- 1Department of Banking and Finance, Eastern Mediterranean University, Famagusta, Turkey

- 2Department of Finance and Banking, HBV University, Ankara, Turkey

The global pressure to reduce carbon emissions on high-carbon-emitting economies has intensified significantly in recent years. However, these efforts’ effect on the firm’s financial performance (FP) has been a major concern. This research investigates the relationship between environmental performance (EP) and FP of Chinese firms considering the effect of the COVID-19 outbreak. Data was collected from Refinitiv DataStream and span the period of 2017–2020. In addition to the fixed-effects regression, the novel dynamic panel bootstrap corrected fixed effects and panel corrected standard errors methods were utilized to test the hypotheses. Obtained results revealed two key findings. First, there is weak evidence that higher EP increases firms’ FP. Second, the relationship between EP and FP is positive in times of economic distress, meaning that firms must continue investing in environmentally ethical and sustainable projects during the crisis. Our empirical findings extend the existing literature by showing that even in times of crisis, such as COVID-19, an environmentally friendly business model positively affects the firm’s financial structure. We discuss the policy recommendations implied by our findings for investors, business owners, managers, and officials in the conclusion section.

1 Introduction

Effects of climate change on the welfare of humanity pushed environmental concerns to the top of governments’ agendas. Ensuring sustainable global growth has become one of the most important goals of the international community in recent decades. For this purpose, governments signed the Paris climate agreement in 2015 and the Glasgow climate pact in 2021 (UNFCCC, 2022). The main target of these efforts was to limit the effects of global warming by holding the increase of global temperature to below 2°C. Reducing greenhouse gas emissions (GHGs), especially carbon emissions, are required to limit the temperature increase (UNFCCC, 2022). These developments have increased international pressure on high carbon-emitting countries (Alam et al., 2019). As the highest carbon-emitting country, China set ambitious goals to meet the targets of international treaties. Besides, in line with China’s state policy, Chinese companies have been spending significant efforts to switch to a more environmentally friendly production model. Although these efforts are inevitable for sustainable growth, the financial burden of this transformation process for the firms is an important concern. The financial difficulties experienced by companies during the COVID-19 period have intensified these concerns significantly. In times of financial distress, following environmentally sensitive policies may cease to be the priority of companies. Based on these concerns, our study reconsiders the relationship between environmental performance (EP) and financial performance (FP) of companies during the COVID-19 period.

Firms play a major role in carbon emissions through the energy use needed to produce goods and services. Pressures from governments and policymakers drove corporations to minimize their carbon footprint and better their EP (Alam et al., 2019). The effect of increasing the EP of companies on their FP is an important field of study in the literature. Theoretically, the natural resource-based view theory claims that corporations with higher environmental activities will have a competitive advantage over those without environmental policies and efforts (Hart, 1995). However, supporters of the neoclassical economic theory argue that an increase in EP leads to increasing costs, which will hinder the FP (Palmer et al., 1995). Theories that propose different and somehow contradictory arguments led to the intensification of empirical research in this field. Many researchers argue that there is harmony and even complementarity between an environmentally friendly business model and the firm’s financial strength. The intense interest in the subject has led to many recent studies that contribute to this debate from different angles (Cheng and Liu, 2018; Duanmu et al., 2018; Banerjee et al., 2019; Ikram et al., 2021; Kordsachia et al., 2021; Zhang, 2021). However, after three decades of theoretical and empirical research, the findings regarding the relationship between EP and FP are still inconclusive (Shen et al., 2019; Brahmana and Kontesa, 2021).

Another point that draws attention in the related literature is that the relationship between EP and FP has not been adequately examined in the case of adverse economic shocks. The crisis period affects the financial health of the firms and forces them to reconsider their priorities. For example, unfavorable market conditions following the 2008 global financial crisis harmed the financial health of the firms and led them to question their position on EP (Gallego-Álvarez et al., 2014). Some researchers believe that investment reduction in environmental practices is the best strategy to follow in case of a negative economic shock to reduce costs and consequently maintain and improve FP (Njoroge, 2009). However, many others disagree with this argument. According to them, EP enhances FP even in a crisis period. EP contributes to sustainable development and yields economic benefits (Brilius, 2010). Environmentally responsible firms have access to crucial resources (Zeidan et al., 2015) and are regarded by stakeholders as trustworthy, even if economic conditions are unfavorable and overall market trust is decreased (Lins et al., 2017). Therefore, the competitive advantage and stakeholders’ trust gained by environmentally responsible corporations is valuable especially in times of turmoil (Godfrey, 2005). In addition, firms with higher EP have a better relationship with their stakeholders and can use their resources more efficiently to generate greater economic benefit (Branco and Rodrigues, 2008). This discussion necessitates investigating whether there is a short-term trade-off between the firm’s FP and EP under crisis conditions.

COVID-19 Pandemic has emerged as a global issue causing harm to human health and damaging environmental quality (Irfan et al., 2021). Besides, COVID-19 brought about economic problems similar to those in the 2008 Financial Crisis. The evolution of the COVID-19 virus, from a national crisis in China to a global pandemic, resulted in one of the worst global economic recessions since 1990 (Nguyen et al., 2021). The outbreak of COVID-19 pushed governments worldwide to impose strict measures to prevent the further spread of the virus, including national lockdowns, travel and transportation restrictions, and business closures (Bakeries, 2012). These measures led to a drastic decline in economic growth, an increase in unemployment levels, disruptions in demand and production chain, cash flow problems, and bankruptcies of firms across the world (Papadopoulos et al., 2020). Although the decline in economic activities caused a temporary decrease in the global carbon emissions level, the effect of the Pandemic on the transition to low-carbon firms and a green economy is still unknown (Guérin and Suntheim, 2021). On the one hand, COVID-19 ramifications have affected corporations and interrupted plans for sustainable development (Ikram et al., 2020). However, on the other hand, it can also motivate a shift towards green products in the preferences of investors and consumers, thus enabling companies to switch to low-carbon production without reducing their FP (Guérin and Suntheim, 2021).

Given the ambiguous nature of the relationship between EP and FP (Brahmana and Kontesa, 2021), the disastrous impact of COVID-19 on the financials of firms, and the lack of studies examining the influence of the Pandemic on the relationship between EP and FP; this article aims to bridge the gap within the EP literature and provide a more comprehensive understanding of this relationship. To this aim, we examine the effect of EP represented by the environment pillar score of firms on FP, represented by return on assets, under unfavorable economic conditions, the COVID-19 global Pandemic. With this goal in mind, Chinese firms were chosen as our sample for three main reasons; first, China had the first reported cases of the COVID-19 virus in 2019, and it was the first country to take precautionary measures to stop the spread of the virus. Thus, China is selected to avoid any misspecification and inaccuracies in our findings. Second, China is considered to be the world’s highest emitting country of CO2 emissions and is under global scrutiny to decrease the emissions levels (WPR, 2022). Third, independent standard EP measurement is lacking in China (Shahab et al., 2018), which calls for an extended examination of EP of Chinese firms using third-party ratings to reveal the influence on FP, specifically under economic downturn conditions. Therefore, a panel of 329 Chinese publicly listed firms spanning from 2017 to 2020 was analysed by using fixed-effects regression. In addition, macroeconomic variables and institutional quality variables were added to the empirical models to ensure the robustness of the results. Moreover, return on capital is used as a proxy for FP to confirm the validity of the results. Furthermore, both the Panel Corrected Standard Errors (PCSE) and Bootstrap Corrected Fixed-Effects (BCFE) were used to correct for any multicollinearity, heteroscedasticity, and autocorrelation in the error term of the analysis (Wooldridge, 2003) and further verify the robustness of our findings.

The rest of the study is structured as follows: The next section offers a review of the previous literature. Section 3 introduces the data and methodological techniques used, alongside the equations studied. Section 4 presents and discusses the study’s findings, while the final section offers concluding remarks together with policy recommendations.

2 Literature review

Corporate Social Responsibility (CSR) is defined as the consideration by corporations of responsibilities towards the society beyond shareholders’ profit-making (Petitjean, 2019). Following the pioneering study of Bowen (1953), the role of CSR, its’ importance, and its’ effect on society have been widely discussed. Some early studies emphasized the companies’ duties toward society (Andrews, 1973); while others argued that companies should only focus on maximizing their benefits (Levitt, 1958). Since the ultimate goal of firms is to maximize profit, research has focused on the relationship between CSR and FP. Theoretically, the literature offers opposing points of view relating to the effect of CSR on FP.

Neo-classical economists advocate that investment in CSR activities lessens opportunities to use resources for firms’ benefits (Friedman, 1970). Investing in CSR implies higher costs, which triggers conflict of interest between stakeholders (Greening and Turban, 2000), eventually hindering the FP of the firm (Palmer et al., 1995). In contrast, the resource-based view suggests that a company’s resources are imitable, invaluable, non-substitutable, and unique (Barney, 1991). These resources allow the firm to engage in CSR investments to enhance its public reputation and brand image, boost customer trust, gain a competitive advantage, and increase FP (Bird et al., 2007). In addition, stakeholder theory asserts that investments in CSR activities can boost the relationship between corporations and their stakeholders (Ahmad et al., 2021). Moreover, the theory suggests that CSR initiatives can enhance a firm’s value in two ways; first, an increase in reputation due to higher CSR investment could boost sales, and second, shareholders’ utility could increase as a result of holding shares of a sustainable firm (Gillan et al., 2021; Abdi et al., 2022).

Empirically, the literature has produced mixed results when examining the relationship between CSR and FP (Gillan et al., 2021). The majority of the literature has reported a positive effect of CSR on FP (Brogi and Lagasio, 2019; Long et al., 2020; Okafor et al., 2021; Qureshi et al., 2021). In an extensive review of more than 250 academic studies, Margolis et al. (2009) concluded that the effect of CSR on FP is positive. Likewise, reviewing 52 papers, Orlitzky et al. (2003) argued that CSR activities are likely to be financially viable for firms. Similarly, Friede et al. (2015), with a vast meta-analysis of more than 2000 empirical studies, reveal a higher positive effect of CSR on FP in emerging economies compared to developed economies (65.4% compared to 38%).

Contrary to researchers supporting a positive relationship, a limited number of authors in the literature argue that the relationship between CSR and FP is negative or neutral (Rodrigo et al., 2016; Buallay, 2019; Duque-Grisales and Aguilera-Caracuel, 2021). The negative relationship is likely due to CSR activities without proper implementation or institutional support; increasing the costs of CSR activities and decreasing stakeholders’ support (Abdi et al., 2022). Studies finding a neutral relationship between CSR and FP maintain that the financial benefits of CSR activities are offset by the associated costs (Lahouel et al., 2019), or that the relationship is too complex to be measured (Margolis and Walsh, 2003).

Overall, the relationship between CSR and FP is widely discussed and well established in the literature, with most empirical studies reporting a positive influence of CSR on FP. More recently, the literature is shifting from the concept of CSR as a whole to specific dimensions, particularly the EP of firms due to environmental deterioration and climate change (Li et al., 2017). Climate change has attracted increased concerns from firms’ stakeholders (Busch and Hoffmann, 2011). In addition, consumers, governments, and financial markets show accelerating concerns about the carbon emission levels of firms (Lee, 2012). Therefore, it is crucial to analyse the EP of firms and investigate its relationship with FP (Wang et al., 2014).

EP is defined as the corporations’ commitment to actions and activities targeting the protection and improvement of the environment while fulfilling economic performance (Li et al., 2017). As underpinned by the natural-resource-based view (NRBV), firms can develop capabilities and resources that are rare, valuable, non-substitutable, and inimitable by managing stakeholder expectations through improved EP. The implementation of environmental strategies can increase operational efficiency, productivity, and environmental reputation; leading to increased revenues while decreasing the environmental risk that can harm firm performance (Peloza, 2006). Furthermore, improved EP can reduce costs of environmental regulation compliance and elevate employees’ productivity and morale (Qi et al., 2014). Moreover, EP improvements were found to lower financing costs (Sharfman and Fernando, 2008). In contrast, firms with low EP usually encounter shareholder boycotts, negative media exposure, and government penalties. For example, the Chinese Harbin Pharmaceutical Group was reported to release excessive amounts of hydrogen sulfide gases, after the exposure, its revenues fell dramatically by 47.15% in 2011 and 46.62% in 2012 (Li et al., 2017). Likewise, Zijin Mining Group was accused of acidic wastewater leakage in 2010 and its’ stock price fell sharply after the incident (Li et al., 2017).

Analytically, despite multiple authors supporting a negative or neutral link between EP and FP (Santis et al., 2016; Lucato et al., 2017), many studies have found a positive relationship between firm’s EP and FP (Nishitani, 2011; Bergmann et al., 2017; Gómez-Bezares et al., 2017; Manrique and Martí-Ballester, 2017; Gangi et al., 2020; Liu, 2020; Sudha, 2020). Similarly, multiple literature surveys and meta-analysis papers have come to the same conclusion. Albertini (2013) analyzed 52 empirical papers and supported the positive relationship between EP and FP. Likewise, Dixon-Fowler et al. (2013), and Endrikat et al. (2014) confirmed the positive links in their meta-analytical studies. According to the competing theories of neo-classical economists and the natural resource-based view discussed above, and based on the fact that the vast bulk of the empirical literature concluded a positive relationship between the variables of interest, we propose the hypothesis given below:

H1. Environmental Performance positively affects the Financial Performance of Chinese firms.The above-mentioned literature and discussion are related to the relationship between CSR and FP, or more specifically EP and FP in normal market conditions, with a majority of empirical articles confirming a positive relationship. However, after the global financial crisis, firms’ behavior might have changed (Gallego-Álvarez et al., 2014). Under unfavorable economic circumstances, managers and researchers believe that reducing CSR activities investments is essential to cut costs, survive the financial shock, and improve FP (Bansal et al., 2015). However, another stream in the literature endorses the opposing behavior because of the benefits that CSR activities have on firms’ economic performance and the FP (Gallego-Álvarez et al., 2014). Companies involved in CSR activities use their capabilities and resources efficiently and increase their economic benefits alongside enhancing the relationship with their stakeholders (Branco and Rodrigues, 2008). Similarly, Giannarakis and Theotokas (2011) argue that increased investment in CSR projects can help firms regain lost trust from consumers. Moreover, decreasing investment in CSR activities would be an oversight due to the positive effect of CSR activities on overcoming financial turmoil (Wilson, 2008).The empirical literature on the relationship between CSR and FP in times of economic downturn is minimal (Petitjean, 2019), and the results are varied. On the one hand, some researchers found the relationship to be either negative or neutral. Hirigoyen and Poulain-Rehm (2015) utilize the data for 329 companies spanning from 2009 to 2010 to examine the relationship between CSR and FP, concluding a negative relationship between the variables. Similarly, Simionescu and Gherghina (2014) found a negative relationship between CSR and return on sales. The authors also could not find a significant relationship between CSR and most FP indices. However, they discovered that CSR positively affects earnings per share.On the other hand, some studies confirmed the positive nature of the association between CSR and FP. Lins et al. (2017) confirm that higher CSR performance is associated with higher returns, and sound FP might be from CSR activities which increased the trust of stakeholders despite the low level of trust during the financial shock. Likewise, Selvi et al. (2010) verify the positive link between CSR and FP before and during the financial crisis in the case of Turkish companies. Similarly, Simionescu and Dumitrescu (2014) found that increased CSR performance leads to higher FP in Romanian companies during the financial downturn.There is a gap in the literature regarding the nature of the relationship between EP and FP in times of turmoil. Although a few studies examine this relationship in periods of low trust, their findings are inconclusive. Gallego-Álvarez et al. (2014) used international data on carbon emissions of 89 companies and concluded a positive effect of EP on FP during the financial crisis of 2008. In addition, Petitjean (2019) investigated the link between EP and FP in the case of 58 US firms. The authors could not confirm the relationship between EP and FP overall and found a weak association between EP and FP in the period of the financial crisis of 2008.The mentioned studies examined the effect of the 2008 financial crisis on the EP–FP relationship. COVID-19 period also had effects similar to those of the 2008 crisis, such as a low trust environment and financial distress. Hence, the impact of the COVID-19 Pandemic on the relationship between FP and EP has to be analysed. This research tests the existence and the direction of the relationship between EP and FP in the case of Chinese companies, taking into account the most recent recession due to the COVID-19 Pandemic, controlling for additional factors, and going beyond carbon emission reduction of corporations. Accordingly, the hypothesis below is proposed:

H2. Environmental Performance positively affects the Financial Performance of Chinese firms during the COVID-19 Pandemic.

3 Materials and methods

3.1 Data description

This article examines the influence of EP on FP in times of an economic downturn, that is, the COVID-19 pandemic period. Since COVID-19 Pandemic started in China, it seems indisputable to focus on Chinese-based firms to avoid any lead-lag effect in our results. Data for 329 Chinese companies were drawn from the Refinitiv database with a yearly frequency that spans from 2017 to 2020. As a measure of EP, the environmental pillar score of the Environmental, Social, and Governance (ESG) Refinitiv Eikon database is selected due to multiple reasons; first, to avoid biased disclosure problems and to rely on a third-party rating, ensuring the robustness of the measure (Han et al., 2016), and second, to go beyond carbon emissions of firms and include both environmental innovation and resources use. To measure corporate FP, return on assets (ROA) is selected to represent profitability, as it is commonly used in previous literature (Lucas and Noordewier, 2016; Wang and Sarkis, 2017; Buallay, 2019) and reflects an efficient proxy of profitability (Gallego-Álvarez et al., 2014). In addition, return on capital (ROC) is included as a measure of FP to verify the empirical results and confirm the validity of the findings.

To represent the recession period due to the COVID-19 Pandemic, we have defined a dummy variable (COVID), which takes the value of 1 in the years 2019 and 2020 and the value of 0 for the other periods included. In addition, an interaction variable between the COVID variable and EP is created (COVEP) to represent the EP of firms in the period of COVID-19 to test the second hypothesis. Moreover, several control variables are added to confirm the results and avoid misspecification. Control variables included fall under three categories; the first is firm performance variables. In line with the existing literature (Adegbite et al., 2019; Lahouel et al., 2020; Zhang et al., 2020), we added three firm performance variables; namely, size represented by the logarithmic form of the market value (LMV), liquidity (LIQ) measured by current ratio, and leverage (TDTE) which is the ratio of total debt over total equity, all of which were obtained from Refinitiv Eikon database. The second category is macroeconomic variables, including the unemployment rate (UN) and inflation rate (INF) collected from the World Bank database (World Bank, 2022). Both inflation and unemployment are determinants of FP within the literature (Issah and Antwi, 2017; Egbunike and Okerekeoti, 2018), and their effect needs to be controlled for. The third category is institutional quality variables consistent with previous literature (Hosny, 2017; Agostino et al., 2020) including voice and accountability (VACR) and political stability (PSR) drawn from Worldwide Governance Indicators (WGI, 2022).

3.2 Model and methodology

To test the aforementioned hypotheses of this study, we employ fixed-effects linear regression for panel data. This methodology ensures consistent estimators by preventing information related to fixed effects to be correlated with the variables in the model. Since the sample studied consists of Chinese firms with similar characteristics, the fixed-effects linear regression model is assumed to be the most suitable. The main model equation assumes ROA to represent profitability and is shown below:

Models 2) and 3) include macroeconomic control variables and institutional quality control variables, respectively.

For robustness purposes, we utilized ROC as the proxy for FP to confirm the results drawn from previous models. Model 4) represent the main model with ROC as the dependent variable

Models 5) and 6) control for macroeconomic and institutional quality, respectively and are represented below

Moreover, we use the novel dynamic panel BCFE estimator to confirm the validity of the results. In contrast to panel estimation methods used in the literature that require a large time span for model estimations to be efficient, BCFE corrects any small-time dimension bias present in panel models (Sarkodie and Owusu, 2020). Model 7) represents the BCFE equation

Furthermore, to validate our findings, PCSE models were employed to check the robustness of the model. PCSE corrects for heteroscedasticity, multicollinearity, and autocorrelation (Wooldridge, 2003). Models (8), (9), and (10) below are estimated with PCSE.

4 Results

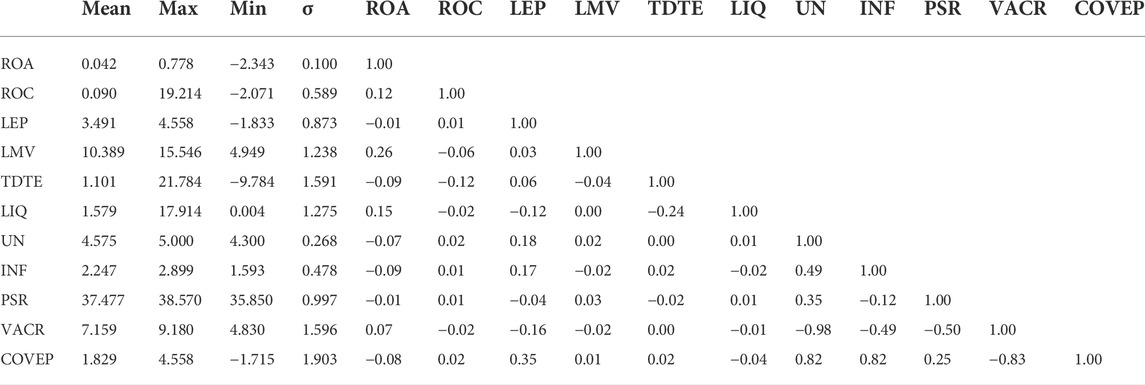

To examine the characteristics of the variables utilized within our empirical models, descriptive statistics and correlation coefficients are presented in Table (1). The minimum value of the environmental performance went up during COVID years while its variability increased from 0.873 to 1.903, indicating uncertainty in spending on EP. ROC has an average of 0.09 while ROA’s average is 0.042. Table 1 shows that the variable most correlated with the dependent variable ROA is the company size, while leverage was the most correlated with ROC. Although the majority of correlation coefficients are low, the correlation coefficients between VACR and UN, COVEP and UN, and COVEP and INF are high, with values of -0.98, 0.82, and 0.82, respectively. Thus, to refrain from any multicollinearity problem, VACR and UN are not included in the same equation. Besides, the PCSE method is used to fix any possible multicollinearity issues and validate the robustness of the results.

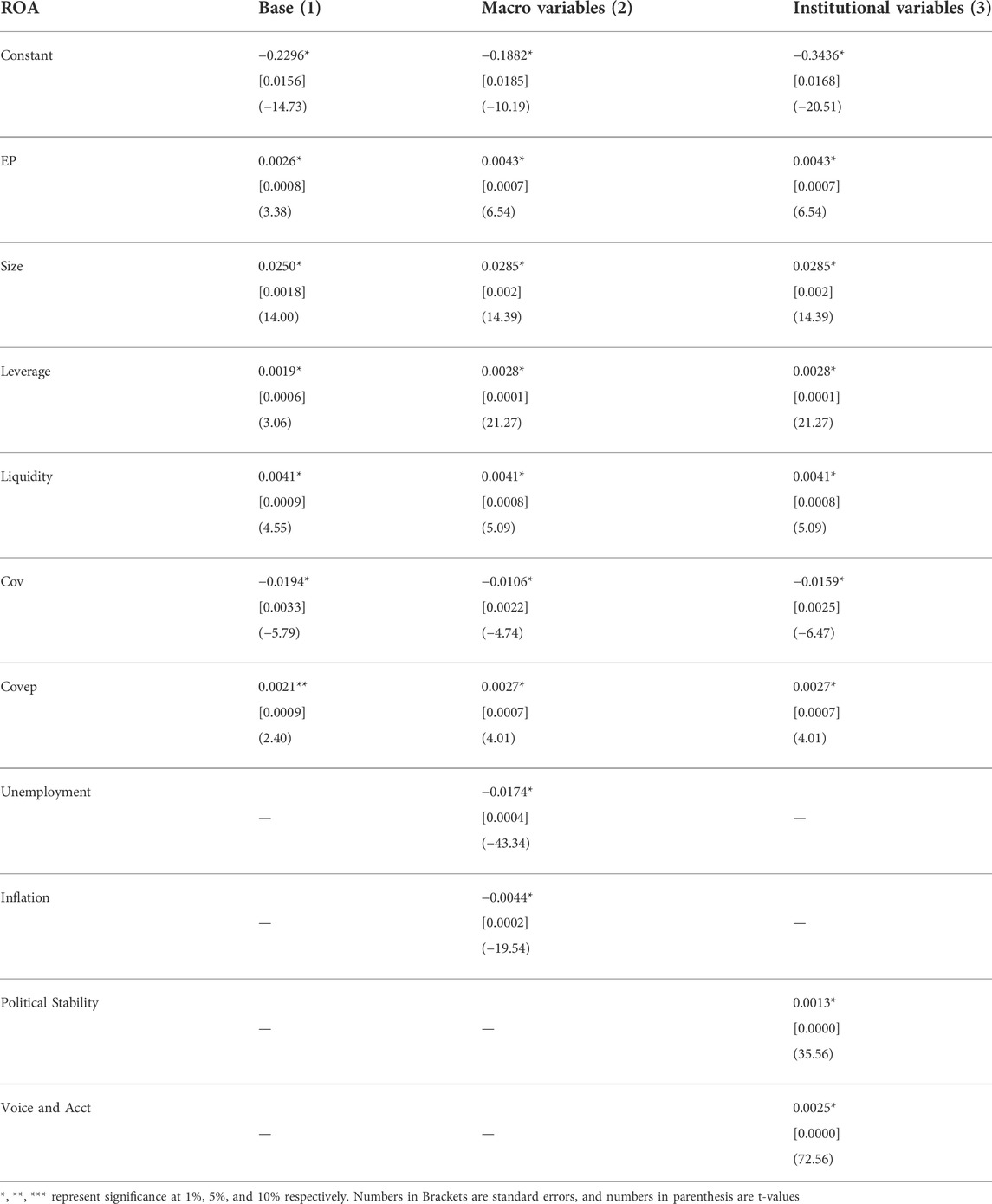

Findings of the main analysis, using fixed-effects linear models, are presented in Table 2. Results regarding the base model, corresponding to Eq. 1 with ROA representing financial performance, suggest that EP has a significant positive effect on companies’ FP. COVID Pandemic decreases FP overall; however, the interaction variable COVEP is positively significant, indicating that increased EP during the Pandemic boosts FP. Control variables, namely, size, leverage, and liquidity, were found to positively influence FP, confirming theoretical expectations. Macroeconomic and institutional quality robustness models 2) and 3) confirm the findings of the base model. Model 2) shows that EP, size, leverage, liquidity, and COVEP have a significant positive effect on FP, while COVID, unemployment, and inflation have a negative effect on the dependent variable. Similarly, model 3) findings support models 1) and (2), as the coefficient signs are consistent with one another. Additionally, an increase in political stability and voice and accountability were found to boost FP.

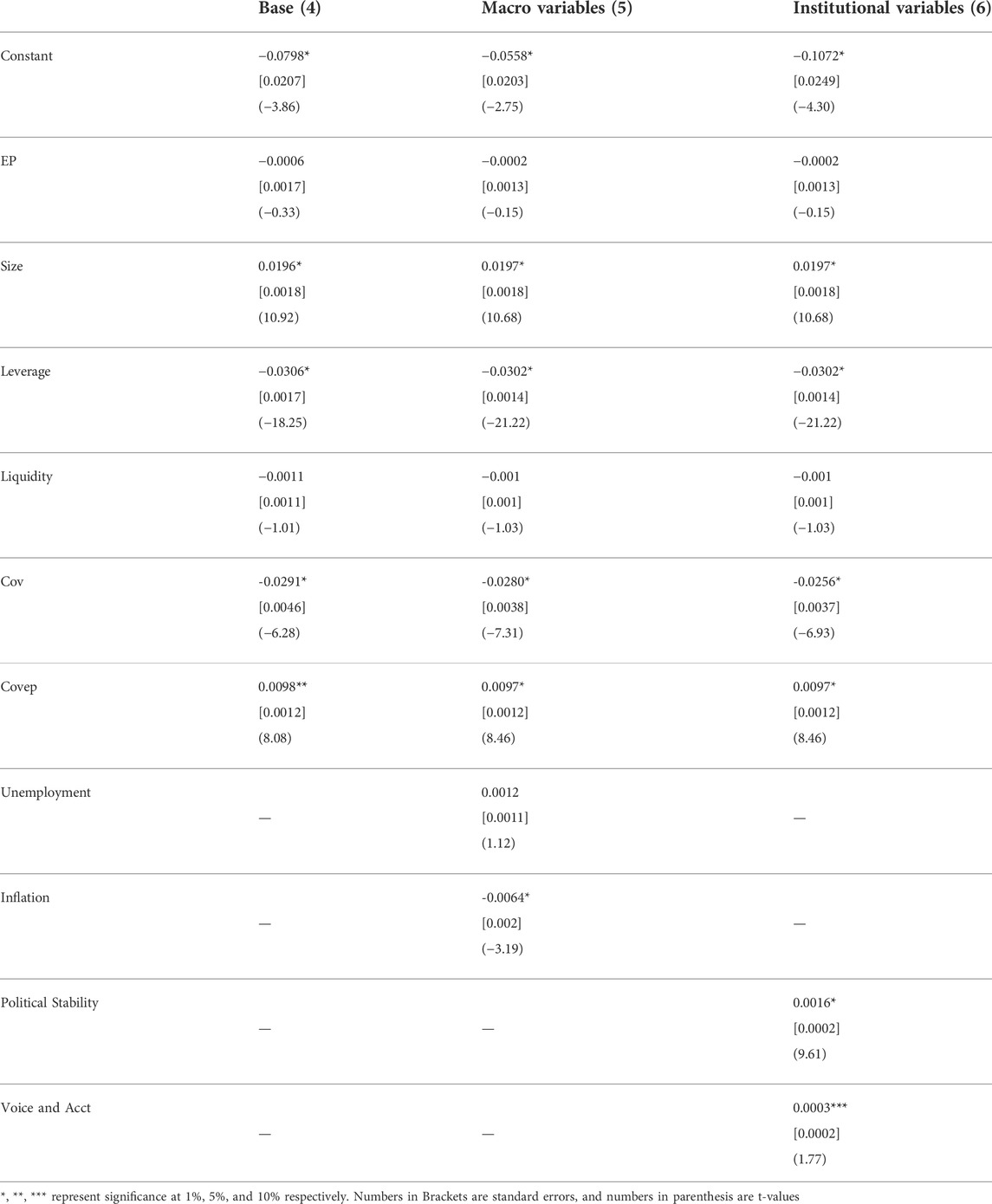

Table 3 demonstrates the findings obtained from fixed-effects linear models (4), (5), and (6), in which the dependent variable financial performance is measured by ROC. EP was found to be statistically insignificant in all three models. The COVID pandemic variable negatively influences FP in all models presented with a very high level of statistical significance. The interaction variable, COVEP, positively affects financial performance consistently in all the models estimated. Control variables size and leverage were statistically significant in each model with consistent signs. In the macroeconomic model (5), inflation negatively influences FP. Model 6) confirms the positive effect of institutional variables on FP with both political stability and voice and accountability.

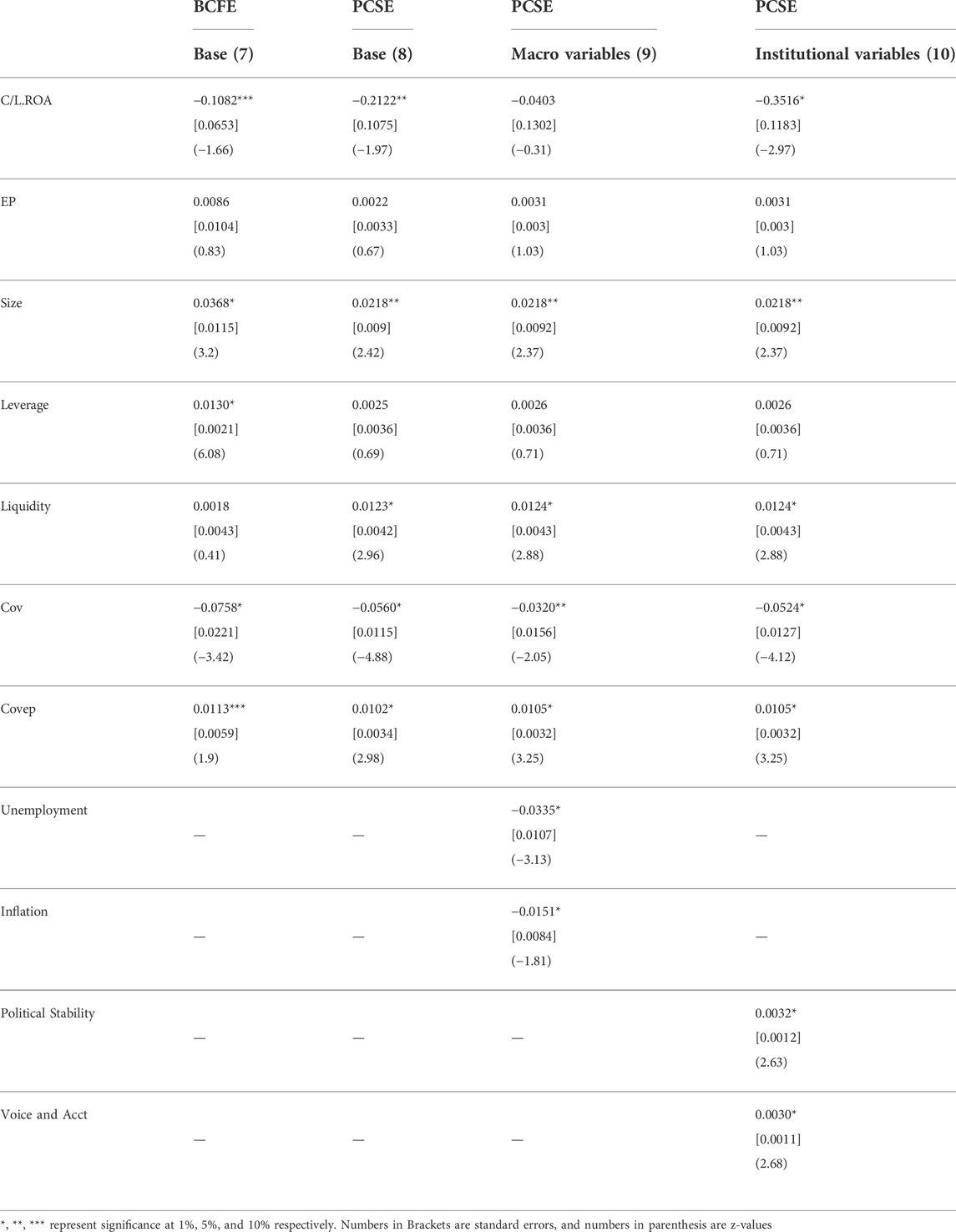

To ensure the robustness of the analysis, obtain efficient findings, and correct any biases within the results, we applied models (7); estimated with the use of BCFE. Models (8), (9), and (10), were analysed using PCSE. Robust findings obtained through BCFE and PCSE are reported in Table 4. The models show that EP has no significant relationship with FP. However, all models confirm the positive link between the interaction variable COVEP and FP. In addition, the results of all robust models investigated display the recent Pandemic to have a significant negative effect on FP. Control variable size is positively significant across all models, while leverage was found to be positively significant in model (7). Liquidity positively affects FP in models (8), (9), and (10). Model 9) confirms the negative influence of inflation and unemployment on FP, and model (10) verifies the positive effect of political stability and voice and accountability on FP.

4.1 Discussion

The vast majority of studies in the literature show that there is a significant relationship between a firm’s EP and its FP. However, the interesting thing is that there is no consensus on whether this effect is positive or negative. This dichotomy can be observed in both empirical results and theoretical explanations. The relationship between the benefit and cost of an investment in EP determines the impact of this investment on FP. Studies claiming a positive relationship between these two variables receive support from NRBV and claim that EP affects companies positively in terms of reputation and productivity, which can lead to competitive advantage. In contrast, the other group bases its arguments on the neoclassical economic framework and argues that firms should focus solely on maximizing shareholders’ value.

The empirical literature on the type of relationship between EP and FP provides mixed findings. While a limited number of studies found a negative relationship between EP and FP (Lu and Taylor, 2016; Stoian and Gilman, 2017), the majority of researchers report a positive relationship (Muhammad et al., 2015; Nishitani et al., 2017; Abban and Hasan, 2021). Our first three models, where ROA represented profitability, suggest that EP positively influences FP for Chinese companies. However, robustness models 4) to (10) do not provide any significant coefficients regarding the EP–FP relationship, similar to some previous research (Venkatraman and Nayak, 2015; Lucato et al., 2017). Therefore, we can conclude that we have weak evidence to support the first hypothesis.

COVID-19 Pandemic had devastating effects on the overall economy. Previous studies emphasized the Pandemic’s severe impact on companies’ financials (Rababah et al., 2020). Similarly, all our models provide strong evidence of a significant negative impact of the COVID-19 Pandemic on the FP of Chinese firms. Some researchers examining the effect of EP on FP argue that investment in CSR activities should be postponed during financial distress (Karaibrahimoglu, 2010). Petitjean (2019) states that investors do not focus on EP during a crisis and are more interested in short-term survival. However, there are also opinions claiming that EP investments should be continued during crisis periods (Selvi et al., 2010; Gallego-Álvarez et al., 2014). Our empirical findings show that FP became more responsive to EP during the COVID-19 Pandemic. This result provides evidence for Hypothesis 2 and states that higher EP could enhance the FP even under unfavorable economic conditions. This finding has a strong policy implication: investments in EP should continue in times of crisis as it is financially rewarding. Investment in CSR during economic turbulence can increase firms’ ability to handle the impacts of the crisis, build a competitive advantage, develop a better relationship with stakeholders, and build greater confidence in the business (Branco and Rodrigues, 2008; Selvi et al., 2010; Gallego-Álvarez et al., 2014). In addition, our study carries the literature in this field one step further by showing the accuracy of this view not only in financial crises but also under global pandemic conditions such as COVID-19.

We used control variables to provide a more comprehensive picture of the nature of the EP-FP relationship. The coefficients of the control variables are significant and in line with the existing literature (Adegbite et al., 2019; Lahouel et al., 2020; Zhang et al., 2020). A firm’s funding sources and the size of its total assets might affect its financial and social performance (Udayasankar, 2008). Size has a positive link with FP implying that firms with more total assets achieve higher profits. This finding is in agreement with the previous literature stating that large companies earn more profits than small ones (Asimakopoulos et al., 2009; Hirsch et al., 2014). Larger companies may leverage their bargaining power to lower the price of their supplies, increasing profitability by lowering their average cost. Similar to the previous literature (Berger and Di Patti, 2006; Nunes et al., 2012; Boadi et al., 2013; Hirsch et al., 2014), leverage and liquidity were found to influence FP significantly. Increased liquidity decreases insolvency risk and enhances firm performance (Pervan et al., 2019), while increased leverage increases resources available to invest; and when allocated efficiently, it maximizes profit.

We found a significant negative relationship between inflation and profitability. When unanticipated inflation occurs, businesses fail to adequately adjust prices, which results in slower growth in income relative to costs and, eventually, a decline in profitability (Perry, 1992). Additionally, Inflation negatively affects a company’s performance by altering taxes and borrowing costs (through higher interest rates) (Pervan et al., 2019). Demir (2009) and Pattitoni et al. (2014) reported a negative association between inflation and firm performance in Turkey and the European Union, respectively. Most of our models indicate unemployment has a detrimental effect on FP. According to Okun (1963), an increase in the unemployment rate corresponds to a roughly three folds decrease in real output. Lower real output reduces the purchasing power of consumers and, ultimately diminishes firm profitability. The negative impact of the unemployment rate on firms’ profitability is also supported by Bekeris (2012) and Zouaghi et al. (2017). Our findings show that institutional quality boosts FP. This finding is in agreement with Phi et al., 2021 and Yasar et al., 2011 who demonstrated that a rise in institutional quality may aid in the expansion of businesses.

5 Conclusion

This study empirically examines the link between EP and FP, which has been the focus of an ongoing discussion over the past three decades, by considering the effect of the COVID-19 Pandemic. Although growing evidence implies that increasing EP can be financially rewarding, this claim has been mainly tested in normal market conditions. Therefore, whether being green is rewarding financially during a crisis period is an important question for stakeholders. To tackle the aforementioned question, we analysed 329 companies from the Chinese market for the 2017–2020 period. We used the environmental pillar score of ESG to represent EP and the interaction variable COVEP to proxy EP during the COVID-19 period. FP was measured using two main indicators, namely, return on assets (ROA) and return on capital (ROC). Fixed-effects regression models were employed to test the hypotheses. In addition, both the BCFE and PCSE methods were used to endorse the findings.

The results from our main models demonstrated that higher investment in EP could stimulate the FP of Chinese firms. Besides, obtained findings reveal a strong, robust association between EP and FP during financial turmoil. All ten models examined throughout the study unveil that increased EP could boost FP in times of economic distress. These findings suggest that firms should proceed to invest in sustainable projects to improve their EP. This will enhance their relationships with their stakeholders and result in superior FP amid an economic downturn. Compared to small firms, large corporations with more funding sources have higher profitability. In addition, improved liquidity reduces the risk of insolvency and improves corporate performance. Macroeconomic variables inflation and unemployment hampers FP. However, enhanced institutional quality measures promote FP.

5.1 Policy implications

Our findings propose noteworthy policy recommendations. First, a well-designed EP strategy has the potential to assist the firm in achieving a fair and ethical image, increasing the firm’s legitimacy, decreasing stakeholders’ financial cost sensitivity, and gaining a competitive advantage over other firms. Second, stakeholders’ perceptions of a firm’s EP influence their behavior and trust. Firms’ ethical image is crucial in times of crisis; if a company is ethical and has an effective EP strategy, relationships with stakeholders will improve, which will be financially beneficial. Moreover, stakeholders’ perceptions of a firm’s ethical image influence their investment behavior and level of trust.

These findings imply that corporations should adopt specific EP programs that are relevant and meaningful to stakeholders, establish efficient communication with stakeholders, and raise awareness of their EP projects to improve brand loyalty and increase trust despite unfavorable market conditions. Managers need to pay closer attention to the stakeholders’ sustainability expectations and design a proactive environmental strategy to increase benefits. At this point, there are also duties falling on regulators. Chinese regulators should provide investors access to firms’ ethical reports, EP projects and strategies, environmental ratings, third-party reports and ratings. This would encourage businesses to implement environmental initiatives to improve their reputation. Furthermore, the government’s costs of implementing and monitoring environmental laws could be reduced, since stakeholders would act as external auditors.

Besides, the information obtained from the control variables in our models could be a guide for both companies and policymakers. Firms’ financial management should make efficient use of the financial resources available, handle day-to-day liquidity needs, and ensure the availability of an adequate level of liquid assets to boost profitability. In addition, firms should aim for higher growth rates in total assets, as this will increase their bargaining power and market share. Leverage can be used to invest in profitable projects, improving a company’s financial performance. Moreover, to strengthen the financial performance of firms, the Chinese government should provide a healthy macroeconomic environment with low inflation and unemployment. To this aim, government officials should make the necessary arrangements for taxation of the private sector, subsidies to employers, and education/training support. In addition, monetary policy should be implemented in line with the stated objectives.

This research explored the link between EP and FP during COVID-19. However, the data availability issue prevented us from comparing the firm performance before and after the Pandemic. Indeed, a longer-term study is required to make this comparison. Furthermore, this study assessed the importance of a better economic environment on firm performance by considering the effect of macroeconomic variables and institutional quality. Because of the institutional quality and macroeconomic variables data are at the country level, the impact of these variables at the provincial level couldn’t be revealed. More specific studies using data that describes the institutional quality and the economic environment at the municipal level could complement our findings.

The findings of this article lay the groundwork for future studies. This research focuses on Chinese firms, and the generalization of our results to other economies could be the subject of future papers. In addition, examining the effects of EP on FP under unfavorable economic conditions in various industries would be intriguing.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abban, A. R., and Hasan, M. Z. (2021). The causality direction between environmental performance and financial performance in Australian mining companies-A panel data analysis. Resour. Policy 70, 101894. doi:10.1016/j.resourpol.2020.101894

Abdi, Y., Li, X., and Càmara-Turull, X. (2022). Exploring the impact of sustainability (ESG) disclosure on firm value and financial performance (FP) in airline industry: The moderating role of size and age. Environ. Dev. Sustain. 24 (4), 5052–5079. doi:10.1007/s10668-021-01649-w

Adegbite, E., Guney, Y., Kwabi, F., and Tahir, S. (2019). Financial and corporate social performance in the UK listed firms: The relevance of non-linearity and lag effects. Rev. Quant. Finan. Acc. 52 (1), 105–158. doi:10.1007/s11156-018-0705-x

Agostino, M., Di Tommaso, M. R., Nifo, A., Rubini, L., and Trivieri, F. (2020). Institutional quality and firms' productivity in European regions. Reg. Stud. 54 (9), 1275–1288. doi:10.1080/00343404.2020.1712689

Ahmad, N., Mobarek, A., and Roni, N. N. (2021). Revisiting the impact of ESG on financial performance of FTSE350 UK firms: Static and dynamic panel data analysis. Cogent Bus. Manag. 8 (1), 1900500. doi:10.1080/23311975.2021.1900500

Alam, M. S., Atif, M., Chien-Chi, C., and Soytaş, U. (2019). Does corporate R&D investment affect firm environmental performance? Evidence from G-6 countries. Energy Econ. 78, 401–411. doi:10.1016/j.eneco.2018.11.031

Albertini, E. (2013). Does environmental management improve financial performance? A meta-analytical review. Organ. Environ. 26 (4), 431–457. doi:10.1177/1086026613510301

Asimakopoulos, I., Samitas, A., and Papadogonas, T. (2009). Firm-specific and economy wide determinants of firm profitability: Greek evidence using panel data. Manag. Financ. 35 (11), 930–939. doi:10.1108/03074350910993818

Banerjee, R., Gupta, K., and McIver, R. (2019). What matters most to firm-level environmentally sustainable practices: Firm-specific or country-level factors? J. Clean. Prod. 218, 225–240. doi:10.1016/j.jclepro.2019.02.008

Bansal, P., Jiang, G. F., and Jung, J. C. (2015). Managing responsibly in tough economic times: Strategic and tactical CSR during the 2008-2009 global recession. Long. Range Plann. 48 (2), 69–79. doi:10.1016/j.lrp.2014.07.002

Barney, J. (1991). Firm resources and sustained competitive advantage. J. Manag. 17 (1), 99–120. doi:10.1177/014920639101700108

Bekeris, R. (2012). The impact of macroeconomic indicators upon SME's profitability. Ekonomika 91 (3), 117–128. doi:10.15388/ekon.2012.0.883

Berger, A. N., and Di Patti, E. B. (2006). Capital structure and firm performance: A new approach to testing agency theory and an application to the banking industry. J. Bank. Finance 30 (4), 1065–1102. doi:10.1016/j.jbankfin.2005.05.015

Bergmann, A., Rotzek, J. N., Wetzel, M., and Guenther, E. (2017). Hang the low-hanging fruit even lower-Evidence that energy efficiency matters for corporate financial performance. J. Clean. Prod. 147, 66–74. doi:10.1016/j.jclepro.2017.01.074

Bird, R., D Hall, A., Momentè, F., and Reggiani, F. (2007). What corporate social responsibility activities are valued by the market? J. Bus. Ethics 76 (2), 189–206. doi:10.1007/s10551-006-9268-1

Boadi, E. K., Antwi, S., and Lartey, V. C. (2013). Determinants of profitability of insurance firms in Ghana. Int. J. Acad. Res. Bus. Soc. Sci. 3 (3), 43–50.

Brahmana, R. K., and Kontesa, M. (2021). Does clean technology weaken the environmental impact on the financial performance? Insight from global oil and gas companies. Bus. Strategy Environ. 30, 3411–3423. doi:10.1002/bse.2810

Branco, M. C., and Rodrigues, L. L. (2008). Factors influencing social responsibility disclosure by Portuguese companies. J. Bus. Ethics 83 (4), 685–701. doi:10.1007/s10551-007-9658-z

Brilius, P. (2010). Dynamic model of dependancies between economic crisis and corporate social responsibility contribution to sustainable development. Econ. Manag. 15 (1), 422–429.

Brogi, M., and Lagasio, V. (2019). Environmental, social, and governance and company profitability: Are financial intermediaries different? Corp. Soc. Responsib. Environ. Manag. 26 (3), 576–587. doi:10.1002/csr.1704

Buallay, A. (2019). Sustainability reporting and firm's performance: Comparative study between manufacturing and banking sectors. Int. J. Product. Perform. Manag. 69 (3), 431–445. doi:10.1108/IJPPM-10-2018-0371

Busch, T., and Hoffmann, V. H. (2011). How hot is your bottom line? Linking carbon and financial performance. Bus. Soc. 50 (2), 233–265. doi:10.1177/0007650311398780

Cheng, J., and Liu, Y. (2018). The effects of public attention on the environmental performance of high-polluting firms: Based on big data from web search in China. J. Clean. Prod. 186, 335–341. doi:10.1016/j.jclepro.2018.03.146

Demir, F. (2009). Financialization and manufacturing firm profitability under uncertainty and macroeconomic volatility: Evidence from an emerging market. Rev. Dev. Econ. 13 (4), 592–609. doi:10.1111/j.1467-9361.2009.00522.x

Dixon-Fowler, H. R., Slater, D. J., Johnson, J. L., Ellstrand, A. E., and Romi, A. M. (2013). Beyond "does it pay to be green?" A meta-analysis of moderators of the CEP-CFP relationship. J. Bus. Ethics 112 (2), 353–366. doi:10.1007/s10551-012-1268-8

Duanmu, J. L., Bu, M., and Pittman, R. (2018). Does market competition dampen environmental performance? Evidence from China. Strateg. Manag. J. 39 (11), 3006–3030. doi:10.1002/smj.2948

Duque-Grisales, E., and Aguilera-Caracuel, J. (2021). Environmental, social and governance (ESG) scores and financial performance of multilatinas: Moderating effects of geographic international diversification and financial slack. J. Bus. Ethics 168 (2), 315–334. doi:10.1007/s10551-019-04177-w

Egbunike, C. F., and Okerekeoti, C. U. (2018). Macroeconomic factors, firm characteristics and financial performance. Asian J. Acc. Res. 3 (2), 142–168. doi:10.1108/AJAR-09-2018-0029

Endrikat, J., Guenther, E., and Hoppe, H. (2014). Making sense of conflicting empirical findings: A meta-analytic review of the relationship between corporate environmental and financial performance. Eur. Manag. J. 32 (5), 735–751. doi:10.1016/j.emj.2013.12.004

Friede, G., Busch, T., and Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Finance Invest. 5 (4), 210–233. doi:10.1080/20430795.2015.1118917

Friedman, M. (1970). The social responsibility of business is to increase its profits. New York, NY: New York Times Magazine.

Gallego‐Álvarez, I., García‐Sánchez, I. M., and da Silva Vieira, C. (2014). Climate change and financial performance in times of crisis. Bus. Strategy Environ. 23 (6), 361–374. doi:10.1002/bse.1786

Gangi, F., Daniele, L. M., and Varrone, N. (2020). How do corporate environmental policy and corporate reputation affect risk‐adjusted financial performance? Bus. Strategy Environ. 29 (5), 1975–1991. doi:10.1002/bse.2482

Giannarakis, G., and Theotokas, I. (2011). The effect of financial crisis in corporate social responsibility performance. Int. J. Mark. Stud. 3 (1), 2–10. doi:10.5539/ijms.v3n1p2

Gillan, S. L., Koch, A., and Starks, L. T. (2021). Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Finance 66, 101889. doi:10.1016/j.jcorpfin.2021.101889

Godfrey, P. C. (2005). The relationship between corporate philanthropy and shareholder wealth: A risk management perspective. Acad. Manage. Rev. 30 (4), 777–798. doi:10.5465/amr.2005.18378878

Gómez‐Bezares, F., Przychodzen, W., and Przychodzen, J. (2017). Bridging the gap: How sustainable development can help companies create shareholder value and improve financial performance. Bus. Ethics A Eur. Rev. 26 (1), 1–17. doi:10.1111/beer.12135

Greening, D. W., and Turban, D. B. (2000). Corporate social performance as a competitive advantage in attracting a quality workforce. Bus. Soc. 39 (3), 254–280. doi:10.1177/000765030003900302

Guérin, P., and Suntheim, F. (2021). Firms' environmental performance and the COVID-19 crisis. Econ. Lett. 205, 109956. doi:10.1016/j.econlet.2021.109956

Han, J. J., Kim, H. J., and Yu, J. (2016). Empirical study on relationship between corporate social responsibility and financial performance in Korea. Asian J. sustain. Soc. Responsib. 1 (1), 61–76. doi:10.1186/s41180-016-0002-3

Hart, S. L. (1995). A natural-resource-based view of the firm. Acad. Manage. Rev. 20 (4), 986–1014. doi:10.5465/amr.1995.9512280033

Hirigoyen, G., and Poulain-Rehm, T. (2015). Relationships between corporate social responsibility and financial performance: What is the causality? J. Bus. Manag. 4 (1), 18–43. doi:10.12735/jbm.v4i1p18

Hirsch, S., Schiefer, J., Gschwandtner, A., and Hartmann, M. (2014). The determinants of firm profitability differences in EU food processing. J. Agric. Econ. 65 (3), 703–721. doi:10.1111/1477-9552.12061

Hosny, A. (2017). Political stability, firm characteristics and performance: Evidence from 6, 083 private firms in the Middle East. Rev. Middle East Econ. Finance 13 (1), 1–21. doi:10.1515/rmeef-2017-0005

Ikram, M., Shen, Y., Ferasso, M., and D’Adamo, I. (2021). Intensifying effects of COVID-19 on economic growth, logistics performance, environmental sustainability and quality management: Evidence from asian countries. J. Asia Bus. Stud. 16, 448–471. doi:10.1108/jabs-07-2021-0316

Ikram, M., Zhang, Q., Sroufe, R., and Ferasso, M. (2020). The social dimensions of corporate sustainability: An integrative framework including COVID-19 insights. Sustainability 12 (20), 8747. doi:10.3390/su12208747

Irfan, M., Ikram, M., Ahmad, M., Wu, H., and Hao, Y. (2021). Does temperature matter for COVID-19 transmissibility? Evidence across Pakistani provinces. Environ. Sci. Pollut. Res. 28 (42), 59705–59719. doi:10.1007/s11356-021-14875-6

Issah, M., and Antwi, S. (2017). Role of macroeconomic variables on firms' performance: Evidence from the UK. Cogent Econ. Finance 5 (1), 1405581. doi:10.1080/23322039.2017.1405581

Karaibrahimoglu, Y. Z. (2010). Corporate social responsibility in times of financial crisis. Afr. J. Bus. Manag. 4 (4), 382–389.

Kordsachia, O., Focke, M., and Velte, P. (2021). Do sustainable institutional investors contribute to firms' environmental performance? Empirical evidence from europe. Rev. Manag. Sci. 1-28, 1409–1436. doi:10.1007/s11846-021-00484-7

Lahouel, B. B., Bruna, M. G., and Zaied, Y. B. (2020). The curvilinear relationship between environmental performance and financial performance: An investigation of listed French firms using panel smooth transition model. Financ. Res. Lett. 35, 101455. doi:10.1016/j.frl.2020.101455

Lahouel, B. B., Gaies, B., Zaied, Y. B., and Jahmane, A. (2019). Accounting for endogeneity and the dynamics of corporate social-corporate financial performance relationship. J. Clean. Prod. 230, 352–364. doi:10.1016/j.jclepro.2019.04.377

Lee, S. Y. (2012). Corporate carbon strategies in responding to climate change. Bus. Strategy Environ. 21 (1), 33–48. doi:10.1002/bse.711

Li, D., Cao, C., Zhang, L., Chen, X., Ren, S., and Zhao, Y. (2017). Effects of corporate environmental responsibility on financial performance: The moderating role of government regulation and organizational slack. J. Clean. Prod. 166, 1323–1334. doi:10.1016/j.jclepro.2017.08.129

Lins, K. V., Servaes, H., and Tamayo, A. (2017). Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. J. Finance 72 (4), 1785–1824. doi:10.1111/jofi.12505

Liu, Z. (2020). Unraveling the complex relationship between environmental and financial performance. A multilevel longitudinal analysis. Int. J. Prod. Econ. 219, 328–340. doi:10.1016/j.ijpe.2019.07.005

Long, W., Li, S., Wu, H., and Song, X. (2020). Corporate social responsibility and financial performance: The roles of government intervention and market competition. Corp. Soc. Responsib. Environ. Manag. 27 (2), 525–541. doi:10.1002/csr.1817

Lu, W., and Taylor, M. E. (2016). Which factors moderate the relationship between sustainability performance and financial performance? A meta-analysis study. J. Int. Acc. Res. 15 (1), 1–15. doi:10.2308/jiar-51103

Lucas, M. T., and Noordewier, T. G. (2016). Environmental management practices and firm financial performance: The moderating effect of industry pollution-related factors. Int. J. Prod. Econ. 175, 24–34. doi:10.1016/j.ijpe.2016.02.003

Lucato, W. C., Costa, E. M., and de Oliveira Neto, G. C. (2017). The environmental performance of SMEs in the Brazilian textile industry and the relationship with their financial performance. J. Environ. Manage. 203, 550–556. doi:10.1016/j.jenvman.2017.06.028

Manrique, S., and Martí-Ballester, C. P. (2017). Analyzing the effect of corporate environmental performance on corporate financial performance in developed and developing countries. Sustainability 9 (11), 1957. doi:10.3390/su9111957

Margolis, J. D., Elfenbein, H. A., and Walsh, P. J. P. (2009). Does it pay to be good and does it matter? A meta-analysis of the relationship between corporate social and financial performance. SSRN J., 1, 68. doi:10.2139/ssrn.1866371

Margolis, J. D., and Walsh, J. P. (2003). Misery loves companies: Rethinking social initiatives by business. Adm. Sci. Q. 48 (2), 268–305. doi:10.2307/3556659

Muhammad, N., Scrimgeour, F., Reddy, K., and Abidin, S. (2015). The impact of corporate environmental performance on market risk: The Australian industry case. J. Bus. Ethics 132 (2), 347–362. doi:10.1007/s10551-014-2324-3

Nguyen, Q. T. T., Anh, D. L. T., and Gan, C. (2021). Epidemics and Chinese firms' stock returns: Is COVID-19 different? China Finance Rev. Int. 11 (3), 302–321. doi:10.1108/CFRI-03-2021-0053

Nishitani, K. (2011). An empirical analysis of the effects on firms' economic performance of implementing environmental management systems. Environ. Resour. Econ. (Dordr). 48 (4), 569–586. doi:10.1007/s10640-010-9404-3

Nishitani, K., Jannah, N., Kaneko, S., and Hardinsyah, H. (2017). Does corporate environmental performance enhance financial performance? An empirical study of Indonesian firms. Environ. Dev. 23, 10–21. doi:10.1016/j.envdev.2017.06.003

Njoroge, J. (2009). Effects of the global financial crisis on corporate social responsibility in multinational companies in Kenya. Available at: www.covalence.ch/docs/Kenya-Crisis.pdf.

Nunes, P. M., Viveiros, A., and Serrasqueiro, Z. (2012). Are the determinants of young SME profitability different? Empirical evidence using dynamic estimators. J. Bus. Econ. Manag. 13 (3), 443–470. doi:10.3846/16111699.2011.620148

Okafor, A., Adeleye, B. N., and Adusei, M. (2021). Corporate social responsibility and financial performance: Evidence from US tech firms. J. Clean. Prod. 292, 126078. doi:10.1016/j.jclepro.2021.126078

Okun, A. (1963). “Potential GNP: Its measurement and significance, American statistical association,” in Proceedings of the business and economics statistics section (Alexandria, VA: American Statistical Association), 98–104.

Orlitzky, M., Schmidt, F. L., and Rynes, S. L. (2003). Corporate social and financial performance: A meta-analysis. Organ. Stud. 24 (3), 403–441. doi:10.1177/0170840603024003910

Palmer, K., Oates, W. E., and Portney, P. R. (1995). Tightening environmental standards: The benefit-cost or the no-cost paradigm? J. Econ. Perspect. 9 (4), 119–132. doi:10.1257/jep.9.4.119

Papadopoulos, T., Baltas, K. N., and Balta, M. E. (2020). The use of digital technologies by small and medium enterprises during COVID-19: Implications for theory and practice. Int. J. Inf. Manage. 55, 102192. doi:10.1016/j.ijinfomgt.2020.102192

Pattitoni, P., Petracci, B., and Spisni, M. (2014). Determinants of profitability in the EU-15 area. Appl. Financ. Econ. 24 (11), 763–775. doi:10.1080/09603107.2014.904488

Peloza, J. (2006). Using corporate social responsibility as insurance for financial performance. Calif. Manage. Rev. 48 (2), 52–72. doi:10.2307/41166338

Perry, P. (1992). Hospitals have new options in off-site sterilization services. Mat. Manag. Health Care 14, 25–30.

Pervan, M., Pervan, I., and Ćurak, M. (2019). Determinants of firm profitability in the Croatian manufacturing industry: Evidence from dynamic panel analysis. Econ. Research-Ekonomska Istraz. 32 (1), 968–981. doi:10.1080/1331677x.2019.1583587

Petitjean, M. (2019). Eco-friendly policies and financial performance: Was the financial crisis a game changer for large US companies? Energy Econ. 80, 502–511. doi:10.1016/j.eneco.2019.01.028

Phi, N. T. M., Taghizadeh-Hesary, F., Tu, C. A., Yoshino, N., and Kim, C. J. (2021). Performance differential between private and state-owned enterprises: An analysis of profitability and solvency. Emerg. Mark. Finance Trade 57 (14), 3913–3928. doi:10.1080/1540496x.2020.1809375

Qi, G. Y., Zeng, S. X., Shi, J. J., Meng, X. H., Lin, H., and Yang, Q. X. (2014). Revisiting the relationship between environmental and financial performance in Chinese industry. J. Environ. Manage. 145, 349–356. doi:10.1016/j.jenvman.2014.07.010

Qureshi, M. A., Akbar, M., Akbar, A., and Poulova, P. (2021). Do ESG endeavors assist firms in achieving superior financial performance? A case of 100 best corporate citizens. SAGE Open 11 (2), 215824402110215. doi:10.1177/21582440211021598

Rababah, A., Al‐Haddad, L., Sial, M. S., Chunmei, Z., and Cherian, J. (2020). Analyzing the effects of COVID‐19 Pandemic on the financial performance of Chinese listed companies. J. Public Aff. 20 (4), e2440. doi:10.1002/pa.2440

Rodrigo, P., Duran, I. J., and Arenas, D. (2016). Does it really pay to be good, everywhere? A first step to understand the corporate social and financial performance link in Latin American controversial industries. Bus. Ethics A Eur. Rev. 25 (3), 286–309. doi:10.1111/beer.12119

Santis, P., Albuquerque, A., and Lizarelli, F. (2016). Do sustainable companies have a better financial performance? A study on Brazilian public companies. J. Clean. Prod. 133, 735–745. doi:10.1016/j.jclepro.2016.05.180

Sarkodie, S. A., and Owusu, P. A. (2020). How to apply dynamic panel bootstrap-corrected fixed-effects (xtbcfe) and heterogeneous dynamics (panelhetero). MethodsX 7, 101045. doi:10.1016/j.mex.2020.101045

Selvi, Y., Wagner, E., and Türel, A. (2010). Corporate social responsibility in the time of financial crisis: Evidence from Turkey. Ann. Univ. Apulensis, Ser. Oeconomica. 12 (1), 281–290. doi:10.29302/oeconomica.2010.12.1.28

Shahab, Y., Ntim, C. G., Chengang, Y., Ullah, F., and Fosu, S. (2018). Environmental policy, environmental performance, and financial distress in China: Do top management team characteristics matter? Bus. Strategy Environ. 27 (8), 1635–1652. doi:10.1002/bse.2229

Sharfman, M. P., and Fernando, C. S. (2008). Environmental risk management and the cost of capital. Strateg. Manag. J. 29 (6), 569–592. doi:10.1002/smj.678

Shen, F., Ma, Y., Wang, R., Pan, N., and Meng, Z. (2019). Does environmental performance affect financial performance? Evidence from Chinese listed companies in heavily polluting industries. Qual. Quant. 53 (4), 1941–1958. doi:10.1007/s11135-019-00849-x

Simionescu, L., and Dumitrescu, D. (2014). Corporate social responsibility and financial crisis. J. Public Adm. Finance Law. 1 (1), 31–37.

Simionescu, L. N., and Gherghina, Ă. C. (2014). Corporate social responsibility and corporate performance: Empirical evidence from a panel of the bucharest stock exchange listed companies. Manag. Mark. 9 (4), 439–458.

Stoian, C., and Gilman, M. (2017). Corporate social responsibility that "pays": A strategic approach to CSR for SMEs. J. Small Bus. Manag. 55 (1), 5–31. doi:10.1111/jsbm.12224

Sudha, S. (2020). Corporate environmental performance-financial performance relationship in India using eco-efficiency metrics. Manag. Environ. Qual. 31 (6), 1497–1514. doi:10.1108/MEQ-01-2020-0011

Udayasankar, K. (2008). Corporate social responsibility and firm size. J. Bus. Ethics 83 (2), 167–175. doi:10.1007/s10551-007-9609-8

UNFCCC (2022). United nations framework convention on climate change. Available at: https://unfccc.int/.

Venkatraman, S., and Nayak, R. R. (2015). Relationships among triple bottom line elements. J. Glob. Responsib. 6 (2), 195–214. doi:10.1108/JGR-04-2012-0013

Wang, L., Li, S., and Gao, S. (2014). Do greenhouse gas emissions affect financial performance?-an empirical examination of Australian public firms. Bus. Strategy Environ. 23 (8), 505–519. doi:10.1002/bse.1790

Wang, Z., and Sarkis, J. (2017). Corporate social responsibility governance, outcomes, and financial performance. J. Clean. Prod. 162, 1607–1616. doi:10.1016/j.jclepro.2017.06.142

WGI (2022). Worldwide governance indicators. Available at: http://info.worldbank.org/governance/wgi/.

Wilson, A. (2008). Deepening financial crisis should not derail corporate social responsibility, Special to Kyiv Post. Available at: http://www.kyivpost.com/business/bus_focus/30379.

Wooldridge, J. M. (2003). Cluster-sample methods in applied econometrics. Am. Econ. Rev. 93 (2), 133–138. doi:10.1257/000282803321946930

World Bank (2022). World Bank database. Available at: https://data.worldbank.org/.

WPR (2022). World population review. Available at: https://worldpopulationreview.com/country-rankings/carbon-footprint-by-country.

Yasar, M., Paul, C. J. M., and Ward, M. R. (2011). Property rights institutions and firm performance: A cross-country analysis. World Dev. 39 (4), 648–661. doi:10.1016/j.worlddev.2010.09.009

Zeidan, R., Boechat, C., and Fleury, A. (2015). Developing a sustainability credit score system. J. Bus. Ethics 127 (2), 283–296. doi:10.1007/s10551-013-2034-2

Zhang, D. (2021). How environmental performance affects firms' access to credit: Evidence from EU countries. J. Clean. Prod. 315, 128294. doi:10.1016/j.jclepro.2021.128294

Zhang, Y., Wei, J., Zhu, Y., and George-Ufot, G. (2020). Untangling the relationship between corporate environmental performance and corporate financial performance: The double-edged moderating effects of environmental uncertainty. J. Clean. Prod. 263, 121584. doi:10.1016/j.jclepro.2020.121584

Keywords: climate change, financial performance, environmental performance, ESG, COVID-19

Citation: Kaakeh M and Gokmenoglu KK (2022) Environmental performance and financial performance during COVID-19 outbreak: Insight from Chinese firms. Front. Environ. Sci. 10:975924. doi: 10.3389/fenvs.2022.975924

Received: 22 June 2022; Accepted: 15 August 2022;

Published: 12 September 2022.

Edited by:

Mobeen Ur Rehman, Shaheed Zulfikar Ali Bhutto Institute of Science and Technology (SZABIST), United Arab EmiratesReviewed by:

Muhammad Ikram, Al Akhawayn University, MoroccoRamayah T, Universiti Sains Malaysia (USM), Malaysia

Copyright © 2022 Kaakeh and Gokmenoglu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mohamad Kaakeh, bW9oYW1hZC5rYWFrZWhAZW11LmVkdS50cg==

Mohamad Kaakeh

Mohamad Kaakeh Korhan K. Gokmenoglu2

Korhan K. Gokmenoglu2