- 1Department of Economics and Applied Statistics, University of Malaya, Kuala Lumpur, Malaysia

- 2Faculty of Business and Economics, University of Malaya, Kuala Lumpur, Malaysia

With the rapid development of internet finance in China, the risk management of internet finance has become an urgent issue. This study analyzes the factors that affect the default risk of Chinese internet finance companies based on measuring the distance to default of companies. This study incorporates ESG rating into the evaluation model to comprehensively reflect the default risk factors. The traditional KMV model is modified with ESG rating, and results are used to construct the panel logit model. Based on internet finance firms listed on China A-Shares data from 2016 to 2020, our results show the following: first, the modified ESG-KMV logit model can effectively analyze the influencing factors of the internet finance default risk. Second, ROE, accounts receivable turnover ratio, asset-liability ratio and z-value are important factors that affect the default risk of internet finance companies. Third, it is also found that COVID-19 has significantly impacted the default risk of internet finance companies. As a policy implication, the regulator can incorporate ESG into the measurement of the default risk to create more awareness among internet finance companies on the importance of the environment and sustainability to human societies.

1 Introduction

After 2013, China ushered in a great development in internet finance (Ping and Chuanwei, 2013). With the rise of new internet finance models such as Yu’ebao, P2P, and crowdfunding, 2013 was known as “the first year of the internet finance in China” (Guan and Gao, 2022). Internet finance is a brand new financial model that makes payment more convenient and cost-effective. The most important thing is that the division of labor and specialization in the financial industry has been greatly diluted under the internet finance model. Market participants are more popular, and the huge benefits of internet finance market exchanges are more inclusive to ordinary people. However, internet finance also faces more complex risks than traditional financial models as a new financial model (Xu et al., 2020). With the development of the internet financial market, credit risk is gradually showing more complex and diversified characteristics, which also seriously impacts the internet financial market (Xiao-li and Long, 2013; Ma and Lv, 2019; Wang and Yang, 2020).

Although internet finance makes it easier and faster for investors to obtain information related to financial products, it also gives fund-raisers more chances to hide their real situation, such as misreporting information or concealing information (Zhongkai and Hassan, 2019). Investors find it very difficult to discovery a practical way to solve the real situation of the fund-raiser like the participants in the traditional financial market, thus leading to the emergence of the misbalance phenomenon between investors and fund-raisers. The information risk caused by information asymmetry factors will not be lost due to the convenience of the internet financial market (Xie et al., 2016). Still, it will become more complex due to network trading for its trading participants. Subsequently, the internet financial market has branched into various sectors, from crowdfunding to payments, insurance, and other financial industries (Xie et al., 2015). In addition, due to the convenient and fast characteristics of internet financial facilities, once a large-scale default event occurs in the internet financial market, its credit risk will quickly spread to the entire financial industry by borrowing network channels. Therefore, compared with the credit risk of the traditional financial market, the credit risk of the internet financial market is higher (Ping and Chuanwei, 2013; Xie et al., 2016; Xu et al., 2020).

Credit risk has been studied for a long time, and many models have been applied to the evaluation process of the credit risk (Altman and Saunders, 1997; Caouette et al., 1998; Dong and Wang, 2014; Li and Wang, 2011). Traditional credit risk assessment methods focus on qualitative indicators and rely on experts’ professional skills and subjective judgment. Among them, the more famous method is the 5C analysis method, which is based on the analysis of character, the evaluated enterprise's capacity and capital, collateral, and conditions (Wu et al., 2021). In addition, the traditional credit risk assessment methods also include similar characteristic analysis and financial ratio analysis. The credit scoring model is a statistical model that reflects the evaluated object’s credit status with systematic data. The model can predict the likelihood that a borrower will default and become insolvent (Chen et al., 2016; Guo et al., 2016).

Altman (1968) first proposed the famous Z-Score model and applied it to analyze enterprises’ financial crisis and default risk. In addition, there are logistic and neural network models proposed by scholars (Angelini et al., 2008; Sanford and Moosa, 2012). With globalization, financial market openness has also increased over the years. However, it has also created more frequent incidents of financial crises, where measuring credit risk is increasingly valued by major banks and regulators (Sachs et al., 1996). Since the 1990s, more modern foreign companies and scholars have begun to pay attention to and successfully developed a series of credit risk measurement models. For example, in 1993, KMV Company launched the KMV model, which could estimate the default probability of borrowing enterprises (Rehm and Rudolf, 2000; Gou and Gui, 2009; Zhang et al., 2010). In 1997, Morgan (1997)and other cooperative financial institutions put forward the CreditMetrics model based on value-at-risk. In 1997, Credit Suisse issued a Credit Risk + model similar to the default mode (Wilde, 2010).

In recent years, a large number of scholars in China have used the KMV model to study the credit risk in the financial field and prove the effectiveness of the KMV model (Valášková et al., 2014; Zhao et al., 2016; Liu and Chen, 2020; Yu, 2021). Internet finance is an emerging field, and some scholars have applied this model to this field. Xiao-li and Long (2013) used the traditional KMV model to calculate the volatility of the asset value (σA), distance to default (DD), and expected default frequency (EDF) of 18 listed companies in China. Aware of the rise of internet finance in China, Xu (2022) chose internet finance companies as objects to study the feasibility of KMV to measure their credit risks. The research results prove the feasibility and effectiveness of KMV in the current credit risk calculation of internet finance in China.

However, in the process of studying the credit risk in the field of internet finance, there is a lack of research on the impact of ESG. ESG is the abbreviation of environmental, social, and governance factors, reflecting the enterprise’s environmental, social responsibility, and corporate governance factors on the three dimensions. ESG is an important concept and standard for the international community to measure enterprises’ ability to achieve sustainable development (Gillan et al., 2021).

Scholars have proved the relative influence of ESG on financial risk. Scholtens and van’t Klooster (2019) analyzed the significant relationship between bank performance and sustainability from the perspective of the risk and proved that this sustainability may affect the entire financial system. Moreover, ESG is considered a key factor influencing investor decisions. The importance of ESG is reflected in financial performance in many studies. Friede et al. (2015) proposed that ESG positively impacts CFP based on more than 2000 empirical studies. Scholars in different countries have verified the positive relationship between ESG and financial performance based on local conditions, such as the United States, China, and Germany (Velte, 2017; Zhao et al., 2018; Dalal and Thaker, 2019; Okafor et al., 2021).

Some scholars have analyzed the relationship between ESG and firm value from different perspectives, such as the influence of company size or CEO power. Overall, ESG has positively impacted the enterprise value and its role in valuation (Aouadi and Marsat, 2018; Fatemi et al., 2018; Li et al., 2018; Wong et al., 2021). In recent years, COVID-19 has become an important factor affecting global development. During this period, the impact of ESG became even more pronounced. Umar and Gubareva (2021) used wavelet analyses to point out that ESG indices can maintain positive effects despite catastrophizing like COVID-19. Broadstock et al. (2021) have studied how ESG can perform better in times of crisis and mitigate financial risk to some extent. There are still many studies on the relationship between ESG and risk in the context of COVID-19. Most scholars have proposed the importance of ESG in the face of disasters (Ferriani and Natoli, 2021; Umar et al., 2021; Lööf et al., 2022). Therefore, the special background of COVID-19 should also be taken into account in the research.

Scholars have proved the relative influence of ESG on the financial system risk. Scholtens and van’t Klooster (2019) analyzed the significant relationship between bank performance and sustainability from the risk perspective and proved that this sustainability may affect the entire financial system. Regarding credit risk, scholars have studied the relationship between ESG and credit risk from different perspectives. Bannier et al. (2022) studied the relationship between companies’ social responsibility and credit risk of US and European companies from 2003 to 2018. Höck et al. (2020) studied the relationship between the ESG level and credit risk premium from the perspective of a bond investment. Barth et al. (2022) analyzed the relationship between the credit risk of American and European companies and ESG from the perspective of credit spreads. Ahmed et al. (2018) analyzed the relationship between ESG and credit risk from banks’ perspectives. No matter from which angle of analysis, most of the final conclusions given by scholars are that there is a significant relationship between them. In addition to the credit risk analysis, some scholars analyzed the impact of ESG from the credit rating perspective. They believed that ESG should be considered in the process of credit rating (Devalle et al., 2017; Kiesel and Lücke, 2019; Höck et al., 2020; Michalski and Low, 2021). Chodnicka-Jaworska (2021)used a group event model to verify the importance of ESG factors in credit ratings, especially in the context of COVID-19. Brogi et al. (2022) showed that higher ESG awareness is closely associated with a better reputation measured by the Altman Z-Score. The research results support the rationality of introducing ESG awareness parameters into the credit evaluation of borrowers. Therefore, ESG factors should be considered in analyzing the credit default risk.

Consequently, 49 listed internet finance companies in China are selected as samples to establish a revised KMV model using ESG ratings. Based on this, it uses a panel logit regression to further find the influence factors of the internet finance credit risk in China. This study’s contribution to the credit risk field incorporates ESG rating into the evaluation model to comprehensively reflect the default risk factors in internet finance. It also considers the relationship between COVID-19 and internet finance credit risk. As a policy implication, the regulator can incorporate ESG into the measurement of default risk to create more awareness among internet finance companies on the importance of the environment and sustainability to human societies.

2 Modified KMV-logistic with the ESG rating model

This study adopts a mixed model to verify the importance of ESG in credit risk management in internet finance. Based on the aforementioned analysis, we believe ESG should be considered in credit risk research. First, the logic of the traditional KMV model is stated. Then, ESG rating data are used to correct the default point of the KMV model. After obtaining the default to distance corrected by ESG, it uses the idea of quantile to determine the internet finance industry’s critical point of DD. The results of DD are used as the explained variable to establish the panel regression model. Finally, the mixed ESG model is used to find the factors affecting the default risk of internet finance. The factor found is the default risk analysis after considering ESG, which is more comprehensive than the original simple default risk analysis.

2.1 KMV model

In the 1990s, KMV Company proposed the KMV model to measure the probability of default, predicting the possibility of default of financial institutions such as companies or banks publicly listed in the security market. The calculation steps are as follows:

Step 1: Calculate the asset value and asset volatility.

where

Step 2: Calculate the default point and default to distance.

where

Step 3: Estimate the expected default rate.

where

2.2 Modification of the KMV model with ESG rating

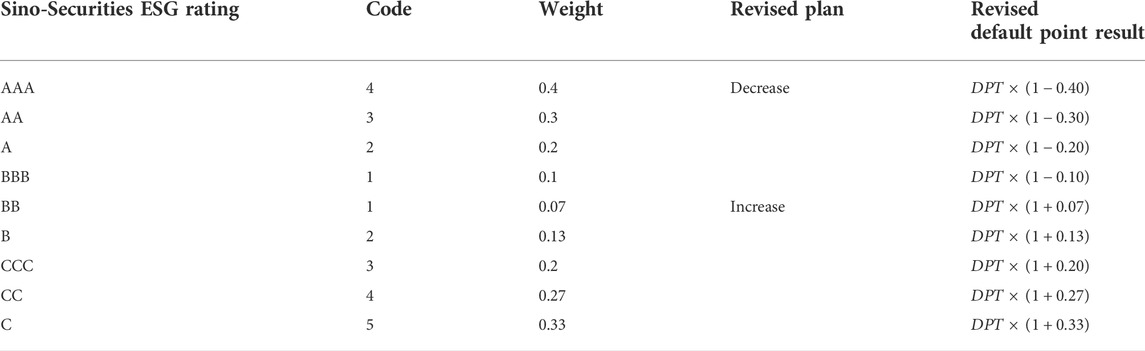

This study incorporates ESG ratings into the KMV model and modifies the traditional KMV model. The ESG rating adopted is Sino-Securities Index ESG Evaluation (also known as the Huazheng ESG rating in China). According to the ESG rating description of Sino-Securities, a rating above BBB indicates that the company has a relatively good ESG situation. Therefore, this study divides the rating into two parts to modify the KMV model. If the rating is above BBB, it will reduce default point weights. If the rating is below the BBB rating, it will be increased by a down-weighted default point. The weight determination is standardized according to the rating level. Table 1 shows the results of ESG rating correction.

The new distance to default and expected default probability of sample companies can be calculated using the modified KMV model. In this study, the distance to default is taken as the representative of the default of sample companies. According to the calculation results of distance to default, an early-warning line for default of internet finance companies can be set, and the sample companies can be further divided into default and non-default groups.

2.3 Panel logit model

The panel logit model is chosen according to the research object of whether the company defaults or not. The expression for the model is shown as follows:

where

If the company defaults,

3 Data and variable selection

3.1 Data selection

This work aims to study the factors influencing the credit risk of listed internet finance companies based on considering ESG rating. This study takes 49 listed internet finance companies in China as the research sample, and the period is from 2016 to 2020. Data were obtained from the Wind database.

3.2 Variable selection

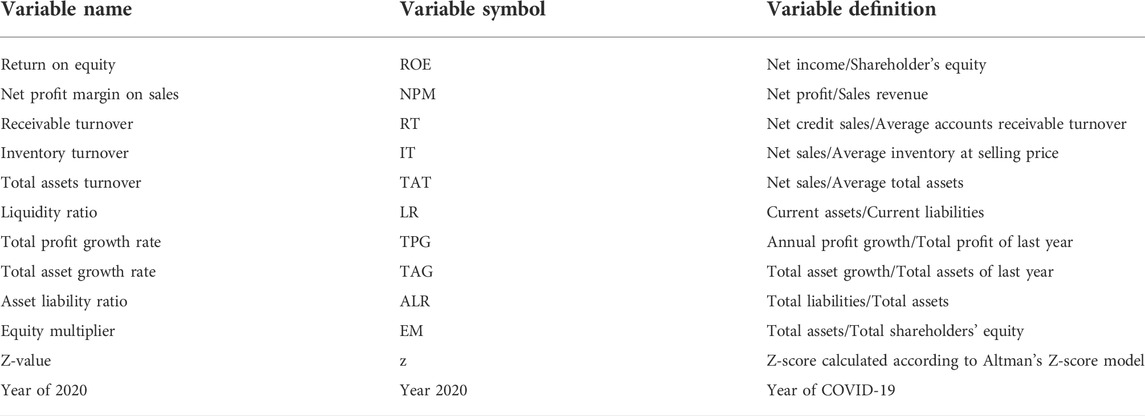

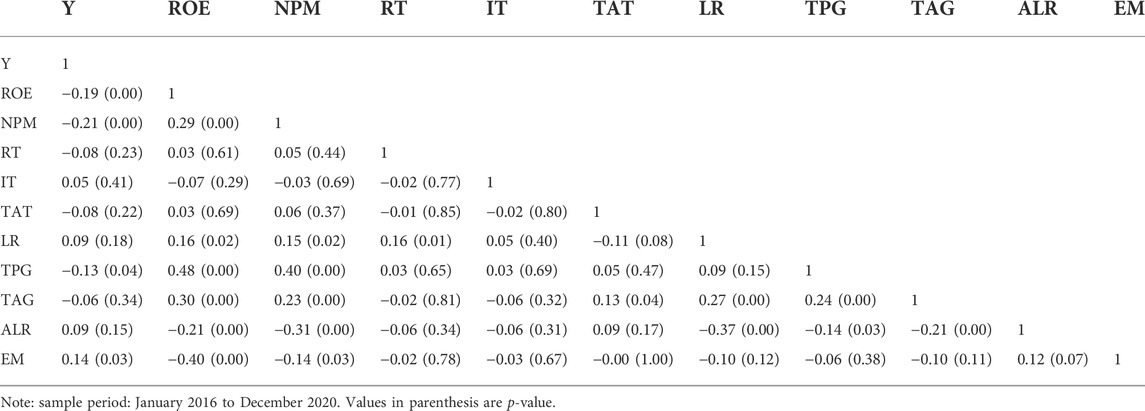

In selecting variables, this study selects independent 12 variables based on the summary of the previous literature. The COVID-19 outbreak occurred in December 2019, so the year 2020 affected by the outbreak was used as the annual dummy variable in this study. Then, the stepwise regression method is performed to select appropriate independent variables. The 12 alternative variables are shown in Table 2. The observation frequency of this study is the year. Correlation analysis was used before the model estimation to check whether the key explanatory variables are highly correlated. The results are shown in Table 3, and there is no high correlation between alternative independent variables.

After establishing the regression equation, all variables are considered by the stepwise regression method. According to the value of McFadden R-Squared of the logit regression model, the statistical significance of variables and whether they conform to the actual economic significance are evaluated. According to the regression results of the model, five indicators are screened out: ROE, RT, ALR, z, and Year 2020.

At the same time, according to literature research and economic common sense, this study puts forward the following hypotheses:

H1: The possibility of internet finance companies defaulting decreases as the return on equity increases.

H2: The possibility of internet finance companies defaulting decreases as the accounts receivable turnover rate rises.

H3: The possibility of internet finance companies defaulting increases as the asset liability ratio rises.

H4: The probability of internet finance companies defaulting increases as the z-value increases.

H5: The probability of internet finance companies defaulting increases with COVID-19.

The credit default risk of internet finance companies results from a combination of factors. It mainly includes repayment ability and repayment willingness. For a company, the factors that affect the repayment ability and willingness include the company’s profitability, operating capacity, capital structure, bankruptcy probability, and macro-environment. If its profitability is strong, it has more revenue to pay off its debts. High operating capacity means that the company’s assets are used efficiently, and the company will have a lower probability of default. A company with a low debt ratio means that the lower the company’s debt load, the less likely the company will default. The Z-value is an indicator that comprehensively reflects the probability of a company going bankrupt. The lower the probability of bankruptcy, the less likely the company will default. China’s economic environment is affected by various factors, such as COVID-19. Hence, the closer we reach 2020, the higher the likelihood companies will default. Based on this, this study proposes the aforementioned hypotheses.

4 Results and discussion

4.1 Descriptive statistics of independence variables

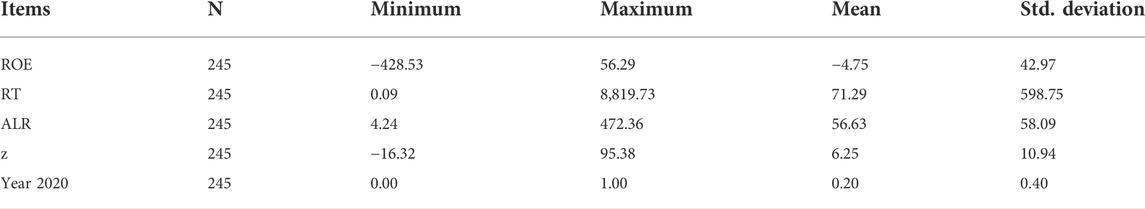

Descriptive statistics of influencing factor variables of sample companies are shown in Table 4 as follows.

4.2 Descriptive statistics of the dependence variable

Distance to default and expected default probability are two corresponding values. This study chooses distance to default as an index to measure the company’s credit default status. The distance to the default of sample companies is the dependent variable of this study.

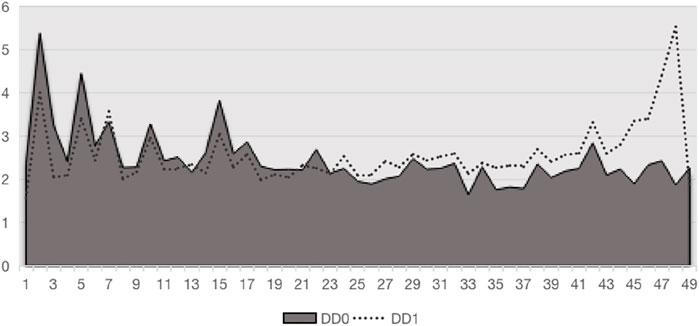

The distance to the default of sample companies was calculated using the modified KMV with the ESG model. Then, the average value of distance to default from 2016 to 2020 was calculated. Figure 1 shows the original distance to default means and corrected distance to default mean with the ESG rating of 49 sample companies. DD0 refers to the original distance to the default mean result, and DD1 refers to the modified results with an ESG rating.

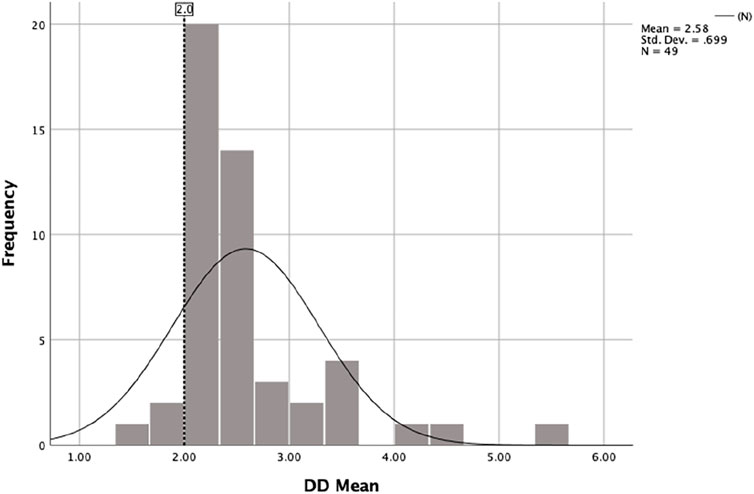

The distance to default means is arranged in an ascending order. Then, the distance to default means of 10% quantile is taken as the critical default value. The frequency histogram of the average distance to default is shown in Figure 2. Distance to default = 2 is the default threshold.

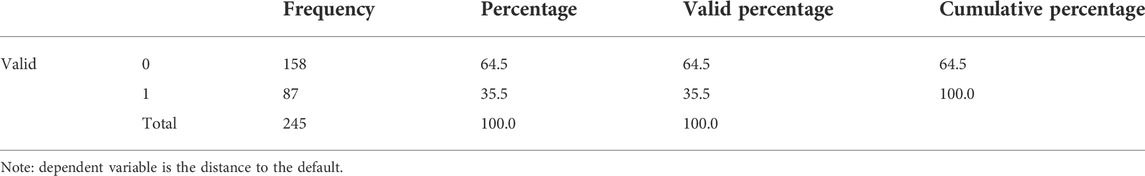

According to the critical value of distance to default, all data can be divided into default and non-default groups. If the distance to default is lower than the critical value 2, the dependent variable is set as 1. If the distance to default is higher than 2, the dependent variable is 0. Descriptive statistics for the dependent variable data is shown in Table 5.

4.2 Panel logit regression results

The distance to the default of sample companies is classified as the independent variable. The five selected variables, ROE, RT, ALR, z, and Year 2020, are independent variables to establish a panel logit model. Before panel data analysis, the Hausman test is performed on the data to determine whether the fixed-effect logit model or random-effect logit model is used in this study. According to Table 6, the p-value is greater than 0.05. The test statistic does not reject the hypothesis. This result shows that the random-effect model is better than the fixed-effect model. Therefore, this study adopts the random-effect logit model for regression.

Table 7 shows the model fitting effect. The p-value is 0.0001, which means that the model’s overall fit is significant at 1%.

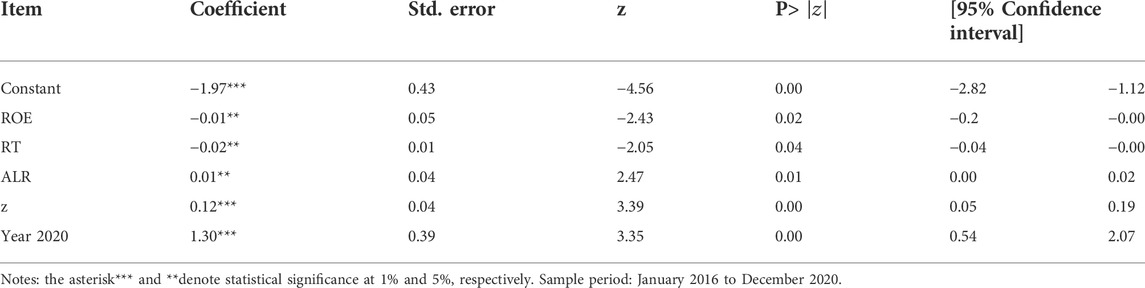

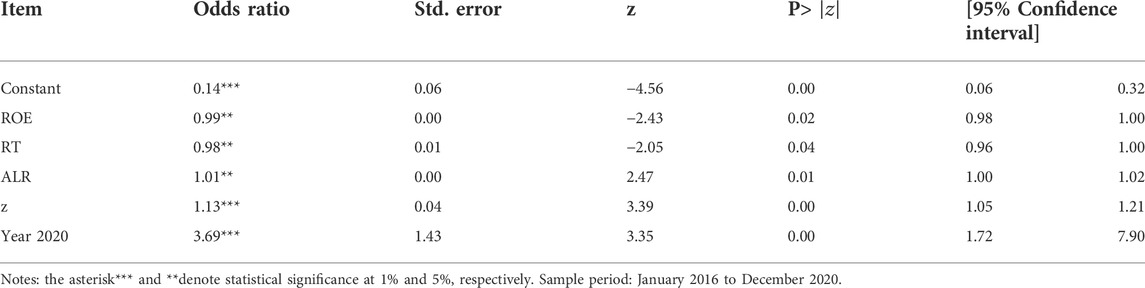

The panel logit results of the model and odds ratio results are shown in Table 8 and Table 9. The influence of the index variable on the credit default risk of listed internet finance companies is judged according to the regression coefficient of the variable. Suppose the regression coefficient of the index variable is positive, in that case, it indicates that the index positively correlates with the default risk of listed internet finance companies. The variation of indicator variables will lead to an increase in the default risk of networked financial companies. Suppose the regression coefficient of the index variable is negative, in that case, it indicates that the index is negatively correlated with the default risk of internet finance companies. The variation of index variables will reduce the default risk for internet finance companies.

According to the regression results in Table 8, the regression coefficients of return on equity are negative, and it is significant at 5%. This shows that the higher the profitability of the Internet financial company, the lower is the default risk. The profitability of an enterprise represents its ability to resist risks. The more profit an enterprise has, the more funds it will invest in ESG, thus reducing its default intention. Therefore, assumption H1 is supported. The inventory turnover coefficient was negative and significant at 5%. With accounts receivable turnover speed and high management efficiency, enterprise ESG performance will improve. Companies are less likely to default. The fast turnover of enterprise assets will bring high liquidity, and the speed of profit will be faster. Enterprises will invest their excess capital in ESG, thus reducing their default risk. This result supports hypothesis H2. The regression coefficient of the asset liability ratio is positive, indicating that it is positively correlated with the credit risk of internet finance companies. A high debt-to-asset ratio means that a higher percentage of a company’s total assets are financed by borrowing. Hence the company will default more. This conclusion supports hypothesis H3.

The regression coefficient of the Z-value is positive and significant under 1%, indicating that it is positively correlated with the credit risk of Internet finance companies. The Z-value itself is a measure of the risk of failure. Companies with a higher risk of bankruptcy are more likely to default. Therefore, H4 has been proved. The regression coefficients for Year 2020 are positive and significant at 1%. The significance of the time dummy variable Year 2020 indicates that COVID-19 impacts the default of internet finance companies. COVID-19 is a catastrophic global health event that has affected the economic growth of the internet finance industry and increased the risk of default. The conclusion supports hypothesis H5. Therefore, all hypotheses are supported.

According to Table 9, when the ROE of an internet finance company increases by 1 unit, the probability of the default risk of the internet finance company decreases by 0.01 (1-odds ratio) units. Similarly, when the accounts receivable turnover of an internet finance company increases by 1 unit, the probability of default risk of the internet finance company decreases by 0.02 units. Likewise, when the asset liability ratio, Z-value, and Year 2020 increase by 1 unit, the probability of the default risk of internet finance companies will increase by 1.01, 1.13, and 3.69 units, respectively. Consequently, COVID-19 has a greater impact on the credit risk of internet finance among all the influencing factors.

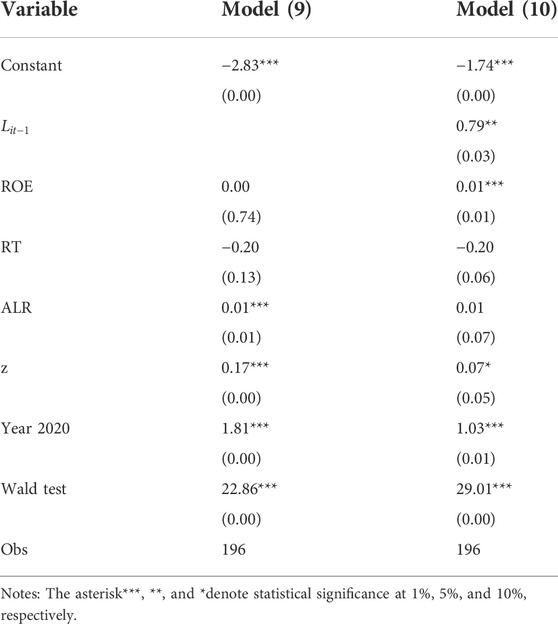

For further discussion, two extended models were established for comparison. In real economic life, many economic variables are affected not only by the same period factor but also by the early-stage factor of the variable. Therefore, the first-order lag variable of the dependent variable was added for analysis in this study. First, the dependent variable is regressed with first-order lag, and a new regression model (9) is established to analyze the explanatory power of the impact indicators. Second, the first-order lag variable of the dependent variable was added to model (8) as an independent variable, and model (10) was established to analyze the influence of its early value.

Table 10 shows the model regression results after adding lag variables, and the results of the Wald test show that the two models are still valid. In the regression results of model (9), the three variables ALR, Z and Year 2020 are still significant, indicating that these three variables are more robust than the other two variables. The regression result of the model (10) shows a significant relationship between the explained variables lagging one period and the original explained variables, which proves that the credit risk of Internet finance integrated with ESG is indeed affected by its early stage.

5 Conclusion

Based on the classic credit risk assessment model, this study constructs a KMV-logit mixed model to study the credit risk of Chinese listed internet finance companies. The traditional KMV model only considers financial factors but ignores non-financial factors. In this study, the ESG index is introduced into the KMV model. The revised KMV-logit mixed model effectively analyzes the influence factors of the default risk for internet finance companies.

Second, return on equity, receivable turnover, asset liability ratio, Z-value, and Year 2020 all affect the default risk of internet finance companies to a certain extent. Among the independent variables, Z-value and the year 2020 have the strongest relationship with default risk. The significant results of the year 2020 indicate that China’s internet finance environment has increased risks because of COVID-19. The Z-value is calculated according to Altman’s Z-value model and represents its bankruptcy probability. This finding further indicates that the default result obtained by the model is valid.

Moreover, this study introduced the hysteresis variable of the explained variable to conduct an extended analysis. The results proved that the credit risk of internet finance after incorporating ESG correction would be affected by its preliminary results. Meanwhile, among all explanatory variables, asset-liability ratio, Z-value and Year 2020 are more rubust. The conclusion is calculated based on the data on internet finance companies in China, so it applies to the reality of China’s internet finance industry. However, the research essence of this study is based on the impact of ESG on credit risk, which is similar to the global financial system. Therefore, this study has reason to believe that the conclusion can also be applied to other countries and industries. However, the specific situation needs further analysis using data from different countries.

The policy implications of this study are as follows:

From the enterprise level, internet finance firms should value ESG in the process of credit risk management and reshape the cognitive concept of sustainable development of the enterprise. ESG is not only in the single dimension of the sustainable idea of corporate social responsibility. It covers enterprise for a sustainable social environment and the internal governance of multi-dimensional concepts, especially during the current economic downturn with the impact of COVID-19. Enterprises are facing long-term transformation and upgrading and performance decline pressure. In this context, enterprises are prone to credit risks and may go bankrupt once they are poorly managed. Therefore, enterprises should strengthen ESG management and integrate it into the credit risk management process by improving their ESG performance to predict and manage credit risks. Based on the conclusion of influence factors, internet finance companies should pay attention to managing their own profitability, operating capacity, and debt capacity to enhance their ability to resist risks.

From an investor’s perspective, ESG performance should be incorporated into investment choices. Under the background of sustainable development, investors are important external supervisors and administrators to promote listed companies to fulfill their social responsibilities and improve corporate governance. When choosing investment objects, corporate investors should pay attention to their financial performance and non-financial performance, such as environmental performance, social performance, and corporate governance performance. This can help enterprises better manage risks, achieve sustainable long-term returns, and enhance the sustainable competitiveness of enterprises.

From the perspective of the government, the company’s ESG performance evaluation system and information disclosure system should be improved. Meanwhile, the government should combine the ESG performance of internet financial companies in credit risk supervision. For those companies with better ESG performance, the government can give appropriate policy support. The government can impose appropriate penalties for companies with poor ESG performance. The government should gradually guide companies to improve their ESG performance and consciously disclose ESG information to provide effective information for credit risk supervision.

Data availability statement

Publicly available datasets were analyzed in this study. These data can be found at: https://www.wind.com.cn/en/edb.html.

Author contributions

The first author has sourced and analyzed the data, and drafted some parts of the manuscript. The second author has been involved in the modeling and discussion of research ideas and drafted some parts of the manuscript. The third author has involved in the discussion of ideas and drafted some parts of the manuscript.

Funding

This publication is partially funded by the Faculty of Business and Economics, Universiti Malaya Special Publication Fund. The authors would also like to thank for the partial funding from the Universiti Malaya under the Impact-Oriented Interdisciplinary Research Grant (IIRG) Programme (Project no. IIRG001C-2020IISS).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ahmed, S. U., Ahmed, S. P., and Hasan, I. (2018). Why should banks consider ESG risk factors in bank lending? Banks bank Syst. 13 (3), 71–80.

Altman, E. I., and Saunders, A. (1997). Credit risk measurement: Developments over the last 20 years. J. Bank. Finance 21 (11-12), 1721–1742.

Angelini, E., Di Tollo, G., and Roli, A. (2008). A neural network approach for credit risk evaluation. Q. Rev. Econ. finance 48 (4), 733–755. doi:10.1016/j.qref.2007.04.001

Aouadi, A., and Marsat, S. (2018). Do ESG controversies matter for firm value? Evidence from international data. J. Bus. Ethics 151 (4), 1027–1047. doi:10.1007/s10551-016-3213-8

Bannier, C. E., Bofinger, Y., and Rock, B. (2022). Corporate social responsibility and credit risk. Finance Res. Lett. 44, 102052. doi:10.1016/j.frl.2021.102052

Barth, F., Hübel, B., and Scholz, H. (2022). ESG and corporate credit spreads. J. Risk Finance 23, 169–190. doi:10.1108/jrf-03-2021-0045

Broadstock, D. C., Chan, K., Cheng, L. T., and Wang, X. (2021). The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Finance Res. Lett. 38, 101716. doi:10.1016/j.frl.2020.101716

Brogi, M., Lagasio, V., and Porretta, P. (2022). Be good to be wise: Environmental, Social, and Governance awareness as a potential credit risk mitigation factor. J. Int. Financial Manag. Account. doi:10.1111/jifm.12156

Caouette, J. B., Caouette, J. B., Altman, E. I., and Narayanan, P. (1998). Managing credit risk: The next great financial challenge. John Wiley & Sons.

Chen, N., Ribeiro, B., and Chen, A. (2016). Financial credit risk assessment: A recent review. Artif. Intell. Rev. 45 (1), 1–23. doi:10.1007/s10462-015-9434-x

Chodnicka-Jaworska, P. (2021). ESG as a measure of credit ratings. Risks 9 (12), 226. doi:10.3390/risks9120226

Dalal, K. K., and Thaker, N. (2019). ESG and corporate financial performance: A panel study of Indian companies. IUP J. Corp. Gov. 18 (1), 44–59.

Devalle, A., Fiandrino, S., and Cantino, V. (2017). The linkage between ESG performance and credit ratings: A firm-level perspective analysis.

Dong, L., and Wang, J. (2014). “Credit risk measurement of the listed company based on modified KMV model,” in Proceedings of the Eighth International Conference on Management Science and Engineering Management (Berlin, Heidelberg: Springer) 281, 915–923. doi:10.1007/978-3-642-55122-2_79

Fatemi, A., Glaum, M., and Kaiser, S. (2018). ESG performance and firm value: The moderating role of disclosure. Glob. Finance J. 38, 45–64. doi:10.1016/j.gfj.2017.03.001

Ferriani, F., and Natoli, F. (2021). ESG risks in times of Covid-19. Appl. Econ. Lett. 28 (18), 1537–1541. doi:10.1080/13504851.2020.1830932

Friede, G., Busch, T., and Bassen, A. (2015). ESG and financial performance: aggregated evidence from more than 2000 empirical studies. J. Sustain. Finance Invest. 5 (4), 210–233.

Gillan, S. L., Koch, A., and Starks, L. T. (2021). Firms and social responsibility: A review of ESG and csr research in corporate finance. J. Corp. Finance 66, 101889. doi:10.1016/j.jcorpfin.2021.101889

Gou, X. J., and Gui, S. W. (2009). “Applying KMV model to credit risk assessment of Chinese listed firms,” in 2009 international conference on information management, innovation management and industrial engineering, 26–27 December 2009 (Xi’an, China: IEEE), 553–557. doi:10.1109/ICIII.2009.139

Guan, Q., and Gao, W. (2022). “Uncover the truth: Ecosystem of internet finance,” in Internet finance (Springer), 41–56.

Guo, Y., Zhou, W., Luo, C., Liu, C., and Xiong, H. (2016). Instance-based credit risk assessment for investment decisions in P2P lending. Eur. J. operational Res. 249 (2), 417–426. doi:10.1016/j.ejor.2015.05.050

Höck, A., Klein, C., Landau, A., and Zwergel, B. (2020). The effect of environmental sustainability on credit risk. J. Asset Manag. 21 (2), 85–93. doi:10.1057/s41260-020-00155-4

Kiesel, F., and Lücke, F. (2019). ESG in credit ratings and the impact on financial markets. Financ. Mark. Inst. Instrum. 28 (3), 263–290.

Li, J., and Wang, Z. (2011). “Study of the credit risk of the listed communication company based on the KMV model,” in Bmei 2011 - proceedings 2011 international conference on business management and electronic information (Guangzhou, China: IEEE).

Li, Y., Gong, M., Zhang, X.-Y., and Koh, L. (2018). The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. Br. Account. Rev. 50 (1), 60–75. doi:10.1016/j.bar.2017.09.007

Liu, T., and Chen, X. (2020). Research on credit risk measurement of China's listed companies with KMV model. Springer.

Lööf, H., Sahamkhadam, M., and Stephan, A. (2022). Is corporate social responsibility investing in a free lunch? The relationship between ESG, tail risk, and upside potential of stocks before and during the COVID-19 crisis. Finance Res. Lett. 46, 102499. doi:10.1016/j.frl.2021.102499

Ma, X., and Lv, S. (2019). Financial credit risk prediction in internet finance driven by machine learning. Neural comput. Appl. 31 (12), 8359–8367. doi:10.1007/s00521-018-3963-6

Michalski, L., and Low, R. K. Y. (2021). Corporate credit rating feature importance: Does ESG matter? Available at SSRN: https://ssrn.com/abstract=3788037.

Okafor, A., Adeleye, B. N., and Adusei, M. (2021). Corporate social responsibility and financial performance: Evidence from US tech firms. J. Clean. Prod. 292, 126078. doi:10.1016/j.jclepro.2021.126078

Ping, X., and Chuanwei, Z. (2013). The theory of internet finance. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2235967.

Rehm, F., and Rudolf, M. (2000). “KMV credit risk modeling,” in Risk management (Springer), 141–154.

Sachs, J. D., Tornell, A., and Velasco, A. (1996). Financial crises in emerging markets: The lessons from 1995 27, 147–199.

Sanford, A. D., and Moosa, I. A. (2012). A Bayesian network structure for operational risk modelling in structured finance operations. J. Operational Res. Soc. 63 (4), 431–444. doi:10.1057/jors.2011.7

Scholtens, B., and van’t Klooster, S. (2019). Sustainability and bank risk. Palgrave Commun. 5 (1), 105–108. doi:10.1057/s41599-019-0315-9

Umar, Z., and Gubareva, M. (2021). The relationship between the covid-19 media coverage and the environmental, social and governance leaders equity volatility: A time-frequency wavelet analysis. Appl. Econ. 53 (27), 3193–3206. doi:10.1080/00036846.2021.1877252

Umar, Z., Gubareva, M., Tran, D. K., and Teplova, T. (2021). Impact of the covid-19 induced panic on the environmental, social and governance leaders equity volatility: A time-frequency analysis. Res. Int. Bus. finance 58, 101493. doi:10.1016/j.ribaf.2021.101493

Valášková, K., Gavláková, P., and Dengov, V. (2014). “Assessing credit risk by Moody's KMV model,” in 2nd international conference on economics and social science (ICESS 2014) (USA: Information Engineering Research Institute).

Velte, P. (2017). Does ESG performance have an impact on financial performance? Evidence from Germany. J. Glob. Responsib. 8, 169–178. doi:10.1108/jgr-11-2016-0029

Wang, M., and Yang, H. (2020). “Research on customer credit scoring model based on bank credit card,” in International Conference on Intelligent Information Processing (Cham: Springer) 581, 232–234. doi:10.1007/978-3-030-46931-3_22

Wong, W. C., Batten, J. A., Mohamed-Arshad, S. B., Nordin, S., and Adzis, A. A. (2021). Does ESG certification add firm value? Finance Res. Lett. 39, 101593. doi:10.1016/j.frl.2020.101593

Wu, Y., Li, X., Liu, Q., and Tong, G. (2021). The analysis of credit risks in agricultural supply chain finance assessment model based on genetic algorithm and backpropagation neural network. Comput. Econ. 2021, 1–24. doi:10.1007/s10614-021-10137-2

Xiao-li, S., and Long, P. (2013). Study the calculation of credit risks based on the KMV model in China's internet finance. J. Beijing Univ. Posts Telecommun. Soc. Sci. Ed. 15 (6), 75.

Xie, P., Zou, C., and Liu, H. (2015). Internet finance in China: Introduction and practical approaches. London: Routledge. doi:10.4324/9781315637921

Xie, P., Zou, C., and Liu, H. (2016). The fundamentals of internet finance and its policy implications in China. China Econ. J. 9 (3), 240–252. doi:10.1080/17538963.2016.1210366

Xu, C. (2022). Credit risk measurement and analysis of internet listed companies based on KMV model. Front. Econ. Manag. 3 (5), 203–214.

Xu, R., Mi, C., Mierzwiak, R., and Meng, R. (2020). Complex network construction of Internet finance risk. Phys. A Stat. Mech. its Appl. 540, 122930. doi:10.1016/j.physa.2019.122930

Yu, H.-H. (2021). Credit risk measurement of credit bonds of Chinese listed companies based on KMV model. Turkish J. Comput. Math. Educ. (TURCOMAT) 12 (11), 4184–4192.

Zhang, S., Li, Q., and Wang, D. (2010). “Global financial crisis's impact on the credit risk of logistics companies: Comparative analysis between China and us with KMV model,” in Proceedings - 2010 international conference on management of e-commerce and e-government, ICMeCG 2010 (Chengdu, China: IEEE).

Zhao, C., Guo, Y., Yuan, J., Wu, M., Li, D., Zhou, Y., et al. (2018). ESG and corporate financial performance: Empirical evidence from China's listed power generation companies. Sustainability 10 (8), 2607. doi:10.3390/su10082607

Zhao, Z., Lan, Y., and Wu, X. (2016). The impact of electronic banking on the credit risk of commercial banks <br/>—an empirical study based on KMV model. J. Math. Finance 6 (05), 778–791. doi:10.4236/jmf.2016.65054

Keywords: default risk, ESG, KMV, internet finance, early warning system

Citation: Zeng L, Lau W-Y and Abdul Bahri EN (2022) Can the modified ESG-KMV logit model explain the default risk of internet finance companies?. Front. Environ. Sci. 10:961239. doi: 10.3389/fenvs.2022.961239

Received: 04 June 2022; Accepted: 21 July 2022;

Published: 31 August 2022.

Edited by:

Sorin Gabriel Anton, Alexandru Ioan Cuza University, RomaniaReviewed by:

Zaghum Umar, Zayed University, United Arab EmiratesPatrycja Chodnicka-Jaworska, University of Warsaw, Poland

Copyright © 2022 Zeng, Lau and Abdul Bahri. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wee-Yeap Lau, d3lsYXVAdW0uZWR1Lm15

Li Zeng

Li Zeng Wee-Yeap Lau

Wee-Yeap Lau Elya Nabila Abdul Bahri

Elya Nabila Abdul Bahri