- 1Department of Money, Finance and Public Administration, Alexandru Ioan Cuza University, Iași, Romania

- 2Faculty of Economics and Business Administration, Alexandru Ioan Cuza University of Iasi, Iasi, Romania

- 3Faculty of Physics, Alexandru Ioan Cuza University, Iași, Romania

- 4Doctoral School of Economics and Business Administration, Alexandru Ioan Cuza University of Iasi, Iasi, Romania

Over the last decades, all countries have pursued an ambitious climate policy, thus showing a growing concern about climate change, global warming, greenhouse gas (GHG) emissions, or environmental taxes. Water, air, and soil pollution caused by gas emissions directly affect human health, but also the economies of states. As people’s ability to adapt to novel changes becomes increasingly difficult, globally, they are constantly trying to reduce their greenhouse gas emissions in a variety of ways. Environmental taxes, in general, and energy taxes, in particular, are considered effective tools, being recommended by specialists, among other instruments used in environmental policy. The aim of this research is to assess, empirically, the influence of environmental taxes levels on greenhouse gas emissions in 28 European countries, with a time span between 1995 and 2019. Regarding the empirical research, the proposed methods are related to Autoregressive Distributed Lag (ARDL) models in panel data and also at country level. At panel level, we used the estimation of non-stationary heterogeneous panels and also the dynamic common-correlated effects model with heterogeneous coefficients over cross-sectional units and time periods. The results obtained show that the increase in environmental taxes leads, in most countries, to a decrease in greenhouse gas emissions. To test the robustness of our results, we have included supplementary economic and social control variables in the model, such as gross domestic product (GDP), population density, exports, or imports. Overall, our paper focuses on the role of environmental policy decisions on greenhouse gas emissions, the results of the study showing, in most cases, an inverse impact of the taxation level on the reduction of gas emissions.

Introduction

The interest of people and governments in global warming and climate change has grown in recent years. The increase in temperature on our planet is mainly generated by greenhouse gas (GHG) emissions. The European Union has stated over the years that preventing climate change is one of its top priorities, thus encouraging other countries to adopt this strategy (Trends and Projections in Europe 2021 — European Environment Agency). It has supported, from the outset, the reduction of greenhouse gas emissions by at least 20% until 2020 (compared to 1990) and then 40%–60% until 2040. Also, another strategic goal of the EU is to reduce greenhouse gas emissions by up to 80% until 2050.

The issue of the impact of economic growth on the environment has been discussed at length by a number of economists. Thus, among the first studies that analyzed this topic is The Limits to Growth by (Meadows et al., 1974). Their results showed that the rates of some variables such as population growth, resource use, and pollution level increased depending on the trajectory of the exponential function. Economic growth requires higher energy consumption, and more efficient use of energy requires a higher level of economic growth. Thus, studies (Iwata et al., 2011; Fujii and Managi, 2013) have shown that the energy sector is considered to be the strongest determinant of greenhouse gas (GHG) emissions.

The interest of the world’s population in the risks of climate change has grown since the first decade of the 21st century, following evidence of human influence on the climate system. Currently, European countries face two major dilemmas (Wang et al., 2021), namely economic development and environmental conservation. In Europe, the main industries underlying economic development play an important role in increasing the level of greenhouse gas emissions (Smith et al., 2021; Zhang et al., 2021; Zhao et al., 2021). The current policy of the states of the world is used as a tool in reducing the level of gas emissions. Thus, various taxes are implemented (Shahzad, 2020) in order to reduce the level of pollution. Although the pandemic created both social and economic problems, it also led to the creation of a new commitment by European countries. Thus, the United Nations Framework Convention on Climate Change established the “joint mobilization of $ 100 billion annually starting up 2020 to improve the quality of the environment” (UN Agenda 2030). By implementing traffic restrictions during the pandemic, a “brake” was put on the level of gas emissions. In 2019 there were the highest temperatures ever recorded, and in 2020 there was a 6% decrease in gas emissions. However, as the global economy recovers from the pandemic, gas emissions are expected to increase (Climate Change—United Nations Sustainable Development). We can say that the pandemic played an important role in achieving the goal of SDG 13-Climate Action. Thus, we can consider that the current crisis is an opportunity for a change towards a sustainable economy, which will help all people, as well as the planet. In other words, the various economic and social problems caused by environmental pollution have led European governments to take action. Thus, the concern of officials automatically translates into the desire of researchers to observe the effects of these measures on the economic and social life.

It is known that energy, in addition to providing personal comfort and mobility, is essential to the generation of industrial and commercial prosperity. But energy production and consumption have a negative impact on the environment through greenhouse gas (GHG) emissions, polluting gases, waste generation and oil spills. All these pressures contribute to climate change, damage natural ecosystems and the human environment, and have adverse effects on human health. The main human activity that emits CO2 is the burning of fossil fuels (coal, natural gas and oil) for energy and transport. Our research focuses only on greenhouse gas emissions from electricity generation. The types of fossil fuels used to generate electricity emit different amounts of CO2. Also, many industrial processes use electricity and therefore indirectly result in CO2 emissions. Fossil fuels are still dominant in the fuel mix: around 77% of Europe’s energy needs are met by oil, natural gas and coal. Nuclear energy provides 14%, and the remaining 9% is provided by renewable energy source (Energy-European Environment Agency, 2022).

Changes in CO2 emissions from burning fossil fuels are influenced by many long-term and short-term factors, including population growth, economic growth, changing energy prices, new technologies, changing behavior and seasonal temperatures. Energy was and still is a policy priority and represents a main area of development that was the object of the targets of the Europe 2020 Strategy: 20% of Europe’s energy consumption was to come from renewable energies, and energy efficiency was to increase all the time by 20% (Energy-European Environment Agency, 2022).

There is a consensus, globally, that an increase in greenhouse gas emissions into the atmosphere is causing climate change. To challenge this problem, governments around the world have committed to controlling greenhouse gas emissions. One driver of carbon dioxide emissions is energy production. In this context, the study investigates the extent to which decision makers in different countries can rely on increased energy taxes to reduce pollution as part of environmental policies.

In the present study, the level of energy taxes, measured as total amount of energy tax revenue in millions of euros for all NACE activities plus households, non-residents and not allocated, was taken as an independent variable, in order to test their financial leverage role regarding reducing greenhouse gas emissions within environmental policies. In other words, the purpose of our study is to test the influence of energy taxes imposed at the European level during the period 1995–2019 on greenhouse gas (GHG) emissions. In addition to the independent variable, i.e., energy taxes, several control variables are also identified: imports, exports, population density, and the results of the study show a possible inverse impact of the taxation level on the reduction of gas emissions (GHG).

The methodology is presented in the section titled Data and Methodology, and is based on methods proposed by Blackburne and Frank (2007), Ditzen (2018, 2019). The proposed approaches are applicable on panels in which the number of cross-sectional observations (N) and the number of time-series observations (T) are both large. The methodologies also control the dynamic non-stationary data in panels by using an error correction model with pooling and/or averaging coefficients (for example the PMG estimator relies on a combination of pooling and averaging). The second method supplementary accounts for unobserved heterogeneity across units, and uses instrumental variables in case of endogenous variables. The results in the latter showed some volatility regarding the robustness of interest variable (entax)—a positive association in one model implied, that suggests possible dissimilar impacts at unit level. Further testing on splitted dataset by GDP per capita reveals that impact is differentiated by level of development. Based on previous findings (suspecting diverse effects on different countries), we continued the investigation at country level, using ARDL methodology, that confirmed some positive association in a limited number of countries.

The novelty of the research lies in the fact that the period under analysis is extensive and current (the last year analyzed is 2019), and the recent methodology is applied to a large number of countries (28 developed and emerging European countries). Our study uses latest available data (at Eurostat, June 2022), but the necessity of strongly balanced, needed for the methodologies (calculations of unit root tests and some panel ARDL), conducted to the removal of some years and countries. The gap covered by our study is that the research results demonstrate that increasing energy taxes cannot be generalized as an environmental policy measure to reduce greenhouse gas emissions. The latest methodology used (Ditzen, 2018; Ditzen, 2019; Ditzen, 2021) is also new, and also few encountered in the GHG literature. The suggestion for policymakers in different countries is that they should increasingly focus on promoting and supporting the deployment of green energy sources.

Materials and methods

Literature review

The idea of sustainable development is being promoted in Europe, and EU Member States are committed to meeting the goals of the UN Agenda. However, in the case of this paper, we will consider countries in the EU, as well as non-EU countries. Thus, there is a discussion and dilemma about whether or not to choose to reduce CO2 emissions through taxation. Thus, a paper Lenzen and Dey (2002) indicates that a policy focused on reducing energy consumption and the effect of the evening brings socio-economic benefits that consist in increasing employment and income, but also in reducing imports. These authors use the input-output analysis that allowed the quantification of both direct and indirect effects of spending to be quantified. Thus, the six studies undertaken indicated other areas of expenditure in which energy consumption and greenhouse gas emissions are reduced; increasing the mobilization of the workforce by shifting the final consumption of the current model of an alternative, environmentally motivated substitute. Studies Metcalf (2009) show that increasing concentrations of greenhouse gases in recent years are influencing climate change and global warming over the next hundred years. This is mainly due to the fact that greenhouse gases persist in the atmosphere for hundreds of years and these emission levels will have a significant effect on the atmosphere for centuries to come. Similarly Onofrei et al. (2017), Haites (2018), and Mihalciuc and Grosu (2021) analyzed the same topic.

Śleszyński (2014) analyzed the problems related to the correct definition of environmental taxes. In his paper, four tax groups were addressed: taxes on energy, taxes on means of transport, taxes on air pollution, and taxes on natural resources. The author concluded that it is difficult to introduce adequate tax benefits for people who behave appropriately towards the environment. A study Lapinskienė et al. (2015) analyzed the relationship between greenhouse gases and the main aspects of economic development, based on a data panel of 20 EU member states from 1995–2011. The results of the study showed that higher energy rates, nuclear heat production and the level of development contribute to reducing the level of greenhouse gas emissions. The same author also points out that during the 2008 crisis, greenhouse gas emissions decreased.

Beck et al. (2015) conducted an analysis of the distribution of the tax based on a general equilibrium model, which can estimate the impact of the tax on both expenditures and revenues. They concluded that the carbon tax is “very progressive,” which shows that the incidence of taxes is more on wages and partly on energy prices. A study Lapinskienė et al. (2017) analyzed the relationship between economic growth and greenhouse gas emissions, based on a panel of data from 22 European Union member states. The data analysis period is 1995–2014. Proxy variables included in the study include GDP per capita, GHG (total emissions), energy taxes, energy consumption, etc. The results of the study showed that a number of factors analyzed (energy consumption, energy taxes, R&D taxes) can be applied to adjust the EKC (Environmental Kuznets Curve) trend in the region and to adjust climate change policy. The authors believe that the approximation of the effects on GHGs of economic growth and various external factors can be seen as an instrument that supports a country’s strategic decision. This view is shared by another paper (Lu, 2017) on the situation in Asia. Thus, for the entire sample of 16 Asian countries, there is a short-term two-way causality between energy consumption and greenhouse gas emissions, between GDP and greenhouse gas emissions, and between growth and energy consumption (Borozan, 2019). investigated in his paper the role of energy-related taxes for residential energy consumption in European economies. Thus, he used the panel quantile regression methods for annual data of variables. The results show that an increase in energy taxes and energy prices has a positive effect on the environment, generated by lower energy consumption of households.

Another study Asghar et al. (2020), conducted at the micro level, evaluates sustainable corporate performance based on the areas of financial, social and environmental performance. Financial and economic performance was assessed through financial reports and surveys, and social and environmental performance were quantified by survey questionnaires for seven multi-factor performance domains, based on Weisbord’s six-box model. The study period was 2011–2015, and data were collected from 517 employees in 19 banks in Pakistan. The results of the study show that the total effect of performance (economic, social and environmental) is much stronger than the individual impact on the performance of the sustainable company. This is a clear indication of the mediating role of social performance, but also of the environment for evaluating the performance of the sustainable company and highlights the importance that the social and environmental dimensions have begun to have in recent years. A study Ghazouani et al. (2020) shows that there is a positive and significant impact of the adoption of the carbon tax on stimulating the reduction of carbon emissions. Thus, the propensity score matching method is used for developed EU countries. The results of the study support the hypothesis that environmental tax regulations and technological innovation in European economies help to achieve higher revenues, but also to reduce greenhouse gas emissions. Based on the consensus that export diversification contributes to the development of less developed countries, Mania (2020) investigated the effect of export diversification on CO2 emissions in the context of a Kuznets environmental curve hypothesis in 98 developed and developing countries in the period 1995–2013. Using short-term (Generalized System of Methods) and long-term (Cumulative Average Group) estimation methods, the author finds that the Kuznets environmental curve is valid and that export diversification has a positive effect on CO2 emissions. And a reduction in carbon emissions can be achieved even in a pandemic through policies (Lahcen et al., 2020).

Several recent studies Ghazouani et al. (2021) and Sharma et al. (2021) argue that environmental regulations, taxes, and energy policies can be used as effective tools for achieving a climate without emissions and cleaner energy sources in Europe. And other authors (Adebayo et al., 2021; Rehman et al., 2021) promote the same opinion through their work for Asian countries.

We have been able to observe various opinions that largely support the hypothesis that taxes are a tool to reduce greenhouse gas emissions (Armeanu et al., 2018; Hussain et al., 2022; Wei et al., 2022). But when the goal is economic growth, the price paid can be a decrease in the quality of the environment, in the context in which most economies are still dependent on fossil fuels (Khan, 2021). It also promotes the idea of investing in new, unpolluted technologies (Rokhmawati, 2021). However, in the current period the biggest changes are given by the IT industry. Thus, the most recent opinion of international researchers (Zhao et al., 2021) is that the development of digital finance should be promoted in order to reduce carbon emissions. These authors used balanced panel data at the provincial level in China from 2011 to 2018 to observe the link between digital financing and carbon emissions. The results show that digital financing has a significant inhibitory effect on carbon emissions. Thus, policy formulations should focus on removing barriers to the development of digital finance. Because global carbon is considered to be the main contributor to global warming, global policymakers are pursuing a series of fiscal policies to reduce carbon emissions (Tu et al., 2022). The largest carbon emitter on our planet is China, which is why the government has introduced a number of environmental regulations. These include the introduction of the environmental protection tax and the emissions trading system in order to reduce carbon emissions and improve the quality of the environment. Desiring to conduct an analysis of the effect of the carbon tax on the economic environment, the authors developed a general equilibrium stochastic system structured in four departments: households, enterprises, government and the environment. The results of the analysis showed that, as a result of the introduction of the carbon tax, the level of environmental quality has improved considerably and the other economic variables have been significantly reduced. Thus, improving environmental efficiency in the emissions sector leads to sustainable environmental development, but to the detriment of economic development (Apetri and Mihalciuc, 2019; Brodny and Tutak, 2020; Li et al., 2022). Out of a desire to address these issues caused by climate change and global warming, policymakers around the world have focused on adopting carbon-based tax reduction policies. In 2008, British Columbia implemented a carbon tax for the first time and by 2012, the tax had reached a level of $ 30/tCO2, managing to cover three-quarters of all greenhouse gas emissions in the province. Therefore, a study Murray and Rivers (2015) analyzed the effect of tax on emissions with evening effect, economy and revenue. The results showed that the implementation of the tax led to a decrease of 5%–15%. The models also showed that the tax had negligible effects on economic performance. Despite the fact that the public initially opposed the implementation of this tax, it is now fully supported.

Carattini et al. (2015) investigated the reasons why individuals and some states adopt or accept behaviors and policies to reduce emissions, despite climate change. Although the vast majority of governments avoid engaging in coordinated international policies, various individual local and environmental actions, such behaviors have become increasingly available lately. The authors believe that trust and social values can help reduce these problems. Henseler et al. (2020) analyzed the implementation of the nitrogen tax. The results of the study showed that the implementation of this tax is more economically efficient than the option to withdraw it from the agricultural circuit. Despite this, differences in effectiveness and efficiency require an adjustment of the nitrogen tax rate to achieve the desired level of reduction.

A number of authors Burtraw et al. (2003), Cox et al. (2018), and McLaren (2020) have analyzed the problem of eliminating greenhouse gases. This is not just a theoretical issue, raising a number of important questions for politics, governance and finance. Similarly, Bispo et al. (2017) analyzed the problem. Agriculture is an important source of greenhouse gases, which demonstrates its contribution to global warming. Stetter and Sauer (2022) analyzed whether GHGs can be attenuated at the micro level. The authors analyzed a number of farms, regarding the ratio of emissions dynamics to performance. Data were processed for the period 2005–2014, including Bavarian farms in the sample. The results of the study showed that the performance of micro emissions improved over time.

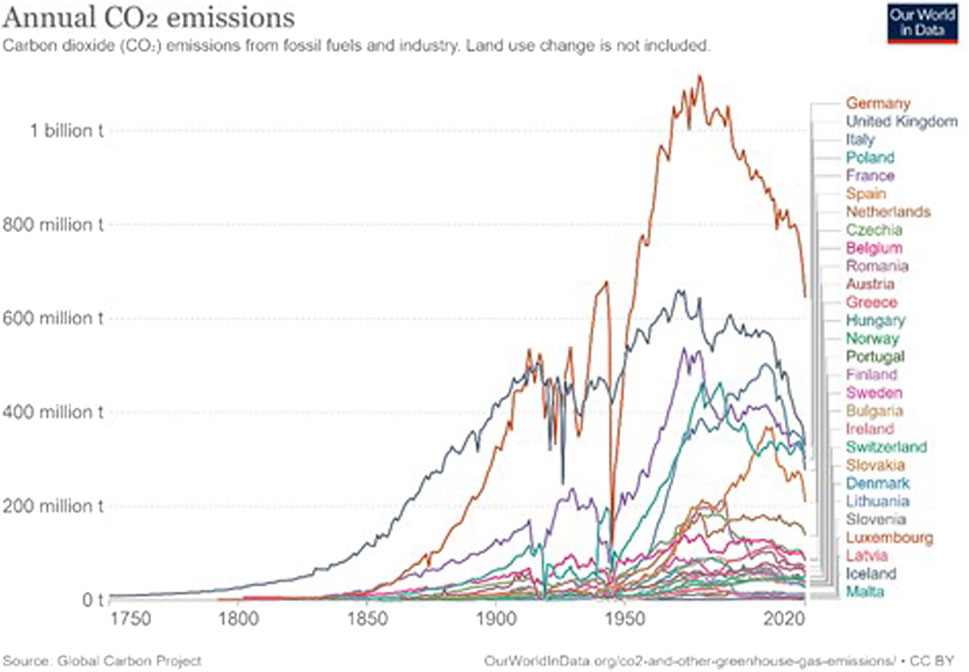

Other authors Cooper (2009) analyzed the proposal to implement a common tax for all global greenhouse gas emissions. Similarly, Kotnik et al. (2014) analyzed the governmental effect of environmental taxes on greenhouse gases, using data from 19 EU member states. The results of the study showed that the effect of taxes on GHG emissions is negative. Emissions and removal of CO2 through natural processes should balance, without anthropogenic impacts. Since the Industrial Revolution, starting around 1750, human activities have contributed substantially to climate change by adding CO2 and other heat-trapping gases, namely greenhouse gases, to the atmosphere. In Europe, the peak of energy consumption occurred in 2006; in 2010, energy consumption was reduced by approximately 4%, a decrease partially explained by the economic crisis of that period (Energy—European Environment Agency). These aspects can also be analyzed based on Figure 1.

FIGURE 1. Evolution of CO2 emissions for the countries included in the sample in the period 1750–2020. Own processing after Global Carbon Project (Ritchie et al., 2020).

It can be observed that in the year 2020, the decrease in CO2 emissions from the burning of fossil fuels corresponded to a decrease in energy consumption as a result of the decrease in economic activity, production and travel, in response to the coronavirus pandemic (US EPA, 2015).

Another study Morley (2012) that analyzed EU member states and Norway found that there is a significant negative impact between environmental taxes and pollution, but not between environmental taxes and energy consumption. The results of the research suggest that the countless exemptions for energy-consuming sectors have had only a limited effect. Thus, the policy promoted by these states does not have direct effects in reducing the level of pollution, but rather pollution is reduced through cleaner technologies. The impact of fiscal instruments on environmental degradation is a research topic that has been analyzed from various approaches.

According to a study by Lacko and Hajduová (2018) higher taxes do not have a positive impact on environmental efficiency or the performance of EU countries. The researchers of this paper used two DEA models—CCR and BCC—and the efficiency was verified by a double bootstrap procedure. Thus, the results show that the efficiency of the environment does not necessarily depend on the classic variables existing on EUROSTAT. Indices such as environmental taxes, waste management, resource productivity and freight management should also be taken into account in policies. Therefore, there are other factors that influence climate change, including changes in technology. These researchers also argue that less environmentally efficient countries should develop their own policies to mitigate the impact of climate change. This view is shared by other papers (Apergis et al., 2018; Johansen et al., 2018) also from 2018.

Zioło et al. (2020) consider that among the most important challenges facing governments today are climate change and environmental pollution. Given that environmental risks are associated with specific costs and expenses, in order to mitigate their negative effects, the financial system has a particularly important role to play, as it creates the necessary instruments that allocate and redistribute public resources. The impact on market participants is materialized in the obligation to pay environmental taxes. The authors analyzed the link between public spending and environmental protection. The analysis period is 2008–2017, focusing on the economies of Central and Eastern Europe and the most developed economies in Western Europe. The results of the study demonstrate the existence of a strong relationship between fiscal instruments and greenhouse gas emissions, in the sense that they lead to improved environmental quality. The author pointed out that, in terms of environmental taxes, their impact varied from country to country, their implementation being particularly useful in countries with higher greenhouse gas emissions, whereas in countries with lower emissions, the impact was insignificant.

In a 1996–2016 study of OECD countries, using the ARDL model, a group of authors (He et al., 2021) demonstrate that the introduction of energy taxes improves energy efficiency only in the short term and not for all sampled countries.

Related to the Research Hypotheses we want to demonstrate that there is an inverse relation between identified variables: energy taxes and greenhouse gas emissions. In this case, the null hypothesis is that.

H0: There is no influence of the level of energy taxes on greenhouse gas emissions, meaning that the coefficient of the variable (enTAX) is not statistically significant (p-value is above 0.1, at 10% level) or in other words, that the coefficient can have zero (0) value. If the coefficient value is negative and statistically significant (the p-value is below 0.1 and the sign is minus), the conclusion is that there is an inverse influence of the energy taxes (enTAX) and greenhouse gas emissions (GHGEbss).

We have primarily analyzed the effect of entax to GHG using panel ARDL (Blackburne and Frank, 2007). The results are stable and statistically significant, suggesting the decreasing of the dependent variable (on long—run) when increasing the energy taxes. In a second phase, we have changed the methodology to control for common correlated effects, using a more actual and newest method (Ditzen, 2018; Ditzen, 2019; Ditzen, 2021). The results are volatile (in one model) regarding the control variable. In this stage, we have suspected different impact in different countries, so we have sliced the dataset in two (using GDP per capita) to further control and improve the robustness. The new set of results shows that the effect is different on types of countries (developed or developing), being in line with other cited studies. Based on previous findings (volatility of some methodologies and different results in sliced data), in a final stage, we have used simple/individual ARDL methodology to analyze the impact at country level. The results confirm that there are different effects by countries, which is also in line with studies that we have cited. The main conclusion is that taxes used as instruments to combat GHG are not enough to combat GHG emissions, further leverages (expand the green technologies, use public subsidies to finance them and so on) are needed.

Data and methodology

The study on the effects of energy taxes level on greenhouse gas emissions (GHGEbss) under environmental policy measures, in the period 1995–2019, extracting from the total population represented by the states of the world only 28 European countries (Austria, Belgium, Bulgaria, Switzerland, the Czeck Republic, Germany, Denmark, Greece, Spain, Finland, France, Hungary, Ireland, Iceland, Italy, Lithuania, Luxembourg, Latvia, Malta, Netherlands, Norway, Poland, Portugal, Romania, Sweden, Slovenia, Slovakia, the United Kingdom). The sample was limited to this number depending on the availability of data collected from the EUROSTAT database.

The data analysis methods used refer to the estimation of non-stationary heterogeneous panels (Blackburne and Frank, 2007) and furthermore (for robust results) the dynamic model of common effects correlated with heterogeneous coefficients on cross-sectional units and time periods (Ditzen, 2018; Ditzen, 2019; Ditzen, 2021). To test the validity of our findings, we added additional economic and social control variables to the model, such as gross domestic product (GDP), population density, imports, and exports.

Data description

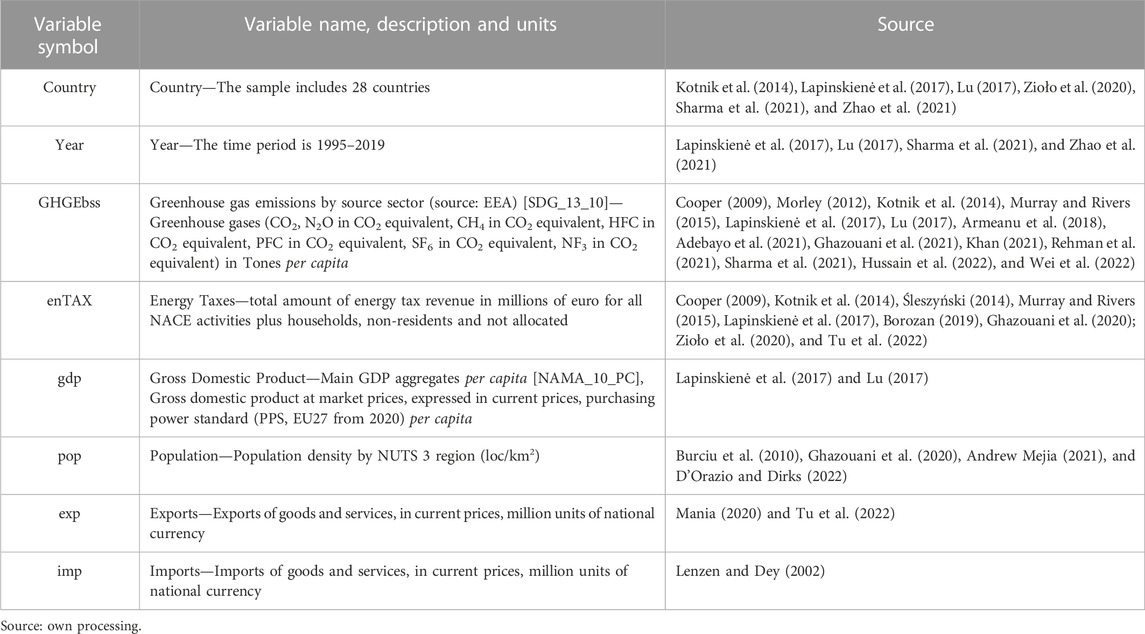

The identified variables, their description, but also the sources of other studies performed that took into account the variables identified in our study are presented in Table 1.

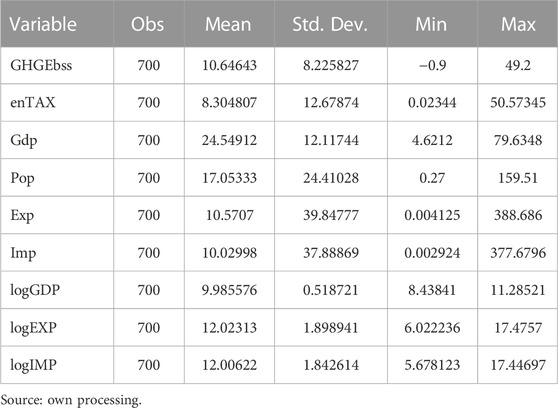

After preliminary data processing, the summary of descriptive statistics is presented in Table 2.

The dataset has 700 observations, with a time length of 25 years, between 1995 and 2019. The unit panel refers to 28 countries from the European Union. The dependent interest variable GHGEbss has an average mean of 10.65, and the independent interest variable is enTAX, which has an average mean of 8.30.

The panel data statistics are presented in Supplementary Appendix Table SA1. There is enough variability in data to consider panel models (different fixed or random effects for countries). As visual representation, the boxplot Supplementary Appendix Figure SA1 enforces the previous conclusion.

The results are in line with graphical analysis (see Supplementary Appendix Figure SA2), which confirm that in developed countries (Germany, France, Netherlands, United Kingdom) there is a clear negative inverse relation, while in some countries (Island or Finland for example) there is no visual impact of the energy environmental taxes on greenhouse gas emissions (GHGEbss).

The inverse relationship can be visually identified as in Supplementary Appendix Figure SA3 [using geopandas python package (Jordahl et al., 2020)], showing that, usually, in countries with higher levels of taxes (right blue chart) there are reduced correspondent levels of greenhouse gas emissions (left orange chart).

Methodology

The methodology is related to our data, which is panel type. The general pooled Ordinary Least Squares (OLS), presented in Eq. 1, is generally not usable in panel data, as it does not account for differences in individual means related to country specifics, as in our case. The panel data general model, which pulls out, for instance the fixed effects (

Another problem related to the linear regression model is that it requires variables X and Y to be stationary in covariance. The presence of non-stationarity in the data needs to be checked, so the choice of methodology is related to the fact that in time series and panel data, variables are usually co-integrated. The presence of cointegration between variables forces us to choose an error-correction model (ECM), which is stationary. To test the stationarity in the panels, we used a variety of tests (for unit roots) in the panel dataset (Harris and Tzavalis, 1999; Hadri, 2000; Choi, 2001; Levin et al., 2002; Im et al., 2003; Breitung and Das, 2005). Most of the tests have the null Hypothesis

At country level (when no panel data is used) the following ARDL model is used (see Pesaran et al., 2001; Hassler and Wolters, 2006; Kripfganz and Schneider, 2016; Kripfganz and Schneider, 2020) as in (3,3’).

For panel data, we used the PMG estimator (Pesaran et al., 1999; Blackburne and Frank, 2007; Chudik and Pesaran, 2015), assuming an autoregressive distributive lag (ARDL), as in (3). Considering that the variables in (4) are, stationary in first-difference I (1) and cointegrated, then the error term is an I (0) process for all i. Furthermore, this implies an error correction model in which the short-run dynamics of the variables in the system are influenced by the deviation from equilibrium [as in (5)].

where:

i = 1, 2, ..., N is the number of groups; t = 1, 2, …, T is the number of periods; X is a k × 1 vector of explanatory variables;

To further control for dynamic common-correlated effects the methodology proposed by J. Ditzen is used (as in Ditzen, 2018; Ditzen, 2019; Ditzen, 2021). In a dynamic panel [as in (5)], where the idiosyncratic errors are cross-sectionally weakly dependent, the lagged dependent variable is no longer strictly exogenous. The estimator is consistent if

where

The pooled mean group (PMG) estimator is an intermediate between “pure” pooled (homogenous coefficients) and MG (heterogeneous coefficients), the assumption being that “regressors have a homogeneous long-run effect and a heterogeneous short-run effect on the dependent variable,” as in the previous methodology. Dynamic models allow the estimation of the long-term. The equation is transformed in an error-correction model (ECM), as in (9), also noted in tables from section Robustness tests of our results as “ec”.

The initial empirical results (based on ECM, no cross-sectionally corrected) and the robustness test (sectionally—corrected estimates) are presented as follows.

Results and discussion

Preliminary tests

The correlation matrix in Supplementary Appendix Table SA2 suggests an inverse relation between our interest variables: environmental taxes and greenhouse gas emissions (GHGEbss), as expected. We found that there is a higher correlation between imports and exports (.9969), so the series will be interchanged using them as control (variables). The correlation between imports and exports shown in Supplementary Appendix Table SA3, and the necessity to use them separately in models, is confirmed by the variance inflation factor table below (an accepted value is under 5, when two variables are concomitantly used, the variance is inflated—the value is 92.96).

The results for unit root tests Levin-Lin-Chu, Im-Pesaran-Shin, Harris-Tzavalis, Breitung, Hadri Lagrange multiplier stationarity test regarding the dependent variable—greenhouse gas emissions (GHGbss)—are presented in Supplementary Appendix Table SA4. The null hypothesis for Levin-Lin-Chu is Ho: Panels contain unit roots, for Im-Pesaran-Shin is H0: All panels contain unit roots, for Harris-Tzavalis is H0: Panels contain unit roots, for Breitung is H0: Panels contain unit roots, for Hadri Lagrange multiplier stationarity test is H0: All panels are stationary.

For the variable GHGEbss in levels, all five of the unit root tests mentioned above suggest that the variable is not stationary in levels (adjusted t* statistic: 0.3207, p-value: 0.6258; Zt-tilde-bar: 4.5822, p-value: 1.0000; z statistic: 2.4333, p-value: 0.9925; lambda: 3.1747, p-value: 0.9993), z: 57.4943, p-value: 0.0000). For the variable in first-difference d.GHGEbss, all five of the unit root tests mentioned above suggest that the variable is stationary in first-difference (adjusted t* statistic: −8.9126; p-value: 0.0000, Zt-tilde-bar: −13.7223, p-value: 0.0000; z statistic: −39.9634, p-value: 0.0000), lambda: −9.9048, p-value: 0.0000; z: −0.9760, p-value: 0.8355).

For the other variables, the results also suggest non-stationarity in levels, but are stationary in first-difference, so a first-difference model is necessary (the full explanations are available on demand).

The results for tests Kao, Pedroni, Westerlund are presented in the following. The null hypothesis for Kao, Pedroni, Westerlund, is H0: No cointegration with some alternative hypothesis. The alternative hypothesis of the Kao and the Pedroni tests is H1: the variables are cointegrated in all panels. In the Westerlund test, the alternative hypothesis is that the variables are cointegrated in some of the panels.

The cointegration tests results between greenhouse gas emissions and environmental taxes are presented in Supplementary Appendix Table SA5.

The statistics for Kao (cointegration) test, regarding the co-integration between GHGEbss and enTAX (Modified Dickey-Fuller t, Dickey-Fuller t, Augmented Dickey-Fuller t, Unadjusted modified Dickey Fuller t, Unadjusted Dickey-Fuller t) are: 2.6917, 2.8630, 3.2710, 1.4777, 1.4734, with the following p-values: 2.6917, 2.8630, 3.2710, 1.4777, 1.4734. Based on the above statistics and p-values (statistically representative at 5% level), we can conclude that the variables are cointegrated in accordance with three tests.

In conclusion, regarding the statistics for all the tests, we found that in five of ten, at 5% level, and seven of ten at 10% level, the null hypothesis could be rejected, so the alternative can be considered (Ha: All panels are cointegrated).

The other statistics (available on demand) also suggest cointegration between variables implied.

The existence of cointegration between variables, corroborated with non-stationarity in levels concludes the necessity of using error-correction models (ECM).

Pooled mean group—PMG models

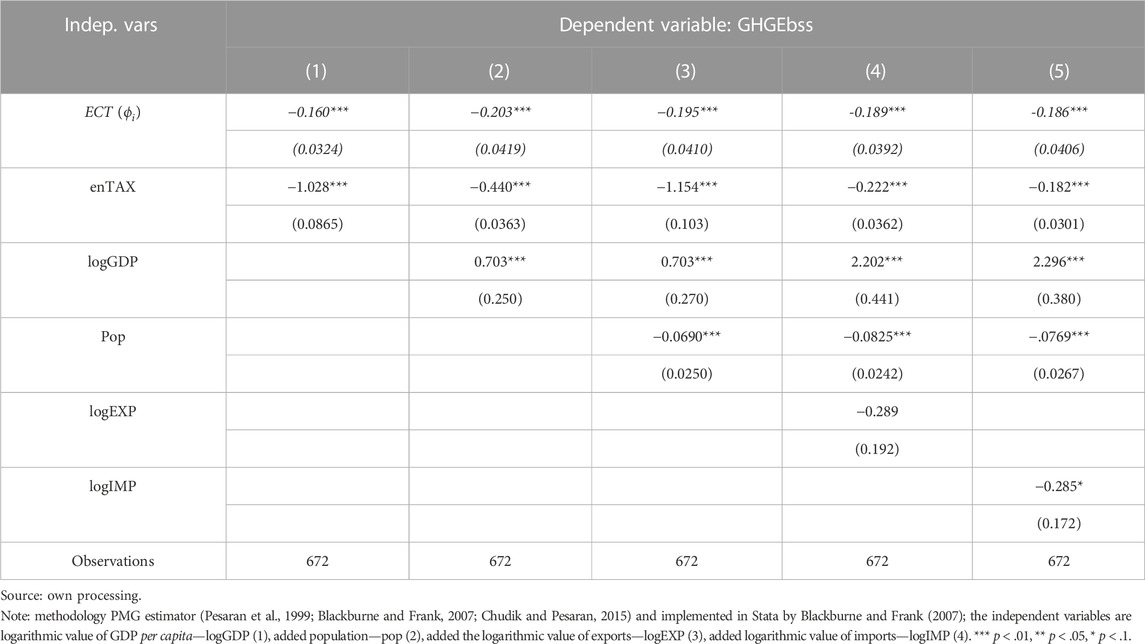

The results for the long - run coefficients (

The independent variables, noted as

In the long run, the relationship between the variables enTAX, GDP, imp and GHGEbss is as expected. The error-correction term (ECT) is negative and statistically significant at 1% level, showing the expected cointegration in considered variables, for all of the models implied. The statistical interpretation is that on every unit of time, the short-run relationship is corrected by 0.16 units. For the other models (2–4) the correction is 0.203, 0.195, 0.189, and 0.186 for achieving long-run cointegration.

The statistical interpretation, for example for enTAX, is that a unit change in environmental energy taxes is associated with a 1.028 (0.44, −1.154, 0.222, and 0.182 in other models) decrease in greenhouse gas emissions in the long-run, at the 1% significance level, on average ceteris paribus. In this case, greenhouse gas emissions and energy (environmental) taxes display an inelastic inverse relationship.

The interpretation of the coefficients is the same for all other variables implied, a negative sign having an inverse effect on dependent variable, while a positive one has a direct (growing) impact. The short-run coefficients have the same logic, the table results being available in the Supplementary Appendix.

Our results are confirmed by other studies (Dietz and Rosa, 1997; Ghazouani et al., 2020; Zioło et al., 2020; Adebayo et al., 2021; Andrew Mejia, 2021; D’Orazio and Dirks, 2022; Tu et al., 2022), in the sense that an increase in energy taxes and imports leads to a decrease in greenhouse gas emissions (GHG), while an increase in GDP has a negative effect on the quality of the environment. On the other hand, in the long run, the same cannot be said about population density and increasing exports, in the sense that an increase in them leads to a decrease in greenhouse gas emissions and not to an increase in them, as we would have expected. Thus, a study Tu et al. (2022) shows, by using a dynamic stochastic general equilibrium model, that once carbon taxes were introduced, the level of carbon emissions fell by 45% in China and the quality of the environment improved by 1.63 units, but with a decrease in production of 46%. The same positive effect of environmental taxes on improving the quality of the environment is confirmed by our study of European countries. In a grouping of developed and emerging countries in Europe, using the analysis of the main components, the results showed a positive relationship between rising energy taxes and environmental quality in developed countries (Germany is central) and a less significant relationship in emerging countries for 2008–2017 (Zioło et al., 2020). Studies show that since the introduction of the carbon tax in 2008 in British Columbia, greenhouse gas emissions have fallen by between 5% and 17% (Murray and Rivers, 2015). The results of the first model show that population density leads to a decrease in greenhouse gas emissions, on average, at the level of the analyzed sample. This can be explained by the fact that an increase in population does not necessarily translate into an increase in labor that will drive production, and has a negative long-term influence on the environment, at the level of the sample analyzed. Following the processing carried out, if we look at the influence of exports on the environment, we see that they lead to a decrease in greenhouse gas emissions, a result that can be explained by the fact that an increase in exports is not always generated by an increase in production, but the fact that much of the domestic production is destined for export. The balance of payments, which is in deficit (Balance of payment statistics, 2022), must also be taken into account, which means that imports are higher than exports. It should be noted that the sampled Central and Eastern European countries have an average of non-EU imports, especially from China, higher than the average of EU imports (China Imports - May 2022 Data—1981–2021 Historical—June Forecast—Calendar). In addition, the transport of imported goods is carried out rather by sea and, to a lesser extent, by land. Under these conditions, the results of the processing carried out also show that the influence of imports on the environment, at the level of the analyzed sample, is a positive one, in the sense that the greenhouse gas emissions decrease on average.

Testing the robustness of our findings

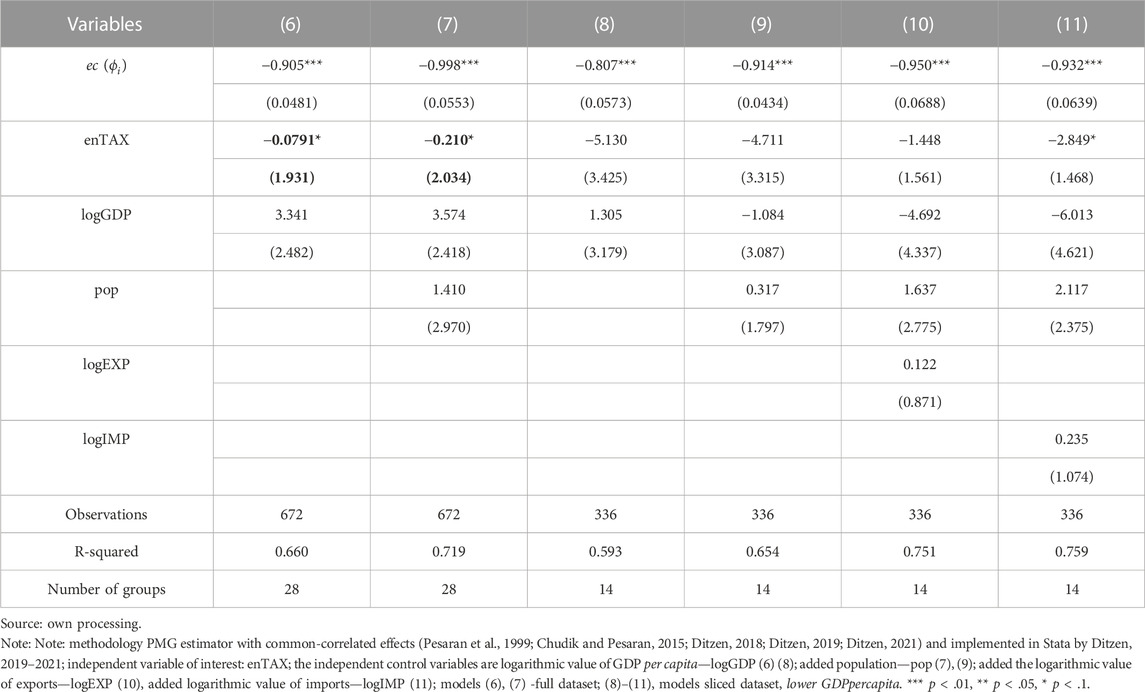

We further control for common-correlated effects by using the methodology proposed by J. Ditzen [as in (Ditzen, 2018; Ditzen, 2019; Ditzen, 2021)]. We control for interferences between countries, and also the situation when independent variables especially GDP, enTAX and pop are not considered as exogenous. Another advantage of the second methodology is that latest variables are instrumented by own first lags and in case of enTAX also by the first lag of logGDP (because higher GDP can lead to higher GHGbss, but also to higher taxes (enTAX)). As in table no. 3, every column noted from 6 to 11, represents a model with different independent variables considered.

In order to test the robustness of the pervious results, we have sliced the data into different data sets, using as criteria the sorted GDP per capita in 2019 (Supplementary Appendix Table SA6). The descriptive statistics are available on demand.

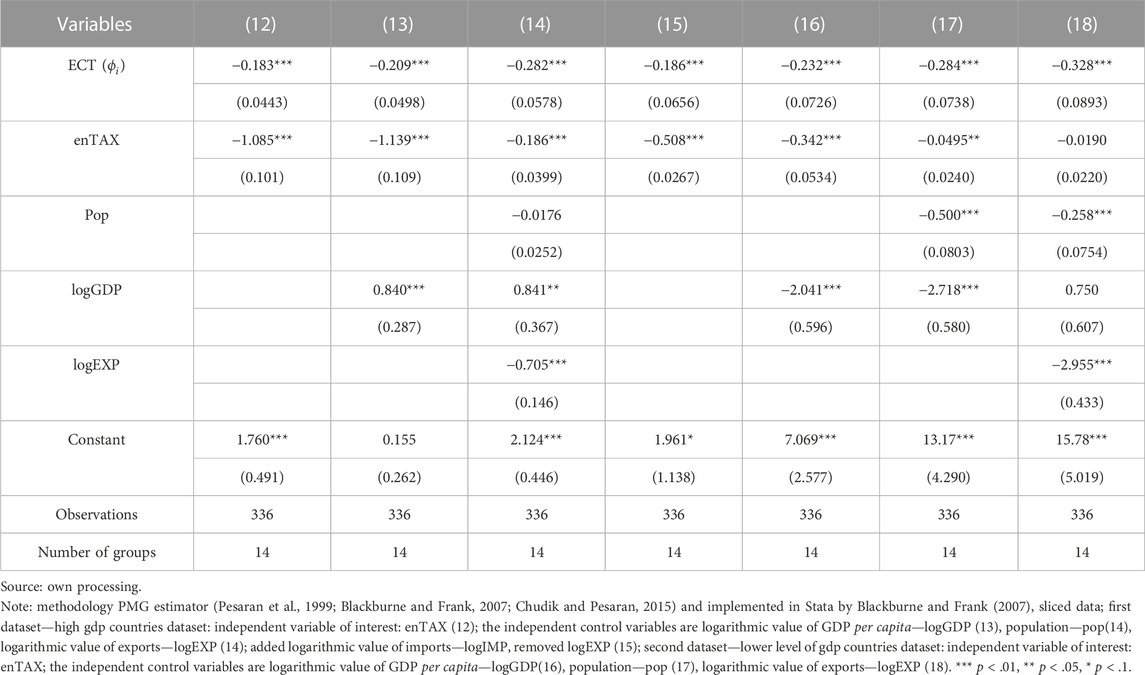

The coefficients with standard errors in brackets for long-run coefficients and ECT are presented in Table 4. Every column heading represents the number of the model conducted.

Regarding the second methodology, the results of the processing presented in Table 4 show that the long-run relationship appears to be present mainly in models of the splitted data (countries with lower GDP per capita) In these models, in the long-run, the relationship between the variables of interest—GHGEbss, enTAX (which explains 0.66 and 0.72 of GHG variation, by R-squared) and GDP per capita are as expected. For long-term processing, the density population, exports and imports negatively affect the quality of the environment. The statistical interpretation for enTAX, is that a unit change in environmental energy taxes is associated with a |−0.08| in model no. (6) and |−0.21| in model no. (7) decrease in greenhouse gas emissions in the long-run, at the 10% significance level, on average ceteris paribus. In this models, greenhouse gas emissions and energy (environmental) taxes display an inelastic inverse relationship., being in accordance to the results of other research (Dietz and Rosa, 1997; Ghazouani et al., 2020; Ghazouani et al., 2021; Mania, 2020; Andrew Mejia, 2021; D’Orazio and Dirks, 2022).

For the models (10) and (11), that implies countries with a lower GDP per capita, the statistical interpretation for enTAX, is that a unit change in environmental energy taxes is associated with |−1.448| and |−2.849| decrease in greenhouse gas emissions in the long-run, at the 10% significance level, on average ceteris paribus. In these models, greenhouse gas emissions and energy (environmental) taxes display an inelastic inverse relationship.

Some results are not statistically significant (some are sensitive to dataset and control variables—available on demand). The results appear in some cases sensitive regarding the control variables. We suspect that the impact could be different at country level, or, in some countries, there is no long-run co-integration, so further investigations to test the robustness of our models were conducted.

The results (standard errors in brackets) using sliced dataset are available in Table 5. Every column heading represents the number of the model conducted.

The results from Table 5 show that in countries with lower GDP per capita rates, the effect of energy taxes on GHG is negative and statistically significant at least at 5% level, as shown by other studies (Hao et al., 2021; He et al., 2021). The results can be interpreted as above, greenhouse gas emissions and energy (environmental) taxes display an inelastic inverse relationship, but in some cases the coefficient is not statistically significant.

One possible explanation is that, in developed countries, the higher price for categories affected by the tax is still acceptable and affordable, not being the case in developing countries, where an increase in costs, indeed determines a reduce of the related “consumption”. The results are in line with other research (Dietz and Rosa, 1997; Ghazouani et al., 2020; Ghazouani et al., 2021; Mania, 2020; Andrew Mejia, 2021; D’Orazio and Dirks, 2022).

In countries with higher values of GDP, it appears that the effect is not as expected, the coefficients being positive and not statistically significant.

The results obtained in some models (1–7) are in line with the research in the structural human ecology tradition, that theorizes that population levels are a key driver of environmental degradation (Dietz and Rosa, 1997). The models in our study shows that there is a positive relationship between population density and air pollution as in other studies (Andrew Mejia, 2021; Falk and Hagsten, 2021; D’Orazio and Dirks, 2022). The main culprits for the increase in pollution are the increase in energy consumption, income and population, and governments must take effective measures to combat this phenomenon (Ghazouani et al., 2020). A study conducted on nine developed countries in Europe for the period 1994–2018 (Ghazouani et al., 2021), which tested the influence of environmental taxes, GDP and urban population on greenhouse gas emissions, using FMOLS techniques and DOLS pointed out that the introduction of environmental taxes has a positive influence on reducing pollution, while the increase in GDP and the urban population leads to an increase in greenhouse gas emissions. Globally, the population is expected to grow, and this growth will put increasing pressure on the environment.

By applying the Arellano-Bover’s two-step dynamic panel approach to a sample of EU and transition countries in the period 1995–2006, Morley (Morley, 2012) shows that the introduction of environmental taxes in the EU has had a positive effect on the reduction of pollution, but a limited effect on energy consumption, which suggests that the use of cleaner technologies would be the solution, a conclusion we reached in our study.

Sharma et al. (2021) conducted a study on BIMSTEC countries over a period of 35 years that looked at the influence of agricultural production on greenhouse gas emissions and showed that limiting agricultural production on a smaller scale can improve the quality of the environment. However, reducing agricultural production is not a solution; it requires the use of clean energy tools, upon the urging of SDG 7-Ensure access to affordable, reliable, sustainable and modern energy for all, a conclusion that also confirms the results of our study. However, ecological solutions largely involve research and development costs (Lapinskienė et al., 2017), which will be considered in a future study.

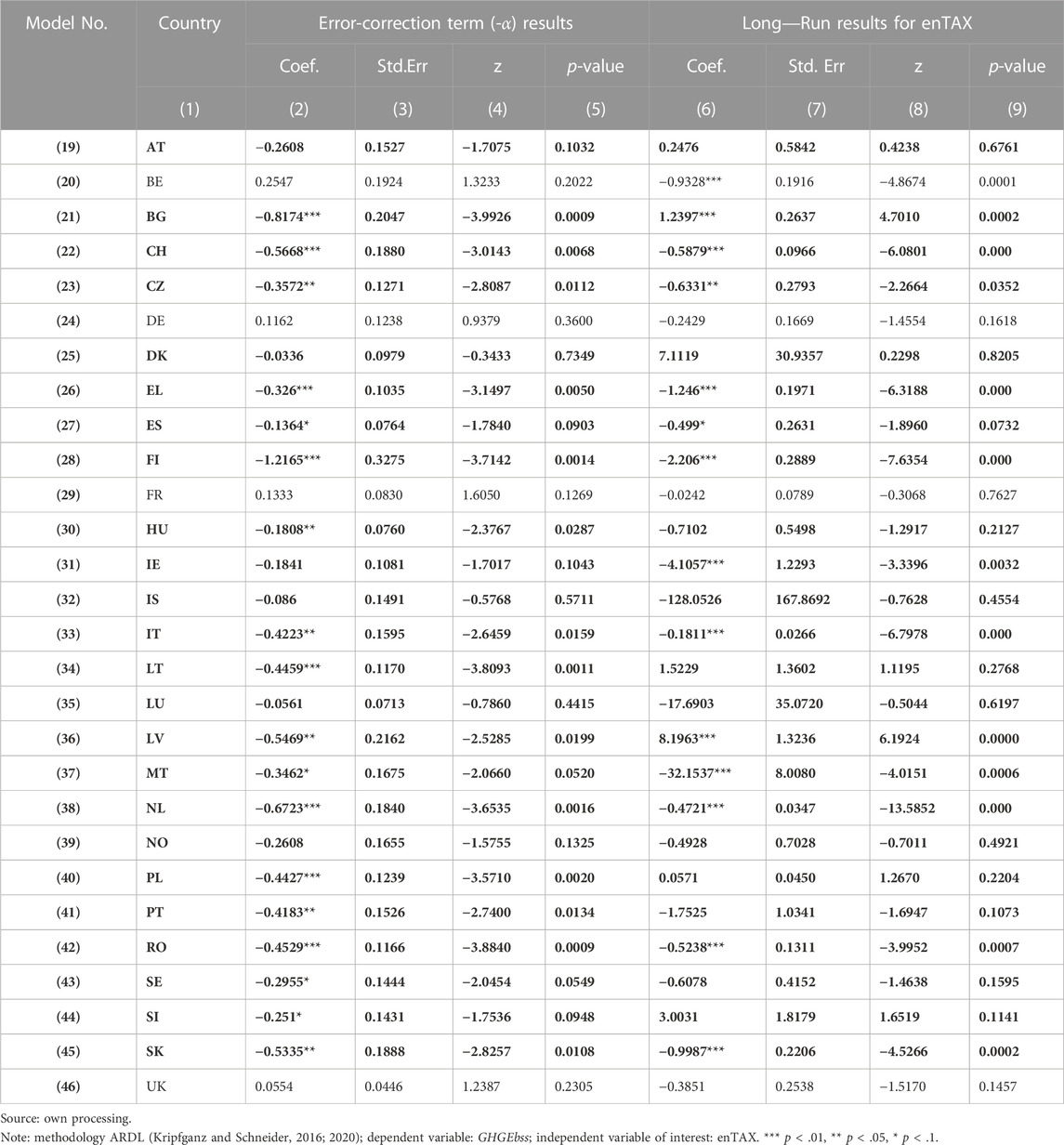

To explain the different results obtained on previous models (especially in 8–11), twenty eight (28) further models were conducted at country levels using ARDL (Kripfganz and Schneider, 2016; Kripfganz and Schneider, 2020), the results being presented in Table 6. In Table 6 every row represents the results of the model at country level.

The first coefficient in the ADJ section is the negative speed-of-adjustment coefficient (−α). The coefficients in the LR section are the long-run coefficients θ. Investigation on individual countries, as seen in Table 6, shows that in 18 cases (α < 0 and θ < 0—green color) from 28, the effect of energy taxes is negative, as expected. We consider that the country level individual analysis enforces the previous ECM results, where the effect is statistically significant only at 5% level [model (17) or not significant (18)].

The impact of energy taxes is different at country level, with higher negative impact on GHGbss in emergent economies. Even if the overall impact can be considered as negative, no strong conclusion can be drawn.

The main findings of the empirical analysis can be highlight as follows:

- the empirical analysis consists in 46 models, from which 28 are applied to country level;

- 25 of 41 models (using different methodologies) suggests an inverse relation between GHG and enTAX;

- at country level, from 24 long-term models (with α < 0), in 18 models an inverse relation between GHG and enTAX is met;

- some results are sensitive to composition of the sample, the choose of the independent variables and methodology;

- in some countries with high levels of GDP per capita, the results suggest no evidence of long-run and inverse relationship, when some methodologies were used;

- in countries with lower levels of GDP per capita in the models implied, there is evidence of inverse relation and long-run cointegration;

- based on the previous findings, the use of environmental taxes appears to have limitations, at least in some developed countries;

- the results are in line with other studies, as we explain below.

The same methodology was used in other articles with similar results (Ntanos et al., 2018; Afolayan et al., 2020; Leitão and Balogh, 2020; Hao et al., 2021; He et al., 2021; Wolde-Rufael and Mulat-Weldemeskel, 2022). In a 1996–2016 study of OECD countries, using the ARDL model, a group of authors (He et al., 2021) demonstrate that the introduction of energy taxes improves energy efficiency only in the short term and not for all sampled countries. A study conducted on a sample of countries grouped into Belt and Road (B&R) and OECD countries for the period 1992–2015 (Sun et al., 2020) using the Common Correlated Effect Mean Group (CCEMG) and Augmented Mean Group (AMG) methods showed that increasing production has a significant positive effect on environmental pollution for all panels. The results also show that other factors, such as trade openness, urbanization and energy use, have been responsible for the recent increase in global carbon emissions. However, there are disparities in the estimated coefficients. The impact is greater in the OECD region than in the Belt and Road region. In these circumstances, it is suggested that efforts to promote a sustainable and low-carbon green environment should take these factors together when developing different policies.

Our study highlights the fact that the application of energy taxes to improve the quality of the environment cannot be generalized, being insufficient for the sustainable development of each individual country. As a consequence of this fact, we rally to the opinion that supports the increasingly accentuated orientation towards investments in renewable energy sources with a positive impact on sustainable development (Karmaker et al., 2021; Wolde-Rufael and Mulat-Weldemeskel, 2022). Although ETR (Environmental Tax Reform) aim to internalize the external cost of pollution, it has not yet created a level playing field between “green” technologies and non-renewable energy sources (Arbolino and Romano, 2014; Cottrell et al., 2016; Takeda and Arimura, 2021).

Recent research (Edziah et al., 2022) on how greenhouse gas emissions could be controlled shows that in developing economies an important role in reducing gas emissions is played by exogenous technological factors in addition to the use of renewable energy. Exogenous technological factors include imports of machinery and equipment, foreign direct investment, and imports of research and development (R&D) knowledge. The study is carried out on 18 developing countries for the period 1995–2017, and using the dynamic specific common correlated effect estimator (DCCE) technique, it is found that the use of renewable energy, imports of machinery, and foreign direct investment significantly reduce carbon dioxide emissions, but in descending order. In contrast, the transfer of research and development (R&D) from abroad increases carbon dioxide emissions in the region.

Conclusion

Today’s society enjoys a life marked by the evolution of innovation and technology, but the facilities conveyed by the technological implementations brought into discussion a new problem that humanity is facing, namely pollution. Thus, water, air and soil pollution caused by gas emissions directly affects human health as well as the economies. At European level, the sustainable development of countries, which includes the desire to reduce the level of pollution, is also needed, while the European legislation has different terms regarding greenhouse gas emissions. Under these conditions, it is the governments that must take measures to reduce pollution, fiscal policy being one of the most common instruments with a demonstrated positive impact on the environmental system. However, the implementation of environmental taxes as a macroeconomic policy measure must be done carefully, as their negative effect on long-term economic sustainability can be admitted. Specifically, when the macro-objective is economic growth, the effect on environmental quality is negative, given that economies are still dependent on fossil fuels.

Our study focuses on the effects of energy taxes level on greenhouse gas emissions under environmental policy measures in the period 1995–2019 on 28 European countries (both at panel and individual—country level). The key variable entax is only partially significant and is very sensitive to specification and method. The findings show that, in the long run, an increase in energy taxes and imports could be a positive factor that possibly decrease greenhouse gas emissions. On the other hand, energy taxes have different results on diverse countries (this conclusion being encountered in different studies cited in our paper), so this leverage could not be generalized and other instruments should be found and used. We have also found that an increase in GDP has a negative effect on the quality of the environment, while population density and increased exports lead to a decrease in greenhouse gas emissions (not as we would expect). This can be explained by the fact that population growth does not necessarily translate into an increase in labor that will drive production and has a negative long-term impact on the environment at the level of the sample analyzed. Then, the influence of exports on the environment is a positive one in our long-term study, in the sense that greenhouse gas emissions decrease as exports increase, being justified by the fact that an increase in exports is not always generated by an increase in production (it could be influenced by the proportion of the domestic production that is destined for export). The producers’ decision to export also depends on the exchange rate (in countries that have not adopted the Euro), being, rather, a reallocation of the same production internally or externally (exports can also increase in case of decrease in production). We found that, in the short term, population density, exports and imports negatively affect the quality of the environment, being in accordance with the results of other research.

Our findings suggest that (environmental/energy) taxes have limited and different effects that vary by countries, other instruments being needed and concentrated efforts should be done. The balance between environmental and sustainable growth policies could be the solution to this problem, so the support for the implementation of green energy must be considered as a foundation for economic growth.

Among the novelty aspects brought by our study are the extended and recent analysis period (the last year analyzed being 2019), the large number of states included in the sample, but also the recently applied methodology. Clearly, the study also has limitations, and these take into account the size of the sample, which depended on the available data, as well as the variables taken into account (that appear to be volatile regarding the robustness of results when combining different control variables in the methodologies implied). Subsequent research will consider expanding the sample, introducing additional variables, especially from the perspective of economic or environmental indices, and/or including the period covered by the COVID-19 pandemic.

Given the results of the research, it can be considered that the paper will be useful to public officials in making environmental policy decisions. More specifically, the results of our study lead to the idea that the growth of energy taxes is not sufficient to reduce greenhouse gas emissions, the effects being different and related to a variety of factors (some of them impossible to be quantified). This leads to another fact, that decision makers have to increasingly focus on promoting and aiding the implementation of green energy sources (e.g., considering as leverages the subsidies or tax advantages related to the use of solar/wind energy or electric cars). Public officials (both on national and local levels) should also consider tax incentives and investment grants for the implementation and use of renewable energy to achieve a higher level of sustainable development.

The novelty of the paper lies, first of all, in the fact that the methodology applied is recent and considers different situations, with the results showing that increasing energy taxes alone cannot be generalized as an environmental policy measure to reduce greenhouse gas emissions, as policymakers have to focus on finding other solutions, such as the deployment of renewable energy sources.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: Eurostat Database.

Author contributions

BF: Concept, data, methodology, econometric analysis, literature review and writing. FB and MG: Conceptualization, data, literature review, and writing. ED and AS: Data, literature review, and writing.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.965841/full#supplementary-material

References

Adebayo, T. S., Awosusi, A. A., Kirikkaleli, D., Akinsola, G. D., and Mwamba, M. N. (2021). Can CO2 emissions and energy consumption determine the economic performance of South Korea? A time series analysis. Environ. Sci. Pollut. Res. 28, 38969–38984. doi:10.1007/s11356-021-13498-1

Afolayan, O. T., Okodua, H., Oaikhenan, H., and Matthew, O. (2020). Carbon emissions, human capital investment and economic development in Nigeria. Int. J. Energy Econ. Policy 10, 427–437. doi:10.32479/ijeep.8476

Andrew Mejia, S. (2021). The climate crisis and export intensity: A comparative international study of greenhouse gas emissions in the global south, 1990–2014. Int. J. Sociol. 51, 1–22. doi:10.1080/00207659.2020.1845011

Apergis, N., Can, M., Gozgor, G., and Lau, C. K. M. (2018). Effects of export concentration on CO2 emissions in developed countries: An empirical analysis. Environ. Sci. Pollut. Res. 25, 14106–14116. doi:10.1007/s11356-018-1634-x

Apetri, A. N., and Mihalciuc, C. C. (2019). “Green bonds - form of ecological projects funding,” in Proceedings of BASIQ (Bari, Italy, 460–465. Available at: https://www.researchgate.net/profile/Ann-Katrin-Arp-2/publication/333902657_Study_on_European_funding_programmes_for_sustainable_development/links/5dbaf94d299bf1a47b05a8d3/Study-on-European-funding-programmes-for-sustainable-development.pdf#page=460.

Arbolino, R., and Romano, O. (2014). A methodological approach for assessing policies: The case of the environmental tax reform at European level. Procedia Econ. Finance 17, 202–210. doi:10.1016/S2212-5671(14)00895-8

Armeanu, D., Vintilă, G., Andrei, J. V., Gherghina, Ş. C., Drăgoi, M. C., and Teodor, C. (2018). Exploring the link between environmental pollution and economic growth in EU-28 countries: Is there an environmental Kuznets curve? PLoS One 13, e0195708. doi:10.1371/journal.pone.0195708

Asghar, B., Wasim, A., Qazi, U., and Rasool, A. (2020). Financial and non-financial practices driving sustainable firm performance: Evidence from banking sector of developing countries. Sustainability 12, 6164. doi:10.3390/su12156164

Balance of payment statistics (2022). Balance of payment statistics. Available at: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Balance_of_payment_statistics (Accessed June 5, 2022).

Beck, M., Rivers, N., Wigle, R., and Yonezawa, H. (2015). Carbon tax and revenue recycling: Impacts on households in British Columbia. Rochester, NY: Social Science Research Network. doi:10.2139/ssrn.2492766

Bispo, A., Andersen, L., Angers, D. A., Bernoux, M., Brossard, M., Cécillon, L., et al. (2017). Accounting for carbon stocks in soils and measuring GHGs emission fluxes from soils: Do we have the necessary standards? Front. Environ. Sci. 5, 41. doi:10.3389/fenvs.2017.00041

Blackburne, E. F., and Frank, M. W. (2007). Estimation of nonstationary heterogeneous panels. Stata J. 7, 197–208. doi:10.1177/1536867X0700700204

Borozan, D. (2019). Unveiling the heterogeneous effect of energy taxes and income on residential energy consumption. Energy Policy 129, 13–22. doi:10.1016/j.enpol.2019.01.069

Breitung, J., and Das, S. (2005). Panel unit root tests under cross-sectional dependence. Stat. Neerl. 59, 414–433. doi:10.1111/j.1467-9574.2005.00299.x

Brodny, J., and Tutak, M. (2020). The analysis of similarities between the European union countries in terms of the level and structure of the emissions of selected gases and air pollutants into the atmosphere. J. Clean. Prod. 279, 123641. doi:10.1016/j.jclepro.2020.123641

Burciu, A., Bostan, I., Condrea, P., and Grosu, V. (2010). Financing the environmental policies in the communitarian space. Environ. Eng. Manag. J. (EEMJ) 9, 1179–1185. doi:10.30638/eemj.2010.153

Burtraw, D., Krupnick, A., Palmer, K., Paul, A., Toman, M., and Bloyd, C. (2003). Ancillary benefits of reduced air pollution in the US from moderate greenhouse gas mitigation policies in the electricity sector. J. Environ. Econ. Manag. 45, 650–673. doi:10.1016/S0095-0696(02)00022-0

Carattini, S., Baranzini, A., and Roca, J. (2015). Unconventional determinants of greenhouse gas emissions: The role of trust. Environ. Policy Gov. 25, 243–257. doi:10.1002/eet.1685

China Imports China imports - may 2022 data - 1981-2021 historical - June Forecast - calendar. Available at: https://tradingeconomics.com/china/imports (Accessed June 5, 2022).

Choi, I. (2001). Unit root tests for panel data. J. Int. money Finance 20, 249–272. doi:10.1016/s0261-5606(00)00048-6

Chudik, A., and Pesaran, M. H. (2015). Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J. Econ. 188, 393–420. doi:10.1016/j.jeconom.2015.03.007

Climate Change Climate change - united Nations sustainable development. Available at: https://www.un.org/sustainabledevelopment/climate-change/(Accessed June 3, 2022).

Cooper, R. N. (2009). “The case for charges on greenhouse gas emissions,” in Post-kyoto international climate policy. Editors J. E. Aldy, and R. N. Stavins (Cambridge: Cambridge University Press), 151–178. doi:10.1017/CBO9780511813207.006

Cottrell, J., Schlegelmilch, K., Runkel, M., and Mahler, A. (2016). Environmental tax reform in developing, emerging and transition economies. Bonn: Deutsches Institut für Entwicklungspolitik gGmbH.

Cox, E. M., Pidgeon, N., Spence, E., and Thomas, G. (2018). Blurred lines: The ethics and policy of greenhouse gas removal at scale. Front. Environ. Sci. 6, 38. doi:10.3389/fenvs.2018.00038

Dietz, T., and Rosa, E. A. (1997). Effects of population and affluence on CO2 emissions. Proc. Natl. Acad. Sci. 94, 175–179. doi:10.1073/pnas.94.1.175

Ditzen, J. (2018). Estimating dynamic common-correlated effects in Stata. Stata J. 18, 585–617. doi:10.1177/1536867X1801800306

Ditzen, J. (2019). XTDCCE2: Stata module to estimate heterogeneous coefficient models using common correlated effects in a dynamic panel. Available at: https://econpapers.repec.org/software/bocbocode/s458204.htm (Accessed November 4, 2020).

Ditzen, J. (2021). Estimating long-run effects and the exponent of cross-sectional dependence: An update to xtdcce2. Stata J. 21, 687–707. doi:10.1177/1536867X211045560

D’Orazio, P., and Dirks, M. W. (2022). Exploring the effects of climate-related financial policies on carbon emissions in G20 countries: A panel quantile regression approach. Environ. Sci. Pollut. Res. Int. 29, 7678–7702. doi:10.1007/s11356-021-15655-y

Edziah, B. K., Sun, H., Adom, P. K., Wang, F., and Agyemang, A. O. (2022). The role of exogenous technological factors and renewable energy in carbon dioxide emission reduction in Sub-Saharan Africa. Renew. Energy 196, 1418–1428. doi:10.1016/j.renene.2022.06.130

Energy-European Environment Agency (2022). Energy-European environment agency. Available at: https://www.eea.europa.eu/ro/themes/energy/intro (Accessed July 14, 2022).

Falk, M. T., and Hagsten, E. (2021). Determinants of CO2 emissions generated by air travel vary across reasons for the trip. Environ. Sci. Pollut. Res. 28, 22969–22980. doi:10.1007/s11356-020-12219-4

Fujii, H., and Managi, S. (2013). Which industry is greener? An empirical study of nine industries in OECD countries. Energy Policy 57, 381–388. doi:10.1016/j.enpol.2013.02.011

Ghazouani, A., Xia, W., Ben Jebli, M., and Shahzad, U. (2020). Exploring the role of carbon taxation policies on CO2 emissions: Contextual evidence from tax implementation and non-implementation European countries. Sustainability 12, 8680. doi:10.3390/su12208680

Ghazouani, A., Jebli, M. B., and Shahzad, U. (2021). Impacts of environmental taxes and technologies on greenhouse gas emissions: Contextual evidence from leading emitter European countries. Environ. Sci. Pollut. Res. 28, 22758–22767. doi:10.1007/s11356-020-11911-9

Hadri, K. (2000). Testing for stationarity in heterogeneous panel data. Econ. J. 3, 148–161. doi:10.1111/1368-423x.00043

Haites, E. (2018). Carbon taxes and greenhouse gas emissions trading systems: What have we learned? Clim. Policy 18, 955–966. doi:10.1080/14693062.2018.1492897

Hao, L.-N., Umar, M., Khan, Z., and Ali, W. (2021). Green growth and low carbon emission in G7 countries: How critical the network of environmental taxes, renewable energy and human capital is. Sci. Total Environ. 752, 141853. doi:10.1016/j.scitotenv.2020.141853

Harris, R. D., and Tzavalis, E. (1999). Inference for unit roots in dynamic panels where the time dimension is fixed. J. Econ. 91, 201–226. doi:10.1016/s0304-4076(98)00076-1

Hassler, U., and Wolters, J. (2006). Autoregressive distributed lag models and cointegration. Allg. Stat. Arch. 90, 59–74. doi:10.1007/s10182-006-0221-5

He, P., Sun, Y., Niu, H., Long, C., and Li, S. (2021). The long and short-term effects of environmental tax on energy efficiency: Perspective of OECD energy tax and vehicle traffic tax. Econ. Model. 97, 307–325. doi:10.1016/j.econmod.2020.04.003

Henseler, M., Delzeit, R., Adenäuer, M., Baum, S., and Kreins, P. (2020). Nitrogen tax and set-aside as greenhouse gas abatement policies under global change scenarios: A case study for Germany. Environ. Resour. Econ. 76, 299–329. doi:10.1007/s10640-020-00425-0

Hussain, Z., Mehmood, B., Khan, M. K., and Tsimisaraka, R. S. M. (2022). Green growth, green technology, and environmental health: Evidence from high-GDP countries. Front. Public Health 9, 816697. doi:10.3389/fpubh.2021.816697

Im, K. S., Pesaran, M. H., and Shin, Y. (2003). Testing for unit roots in heterogeneous panels. J. Econ. 115, 53–74. doi:10.1016/S0304-4076(03)00092-7

Iwata, H., Okada, K., and Samreth, S. (2011). A note on the environmental Kuznets curve for CO2: A pooled mean group approach. Appl. Energy 88, 1986–1996. doi:10.1016/j.apenergy.2010.11.005

Johansen, U., Perez-Valdes, G. A., and Werner, A. T. (2018). Regional aspects of a climate and energy tax reform in Norway—exploring double and multiple dividends. Sustainability 10, 4175. doi:10.3390/su10114175

Jordahl, K., Bossche, J. V. D., Fleischmann, M., Wasserman, J., McBride, J., Gerard, J., et al. (2020). geopandas/geopandas: v0.8.1. doi:10.5281/zenodo.3946761

Karmaker, S. C., Hosan, S., Chapman, A. J., and Saha, B. B. (2021). The role of environmental taxes on technological innovation. Energy 232, 121052. doi:10.1016/j.energy.2021.121052

Khan, R. (2021). Beta decoupling relationship between CO2 emissions by GDP, energy consumption, electricity production, value-added industries, and population in China. PLoS One 16, e0249444. doi:10.1371/journal.pone.0249444

Kotnik, Ž., Klun, M., and Škulj, D. (2014). The effect of taxation on greenhouse gas emissions. Transylv. Rev. Adm. Sci. 10 (43), 168–185.

Kripfganz, S., and Schneider, D. C. (2016). ardl: Stata module to estimate autoregressive distributed lag models. Chicago: Stata Users Group. Available at: https://ideas.repec.org/p/boc/scon16/18.html (Accessed August 15, 2022).

Kripfganz, S., and Schneider, D. C. (2020). Response surface regressions for critical value bounds and approximate p-values in equilibrium correction models. Oxf. Bull. Econ. Statistics 82, 1456–1481. doi:10.1111/obes.12377

Lacko, R., and Hajduová, Z. (2018). Determinants of environmental efficiency of the EU countries using two-step DEA approach. Sustainability 10, 3525. doi:10.3390/su10103525

Lahcen, B., Brusselaers, J., Vrancken, K., Dams, Y., Da Silva Paes, C., Eyckmans, J., et al. (2020). Green recovery policies for the COVID-19 crisis: Modelling the impact on the economy and greenhouse gas emissions. Environ. Resour. Econ. 76, 731–750. doi:10.1007/s10640-020-00454-9

Lapinskienė, G., Peleckis, K., and Radavičius, M. (2015). Economic development and greenhouse gas emissions in the European Union countries. J. Bus. Econ. Manag. 16, 1109–1123. doi:10.3846/16111699.2015.1112830

Lapinskienė, G., Peleckis, K., and Slavinskaite, N. (2017). Energy consumption, economic growth and greenhouse gas emissions in the European Union countries. J. Bus. Econ. Manag. 18, 1082–1097. doi:10.3846/16111699.2017.1393457

Leitão, N. C., and Balogh, J. M. (2020). The impact of energy consumption and agricultural production on carbon dioxide emissions in Portugal. AGRIS on-line Pap. Econ. Inf. 12, 49–59. doi:10.7160/aol.2020.120105

Lenzen, M., and Dey, C. J. (2002). Economic, energy and greenhouse emissions impacts of some consumer choice, technology and government outlay options. Energy Econ. 24, 377–403. doi:10.1016/S0140-9883(02)00007-5

Levin, A., Lin, C.-F., and Chu, C.-S. J. (2002). Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econ. 108, 1–24. doi:10.1016/s0304-4076(01)00098-7

Li, D., Bae, J. H., and Rishi, M. (2022). Sustainable development and SDG-7 in sub-saharan africa: Balancing energy access, economic growth, and carbon emissions. Eur. J. Dev. Res. Berlin, Germany: Springer, 1–26. doi:10.1057/s41287-021-00502-0

Lu, W.-C. (2017). Greenhouse gas emissions, energy consumption and economic growth: A panel cointegration analysis for 16 asian countries. Int. J. Environ. Res. Public Health 14, 1436. doi:10.3390/ijerph14111436

Mania, E. (2020). Export diversification and CO2 emissions: An augmented environmental Kuznets curve. J. Int. Dev. 32, 168–185. doi:10.1002/jid.3441

McLaren, D. (2020). Quantifying the potential scale of mitigation deterrence from greenhouse gas removal techniques. Clim. Change 162, 2411–2428. doi:10.1007/s10584-020-02732-3

Meadows, D. H., Meadows, D. L., Randers, J., and Behrens, W. W. (1974). The Limits to growth: A report for the club of rome’s Project on the predicament of mankind. 1st edition. New York: Universe Books.

Metcalf, G. E. (2009). Market-based policy options to control U.S. Greenhouse gas emissions. J. Econ. Perspect. 23, 5–27. doi:10.1257/jep.23.2.5

Mihalciuc, C. C., and Grosu, M.Faculty of Economics and Business Administration, „Alexandru Ioan Cuza“ University of Iasi (2021). The concern of energy companies in obtaining and maintaining their sustainable value. LUMEN Proc. 17, 447–464. doi:10.18662/wlc2021/45

Morley, B. (2012). Empirical evidence on the effectiveness of environmental taxes. Appl. Econ. Lett. - Appl. Econ. Lett. 19, 1817–1820. doi:10.1080/13504851.2011.650324

Murray, B., and Rivers, N. (2015). British columbia’s revenue-neutral carbon tax: A review of the latest “grand experiment” in environmental policy. Energy Policy 86, 674–683. doi:10.1016/j.enpol.2015.08.011

Ntanos, S., Skordoulis, M., Kyriakopoulos, G., Arabatzis, G., Chalikias, M., Galatsidas, S., et al. (2018). Renewable energy and economic growth: Evidence from European countries. Sustainability. Basel, Switzerland: MDPI 10 (8), 2626. doi:10.3390/su10082626

Onofrei, M., Vintila, G., Dascalu, E., Roman, A., and Firtescu, B. (2017). The impact of environmental tax reform on greenhouse gas emissions: Empirical evidence from European countries. Environ. Eng. Manag. J. 16, 2843–2849. doi:10.30638/eemj.2017.293

Pesaran, M. H., Shin, Y., and Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. J. Appl. Econ. 16, 289–326. doi:10.1002/jae.616

Pesaran, M. H., Shin, Y., and Smith, R. P. (1999). Pooled mean group estimation of dynamic heterogeneous panels. J. Am. Stat. Assoc. 94, 621–634. doi:10.1080/01621459.1999.10474156

Rehman, M. A., Fareed, Z., Salem, S., Kanwal, A., and Pata, U. K. (2021). Do diversified export, agriculture, and cleaner energy consumption induce atmospheric pollution in Asia? Application of method of moments quantile regression. Front. Environ. Sci. 9, 781097. doi:10.3389/fenvs.2021.781097

Ritchie, H., Roser, M., and Rosado, P. (2020). CO₂ and greenhouse gas emissions. Our World Data. Available at: https://ourworldindata.org/co2-and-other-greenhouse-gas-emissions (Accessed July 7, 2022).

Rokhmawati, A. (2021). The nexus among green investment, foreign ownership, export, greenhouse gas emissions, and competitiveness. Energy Strategy Rev. 37, 100679. doi:10.1016/j.esr.2021.100679

Shahzad, U. (2020). Environmental taxes, energy consumption, and environmental quality: Theoretical survey with policy implications. Environ. Sci. Pollut. Res. 27, 24848–24862. doi:10.1007/s11356-020-08349-4

Sharma, G. D., Shah, M. I., Shahzad, U., Jain, M., and Chopra, R. (2021). Exploring the nexus between agriculture and greenhouse gas emissions in BIMSTEC region: The role of renewable energy and human capital as moderators. J. Environ. Manag. 297, 113316. doi:10.1016/j.jenvman.2021.113316

Śleszyński, J. (2014). “Podatki środowiskowe i podział na grupy podatków według metodyki Eurostatu,” in Ecological taxes and their classification in accordance with Eurostat methodology, 52–68. doi:10.15290/ose.2014.03.69.04

Smith, L. V., Tarui, N., and Yamagata, T. (2021). Assessing the impact of COVID-19 on global fossil fuel consumption and CO2 emissions. Energy Econ. 97, 105170. doi:10.1016/j.eneco.2021.105170

Stetter, C., and Sauer, J. (2022). Greenhouse gas emissions and eco-performance at farm level: A parametric approach. Environ. Resour. Econ. 81, 617–647. doi:10.1007/s10640-021-00642-1

Sun, H., Samuel, C. A., Kofi Amissah, J. C., Taghizadeh-Hesary, F., and Mensah, I. A. (2020). Non-linear nexus between CO2 emissions and economic growth: A comparison of OECD and B&R countries. Energy 212, 118637. doi:10.1016/j.energy.2020.118637

Takeda, S., and Arimura, T. H. (2021). A computable general equilibrium analysis of environmental tax reform in Japan with a forward-looking dynamic model. Sustain Sci. 16, 503–521. doi:10.1007/s11625-021-00903-4

Trends and Projections Trends and Projections in Europe 2021 — European environment agency. Available at: https://www.eea.europa.eu/publications/trends-and-projections-in-europe-2021 (Accessed June 1, 2022).

Tu, Z., Liu, B., Jin, D., Wei, W., and Kong, J. (2022). The effect of carbon emission taxes on environmental and economic systems. Int. J. Environ. Res. Public Health 19, 3706. doi:10.3390/ijerph19063706

UN Agenda 2030 Office of the directorate general