- 1School of Social Audit, Nanjing Audit University of China, Nanjing, China

- 2School of Accounting, Nanjing Audit University of China, Nanjing, China

Directors’ and Officers’ liability insurance (abbreviated as “D&O insurance”) was born in the United States in the 1930s and has been widely used in Western countries. In contrast, China introduced D&O insurance in 2002, and its development has been relatively slow. With the revision and improvement of Chinese regulatory laws and regulations, such as the new Securities Law in March 2020, which further regulates the obligations and responsibilities of corporate management, and increases the penalties for information disclosure violations of listed companies, the risk to directors and executives performing their duties is promoted. This makes D&O insurance the focus of China’s capital market, with huge potential for future development. Therefore, it is of urgent practical importance to study the impact of director liability insurance on corporate governance in China. At the same time, D&O insurance, as an effective risk management mechanism, has not yet reached a unified conclusion in the academic circles on its corporate governance effectiveness. On the one hand, D&O insurance may encourage directors and senior executives to be proactive to enhance the company’s market value by taking risks, and on the other hand, it may induce opportunistic behavior of managers and reduce the company’s value. Under the new development form, analyzing and researching the governance effect of D&O insurance from different angles will help to provide a theoretical basis for its further development and popularization in China’s capital market. Thus, using a sample of Chinese A-share listed companies from 2011 to 2020, this study investigates the impact of D&O insurance on corporate ESG performance. The results show that D&O insurance significantly improves corporate ESG performance. Additional analysis suggests that the contribution of D&O insurance to ESG performance is achieved by improving independent director function-performing effectiveness and increasing corporate risk-taking. The findings of this paper have policy implications for a better understanding of the governance role of D&O insurance, encouraging companies to improve corporate ESG performance.

1 Introduction

Directors’ and officers’ (D&O) liability insurance is designed to protect the directors, supervisors, and senior management from personal liability that may stem from negligence or misconduct in the course of performing their regular duties (Lin et al., 2013; Aguir and Aguir 2020). D&O insurance has gained mature practice in developed countries. According to a survey by Tillinghast-Towers Perrin1, 96% of U.S. companies and 88% of Canadian companies have purchased D&O insurance. In 2002, the China Securities Regulatory Commission issued the Code of Corporate Governance, which sets forth that listed companies can purchase D&O insurance for their directors and officers to protect their assets in the event of a lawsuit. However, as of November 2021, no more than 15% of listed companies in China have purchased D&O insurance. In 2020, the Luxin coffee’s financial fraud incident broke out suddenly, and then it was revealed by investors that they had bought directors and executives with a large amount of D&O insurance. Whether the insurance can obtain claims and help investors recover losses has sparked a lot of discussions. D&O insurance has also received more attention from listed companies and academics as a result of Luxin Coffee.2 With the establishment and improvement of the legal and capital market systems, D&O insurance has gradually gained popularity among emerging countries.

At the same time, with the gradual deterioration of the ecological environment and the acceleration of the global integration process, the world has shown an unprecedentedly high concern for sustainable development. The concept of sustainable development and corporate social responsibility has gained widespread public attention and recognition. As a systematic methodology to promote enterprise sustainability, ESG is a non-financial enterprise evaluation system focusing on the environment, society, and governance. It promotes enterprises to move from the pursuit of self-interest maximization to the pursuit of social value maximization, which is both a core framework and an inherent requirement for companies to pursue green development.

Using a sample of Chinese A-share listed companies from 2011 to 2020, this study investigates the impact of D&O insurance on corporate ESG performance. From a regression analysis of the data, followed by robustness tests, we reached the following conclusions. D&O insurance significantly improves corporate ESG performance. Meanwhile, this positive relationship is affected by economic policy uncertainty and industry competition. Additional analysis suggests that the contribution of D&O insurance to ESG performance is achieved by improving independent director function-performing effectiveness and increasing corporate risk-taking.

This paper contributes to the literature in three ways. First, our study enriched the literature on the factors influencing corporate ESG performance. Previous studies mostly discuss this issue from the perspective of market, firm leadership, and ownership. Empirical studies focused on the insurance perspective are insufficient, our study takes D&O insurance as an example, which uncovers a new factor affecting corporate ESG performance and further enriches the literature on ESG performance. Second, our study provides a new perspective to study the consequences of D&O insurance. Extant literature on the governance function of D&O insurance tends to focus on the economic consequence of D&O insurance (Yuan et al., 2016; Wang et al., 2020). We, however, analyze the comprehensive governance consequences of D&O insurance from the perspective of ESG, expanding the research horizon of relevant literature. Third, our study revealed the transmission mechanisms of D&O insurance to ESG. It deepens the understanding of the relationship between D&O insurance and corporate ESG performance. Our study also provides practical guiding significance for management to improve ESG performance.

The remainder of this paper is organized as follows. The “Theoretical analysis and hypothesis developments” section develops our main hypotheses, “Literature review” combs through the related literature, the “Research Design” section refers to research design, and the “Empirical results” section presents the main empirical results and robustness tests. The “Additional analyses” section provides the intermediary mechanism tests. Finally, the “Conclusions and future perspective” section gives conclusions and policy suggestions.

2 Literature review

2.1 Theoretical hypotheses of D&O insurance

As one of the hedging tools for listed companies, D&O insurance can reduce the risk of directors, supervisors, and senior executives’ practice, but also may cause a moral hazard to directors, supervisors, and senior executives, and damage the company’s value.

Based on the external supervision hypothesis, scholars believe that director liability insurance can effectively play the role of third-party supervision of insurance companies, improve the level of corporate risk control, and thus enhance corporate performance (O’Sullivan, 2002; Yuan et al., 2016; Li and Xu, 2020). This is because insurance companies price premiums and assess risk based on a company’s past credit and behavioral performance before underwriting. In underwriting, the insurer, as a stakeholder and independent external monitor, has the incentive and ability to externally monitor the manager’s actions (Holderness, 1990), which helps to improve the level of corporate governance, reduce corporate agency costs and thus improve corporate performance (Ling, 2020). Based on the management incentive hypothesis, companies subscribe to D&O insurance initially to protect the private property of directors and officers from loss in the normal performance of their duties (Aguir and Aguir, 2020). Therefore, the subscription to D&O insurance can reduce the risk aversion and occupational risks of the insured managers (Hu and Hu, 2017), encourage the management to combine their interests with the interests of shareholders, stimulate the innovation enthusiasm of the management (Lei et al., 2020), and then enhance the creation of enterprise value. Based on the opportunistic hypothesis, some scholars pointed out that on the one hand, D&O insurance diverts the responsibility and risk of management, stimulates its opportunistic motivation to seek personal interests, and hurts corporate governance (Boyer and Stern, 2013). On the other hand, D&O insurance provides a bottom line for management’s investment and decision-making behavior, which may reduce the deterrent effect of legal proceedings, and may even further exacerbate principal-agent conflicts (Gillan and Panasian, 2015).

2.2 Economic consequences of D&O insurance

Since the corporate governance effects of D&O insurance are divergent, to further investigate which hypothesis dominates, scholars further investigate the economic consequences of D&O insurance from the perspectives of business risk, corporate value, innovation-decision, and investment financing concerning the characteristics of their respective capital markets.

In terms of operational risk, scholars have found that D&O insurance has a strong risk transfer function, which helps to alleviate the contradiction of risk aversion of managers and enhance the risk-bearing capacity of enterprises (Hu and Hu, 2017; Wen, 2017). In terms of corporate value, scholars believe that D&O insurance can help improve its profitability and market value. Zou et al. (2008) found that there is a critical value between D&O insurance and enterprise value, showing an inverted U-shaped relationship. Jia et al. (2019) found that D&O insurance can enhance firm value by reducing inefficient investments and that the nature of state ownership and increased equity concentration reduce this enhancement. In terms of enterprise innovation decision-making, D&O insurance can help improve the risk tolerance of managers, thereby promoting the level of independent innovation of enterprises. Fang and Qin (2018) empirically found that the subscription of D&O insurance by enterprises is conducive to reducing the level of concern about management decision-making risks, and positively improves enterprise innovation decision-making, and the incentive effect is less in high-tech industries, state-owned property rights, and management’s shareholding more significant in companies. Li and Xu (2020) found that D&O insurance can help improve the level of risk-taking and management efficiency and then significantly improve the innovation output and innovation efficiency of enterprises. In terms of investment and financing, Hu and Hu (2017) took Chinese listed companies as the research object and found that D&O insurance is selective in the impact of inefficient investment, over-investment behavior can be supervised, while under-investment has not been significantly Effect. From the perspective of external financing, Lin et al. (2011) discussed whether D&O insurance induces opportunistic investment by management. They found that the higher the D&O insurance premium, the more frequent but less efficient the external financing of the firm. Li (2020) found that insurance-purchasing firms were subject to stricter financing constraints compared to firms that did not purchase D&O insurance and that the positive relationship was more pronounced among firms with non-state ownership, dual employment, and lower regional marketization.

In summary, there is no unified academic conclusion on the supervisory governance effect or opportunistic effect of D&O insurance. The reasons for the discrepancy may be the following. First, the research samples are different. In developed countries, the D&O insurance started early, the coverage rate is high, and the system is more well developed. In contrast, China’s D&O insurance started late and has a low coverage rate. Therefore, differences in sample selection and period, etc., may have an impact on the results. Second, the metrics of D&O insurance are different. The China Securities Regulatory Commission (CSRC) has not yet mandated companies to disclose the premium amount of D&O insurance. Therefore, most Chinese scholars have studied whether firms purchase D&O insurance as a dummy variable. In contrast, the development of foreign mechanisms in the D&O insurance system has been more mature, scholars will also include the amount of D&O insurance premiums, and insurance ratios into the analysis, the research perspective is more diverse. Third, when analyzing the economic consequences of D&O insurance based on different research perspectives, scholars have chosen different moderating and mediating variables, which may also make a difference to the research results.

2.3 Factors influencing ESG performance

The growing focus on environmental changes, social events, and corporate responsibility has triggered a trend that a substantial body of literature developed to monitor ESG performance. By combing through the extant literature, we found most previous research on the factors influencing ESG performance has been based on the perspective of market characteristics, firm leadership characteristics, and ownership characteristics. As for market characteristics, many studies have provided evidence that a country’s economic development (Cai et al., 2016), industry (Borghesi et al., 2014), political leanings of the state’s citizens (Liang and Renneboog, 2013), the social capital of the county (Jha and Cox, 2015) affect ESG performance. Firm leadership characteristics include multinational board members (Iliev and Roth, 2020), women leaders (McGuinness et al., 2017), married CEOs (Hegde and Mishra, 2017), CEO confidence (McCarthy et al., 2017), and CEO pay (Ikram et al., 2019). Other studies argue that firms’ ESG performance is associated with the size of institutional ownership (Chen et al., 2016), family ownership (El Ghoul et al., 2016), and state ownership (Boubakri et al., 2016).

However, whether D&O insurance can effectively play a role in corporate governance to improve corporate ESG performance remains to be studied. According to existing theories, on the one hand, the supervisory and governance role of D&O insurance can urge companies to improve the quality of ESG information disclosure and facilitate stakeholders’ monitoring of corporate ESG performance. In addition, it can also motivate management to be diligent, focus on long-term development goals, improve risk-taking ability, and actively participate in green innovation activities, which can ultimately improve ESG performance. On the other hand, the “bottom line” effect of D&O insurance may also stimulate moral hazard and opportunistic behavior of directors and executives, causing managers to act to satisfy their interests at the expense of corporate sustainability, leading to a decline in corporate ESG performance. Therefore, the actual effect of D&O insurance on ESG performance is an important issue for empirical research.

3 Theoretical analysis and hypothesis developments

3.1 D&O insurance and ESG performance

ESG performance differs from traditional financial indicators in that it comprehensively considers whether an enterprise can achieve long-term sustainable development from three dimensions: environment, society, and corporate governance. Among them, E mainly emphasizes that enterprises take the initiative to protect the environment, adopt environmental protection measures and incorporate environmental protection into the company’s constitution; S requires enterprises to comply with social morality, rule of law, and ethics, assume and protect the rights and interests of various stakeholders; G represents the corporate governance system established by the company to maintain orderly operation.

In the past 2 decades, with the evolvement of sustainability reporting and integrated reporting, an increasing number of entities started to realize the importance of ESG (Camilleri, 2015). Firstly, they may be influenced by regulatory pressures and stakeholders’ expectations (Brammer et al., 2011; Golob et al., 2013). According to the stakeholder theory and legitimacy theory, companies attempt to disclose ESG performance to maintain and repair their legitimacy among stakeholders, which further helps them satisfy stakeholders’ expectations and forge strong relationships with stakeholders (De Villiers et al., 2017; Camilleri, 2018). Secondly, ESG disclosures become widely accepted across companies and are closely related to the companies’ institutional context (Adams et al., 2016; Nirino et al., 2021). On one hand, companies disclose ESG to improve their reputation and offset the threat of regulation. On the other hand, irresponsible companies will be severely punished by socio-political forces and pressure groups if they do not respect societal norms and ethical values (Elving et al., 2015; Camilleri, 2018). Thirdly, following the resource-based view (RBV), environmental and social activities can lead to the development of a competitive advantage within a company (Hull and Rothenberg, 2008; Camilleri, 2015; 2018). Hence, companies have an incentive to improve their ESG performance to access resources that affect the survival and development of the company.

Previous studies have suggested that D&O insurance can provide a “bottom line” effect for the management in terms of behavior and personal property (Wang et al., 2020). However, this “bottom line” effect may have positive or negative effects on the management of the company. Therefore, D&O insurance may also have positive or negative effects on corporate ESG performance.

In terms of positive impact, D&O insurance can encourage managers to make positive progress, forcing managers to engage in responsible conduct and improve corporate ESG performance. On one hand, D&O insurance can lower directors’ and officers’ litigation exposures, alleviate the potential risk aversion problem and increase their risk appetite, thereby stimulating them to invest more in innovation (Hu et al., 2019). Moreover, before a company subscribes to D&O insurance, the insurance company often requires the client company to appoint enough independent directors to reduce the risk (O’Sullivan 2002). The independent directors are more inclined to focus on business development and governance efficiency (Wang and Lu 2013) to prove they are diligent and responsible. Meanwhile, the independence of independent directors enables them to make independent judgments on the company’s decision-making and development strategies objectively and neutrally and to focus on long-term development rather than current interests (Wang and Chen 2018). Hence, independent directors are more likely to support green technology innovation, which has been increasingly emphasized by policymakers and academics alike as a mechanism for effectively solving environmental problems and enhancing firm sustainability (Kallio and Nordberg 2016).

On the other hand, after an enterprise subscribes to D&O insurance, the insurance company will participate in corporate governance as a third-party external supervisor, which can reduce the information asymmetry and investment concerns of external stakeholders, thus helping to improve the availability of exogenous financing. According to the “signaling” hypothesis, the fulfillment of environmental and social responsibilities will lead stakeholders to believe that the company’s performance is good enough to support its continued sustainability practices. Hence, companies tend to undertake social responsibilities to form reputation capital, which can also help the company better survive the legitimacy crisis especially when the company is affected by negative events (Dowling and Pfeffer 1975; Broadstock et al., 2021).

In contrast, the negative impact of D&O insurance is manifested in its “bottom line” effect that can induce unintended moral hazards, gradually becoming a “protective umbrella” for management’s self-interested behavior (Chung and Wynn, 2014). On one hand, the introduction of D&O insurance may reduce the diligence of management in performing their duties (Gillan and Panasian 2015; Jia and Tang 2018), leading to managerial opportunism. On the other hand, D&O insurance reduces the disciplining effect of shareholder litigation, which may lead to the waste or improper use of corporate resources and shareholders’ interests. In turn, it may hurt business management and cause firms to reduce long-term corporate value enhancement activities, which finally hurts corporate ESG performance.

Therefore, we propose two competing hypotheses for the effect of D&O insurance on corporate ESG performance.

H1a: The purchase of D&O insurance improves corporate ESG performance, other things being equal.

H1b: The purchase of D&O insurance decreases corporate ESG performance, other things being equal.

3.2 The moderating effect of economic policy uncertainty

According to the real options theory, firms exercise increasingly prudent investment behavior and tend to reduce or postpone long-term ESG investment in response to the high uncertainty of economic policies (Bloom et al., 2016). This is because improving ESG performance requires a large amount of sunk costs, while companies prefer to hold more cash or increase dividend payout during a high EPU period. At the same time, the incentive and supervisory functions of D&O insurance are largely dependent on the external environment of the company (Jia and Liang 2013; Feng et al., 2017). On one hand, the external environment may affect people psychologically and change their expectations. The theory of attribution suggests that people tend to underestimate the impact of external factors and overestimate the impact of internal or personal factors. Thus, directors and officers are more likely to be blamed for the enterprise’s distress, which rises the legitimacy risk faced by management (Lou et al., 2022). Thus, the “bottom line” effect provided by D&O insurance is diminished when EPU grows. On the other hand, EPU may reduce the observability of management’s diligence and create information asymmetries between management and the stakeholders (Boyle and Guthrie 2003), encouraging directors and officers to adopt opportunistic practices (Johnson et al., 2000; Bae et al., 2012) rather than improving corporate ESG performance. Following the empirical evidence and the above discussion, we propose the following hypothesis:

H2: Economic policy uncertainty negatively moderates the relationship between D&O insurance and corporate ESG performance.

3.3 The moderating effect of industry competition

According to strategic management theory and signaling theory, companies need to pay attention to the dynamic requirements of various stakeholders to gain a sustainable competitive advantage. The intensified competition will inevitably lead to a large number of substitutes in the market. At this time, consumers tend to choose goods produced by companies with a good reputation and excellent ESG performance (Brammer and Pavelin, 2004). Therefore, companies have the incentive to practice environmental, social, and corporate governance responsibilities to release positive signals about their operations and development to the outside. In addition, the competitive information hypothesis suggests that when the industry becomes more competitive, it provides a more transparent information environment for the management. Therefore, independent directors can perform advisory and monitoring functions at lower monitoring costs. Meanwhile, it also makes management under greater pressure for performance evaluation and is faced with a higher risk of business failure and departure. At this time, the signaling effect of the company’s subscription to D&O insurance is reduced, and the effect on ESG performance is diminished. Based on this, this paper proposes the following hypothesis:

H3: Industry competition negatively moderates the relationship between D&O insurance and corporate ESG performance.

4 Research design

4.1 Sample selection and data source

To ensure consistency and availability of research data, we based our sample selection on all firms listed on the Shanghai and Shenzhen Stock Exchanges from 2011 to 2020. At present, the China Securities Regulatory Commission (CSRC) follows the principle of voluntary disclosure to disclose information related to D&O insurance. For this reason, we manually compile information about D&O insurance (Insured) by reviewing the annual reports of listed companies and combining them with the announcements of listed companies downloaded from China Information Bank. ESG disclosure scores (ESG) are obtained from Bloomberg, economic policy uncertainty (Epu) constructed from the China Economic Policy Uncertainty Index. The rest of the data are obtained from the China Stock Market and Accounting Research (CSMAR) Database. To improve the reliability and validity of the data, the initial sample is excluded as follows: 1) Financial and insurance industry; 2) ST and *ST companies; 3) Companies with missing relevant financial data. After the above processing, we finally obtained a sample of 6,223 firm-years observations. To avoid the impact of extreme values on the accuracy of the empirical results, all continuous variables are Winsorized at the upper and lower 1% levels. The statistical analysis software is Stata 16.0.

4.2 Variable definition

4.2.1 Explained variable (ESG)

Bloomberg measures ESG performance in terms of environment (E), society (S), and governance (G) dimensions. The scale ranges from 0.1 to 100, meaning that the more data disclosed, the higher the level of disclosure, and the better the ESG performance. In addition, the Bloomberg database is weighted based on the importance of the data points and adjusted accordingly for each industry.

4.2.2 Main explanatory variable (Insured)

Overseas research on D&O insurance mostly uses the amount of D&O insurance as a proxy variable. Chinese companies are not mandated to disclose the specific amount of D&O insurance. Therefore, we draw on the studies of Lin et al. (2011) and Yuan et al. (2016) to select a binary dummy variable Insured to measure the purchase of D&O insurance. A listed company is considered to have purchased D&O insurance if the information related to the purchase of D&O insurance is disclosed in its announcement and voted by the board of directors and shareholders’ meeting, Insured = 1; conversely, Insured = 0.

4.2.3 Moderating variables

Our study draws on the Chinese economic policy uncertainty index developed and compiled by Baker et al. (2013) to measure economic policy uncertainty. However, the economic policy uncertainty data given by Baker et al. (2013) are monthly data. Following Zhang and Wang (2021), the annual data on economic policy uncertainty is obtained by arithmetically averaging the monthly data for each year and dividing it by 100.

Referring to scholars such as Peress (2010) and Sun et al. (2021), the industry Lerner index is used to measure the degree of industry competition. The industry Lerner index is obtained by using the ratio of the operating revenue of individual companies to the operating revenue of a single industry and then weighting the individual Lerner index within the industry.

It should be noted that the higher the industry Lerner Index is, the stronger the monopoly power in the industry and the less competitive the industry is.

4.2.4 Control variables

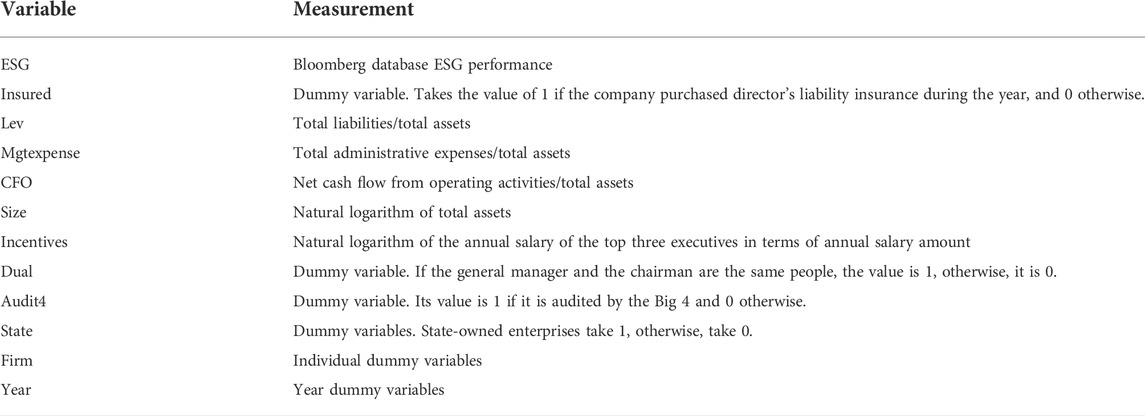

Our firm-specific control variables are defined in previous studies such as Arora and Dharwadkar (2011) and Zamir et al. (2020), to capture the effect of other factors on ESG performance. The detailed definitions of all variables used in this study are presented in Table A1.

4.3 Model design

Model Eq. 1 is used to test hypothesis H1, which examines the effect of D&O insurance on corporate ESG performance. Our study uses the firm-fixed effects model to control for unobserved time-invariant firm characteristics. We also use the heteroscedasticity-robust standard errors clustered by firms for statistical inference.

To test how economic policy uncertainty and industry competition influence the relationship between D&O insurance and corporate ESG performance, the baseline regression Eq. 1 is augmented as follows:

5 Empirical results

5.1 Descriptive statistics

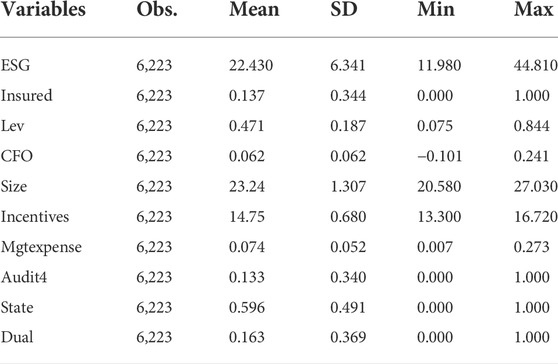

Table 1 shows the descriptive statistics results of the main variables. The mean value of ESG performance (ESG) is 22.43 and the standard deviation is 6.341, indicating that there are significant differences in ESG performance among different companies. The mean value of D&O insurance (Insured) is 0.137, which shows that only 13.7% of the enterprises in the study sample have purchased D&O insurance, reflecting that the percentage of enterprises purchasing D&O insurance among A-share listed companies in China is still low and there is a significant gap with Western countries.

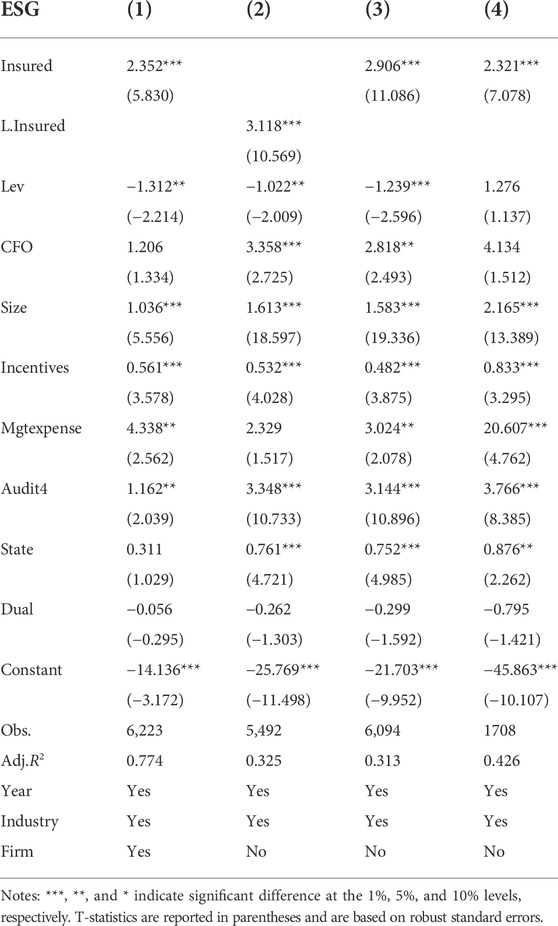

5.2 Baseline regression results

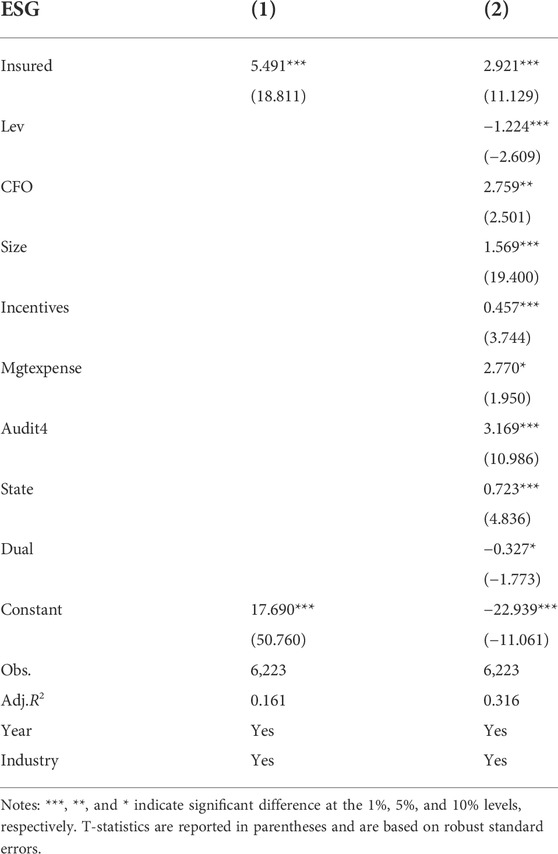

Table 2 presents the regression results for the test of H1. As shown in columns (1) and (2) of Table 2, regardless of whether control variables were included or not, D&O insurance coefficients (α1 = 5.491 and 2.921, respectively) were significantly positive at the 1% level, indicating that D&O insurance can significantly enhance corporate ESG performance. The regression results reported in columns (2) of Table 2 further confirm H1a.

5.3 Regression results for moderating effects

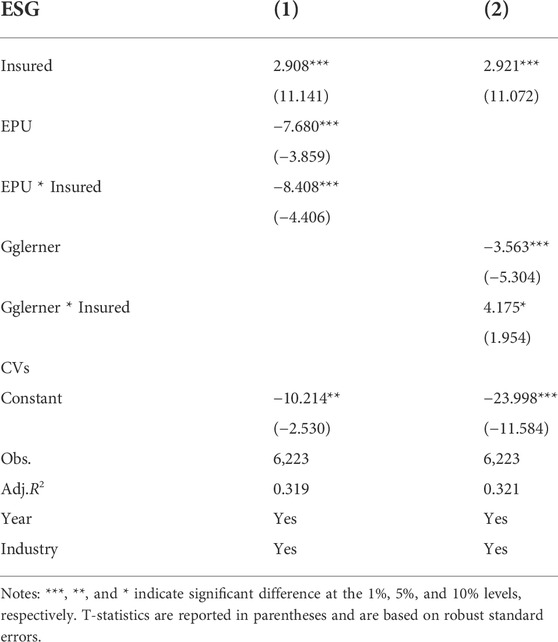

Table 3 presents the regression results for the test of the moderating effect of Economic Policy Uncertainty and Industry competition. Columns (1) to (2) are respectively based on the regression results of models Eqs 2, 3. Table 3 shows that when economic policy uncertainty (Epu) increases, the contribution of D&O insurance to corporate ESG performance is weakened, which suggests that the interaction effect of economic policy uncertainty and D&O insurance have a substitution effect on corporate ESG performance. In addition, based on the new institutional economics, it has been argued that competition can generate financial pressure on firms and management, thus forming an alternative governance mechanism (Aghion et al., 1999), Therefore, a more competitive market environment is less conducive to the role of fault-tolerant incentives. Column (2) of Table 3 shows that the higher the industry competition, the less effect introducing D&O insurance on ESG performance.

6 Robustness tests

6.1 Dealing with endogeneity

It is possible that the purchase of D&O insurance is endogenous, which is to say, both D&O insurance and corporate ESG performance are jointly determined by unobservable factors. In this section, we aim to address this type of endogeneity issue using the following approaches.

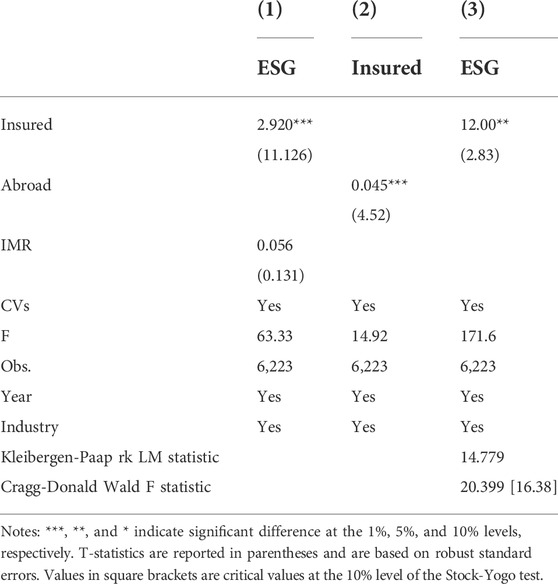

First, to mitigate the possible self-selection problem of the purchase of D&O insurance that affects the accuracy of the research results, this paper adopts Heckman’s two-stage regression. In the first stage, we consider the influence of factors such as financial status and corporate governance characteristics on the demand for D&O insurance, and build a Probit model to estimate the inverse Mills ratio (IMR) of directors’ liability insurance for listed companies; In the second stage, we add the inverse Mills ratio (IMR) of D&O insurance for listed companies estimated in the first stage to model Eq. 1. Columns (1) of Table 4 suggest that our conclusion is still robust.

Second, we applied the instrumental variable (IV) estimation method. Drawing on Yuan et al. (2016) and Gao et al. (2021), we use the overseas work background of executives (Abroad) as an instrumental variable for D&O insurance to carry out 2SLS regression. The instrument variable is measured by taking the logarithm of the number of corporate executives with overseas working backgrounds. On one hand, the coverage rate of D&O insurance in developed countries such as Europe and the United States has reached over 90%, thus executives with overseas working backgrounds have a better understanding of the mechanism of the role of directors’ liability insurance. According to the “branding theory” and “cognitive consistency theory,” the values and preferences of executives with overseas working backgrounds are influenced by western companies, and they tend to purchase D&O insurance after returning to work in China. Therefore, we expect that the higher the number of executives with overseas working backgrounds, the more likely the company is to purchase D&O insurance, which satisfies the correlation condition of an instrumental variable. On the other hand, the executive’s overseas work background can hardly have a direct impact on the corporate ESG performance, satisfying the exogenous condition of the instrumental variable. The regression results in columns (2) and (3) of Table 4 show that the regression coefficient of D&O insurance (Insured) continues to positively contribute to corporate ESG performance at the 5% significance level. Meanwhile, the F-value of the first stage regression of the instrumental variables is greater than 10, and the Wald F statistic in the second stage regression is greater than the Stock-Yogo critical value of 16.38 at the 10% level, which rejects the hypothesis of weak instrumental variables and indicates that the selected instrumental variables are valid.

6.2 Other robustness tests

First, the estimation error caused by omitted variables is further solved to a certain extent by controlling for individual effects and year effects in the baseline model.

Second, to exclude the possible existence of endogeneity problems such as reverse causality, we lag the explanatory variable (Insured) in model Eq. 1 by one period. As shown in columns (2) of Table 5, which suggests that our conclusion is still robust.

Third, to more accurately compare the impact of the introduction of D&O insurance on ESG performance, we exclude the industries that never introduced D&O insurance in recent years. The regression results are reported in column (3) of Table 5, we find that our results hold after excluding these samples.

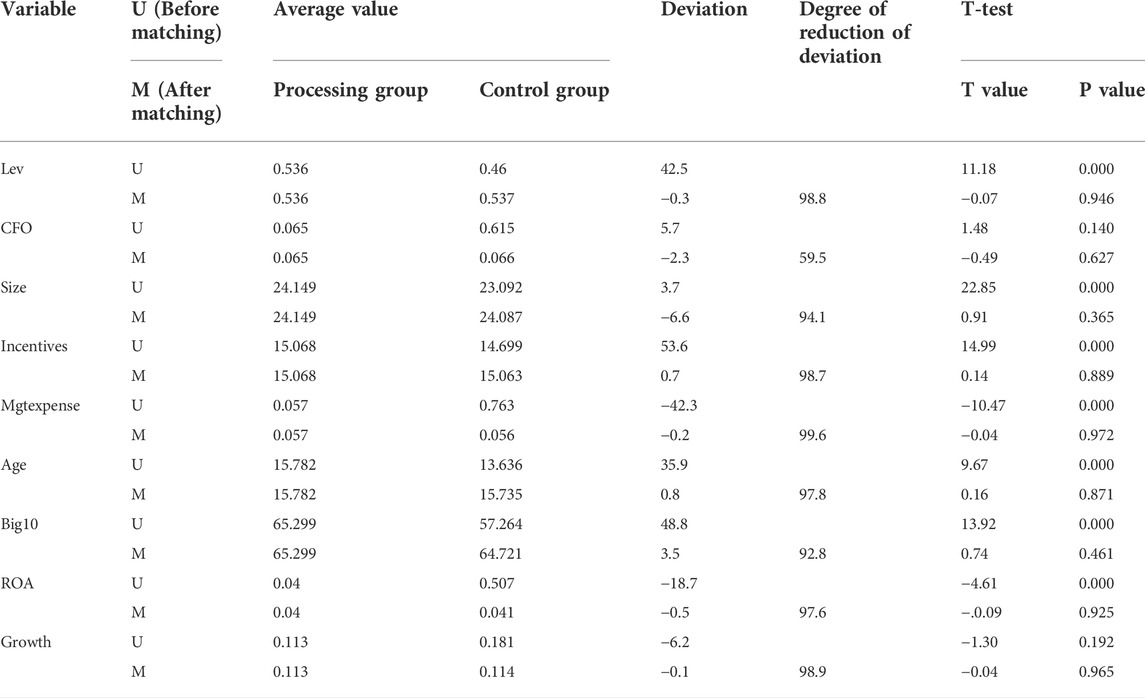

Fourth, since the introduction of D&O insurance by Chinese listed firms is still low, there may be a screening phenomenon of insured firms by insurance companies, i.e., only firms with inherently excellent financial and ESG performance can purchase D&O insurance. For this reason, we performed a propensity score-matched (PSM) estimation. To begin with, the Probit model is set up, with D&O Insurance (Insured) as the dependent variable. The independent variables include Balance Sheet Ratio, Cash Ratio, Corporate Size, Executive Incentive, Management Expense Ratio, Corporate Age, Top Ten Shareholders’ shareholding, Profitability, and Corporate Growth. The comparison of differences before and after matching variables is presented in Table A2. The estimation applies a one-to-one paring principle to the matching sample. Based on the new paired sample, column (4) of Table 5 shows similar results to our main regression, which supports that our results are not driven by self-selection.

7 Additional analyses

7.1 Mediating effect analysis

In the previous section, we provide evidence that D&O insurance plays an important role in improving corporate ESG performance, but the transmission mechanism between the two remains at the theoretical level. In this section, we construct models Eqs 4–6 to empirically test two possible mediating paths: improving independent director function-performing effectiveness (Scores) and increasing corporate risk-taking (Risk).

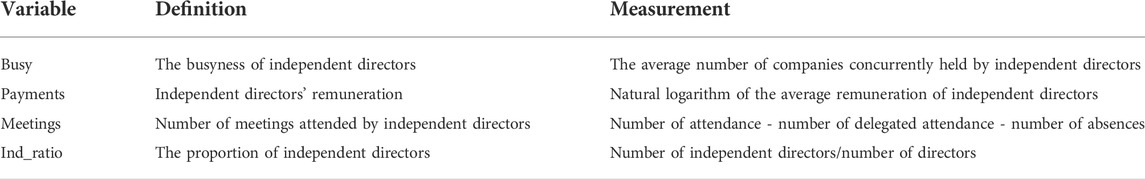

Following Jia and Tang (2018), this study selects four indicators: the busyness of independent directors, the level of independent directors’ remuneration, the number of meetings attended by independent directors, and the proportion of independent directors, using the entropy method to calculate the comprehensive score of independent directors’ performance, the specific indicators are shown in Table 6. In addition, we also use the comprehensive score of independent directors’ performance calculated by the CRITIC assignment method as a robustness test.

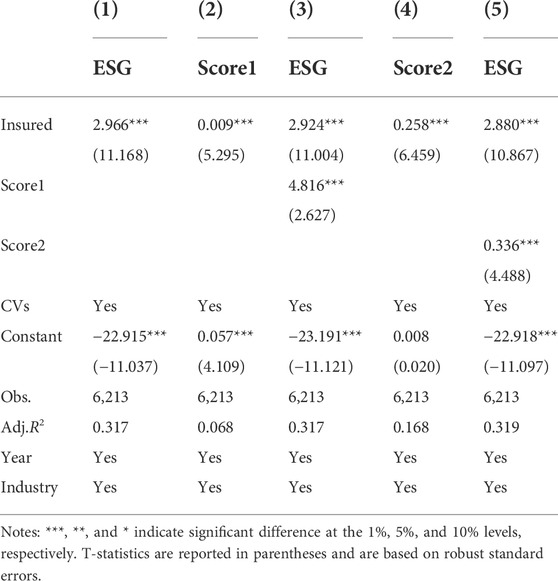

The regression results are presented in Table 7, D&O insurance improves the effectiveness of independent directors in performing their duties. When a company purchases D&O insurance, the independent directors will actively promote the effectiveness of their performance to prove they are diligent and responsible. Further, the extensive experience and social resources of independent directors can also send positive signals and alleviate information asymmetry, thus significantly improving the ESG performance of the company.

Referring to scholars such as John et al. (2008) and He et al. (2019), we use the volatility of a firm’s earnings to measure corporate risk-taking. First, as shown in model Eq. 7, we subtract the industry average from the company’s annual Roa to mitigate the effects of industry and cycles. Second, as shown in models Eqs 8, 9, we take every 5 years (t − 2 to t + 2) as an observation period and calculate the standard deviation and extreme deviation of industry-adjusted Roa (

Columns (2) and (4) of Table 8 indicate that D&O insurance increases enterprise risk-taking. Further, after adding the Risk1/Risk2 to model Eq. 4, the coefficient of Insured is increased from 2.418, when there is no mediating variable, to 2.433. It indicates that D&O insurance can lower directors’ and officers’ litigation exposures, and increase enterprise risk-taking. Meanwhile, the underwriting effect of D&O insurance can transfer the financial losses caused by the top management’s decision errors to the insurance company, thus greatly eliminating the managers’ concerns and motivating them to choose green innovation activities that are beneficial to improving corporate ESG performance.

8 Conclusion and future research directions

8.1 Conclusion

D&O insurance was introduced to the Chinese capital market in 2002, but after 2 decades of development, the current insurance coverage rate for Chinese A-share listed companies is less than 15%. In Europe and the United States and other developed capital markets, the insured rate of D&O insurance is mostly above 90%. Thus, it can be seen that D&O insurance is still in the initial stage of development in the Chinese capital market, and there is still much room for future development, and the governance effect of D&O insurance in the Chinese capital market needs to be further examined. At the same time, promoting the construction of an ecological civilization system is an important part of achieving high-quality economic development in China. As enterprises are responsible for environmental pollution and resource consumption, it is worthwhile to study how to better guide and motivate them to improve their ESG performance and achieve a win-win situation between environmental management and economic development. Therefore, this study attempts to examine the impact of corporate on ESG performance from the perspective of D&O insurance, a governance mechanism, and insurance instrument. We find that D&O insurance can improve corporate ESG performance and when economic policy uncertainty and industry competition rise, the contribution of D&O insurance to ESG performance weakens. Additional analysis suggests that this promotion is achieved by improving independent director function-performing effectiveness and increasing corporate risk-taking.

This paper argues that the above research findings have important theoretical value and policy implications. At the theoretical level, this paper examines the role of D&O insurance on corporate ESG performance and the specific impact mechanisms from a corporate governance perspective. It provides new evidence for the management incentive hypothesis and the external monitoring hypothesis of D&O insurance and further complements the research on the economic consequences and governance effects of D&O, which is also an important reference for an in-depth understanding of the governance effects of D&O insurance in emerging capital markets. Specifically, our research enriches the extant literature by taking the D&O insurance as an example to uncover a new factor affecting corporate ESG performance within a broader legitimation strategy. Further, our study analyzes the comprehensive governance consequences of D&O insurance from the perspective of ESG. Third, our study revealed the transmission mechanisms of D&O insurance to ESG. It deepens the understanding of the relationship between D&O insurance and corporate ESG performance.

The practical enlightenment offered by our study lies in the following. First, D&O insurance is an external corporate governance mechanism that can have a positive governance effect and help companies improve their ESG performance. Therefore, for the Chinese capital market, which is in a special period of emerging and transition, the legislature and regulatory authorities should guide and encourage listed companies to introduce D&O insurance governance mechanisms promptly according to their corporate governance level, risk profile, and other factors. Second, the study finds that D&O insurance can improve corporate ESG performance by enhancing management risk-taking and improving independent director function-performing effectiveness. Therefore, when companies introduce the governance mechanism of D&O insurance, they should understand the functions of D&O insurance comprehensively and correctly. To improve the incentive and restraint mechanism for the main body of officers and directors, the synergistic effect of the two can be brought into play, so that the management can better fulfill its fiduciary duties and ultimately improve the ESG performance of the enterprise. Third, insurance institutions should optimize the contract design of D&O insurance. At present, China’s D&O insurance has some overly restrictive clauses and vague judgment criteria. The development of D&O insurance in China’s capital market is relatively late, so some foreign standards are inevitably used in the process of implementation. However, there are differences in the national conditions of each country, and to further promote the development of D&O insurance in the Chinese capital market, it is necessary to set up insurance clauses by the national conditions of China.

8.2 Limitations and further research

Constrained by the availability of data and the level of research, there are some limitations in this paper. The China Securities Regulatory Commission (CSRC) has not yet made it mandatory for companies to disclose information related to D&O insurance subscriptions, and therefore detailed data on D&O insurance premiums and insurance amounts are not fully available. Therefore, we can only examine the economic impact of D&O insurance in the form of dummy variables, which can be improved in subsequent studies as corporate information disclosure becomes more transparent and specific. In addition, the governance functions, pathways, and interactions with other mechanisms of D&O insurance can be further studied to maximize its positive governance functions.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

Conceptualization: JZ and HX. Methodology: JZ. Writing-original draft preparation: JZ. Writing-review and editing: JZ and HX. All authors have read and approved the final manuscript.

Funding

This research was funded by the Priority Academic Program Development of Jiangsu Higher Education Institutions (PAPD), and the “Youth and Blue Project” of Jiangsu university.

Acknowledgments

The authors express gratitude to all those who helped us during the writing of the paper and acknowledge the advice of the anonymous reviewers to improve the quality of this study. We have submitted our manuscript to a preprint server before submitting it to Frontiers in Environmental Science. The DOI is: 10.21203/rs.3.rs-1641589/v1.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Towers Perrin is one of the world's largest global management and human resource consulting firms. Tillinghast—provides business management and actuarial consulting services to the insurance and financial industries, as well as risk management consulting services to a variety of public and private institutions.

2In April 2020, the fraud incident of Luxin Coffee suddenly broke out. Subsequently, investors discovered that Luxin Coffee had previously purchased D&O insurance with a large insured amount. Whether Luxin Coffee could get claims from the insurance company to help the majority of investors to recover part of the loss has become a hot topic of discussion for a while.

References

Adams, C. A., Potter, B., Singh, P. J., and York, J. (2016). Exploring the implications of integrated reporting for social investment (disclosures). Br. Account. Rev. 48 (3), 283–296. doi:10.1016/j.bar.2016.05.002

Aghion, P., Dewatripont, M., and Rey, P. (1999). Competition, financial discipline and growth. Rev. Econ. Stud. 66 (4), 825–852. doi:10.1111/1467-937x.00110

Aguir, I., and Aguir, W. (2020). Director and officer liability protection and firm value: Unintended consequences. Finance Res. Lett. 32, 101177. doi:10.1016/j.frl.2019.04.033

Arora, P., and Dharwadkar, R. (2011). Corporate governance and corporate social responsibility (CSR): The moderating roles of attainment discrepancy and organization slack. Corp. Gov. An Int. Rev. 19 (2), 136–152. doi:10.1111/j.1467-8683.2010.00843.x

Bae, K.-H., Baek, J.-S., Kang, J.-K., and Liu, W.-L. (2012). Do controlling shareholders' expropriation incentives imply a link between corporate governance and firm value? Theory and evidence. J. Financial Econ. 105 (2), 412–435. doi:10.1016/j.jfineco.2012.02.007

Baker, S. R., Bloom, N., and Davis, S. J. (2013). Measuring Economic Policy Uncertainty. SSRN Electronic Journal. doi:10.2139/ssrn.2198490

Bloom, N., Draca, M., and Van Reenen, J. (2016). Trade induced technical change? The impact of Chinese imports on innovation, IT and productivity. Rev. Econ. Stud. 83 (1), 87–117. doi:10.1093/restud/rdv039

Borghesi, R., Houston, J. F., and Naranjo, A. (2014). Corporate socially responsible investments: CEO altruism, reputation, and shareholder interests. J. Corp. Finance. 26, 164–181. doi:10.1016/j.jcorpfin.2014.03.008

Boubakri, N., Guedhami, O., Kwok, C. C. Y., and Wang, H. (2016). Is privatization a socially responsible reform? SSRN J. doi:10.2139/ssrn.2735619

Boyer, M. M., and Stern, L. H. (2013). D&O insurance and IPO performance: What can we learn from insurers? SSRN J. doi:10.2139/ssrn.2351375

Boyle, G. W., and Guthrie, G. A. (2003). Investment, uncertainty, and liquidity. J. Finance. 58 (5), 2143–2166. doi:10.1111/1540-6261.00600

Brammer, S., Jackson, G., and Matten, D. (2011). Corporate social responsibility and institutional theory: New perspectives on private governance. Socio-Economic Rev. 10 (1), 3–28. doi:10.1093/ser/mwr030

Brammer, S., and Pavelin, S. (2004). Building a good reputation. Eur. Manag. J. 22 (6), 704–713. doi:10.1016/j.emj.2004.09.033

Broadstock, D. C., Chan, K., Cheng, L. T. W., and Wang, X. (2021). The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Financ. Res. Lett. 38, 101716. doi:10.1016/j.frl.2020.101716

Cai, Y., Pan, C. H., and Statman, M. (2016). Why do countries matter so much in corporate social performance? J. Corp. Finance. 41, 591–609. doi:10.1016/j.jcorpfin.2016.09.004

Camilleri, M. A. (2015). Environmental, social and governance disclosures in Europe. Sustain. Account. Manag. Policy J. 6 (2), 224–242. doi:10.1108/sampj-10-2014-0065

Camilleri, M. A. (2018). Theoretical insights on integrated reporting. Corp. Commun. An Int. J. 23 (4), 567–581. doi:10.1108/ccij-01-2018-0016

Chen, T., Dong, H., and Lin, C. (2016). Institutional shareholders and corporate social responsibility: Evidence from two quasi-natural experiments. SSRN J. doi:10.2139/ssrn.2924752

Chung, H. H., and Wynn, P. J. (2014). Corporate governance, directors' and officers' insurance premiums, and audit fees. Manag. Auditing J. 29 (2), 173–195. doi:10.1108/maj-04-2013-0856

De Villiers, C., Venter, E. R., and Hsiao, P.-C. K. (2017). Integrated reporting: Background, measurement issues, approaches and an agenda for future research. Acc. Finance. 57 (4), 937–959. doi:10.1111/acfi.12246

Dowling, J., and Pfeffer, J. (1975). Organizational legitimacy: Social values and organizational behavior. Pac. Sociol. Rev. 18 (1), 122–136. doi:10.2307/1388226

El Ghoul, S., Guedhami, O., Wang, H., and Kwok, C. C. Y. (2016). Family control and corporate social responsibility. J. Bank. Finance. 73, 131–146. doi:10.1016/j.jbankfin.2016.08.008

Elving, W. J. L., Wim, J. L., Elving, D. U. G. D. D., Golob, U., Podnar, K., Ellerup - Nielsen, A., et al. (2015). The bad, the ugly and the good: New challenges for CSR communication. Corp. Comm. An Int. Jnl. 20 (2), 118–127. doi:10.1108/ccij-02-2015-0006

Fang, J., and Qin, X. (2018). The relief of executive professional risk and improvement of innovation decision—based on the evidence of D&O insurance. Insur. Stud. (11), 54–70. doi:10.13497/j.cnki.is.2018.11.005

Feng, L., Kong, X., and Cao, H. (2017). Directors' and officers' liability insurance and the cost of capital———empirical evidence from channels of information quality. Account. Res. (11), 65–71+97.

Gao, T., Zhang, Y., and Xu, H. (2021). D&O insurance and the quality of internal control of enterprises——based on empirical evidence of A-share listed companies. J. Financial Res. (05), 33–48. doi:10.13490/j.cnki.frr.2021.05.003

Gillan, S. L., and Panasian, C. A. (2015). On lawsuits, corporate governance, and directors' and officers' liability insurance. J. Risk Insur. 82 (4), 793–822. doi:10.1111/jori.12043

Golob, U., Golob, U., Podnar, K., Elving, W. J., Ellerup Nielsen, A., Thomsen, C., et al. (2013). CSR communication: Quo vadis? Corp. Commun. An Int. J. 18 (2), 176–192. doi:10.1108/13563281311319472

Hegde, S. P., and Mishra, D. R. (2017). Marriage and CEO’s concern for corporate social responsibility.. SSRN Electronic Journal. doi:10.2139/ssrn.3055306

He, Y., Yu, W., and Yang, J. (2019). CEOs with rich career experience, corporate risk-taking, and the value of enterprises. China Ind. Econ. (09), 155–173. doi:10.19581/j.cnki.ciejournal.2019.09.009

Holderness, C. G. (1990). Liability insurers as corporate monitors. Int. Rev. Law Econ. 10 (2), 115–129. doi:10.1016/0144-8188(90)90018-o

Hu, G., and Hu, J. (2017). Director liability insurance and corporate risk taking: Theoretical approach and empirical evidence. Account. Res. (05), 40–46+96.

Hu, G., Zhao, Y., and Hu, J. (2019). Directors' and officers' liability insurance, risk tolerance, and enterprise independent innovation. Manag. World. (8), 121–135. doi:10.19744/j.cnki.11-1235/f.2019.0110

Hull, C. E., and Rothenberg, S. (2008). Firm performance: The interactions of corporate social performance with innovation and industry differentiation. Strateg. Manag. J. 29 (7), 781–789. doi:10.1002/smj.675

Ikram, A., Li, Z., and Minor, D. (2019). CSR-contingent executive compensation contracts. J. Bank. Finance., 105655. doi:10.1016/j.jbankfin.2019.105655

Iliev, P., and Roth, L. (2020). Do directors drive corporate sustainability? SSRN J. doi:10.2139/ssrn.3575501

Jha, A., and Cox, J. (2015). Corporate social responsibility and social capital. J. Bank. Finance. 60, 252–270. doi:10.1016/j.jbankfin.2015.08.003

Jia, N., and Liang, C. (2013). Directors’and Officers’Liability insurance, institutional environment and corporate governance-based on the earnings management of publicly listed companies in China. Insur. Stud. (07), 57–67. doi:10.13497/j.cnki.is.2013.07.006

Jia, N., Mao, X., and Yuan, R. (2019). Political connections and directors’ and officers’ liability insurance ‐ Evidence from China. J. Corp. Finance 58, 353–372. doi:10.1016/j.jcorpfin.2019.06.001

Jia, N., and Tang, X. (2018). Directors’ and officers’ liability insurance, independent director behavior, and governance effect. J. Risk Insur. 85 (4), 1013–1054. doi:10.1111/jori.12193

John, K., Litov, L., and Yeung, B. (2008). Corporate governance and risk-taking. J. Finance. 63 (4), 1679–1728. doi:10.1111/j.1540-6261.2008.01372.x

Johnson, S., Boone, P., Breach, A., and Friedman, E. (2000). Corporate governance in the Asian financial crisis. J. Financial Econ. 58 (1-2), 141–186. doi:10.1016/s0304-405x(00)00069-6

Kallio, T. J., and Nordberg, P. (2016). The evolution of organizations and natural environment discourse. Organ. Environ. 19 (4), 439–457. doi:10.1177/1086026606294955

Lei, X., Tang, X., and Jiang, X. (2020). Can directors' and officers' liability insurance suppress corporate violations? Res. Econ. Manag. 41 (02), 127–144. doi:10.13502/j.cnki.issn1000-7636.2020.02.009

Li, C. (2020). Directors and Officers liability insurance and financing constraints: Empirical evidence based on innovative insurance products. J. Chongqing Univ. Sci. Ed. 26 (05), 83–101.

Li, C., and Xu, R. (2020). Does D&O insurance deter corporate fraud? A study from the perspective of insurance institutions' governance. J. Financial Econ. (06), 188–206.

Liang, H., and Renneboog, L. (2013). The foundations of corporate social responsibility. SSRN J. doi:10.2139/ssrn.2360633

Lin, C., Officer, M. S., Wang, R., and Zou, H. (2013). Directors' and officers' liability insurance and loan spreads. J. Financial Econ. 110 (1), 37–60. doi:10.1016/j.jfineco.2013.04.005

Lin, C., Officer, M. S., and Zou, H. (2011). Directors' and officers' liability insurance and acquisition outcomes. J. Financial Econ. 102 (3), 507–525. doi:10.1016/j.jfineco.2011.08.004

Ling, S. (2020). Directors’ ’and officers’ ’liability insurance and audit fees increase: Supervision, ,incentives or indulgence? An empirical study based on the data of Chinese A-share. J. Audit Econ. 35 (01), 51–60. doi:10.3969/j.issn.1004-4833.2020.01.015

Lou, Z., Chen, S., Yin, W., Zhang, C., and Yu, X. (2022). Economic policy uncertainty and firm innovation: Evidence from a risk-taking perspective. Int. Rev. Econ. Finance. 77, 78–96. doi:10.1016/j.iref.2021.09.014

McCarthy, S., Oliver, B., and Song, S. (2017). Corporate social responsibility and CEO confidence. J. Bank. Finance. 75, 280–291. doi:10.1016/j.jbankfin.2016.11.024

McGuinness, P. B., Vieito, J. P., and Wang, M. (2017). The role of board gender and foreign ownership in the CSR performance of Chinese listed firms. J. Corp. Finance. 42, 75–99. doi:10.1016/j.jcorpfin.2016.11.001

Nirino, N., Santoro, G., Miglietta, N., and Quaglia, R. (2021). Corporate controversies and company's financial performance: Exploring the moderating role of ESG practices. Technol. Forecast. Soc. Change. 162, 120341. doi:10.1016/j.techfore.2020.120341

O’Sullivan, N. (2002). The demand for directors’ and officers’ insurance by large UK companies. Eur. Manag. J. 20 (5), 574–583. doi:10.1016/s0263-2373(02)00096-8

Peress, J. (2010). Product market competition, insider trading, and stock market efficiency. J. Finance. 65 (1), 1–43. doi:10.1111/j.1540-6261.2009.01522.x

Sun, C., Wang, H., and Wang, P. (2021). Influence of corporate core competence on supply chain finance: Financial support or occupation? China Soft Sci. (06), 120–134.

Wang, F., and Chen, F. (2018). Board governance, environmental regulation, and green technology innovation———empirical test based on listed companies in China’s heavy polluting industry. Stud. Sci. Sci. 36 (02), 361–369. doi:10.16192/j.cnki.1003-2053.2018.02.019

Wang, J., and Lu, X. (2013). Directors reputation, busy boards, and the quality of information disclosure. J. Audit Econ. 28 (04), 67–74.

Wang, J., Zhang, J., Huang, H., and Zhang, F. (2020). Directors’ and officers’ liability insurance and firm innovation. Econ. Model. 89, 414–426. doi:10.1016/j.econmod.2019.11.011

Wen, W. (2017). Directors and officers liability insurance and enterprise risk-bearing. J. Shanxi Univ. Finance Econ. 39 (08), 101–112. doi:10.13781/j.cnki.1007-9556.2017.08.008

Yuan, R., Sun, J., and Cao, F. (2016). Directors' and officers' liability insurance and stock price crash risk. J. Corp. Finance. 37, 173–192. doi:10.1016/j.jcorpfin.2015.12.015

Zamir, F., Shailer, G., and Saeed, A. (2020). Do corporate social responsibility disclosures influence investment efficiency in the emerging markets of Asia? Int. J. Manag. Finance. 18 (1), 28–48. doi:10.1108/ijmf-02-2020-0084

Zhang, S., and Wang, X. (2021). Directors’ and officer’ liability insurance and accounting information quality——the moderating role of economic policy uncertainty. Insur. Stud. (05), 33–49. doi:10.13497/j.cnki.is.2021.05.003

Zou, H., Wong, S., Shum, C., Xiong, J., and Yan, J. (2008). Controlling-minority shareholder incentive conflicts and directors’ and officers’ liability insurance: Evidence from China. J. Bank. Finance. 32 (12), 2636–2645. doi:10.1016/j.jbankfin.2008.05.015

Appendix

Keywords: directors’ and officers’ liability insurance, ESG, independent director function-performing effectiveness, corporate risk-taking, economic policy uncertainty, industry competition

Citation: Xu H and Zhao J (2022) Can directors’ and officers’ liability insurance improve corporate ESG performance?. Front. Environ. Sci. 10:949982. doi: 10.3389/fenvs.2022.949982

Received: 22 May 2022; Accepted: 14 July 2022;

Published: 11 August 2022.

Edited by:

Haiyue Liu, Sichuan University, ChinaReviewed by:

Mark Anthony Camilleri, University of Malta, MaltaMagdalena Ziolo, University of Szczecin, Poland

Copyright © 2022 Xu and Zhao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jing Zhao, NzM5MTA2NzEzQHFxLmNvbQ==

Hanyou Xu

Hanyou Xu Jing Zhao

Jing Zhao