- School of Finance and Economics, Jiangsu University, Zhenjiang, China

This paper defined heavily polluting enterprises as the treatment group based on relevant data on the listed companies in the 5 years from 2016 to 2020. Companies other than the heavily polluting enterprises were defined as the control group. An empirical analysis applying the double-difference technique was performed to assess the impact of China’s environmental tax on the economic performance and technological innovation input of industries that pollute heavily. The findings demonstrated an increased positive effects of environmental taxes on the economic performance and technology innovation input of heavily polluting industries since the inception of the environmental tax in China. As some enterprises in heavily polluting industries are under increased financial pressure owing to green upgrades and the low environmental tax rate in some regions, recommendations are presented to improve the environmental regulation system, adapt environmental taxes to local conditions, and strengthen the implementation and supervision of environmental taxes through big data technology.

1 Introduction

Since the reform and opening-up in China, the country’s economy has grown relatively quickly. However, this rapid growth has come at the expense of the natural environment. Economic growth at the cost of the excessive consumption of natural resources and environmental quality is often short-lived (Abdullah and Morley, 2014). Moreover, the deterioration of environmental quality inevitably inhibits economic growth. Thus, this traditionally inefficient mode of production cannot meet China’s needs for sustainable economic development (Cannan and Pigou, 1921). In China, green economic transformation has become an important guide for future development. The Chinese government officially enacted the “Environmental Tax Law of the People’s Republic of China" on January 1, 2018, to enhance the phenomenon of enterprises’ random discharge. However, insufficient research was performed to determine whether the installation of an environmental tax in China would result in long-term double dividends. This study investigated and analyzed the economic and technical effects of this environmental tax on heavily polluting industries based on domestic listed companies to verify the implementation of an environmental tax policy is required. In addition, this study also discussed the impact of environmental taxes on enterprises with different property rights and economic scales. These findings not only add to empirical research on environmental taxes but also evaluate the effects of environmental taxes in China on economic growth and technology innovation input, thus providing theoretical support and empirical guidance for the more accurate implementation of future environmental tax policy. These findings could serve as a model for improving the environmental tax collection and management system in China.

Previous studies have assessed the potential for beneficial effects of environmental taxes on economic growth and technological innovation input in China, with some scholars proposing positive benefits and others suggesting no or even negative benefits. First, Lei et al. (2022), Abdullah and Morley, 2014, and Walid Oueslati, (2014) reported a causal relationship between environmental tax and enterprise performance. Early studies suggested a positive relationship between environmental tax and economic growth. That is, environmental taxes promote economic growth. Cannan and Pigou (1921) performed the first research on environmental taxes in “Welfare Economics,” which proposed the need to levy taxes and fees on polluters according to the extent of pollution-related harm via taxation and the private costs that polluters need to bear in production. Nevertheless, the authors did not provide a detailed explanation of the environmental tax mechanism. Subsequently, Tullock (1967)was the first toexplore the double dividend effect of environmental tax in the context of water resources. Pearce did not explicitly present the “double dividend” idea until 1991. Its basic theoretical logic of this concept in economic efficiency is that environmental tax reform will enhance economic benefits by shifting the tax burden from taxes with higher distortion to those with lower distortion (Xu and Shang, 2022), thereby promoting Pareto betterment and achieving the “Blue Dividend” (Pearce, 1991; Bovenberg and De Mooij, 1996). Goulder (1995) took “double dividend” a step further by dividing it into two categories: strong double and weak double. The former proposes that in the case of environmental tax reform, utilizing environmental tax revenue to finance more distorted tax cuts can enhance the overall economic efficiency (Landa Rivera et al., 2016). Hence, from the perspective of the overall cost, environmental tax reform has a very low, or even zero, cost. In their study of strong double dividend, by simulating the effect of a special carbon tax in Scotland, Allan et al. (2017) demonstrated that the “double dividend” effect would only increase if the carbon tax revenue was used to reduce income taxes, proving the presence of a robust double dividend. The latter is of the view that, compared to one-time transfer payments (Nyarko Mensah, 2019), when environmental tax is used to structurally reduce distorting taxes, the cost of environmental tax reform will be lower. Dagar et al. (2022) suggested that environmental degradation will be reduced in the long run if real GDP growth moves towards greener (Qiu et al., 2018), more technologically advanced, and more environmentally friendly areas. Therefore, they proposed that under certain conditions, environmental taxes will not negatively impact enterprises (Adamou et al., 2012; Liu et al., 2022). Feng et al. (2022) proved the existence of a double dividend effect in China under the low-carbon tax policy. Moreover, Atif et al. (2022) suggested that technology innovation input can play a moderating role in reducing the negative environmental consequences associated with the consumption of natural resources by analyzing subsamples from developing countries (Zhu et al., 2020b). Kousar et al. (2022) used square structural equation modeling to show the mediating role of environmental protection behavior in society, as well as the significant and positive effects of environmental awareness on environmental quality and pro-environmental behavior. Ma et al. (2022) also proposed that technological innovation can reduce CO2 emissions. In addition, environmental taxes also result in reduced SO2 emissions (Xu and Chen, 2022), which reduces environmental costs to some extent. Nevertheless, some studies have shown that environmental taxes do not promote economic growth. For example, Babiker et al. (2003) examined the “double dividend” from a theoretical point of view, arguing that the “weak double dividend” may not exist in an economy with multiple illusions. Bovenberg et al. believed that environmental taxes have egregious effects on the original tax distortion issue. Even if the income from environmental taxes is utilized for the structural tax reduction of distorting taxes, this issue cannot be ignored (Bovenberg and De Mooij., 1996). Later studies showed that if the “double dividend” effect is to exist, then the labor supply curve must be “backward curved.” Empirical studies could not prove that the labor supply curve was “backward curved” (Van Irland., 1994). Additionally, Oates (1995) and Chandra Karmaker et al., 2021 suggested that the “dividend” hypothesis was unlikely to materialize (Chen et al., 2022). Boyd and Ibarrarán. (2002) reported that it was almost impossible to have the so-called “double dividend” effect. Glomm et al. (2008) introduced the non-market assessment method in their investigation of the United States. They also demonstrated that environmental taxes did not have a “double dividend” effect. Zhu et al. (2020a) reported that a carbon tax negatively impacted the economy, with the potential to slow economic growth in particular (Tu et al., 2022). Combined, these findings underscore the uncertainty of whether environmental taxes can bring into full play the benefits of economic growth and technological innovation investment in China.

In summary, the conclusions in the literature are contradictory due to their differences in research perspectives, research objects, and sample selection. However, the existing literature had several deficiencies. 1) Existing literature mainly focuses on exploring the impact of environmental taxes from a macro perspective, with relatively little attention paid to the micro effects of environmental taxes. 2) Most studies on the effects of environmental taxes on technology innovation input use the annual numbers of patent applications by enterprises as the measurement index. However, the number of patents is more a result of successful R&D by businesses. Thus, the use of the number of patents as a measurement index ignores the investments by enterprises that do not result in gains; that is, it cannot correctly measure the changes in the R&D intentions of enterprises caused by environmental taxes. While some studies instead used R&D investment as a measurement index, there are also problems with using R&D spending. For example, in terms of level comparisons, if companies of different economic sizes invest the same amount of capital, smaller companies show stronger R&D intentions. In vertical comparisons, the same company has different profitability in different years. If an enterprise invests the same amount of money under different profit conditions, the enterprise shows stronger R&D intentions in years with poor profits. In other words, it is unfair to small enterprises with strong R&D intentions and with poor profitability to measure technology innovation input directly based on R&D investment.

Compared to the existing literature, the current study has the following strengths. 1) This study used unique data on enterprise economic performance and technology innovation input to investigate the effects of environmental tax policy on enterprise economic performance and green technology innovation input from the micro-enterprise level, further enriching the current literature. 2) This study determined the ratio of the current year’s R&D investment to the current year’s operating income as an index to measure the green technology innovation of enterprises. Although the input but not the output of the enterprise is considered, the impact of the company’s economic size and profitability on R&D investment is mitigated to some extent. 3) This study further classified the sample enterprises according to their property rights and economic volume according to the economic growth and technological innovation input benefits of the environmental tax on heavily polluting enterprises with different property rights and economic volumes.

2 Literature review, theoretical analysis, and research hypothesis

2.1 Environmental tax revenue and enterprise economic growth

Although the environmental protection tax will initially increase the operating costs of enterprises, in the long run, due to the reduction of the treatment costs of the “three wastes” and upgrades in industrial technology, the production costs of enterprises will gradually decrease, their performance will gradually increase, and their competitiveness will be further enhanced. First, companies will experience increased costs of doing business due to the compulsory environmental taxes. In the short term after the environmental tax reform, the environmental tax will have a direct negative impact on enterprises in heavily polluting industries compared to the period before the changes to the pollution discharge fee. Enterprises in heavily polluting industries will experiences losses due to the mandatory environmental tax and less room for changes in the implementation of the tax. Part of the room for negotiation on the cost of taxes and fees results in increased production and operation costs (Liao and Wang., 2022). Secondly, environmental taxes have higher requirements for energy conservation, emission reduction, and technological innovation, which lead to increased production costs and reduced business capacity by enterprises. Some of these enterprises comply with the requirements of the environmental protection tax through the research and development of green technology and green energy investments (Xu and Chen, 2022). However, these actions occupy a certain amount of capital for some time; however, this money is a part of the productive investment for the enterprise. This damages the economic performance of the enterprise (Liu et al., 2018), thereby reducing its profitability (Rassier and Earnhart, 2010). Therefore, such enterprises are at a competitive disadvantage compared to enterprises in the same industry that choose to maintain the status quo; that is, not upgrading to green technology. However, in the long run, environmental taxes will have a positive impact on the economic benefits of enterprises (Yi et al., 2021; Landa Rivera et al., 2016; Takeda and Arimura. 2021; Fisher and van Marrewijk, 1998). First, the current environmental tax rate in China is generally low (Wang and Yu, 2020); thus, most enterprises in heavily polluting industries can fully withstand the direct negative impact of an environmental tax on their economic performance without significantly increasing production and operation costs. The direct occupation of environmental taxes and fees on capital is not obvious, with little inhibitory effect on production and investment activities. Second, the enterprise spends substantial resources on technology research and development in the short term. These technical upgrades can result in reduced taxes, including those related to the “three wastes” treatment costs (Zhang et al., 2020), as well as reduced production of the intermediate, reduced production costs, and improved product quality (Nyarko Mensah et al., 2019). This fully offsets the cost of green technology upgrades since they can allow more efficient resource allocation. The taxes also encourage businesses to reallocate their facilities and substitutes according to the amount of investment (Gaigné et al., 2020). Furthermore, compared to industries without green upgrades, the reduction in tax burden due to technology upgrades becomes a competitive advantage. In other words, the “innovation compensation” effect of environmental regulations offsets the cost of environmental regulation compliance (Qiu et al., 2018) and increases enterprise productivity and performance (Hamamoto, 2006). In addition, when the green technologies mastered by these enterprises are mature, they will also have a first-mover advantage (Lei et al., 2022). The market competitiveness of technologically upgraded enterprises will be further strengthened in the future, resulting in the growth of enterprise economic benefits. Due to technology innovation input, it also greatly increases the ability of enterprises to resist risks (Khan et al., 2021; Zhang and Zheng, 2022). In addition to the advantages mentioned above, environmental taxes also positively impact corporate costs (Morris et al., 1999), production (Yamazaki, 2022; Zárate-Marco and Vallés-Giménez, 2015; Beladi et al., 2021; Li and Masui, 2019; Berman and Bui, 2001), financing (Zhu et al., 2020b) and redistribution (Leiter et al., 2011; Karydas and Zhang, 2017; Garbaccio et al., 1999), tax payment Cadoret et al., 2020; Zhou et al., 2019), and even macro industrial upgrading (He et al., 2021; Guan et al., 2019). In other words, even if a mandatory environmental tax increases some enterprise operating costs, these costs will be offset in the long run by a series of benefits brought about by technological advancement. Based on the implementation of environmental tax reform for some time in China and the above analysis, this study proposes Hypothesis 1:

Hypothesis 1. Environmental tax reform has a positive effect on the economic benefits of heavily polluting industries in China.

2.2 Environmental taxation and innovation input of enterprise technologies

Based on the porter hypothesis and compensation effect, the environmental tax increases pollution costs to enterprises after environmental tax reform, thereby crowding out capital investment for innovation (Faucheux and Nicolai, 1998), which is not conducive to technology research and development (Van Leeuwen and Mohnen, 2017; Liu et al., 2018). Given the high risk of technology innovation input activities (Zhao et al., 2022), enterprises in heavily polluting industries choose to maintain the status quo to avoid losses in R&D. In these cases, environmental taxes reduce the amount of money available for technological innovation. The heavily polluting industries, as well as other profit-maximizing enterprises, may choose to invest in green original equipment manufacturing to reduce environmental taxes for their future economic benefits and long-term negative effects. Environmental taxes for green technology have higher demands. These measures are taken to increase the environmental tax benefits via technology innovation. The present study suggests that appropriate environmental regulations can motivate enterprises to enhance environmental investment (Yang et al., 2012; Chandra Karmaker et al., 2021; Yu and Cheng, 2021) and innovation activities. (Porter and van der Linde, 1995; Chen et al., 2022). Since the current environmental tax rate in China is generally low (Wang and Yu, 2020), most enterprises in heavily polluting industries can fully withstand their direct negative impact on economic performance, obviously reducing the direct negative impact of an environmental tax on enterprise green technology research and development. Similarly, the development cost of green technology innovation for utility models is relatively low, and enterprises in heavily polluting industries can bear the expenditure and risk of green technology innovation more than those in innovative green technology innovation (Qiu et al., 2018). Therefore, the negative impact of higher technology R&D costs on green technology innovation is relatively low. Compared with other measures, such as the adjustment in production plans, green innovation has less impact on normal production and short-term profits of enterprises (Popp, 2006). Based on the above analysis, the present study proposes Hypothesis 2:

Hypothesis 2. Environmental tax reform has a positive effect on the technology innovation input benefits of heavily polluting industries in China.

3 Materials and methods

3.1 Data sources and sample selection

To determine whether an environmental tax could help increase the economic benefits and technological innovation input of heavily polluting industries, this study used data from the China Stock Market & Accounting Research Database (http://cndata1.csmar.com/) and the Wind Database (https://www.wind.com.cn/). Additionally, to increase the accuracy of the research findings, the data were processed as follows: 1) ST, *ST, or PT listed company samples were excluded; 2) listed companies lacking research data were excluded; 3) financial samples were suggested due to the uniqueness of the financial business; 4) to decrease errors, the relevant data were winsorized at the 1% and 99% levels; and 5) considering the availability of data, there was less disclosure of relevant information and more missing data before the implementation of the policy. To maintain the continuity of sample data and sufficient sample size, this study included 2 years before and 3 years after the implementation of the policy as the research periods. After matching, 9,783 samples were included in the evaluations of the economic growth benefit of environmental taxes, while 9,251 samples were included in the assessments of the input benefit of technological innovation due to environmental taxes.

3.2 Variable selection

3.2.1 Dependent variables

The net profit ratio on total assets (ROA) can reflect a business’s overall profitability. To study the effects of environmental taxes on the economic benefits of companies in heavily polluting industries, the effect of environmental taxes on the economic advantages of businesses was measured using ROA in this study. Enterprises attach great importance to R&D, which is reflected in their R&D investment; thus, RD was set as the ratio of R&D expenditure to the operating income to gauge the promotion effect of environmental taxes on technology innovation input. Moreover, this study defined ROE and RA as new dependent variables for the regression analyses.

3.2.2 Independent variables

PI values of 1 indicated whether a company was a heavily polluting enterprise; otherwise, the value was 0. YEAR represented the passage of time. As China officially enacted the environmental tax in 2018, the value of YEAR before 2018 was 0, and 1 for 2018 and later years. PY is the multiplication term of PI and YEAR. To avoid backward causality caused by the lag effect, PY, PI, and YEAR were all treated with lag in this study.

3.2.3 Control variables

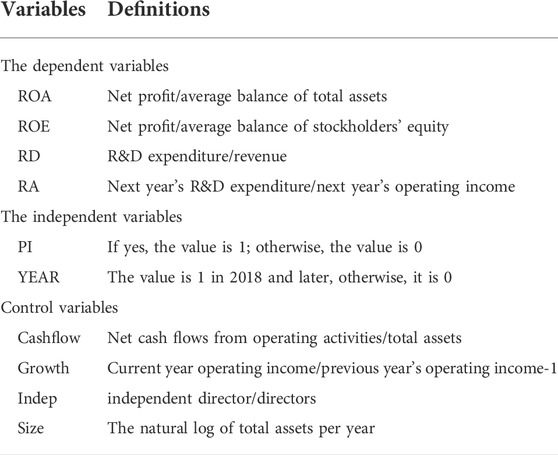

This study included several variables that could interfere with the dependent variables ROA and RA; namely, the cash flow ratio, operating income growth rate, independent director ratio, and size. The details of the variables are depicted in Table 1.

This study, adopted a difference-in-difference approach, with heavily polluting companies as the treatment group and non-heavily polluting enterprises as the control group. I represented the region, t represented the time, Xi,t represented the matrix of other economic characteristics control variables of the listed companies that might affect ROA or RD, respectively. εi,t represented the random error term; that is, the influence of factors omitted from the model that were not important to the explained variable, the observation error of the explained variable and the explained variable, and the uncontrollable and difficult to measure random factors in the economic system. The following depicts how the model was built:

Here, PY is the core explanatory variable that was the focus of this study. A positive PY coefficient β1 meant that under the effects of the other factors, the environmental tax promoted the economic growth and technology innovation input of companies.

4 Results

4.1 Descriptive statistics of the variables

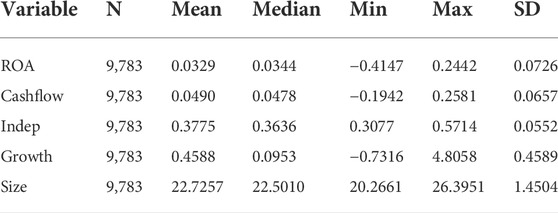

Table 2 shows the descriptive statistics of variable data to assess the influence of environmental tax on the economic advantages evaluated in this study. The dependent variable ROA was left-biased under the influence of low values, with a mean value less than the median indicating that some companies in the sample had low profitability and lower than average levels, as shown in the table.

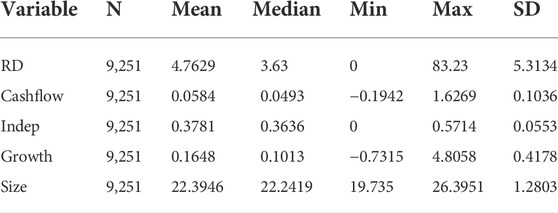

Table 3 displays the explaining statistics of the variable data used to investigate the impact of environmental taxes on the technology innovation input in this study. The mean value of the dependent variable RD is higher than the median because the distribution is biased to the right due to the effect of the greatest value. This finding indicated that some enterprises in the sample attached great significance to technology innovation input and invested substantial money in research and development.

4.2 Regression results

4.2.1 Analysis of the effect of environmental taxes on enterprise economic benefits

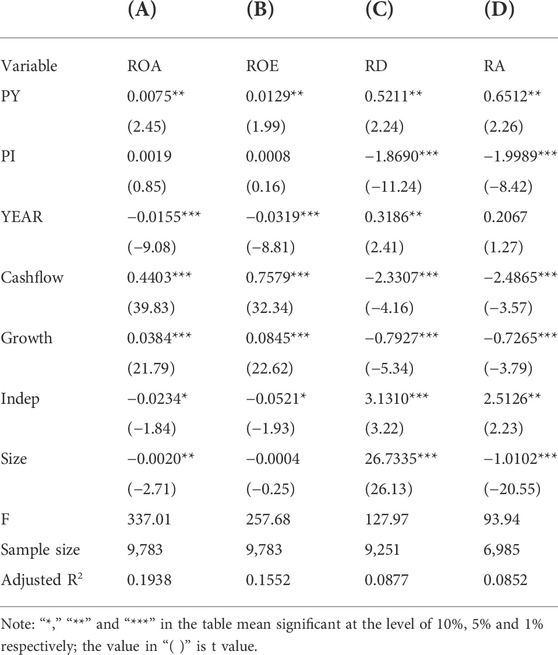

Columns (A) and (C) of Table 4 show the regression findings for the full sample. The PY coefficients were 0.0075 and 0.5211, respectively, passing the significance test of 5%, indicating that environmental taxes had a significant beneficial impact on the economic benefits and technology innovation input of enterprises in heavily polluting industries; thus, the hypothesis in this paper was valid.

4.2.2 Robustness test

To ensure that the empirical findings were reliable, this study adopted the technique of replacing the dependent variable measurement index with ROE and RA as new dependent variables for re-regression. The regression findings are shown in Columns (B) and (D) of Table 4. The PY coefficients are 0.0129 and 0.6512, respectively, passing the significance test of 5%. This is consistent with the regression results shown above.

5 Discussion

The findings of the present study, preliminarily demonstrate the obvious benefits on economic growth and technological innovation investment of enterprises in China’s heavily polluting industries shortly after the implementation of environmental taxes. Several reasons may explain these findings: First, environmental taxes have a high requirement for green technology, which forces enterprises to increase their investment in green technology. Green technology has been fully developed under the premise of increased capital investment. The tax deduction resulting from enterprises upgrading to green technology may offset the cost of green technology investment and become a competitive advantage over enterprises that have upgraded to green technology after the investment cost is offset. Secondly, upgrades to green technology will not only provide competitive advantages in taxation but also reduce the cost of “waste” treatment. Finally, some enterprises will have first-mover advantages when they acquire upgraded green technologies by increasing their R&D investments. Based on these factors, the environmental tax provides obvious economic growth and technological innovation benefits for heavily polluting enterprises in China. In other words, the implementation of environmental taxes in China is reasonable and necessary.

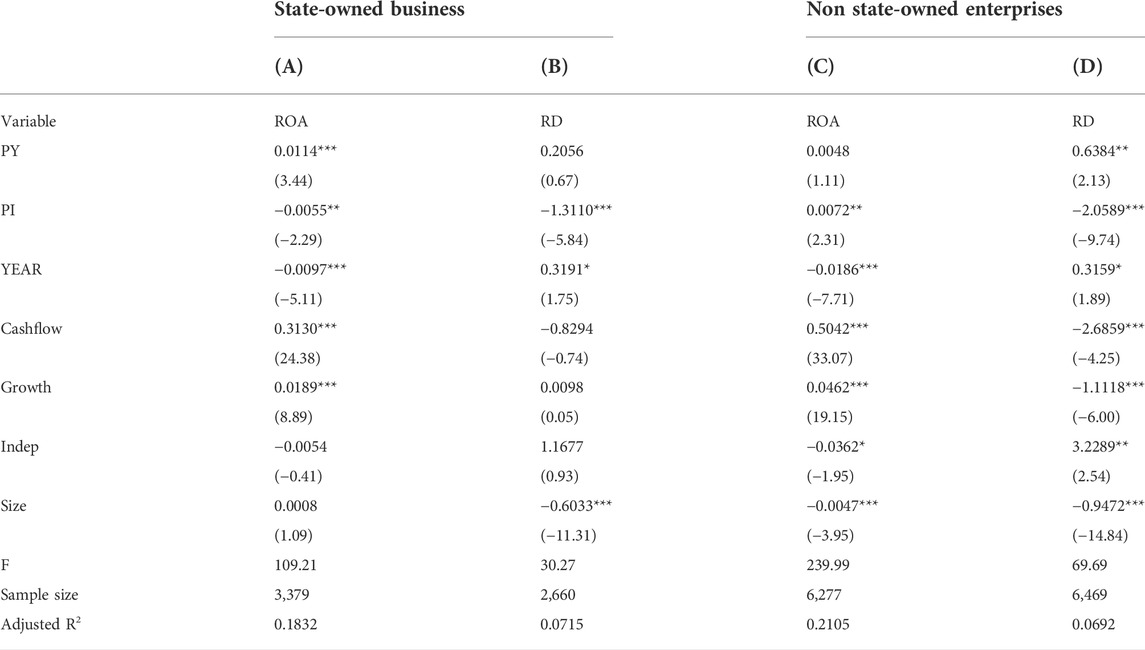

To further refine the impact of environmental taxes on economic growth and technology innovation input of listed enterprises in heavily polluting industries with different property rights and different economic volumes, we divided the sample enterprises into state-owned and non-state-owned enterprises, as well as large and small enterprises.

5.1 Influence of environmental taxes on listed companies in heavily polluting industries with different property rights

This study divided the sample enterprises into state-owned and non-state-owned enterprises according to their different property rights and performed regressions respectively. The regression results are shown in Table 5.

As shown in Table 5, the coefficients of PY in columns (A) and (D) are 0.0114 and 0.6384 respectively, which are significant at the 1% and 5% levels, respectively. However, the coefficients are not significant in columns (B) and (C). Thus, the environmental taxes had a strong effect on the economic growth of state-owned enterprises but a weak effect on technology innovation input. This may be because state-owned enterprises can get more preferential policies due to their special property rights. In addition, state-owned enterprises have a special relationship with the government, which provides them a hidden advantage. Compared to other enterprises, state-owned enterprises have more stable financial support and are better adapted to the economic environment after environmental tax reform. Thus, the effect of economic growth is obvious. However, compared to non-state-owned enterprises, the rigidity of their organizations and their vulnerability to state intervention restrict further expansion of their R&D investments. To give full play to the technological innovation input benefit of environmental tax, state-owned enterprises should consider softening their organizational structure appropriately and releasing more decision-making power to R&D. The impact of environmental taxes on the economic growth of non-state-owned enterprises is not obvious, while the obvious impact of technological innovation input may be because non-state-owned enterprises are not as adaptable as state-owned enterprises, have poor financial stability, and lack resources and talent compared to state-owned enterprises. However, the relatively flexible system, relatively flexible use of funds, and more independent decision-making make it easier to increase R&D investments.

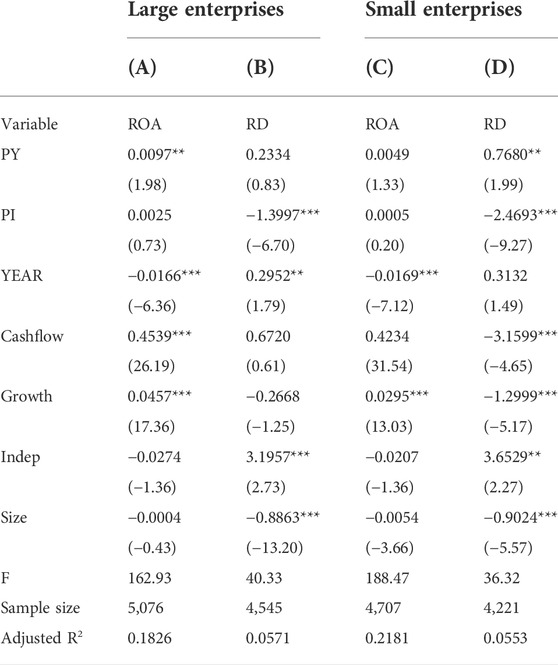

5.2 Influence of environmental taxes on listed companies in heavily polluting industries of different scales

This study re-divided the sample enterprises into large and small enterprises according to the median of the variable Size in the sample and performed regression analysis. The regression results are shown in Table 6:

As shown in Table 6, the PY coefficients of columns (A) and (D) are 0.0097 and 0.7680, respectively, and are significant at the level of 1%, but are not significant in columns (B) and (C). This indicates that environmental tax had a significant effect on the economic growth of the listed enterprises with large economic volume and heavy pollution but a small effect on technology innovation input. This may be because large-scale enterprises usually have good economic and management foundations, and have more advantages in talents, capital, and other aspects compared to small-scale enterprises. Therefore, it is easier for them to quickly stabilize and adapt after being affected by environmental taxes, thus achieving faster economic growth. However, although large, heavily polluting enterprises often have better management and governance systems, their R&D decision-making procedures are more complicated; more problems must be considered in R&D decision-making, and the R&D decision-making cycle is usually longer than that of small, heavily polluting enterprises. Therefore, the technological innovation investment effect of environmental tax lags. Thus, the technology innovation input effect of environmental taxes has no obvious influence on these enterprises. Environmental taxes showed a weaker impact on economic growth and a more visible impact on the technological innovation input of small and heavily polluted listed enterprises. This may be due to the following: 1) China’s government has issued a series of technical innovation investment preferential policies to the heavy pollution industry and smaller companies, which make the smaller companies more likely to comply with the implementation of environmental taxes. 2) Small listed enterprises with heavy pollution are limited by their size, capital, talents, and resources; moreover, their economic performance is greatly impacted by environmental taxes it is difficult for them to adapt quickly. As a result, environmental taxes provide no obvious benefit to their economic growth. 3) This study used the ratio of R&D investment to operating income as the standard to measure the benefits of technology innovation input of enterprises, which also affects the study results. The average operating income of small enterprises is usually lower than that of large enterprises; thus, high RD values are easily obtained by small enterprises, while it is difficult for large enterprises to obtain high RD values.

6 Conclusion

This study analyzed the impact of environmental taxes on enterprises in heavily polluting industries in China, further enriching empirical research on environmental taxes. The findings provide theoretical support and empirical guidance for the economic growth and technology innovation input effects of environmental taxes in China. Based on the relevant data of listed companies in the 5 years from 2016 to 2020, this paper defined extremely contaminating enterprises as the treatment group, and all other enterprises as the control group. The double-difference technique showed significantly positive values of the coefficient β1 of PY. Therefore, since China officially levied an environmental tax in 2018, the environmental taxes have resulted in enormous economic advantages and technology innovation input of companies in heavily polluting industries in China. This study also assessed the environmental taxes according to different types of property rights and the influence of different economic dimensions on heavy pollution in the listed companies. The comparison and analysis of the core variable coefficient of PY showed differences among the varied property rights and the economic dimension of heavy pollution in the listed companies and the effect of technology innovation input. Regarding the economic growth effect of environmental taxes, the β1 of state-owned enterprises and large enterprises was significantly positive, which indicated that environmental taxes had a strong economic growth effect on state-owned or large enterprises. β1 was also significantly positive for non-state-owned or small-scale enterprises, which indicated that the technology innovation input effect of these enterprises was strong.

The findings of this the present study showed that environmental taxes promote the economic growth and technological innovation input of enterprises in heavily polluting industries. Based on these findings, this study makes the following three policy recommendations.

6.1 Improving the environmental regulation system

As China only started to implement the environmental tax in 2018, there may be some unreasonable aspects in the formulation of the environmental tax policy, which may impact the effect of the environmental tax on China’s economic growth and technological innovation investment benefits. Therefore, China should revise the Environmental Protection Tax Law to address some problems exposed since the implementation of the policy. Other relevant environmental regulations should also be modified to synthesize the advantages of all kinds of environmental regulations to give full play to the benefits of environmental taxes on China’s economic growth and technological innovation investments.

6.2 Adapting environmental taxes to local conditions according to international law

China has a vast territory; thus, the actual situations differ according to place. The inevitable “one size fits all” problem in the implementation of the environmental tax will undoubtedly affect the economic growth and technological innovation input benefits of the environmental tax. Therefore, local governments should combine the implementation process of the environmental tax with actual local situations and fully consider the scientific and reasonable implementation details of the environmental tax to achieve the positive benefits of this tax on China’s economy and optimize the technological innovation investments.

6.3 Applying big data technology to strengthen environmental tax implementation and supervision

Environmental taxes are difficult to implement and supervise due to the complex national conditions in China. For instance, some law enforcement personnel disregard professional ethics. Moreover, some enterprises lie and conceal the difficulties caused by the implementation of the environmental tax. In remote areas, it is even more difficult for the state to effectively determine whether the implementation of the environmental tax is reasonable and legal, which can negatively impact the economic growth and technological innovation investment benefits of environmental tax. At present, China’s big data technology is developing rapidly, and technology related to the implementation and supervision of environmental tax is relatively mature. Therefore, China can use big data to strengthen the implementation and supervision of environmental taxes and provide more effective technical support for environmental tax policy.

This study has several limitations. First, this study aimed to identify and assess the impact of environmental taxes from a micro perspective by defining enterprises in heavily polluting industries as the research samples. However, enterprises in heavily polluting industries are still a large sample for microscopic observation. Subsequent studies are needed that make more subtle classifications of industry categories to identify more specific changes in economic and technology innovation input benefits of the industries impacted by environmental taxes. Moreover, while this study used the ratio of R&D investment and operating income in the current year to analyze the technology innovation input benefits of enterprises, this index has some problems. While operating income cannot fully measure the operating results and financial status of enterprises, due to the lack of sample data, this study could not use more effective indicators to more effectively analyze the technology innovation input of these enterprises.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: http://cndata1.csmar.com/ https://www.wind.com.cn/.

Author contributions

ZW has contributed to the definition of research objectives, data collection, data analysis, article writing and proofreading, and final approval. NZ has contributed in revision and the conclusion of the study. JW has contributed by developing models, hypothesis revision, and proofreading. YH has contributed in research objectives and data analysis plan. NM has contributed in proofreading, data analysis plan and the revision of the study. All authors contributed to the article and approved the submitted version.

Funding

This research was funded by the National Social Science Fund of China (grant number 20BGL099).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abdullah, S., and Morley, B. (2014). Environmental taxes and economic growth: Evidence from panel causality tests. Energy Econ. 42, 27–33. doi:10.1016/j.eneco.2013.11.013

Adamou, A., Clerides, S., and Zachariadis, T. (2012). Trade-offs in CO2-oriented vehicle tax reforms: A case study of Greece. Transp. Res. Part D Transp. Environ. 17 (6), 451–456. doi:10.1016/j.trd.2012.05.005

Allan, G. J., Lecca, P., McGregor, P. G., McIntyre, S. G., and Kim Swales, J. K. (2017). Computable general equilibrium modelling in regional science. Cham: Springer International Publishing, 59–78. doi:10.1007/978-3-319-50590-9_4

Atif, J., Muhammad, U., Muntasir, M., Haider, M., and Daniel, B-L. (2022). The linkages between natural resources, human capital, globalization, economic growth, financial development, and ecological footprint: The moderating role of technology innovation inputs. Resour. Policy 76, 102569. doi:10.1016/j.resourpol.2022.102569

Babiker, M. H., Metcalf, G. E., and Reilly, J. (2003). Tax distortions and global climate policy. J. Environ. Econ. Manag. 46 (2), 269–287. doi:10.1016/s0095-0696(02)00039-6

Beladi, H., Chen, P., Chu, H., Hu, M., and Lai, C. (2021). Environmental taxes and economic growth with multiple growth engines. B.E. J. Macroecon. 21 (2), 629–658. doi:10.1515/bejm-2020-0108

Berman, E., and Bui, T. M. (2001). Environmental regulation and productivity: Evidence from oil refineries. Rev. Econ. Statistics 83 (3), 498–510. doi:10.1162/00346530152480144

Bovenberg, A. L., and De Mooij, R. A. (1996). Environmental taxation and the double-dividend: The role of factor substitution and capital mobility. doi:10.1007/978-94-015-8652-8_1

Boyd, R., and Ibarrarán, M. E. (2002). Costs of compliance with the kyoto protocol: A developing country perspective. Energy Econ. 24 (1), 21–39. doi:10.1016/s0140-9883(01)00080-9

Cadoret, I., Galli, E., and Padovano, F. (2020). How do governments actually use environmental taxes? Appl. Econ. 52 (48), 5263–5281. doi:10.1080/00036846.2020.1761536

Cannan, E., and Pigou, A. C. (1921). The economics of welfare. Econ. J. 31 (122), 206–213. doi:10.2307/2222816

Chandra Karmaker, S., Hosan, S., Andrew, J., and Saha, B. B. (2021). The role of environmental taxes on technology innovation input. Energy 232, 121052. doi:10.1016/j.energy.2021.121052

Chen, Y., Zhang, T., and Dragana, O. (2022). Research on the green technology innovation cultivation path of manufacturing enterprises under the regulation of environmental protection tax law in China. Front. Environ. Sci. 10, 874865. doi:10.3389/fenvs.2022.874865

Dagar, V., Ahmed, F., Waheed, F., Bojnec, Š., Khan, M. K., and Shaikh, S. (2022). Testing the pollution haven hypothesis with the role of foreign direct investments and total energy consumption. Energies 15 (11), 4046. doi:10.3390/en1511404610.3390/en15114046

Faucheux, S., and Nicolaı̈, I. (1998). Environmental technological change and governance in sustainable development policy. Ecol. Econ. 27 (3), 243–256. doi:10.1016/S0921-8009(97)00176-6

Feng, P., Lu, H., Li, W., and Wang, X. (2022). Tax policies of low carbon in China: Effectiveness evaluation, system design and prospects. Front. Environ. Sci. 10, 953512. doi:10.3389/fenvs.2022.953512

Fisher, E. O., and van Marrewijk, C. (1998). Pollution and economic growth. J. Int. Trade & Econ. Dev. 7 (1), 55–69. doi:10.1080/09638199800000004

Gaigné, C., Hovelaque, V., and Mechouar, Y. (2020). Carbon tax and sustainable facility location: The role of production technology. Int. J. Prod. Econ. 224, 107562. doi:10.1016/j.ijpe.2019.107562

Garbaccio, R. F., Ho, M. S., and Jorgenson, D. W. (1999). Controlling carbon emissions in China. Environ. Dev. Econ. 4 (4), 493–518. doi:10.1017/s1355770x99000303

Glomm, G., Kawaguchi, D., and Sepulveda, F. (2008). Green taxes and double dividends in a dynamic economy. J. Policy Model. 30 (1), 19–32. doi:10.1016/j.jpolmod.2007.09.001

Goulder, L. H. (1995). Environmental taxation and the double dividend: A reader' s guide. Int. Tax Public Finance 2, 155–182. doi:10.1007/BF00877495

Guan, A., Xie, J., and Meng, Y. (2019). The impact of environmental protection tax on the upgrading of industrial structure-based on spatial econometric analysis. E3S Web Conf. 131, 01070. doi:10.1051/e3sconf/201913101070

Hamamoto, M. (2006). Environmental regulation and the productivity of Japanese manufacturing industries. Resour. Energy Econ. 28 (4), 299–312. doi:10.1016/j.reseneeco.2005.11.001

He, P., Sun, Y., Niu, H., Long, C., and Li, S. (2021). The long and short-term effects of environmental tax on energy efficiency: Perspective of OECD energy tax and vehicle traffic tax. Econ. Model. 97, 307–325. doi:10.1016/j.econmod.2020.04.003

Karydas, C., and Zhang, L. (2017). Green tax reform, endogenous innovation and the growth dividend. Working Paper 17/266. CER-ETH – Center of Economic Research at ETH Zurich. doi:10.2139/ssrn.2908837

Khan, S. A. R., Ponce, P., Tanveer, M., Aguirre-Padilla, N., Mahmood, H., and Shah, S. A. A. (2021). Technology innovation input and circular economy practices: Business strategies to mitigate the effects of COVID-19. Sustainability 13 (15), 8479. doi:10.3390/su13158479

Kousar, S., Afzal, M., and Ahmed, F. (2022). Environmental awareness and air quality: The mediating role of environmental protective behaviors. Sustainability 14 (6), 3138. doi:10.3390/su14063138

Landa Rivera, G., Reynès, F., Bellocq, F-X., and Grazi, F. (2016). Towards a low carbon growth in Mexico: Is a double dividend possible? A dynamic general equilibrium assessment. Energy Policy 96, 314–327. doi:10.1016/j.enpol.2016.06.012

Lei, Z., Huang, L., and Cai, Y. (2022). Can environmental tax bring strong porter effect? Evidence from Chinese listed companies. Environ. Sci. Pollut. Res. 29, 32246–32260. doi:10.1007/s11356-021-17119-9

Leiter, A. M., Parolini, A., and Winner, H. (2011) Winner environmental regulation and investment: Evidence from European industries. Ecol. Econ. 70 (4), 759–770. doi:10.1016/j.ecolecon.2010.11.013

Li, G., and Masui, T. (2019). Assessing the impacts of China's environmental tax using a dynamic computable general equilibrium model. J. Clean. Prod. 208, 316–324. doi:10.1016/j.jclepro.2018.10.016

Liao, G., and Wang, C. (2022). Study on the impact of environmental tax on green technology innovation of Heavy Pollution Enterprises. Commun. Finance Account. 10, 54–59. doi:10.16144/j.cnki.issn1002-8072.2022.10.026

Liu, W., Liu, M., Liu, T., Li, Y., and Hao, Y. (2022). Does a recycling carbon tax with technological progress in clean electricity drive the green economy? Int. J. Environ. Res. Public Health 19 (3), 1708. doi:10.3390/ijerph19031708

Liu, Y., Li, Z., and Yin, X. (2018). Environmental regulation, technology innovation input and energy consumption, a cross-region analysis in China. J. Clean. Prod. 203, 885–897. doi:10.1016/j.jclepro.2018.08.277

Ma, Q., Tariq, M., Mahmood, H., and Khan, Z. (2022). The nexus between digital economy and carbon dioxide emissions in China: The moderating role of investments in research and development. Technol. Soc. 68, 101910. doi:10.1016/j.techsoc.2022.101910

Morris, G. E., Révész, T., Zalai, E., Fucskó, J., and Fueskó, J. (1999). Integrating environmental taxes on local air pollutants with fiscal reform in Hungary: Simulations with a computable general equilibrium model. Environ. Dev. Econ. 4 (4), 537–564. doi:10.1017/s1355770x99000327

Nyarko Mensah, C., Long, X., Dauda, L., Boamah, K. B., Salman, M., Appiah-Twum, F., et al. (2019). Technology innovation input and green growth in the Organization for Economic Cooperation and Development economies. J. Clean. Prod. 240, 118204. doi:10.1016/j.jclepro.2019.118204

Oates, W. E. (1995). Green taxes: Can we protect the environment and improve the tax system at the same time? South. Econ. J. 61 (4), 915–922. doi:10.2307/1060731

Oueslati, Walid (2014). Environmental tax reform: Short-term versus long-term macroeconomic effects. J. Macroecon. 40, 190–201. doi:10.1016/j.jmacro.2014.02.004

Pearce, D. (1991). The role of carbon taxes in adjusting to global warming. Econ. J. 101 (407), 938–948. doi:10.2307/2233865

Popp, D. (2006). International innovation and diffusion of air pollution control technologies: The effects of NOX and SO2 regulation in the US, Japan, and Germany. J. Environ. Econ. Manag. 51 (1), 46–71. doi:10.1016/j.jeem.2005.04.006

Porter, M. E., and van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Qiu, L. D., Zhou, M., and Xu, W. (2018). Regulation, innovation, and firm selection: The porter hypothesis under monopolistic competition. J. Environ. Econ. Manag. 92, 638–658. doi:10.1016/j.jeem.2017.08.012

Rassier, D. G., and Earnhart, D. (2010). Does the porter hypothesis explain expected future financial performance? The effect of clean water regulation on chemical manufacturing firms. Environ. Resour. Econ. 45, 353–377. doi:10.1007/s10640-009-9318-0

Takeda, S., and Arimura, T. H. (2021). A computable general equilibrium analysis of environmental tax reform in Japan with a forward-looking dynamic model. Sustain Sci. 16, 503–521. doi:10.1007/s11625-021-00903-4

Tu, Z., Liu, B., Jin, D., Wei, W., and Kong, J. (2022). The effect of carbon emission taxes on environmental and economic systems. Int. J. Environ. Res. Public Health 19 (6), 3706. doi:10.3390/ijerph19063706

Van Irland, E. C. (1994). International environmental economics:theories,models and applications to climate change,international trade and acidification. Amsterdam: Elsevier, 347–352. doi:10.1017/S1355770X97220073

Van Leeuwen, G., and Mohnen, P. (2017). Revisiting the porter hypothesis: An empirical analysis of green innovation for The Netherlands. Econ. Innovation New Technol. 26, 63–77. doi:10.1080/10438599.2016.1202521

Wang, Y., and Yu, L. (2020). Can the current environmental tax rate promote green technology innovation?evidence from China’s resource-based industries. J. Clean. Prod. 278, 123443. doi:10.1016/j.jclepro.2020.123443

Xu, D., and Shang, G. (2022). Research on the impact of environmental tax collection on enterprise green technology innovation: A quasi-natural experiment based on sewage charge tax reform system. Mod. Manag. Sci. 2, 98–107.

Xu, Y., and Chen, P. (2022). Energy transition and regional heterogeneity of environmental taxation in China: From the perspective of emission reduction effects. Front. Environ. Sci. 10, 944131. doi:10.3389/fenvs.2022.944131

Yamazaki, A. (2022). Environmental taxes and productivity: Lessons from Canadian manufacturing. J. Public Econ. 205, 104560. doi:10.1016/j.jpubeco.2021.104560

Yang, C-H., Tseng, Y-H., and Chen, C-P. (2012). Environmental regulations, induced R&D, and productivity: Evidence from Taiwan's manufacturing industries. Resour. Energy Econ. 34 (4), 514–532. doi:10.1016/j.reseneeco.2012.05.001

Yi, Y., Wei, Z., and Fu, C. (2021). An optimal combination of emissions tax and green innovation subsidies for polluting oligopolies. J. Clean. Prod. 284, 124693. doi:10.1016/j.jclepro.2020.124693

Yu, Y., and Cheng, H. (2021). Environmental taxes and innovation in Chinese textile enterprises: Influence of mediating effects and heterogeneous factors. Sustainability 13 (8), 4561. doi:10.3390/su13084561

Zárate-Marco, A., and Vallés-Giménez, J. (2015). Environmental tax and productivity in a decentralized context: New findings on the porter hypothesis. Eur. J. Law Econ. 40, 313–339. doi:10.1007/s10657-013-9400-5

Zhang, D., and Zheng, W. (2022). Does COVID-19 make the firms’ performance worse? Evidence from the Chinese listed companies. Econ. Analysis Policy 74, 560–570. doi:10.1016/j.eap.2022.03.001

Zhang, Y., Sun, J., Yang, Z., and Wang, Y. (2020). Critical success factors of green innovation: Technology, organization and environment readiness. J. Clean. Prod. 264, 121701. doi:10.1016/j.jclepro.2020.121701

Zhao, A., Wang, J., Sun, Z., and Guan, H. (2022). Environmental taxes, technology innovation quality and firm performance in China-A test of effects based on the Porter hypothesis. Econ. Analysis Policy 74, 309–325. doi:10.1016/j.eap.2022.02.009

Zhou, J., Zhao, Y., and Kuang, H. (2019). Environmental tax on directed technology innovation input in a green growth model. Environ. Eng. Manag. J. 9, 2045–2054. doi:10.30638/eemj.2019.194

Zhu, N., Bu, Y., Jin, M., and Mbroh, N. (2020b). Green financial behavior and green development strategy of Chinese power companies in the context of carbon tax. J. Clean. Prod. 245, 118908. doi:10.1016/j.jclepro.2019.118908

Keywords: environmental tax, difference-in-difference approach, heavily polluting industries, economic benefits, technological innovation

Citation: Wang Z, Zhu N, Wang J, Hu Y and Nkana M (2022) The impact of environmental taxes on economic benefits and technology innovation input of heavily polluting industries in China. Front. Environ. Sci. 10:959939. doi: 10.3389/fenvs.2022.959939

Received: 02 June 2022; Accepted: 22 July 2022;

Published: 29 August 2022.

Edited by:

Haider Mahmood, Prince Sattam Bin Abdulaziz University, Saudi ArabiaReviewed by:

Štefan Bojnec, University of Primorska, SloveniaJing Zhang, Chongqing University, China

Copyright © 2022 Wang, Zhu, Wang, Hu and Nkana. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Naiping Zhu, bnB6aHVAdWpzLmVkdS5jbg==

Zhengyan Wang

Zhengyan Wang Naiping Zhu*

Naiping Zhu*