- 1State Information Center, Beijing, China

- 2School of Business, Renmin University of China, Beijing, China

- 3Beijing Blue and Black Consulting Co., Ltd., Beijing, China

- 4Research Center for Environmental Economy, Fudan University, Shanghai, China

- 5Business School, University of Shanghai for Science and Technology, Shanghai, China

Flourishing sales of new electric vehicles have led to a considerable surge in demand for the vital, upstream raw material, lithium (Li). As an essential energy metal and raw material for the production of batteries, lithium has become indispensable to the electric vehicle industry. It has been identified as a strategic, emerging industrial mineral in China. Based on a literature review and qualitative analysis of the imbalance between the supply and demand of lithium raw materials in China, this paper analyzes the current challenges of China’s lithium supply chain, especially mining, pricing and recycling, that are obstructing the realization of China’s carbon neutrality. On this basis, relevant policy suggestions are proposed from three perspectives: strengthening lithium resource development and reserve capacity, promoting international cooperation for lithium supply, and properly regulating the circular economy of domestic lithium resources.

Introduction

As climate change has an increasingly negative impact on the living environment, it is urgent to mitigate carbon dioxide emissions. As the main sources of carbon emissions, buildings, energy, transportation and industry have become the main focus of China’s emission reduction efforts. For example, many previous studies have investigated the low-carbon roadmap or carbon-neutral pathway of the building sector (Li et al., 2022; Sun et al., 2022; Xiang et al., 2022). This paper, however, focus on another sector with vast potential for carbon emission reduction: transportation.

According to the International Energy Agency (IEA), global electric vehicle sales reached 6.6 million in 2021, more than double the 2020 level of three million. By the close of 2020, more than 20 countries/regions had either announced plans to ban the sale of conventional cars or mandated that all newly sold vehicles must be zero-emissions. Many governments have further stimulated consumer demand for electric vehicles through incentives such as subsidies. Moreover, many large automobile manufacturers worldwide have announced plans to expand the scale of electric vehicle production. Therefore, because lithium-ion technology is the most widely used path for powering electric vehicles, the most critical resource, lithium (Li), has been listed as a strategic resource in many countries, such as the United States and China.

Lithium has the strongest charge mobility among the metals and the highest electrical storage density of known elements and, therefore, is an essential mineral for new electric technologies. Lithium has the highest standard oxidation potential among all elements. It can be easily used in various battery sizes and configurations for energy storage and, thus, is called the “energy metal for the 21st century”.

Lithium resources are primarily stored in hard rock and brines. Mined materials are processed to capture lithium compounds, including lithium carbonate, lithium hydroxide, lithium halide, etc. Finally, the concentrated lithium products are used in downstream industrial production in the form of energy storage compounds. As a vital raw material for batteries, lithium is indispensable in the new energy automobile industry.

According to the United States Geological Survey (USGS), there are 89 million tons of identified lithium resources worldwide. However, due to insufficient exploitation, the available reserves are only 22 million tons, of which China accounts for approximately 6.8% with 1.5 million tons. As suggested by Wei et al. (2022), the current capacity for supplying critical minerals in China cannot satisfy the demand, especially under carbon neutrality-focused plans.

Although it is among the major suppliers of lithium, China’s lithium resources are still highly dependent on foreign entities due to insufficient national development of its exploitation potential and the poor quality of its mineral resources, leaving a large gap between supply and demand. This intensified import-dependent situation is risky to the domestic market (Guo et al., 2021). For example, the production of downstream lithium batteries for electric automobiles is restricted by international resource development, which restricts the development of essential industries in China. Based on the available literature and the current supply-demand situation, this policy brief analyzes the current challenges facing China’s lithium resource supply chain from the aspects of supply, distribution, and the circular economy.

Previous studies on lithium have focused on three aspects. First, the supply-demand situation of lithium resources has been investigated (Tabelin et al., 2021). For example, debate persists about whether the supply is adequate to meet demand (Gruber et al., 2011). Second, the recycling of lithium resources, including the effects of the recycling of lithium resources on lithium supply and the environment, the efficient methods for recycling, and so on, have been studied (Oliveira et al., 2015; Tabelin et al., 2021). Finally, researchers have explored the usage of lithium resources in electric vehicles and some new technologies (Laadjal and Cardoso, 2021; Wang and Yu, 2021). However, a systematic analysis of the current challenges in China’s lithium supply chain, including mining, pricing and recycling, as well as the proposition of related policy suggestions, remain to be done. Our paper is intended to fill this gap. Furthermore, based on China’s actual situation, this paper clarifies the problems China faces in its lithium resources reserves, which involve energy security and the realization of China’s goal of carbon neutrality. Our policy suggestions provide a useful reference for policymakers around the world to improve the capacity to development lithium resources. Introduction of this paper describes the current demand for lithium resources. Introduction identifies the challenges regarding lithium resources at all stages of China’s the supply chain. Relevant policy recommendations are proposed in Introduction. Finally, we conclude our paper in Introduction.

Present Situation of Lithium Resource Demand in China

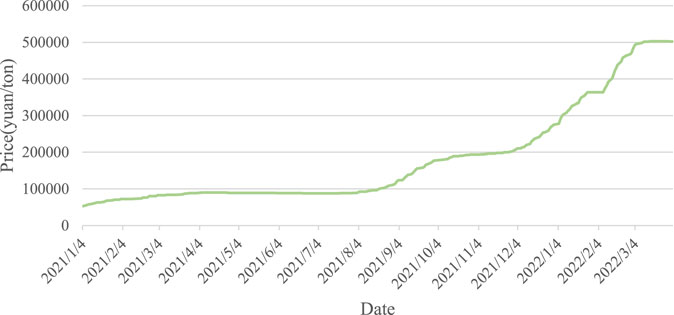

In recent years, booming production of electric vehicles has led to a surge in demand for the primary upstream raw material, lithium. According to SNE Research, a South Korean market research institution, the total battery energy requirement for electric vehicles (EVs) reached 53.5 GWh globally in the first 2 months of 2022, more than double the figure from the same period in 2021. Among suppliers, Contemporary Amperex Technology Co., Ltd. (CATL), and BYD shipments ranked first and third globally, with market shares of 34.4 and 11.9%, respectively. Due to the sharp increase in demand, China’s lithium resource enterprises have increased their production to varying degrees. For example, the industry leader Tianqi Lithium Corporation’s production of lithium concentrates increased by 39% and sales volume increased by 56% in the first 2 months of 2022 years-on-year. The rapid growth in demand has correspondingly escalated the price of lithium resources. According to the Shanghai Metals Market (SMM), the price of lithium carbonate, which is the primary battery material, rose from 53,000 yuan/ton in January 2021 to 525,000 yuan/ton on 1 April 2022, representing a year-on-year increase of 487.72%, including an increase of 52.88% between January and the end of March 2022 (as shown in Figure 1).

As many countries, such as China and the United States, shift toward low-carbon and new energy technologies, the demand for lithium will continue to increase (Tabelin et al., 2021). China has committed to capping its peak carbon dioxide emissions by 2030 and reaching carbon neutralization before 2060 (UNFCC, 2015; Xi, 2020). Substituting electric vehicles for traditional energy vehicles is critical to achieving this plan.

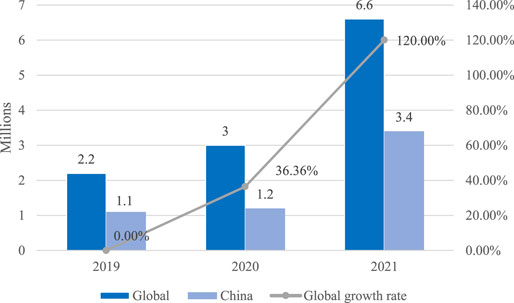

According to the IEA, in 2021, global electric car sales reached 6.6 million, a year-on-year increase of 120% (as shown in Figure 2). The IEA expects global new energy vehicle yearly sales to reach 13 million in 2025 and 25.8 million by 2030, maintaining an annual growth rate of approximately 30%. China is the world’s largest consumer of new energy lithium resources.

According to Figure 2, the sales volume of electric vehicles was 3.4 million units in China in 2021, up 183.33% year-on-year, accounting for 51.5% of the global electric vehicle market. China also drove the consumption of lithium resources (calculated as lithium carbonate) to 303,400 tons in 2021, up 61.7% year on year. Statista predicts that the growth of battery demand for electric vehicles will continue to be a strong driving force for lithium consumption over the next 10 years. The global demand for lithium carbonate will exceed two million tons in 2030, more than twice the predicted demand in 2025. Sun et al. (2019) also predict that the flow of lithium resources in 2050 will be 13-20 times that in 2015. Beginning in 2022, lithium for electric vehicles will account for the largest proportion of lithium usage.

Current Challenges in Lithium Resources

The scarcity of lithium resources and the rapid growth of demand lead to an imbalance between supply and demand in China. At present, China is confronted with three main challenges in lithium resources: insufficient resource endowment and exploitation, insufficient ability to participate in the formulation of lithium resource prices, and realization of its aspirations regarding the circular economy of lithium resources. Therefore, China’s related industries are constrained by foreign development and supply of lithium resources.

First, China’s identified lithium resources are insufficient. Lithium resources are primarily embodied in natural mineral reserves. The USGS reports that the globally identified lithium resources are 89 million tons. Identified resources are defined as “Resources for which location, grade, quality, and quantity are known or estimated from specific geologic evidence”. Figure 3A shows the global distribution of identified lithium resources, chiefly distributed in South America and Australia, with the top four countries being Bolivia, Argentina, Chile, Australia, and China, accounting for 23.6, 21.3, 11, 8.2, and 5.7%, respectively. In addition, the USGS also reported that global lithium reserves in 2021 were approximately 22 million tons. Relative to the identified lithium resources, the USGS defined reserves as “that part of the reserve base that could be economically extracted or produced at determination”. The global distribution of lithium reserves is shown in Figure 3B. Compared with the amount of identified lithium resources, the available lithium reserves are minuscule, making the identification of new lithium resources a top global priority.

China’s lithium resources are characterized by a scattered distribution and inferior quality. Lithium is mainly stored in brines, lithium spodumene hard rock, and lepidolite. Brines in China are mainly distributed in salt lakes in Qinghai and Tibet. Lithium spodumene hard rock is mainly distributed in Sichuan, and Jiangxi also has significant lepidolite resources. Seventy-five percent of China’s lithium resources are stored in salt lakes in Qinghai and Tibet. However, due to a low lithium-ion concentration and relatively elevated levels of impurities, while salt lakes are rich in lithium and magnesium it is challenging to extract lithium from such brines. In addition, Sichuan Province is also rich in lithium spodumene hard rock. However, most of the spodumene mines are located in high-altitude areas with poor vegetation coverage and severe soil and water loss. Moreover, due to the influence of harsh natural conditions and inadequate mine infrastructure in these areas, the development potential is low. Therefore, the exploitation of lithium resources in China is limited by natural conditions, cost, and technology. As a result, the production capacity for exploiting lithium resources has not yet been fully realized.

Second, because China is highly dependent on imported lithium raw materials it is not able to participate in the formulation of lithium resource prices. From the perspective of the supply structure, the global development of lithium resources is unbalanced and inadequate. The global output of lithium mines is mainly concentrated in Australia, Chile, and China, accounting for 55, 26, and 14%, respectively, in 2021. Although Argentina and Bolivia have resource advantages, they are limited by a challenging geographical environment, development technology, etc., leaving only a small number of available sources. With its remarkable output advantage, Australia dominates the current supply of lithium mineral resources globally. As China’s domestic supply of lithium resources cannot meet the rapidly growing demand, dependence on foreign lithium resources remains at a prominent level, requiring the importation of 86.5% of China’s current lithium demand (Song et al., 2019). Although the statistics1are incomplete, nearly 90% of lithium imports in 2021 came from Australia. The key to improving China’s domestic lithium security is to reduce the excessive dependence on foreign resources. Although Chinese enterprises such as Zijin Mining and Ganfeng Lithium have begun to invest in lithium resource development projects in many countries around the world, most of the projects are still in early development, which cannot ease China’s high dependence on foreign lithium resources in the short term.

Third, China’s lithium recycling economy has not yet formed a complete chain. Recycling lithium resources is generally considered an effective way to reduce the demand for primary raw materials supply and to mitigate the potential risks of spent lithium disposal (Sun et al., 2019; Guo, Zhang, and Tian, 2021). Therefore, to achieve a balanced supply and demand for lithium resources, the well-established recycling systems is necessary. Gruber et al. (2011) suggested that if the recovery rate of lithium were 90–100%, the recovered lithium could meet 50–63% of the cumulative demand for lithium for 2010 to 2,100 worldwide.

The service life of lithium-ion batteries is generally 5–8 years, and the practical life is 4–6 years. When the battery capacity drops to 80% of the rated capacity, it will not meet the needs of electric vehicles and will be scrapped (Olivetti et al., 2017). Approximately 200,000 tons of power batteries were retired in China in 2020, according to data from the China Automotive Technology Research Center (CATARC). As the rapid growth of the electric vehicle market in recent years has significantly increased the use of lithium batteries, China will face a rapidly increasing battery retirement situation in the next few years and become one of the largest markets for lithium-ion battery recycling. The lithium concentration in waste batteries is 3–7% of their weight, much higher than the lithium concentration in natural ore (Barik et al., 2016). Sun et al. (2019) predicted that by 2050, the total amount of lithium in end-of-life products will reach 45-121 kt, which will represent half of the chemical consumption. The comprehensive utilization and recycling of waste power batteries plays an essential role in protecting the ecological environment and ensuring the safety of resources. However, the recycling economy of lithium resources has not been properly guided in China.

The infrastructure for recycling spent lithium batteries is still in the development stage, far from meeting the requirements of battery recycling technology. The recycling of lithium batteries includes collection and classification, discharge, disassembly, separation of active substances, metallurgy, etc. and is a complicated process with high costs and a low rate of recovery. In addition, with an increasing number of batteries being scrapped, a certain chaos is emerging in the battery recycling marketplace. Many recycling enterprises lacking professional qualifications are already crowding out the profitability of qualified enterprises. This situation has created escalating problems in the battery recycling process due to the unregulated participation of unqualified enterprises, which reduces economic benefits, increases environmental pollution, and creates potential safety hazards from unprofessional dismantling practices.

The three main challenges confronted by China in the lithium resources supply chain make it difficult for domestic supply to meet demand, leading to high dependence on foreign supplies of lithium raw materials and threatening the security of China’s related industries. To solve this problem, we present the following policy suggestions.

First, since the exploitation of lithium resources in China is limited mainly by technology, it is essential to upgrade the technical requirements and professionalize the technical capacity of lithium resource recycling and development. China still faces many technical challenges in developing lithium resources from high-altitude ores and low-concentration brines. For example, high-altitude areas are often accompanied by a fragile ecological environment, increasing the difficulty of realizing green development. Further, the currently poor recovery rate of using low-concentration brine lithium resources must be improved. Addressing these core issues will require a unified, multi-department response including the resources, environment, science and technology, industry, and other departments to formulate achievable technology development plans. Furthermore, the government should coordinate the use of natural science funds, venture capital, and other diversified tools to promote breakthroughs in required technologies as soon as possible to allow the effective realization of adequate resource development.

In addition, China should strengthen cooperation with other countries to increase the quality and quantity of global lithium resource supplies. At present, although several countries, such as Bolivia and Chile, have identified abundant lithium resources, resource nationalization, technology limitations, and other problems thwart the development of adequate lithium resources, leaving the global lithium resource supply far from meeting the present and increasing global demand. China should engage in building a community with a shared future through cooperative development with the countries where resources are located, using multiple channels to ensure adequate progress toward global peak carbon dioxide emissions and carbon neutrality.

Finally, the government should further perfect laws and regulations to improve domestic capacity for lithium resource recycling. For example, the government could create a qualified resource cycling enterprise list and impose measures to require a high quality, professional business environment for compliant enterprises to avoid risks in safety and environmental protection. Simultaneously, according to the endowment characteristics of each province and their various advantages of energy, technology talent, capital, and market factors, the provinces should be encouraged to form a strong, closed-loop, green recycling industrial chain of lithium resources and to realize the “green” in the process of industrial upgrading.

Conclusion

Carbon neutrality is an important goal for China in the coming decades, and substituting electric vehicles for traditional energy vehicles is critical to achieving this goal. In recent years, as sales in new electric vehicles have flourished, the upstream raw material, lithium, has been in short supply relative to its demand in China. Furthermore, China’s related industries are constrained by foreign development and supply of lithium resources because of China’s insufficient resource endowment and exploitation, insufficient ability to participate in the formulation of lithium resource prices, and immature circular economy of lithium resources. Therefore, we propose that related policy-making focus on the following issues: (i) upgrading the technical requirements and professionalizing the technical capacity of lithium resource recycling and development, (ii) strengthening cooperation with other countries to increase the quality and quantity of global lithium resource supplies, and (iii) updating laws and regulations to improve domestic capacity for lithium resource recycling.

Author Contributions

HLiu conceived of the idea, outlined and made important modifications to the brief. HLi collected data and wrote the first draft ofthe article. TZ, XC, and GH made important modifications and provided data support for the brief. All authors contributed to article revisionand have both read and approved of the submitted version.

Conflict of Interest

Author XC is employed by the Beijing Blue and Black Consulting Co., Ltd.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The handling editor WW declared a past co-authorship with the author LH.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Part of the data comes from Chinese Customs Statistics.

References

Barik, S. P., Prabaharan, G., and Kumar, B. (2016). An Innovative Approach to Recover the Metal Values from Spent Lithium-Ion Batteries. Waste Manag. 51, 222–226. doi:10.1016/j.wasman.2015.11.004

Gruber, P. W., Medina, P. A., Keoleian, G. A., Kesler, S. E., Everson, M. P., and Wallington, T. J. (2011). Global Lithium Availability: A Constraint for Electric Vehicles? J. Ind. Ecol. 15 (5), 760–775. doi:10.1111/j.1530-9290.2011.00359.x

Guo, X., Zhang, J., and Tian, Q. (2021). Modeling the Potential Impact of Future Lithium Recycling on Lithium Demand in China: A Dynamic SFA Approach. Renew. Sustain. Energy Rev. 137, 110461. doi:10.1016/j.rser.2020.110461

Laadjal, K., and Cardoso, A. J. M. (2021). Estimation of Lithium-Ion Batteries State-Condition in Electric Vehicle Applications: Issues and State of the Art. Electronics 10 (13), 1588. doi:10.3390/electronics10131588

Li, K., Ma, M., Xiang, X., Feng, W., Ma, Z., Cai, W., et al. (2022). Carbon Reduction in Commercial Building Operations: A Provincial Retrospection in China. Appl. Energy 306, 118098. doi:10.1016/j.apenergy.2021.118098

Oliveira, L., Messagie, M., Rangaraju, S., Sanfelix, J., Hernandez Rivas, M., and Van Mierlo, J. (2015). Key Issues of Lithium-Ion Batteries - from Resource Depletion to Environmental Performance Indicators. J. Clean. Prod. 108, 354–362. doi:10.1016/j.jclepro.2015.06.021

Olivetti, E. A., Ceder, G., Gaustad, G. G., and Fu, X. (2017). Lithium-Ion Battery Supply Chain Considerations: Analysis of Potential Bottlenecks in Critical Metals. Joule 1 (2), 229–243. doi:10.1016/j.joule.2017.08.019

Song, J., Yan, W., Cao, H., Song, Q., Ding, H., Lv, Z., et al. (2019). Material Flow Analysis on Critical Raw Materials of Lithium-Ion Batteries in China. J. Clean. Prod. 215, 570–581. doi:10.1016/j.jclepro.2019.01.081

Sun, X., Hao, H., Zhao, F., and Liu, Z. (2019). The Dynamic Equilibrium Mechanism of Regional Lithium Flow for Transportation Electrification. Environ. Sci. Technol. 53 (2), 743–751. doi:10.1021/acs.est.8b04288

Sun, Z., Ma, Z., Ma, M., Cai, W., Xiang, X., Zhang, S., et al. (2022). Carbon Peak and Carbon Neutrality in the Building Sector: A Bibliometric Review. Buildings 12 (2), 128. doi:10.3390/buildings12020128

Tabelin, C. B., Dallas, J., Casanova, S., Pelech, T., Bournival, G., Saydam, S., et al. (2021). Towards A Low-Carbon Society: A Review of Lithium Resource Availability, Challenges and Innovations in Mining, Extraction and Recycling, and Future Perspectives. Miner. Eng. 163, 106743. doi:10.1016/j.mineng.2020.106743

UNFCC (2015). Paris Agreement. In: United Nations/Framework Convention on Climate Change, in 21st Conference of the Parties; 2015 Nov 30–Dec 12; France.

Wang, S., and Yu, J. (2021). A Comparative Life Cycle Assessment on Lithium-Ion Battery: Case Study on Electric Vehicle Battery in China Considering Battery Evolution. Waste Manag. Res. 39 (1), 156–164. doi:10.1177/0734242x20966637

Wei, W., Ge, Z., Geng, Y., Jiang, M., Chen, Z., and Wu, W. (2022). Toward Carbon Neutrality: Uncovering Constraints on Critical Minerals in the Chinese Power System. Fundam. Res. 2, 367–374. doi:10.1016/j.fmre.2022.02.006

Xi, J. P., (2020). Xi Delivered an Important Speech at the Climate Ambition Summit. Available at: http://www.gov.cn/xinwen/2020-12/13/content_5569136.htm, (accessed on January 5th, 2021).

Keywords: lithium, supply and demand imbalance, new energy, electric vehicle industry, carbon neutrality, policy implications

Citation: Li H, Zhu T, Chen X, Liu H and He G (2022) Improving China’s Global Lithium Resource Development Capacity. Front. Environ. Sci. 10:938534. doi: 10.3389/fenvs.2022.938534

Received: 07 May 2022; Accepted: 31 May 2022;

Published: 17 June 2022.

Edited by:

Wendong Wei, Shanghai Jiao Tong University, ChinaCopyright © 2022 Li, Zhu, Chen, Liu and He. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hanbin Liu, aGJsaXUxNEBmdWRhbi5lZHUuY24=

Hanshi Li1

Hanshi Li1 Ting Zhu

Ting Zhu Hanbin Liu

Hanbin Liu Guangsheng He

Guangsheng He