- 1Department of Taxes and Taxation, Financial University Under the Government of the Russian Federation, Moscow, Russia

- 2Department of Taxes and Taxation, Plekhanov Russian University of Economics, Moscow, Russia

- 3Department of Economics, Moscow Region State University, Moscow, Russia

- 4Independent Researcher, Moscow, Russia

- 5Institute of Linguistics and Intercultural Communication, Sechenov First Moscow State Medical University of the Ministry of Health of the Russian Federation (Sechenov University), Moscow, Russia

Introduction

The Sustainable Development Goals (WEH) are the embodiment of sustainable development, therefore, it is advisable to evaluate its progress based on their results. Due to the diversity of the SDGs, integrated management of them should be combined with initiatives in the implementation of certain areas of sustainable development. In the direction of social progress, serious progress has been made to date both in improving living standards and in reducing gender and income inequality.

In the direction of economic growth, the results are also impressive. The COVID-19 crisis, although rightly considered the deepest since the beginning of the XXI century, was limited to 1 year (2020) and has now been replaced by a rapid recovery of the world economic system. Thus, according to the World Bank (2022), the reduction of world GDP was 3.3% in 2020, but as soon as 2021 the growth rate of the world economy was 5.8%, which is much higher than the 2019 level when it was 2.6%.

The ecological direction deserves special attention since it demonstrates more limited results. Despite the unprecedented efforts of the world community, the problem of biodiversity reduction remains critical, and the COVID-19 pandemic (which, according to a common hypothesis, is caused by the above problem) continues to this day and threatens new waves of morbidity. The World Health Organization (2022) informed (as of the end of October 2022) of 162,207 new cases in the last 24 h (as of 5:43 p.m. CEST, 28 October 2022). In this regard, the growth of the ecological economy is a priority for sustainable development, the success in the implementation of which determines the prospects for a balanced achievement of the SDGs in the Decade of Action.

The shortage of financial resources is considered in the existing literature among the key barriers to the sustainable development of the ecological economy. Private investments in environmental protection, responsible production and consumption practices remain at the discretion of market agents (business structures and households) and therefore provide a pronounced effect for sustainable development only in progressive societies (mainly in developed countries) (Congjuan et al., 2022; Cordova-Buiza et al., 2022; Huang et al. al., 2022; Tu et al., 2022; Yang et al., 2022). Consequently, regulatory financial mechanisms require the most attention (because of their universality, i.e., accessibility for developing countries), among which environmental taxation occupies an important place.

The essence and experience of applying environmental taxation are considered in the works of Lei et al. (2022), Liu et al. (2022), Matti et al. (2022), Zhao et al. (2022). But the contribution of environmental taxation to the sustainable development of the ecological economy has not been sufficiently studied and defined, which is a gap in the literature. In the works of Barbanti et al. (2022), Barik et al. (2022), Giuliani et al. (2020), Xu et al. (2022), it is noted that lagging countries (for example, in Africa) have a much higher level of development of the ecological economy and, in particular, more pronounced success in preserving biodiversity than in developed countries due to a lower level of industrial development and greater dependence of the society on the environment in terms of livelihood.

This is presented as an argument in favour of the insignificant role of environmental taxation in the sustainable development of the ecological economy, which is mainly determined by industrial development. Recognizing the high priority of industrial development, attention should be paid to the consistency of the SDGs and the need to find a common solution that allows preserving biodiversity without limiting industrial development. In this regard, environmental taxation can be very important, which requires research.

The general advantages of the formation of the AI economy for environmental protection and sustainable development are noted in the works of Lobova et al. (2022), Popkova et al. (2022), and Popkova et al. (2021). The available publications of Li and Zhu (2021), Zackrisson et al. (2020) indicate the advantages of using advanced “smart” technologies of the AI economy for modernization and optimization of taxation. However, the features of the use of “smart” technologies in environmental taxation are poorly understood, which is another gap in the literature. To fill both identified gaps, this article aims to study the contribution of environmental taxation to the sustainable development of the ecological economy, as well as substantiate the prospects for increasing this contribution with the use of AI. The goal is achieved by using the following set of research tasks:

˗ Analysis of international best practices and econometric modelling of the contribution of environmental taxation to sustainable development;

˗ Case study of Russia’s progressive experience in the field of environmental taxation;

˗ Development of recommendations for improving environmental taxation based on artificial intelligence to ensure sustainable development.

The originality of this article lies in the identification of new prospects for improving environmental taxation, which are provided by the introduction of artificial intelligence.

Methodology

We have selected the corresponding methodology for each task. Analysis of the leading international experience and econometric modelling of the environmental taxation’s contribution to sustainable development is performed with the help of regression analysis. We also perform the econometric modelling of the connection between the ecosystems protection and preservation of biodiversity (result on SDG 15) and environmentally related tax revenue, in % of GDP and in monetary units per capita. The reliability of regression equations is determined with the help of an F-test, t-test, coefficients of correlation and standard errors.

The sample contains the top 10 developed and the top 10 developing countries with the highest level of environmental taxation (leaders of the ranking Compare your country, 2022), which ensures the representativeness of the sample and allows applying the research results to the world economy. The size of the sample is sufficient for the correct reflection of the leading experience, while this paper is not aimed at representing the entire population of the planet, which would require larger studies in the future.

The case research of the progressive experience of Russia in the sphere of environmental taxation is performed with the help of the method of the case study. As a result, we develop a range of authors’ recommendations on the improvement of environmental taxation based on artificial intelligence, in the interests of sustainable development.

Contribution of environmental taxation to sustainable development: Modelling based on a review of international experience

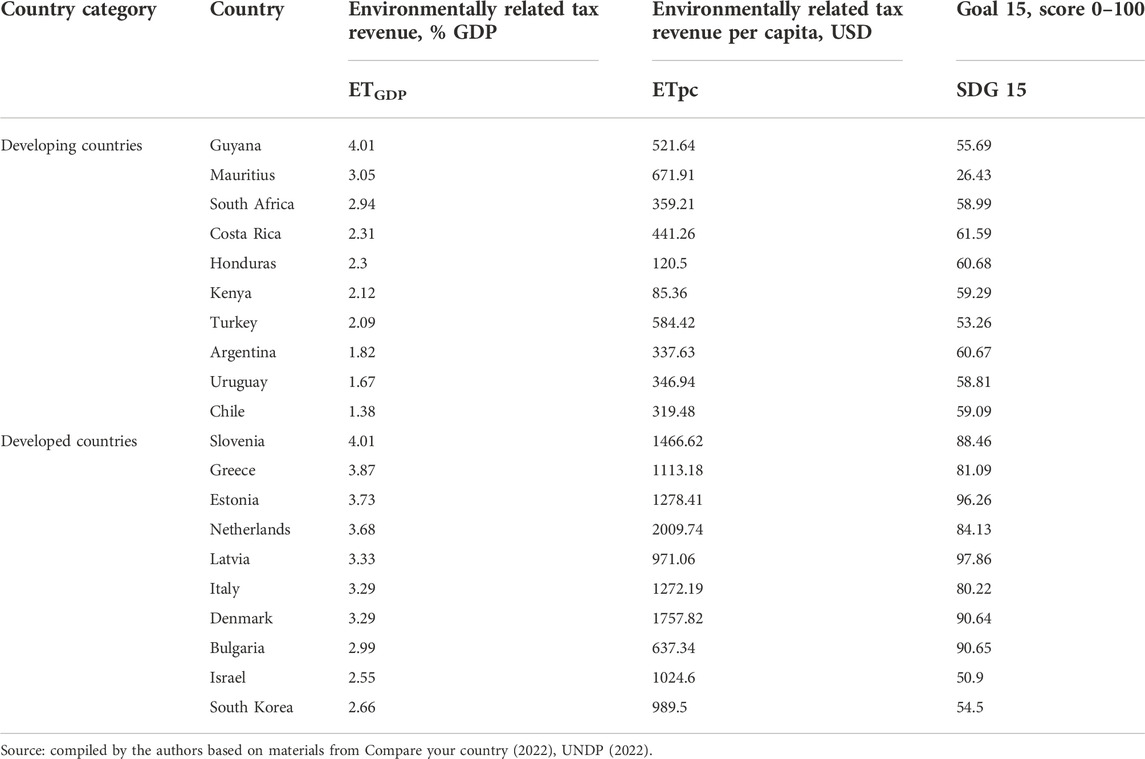

To determine the contribution of environmental taxation to sustainable development, its modelling is carried out by regression analysis. The dependence of the results of biodiversity conservation (according to SDG 15 based on the assessment report of the UNDP, 2022) in 2021 on environmental taxation in 2019 (having a delayed effect) is determined. To analyze international best practices, the study is conducted on a sample of the top 10 developed and top 10 developing countries with the highest level of environmental taxation (which are the leaders of the “Compare your country” ranking, 2022), for which data on SDG 15 are available (Table 1, in additional materials).

TABLE 1. Environmental taxation in 2019 and the results of the implementation of SDG 15 in 2021 in developed and developing countries.

As a result of econometric modelling based on the data from Table 1, the following regression equations are obtained:

To obtain Eqs 1, 2, we use the method of regression analysis to determine the regression dependence of SDG 15 on factor variables ETGDP and ETpc and then the dependence ETGDP (which in this case is a resulting variable) on the factor variable ETpc. The described mathematical steps are performed automatically in Microsoft Excel, using the built-in function of regression analysis.

To check the reliability of the regression equations, we perform an F-test. For Eq. 1, the automatically found significance F equals 0.01961. Therefore, Eq. 1 conforms to the significance level of 0.05. At two factor variables (m = 2) and 20 observations (n = 20), i.e., at the number of degrees of freedom k1 = m = 2 and k2 = n − m − 1 = 20 − 2 − 1 = 17, the table value of F is 3.59. The observed value of F equals 4.999, exceeding the table value.

Therefore, the F-test has been passed. This means that the regression equation is reliable at the significance level of 0.05. The correlation coefficient in Eq. 1 equals 0.6085. Therefore, the change in results in the sphere of preservation of ecosystems of land and protection of biodiversity, manifested in SDG 15, is by 60.85% explained by the environmental taxation factors.

For Eq. 2, the automatically found significance F equals 0.000877. Therefore, Eq. 2 conforms to the significance level of 0.01. At one factor variable (m = 1) and 20 observations (n = 20), i.e., at the number of degrees of freedom of k1 = m = 1 and k2 = n − m − 1 = 20 − 1 − 1 = 18, the table value of F is 8.29. The observed value of F equals 15.846, exceeding the table value. Therefore, the F-test has been passed.

We also performed a t-test. At 19 degrees of freedom at the set level of significance of 0.05, the table value of t equals 2.86. The observed value of t for the factor variable equals 3.98, exceeding the table value. This means that the regression equations is reliable at the level of significance of 0.01. The correlation coefficient in Eq. 2 equals 0.6842. Therefore, the environmentally related tax revenue in % of GDP is by 68.42% explained by the change in environmentally related tax revenue per capita.

Based on the modelling results, it was found that for the most complete conservation of biodiversity (maximizing the result according to SDG 15: 100 points, +46.07% compared to the average value in 2021), an increase in environmentally related tax revenue by 189.37% is necessary (from $815.44 per capita to $2359.63 per capita). This will lead to an increase in environmentally related tax revenue by 54.92% (from 2.85% of GDP to 4.425% of GDP).

Standard errors are moderate in Eq. 1, equalling 6.18 and 0.0009 for the first and second factor variables, accordingly. In Eq. 2, the standard error is 0.60, i.e., it is small. The limitation of the proposed model is that it reflects the influence of environmental taxation on one Sustainable Development Goal only, namely SDG 15, while there might be a connection also with other SDGs, which are not necessarily connected with environmental protection but have socioeconomic nature. For example, there might be clear or hidden consequences—expressed to varying degrees—consequences for green employment and green growth of the economy (SDG 8).

The advantage of the created econometric model is the precise quantitative reflection of the regularities of protection of land ecosystems and preservation of biodiversity in the course of an increase in environmental taxation. Due to this, the model specified the causal connections and allows compiling high-precision forecasts for the achievement of SDG 15. A drawback of the model is the generalisation of the experience of developed and developing countries, while their specific features could determine the specifics of the change in the level of land ecosystems protection and preservation of biodiversity in the course of an increase in environmental taxation.

Case experience of Russia in the field of environmental taxation

Additionally, the case experience of Russia in the field of environmental taxation has been studied, which makes it possible to highlight successful practical examples and consider them both from the positions of enterprises and the positions of the state and society. In Russia, the environmental tax is a mandatory payment (compensation) for the negative impact on the environment, which covers pollution of atmospheric air, water, subsoil, soil with noise, heat, electromagnetic ionizing and other types of physical actions, production and consumption waste (stationary and mobile objects) (Aero-Soft Information Technology Bureau, 2022).

It is important to note that the payment of the environmental tax does not exempt economic entities from the obligation to protect the environment and fully compensate for damage caused to the environment and the health of interested persons. Environmental taxation has been practised in Russia since 2002 (for 20 years). The amount of the environmental tax is calculated by taxpayers (all those who pollute the environment) independently, taking into account the established tax rates for the amount of pollution exceeding the statutory standards, as well as increasing coefficients (Aero-Soft Information Technology Bureau, 2022).

Traditional (used over the course of 20 years) environmental taxes in Russia include, first, a fee for use of fauna objects and water biological resources (tax rates are determined in rubles per one animal or one ton of biological resource). Second, water tax (a large list of tax rates in rubles per 1,000 cubic meters of water). Third, tax on minerals extraction (% rate in rubles per one ton or 1,000 cubic meters of extracted minerals).

Fourth, transport tax (tax rates in rubles per horsepower; the values are changed depending on the horsepower, varying among regions). Fifth, land tax (up to 0.3% and up to 1.5%—depending on the land category) (Taxation in the Russian Federation, 2022). In 2022, a new environmental tax was introduced—a fee for direct violation of environmental laws and harm to the ecology. The tax base is determined as the volume of produced production waste minus the weight of waste that was recycled (Accounting in the Russian Federation, 2022).

The result of the case study showed that environmental taxation in Russia makes a great contribution to environmental protection and biodiversity conservation, as it forms a reliable regulatory framework for responsible environmental management. At the same time, the shortcomings of environmental taxation in Russia have been identified, including a rather complex, knowledge-intensive and time-consuming procedure for calculating and paying environmental tax, insufficient control (administration) over the payment of environmental tax and high risks of environmental tax evasion.

Due to the reformation of the tax law, there is no quantitative view of the value of environmental taxation in Russia yet. However, there is the quantitative value of the achieved serious results in the sphere of sustainable development of the environmental economy in Russia. The result on SDG 13 in 2022 was assessed at 73.441 points, the result on SDG 14–52.321 points and the result on SDG 15–66.183 points (UNDP, 2022). This is a sign of the successful fight against climate change, protection of ecosystems and preservation of biodiversity in Russia. Improvement (addition with a new tax) of the tax law will allow increasing and multiplying the achieved results in the sphere of the sustainable development of the environmental economy in Russia in the Decade of Action.

Recommendations for improving environmental taxation based on artificial intelligence to ensure sustainable development

The AI economy opens up new opportunities for improving environmental taxation, allowing us to overcome all its shortcomings identified in Russia. To do this, we propose a set of the following practice-oriented recommendations for improving environmental taxation based on artificial intelligence to achieve sustainable development:

˗ Automation of the taxing process and tax optimization using AI, which allows simplifying and speeding up the process of calculating and paying environmental taxes;

˗ Transition to “smart” tax administration based on electronic document management. This transition will ensure full-scale control of the correctness of the calculation and payment of environmental tax by all taxpayers;

˗ Monitoring of environmental tax evasion based on “machine vision”, which allows timely detection of facts of environmental pollution exceeding the standards and prevention of environmental tax evasion.

The proposed recommendations will be useful for all countries of the world—both developing and developed, as they will contribute to improving the efficiency of environmental taxation and maximizing its contribution to environmental protection and biodiversity conservation.

Discussion

The contribution of the article to the literature is to clarify the role of environmental taxation in the sustainable development of the ecological economy, as well as to substantiate the prospects for improving environmental taxation based on “smart” technologies of the AI economy. The results obtained in this study are different from the results received in similar studies.

Unlike Barbanti et al. (2022), Barik et al. (2022), Giuliani et al. (2020), Xu et al. (2022), it has been proved that environmental taxation plays an important role in ensuring the sustainable development of the ecological economy. The advantage of environmental taxation is that it is a widely accessible tool for environmental protection and biodiversity conservation, while the limitation of industrial development is available only to lagging countries and has a contradictory interpretation from the standpoint of socio-economic development.

Unlike Congjuan et al. (2022), Cordova-Buiza et al. (2022), Huang et al. (2022), Tu et al. (2022), Yang et al. (2022), it has been justified that state intervention in market processes in the ecological economy (through environmental taxation) does not reduce, but increases its effectiveness. Environmental taxation makes it possible to overcome “market failures” associated with the insufficient motivation of economic entities to protect the environment and preserve biodiversity, especially clearly manifested in developing countries. The “smart” AI economy technologies make it possible to significantly improve environmental taxation.

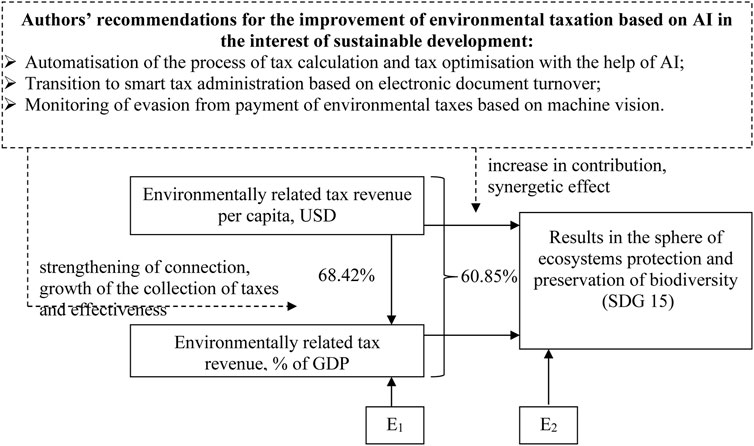

The results obtained and the authors’ conclusions are shown—in a systemic and representative manner—by the framework model of the research (Figure 1).

The framework model of the research (Figure 1) demonstrates that results in the sphere of ecosystems protection and preservation of biodiversity (SDG 15) are by 60.85% explained by environmental taxation, and in the remaining—by errors (E2) or other factors, which are not included in the model. The share of environmental taxation in GDP is by 68.42% explained by its value in the monetary expression, and in the remaining—by errors (E2) or other factors, which are not included in the model. Errors are factors of the social environment, economy and institutions.

The authors’ recommendations on the improvement of environmental taxation based on AI in the interest of sustainable development ensure, first, the strengthening of the connection and growth of collection and effectiveness of environmental taxation. Second, an increase in the contribution and the synergetic effect from environmental taxation in the form of increased growth of results in the sphere of ecosystem protection and preservation of biodiversity (SDG 15).

This study is consistent with findings from past and recent studies in other country settings: Chawla et al. (2022), Ghosh et al. (2022), Wang et al. (2022), Xie and Jamaani (2022). It strengthens the evidence base that economic tools, such as environmental taxation, could make (in practice) a significant contribution to the environmental protection and development of the environmental economy. The paper has advanced our understanding on the previous work on the existing theories of the environmental economy (Nita, 2019; Adebayo et al., 2022; Borojo et al., 2022; Hassan et al., 2022; Nita et al., 2022; Nwani et al., 2022; Pinheiro et al., 2022; Rani et al., 2022), proving the existence of a close direct connection between the collection of environmental taxes, protection of ecosystems and preservation of biodiversity.

The authors’ contribution in the political context consists in substantiating the necessity for the joint development and systemic implementation of state economic and environmental policy in the Decade of Action; in the economic context—in proving high environmental (not only economic) effectiveness of environmental taxation; in the social context—in supporting the practical implementation of SDG 15; in the technological context—in the strengthening of the technological provision of environmental taxation through proving the necessity for the active use of smart technologies during its application in the AI economy.

The obtained results demonstrated the universal character of environmental taxation as a prospective tool for stimulating the sustainable development of the environmental economy in all countries of the world—developed and developing. Environmental taxation already significantly (by 60.85%) facilitates the protection of land ecosystems and the preservation of biodiversity. In the future of the AI economy, the contribution of environmental taxation to the achievement of SDG 15 might be increased.

This will take place due to an increase in the collection of environmental taxes—an increase in the level of tax responsibility, simplification of the process of calculation and payment of environmental tax and inclusion of the information on the payment in corporate reporting on sustainable development, as well as the limitation of the opportunities for evasion from payment of environmental taxes. The proposed authors’ recommendations are universal since they are based on a wide analysis of the international experience and generally accessible technologies of the AI economy. They will be suitable for all countries of the world.

Conclusion

The set goal was achieved as a result of the performed research. We substantiated the contribution of environmental taxation to the sustainable development of the environmental economy in developed and developing countries around the world—the share of environmentally related tax revenue in GDP by 60.85% explains and ensures the results of implementing SDG 15. We also substantiated the prospects for an increase in this contribution with the help of AI. For this, we offered a set of authors’ recommendations, which include the following: 1) automatization of the process of tax calculation and tax optimisation with the help of AI; 2) transition to smart tax administration based on electronic document turnover; 3) monitoring of evasion from payment of environmental taxes based on machine vision.

As a result of the conducted research, both gaps in the literature are filled. Firstly, a serious contribution of environmental taxation to the sustainable development of the ecological economy associated with the support of biodiversity conservation has been identified—SDG 15 can be fully and successfully implemented solely through environmental taxation. Secondly, the advantages of using advanced “smart” technologies of the AI economy for modernization and optimization of taxation have been determined, including simplification and expediting of the process of calculating and paying environmental tax, full-scale administration of environmental tax, as well as prevention of environmental tax evasion.

The theoretical significance of the results obtained is because they allowed us to offer a universal tool for environmental protection and biodiversity conservation (accessible and effective in all countries of the world), overcoming the limitations of existing alternative tools: limitations of industrial development (practiced in lagging countries) and responsible production and consumption practices (characteristic of developed countries). The empirical significance of the proposed authors’ recommendations makes it possible to fully and effectively use the new opportunities provided by the AI economy to maximize the contribution of environmental taxation to environmental protection and biodiversity conservation.

The results obtained contribute to the development of the theory and practice of the environmental economy since they elaborated on the deeply rooted and poorly studied causal connection between taxation, which has been traditionally regarded as a purely economic tool, and environmental protection, which traditionally belonged to the sphere of economy. Based on the obtained results, environmental taxation should be considered a prospective and highly-effective tool of state management for the development of the environmental economy.

The authors’ results and conclusion made will benefit production and society on the whole through the support of green economic growth. Digital technologies of the AI economy will contribute to the development of the environmental economy through the improvement of environmental taxation, which, in its turn, will strengthen the protection of ecosystems and increase the results in the sphere of biodiversity preservation.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Accounting in the Russian Federation (2022). New environmental tax in 2022. available at: https://online-buhuchet.ru/novyj-ekologicheskij-nalog-v-2019-godu/ (data accessed 10 30, 2022).

Adebayo, T. S., Altuntaş, M., Goyibnazarov, S., Zawbaa, H. M., and Kamel, S. (2022). Dynamic effect of disintegrated energy consumption and economic complexity on environmental degradation in top economic complexity economies. Energy Rep. 8, 12832–12842. doi:10.1016/j.egyr.2022.09.161

Aero-Soft Information Technology Bureau (2022). Environmental payments: Payment for negative impact on the environment. available at: https://www.airsoft-bit.ru/stati-po-ekologii/188-ekologicheskie-platezhi (data accessed 05 11, 2022).

Barbanti, A., Blumenthal, J. M., Broderick, A. C., Pascual, M., Carreras, C., Turmo, M., et al. (2022). The architecture of assisted colonisation in sea turtles: Building new populations in a biodiversity crisis. Nat. Commun. 13 (1), 1580. doi:10.1038/s41467-022-29232-5

Barik, S., Saha, G. K., and Mazumdar, S. (2022). Influence of land cover features on avian community and potential conservation priority areas for biodiversity at a Ramsar site in India. Ecol. Process. 11 (1), 25. doi:10.1186/s13717-022-00369-x

Borojo, D. G., Yushi, J., and Miao, M. (2022). The effects of COVID-19 on trade, production, environmental quality and its implications for green economy. J. Econ. Stud. 49 (8), 1340–1359. doi:10.1108/JES-06-2021-0307

Chawla, S., Varghese, B. S., Chithra, A., Keçili, R., and Hussain, C. M. (2022). Environmental impacts of post-consumer plastic wastes: Treatment technologies towards eco-sustainability and circular economy. Chemosphere 308, 135867. doi:10.1016/j.chemosphere.2022.135867

Compare your country (2022). Environmentally related tax revenue in 2019. available at: https://www.compareyourcountry.org/environmental-taxes (data accessed 05 11, 2022).

Congjuan, L., Abulimiti, M., Jinglong, F., and Haifeng, W. (2022). Ecologic service, economic benefits, and sustainability of the man-made ecosystem in the taklamakan desert. Front. Environ. Sci. 10, 813932. doi:10.3389/fenvs.2022.813932

Cordova-Buiza, F., Paucar-Caceres, A., Quispe-Prieto, S. C., de León-Panduro, C. V. P., Burrowes-Cromwell, T., Valle-Paucar, J. E., et al. (2022). Strengthening collaborative food waste prevention in Peru: Towards responsible consumption and production. Sustain. Switz. 14 (3), 1050. doi:10.3390/su14031050

Ghosh, S., Balsalobre-Lorente, D., Doğan, B., Paiano, A., and Talbi, B. (2022). Modelling an empirical framework of the implications of tourism and economic complexity on environmental sustainability in G7 economies. J. Clean. Prod. 376, 134281. doi:10.1016/j.jclepro.2022.134281

Giuliani, G., Chatenoux, B., Benvenuti, A., Santoro, M., and Mazzetti, P. (2020). Monitoring land degradation at national level using satellite Earth Observation time-series data to support SDG15–exploring the potential of data cube. Big Earth Data 4 (1), 3–22. doi:10.1080/20964471.2020.1711633

Hassan, T., Khan, Y., He, C., Chen, J., Alsagr, N., Song, H., et al. (2022). Environmental regulations, political risk and consumption-based carbon emissions: Evidence from OECD economies. J. Environ. Manag. 320, 115893. doi:10.1016/j.jenvman.2022.115893

Huang, X., Chau, K. Y., Tang, Y. M., and Iqbal, W. (2022). Business ethics and irrationality in SME during COVID-19: Does it impact on sustainable business resilience? Front. Environ. Sci. 10, 870476. doi:10.3389/fenvs.2022.870476

Lei, Z., Huang, L., and Cai, Y. (2022). Can environmental tax bring strong porter effect? Evidence from Chinese listed companies. Environ. Sci. Pollut. Res. 29 (21), 32246–32260. doi:10.1007/s11356-021-17119-9

Li, H., and Zhu, D. (2021). “AI technology and tax administration: An analysis of tax services technology in China,” in Proceedings of the Conference Proceedings of the 9th International Symposium on Project Management (ISPM 2021), Beijing, China, July 2021, 1194–1199.

Liu, G., Yang, Z., Zhang, F., and Zhang, N. (2022). Environmental tax reform and environmental investment: A quasi-natural experiment based on China's environmental protection tax law. Energy Econ. 109, 106000. doi:10.1016/j.eneco.2022.106000

Lobova, S. V., Bogoviz, A. V., and Alekseev, A. N. (2022). Responsible smart agriculture and its contribution to the sustainable development of modern economic and environmental systems. Smart Innovation, Syst. Technol. 264, 287–293. doi:10.1007/978-981-16-7633-8_32

Matti, S., Nässén, J., and Larsson, J. (2022). Are fee-and-dividend sche (1mes the savior of environmental taxation? Analyses of how different revenue use alternatives affect public support for Sweden's air passenger tax. Environ. Sci. Policy 132, 181–189. doi:10.1016/j.envsci.2022.02.024

Nita, A. (2019). Empowering impact assessments knowledge and international research collaboration – A bibliometric analysis of environmental impact assessment review journal. Environ. Impact Assess. Rev. 78, 106283. doi:10.1016/j.eiar.2019.106283

Nita, A., Fineran, S., and Rozylowicz, L. (2022). Researchers’ perspective on the main strengths and weaknesses of Environmental Impact Assessment (EIA) procedures. Environ. Impact Assess. Rev. 92, 106690. doi:10.1016/j.eiar.2021.106690

Nwani, C., Alola, A. A., Omoke, C. P., Adeleye, B. N., and Bekun, F. V. (2022). Responding to the environmental effects of remittances and trade liberalization in net-importing economies: The role of renewable energy in sub-saharan Africa. Econ. Change Restruct. 55 (4), 2631–2661. doi:10.1007/s10644-022-09403-6

Pinheiro, A. B., Oliveira, M. C., and Lozano, M. B. (2022). The mirror effect: Influence of national governance on environmental disclosure in coordinated economies. J. Glob. Responsib. 13 (4), 380–395. doi:10.1108/JGR-01-2022-0009

Popkova, E. G., De Bernardi, P., Tyurina, Y. G., and Sergi, B. S. (2022). A theory of digital technology advancement to address the grand challenges of sustainable development. Technol. Soc. 68, 101831. doi:10.1016/j.techsoc.2021.101831

Popkova, E. G., Oudah, A.-M. M. Y., Ermolina, L. V., and Sergi, B. S. (2021). Financing sustainable development amid the crisis of 2020. A research note. Lect. Notes Netw. Syst. 198, 773–780. doi:10.1007/978-3-030-69415-9_88

Rani, T., Amjad, M. A., Asghar, N., and Rehman, H. U. (2022). Revisiting the environmental impact of financial development on economic growth and carbon emissions: Evidence from south asian economies. Clean. Technol. Environ. Policy 24 (9), 2957–2965. doi:10.1007/s10098-022-02360-8

Taxation in the Russian Federation (2022). Environmental tax in 2021-2022 — Terms of payment and rates. available at: https://nalog-nalog.ru/ekologicheskij_nalog/#more (data accessed 10 30, 2022).

Tu, C., Ma, H., Li, Y., You, Z., Newton, A., Luo, Y., et al. (2022). Transdisciplinary, Co-designed and adaptive management for the sustainable development of rongcheng, a coastal city in China in the context of human activities and climate change. Front. Environ. Sci. 10, 670397. doi:10.3389/fenvs.2022.670397

UNDP (2022). Sustainable development report 2021. available at: https://dashboards.sdgindex.org/ (data accessed 05 11, 2022).

Wang, Q., Wang, L., and Li, R. (2022). Does the energy transition alleviate environmental degradation? Evidence from the high income, upper and lower middle income economies. Energy Strategy Rev. 44, 100966. doi:10.1016/j.esr.2022.100966

World Bank (2022). GDP growth (annual %). available at: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?view=chart (data accessed 10 30, 2022).

World Health Organization (2022). WHO coronavirus (COVID-19) dashboard: Globally, as of 5:43pm CEST, 28 october 2022. available at: https://covid19.who.int/?gclidCj0KCQjwrIf3BRD1ARIsAMuugNsIqvkZsmIoto8RJ964Wv1YdYllaCbKloYu2Z9HLeUkZuatNROZyzgaAvEiEALw_wcB (data accessed 10 30, 2022).

Xie, P., and Jamaani, F. (2022). Does green innovation, energy productivity and environmental taxes limit carbon emissions in developed economies: Implications for sustainable development. Struct. Change Econ. Dyn. 63, 66–78. doi:10.1016/j.strueco.2022.09.002

Xu, K., Wang, X., Wang, J., Zhang, X., Fu, L., Tian, R., et al. (2022). Effectiveness of protection areas in safeguarding biodiversity and ecosystem services in Tibet Autonomous Region. Sci. Rep. 12 (1), 1161. doi:10.1038/s41598-021-03653-6

Yang, F., Choi, Y., Lee, H., and Debbarma, J. (2022). Sustainability of overlapped emission trading and command-and-control CO2 regulation for Korean coal power production: A DEA-based cost-benefit analysis. Front. Environ. Sci. 10, 877823. doi:10.3389/fenvs.2022.877823

Zackrisson, M., Bakker, A., and Hagelin, J. (2020). AI and tax administrations: A good match. Bull. Int. Tax. 74 (10), 619–625.

Keywords: environmental taxation, sustainable development, ecological economics, biodiversity conservation, SDG 15, artificial intelligence (AI)

Citation: Khoruzhy VI, Semenova GN, Bogoviz AV and Krasilnikova VG (2022) Environmental taxation: Contribution to sustainable development and AI prospects. Front. Environ. Sci. 10:953981. doi: 10.3389/fenvs.2022.953981

Received: 26 May 2022; Accepted: 04 November 2022;

Published: 18 November 2022.

Edited by:

Taqwa Hariguna, Amikom University Purwokerto, IndonesiaReviewed by:

Ivan Milenkovic, University of Novi Sad, SerbiaAidarbek T. Giyazov, Batken State University, Kyrgyzstan

Stefan Talu, Technical University of Cluj-Napoca, Romania

Benson Turyasingura, Kabale University, Uganda

Andreea Nita, University of Bucharest, Romania

Copyright © 2022 Khoruzhy, Semenova, Bogoviz and Krasilnikova. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Aleksei V. Bogoviz, YWxla3NlaS5ib2dvdml6QGdtYWlsLmNvbQ==

Valery I. Khoruzhy

Valery I. Khoruzhy Galina N. Semenova

Galina N. Semenova Aleksei V. Bogoviz

Aleksei V. Bogoviz Varvara G. Krasilnikova5

Varvara G. Krasilnikova5