- Dhurakij Pundit University, Bangkok, Thailand

With the rapid progress of digital technology, finance has also embarked on the fast lane of its development. Whether and how the development of digital inclusive finance can improve the efficiency of financial resource allocation have both been significant questions for the Chinese government to answer. This study adopted the super-efficiency DEA method to measure the allocation efficiency of regional financial resources in China, integrating with the Digital Inclusive Finance (DIF) index published by the Digital Finance Research Center of Peking University, to study the influences of Digital Inclusive Finance on the Financial Resource Allocation Efficiency (FRAE). After considering the spatial factors, we found that the development of DIF could significantly promote Financial Resource Allocation Efficiency mainly in three aspects of coverage, depth, and credit. Meanwhile, in the analysis of its mechanisms, we also discovered that DIF could promote FRAE through human capital and enterprise innovations. Finally, this study indicated that the differences in regions and overcapacity levels would also modify the influences of DIF on FRAE. The enlightenment from this study is that relevant government departments should actively promote the development of digital inclusive finance, thereby, not only improving the efficiency of financial resource allocation and the coordinated action between regions but also promoting the transformation and upgrade of economic development methods.

Introduction

Since the reform and opening up, China has experienced decades of rapid development and has become a strong economic power. However, with the decline of “demographic dividend,” the accumulation of the “middle income trap” risk, the in-depth adjustment of international economic patterns and a series of internal and external factors, Chinese economic development has officially bid farewell to high-speed growth and entered the “normal growth” stage at the medium-high rates (Xie et al., 2018). With the acceleration of economic and financial globalizations, financial resources have become the core element of economic development. In 2014, Chinese Premier Li Keqiang first proposed encouraging the development of “internet finance” and bringing China’s financial development into the Information Age. Supported by information technologies, traditional finance has evolved into DIF, enabling underdeveloped regions to equally enjoy convenient financial services and reducing the financing costs of small and micro enterprises (Wang and Huang, 2017). After years of development, China has already become the country with the fastest development of DIF in the world. Whether this development can improve FRAE or not, the transition of the Chinese economy from extensive to intensive growth relies on not only the improvement of resource allocation efficiency but also the realization of the mode upgrade and growth sustainability. They have been two of the most significant issues to be addressed in present China.

In recent years, through the development of information and big data technologies, DIF has successfully reduced financial transaction costs and provided huge development spaces for expanding financial services (Guo, 2016). At present, the research on DIF has been also widespread, especially after the research group of the Digital Finance Research Center of Peking University publicized a set of “digital inclusive finance indexes.” Generally speaking, numerous scholars believed DIF to be inclusive (Sun, 2021) and beneficial to a broad range of groups (Allen et al., 2006; Jiao and Jin, 2009), especially those in remote areas (Du, 2006), for promoting the progress of poverty eradication (Pu et al., 2019), and then sustaining economic and social developments (McKinnon, 1973; Magdoff and Sweezy, 1987; Wang and Wang, 2011). Digital inclusive finance relies on the Internet, digital technology, financial technology, and other financial services to bring more consumers into the financial service system. It has the characteristics of low threshold, convenient transaction, and low transaction cost (song et al., 2022). DIF can be embodied in e-money, e-commerce (integration of online and offline services), crowdfunding, online car-hailing, rural Taobao, and others. E-money made financial services more popular and convenient. On the one hand, it accelerated the flow of capital elements, and on the other hand, it brought new entrepreneurial opportunities (Xie et al., 2018). Grossman and Tarazi (2014) believed that DIF could help farmers in Kenya through convenient payments and smooth consumptions. Crowdfunding was believed as unable to facilitate start-ups in meeting their financing needs at a lower cost (Mollick and Kuppuswamy, 2014). Its source has been not only the concentration of social capitals but also the effective integration and connection of all economic resources (Wang et al., 2021). DIF has contributed to creating a healthier ecological environment for rural finances through rural Taobao and live commerce, playing an important role in integrating the rural tertiary industry (Ge et al., 2022). In terms of measurement indicators, Allen et al. (2016) used financial availability indicators such as the geographical density of bank outlets, population density of bank outlets, and number of loan accounts per capita to measure the development of traditional inclusive finance. In terms of digital inclusive finance, Guo et al. (2020) compiled the Peking University China Digital inclusive finance index based on ant group data, covering 31 provinces in China. Scholars have also made meaningful explorations in studying the influential factors of DIF. David Mhlanga (2020) found that AI exerted a relatively strong effect on DIF in the fields of risk detection, measurement and management, and solutions to the information asymmetry problem. Wu et al. (2018) believed that the improvement of online consumption levels was also conducive to the development of DIF. In the study of the impact of digital inclusive finance on the economy, most scholars believe that digital inclusive finance can have a beneficial impact on the economy. Ozili (2018) pointed out that it is inevitable that the development of science and technology will promote people to move toward the digital financial era. Digital inclusive finance adds mobile banking, mobile payment, online lending, and other businesses on the basis of traditional inclusive finance, reducing people’s transaction costs and time costs, broadening the channels of capital circulation, and increasing financial dividends. Abu Bader and Abu QAM (2008) showed that inclusive finance can improve investment efficiency and, thus, promote economic growth; Corrado and Corrado (2017) believed that digital inclusive finance can promote inclusive economic growth and development.

The literature on the FRAE mainly focused on its definition, calculation, influencing factors, and effects on economic growth. General measures of efficiency improvement could be divided into parametric methods (Koengkan. et al., 2022) and non-parametric methods (Kazemzadeh. et al., 2022). From a macroscopic perspective, FRAE referred to the allocation efficiency of internal resources of the financial system under a certain institution (Li, 2018), which could be measured by the proportions of state-owned banks’ assets (Levine, 1997), data envelopment analysis (Xu.et al., 2014), and stochastic frontier analysis (Peng, 2017). From the microscopic level, FRAE meant the efficiency of micro-financial intermediaries utilizing financial resources (Shen, 2006), which could be measured by the capital allocation efficiency model (Wurgler, 2000) and deposit-to-loan conversion efficiency (Asongu, 2013). Zhou and Hu (2007) initiated China’s FRAE construct in detail by using indicators such as capital adequacy ratio, non-performing loan ratio, return on net assets, and per capita profit. Moreover, many studies have shown that FRAE would decline under the influences of financial frictions [26][27] and government interventions [28], which was unfavorable to economic and social developments. Bleck and Liu (2018) constructed a general equilibrium model to explore the impacts of financial frictions on the efficiency of credit resource allocation, before finding that industries with low financial frictions would attract more credits and crowd out those with high financial frictions. Lei et al. (2021) found from their research that private enterprises in China were plagued with credit discrimination problems, which had been hindering their long-term growth.

Although improvements in resource allocation efficiency have been emphasized in recent years, few articles have directly associated digital inclusion with its financial application. Empirical studies on whether digital inclusion improved FRAE were even more lacking. Therefore, this study employed the panel data of 31 provinces in China from 2011 to 2019 to explore the influences of DIF on FRAE and conduct an empirical analysis of its intermediary effect. Compared with the existing studies, the marginal contributions of this study were as follows: first, we incorporated DIF into the research system of FRAE, considered all the possible spatial correlations between different regions, and adopted the spatial Dobbin model for empirical analysis, so that we could provide empirical evidence for the development of DIF to promote FRAE; second, with the individual applications of human capital effect and enterprise innovation effect, this study analyzed the internal mechanism of DIF affecting FRAE, which made up for the lacking of relevant research; the third was running a heterogeneity analysis on whether the regional differences and overcapacity level gaps would change the effects of DIF on FRAE, so that we could offer some enlightenment on how regions should improve their FRAE.

Analysis of mechanisms

The development history of DIF is the evolution of ordinary people achieving the goal of financing independence. DIF is an inclusive financial system that provides universal financial services to all citizens to meet their financial service demands. Therefore, as a new financial model, DIF has been a powerful supplement to traditional finances and an adequate improvement on FRAE. This study believes that DIF can affect FRAE in the following two ways:

First, the inclusiveness and universality of DIF make financial services available to a wider range of groups, which will raise the overall allocation level of human capital, especially in underdeveloped areas, thus improving FRAE. Liao et al. (2014) pointed out that the construction of DIF could elevate the financial literacy of rural residents, then the resultant higher education level and cognitive ability would jointly improve the probability of them participating in the financial market and the proportion of them investing on risky financial assets (Zhou and He, 2020). As people with higher education levels participated in the allocation of financial resources, the resistance to financial development would be mitigated and FRAE would be improved as a result.

Second, as a type of financial infrastructure, DIF provides a good environment for enterprise innovation, which further improves FRAE. Enterprise innovation is a business activity with long cycles and high risks, which can only be sustained with a stable and efficient supply of financing (Zhao et al., 2021). The development of DIF enriched the financing channels of micro-enterprise entities, realized the efficient matching of information between them, avoided adverse selections and moral hazards in the financial market (Demertzis et al., 2018), and resultantly promoted enterprise innovations. As the main body of financial resource utilization, the improvement on innovation levels would improve the business efficiency of the enterprise itself, bring higher quality use of financial resources, and reduce the cost of risk assessment, so FRAE is improved in the end.

To summarize, DIF, as a general trend of financial development, facilitated elevating human capital utilization and then improving FRAE. Meanwhile, DIF could also promote enterprise innovation and better use of financial resources, which also improved FRAE from the other perspective.

Model construction, variable selection, and data description

Model construction

The first law of geographical economics tells that economic factors are related to each other, and adjacent ones share a strong relation in-between, which reminds us to consider spatial elements during our research. In spatial econometrics, there are three standard models: spatial lag model, spatial error model, and spatial Durbin model. This study constructed the commonest spatial Dobbin model to investigate the influences of DIF on FRAE, which are specified as follows:

In Equation 1, i and t individually represent the region and time, eff represents the efficiency of financial resource allocation, num represents digital inclusive finance, and indu, open, capi, labo, and eco represent the level of the industrial structure, the level of economic openness, the degree of capital mismatch, the degree of labor mismatch, and the level of economic development, respectively.

To further empirically test the influences of DIF on FRAE, this study established the following intermediary effects’ models:

In Eqs 2, 3, chan is the intermediary variable jointly expressed by human capital (huma) and enterprise innovation (comp). If

Variable selection

Explained variable: the efficiency of financial resource allocation. Based on the research of Shi (2021)[34], taking the regional fixed-asset investments and deposit balances of financial institutions as input indicators with the regional GDPs as output indicators, this study applied the super-efficiency non-radial DEA model (super SBM) of relaxation variables to measure FRAEs in different regions of China. The super-efficiency DEA model is an evolution of the original DEA one, which improved the inadequate differentiation problem during efficiency comparison; therefore, it presents greater applicability. Its model is specified as follows:

In Eq. 4, ρ represents the efficiency of financial resource allocation and s is the relaxation variable. Through Maxdea software, we could obtain all FRAEs of 31 provinces in China from 2011 to 2019.

Core explanatory variable: digital inclusive finance. This study employed the General Index of DIF issued by the Digital Finance Research Center of Peking University to indicate its development level and discussed the influences of the other six sub-indexes on FRAE.

Control variables: the levels of the industry structure are measured by the ratios of the values of three major industries added to the regional production in total, which is specified as indu = 1*

Data descriptions

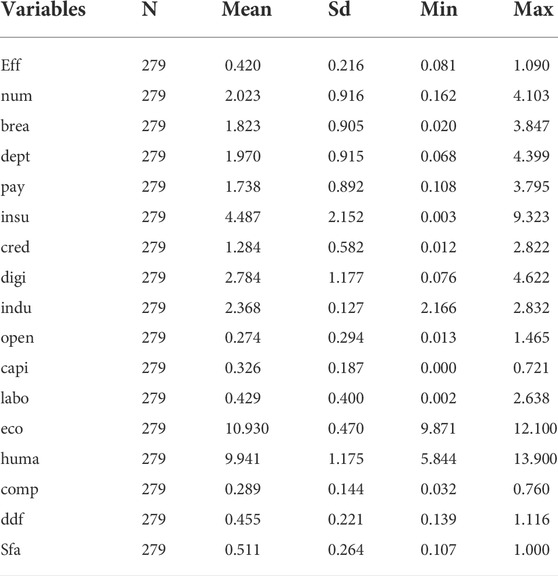

This study selected the panel data of 31 provinces in China from 2011 to 2019, in which the DIF index came from the Digital Finance Research Center of Peking University, and all the other original data sourced from “China Statistical Yearbook,” “Compilation of Statistical Data in 60 years of New China,” “China Financial Statistical Yearbook,” and “China Regional Financial Operation Report,” respectively. Table 1 provided descriptive statistics of the main variables in this paper. The mean value and standard deviation of financial resource allocation efficiency (eff) were 0.420 and 0.216 respectively. The mean value of digital financial inclusion (num) is 2.023, and the standard deviation is 0.916, indicating that the overall fluctuation of digital financial inclusion in China is relatively large.

Empirical analysis

Description of FRAE in each region

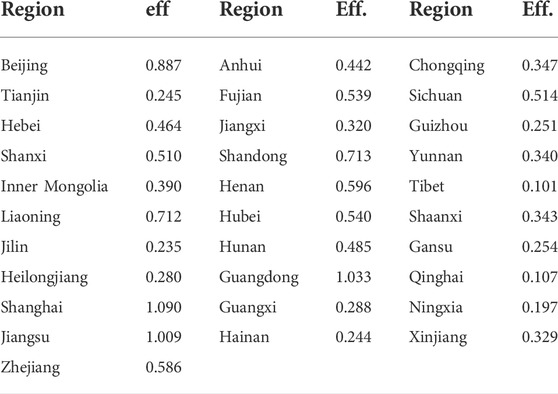

Table 2 lists the FRAE values of 31 Chinese provinces in 2019. It could be seen that these values were generally higher in the eastern coastal areas but lower in mid-west China, for example, they were higher in Beijing, Shanghai, Jiangsu, and Guangdong, while they were generally lower in Tibet, Gansu, Qinghai, and Ningxia. This was consistent with their individual DIF levels and economic growth levels that reflected their disparate developments.

Spatial autocorrelation analysis

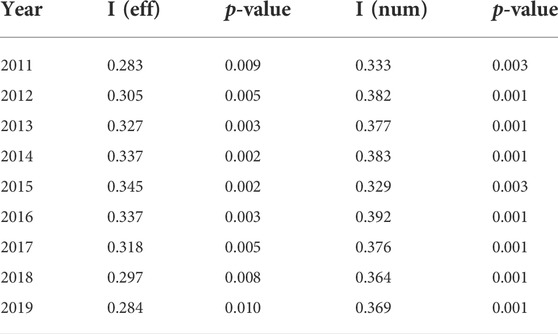

Before the standard spatial econometric regression, this study first made the global and local spatial autocorrelation tests on the FRAE and DIF to validate if the spatial econometric model was reasonable or not. Table 3 lists the Global Moran Index’s spatial autocorrelation tests of FRAE and DIF, from which it could be seen that both of them shared a significant spatial autocorrelation within the sample period.

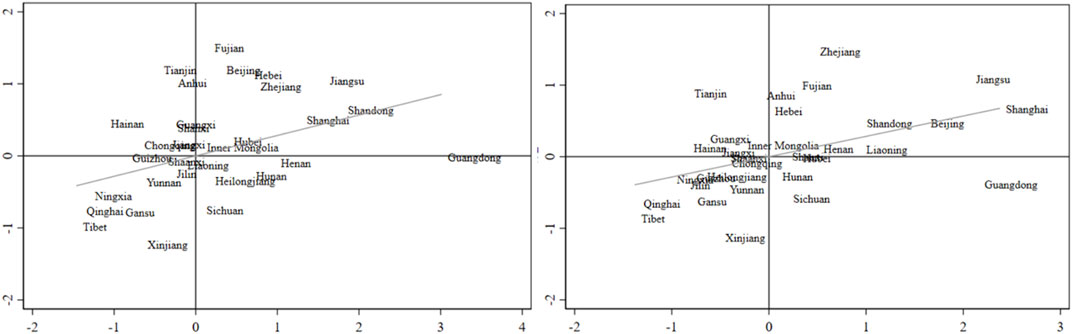

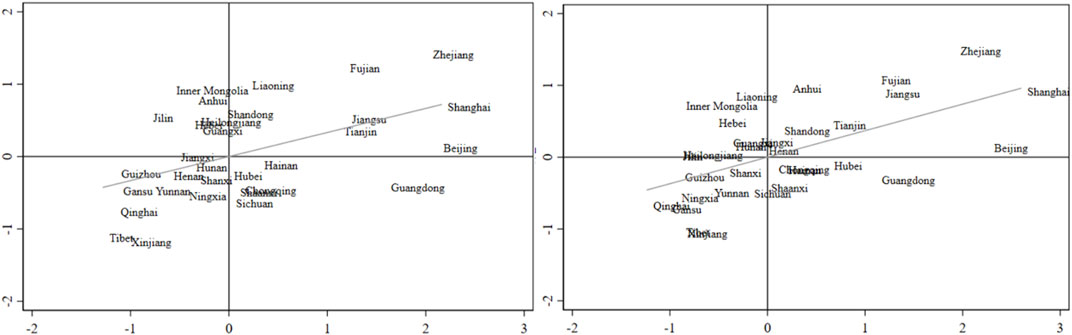

Figure 1 shows the Moran scatter diagrams of the FRAEs of 31 Chinese provinces in 2011 and in 2019. It could be seen from the figure that the majority of provinces were distributed within the first and third quadrants, among which most of the eastern coastal ones were located in the first quadrant and most of the mid-west ones were placed in the third quadrant, indicating that there was a high clustering in the eastern regions and a low clustering in the mid-west regions.

Figure 2 shows the Moran scatter diagrams of DIFs of 31 Chinese provinces in 2011 and 2019. It could also be seen from the figure that the majority of provinces were distributed within the first and third quadrants, while there was a high clustering in the eastern coastal provinces and a low clustering in the mid-west provinces. From the test results of global and local spatial autocorrelation, it could be inferred that it was rational for this study to choose the spatial econometric model to analyze the influences of DIF on FRAE.

Benchmark regression

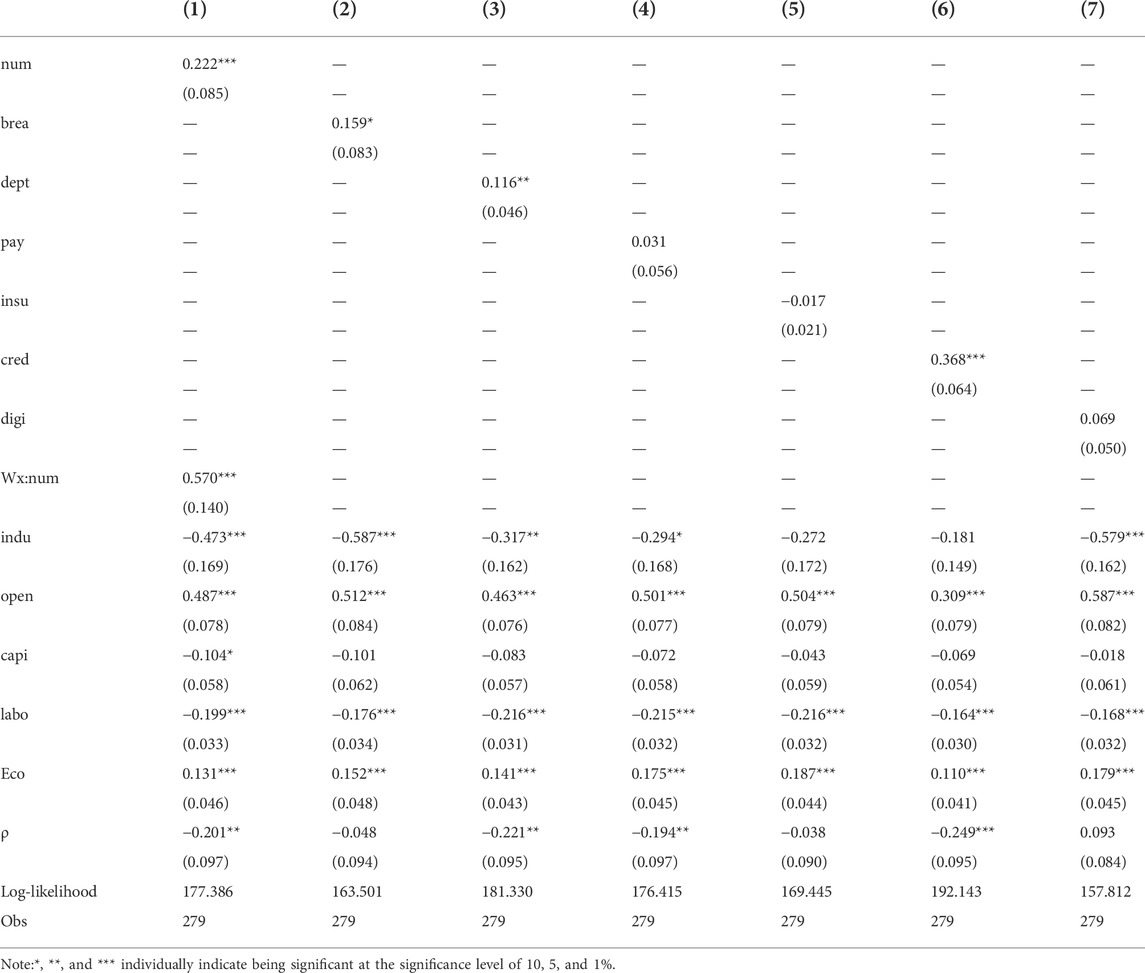

Column (1) in Table 4 shows the regression results of DIF effects on FRAE. It could be seen that the coefficient of DIF was significantly positive, indicating that its development could considerably improve FRAE. The spatial lag coefficient of DIF was also significantly positive, which proved to a certain extent that there was a positive spatial spillover effect of DIF on FRAE, meaning that the development of DIF in this region would promote the FRAEs in adjacent regions. For the control variables, the development of the industrial structure would inhibit the improvement of FRAE, which might be attributed to the irrational internal structure of the tertiary industry and the insufficient proportion of capital-intensive and high-value-added businesses; the level of economic openness could also significantly promote FRAE. With the opening to the outside world and the development of international trade, financial resources could flow on a broader platform, thus improving FRAE. Moreover, the ratification of capital mismatch and labor mismatch would also promote FRAE; last but not least, the improvement of the economic development level would increase FRAE. This was because, with economic development, the economic scale would continue to expand and people’s living standards would continue to rise, while education, medical treatments, and innovations would also be improved, then the utilization and allocation efficiencies of financial resources would resultantly be elevated.

In addition to issuing the General Index of DIF, the Digital Finance Research Center of Peking University also proposed the sub-indexes of DIF from six aspects: coverage (brea), depth of using (dept), payment (pay), insurance (insu), credit (cred), and digital level (digi); their individual regression results are listed in columns (2) to (6) of Table 4. It could be seen that in these sub-indexes, coverage, using depth and credit, could all significantly promote FRAE, while payment, insurance, and digital level exerted no significant effect, indicating that DIF mainly improved FRAE from the former three aspects.

Breakdown of the total effect

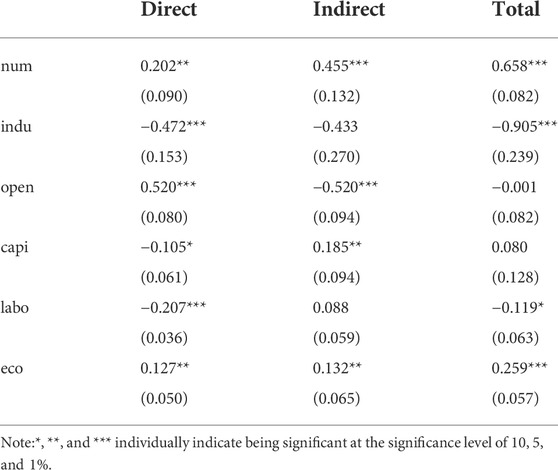

Lesage and Pace. (2009)[36] argued that the indirect effect of core explanatory variables should be concerned when testing if the impacts of spatial spillovers were significant. Table 5 lists the total effect and its breakdown outcomes from the regression results of the spatial Durbin model. It could be seen that the direct effect, indirect effect, and total effect of DIF on FRAE were all significantly positive, indicating again that the development of DIF could significantly improve FRAE and it was a positive spillover effect.

Robust test

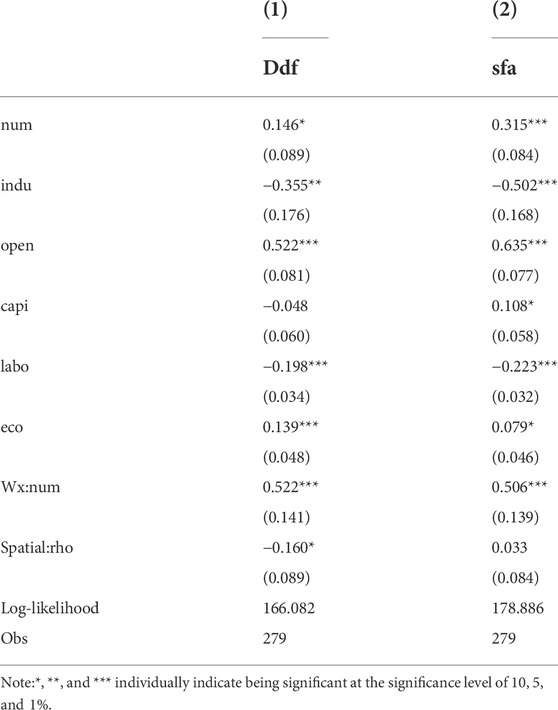

This study chose to replace the method of weighing FRAE to test if the conclusion of DIF development bringing FRAE improvement was robust or not. The common function forms of super-efficiency DEA were SBM and DDF. First, this study selected the super-efficiency DDF to weigh FRAE for the robust test. The regression results are listed in column (1) of Table 6, from which it could be seen that the development of DIF could still significantly improve FRAE, revealing that the results of this study were robust. Furthermore, this study adopted the Stochastic Frontier Analysis (SFA) approach to calculate FRAE, assuming that the production function was in the form of the transcendental logarithm (trans-log):

In Eq. 5, y, g, and c individually represent the regional production, fixed-asset investment, and deposit balance of financial institutions. After calculating the production function coefficient, the efficiency value could be obtained by referring to the breakdown method of Kumbhakar and Lovell (2000). Column (2) in Table 6 lists the regression results of DIF effects on FRAE calculated by the SFA approach, and its coefficient remained significantly positive, indicating that the development of DIF could still promote FRAE, which once again proved the robustness of this conclusion.

Empirical test of the influence mechanism

The aforementioned analysis showed that the more developed a region’s digital finance was, the more human capitals and enterprise innovations there would be. The developments of DIF in terms of coverage, using depth and credit, have all been effective ways to improve FRAE. Then what needed to be further explained was the mechanism of DIF affecting the FRAE. As illustrated previously, this mechanism might include the two aspects of improvements in the levels of human capital and encouraging enterprise innovation.

Improving the level of human capital and promoting efficiency

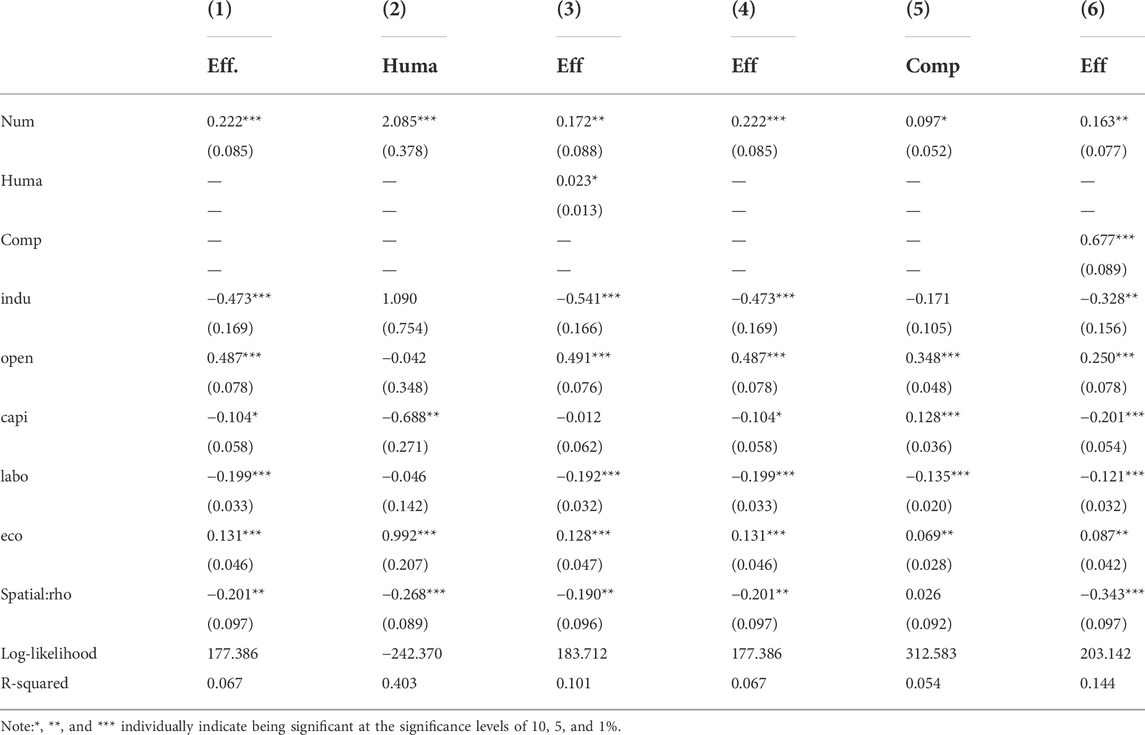

With the development of DIF, education levels in all regions would be positively affected, especially in underdeveloped areas. This study weighed the levels of human capital in 31 Chinese provinces by the years of education and applied the aforementioned three-step model of the intermediary effect to test if the intermediary effect of human capital (huma) was significant or not. Columns (1) to (3) of Table 7 separately list the regression results of DIF affecting FRAE, DIF affecting human capital, and DIF and human capital concurrently affecting FRAE. It could be seen that the effect of DIF on human capital was significantly positive, and the coefficients of human capital and DIF were both significantly positive when concurrently regressing to FRAE.

Promoting enterprise innovation and improving FRAE

If DIF encouraged enterprise innovations and then affected FRAE, we should be able to see its significant effect on enterprise innovations. During the empirical analysis, this study selected the enterprise innovation’s utility value in the “Evaluation Report of China’s Regional Innovation Capability” as the weighing index of enterprise innovation to test this mechanism. Columns (4) to (6) of Table 7 individually list the test results of whether enterprise innovation (comp) was an intermediary variable. From column (5), it can be seen that DIF could significantly promote enterprise innovation; it can be seen from column (6) that DIF and enterprise innovation could concurrently improve FRAE, while the coefficient values of DIF were less than that of single regression, indicating that enterprise innovation was an intermediary variable of DIF affecting FRAE, with an intermediary effect value of 0.066, in addition to other intermediary effects.

Further analysis

Whether China’s regional differences would affect DIF’s effects on FRAE

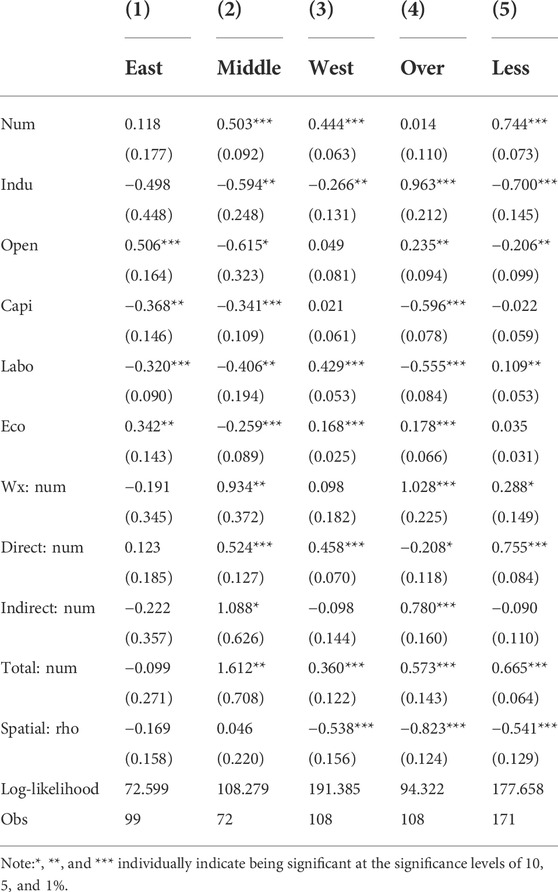

As the third-largest country in the world, China has a vast territory and has developed its economy rapidly since the reform and opening up, but the problem of disparate developments among regions still exists. Is there any regional difference in the effects of DIF on improving FRAE? Next, this study would test it by dividing the entire sample into three sub-samples of the East, the Middle, and the West, representing these three regions of China, respectively, for checking the regional differences in the effects of DIF on FRAE. Columns (1) to (3) of Table 8 are the regression results of the East, Middle, and West sub-samples, respectively. It could be seen that the effect of DIF on FRAE was insignificant in the East but significantly positive in both the Middle and West, while this type of effect was the most significant in the Middle. This demonstrated that there were indeed regional differences in the effects of DIF on FRAE and the promotion effect in the eastern region was insignificant, possibly because DIF there had been relatively more developed and optimized and its improvement effect on FRAE had already been exhausted and the marginal had already been minimal, while DIF in the middle and western regions remained in the peak period of development; therefore, its improvement effects on both of their FRAEs were still significant.

Whether the differences of overcapacity levels in different regions of China changed the DIF effects on FRAE

The problem of overcapacity has attracted wide attention in Chinese society and it has also been the focus of macroeconomic regulation and control by relevant government departments in recent years [35]. According to the overcapacity calculation and research by Cheng (2015)[38], this study further divided the entire sample into two sub-samples of oversized and undersized capacities to investigate if these different levels of overcapacity would change the initial estimation results. Columns (4) and (5) of Table 8 are the regression results of regions with oversized capacity and regions with undersized capacity, respectively. It could be seen that DIF would significantly promote FRAE in regions with undersized capacity, while it did not significantly improve FRAE in regions with oversized capacity. This might be because, in areas with oversized capacity, the market has been relatively saturated; thus, the promotion effect of DIF on FRAE was insignificant in the short term. However, in areas with undersized capacity, the market space remained sufficient and innovation incentives remained large; resultantly, the FRAE could still be significantly improved. Details are given in Table 8.

Conclusion and policy implications

After the reform and opening-up, China’s economy has developed rapidly, but all kinds of social contradictions have become increasingly aggravated. How to improve FRAE has become one of the most important issues in the process of promoting the transformation of economic development modes in China and other countries all over the world. At present, China is vigorously advocating the development of DIF and is strongly committed to creating a social environment favorable for improving FRAE. The development of DIF itself means the improvement of financial infrastructure, brings convenient services to poor areas that were unable to be reached by traditional finances, and also provides financing facilities for enterprise innovations, especially those of micro, small, and medium-sized companies. These could eventually promote FRAE together. Based on the theoretical analysis of DIF’s effects on FRAE, this study adopted the panel data of 31 provinces in China (excluding Tibet or Hong Kong, Macao, and Taiwan) from 2011 to 2019, employed the super-efficiency DEA approach to calculate the individual FRAEs in various regions, and then applied the spatial Durbin model to investigate the various effects of DIF on FRAE. Through these empirical analyses, the following conclusions were drawn.

According to the General Index of DIF, its development could promote FRAE. This conclusion remained significant even after varying the weighing method of FRAE; from the perspective of six sub-indexes of DIF, it was found to have mainly improved FRAE through three aspects: coverage, using depth, and credit. In other words, the more numerous the DIF participants and the more effective the credit function, the greater the possibility of DIF in improving the local FRAE.

In exploring the mechanisms behind the promotion of FRAE by DIF, this study also found that the development of DIF would first elevate the levels of human capital and enterprise innovation, before finally improving FRAE. In the subsequent heterogeneity analysis, this study also revealed that in the mid-west regions of China, the development of DIF could effectively promote FRAE again, but this effect was insignificant in the eastern regions. This demonstrated that DIF could indeed exert its inclusive effect and play a certain role in narrowing the regional gaps by promoting balanced developments. In addition, the developments of DIFs in Chinese regions with undersized capacities could also significantly improve their FRAEs, but the effect was insignificant again in areas with oversized capacity. This study provides useful empirical evidence and policy enlightenment for accurately grasping the relationship between the development of digital inclusive finance and the efficiency of financial resource allocation, thus continuing to promote the development of digital inclusive finance and improve the efficiency of financial resource allocation in the new era.

Future recommendations and current limitations

First, DIF should be continually developed and full play could be given to its positive effects on FRAE. The government can implement proactive financial inclusion policies, such as improving financial infrastructures and raising residents’ financial literacies, to elevate both the development and popularity of DIF. Second, exchanges and cooperation ought to be strengthened between regions to optimize the spatial allocation of economic factors. Positive spatial spillover effects illustrated the significance of enhancing regional cooperation and bringing inter-regional factor synergies into play. On the one hand, the construction of DIF should be laid out on a larger scale for the development of key regions to motivate the development of DIF in the whole country, so that it promotes the overall improvement of FRAE. On the other hand, all regions should cooperate with each other to remove barriers to the flow of economic factors so that economic factors can flow freely not only on a broader magnitude but also on a wider scope and higher efficiency. Third, it is also essential to promote human capital developments and enterprise innovations for elevating FRAE. Improving the external environment for DIF to continuously support corporate innovations. Special financial subsidies, collateral-free loans, and other financial services are supposed to be implemented for enterprises’ technology innovation activities. If the company is a high-tech enterprise, the scope of concessions can be extended further to it for creating a more favorable atmosphere for its innovation.

Nevertheless, this study is not without limitations. It only focused on China and the sample period only covered 2011–2019. In addition, if more pathways of the effect of digital inclusion on FRAE could be explored, it would provide more solid theoretical evidence for advocating the development of digital inclusion. In the future, researchers should consider the long-term influences of digital inclusion on FRAE and more approaches to measure it in China. They could also study relevant developments of DIF in other countries.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding authors.

Author contributions

YF: methodology, data curation, writing—original draft, and investigation; SC: conceptualization, resources, supervision, and writing—review and editing.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abu−Bader, S., and Abu−Qam, A. S. (2008). Financial development and economic growth:empirical evidence from six MENA countries. Rev. Dev. Econ. 12 (4), 803–817. doi:10.1111/j.1467−9361.2008.00427.x

Allen, F., Demirgüc−Kunt, A., Klapper, L., and Pería, M. S. M. (2016). The foundations of financial inclusion: Understanding ownership and use of formal accounts. J. Financial Intermediation (27), 1–30. doi:10.1016/j.jfi.2015.12.003

Asongu, S. A. (2013). How has politico−economic liberalization affected financial allocation efficiency: Fresh african evidence. Mpra Pap. 33 (1), 663–676. https://mpra.ub.uni-muenchen.de/id/eprint/44995

Bai, Junhong, and Liu, Yuying (2018). Can Foreign Direct Investment improve China's resource mismatch? China Ind. Econ. (01), 60–78.

Bleck, A., and Liu, X. (2018). Credit expansion and credit misallocation. J. Monetary Econ. 94 (1), 27–40. doi:10.1016/j.jmoneco.2017.09.012

Chen, Y., and Sivakumar, V. (2021). Investigation of finance industry on risk awareness model and digital economic growth. Ann. Oper. Res., 1–22. doi:10.1007/s10479−021−04287−7

Cheng, Junjie (2015). Measurement of China's regional overcapacity in the transition period: A comparative analysis based on co−integration method and stochastic frontier production function method. Econ. Theory Econ. Manag. (04), 13–29. http://jjll.ruc.edu.cn/CN/

Corrado, G., and Corrado, L. (2017). Inclusive finance for inclusive growth and development. Curr. Opin. Environ. Sustain. 24, 19–23. doi:10.1016/j.cosust.2017.01.013

Demertzis, M., Merler, S., and Wolff, G. B. (2018). Capital markets union and the fin−tech opportunity. J. Financial Regul. 4 (1), 157–165. doi:10.1093/jfr/fjx012

Du, Xiaoshan (2006). The development of microfinance and the framework of inclusive financial system. China Rural. Econ. (8), 70–73.

Ge, H., Li, B., Tang, D., Xu, H., and Boamah, V. (2022). Research on digital inclusive finance promoting the integration of rural three−industry. Int. J. Environ. Res. Public Health 19 (6), 3363. doi:10.3390/ijerph19063363

Grossman, J., and Tarazi, M. (2014). Serving smallholder farmers: Recent developments in digital finance. Focus Note 94.

Guo, Feng, Kong, Tao, Wang, Jingyi, Zhang, Xun, Cheng, Zhiyun, Ruan, Fangyuan, et al. (2016). China's digital inclusive finance index system and index compilation. Beijing: Working paper of digital finance research center of Peking University.

Guo, Feng, Wang, Jingyi, Wang, Fang, Kong, Tao, and Zhang, Xun (2020). Measuring the development of digital inclusive finance in China: Index compilation and spatial characteristics. Econ. Q. 19 (4), 1401–1418.

Jiao, Jinpu, and Jin, Chen (2009). Building China's an inclusive financial system: Providing opportunities and approaches for the whole people to enjoy modern financial services. Beijing: China Finance Press.

Kazemzadeh, E., Fuinhas, J. A., Koengkan, M., Osmani, F., and Silva, N. (2022). Do energy efficiency and export quality affect the ecological footprint in emerging countries? A two−step approach using the SBM–DEA model and panel quantile regression. Environ. Syst. Decis., 1–18. doi:10.1007/s10669−022−09846−2

Koengkan, M., Fuinhas, J. A., Kazemzadeh, E., Osmani, F., Alavijeh, N. K., Auza, A., et al. (2022). Measuring the economic efficiency performance in Latin American and Caribbean countries: An empirical evidence from stochastic production frontier and data envelopment analysis. Int. Econ. 169, 43–54. doi:10.1016/j.inteco.2021.11.004

Kumbhakar, S. C., and Lovell, C. A. K. (2000). Stochastic frontier analysis. Cambridge: Cambridge University Press.

Lei, X. T., Xu, Q. Y., and Jin, C. Z. (2021). Nature of property right and the motives for holding cash: Empirical evidence from Chinese listed companies. MDE. Manage. Decis. Econ. 43, 1482–1500. doi:10.1002/mde.3469

Lesage, J., and Pace, R. K. (2009). Introduction to spatial econometrics. Boca Raton, Florida: CRC Press.

Levine, R. (1997). Financial development and economic growth: Views and agenda. J. Econ. Literature 35 (2), 688–726. https://www.jstor.org/stable/2729790

Li, Yuke (2018). Theoretical and empirical research on the efficiency of regional financial resource allocation in China. Chengdu: Southwest University of Nationalities.

Liao, Li, Li, Mengran, and Wang, Zhengwei (2014). Smart investors: Incomplete marketing interest rate and risk identification: Proof from P2P network lending. Econ. Res. 49 (07), 125–137.

Magdoff, H., and Sweezy, P. (1987). Stagnation and the financial explosion. New York: Monthly Review Press.

Mckinnon, R. I. (1973). Money and capital in economic development. Washington DC: Brooking Institution.

Mhlanga, David (2020). Industry 4.0 in finance: The impact of artificial intelligence (AI) on digital financial inclusion. Int. J. Financial Stud. 8 (3), 45. doi:10.3390/ijfs8030045

Moll, B. (2014). Productivity losses from financial frictions: Can self−financing undo capital misallocation? Am. Econ. Rev. 10, 3186–3221. doi:10.1257/aer.104.10.3186

Mollick, E., and Kuppuswamy, V. (2014). “Crowdfunding: Evidence on the democratization of startup funding,” in Revolutionizing innovation: Users, communities and openness. Editors K. Lakhani,, and D. Harhoff (Cambridge: MIT Press).

Ozili, P. K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 18 (4), 329–340. doi:10.1016/j.bir.2017.12.003

Peng, Lei (2017). Research on the efficiency of financial resource allocation in the Beijing−Tianjin−Hebei region. Beijing: China University of Geosciences.

Pu, Xiaoyue, Chen, Hongxi, and Xia, Fandi (2019). Research on regional poverty reduction effect of digital inclusive finance: Flat regression analysis based on Chinese provincial data. Int. J. Educ. Manag. 4 (1).

Restuccia, D., and Rogerson, D. (2013). Misallocation and productivity. Rev. Econ. Dyn. 16 (1), 1–10. doi:10.1016/j.red.2012.11.003

Shen, Jun (2006). Empirical research on financial efficiency. Statistics Decision−making (22), 138–139.

Shi, Zhen (2021). Research on the dynamic effect of spatial allocation of financial resources on economic development. Statistics Decision−making (19), 161–165.

Song, Ke, Liu, Jialin, and Li, Zhoujia (2022). Can digital inclusive finance narrow the income gap between urban and rural areas in the county—— on the synergy between digital inclusive finance and traditional finance. China soft Sci. (06), 133–145.

Sun, Yujie (2021). Research on the effects of digital inclusive finance on regional innovation. Jinan: Shandong University of Finance and Economics.

Wang, Jingyi, and Huang, Yiping (2017). Investigation report on American financial technology. Beijing: Research Report of Digital Finance Research Center of Peking University.

Wang, Shuguang, and Wang, Dongbin (2011). Dual binary financial structure, farmers' credit demands and rural financial reform: Based on a field survey of 14 counties and cities in 11 provinces. Finance Trade Econ. (5), 38–44. doi:10.19795/j.cnki.cn11-1166/f.2011.05.006

Wang, Yaning, Jing, Yi, and An, Qiqi (2021). Research on the development of crowd funding platform in the era of Internet finance. Front. Econ. Manag. 2 (9), 126–130. doi:10.6981/FEM.202109_2(9).0018

Wu, G. L. (2017). Capital misallocation in China: Financial frictions or policy distortions? J. Dev. Econ. 130, 203–223. doi:10.1016/j.jdeveco.2017.10.014

Wu, Jinwang, Guo, Fuchun, and Gu, Zhouyi (2018). An empirical analysis of the influencing factors of the development of digital inclusive finance: A test based on spatial panel model. Zhejiang Acad. J. (03), 136–146. doi:10.16235/j.cnki.33-1005/c.2018.03.016

Wurgler, J. (2000). Financial markets and the allocation of capital. J. Financial Econ. 58 (1), 187–214. doi:10.1016/s0304−405x(00)00070−2

Xie, Xuanli, Shen, Yan, Zhang, Haoxing, and Guo, Feng (2018). Can digital finance promote entrepreneurship: Evidence from China. Econ. Q. (04), 1557–1580. doi:10.13821/j.cnki.ceq.2018.03.12

Xu, Xiaoguang, Xian, Juncheng, and Zheng, Zunxin (2014). On the path of improving urban financial efficiency in China. Res. Quantitative Econ. Tech. Econ. (10), 53–68.

Zhao, Xiaoge, Zhong, Shihu, and Guo, Xiaoxin (2021). Digital Inclusive Finance's development, financial mismatch alleviation and enterprise innovation. Sci. Res. Manag. (04), 158–169. doi:10.19571/j.cnki.1000-2995.2021.04.017

Zhou, Guofu, and Hu, Huimin (2007). Research on the criteria system of financial efficiency. Financial Theory Pract. (8), 15–18.

Zhou, Yuqing, and He, Guangwen (2020). The impacts of the development of Digital Inclusive Finance on the allocation of household financial assets. Contemp. Econ. Sci. (03), 92–105.

Keywords: digital inclusive finance (DIF), financial resource allocation efficiency (FRAE), super-efficiency DEA, spatial durbin model, capital mismatch

Citation: Fan Y and Chen ST (2022) Research on the effects of digital inclusive finance on the efficiency of financial resource allocation. Front. Environ. Sci. 10:957941. doi: 10.3389/fenvs.2022.957941

Received: 31 May 2022; Accepted: 29 August 2022;

Published: 05 October 2022.

Edited by:

Faik Bilgili, Erciyes University, TurkeyReviewed by:

Xiaomin Gu, Shanghai Lixin University of Accounting and Finance, ChinaMatheus Koengkan, University of Aveiro, Portugal

Copyright © 2022 Fan and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yaojun Fan, WWFvanVuLmZhbkBkcHUuYWMudGg=; Sze Ting Chen, c3plLXRpbmcuY2hlQGRwdS5hYy50aA==

Yaojun Fan

Yaojun Fan Sze Ting Chen

Sze Ting Chen