literature mostly uses technological innovation inputs such as R&D expenses, R&D personnel and R&D input density (Zachariadis and Rand, 2003; Zhi and Wang, 2007; Yang et al., 2015) or technological innovation outputs such as the number of patent applications (Tong et al., 2014; Liu and Qiu, 2016; Wu and Tang, 2016; Zhang J. et al., 2016; Sun et al., 2021), new product output value or new product sales revenue (Li and Song, 2010; Wu and Li, 2017) to measure the level of technological innovation, but these two types of measures can only represent a certain aspect of innovation, and cannot deeply measure the quality and benefits of technological innovation of enterprises (Cao et al., 2020). On the other hand, data on R&D investment, number of patents, and new product output value are missing in a wide range of existing databases at the micro enterprise level, such as The Database of Chinese Industrial Enterprise and the China Listed Companies Database (CSMAR). In addition, as Lederman (2010) points out, innovation differs significantly between developing and developed countries: in developing countries, where innovation capabilities are in the process of imitation and learning, firm innovation is more likely to be a further exploitation of existing technologies. In view of this, this paper uses the time-varying form of the beyond-log stochastic frontier production function (SFA) proposed by Christensen et al. (1973) to measure and decompose the firm’s technological progress (technological change) which measures the level of technological innovation in micro firms (Deng and Ding, 2010). This method can not only reflect the quality and efficiency of technological innovation, but also better overcome the problem of insufficient availability of R&D or patent data at the firm level.

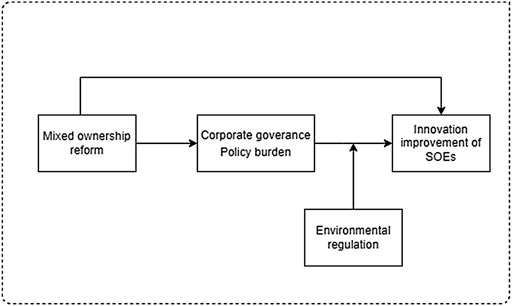

This study explores the role of corporate governance and policy burden to enhance the greater coordination of innovation improvement in SOEs. Although research on corporate governance and policy burdens is evolving, few studies have explicitly investigated the impact of corporate governance and policy burden on mixed ownership reform mechanisms. The roles of corporate governance and policy burden have not been studied together at the level of reform mechanisms, which is an important gap. Moreover, little is known about how environmental regulation plays a role between mixed ownership reforms and improved SOEs’ innovation performance. This paper seeks to extend the research by answering the following questions: 1) What is the relationship between mixed-ownership reform and innovation efficiency improvement in SOEs? 2) Do corporate governance and policy burden play a mediating role between mixed ownership reforms to enhance innovation efficiency improvement of SOEs? 3) Does environmental regulation play a moderating role between mixed ownership reforms to enhance innovation efficiency improvement of SOEs?

This study has important contributions in both theory and practice. For one, this paper uses the level of technological progress to measure the innovation capability of enterprises, which enriches the empirical research on the influence of China’s state-sector reform on SOEs. Since one-way indicators such as R&D input or patent output are difficult to accurately measure the quality and efficiency of enterprise innovation, this paper constructs a time-varying transcendental logarithmic stochastic frontier production function model to measure the innovation level of micro enterprises. Second, this paper can provide a new explanatory perspective for promoting SOE reform. The previous literatures (Tang et al., 2011; Wang and Chen, 2017; Guan et al., 2021) focused on corporate governance and divestment of policy burden, respectively, and lacked the integration analysis of the two. This paper argues that corporate governance and policy burden are two parallel dimensions of the institutional reform process of SOEs and affect the internal incentive system and external constraint system of SOEs’ innovation, respectively. Third, our study extends beyond the question of enterprise innovation to environmental regulation. Few studies have been conducted to incorporate environmental regulation into the research system on the impact of mixed ownership reform on SOE innovation. Thus, our study explores how environmental regulation may affect the relationship between mixed ownership and SOEs’ innovation. In doing so, we build a moderating effect model where environmental regulation may moderate the impact of mixed ownership reform on innovation in SOEs.

2 Theoretical mechanism and research hypothesis

Clarifying the incentive and constraint mechanism of mixed ownership reform on innovation of state-owned enterprises is the basic premise of deepening the reform of state-owned enterprises and promoting innovation of state-owned enterprises.

2.1 Impact of mixed ownership reform on innovation of state-owned enterprises

Due to the lack of effective incentive and supervision mechanisms for operators, SOEs usually suffer from serious agency problems (D’Souza and Nash, 2017). Mixed ownership reform can strengthen incentives and constraints for managers: after the mixed ownership reform of SOEs, state-owned shareholders are transformed into private shareholders, and the private shareholders will actively intervene and supervise managers based on their own interest concerns, reducing the manager’s principal-agent cost and improving the efficiency of corporate governance. Therefore, mixed ownership reform helps enterprises improve corporate governance, reduce moral hazard of operators, and encourage innovative activities by increasing the proportion of non-state shares, employee stock ownership plan, and improving the system of state capital operation (Aghinon et al., 2013).

At the same time, SOEs’ production decision-making behavior will be greatly influenced by the policy burden and soft budget constraints (Megginson et al., 2014). Moreover, the government will intervene strongly in business operations to achieve certain political goals, causing SOEs to make short-term investment decisions under these political goals, abandon innovative investment projects with higher risks and profits, and reduce new technological innovations (Gao et al., 2018). After the mixed ownership reform, the proportion of state-owned equity decreases and the policy burden borne by SOEs is relieved, which is conducive to the improvement of corporate governance efficiency and technological innovation. In view of this, this paper proposes the following hypothesis.

Hypothesis 1. Mixed ownership reform can promote the innovation capability of SOEs.

Hypothesis 2a. Mixed ownership reform promotes innovation in SOEs by optimizing corporate governance.

Hypothesis 2b. Mixed ownership reforms promote innovation in SOEs by reducing the policy burden.

2.2 Environmental regulation and enterprise innovation

Environmental regulations are relevant environmental laws and policies formulated by the government for the purpose of protecting the environment, aiming to guide enterprises to make decisions to improve the environment. The goal of environmental sustainability is achieved by reducing pollutant emissions while improving overall economic efficiency (Jiang et al., 2021). In the existing studies, many scholars have argued that environmental regulations can promote firms’ technological innovation. For example, Hojnik and Ruzzier (2016), Liu and He (2021), and Hu et al. (2022) mainly based on the “Porter’s hypothesis” theory, argue that enterprises will enhance technological research and development with the guidance of policies to achieve the goals of improving resource utilization, enhancing product performance, and meeting production and emission standards. In this process, the revenue from innovation is greater than the cost of innovation, resulting in the “innovation compensation” effect and achieving the “win-win” goal of environmental protection and economy. In view of this, this paper proposes the following hypothesis.

Hypothesis 3. The impact of mixed ownership reform on SOEs’ innovation is moderated by the environmental regulation.This pattern of moderated mediation between the variables is depicted in Figure 1.

3 Research design

Firstly, we selected micro data from the database of Chinese industrial enterprises, and then processed our data: mainly to remove abnormal samples and deflate the nominal indicators. Then we define the independent and dependent variables. We define the mixed ownership reform using the dummy variable and delineate the different measurement ranges of mixed ownership reform. Next, we show how to construct a transcendental log stochastic frontier production function and decompose the final explanatory variable --the level of technological progress, and use it to measure the innovation capacity of SOEs. Then, after comparing the results of Wald test, B-P test and Hausman test, we choose to use a fixed effects model for regression analysis and define other control variables.

3.1 Data source and processing

3.1.1 Data source

The micro data used in this paper are from The Database of Chinese Industrial Enterprise, spanning the period of 1998–2007 and involving different industries. The database of Chinese Industrial Enterprises is the annual industrial statistics results of the National Bureau of Statistics and its subordinate agencies, and is a summary of the original reports submitted to the statistics department by all industrial enterprises above the scale. While this article was being written, data from The Database of Chinese Industrial Enterprises was only published through 2013. In the selection of the sample period, the data from 2008–2013 are not taken because: 1) the data from 2008 to 2009 have serious problems of missing indicators, and the data from 2010–2013 are not of high quality1. 2) After 2011, the statistical caliber of the database has changed, and “above-scale” has been adjusted from five million yuan to 20 million yuan (Liu and Wu, 2019). In addition, both the retail price index and the fixed asset investment price index are from the China Statistical Yearbook 1999–2008.

3.1.2 Data processing

The above are considerations for data selection, and the specific process of data processing is briefly described below. In view of the many shortcomings of the industrial enterprise database (Nie et al., 2012) , this paper makes the following adjustments by referring to relevant research literature and combining the main research object -- state-owned enterprises: 1) To avoid deleting too many observation samples, observations with missing or zero values for key variables such as: start-up time, gross industrial output value (current value), all employees, etc. are before and after one period of filling, and then delete the missing values and observations that are less than zero. 2) Delete the sample with the number of all employees less than 8 (Brandt et al., 2012). 3) Delete the sample of observations that do not comply with the general accounting standards and remove the enterprises that start in unreasonable years (less than 1,000 or more than 2007) (Cai and Liu, 2009). 4) Refer to Nie et al. (2012), use the ratio of state-owned capital to paid-in capital to measure the ownership characteristics of enterprises, and draw on the views of most scholars, such as Chen and Tang (2014) who define enterprises with 100% state-owned capital as state-owned enterprises. In deflating the nominal indicators, the paper sets 1998 as the base period and deflates net fixed assets by the fixed asset investment price index and sales revenue by the retail price index for each year.

After the above processing, this paper finally forms a panel dataset of unbalanced firms spanning the period 1998–2007, with a total of 136,073 valid observations, and the following data are reported based on the results of this data.

3.2 Dependent variable and independent variable

In order to measure the effect of mixed ownership reform of SOEs on enterprise innovation, this paper first addresses two difficulties.

3.2.1 Definition of mixed ownership reform

How to define whether SOEs have carried out mixed ownership reform. To facilitate the econometric analysis, the mixed ownership reform variable in this paper

where

At the same time, For the determination of the scope of mixed ownership reform, this paper sets three types of: 1) a broader definition: the mixed ownership reform is defined as an enterprise in which the proportion of state-owned capital to paid-in capital is greater than 0 and less than 100%, and for simplicity, the proportion of state-owned capital after such mixed ownership reform is denoted as (0,1) in this paper. 2) Stricter definition: Drawing on Laeven and Levine’s (2008) study, 10% is chosen as the cut-off point, and if the proportion of state-owned capital exceeds 10% of paid-in capital, it is defined as having carried out mixed ownership reform, which is also drawn on by Hao and Gong (2017). Therefore, this paper defines mixed ownership as an enterprise with greater than or equal to 10% and less than or equal to 90%, i.e., the proportion of state-owned capital is [0.1,0.9] after the reform. 3) In order to avoid deleting too many reformed enterprise samples, the mixed ownership reformed enterprises are defined as those with the proportion of state-owned capital greater than or equal to 5% and less than or equal to 95%, i.e., the proportion of state-owned capital after the mixed ownership reform is [0.05,0.95].

Next, we show how the stochastic frontier method can be used to measure firms’ technological progress rates, and then construct a benchmark model to lay the groundwork for quantitatively examining the impact of mixed ownership reform on SOEs’ innovation.

3.2.2 Measurement index of enterprise innovation

Much literature such as Jian et al. (2014), Lu and Lian (2007) have talked about using industrial value added to represent output. However, for empirical purposes, traditional models tend to remove many samples with negative and zero industrial value added. In reality, it is normal to have losses in some years, and as long as there are no consecutive losses for many years, the enterprises that turn into profit are still consistent with the economic assumption of continuous operation. Therefore, we draw on Xia and Cheng (2010) use of sales revenue

Second, for the firm’s capital input (

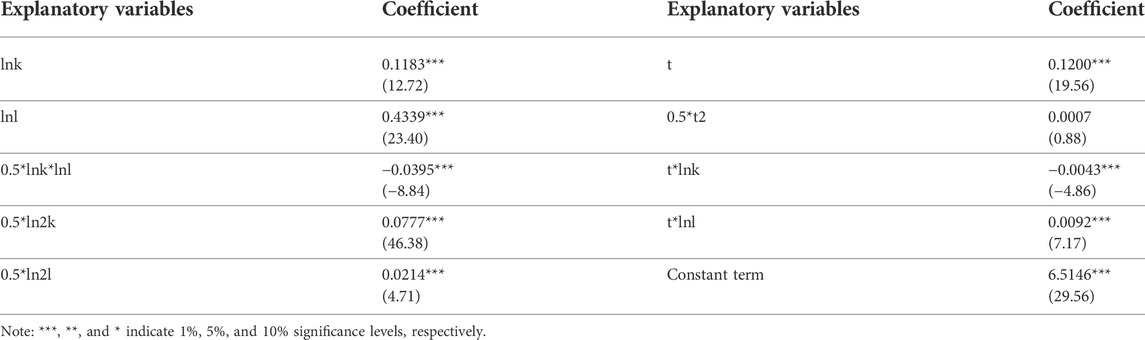

Drawing on the transcendental logarithmic stochastic frontier production function (SFA) form used by Han (2009), the specific type of stochastic frontier production function is set in this paper as follows

where

And then we refer to the decomposition idea of Kumbhakar and Lovell, 2000.to decompose the final explanatory variable to be studied, technological progress (tec). It reflects the movement of the production possibility frontier of the firm as time continues to advance under the condition that the capital and labor input factors are determined. It is generally calculated as follows.

where (

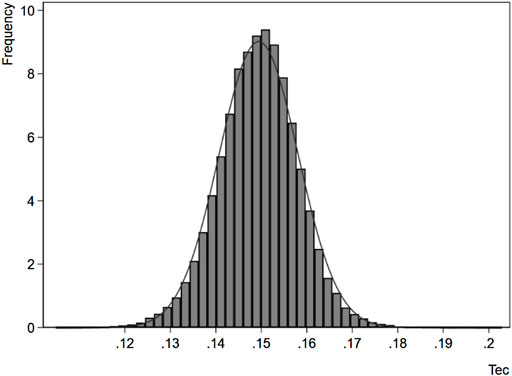

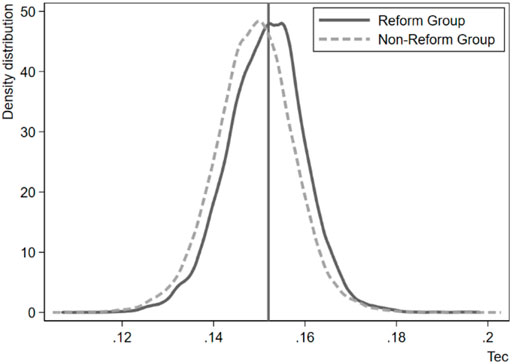

An important feature of using stochastic frontier analysis is the possibility of quantitatively analyzing the innovation capacity of each firm per year. The frequency distribution of technological progress (tec) decomposed according to Eq. 2 is given in Figure 2. Figure 1 basically shows the characteristics of a normal distribution, and from the overall distribution, the technological progress rate of enterprises is mainly distributed between 0.12 and 0.18.

3.3 Model construction and control variables

For empirical testing of panel data, this paper selects the optimal estimation method according to the specific situation. Before determining which model to use for the empirical analysis, this paper compares the mixed least squares, fixed effects estimation, and random effects estimation methods. Through Wald test, B-P test and Hausman test, the fixed-effects model was finally chosen for the regression analysis. The specific regression model is as follows.

where the explanatory variable

Drawing on the existing literature (Jian and Duan, 2012; Liu and Qiu, 2016; Wu and Tang, 2016), we control for other factors affecting firm innovation in our model, with the specific control variables (

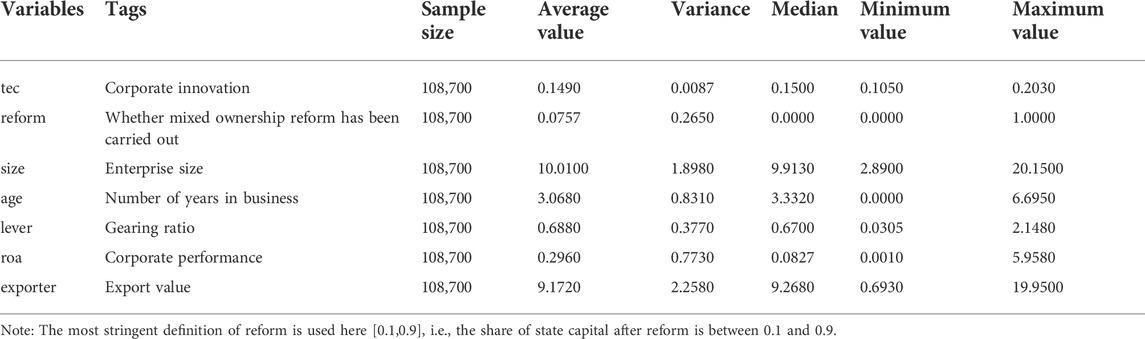

3.4 Descriptive statistics

Table 2 reports the descriptive statistics of the main variables. From the results of the full sample description, the mean value of the technological level of the enterprises is 0.149, and the maximum and minimum values are 0.203 and 0.105, respectively, indicating that there are large differences between the rates of technological progress of the enterprises. The other variables are within the normal interval and there are no extreme values.

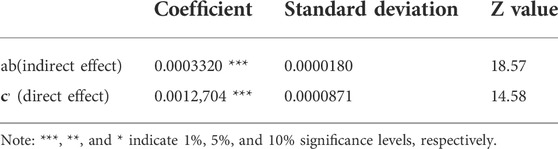

Further, we compare the density of tec distribution between the reformed group, which has carried out mixed ownership reform, and the non-reformed group, which has not carried out mixed ownership reform, as shown in Figure 3. From it, we can intuitively feel that the level of tec in the reform group is higher than that in the non-reform group, which proves from the side that conducting mixed ownership reform has a stimulating effect on the innovation of SOEs.

4 Empirical analysis

4.1 Estimation results of the benchmark model

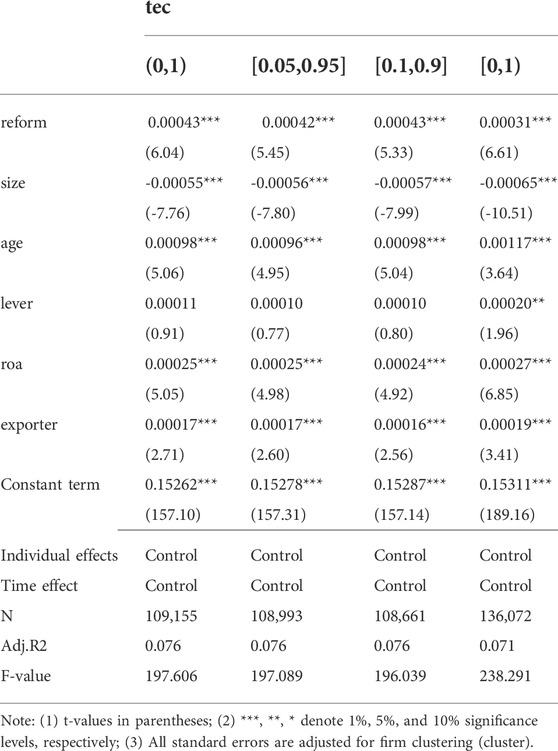

Table 3 presents the test results of the effect of mixed ownership reform on the innovation effect of SOEs from 1998–2007. In this paper, (0,1), [0.05,0.95] and [0.1,0.9] denote the share of state-owned capital in paid-in capital after carrying out mixed ownership reforms, respectively, while [0,1) denotes the change in the share of state-owned capital from 1 to any less than 1. From the first three columns of Table 3, it is found that

One of the more meaningful findings among the control variables is that the estimated coefficient of firm size (

4.2 Further analysis: refinement of the degree of reform

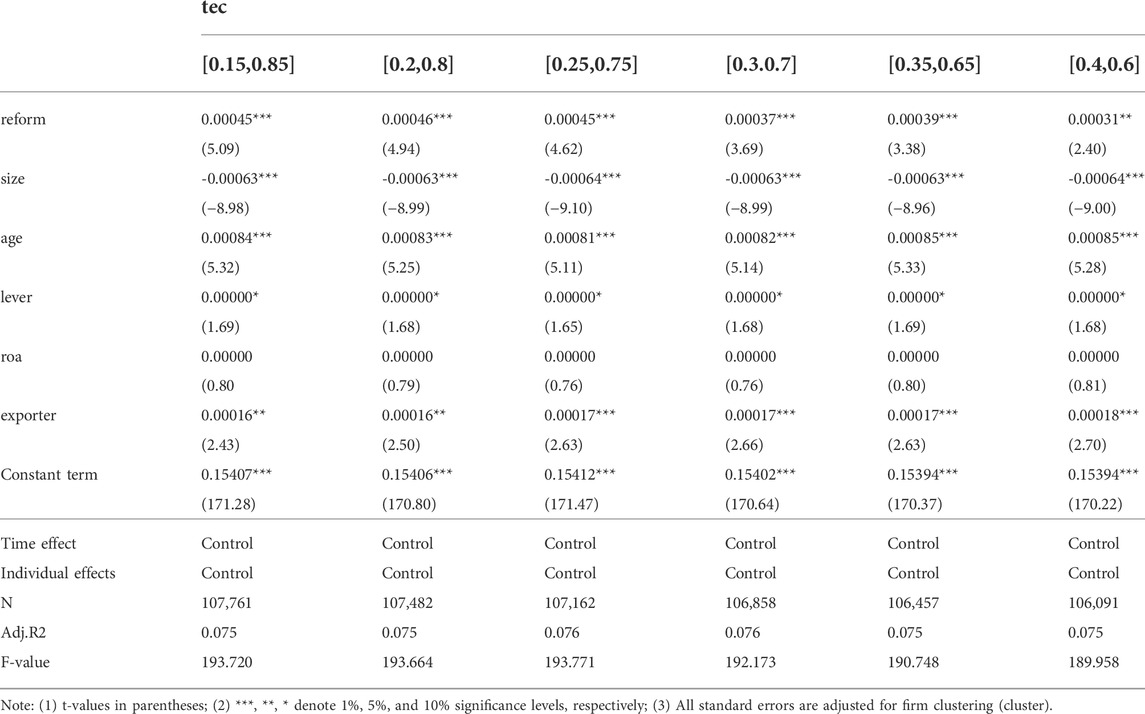

In further analysis, this paper gradually relaxes the definition of carrying out mixed ownership reform, using 5% as the key node gradually relaxing to [0.4,0.6] of state-owned capital after the reform.

Table 4 details the results for further breakdown of the degree of reform.

4.3 Robustness test

4.3.1 PSM test

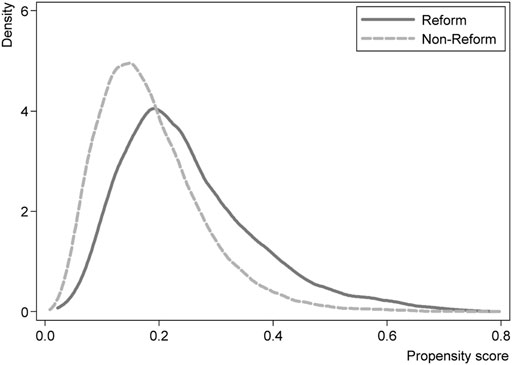

The main objective of this paper is to investigate the effect of mixed ownership reform on SOEs’ innovation, i.e., to reveal whether there is an actual causal relationship between “mixed reform” and firm innovation. However, whether SOEs undertake mixed ownership reforms may be non-random (Guo and Yao, 2005) and the government may target mixed reforms based on improving SOE efficiency or fiscal pressure (stopping subsidies for loss-making enterprises). Therefore, using a fixed effects model for the analysis may create the problem of selectivity bias in the sample. Therefore, in order to obtain more reliable estimation results, a propensity score matching method (PSM) is used (Rosenbaum and Rubin, 1983), with those firms that did not reform as the “control group” and those that did reform as the “treatment group”. The treatment effect is the difference between the treatment group and the control group, which have relatively similar characteristics.

The specific PSM tests in this paper are as follows: 1) variables based on firm characteristics such as firm size, years of operation, debt ratio, firm performance, and export status, drawing on Rosenbaum and Rubin’s (1983) use of a flexible form of logit model, the main matching variables are screened by logit model stepwise regression (variables with significance levels less than 5% are retained) and obtained estimated propensity scores. 2) The sample was matched using 1:1 nearest neighbor matching (NNM) and compared before and after matching; it was concluded that the propensity score was estimated accurately and met the standardized bias of no more than 10%.

Density function plots for the two groups before and after matching were drawn based on the proximity matching method. It is clear that (Figure 4): there is a significant difference between the reform group and the non-reform group before matching, which also proves that the results of comparing the two groups directly may have some sample selection bias. Therefore, we used the propensity matching score to match the reform group with the non-reform group. After matching (Figure 5), the gap between the two groups narrowed. To further validate this finding, the samples were matched using the post-reform state capital share of [0.05,0.95] and [0.1,0.9], and the findings were consistent.

Based on the matched data, this paper also tests that the effect of mixed ownership reform on SOEs’ innovation is significant.

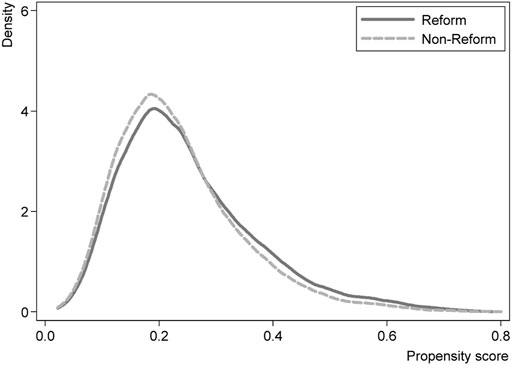

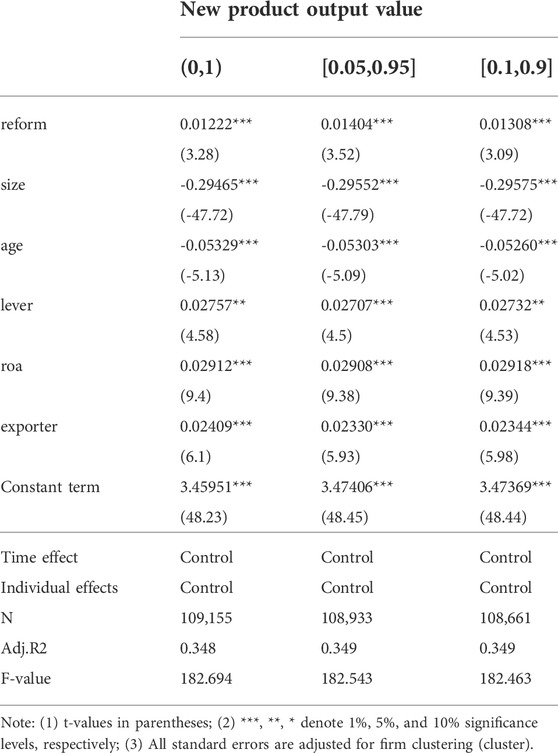

4.3.2 Replacement measurement index of enterprise innovation

To check the robustness of the empirical analysis and to test the hypothesis of this paper in more depth, we replace different innovation indicators to measure corporate innovation and examine again the impact of SOEs’ mixed ownership reform on corporate innovation in the following. In this paper, we use new product output value as a proxy variable for SOEs’ innovation from the perspective of enterprise innovation inputs. The basic treatment idea is as follows.

The new product output value is treated as new product output value as a percentage of total assets plus one and then expressed as a logarithm. The advantage of using this treatment is that it does not only consider the market value of the product, but also incorporates the efficiency of capital use within the firm and therefore uses this indicator to measure firm innovation.

Finally, the paper sets up an econometric model of the following form using the above dependent variables with reference to Eq. 3.

where the dependent variable

The results show that after replacing the dependent variable with new product output value as a percentage of total assets plus 1 and taking the log

4.3.3 Replacement measurement index of mixed ownership reform

Further, this paper uses the continuous variable (

where

5 Mechanism analysis

5.1 Corporate governance

This article draws on Li’s (2007) approach to examine whether mixed ownership reform is conducive to improving corporate governance efficiency using the overhead rate as a proxy variable for corporate governance efficiency. Where the overhead rate is the share of overhead expenses to product sales revenue plus one and taken as a logarithm. The overhead ratio reveals the efficiency of controlling operating expenses including on-the-job spending, and the use of overhead as a share of product sales revenue eliminates the effect of firm size (Wei et al., 2012). To test the effect of mixed ownership reform on corporate governance efficiency, the following mediating effect model is constructed in this paper.

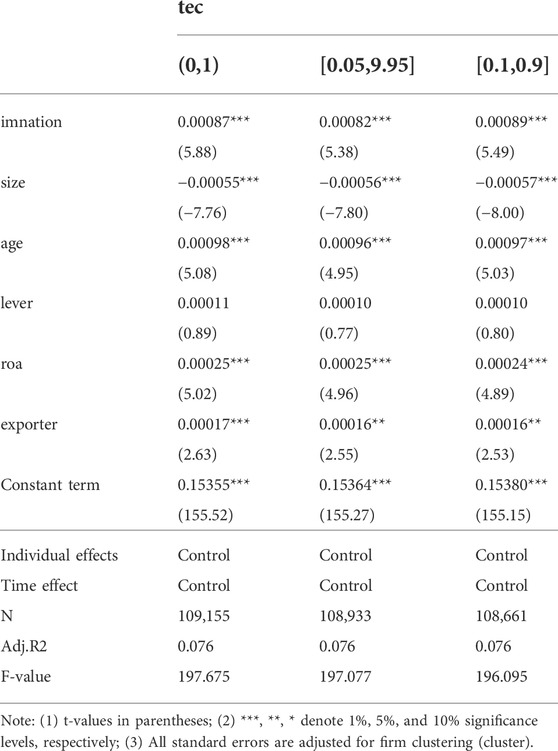

Equations 6, 7 treat the rate of technological progress

Table 7 reports the results of Bootstrap test for Eqs. 6, 7. The results show that corporate governance plays a significant mediating role in the path of the impact of mixed ownership on corporate innovation, with the direct effect of mixed ownership reform on corporate innovation being 0.0012704 and the indirect effect through corporate governance being 0.0003320, with the mediating effect accounting for about 0.21, which means that mixed ownership reform can improve SOEs’ innovation through optimizing corporate governance, which means that Hypothesis 2a is confirmed.

5.2 Policy burden

Drawing on Liao and Shen (2014), Zhang H. et al. (2016), this paper defines the policy burden of enterprises

In addition, in this model, the set of control variables (

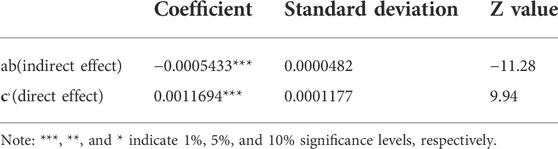

Table 8 reports the results of Bootstrap test for Eq. 8. The results show that policy burden plays a significant mediating role in the path of the impact of mixed ownership on corporate innovation, with the direct effect of mixed ownership reform on corporate innovation being 0.0011694 and the indirect effect through corporate governance being −0.0005433, with the mediating effect accounting for about −0.87, which means that mixed ownership reform can improve SOEs’ innovation through reducing policy burden, which means that Hypothesis 2b is confirmed. Policy burdens can inhibit the innovation improvement of SOEs, and mixed ownership reform positively affects the innovation improvement of SOEs by reducing policy burdens.

5.3 Environmental regulation

Referring to Liu and He (2021), we measure the intensity of environmental regulation using the share of completed industrial pollution control investments in the secondary sector. Using the degree of

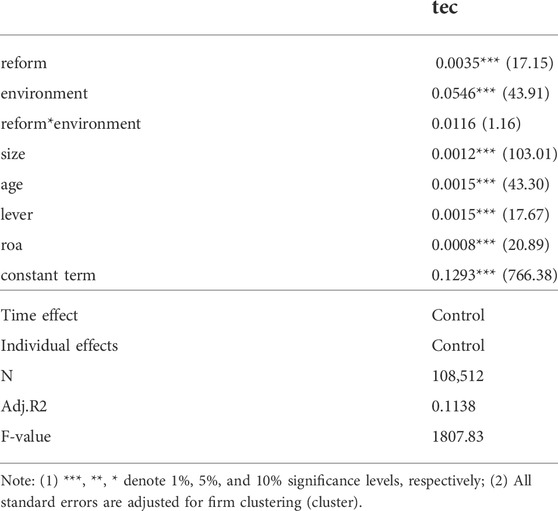

According to the test results reported in Table 9, we can see that environmental regulation (

6 Conclusion and policy implications

6.1 Conclusion

This study analyzes the impact of mixed ownership reform on innovation of SOEs and examines whether this impact is mediated by corporate governance and policy burdens and moderated by environmental regulation.

Firstly, obtain a sample of 136,073 valid observations from the database of industrial enterprises from 1998 to 2007. The transcendental log stochastic frontier production function is then used to analyze the level of technological progress. Subsequently, use a fixed effect model to analyze the impact of mixed ownership reform on innovation of SOEs. Afterward, use a mediation model to illustrate that the impact of corporate governance and policy burden, and use a moderation model to illustrate that the influence of environmental regulations.

Based on fixed effect model, the result shows the extent to which mixed-ownership reforms have contributed to the improvement of firm innovation. It is worth noting that the innovation level of SOEs grows with the duration of survival of the enterprise, but the innovation level of larger SOEs is smaller, which is consistent with the results of previous studies (Zhou and Luo, 2005). They argue that the positive relationship between enterprise size and innovation is mainly found in non-SOEs, while there is no significant association between enterprise size and innovation in SOEs. The results of our study prove this point well, complementing the empirical evidence.

The mediation model and moderation model are used to analyze the impact of corporate governance, policy burden and environmental regulation. The results show that corporate governance and policy burdens mediate the impact of mixed ownership reforms on innovation performance improvement. The mediating effects of corporate governance and policy burden account for 0.21 and 0.87 (in absolute terms), respectively, suggesting that both together almost completely explain the impact of mixed ownership reforms on SOEs’ innovation. When the level of governance becomes higher, SOEs increase efficiency of resource allocation and employees are more productive, thus improving innovation efficiency. Sustainable innovation requires lighter policy burden on SOEs, relieving constraints on firms to pursue innovation invest, and increasing employee productivity motivation, thereby significantly increasing the generation of ideas to implement new processes and products. The coming period is likely to be a period of rapidly expanding green production practices in industrial firms, which will require more specific and normative environmental regulation. The empirical results suggest that environmental regulation can significantly increase SOEs’ innovation. This responds to this study (Hu et al., 2020) that the intention and capacity of green innovation of state-owned companies may generally differ from those of private or foreign-owned companies. Environmental regulation drives enterprises to undertake green technology updates, reduce emissions, and improve efficiency, and SOEs are more likely to undertake these efforts (Wang et al., 2022).

6.2 Implications and future directions

The managerial implications of our study for the government sector in China and other developing economies that have undergone similar institutional reforms include the following. First, the government needs to move forward with mixed ownership reform to sustain the efficiency improvement of SOEs’ innovation. Consistent with previous research (Tan et al., 2020), we believe that strong government support for reform leads to positive outcomes. Second, SOEs should broaden the participation levels of non-state-owned shareholders especially for the executives with a professional R&D background and give full play to their governance roles. Han et al. (2014) highlight that executives with professional R&D backgrounds are more likely to exert an innovative spirit and accurately grasp the market demand. Executives with professional R&D backgrounds in SOEs can use their own professional experience to effectively judge internal scientific innovation decisions, improve the probability of success of R&D activities, and reduce the uncertainty of exploratory innovation. Third, the government needs to ease policy pressure on SOEs, reduce budget constraints on SOEs, and encourage SOEs to implement innovative activities. The government’s liberalization of investment constraints will enable SOEs to take innovative investment projects with higher risks and profits, and to generate new technological innovations (Gao et al., 2018). Fourth, the government could appropriately increase environmental regulations on SOEs and provide clear targets for emission reductions in various ways to facilitate their demand for technological innovation. With the deepening of environmental regulation, it forces the industry to reduce the cost of pollution control by improving technological innovation capacity, thus creating a “compensation effect” (Ouyang et al., 2020). The findings of Awan et al. (2021) also highlight the importance of investment in environmental management for overcoming the challenges in the green innovation.

Our findings contribute to our understanding of the role of mixed ownership reforms while shaping the improved innovation performance of SOEs in developing economies. As the newly developing country with the most SOEs in the world, the study of the reform of SOEs in China presents abundant materials for study. The results provided are applicable to other countries in the context of other emerging economies.

Some limitations of this study presented here are expected to open multiple avenues for future research. First, due to the data accessibility restrictions and data is bit old. Future research may update the data or use the public company data to do comparative analysis. Second, our analyzes should be generalize for other emergent countries, which might face the same Chinese development challenges, such as Brazil, India, and South Africa. Third, more research is needed as to how and under what conditions the relationship between environmental regulations and innovation of SOEs could be strengthened.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

WX designed the research framework, wrote, and edited the manuscript. WX analysed the data. XZ revised the paper for important intellectual content and made the final revision of the paper. All authors contributed to the paper and approved the submitted version.

Funding

This work was supported in part grants from Major Supporting Project of the National Social Science Fund of China (21BJY002, 20AZD033); The Philosophy and Social Sciences in Zhejiang Province (20XXJC03ZD).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1The authors summed the microenterprise data by industry and compared the summed data with the main economic indicators of industrial enterprises above the scale published by the National Bureau of Statistics and found that the data for 1998–2009 were consistent with the published data, but the data for 2012–2013 did not satisfy this condition

References

Aghion, P., Reenen, J. V., and Zingales, L. (2013). Innovation and Institutional Ownership. Am. Econ. Rev. 01, 277–304. doi:10.1257/aer.103.1.277

Awan, U., Arnold, M. G., and Gölgeci, I. (2021). Enhancing Green Product and Process Innovation: Towards an Integrative Framework of Knowledge Acquisition and Environmental Investment. Bus. Strategy Environ. 30, 1283–1295. doi:10.1002/bse.2684

Baumol, W. J. (2002). The Free-Market Innovation Machine: Analyzing the Growth Miracle of Capitalism. Princeton: Princeton University Press.

Brandt, L., Biesebroeck, J. V., and Zhang, Y. F. (2012). Creative Accounting or Creative Destruction? Firm-Level Productivity Growth in Chinese Manufacturing. Natl. Bureau Econ. Res. 97, 339–351. doi:10.1016/j.jdeveco.2011.02.002

Cai, H., and Liu, Q. (2009). Competition and Corporate Tax Avoidance: Evidence from Chinese Industrial Firms. Econ. J. 119, 764–795. doi:10.1111/j.1468-0297.2009.02217.x

Cao, X. P., Cumming, D., and Zhou, S. L. (2020). State Ownership and Corporate Innovative Efficiency. Emerg. Mark. Rev. 44, 100699. doi:10.1016/j.ememar.2020.100699

Castelnovo, P. (2022). Innovation in Private and State-Owned Enterprises: A Cross-Industry Analysis of Patenting Activity. Struct. Change Econ. Dyn. 62, 98–113. doi:10.1016/j.strueco.2022.05.007

Chen, L., and Tang, Y. L. (2014). Mixed Ownership Reform and Policy Burden of State-Owned Enterprises-An Empirical Study Based on Big Data of Early State-Owned Enterprises' Property Rights Reform. Econ. 11, 13–23. doi:10.16158/j.cnki.51-1312/f.2014.11.016

Christensen, L. R. (1971). Entrepreneurial Income: How Does It Measure Up?. Am. Econ. Rev. 61 (4), 575–585.

Cui, J. B., Dai, J., Wang, Z. X., and Zhao, X. D. (2022). Does Environmental Regulation Induce Green Innovation? A Panel Study of Chinese Listed Firms. Technol. Forecast. Soc. Change 176, 121492. doi:10.1016/j.techfore.2022.121492

D'Souza, J., and Nash, R. (2017). Private Benefits of Public Control: Evidence of Political and Economic Benefits of State Ownership. J. Corp. Finance 46, 232–247. doi:10.1016/j.jcorpfin.2017.07.001

Deng, K. B., and Ding, C. (2010). Why Is There a Lack of Creative Destruction in China? --Empirical Evidence Based on Idiosyncratic In-Formation of Listed Companies. Econ. Res. J. 06, 66–79.

Gao, H., Hsu, P., and Li, K. (2018). Innovation Strategy of Private Firms. J. Financ. Quant. Anal. 53, 1–32. doi:10.1017/s0022109017001119

Gershman, M., Bredikhin, S., and Vishnevskiy, K. (2016). The Role of Corporate Foresight and Technology Road Mapping in Companies' Innovation Development: The Case of Russian State-Owned Enterprises. Technol. Forecast. Soc. Change 110, 187–195. doi:10.1016/j.techfore.2015.11.018

Guan, J., Gao, Z. M., Tan, J., Sun, W. Z., and Shi, F. (2021). Does the Mixed Ownership Reform Work? Influence of Board Chair on Performance of State-Owned Enterprises. J. Bus. Res. 122, 51–59. doi:10.1016/j.jbusres.2020.08.038

Guo, K., and Yao, Y. (2005). Causes of Privatization in China . Testing Several Hypotheses+. Econ. Transition 13, 211–238. doi:10.1111/j.1468-0351.2005.00221.x

Han, Z. X., Cui, J. W., and Wang, S. (2014). Do technology Executives Improve the Technical Efficiency of Enterprises? Stud. Sci. Sci. 32, 559–568.

Han, Y. (2009). Research on Regional Variability of Total Factor Productivity in Chinese industry. Lanzhou: Lanzhou University.

Hao, Y., and Gong, L. T. (2017). State and Private Non-controlling Shareholders in SOEs and Private Firms, and Firm Performance. Econ. Res. J. 03, 122–135.

Hojnik, J., and Ruzzier, M. (2016). What Drives Eco-Innovation? A Review of an Emerging Literature. Environ. Innovation Soc. Transitions 19, 31–41. doi:10.1016/j.eist.2015.09.006

Hu, Y. Q., Zhao, L., and Yang, C. L. (2022). The Influence of Public Complaint and Environmental Regulation on Industrial Technology Innovation. Chin. J. Environ. Manag. 03, 105–111+96. doi:10.16868/j.cnki.1674-6252.2022.03.105

Hu, C., Mao, J. H., Tian, M., Wei, Y. Y., Guo, L. Y., and Wang, Z. H. (2020). Distance matters:Investigating how geographic proximity to ENGOs triggers green innovation of heavy-polluting firms in China. J. Environ. Manag. 279, 111542. doi:10.1016/j.jenvman.2020.111542

Jian, X., and Duan, Y. R. (2012). Convergence of Firm Heterogeneity, Competition and TFP. J. Manag. World 08, 15–29. doi:10.19744/j.cnki.11-1235/f.2012.08.003

Jian, Z., Zhang, T., and Fu, Y. L. (2014). Import Liberalization, Competition and TFP of Firms: Chinese Accession to the WTO as a Natural Experiment. Econ. Res. J. 08, 120–132.

Jiang, Z. S., Zhou, J., Zhao, X. Z., and Wang, F. F. (2021). Dual Environmental Regulation, Innovation Openness and Manufacturing Enterprise Innovation Input. Chin. J. Environ. Manag. 01, 128–135. doi:10.16868/j.cnki.1674-6252.2021.01.128

Kumbhakar, C., and Lovell, C. A. (2000). Stochastic Frontier Analysis. Cambridge:: Cambridge University Press.

Laeven, L., and Levine, R. (2008). Complex Ownership Structures and Corporate Valuations. Rev. Financ. Stud. 21, 579–604. doi:10.1093/rfs/hhm068

Lederman, D. (2010). Innovation and Development Around the World, 1960–2000. World Bank Policy Research Working Paper No. 3774. Available at SSRN: https://ssrn.com/abstract=871229.

Li, C. l., Yuan, R. S., Khan, M. A., Pervaiz, K., and Sun, X. R. (2020). Does the Mixed-Ownership Reform Affect the Innovation Strategy Choices of Chinese State-Owned Enterprises? Sustainability 12, 2587. doi:10.3390/su12072587

Li, C. T., and Song, M. (2010). Innovation Activities of Chinese Manufacturing Firms: The Role of Ownership and CEO Incentives. Econ. Res. J. 05, 55–67.

Li, M. S., and Guan, S. (2022). Does China's State-Owned Sector Lead Industrial Transformation and Upgrading? J. Clean. Prod. 338, 130412. doi:10.1016/j.jclepro.2022.130412

Li, S. M., and Xia, J. (2008). The Roles and Performance of State Firms and Non-state Firms in China’s Economic Transition. World Dev. 36, 39–54. doi:10.1016/j.worlddev.2007.01.008

Li, W. G., and Yu, M. G. (2015). Ownership Structure and Innovation of Private Enterprises. J. Manag. World 04, 112–125. doi:10.19744/j.cnki.11-1235/f.2015.04.011

Liao, K. M., and Shen, H. B. (2014). Policy Burden of State-Owned Enterprises: Motivations, Consequences and Governance. China Ind. Econ. 06, 96–108. doi:10.19581/j.cnki.ciejournal.2014.06.009

Liu, Q., and Qiu, L. D. (2016). Intermediate Input Imports and Innovations: Evidence from Chinese Firms' Patent Filings. J. Int. Econ. 103, 166–183. doi:10.1016/j.jinteco.2016.09.009

Liu, R. Z., and He, C. (2021). Study on the Threshold Effect of Environmental Regulation on Income Inequality of Urban Residents. China Soft Sci. 08, 41–52.

Liu, Z. M., and Wu, Z. Q. (2019). Will Intermediate Product Market Distortion Hinder the Improvement of Total Factor Productivity in Energy Industry—A Theoretical and Empirical Research Based on Micro-enterprise Data. China Ind. Econ. 08, 42–60. doi:10.19581/j.cnki.ciejournal.2019.08.003

Lo, D., Gao, L., and Lin, Y. C. (2022). State Ownership and Innovations: Lessons from the Mixed-Ownership Reforms of China's Listed Companies. Struct. Change Econ. Dyn. 60, 302–314. doi:10.1016/j.strueco.2021.12.002

Lu, X. D., and Lian, Y. J. (2007). Total Factor Productivity Estimation of Chinese Industrial Enterprises:1999-2007. China Econ. Q. 02, 541–558. doi:10.13821/j.cnki.ceq.2012.02.013

Megginson, W. L., Ullah, B., and Wei, Z. B. (2014). State Ownership, Soft-Budget Constraints, and Cash Holdings: Evidence from China’s Privatized Firms. J. Bank. Finance 48, 276–291. doi:10.1016/j.jbankfin.2014.06.011

Naughton, B. (2017). The Current Wave of State Enterprise Reform in China: A Preliminary Appraisal. Asian Econ. Policy Rev. 12, 282–298. doi:10.1111/aepr.12185

Nie, H. H., Jiang, T., and Yang, R. D. (2012). The Current Situation and Potential Problems of Industrial Enterprise Database Usage in China. J. World Econ. 05, 142–158.

Ouyang, X. L., Li, Q., and Du, K. R. (2020). How Does Environmental Regulation Promote Technological Innovations in the Industrial Sector? Evidence from Chinese Provincial Panel Data. Energy Policy 111310. doi:10.1016/j.enpol.2020.111310

Rosenbaum, P. R., and Rubin, D. B. (1983). The Central Role of the Propensity Score in Observational Studies for Causal Effects. Biometrika 70, 41–55. doi:10.1093/biomet/70.1.41

Shahzad, U., Ferraz, D., Nguyen, H. H., and Cui, L. B. (2022). Investigating the Spill Overs and Connectedness between Financial Globalization, High-Tech Industries, and Environmental Footprints: Fresh Evidence in Context of China. Technol. Forecast. Soc. Change 174, 121205. doi:10.1016/j.techfore.2021.121205

Sun, H. P., Edziah, B. K., Kporsu, A. K., Sarkodie, S. A., and Taghizadeh-Hesary, F. (2021). Energy Efficiency: The Role of Technological Innovation and Knowledge Spillover. Technol. Forecast. Soc. Change 167, 120659. doi:10.1016/j.techfore.2021.120659

Tan, Y. X., Tian, X., Zhang, X. D., and Zhao, H. L. (2020). The Real Effect of Partial Privatization on Corporate Innovation: Evidence from China's Split Share Structure Reform. J. Corp. Finance 64, 101661. doi:10.1016/j.jcorpfin.2020.101661

Tang, Q. Q., Li, H. W., and Zhou, Y. M. (2011). The Choice of Innovation Mode of Chinese Enterprises-Based on the Perspective of Corporate Governance. Contemp. Econ. Manag. 12, 23–31. doi:10.13253/j.cnki.ddjjgl.2011.12.004

Tong, T. W., He, W., He, Z. L., and Lu, J. (2014). Patent Regime Shift and Firm Innovation: Evidence from the Second Amendment to China's Patent Law. Acad. Manag. Annu. Meet. Proc. 01, 14174. doi:10.5465/ambpp.2014.14174abstract

Wang, J., and Deng, J. (2021). Research on the Effect of Executive Incentive Institutional Innovation on the Cost of Equity—Evidence from Chinese Listed Companies. Front. Psychol. 12, 686955. doi:10.3389/fpsyg.2021.686955

Wang, Q., Liu, M. D., and Zhang, B. (2022). Do state-owned Enterprises Really Have Better Environmental Performance in China? Environmental Regulation and Corporate Environmental Strategies. Resour. Conservation Recycl. 185, 106500. doi:10.1016/j.resconrec.2022.106500

Wang, Y. W., and Chen, L. (2017). Does Mixed Ownership Reform Promote Enterprise Innovation? Res. Econ. Manag. 11, 112–121. doi:10.13502/j.cnki.issn1000-7636.2017.11.012

Wang, Y. X., and Sun, Y. Y. (2018). The Impact of Corporate Governance on Innovation Strategy-An Empirical Study Based on R&D Expenditure Heterogeneity. Financial Econ. Res. 12, 113–121. doi:10.19654/j.cnki.cjwtyj.2018.12.015

Wei, C. H., Wu, Y. F., and Li, C. Q. (2012). Family Control, Dual Principal-Agent Conflict and Cash Dividend Policy: an Empirical Study of Chinese Listed Companies. J. Financial Res. 07, 168–181.

Wu, C. P., and Tang, D. (2016). Intellectual Property Rights Enforcement, Corporate Innovation and Operating Performance: Evidence from China’s Listed Companies. Econ. Res. J. 11, 125–139.

Wu, Y. P., and Li, L. (2017). Policy Performance Assessment of China's Development Zones: A Perspective Based on the Innovation Capacity of Enterprises. J. Financial Res. 06, 126–141.

Xia, Y. L., and Cheng, L. (2010). A Study on the Spillover Effect of Foreign Direct Investment on the Technical Efficiency of Chinese Industrial Enterprises-Aan Empirical Analysis Based on the Data of Chinese Industrial Enterprises from 2002-2006. China Ind. Econ. 07, 55–65. doi:10.19581/j.cnki.ciejournal.2010.07.006

Xu, Y., Li, S. S., Zhou, X. X., Shahzad, U., and Zhao, X. (2022). How Environmental Regulations Affect the Development of Green Finance: Recent Evidence from Polluting Firms in China. Renew. Energy 189, 917–926. doi:10.1016/j.renene.2022.03.020

Yang, Z., Yan, Z. B., Yu, L. H., and Xu, J. H. (2015). The Impact of R&D Investments in State-Owned Enterprises on the Innovative Behavior of Private Owned Enterprises. Sci. Res. Manag. 0436, 82–90. doi:10.19571/j.cnki.1000-2995.2015.04.010

Yuan, J. G., Hou, Q. S., and Cheng, C. (2015). The Curse Effect of Enterprise Political Resources-Based on the Investigation of Political Connection and Enterprise Technological Innovation. J. Manag. World 01, 139–155. doi:10.19744/j.cnki.11-1235/f.2015.01.014

Zachariadis, M., and Rand, D. (2003). R&D, Innovation, and Technological Progress: a Test of the Schumpeterian Framework without Scale Effects. Can. J. Econ. 36, 566–586. doi:10.1111/1540-5982.t01-2-00003

Zhang, J., Gao, D. B., and Xia, Y. L. (2016). Can Patents Promote China's Economic Growth - an Explanation Based on the Perspective of China's Patent Funding Policy. China Ind. Econ. 01, 83–98. doi:10.19581/j.cnki.ciejournal.2016.01.006

Zhang, X. Q., Yu, M., and Chen, G. G. (2020). Does Mixed-Ownership Reform Improve SOEs' Innovation? Evidence from State Ownership. China Econ. Rev. 61, 101450. doi:10.1016/j.chieco.2020.101450

ZhangH., , Huang, H., and Yan, Q. M. (2016). Mixed Ownership Reform, Policy Burden and SOE Performance-An Empirical Study Based on a Database of Industrial Enterprises from 1999-2007. Economist 09, 32–41. doi:10.16158/j.cnki.51-1312/f.2016.09.004

Zhi, J., and Wang, Z. H. (2007). The Theory of Independent Innovation Capability Measurement and Assessment Index System Construction. J. Manag. World 05, 168–169. doi:10.19744/j.cnki.11-1235/f.2007.05.027

Zhong, Z. Y., and Zhao, G. Q. (2012). FDI, Environmental Regulation and Technological Progress. J. Quantitative Tech. Econ. 04, 19–32. doi:10.13653/j.cnki.jqte.2012.04.006

Keywords: mixed ownership reform, state-owned enterprises, enterprise innovation, corporate governace, policy burden, environmental regulation

Citation: Xia W and Zhou X (2022) Research on the impact of mixed ownership reform on innovation of state-owned enterprises: Evidence from Chinese industrial enterprises. Front. Environ. Sci. 10:978090. doi: 10.3389/fenvs.2022.978090

Received: 25 June 2022; Accepted: 29 July 2022;

Published: 06 September 2022.

Edited by:

Usama Awan, Lappeenranta University of Technology, FinlandReviewed by:

Huaping Sun, Jiangsu University, ChinaUmer Shahzad, Anhui University of Finance and Economics, China

Gulnaz Muneer, Bahauddin Zakariya University, Pakistan

Copyright © 2022 Xia and Zhou. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xinmiao Zhou, emhvdXhpbm1pYW9AbmJ1LmVkdS5jbg==

Wei Xia

Wei Xia Xinmiao Zhou*

Xinmiao Zhou*