- 1School of Accounting, Zibo Vocational Institute, Zibo, China

- 2Department of Business Administration, Honam University, Gwangju, South Korea

- 3College of Business, Gachon University, Seongnam, South Korea

Faced with global environmental problems, such as global warming, enterprises have become important players in environmental protection. By fulfilling their environmental responsibilities, enterprises can create a good external image and gain support from the public and government, thereby increasing the influence of their enterprises. At the same time, the media plays the role of guiding public opinion and supervising the market economy in enterprise development and market economy. Therefore, this study investigates whether the environmental protection measures taken by enterprises have a positive effect on their sustainable development, and how media attention affects the relationship between environmental protection and sustainable development. This study uses the fixed effect regression method to empirically study the data of A share listed companies in China, from 2016 to 2019. The results of the study show that the enterprises’ fulfillment of environmental responsibilities or carbon trading can promote sustainable development. Furthermore, the higher the network or print media attention, the more environmentally responsible behavior and carbon emissions trading can promote sustainable development capabilities of enterprises. This study enriches the understanding of the important role played by environmental protection in driving enterprise sustainability and contributes to the literature by emphasizing the need for media attention about environmental responsibilities and carbon emissions trading.

1 Introduction

In recent years, with global economic development, the problem of environmental pollution and ecological damage has become a common concern, worldwide. To cope with the issue of environmental damage, enterprises, as essential participants in protecting the environment, should increase their investment in environmental protection and actively assume environmental responsibility while developing their economies (Klemke-Pitek and Majchrzak, 2022). With the increasing awareness of environmental protection in China, the participation of enterprises in environmental protection has received significant attention from the government, shareholders, and the public and attracted the attention of investors who seek references for their investment decisions (Siedschlag and Yan, 2021). Therefore, does corporate involvement in environmental protection significantly impact sustainable corporate development?

First, corporate environmental responsibility and economic growth are inextricably linked. If companies do not want to be overwhelmed and eliminated in the fiercely competitive market environment, they should follow the global trend of green development and develop a quality certification system aligned with international standards to regulate and adjust their industrial structure, optimize human resources, improve technological content, reduce resource consumption and environmental pollution, as a responsible enterprise (Ahmed and Streimikiene, 2021). Environmental protection is beneficial for enterprises to improve the utilization rate of enterprise resources, win more market and social resources, establish a good social image, gain competitive advantage, and achieve sustainable development (Wamba, 2022). Taylor et al. (2018) concluded that the fulfillment of environmental responsibility may sacrifice certain economic benefits in the short term, but it guarantees sustainable development in the long term. Corporate fulfillment of environmental responsibility can be seen as a process of absorptive capacity (Gangi et al., 2019; Hadj, 2019), a process of developing specific and rare environmental capabilities that can lead to superior competitive advantage (Veronica et al., 2019). Corporate fulfillment of environmental responsibility is a direct form of positive corporate attitude towards environmental protection issues. Companies willing to take the initiative in environmental responsibility usually have an advantage in achieving sustainable development (Huk and Kurowski, 2021). Graafland (2021) concluded that fulfilling corporate environmental responsibility has become a hard standard from a soft constraint, as social forces from all sides are highly concerned, and active environmental responsibility has become an opportunity and goal for corporate development.

Second, the carbon market has played a positive role in promoting the effect of environmental protection (Schneider and Stephanie, 2018). Establishing a carbon market can effectively improve the emission reduction effect and reduce the marginal cost of emission control enterprises, promoting the goals of enterprises as well as regional economic growth while improving the environment (Dabhi, 2019). Carbon emissions trading is an economical means to solve climate problems based on the market. At present, most countries adopt the full amount trading mode. The basic idea is that the government sets the total carbon emission target to be reduced yearly according to the environmental capacity and allocates or sells allowances to enterprises. Enterprises and investors can buy and sell quotas in the market. Enterprises with actual carbon dioxide emissions lower than the quotas can sell the quotas. Enterprises whose actual emissions exceed the quotas must purchase the quotas of the excess emissions to complete the appointment (Sadawi et al., 2021). Lee and Cho (2021) examined the economic consequences of carbon trading and suggested that the implementation of carbon trading can promote the increase of firm value. Yu (2018) concluded that the implementation of carbon emissions has a significant positive impact on corporate sustainable development, indicating that carbon reduction is beneficial to the ecological environment and corporate sustainability. After enterprises join the carbon emissions trading pilot, strict regulation and verification systems are expected to ensure that the disclosure of enterprise carbon emission information is adequate and more transparent, which is beneficial to the decision making of relevant stakeholders, thus enhancing the sustainability of enterprises (Cherian et al., 2017).

With the rapid development of information technology and the Internet, the role of the media has gained prominence and scholarly studies increasingly focus on the role of the media in the capital market. Media has been shown to play an essential role in monitoring the environmental legality of companies (Abbas et al., 2019), because it can convey timely information about companies to the outside world and allow them to understand the companies better. Diamastuti et al. (2021) believed that the participation of the media in the supervision of enterprises’ environmental behavior promoted enterprises to adopt a positive attitude towards environmental issues. Su et al. (2021) argued that media coverage of environmental issues can make companies take environmental issues more seriously. The media may also visit and deeply investigate the environmental pollution situation of a company compared to the public; thus, when media attention is high, companies face more social pressure to pay more attention to environmental protection. This has expanded the impact of corporate involvement in environmental protection and influenced business operations and development. In contrast, media attention has become a vital force for monitoring companies as an external governance condition that cannot be ignored and has a significant impact on business operations and development (Vliegenthart and van der Meer, 2018).

In recent years, China’s economy has developed rapidly, resulting in damages to the ecological environment (Zhang W et al., 2020). Leading as environmental polluters, enterprises should take responsibility for environmental protection (Nassani et al., 2022). How to protect the environment and, simultaneously, maintain the long-term stable development of enterprises has been the core issue for the future development of Chinese enterprises (Zheng et al., 2022). Therefore, this study analyzes the relationship between corporate participation in environmental protection and sustainable development by combining theoretical analysis and empirical analysis and explores whether media attention can influence the relationship between enterprise environmental protection and corporate sustainable development. Accordingly, this study analyzes the behavior of enterprises participating in environmental protection from two aspects: corporate environmental responsibility and carbon emissions trading. This study enriches the literature on the influence of corporate environmental responsibility and carbon emissions trading on corporate sustainable development and provides a theoretical basis for research in related fields. It also studies the role of media attention in promoting the relationship between environmental protection and corporate sustainability and provides implications for enterprises and government departments.

2 Literature review and hypothesis

2.1 Enterprise environmental protection and sustainable development capability

The theory of environmental economics puts forward that the development of the economy depends on the development of the ecological environment, and the balance and coordination between environment and economy should be grasped. Environmental economics provides an essential theoretical basis for the study of environmental responsibility. Environmental economics emphasizes that while meeting people’s growing material needs, it considers the relationship between economic development and the environment, coordinates the relationship between man and nature, and always takes maintaining ecological balance as the precondition for enterprise development (Felício et al., 2021). Therefore, enterprises need to fulfill their environmental responsibilities in sustainable development. To undertake environmental responsibility, enterprises need to make use of relevant theories in environmental economics, such as the environmental assessment method, environmental cost-benefit analysis, and economic analysis of environmental protection, to make decisions that are beneficial to both enterprises and the environment to achieve a win-win situation between enterprises and environmental protection.

Juríčková et al. (2020) showed that the corporate approach to environmental protection is essential to promote corporate sustainable development. Some scholars consider corporate investment in environmental protection as social investment, and studies have shown that corporate investment in environmental protection improves corporate efficiency and enhances corporate sustainability (Zheng et al., 2022). In the context of the new normal of economic development, studies have found that the positive interaction between corporate environmental responsibility and internal control can promote corporate sustainable development (Yang et al., 2020). Beatriz et al. (2019) identified three elements of sustainable development in management science: innovation, normative, and rational. Innovation-based sustainable development is the concept of eco-efficiency. Eco-innovation is implemented while achieving economic advantage to reduce costs and promote corporate sustainable development by improving resource (material and energy) efficiency and reducing emissions. Corporate fulfillment of environmental responsibility has a positive impact on economic growth and enables firms to enhance economic sustainability (Sumita and Niraj, 2012; Qin et al., 2019). Corporate environmental responsibility is an essential requirement for corporate sustainable development and an effective measure to harmonize economic, social, and environmental development and achieve corporate sustainable development (Gangi et al., 2022). Tsendsuren et al. (2021) argued that corporate fulfillment of environmental responsibility is beneficial to increase corporate competitiveness and gain stakeholders’ support to break through trade and market barriers, thus achieving corporate sustainable development. Enterprises increasingly consider environmental issues as an essential element of strategic management, using it as a driving force to improve the sustainability of enterprises (Anser et al., 2020). Corporate environmental responsibility can enhance corporate value, thus increasing the awareness of potential investors, and enabling them to learn more about the company’s products and practices, including its corporate environmental performance, which can influence corporate sustainable development (Chuang and Huang, 2018; Elmagrhi et al., 2019; Bu et al., 2022).

In summary, corporate environmental responsibility can help companies identify their environmental concerns and contribute to sustainable development. Companies that perform well in implementing their corporate environmental responsibility are better able to achieve sustainable development. Therefore, this study proposes the following hypothesis.

Hypothesis 1. The better the fulfillment of corporate environmental responsibility, the better their corporate sustainable development ability.The idea of emission trading was first proposed by American economist Dales in 1968. The theory of emissions trading refers to administrative leading by the government, the pollution discharge as property rights are assigned to the enterprise, make the property rights can be traded, and establish the market through market configuration function of improving the efficiency of environmental protection and natural resources use efficiency (Dales, 1968). Carbon emissions trading based on the emission trading theory is not only the embodiment of the commercialization of environmental capacity but also the market-oriented form of the emission permit system. Government environmental regulatory agencies can allocate carbon quotas to emission subjects through laws and regulations, and only enterprises with carbon quotas can be allowed to discharge within the specified total amount of emissions. Environmental protection authorities will punish the emissions exceeding the quota (Brouwers et al., 2018). After obtaining the carbon quota, the enterprise makes production and operation decisions according to its total emissions, production scale and allocation of carbon emission rights. If the carbon emission right is saved, it can be sold in the trading market, and the income obtained is essentially compensation for the positive externalities of its environmental protection behaviour. If the use of carbon rights exceeds the quota, it must be purchased, and the cost and expense of the extra expenditure are essentially the cost of the negative externality. Therefore, the essence of emission trading theory is an effective means to control environmental pollution through economic incentives.Zhang Y et al. (2020) found that firms can create additional economic output through carbon emissions trading. Bode (2006) focused on the impact of carbon emissions trading on the European power industry and proposed that the aggregate profit of the power industry increases after being regulated by carbon emissions trading. Luo et al. (2021) used a bootstrap multiple mediated effects analysis method to examine the relationship between carbon trading pilots, firm behavior, and firm competitiveness, to show that carbon trading pilots have a positive impact on firms’ management, trading, and technology behavior. The more firms participate in carbon trading, the greater the mediating effect on firm competitiveness. Oestreich and Tsiakas (2015) found that firms’ access to free allowances can lead to cash inflows, which increase firm value by examining the stock market response to the first and second phases of the EU carbon trading system. Conversely, most firms in carbon trading belong to monopolistic industries, such as electricity, steel, and cement, and pass on the carbon price to the product price. When allowances are not all issued for a fee but still raise the price, firms receive excessive compensation to realize windfall profits (Strojek-Filus and Sulik-Górecka, 2022). Enterprises’ increased investment in carbon emission reduction produces spillover effect. For example, energy-efficient equipment in coal power enterprises can reduce coal consumption and carbon emissions. The reduction in coal consumption can also reduce pollutant emissions, such as sulfur dioxide and waste residue, reducing the overall environmental risk of enterprises (Chen L et al., 2022). As a result, this study proposes hypothesis 2.

Hypothesis 2. Compared with other enterprises, the enterprises involved in carbon emissions trading have stronger sustainable development ability.

2.2 The moderating effect of media attention

The theory of media governance holds that media can effectively reduce information asymmetry through its information dissemination function and exert its corporate governance function through external mechanisms such as the reputation mechanism. The theory analyzes the way that media plays a role in corporate governance through the function of information dissemination and supervision. Media attention, as a restraint and punishment mechanism beyond legal and administrative coercion, has an important impact on the decision-making of senior managers and can promote the realization of shareholder value maximization (Dyck and Zingales, 2004).

The study concluded that media attention includes online and print media attention (Müller, 2022). Online media attention is the company news coverage by online media, including the number of articles published and reprinted by online media related to companies (Zheng et al., 2021). Print media attention includes newspapers and periodicals as the main body of the media system (Jonker et al., 2022). The number of reports is collectively called media attention. Chang et al. (2020) research shows that media reports have a significant positive impact on the total investment and environmental protection investment of listed companies in the pollution industry. The media plays a vital monitoring role and enhances the social responsibility of enterprises. Tavakolifar et al. (2021) show that the increasing attention of the media also increases the possibility of enterprises fulfilling their environmental responsibilities and committing to acting on climate change.

Media coverage and promotion of environmental responsibility reinforce public awareness of environmental protection and behavioral response motives, resulting in different economic rewards for firms with different corporate environmental responsibility performances (Kong et al., 2019). Enterprises with greater media attention have higher visibility, which can improve the awareness of environmental protection and enhance the value of enterprises (Wu et al., 2020). The media may also visit and investigate companies’ environmental pollution compared to the general public; thus, when media attention increases, companies face more social pressure to pay more attention to environmental protection (Graafland, 2021).

In summary, the pressure of media attention on the environmental legitimacy of enterprises may encourage enterprises to focus on environmental protection to improve their sustainable development ability. Therefore, this study proposes the following hypotheses.

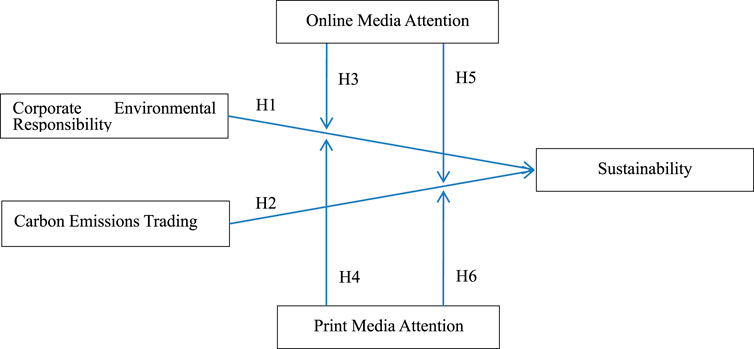

Hypothesis 3. Online media attention plays a positive moderating role in the impact of corporate environmental responsibility on corporate sustainability ability.

Hypothesis 4. Print media attention plays a positive moderating role in the impact of corporate environmental responsibility on corporate sustainability ability.

Hypothesis 5. Online media attention plays a positive moderating role in the impact of carbon emissions trading on corporate sustainability ability.

Hypothesis 6. Print media attention plays a positive moderating role in the impact of carbon emissions trading on corporate sustainability ability.Figure 1 shows the model of this study.

3 Research design

3.1 Data and samples

This study selects Chinese A-share listed companies from 2016 to 2019 as the research object and exclude the following elements from the data, 1) ST, ST*, PT and other non-regularly traded companies; 2) companies in the financial industry; 3) samples with missing data and extreme data abnormalities. The financial, environmental responsibility, carbon emission, list of companies in the carbon emissions trading market, and media attention data in this study are obtained from the CSMAR database and the WIND database; corporate environmental responsibility rating score in Hexun Social Responsibility Assessment System; China Carbon Emission Database (CEADs); manually through the data disclosed by each pilot; and CNRDS database, respectively.

3.2 Definition of the variables

3.2.1 Dependent variable

Corporate sustainable development ability is the ability of a firm to sustain profitability and robust growth in its existing competitive field and future business development environment. Based on this, this study adopts James C. Van Horne’s static model to measure corporate sustainable development ability in terms of the firms’ profitability and competitiveness, following Liao et al. (2022).

3.2.2 Independent variables

In this study, corporate environmental responsibility and implementation of carbon emissions trading are selected as the explanatory variables. Considering Chen Z et al. (2022), this study adopts the corporate environmental responsibility rating score totaling 30 points published by Hexun to measure the performance of enterprises’ environmental responsibility. The higher the score, the better the enterprises are in fulfilling their environmental responsibility and more motivated to undertake it. This is also the current method adopted by many scholars. Meanwhile, drawing lessons from Chen L et al. (2022), whether an enterprise is included in carbon trading is adopted as the carbon trading variable and assigned a value of one if the answer is yes, and 0 otherwise. Based on the manual collection and collation of the list of enterprises included in carbon trading announced by each carbon trading pilot region, the enterprises included in carbon market trading are assigned a value of one b y matching the unified social credit code of each enterprise with the database of listed companies; otherwise, the value is 0.

3.2.3 Moderating variables

In terms of media attention research, Luo et al. (2022) used online media data to measure media attention, and An et al. (2022) used the number of print media reports to measure media attention. The moderating effect of media attention from online and print news data, is studied. MEDIA1 is online media attention and the number of online media reports +1 is considered as the natural logarithm as the study data; MEDIA2 is print media attention and the number of print media reports +1 is considered as the natural logarithm as the study data. +MEDIA1 is online media attention and the natural logarithm of the number of online media reports is considered as the study data; MEDIA2 is print media attention, and the natural logarithm of the number of print media reports +1 is taken as the study data.

3.2.4 Control variables

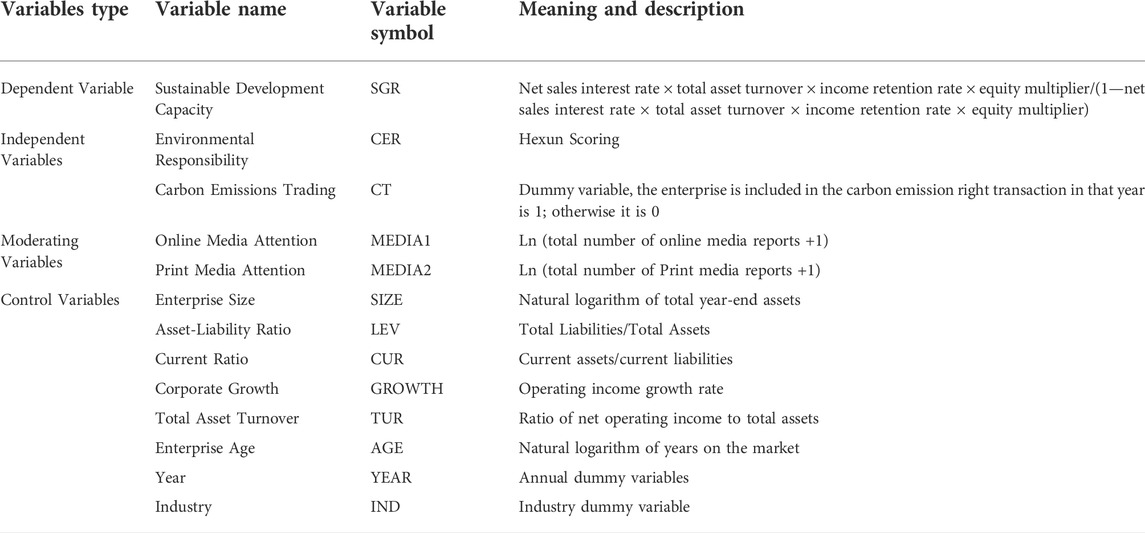

To exclude the interference of other factors on the research results, combined with the Liu et al.’s (2022) findings, the control variables selected in this study are: firm size (SIZE), the gearing ratio (LEV), current ratio (CUR), firm growth (Growth), total asset turnover ratio (TUR), firm age (AGE), year (Year), and industry (Ind), as defined in Table 1.

3.3 The model design

To support hypotheses one and two of this study, i.e., the effect of corporate environmental responsibility and implementation of carbon trading on corporate sustainability, fixed-effects regression models 1) and 2) are constructed.

A positive and significant β1 in model (Eq. 1) indicates that the enterprises that fulfill more environmental responsibility gain more sustainable development ability. A positive and significant β1 in model (Eq. 2) is significant indicates higher sustainable development ability of the enterprises to incorporate carbon emissions trading.

To support hypotheses three to six and the moderating effect of media attention on the relationship between environmental protection and corporate sustainable development ability, we constructed models (Eqs. 3–6).

If β3 in the models (Eqs. 3, 4) is greater than 0 and significant, it indicates that online media attention and print media attention have positive moderating effects on environmental responsibility and corporate sustainable development ability; if β3 in the models (Eqs. 5, 6) is greater than 0 and significant, it indicates that online media attention and print media attention have positive moderating effects on corporate carbon emissions trading and sustainable development ability.

4 Empirical results

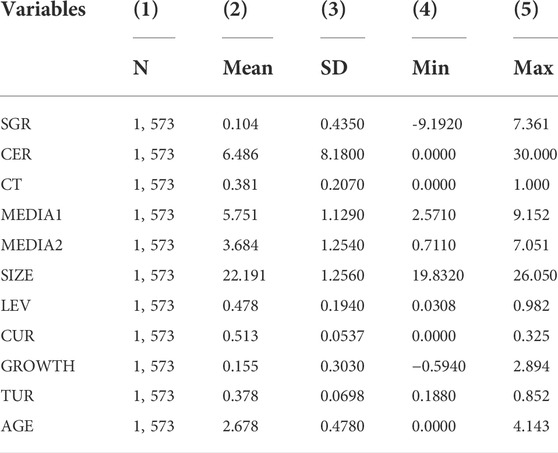

4.1 Descriptive statistics

Table 2 presents a descriptive statistical analysis of each variable. The corporate sustainable development ability (SGR) has a mean value of 0.104 and a standard deviation of 0.435, which indicates that the sample companies’ level of sustainable development ability is generally low and varies widely. The environmental responsibility (CER) has a mean value of 6.486, a maximum value of 30, and a minimum of 0, which implies that variability exists in the environmental responsibility scores among different firms. The carbon emissions trading (CT) has a mean value of 0.381, indicating that fewer firms are included in carbon emissions trading.

4.2 Correlation analysis

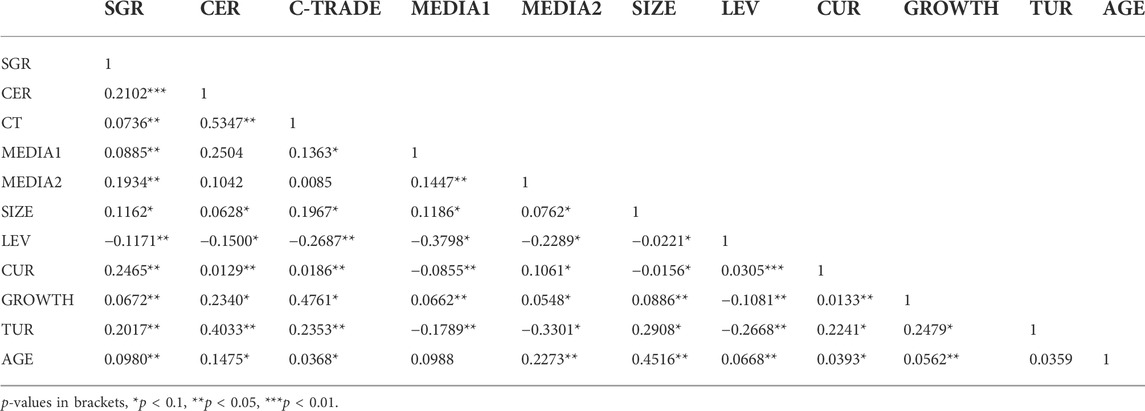

This study uses the Pearson correlation coefficient matrix to analyze the correlation between the models’ dependent and independent variables. Table 3 shows a significant positive correlation between environmental responsibility and corporate sustainable development ability. Similarly, carbon emissions trading, online media attention, and print media attention are significantly and positively correlated with corporate sustainable development ability. Furthermore, the VIF (4.03) of the regression model is less than 10, which implies that the influence of the multicollinearity problem on the main results can be ignored in this study.

4.3 Regression analysis

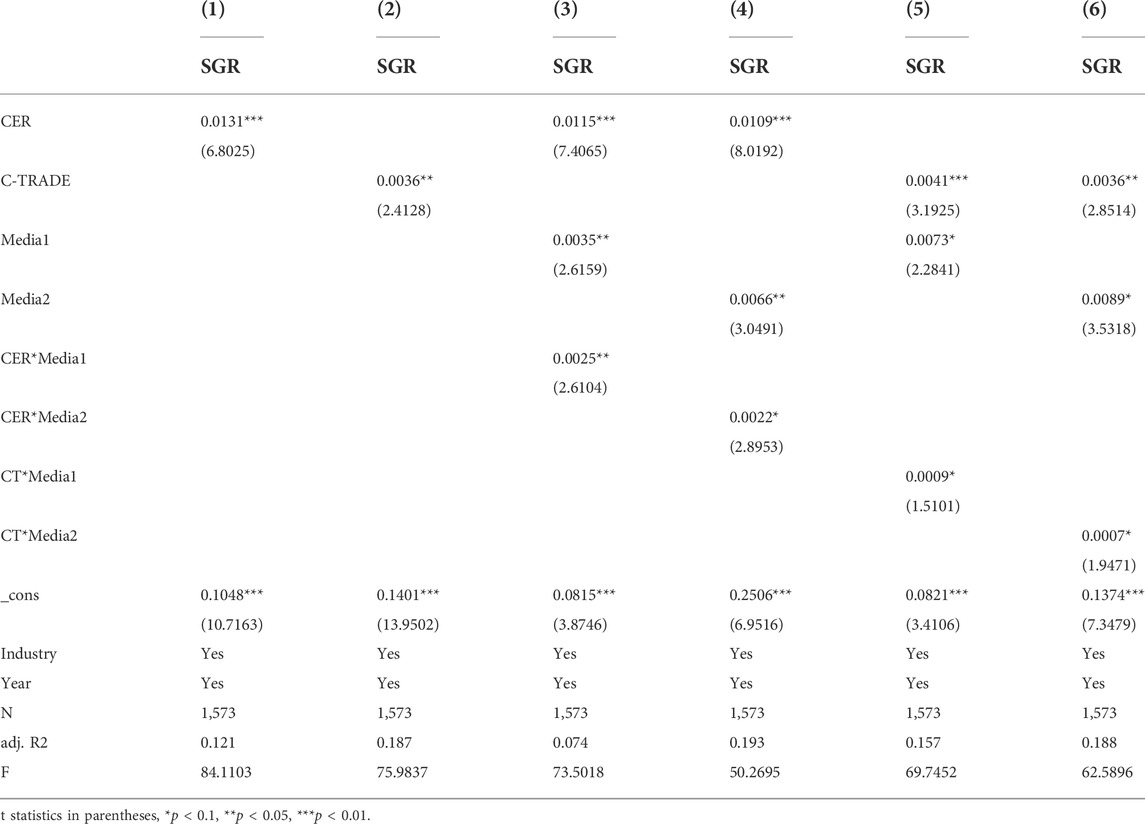

The results of the regression analysis are shown in Table 4. In column (1), environmental responsibility has a significant positive impact on the sustainable development ability of enterprises, therefore hypothesis one is supported. In column (2), the implementation of carbon emissions trading has a significant positive impact on the sustainable development ability of enterprises, thus hypothesis two is supported. This study uses online and print media attention as moderating variables. The interaction term between moderating variables and independent variables is added based on the regression model to test the moderating effect. The results are shown in Table 4. The interaction term coefficient between environmental responsibility and online media attention in column 3) is positive and significant at 5%, supporting hypothesis 3. In column (4), the interaction term coefficient between environmental responsibility and print media attention is positive and significant at 10%, supporting hypothesis 4. In columns 5) and (6), the coefficients of the interaction term between carbon emissions trading and online media attention and the coefficient of the interaction term between carbon emissions trading and print media attention are both greater than 0 and significant at the 10% level; thus, hypotheses five and six are supported. The empirical results show that both online media attention and print media attention have a monitoring effect on enterprises with higher environmental responsibility and those involved in carbon emissions trading, which can strengthen these enterprises’ participation in environmental protection and positively influence their sustainable development ability, forming a virtuous circle.

4.4 Robustness tests

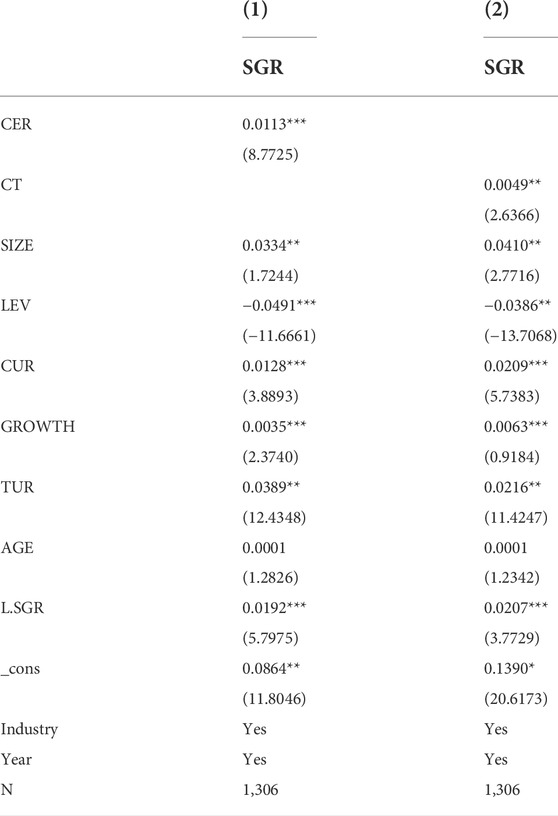

An insignificant endogeneity problem may exist between the dependent variables and independent variables, thus confounding the findings. The regression analysis is conducted again using the GMM method. The final regression results are shown in Table 5, which are consistent with the baseline regression. Thus, the systematic GMM estimates are valid, indicating that the endogeneity problem cannot interfere with the findings of this study.

5 Conclusion and implications

This study takes Chinese A-share listed companies from 2016 to 2019 as the research object. The relationship between enterprises’ participation in environmental protection and corporate sustainable development ability is empirically analyzed based on the fixed effect regression model. Moreover, we analyzed the environmental protection from enterprises’ performance of environmental responsibilities and implementation of carbon emissions trading. Simultaneously, media attention was used as a moderating variable in the study to assess its role in the relationship between environmental protection and corporate sustainability. This study concludes that 1) environmental responsibility positively impacts corporate sustainability, and corporate fulfillment of environmental responsibility can improve corporate sustainable development ability. 2) Carbon emissions trading has a positive impact on enhancing the sustainable development ability of enterprises, and the implementation of carbon emissions trading by enterprises can effectively enhance the enterprise sustainable development ability. 3) Online and print media attention play a positive moderating role in environmental responsibility and carbon emissions trading, influencing the sustainable development ability of enterprises. Companies that receive more attention from online and print media are motivated to actively participate in environmental protection and, thus, improve their sustainable development ability.

Based on the findings of this study, the following implications can be drawn.

1) Listed enterprises should pay attention to fulfilling their environmental responsibilities, reduce energy consumption and pollutant emissions using technological innovation and process upgrading, and gain strategic advantages for sustainable development to achieve win-win economic and environmental benefits. 2) The government and corporate management departments should further improve the system of laws and regulations in environmental protection and carbon emissions trading, refine management tools and reward and punishment mechanisms, and enhance management and law enforcement. At the same time, enterprises should be encouraged to participate in carbon emissions trading and be guided to improve their environmental protection information and carbon information disclosure system to enhance their sustainable development ability and ensure sound economic and social development. 3) The media should pay more attention to enterprises’ fulfillment of environmental protection responsibilities and participation in carbon emissions trading, report on the situation objectively and fairly, play a monitoring function, improve enterprises’ environmental protection awareness, and ultimately achieve sustainable development of enterprises.

Due to the author’s limitations, there are some deficiencies in this study. The study mainly considered the impact of corporate environmental protection on corporate sustainable development ability and the moderating effect of media attention. It is necessary to conduct in-depth research on all aspects of corporate sustainability development in future studies. For example, We will study whether the government supervision and governance structure plays a moderating role in the impact of corporate environmental protection on corporate sustainability ability. According to H1, the better a company fulfills its environmental responsibilities, the better a company’s ability to develop sustainably. Conversely, maybe improved capacity for sustainable development can also lead to better fulfillment of environmental responsibilities. Further verification is required for this.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

Data curation, CQ; Methodology and draft, LW; Review and editing, SJ All authors have read and agreed to the published version of the manuscript.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbas, J., Mahmood, S., Ali, H., Raza, , Ali, , Jaffar, A., et al. (2019). The effects of corporate social responsibility practices and environmental factors through a moderating role of social media marketing on sustainable performance of firms’ operating in multan, Pakistan. Sustainability 11 (12), 3434. doi:10.3390/su11123434

Ahmed, R. R., and Streimikiene, D. (2021). Environmental issues and strategic corporate social responsibility for organizational competitiveness. J. Compet. 13 (2), 5–22. doi:10.7441/joc.2021.02.01

An, Y., Jin, H., Liu, Q., and Zheng, K. (2022). Media attention and agency costs: Evidence from listed companies in China. J. Int. Money Finance 124, 102609. doi:10.1016/J.JIMONFIN.2022.102609

Anser, M. K., Yousaf, Z., Majid, A., and Yasir, M. (2020). Does corporate social responsibility commitment and participation predict environmental and social performance? Corp. Soc. Responsib. Environ. Manag. 27 (1), 2578–2587. doi:10.1002/csr.1977

Beatriz, L., Ndubisi, N. O., and Michel, R. (2019). Sustainable development in Asian manufacturing SMEs: Progress and directions. Int. J. Prod. Econ. 225, 107567. doi:10.1016/j.ijpe.2019.107567

Bode, S. (2006). Multi-period emissions trading in the electricity sector-winners and losers. Energy Policy 34 (6), 680–691. doi:10.1016/j.enpol.2004.06.017

Brouwers, R., Schoubben, F., and Van Hulle, C. (2018). The influence of carbon cost pass through on the link between carbon emission and corporate financial performance in the context of the European Union Emission Trading Scheme. Bus. Strategy Environ. 27 (8), 1422–1436. doi:10.1002/bse.2193

Bu, X., Dang, W., Wang, J., and Liu, Q. (2022). Environmental orientation, green supply chain management, and firm performance: Empirical evidence from Chinese small and medium-sized enterprises. Finance Res. Lett. 48 (8), 102889. doi:10.1016/J.FRL.2022.102889

Chang, Y., He, Y., Jin, X., Li, T., and Shih, C. (2020). Media coverage of environmental pollution and the investment of polluting companies*. Asia Pac. J. Financial Stud. 49 (5), 750–771. doi:10.1111/ajfs.12315

Chen L, L., Liu, S., Liu, X., and Wang, J. (2022). The carbon emissions trading scheme and corporate environmental investments: A quasi-natural experiment from China. Emerg. Mark. Finance Trade 58 (9), 2670–2681. doi:10.1080/1540496X.2021.2009338

Chen Z, Z., Zhou, M., and Ma, C. (2022). Anti-corruption and corporate environmental responsibility: Evidence from China’s anti-corruption campaign. Glob. Environ. Change 72, 102449. doi:10.1016/J.GLOENVCHA.2021.102449

Cherian, J., Jacob, J., and Farouk, S. (2017). A review on carbon trading: New age enterprise for sustainable development and profitability with special reference to UAE. World Review of Science. Technol. Sustain. Dev. 13 (2), 117–132. doi:10.1504/WRSTSD.2017.084172

Chuang, S. P., and Huang, S. J. (2018). The effect of environmental corporate social responsibility on environmental performance and business competitiveness: The mediation of green information technology capital. J. Bus. Ethics 150 (4), 991–1009. doi:10.1007/s10551-016-3167-x

Dabhi, S. (2019). The evolution of carbon markets: Design and diffusion. Glob. Environ. Polit. 19 (1), 131–132. doi:10.1162/glep_r_00492

Diamastuti, E., Muafi, M., and Fitri, A. (2021). The role of corporate governance in the corporate social and environmental responsibility disclosure. J. Asian Finance Econ. Bus. 8 (1), 187–198. doi:10.13106/jafeb.2021.vol8.no1.187

Dyck, A., and Zingales, L. (2004). Private benefits of control: An international comparison. J. Finance 59 (2), 537–600. doi:10.1111/j.1540-6261.2004.00642.x

Elmagrhi, M. H., Ntim, C. G., Elamer, A. A., and Zhang, Q. (2019). A study of environmental policies and regulations, governance structures, and environmental performance: The role of female directors. Bus. Strategy Environ. 28 (1), 206–220. doi:10.1002/bse.2250

Felício, J. A., Rodrigues, R., and Caldeirinha, V. (2021). Green shipping effect on sustainable economy and environmental performance. Sustainability 13 (8), 4256. doi:10.3390/su13084256

Gangi, F., Meles, A., D’Angelo, E., and Daniele, L. M. (2019). Sustainable development and corporate governance in the financial system: Are environmentally friendly banks less risky? Corp. Soc. Responsib. Environ. Manag. 26 (3), 529–547. doi:10.1002/csr.1699

Gangi, F., Mustilli, M., Daniele, L. M., and Coscia, M. (2022). The sustainable development of the aerospace industry: Drivers and impact of corporate environmental responsibility. Bus. Strategy Environ. 31 (1), 218–235. doi:10.1002/bse.2883

Graafland, J., and de Bakker, F. (2021). Crowding in or crowdingout? How non-governmental organizations and media influence intrinsic motivations toward corporate social and environmental responsibility. J. Environ. Plan. Manag. 64 (13), 2386–2409. doi:10.1080/09640568.2021.1873110

Hadj, T. B. (2019). Effects of corporate social responsibility towards stakeholders and environmental management on responsible innovation and competitiveness. J. Clean. Prod. 250, 119490. doi:10.1016/j.jclepro.2019.119490

Huk, K., and Kurowski, M. (2021). The environmental aspect in the concept of corporate social responsibility in the energy industry and sustainable development of the economy. Energies 14 (18), 5993. doi:10.3390/EN14185993

Jonker, H., Vanlee, F., and Ysebaert, W. (2022). Societal impact of University research in the written press: Media attention in the context of SIUR and the open science agenda among social scientists in flanders, Belgium. Scientometrics 2022, 11–18. doi:10.1007/s11192-022-04374-x

Juríčková, Z., Lušňáková, Z., Hallová, M., Horská, E., and Hudáková, M. (2020). Environmental impacts and attitudes of agricultural enterprises for environmental protection and sustainable development. Agriculture 10 (10), 440. doi:10.3390/agriculture10100440

Klemke-Pitek, M., and Majchrzak, M. (2022). Pro-ecological activities and shaping the competitive advantage of small and medium-sized enterprises in the aspect of sustainable energy management. Energies 15 (6), 2192. doi:10.3390/en15062192

Kong, G. W., Kong, D. M., and Wang, M. (2019). Does media attention affect firms’ environmental protection efforts? Evidence from China. Singap. Econ. Rev. 65 (3), 1–24. doi:10.1142/S021759081741003X

Lee, J. H., and Cho, J. H. (2021). Firm-value effects of carbon emissions and carbon disclosures-evidence from Korea. Int. J. Environ. Res. Public Health 18 (22), 12166. doi:10.3390/ijerph182212166

Liao, Y., Qiu, X., Wu, A., Sun, Q., Shen, H., and Li, P. (2022). Assessing the impact of green innovation on corporate sustainable development. Front. Energy Res. 2022 (2), 800848. doi:10.3389/fenrg.2021.8008

Liu, L., Liu, X., Guo, Z., Fan, S., and Li, Y. (2022). An examination of impact of the board of directors’ capital on enterprises’ low-carbon sustainable development. J. Sensors 2022, 7740946. doi:10.1155/2022/7740946

Luo, Y., Li, X., Qi, X., and Zhao, D. (2021). The impact of emission trading schemes on firm competitiveness: Evidence of the mediating effects of firm behaviors from the guangdong ETS. J. Environ. Manag. 290 (5), 112633. doi:10.1016/j.jenvman.2021.112633

Luo, Y., Xiong, G., and Mardani, A. (2022). Environmental information disclosure and corporate innovation: The “Inverted U-shaped” regulating effect of media attention. J. Bus. Res. 146, 453–463. doi:10.1016/J.JBUSRES.2022.03.089

Müller, M. (2022). Spreading the word? European union agencies and social media attention. Gov. Inf. Q. 39 (2), 101682. doi:10.1016/j.giq.2022.101682

Nassani, A. A., Yousaf, Z., Radulescu, M., and Haffar, M. (2022). Environmental performance through environmental resources conservation efforts: Does corporate social responsibility authenticity act as mediator? Sustainability 14 (4), 2330. doi:10.3390/su14042330

Oestreich, A. M., and Tsiakas, I. (2015). Carbon emissions and stock returns: Evidence from the EU emissions trading scheme. J. Bank. Finance 58, 294–308. doi:10.1016/j.jbankfin.2015.05.005

Qin, Y., Harrison, J., and Chen, L. (2019). A framework for the practice of corporate environmental responsibility in China. J. Clean. Prod. 235, 426–452. doi:10.1016/j.jclepro.2019.06.245

Sadawi, A. A., Madani, B., Saboor, S., Ndiaye, M., and Abu-Lebdeh, G. (2021). A comprehensive hierarchical blockchain system for carbon emission trading utilizing blockchain of things and smart contract. Technol. Forecast. Soc. Change 173, 121124. doi:10.1016/j.techfore.2021.121124

Schneider, L., and Stephanie, L. H. T. (2018). Environmental integrity of international carbon market mechanisms under the Paris Agreement. Clim. Policy 19 (3), 386–400. doi:10.1080/14693062.2018.1521332

Siedschlag, I., and Yan, W. (2021). Firms’ green investments: What factors matter? J. Clean. Prod. 310 (7), 127554. doi:10.1016/j.jclepro.2021.127554

Strojek-Filus, M., and Sulik-Górecka, A. (2022). Assesment of the quality of reporting information on CO2 emission rights on the example of energy sector groups listed on the warsaw stock exchange. Manag. Syst. Prod. Eng. 30 (2), 116–129. doi:10.2478/MSPE-2022-0015

Su, W., Guo, C., and Song, X. (2021). Media coverage, environment protection law and environmental research and development: Evidence from the Chinese-listed firms. Environment. Dev. Sustain. 2021 (8), 1–31. doi:10.1007/S10668-021-01735-Z

Sumita, S., and Niraj, K. (2012). Corporate environmental responsibility: Transitional and evolving. Manag. Environ. Qual. Int. J. 23 (6), 640–657. doi:10.1108/14777831211262927

Tavakolifar, M., Omar, A., Lemma, T. T., and Samkin, G. (2021). Media attention and its impact on corporate commitment to climate change action. J. Clean. Prod. 2021, 313. doi:10.1016/J.JCLEPRO.2021.127833

Taylor, J., Vithayathil, J., and Yim, D. (2018). Are corporate social responsibility (CSR) initiatives such as sustainable development and environmental policies value enhancing or window dressing? Corp. Soc. Responsib. Environ. Manag. 25 (5), 971–980. doi:10.1002/csr.1513

Tsendsuren, C., Yadav, P. L., Han, S. H., and Mun, S. (2021). The effect of corporate environmental responsibility and religiosity on corporate cash holding decisions and profitability: Evidence from the United States’ policies for sustainable development. Sustain. Dev. 29 (5), 987–1000. doi:10.1002/sd.2189

Veronica, S., Alexeis, G. P., Valentina, C., and Elisa, G. (2019). Do stakeholder capabilities promote sustainable business innovation in small and medium-sized enterprises? Evidence from Italy. J. Bus. Res. 119, 131–141. doi:10.1016/j.jbusres.2019.06.025

Vliegenthart, R., and van der Meer, T. G. L. A. (2018). The consequences of being on the agenda: The effect of media and public attention on firms’ stock market performance. Communications 43 (1), 5–24. doi:10.1515/commun-2017-0027

Wamba, L. D. (2022). The determinants of environmental performance and its effect on the financial performance of European-listed companies. J. General Manag. 47 (2), 97–110. doi:10.1177/03063070211021050

Wu, W., Liang, Z., and Zhang, Q. (2020). Effects of corporate environmental responsibility strength and concern on innovation performance: The moderating role of firm visibility. Corp. Soc. Responsib. Environ. Manag. 27 (3), 1487–1497. doi:10.1002/csr.1902

Yang, L., Qin, H., Gan, Q., and Su, J. (2020). Internal control quality, enterprise environmental protection investment and finance performance: An empirical study of China’s A-Share heavy pollution industry. Int. J. Environ. Res. Public Health 17 (17), 6082. doi:10.3390/ijerph17176082

Yu, H., and Tsai, B. Y. (2018). Environmental policy and sustainable development: An empirical study on carbon reduction among Chinese enterprises. Corp. Soc. Responsib. Environ. Manag. 25 (5), 1019–1026. doi:10.1002/csr.1499

Zhang W, W., Zhang, X., Zhang, M., and Li, W. (2020). How to coordinate economic, logistics and ecological environment? Evidences from 30 provinces and cities in China. Sustainability 12 (3), 1058. doi:10.3390/su12031058

Zhang Y, Y. J., Liang, T., Jin, Y. L., and Shen, B. (2020). The impact of carbon trading on economic output and carbon emissions reduction in China’s industrial sectors. Appl. Energy 260, 114290. doi:10.1016/j.apenergy.2019.114290

Zheng, J., Khurram, M. U., and Chen, L. (2022). Can green innovation affect ESG ratings and financial performance? Evidence from Chinese GEM listed companies. Sustainability 14 (14), 8677. doi:10.3390/su14148677

Keywords: carbon emissions, environmental responsibility, internet media attention, print media attention, sustainable development

Citation: Wu L, Qing C and Jin S (2022) Environmental protection and sustainable development of enterprises in China: The moderating role of media attention. Front. Environ. Sci. 10:966479. doi: 10.3389/fenvs.2022.966479

Received: 13 June 2022; Accepted: 31 August 2022;

Published: 19 September 2022.

Edited by:

Alex Oriel Godoy, Universidad del Desarrollo, ChileReviewed by:

Kun Woo Yoo, Kyung Hee University, South KoreaMuhammad Usman Khurram, Zhejiang University, China

Choon Kwang Kim, Baekseok University, South Korea

Copyright © 2022 Wu, Qing and Jin. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shanyue Jin, anN5cmVuYTA5MjNAZ2FjaG9uLmFjLmty

Lijuan Wu1

Lijuan Wu1 Chenglin Qing

Chenglin Qing Shanyue Jin

Shanyue Jin