94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 30 August 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.955055

This article is part of the Research TopicESG Investment and Its Societal ImpactsView all 28 articles

This study analyzes the influence of urban digital economy development on enterprise ESG performance in China and its enterprise innovation channels. Based on matching micro-level data of enterprises and macro-level data of prefecture-level cities from 2012 to 2020, this study uses OLS to conduct empirical estimation and uses a multiple mediation effect model to test the influencing mechanism. Our findings demonstrate that the development of an urban digital economy significantly improves enterprise ESG performance in China. Additionally, the development of the digital economy can boost enterprise ESG performance by enhancing innovation input intensity, improving innovation output capacity, and enhancing innovation input intensity to improve innovation output capacity. Furthermore, we find that the development of the digital economy in eastern and northeastern China significantly improves enterprise ESG performance, urban agglomerations play a central role in the process of digital economy development improving enterprise ESG performance, and the development of the digital economy significantly enhances enterprise ESG performance in younger enterprises. Overall, our findings improve and enrich the research on the digital economy and enterprise development from the perspective of micro-enterprises and macro development. Moreover, they provide theoretical support and empirical evidence for the development of the digital economy and the realization of enterprises’ sustainable development.

Environmental, social, and governance (ESG) performance is an important dimension of enterprises’ sustainable development. For example, ESG progress for digital infrastructure vendors is predicted by the market research firm IDC to become mandatory by 2024 (IDC, 2022). Technology is key to implementing an ESG strategy. For an enterprise undergoing digital transformation, ESG should be part of its development process to ensure that new technology systems are integrated into ESG (Hodge, 2021). The global economy has entered a new stage of digital economy development, and the technological revolution is developing rapidly, having a profound impact on firm development and transformation. Currently, China’s economy faces new characteristics and requirements in the high-quality development stage, and Chinese enterprises are urged to constantly adjust their development concepts to cater to green and responsible investment. This is a relevant context for further study on the impact of digital economy development on ESG performance.

Tapscott (1996) first proposed the concept of the “digital economy” in 1996, pointing out that it was an economic system with extensive use of information and communications technology (ICT). Since then, the meaning of the term “digital economy” has been considered and extended by the Organization for Economic Cooperation and Development, Bureau of Economic Analysis, G20, China Academy of Information and Communication Technology, and Chinese National Bureau of Statistics, among others. There are three primary digital economy measurement methods. First, in the direct estimation method (Machlup, 1962; Porat, 1977), the measurement range and method of value-added of the digital economy are not unified, resulting in significant differences in the measurement results and disputes over the measurement details. The second method involves building a digital economy satellite account. Research on this approach is still being refined and the method has not yet been fully developed. The third method involves establishing a multidimensional digital economy evaluation index system and constructing a digital economy index. In terms of measuring the index systems of the digital economy at home and abroad, international organizations, government agencies, and scholars have proposed different index systems based on defining the concept and scope of the digital economy. Digital infrastructure refers mainly to information infrastructure. Digital industrialization refers to the ICT industry as the foundation for digital economy development, including computer communication and other electronic equipment manufacturing, software, and information technology services (Chinese National Bureau of Statistics, 2021). Industrial digitalization, the integration of exponential technology, and the real economy mainly manifest in e-commerce (OECD, 2014), digital inclusive finance (Zhao et al., 2020), and other aspects. The developmental environment of the digital economy is reflected in its governance and innovation environments (Wang et al., 2021).

Research on ESG has primarily focused on the following aspects. First, the related literature mainly focuses on the actual performance and information disclosure of ESG. Notably, ESG performance is not completely equivalent to ESG disclosure. What is the relationship between ESG performance and ESG information disclosure? Some scholars find no correlation between actual ESG performance and ESG information disclosure (Wiseman, 1982). However, other studies have found evidence of a correlation. For example, Clarkson et al. (2008) found a positive correlation between corporate environmental performance and voluntary environmental information disclosure for 191 companies in the five most polluting industries in the United States. Bewley and Li (2000) showed that Canadian manufacturing enterprises with higher pollution levels were more inclined to disclose conventional environmental information. Shen et al. (2014) found a significant U-shaped nonlinear relationship between corporate environmental performance and environmental information disclosure. Second, there are two main approaches to calculating ESG scores. On the one hand, some scholars constructed an ESG index system based on ESG core connotation and market development, and used principal component analysis to measure the ESG index (Bai et al., 2005; Qiu and Yin, 2019; Chen et al., 2022). On the other hand, some professional institutions issued ESG rating databases, such as the ESG rating system of Sino-Securities and the ESG database of Hexun.com. Third, a few studies have analyzed the factors that influence ESG performance. Farooq et al. (2015) used a sample of 247 United States companies from 2007 to 2011 to explore the impact of company size on social responsibility and found that large companies paid more attention to external market reputation than did small ones. Corporate social responsibility investment may have a significant positive correlation with corporate image. The literature directly related to this study discusses the impact of digital economy development on enterprise development, mainly focusing on the impact of digital economy development on energy use, pollutant emissions, and other environmental aspects (Moyer and Hughes, 2012; Ishida, 2015; Li et al., 2021), the impact of digital economy development on employment structure, employment quality, and other labor market aspects (Qi et al., 2020b), and the impact of the development of the digital economy on corporate governance (Qi et al, 2020a). However, digital economy development is not systematically linked to enterprise ESG performance.

There is a lack of research on the impact of digital economy development on ESG. What impact does urban digital economy development have on enterprise ESG performance in China? What is its action mechanism? The practical significance of these problems has not been effectively resolved. This study constructs an enterprise ESG performance index through environmental (E), social responsibility (S), and corporate governance (G) variables, and constructs an urban digital economy index with Internet development and digital financial inclusion dimensions based on the micro-level data of enterprises and macro-level data of prefecture-level cities in China from 2012 to 2020. Furthermore, this study examines the impact of urban digital economy development on enterprise ESG performance in China and its mechanism and expands the heterogeneity analysis based on matching micro and macro data. We hope that the results of this study can be used to promote the development of the urban digital economy, improve the ESG performance of enterprises, and ultimately realize the digital transformation and sustainable development of enterprises.

The contributions of this study are as follows. First, neither theoretical nor empirical studies exist on the relationship between urban digital economy development and enterprise ESG performance. This study discusses the relationship between digital economy development and enterprise ESG performance using both theoretical and empirical analyses. Second, existing research lacks an exploration of the influencing mechanism of how the digital economy improves enterprise ESG performance. This study proposes the influencing mechanism based on innovation input and output paths. The existence of the influencing mechanism is verified by using a multiple mediation effect model. Finally, this study focuses on the heterogeneity analysis of the four economic regions, urban agglomerations, and enterprise development stages.

The remainder of this paper is organized as follows. Section 2 presents the hypothesis development. Section 3 discusses the data source, variable selection and measurement, and specification of the econometric models. Section 4 presents the empirical results and a discussion. Section 5 discusses influencing mechanism. Section 6 expands on the analysis of heterogeneity. Section 7 presents the robustness test. Section 8 concludes the paper with policy directions.

With the wide application of digital technology in various industries and rapid development of the digital economy, the production efficiency of enterprises has significantly improved, and the development mode of enterprises has undergone significant changes. Technology has become the key to ESG strategy implementation (Hodge, 2021). From a broad perspective, the development of the digital economy significantly improves total factor productivity, economic structure, and social welfare while reducing ecological and environmental pollution and promoting China’s high-quality economic development (Zhang et al., 2021; Wang et al., 2022). First, in terms of the environment, the development of the digital economy is closely related to the environment. Internet technology has gradually been applied to energy and environmental protection, directly affecting energy consumption and pollutant emissions. Overall, digital economy development is conducive to improving environmental quality, and the impact of the digital economy on pollutant emissions has a threshold effect (Li et al., 2021). Many studies have shown that digital technology represented by ICT can improve energy efficiency and reduce energy consumption to a certain extent to achieve environmental protection (Moyer and Hughes, 2012; Ishida, 2015). Second, in terms of social responsibility, the implementation of digital reform inevitably impacts the rights and interests of shareholders, employees, consumers, and others. The digital economy enables enterprises to transform from being product-oriented to focusing on users’ experience to meet their needs and experience (Jiao, 2020). The development of the digital economy can significantly improve enterprise economic efficiency and effectively improve workers’ rights and interests, such as the employment environment, labor remuneration, and labor protection (Qi et al., 2020b). Third, in terms of corporate governance, digital technology improves its level by broadening the depth and breadth of enterprises’ access to information, improving information transparency, and reducing the irrational degree of managers’ decision-making (Qi et al, 2020a).

Considering the impact of the digital economy development on the environment, social responsibility, and corporate governance, digital technology supports high-quality economic growth and helps enterprises achieve sustainable development. Therefore, this study proposes the following hypothesis:

Hypothesis 1. Overall, the development of the digital economy positively affects enterprise ESG performance.Meanwhile, given the complexity of the impact of the digital economy on enterprise ESG performance, there are bound to be differences among the various enterprise groups. In summary, this study further explores the heterogeneous impact of the digital economy on ESG performance based on regional and firm characteristics, including the differentiation of four economic regions, urban agglomerations, and the development stage of enterprises.

The digital economy has brought profound changes to enterprise production and other fields, encouraging enterprises to engage in economic behavior having a positive impact on environmental protection, social responsibility, and corporate governance. The development of the digital economy can improve enterprises’ ESG performance by influencing their economic activity innovation.

The development of the digital economy has accelerated the coupling of digital technology and research and development (R&D) systems and can significantly improve innovation efficiency (Wang and Cen, 2022). First, the development of the digital economy positively affects enterprise innovation input. The digital economy simplifies the channels for multiple innovation subjects to obtain information, and digital platforms provide technological sources and a knowledge base for innovation (Su et al., 2021). The development of the digital economy improves the efficiency of resource allocation and utilization by enterprises, improves their profitability, releases more resources within enterprises (Thompson et al., 2013), and encourages the input of innovation resources. The digital economy aims to achieve innovative development by increasing R&D and human capital investments in enterprises (Dai et al., 2022). Second, the development of the digital economy positively affects enterprise innovation output. The digital economy has a feedback effect. The widespread use of digital technology pushes enterprises to update and upgrade products, learn and use new technologies, and promote periodic technological innovation (Su et al., 2021). The development of the digital economy encourages enterprises to conduct R&D activities, improve the output level of innovation patents, and raise the quality and diversification of new products.

To clarify enterprise innovation’s mediating role on the influence of digital economy development on ESG performance, we comprehensively consider how enterprise innovation affects ESG performance. The direction of enterprise innovation is often financial performance and value creation, which is important in improving enterprise competitiveness and profitability (Michelino et al., 2014; Chouaibi et al., 2021). Innovation is essential for pursuing ESG (Esposito De Falco et al., 2021). First, innovation is an important way to solve environmental problems (Kivimaa, 2008). Innovation in this domain improves environmental performance (Ghisetti and Quatraro, 2017). Innovation reduces enterprise pollutant emissions and pollution through technology, configuration, and structural effects (Shi et al., 2018). The development of Internet technology has accelerated declining energy consumption intensity through innovative R&D investment and human capital (Ren et al., 2021). Second, innovation should be considered a valid argument for corporate social responsibility (Asongu, 2007). Enterprises can meet stakeholders’ needs and offer advantages for firm development through innovation. With fierce market competition, social consciousness and innovation are key to enterprises’ survival (Ullah and Sun, 2021). Asongu (2007), taking DuPont as an example, pointed out that it keeps innovating, reduces production costs, improves product lines, and actively responds to climate change challenges to fulfil corporate social responsibility commitments. Third, innovation has a positive impact on corporate governance. Innovation includes not only the innovation of the business model (content) and business structure (organization) but also the innovation of business governance (Zott and Amit, 2010; Qi et al, 2020a).

In summary, the digital economy can achieve innovative development by increasing innovation input and innovation output, and encourage enterprises to comprehensively improve ESG performance, including environmental protection, social responsibility, and corporate governance through innovation. Accordingly, this study proposes the following hypothesis:

Hypothesis 2. Development of the digital economy improves enterprise ESG performance by enhancing their innovation input.

Hypothesis 3. Development of the digital economy improves enterprise ESG performance by improving their innovation output.Additionally, this study considers that innovation input affects innovation output. The effectiveness of the National Innovation Systems (NIS) mainly covers the efficiency evaluation of the input–output system, that is, the transformation from innovation input to innovation output (Wang et al., 2016). Increasing R&D investment stimulates firms to conduct R&D activities, thereby increasing the output of their R&D activities. This study considers that innovation input plays a mediating role in digital economy development and innovation output, because it affects the latter. Innovation output mediates the relationship between innovation input and ESG performance. Therefore, innovation input and output have a chain multiple mediation effect on digital economy development and enterprise ESG performance.Accordingly, this study proposes that:

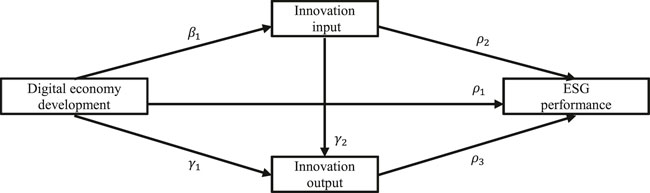

Hypothesis 4. Development of the digital economy improves enterprise ESG performance by enhancing innovation input intensity to improve innovation output capacity.This study preliminarily proposes influencing mechanism between digital economy development and enterprise ESG performance through innovation input and output, as shown in Figure 1.

FIGURE 1. How does digital economy development affect enterprise ESG performance through innovation input and output?.

A-share listed companies from 2012 to 2020 were selected as samples. We conducted the following data-processing steps in this study: eliminated financial industry samples; eliminated stocks that used to be ST, *ST, PT; and excluded abnormal samples of financial indicators, such as net profit rate greater than 1 and asset–liability ratio not in the range of 0–1 (Liu et al., 2020). After sorting, the final sample contained 16,203 observations covering 3,085 listed enterprises distributed in 242 prefecture-level cities over nine years.1 The data of the listed companies utilized here were obtained from the China Stock Market and Accounting Research database. For continuous variables, we conducted a 1% winsorization to reduce the influence of extreme values. The data on prefecture-level cities come from the China City Statistical Yearbook, Peking University Digital Financial Inclusion Index, some prefecture-level cities’ statistical yearbooks and bulletins, and China Entrepreneur Investment Club database.

ESG performance includes three aspects: environment, social responsibility, and corporate governance. Specifically, the environment refers to enterprises’ emissions from resource management and others. Social responsibility refers to firm’s responsibility to stakeholders, such as shareholders, employees, customers, and consumers; it comprehensively considers the enterprise’s internal and external economic, ecological, and social environment to ensure its sustainable development. Corporate governance is an institutional arrangement that balances stakeholders, such as shareholders, the board of directors, and management (Alda, 2021; Ullah and Sun, 2021).

First, for the environmental variable (E), we referred to Long et al. (2015) and Qiu and Yin (2019). Specifically, we selected indicators based on whether the company is a key monitoring unit, the discharge of pollutants is up to standard, there is a major environmental pollution incident, there is an environmental illegal event, there is an environmental petition letter event, it has ISO9001 environmental management system certification, and it has developed an environmental management system.

Second, for the social variable (S), this study refers to Qiu and Yin (2019) and basic information based on social responsibility reports. We select indicators based on the design of the shareholders’ rights and interests protection, creditors’ rights and interests protection, staff’s rights and interests protection, safety production, suppliers’ rights and interests protection, consumers’ rights and interests protection, the GRI’s Sustainability Reporting Guidelines, environmental and sustainable development, public relations and social public welfare undertakings, and social responsibility system construction and improvement measures.

Third, for the governance variable (G), this study refers to Bai et al. (2005) and Qiu and Yin (2019) and selects the nature of the controlling shareholders, integration of two key positions (whether the chair and general manager are the same person), proportion of independent directors, sum of squares of the shareholding ratio of the top 10 major company shareholders (concentration), and the management’s shareholding ratio.

Finally, for the ESG comprehensive variable, the ESG comprehensive score was calculated with equal weights according to the three-dimensional variables of the environment, social responsibility, and corporate governance.

Development of the digital economy. (1) Index Selection. Based on the core content of the meaning of the digital economy, this study uses Huang et al. (2019) and Zhao et al. (2020) as references and combines relevant data availability at the city level to measure the comprehensive digital economy development level from the two dimensions of Internet development and digital financial inclusion. First, the dimension of Internet development covers the digital infrastructure and the development of related digital industries. Indicators are adopted from four aspects: mobile phone penetration rate, Internet penetration rate, output of related industries, and employees of related industries. The specific corresponding indicators were as follows: the number of mobile phone users among 100 people, number of Internet broadband access users among 100 people, per capita income of telecom services, and number of computer services and software employees that account for the proportion of urban employees. Second, the development dimension of digital finance reflects the integration of the digital industry, and adopts the China Digital Inclusive Finance Index. (2) Measurement methods. In this study, a combined weighting method was adopted to determine the weight. Specifically, the entropy method of the objective weighting method is used to assign weights to specific evaluation indicators of internet development. The time variable was added by referring to an improved entropy weight method (Yang and Sun, 2015). The two dimensions of Internet development and digital inclusive finance have equal granted value of 0.5.

Enterprise innovation includes both innovation input and output. It is generally measured by R&D investment, number of patents, and output value of new products (Hagedoorn and Cloodt, 2003). In this study, the percentage of R&D investment in operating revenue is used to measure enterprise innovation input. The number of patent applications granted in the year was used to measure enterprise innovation output.

This study selects enterprise and regional variables. At the enterprise level, company size, profitability, corporate risk, and development ability were selected based on Qiu and Yin (2019), Alda (2021), and Chang et al. (2021). At the city level, this study also selected the logarithm of per capita gross domestic product (GDP), industrial structure upgrading, government size, population size, and city administrative rank (provincial capital) indicators. In addition, we controlled for province, industry, and time effects. The definitions of these variables are listed in Table 1. The descriptive statistics for each variable are shown in Table 2.

Ordinary least-squares (OLS) regression was adopted in this study. We constructed the following model to test the overall effect of urban digital economy development on enterprise ESG performance:

where

To test Hypothesis 1, we performed a regression on Eq. 1. In the equation with ESG as the explained variable, if the estimation coefficient

Based on Liu and Ling (2009) and Dong et al. (2020), this study further constructs the following multiple mediation effect model to test the mediation channel of urban digital economy development on enterprise ESG performance, that is, the influencing mechanism test model:

where

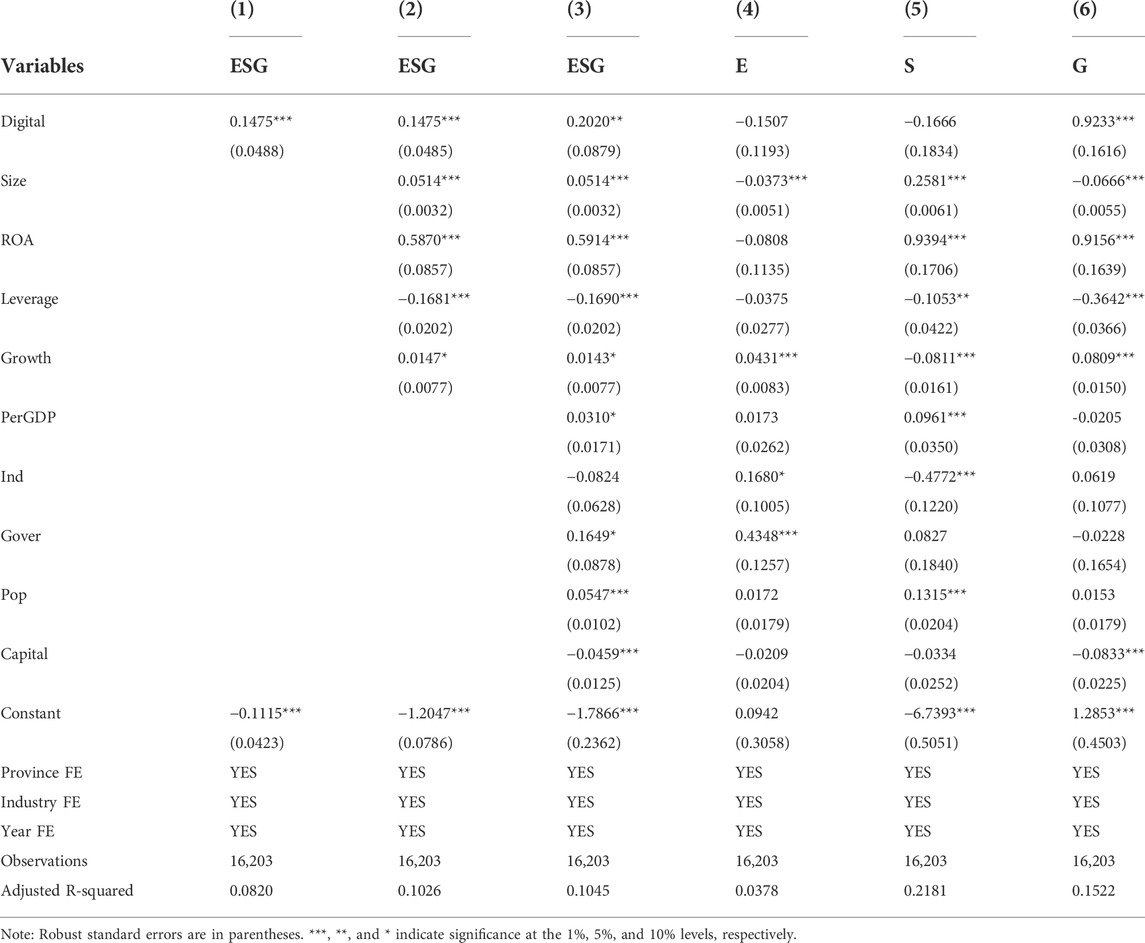

Eq. 1 was used to estimate the results presented in Table 3, which reports the benchmark test results vis-à-vis the impact of urban digital economy development on enterprise ESG performance. Columns (1)–(3) show the regression results of the impact of digital economy development on total ESG performance, and Columns (4)–(6) show the regression results of the impact of digital economy development on environment (E), social responsibility (S), and corporate governance (G), respectively. Column (1) reports the estimation results without adding control variables. The estimation coefficient of the digital economy development (Digital) is positive and significant at the 1% significance level. Column (2) shows the estimation results for the addition of the enterprise characteristic control variables. The estimation coefficient of the digital economy development (Digital) is 0.1475, which is significantly positive at the 1% significance level. In Column (3), the estimated results of the enterprise and regional characteristic control variables are added. The estimated coefficient of digital economy development (Digital) is 0.2020, which is still significantly positive. This indicates that the development of the urban digital economy significantly improves enterprise ESG performance, which supports Hypothesis 1.

TABLE 3. Regression results of the impact of urban digital economy development on enterprise ESG performance.

The regression results for the control variables are basically in line with our expectations. Company size (Size), profitability (ROA), and development ability (Growth) all play significant roles in promoting ESG performance, while corporate risk (Leverage) is not conducive to the improvement of ESG performance. The level of economic development (PerGDP), government size (Gover), and population size (Pop) all have significant positive effects on ESG performance. Provincial capitals (Capital) do not have superior ESG performance.

The regression results for each component of ESG are shown in Columns (4)–(6) of Table 3. The estimated coefficients of digital economy development (Digital) in columns (4) and (5) are all negative, but not significant. The development of the digital economy not only has positive effects, but may also have negative effects. Specifically, there is an inverted U-shaped relationship between digitization and environmental performance; that is, excessive levels of digitization can have a “rebound effect” that increases resource use and leads to higher pollution (Ahmadova et al., 2022). In addition, digital transformation and technological change may damage workers’ rights and interests (Stevenson, 2019; Trajtenberg, 2019). This study also finds that digital economy development significantly improves corporate governance (G), which is consistent with the conclusion of Qi et al. (2020a) that digital economization improves corporate governance.

According to the above theoretical analysis, the impact of urban digital economy development on enterprise ESG performance is mainly through the enterprise innovation path. The influencing mechanism includes two aspects: innovation input (InnoIn) and innovation output (InnoOut).

As the sample size changes with the addition of intermediary variables, Eq. 1 is re-estimated. According to the regression results in Column (1) of Table 4, the estimated coefficient of digital economy development (Digital) is 0.4395 and passes the 1% significance level test, which is consistent with the previous baseline regression results. This shows that the overall effect of digital economy development on ESG performance is significantly positive, again supporting Hypothesis 1.

The regression results in Columns (2) and (3) of Table 4 were obtained by estimating Eqs 2, 3, respectively. Column (2) takes innovation input (InnoIn) as the explained variable, and the estimated coefficient of digital economy development (Digital) is significantly positive. This finding shows that development of the digital economy increases enterprises’ R&D capital investment intensity. Column (3) takes innovation output (InnoOut) as the explained variable, and the estimated coefficients of digital economy development (Digital) and innovation input (InnoIn) are significantly positive. This result shows that both the development of the digital economy and innovation input significantly increase innovation output.

The regression results in Column (4) of Table 4 were obtained by estimating Eq. 4. Column (4) considers ESG to be the explained variable. Compared with the regression results in Column (1), the estimation coefficient of digital economy development (Digital) on ESG performance is still significantly positive, but the absolute value of the coefficient is smaller. The estimation coefficients of innovation input (InnoIn) and innovation output (InnoOut) are significantly positive.

In summary, the empirical results in Columns (1)–(4) of Table 4 show that multiple mediation effect test conditions are established, indicating that the overall effect of digital economy development on ESG performance is significant, and that there are parallel and chain mediation effects. Specifically, there is the first parallel mediation effect, namely, “digital economy development → enhancing innovation input intensity → improving ESG performance.” Thus, Hypothesis 2 is established. There is the second parallel mediation effect, namely, “digital economy development → improving innovation output capacity → improving ESG performance,” and thus, Hypothesis 3 is established. There is chain mediation effect, namely, “digital economy development → enhancing innovation input intensity → improving innovation output capacity → improving ESG performance,” and thus, Hypothesis 4 is established.

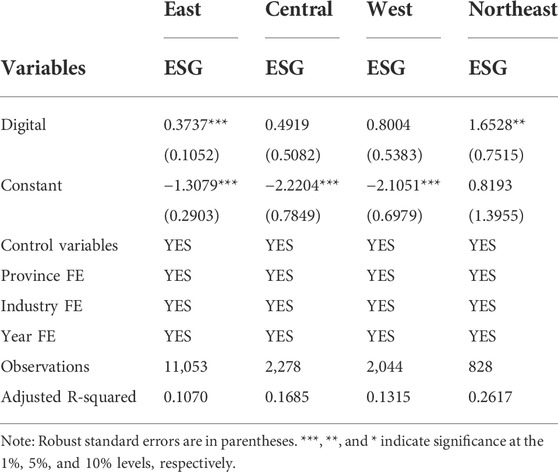

According to the regression results in Table 5, among the four economic regions, the coefficients of digital economy development (Digital) in the eastern and northeastern regions are significantly positive at the 1% and 5% levels, respectively, indicating that the development of the urban digital economy has a significantly positive impact on ESG performance in the eastern and northeastern regions. Furthermore, the positive impact was greater in the northeastern region than that in the eastern region. However, in the central and western regions, the digital economy effect is not significant.

TABLE 5. Impact of digital economy development on ESG performance by distinguishing the four economic regions.

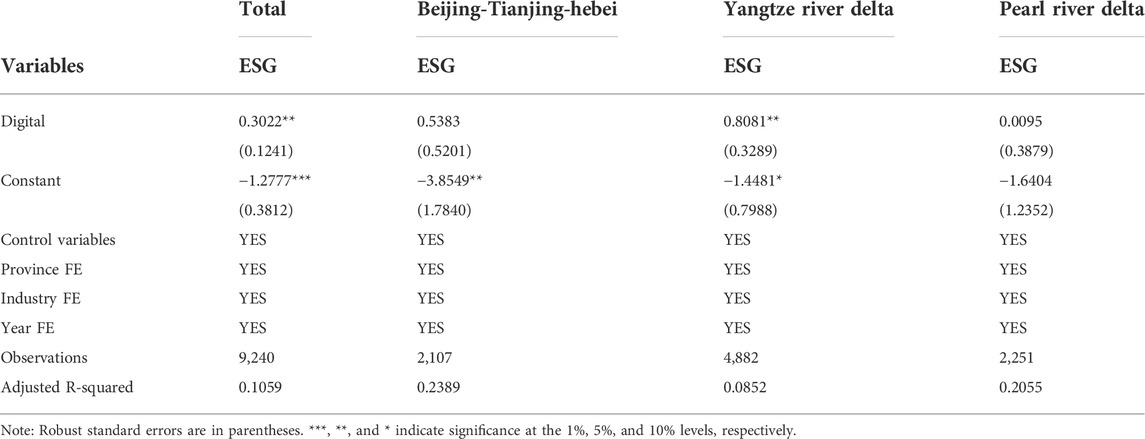

This subsection further selects representative urban agglomerations of the Beijing-Tianjin-Hebei, Yangtze River Delta, and Pearl River Delta as research objects to analyze the heterogeneity of urban agglomerations. The regression results in Table 6 show that the estimated coefficients of digital economy development (Digital) of the representative urban agglomeration as a whole and the Yangtze River Delta urban agglomeration are significantly positive at the 5% level. This indicates that the development of the digital economy significantly improves the ESG performance of enterprises in the representative urban agglomeration as a whole and the Yangtze River Delta urban agglomeration. In addition, the estimated coefficients of digital economy development (Digital) of the representative urban agglomeration as a whole and the Yangtze River Delta urban agglomeration (0.3022 and 0.8081, respectively) were much higher than the baseline regression estimation result (0.2020). This indicates that urban agglomerations, as new engines of digital economy development, play a central role in such development, promoting the economic transformation of enterprises. The Yangtze River Delta urban agglomeration, with Shanghai, Hangzhou, Nanjing, and other central cities, performed well.

TABLE 6. Impact of digital economy development on ESG performance by distinguishing urban agglomerations.

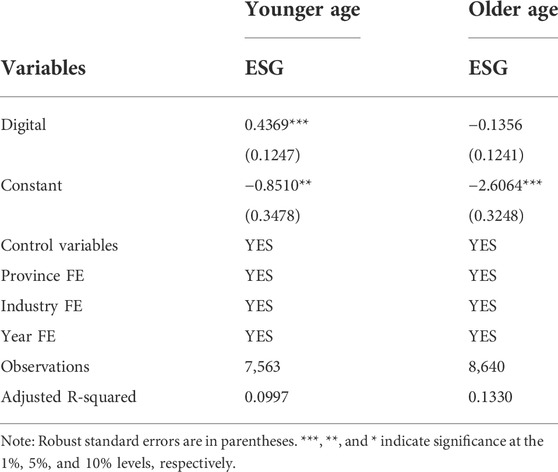

The samples were divided into two groups according to the median age of the listed companies: older and younger. According to the descriptive statistics of all the samples of listed companies, the median age of the companies was 8 years. Therefore, the sample group of listed companies whose company age is less than 8 years is defined as the younger age group, and the sample group of listed companies whose company age is greater than or equal to 8 years is defined as the older age group. As the regression results in Table 7 show, the development of the urban digital economy has a significant promotion effect on the ESG performance of enterprises in the younger age group, passing the 1% significance level test. However, the development of the urban digital economy had no significant impact on the ESG performance of enterprises in the older age group. According to enterprise life cycle theory, the development of enterprises shows different characteristics as firms age. In the early stages of development, enterprises must establish core competitiveness to survive. Therefore, the younger a company is, the stronger its desire for innovation, and the stronger its ESG performance to attract more investment.

TABLE 7. Impact of digital economy development on ESG performance by distinguishing company age groups.

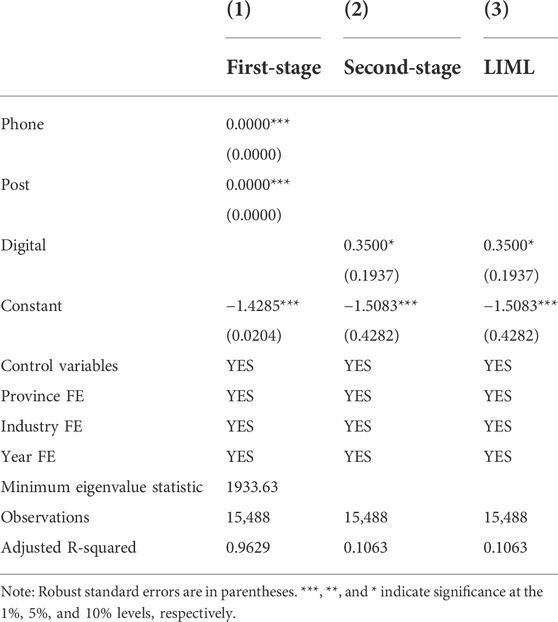

On the one hand, there may be a reverse causal relationship between urban digital economy development and enterprise ESG performance. On the other hand, owing to the complexity of the factors influencing ESG performance, it is difficult to prevent the occurrence of missing variables in the current study design. The core explanatory variable is treated as a one-period lag, which can alleviate endogeneity to a certain extent. Furthermore, this study attempts to solve the endogeneity problem using instrumental variables. Therefore, based on the methods of Nunn and Qian (2014), Huang et al. (2019), and Zhao et al. (2020), we construct the interaction terms of the number of fixed-line telephones and post offices per 100 people in each city in 1984 (related to individual change) and the number of Internet users in China in the previous year (related to time) as instrumental variables (Phone and Post) of the urban digital economy development index for the year.

Table 8 reports the results of the two-stage regression and limited information maximum likelihood (LIML) estimation. From the regression results of the first stage in Column (1), the interaction between the number of fixed-line phones per 100 people in 1984 and the number of Internet users in the last year (Phone), and the interaction between the number of post offices per 100 people and the number of Internet users in the last year (Post) are both significantly positively correlated with the development of the digital economy. It can be seen from the regression results of the second stage in Column (2) that the estimated coefficient of digital economy development (Digital) is significantly positive, which indicates that the conclusions of this study remain robust after considering endogeneity. In addition, we test whether the instruments are weak, and find that the minimum eigenvalue statistic is 1933.63, which is far greater than the critical value of 19.93 of the 10% Wald’s test, ruling out the possibility of weak instruments. In this study, the LIML method is used to test the samples, and the results are shown in Table 8. The regression coefficient of LIML is consistent with the coefficient of the two-stage regression of instrumental variables, which is significantly positive, and it also indicates that urban digital economy development is closely positively correlated with enterprise ESG performance. In general, the selected instrumental variables are reasonable.

TABLE 8. Impact of digital economy development on ESG performance: two-stage regression and LIML estimation.

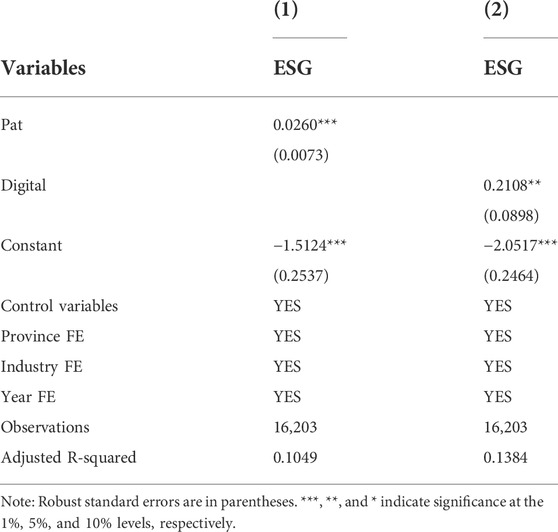

As the number of patents granted in the region where the enterprise is located can well reflect the development level of the regional digital economy, we conduct a robustness test from the perspective of regional patent authorization, which is processed as follows: weighted number of patents granted = number of inventions obtained in the year *0.5 + number of utility models obtained in the year *0.3 + number of exterior designs obtained in the year *0.2. The logarithm of the weighted number of patents granted with a one-period lag in the city was taken as the core explanatory variable. The results are shown in Column (1) of Table 9. The number of patents granted (Pat) is significantly positively correlated with enterprise ESG performance and passes the 1% significance level test, indicating that patent grants significantly improve the ESG performance of enterprises, which is consistent with the previous conclusions of this study.

TABLE 9. Impact of digital economy development on ESG performance: Substitution of core explanatory variable and test of missing variables.

Factors such as enterprise capital structure, enterprise relative value, financial development, and level of human capital in the region may also affect ESG performance. Therefore, relevant factors were further controlled in this study to mitigate the impact of missing variables on the main results. Specifically, this study places the following variables in the regression model: company’s age (Age), tangible asset ratio (TAR), price–earnings ratio (PE), current ratio (CurrentRatio), Tobin’s Q (TobinQ), ratio of loans of the national banking system at year-end to GDP (Loan), and logarithm of the number of university students per 10,000 people (Sch). According to Column (2) of the regression results in Table 9, the estimation coefficient of digital economy development (Digital) is still significantly positive even after possible missing variables are included. This result is consistent with that of the baseline regression.

Because the data are unbalanced panel data, this study uses the fixed effects model and random effects model for an additional test. The regression results of Columns (1) and (2) in Table 10 show that the estimation coefficients of digital economy development (Digital) are still significantly positive, which again highlights the robustness of this study’s conclusions.

Based on the matching of micro-level data of enterprises and macro-level data of prefecture-level cities in China from 2012 to 2020, this study constructs the enterprise ESG performance index and urban digital economy index. This study examines the influence and mechanism of urban digital economy development on the ESG performance of enterprises in China. The conclusions are summarized as follows:

First, it innovatively finds that the development of the urban digital economy significantly improves enterprise ESG performance in China from a general perspective. In addition, certain factors such as company size, profitability, company risk, development capacity, economic development, population size, and government size also affect enterprise ESG performance. Second, this study innovatively proposes and tests influencing mechanism. We find evidence for the two parallel mediating effect channels of “digital economy development → enhancing innovation input intensity → improving ESG performance” and “digital economy development → improving innovation output capacity → improving ESG performance.” We also find evidence for the chain mediation effect channel of “digital economy development → enhancing innovation input intensity → improving innovation output capacity → improving ESG performance.” Third, a heterogeneity analysis was conducted in terms of the four economic regions, urban agglomerations, and company age. The results show that among the four economic regions, the development of the urban digital economy in eastern and northeastern China significantly improves enterprise ESG performance. The development of the digital economy significantly improves enterprise ESG performance in representative urban agglomerations as a whole and the Yangtze River Delta urban agglomeration. The development of the digital economy significantly improves the ESG performance of enterprises in the younger age cohort. Finally, the main conclusions of this study remain valid after a series of robustness tests such as alleviating endogeneity, replacing the core explanatory variable, testing omitted variables, and alternative measures.

Based on these conclusions, the following suggestions are proposed for the government and enterprises. First, it is important to comprehensively promote the development of digital China. The level of digital economy development varies among the different regions in China, and there is still extensive room for improvement. The government should accelerate the promotion of digital industrialization and industrial digitization, realize the transformation and upgrading of traditional industries, and support the development of emerging industries. Enterprises should seize new opportunities in the digital economy era and realize their digital transformation. Second, the government should accelerate the construction of ESG information disclosure systems, improve ESG rating standards, and create better investment environment. Third, enterprises should consider not only the cost of their input into ESG activities but also ESG performance’s sustainability benefits. Finally, it is significant to promote enterprise innovation to improve ESG performance effectively and achieve a path toward firms’ sustainable development. Specifically, it includes boosting the intensity of enterprise R&D investment, optimizing the quantity and quality of enterprise patents, and promoting the transformation of the output value of new products to improve the level of enterprise innovation capability.

This study has several limitations. First, due to data limitations, the indicators of urban digital economy development and enterprise ESG performance are not perfect at present. Future research should keep pace with the times and continue to improve relevant measures combined with the new characteristics of digital technology and enterprise reform. Second, as the global digital economy enters a new stage, digital transformation leads to economic and social changes and has a profound impact on enterprises’ sustainable development, including countries, regions, and even individuals. This study uses China as an example to analyze the impact of digital economy development on ESG performance. Future research could consider global economic development as a perspective for establishing and improving the ESG system. Achieving sustainable development by promoting the development of the digital economy and enhancing the ESG performance of enterprises is a comprehensive and long-term strategy.

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

GC conceived and designed the research method; JH analyzed the data and wrote and finalized the manuscript; and HY collected the data and performed preliminary analysis and writing. All authors have read and agreed to the published version of the manuscript.

This work was supported by the 2021 Undergraduate Education and Teaching Reform Research Project of Fujian Province (Grant No. FBJG20210010), and Key Research Institutes of Humanities and Social Sciences of the Ministry of Education of China (Grant No. 17JJD790014).

The authors thank the editors and four reviewers for their helpful comments and suggestions for improving this paper and Jiajun Yuan for providing lab support. The remaining errors were our own.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

1In December 2018, Laiwu City was revoked and the area under its jurisdiction was placed under the jurisdiction of Jinan City. Therefore, this study combines the data of Jinan and Laiwu in the study period.

2This study does not consider the time lags between digital economy development and enterprise innovation, which are reflected as technological progress. Therefore, Eqs 2, 3 are not treated with time lags.

Ahmadova, G., Delgado-Márquez, B. L., Pedauga, L. E., and Leyva-de la Hiz, D. I. (2022). Too good to be true: The inverted U-shaped relationship between home-country digitalization and environmental performance. Ecol. Econ. 196, 107393. doi:10.1016/j.ecolecon.2022.107393

Alda, M. (2021). The environmental, social, and governance (ESG) dimension of firms in which social responsible investment (SRI) and conventional pension funds invest: The mainstream SRI and the ESG inclusion. J. Clean. Prod. 298, 126812. doi:10.1016/j.jclepro.2021.126812

Asongu, J. J. (2007). Innovation as an argument for corporate social responsibility. J. Bus. Public Policy 1 (3), 1–21.

Bai, C., Liu, Q., Lu, Z., Song, M., and Zhang, J. (2005). An empirical study on Chinese listed firms’ corporate governance. Econ. Res. J. (02), 81–91. CNKI. Sun. JJYJ, 0.2005-02-008 (in Chinese).

Bewley, K., and Li, Y. (2000). Disclosure of environmental information by Canadian manufacturing companies: A voluntary disclosure perspective. Adv. Environ. Acc. Manag. 1, 201–226. doi:10.1016/S1479-3598(00)01011-6

Chang, K., Cheng, X., Wang, Y., Liu, Q., and Hu, J. (2021). The impacts of ESG performance and digital finance on corporate financing efficiency in China. Appl. Econ. Lett. 1, 1–8. doi:10.1080/13504851.2021.1996527

Chen, G., Wei, B., and Dai, L. (2022). Can ESG-responsible investing attract sovereign wealth funds' investments? Evidence from Chinese listed firms. Front. Environ. Sci. 10, 935466. doi:10.3389/fenvs.2022.935466

Chinese National Bureau of Statistics (2021). Digital economy and its core industry statistical classification. (in Chinese) Available at: http://www.stats.gov.cn/tjgz/tzgb/202106/t20210603_1818129.html (Accessed: May 19, 2022).

Chouaibi, S., Chouaibi, J., and Rossi, M. (2021). ESG and corporate financial performance: The mediating role of green innovation: UK common law versus Germany civil law. EuroMed J. Bus. 17 (1), 46–71. doi:10.1108/emjb-09-2020-0101

Clarkson, P. M., Li, Y., Richardson, G. D., and Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 33 (4/5), 303–327. doi:10.1016/j.aos.2007.05.003

Dai, D., Fan, Y., Wang, G., and Xie, J. (2022). Digital economy, R&D investment, and regional green innovation—analysis based on provincial panel data in China. Sustainability 14 (11), 6508. doi:10.3390/su14116508

Dong, J., Feng, T., and Li, J. (2020). Impact of interprovincial factor misallocation on quality of economic development in China: Based on the chain multiple mediation effect model. Fin. Trade Res. 31 (05), 1–12. + 51(in Chinese). doi:10.19337/j.cnki.34-1093/f.2020.05.001

Esposito De Falco, S., Scandurra, G., and Thomas, A. (2021). How stakeholders affect the pursuit of the environmental, social, and governance. Evidence from innovative small and medium enterprises. Corp. Soc. Responsib. Environ. Manag. 28 (5), 1528–1539. doi:10.1002/csr.2183

Farooq, S. U., Ullah, S., and Kimani, D. (2015). The relationship between corporate governance and corporate social responsibility (CSR) disclosure: Evidence from the USA. Abasyn Univ. J. Soc. Sci. 8 (2), 197–212.

Ghisetti, C., and Quatraro, F. (2017). Green technologies and environmental productivity: A cross-sectoral analysis of direct and indirect effects in Italian regions. Ecol. Econ. 132, 1–13. doi:10.1016/j.ecolecon.2016.10.003

Hagedoorn, J., and Cloodt, M. (2003). Measuring innovative performance: Is there an advantage in using multiple indicators? Res. Policy 32 (8), 1365–1379. doi:10.1016/S0048-7333(02)00137-3

Huang, Q., Yu, Y., and Zhang, S. (2019). Internet development and productivity growth in manufacturing industry: Internal mechanism and China experiences. China’s Ind. Econ. (08), 5–23. (in Chinese). doi:10.19581/j.cnki.ciejournal.2019.08.001

IDC (2022). Digital infra vendors’ ESG progress will be mandatory by 2024: Idc, 11–12. FRPT-Fin. Snapshot.

Ishida, H. (2015). The effect of ICT development on economic growth and energy consumption in Japan. Telemat. Inf. 32 (1), 79–88. doi:10.1016/j.tele.2014.04.003

Jiao, Y. (2020). Digital economy empowers manufacturing transformation: From value remodeling to value creation. Economists (06), 87–94. (in Chinese). doi:10.16158/j.cnki.51-1312/f.2020.06.010

Kivimaa, P. (2008). Integrating environment for innovation: Experiences from product development in paper and packaging. Organ. Environ. 21 (1), 56–75. doi:10.1177/1086026608314282

Li, Z., Li, N., and Wen, H. (2021). Digital economy and environmental quality: Evidence from 217 cities in China. Sustainability 13 (14), 107393. doi:10.3390/su13148058

Liu, S., Lin, Z., and Leng, Z. (2020). Whether tax incentives stimulate corporate innovation: Empirical evidence based on corporate life cycle theory. Econ. Res. J. 55 (06), 105–121. (in Chinese).

Liu, S., and Ling, W. (2009). Multiple mediation models and their applications. Psychol. Sci. 32 (02), 433–435. + 407(in Chinese). doi:10.16719/j.cnki.1671-6981.2009.02.043

Long, W., Li, S., and Song, X. (2015). Environmental regulation and the environmental performance of small and medium-sized enterprises (SMEs): Evidence from the SME board and growth enterprise board listed firms in China. J. Public Admin 8 (06), 25–58. + 185–186 (in Chinese).

Machlup, F. (1962). The production and distribution of knowledge in the United States. New Jersey: Princeton University Press.

Michelino, F., Caputo, M., Cammarano, A., and Lamberti, E. (2014). Inbound and outbound open innovation: Organization and performances. J. Technol. Manag. Innovation 9 (3), 65–82. doi:10.4067/S0718-27242014000300005

Moyer, J. D., and Hughes, B. B. (2012). ICTs: Do they contribute to increased carbon emissions? Technol. Forecast. Soc. Change 79 (5), 919–931. doi:10.1016/j.techfore.2011.12.005

Nunn, N., and Qian, N. (2014). US food aid and civil conflict. Am. Econ. Rev. 104 (6), 1630–1666. doi:10.1257/aer.104.6.1630

Porat, M. U. (1977). The information economy: Definition and measurement. Washington, DC: United States Department of Commerce.

Qi, H., Cao, X., and Liu, Y. (2020a). The influence of digital economy on corporate governance: Analyzed from information asymmetry and irrational behavior perspective. Reform (04), 50–64. (in Chinese).

Qi, Y., Liu, C., and Ding, S. (2020b). Digital economy development, employment structure optimization and employment quality upgrading. Econ. Perspect. (11), 17–35. (in Chinese).

Qiu, M., and Yin, H. (2019). An analysis of enterprises’ financing cost with ESG performance under the background of ecological civilization construction. J. Quant. Tech. Econ. 36 (03), 108–123. (in Chinese). doi:10.13653/j.cnki.jqte.2019.03.007

Ren, S., Hao, Y., Xu, L., Wu, H., and Ba, N. (2021). Digitalization and energy: How does internet development affect China’s energy consumption? Energy Econ. 98, 105220. doi:10.1016/j.eneco.2021.105220

Shen, H., Huang, Z., and Guo, F. (2014). Confess or defense? A study on the relationship between environmental performance and environmental disclosure. Nankai Bus. Rev. 17 (02), 56–63+73. (in Chinese).

Shi, D., Ding, H., Wei, P., and Liu, J. (2018). Can smart city construction reduce environmental pollution. China’s Ind. Econ. (06), 117–135. (in Chinese). doi:10.19581/j.cnki.ciejournal.2018.06.008

Stevenson, B. (2019). “Artificial intelligence, income, employment, and meaning,” in The economics of artificial intelligence: An agenda. Editors A. Agrawal, J. Gans, and A. Goldfarb (Chicago, IL: University of Chicago Press), 189–195.

Su, J., Su, K., and Wang, S. (2021). Does the digital economy promote industrial structural upgrading?—a test of mediating effects based on heterogeneous technological innovation. Sustainability 13 (18), 10105. doi:10.3390/su131810105

Tapscott, D. (1996). The digital economy: Promise and peril in the age of networked intelligence. New York: McGraw-Hill.

Thompson, P., Williams, R., and Thomas, B. (2013). Are UK SMEs with active web sites more likely to achieve both innovation and growth? J. Small Bus. Enterpr. Dev. 20 (4), 934–965. doi:10.1108/JSBED-05-2012-0067

Trajtenberg, M. (2019). “Artificial intelligence as the next gpt: A political-economy perspective,” in The economics of artificial intelligence: An agenda. Editors A. Agrawal, J. Gans, and A. Goldfarb (Chicago, IL: University of Chicago Press), 175–186.

Ullah, S., and Sun, D. (2021). Corporate social responsibility corporate innovation: A cross‐country study of developing countries. Corp. Soc. Responsib. Environ. Manag. 28 (3), 1066–1077. doi:10.1002/csr.2106

Wang, P., and Cen, C. (2022). Does digital economy development promote innovation efficiency? A spatial econometric approach for Chinese regions. Technol. Anal. Strateg. Manag., 1–15. doi:10.1080/09537325.2022.2065980

Wang, D., Zhao, X., and Zhang, Z. (2016). The time lags effects of innovation input on output in national innovation systems: The case of China. Discrete Dyn. Nat. Soc. 2016, 1–12. doi:10.1155/2016/1963815

Wang, J., Zhu, J., and Luo, X. (2021). Research on the measurement of China’s digital economy development and characteristics. J. Quant. Tech. Econ. 38 (07), 26–42. (in Chinese). doi:10.13653/j.cnki.jqte.2021.07.002

Wang, X., Wang, X., Ren, X., and Wen, F. (2022). Can digital financial inclusion affect CO2 emissions of China at the prefecture level? Evidence from a spatial econometric approach. Energy Econ. 109, 105966. doi:10.1016/j.eneco.2022.105966

Wiseman, J. (1982). An evaluation of environmental disclosures made in corporate annual reports. Account. Organ. Soc. 7 (1), 53–63. doi:10.1016/0361-3682(82)90025-3

Yang, L., and Sun, Z. (2015). The development of Western new-type urbanization level evaluation based on entropy method. Econ. Probl. (03), 115–119. (in Chinese). doi:10.16011/j.cnki.jjwt.2015.03.023

Zhang, T., Jiang, F., and Wei, Z. (2021). Can digital economy become a new driving force for China’s high-quality economic development? Inq. Econ. Issues (01), 25–39. (in Chinese).

Zhao, T., Zhang, Z., and Liang, S. (2020). Digital economy, entrepreneurship, and high-quality economic development: Empirical evidence from urban China. Manag. World 36 (10), 65–76. (in Chinese). doi:10.19744/j.cnki.11-1235/f.2020.0154

Keywords: ESG performance, digital economy, innovation input, innovation output, Chain multiple mediation effect

Citation: Chen G, Han J and Yuan H (2022) Urban digital economy development, enterprise innovation, and ESG performance in China. Front. Environ. Sci. 10:955055. doi: 10.3389/fenvs.2022.955055

Received: 28 May 2022; Accepted: 09 August 2022;

Published: 30 August 2022.

Edited by:

Xiao-Guang Yue, European University Cyprus, CyprusReviewed by:

Yu-Ching Hsieh, Anhui Normal University, ChinaCopyright © 2022 Chen, Han and Yuan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Guifu Chen, Y2hlbmd1aWZ1QHhtdS5lZHUuY24=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.