95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

OPINION article

Front. Environ. Sci. , 06 September 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.952102

This article is part of the Research Topic Evolution of Environmental Economics & Management in the Age of Artificial Intelligence for Sustainable Development View all 18 articles

The purpose of the article is to study the current international experience and determine the prospects for improving the environmental management of companies in the oil and gas markets based on AI in the interests of sustainable development. Relying on variation analysis and correlation analysis methods, it has been substantiated that environmental management have significant impact on companies from the perspective of social LCA, which has an impact on the competitive ability of companies. Relying on the IPAT-method, it has been proven that technology is a key factor which determines this impact. As a result, it has been proved on the example of the case experience of the largest energy companies in Russia in 2022 that the environmental management of oil and gas companies creates advantages not only for the environment but also for financial efficiency and stability (break-even operation) of these companies (implementation of SDG 8). Using the example of the international experience of energy companies (from the UAE, Sweden, the UK, the USA and Japan), it has been proved that AI can play a much greater role in the oil and gas markets, contributing not only to ensuring a deficit-free energy economy (the implementation of SDG 7) but also to environmental protection (the implementation of SDGs 13-15). The best practices of using AI in each selected sector of the oil and gas industry were studied and a quantitative and qualitative assessment of the benefits of AI was carried out. Thirdly, the most promising use of AI in the sector of environmental management for environmental economics and management is substantiated. It is proven that the options for environmental management can be different and specific to a particular object. Thanks to the results obtained in the course of the study, a systematic view of the prospects for the sustainable development of oil and gas markets has been formed, and the importance of AI for this process has been demonstrated. The theoretical significance of the study consists in expanding the existing understanding of the use of AI in the practice of environmental management of energy companies and clarifying its contribution to the implementation of the SDGs.

The attention of the world community is currently focused on the oil and gas markets. The criteria for the sustainability of these markets are, firstly, the environmental friendliness of oil and gas. Environmental protection is a modern priority in all sectors of the economy, but it is especially important in the oil and gas industry.

This is explained by the fact that oil and gas production leads to the depletion of natural resources, therefore, it must be economical in order to preserve resources for future generations. Also, oil and natural gas extraction and transportation are associated with waste that needs to be reduced to prevent environmental disasters (for example, gas leaks and oil spills) (Popkova et al., 2021; Liu and Luo, 2022; Zhang et al., 2022).

Secondly, the balance of supply and demand in the oil and gas markets: energy scarcity. Oil and gas are critically needed for the state (for example, to maintain the stable operation of public infrastructure and public institutions), households and businesses. The sustainability of the oil and gas markets is to fully meet the demand, but this is becoming increasingly difficult every year, as the “clean” energy industry is actively developing, and the demand for oil and gas seems to be increasingly unpredictable (Popkova and Sergi, 2021; Marcon et al., 2022).

The barrier to meeting this criterion is that “clean” energy in the current technological mode is not able to constitute a robust alternative to fossil fuels. Even the world’s most environmentally friendly economies are characterized by hybrid energy systems which combine “clean” and fossil energy in varying proportions (Yang et al., 2022). The technological origins of the problem under consideration appear in the low and unstable productivity of “clean” energy, as well as in the complexity of its storage and distribution (Maka and Alabid, 2022; Qamar et al., 2022).

As commercial entities, oil and gas companies must cover their expenses, recover their investments and produce profits for shareholders and investors. In addition to this, many oil and gas companies are large employers and even city-forming enterprises. Therefore, society (especially their employees) and the state are also interested in maintaining a stable financial position (break-even operation) of energy companies (Habeşoğlu et al., 2022; Hunt et al., 2022).

Simultaneous compliance with these three criteria is a difficult task and is an urgent scientific and practical problem. This article offers a look at the problem from the positions of fuel and energy companies in the oil and gas markets. The basic idea which forms the basis of this research and ensures its contribution to literature is that the observance of criteria of sustainability of companies in the oil and gas markets is greatly determined by technology.

This idea is based on existing contemporary literature, which points out considerable contribution of the leading technologies of the AI era to the development of the energy economy (David et al., 2022; Guzović et al., 2022; Liu et al., 2022; Santillan et al., 2022). A promising technology for intelligent support of complex decision-making is artificial intelligence (AI).

Therefore, the purpose of this article is to study the current international experience and determine the prospects for improving the environmental management of companies in the oil and gas markets based on AI in the interests of sustainable development. The originality of this article is based on the scientific study of artificial intelligence as a new and promising source of stability for fuel and energy companies in the oil and gas markets.

AI in the environmental management of companies in the oil and gas markets: a literature review and gap analysis.

As a result of the structural-functional analysis of value chains in the oil and gas industry, three sectors were identified: 1) product and market supply (energy distribution, efficiency and energy supply), 2) financial management (investment, recovery and stakeholders’ profit including employment and society welfare) and 3) environmental management that makes the oil and gas business sustainable.

Due to the allocation of three designated sectors, a comprehensive understanding of the oil and gas industry has been formed, which opens up the possibility for its systematic study. In this regard, in this article, it is advisable to conduct a study in each of the identified three sectors of the oil and gas industry and reveal the features of the use of AI in various sectors.

In the existing literature, the essence of environmental management of oil and gas companies is disclosed in detail. Ibrahim et al. (2020), Margheritini et al. (2020), Wu et al. (2020), Basile et al. (2021) note in their works that the environmental management of oil and gas companies makes an important contribution to environmental protection and improvement the environmental friendliness of the energy economy. At the same time, the financial consequences of environmental management for the energy companies themselves remain poorly studied and poorly understood.

The role of AI in the oil and gas markets is also discussed in sufficient detail in the available publications. Blumenthal et al. (2020), Agbaji (2021), Desai et al. (2021), Di et al. (2021) in their works point to the significant role of AI in energy distribution and energy efficiency improvement of the economy, that is, in the implementation of SDG 7. At the same time, the role of AI in the environmental management of oil and gas companies is not defined. An assessment of the existing literature showed that, despite a significant number of publications, the problem of sustainable development of oil and gas markets has been only partially studied.

The experience and prospects of using AI in selected sectors of the oil and gas industry are poorly understood and unclear. In this regard, the prospects for the systemic (in the unity of the criteria of environmental friendliness, lack of scarcity and break-even operation) sustainable development of oil and gas markets, as well as the importance of AI to achieve it, have not been determined.

Along with the assessment of sustainable development, it is expedient to perform the life cycle assessment of technology as the factor of production of power resources in the oil and gas markets–the expert evaluation of the environmental impact. Life cycle assessment that has been performed based on existing literature, has shown the close relationship between AI and environmental management. At the first life cycle stage involved with oil and gas production, AI allows optimizing exploration and using them in the most efficient way to preserve untapped oil and gas fields for the future generations (Li et al., 2021).

At the second life cycle stage, AI helps to optimize logistics and increase safety of oil and gas transportation and storage (Ligozat et al., 2022). At the third life cycle stage, in the use of oil and gas, AI contributes to the more efficient and money-saving “smart” consumption of oil and gas resources in the energy economy (Sulistyawati et al., 2020).

Life cycle assessment has shown that there is a close relationship between environmental management of energy companies in the oil and gas markets and the role of AI. Nevertheless, given the fact that the real-life experience of energy companies is understudied, the actual closeness of this relationship is yet to be clarified and is still only potential.

The gap analysis has revealed the first gap in literature which is involved with the uncertainty of causal relationships of environmental management of companies in the oil and gas markets. Thus, despite the abundance of existing literature, it remains unclear how environmental management was implemented in the activities of energy companies. While sustainability is assessed at the general market level, the business practices of environmental responsibility are deficiently covered and are not adequately investigated.

Due to the mentioned gap, environmental management in the oil and gas markets is a “black box”, where state environmental regulations (from regulation of the volume of oil and gas production to environmental taxation of energy companies) and industry-specific environmental standards are at the entry, and the achieved level of environmental performance of markets under consideration is at the output.

The need to fill the mentioned gap is due to the fact that it is a barrier on the way to the management of environmental performance of oil and gas markets. Existing literature reveals the status quo, but prevents from changing a take on it. From the research and practice perspective, it is extremely important to study the actual practices of environmental management of energy companies, because it opens up possibilities and prospects to manage and improve the environmental performance of oil and gas markets.

The second gap in literature consists in the ambiguous role of AI in the environmental management of companies in the oil and gas markets. Thus, available literature points to the active digital modenization of the energy economy; however, it remains unclear how exactly high technologies of the AI era are used in the activities of energy companies.

The importance of filling the identified gap is attributable to the fact that it prevents from determining the degree of fulfillment of potential of using AI in the environmental management of energy companies. The existing view from the standpoint of oil and gas markets in general only shows their general level of digitalization, which is fairly high. That said, the rate of active use of AI in the environmental management of energy companies, which remains outside the existing view, can be either high or low.

Based on the existing works of Yu et al. (2020), Zhu et al. (2022), revealing the advantages of using AI for environmental management of energy companies, this article hypothesizes that this management in the oil and gas markets in the interests of sustainable development should be carried out based on AI since this will ensure simultaneous compliance with all the specified criteria.

In this regard, this article raises the research question on how the environmental management of companies in the oil and gas markets for the sustainable development should be performed. Relying on existing works by Yu et al. (2020), Zhu et al. (2022), which reveal the benefits of using AI for the environmental management of energy companies, the authors of this article put forward a hypothesis that this management in the oil and gas markets for the sustainable development must be performed through the use of AI, since this will ensure simultaneous observance of all abovementioned criteria.

The contribution of this article to literature consists in filling the two identified gaps which ensures, first, the disclosure of contents of the “black box” of environmental management of companies in the oil and gas markets. As a result, the article opens up possibilities to manage the environmental performance of oil and gas markets through the adjustment of the practices of environmental management of energy companies.

Second, the detected degree of involvement of the potential to use AI in the environmental management of companies in the oil and gas markets, as well as identifying the prospects for a more perfect fulfillment of this potential. The mentioned academic contribution is made and the identified gaps are filled in this article through a fresh approach to the oil and gas markets–from the standpoint of environmental management of energy companies, which means the study of these markets at the corporate (micro-) level.

This article uses the Impact, Population, Affluence, and Technology (IPAT) method to clarify the factors that have an impact on renewable energy sources. Reliable and authoritative official statistics from the World Bank (2022) at the global level serves as the empirical basis of the research of international practices.

In accordance with the selected method, the “I” variable in the “I=PAT” equation is reflective of the result of environmental management of companies in the oil and gas markets, whose indicator is renewable energy consumption (% of total final energy consumption), which increased from 16.86% in 2010 to 17.54% (the most up-to-date statistics) (World Bank, 2022). Hence, the Impact in recent years decreased by 4.03%.

Population, despite a significant increase in the world population in the period under consideration, demonstrated a responsibility towards the environment in terms of energy use. In this article, it is assessed in terms of fossil fuel energy consumption (% of total), which decreased from 80.8% in 2010 to 79.7% (the most up-to-date statistics) (World Bank, 2022). Hence, the Population in recent years decreased by 1.36%.

Affluence, even with intensive economic growth, also decreased due to the environmental responsibility of society and the economy. In this article, it is assessed in terms of total natural resources rents (% of GDP), which decreased from 3.7% in 2010 to 2% (the most up-to-date statistics) (World Bank, 2022). Hence, the Affluence in recent years decreased by 45.95%.

Technology gained momentum thanks to the Fourth Industrial Revolution, as a result of which the world entered the AI era in the period under consideration. In this article, it is assessed in terms of alternative and nuclear energy (% of total energy use), which increased from 8.3% in 2010 to 13.4% (the most up-to-date statistics) (World Bank, 2022). Hence, the Technology in recent years decreased by 61.45%.

Thus, technology has made the most significant contribution to the minimization of detrimental effect of the energy economy on environment over the period from 2010 to the present day. In this regard, the technological progress is a key factor in improving the efficiency of environmental management of energy companies in the oil and gas markets. Therefore, it is expedient to focus further research in this paper on the in-depth study of the selected technology factor.

Based on the results of the structural and functional analysis of value chains in the oil and gas industry conducted in this article, we will analyze the practical experience of using AI in various sectors of the oil and gas industry.

In the production and market supply sector (energy distribution, efficiency and supply), the analysis of seismic data and exploration drilling data using AI allows drilling fewer wells and doing less testing in exploration, which saves both money and time. The return on smart fields, even due to the introduction of AI, has increased by 2–10%.

Chevron has invested more than $6 billion in the i-Field “Connected fields” project and is now generating about $1 billion in additional revenue per year. Productivity of production facilities increased by 4%, and oil recovery factor by six p. p. At Gazprom Neft, the time for interpreting geological data due to the work of AI was reduced by 6 times, and the amount of useful information extracted from them increased by 30% (Vedomosti, 2022).

In the financial management sector (investment, recovery and stakeholders’ profit including employment and society welfare), the implementation of AI increases the return on investment. In this regard, C3. ai is a good example - it is an applied artificial intelligence company that has created several commercial platforms for introducing machine intelligence into business processes, including in the field of oil and gas.

The company was founded in 2009 by billionaire and tech investor Thomas Siebel, a native of Oracle. Clients (about 30 in total) include oil and gas companies such as Shell and Baker Hughes. The company’s revenue has been growing exponentially over the last 5 years: in 2017 it was estimated at $33 million, and in 2021 at $183 million. Oil and gas investors can invest in projects involving the implementation of AI in the activities of oil and gas enterprises, both through the acquisition of C3. ai shares (indirectly) and through financing the development of applied solutions for expanding the use of AI in the activities of oil and gas enterprises (BCS-express, 2021).

In the environmental management sector that makes the oil and gas business sustainable, due to the introduction of AI, Gazprom’s environmental performance has increased, which is reflected in corporate sustainability reports for 2021. In particular, a 6% reduction in waste was achieved. Due to the optimization of logistics with the help of AI, the frequency of accidents during the transportation of oil has decreased - this has ensured savings in fuel and energy resources in the implementation of energy supply programs by 24.6%.

The data presented on whether AI has been used in this oil and gas industry showed that AI provides significant benefits in all sectors of the oil and gas industry. In the first two sectors (product development and financial management), AI improves only the economic efficiency of oil and gas companies. In the third sector (environmental management), both the economic (saving of oil and gas resources) and environmental (environmental protection) efficiency of oil and gas companies are simultaneously increasing.

In this regard, the most promising and should be carried out as a matter of priority is the expansion of the use of AI in the third sector (environmental management). Therefore, in this article, it is advisable to focus on the third sector (environmental management) of the oil and gas industry as the most promising from the standpoint of environmental economics and management.

The activities of oil and gas companies in the environmental management sector can differ in terms of their site-specific operations, environmental issues, and waste generation and disposal. Options for environmental management can be different and specific to a particular facility.

AI can be useful for the environmental management of oil and gas companies, firstly, for planning oil and gas production, the most efficient use of fields and slowing down the depletion of oil and gas resources - their conservation for future generations. In this case, oil and gas fields act as an object of environmental management, and as an option for environmental management based on AI, intellectual support for planning and development of fields. The successful experience of Chevron can serve as an example.

Secondly, to reduce production waste: optimize logistics and prevent accidents (natural disasters) during the transportation of oil and gas. In this case, the object of environmental management is the transportation of oil and gas, and the environmental management option based on AI is environmentally responsible optimization of logistics. The successful experience of Gazprom can serve as an example.

In order to get the most complete, accurate and reliable picture of the global prospects of environmental management companies in the oil and gas markets based on AI in the interests of sustainable development, we will conduct an international review of the experience of the largest fuel and energy companies operating in these markets.

As a result of the systematization of international experience (based on the materials of What Next, 2022), the following areas of environmental management of companies in the oil and gas markets based on AI in the interests of sustainable development have been identified, firstly, reduction of greenhouse gas emissions and freshwater consumption (for example, Abu Dhabi National Oil Company (ADNOC), the UAE).

Secondly, prediction of production waste (for example, Swedish multinational corporation, ABB, Sweden). Thirdly, decarbonization and achieving zero carbon emissions (for example, British Petroleum, the UK). Fourthly, optimization of oil and gas production (for example, Baker Hughes, the United States) and their processing (for example, JXTG Holdings, Japan).

The international review of best practices conducted in the study allows us to propose a universal recommendation to expand the range of AI use in the oil and gas markets from the achievement of SDG seven to the implementation of environmental management–the achievement of SDGs 13–15–in the interests of sustainable development. Nevertheless, international experience does not reveal the prospect for compliance with the third (financial) criterion of stability of markets and gas with the help of AI, which requires an in-depth (case) study.

The methodology of this study is based on the application of a systematic approach. The empirical basis of the study is the materials of Global 2000 (Forbes, 2022). Further, the article presents a quantitative and qualitative study on the example of Russia, which allows us to obtain the most objective results. The top five Russian oil and gas companies in 2022 (with the industry affiliation “Energy: Oil & Gas Operations”) were selected for the study (based on the results of 2021), according to the Forbes rating (2022).

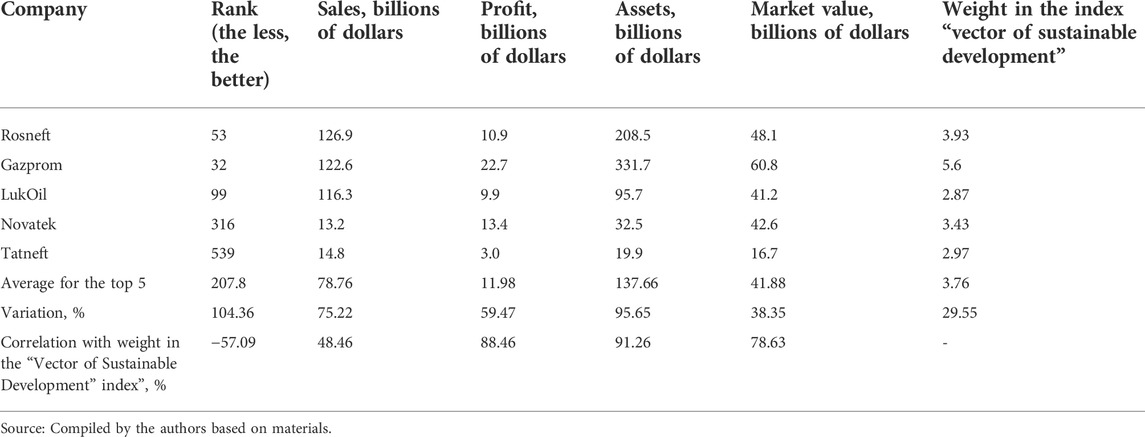

Table 1 shows their financial indicators (based on the results of 2021) from the Forbes Global-500 rating (2022), as well as their weight in the Moscow Exchange (2022) “Vector of Sustainable Development” (as of 18 May 2022).

TABLE 1. Financial indicators and weight in the index “Vector of sustainable development” of the top five Russian oil and gas companies in 2022.

The variation analysis in Table 1 has shown that the rank of TOP five Russian oil and gas companies in 2022 in the Global-500 Forbes ranking (2022) is highly differentiated (the variation is 104.36%). The market value of their assets (the variation is 95.65%), the volume of sales (the variation is 75.22%) and the amount of profit (the variation is 59.47%) vary highly as well.

This being said, the market capitalization (the variation is 38.35%) and weighting coefficient in the Index “Sustainable development vector” (the variation is 29.55%) are moderately differentiated and fairly uniform. This is indicative of potential relation between the market value of energy companies in the oil and gas markets and their environmental management. To prove the existence of this relation, we shall turn to the results of the correlation analysis.

Correlation analysis of statistics in Table 1 showed that environmental management (reflected in the index “Vector of Sustainable Development”) contributes to improving the position of companies in the global ranking (correlation -57.09%), increasing sales (48.46%), profit (88.46%), asset value (91.26%) and market share (78.63%) of oil and gas companies. As a result of studying the applied experience of oil and gas companies in Russia, it was revealed that they actively carry out AI-based environmental management in the interests of sustainable development.

Since 2020, Tatneft has been implementing a project to use AI in field development (in drilling, that is, in production management). This energy company also creates and actively uses digital twins of drilling rigs in order to minimize the environmental costs of its operation (Energy Land, 2022). Novatek uses AI to prevent accidents during oil production (drilling) and prevent environmental disasters (ComNews, 2022b).

LukOil uses AI to monitor serviceability, predict and prevent equipment breakdowns for reducing environmental costs (Perm Oil, 2022). Gazprom (2022a) applies AI in oil engineering. Rosneft uses AI for oil exploration and production, which makes it possible to ensure eco-friendly drilling and use it most effectively to preserve untouched oil fields for future generations (ComNews, 2022a).

Thus, the prospects for improving the environmental management of companies in the oil and gas markets based on AI in the interests of sustainable development are associated with its use for the systematic implementation of SDGs seven to eight and SDGs 13–15.

The article contributes to the development of the concept of environmental management of oil and gas companies, revealing the role of AI in its improvement in support of sustainable development. In contrast to the works of Ibrahim et al. (2020), Margheritini et al. (2020), Wu et al. (2020), Basile et al. (2021) the article substantiates (by the example of the case experience of the largest energy companies in Russia in 2022) that the environmental management of oil and gas companies creates advantages not only for the environment but also for the financial efficiency and stability (break-even operation) of these companies (implementation of SDG 8).

The obtained results also contradict the existing works of Blumenthal et al. (2020), Agbaji (2021), Desai et al. (2021), Di et al. (2021), as it has been proved (using the example of the international experience of energy companies from the UAE, Sweden, the UK, the United States and Japan) that AI can play an important role in the oil and gas markets, contributing not only to ensuring a deficit-free energy economy (implementation of SDG 7) but also to environmental protection (implementation of SDGs 13–15). Thanks to the results obtained in the course of the study, a systematic view of the prospects for the sustainable development of oil and gas markets has been formed, and the importance of AI for this process has been demonstrated.

Thus, the following results have been obtained in the course of research. First, the structural and functional analysis of value chains in the oil and gas industry has made it possible to distinguish between three sectors: 1) production and supply on the market (energy distribution, energy efficiency and energy supply), 2) financial management (investment, recovery of investment, and the benefit of parties concerned, including employment and welfare of the community) and 3) environmental management, which makes oil and gas business socially responsible.

Second, the advanced experience of using AI in each identified sector of oil and gas industry has been studied, and the quantitative and qualitive assessment of advantages of AI has been performed. Third, the maximum potential of using AI in the environmental management sector has been substantiated, since it ensures the growth of both economic and environmental performance at the same time, and, accordingly, is the most beneficial to environmental economics and management.

Fourth, it has been substantiated that the options of environmental management can be diverse and characteristic of a particular object. It has been shown how AI can be useful to environmental management of oil and gas companies in such an object as oil and gas fields (intelligent support of reservoir planning and development by AI based on Chevron’s experience for resource conservation), as well as in such an object as oil and gas transportation (environmentally responsible optimization of logistics using AI based on Gasprom’s experience).

So, the hypothesis put forward in the article has been confirmed and it has been revealed that management in the oil and gas markets in the interests of sustainable development should be carried out based on AI since this ensures simultaneous compliance with all the criteria for the sustainability of these markets: environmental friendliness, energy scarcity and financial efficiency of oil and gas companies. The theoretical significance of the study consists in expanding the existing understanding of the use of AI in the practice of environmental management of energy companies and clarifying its contribution to the implementation of the SDGs.

The practical significance of the article is that the progressive international experience illustrated and systematized in it can become more widespread around the world in support of the sustainable development of oil and gas markets. Management implications are related to the fact that the authors’ conclusions and recommendations make it possible to increase the efficiency of using AI in the activities of oil and gas companies and provide them with an application guide for the practical implementation of the SDGs. Social implications consist in the fact that the article has formed scientific and methodological support and revealed the applied perspective of a more complete (systemic) support of the SDGs in the oil and gas markets with the help of AI.

This article uses reliance on the experience of individual energy companies as the limitation of results obtained. This is attributable to the goal setting of this article and the intention to study the real-life experience of environmental management of companies in the oil and gas markets in the most thorough and deep way possible. Nevertheless, the focus on the case experience of Russia as an energy exporting country is the limitation of this article.

It appears that in other countries, especially in the energy importing countries, sustainability of energy companies, although being heavily dependent on of the AI era, still implies some other role of these technologies in the environmental management. While the exporting countries mainly use AI in oil and gas extraction and transportation, it is obvious that the use of AI to increase sustainability of oil and gas storage and consumption is dominant in the importing countries–it is expedient to engage in the study of relevant practices during further research following this article.

To solve the raised problem of ensuring sustainability of energy companies in the oil and gas markets, it is suggested to increase the rate of active use of AI in the environmental management. The case experience of Russia has shown that despite diversification and success rate, the practices of using AI in the environmental management are fragmented and are implemented by individual separate companies. In this regard, the solution is involved with the institutionalization of the most advanced practices.

It is recommended, first, to use AI in the exploration and development of oil and gas fields. Second, in the “smart” oil production for the lean drilling, as well as for the prevention of accidents during oil production and prevention of environmental disasters. Third, for the monitoring of working order and equipment failure prediction and prevention to reduce environmental costs in oil engineering.

The proposed recommendations ensure the consistent use of AI throughout the life cycle in the oil and gas markets and allow for the maximum possible fulfillment of the potential of AI to support sustainable development of companies in these markets.

Hence, it may be concluded that the article has filled both identified gaps in literature, having formed a new approach to the oil and gas markets–from the standpoint of environmental management of energy companies, that is, after the study of these markets at the corporate (micro-) level.

First, this article revealed the contents of the “black box” of environmental management of companies in the oil and gas markets, having demonstrated the modern real-life experience of using AI in the environmental management at each stage of life cycle in the oil and gas markets. As a result, the article has opened up possibilities to manage the environmental performance of oil and gas markets through the adjustment of the practices of environmental management of energy companies.

Second, this article has demonstrated that there is a substantial potential of using AI in the environmental management of companies in the oil and gas markets; however, the experience of Russian companies has shown that this potential has not been fully unlocked. Each company focuses on using AI at a certain life cycle stage. The prospects for the better fulfillment of this potential are involved with the consistent use of AI at all life cycle stages in the oil and gas markets.

Policy implications are involved with the need to support the institutionalization of practices of using AI in the environmental management of energy companies in the oil and gas markets. In order to have an impact on environmental management, it is expedient to promote tax and subsidiary encouragement of investments to “smart” innovations of energy companies.

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Agbaji, A. L. (2021). “Leadership and managerial decision-making in an AI-enabled oil and gas industry,” in Society of Petroleum Engineers - Abu Dhabi International Petroleum Exhibition and Conference, Abu Dhabi. ADIP 2021. doi:10.2118/207613-MS

Basile, V., Capobianco, N., and Vona, R. (2021). The usefulness of sustainable business models: Analysis from oil and gas industry. Corp. Soc. Responsib. Environ. Manag. 28 (6), 1801–1821. doi:10.1002/csr.2153

BCS-express (2021). Investments in artificial intelligence: A new tool at st. Petersburg. Available at: https://bcs-express.ru/novosti-i-analitika/2022088850-investitsii-v-iskusstvennyi-intellekt-novyi-instrument-na-spb (Accessed 07 07, 2022).

Blumenthal, R., El Naser, A., and Blug, C. (2020). “Generating green value from data: Applying AI-based analytics to monitor and manage energy usage across oil and gas operations,” in Society of Petroleum Engineers - Abu Dhabi International Petroleum Exhibition and Conference 2020, Abu Dhabi. ADIP 2020.

ComNews (2022a). Artificial intelligence helps Rosneft in drilling. Available at: https://www.comnews.ru/content/202453/2019-10-18/2019-w42/iskusstvennyy-intellekt-pomogaet-rosnefti-burenii (Accessed 05 18, 2022).

ComNews (2022b). NOVATEK reduced drilling accident rate with the help of AI. Available at: https://www.comnews.ru/content/219388/2022-03-23/2022-w12/novatek-snizil-avariynost-bureniya-pri-pomoschi-ai (Accessed: 05 18, 2022).

David, L. O., Nwulu, N. I., Aigbavboa, C. O., and Adepoju, O. O. (2022). Integrating fourth industrial revolution (4IR) technologies into the water, energy & food nexus for sustainable security: A bibliometric analysis. J. Clean. Prod. 363, 132522. doi:10.1016/j.jclepro.2022.132522

Desai, J. N., Pandian, S., and Vij, R. K. (2021). Big data analytics in upstream oil and gas industries for sustainable exploration and development: A review. Environ. Technol. Innov. 21, 101186. doi:10.1016/j.eti.2020.101186

Di, S., Cheng, S., Cao, N., Gao, C., and Miao, L. (2021). AI-based geo-engineering integration in unconventional oil and gas. J. King Saud Univ. - Sci. 33 (6), 101542. doi:10.1016/j.jksus.2021.101542

Energy Land (2022). Tatneft implements artificial intelligence in field development. Available at: http://energyland.info/news-show--neftegaz-196196 (Accessed 05 18, 2022).

Forbes (2022). Global 500 – 2021. Available at: https://www.forbes.com/lists/global2000/?sh=4e4a20275ac0 (Accessed 05 18, 2022).

Gazprom (2022a). Artificial intelligence in petroleum engineering: Opportunities and prospects. Available at: https://www.oil-industry.net/SD_Prezent/2021/04/Хасанов%20ММ.pdf (Accessed 05 18, 2022).

Guzović, Z., Duic, N., Piacentino, A., Mathiesen, B. V., and Lund, H. (2022). Recent advances in methods, policies and technologies at sustainable energy systems development. Energy 245, 123276. doi:10.1016/j.energy.2022.123276

Habeşoğlu, O., Samour, A., Tursoy, T., Abdullah, L., and Othman, M. (2022). A study of environmental degradation in Turkey and its relationship to oil prices and financial strategies: Novel findings in context of energy transition. Front. Environ. Sci. 10, 876809. doi:10.3389/fenvs.2022.876809

Hunt, J. D., Nascimento, A., Nascimento, N., Vieira, L. W., and Romero, O. J. (2022). Possible pathways for oil and gas companies in a sustainable future: From the perspective of a hydrogen economy. Renew. Sustain. Energy Rev. 160, 112291. doi:10.1016/j.rser.2022.112291

Ibrahim, Y. M., Hami, N., and Abdulameer, S. S. (2020). Assessing sustainable manufacturing practices and sustainability performance among oil and gas industry in Iraq. Int. J. Energy Econ. Policy 10 (4), 60–67. doi:10.32479/ijeep.9228

Li, H., Yu, H., Cao, N., Tian, H., and Cheng, S. (2021). Applications of artificial intelligence in oil and gas development. Arch. Comput. Methods Eng. 28, 937–949. doi:10.1007/s11831-020-09402-8

Ligozat, A.-L., Lefevre, J., Bugeau, A., and Combaz, J. (2022). Unraveling the hidden environmental impacts of AI solutions for environment life cycle assessment of AI solutions. Sustainability 14, 5172. doi:10.3390/su14095172

Liu, P., and Luo, Z. (2022). A measurement and analysis of the growth of urban green total factor productivity – based on the perspective of energy and Land elements. Front. Environ. Sci. 10, 838748. doi:10.3389/fenvs.2022.838748

Liu, Y., Li, Z., and Huang, L. (2022). The application of blockchain technology in smart sustainable energy business model. Energy Rep. 8, 7063–7070. doi:10.1016/j.egyr.2022.05.002

Maka, A. O. M., and Alabid, J. M. (2022). Solar energy technology and its roles in sustainable development. Clean. Energy 6 (3), 476–483. doi:10.1093/ce/zkac023

Marcon, L., Sotiri, K., Bleninger, T., Mannich, M., Männich, M., and Hilgert, S. (2022). Acoustic mapping of gas stored in sediments of shallow aquatic systems linked to methane production and ebullition patterns. Front. Environ. Sci. 10, 876540. doi:10.3389/fenvs.2022.876540

Margheritini, L., Colaleo, G., Contestabile, P., Simonsen, M. E., Lanfredi, C., Dell'Anno, A., et al. (2020). Development of an eco-sustainable solution for the second life of decommissioned oil and gas platforms: The mineral accretion technology. Sustain. Switz. 12 (9), 3742. doi:10.3390/su12093742

Moscow Exchange (2022). Index "vector of sustainable development": Database of values as of 05/18/2022. Available at: https://www.moex.com/ru/index/MRSV/constituents/(Accessed 05 18, 2022).

Perm oil (2022). Artificial intelligence in action – Lukoil. Available at: https://permneft-portal.ru/newspaper/articles/iskusstvennyy-intellekt-v-deystvii/(Accessed 05 18, 2022).

Popkova, E. G., Inshakova, A. O., Bogoviz, A. V., and Lobova, S. V. (2021). Energy efficiency and pollution control through ICTs for sustainable development. Front. Energy Res. 9, 735551. doi:10.3389/fenrg.2021.735551

Popkova, E. G., and Sergi, B. S. (2021). Energy efficiency in leading emerging and developed countries. Energy 221, 119730. doi:10.1016/j.energy.2020.119730

Qamar, S., Ahmad, M., Oryani, B., and Zhang, Q. (2022). Solar energy technology adoption and diffusion by micro, small, and medium enterprises: Sustainable energy for climate change mitigation. Environ. Sci. Pollut. Res. 29 (32), 49385–49403. doi:10.1007/s11356-022-19406-5

Santillan, M. R., Syn, J. W., Charani Shandiz, S., Pires de Lacerda, M., Pires de Lacerda, M., and Rismanchi, B. (2022). A technology assessment approach for achieving sustainable communities: An energy master plan for a new urban development. Appl. Sci. Switz. 12 (8), 3860. doi:10.3390/app12083860

Sulistyawati, S., Iswara, A. P., and Boedisantoso, R. (2020). Impacts assessment of crude oil exploration using life cycle assessment (LCA). IOP Conf. Ser. Earth Environ. Sci. 506, 012025. doi:10.1088/1755-1315/506/1/012025

Vedomosti (2022). Robots are here. Available at: https://www.vedomosti.ru/partner/articles/2018/11/21/786829-roboti-zdes (Accessed 0707, 2022).

What Next (2022). Artificial intelligence and oil & gas industry – partnership towards sustainable future. Available at: https://www.whatnextglobal.com/post/artificial-intelligence-and-oil-gas-industry-partnership-towards-sustainable-future (Accessed: 05 19, 2022).

World Bank (2022). Indicators: Energy & mining. Available at: https://data.worldbank.org/indicator (Accessed 0808, 2022).

Wu, L., Yang, Y., Yan, T., Zheng, L., Qian, K., Hong, F., et al. (2020). Sustainable design and optimization of co-processing of bio-oil and vacuum gas oil in an existing refinery. Renew. Sustain. Energy Rev. 130, 109952. doi:10.1016/j.rser.2020.109952

Yang, X., Guo, Y., Liu, Q., and Zhang, D. (2022). Dynamic Co-evolution analysis of low-carbon technology innovation compound system of new energy enterprise based on the perspective of sustainable development. J. Clean. Prod. 349, 131330. doi:10.1016/j.jclepro.2022.131330

Yu, K.-H., Jaimes, E., and Wang, C.-C. (2020). “Ai based energy optimization in association with class environment,” in ASME 2020 14th International Conference on Energy Sustainability, June 17–18, 2020, V001T16A004. doi:10.1115/ES2020-1696

Zhang, H., Sun, X., Ahmad, M., Lu, Y., and Xue, C. (2022). A step towards a green future: Does sustainable development policy reduce energy consumption in resource-based cities of China? Front. Environ. Sci. 10, 901721. doi:10.3389/fenvs.2022.901721

Keywords: environmental management, energy companies, oil and gas markets, AI, sustainable development, international review

Citation: Chutcheva YV, Kuprianova LM, Seregina AA and Kukushkin SN (2022) Environmental management of companies in the oil and gas markets based on AI for sustainable development: An international review. Front. Environ. Sci. 10:952102. doi: 10.3389/fenvs.2022.952102

Received: 24 May 2022; Accepted: 11 August 2022;

Published: 06 September 2022.

Edited by:

Elena G. Popkova, Moscow State Institute of International Relations, RussiaReviewed by:

Nibedita Saha, Tomas Bata University in Zlín, CzechiaCopyright © 2022 Chutcheva, Kuprianova, Seregina and Kukushkin. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yuliya V. Chutcheva, WXV2LmNodXRjaGV2YUB5YW5kZXgucnU=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.