- 1School of Management, Wuhan University of Technology, Wuhan, China

- 2Shanghai Lixin University of Accounting and Finance, Shanghai, China

Traditional management accounting methods are difficult to provide the necessary information for environmental economic management decisions. In response to the increasingly urgent need for decision-related information, a new branch of accounting, environmental management accounting, has emerged and is receiving increasing attention. Material Flow Cost Accounting (MFCA) is a useful tool for managing complex resource and waste streams. However, MFCA is mainly used for ex-post accounting and reporting and no efforts are made to use it for forecasting. In this study, we introduce MFCA method into the budgeting process of manufacturing firms, and thus construct an MFCA-ABB (Activity-Based Budget) model. This model is applied to JLC Company which is a fragrant liquor manufacturer in China, in order to forecast and plan for its resource consumption, positive product output, and negative product generation. Based on the forecasts of involved material flows, inefficiencies in the company’s liquor production process are identified; scenario analysis is then conducted to determine the optimal process and the technology adopted. The proposed MFCA-ABB model turns a pure operating budget into an environmental-economic budget, thus achieving both environmental and economic benefits for the company. Besides, this study makes an attempt to apply ABB in environmental management accounting, which suggests the possibility of applying the conventional management accounting tools, after modified, to the environmental-economic management of manufacturing firms in the future.

1 Introduction

Since the Industrial Revolution, the problems of resource consumption and environmental pollution have been increasingly serious due to the rapid development of the manufacturing industry and the rising economic aggregate. Therefore, resource and environmental issues are receiving extensive attention from all walks of life (Young et al., 1997; Yadav et al., 2021). The production and operation of the company causes negative impact on the environment. Major environmental challenges such as climate change, waste generation and environmental pollution are largely attributable to profit-driven decisions made by firms (Welbeck, 2017). These decisions can lead to continued environmental degradation, which adversely affects the Earth’s ecosystems and the maintenance of life. In 2018, the World Health Organization proposed that approximately 91% of the world’s population is exposed to environmental pollution to some degree. The impacts of environment-related pollution are greater and more deadly than the combined impacts of AIDS, tuberculosis and malaria (Landrigan et al., 2018). Therefore, the pursuit of rapid economic development cannot be at the cost of resource depletion and environmental pollution, it is necessary to consider the environmental benefits in the production and management of companies. At present, countries around the world are actively advocating energy conservation and emission reduction, such as giving tax breaks and making financial subsidies. For example, in China, the policy stipulates that income from engaging in qualified environmental protection, energy and water conservation projects can be periodically reduced or exempted from corporate income tax; income from the comprehensive use of resources to produce products can be deducted according to certain criteria when calculating taxable income. Germany has implemented the Federal Funding for Efficient Buildings program, which provides special subsidies for energy-efficient building retrofits. In the Energy Efficient Refurbishment program implemented from 2005 to 2017, Germany saved 20.4 TWh of end-use energy demand per year (equivalent to 2.507 million tons of standard coal), which is equivalent to an annual reduction of 7.5 million tons of carbon dioxide equivalent of greenhouse gases. National policies play a role in guiding and monitoring to some extent, but in the final analysis, it is still necessary to focus on the company and optimize its production and management. We can use micro-management tools such as accounting to help polluting companies reconcile environmental and economic benefits and drive them toward an environmentally sustainable development path (Xiao and Xiong, 2015; Wu et al., 2018).

However, traditional management accounting methods are difficult to provide the necessary information for environmental economic management decisions. In response to the increasingly urgent need for decision-related information, a new branch of accounting, environmental management accounting, has emerged and is receiving increasing attention (Jasch, 2006). The International Federation of Accountants points out that from 1950 to the present, the focus of management accounting has gradually shifted from initial cost calculation and financial control to how to reduce waste (i.e., reduce loss of resources) and create value (i.e., use resources efficiently). Material Flow Cost Accounting (MFCA) is a useful tool for managing complex resource and waste streams. The adoption of the MFCA at micro level (i.e., single industrial plant) provides either economic or environmental quantitative and qualitative data, and MFCA results can help business decisions by highlighting quantities, qualities and costs that are not considered in common financial reports, thus helping companies reach high levels of transparency in production information (Bux and Amicarelli, 2022). Since negative output products lead to higher production and disposal costs at the same time, companies can bring significant savings potential by reducing undesirable negative material flows, which also improves resource efficiency and can help companies generate financial benefits while reducing negative environmental impacts (Amicarelli et al., 2022). MFCA provides data on operating costs and revenues, resource consumption and utilization, and environmental impact by effectively integrating information on resource inputs, positive and negative outputs in production (Guenther et al., 2015; Zhou et al., 2017). These data are well suited to meet the needs of manufacturing companies to balance economic and environmental benefits. However, MFCA is mainly used for ex-post accounting and reporting, and there is no practice of introducing MFCA method into the field of ex-ante forecasting and planning. Then, is it possible for MFCA to move from ex post to ex ante, and have a reasonable estimation and plan of resource consumption cost, positive product output and negative product generation in each step of the production process beforehand, so as to facilitate target control in the field of environmental and economic management?

As a business management tool, budget can facilitate resource allocation and improve cost control effect and profitability. Activity-Based Budget is a new budget management method based on activity analysis, promoting business process improvement, and aiming at enterprise value appreciation. In recent years, it has been favored for its outstanding performance in corporate strategic management (Rong, 2008). ABB is based on the Activities-Based Cost Method, Its principle is that “products consume activities, activities consume resources,” and its focus is on “activities” rather than products or departments (Huynh et al., 2013). ABB regards “activities” as the basis of enterprise cost budgeting and control, and establishes an activity center to ensure the correct collection and distribution of relevant operating costs, which provides more reasonable and reliable basic information for the preparation and execution of company budgets. By using Activity-Based Budget, manufacturing companies can divide their entire production process into different activity centers in order to estimate and plan the resource consumption of each activity center in advance. However, it cannot reflect the waste discharge and its impact on the environment, and this information that ABB cannot disclose is one of the accounting contents of MFCA. Then a reasonable idea is to integrate MFCA in the Activity-Based Budget system (this paper calls it the MFCA-ABB model), which helps companies to plan and control the cost of resource consumption, positive product output, negative product generation and other aspects. This moves budget management from a purely operational budget to an environmental economy budget.

This study aims to turn a pure operating budget into an environmental-economic budget by forecasting and planning for all such things as resource consumption, positive products and negative products, thus achieving both environmental and economic benefits for the company. Towards this end, we attempt to introduce the MFCA method into the budgeting process of manufacturing firms by constructing an MFCA-ABB model. And a case study, including a scenario analysis, is also conducted for liquor production for the environmental and economic purposes. The rest of the paper is divided into the following sections: Section 2 describes the relevant literature on three aspects of budget management, environmental management accounting methods, and MFCA. Section 3 discusses the research methodology. Section 4 presents the case study, i.e., the application of MFCA-ABB model in a liquor manufacturing company. Section 5 provides a discussion. Finally, the article ends with conclusions stating the implications, limitations and future research directions of the present study in Section 6.

2 Literature review

2.1 Budgeting

Budgets are a proven management accounting tool (Amin and Nengzih, 2021), However, traditional budgeting can lead to conflicts of interest between corporate strategy and business units because it does not consider the integration of corporate strategy and value activities (Zhang and Yin, 2006). Compared to the conventional budgeting, the overall budgetary management, which is strategy-based, is more likely to help companies reduce expenses (Kowalcyzk et al., 2006). The key to a company’s economic activity is to establish an effective budgeting system that connects the company’s short-term and long-term goals in order to discover and solve problems in time to achieve its strategic goals.

In terms of integrating budget management with ecological, Pan et al. (2016) suggested that energy saving and emission reduction targets should be incorporated into a comprehensive budget system to mitigate the conflict between corporate financial goals and environmental protection, introducing accounting tools to identify and measure environmental resource consumption and ecological compensation costs, and preparing corporate environmental budgets. Feng (2016) extends budget management by expanding its functions around three perspectives: value-added, management control, and information support, which enhances the resilience of the budget and makes it effective in unifying economic, social, and environmental benefits. Shen et al. (2014) explore the integration of corporate environmental budgeting and comprehensive budgeting from environmental accounting activities, suggesting that a company’s environmental behavior should be recognized and measured from the perspective of cost management and operational processes, and they build a framework for corporate environmental budgeting. Dierkes and Siepelmeyer (2019) developed an MFCA system based on production and cost theory to help companies identify effective and ineffective costs in their budgets, thus helping them with resource optimization and environmental improvements. Yin et al. (2021) proposed a triple budgeting model embedded in carbon emissions to help companies achieve the integration of operation, finance, and carbon emissions management and promote the unification of economic and environmental benefits.

2.2 Activity-based budget

According to CAM-I (Consortium for Advanced Manufacturing, International), ABB is a way for companies to forecast activities and resource requirements for future periods based on an understanding of activity and cost drivers (Ou and Wang, 2004). It is an extension of activity-based and capability-based concepts in the budgeting realm (Hansen, 2011). ABB is a cost-effective way to plan and control the organization’s expected activities to arrive at a budget that matches the projected workload (Brimson et al., 2012). It uses activity and process analysis to help companies manage and optimize resource allocation (Ou and Wang, 2004), and improve the accuracy of financial forecasts (Huynh et al., 2013). Besides, the implementation of ABB can help companies to strengthen the horizontal communication between departments, which also helps to motivate employees (Hansen et al., 2003). Elmac and Tutkavul (2020) integrate ABB with Balanced Score Card and construct a model to reveal more rationally the process of corporate value creation and the benchmarking of corporate strategy.

2.3 Environmental management accounting

Environmental Management Accounting: Procedures and Principles, published by the United Nations Commission on Sustainable Development in 2001, states that implementing Environmental Management Accounting (EMA) is the implementation of a better and more comprehensive management accounting. Hidden costs can be better identified from environmental impacts. Numerous studies on environmental management accounting have shown that it can help companies meet their environmental responsibilities by analyzing financial and non-financial information and identifying processes that can be optimized from corporate activities, thus improving both environmental and economic benefits (Ferreira et al., 2010; Henri and Journeault, 2010). As the bridge between management accounting and corporate environmental strategy, environmental management accounting plays a crucial role in the sustainable development of companies (Gunarathne and Lee, 2019). Especially in the implementation of cleaner production strategies, EMA can provide relevant economic and environmental information for managers to make decisions and evaluate performance (Burritt et al., 2019). In the exploration of environmental management accounting methods suitable for firms, Xiao and Xiong (2015) constructed a PDCA cycle model based on “material flow-value flow” and applied it to an electrolytic aluminum company to explore potential improvements in its production process, driving the company’s circular economy practices forward. To improve corporate environmental cost management in South Africa, De Beer and Friend (2006) proposed the EEGECOST model, which is based on a life-cycle evaluation of the product production process and uses a cost list to assign environmental costs to specific cost types and cost drivers, this considers a wider range of environmental costs and environmental benefits. Burritt and Saka (2006) combined environmental management accounting and eco-efficiency measurement, and conducted a case study of Japanese companies. The results show that there is still much room for this combination. German scholars introduced material flow cost accounting in the 1990s (Wagner, 2015), and Japanese companies have improved it in use and achieved significant benefits (Prox, 2015). Feng (2008) believes that material flow cost accounting is an important part of environmental management accounting, as well as an important tool for implementing environmental management, which can help companies to reach the unity between management and environment.

Life Cycle Assessment (LCA) and Material Flow Analysis (MFA) are both commonly used methods in environmental management research, and they are often applied in combination and play an important role in the field of economic and social development. For example, Westin et al. (2019) combined MFA of urban areas with LCA to identify environmental hotspots of consumption. De Meester et al. (2019) presents how MFA and LCA can be used to predict material flows and the potential environmental benefit of the recycling chain. Liu et al. (2020) integrated these two methods into the model construction of China’s waste paper recycling decision system to evaluate the economic benefits and environmental impacts of current waste paper recycling in China. Since LCA involves environmental impacts expressed in different units of measurement, they are usually monetized to determine the degree of impact of different pollutants on the environment (Arendt et al., 2022). And the Monetary Valuation Coefficients (MVCs) resulting from diverse monetary valuation methods are inherently different, and the availability of MVCs varies significantly across impact categories (Amadei et al., 2021).

2.4 Material flow cost accounting

Traditional accounting does not contain enough environmental information (Walz and Guenther, 2021), while MFCA can solve this problem exactly. MFCA tracks and quantifies material flows and inventories within an organization in physical units (e.g., mass, volume) and assesses the costs associated with material flows (ISO, 2011; Christ and Burritt, 2015). It not only helps companies to identify the inefficient use of resources in their production process, but also reflects the environmental impact of their production operations by accounting for the generation of negative products. Furthermore, it can improve the transparency of waste management cost sources in complex production processes and determine the actual product cost in a zero-waste scenario (Schmidt, 2015), and can guide companies to improve resource utilization and help them achieve a low-carbon economy (Luo and Xiao, 2011). Approximately 90% of a company’s environmental expenses are caused by costs associated with non-product outputs. To some extent, companies using MFCA to improve resource efficiency can reduce the environmental impact of upstream supply chains and thus improve overall environmental performance (Jasch and Lavicka, 2006; Christ and Burritt, 2015). Sulong et al. (2015), Yagi and Kokubu (2018), and Sahu et al. (2021) found through case studies that the application of MFCA to SMEs was able to achieve simultaneous growth in economic and environmental sustainability.

Despite the fact that ISO 14051:2011 has given a detailed specification of MFCA and companies can benefit from this in many ways, not many have implemented it in practice. One of the reasons is that decision makers may not realize the opportunities of combining financial and material flows in an accounting process (Jasch, 2008). According to Guenther et al. (2015), for confidentiality and competition, many companies are reluctant to make publicly available the detailed information of material flows, efficiency enhancement, and resource savings. Besides, the lack of data also limits the implementation of MFCA (Amicarelli et al., 2022). And the potential conflicts between MFCA and the existing management perspectives may also contribute to the less widespread use of MFCA (Kokubu and Kitada, 2015).

On the extension of MFCA, Xiao et al. (2016) constructed a methodological system including an integrated MFCA-LCA model and accounting methods from a life-cycle perspective. Rieckhof and Guenther (2018) similarly combined MFCA and Life Cycle Assessment (LCA) in order to identify the environmental burden caused by production and thus adjust the production process for the purpose of resource conservation. Fakoya and van der Poll (2013) argue for the importance of integrating MFCA with Enterprise Resource Planning (ERP) systems. Rieckhof et al. (2015) emphasize that MFCA requires an increased relationship with management control systems, which can drive corporate strategy toward resource efficiency.

In summary, research on budgeting has yielded a number of results. Systems of the overall budgetary management and ABB have received much attention because of their strategic orientation. However, few studies have been conducted to introduce environmental variables into the budget. Environmental management accounting is an emerging field of study, which has advanced in recent years along with human efforts to address environmental issues. MFCA is an environmental management accounting method that is relatively well established and has been applied in practices. However, MFCA is mainly used for ex-post accounting and reporting, and has not been used for forecasting or planning. In view of this, we attempt to introduce the MFCA method into the budgeting process of manufacturing firms, and thus construct an MFCA-ABB model, which is intended to forecast and plan for the resource consumption, positive product output, and negative product generation. It is also expected to turn a pure operating budget into an environmental-economic budget, thus achieving both environmental and economic benefits for the company.

3 Research methodology

The methodology used in this study involves two aspects, one is the development of the MFCA-ABB model, including the model framework and the description of its implementation process, and the second is the application of the model to the case firm with reference to the study by Yin et al. (2021). Taking into account the implementation scheme of MFCA proposed by ISO 14051:2011, our case study consists of the following steps. Step 1: Identification of implementation boundary for products/processes; Step 2: Data collection, processing and budgeting based on the MFCA-ABB model; Step 3: Interpretation and communication of budgeting results; Step 4: Improving production processes by scenario analysis.

3.1 Development of MFCA-ABB model

3.1.1 Framework of MFCA-ABB model

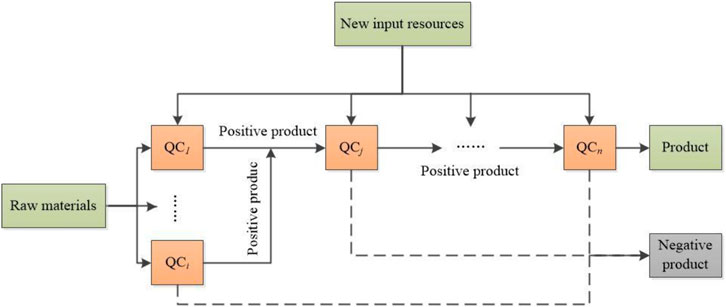

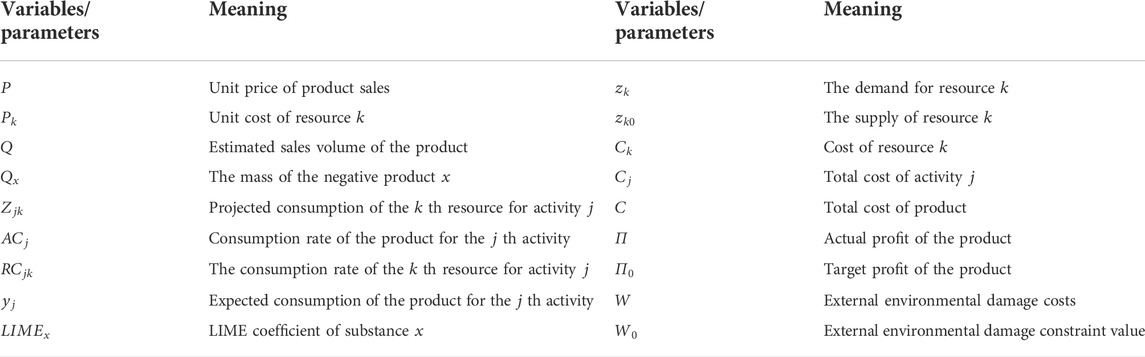

The MFCA tool focuses on quantifying the marketable product (called “positive product”) and process waste (called “negative product”) generated during the manufacturing process (Zhou et al., 2017). It is based on the principle of material input-output balance, where the physical input into the system should be equal to the physical output of the system, and introduces the concept of “quantity centers,” where the input and waste of each quantity center are quantified in physical and monetary terms (ISO, 2011). There are two main types of input sources for the resources of each quantity center, i.e., newly committed resources and resources transferred from the previous quantity center. There are also two main outflow paths of resources, i. e., products and negative products. The specific material flow is shown in Figure 1.

Traditional ABB emphasizes the balance between business operations and finance. Along with the consumption and transfer of production resources, the value is transferred to semi-finished and finished products. But in fact, not only the value flows with it, but as the resources flow, some of the resources and values will also be transferred to the waste, becoming negative products and causing damage to the environment. Traditional budget management pursues profit maximization and does not give much consideration to whether the production process is clean enough and whether the emission of exhaust gas and wastewater will pollute the ecological environment. In order to consider the environmental impact in the corporate budget, we attempt to combine ABB and MFCA.

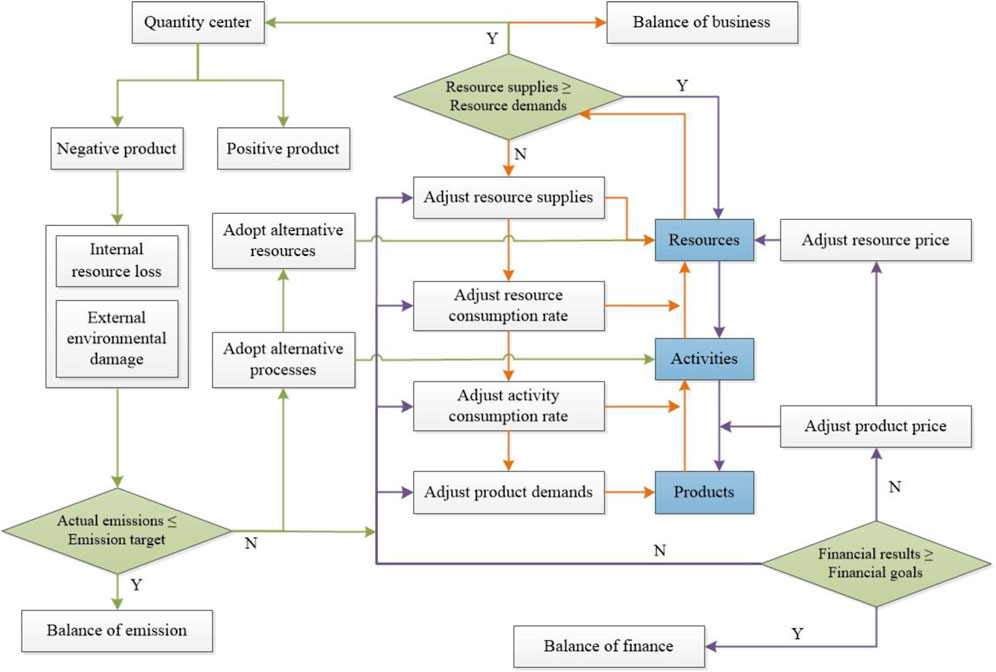

The activity centers in ABB and the quantity centers in MFCA are divided according to the production process, and both include the process of resource input, consumption and output. And for the same product, the production process is determined, if the division of quantity centers and activity centers are matched, then their resource consumption and technology level in the same link are the same, and the resource demand of each activity center is equal to the new input resources of each quantity center, which provides the conditions for the combination of MFCA and ABB. Based on this the construction of MFCA-ABB model is carried out, as shown in Figure 2.

The MFCA-ABB model starts with determining the product demand, that is, it first needs to forecast the market demand for the product in a future operating period, then forecast the product demand for the activity based on the activity consumption rate, and finally calculate the demand for each resource required to satisfy the activity based on the resource consumption rate. If the company’s resource supply can meet the resource demand in the future operation period, then it has reached the resource consumption budget balance and can further calculate its cost, profit and the value amount of environmental damage caused by negative product generations. This study uses whether the desired level of profitability of the company is achieved as a measure of whether it has reached financial budget balance, i.e., financial balance is considered to be achieved when the profit of the product is higher than the target set by the company. ABB and MFCA use resource consumption as a bridge, the resource requirements obtained in ABB are the material input of each quantity center of MFCA, and the positive and negative product quantity of each center can be inferred and analyzed by the workshop technology level and related data. The total value of negative products in each quantity center is the internal resource loss of this production process, and the value of negative products discharged into the environment and causing pollution to the environment (This value is accounted by using the Japanese LIME coefficient) is the external environmental damage. A waste generation balance is considered to be reached when the external environmental damage value of the company is less than the target value. When a company does not meet any of the three balances, it can achieve balance by adjusting resource supplies, product demands, and resource/activity consumption rate. In addition, if financial balance cannot be reached, product prices or resource prices can be adjusted; if environmental balance cannot be reached, alternative resources or alternative processes can be found for optimization.

3.1.2 Formulation of budgeting balance

In order to study the extended application of ABB in the field of environmental management accounting and to reveal its inner mechanism and specific operation process, this paper designs a specific plan to carry out MFCA-ABB in manufacturing enterprises under the MFCA-ABB model.

Suppose a manufacturing enterprise produces a certain product, requires

3.1.2.1 Balance of resource consumption budget

Resource consumption budget balance requires that the company’s supply of resources can meet the consumption of resources in the production process, including raw materials, human resources and production facilities supply, is the prerequisite for normal production.

Due to the “product consuming activity,” the expected consumption of the

Also due to the “activity consuming resources,” the expected consumption of resources in the

Then the expected consumption of resource

When

3.1.2.2 Balance of financial budget

The financial budget balance is based on the resource consumption budget balance, which is the economic matching relationship between the amount of resources input and the amount of output produced during the operating period. In this paper, the financial budget balance is judged based on whether the product profit meets the target.

From the budget balance of resource consumption, the expected consumption of resources is

The product cost is the sum of the costs of the activities and is expressed by the formula

Therefore, the total product profit is

If

3.1.2.3 Balance of waste generation budget

Bringing the waste generation budget into balance means that the external environmental costs caused by production are less than the target. This balance is also dependent on the resource consumption budget. First, according to the resource consumption budget derived from the amount of resources required by each activity center, and then through MFCA to get the output of positive and negative products for each quantity center, and use the positive product generation ratio to attribute the cost of positive and negative products for each quantity center, the final sum of the cost of negative products is the cost of internal resource loss. Companies can use this link to aggregate negative products to account for external environmental damage costs, and this paper selects the life cycle damage evaluation method LIME for measurement. The external environmental damage cost monetization path broadly consists of the following steps.

In the first step, classify and assemble the waste generations in each quantity center.

In the second step, summarize the quantity of waste generations and standardize these data according to the LIME coefficient table, and the main wastes of the case companies in this paper are expressed in terms of mass.

In the third step, find the coefficient value corresponding to the waste type in the LIME table and multiply it by the waste quantity to get the external damage cost caused by the waste discharge.

In the fourth step, aggregate the external environmental damage cost of waste, i.e., the external environmental damage reflected in monetary terms.

It is expected that there are

If W ≤

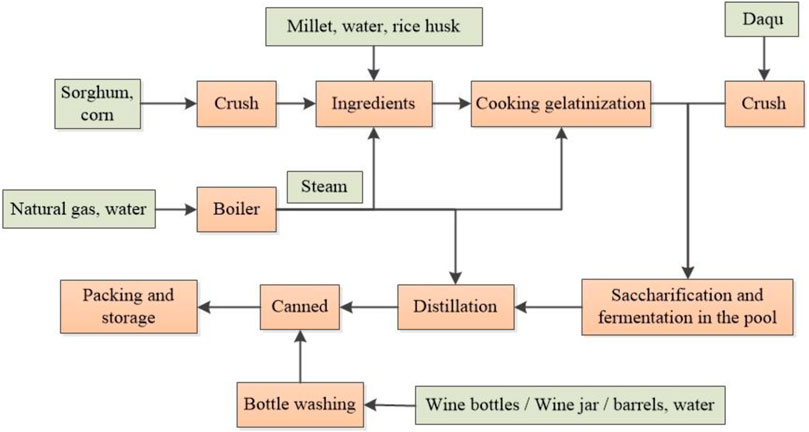

3.2 Case of liquor production

In this study, a Chinese fragrant liquor manufacturer, JLC Company, is selected as the research case. We apply the MFCA-ABB model to its budgeting for 2022 based on its manufacturing process. The production process as discussed in this study is only applicable to the production of fragrant liquor, which is shown in Figure 3.

3.2.1 Data sources

Since the material flow cost accounting has not been actually carried out in the target enterprise, the basic data and activity costing process of the workshop are obtained from the environmental impact report of the project, and the few unavailable data are inferred by data completion techniques.

The prices of raw materials and finished goods for liquor production are derived from data publicly available on the website of Baidu Aicaigou and are based on the average value of the top five material prices. The prices of water, electricity and natural gas are determined by the administrative area where the company is located. The fixed assets are depreciated on a straight-line basis over a period of not less than 10 years with a residual value of 5%. The salary expense is determined based on the average wages of employees in urban manufacturing enterprises during the period of 2017–2021 as reported by the China National Bureau of Statistics, which is estimated to be ¥57,411.14 in 20221. At 280 working days a year and eight working hours a day, an employee’s wage per hour should be ¥25.60. Since the steam needed in the production process is provided by the boiler operation, the cost of steam is reasonably assumed to be zero. The indirect

3.2.2 Scenarios

Scenario analysis is an effective technique for forecasting which is usually adopted to support strategic planning. This study seeks to forecast the environmental and economic performance of the case company under different scenarios so that the optimal production alternative(s) can be selected. Through literature research and expert interviews, it is found that, for aromatic liquor, the case company can improve the production process in terms of “emission reduction” and “consumption reduction.” There are three potential alternatives as described below, all of which are to be analyzed as a part of the company’s budgeting.

From the perspective of “emission reduction,” a large amount of carbon dioxide is produced in the fermentation process of alcohol, and the concentration of carbon dioxide in alcohol fermentation gas is up to 96% or more (Liu and Liu, 2009; Wang, 2015), and the current carbon dioxide recovery processes have been relatively mature, including adsorption distillation, catalytic combustion, variable pressure adsorption, solvent absorption, organic membrane separation, etc. Among them, adsorption distillation is suitable for high carbon dioxide content in the raw gas, and is more applicable in the fermentation industry. A study by Wang (2015) found that the recovery of CO2 by adsorption distillation can produce 1 ton of liquid CO2 for every 1.25 tons of feed gas consumed. So, one abatement option is to use an adsorption distillation process to recover carbon dioxide gas generated from the fermentation process, purify it and use it for production in related industries.

Besides, as people pay more attention to environmental protection, biomass boilers are gradually coming into people’s view. The burning biomass pellets of biomass boilers are made of woody and herbaceous plants (such as straw, paddy bran, wood chips, tree-bark, peanut shells, hemp sticks, etc.) and their waste materials, which are renewable fuels, and their carbon dioxide emissions after combustion belong to the carbon cycle in nature, which do not constitute pollution and can be considered as “zero emission” of carbon dioxide. The use of biomass boilers to provide steam can reduce

From the perspective of “consumption reduction,” potential improvements can be found in production equipment. Zhang et al. (2021) designed a water resources and thermal energy gradient utilization system for liquor brewing and found that the use of this system in a fragrant liquor company could improve the reuse of water in production, thus reducing the pressure on wastewater treatment facilities and the water environment. So, we can add this system to the original production equipment of the company, so as to achieve the purpose of reducing consumption.

4 Case study

4.1 Identification of boundary

To explain the practical application of the MFCA-ABB system at the firm level, this paper is based on the manufacturing process of the JLC fragrant liquor production project for budgeting in 2022. We define process implementation boundaries: the manufacturing process discussed in this study applies only to the production of fragrant liquor.

JLC’s production target is to produce 1,500 tons of fragrant liquor per year, and the sales price refers to the data of Baidu Aicaigou website, and the average price of the same fragrance products is 28 ¥/kg.

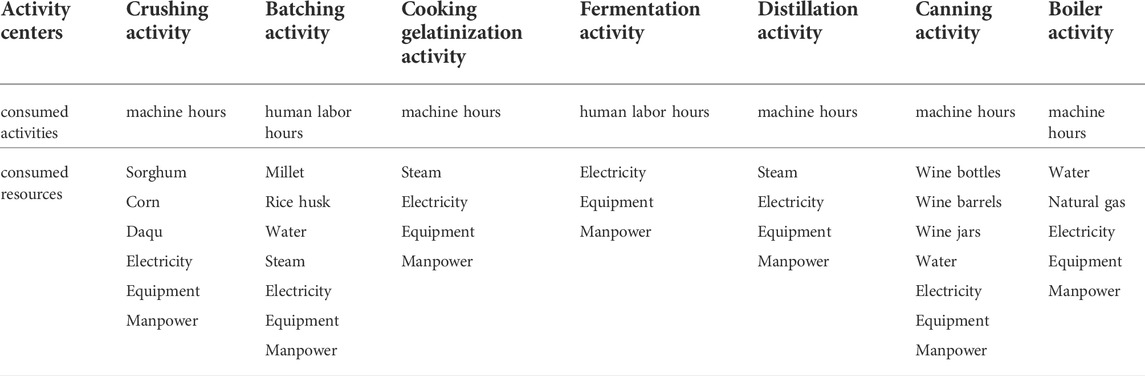

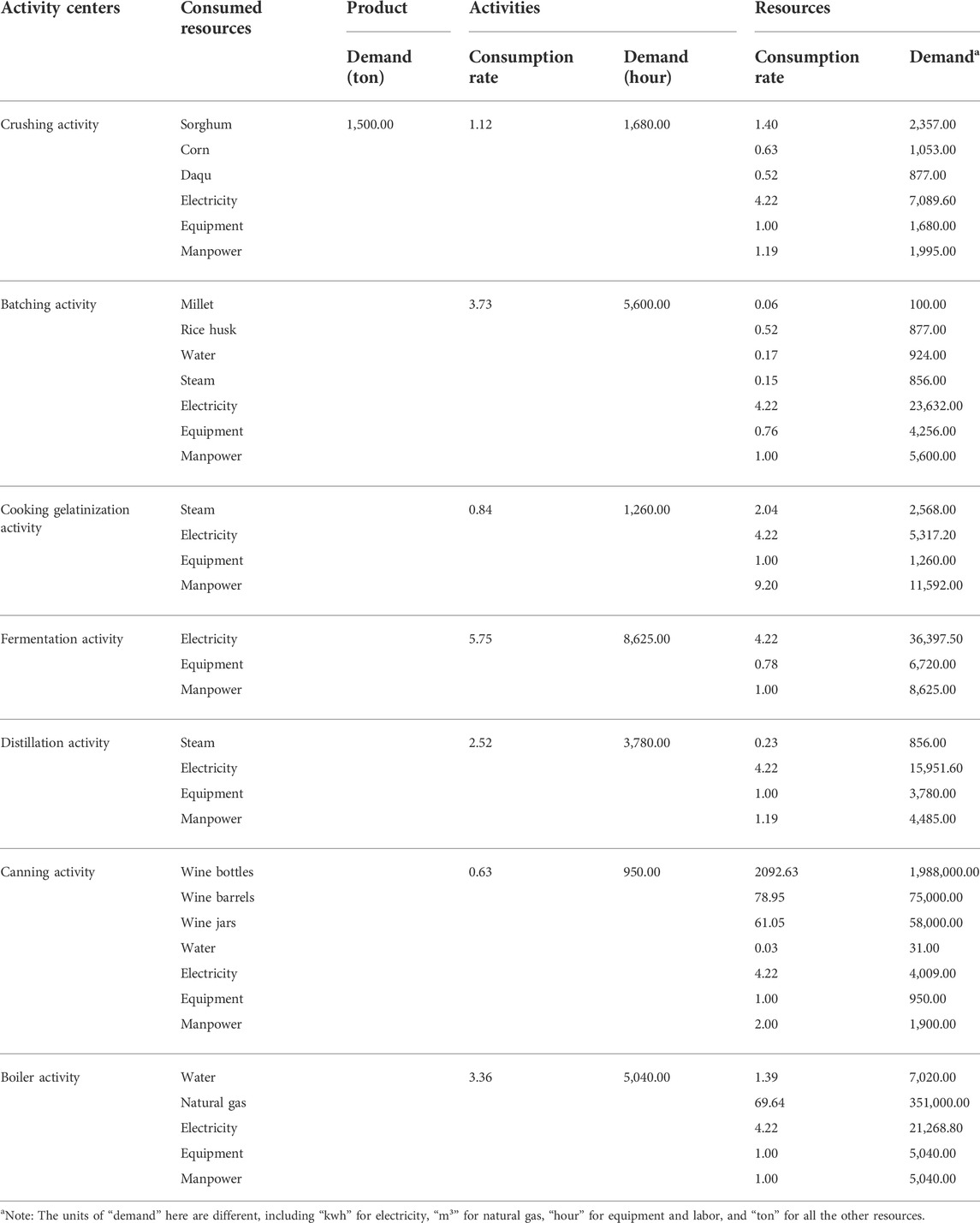

As shown in Figure 3, the entire production process involves seven activity centers, with the boiler activity providing the steam needed for the three activities of ingredients, cooking gelatinization and distillation. The consumption activities and consumption resources of each activity center are analyzed (Table 2). All activity centers are expressed in machine hours, except for batching activities and fermentation activities, which are expressed in human labor hours.

4.2 Data collection, processing and budgeting

4.2.1 Resource consumption budget

As mentioned before, the product demand is 1,500 tons, and the activity consumption rate

4.2.2 Financial budget

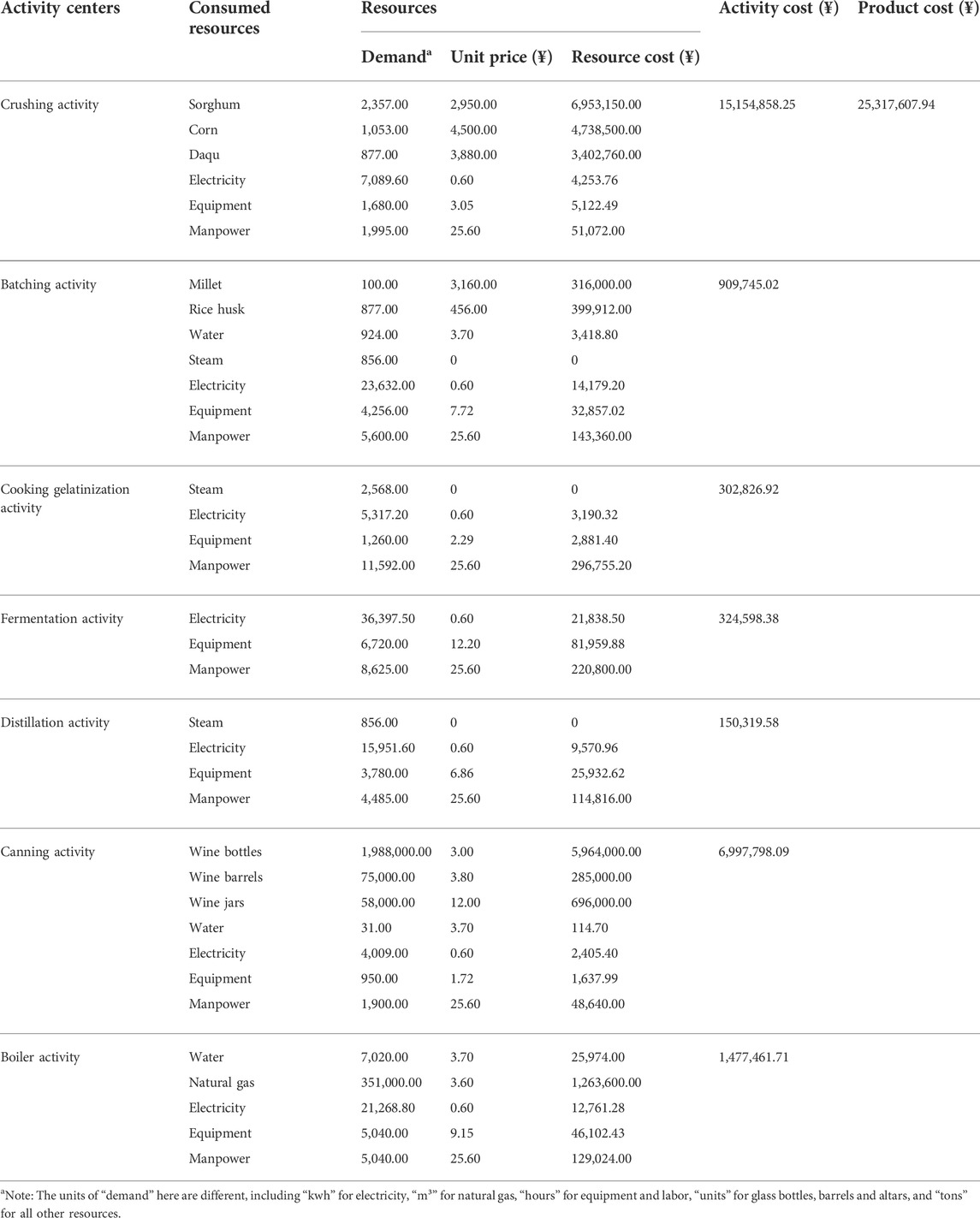

From Table 3, the demand for each resource

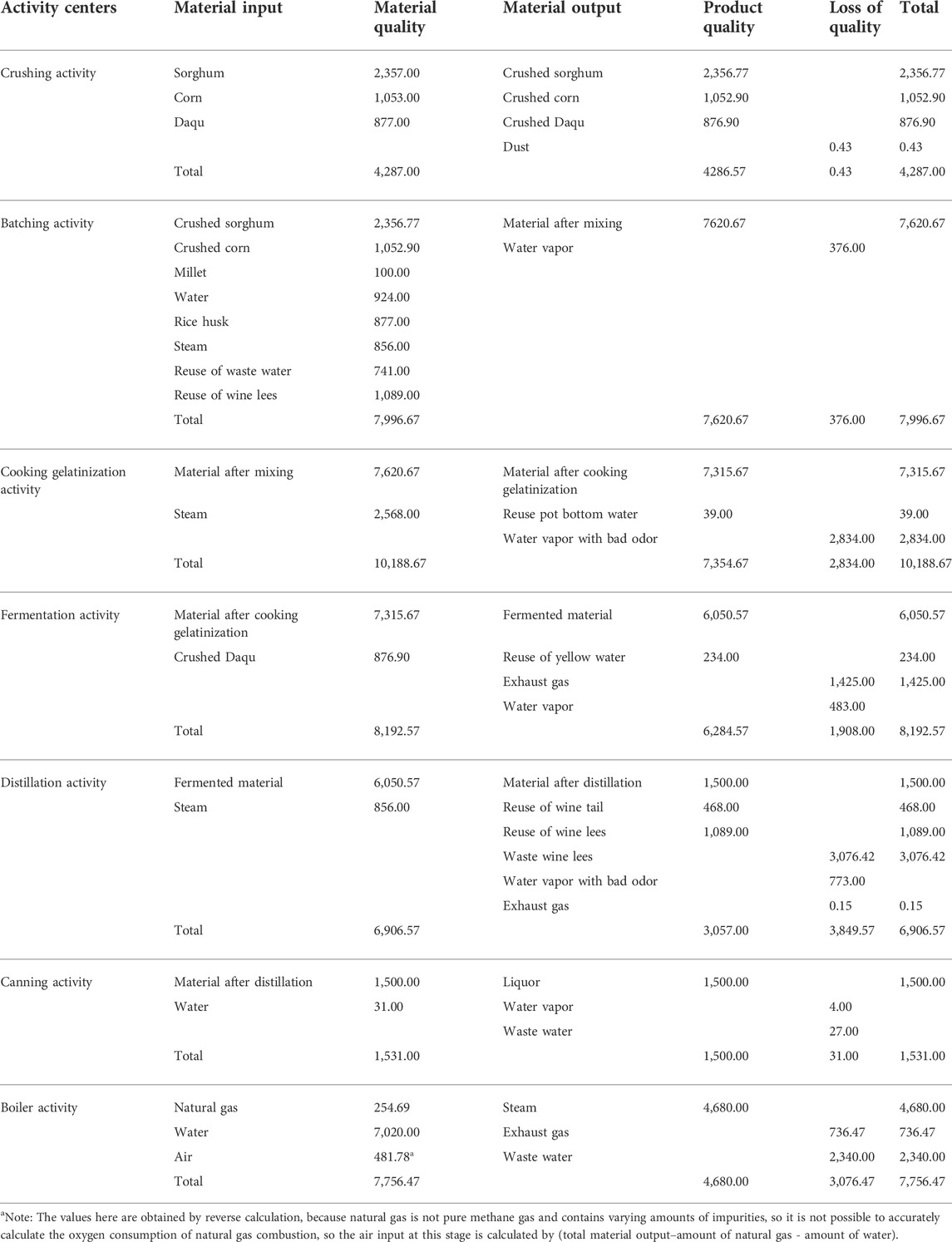

4.2.3 waste generation budget

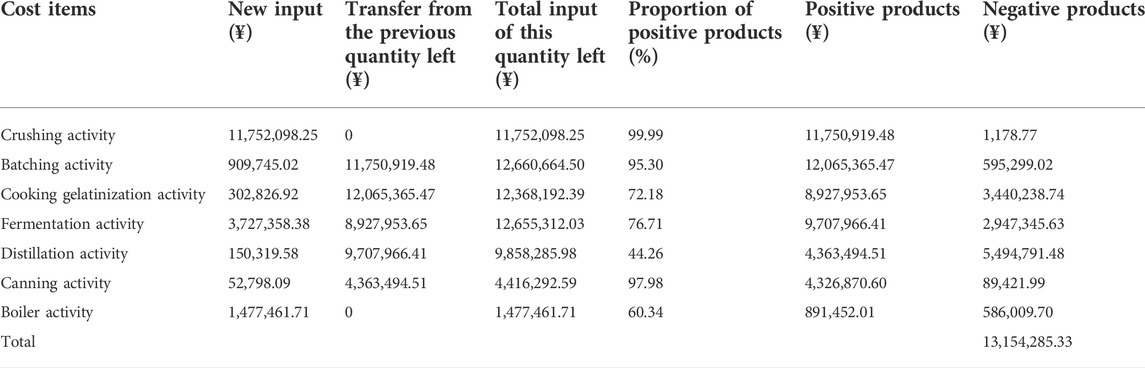

According to the accounting principle of material flow cost accounting, resource value stream analysis can be performed for this product item to identify which parts of the entire production process are inefficient in resource utilization, which is the internal resource loss of the enterprise. At the same time, the negative products of each activity are summarized and analyzed to calculate the cost of environmental damage caused by their emissions, and the results of the material input-output budget of this project are shown in Table 5. Here, the “exhaust gas” and “waste water” generation of each activity center are predicted and calculated in order to estimate the resource efficiency of each activity center.

Based on the calculations in Table 5, the internal resource value flow of the project can be pre-accounted for. As shown in Table 6, the total cost of negative products is the cost of lost resource value. The proportion of positive products for each activity center is obtained from Eq. 8.

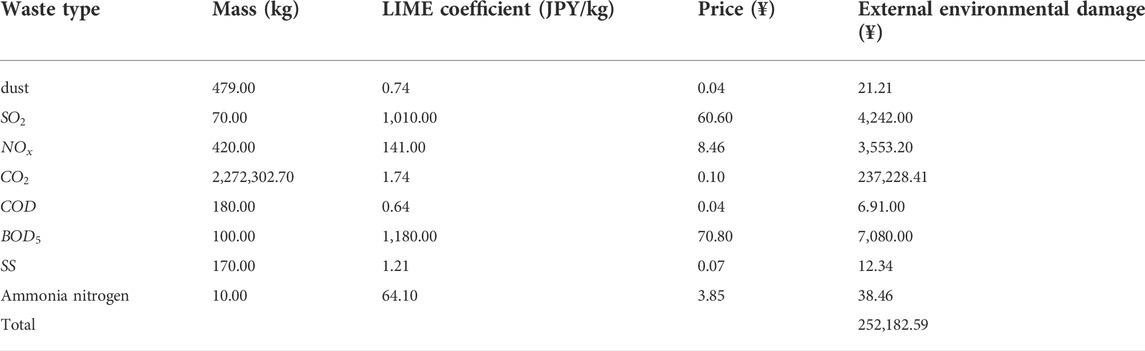

The negative products of the production process are mainly exhaust gas and waste water, and their emissions can have a large negative impact on the ecological environment. The wastewater produced by liquor production includes pollutants such as Chemical oxygen demand (

4.3 Results

Through a preliminary MFCA-ABB of JLC’s liquor project, it was found that the distillation activity had the lowest resource utilization efficiency in the whole production process, with only 44.26% of positive products generated, but the negative products of this activity were mainly waste lees, which were collected by the company and sold to the public as feed, also creating additional economic value and reducing solid waste generation. The next lowest resource utilization is the boiler activity with a positive product percentage of 60.34%, this is due to the large amount of

From Table 7, it can be seen that the value of waste generations to external environmental damage is ¥252,182.59, the main reason for the high cost of external environmental damage is the large amount of carbon dioxide gas produced during the production process, which causes up to 94% of the total environmental damage cost. Tracing the source of carbon dioxide, it comes from three main sources, one is the emission from the fermentation process, amounting to 1,425 tons; the second is the direct emissions caused by the combustion of natural gas, amounting to 758.93 tons; the third is the indirect emissions caused by the consumption of electricity, amounting to 88.38 tons. In response, companies can reduce the

The scenario analysis as describe in Section 3.2.2 is conducted as follows.

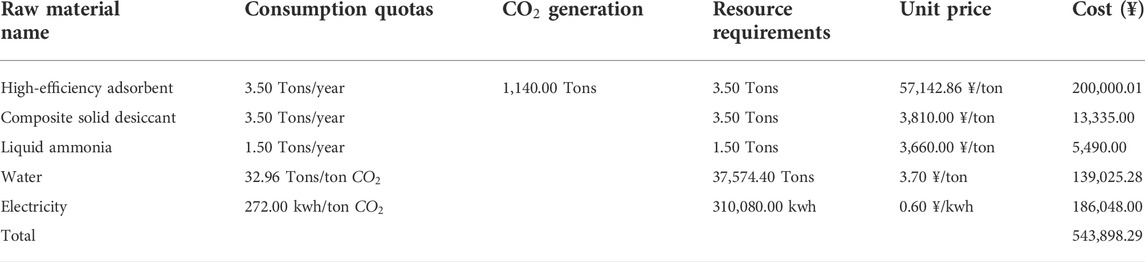

Scenario 1: The adsorption and distillation processes are used to absorb the

According to Wang (2015), the recovery of

The average sales price of purified carbon dioxide is 730 ¥/ton3 and the cost is ¥543,898.29, which can increase the profit for the enterprise by ¥288,301.714 and obtain a good economic benefit. In terms of environmental benefits, the company recycles the carbon dioxide produced by the fermentation operation, reducing the negative environmental impact of this part of 1,425 tons of carbon dioxide gas, but because the electricity consumption increases by 31,080 kWh, which means an increase of 164,522.25 kg of indirect emissions of carbon dioxide, so in comparison with the original scheme of the company, the total reduction of carbon dioxide emissions is 1,260,477.75 kg, according to the LIME coefficient of CO2 1.74 JPY/kg, the unit conversion is 0.10 ¥/kg, so the change of external environmental damage cost is ¥-131,593.88.

Therefore, JLC will reduce external environmental damage of ¥131,593.88 and increase operating income of ¥288,301.71 by recycling

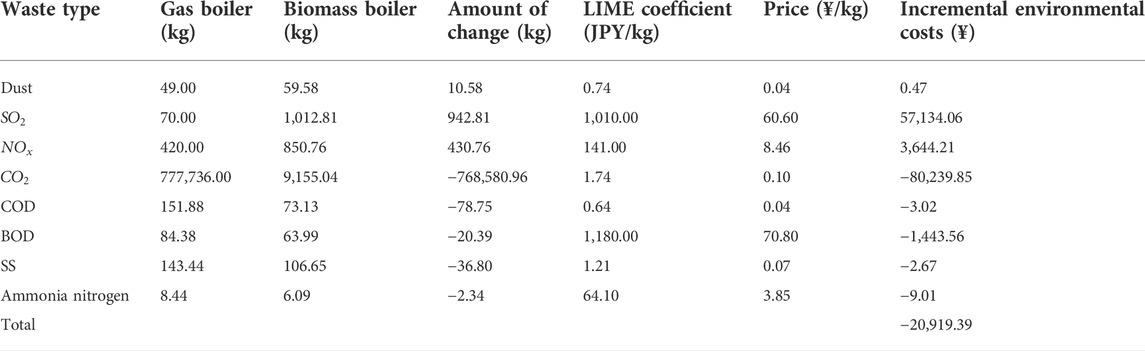

Scenario 2: Biomass boilers are put into production instead of gas boilers.

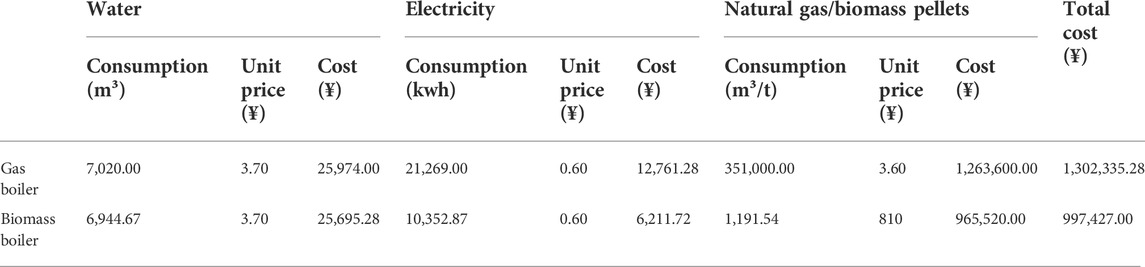

Based on the 4,280 tons of steam required for the production of JLC Company, we calculated the consumption of water, electricity and energy by the gas boiler and biomass boiler separately, as shown in Table 9.

It is easy to see from Table 9 that when the gas boilers are replaced with biomass boilers, the consumption of water and electricity are reduced to varying degrees.

The waste generations from different boilers and the amount of environmental cost changes before and after boiler replacement are shown in Table 10.

Therefore, using biomass boilers instead of gas boilers, the annual cost savings can reach ¥304908.285. Besides, the use of biomass boilers to replace gas boilers will reduce the

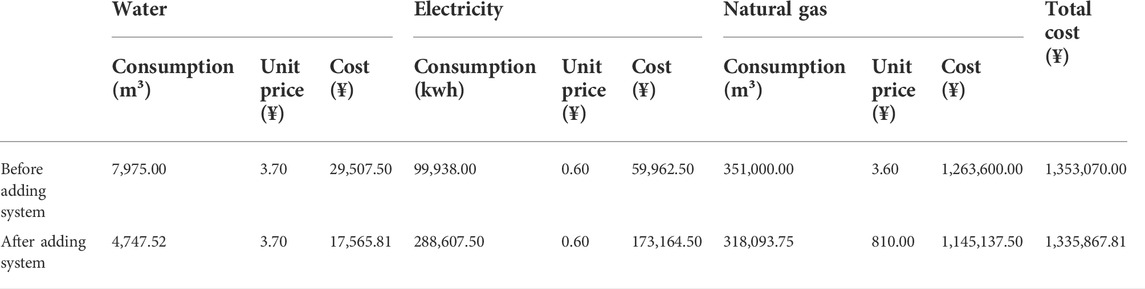

Scenario 3: Adding water resources and thermal energy gradient utilization system.

We forecast and compare the material consumption, waste generations and environmental damage cost of JLC before and after adding the system, in order to clarify the impact on economic and environmental benefits. Table 11 presents the material consumption and cost comparison before and after the addition of the system.

From Table 11, we can find that the consumption of both water and natural gas decreases with the additional system, but the electricity consumption and its cost will increase significantly.

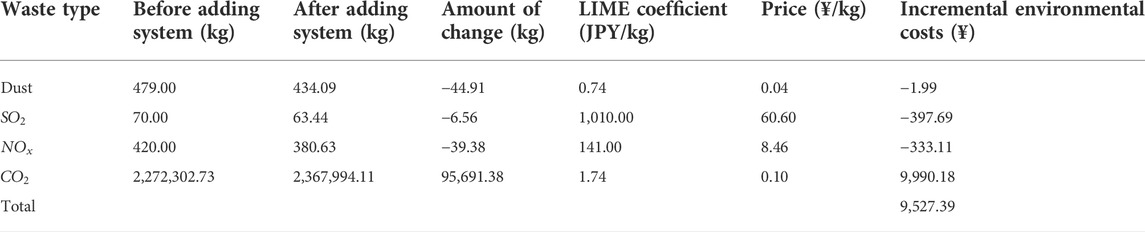

The comparison of waste generations and the incremental environmental costs before and after the addition of the system are shown in Table 12.

From scenario 3, although the use of water resources and thermal energy gradient systems results in lower production costs, it also leads to higher external environmental damage costs. The reason for this is that the use of the system will lead to a significant increase in electricity consumption and consequently to a significant increase in the indirect

According to the above calculation analysis, both scenario 1 and scenario 2 will bring better economic and environmental benefits to the company, and these two optimization options are not mutually exclusive in nature, in other words, if there are sufficient funds, we can consider a two-pronged approach. The optimization scenario under scenario 3 can save material costs to a certain extent, but the economic benefits obtained are smaller compared to the first two scenarios, while it may lead to greater environmental damage costs. Therefore, based on the budget analysis of the three scenarios, the process improvement under scenario 3 is not desirable, and the company can choose both the first two optimization options (when there is no financing constraint) or one of them (when there is financing constraint) in order to achieve the desired goal.

5 Discussion

This research enriches the theoretical study of MFCA and ABB, and brings the accounting of MFCA from ex post to ex ante, and also extends ABB to the field of environmental management accounting, so that the traditional budget can serve the economic quality development. The MFCA-ABB model is based on the traditional ABB model, and adds the dimension of waste generation in the production of the company, so as to develop a two-dimensional analysis of “internal resource loss - external environmental damage,” and uses the value of resource flow and the value of damage to the external environment to identify the process points that need to be optimized as a priority for production improvement.

For example, the waste generation budget allow us to specify the quality of product output (positive products) and material losses (negative products) for each activity center, but these data on quality are of little use to companies (Amicarelli et al., 2022), and they are more concerned with profit levels. The accounting of internal resource value flows allows companies to determine the economic costs of positive and negative products in each activity center, which allows managers to increase their attention to resource utilization. Combined with the external environmental damage costs it can be found that activities with inefficient use of resources are the main source of environmental damage, for which we make targeted process improvements to achieve a higher level of production.

The MFCA-ABB model can strengthen the awareness of companies that negative products not only waste resources but also cause environmental damage. It can determine the amount of waste generated in production and the damage caused to the environment, so that the efficiency of resource use for each activity in production can be predicted, providing business managers with data available for adjusting production operations and making business decisions, and helping companies to make better business plans. Also, based on the realization of the forecast of resource consumption in each activity center, it reflects the discharge of corporate waste and its impact on the environment, and promotes the level of corporate waste management.

6 Conclusion

In this study, we introduce the MFCA method into the budgeting process of manufacturing firms, and thus construct an MFCA-ABB model. This model is applied to the JLC Company in order to forecast and plan for its resource consumption, positive product output, and negative product generation. Based on the forecasts of involved material flows, inefficiencies in the company’s liquor production process are identified; scenario analysis is then conducted to determine the optimal process which is expected to increase the environmental benefits as well as economic benefits. The success of applying the MFCA-ABB model to an entity demonstrates its applicability and feasibility.

The academic contribution of this study is the proposal of an MFCA-ABB approach. The introduction of MFCA into budgeting for manufacturing firms will turn a pure operating budget into an environmental-economic one, thus achieving both environmental and economic benefits for the company. Besides, this study makes an attempt to apply ABB in environmental management accounting, which suggests the possibility of applying the conventional management accounting tools, after modified, to the environmental-economic management of manufacturing firms in the future. In practice, we have successfully applied the MFCA-ABB model to the target company, which provides a feasible solution for the implementation of MFCA-ABB.

There are still some deficiencies in this study. They include: 1) The proposed model and the case focus on the manufacturing process. In fact, however, some enterprises also generate large amount of waste in transportation, packaging and distribution. Therefore, the follow-up study will seek to incorporate the data from these segments into budgeting and control as well. 2) MFCA-ABB is essentially a budgeting system that aims to create value at a strategic level by taking into account resource inputs, economic benefits and environmental impact. Theoretically it can be applied not only to individual businesses, but also to the supply chain by optimizing the processes based on the co-creation of value between upstream and downstream companies, thus implementing MFCA-ABB along the supply chain. That is what the follow-up study will do.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

LQ: Investigation, data curation, writing-original draft preparation and editing. ZW: Conceptualization, methodology, writing-reviewing and editing, supervision. CS: Investigation, methodology. LY: Writing-reviewing and editing.

Acknowledgments

The authors would like to express our sincerest gratitude to the accounting staff of liquor manufacturers for their kind offering of some essential data that have not been made public.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1The average wage in 2022 is projected based on historical data using the exponential smoothing method.

2Profit of ¥

3Data source: https://max.book118.com/html/2017/1219/144932385.shtm

4Profit of ¥

5The cost savings ¥ 304,908.279 is obtained from equation

References

Amadei, A. M., De Laurentiis, V., and Sala, S. (2021). A review of monetary valuation in life cycle assessment: State of the art and future needs. J. Clean. Prod. 329, 129668. doi:10.1016/j.jclepro.2021.129668

Amicarelli, V., Roe, B. E., and Bux, C. (2022). Measuring food loss and waste costs in the Italian potato chip industry using material flow cost accounting. Agriculture 12 (4), 523. doi:10.3390/agriculture12040523

Amin, M. N., and Nengzih, N. (2021). Proposed application of the use of activity-based budgeting (ABB) method for cost control of daily and casual workers (A case study at PT XYZ). Saudi J. Econ. Fin. 5 (9), 411–420. doi:10.36348/sjef.2021.v05i09.007

Arendt, R., Bach, V., and Finkbeiner, M. (2022). The global environmental costs of mining and processing abiotic raw materials and their geographic distribution. J. Clean. Prod. 361, 132232. doi:10.1016/j.jclepro.2022.132232

Brimson, J. A., Antos, J. J., and Mendlowitz, E. (2012). "Activity‐based budgeting," in Handbook of budgeting 6th Edition. Editor R. L. William. (New York, NY: John Wiley & Sons), 767–790. doi:10.1002/9781119200871.ch33

Burritt, R. L., Herzig, C., Schaltegger, S., and Viere, T. (2019). Diffusion of environmental management accounting for cleaner production: Evidence from some case studies. J. Clean. Prod. 224, 479–491. doi:10.1016/j.jclepro.2019.03.227

Burritt, R. L., and Saka, C. (2006). Environmental management accounting applications and eco-efficiency: Case studies from Japan. J. Clean. Prod. 14 (14), 1262–1275. doi:10.1016/j.jclepro.2005.08.012

Bux, C., and Amicarelli, V. (2022). Material flow cost accounting (MFCA) to enhance environmental entrepreneurship in the meat sector: Challenges and opportunities. J. Environ. Manag. 313, 115001. doi:10.1016/j.jenvman.2022.115001

Christ, K. L., and Burritt, R. L. (2015). Material flow cost accounting: A review and agenda for future research. J. Clean. Prod. 108, 1378–1389. doi:10.1016/j.jclepro.2014.09.005

De Beer, P., and Friend, F. (2006). Environmental accounting: A management tool for enhancing corporate environmental and economic performance. Ecol. Econ. 58 (3), 548–560. doi:10.1016/j.ecolecon.2005.07.026

De Meester, S., Nachtergaele, P., Debaveye, S., Vos, P., and Dewulf, J. (2019). Using material flow analysis and life cycle assessment in decision support: A case study on weee valorization in Belgium. Resour. Conservation Recycl. 142, 1–9. doi:10.1016/j.resconrec.2018.10.015

Dierkes, S., and Siepelmeyer, D. (2019). Production and cost theory-based material flow cost accounting. J. Clean. Prod. 235, 483–492. doi:10.1016/j.jclepro.2019.06.212

Elmacı, O., and Tutkavul, K. (2020). Activity based budgeting model integrated with balanced scorecard as A cycle of increasing corporate performance. Int. J. Acad. Value Stud. (Javstudies JAVS) 6, 280–287. doi:10.29228/javs.45870

Fakoya, M. B., and van der Poll, H. M. (2013). Integrating ERP and MFCA systems for improved waste-reduction decisions in a brewery in South Africa. J. Clean. Prod. 40, 136–140. doi:10.1016/j.jclepro.2012.09.013

Feng, Q. G. (2016). Functional expansion and innovative practice of budget management. Friends Account. 9, 127–133. doi:10.3969/j.issn.1009-9972.2018.09.145

Feng, Q. G. (2008). Material flow cost accounting based on environment management and its application. Account. Res. 12, 69–76. doi:10.3969/j.issn.1003-2886.2008.12.009

Ferreira, A., Moulang, C., and Hendro, B. (2010). Environmental management accounting and innovation: An exploratory analysis. Auditing Account. J. 23, 920–948. doi:10.1108/09513571011080180

Guenther, E., Jasch, C., Schmidt, M., Wagner, B., and Ilg, P. (2015). Material flow cost accounting–looking back and ahead. J. Clean. Prod. 108, 1249–1254. doi:10.1016/j.jclepro.2015.10.018

Gunarathne, A. N., and Lee, K. H. (2019). Environmental and managerial information for cleaner production strategies: An environmental management development perspective. J. Clean. Prod. 237, 117849. doi:10.1016/j.jclepro.2019.117849

Hansen, S. C. (2011). A theoretical analysis of the impact of adopting rolling budgets, activity-based budgeting and beyond budgeting. Eur. Account. Rev. 20 (2), 289–319. doi:10.1080/09638180.2010.496260

Hansen, S. C., Otley, D. T., and Van der Stede, W. A. (2003). Practice developments in budgeting: An overview and research perspective. J. Manag. Account. Res. 15 (1), 95–116. doi:10.2308/jmar.2003.15.1.95

Henri, J. F., and Journeault, M. (2010). Eco-control: The influence of management control systems on environmental and economic performance. Account. Organ. Soc. 35 (1), 63–80. doi:10.1016/j.aos.2009.02.001

Huynh, T., Gong, G., and Huynh, H. (2013). Integration of activity-based budgeting and activity-based management. Int. J. Econ. Finance Manag. Sci. 1 (4), 181–187. doi:10.11648/j.ijefm.20130104.11

ISO (2011). Environmental management - material flow cost accounting – general framework. Geneva: International Organization for Standardization.

Jasch, C. M. (2008). Environmental and material flow cost accounting: Principles and procedures. London: Springer Science & Business Media.

Jasch, C., and Lavicka, A. (2006). Pilot project on sustainability management accounting with the Styrian automobile cluster. J. Clean. Prod. 14 (14), 1214–1227. doi:10.1016/j.jclepro.2005.08.007

Jasch, C. M. (2008). Environmental and material flow cost accounting: Principles and procedures. London: Springer Sci. Bus. Media 25. doi:10.1007/978-1-4020-9028-8

Kokubu, K., and Kitada, H. (2015). Material flow cost accounting and existing management perspectives. J. Clean. Prod. 108, 1279–1288. doi:10.1016/j.jclepro.2014.08.037

Kowalczyk, T., Rafai, S., and Taylor, A. (2006). “An experimental investigation of strategic budgeting: a technique for integrating information symmetry,” in Advances in management accounting. Editors M. J. Epstein, and J. Y. Lee (Oxford: JAI Press), 1–20.

Landrigan, P. J., Fuller, R., Acosta, N. J., Adeyi, O., Arnold, R., Baldé, A. B., et al. (2018). The Lancet Commission on pollution and health. lancet 391 (10119), 462–512. doi:10.1016/S0140-6736(17)32345-0

Liu, M., Tan, S., Zhang, M., He, G., Chen, Z., Fu, Z., et al. (2020). Waste paper recycling decision system based on material flow analysis and life cycle assessment: A case study of waste paper recycling from China. J. Environ. Manag. 255, 109859. doi:10.1016/j.jenvman.2019.109859

Liu, X. Y., and Liu, Z. G. (2009). Recycling and utilization of carbon dioxide in alcohol production. Heilongjiang Sci. Technol. Inf. 5, 48. doi:10.3969/j.issn.1673-1328.2009.05.047

Luo, X. Y., and Xiao, X. (2011). Study on material flow cost accounting's theory and its application. East China Econ. Manag. 7, 113–117. doi:10.3969/j.issn.1007-5097.2011.07.028

Ou, P. Y., and Wang, P. X. (2004). Study of activity-based budgeting model. Contemp. Finance Econ. 6, 122–124. doi:10.3969/j.issn.1005-0892.2004.06.030

Pan, J., Shen, X. F., and Cai, F. J. (2016). The framework design and application strategy of enterprise environmental budget:embedded in the comprehensive budget system. J. Account. Econ. 30 (6), 60–70. doi:10.16314/j.cnki.31-2074/f.2016.06.005

Prox, M. (2015). Material flow cost accounting extended to the supply chain–challenges, benefits and links to life cycle engineering. Procedia Cirp 29, 486–491. doi:10.1016/j.procir.2015.02.077

Rieckhof, R., Bergmann, A., and Guenther, E. (2015). Interrelating material flow cost accounting with management control systems to introduce resource efficiency into strategy. J. Clean. Prod. 108, 1262–1278. doi:10.1016/j.jclepro.2014.10.040

Rieckhof, R., and Guenther, E. (2018). Integrating life cycle assessment and material flow cost accounting to account for resource productivity and economic-environmental performance. Int. J. Life Cycle Assess. 23 (7), 1491–1506. doi:10.1007/s11367-018-1447-7

Rong, F. Z. (2008). Introduce Activity-Based Budget to enhance comprehensive budget management. J. Friends Account. 22, 15–16. doi:10.3969/j.issn.1004-5937.2008.22.005

Sahu, A. K., Padhy, R. K., Das, D., and Gautam, A. (2021). Improving financial and environmental performance through MFCA: A sme case study. J. Clean. Prod. 279, 123751. doi:10.1016/j.jclepro.2020.123751

Schmidt, M. (2015). The interpretation and extension of Material Flow Cost Accounting (MFCA) in the context of environmental material flow analysis. J. Clean. Prod. 108, 1310–1319. doi:10.1016/j.jclepro.2014.11.038

Shen, X. F., Pan, J., and Cai, F. J. (2014). “The motivation, embeddedness and strategy of enterprise environment budget (Case Study Based on GE Paper),” in Proceedings of the 2014 academic annual conference of the environmental accounting professional committee of the accounting society of China. Beijing: Accounting society of China, 98–112.

Sulong, F., Sulaiman, M., and Norhayati, M. A. (2015). Material flow cost accounting (MFCA) enablers and barriers: The case of a Malaysian small and medium-sized enterprise (SME). J. Clean. Prod. 108, 1365–1374. doi:10.1016/j.jclepro.2014.08.038

Wagner, B. (2015). A report on the origins of Material Flow Cost Accounting (MFCA) research activities. J. Clean. Prod. 108, 1255–1261. doi:10.1016/j.jclepro.2015.10.020

Walz, M., and Guenther, E. (2021). What effects does material flow cost accounting have for companies? Evidence from a case studies analysis. J. Industrial Ecol. 25 (3), 593–613. doi:10.1111/jiec.13064

Wang, S. Y. (2015). Alcoholic fermentation carbondioxiderecovery technology research. Jinan: Qilu University of Technology. [Master's thesis].

Welbeck, E. E. (2017). The influence of institutional environment on corporate responsibility disclosures in Ghana. Meditari Account. Res. 25, 216–240. doi:10.1108/MEDAR-11-2016-0092

Westin, A. L., Kalmykova, Y., Rosado, L., Oliveira, F., Laurenti, R., and Rydberg, T. (2019). Combining material flow analysis with life cycle assessment to identify environmental hotspots of urban consumption. J. Clean. Prod. 226, 526–539. doi:10.1016/j.jclepro.2019.04.036

Wu, Q. T., Li, X. N., and Wang, Z. F. (2018). Empirical study on the correlation between social responsibility and economic performance of shandong listed companies. Orient Forum 5, 78–84. doi:10.3969/j.issn.1005-7110.2018.05.013

Xiao, X., Li, C., and Zeng, X. H. (2016). MFCA extension form a life cycle perspective: Mechanisms, methods and case study. Syst. Eng. —Theory Pract. 36 (12), 3164–3174. doi:10.12011/1000-6788(2016)12-3164-11

Xiao, X., and Xiong, F. (2015). Study of the PDCA cycle of environmental management accounting. Account. Res. 4, 62–69. doi:10.3969/j.issn.1003-2886.2015.04.009

Yadav, P., Singh, J., Srivastava, D. K., and Mishra, V. (2021). “Environmental pollution and sustainability,” in Environmental sustainability and economy. Editors P. Singh, P. Verma, D. Perrotti, and K. K. Srivastava (San Diego: Elsevier), 111–120. doi:10.1016/B978-0-12-822188-4.00015-4

Yagi, M., and Kokubu, K. (2018). Corporate material flow management in Thailand: The way to material flow cost accounting. J. Clean. Prod. 198, 763–775. doi:10.1016/j.jclepro.2018.07.007

Yin, J. M., Deng, Q., Jiang, L. J., and Huang, N. (2021). Research on triple budget model embedded in carbon. Emissions 2020, 78–89. doi:10.3969/j.issn.1003-2886.2020.07.007

Young, P., Byrne, G., and Cotterell, M. (1997). Manufacturing and the environment. Int. J. Adv. Manuf. Technol. 13 (7), 488–493. doi:10.1007/BF01624609

Zhang, H. S., Li, J. S., Zhang, C., Chen, T., Lin, Y. K., and Tang, Y. Q. (2021). Research on energy saving during fen-flavor liquor production. Packag. Food Mach. 39 (4), 12–17. doi:10.3969/j.issn.1005-1295.2021.04.003

Zhang, R. J., and Yin, J. H. (2006). Dynamic budgeting based on value chain. Econ. Theory Bus. Manag. 1, 66–70. doi:10.3969/j.issn.1000-596X.2006.01.012

Keywords: environmental management accounting, activity-based budgeting, material flow cost accounting, manufacturing firms, liquor production

Citation: Qu L, Wang Z, Sun C and Yin L (2022) Application of ABB in environmental management accounting: Incorporating MFCA into the budget process. Front. Environ. Sci. 10:963903. doi: 10.3389/fenvs.2022.963903

Received: 08 June 2022; Accepted: 26 July 2022;

Published: 29 August 2022.

Edited by:

Irfan Ali, Aligarh Muslim University, IndiaReviewed by:

Ahmad Yusuf Adhami, Aligarh Muslim University, IndiaVera Amicarelli, University of Bari Aldo Moro, Italy

Copyright © 2022 Qu, Wang, Sun and Yin. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Linsen Yin, eWxzQGxpeGluLmVkdS5jbg==

Longyu Qu

Longyu Qu Zhan Wang

Zhan Wang Chang Sun

Chang Sun Linsen Yin

Linsen Yin