- 1City College, KunMing University of Science and Technology, KunMing, China

- 2School of Business and Economics, United International University, Dhaka, Bangladesh

- 3Business School Beijing International Studies University, Beijing, China

- 4Department of Commerce Motilal Nehru College (E), University of Delhi, New Delhi, India

Domestic capital adequacy and sustainable economic growth are heavily reliant on technological advancement, managerial know-how, and money supply in the economy. In this context, FDI has emerged and is placed at an apex position due to its unprecedented impact on achieving sustainability across the world. The motivation of this study is to scale the effects of good governance, financial inclusion, and environmental quality on inflows of FDI in BRI nations for the period from 1990 to 2020. Several panel econometrical tools have been applied, for example, CDS, CADF, CIPS, CS-ARDL, and NARDL, to investigate the association and explanatory variables elasticity on inflows of FDI in BRI nations. CDS results revealed that research units share common dynamism and second-generation panel unit root test-documented variables are stationary after the first difference. The results of the panel co-integration with an error-correction term confirmed the empirical equation’s long-run association. According to the CS-ARDL assessment, positive and statistically significant impacts have been documented, from financial inclusion, good governance, and environmental quality to FDI inflows. Study findings suggest that governmental effectiveness, easy access to financial services and benefits, and a less-regulated environmental concern economy motivate capital transfer decisions. The asymmetric assessment documented a long-run asymmetric association between FI, GG, EQ, and FDI. Referring to asymmetric shock elasticity, the study disclosed a positive and statistically significant relation to FDI inflows, especially in the long run. The directional causality test documented bidirectional causality running between FI, EQ, GG, and FDI [FI←→FDI; GG←→FDI; and EQ←→FDI] in the short-run.

1 Background

Globalization has had a profound effect on the global economy and has played a significant role in the increase of FDI and its influence on economic growth during the last few decades (Sokang, 2018). Consequently, FDI has gained prominence as a source of foreign money, especially for developing countries (Oke et al., 2007). While the effect of FDI varies in the economic sector, it has the potential to make a considerable overall contribution to a country’s economy by encouraging investment in manufacturing facilities and the host country’s manufacturing sector. FDI promotes capital creation, provides for cross-border technology and information exchanges, and strengthens the host country’s skills (Boateng et al., 2015; Logun, 2020; Andriamahery and Qamruzzaman, 2022a; 2022b). Foreign direct investment also helps emerging nations increase their total productivity, employment, and income development. However, research on the influence of FDI on economic development in LDCs and developing economies provides inconclusive findings. FDI flows have expanded considerably over the world during the last 3 decades. This drew our attention to the effect of such a surge in FDI on the host country’s economic development. The link between FDI and economic advancement has since been a source of debate among scholars (Rehman and Ding, 2020). The literature suggests that FDI promotes economic development by promoting cross-border technology and knowledge transfer, resulting in more employment and enhancing the host country’s skill capacity. Taking account the existing literature, two lines of research findings focusing on FDI can be found : the first group of researchers investigated the role of FDI inflows in the economy and subsequently advocated its positive link to economic growth (Azman-Saini et al., 2010; Pegkas, 2015; Saibu et al., 2022), employment generation, financial development (Alfaro et al., 2009), trade liberalization (Liargovas and Skandalis, 2012; Rehman & Sohag, 2022), industrialization (Adom and Amuakwa-Mensah, 2016; Ma and Qamruzzaman, 2022; Xia et al., 2022; Zhuo and Qamruzzaman, 2022), poverty reduction (Klein et al., 2001; Magombeyi and Odhiambo, 2017), and technological development (Liu & Wang, 2003). At the same time, another group of researchers showed the adverse effects of FDI, especially in environmental degradation through carbon emission and energy consumption escalation, typically fossil fuels. Second, the line of empirical evidence concentrated on exploring the key determinants attracting foreign investments and subsequently advocated for both macro and micro fundamentals, which can play an important role in ensuring persistent inflows of FDI in the economy, such as institutional quality, economic growth, financial development, domestic capital formation, and financial inclusion (Vijayakumar et al., 2010; Barthel et al., 2011; Saini and Singhania, 2018; Chattopadhyay et al., 2022). For example, Samargandi et al. (2022) investigated the key factors responsible for encouraging FDI inflows in Saudi from 1981 to 2018 by implementing an ARDL-bound testing approach with a structural break. The study documented that domestic trade liberalization and institutional quality promise FDI inflow augmentation.

The study considered environmental quality (EQ), good governance (GG), and financial inclusion (FI) in the FDI inflow assessment. Nowadays, efficient markets and financial services with an appropriate attitude toward financial activity simplify the whole financial work, creating a mass area and the desire for improved cross-border capital flow or foreign direct investment (Nasreen et al., 2020; Jia et al., 2021). The financial efficiency that offers a clear picture of any firm’s financial data and activities is why it significantly influences the foreign currency flow across borders (Alam and Shah, 2013; Qamruzzaman, 2015, 2021). This ease of entrance results in a wide positive acceleration for all international and domestic investors. Foreign investment is highly dependent on the success of the stock market and the quality of accounting data. A robust capital system contributes significantly to the economic activity by cutting transaction costs and effectively allocating resources (Greenwood and Jovanovic, 1990; Levine, 1997). Moreover, according to the literature, a robust financial sector is essential for developing commercial activities and the country’s overall economic growth (Bourkhis and Nabi, 2013; Bilawal et al., 2014). Enhancing money flows across borders, promoting financial inclusion, and improving financial efficiency are critical (Abid and Goaied, 2017). The company’s cash flow is built on financial efficiency since it attracts investors from both domestic and international markets. International capital flows may be optimistic if a country’s financial market seems efficient (Kablan, 2009). The positive feedback shed more light on the link between financial inclusion and cross-border capital flows (Krause ad Rioja, 2006). Financial reform, effective financial intermediation, the adoption and distribution of financial technology, the transformation of financial aid, the efficient mobilization of economic resources, and the expansion of financial markets are all examples of policies that can be implemented. Another factor contributing to foreign investment is effective governmental practices (Aibai et al., 2019; Huynh and Hoang, 2019; Dorozynski et al., 2020; Cong Minh Huynh, 2022). The study of Narayanan et al. (2020), for example, explored the relationship of FDI and good governance for the ASEAN countries, as a sample, for the period from 2002 to 2015 using the PMG estimation method. The study concluded that FDI positively impacts the economic growth in good governance, so it should be encouraged to attain maximum benefit. In their study, Cong Minh Huynh (2022) concluded that at the beginning, FDI inflows aid in improving institutional quality, but in the presence of an underground economy it has negative impacts, reducing the merits. Thus, it is suggested to ensure governmental effectiveness for efficient reallocation of FDI inflows in the economy. Recent literature studies have documented that environmental protection particularly carbon reduction, green energy inclusion, and energy efficient technology adaptation have become prominent and considerable factors in foreign capital flows (Assadzadeh and Pourqoly, 2013; Herrera-Echeverri et al., 2014a; Mengistu and Adhikary, 2011; Shah et al., 2015). The study of Bhujabal et al. (2021), for example, examined the impact of FDU on the environmental quality in the prime Asia-Pacific countries for time series of 1990–2018 using the PMG causality test. A study documented that as FDI increases, ICT infrastructure rises and it reduces the air pollution, making the environment better in the long run. In their study, Contractor et al. (2020) studied the connection of FDI in improving the environment and economy using proper regulations on 189 economies (World Bank 2016 data) applying random-effect, fixed-effect, and regression models. Studies prove a strong positive connection between business and the overall environment. As FDI is more inclined toward investment in less efficient entry and exit systems, government policies must be restructured (Alam, 2022; Rehman and Islam, 2022; Xia et al., 2022).

This study aims to evaluate the impact of environmental quality, good governance, and financial inclusion on inflows of forcing cash flows in BRI nations for 1990–2020.

As a case study, we considered a panel of 46 BRI countries. The BRI, which aspires to increase China’s international collaboration with new partners, is a driving force behind China’s long-term economic growth. BRI was the premier platform for national connectivity in 2013 through promoting regional and intra-regional integration. Because of the Chinese government’s commitment to establishing a more open economy, this program emphasized the need to invest in a solid infrastructure that enables connections within China and with China on a global scale (Rehman and Noman, 2021). Infrastructure building is a key component of the Belt and Road Initiative, but the endeavor also involves policy discussions, access to infrastructure, unrestricted commerce, financial help, and human relationships (Dai et al., 2022; Muhammad et al., 2022; Shi and Qamruzzaman, 2022; Xia et al., 2022). Given China’s track record of economic growth, infrastructure is projected to play a critical role, especially in the initiative’s early stages. Several plans have been proposed to connect different areas, including building superhighways, installing oil and gas pipelines, and installing power and communication lines. In addition to the funds provided by the AIIB, the BRICS New Development Bank, and the World Bank and the Asian Development Bank, major investments are expected to be made by Chinese institutions such as the Silk Road Fund (SRF), the China Development Bank (CDB), and numerous Chinese firms. To reduce trade costs and increase foreign direct investment (FDI) into China and other Belt and Road nations, one of the primary objectives of BRI is to develop transportation networks linking countries of the Belt and Road Initiative (Hussain et al., 2022; Su et al., 2022).

Additionally, the Belt and Road Initiative (BRI) has the potential to significantly reduce policy uncertainty and policy risks posed by host countries for Chinese companies that invest in the Belt and Road countries. This further encourages China’s foreign and internal FDIs within the belt–road countries through top-level international political cooperation, policy coordination, and government support. At this early point in the construction of the Belt and Road Initiative (BRI), some of these incentives for foreign direct investment (FDI) are already in place, while others are still mostly anticipated rather than fully realized. Because of the bright prospects for the BR program, Chinese companies, who have always played a significant role in ensuring the success of the program, will increase their trade and foreign direct investments more rapidly than their counterparts in other countries (Du & Zhang, 2022; Fuest et al., 2022). Empirical studies focusing on BRI countries have created intense interest among researchers, and a growing number of studies have been performed to explore fresh insights with diverse motivations. Foreign investors need extensive information on the market’s financial stability, economic health, and level of financial inclusion. Almost every major industrialized country strives to boost the effectiveness of its courtiers’ financial openness to attract foreign investments. If a market risk occurs due to the foreign company’s activities, the foreign direct investor or corporation will want to be shown a varied market. To compile all of these data and analyze economic circumstances, the host country must provide sufficient financial inclusion to attract foreign direct investments. The only source of change is cross-border financial flows. On the other side, financial inclusion entails the widespread availability of all financial services and the prevalence of monetary transactions. Macroeconomic growth seems necessary because easy access to financial instruments enables smooth spending and asset building, boosting individual wellbeing and economic development potential. Domestic capital adequacy and sustainable economic growth immensely rely on technological advancement, managerial know-how, and money supply in the economy. In this context, FDI has emerged and is placed at an apex position due to its unprecedented impact on achieving sustainability across the world (Lingyan et al., 2021; Meng et al., 2021; Pu et al., 2021; Xu et al., 2021).

The motivation of the study is to scale the effects of good governance, financial inclusion, and environmental quality on inflows of FDI in BRI nations for the period from 1990 to 2020. Several panel econometrical tools have been applied, for example, CDS, CADF, CIPS, CS-ARDL, and NARDL, in investigating the association and explanatory variable elasticity on the inflows of FDI in BRI nations. CDS results revealed that research units share common dynamism, and second-generation panel unit root test-documented variables are stationary after the first difference, and neither has been exposed after the first difference. The results of panel co-integration with the error correction term confirmed the empirical equation’s long-run association. According to the CS-ARDL assessment, positive and statistically significant impacts have been documented, from financial inclusion, good governance, and environmental quality to FDI inflows. The study findings suggest that governmental effectiveness, easy access to financial services and benefits, and a less-regulated environmental concern economy motivate capital transfer decisions. The asymmetric assessment documented a long-run asymmetric association between FI, GG, EQ, and FDI. Referring to asymmetric shock elasticity, the study disclosed a positive and statistically significant tie to FDI inflows, especially in the long run. Directional causality test documented bidirectional casualty running between FI, EQ, GG, and FDI [FI←→FDI; GG←→FDI; EQ←→FDI] in the short-run.

The contribution of the present study to the existing literature is as follows: First, according to the existing literature, financial development in the financial system plays an important role in accelerating foreign participation in the economy. However, the effects of financial inclusion, that is, the accessibility to financial services and benefits in the financial institutions on the inflows of FDI, are yet to be investigated, focusing on the BRI initiatives extensively. The present study has included financial inclusion in the equation of FDI for exploring fresh insights and the new direction of FDI development in BRI nations. Second, the present study has implemented symmetric and asymmetric frameworks to establish the empirical nexus. It is mentioned here that the implementation of an asymmetric framework offers diverse information dealing with an appropriate explanation of positive and negative innovations in explanatory variables and their appropriate influence on explained variables. Thus, it is plausible to assist and support effective policy formulation for future development.

The remaining structure of the article is as follows. The literature survey of the study deals with Section 2. Section 3 reports the study’s variables’ definitions, model specifications, and econometrical methodology. The empirical model estimation and output are shown in Section 4. Discussion of the findings is available in Section 5. Finally, Section 6 deals with the conclusion and policy suggestions.

2 Literature review

2.1 Financial inclusion and foreign direct investment

The hand of international money flows is a vital component in driving any country’s economic progress. Cross-border cash flow has become an important part of the global economy’s financial sector development. Cross-border cash flow is crucial for improving the industry service and financial affectivity, supporting developing economies and ensuring sustained GDP and international trade growth. Financial inclusion and efficiency are linked to cross-border cash transfers. In the study by Toxopeus and Lensink (2008), financial inclusion positively impacts cross-border capital flows. According to the research, which analyzed 2008 data from 63 countries from the IFM, World Bank, and GLS, remittances are included in international or cross-border cash flows. Additionally, remittances may increase if financial inclusion is properly implemented. According to them, financial inclusion boosts economic activity, which supports remittance providers by making it easier to send money back home. Foreign currency reserves must be increased to increase financial inclusion. Qamruzzaman and Jianguo (2018) used the System GMM technique in 58 developing nations between 1993 and 2017 to show that foreign capital flow has significantly impacted a vital economic development function. A country’s financial inclusion must be improved to promote cross-border cash mobility, demonstrating a positive association.

G. A. Zwedu (2014) used the BDY financial stability and inclusive development model to assess 593 banks from 2010 to 2013. In other words, increasing access to financial services may help a country’s commercial and economic standing. What makes a foreign investor want to invest money into a nation with more financial users? The lack of financial inclusion and foreign capital inflows that do not improve the growth rates are emphasized. Sarma and Pais (2011) showed that improving financial inclusion boosted the daily financial activity and the number of financial employees, which enhanced the effectiveness of foreign capital flows in the nation, according to an empirical analysis done on 88 countries in 2010. This is proof of a favorable relationship. According to Ramasamy and Yeung (2010), financial inclusion incentives increased the number of financial users from 1988 to 2010. The number of transactions from this rise was directly proportional to the FDI attracted. This demonstrates a favorable relationship between FDI and foreign cash flow. Based on an analysis of a panel of 16 EU countries from 1988 to 2004, Bevan et al. (2004) concluded that the financial inclusion rate of developed countries is higher in those countries that implement financial inclusion than those countries that do not. Therefore, it has a lower growth rate in foreign cash flows, which does not practice or promote financial inclusion.

Morgan and Pontines (2018) discovered mutually reinforcing financial inclusion and financial market stability. The short period and restricted availability of foreign capital exacerbated the connection between foreign capital flow and foreign financial inclusion. This was discovered in another study by Singh and Zammit (2000), who used the financial stability and inclusive growth model with 63 developing countries in the 1990s and 2000s and discovered that rural poverty and gender inequality could affect financial inclusion, implying that the relationship between foreign cash flow and foreign cash flow appears to be negative. Other studies have indicated that expanding financial inclusion does not influence foreign capital flows, but the country’s overall financial status may impact FDI, making the statement neutral. Barrell et al. (2003) used a panel of nine European Union countries to study system dynamics between 1991 and 1997. According to the findings, technology transfer is linked to financial inclusion risk, affecting cross-border cash flow. There is a risk that the liquid cash problem may develop differently with maximum financial inclusion applications if the monetary transaction assessment is reduced considerably. According to a study conducted by Barajas et al. (2000), financial inclusion has a general financial development in the cross-border cash flow sector, implying a positive relationship between financial inclusion and cross-border cash flows. Bailliu (2000) created an economic growth model for 1975–2000 using panel data from 40 developing countries gathered between 1975 and 2000. Financial data show the financial effectiveness of an organization. Due to increased financial efficiency, FDI transparency improves, which benefits foreign cash flows.

The empirical analytic technique, FDI-growth, was used by Adeniyi et al. (2015) to evaluate the financial efficiency of different financial resistances throughout the country that may affect cross-border cash flow between 1990 and 2015. Remittances and cross-border cash flow may suffer as a result of increased efficiency. The study found that foreign capital has been important to the sustained high investment and output rate in three countries from 1990 through 1996, using a dynamic model and a panel from Korea, Malaysia, and Indonesia. Only Korea was unwilling to accept any foreign investment, no matter how mature it was. All three East Asian countries were prepared to accept foreign funding strongly dependent on financial efficiency. Economic and financial developments rely on a country’s level of financial affectivity, which has been positively related to foreign capital flows in a separate study.

According to Taylor and Sarno (1997), as a counteraction plan between the United States and Latin American and Asian nations from 1988 to 1997 in developed countries, FDI was difficult to identify as an effective financial instrument, causing difficulty in foreign investor linkage and foreign cash flow. Another study by Katarzyna Anna and Adam (2012) found a positive association between financial efficiency and cross-border cash flow. Sturm and Williams (2008) used the system dynamic approach on a panel of foreign banks in Australia between 1998 and 2008 to investigate how different financial barriers impact cross-border cash flow. The efficiency of cross-border money transfers may have a detrimental influence on remittances.

2.2 Good governance/institutional quality and foreign direct investment

Existing literature has suggested that researchers and academicians have extensively assessed the key determinants of foreign capital flows and documented several macros and micro agents such as exchange rates, domestic capital formation, and trade liberalization. However, many studies have established good governance, referred to as institutions and traditions, by which power exercised by the authority significantly influences foreign capital flows (Kaufmann and Wei, 1999; Rehman et al., 2021). Even though good governance has been extensively investigated, focusing on FDI, the conclusive direction has yet to be established (Herrera-Echeverri et al., 2014b; Shah et al., 2015; Hamid et al., 2022a). The study of Ross (2019), for example, investigated the current, holistic governance of FDI in 122 developing countries from 2002 to 2017 using World Bank’s “good governance index” and econometrics method. The results say good governance is an undeniable indicator of a host country’s FDI, as weak institutional capacity can adversely impact those economies. Furthermore, Cong Minh Huynh (2022) established the FDI inflows on institutional quality in 43 developing countries worldwide during 2002–2009 using FGLS and SGMM estimations. The findings concluded that at the beginning, FDI inflows aided in improving institutional quality, but in the presence of an underground economy, it had negative impacts, reducing the merits. Thus, this is indifferent to conclude, and it suggests controlling the underground economy to minimize the demerits. However, considering the present literature on good governance-led FDI, we can be segregated it into two lines positive association linkage and neutral effects.

The first line of literature has suggested a positive and statistically significant association between good governance and inflows of FDI (Assadzadeh et al., 2013; Aziz, 2018; Younsi et al., 2019; Bouchoucha and Benammou, 2020; Mengistu and Adhikary, 2011; Shittu et al., 2020). The study of Dorozynski et al. (2020), for example, verified the institutional quality on FDI for 17 countries of Central and Eastern Europe from 2007–2017, exercising hierarchical cluster analysis; panel models. The study documented a positive association of FDI with GDP with efficient institutional systems and quality. Furthermore, Narayanan et al. (2020) explored the relationship between FDI and good governance using the ASEAN countries as samples from 2002 to 2015 using the PMG estimation method. The study concludes that FDI positively impacts economic growth in the presence of good governance, so it should be encouraged to attain maximum benefit from it. The article of Omri and Mabrouk (2020) established that political and good governance positively relates to the FDI improving the economy and environment but could have some minor adverse impacts on human flourishing. This could be reduced by improving both political and institutional governance. Huynh and Hoang (2019) postulated that proper policies should be implemented, and better governance ensures that FDI can positively help reduce the shadow economy while improving institutional quality. Moreover, in a study, Khan et al. (2019) analyzed the relationship between good governance and FDI in India from 1996 to 2012 through multiple regression models. A study proves that India could attract more FDI due to its good governance system, which helps them attain employment and expand economic growth and income through the investment of more outside investors.

In their research, Raza et al. (2021b) investigated the relationship between FDI and economic expansion with good governance of OECD countries for the period of 1996 to 2013, exercising the fixed-effect model and GMM estimators. The study documented a positive association of the variables, but it is necessary to modify the laws to reduce corruption. Aibai, Huang, Luo, Peng, et al. (2019) explored the role of FDI on financial expansion and institutional quality in a sample of 50 countries from 1989 to 2011 that joined the Belt and Road Initiative by conducting the GMM method. From the result of the study, it is concluded that there is a stronger and more positive relationship which says FDI can easily thrive in financial enhancement by improving institutional quality and financial function. Biro et al. (2019) examined the effect of good governance on FDI in Latin American countries from 2001 to 2012 using the gravity model, OLS, and PPML measures. The study established a positive association stating good governance can attract FDI for developing the target economies. Sabir et al. (2019) documented a positive relationship between FDI and institutional quality in all the assigned countries, but developed countries have more significance in institutional quality than developing countries.

In their study, Kasasbeh et al. (2018) showed the FDI and institutional quality and good governance relationship using developing economies, i.e., Jordan, from 1980 to 2016, applying multivariate VAR analysis. The study says FDI significantly reduces corruption while effectively improving governance and institutional quality, assuring a positive relationship. Peres et al. (2018) investigated the importance of FDI on the productivity of technology, employment, and many more economic factors using 110 developed and developing countries for the period of 2002–2012, exercising panel data set and econometrics models including OLS. The findings concluded that good governance can significantly affect FDI, though, for some developing countries, it is not that significant. But, it is inferred from the study that proper governance can attract more FDI inflows. The study of Kayalvizhi and Thenmozhi (2018) explored the technology, culture, and corporate governance relationship with inward FDI in 22 emerging economies from 1996 to 2014 using panel models with fixed effects. The study’s findings prove a positive proportional relationship between corporate governance and FDI, improving economy, technology, and culture. The research article of Hayat and Development (2019) investigated whether institutional quality plays a crucial role in enhancing economic flourish through FDI, considering a sample of 104 countries from the years 1996–2015 applying the GMM method. The study concludes a positive association between FDI and institutional quality in low- and middle-income economies but a slowed association in high-income nations.

The second direction line explains the neutral effects of good governance on FDI inflows. The study of Cong Minh Huynh (2022), for example, established the FDI inflows on institutional quality in 43 developing countries throughout the world during 2002–2009 using FGLS and SGMM estimations. The findings concluded that at the beginning, FDI inflows aid in improving institutional quality, but in the presence of an underground economy, it has negative impacts, reducing the merits. Thus, this is indifferent to conclude, and it suggests controlling the underground economy to minimize the demerits. Thus, it is postulated that FDI inflows improve institutional quality and ensure efficient mobilization in the economy. Similar evidence is available in the study of Miao et al. (2020). The study established contingent impacts from country to country, based on the efficiency of policy to control intuitional quality.

2.3 Environmental quality and foreign direct investment

FDI inflow in the economy ensures technological advancement, knowledge sharing, and industrial development with capital support. On the other hand, the excessive application of conventional energy, that is, fossil fuel integration, causes environmental degradation (Abdouli and Hammami, 2017; Zomorrodi and Zhou, 2017; Hao et al., 2020). Foreign direct investment has an environmental impact, whether it improves or degrades the quality of natural resources or living organisms. Environmental degradation may be triggered by several circumstances, including resource depletion, the risk to living creatures, and human activity contributing to environmental degradation. Degradation of the environment is an essential prerequisite for the growth of these factors, which ultimately results in rising costs and capital depletion. The growing cost of conducting business in terms of capital loss emphasizes the critical importance of environmental quality. Additionally, since the environment significantly impacts clean drinking water and air availability, it is critical to resolve this problem. As a result, environmental quality is crucial for human and business health alike. Given that FDI inflows account for a significant portion of economically developed enterprises and institutions, it is critical to keep a check on them via environmental regulations. Three major elements affect the environmental quality of FDI inflows: environmental legislation, pollutant levels, and industry-specific FDI. Three lines of evidence have been found in the empirical literature focusing on the nexus between environmental quality and foreign direct investment (Alam et al., 2022). The first positive linkage was done by Opoku and Boachie, 2020; Bao et al., 2011; Kirkulak et al., 2011; and An et al., 2021. Bhujabal et al. (2021), for example, examined the impact of FDU on the environmental quality in the prime Asia-Pacific countries for the time series from 1990–2018 using the PMG causality test. The study documented that as FDI increases, ICT infrastructure rises, reducing air pollution and making the environment better in the long run. Contractor et al. (2020) disclosed a strong positive connection between business and the overall environment. As FDI is more attracted to investing in less efficient entry and exit systems, government policies must be restructured. In their study, Ssali et al. (2019) explored the nexus between environmental quality on FDI using six selected sub-Saharan African nations from 1980 to 2014 using ARDL and other methods. The study established a positive causality of FDI on the environment by properly using eco-technology to maintain a green environment. The research of Saini and Sighania (2019) reviewed the economic expansion and environmental quality of FDI inflows using developed and developing countries from 1990 to 2017 using the GMM technique. The study documented the existence of the Kuznets curve saying cleaner environment can eradicate the bad impacts of economic growth on the environment.

In their study, Wang et al. (2019) examined the relationship between FDI on environmental regulation and pollution using eastern, central, and western regions of China from 2000 to 2014, applying the PCSE method. The results showed that FDI can substantially reduce environmental pollution more in the eastern and central regions than in the western regions, providing a stricter environmental regulatory system. Sapkota and Bastola (2017) analyzed the impact of FDI and income on pollution in 14 Latin-American countries for the time series of 1980–2010, applying PHH and EKC hypotheses. The results conveyed that policies concentrating on clean and energy-effective industries through FDI would be sustainable and flourish economically. The research of Zomorrodi et al. (2017) suggested that better environmental regulation with modern technology from FDI can help reduce problems regarding pollution, making FDI beneficial. A similar line of findings is available in the study of Seker et al. (2015).

The second line of association documented a negative association between them (Hitam et al., 2012; Arif et al., 2021). The study of Bulus et al. (2021), see, for example, analyzed the impact of FDI and government spending on the environmental quality in Korea from 1970 to 2018 using ARDL. The results of the study say that as FDI increases, pollution increases, limiting and degrading environmental quality. Thus, it recommends implementing holistic green-growth measures. The study by Khan et al. (2020) examined the connection between environmental pollution by carbon dioxide emission through FDI in 17 countries in Asia for the phase from 1980 to 2014. Through panel co-integration and other tests, the results conveyed that FDI increases environmental pollution, so more government initiatives should be implemented to reduce such pollution from FDI. Rafindadi et al. (2018) examined the impact of FDI and energy consumption on the environment of GCC economies from 1990–2014, applying the PMG methodology. The study results show a negative association with the environment as FDI inflows, suggesting promoting green energy to assure the reduction of carbon dioxide emission. The study of Doytch and Uctum (2016) analyzed the correlation of environment on FDI inflows in low and lower-middle income countries for the period of 1984–2011 using the system GMM method. The results showed a negative association as FDI inflows degrades the environment which is proved in three levels of studies and for the reliability of the conclusion it used all sectors’ data but not just the firm level. The article of Hakimi et al. (2016) investigated the economic impact of FDI on environmental quality in Tunisia and Morocco (1971–2013) using VECM and co-integration techniques. The results concluded that trade liberation has a negative impact on the environment though it may benefit economies. The research investigated whether environmental pollution is a concerning issue of FDI in Malaysia for the phase 1965–2010, applying a non-linear model. The study documented the existence of the Kuznets curve and as FDI increases, the environment degrades badly.

The third line of evidence suggests a neutral association between environmental quality and FDI inflows in the economy (Kurtishi-Kastrati, 2013; Adeel-Farooq et al., 2021; Neequaye and Oladi, 2015). The study of Demena and Afesorgbor (2020), for example, investigated the impact of FDI on environment quality using mixed-income countries for 2017 and 2018 using meta-analysis. Contrary to the literature, which conveys the negative impact of these two variables, the study shows the likelihood of a positive association between them. Thus, theoretically, there could be positive and negative associations of FDI and a cleaner environment (Manigandan et al., 2022). Different pollutants represent controversial outcomes following a neutral outcome of the study. Pazienza (2019) investigated the relationship and magnitude of the FDI impact on the environment in 30 OECD countries from 1989-to 2016 using the panel data technique. The study’s findings mostly supported the positive coalition of FDI on the environment through some adverse impacts on some alternative specifications, making the study reconsider. The research of Shahbaz et al. (2015) aimed to examine the non-linear correlation of FDI and environmental degradation for all 99 income-based economies from 1975 to 2012 using the FMLOS and causality test. The study documented that different levels have different impacts of FDO on their respective environment, so sound policies should be implemented to improve the environmental quality and economic situation using FDI (Rehman and Noman, 2022).

3 Data and methodology

3.1 Model specification

The present study intended to investigate the impact of environmental quality, good governance, and financial inclusion on FDI inflows in the BRI counties (a panel of 59 nations) from 1990 to 2020. The study considered a panel of six BRI nations and selected target countries purely relying on data availability. The pertinent data for the study have been extracted from world development indicators published by the World Bank and international financial statistics published by the International Monetary Fund (IMF). All the data were transformed into a natural logarithm prior to empirical estimation to reduce internal data inconsistencies (Qamruzzaman and Karim, 2020). The generalized empirical model is as follows:

FDI stands for foreign direct investment in the economy, FI denotes financial inclusion, EQ specifies environmental quality, GG stands for good governance, and X* for the equation’s list of control variables. Table 1 displays the research variables, proxies, and data sources.

3.2 Variables’ definitions

As an explained variable, FDI is proxied by net inflows of FDI as a % GDP. For explanatory variables, the study has accounted for financial accessibility, financial inclusion, the stats of environmental protection measured by carbon emission, and a strong governmental initiative in the economy Table 2.

Apart from the explained and explanatory variables, following the existing literature dealing with the determinants of FDI, the present study has considered trade openness (TO) which is measured by the total trades as a % of the GDP and gross capital formation (GCF), which is proxied by total gross capital formation as a % of GDP. It is anticipated that economic openness and capital adequacy in the economy positively accelerate the inflows of FDI by enticing foreign investors to channel their capital in the form of FDI (Hamid et al., 2022b).

3.3 Estimation strategy

3.3.1 Cross-sectional dependency test and test of heterogeneity.

Globalization established interconnection across the world; therefore, every economy is prone to react due to economic shocks in other economies (Jia et al., 2021; Qamruzzaman, 2022b; Zhuo and Qamruzzaman, 2022). As a result, empirical research employing panel data will almost certainly be necessary to ascertain the existence of cross-sectional dependence. The literature has suggested several ways to detect the possible presence of cross-sectional dependency by employing the CDlm test offered by Breusch and Pagan (1980), the CDlm test with a scaled version following Pesaran (2021), the CD test following Pesaran (2006), and the bias-adjusted LM test proposed by Pesaran et al. (2008).

The LM test statistics can be computed with the following equation:

where

The scaled version of the Lagrange multiplier (CDlm) can be implemented in the following manner

The proposed cross-sectional test established by Pesaran (2006), commonly known as the CD test, can be executed with the following equation.

Finally, the CD test following Pesaran et al. (2008), known as bias-adjusted LM statistics, can be computed with the following equation:

3.4 Panel unit root test

The framework for the unit root test with CADE following Pesaran (2007) is as follows:

Putting long-term in Eq. 7 results in the subsequent Eq. 8:

where

where the parameter

3.5 Westerlund co-integration test

The error-correction techniques for long-run co-integration assessment following Westerlund (2007) are as follows:

The results of the group test statistics can be derived with Eqs 12, 13.

The test statistics for panel co-integration can be extracted by implementing Eqs 14, 15:

3.6 Cross-sectional ARDL

Nonetheless, the defects in panel ARDL are cross-sectional. However, if the unobserved common components of the regressors are connected, such apparent conceptions may result in erroneous estimates and adversely biased estimations in certain cases. Chudik and Pesaran (2015) proposed the common correlated effects (CCE) approach to panel ARDL models. Pesaran (2006) explains how the equation’s average values represent unobserved common components as proxy variables for dependent and independent variables. As a consequence, when Eqs 2, 3 are averaged across time, the result is that we obtain:

where

It is further extended as follows:

Thus, the panel CS-ARDL specification of Eq. 17 is

where

where

3.7 Asymmetric ARDL estimation

In the recent literature, the application of a non-linear framework has extensively considered addressing the asymmetric effects of explanatory variables on target variables (Anwar et al., 2021; Liu and Qamruzzaman, 2021; Yang et al., 2021; Adebayo et al., 2022; Qamruzzaman, 2022a; Xia et al., 2022). The following non-linear equation has been developed following the initial non-linear framework familiarized by Shin et al. (2014).

The asymmetric shocks of financial inclusion (FI+/ FI−), good governance (GG+/ GG−), and environmental quality (EQ+/ EQ−) can be derived by executing the following equations.

The error correction version of Eq. 19 is as follows:

4 Model estimation and interpretation

4.1 Unit root test, homogeneity test, and cross-sectional dependency test

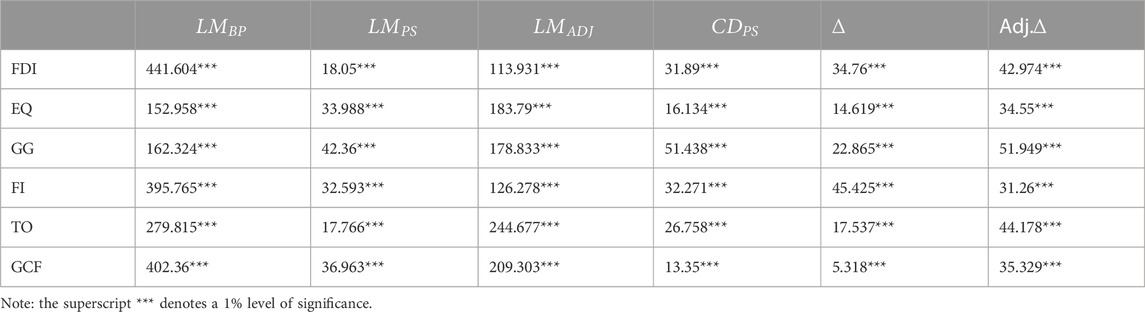

In the cross-sectional dependency test, we evaluated all four tests. All test variable values were statistically significant in the Breusch–Pagan LM (Breusch and Pagan, 1980), Pesaran-scaled LM, Pesaran bias-corrected scaled LM, and Pesaran CD. The four cross-sectional dependency tests have a cross-sectional relationship between all variables. Each variable influences or contributes to the outcome of another value. Each of the six variables is dependent on the others. They do not have to be mutually exclusive; one influences the other. Each variable seems significant, implying that the data and variables we use to describe teats are cross-sectionally dependent and influence one another. Along with CDS, the following section will look into heterogeneity using the Pesaran and Yamagata (2008) framework. The estimate’s findings Table 2. Comprising two coefficients, adj., and by rejecting the null hypothesis of homogeneity at a 1% significance level, the study’s findings show that heterogeneous traits are present in the sampled dataset.

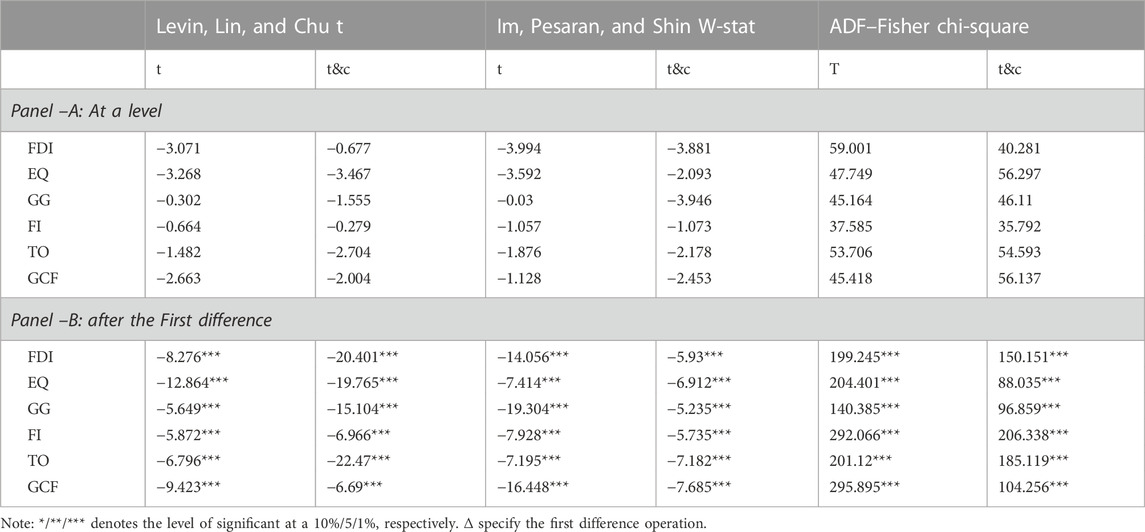

Next, the study employed first-generation and second-generation unit root tests to document the variable’s order of integration. The panel unit root test result is displayed in Tables 3, 4. According to the first-generation unit root test statistics, all the variables are exposed to stationary after the first difference but neither revealed stationary after the second difference.

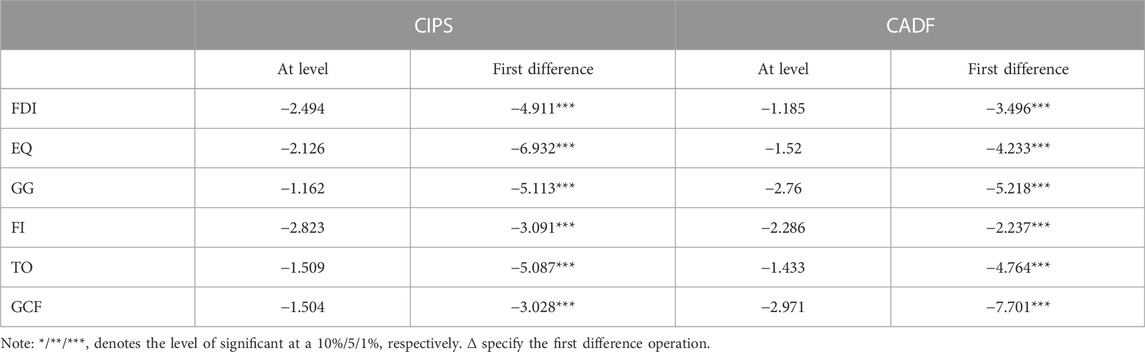

The second-generation unit root test has been implemented following the framework proposed by Pesaran (2007), which is widely known as CIPS and CADF. Referring to the test statistics seen in Table 3, the null hypothesis of non-stationary has been rejected after the first difference assessment. The study established that all the research units are stationary after the first difference, and none are exposed to the second difference. Study findings from Unit root test has suggested the inclusion and implementation of robust econometric techniques for empirical assessment.

The study has executed a panel co-integration test following Pedroni (2001) and further developed by Pedroni (2004) and Westerlund (2007) in assessing the long-run association between FDI and explanatory variables. The results of the panel co-integration test are displayed in Table 5. The Pedroni co-integration test results are displayed in Panel–A of Table 5. The study documented that the majority of the test statistics revealed statistical significance at a 1% level, explaining the rejection of the null hypothesis, that is, no co-integration. Alternatively, the study unveiled the long-run association between FDI, environmental quality, financial inclusion, good governance, trade openness, and gross capital formation in BRI nations. The study further moves in assessing the long-run association by using the co-integration test based on the error-correction term. According to the test output, panel-B in Table 5, all the statistics are statistically significant at a 1% level, suggesting the long-term relationship between FDI inflows and explanatory variables.

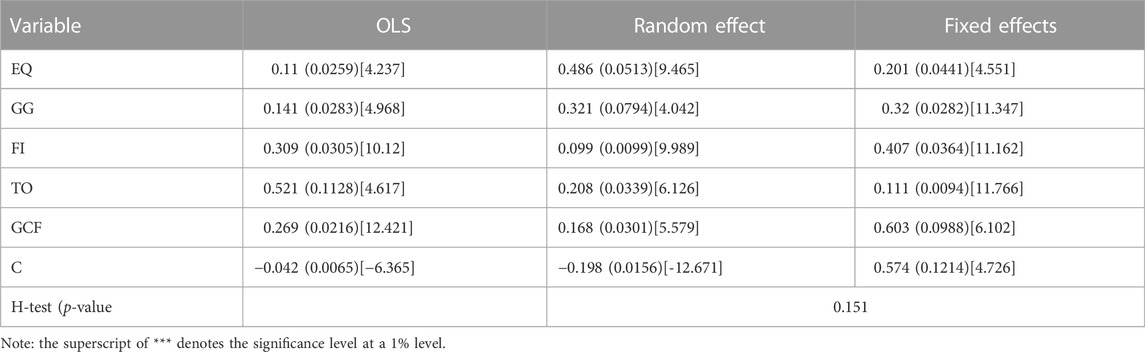

4.2 Baseline estimation with OLS, RE, and FE

Prior to executing the target model, the study assessed the empirical equation by implementing OLS, random-effect, and fixed-effects regression to get the intended association between environmental quality, good governance, and financial inclusion on FDI inflows in BRI nations. According to the Hausman test statistic and associated p-value, the fixed-effects model estimation revealed efficiency in explaining the empirical association between FDI and explanatory variables. The results of baseline estimation are displayed in Table 6. The studies documented that environmental quality measured by carbon emission is positively connected with FDI inflows, suggesting that less-regulated environmental policies act as inducing factors and motivate the foreign investor to channel funds to the host economy. Furthermore, good governance and institutional quality revealed a positive relation with FDI inflows, implying that the protection of invested capital, stability of law and order, and governmental effectiveness in ensuring a congenial environment indulge the foreign investors in transferring knowledge and technology in those economies. The role of financial inclusion has been disclosed as positive and statistically significant to FDI, implying that financial institutions’ access to financial services and benefits ensure efficient financial intermediation and efficient reallocation of economic resources in the economy. Referring to the control variable’s impact on FDI inflows, it is apparent that a positive effect running from trade openness and gross capital formation in the economy accelerates the present trend in FDI inflows in the economy.

TABLE 6. Baseline estimation: financial inclusion, financial efficiency, and foreign capital inflows.

4.3 CS-ARDL estimation

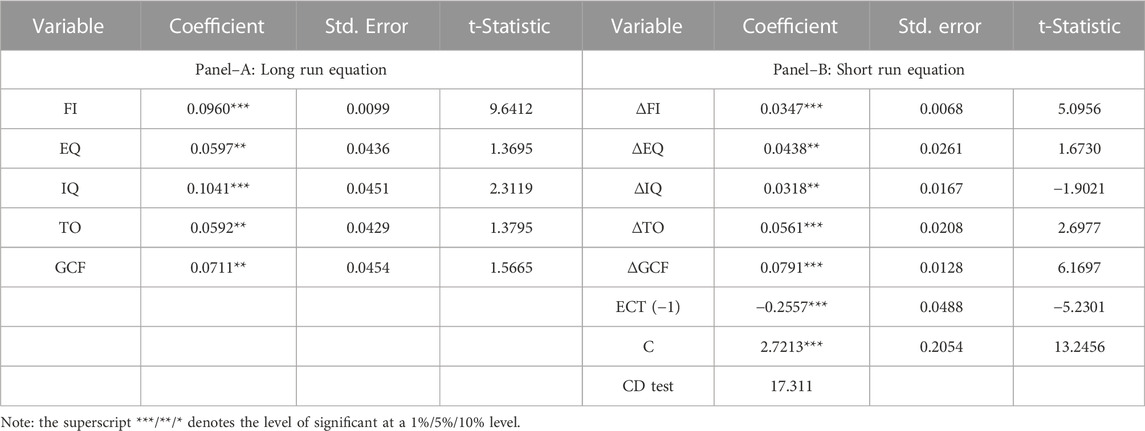

Next, the study investigates the impact of financial inclusion, environmental quality, and good governance on FDI inflows in BRI nations using Equation 16. The results of CS-ARDL are displayed in Table 7.

Financial inclusion on FDI inflows in BRI countries has been positive and statistically significant in the long run (short-run) with a coefficient of 0.096 (0.0347). It suggests that access to financial services and benefits in the financial system allows investors to get pertinent information and efficient financial intermediation, which motivates foreign investors to select an economy for their capital investment destination. In particular, study coefficients advocated that a 10% development in access to financial services will increase the present trend of FDI inflows in the economy by 0.96% in the long run and 0.347% in the short run. The existing literature supports our study findings, for instance, Bevan et al. (2004), Toxopeus and Lensink (2008), Qamruzzaman and Wei (2019), and Zwedu (2014), but conflicts with the study findings of Morgan and Pontines (2014), Singh and Zammit (2000), and Morgan and Pontines (2018).

The study documented the positive effects of environmental quality on FDI inflows in the long run (a coefficient of 0.0597) and the short run (a coefficient of 0.0438). This suggests a 10% increase in carbon emission will augment FDI inflows in the economy by 0.597% in the long run and 0.438% in the short run. The positive association between carbon emission and FDI indicates the “pollution haven” hypothesis that foreign investors prefer an environmentally less-regulated economy for their capital flows because clean energy integration in the production process incurs additional investment costs. The study’s findings are in line with the existing literature, for instance, Pingfang et al. (2011), Shao et al. (2022), but contradict the study findings of Yüksel et al. (2020) for G7 countries and those of Shao et al. (2022) in China.

The impact of good governance on FDI inflows in BRI was established to be positive and statistically significant both in the long run (a coefficient of 0.1041) and in the short run (a coefficient of 0.0318). In particular, a 1% institutional development can accelerate the economy’s FDI inflow by 0.1041% in the long run and 0.0318% in the short run. Study findings postulate that governmental effectiveness ensures investment protection and amicable ambiance for investment, which induces foreign investors to transfer capital to an economy with a strong governmental presence. The existing literature supports our study findings such as Mengistu and Adhikary (2011) in Asian countries, Fazio and Chiara Talamo (2008), (Shah et al., 2015) in SAARC nations, Niarachma et al. (2021) in ASEAN countries, and Kayani and Ganic (2021) in China.

Referring to controlling variables’ effects on foreign direct investment, the study documented that trade openness (TO) and gross capital formation (gcf) are positively associated in the long run and short run. More precisely, 10% domestic trade openness (gross capital formation) increases the foreign direct investment by 0.592% (0.911%) in the long run and by 0.561% (0.791%) in the short run. The study findings postulated that domestic trade internationalization creates an open market for additional demand that offers investment opportunities in the economy. Furthermore, capital adequacy ensures investment capitalization and aggregate output expansion, which is the opportunity for further investment, eventually motivating foreign investors to maximize economic resource reallocation.

4.4 Non-ARDL estimation

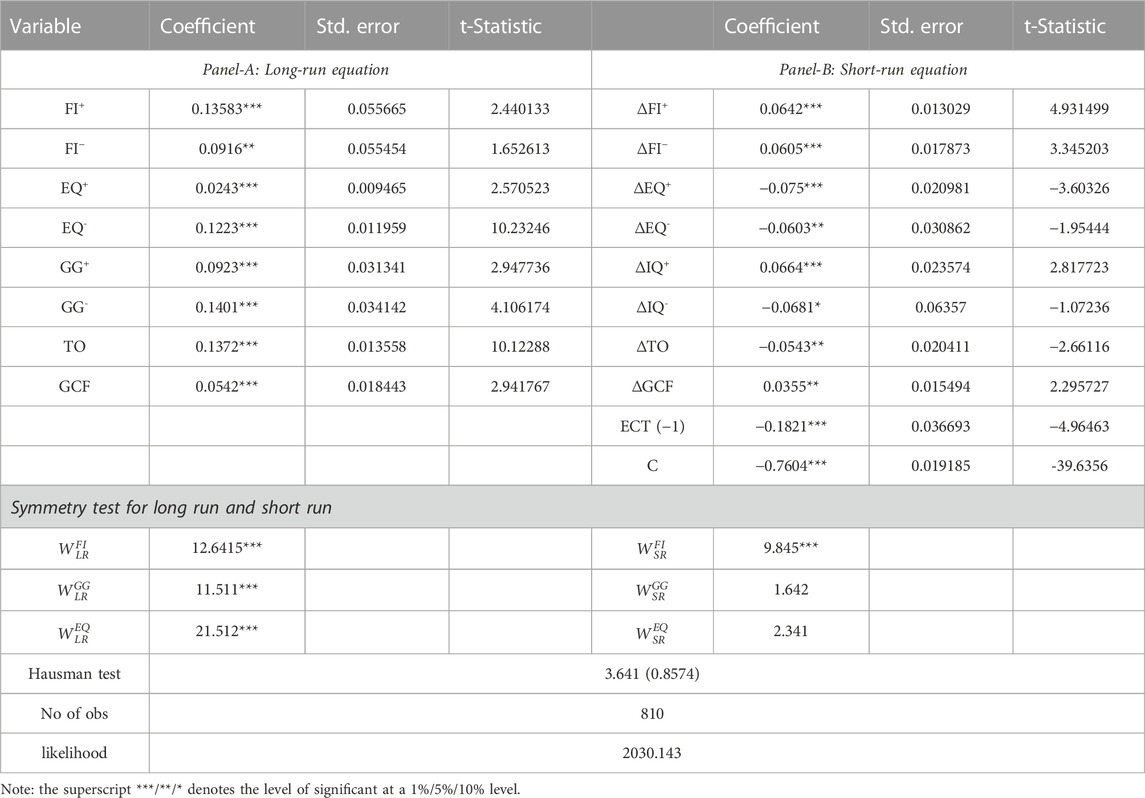

The study has implemented the non-linear framework for assessing the asymmetric effects of financial inclusion, environmental quality, and good governance on inflows of FDI in BRI nations. The result of asymmetric estimation is displayed in Table 8. The long-run asymmetric coefficients and symmetry tests are displayed in Panel-A, and the short-run coefficient and symmetry test results are available in Panel-B.

Reforest to asymmetric effects of financial inclusion on FDI inflows in a long-run study documented positive and statistically significant links between asymmetric shocks that are positive (a coefficient of 0.1358) and negative (a coefficient of 0.0916) and FDI inflows in the BRI. The study findings postulated that access to financial services and benefits increases FDI inflow and vice versa. In particular, a 10% positive (negative) innovation in financial inclusion in the financial system can accelerate (decrease) the inflows of FDI by 1.1358% (0.9165). A similar line of evidence can be found that is a positive and statistically significant relation between the asymmetric shock of financial inclusion and FDI in the short run. More precisely, a 10% development in financial inclusion will increase FDI inflows by 0.642%. The disadvantageous outcome can be derived from a 10% negative innovation in financial accessibility with an elasticity of 0.605%. The study documented that environmental quality positively influences FDI inflows. A 1% increase in carbon emission will boost the trend of FDI in the economy by 0.234%. The similar rate of carbon contraction results in a downward trend in receiving FDI in the BRI nations by 1.223%. In terms of a short-run assessment, the study documented asymmetric shocks of environmental quality that are positive (a coefficient of −0.0756) and negative (a coefficient of −0.06032), exposing a negative and statistically significant link with FDI inflows. Accounting for the asymmetric environmental quality assessment on FDI, it is apparent that relaxed and less-regulated environmental regulations motivate foreign investment. It indicates that foreign investors prefer to mobilize their capital to those economies where they can capitalize on the benefits of conventional energy application at the cost of ecological degradation. Furthermore, the inclusion of clean energy becomes costly in the initial stage; therefore, an environmentally strict and strongly regulated economy is the least preferred among foreign investors.

The asymmetric effects of good governance on FDI inflows have been positively and statistically significant, suggesting that storing governmental activities and investment protection induce foreign capital flow in the economy. In particular, a 10% positive (negative) shock in good governance can increase (decrease) FDI inflows in the BRI by 0.923% (1.401%). A study suggests that governmental quality determination significantly impacts FDI, and its elasticity has a greater impact than a positive development in governmental practices. For the short run, the asymmetric short of good governance has established that positive (negative) shocks are positive (negative) and statistically significant. More precisely, 10% positive (negative) innovation causes inflows of FDI by 0.664% (−0.681%).

The standard Wald test has been implemented to assess the possible asymmetric association between financial inclusion, good governance, environmental quality, and FDI in the long and short runs with a null symmetry hypothesis. The results of the Wald test suggested that rejecting the null hypothesis alternatively established asymmetric association, especially in the long run.

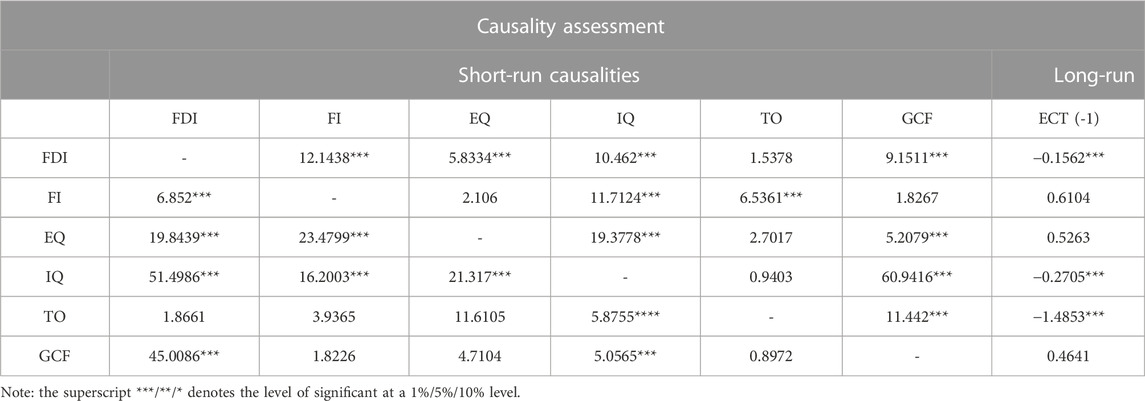

4.5 Panel Granger causality test under VECM

The study implements the Granger causality test under the error correction term to assess the directional association between environmental qualities, good governance, financial inclusion, trade openness, gross capital formation, and FDI. The causality test results are displayed in Table 9. The coefficient of long-run causalities can be derived from ECT (−1), which must be negative and statistically significant. According to an ECT (−1) study which documented long-run causalities in the empirical equation with FDI, IQ too is a dependent variable. In the short run, the study documented several causalities. The bidirectional causality has been established between financial inclusion, environmental quality, good governance, and gross capital formation with foreign direct investment [FI←→FDI; EQ←→FDI; IQ←→FDI; and GCF←→FDI].

5 Discussion of the study findings

Financial inclusion has revealed a catalyst for augmenting FDI inflows in BRI nations, suggesting a 1% growth of easy accessibility to financial services and benefits in the financial system which can accelerate the FDI inflows by 0.097% in the long run to 0.0346% in the short run. The study postulated that opening the financial services and benefits with a reasonable cost and process will boost foreign investors and support investment decisions, eventually transferring capital and technology to those economies in the form of investments. Due to its potential to accelerate an economy’s growth and sustainability, financial inclusion has focused worldwide interest in development finance and economics for years. Because millions of individuals throughout the world are banned from formal financial institutions, there is a risk of losing deposits or savings and investable money, and hence the global economy’s ability to build wealth. The potential of financial services to facilitate credit creation and capital accumulation, hence promoting investment and economic activity, is well-recognized. Martinez (2011) advocated that governments and politicians should use financial access to support economic progress. Economic activity and production are increased by improving economic actors’ access to and the availability of money. Financial inclusion helps people of all income levels to participate in the financial system and contribute to inclusive development. The study of Al-Zubaidi and Khudair (2021) established that the host’s economy financial accessibility and easy access to essential financial supports motivate foreign investors to transfer their expertise, technological know-how, and competencies in the form of capital. Furthermore, the study suggested that financial inclusion helps the country’s economic and social development by maintaining a continuous contact between clients and banks and providing them with simple and quick access to money, all of which are necessary for growth and development.

FDI inflows in the economy accelerated capital formation and aggregated output with the potential effect of poverty reduction and trade liberalization. The study documented the positive relation between good governance and FDI inflows in BRI nations, suggesting that good governance is an effective tool for attracting foreign investors; moreover, the practices of good governance increase investors’ confidence in its economic performance in the light of their investment protection (Fertő and Sass, 2020; Raza et al., 2021a). For the inflow of FDI into China, Kayani and Ganic (2021) documented that political stability, accountability, and law rules motivate foreign investors to transfer their capital and technological know-how to China. The existence of private capital defines international economic openness flows in the form of foreign direct investment (FDI), which is one of the most important sources of funding for development and productivity growth (Sahoo, 2012; Zhuo and Qamruzzaman, 2021). Foreign direct investment (FDI) is advantageous to most countries because it creates employment, increases market competition, and offers a way of transferring foreign-acquired technology and skills (Borensztein et al., 1998; Qamruzzaman, 2015; Iamsiraroj, 2016). In their respective studies, Cuervo-Cazurra (2008) and Jensen (2003) explained that the capacity of a government to maintain stable governance circumstances results in predictable and trustworthy market conditions. The government may issue this assurance to potential investors and enterprises to boost productivity and reduce manufacturing costs. Furthermore, the existing literature suggests that good governance has augmented the economic performance in terms of aggregated level and firms’ level, indicating that a higher return is ensured from investment with a lower degree of risk (Billett et al., 2011; Shank et al., 2013; Qamruzzaman, 2022b; 2022c; Li and Qamruzzaman, 2022; Zhuo and Qamruzzaman, 2022). The study of Albaity et al. (2021), for example, disclosed that risk-assuming behavior had been indulged by the governmental quality that is good governance substantially reduces investment risk exposure in MENA countries. Corporate governance structures and processes become critical components in this context for maximizing returns on investment and minimizing risk. Increased interest in corporate governance laws and standards may also represent a growing realization among international and domestic investors that they assess the quality of corporate governance, financial performance, and other factors. Corporate governance mechanisms help companies demonstrate their accountability to society and investors and help domestic firms gain a competitive edge over foreign competitors, resulting in increased productivity and long-term benefits for industrialization, growth, and overall corporate performance.

Environmental development and ecological protection have been placed at the top of every discussion, indicating that economic processes at the cost of environmental degradation should not be appreciated. Therefore, controlled environment guidelines and effective implementation have been initiated worldwide. Moreover, the inclusion of clean energy and energy-efficient technology has acted differently, implying that the economic structure and status have different motivations in controlling the environment. With the increasingly serious environmental pollution, the environmental policies introduced by governments to reduce environmental pollution may lead to a decrease in foreign investment. Furthermore, relaxed and less-regulated environmental regulations act as a motivating factor for foreign investment. It indicates that foreign investors prefer to mobilize their capital to those economies where they can capitalize on the benefits of conventional energy application at the cost of ecological degradation. Furthermore, the inclusion of clean energy becomes costly in the initial stage; therefore, an environmentally strict and strongly regulated economy is the least-preferred among foreign investors (Saini and Sighania, 2019; Ssali et al., 2019; Guang-Wen et al., 2022). The positive association between carbon emission and FDI indicates the “pollution haven” hypothesis where foreign investors prefer an environmentally less-regulated economy for their capital flows because clean energy integration in the production process incurs additional investment costs. The study findings are in line with the existing literature, for instance, Pingfang et al. (2011) and Shao et al. (2022), but contradict the study findings of Yüksel et al. (2020) for G7 countries and those of Shao et al. (2022) in China.

6 Conclusion

Receipts of foreign capital have become the key pillar for sustainable development, especially in developing nations. Moreover, the role of FDI is widely appreciated and acknowledged in capital accumulation, increase of production capacity, transfer and sharing of knowledge, and economic competitiveness (Borensztein et al., 1998). Domestic capital adequacy and sustainable economic growth immensely rely on technological advancement, managerial know-how, and money supply in the economy. In this context, FDI has emerged and is placed at an apex position due to its unprecedented impact on achieving sustainability across the world. The motivation of the study is to scale the effects of good governance, financial inclusion, and environmental quality on inflows of FDI in BRI nations for the period 1990 to 2020. Several panel econometrical tools have been applied, for example, CDS, CADF, CIPS, CS-ARDL, and NARDL, in investigating the association and explanatory variables elasticity on inflows of FDI in BRI nations. CDS results revealed that research units share common dynamism, and second-generation panel unit root test-documented variables are stationary after the first difference, and neither has been exposed after the first difference. The results of panel co-integration with the error correction term confirmed the empirical equation’s long-run association. According to the CS-ARDL assessment, positive and statistically significant impacts have been documented from financial inclusion, good governance, and environmental quality to FDI inflows. The study findings suggest that governmental effectiveness, easy access to financial services and benefits, and a less-regulated environmental concern economy motivate capital transfer decisions. The asymmetric assessment documented a long-run asymmetric association between FI, GG, EQ, and FDI. Referring to asymmetric shock elasticity, the study disclosed a positive and statistically significant tie to FDI inflows, especially in the long run. Directional causality test documented bidirectional casualty running between FI, EQ, GG, and FDI [FI←→FDI; GG←→FDI; EQ←→FDI] in the short run.

Data availability statement

Publicly available datasets were analyzed in this study. These data can be found here: WDI and WGI public data base.

Author contributions

LJ: introduction, empirical estimation, and final version; MQ: literature survey, empirical estimation, first draft, and final version; WH: literature survey, data curation, and the final draft; and RK: literature survey, methodology, and the final version of the manuscript.

Funding

The study has received financial support from the Institutions for Advanced Research (IAR) under project financing—IAR/2022/PUB/15.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abdouli, M., and Hammami, S. (2017). The impact of FDI inflows and environmental quality on economic growth: An empirical study for the MENA countries. J. Knowl. Econ. 8 (1), 254–278. doi:10.1007/s13132-015-0323-y

Abid, I., and Goaied, M. (2017). A meta-frontier assessment of bank efficiency in Middle East and North Africa countries. Int. J. Prod. Perform. Manag. 66, 266–296. doi:10.1108/ijppm-01-2016-0020

Adebayo, T. S., Oladipupo, S. D., Kirikkaleli, D., and Adeshola, I. (2022). Asymmetric nexus between technological innovation and environmental degradation in Sweden: An aggregated and disaggregated analysis. Environ. Sci. Pollut. Res. 29, 36547–36564. doi:10.1007/s11356-021-17982-6

Adeel-Farooq, R. M., Riaz, M. F., and Ali, T. J. E. (2021). Improving the environment begins at home: Revisiting the links between FDI and environment, 215.119150

Adeniyi, O., Oyinlola, A., Omisakin, O., and Egwaikhide, F. O. (2015). Financial development and economic growth in Nigeria: Evidence from threshold modelling. Econ. Analysis Policy 47, 11–21. doi:10.1016/j.eap.2015.06.003

Adom, P. K., and Amuakwa-Mensah, F. (2016). What drives the energy saving role of FDI and industrialization in East Africa? Renew. Sustain. Energy Rev., 65, 925–942. doi:10.1016/j.rser.2016.07.039

Aibai, A., Huang, X., Luo, Y., and Peng, Y. (2019). Foreign direct investment, institutional quality, and financial development along the belt and road: An empirical investigation. Emerg. Mark. Finance Trade 55 (14), 3275–3294. doi:10.1080/1540496x.2018.1559139

Al-Zubaidi, M. N., and Khudair, J. M. (2021). Financial inclusion and foreign direct investments/obstacles and solutions. Warith Sci. J. 3 (7).

Alam, A., and Shah, S. Z. A. (2013). Determinants of foreign direct investment in OECD member countries. J. Econ. Stud. 40, 515–527. doi:10.1108/jes-10-2011-0132

Alam, M. S., Alam, M. N., Murshed, M., Mahmood, H., and Alam, R. (2022). Pathways to securing environmentally sustainable economic growth through efficient use of energy: A bootstrapped ARDL analysis. Environ. Sci. Pollut. Res. 29 (33), 50025–50039. doi:10.1007/s11356-022-19410-9

Alam, M. S. (2022). Is trade, energy consumption and economic growth threat to environmental quality in Bahrain–evidence from VECM and ARDL bound test approach. Int. J. Emerg. Serv. 11 (3), 396–408. doi:10.1108/IJES-12-2021-0084

Albaity, M., Md Noman, A. H., and Mallek, R. S. (2021). Trustworthiness, good governance and risk taking in MENA countries. Borsa Istanb. Rev., 21(4), 359–374. doi:10.1016/j.bir.2020.12.002

Alfaro, L., Kalemli-Ozcan, S., and Sayek, S. (2009). FDI, productivity and financial development. World Econ. 32 (1), 111–135. doi:10.1111/j.1467-9701.2009.01159.x

An, T., Xu, C., Liao, X. J. E. S., and Research, P. (2021). The impact of FDI on environmental pollution in China: Evidence from spatial panel data. Environ. Sci. Pollut. Res. 28 (32), 44085–44097. doi:10.1007/s11356-021-13903-9

Andriamahery, A., and Qamruzzaman, M. (2022b). A symmetry and asymmetry investigation of the nexus between environmental sustainability, renewable energy, energy innovation, and trade: Evidence from environmental Kuznets curve hypothesis in selected MENA countries. Front. Energy Res. 9. doi:10.3389/fenrg.2021.778202

Andriamahery, A., and Qamruzzaman, M. (2022a). Do access to finance, technical know-how, and financial literacy offer women empowerment through women’s entrepreneurial development? [Original research]. Front. Psychol. 12 (5889), 776844. doi:10.3389/fpsyg.2021.776844

Anwar, A., Sharif, A., Fatima, S., Ahmad, P., Sinha, A., Rehman Khan, S. A., et al. (2021). The asymmetric effect of public private partnership investment on transport CO2 emission in China: Evidence from quantile ARDL approach. J. Clean. Prod., 288, 125282. doi:10.1016/j.jclepro.2020.125282

Arif, U., Arif, A., and Khan, F. N. (2021). Environmental impacts of FDI: evidence from heterogeneous panel methods. Environ. Sci. Pollut. Res. Int. 29 (16), 23639–23649. doi:10.1007/s11356-021-17629-6

Assadzadeh, A., Pourqoly, J. J. J. o. E., Business, , and Management, (2013). The relationship between foreign direct investment, institutional quality and poverty: Case of MENA countries. Case MENA Ctries. 1 (2), 161–165. doi:10.7763/joebm.2013.v1.35

Assadzadeh, A., and Pourqoly, J. (2013). The relationship between foreign direct investment, institutional quality and poverty: Case of MENA countries. J. Econ. Bus. Manag. 1 (2), 161–165. doi:10.7763/joebm.2013.v1.35

Aziz, O. G. J. F. R. L. (2018). Institutional quality and FDI inflows in Arab economies. Financ. Res. Lett. 25, 111–123. doi:10.1016/j.frl.2017.10.026

Azman-Saini, W. N. W., Law, S. H., and Ahmad, A. H. (2010). FDI and economic growth: New evidence on the role of financial markets. Econ. Lett., 107(2), 211–213. doi:10.1016/j.econlet.2010.01.027

Bailliu, J. (2000). “Private capital flows, financial development, and economic growth in developing countries,” in Staff Working Papers 00-15, (Bank of Canada).

Bao, Q., Chen, Y., Song, L. J. E., and Economics, D. (2011). Foreign direct investment and environmental pollution in China: A simultaneous equations estimation. Environ. Dev. Econ. 16 (1), 71–92. doi:10.1017/s1355770x10000380

Barajas, A., Steiner, R., and Salazar, N. J. J. o. d. e. (2000). The impact of liberalization and foreign investment in Colombia's financial sector. J. Dev. Econ. 63 (1), 157–196. doi:10.1016/s0304-3878(00)00104-8

Barrell, R., Gottschalk, S., and Hall, S. G. (2003). Foreign direct investment and exchange rate uncertainty in imperfectly competitive industries. Discussion Papers-National Institute Of Economic And Social Research.

Barthel, F., Busse, M., and Osei, R. (2011). The characteristics and determinants of FDI in Ghana. Eur. J. Dev. Res. 23 (3), 389–408. doi:10.1057/ejdr.2011.4

Bevan, A., Estrin, S., and Meyer, K. J. I. b. r. (2004). Foreign investment location and institutional development in transition economies. Int. Bus. Rev. 13 (1), 43–64. doi:10.1016/j.ibusrev.2003.05.005

Bhujabal, P., Sethi, N., and Padhan, P. C. (2021). ICT, foreign direct investment and environmental pollution in major Asia Pacific countries. Environ. Sci. Pollut. Res. 28 (31), 42649–42669. doi:10.1007/s11356-021-13619-w

Bilawal, M., Ibrahim, M., Abbas, A., Shuaib, M., Ahmed, M., Hussain, I., et al. (2014). Impact of exchange rate on foreign direct investment in Pakistan. Adv. Econ. Bus. 2 (6), 223–231. doi:10.13189/aeb.2014.020602

Billett, M. T., Garfinkel, J. A., and Jiang, Y. (2011). The influence of governance on investment: Evidence from a hazard model. J. Financial Econ., 102(3), 643–670. doi:10.1016/j.jfineco.2011.07.004

Biro, F. P., Erdey, L., Gall, J., and Markus, A. J. G. E. J. (2019). The effect of governance on foreign direct investment in Latin America—Issues of model selection. Glob. Econ. J. 19 (01), 1950006. doi:10.1142/s2194565919500064

Boateng, A., Hua, X., Nisar, S., and Wu, J. (2015). Examining the determinants of inward FDI: Evidence from Norway. Econ. Model. 47, 118–127. doi:10.1016/j.econmod.2015.02.018

Borensztein, E., De Gregorio, J., and Lee, J.-W. (1998). How does foreign direct investment affect economic growth? J. Int. Econ. 45 (1), 115–135. doi:10.1016/s0022-1996(97)00033-0

Bouchoucha, N., and Benammou, S. J. J. o. t. K. E. (2020). Does institutional quality matter foreign direct investment? J. Knowl. Econ. 11 (1), 390–404. doi:10.1007/s13132-018-0552-y

Bourkhis, K., and Nabi, M. S. (2013). Islamic and conventional banks' soundness during the 2007–2008 financial crisis. Rev. Financ. Econ. 22 (2), 68–77. doi:10.1016/j.rfe.2013.01.001

Breusch, T. S., and Pagan, A. R. (1980). The Lagrange multiplier test and its applications to model specification in econometrics. Rev. Econ. Stud. 47 (1), 239–253. doi:10.2307/2297111

Bulus, G. C., Koc, S. J. E. S., and Research, P. (2021). The effects of FDI and government expenditures on environmental pollution in Korea: The pollution haven hypothesis revisited. Environ. Sci. Pollut. Res. 28 (28), 38238–38253. doi:10.1007/s11356-021-13462-z

Chattopadhyay, A. K., Rakshit, D., Chatterjee, P., and Paul, A. (2022). Trends and determinants of FDI with implications of COVID-19 in BRICS. Glob. J. Emerg. Mark. Econ. 14, 43–59. doi:10.1177/09749101211067091

Chudik, A., and Pesaran, M. H. (2015). Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J. Econ. 188 (2), 393–420. doi:10.1016/j.jeconom.2015.03.007

Cong Minh Huynh, (2022). How does the impact of foreign direct investment on institutional quality depend on the underground economy? J. Sustain. Finance Invest. 12 (2), 554–569. doi:10.1080/20430795.2020.1788851

Contractor, F. J., Dangol, R., Nuruzzaman, N., and Raghunath, S. J. I. B. R. (2020). How do country regulations and business environment impact foreign direct investment (FDI) inflows? Int. Bus. Rev. 29 (2), 101640. doi:10.1016/j.ibusrev.2019.101640

Cuervo-Cazurra, A. (2008). Better the devil you don't know: Types of corruption and FDI in transition economies. J. Int. Manag., 14(1), 12–27. doi:10.1016/j.intman.2007.02.003

Dai, M., Qamruzzaman, M., and Hamadelneel Adow, A. (2022). An assessment of the impact of natural resource price and global economic policy uncertainty on financial asset performance: Evidence from bitcoin. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.897496

Demena, B. A., and Afesorgbor, S. K. J. E. P. (2020). The effect of FDI on environmental emissions: Evidence from a meta-analysis. Energy Policy 138, 111192. doi:10.1016/j.enpol.2019.111192

Dorozynski, T., Dobrowolska, B., Kuna-Marszalek, A. J. E. B., and Review, E. (2020). Institutional quality in central and East European countries and its impact on. FDI Inflow 8 (1), 91–110.

Doytch, N., and Uctum, M. J. E. S. (2016). Globalization and the environmental impact of sectoral FDI. Econ. Syst. 40 (4), 582–594. doi:10.1016/j.ecosys.2016.02.005

Du, J., and Zhang, Y. (2022). “In fear of trojan horse? China’s cross-border acquisitions in Europe amid the one belt one road initiative,” in China and the belt and road initiative: Trade relationships, business opportunities and political impacts. Editor Y.-C. Kim (Springer International Publishing), 75–109. doi:10.1007/978-3-030-86122-3_5

Fazio, G., and Chiara Talamo, G. M. (2008). “How “attractive” is good governance for FDI?,”. Editors J. J. Choi, and S. Dow (Emerald Group Publishing Limited), 9, 33–54. doi:10.1016/S1569-3767(08)09002-XInstitutional Approach Glob. Corp. Gov. Bus. Syst. Beyond

Fertő, I., and Sass, M. (2020). FDI according to ultimate versus immediate investor countries: Which dataset performs better? Appl. Econ. Lett. 27 (13), 1067–1070. doi:10.1080/13504851.2019.1659925

Fuest, C., Hugger, F., Sultan, S., and Xing, J. (2022). What drives Chinese overseas M&A investment? Evidence from micro data. Rev. Int. Econ., 30(1), 306–344. doi:10.1111/roie.12566

Greenwood, J., and Jovanovic, B. (1990). Financial development, growth, and the distribution of income. J. Political Econ. 98 (5), 10761076–10761107. doi:10.1086/261720https://EconPapers.repec.org/RePEc:ucp:jpolec:v:98:y

Guang-Wen, Z., Murshed, M., Siddik, A. B., Alam, M. S., Balsalobre-Lorente, D., and Mahmood, H. (2022). Achieving the objectives of the 2030 sustainable development goals agenda: Causalities between economic growth, environmental sustainability, financial development, and renewable energy consumption. Sustainable Development.

Hakimi, A., Hamdi, H. J. R., and Reviews, S. E. (2016). Trade liberalization, FDI inflows, environmental quality and economic growth: A comparative analysis between Tunisia and Morocco. Renew. Sustain. Energy Rev. 58, 1445–1456. doi:10.1016/j.rser.2015.12.280

Hamid, I., Alam, M. S., Kanwal, A., Jena, P. K., Murshed, M., and Alam, R. (2022a). Decarbonization pathways: The roles of foreign direct investments, governance, democracy, economic growth, and renewable energy transition. Environ. Sci. Pollut. Res. 29 (33), 49816–49831. doi:10.1007/s11356-022-18935-3