- 1Tianjin University of Commerce, Tianjin, China

- 2Southwestern University of Finance and Economics, Chengdu, China

- 3Xinxiang University, Xinxiang, China

Both green finance and industrial technology innovation play irreplaceable roles in the framework of sustainable development. Research on the coupling and coordination between these systems will deepen the realization of sustainable development models. This study applied the TOPSIS entropy weight method to measure the development of green finance and industrial technology innovation in Zhejiang Province between 2012 and 2019 and used the coupling coordination degree model to determine the strength and effect of the interaction between these systems in Zhejiang Province. The results showed strong regional heterogeneity in the development of green finance and industrial technology innovation in the nine cities in Zhejiang Province within the study period. Moreover, mutual assistance and correlation between green finance and industrial technology innovation in the nine cities of Zhejiang Province increased over time. Finally, the effect of green finance and industrial technology innovation in the nine cities of Zhejiang Province was complex. The results of this study may inform policy suggestions regarding the roles potential roles of the government, commercial banks, and enterprises.

1 Introduction

In the previous period of relatively low productivity, the limited scope and frequency of human activities did not significantly impact resource status and environmental quality (Bugnot et al., 2019). However, during industrialization and urbanization, the active pursuit of productivity has expanded the scope and frequency of human activities, with obvious increases in the intensity of resource exploitation and environmental utilization (Whiting, 2022). While appropriate exploitation and utilization have positive effects on improving productivity (Liu et al., 2023), human activities are full of disorder and inefficiency when blindly pursuing productivity, which amplifies the negative effects on resources and the environment; namely, destroying stable human development of the environment (Erum and Shazia, 2022). The importance of the positive development of resources and the environment has gradually attracted worldwide attention. The book, “Limits of Growth” put forward the concept of “sustainable development”, which triggered discussion and reflection on the rationality of the development mode among academic circles (Koutaissoff, 1980). Since then, sustainable development has been cited by many scholars and has become the most advanced concept and representative theoretical perspective in academic research. Moreover, many institutions have adopted sustainable development, which has become the most valued core value in practical application as a progress orientation (Sun et al., 2022a).

Among practical cases that embody the concept of sustainable development, green finance and industrial technology innovation have shown remarkable achievement. As a service method for the comprehensive development of projects in the fields of environmental protection and energy conservation, green finance provides the advantages of supporting environmental improvement, addressing climate change, and promoting the efficient use of resources (Mamun et al., 2022). From a broader perspective, the effects of green finance are recognized worldwide, including the optimization of the supply structure of regional production factors (Wang and Wang, 2021), significantly weakening the excess capacity of regional traditional industries (Xiao and Peng, 2021), improving the development speed of regional green industries (Wu, 2022), and improving the regional green production engine (Rasoulinezhad and Taghizadeh-Hesary, 2022). Green finance has injected vitality into sustainable development. As the sum of all material means and methods developed by using natural laws to promote the transformation and upgrading of traditional industries, industrial technology innovation can also stimulate interest in relevant subjects (Desmet et al., 2020), effectively reducing the unit cost of industrial products (Chen et al., 2021), and enhance the market competitiveness of industrial products (Nawaz, 2021). From a broader perspective, the effects of industrial technology innovation are recognized worldwide, including clarifying the strategic focus of regional development (Li et al., 2022), effectively reducing the process loss of regional industrial development (Zhang and Fu, 2022), enhancing the driving effects of regional industrial development (Su and Fan, 2022), and organically adjusting the regional industrial production system (Wu et al., 2022). Thus, industrial technology innovation can improve the resilience of sustainable development.

As an institutional innovation to achieve energy conservation and environmental protection, green finance is an implementation path to promote sustainable development. As a method of ensuring industrial development, industrial technology innovation is another implementation path to promote sustainable development. Cautious evaluation of the relationship between green finance and industrial technology innovation shows that both attach adequate importance to ecological quality, environmental conditions, and pollution status (Sun et al., 2022b). Therefore, green finance and industrial technology innovation can be regarded as a group of concepts that extend the logic of sustainable development and show a strong correlation. Based on this correlation, it is of practical significance to explore the mechanism of interactions between green finance and industrial technology innovation.

Current research seldom discusses green finance and industrial technology innovation, instead focusing on the identification of the causal relationship between financial development and technology innovation. For example, finance development can provide an inexhaustible source of funds, ensure the continuity, and reduce the external risk impact of technology innovation (Irwan et al., 2021; Stefano et al., 2022; Wang W. J. et al., 2022). Technology innovation can significantly improve, accelerate, and stabilize the quality of finance development (Chi et al., 2021; Ge et al., 2022; Sun and Razzaq, 2022). Strictly speaking, there are three main points. First, with increasing sample size, the internal differences between finance development and technology innovation will be obscured by the average effect; thus, the conclusions will be distorted. Second, organic components, each with strong heterogeneity, exist between finance development and technology innovation. Therefore, discussions of the relationship between finance development and technology innovation cannot highlight the pertinence of the research in a general sense. Third, whether at the theoretical or social application levels, the relationship between finance development and technology innovation is more likely to be mutually causal. In other words, from the perspective of causal mechanism, discussion of this issue will affect the degrees of practical or theoretical connections.

The present study aimed to correct for shortcomings of previous research. First, this study explored the relationship between green finance and industrial technology innovation in a setting with a reasonably controlled sample size and representative cases. The rationale for this study location is that Zhejiang Province in China was an early adopter of green finance reform; thus, its development achievements and experience make it a demonstration and experimental area for green finance; therefore, it is a vivid link for green finance development cases. Moreover, industrial technology innovation in Zhejiang Province is occurring within a relatively complex industrial process; that is, the steady growth of industrial added value but the decline of industrial proportion. This characteristic fully demonstrates the uniqueness of industrial technology innovation in Zhejiang Province; its existence is an indispensable part of the process of regional industrialization. In Zhejiang Province, discussion on the relationship between green finance and industrial technology innovation is very relevant, which is helpful to clarify its real effect. Additionally, this study has developed an indicator system for green finance and industrial technology innovation, which increases the amount of information compared to previous studies focusing on only a single variable from a single dimension. Moreover, the present study applied the TOPSIS entropy weight method to measure green finance and industrial technology innovation, to provide a more objective and accurate assessment. Finally, this study demonstrates the effect of the coupling of green finance and industrial technology innovation from the perspective of system theory and used the coupling coordination degree model, a more appropriate method to analyze the theoretical mechanism, as it can effectively avoid confusion at the causal level.

The following sections of the study are arranged as follows. Part 2 describes the literature review. Part 3 expounds on the materials and methods, while Part 4 demonstrates empirical results and discussion. Finally, Part 5 offers the conclusions and policy recommendations.

2 Literature review

2.1 Development and innovation

The pursuit of innovation is the vein of development. Strictly speaking, development and innovation promote and support each other. However, the role of innovation in promoting development has received more attention. Innovation can be categorized as progressive or radical. The former is more extensive than the latter, while the latter has a higher threshold than the former (Zhang et al., 2022). Regarding practical cases of innovation, industrial technology innovation can effectively respond to climate change and the energy crisis, thereby promoting the sustainable development of renewable energy (Bano et al., 2022). Innovations in production technology can reduce production costs and improve production efficiency and the return rates of industrial products (Wen et al., 2021). In the context of the innovation era value, the implementation of a low-carbon economy is key for the sustainable development of economies and societies; thus, low-carbon technology innovations related to new energy enterprises are driving forces and core to the promotion of low-carbon economies. Effectively achieving innovation for low-carbon economies is not only the key to the sustainable development of new energy enterprises but also a significant challenge and important task faced by new energy enterprises (Yang et al., 2022). The product of the development of another era, the digital economy, plays an increasingly important role in the national economic system. The development of digital technology innovation has provided an industry breakthrough in the limitations of the traditional budget and become a driving force for sustainable development (Ma and Zhu, 2022). Green innovation has a spatial spillover effect, which is an important method for accelerating the transformation and upgrading of China’s urban economic structure and the realization of sustainable urban development (Peng et al., 2021). Regarding the conditions required for innovation, innovation is closely related to the basis of development, from which further development based on innovation is achieved (Kong et al., 2021).

2.2 Finance development and technology innovation

Generally speaking, finance development and technology innovation are related and permeate each other. However, the discussion of the two is often based on the premise that technology innovation is an important engine of finance development in the new era. Therefore, previous literature focused more on the mechanisms of technology innovation in finance development. Some studies showed that, due to the high-risk and long-term externalities of technology innovation, long-term capital inflow is often required for technology innovation (Xiang et al., 2022). Research has also shown that finance development institutions promote the sustainable development of innovation activities by providing strong financial (especially long-term) support for technological innovation (Stefano et al., 2022). With the deepening of finance development, trade credit and bank finances are now the most common methods of finance in enterprise innovation activities. These activities have different effects due to different finance methods and the effectiveness of finance capital sources (Yano and Shiraishi, 2022). However, widespread financial constraints in the finance field are an important factor restricting enterprise innovation. When enterprises face higher finance constraints, the level of technological innovation decreases. Due to more stringent finance constraints, private enterprises are especially vulnerable in innovation activities compared to state-owned enterprises (Yu et al., 2021). To address the constraints and challenges that hinder innovation, emerging policy tools have been introduced to effectively promote the improvement of enterprise innovation ability (Liu and Xiong, 2022). For example, green finance specifically provides financial support for green projects, promotes technology progress and innovation activities, and is an important driving force for green economic growth and structural transformation (Wang and Wang, 2021). The development of green finance has a spatial spillover effect on technology innovation activities and is conducive to reducing the differences between regions (Huang et al., 2022). Climate finance specifically invests in activities related to climate change and strongly supports technology innovation and policy innovation (Warren, 2020). Therefore, much evidence supports the role of finance development in promoting technology innovation. However, disordered finance will hinder technology innovation. Thus, it is important to promote the appropriate development of finance to match steady technological innovation (Zhu et al., 2020).

2.3 Green finance and industrial technology innovation

The results of the literature review showed that the relationship between green finance and industrial technology innovation is not clear. The answer to this question is of great significance. First, clarifying the relationship between green finance and industrial technology innovation will provide empirical support for expanding the scope of application of finance development and technology innovation. Second, exploring the development level of green finance and industrial technology innovation will provide examples for the adjustment of regional development strategies. Third, demonstrating the strength of the force between the two systems of green finance and industrial technology innovation will provide a numerical reference for the further removal of obstacles to development and the design of stability mechanisms.

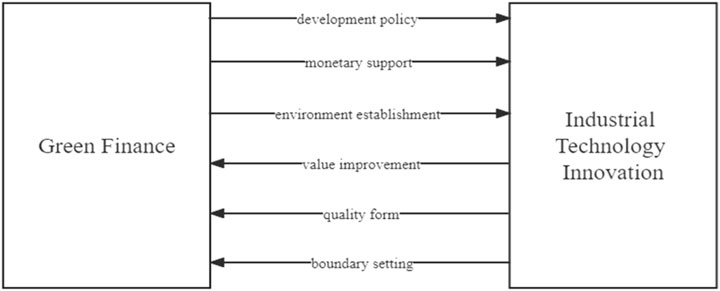

In this context, this study expounded on the coupling mechanism of green finance and industrial technology innovation as follows, As is shown in Figure 1. Starting from the bottom of green finance, first, as a development policy, the purpose of green finance is to promote green-biased technology innovation through the rational allocation of human resources. In the system of green technology innovation, industrial technology innovation has received the greatest attention; therefore, green finance promotes industrial technology innovation through the efficient flow of human resources. Second, as a development tool, green finance can directly provide substantial funds to relevant stakeholders. As a typical example of high pollution and high emissions, industry covers a large proportion of relevant stakeholders; that is, green finance provides sufficient capital elements for industrial technology innovation. Third, as a development orientation, green finance can help to create green development and provide green concept guidance for industrial technology innovation. In other words, green finance allows the development of industrial technology innovation that closely matches its own situation. Starting from the bottom of industrial technology innovation, first, as a means of value realization, industrial technology innovation aims to achieve green development goals such as energy conservation and emission reduction through the recreation of the core value of technology. To a certain extent, it can reduce industrial production costs and promote industry to a development path consistent with the value connotation of green finance to expand the development scale of green finance. Second, as a form of quality, industrial technology innovation can stimulate the demand for relevant subjects for finance services to promote the reform of green finance service modes and provide an impetus for the development of green finance. Third, as a development system, industrial technology innovation has clear positioning for its own development. With clear objectives, the radiation boundary of industrial technology innovation is also clear; that is, the relevant information for industrial technology innovation also tends to be complete and clear to make the disclosure of the connected green finance information more transparent.

3 Materials and methods

3.1 Indicator system

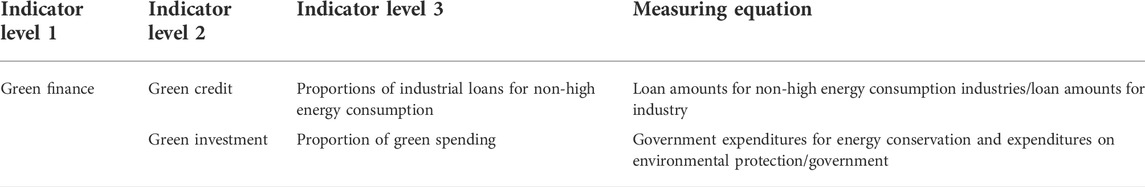

Based on the design of the index systems of green finance and industrial technology innovation in previous literature (Jiang et al., 2020; Chen and Chen, 2021; Shao et al., 2021; Wang et al., 2021), the present study depicted the development level of green finance from the two levels (green credit and green investment) (Table 1) and reflected the level of industrial technology innovation from four dimensions (economic, innovation, social and environmental performances) (Table 2) based on the availability of these data in Zhejiang Province.

3.2 Data sources

The study period was from 2012 to 2019. Relevant data on green finance and industrial technology innovation were obtained from the CSMAR database and the statistical yearbooks of various regions in Zhejiang Province, respectively. Due to the certain incompleteness of information disclosure, annual data in some regions could not be obtained. This study used interpolation to supplement the relevant missing data.

3.3 Method selection

3.3.1 TOPSIS entropy weight method

The TOPSIS entropy weight method is an objective valuation method that determines the weight of each indicator according to its numerical change and the amount of information (Chaudhary et al., 2021). The weight of the indicator is directly proportional to the influencing factors; that is, the greater the weight of the indicator, the higher the influence degree. The principle of the TOPSIS entropy weight method lies in a unified matrix reference system that identified the best and worst scheme in the finite scheme, calculates and analyzes the distance between a scheme and the best and worst schemes to provide the degree of the scheme and the best scheme, and finally uses these result to determine the merits of the evaluation unit. The specific modeling process is as follows.

Step 1. Establish a matrix arrangement of evaluations. After the evaluation object is determined, a judgment matrix is established to obtain positive trends for non-positive indexes. There are a treatments, each of which has ß evaluations. The original data matrix of the indicators is as follows.

Step 2. Normalize the original data matrix.

Step 3. Calculate the information entropy.

Step 4. Determine the weight of the index j.

Step 5. Construct a weighted norm matrix Z.

Step 6. Determine the optimal value vector

Step 7. Calculate each evaluation unit and the Euclidean distance between the optimal and worst solutions. As the chi-square distance has processed the information repeatability, the chi-square distance is used instead of the Euclidean distance to measure each evaluation unit close to the ideal solution.

Among them,

Step 8. Calculate the comprehensive evaluation index.

Step 9. Compare the results to the reference frame and rank them. The larger the solution, the closer the result is to the optimal solution.

3.3.2 Coupling degree model

According to the concept and physical principle of electromagnetic field coupling, a coupling degree model covering M systems can be established.

Next, the coupling degree model of the green finance development and industrial technology innovation systems is established.

In this case,

3.3.3 Coupling coordination degree model

The degree of system coupling and coordination is reflected by D, while T represents the comprehensive harmony index of the green finance development and industrial technology innovation systems, where 0 ≤ T ≤ 1. a and ß are the weights of the green finance and industrial technology innovation systems, respectively. This present study used a = β = 0.5; that is, the two subsystems are equally important.

4 Results and discussion

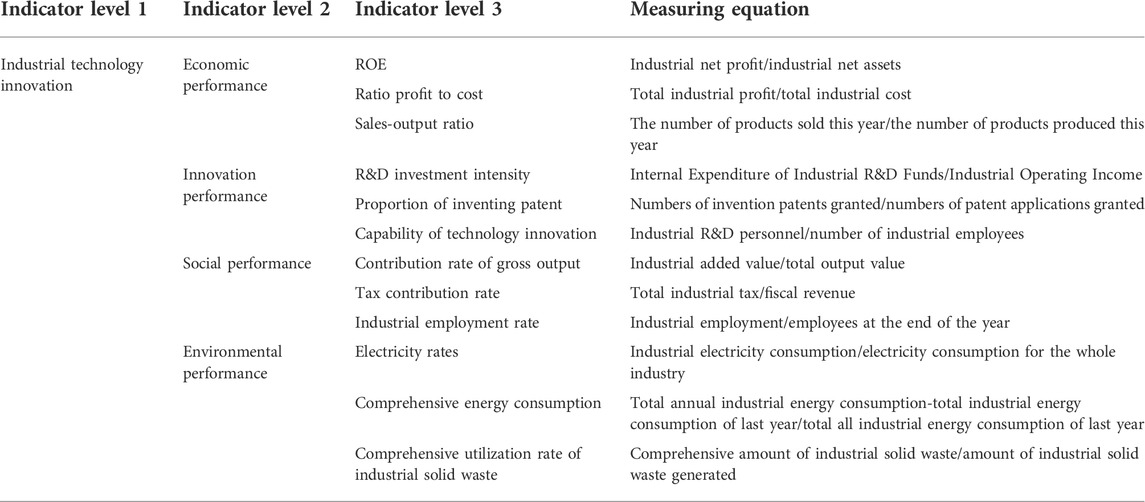

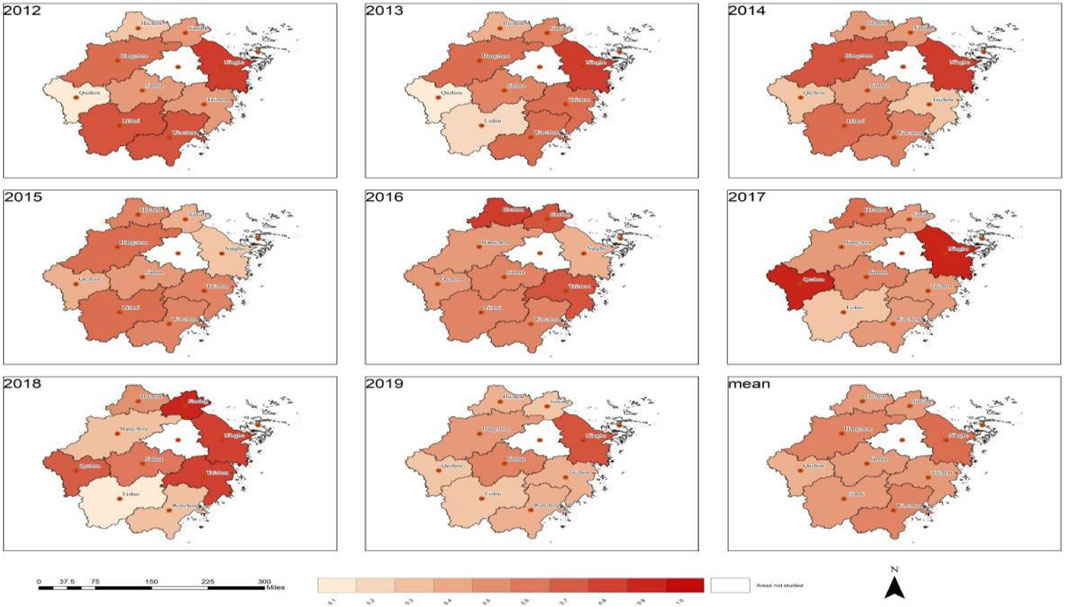

As shown in Figure 2, analysis of spatial–temporal evolution demonstrated upward trends in the development of green finance in nine cities in Zhejiang Province, while green finance in parts of cities showed the complex spatial–temporal evolution. Concerning the differences, the range of green finance in nine cities in Zhejiang Province was obvious; all were >0.6 and showed no volatility. The development of green finance in some cities changed greatly in specific years. For example, the development of green finance in Taizhou increased by 0.856 from 2016 to 2017, while the development of green finance in Wenzhou increased by 0.541 from 2016 to 2017, indicating that the development of green finance in Zhejiang province lacked stability. Regarding the ideal values, in 2019, the development of green finance in Taizhou (1.000) and Quzhou (1.000) reached the ideal scheme, while the development of green finance in Jinhua (0.993) was close to the ideal scheme. The average values of the development of green finance in Jinhua (0.733) and Ningbo (0.597) were relatively ideal, while that of Lishui (0.385) was relatively unsatisfactory, indicating the presence of regional differences in the development of green finance in Zhejiang Province. Regarding prominent time periods, the data from 2017 to 2019 showed a general increase in the development of green finance in nine cities in Zhejiang Province, which was related to the fact that Zhejiang Province became a pilot zone for green finance reform in 2017. The success of the pilot zone has provided a replicable and promotable development mechanism and improved the development of green finance in nine cities in Zhejiang Province. Overall, the average development of green finance in nine cities in Zhejiang Province was 0.482, indicating a moderate gap between the development of green finance in Zhejiang Province and the ideal status; however, the overall situation remains at a stable and good level. This is closely related to the economic foundation of Zhejiang Province.

FIGURE 2. Spatial–temporal evolution of green finance in nine cities in Zhejiang Province (2012–2019).

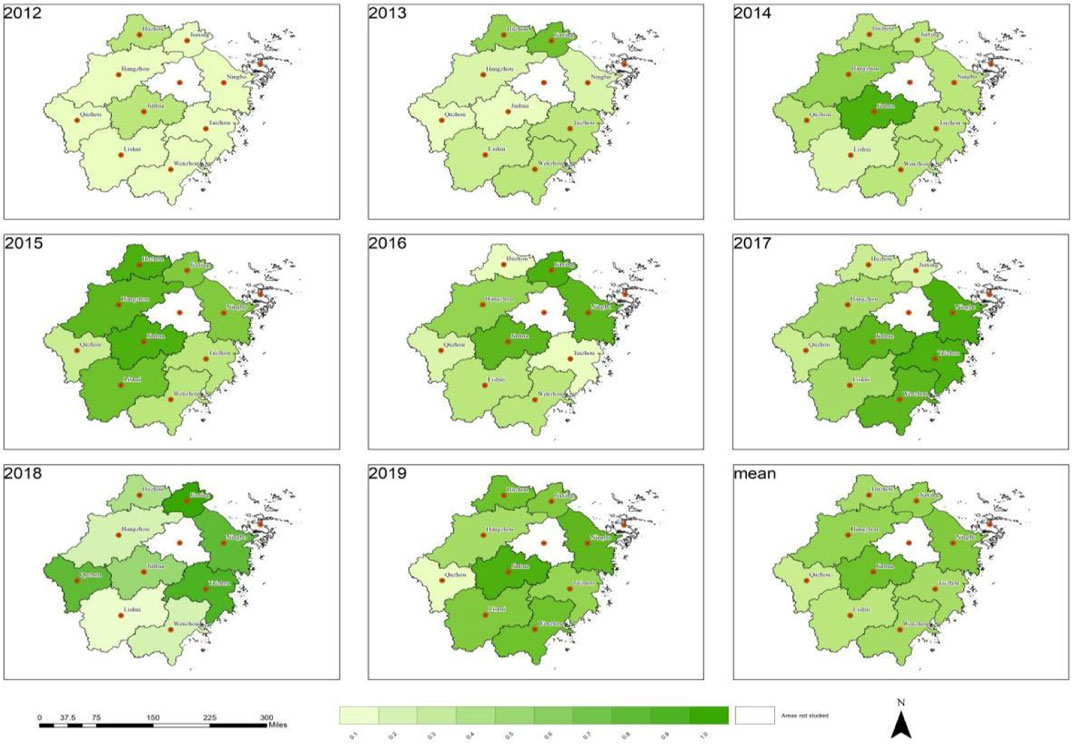

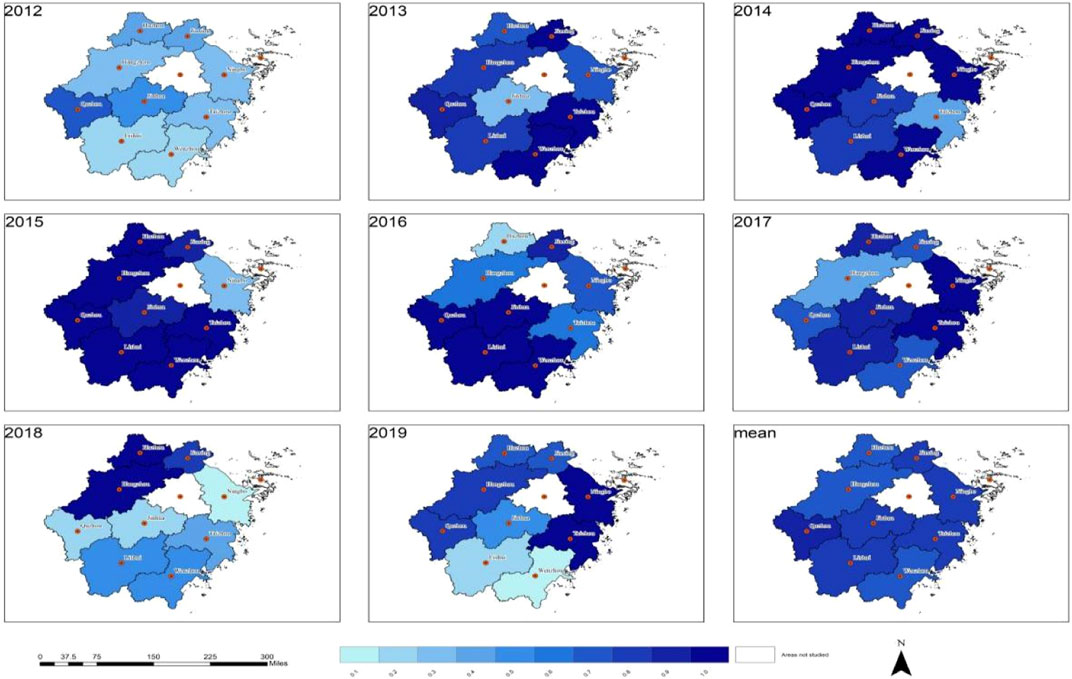

As shown in Figure 3, concerning spatial–temporal evolution, the development trends of industrial technology innovation in Huzhou, Jinhua, and Quzhou showed slight increases in shock, while the industrial technology innovation in the other six cities showed the evolution characteristics of decline. The range of industrial technology innovation development in more than half of the cities was >0.6, reflecting obvious volatility. The range of industrial technology innovation in Quzhou reached 0.983, demonstrating a lack of stability in the development of industrial technology innovation in Zhejiang Province. Regarding the ideal value, the development of industrial technology innovation in Ningbo (0.933) and Quzhou (0.998) in 2017 was the closest to the ideal scheme. In 2013, the development of industrial technology innovation in Quzhou (0.015) was far from the ideal scheme. The average values of the development of industrial technology innovation in Ningbo (0.692), Hangzhou (0.570), and Wenzhou (0.509) were ideal and higher than the average values of nine cities in Zhejiang Province. The scores of the other six cities are lower than the average value of nine cities in Zhejiang Province. These findings demonstrated the regional differences in the development of industrial technology innovation in Zhejiang Province. The tense development of industrial technology innovation is the result of the joint action of multi-dimensional factors, among which deindustrialization cannot be ignored. The direct impact of this phenomenon is to reduce the proportion of industry. The indirect impact is to destroy the stability of the real economy and cause a lack of motivation for industrial technology innovation. Overall, the average development of industrial technology innovation in nine cities in Zhejiang Province was 0.5, indicating a moderate gap between the development of industrial technology innovation in Zhejiang Province and the ideal status, and the overall situation remains at a peaceful and optimized level. This is closely related to the development strategy of Zhejiang Province.

FIGURE 3. Spatial–temporal evolution of industrial technology innovation in nine cities in Zhejiang Province (2012–2019).

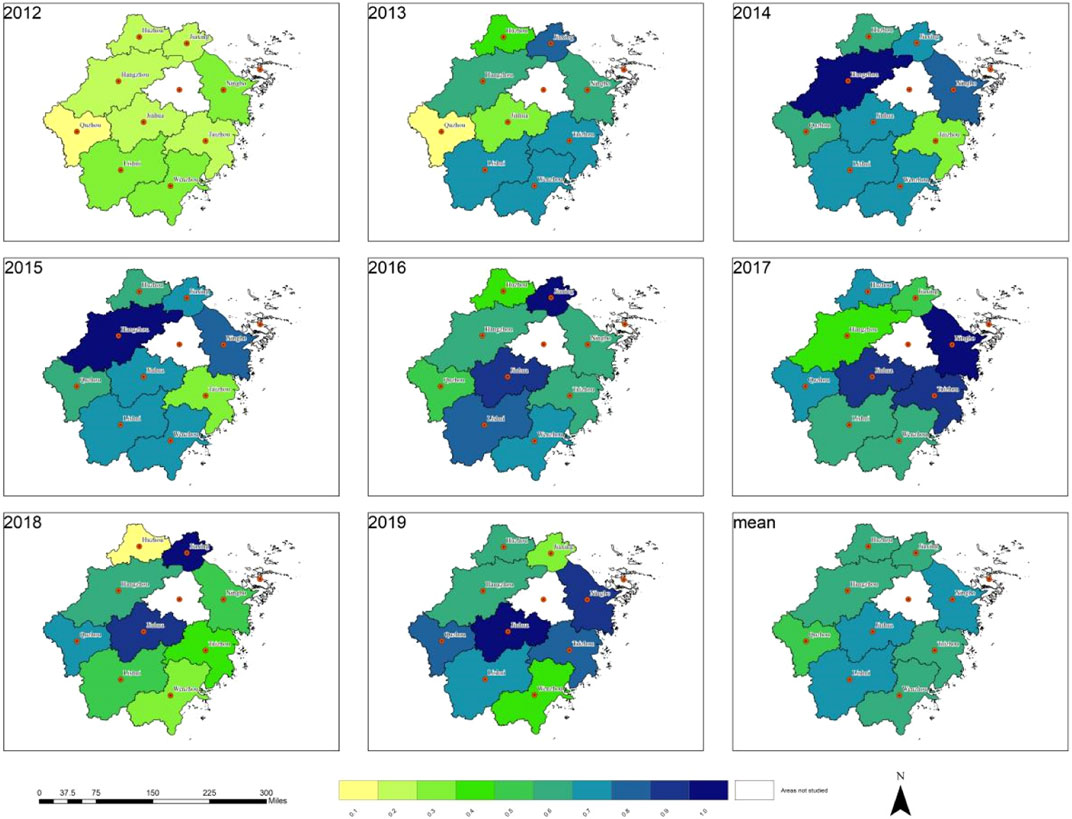

As shown in Figure 4, from the perspective of spatial–temporal evolution, the development trend of coupling degree of other cities except for Jiaxing from 2012 to 2019 shows that it rises in shock. The coupling degrees in Hangzhou City, Ningbo, and Jinhua has improved significantly from 2012 to 2019. The coupling degrees in Wenzhou and Quzhou have not increased significantly, while the coupling degree in Jiaxing has decreased, demonstrating regional differences in the intensity of the two systems in cities in Zhejiang Province. The average coupling degree of green finance and industrial technology innovation in nine cities of Zhejiang Province was 0.726, which indicated that the interaction intensity between the two systems in Zhejiang Province was high and tended to be orderly.

FIGURE 4. Coupling degree between green finance and industrial technology innovation in nine cities in Zhejiang Province (2012–2019).

As is shown in Figure 5, assessment of the spatial–temporal evolution showed that the coupling coordination degree of nine cities in Zhejiang Province was in a state of shock and upward. Except for Jiaxing and Wenzhou, the average values in the other cities reached the barely coordinated level or above in 2019, demonstrating that the coupling and coordination relationship between green finance and industrial technology innovation systems among regions in Zhejiang Province was relatively balanced. The results of the analysis of coupling coordination degrees in cities showed that the changes in these degree were closely related to the development of green finance and industrial technology innovation. That is, the development and regression of green finance and industrial technology innovation in nine cities in Zhejiang Province will affect the rise and fall of the coupling coordination degree in the corresponding cities. Except for Taizhou and Wenzhou, the range of coupling coordination degrees of other cities was >0.6, reflecting high volatility. Regarding the degree of coupling coordination, Hangzhou, Jiaxing, Ningbo, Lishui, and Jinhua have achieved high-quality coordination, among which Jinhua maintained high-quality coordination in 2019. The average degree of the coupling coordination between the green finance and industrial technology innovation systems in nine cities of Zhejiang Province was 0.575, reaching the level of barely coordinated, suggesting that the two systems tend to have a benign correlation and are moving towards coordinated development. This is closely related to the vigorous development of green finance and industrial technology innovation in Zhejiang Province.

FIGURE 5. Coupling coordination degree between green finance and industrial technology innovation in nine cities in Zhejiang Province (2012–2019).

5 Conclusion and policy recommendations

5.1 Conclusion

1) The development of green finance and industrial technology innovation in nine cities in Zhejiang Province showed strong regional heterogeneity within the study period. While the development momentum of green finance was better than that of industrial technology innovation, its stability was worse.

2) The relationship between green finance and industrial technology innovation in nine cities in Zhejiang Province has become closer over time. The communication and coordination mechanism between green finance and industrial technology innovation is more complete with improvement in relevant policies.

3) The effects of green finance and industrial technology innovation in nine cities in Zhejiang Province are complex. Subject to the volatility of the development of green finance and industrial technology innovation, the coupling and coordination between the two systems was characterized by the superposition of mutual constraints at a low level and related promotion at a high level.

5.2 Policy recommendations

1) The government should play an active role in macro-control, integrate the industrial resources of different regions in Zhejiang Province, and establish industrial cluster areas, to fully release the spillover and radiation effects of industrial innovation technology, effectively break the spatial barriers of industrial technology innovation, promote the sustainable development of industrial innovation technology, and realize the optimization of regional industrial development patterns (Wang X. Y. et al., 2022). During resource integration, we should pay increased attention to areas with low industrial innovation technology. In these instances, green finance should be used as a means for development to give full play to the supporting effect of green finance policies, formulate the development plan for regional industrial technology innovation and green finance from the perspective of coordination, actively explore interactive mechanisms, and steadily promote the green diffusion and industrial technology transfer between regions. These actions will ensure the linkage of green finance and industrial technology innovation on the premise of considering both speed and quality (You et al., 2022).

2) As the main body of green finance, commercial banks should provide different financial measures for different regions. While banks should increase the credit threshold of polluting enterprises or reduce the loan repayment period, we also need to guide the flow of funds to enterprises engaged in green production. Furthermore, we should also classify and implement policies according to the finance development and resource utilization efficiency of different cities, end the use of rigid pricing mechanisms to restrict the development of enterprises in different regions, and reduce the asymmetric effects of policies on enterprises.

3) Enterprises should fully grasp the dividends of green financial policies and strive for long-term financial support by improving production technology, strengthening investment in innovation, and accelerating their information disclosure. Moreover, we should increase the awareness of learning, actively learn industrial technology suitable for our own development from enterprises in adjacent areas with better development and realize full exchange and stable cooperation between industrial and supply chains. These steps are necessary to achieve not only the end goals but also green production.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material. Further inquiries can be directed to the corresponding authors.

Author contributions

WW conceived of the study, JL wrote the manuscript, TH polished the manuscript, HZ developed the figures, XZ edited the manuscript, and TH just performed the final check of the manuscript.

Funding

This paper was supported by the National Natural Science Foundation of China (72001157).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Bano, S., Liu, L., and Khan, A. (2022). Dynamic influence of aging, industrial innovations, and ICT on tourism development and renewable energy consumption in BRICS economies. Renew. Energy 192, 431–442. doi:10.1016/j.renene.2022.04.134

Bugnot, A. B., Hose, G. C., Walsh, C. J., Floerl, O., French, K., Dafforn, K. A., et al. (2019). Urban impacts across realms: Making the case for inter-realm monitoring and management. Sci. Total Environ. 648, 711–719. doi:10.1016/j.scitotenv.2018.08.134

Chaudhary, T., Siddiquee, A. N., Chanda, A. K., Ahmad, S., Badruddin, I. A., and Khan, Z. A. (2021). Multiple response optimization of dimensional accuracy of nimonic alloy miniature gear machined on wire edm using entropy Topsis andpareto anova. Comput. Model. Eng. Sci. 126 (1), 241–259. doi:10.32604/cmes.2021.013368

Chen, F. Q., Zhu, J. R., and Wang, W. J. (2021). Driving force of industrial technology innovation: Coevolution of multistage overseas M&A integration and knowledge network reconfiguration. J. Bus. Industrial Mark. 36 (8), 1344–1357. doi:10.1108/jbim-07-2020-0329

Chen, X., and Chen, Z. G. (2021). Can green finance development reduce carbon emissions? Empirical evidence from 30 Chinese provinces. Sustainability 13 (21), 12137. doi:10.3390/su132112137

Chi, M. Q., Muhammad, S., Khan, Z., Ali, S., Li, R. T., and Yi, M. (2021). Is centralization killing innovation? The success story of technological innovation in fiscally decentralized countries. Technol. Forecast. Soc. Change 168, 120731. doi:10.1016/j.techfore.2021.120731

Desmet, K., Greif, A., and Parente, S. L. (2020). Spatial competition, innovation and institutions: The industrial revolution and the great divergence. J. Econ. GrowthBost. 25 (2), 1–35. doi:10.1007/s10887-019-09173-3

Erum, R., and Shazia, R. (2022). Modeling the nexus between carbon emissions, uurbanization, population growth, energy consumption, and economic development in asia: Evidence from grey relational analysis. Energy Rep. 8, 5430–5442. doi:10.1016/j.egyr.2022.03.179

Ge, L., Zhao, H. X., Yang, J. Y., Yang, J. Y., and He, T. Y. (2022). Green finance, technological progress, and ecological performance—evidence from 30 provinces in China. Environ. Sci. Pollut. Res. Int. doi:10.1007/s11356-022-20501-w

Huang, Y. M., Chen, C., Lei, L., and Zhang, Y. (2022). Impacts of green finance on green innovation: A spatial and nonlinear perspective. J. Clean. Prod. 365, 132548. doi:10.1016/j.jclepro.2022.132548

Irwan, T., Hook, L. S., Chang, L. W., Jamal, W., and Sergio, S. B. (2021). Effect of financial development on innovation: Roles of market institutions. Econ. Model. 103, 105598. doi:10.1016/j.econmod.2021.105598

Jiang, L. L., Wang, H., Tong, A. H., Hu, Z. F., Duan, H. J., Zhang, X. L., et al. (2020). The measurement of green finance development index and its poverty reduction effect: Dynamic panel analysis based on improved entropy method. Discrete Dyn. Nat. Soc., 1–13. doi:10.1155/2020/8851684

Kong, Q. X., Li, R. R., Peng, D., and Wong, Z. (2021). High-technology development zones and innovation in knowledge-intensive service firms: Evidence from Chinese A-share listed firms. Int. Rev. Financial Analysis 78, 101883. doi:10.1016/j.irfa.2021.101883

Koutaissoff, E. (1980). The dispossessed of the earth: Land reform and sustainable development, by erik eckholm. (Worldwatch paper 30.) WorldWatch institute, 1776 Massachusetts avenue NW, Washington, DC 20036: 48 pp., 21.5 × 14 × 0.4 cm, stiff paper cover, US$ 2. 1979. - knowledge and power: The global research and development budget, by colin norman. (Worldwatch paper 31.) worldwatch institute, 1776 massachesetts avenue NW, Washington, DC 20036, USA: 56 pp., 21.5 × 14 × 0.4 cm, stiff paper cover, $2, 1979. - international migration: The search for work, by kathleen newland. (Worldwatch paper 33.) worldwatch institute, 1776 Massachusetts avenue NW, Washington, DC 20036, USA: 31 pp., 21.5 × 14 × 0.3 cm, stiff paper cover, $2, 1979. Environ. Conserv. 7 (3), 253–254. doi:10.1017/s0376892900007852

Li, L., Lin, H., and Lyu, Y. (2022). Technology cluster coupling and invulnerability of industrial innovation networks: The role of centralized structure and technological turbulence. Scientometrics 127, 1209–1231. doi:10.1007/s11192-022-04269-x

Liu, C., and Xiong, M. (2022). Green finance reform and corporate innovation: Evidence from China. Finance Res. Lett. 48, 102993. doi:10.1016/j.frl.2022.102993

Liu, Y. B., Lu, F., Xian, C. F., and Ouyang, Z. Y. (2023). Urban development and resource endowments shape natural resource utilization efficiency in Chinese cities. J. Environ. Sci. 126, 806–816. doi:10.1016/j.jes.2022.03.025

Ma, D., and Zhu, Q. (2022). Innovation in emerging economies: Research on the digital economy driving high-quality green development. J. Bus. Res. 145, 801–813. doi:10.1016/j.jbusres.2022.03.041

Mamun, M. A., Boubaker, S., and Nguyen, D. K. (2022). Green finance and decarbonization: Evidence from around the world. Finance Res. Lett. 46, 102807. doi:10.1016/j.frl.2022.102807

Nawaz, S. M. (2021). Industrial technology innovation management for sustained prosperity: True stories revealing the complexity of replicating south Korean success. Technol. Forecast. Soc. Change 167, 120735. doi:10.1016/j.techfore.2021.120735

Peng, W. B., Yin, Y., Kuang, C., Wen, Z. Z., and Kuang, J. S. (2021). Spatial spillover effect of green innovation on economic development quality in China: Evidence from a panel data of 270 prefecture-level and above cities. Sustain. Cities Soc. 69, 102863. doi:10.1016/j.scs.2021.102863

Rasoulinezhad, E., and Taghizadeh-Hesary, F. (2022). Role of green finance in improving energy efficiency and renewable energy development. Energy Effic. 15 (2), 14–12. doi:10.1007/s12053-022-10021-4

Shao, X. F., Zhong, Y. F., Liu, W., Li, R. T., and Yi, M. (2021). Modeling the effect of green technology innovation and renewable energy on carbon neutrality in N-11 countries? Evidence from advance panel estimations. J. Environ. Manag. 296, 113189. doi:10.1016/j.jenvman.2021.113189

Stefano, C., Marco, F., and Daniela, V. (2022). Financial support to innovation: The role of European development financial institutions. Res. Policy 51 (10), 104566. doi:10.1016/j.respol.2022.104566

Su, Y., and Fan, Q. M. (2022). Renewable energy technology innovation, industrial structure upgrading and green development from the perspective of China's provinces. Technol. Forecast. Soc. Change 180, 121727. doi:10.1016/j.techfore.2022.121727

Sun, Y. P., Ahsan, A., Razzaq, A., Liang, X. P., and Muhammad, S. (2022a). Asymmetric role of renewable energy, green innovation, and globalization in deriving environmental sustainability: Evidence from top-10 polluted countries. Renew. Energy 18, 280–290. doi:10.1016/j.renene.2021.12.038

Sun, Y. P., and Razzaq, A. (2022). Composite fiscal decentralisation and green innovation: Imperative strategy for institutional reforms and sustainable development in OECD countries. Sustain. Dev., 1–14. doi:10.1002/sd.2292

Sun, Y. P., Razzaq, A., Sun, H. P., and Muhammad, I. (2022b). The asymmetric influence of renewable energy and green innovation on carbon neutrality in China: Analysis from non-linear ARDL model. Renew. Energy 193, 334–343. doi:10.1016/j.renene.2022.04.159

Wang, W. J., He, T. Y., and Li, Z. H. (2022). Digital inclusive finance, economic growth and innovative development. Kybernetes. doi:10.1108/K-09-2021-0866

Wang, X. Y., Sun, X. M., Zhang, H. T., and Xue, C. K. (2022). Does green financial reform pilot policy promote green technology innovation? Empirical evidence from China. Environ. Sci. Pollut. Res. Int. doi:10.1007/s11356-022-21291-x

Wang, X. Y., and Wang, Q. (2021). Research on the impact of green finance on the upgrading of China's regional industrial structure from the perspective of sustainable development. Resour. Policy 74, 102436. doi:10.1016/j.resourpol.2021.102436

Wang, X. Y., Zhao, H. K., and Bi, K. X. (2021). The measurement of green finance index and the development forecast of green finance in China. Environ. Ecol. Stat. 28 (2), 263–285. doi:10.1007/s10651-021-00483-7

Warren, P. (2020). Blind spots in climate finance for innovation. Adv. Clim. change Res. 11 (1), 60–64. doi:10.1016/j.accre.2020.05.001

Wen, H. W., Lee, C. C., and Song, Z. Y. (2021). Digitalization and environment: How does ICT affect enterprise environmental performance? Environ. Sci. Pollut. Res. 28 (39), 54826–54841. doi:10.1007/s11356-021-14474-5

Whiting, S. H. (2022). Land rights, industrialization, and urbanization: China in comparative context. J. Chin. Polit. Sci. 27, 399–414. doi:10.1007/s11366-022-09786-3

Wu, G. S. (2022). Research on the spatial impact of green finance on the ecological development of Chinese economy. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.887896

Wu, X. H., Wu, Z., and Hu, J. (2022). Global competitiveness analysis of industrial robot technology innovations market layout using visibility graph. Phys. A Stat. Mech. its Appl., 127672. doi:10.1016/j.physa.2022.127672

Xiang, X. J., Liu, C. J., and Yang, M. (2022). Who is financing corporate green innovation? Int. Rev. Econ. Finance 78, 321–337. doi:10.1016/j.iref.2021.12.011

Xiao, Y., and Peng, W. (2021). Economic effects analysis of environmental regulation policy in the process of industrial structure upgrading: Evidence from Chinese provincial panel data. Sci. Total Environ. 753, 142004. doi:10.1016/j.scitotenv.2020.142004

Yang, X., Guo, Y., Liu, Q., and Zhang, D. M. (2022). Dynamic Co-evolution analysis of low-carbon technology innovation compound system of new energy enterprise based on the perspective of sustainable development. J. Clean. Prod. 349, 131330. doi:10.1016/j.jclepro.2022.131330

Yano, G., and Shiraishi, M. (2020). Finance, institutions, and innovation activities in China. Econ. Syst. 44 (4), 100835. doi:10.1016/j.ecosys.2020.100835

You, X. T., Sun, Y. N., and Liu, J. W. (2022). Evolution and analysis of urban resilience and its influencing factors: A case study of jiangsu province, China. Nat. Hazards, 1–32. doi:10.1007/s11069-022-05368-x

Yu, C. H., Wu, X., Zhang, D., Chen, S., and Zhao, J. (2021). Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 153, 112255. doi:10.1016/j.enpol.2021.112255

Zhang, R., and Fu, Y. H. (2022). Technological progress effects on energy efficiency from the perspective of technological innovation and technology introduction: An empirical study of guangdong, China. Energy Rep. 8, 425–437. doi:10.1016/j.egyr.2021.11.282

Zhang, Y. M., Li, X. L., and Xing, C. (2022). How does China's green credit policy affect the green innovation of high polluting enterprises? The perspective of radical and incremental innovations. J. Clean. Prod. 336, 130387. doi:10.1016/j.jclepro.2022.130387

Zhu, S. C., Huang, J. L., and Zhao, Y. L. (2022). Coupling coordination analysis of ecosystem services and urban development of resource-based cities: A case study of tangshan city. Ecol. Indic. 136, 108706. doi:10.1016/j.ecolind.2022.108706

Keywords: green finance, industrial technology innovation, coupling, coordination, TOPSIS

Citation: Wang W, Lin J, He T, Zhao H and Zhao X (2022) Coupling coordination analysis of green finance and industrial technology innovation: A case study in Zhejiang Province, China. Front. Environ. Sci. 10:958311. doi: 10.3389/fenvs.2022.958311

Received: 31 May 2022; Accepted: 19 July 2022;

Published: 16 August 2022.

Edited by:

Lucian-Ionel Cioca, Lucian Blaga University of Sibiu, RomaniaReviewed by:

Rita Yi Man Li, Hong Kong Shue Yan University Hong Kong SAR, ChinaPeng Jiquan, Jiangxi University of Finance and Economics, China

Yunfeng Shang, Zhejiang Yuexiu University of Foreign Languages, China

Copyright © 2022 Wang, Lin, He, Zhao and Zhao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wenjing Wang, bWFnZ2lld3dqQDE2My5jb20=; Taiyi He, MTIyMDUyNjEyM0BxcS5jb20=

Wenjing Wang

Wenjing Wang Jingcheng Lin1

Jingcheng Lin1 Taiyi He

Taiyi He Haoxiang Zhao

Haoxiang Zhao