- 1Business School, Jiangsu Open University, Nanjing, China

- 2School of Economics and Management, Chuzhou University, Chuzhou, China

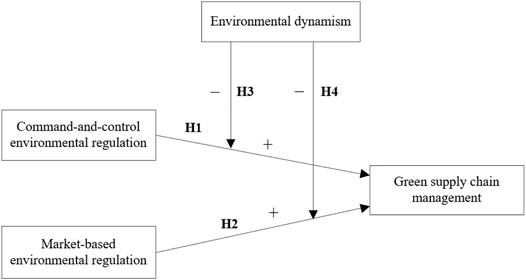

Environmental pollution, resource waste, and ecological imbalance have raised global concerns. Against this backdrop, green supply chain management (GSCM) becomes the focus of corporate sustainable development. Based on the institutional theory, thus study explores the influence of command-and-control environmental regulation (CCER) and market-based environmental regulation (MBER) over GSCM, as well as the regulating effect of environmental dynamism on the influence. A total of 191 valid responses were obtained through a questionnaire survey. The analysis of these responses shows that: CCER and MBER positive affect GSCM; environmental dynamism negatively regulates the correlations of CCER and MBER with GSCM. Based on these findings, theoretical guides and managerial implications were obtained for corporate GSCM.

1 Introduction

With the depletion of natural resources and the rise of environmental problems, environmental protection has been regarded by many countries as a necessary step in economic development. Through effective green supply chain management (GSCM), enterprises can obtain economic benefits, gain more competitive advantages, and realize the sustainable development of social economy (Bhatia and Gangwani, 2021). The theoretical and practical research on GSCM is in progress, and complete theories or sound management systems are constantly being established. As a novel management mode of supply chains, GSCM emphasizes on the integration of environmental factors into different processes of supply chain management (Srivastava, 2007), and highlights the overall “greening” of the supply chain by various stakeholders (e.g., producers, suppliers, logistics operators, purchasers, users, and recyclers), aiming to realize economic, social, and environmental benefits (Beamon, 1999).

Many environmental regulation (ER) measures have been rolled out around the world, including administrative regulations, penalties against pollution, and pollution charges. These measures promote the GSCM among enterprises to a certain extent (Tseng et al., 2019), but fall short of the expected effect (Wang et al., 2019). Therefore, it is urgent to explore the mechanism of ER acting on GSCM.

The academia holds three different views on the relationship between ER and GSCM. Firstly, ER would promote corporate green development, and thus enhance corporate GSCM. Under a strict ER, the enterprises would actively pursue green development, and benefit from the development mode. In this way, the cost of GSCM among enterprises would fall (Abrell and Rausch, 2017). Secondly, ER does not significantly promote GSCM. Mandatory ER may change the original technical path of enterprises, bringing extra costs that affect GSCM (Rubashkina et al., 2015). Thirdly, the relationship between ER and GSCM is uncertain, and should be judged by external environmental factors (Abdel-Baset et al., 2019). This study introduces environmental dynamism as external environmental factors. The reason is that when enterprises conduct GSCM, they are often faced with the external environment that is constantly changing. Whether the enterprise can adapt to the complex and changeable external environment has a pivotal impact on GSCM (Zhang et al., 2021).

Therefore, this study will explore the influence of ER on GSCM, and examine the effect of environmental dynamism on the relationship between ER and GSCM. Based on the research results, some suggestions were presented for implementing corporate GSCM.

2 Theoretical Analysis and Research Hypotheses

The institutional theory explains how ER affects corporate behavior (Zucker, 1987). ER provides enterprises with regular expectations and rules. To acquire the necessary resources, enterprises must operate according to these expectations and rules (Meyer and Rowan, 1977). During the implementation of GSCM, enterprises will consider the expectations and rules in ER, evaluate the potential costs and benefits, and adjust the practice to increase their legitimacy. When they comply with ER, enterprises mainly face environmental pressures from the government and the market (Yang et al., 2019). Driven by command-and-control environmental regulation (CCER) and market-based environmental regulation (MBER), enterprises will pursue the legitimacy in terms of both government and market, and implement GSCM more vigorously.

2.1 Environmental Regulation and Green Supply Chain Management

ER mainly manifests as CCER and MBER, both of which affect corporate GSCM (Dechezleprêtre and Sato, 2020).

CCER, which is highly mandatory and certain, can affect corporate GSCM. Normally, the goal setting, as well as policy design, execution, and supervision of CCER need to be confirmed by laws, and intervened by government departments. If the GSCM of an enterprise fails to reach the environmental standard required by the policy, ER departments can directly impose fines, production restriction, and temporary production ban on the enterprise, or order the enterprise to exit the market (Du et al., 2021). Thus, CCER compresses the degree of freedom of the enterprise, and increases the certainty of GSCM. In addition, CCER is suitable for solving some serious and sudden environmental problems. When urgent problems arise in supply chain management, direct and forceful policies are needed. There is no time for the regulator to indirectly control corporate GSCM by market means like taxation, and pollution right transaction. In this case, CCER policy is the primary and even only choice. With forceful administrative orders, the ER department can quickly improve corporate GSCM. Therefore, the following hypothesis was presented:

H1. CCER Positively Affects GSCM

MBER also affects corporate GSCM. Rather than clarify specific environmental standards, MBER changes corporate GSCM via the market incentive mechanism. MBER can be implemented at a low cost. The ER department would set the tax rate as the marginal cost of pollution, thereby improving corporate GSCM at a low cost (Li and Du, 2021). Besides, MBER allows enterprises to operate flexibly with a high degree of freedom, and to strike a balance between emission reduction and development. Polluters vary in the ability to reduce emissions. Therefore, different polluters choose to emit different amounts of pollutants. On cost payment, MBER policies require polluters to pay a fee proportional to the amount of pollution. Thus, enterprises have a large room of discretion, and implement GSCM flexibly (Pang et al., 2019). Finally, MBER is usually continuous, and not easily changed when local governors are replaced (Jiang et al., 2020). The continuity allows enterprises to optimize GSCM robustly. Therefore, the following hypothesis was presented:

H2. MBER Positively Affects GSCM

2.2 Regulatory Role of Environmental Dynamism

The external environment is the condition for enterprises to survive and development. It influences the corporate strategies or business decisions. For enterprises, environmental dynamism often stems from changes in customers, competitors, and the market. The unpredictability and instability of environmental dynamism hinder the corporate acquisition, integration, and use of resources (Li and Zhu, 2020), and thereby affect the relationship between ER and corporate GSCM.

Meanwhile, environmental dynamism changes the external environment of enterprises. Then, CCER like environmental standards cannot adapt to the changing environment, or match the stakeholders of the green supply chain, such as producers, suppliers, logistics operators, purchasers, users, and recyclers. As a result, CCER has a weaker influence on GSCM (Iraldo et al., 2011). Therefore, the following hypothesis was presented:

H3. Environmental Dynamism Negatively Regulates the Relationship Between CCER and GSCM

Due to environmental dynamism, the existing knowledge, production technology, and products in corporate GSCM face the risk of being eliminated, making it hard for enterprises to adapt to MBER. Besides, when the external environment changes, the market incentive mechanism can no longer act well on corporate behavior, and thus impede corporate GSCM (Sarkis et al., 2011). In addition, environmental dynamism will affect the stability of the supply chain itself, making it impossible for enterprises to communicate effectively with market players upstream and downstream of the supply chain, thus affecting the implementation of GSCM. Therefore, the following hypothesis was presented:

H4. Environmental Dynamism Negatively Regulates the Relationship Between MBER and GSCM

To sum up, the theoretical model of this study is shown in Figure 1.

3 Methodology

3.1 Data Collection

3.1.1 Sample Selection

The survey objects were selected by the following criteria:

1) The diversity of industries

Multiple industries related to GSCM were selected, including the mechanical industry, electronics industry and energy industry, etc. To obtain valid responses, the questionnaire was distributed among middle and senior managers in enterprises, who have been working in their enterprises for more than 2 years, and know a lot about their enterprises and industries.

2) The diversity of age, size, and ownership of enterprises

This study mainly explores the relationship between ER and GSCM. Therefore, samples of different ages, sizes, and ownerships were selected.

3.1.2 Questionnaire Distribution and Recovery

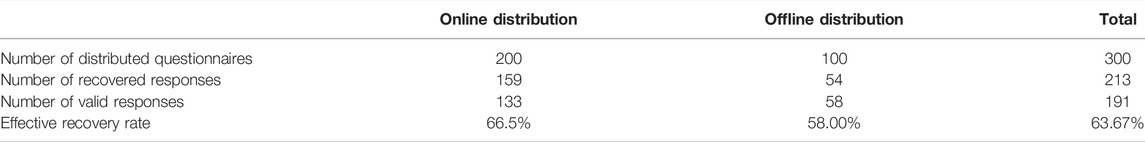

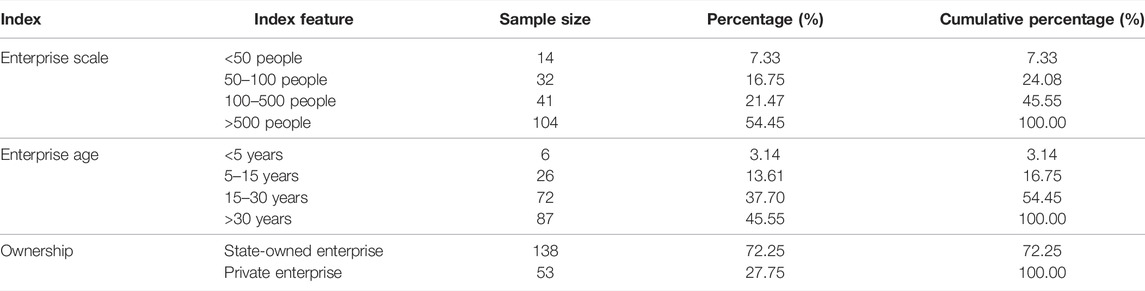

The questionnaires were distributed both offline and online from January to March, 2022. A total of 300 questionnaires were distributed, and 213 responses were collected. The recovery rate was 71.00%. Among the questionnaires, 191 were responded validly, putting the effective recovery rate at 63.67%. The recovery means and statistics on the recovered samples are given in Table 1.

3.2 Variable Measurement

The independent variables are CCER and MBER. The CCER was measured by the following indices in the locality of the enterprise: proportion of environmental penalty cases in population, proportion of environmental pollution in GDP, execution rate of environmental risk assessment, and proportion of environmental personnel in population. The MBER was measured by the following indices in the locality of the enterprise: proportion of pollution charge in gross domestic product (GDP), proportion of vehicle and vessel tax in GDP, and proportion of resource tax in GDP (Du et al., 2021). Then, each index was normalized by the range method, and averaged for further calculation.

The dependent variable is GSCM, which was rated against Zhu and Sarkis (2004) 7-point Likert scale, involving 19 items. The regulatory variable is environmental dynamism. Drawing on Shen (2010) measuring method for environmental dynamism, the sales income of the enterprise in the t-1-th year, t-2-th year, t-3-th year, and t-4-th year were taken as the dependent variables, and 5, 4, 3, 2, and 1 were taken as independent variables for regression. Then, the standard deviation of the regression coefficients was divided by the mean sales income of the enterprise in the recent 5 years, yielding the value of environmental dynamism.

Among the enterprises conducting GSCM, the differences in scale, age, and ownership of enterprises are relatively large, which may affect the research conclusions, so they are selected as control variables. The enterprise size was measured by the log of the number of employees; the enterprise age was measured by the operating years since the establishment of the enterprises; the enterprise ownership was a dummy variable: the value was 2 for state-owned enterprises (or state-controlled enterprises), and 1 for private enterprises (or private-controlled enterprises).

4 Data Analysis and Results

4.1 Reliability and Validity Analysis

4.1.1 Reliability Analysis

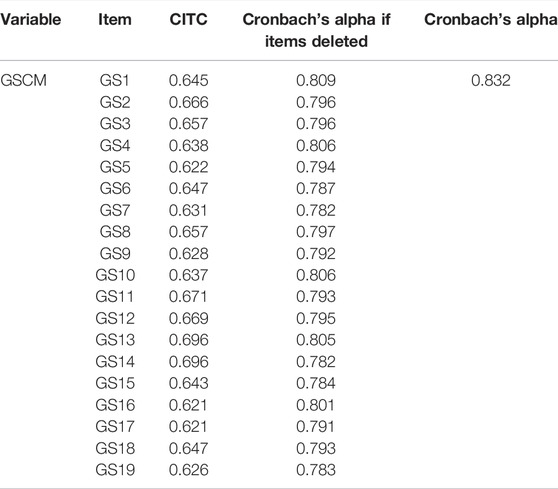

The Cronbach’s alpha of the GSCM scale was tested on SPSS 22.0. The results in Table 2 show that the Cronbach’s alphas of all variables were greater than 0.7. Besides, the corrected item-total correlations (CITCs) of all items were greater than the threshold of 0.5, a sign of strong correlation between the items. To sum up, the variables in the scale are reliable and consistent.

4.1.2 Validity Analysis and Factor Analysis

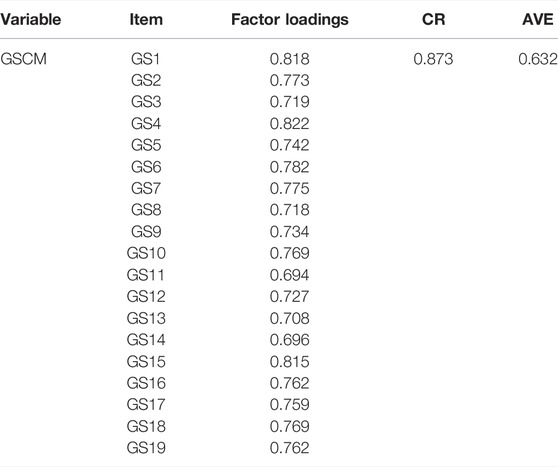

To further test the validity of the scale, this paper carries out confirmatory factor analysis on Mplus8.3. As shown in Table 3, the standardized factor loadings of all items were greater than 0.7, the consistency ratios (CRs) of all variables were greater than 0.8, and the average variance explained (AVE) of each variable was larger than 0.6. Both exploratory and confirmatory factor analyses were passed, indicating that the selected variables and the corresponding items have a good convergent validity.

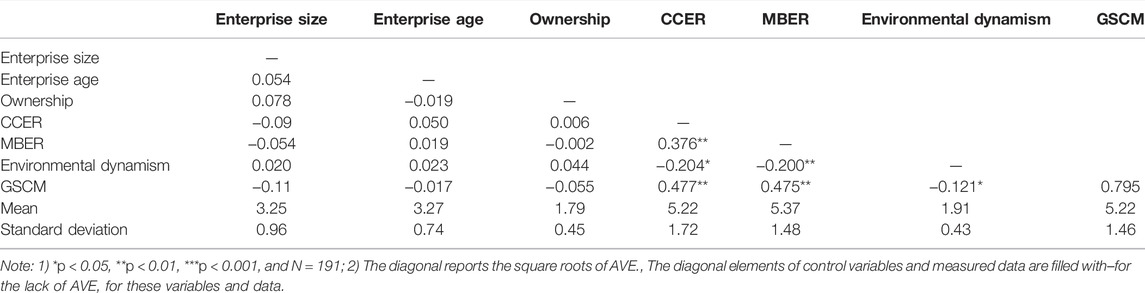

The discriminant validity was verified by observing whether the arithmetic root of AVE is greater than the absolute value of the correlation coefficient between variables. If yes, then the scale has a good discriminant validity (Fornell and Larcker, 1981). As shown in Table 5, the square root of AVE on the diagonal of the variables was 0.795, which is far greater than the correlation coefficients (0.200–0.477). Thus, the scale has a good discriminant validity.

4.2 Descriptive Statistics and Correlation Analysis

According to the sample data, most enterprises were established more than three decades ago. On enterprise size, most samples are large and medium enterprises. On ownership, state-owned enterprises take up most of the samples. Table 4 gives the descriptive statistics of the samples.

To further test and preliminarily judge the data quality, this study analyzes the basic statistical data on each item. The skewness and kurtosis of the items were descriptively analyzed on SPSS 22.0. The results show that the absolute skewness and absolute kurtosis of the variables were smaller than 2 and 5, respectively. It can be preliminarily concluded that the research samples are of high quality, and the sample data have the basic statistical features required for empirical analysis, laying the basis for subsequent statistical testing and regression analysis.

Table 5 shows the correlations between CCER, MBER, environmental dynamism, GSCM, and other variables. The statistics indicate a strong correlation between most variables, that is, the relevant data are suitable for subsequent regression analysis.

4.3 Multiple Regression Analysis

To ensure the stability and reliability of the multiple regression model, the multicollinearity, serial correlation, and heteroscedasticity of the model were tested before the regression analysis. Firstly, the multicollinearity was tested: The variance inflation factors (VIFs) of different regression models fell between 1.002 and 1.040 (VIF<10), excluding the possibility of serious multicollinearity. Next, serial correlation was tested. The Durbin Watson (DW) statistics of all models ranged between 1.652 and 1.934. This is smaller than the critical range of 1<DW<3. Thus, there is no problem with serial correlation. Finally, standardized predicted values and standardized residuals (ZPRED and ZRESID) were taken as Y and X variables, respectively, to plot the standardized residual scatterplot of each model. The test results show that all scatterplots were disorderly, i.e., the heteroscedasticity does not exist.

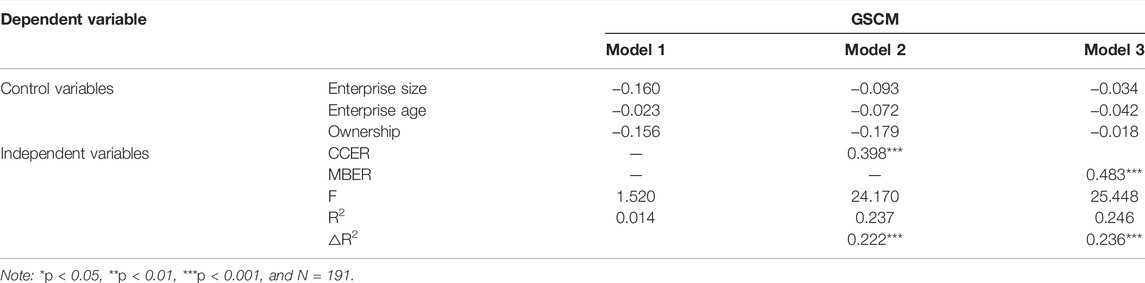

4.3.1 Regression Analysis on Direct Relationship

ER (CCER and MBER) have direct effects on GSCM. Table 6 shows the regression analysis results on the direct relationship between ER and GSCM.

As shown in Table 6, the results of Models 1 and 2 indicate that CCER positively affects GSCM, i.e., H1 is valid; the results of Models 1 and 3 indicate that MBER positively affects GSCM, i.e., H2 is valid.

4.3.2 Regression Analysis on Regulating Effect

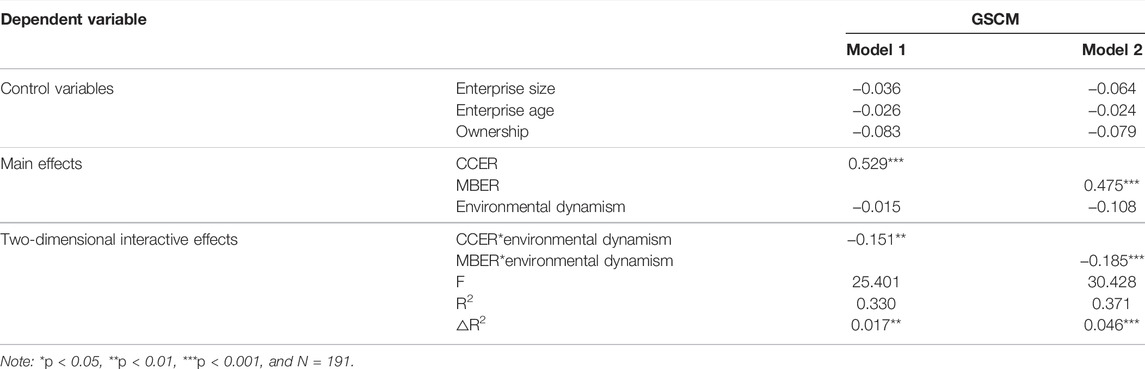

The environmental dynamism regulates the relationship between ER and GSCM. Table 7 shows the regression analysis results on the regulating effect.

TABLE 7. Regression analysis results on the regulating effect on the relationship between ER and GSCM.

As shown in Table 7, the results of Model 1 indicates that environmental dynamism has a significant negative regulating effect on the influence of CCER over GSCM, i.e., H3 is valid; the results of Model 2 indicates that environmental dynamism has a significant negative regulating effect on the influence of MBER over GSCM, i.e., H4 is valid.

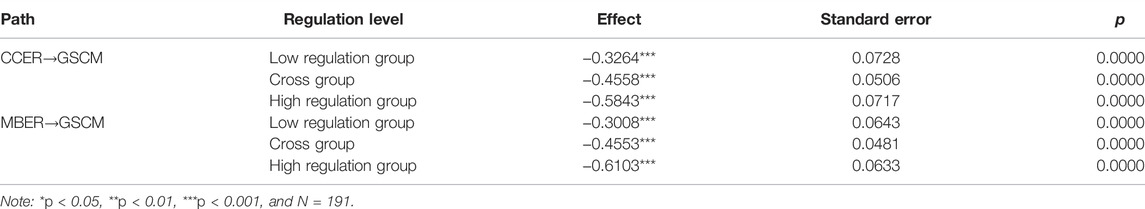

In addition, the simple slope test and slope difference test of bootstrapping were adopted to verify the robustness of the regulating effect of environmental dynamism (Hayes, 2017). As shown in Table 8, the paths from CCER and MBER to GSCM indicate that the high regulation group has a greater effect than the low regulation group and the cross group. Thus, environmental dynamism negatively regulates these paths, which again validates H3 and H4.

5 Conclusion and Discussion

5.1 Conclusion

This study analyzes the direct influence of ER on corporate GSCM, and the regulating effect of environmental dynamism on the influence. The results show that: 1) CCER positively affects GSCM; 2) MBER positively affects GSCM; 3) environmental dynamism negatively regulates the relationship between CCER and GSCM; 4) environmental dynamism negatively regulates the relationship between MBER and GSCM.

5.2 Theoretical Contributions

The previous literature disagrees on how ER influences GSCM. From a new perspective, this study analyzes the influence of CCER and MBER over GSCM, and considers the regulating effect of environmental dynamism. Two theoretical contributions were made: 1) This study constructs a theoretical framework for the influence of ER on GSCM under the regulating effect of external environmental factors making up for the deficiency of previous studies on the relationship between ER and GSCM; 2) CCER and MBER jointly affect GSCM, which enriches the application of the institutional theory in GSCM; 3) The previous literature ignores the regulating effect of environmental dynamism. This study discovers that environmental dynamism regulates the relationship between different types of ER and GSCM, providing a solution to the inconsistent views on the influence of ER over GSCM.

5.3 Managerial Implications

1) With the growing environmental awareness in the society, enterprises will be very passive in the commercial environment, if they only consider the government policies and other social environmental requirements. Enterprises should timely adjust the GSCM mode, and pay equal attention to environmental policies of the government, and the environmental appeals of market players.

2) Enterprises must track the changes of external environment. If the changes are small, it is easy to rely on ER to implement GSCM. If the changes are large, ER can hardly affect GSCM. Then, enterprises should standardize internal management, and implement GSCM according to standards and requirements, ensuring the normal production and operation.

3) While formulating environmental policies, relevant government departments should also pay attention to the market situation and make the policy orientation consistent with the demands of all market players. In this way, enterprises can further ensure the performance of GSCM.

5.4 Limitations and Future Directions

1) Our samples come from various industries. To control the possible effect of industrial differences, the future work could treat industry type as a control variable, or collect the data from a specific industry, aiming to further verify and promote the research findings.

2) The role of environmental dynamism is considered in this study. In future, other regulating variables could be taken into account. From the perspective of internal factors, there is dynamic capability, corporate social responsibility and so on. From the perspective of external factors of enterprises, there is environmental uncertainty, institutional distance and so on.

3) This study analyzes the direct influence of CCER and MBER on corporate GSCM. The future work could study the influence of their interaction on GSCM.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author Contributions

SW is responsible for problem proposal, data analysis, result analysis, and discussion; XZ is responsible for external communication, literature sorting, and data collection.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abdel-Baset, M., Chang, V., and Gamal, A. (2019). RETRACTED: Evaluation of the Green Supply Chain Management Practices: A Novel Neutrosophic Approach. Comput. Industry 108, 210–220. doi:10.1016/j.compind.2019.02.013

Abrell, J., and Rausch, S. (2017). Combining Price and Quantity Controls under Partitioned Environmental Regulation. J. Public Econ. 145, 226–242. doi:10.1016/j.jpubeco.2016.11.018

Beamon, B. M. (1999). Designing the Green Supply Chain. Logist. Inf. Manag. 12 (4), 332–342. doi:10.1108/09576059910284159

Bhatia, M. S., and Gangwani, K. K. (2021). Green Supply Chain Management: Scientometric Review and Analysis of Empirical Research. J. Clean. Prod. 284, 124722. doi:10.1016/j.jclepro.2020.124722

Dechezleprêtre, A., and Sato, M. (2017). The Impacts of Environmental Regulations on Competitiveness. Rev. Environ. Econ. Policy 11 (2), 183–206. doi:10.1093/reep/rex013

Du, K., Cheng, Y., and Yao, X. (2021). Environmental Regulation, Green Technology Innovation, and Industrial Structure Upgrading: The Road to the Green Transformation of Chinese Cities. Energy Econ. 98, 105247. doi:10.1016/j.eneco.2021.105247

Fornell, C., and Larcker, D. F. (1981). Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 18 (1), 39–50. doi:10.2307/3151312

Hayes, A. F. (2017). Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach. New York, NY: Guilford Publications.

Iraldo, F., Testa, F., Melis, M., and Frey, M. (2011). A Literature Review on the Links between Environmental Regulation and Competitiveness. Env. Pol. Gov. 21 (3), 210–222. doi:10.1002/eet.568

Jiang, Z., Wang, Z., and Zeng, Y. (2020). Can Voluntary Environmental Regulation Promote Corporate Technological Innovation? Bus. Strat. Env. 29 (2), 390–406. doi:10.1002/bse.2372

Li, J., and Du, Y. (2021). Spatial Effect of Environmental Regulation on Green Innovation Efficiency: Evidence from Prefectural-Level Cities in China. J. Clean. Prod. 286, 125032. doi:10.1016/j.jclepro.2020.125032

Li, Z. H., and Zhu, Z. Y. (2020). Research on the Mechanism of Environmental Dynamics on Enterprise Performance-Intermediary Effect Based on Technology Orientation. J. Guizhou Univ. Finance Econ. 38 (5), 73–79. doi:10.3969/j.issn.1003-6636.2020.05.008

Meyer, J. W., and Rowan, B. (1977). Institutionalized Organizations: Formal Structure as Myth and Ceremony. Am. J. Sociol. 83 (2), 340–363. doi:10.1086/226550

Pang, R., Zheng, D., Shi, M., and Zhang, X. (2019). Pollute First, Control Later? Exploring the Economic Threshold of Effective Environmental Regulation in China's Context. J. Environ. Manag. 248, 109275. doi:10.1016/j.jenvman.2019.109275

Rubashkina, Y., Galeotti, M., and Verdolini, E. (2015). Environmental Regulation and Competitiveness: Empirical Evidence on the Porter Hypothesis from European Manufacturing Sectors. Energy Policy 83, 288–300. doi:10.1016/j.enpol.2015.02.014

Sarkis, J., Zhu, Q., and Lai, K.-h. (2011). An Organizational Theoretic Review of Green Supply Chain Management Literature. Int. J. Prod. Econ. 130 (1), 1–15. doi:10.1016/j.ijpe.2010.11.010

Shen, H. H. (2010). The Impact of Environmental Uncertainty on Earnings Management. Auditing Res. 153 (1), 89–96.

Srivastava, S. K. (2007). Green Supply-Chain Management: A State-Of-The-Art Literature Review. Int. J. Manag. Rev. 9 (1), 53–80. doi:10.1111/j.1468-2370.2007.00202.x

Tseng, M.-L., Islam, M. S., Karia, N., Fauzi, F. A., and Afrin, S. (2019). A Literature Review on Green Supply Chain Management: Trends and Future Challenges. Resour. Conservation Recycl. 141, 145–162. doi:10.1016/j.resconrec.2018.10.009

Wang, J., Ye, X., and Wei, Y. (2019). Effects of Agglomeration, Environmental Regulations, and Technology on Pollutant Emissions in China: Integrating Spatial, Social, and Economic Network Analyses. Sustainability 11 (2), 363. doi:10.3390/su11020363

Yang, D., Wang, A. X., Zhou, K. Z., and Jiang, W. (2019). Environmental Strategy, Institutional Force, and Innovation Capability: A Managerial Cognition Perspective. J. Bus. Ethics 159 (4), 1147–1161. doi:10.1007/s10551-018-3830-5

Zhang, F., Chen, J., and Zhu, L. (2021). How Does Environmental Dynamism Impact Green Process Innovation? A Supply Chain Cooperation Perspective. IEEE Trans. Eng. Manage. 1 (2), 1–14. (Early Access). doi:10.1109/TEM.2020.3046711

Zhu, Q., and Sarkis, J. (2004). Relationships between Operational Practices and Performance Among Early Adopters of Green Supply Chain Management Practices in Chinese Manufacturing Enterprises. J. Operations Manag. 22 (3), 265–289. doi:10.1016/j.jom.2004.01.005

Keywords: environmental regulation (ER), green supply chain management (GSCM), environmental dynamism, regulating effect, hypothesis testing

Citation: Wang S and Zhang X (2022) Influence of Environmental Regulation on Corporate Green Supply Chain Management: The Regulating Effect of Environmental Dynamism. Front. Environ. Sci. 10:947022. doi: 10.3389/fenvs.2022.947022

Received: 18 May 2022; Accepted: 31 May 2022;

Published: 20 June 2022.

Edited by:

Umer Shahzad, Anhui University of Finance and Economics, ChinaReviewed by:

Ahmed Samour, Near East University, CyprusYawei Qi, Jiangxi University of Finance and Economics, China

Khoa Bui Thanh, Industrial University of Ho Chi Minh City, Vietnam

Mincong Tang, Beijing Jiaotong University, China

Copyright © 2022 Wang and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xuan Zhang, Z3JhY2V6aGFuZ3h1YW5AMTI2LmNvbQ==

Songlin Wang

Songlin Wang Xuan Zhang2*

Xuan Zhang2*