- 1School of Economics, Beijing Technology and Business University, Beijing, China

- 2Department of Economics and Management, Yuncheng University, Yuncheng, China

With the deteriorating ecological environment, green technological innovation (GTI) has become an effective way to strengthen environmental protection and promote economic development. Based on the 2011–2019 panel data of 30 provinces in China, this study constructs a spatial Durbin model to examine the spatial spillover effect of environmental regulation and digital finance on green technological innovation. Meanwhile, a moderating effect model and threshold effect model are employed to explore the function of digital finance in terms of the impact of environmental regulation on green technological innovation. The empirical results show that: 1) environmental regulation has significantly promoted local GTI, green invention patents (GIP) and green utility model patents (GUP), while having had negative spatial spillover effects on those three things in neighboring regions. Digital finance promotes GTI and GIP in both local and neighboring areas, but digital finance’s direct and spatial spillover effects on GUP are not significant. 2) A regional analysis shows that different intensities of environmental regulation and different digital finance levels in different regions lead to the heterogeneity of green technological innovation’s response to them. 3) Digital finance produces a positive moderating effect on environmental regulation affecting GTI and GIP in local and neighboring regions. However, digital finance’s moderating effect in terms of the influence of environmental regulation on GUP is not significant. 4) When digital finance reaches a certain threshold, environmental regulation will have a stronger role in promoting GTI. Therefore, to improve regional green technology innovation and environmental governance, the government should strengthen the integration of digital technology and financial services, and promote the construction of environmental supervision systems and green innovation policy systems.

1 Introduction

Since reform and opening up, relying on the extensive development model, the China’s economy has achieved rapid growth (Ren et al., 2021a; Yang et al., 2021; Fang et al., 2022; Wang et al., 2022) and has become the second largest economy in the world (Wu et al., 2019; Abbasi et al., 2022; Irfan and Ahmad, 2022). However, this development model leads to excessive consumption of natural resources and a deteriorating ecological environment (Wu et al., 2021a; Yan et al., 2021; Ren et al., 2022b), which negatively affects the long-term high-quality development of the economy and society (Cao and Wang, 2017; Khan et al., 2020). Green technology innovation (hereafter “GTI”) can be considered as an effective way to realize a “win-win” result between the ecological environment and economic development (Dong et al., 2020; Wang and Feng, 2021). As an important supporting factor in realizing China’s green development goals (Rauf et al., 2021; Shao et al., 2021; Xiang et al., 2022), GTI refers to a form of the research and development of the industrial technology system that is conducive to energy conservation, pollution prevention and control, and elevating energy efficiency and recycling levels (Irfan et al., 2021; Qiu et al., 2022; Shi et al., 2022). GTI has both “innovation” and “green” characteristics. By incorporating green technology and environmental factors into the framework of technological innovation, GTI improves the utilization of resources and energy, and plays a critical role in reducing resource consumption and controlling pollution (Yi et al., 2022). Therefore, to guarantee the sustainable development of the economy, it is becoming increasingly urgent to promote green development and construct an ecological civilization through GTI.

The Chinese government has issued many policies that are intended to promote both green development and GTI. Examples include formulating and promulgating pollution prevention laws, implementing environmental regulation measures for enterprises, and increasing R&D investment (Cai et al., 2020; Ren et al., 2021b). According to China’s “Annual Report of Ecological Environment Statistics,” the total investment in environmental pollution control in 2020 was 1063.89 billion yuan, accounting for 2% of the government total investment in fixed assets. Meanwhile, the environmental protection investment system (urban environmental infrastructure construction investment, industrial pollution source control investment and construction project acceptance investment) have been consistently improved and developed. Environmental regulation has been adopted by policy makers as an important means to control environmental pollution. Nevertheless, there is still no consistent conclusion with regard to the impact of environmental regulation on GTI. Some scholars have stated that, for enterprises, environmental regulation raises the cost of pollution control, decreases R&D innovation investment and inhibits GTI (Stucki et al., 2018; Shang et al., 2022). Conversely, some scholars have maintained that, when enterprises carry out GTI based on long-term development needs, their production efficiency and profitability will be improved. This, in turn, will counteract the negative effects of environmental regulation (Chakraborty and Chatterjee, 2017; Hu et al., 2020).

In addition, in the background of increased environmental regulation, to exert environmental regulation’s positive function in GTI, the financial industry must provide a stable and sufficient source of funds for innovation. Although China’s financial development system has gradually improved in recent years; there is still a structural mismatch of funds when traditional banking institutions provide financial services to enterprises. As a result, enterprises often face financing constraints due to failure to obtain financial support for R&D investment activities (Wu et al., 2021b). Compared with general innovation activities, GTI activities have the features of being long-term, high-risk and irreversible, and also face the issues of high cost, resource constraints and failure risks in the transformation process. Therefore, enterprises frequently face greater financing constraints in the process of technological innovation (Ji and Zhang, 2019). Recently, under the background of the vigorous development of the digital economy, a new financial format is being formed with the extensive integration of digital technology and financial products and services (Guo et al., 2020). With advanced technologies (such as blockchain and big data), digital finance has strengthened the connection between financial entities, expanded the content and boundary of traditional financial services, and provided new methods for solving the existing problems in traditional financial services (Gomber et al., 2018; Cao et al., 2021). However, the relationship between digital finance and corporate GTI has not been discussed in detail in the previous literature.

Nowadays, the impact of environmental regulation on GTI has become a hot research topic, and a few scholars have analyzed the mechanism of digital finance on GTI. However, few studies incorporate environmental regulation, digital finance and GTI into a unified analytical framework. In addition, the existing research has not yet studied the impact of environmental regulation on GTI from the perspective of digital finance. Under the macro background of tightening environmental regulations, digital finance provides effective financial support for green technological innovation activities by expanding corporate financing channels and reducing information asymmetry (Dendramis et al., 2018; Liao et al., 2020; Cao et al., 2021). Therefore, this paper aims to analyze the following issues. How do environmental regulation and digital finance affect GTI? Will digital finance indirectly affect the effect of environmental regulation on GTI? Is there a threshold effect on the impact of environmental regulation on GTI?

The rest of the paper is arranged as follows: Section 2 reviews the related literature. Section 3 presents the mechanism analysis. Section 4 constructs the econometric model and explains the data sources. Empirical results and analysis of the benchmark research are reported in Section 5, and Section 6 further explores the moderating effect and threshold effect of digital finance. Finally, Section 7 summarizes the full text and puts forward corresponding policy suggestions.

2 Literature Review

Current literature about environmental regulation, digital finance and GTI mainly focuses on both the relationship between environmental regulation and GTI, and the relationship between digital finance and GTI. Therefore, this section also reviews the relevant research from these two aspects.

2.1 Environmental Regulation and Green Technological Innovation

Environmental regulation is an effective way to manage environmental problems; this has been verified in practice (Porter and Van der Linde, 1995a). However, research on environmental regulation’s impact on GTI (and the corresponding conclusions) is still controversial. At present, there are mainly three viewpoints regarding environmental regulation’s impact: positive promotion, negative inhibition and uncertain effect. First, the positive promotion view holds that, when the government implements environmental regulations, enterprises will actively carry out GTI to reduce production costs and strengthen competitiveness. These enterprises obtain high profits by developing green processes and products (Guellec and Van Pottelsberghe De La Potterie, 2003), thus resulting in an “innovation compensation” effect. Perino and Requate (2012) put forward the hypothesis of green advanced production technology diffusion. Specifically, to decrease the pollution discharge expenses caused by an environmental protection policy, enterprises will have the motivation to introduce new green technology or buy green production technology in the market. This will promote the emergence and diffusion of green advanced production technology. Bréchet and Meunier (2014) analyzed the influence of technological innovation diffusion on environmental regulation by building a model. The study found that the implementation of either a pollution emission tax or a pollution permit will increase the rate of adoption of environmental innovation technology. Second, the view of reverse inhibition holds that environmental regulation is unfavorable to GTI. This is mainly manifested in the fact that environmental regulation has brought about high costs to enterprises, which in turn makes them unable to engage in GTI. This is called the “following cost” effect (Stucki et al., 2018; Li et al., 2019). Further, the cost borne by enterprises mainly includes two parts. One is the direct cost of dealing with pollution emissions; the other is the opportunity cost of investment activities abandoned to meet the requisite environmental protection policy standards (Rubashkina et al., 2015). Third, the view of uncertain effect maintains that a non-monotonic or insignificant correlation exists between environment regulation and GTI, and the relationship between them is complicated and unsure (Yuan et al., 2017; Fan et al., 2021). Scherer et al. (2001) took U.S. and German patents as samples, and concluded that environmental regulation is not related to GTI. Perino and Requate (2012) pointed outed that, when a company’s new technology paradigm intersects the marginal “abatement” cost curve of the traditional technological paradigm, environmental regulation affects GTI in an inverted “U” shape. In addition, some scholars have classified environmental regulations and have found that command-controlled environmental regulations and market-driven environmental regulations produce different effects on GTI (Kesidou and Wu, 2020; Peng, 2020).

2.2 Digital Finance and Green Technological Innovation

Related literature in this field mainly falls into two categories. One discusses digital finance’s impact on regional GTI from a macro view. Sun (2020) showed that the level of digitalization has a positive correlation with the benefits of the green economy, among which technological innovation is a factor that cannot be ignored if the former is to influence the latter. Cao et al. (2021) believed that digital finance has obviously improved regional GTI, thus improving the energy and environmental performance. Feng et al. (2022) drew the conclusion that digital finance promotes regional GTI by elevating the efficiency of capital allocation and optimizing the industrial structure. The second category explores the relationship of digital finance and GTI from a corporate micro view. For example, Yu et al. (2021) claimed that many enterprises often cannot obtain the necessary financial support for green innovation; rather, these enterprises usually face the problem of financing constraints. With the help of advanced technical means, digital finance effectively deals with this problem, generating a positive influence on enterprises’ GTI. Frost et al. (2019) took the micro-loan data of Ant Financial as the research sample. The study found that digital finance has changed the traditional financial service mode by means of an internet platform and digital technology. This approach has greatly shortened the credit approval process and reduced the financing cost of enterprises, thus promoting enterprise innovation. Utilizing a sample of Chinese enterprises, Liu et al. (2022) showed that digital finance can greatly elevate the availability and inclusiveness of finance. As such, digital finance improves the normal situation in which financing is difficult and expensive for enterprises, and then promotes enterprises’ GTI. Moreover, the promotion of digital finance to GTI is more obvious in economically underdeveloped areas and high-pollution industries. However, most of the above-mentioned studies were conducted from a spatially independent perspective, without considering the spatial spillover effect of financial resources.

To sum up, the existing research on environmental regulation, digital finance and GTI is relatively fruitful, but the following points still need to be further discussed: first, current research mainly concentrates on the relationship between environmental regulation and GTI, or between digital finance and GTI. These studies generally fail to incorporate the three (digital finance, GTI and environmental regulation) into the same research framework for systematic analysis. In addition, existing literature has classified the different means of environmental regulation to make differential analyses, but the differentiation analysis of different kinds of GTI still needs further detailed research. Second, most related researches are based on the spatial independence perspective. However, environmental regulation will influence the migration of enterprises, thus affecting the GTI in adjacent regions. Financial elements also have spatial spillover effects, so an independent perspective will inevitably lead to neglecting the spatial connection between regions. Third, the tightening of an environmental regulation policy will inevitably impose higher requirements on enterprises’ capital and technology resources. At present, there is an extreme lack of research on whether or not digital finance can modulate environmental regulation’s impact on GTI.

The possible contributions of this study are as follows: First, from the research perspective, environmental regulation, digital finance and GTI are incorporated into the same research framework to comprehensively analyze the spatial spillover effects between them. Furthermore, unlike existing studies that only consider the overall GTI, GTI is further subdivided into green invention patents (hereafter GIP) and green utility model patents (hereafter GUP) to analyze the impact of environmental regulations on different innovation models. Secondly, in terms of research methods, given the spatial dependence of economic activities, the spatial Durbin model is adopted to empirically explore the direct impact and spatial spillover effects of environmental regulation and digital finance on cross-provincial GTI. Thirdly, the moderating effect model and threshold effect model are employed to explore the moderating and nonlinear influence of environmental regulation on GTI under different digital finance development levels.

3 Mechanism Analysis

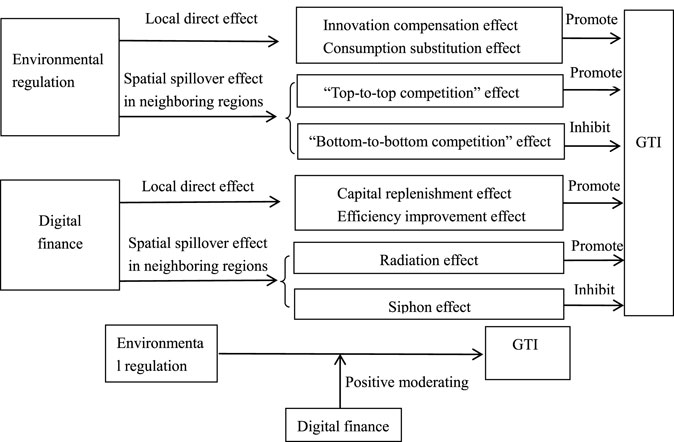

The spatial correlation of economic activities will produce a spillover effect. Therefore, the mechanism between environmental regulation, digital finance and GTI should be discussed from the spatial perspective.

3.1 Mechanism of Environmental Regulation on Green Technological Innovation

Direct effect of environmental regulation on local GTI: To meet environmental protection requirements, enterprises’ pollution control expenses will provisionally rise. However, in the long term, under the innovation compensation effect, enterprises will take measures to raise investment in R&D, driven by the pursuit of their own profits. These enterprises will also improve their competitiveness and the overall technical level of the industry by elevating production efficiency and changing production methods, in order to adapt to environmental standards (Peuckert, 2014; Wang and Shen, 2016; Chakraborty and Chatterjee, 2017; Cainelli et al., 2020). Moreover, due to the implementation of environmental protection policies, enterprises will decrease the consumption of high-pollution energy. Consumers will also turn to the consumption of environmentally friendly products, resulting in a consumption substitution effect. The changes in consumption concept and consumption structure will impel enterprises to conduct GTI. Therefore, environmental regulation will promote the level of GTI through both the innovation compensation effect and consumption substitution effect.

Spatial spillover effect of environmental regulation on GTI in neighboring regions: The “Pollution Shelter Hypothesis” (Porter and Van der Linde, 1995b) pointed out that, if a region’s environmental regulations become strict, polluting enterprises will choose to move out of that region, because of rising costs (List and Co., 2000; Xing and Kolstad, 2002; Yin et al., 2015; Wu et al., 2017). Under the transfer effect of polluting industries, the green innovation capability of the areas where the polluting industries transferred is solidified at a low level. At the same time, China’s current political system framework is made up of “political centralization and fiscal decentralization.” Local economic performance is also often used as a standard for the promotion of government officials. When a certain place implements a stricter environmental access policy, the neighboring regional governments take on the mode of “bottom-to-bottom competition,” in order to achieve GDP growth (Wheeler, 2001). These areas do not raise or even lower environmental standards to attract an inflow of resources, thus inhibiting GTI. However, even when the level of economic development varies among regions, some studies have pointed out that, under the background of high-quality economic development, a central environmental protection inspector will require the region’s environmental regulation policies to be upgraded. In addition, the intergovernmental competition mode may also be expressed as being in the mode of “top-to-top competition” (Bu and Wagner, 2016). When one region improves the regulatory intensity, and adjacent places follow suit, the result will be a demonstration learning effect. Therefore, enhancing environmental regulation intensity may also produce a positive spillover effect on GTI in neighboring areas.

3.2 Mechanism of Digital Finance on Green Technological Innovation

Direct effect of digital finance on local GTI: The characteristics of high risk and high investment in GTI automatically mean that GTI requires long-term financial support (Stanko and Henard, 2017). The advantages of digital finance (such as wide coverage and low cost) mean the financial needs of green innovation can easily be met. Specifically, first of all, digital finance can enrich the sources of corporate funds and broaden the boundaries of financial services. Under the traditional financial service mode, a great deal of small and medium-sized enterprises with active innovation cannot obtain the required funding support from formal and traditional financial services. In the era of the digital economy, a new financial format has broken the constraints of the traditional modes of financial service through hardware facilities and geographical location. Digital finance offers coverage to a wider range of customers, as well as more modes of financial services. Digital finance has greatly improved the availability of corporate credit resources and provided a continuous capital supply for enterprises’ GTI (Liao et al., 2020; Ozili, 2021). Secondly, digital finance can improve information transparency and financial service efficiency. The asymmetric information between enterprises and the traditional capital suppliers is one of the reasons why enterprises have difficulty obtaining external financing (Kaplan and Zingales, 1997). Digital finance is able to accurately obtain the enterprises’ relevant data (and that of their innovative projects) by means of emerging technologies. Thus, a complete information monitoring system and risk assessment system can be set up accordingly (Du et al., 2021). This method not only improves the information transparency of enterprises and avoids credit discrimination under the influence of information asymmetry (Kshetri, 2016; Dendramis et al., 2018), but also simplifies the credit review and evaluation process of enterprises and improves their financing efficiency (Gomber et al., 2018; Feng et al., 2022). Therefore, digital finance can meet the capital needs of enterprises through the capital replenishment effect and efficiency improvement effect, thereby mobilizing the innovation initiative of enterprises, and enhancing the innovation ability of green technology.

Spatial spillover effect of digital finance on GTI in neighboring regions: Digital finance has strong spatial correlation and an agglomeration effect (Wang and Guan, 2017; Shen et al., 2021). This not only affects the local technological innovation activities, but also affects the neighboring technological innovation activities through the “correlation effect.” For one thing, local digital finance can produce a radiation effect. Capital flow, personnel flow and data sharing drive the promotion of digital finance in adjacent areas and also alleviate the financing constraints faced by those adjacent areas. Thus, the innovation environment in adjacent areas is improved, and the level of GTI in those areas is elevated. For another thing, the development of digital finance will also produce a siphon effect. Relying on the first-mover advantage, a characteristic of digital finance, a better financial support and innovation environment has been created locally, thus attracting investment and consumption from the surrounding areas. Shortages of supply-side investment and demand-side consumption have simultaneously inhibited the innovation vitality of the surrounding areas. Meanwhile, the “digital divide” caused by the continuous improvement of local digital finance, as well as the high technical threshold of digital finance itself, makes it impossible for neighboring areas to quickly improve the level of digital finance in a short time. This inhibits the improvement of GTI levels in neighboring areas.

3.3 Coordination Mechanism of Environmental Regulation and Digital Finance on Green Technological Innovation

The implementation of an environmental regulation policy will impose higher standards on enterprise production. Enterprises will adopt technological innovation to meet environmental protection requirements, but this will put pressure on their ability to invest. Under the background of tightening environmental regulations, enterprises’ production funds are facing constraint pressure. Meanwhile, traditional finance methods and sources lead to capital mismatch, due to the asymmetric information between banks and enterprises; financial discrimination also exists (Talavera et al., 2012). The development of digital finance, which relies on information processing, can effectively achieve accurate data matching and more accurate risk assessment, thus realizing a more effective allocation of funds (Li et al., 2020). Meanwhile, digital finance can use its own information and technology advantages to broaden enterprises’ financing channels. Digital finance can touch more long tail groups that are facing the pressure of financial constraints due to the tightening of environmental regulations, alleviate the phenomenon of financial discrimination, and help inclusive finance to realize its due meaning. Therefore, with the strengthening of environmental regulation, the development of digital finance can optimize the resource allocation structure, slow down financial discrimination, promote the continuous improvement of the financial system, and ultimately provide potential fund support for enterprises. Finally, digital finance will positively modulate the influence of environmental regulation on GTI.

According to the above analysis, the mechanism of environmental regulation and digital finance on GTI is organized in Figure 1.

4 Methodology and Data

4.1 Econometric Methodology

4.1.1 Spatial Durbin Model

The development of environmental policies and digital finance in China’s provinces has significant spatial dependence. Meanwhile, many studies have shown that when the variables are spatially correlated, traditional econometric estimation models will lead to biased estimation results (Feng and Chen, 2018; Feng et al., 2019). Therefore, to better reflect the spatial effect of economic variables, this paper adopts a spatial econometric model to explore the influence of environmental regulation and digital finance on GTI in the spatial category. The spatial Durbin model comprehensively considers the spatial effects of independent variables and dependent variables, thereby effectively capturing the spillover effects of economic activities (LeSage and Pace, 2009; Ren et al., 2022a). Therefore, this study employs the spatial Durbin model for empirical analysis. The specific model setting is as follows:

Here,

If the province i and province j are geographically adjacent,

where dij is the spherical distance between cities, calculated according to the longitude and latitude coordinates of municipalities and provincial capitals.

where

4.1.2 Moderating Effect Model

To investigate the moderating role of digital finance (dfi) in the influence of environmental regulation on GTI, the interaction term er*dfi between environmental regulation and digital finance, and its spatial lag term W*er*dfi, are added into the benchmark model. When a model contains interactive terms, it is generally necessary to centralize the interactive variables. This approach can alleviate the problem of multicollinearity to some extent, and make the interactive variables more economical (Balli and Sørensen, 2013). The moderating effect model is designed as follows:

4.1.3 Threshold Effect Model

Under different levels of digital finance, environmental regulations are likely to have varying degrees of impact on GTI. To further verify the above moderating effect, this study sets up a panel threshold model to examine the nonlinear effect of environmental regulation on GTI, under the influence of different levels of digital finance. Referring to Hansen (1999), the panel threshold model is built as follows:

Here, the explained variable is GTI; the core explanatory variable is environmental regulation (er); the threshold variable is digital finance (dfi); control represents the control variables set for the model; λ1, λ2…λn, λn+1 are the staged influence of environmental regulation on GTI under different threshold variable values; I(∙) is an instruction function;

4.2 Explanation of the Variables

4.2.1 Explained Variables

Green technological innovation (GTI): Existing research mainly takes the number of green patents to represent the level of GTI (Wagner, 2007; Johnstone et al., 2010). Furthermore, the number of green patents includes the number of both applications and authorizations. To some extent, the number of patent applications merely reflects the willingness to carry out GTI, but the number itself does not represent the actual upgrading of the technical level. Based on this and referring to Liu et al. (2020), this paper chooses the number of granted green patents to represent the level of GTI in each province and city. Specifically, according to all the patent application information published by the Intellectual Property Office of China, combined with the international patent classification code of green patents provided by the World Intellectual Property Organization (WIPO), the patent data of different provinces have been obtained. The logarithm values of patent data are taken to construct the GTI index.

Green invention patents (GIP) and green utility model patents (GUP): GTI includes both GIP and GUP. Therefore, to further discuss the impact of environmental regulation and digital finance on different GTI, the authorized number of GIP and GUP are sorted out, and their logarithmic values are utilized as the proxy variables of GIP and GUP, respectively.

4.2.2 Core Explanatory Variables

Environmental regulation: To reflect the implementation effect of environmental regulation as a whole and to overcome the defect whereby a single index has difficulty in fully expressing environmental regulation, this study refers to Du and Li (2020) and Wang and Zhang (2022). Specifically, four indicators of 1) industrial solid waste, 2) industrial wastewater discharge, 3) sulfur dioxide discharge in industrial waste gas and 4) energy consumption in various regions are selected, in order to construct comprehensive indicators of environmental regulation intensity. Because these four indexes can comprehensively represent the control of the three wastes in a region, they have good representativeness. In addition, the entropy method is adopted in the determination of index weights. Specifically, after standardizing the indicators of different dimensions and units, the weight, entropy value and coefficient of difference are further calculated. Finally, the annual comprehensive score of each province is obtained; that is, the environmental regulation intensity index of each province, which is denoted by er.

Digital finance: Following Guo et al. (2020), the digital inclusive finance index developed by the Peking University Digital Financial Center is used as the proxy variable of digital finance. This index includes multidimensional data, such as coverage, depth of use, degree of digitization, etc. These data can comprehensively measure the current status of digital finance in China, and have certain representativeness and reliability. This study selects the provincial-level digital financial inclusion index, from 2014 to 2019, as the proxy variable of digital finance in the empirical analysis, represented by dfi.

4.2.3 Control Variables

Referring to existing studies (Luo and Liang, 2016; Feng et al., 2020; Shang et al., 2022), we select a series of control variables that affect GTI in the basic model.

Economic development (pergdp): Economic development can influence the industrial structure and energy utilization efficiency and plays an important role in GTI. We adopt the per capita GDP of each province to measure it.

Governmental support (gov): Government public financial support can help optimize resource allocation, improve economic efficiency, and promote GTI. We use the proportion of government public financial expenditure in GDP to express the size of the government.

Financial development (fiance): Financial development can provide more convenient financial services for enterprises to carry out technological innovation activities by lowering the threshold of financial services and improving the efficiency of financial services (Ren et al., 2022c). It is expressed by the proportion of the balance of loans from financial institutions to GDP at the end of the year.

Information level (inform): Information technology development can influence industrial agglomeration, promote industrial structure adjustment and promote enterprise innovation. Per capita post and telecommunications are used to measure the level of representative informatization (inform).

Economic openness (open): Economic openness can affect the regional GTI by introducing the leading energy-saving technology in developed countries. This paper uses the proportion of actual foreign investment and GDP to measure it.

R&D investment (rd): Green technology innovation is inseparable from a large amount of financial support. Therefore, increasing R&D investment can increase innovation output and improve GTI. This paper uses the ratio of R&D investment to GDP in each province to represent.

4.2.4 Date Sources

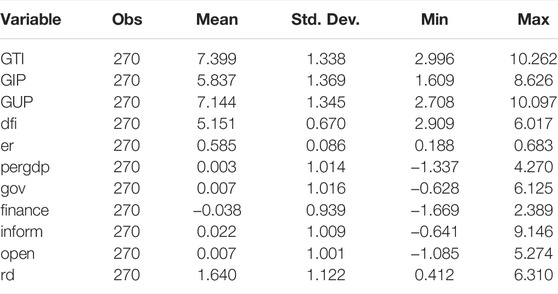

In this study, China’s provincial panel data from 2011 to 2019 are used for empirical analysis. Digital finance index comes from the website of Institute of Digital Finance, Peking University. The environmental regulation data, GTI, GIP, GUP and control variables come from the State Intellectual Property Office, the website of the National Bureau of Statistics, the China Statistical Yearbook, China Regional Economic Statistical Yearbook and the statistical yearbooks of various provinces. Some missing data are filled in according to the linear interpolation method. The descriptive statistics of sample data are displayed in Table 1.

5 Empirical Results and Analysis

5.1 Estimation Results of Spatial Model

5.1.1 Spatial Correlation Test

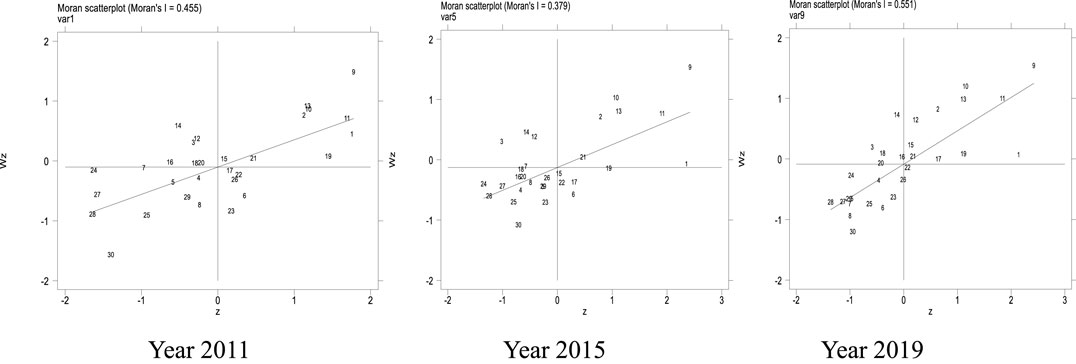

To explore whether spatial auto correlation exists between environmental regulation, digital finance and GTI, the global Moran’s indexes of 2011–2019 are calculated respectively. Table 2 demonstrates the results. As can be seen, from 2011 to 2019, the Moran’s I indexes of environmental regulation, digital finance and GTI are all significantly positive.

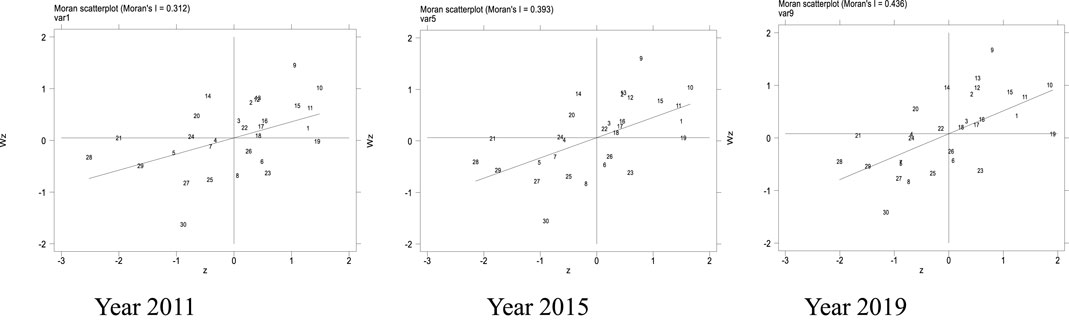

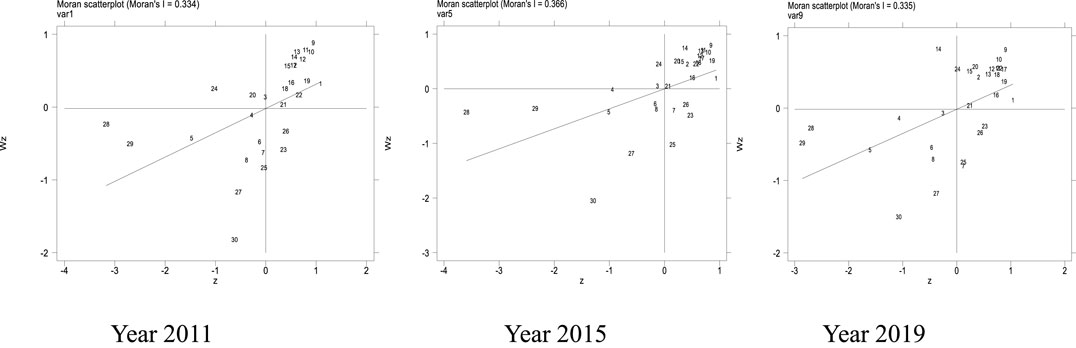

Next, this paper tests the local spatial correlation of GTI, environmental regulation and digital finance. According to the average values of the three in 2011–2019, Moran’s index scatter plots were drawn, as shown in Figures 2–4. Due to space limitations, only the scatter plots for 2011, 2015, and 2019 are presented. One can intuitively see that most provinces in the scatter chart of the three indicators are distributed in the first and third quadrants, whether in 2011, 2015 or 2019. These findings show that the three factors have a significant spatial agglomeration effect, showing obvious characteristics of high agglomeration and low agglomeration. All the evidence shows that environmental regulation, digital finance and GTI have significant positive spatial correlations in the spatial scope, as well as having the characteristics of spatial agglomeration. Therefore, the spatial effect should be considered when constructing a model of the influence of environmental regulation and digital finance on GTI.

FIGURE 2. Scatter plot of the Moran’s I of China’s green technology innovation in 2011, 2015, and 2019.

FIGURE 3. Scatter plot of the Moran’s I of China’s environmental regulation in 2011, 2015, and 2019.

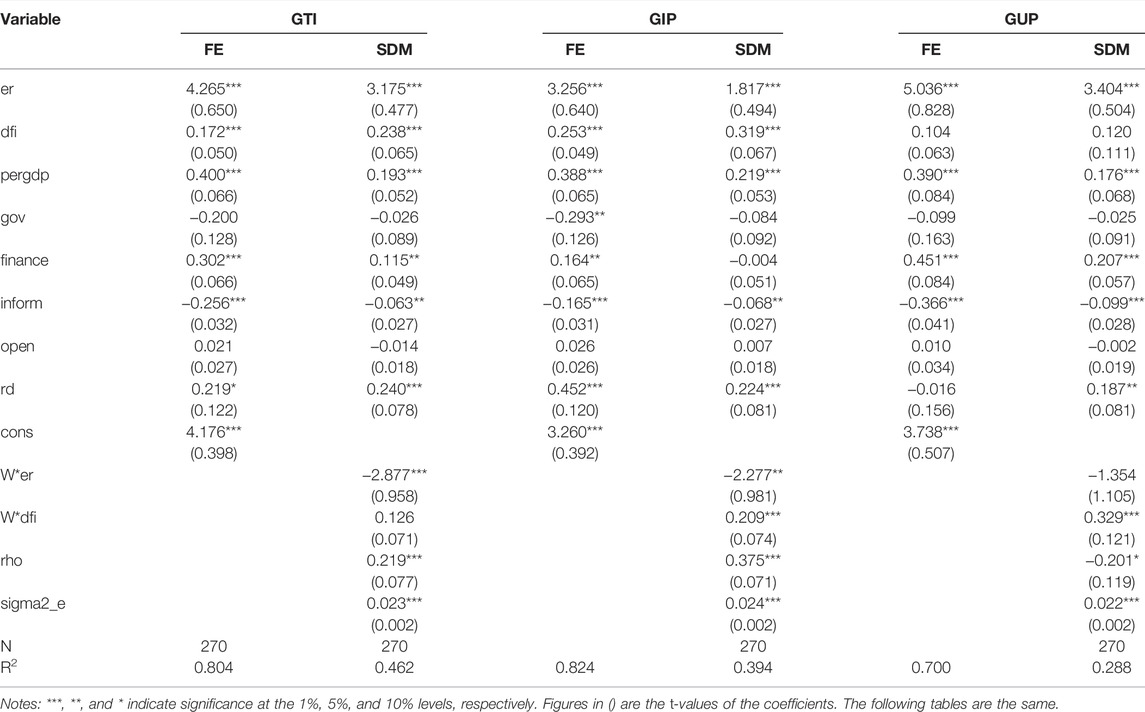

5.1.2 Estimation Results of the Spatial Durbin Model

Table 3 displays the GTI, GIP and GUP regression results. For comparative analysis, the regression results of fixed effect (FE) and the 0-1 weight matrix SDM model are both reported. From Table 3, the regression of principal variables suggests that both environmental regulation (er) and digital finance (dfi) promote GTI, but there are differences in terms of promoting GIP and GUP. As for control variables, the regression coefficients of economic development level (pergdp), financial development (finance) and R&D investment (rd) are all significantly positive and in accordance with economic significance. The higher a region’s economic development level (pergdp), financial development level (finance) and R&D investment intensity (rd) are, the more effectively that region can promote their own GTI level. The impact of informatization (inform) on GTI is significantly negative. This finding suggests that the flow and diffusion of information technology may not be the driving force of GTI, and may not even produce an inhibitory effect on GTI. In addition, the coefficients of government expenditure (gov) and the degree of openness (open) in the SDM model do not pass the significance test. This finding means that government expenditure and the degree of external development are not the main driving forces behind promoting GTI.

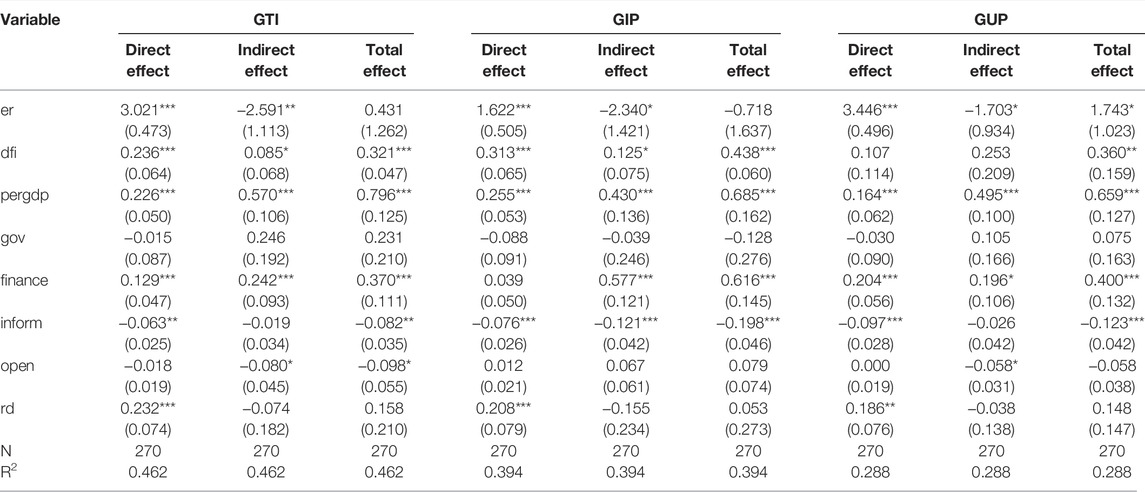

5.1.3 Estimation Results for the Decomposition Effects

To further investigate the spatial influence of environmental regulation and digital finance on GTI, this study made a partial differential decomposition of the SDM model to analyze the impact’s direct effects and indirect effects (spatial spillover effects). The GTI partial decomposition results show that the direct impact of environmental regulation on GTI is significantly positive (see Table 4). This finding suggests that the enhancement of environmental regulation intensity in one area will improve the local GTI capability. The conclusion is consistent with the “innovation compensation effect” of environmental regulation (Guellec and Van Pottelsberghe De La Potterie, 2003; Bréchet and Meunier, 2014). Digital finance also has a positive effect on GTI, which is consistent with the research results of Cao et al. (2021) and Feng et al. (2022). The main reason is that digital finance can provide financial guarantees for innovation activities. For the spatial spillover effect, the results imply that environmental regulation’s spillover effect on GTI is significantly negative. One possible reason for this finding is that strict environmental regulation makes local governments more competitive compared to surrounding regions, which has a spatially inhibiting effect on GTI in neighboring regions (Wheeler, 2001). Digital finance’s indirect effect on GTI is positive. This finding implies that the spatial interaction of digital finance will produce a positive spillover effect and promote GTI in adjacent regions.

From the spatial decomposition results of GIP, environmental regulation (er) and digital finance (dfi) have direct positive effects on local GIP. The spatial spillover effects of both er and dfi on GIP in neighboring regions are consistent with the effects on GTI.

The GUP spatial decomposition results indicate that environmental regulation can promote local GUP, while negatively inhibiting GUP in neighboring regions. Neither the direct effect nor the spillover effect of digital finance on GUP is significant. This is because digital finance has greatly improved the financing environment for enterprises. With a stable source of funds, enterprises are more likely to carry out GIP, which in turn can bring them core competitiveness. However, the research and development of GUP is less difficult; the cost is low, and the financing constraints are minimal (Tong et al., 2014). Therefore, the promotion effect of digital finance on GUP is not significant.

5.2 Heterogeneity Analysis

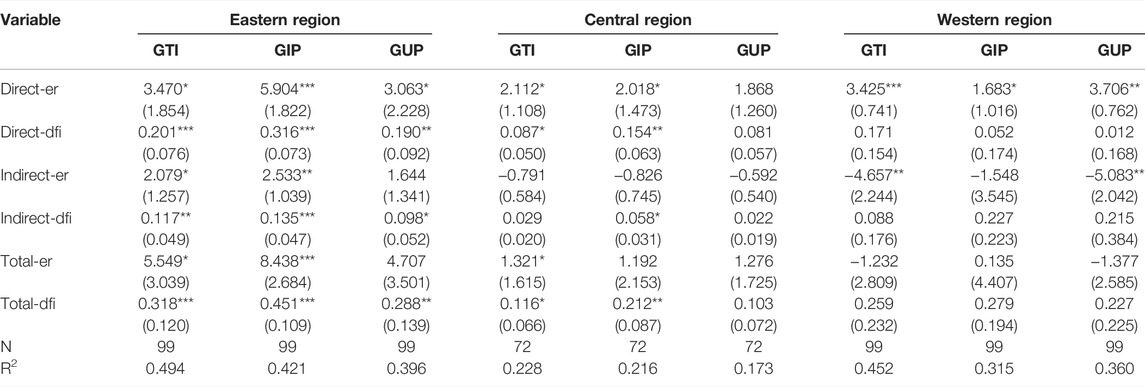

Considering China’s vast territory, the strength of environmental regulation, the level of digital finance and the innovation ability all vary from region to region. This may cause the heterogeneity of GTI’s response to environmental regulation and digital finance. Therefore, this study divided the 30 provinces into eastern, central, and western regions for further heterogeneity analysis. Table 5 presents the regression results.

In terms of the GTI regression results, environmental regulation’s direct effects on GTI were significantly positive in all three regions during the study period. However, the spillover effects of environmental regulation on GTI varied in the three regions. Specifically, in the eastern region, this spillover effect was significantly positive. The economies of the eastern provinces and cities are relatively developed, and the tightening of environmental protection may produce a demonstration effect, thus prompting the GTI in neighboring areas. In the central region, this spillover effect is not significant, while in the western region, the effect is significantly negative. This negative effect occurs because most western provinces and cities are underdeveloped. Therefore, to achieve economic growth, local governments choose the “bottom-to-bottom” mode of competition and allow inefficient polluting industries to develop. This results in a spatial inhibition effect. As for the influence of digital finance on GTI, only in the western region has digital finance’s direct effect on GTI not appeared. The reason may be that the development of digital finance in western provinces and cities is still immature, so digital finance’s promotion effect on GTI is not obvious. The spillover effect of digital finance on GTI only passed the significance test in the eastern region. This occurred because the eastern region has a relatively complete financial infrastructure and a high degree of digitalization, so the spatial spillover effect is more obvious.

In terms of the GIP regression results, environmental regulation’s direct effects on GIP are significantly positive in all three regions, while the spillover effects are regional heterogeneous. Specifically, only in the eastern region did environmental regulation produce a spillover effect and improve GIP in neighboring regions. Digital finance’s direct and spillover effects on GIP are generally consistent with its impact on GTI. However, in the central region, digital finance’s spillover effect on GIP passed the significance test for the studied period, while this effect still had not appeared in the western region. The reason for this lies mainly in the low level of digital finance resources in western provinces and cities; digital finance’s spillover effects may also be limited by geographical factors. Only when digital finance rises to a certain level can more of the small and medium-sized enterprises obtain its benefits, realize the coming together of enterprise goals and inclusive goals, and promote an improvement of the GIP level.

In terms of the GUP regression results, the direct effects of environmental regulation on GUP were significantly positive in the eastern and western regions, but the effects were not significant in the central region during the study period. Meanwhile, environmental regulation’s spillover effects on GUP were completely different in these three regions. This is mainly the result of the differences in environmental regulation intensity in various regions, as well as the differences in the competition modes adopted by the government. The influence of digital finance on local and neighboring GUP also varies across regions. In underdeveloped areas, such as central and western regions, the degree of digitalization is low, and the financial market is underdeveloped. As such, the influence of digital finance on GUP has not yet appeared.

5.3 The Robustness Test

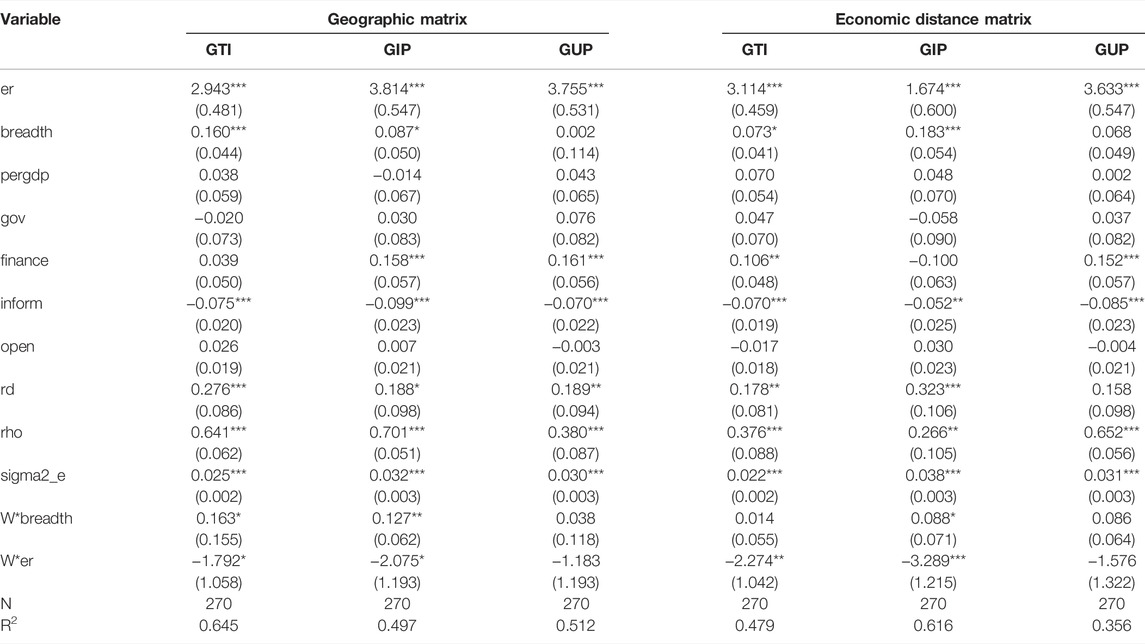

To enhance the reliability of the conclusions, the following robustness tests were conducted. First, to avoid the bias of regression results caused by the choice of spatial weights, the geographic distance matrix and economic distance matrix were utilized to regress. Second, we sought alternative indicators of the main explanatory variable (digital finance) for a robustness analysis. Based on Guo et al. (2020), digital financial index includes breadth of coverage, depth of usage and level of digitalization. Among them, the breadth of coverage index accounts for the highest proportion of the digital financial index, at 54%. Therefore, as an important part of the digital finance index, this study chooses the breadth index as a proxy variable to regress the SDM model. Table 6 reports the robustness test, which shows that the results after regression are roughly the same as the previous results. All these tests indicate that the conclusions of this paper are still valid after changing the weight matrix and the measurement methods of core variables.

6 The Moderating Effect and Threshold Effect of Digital Finance

The above research confirms that environmental regulation and digital finance have direct effects on local GTI, as well as spatial spillover effects on the GTI in adjacent regions. This section will empirically analyze the moderating role and threshold role of digital finance in environmental regulation’s effect on GTI from the perspectives of coordination and interaction.

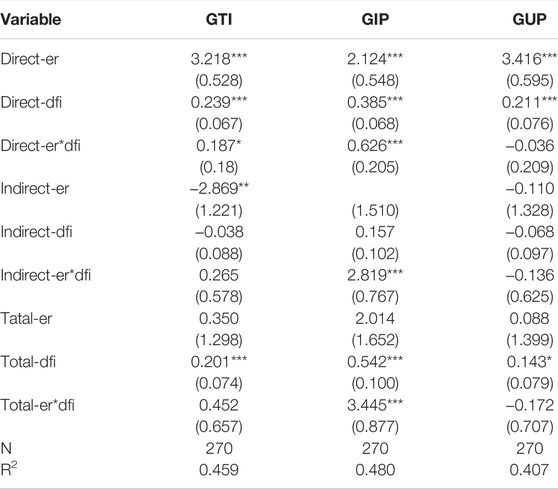

6.1 Empirical Verification of Moderating Effect

To verify the moderating role of digital finance, the interaction term er*dfi between environmental regulation and digital finance is introduced into the benchmark model. The decomposition results of spatial effects after adding interactive terms are displayed in Table 7. As can be seen from the results of GTI, the coefficient of interaction term Direct-er*dfi is significantly positive. This finding suggests that digital finance has played an active role in environmental regulation’s effect on local GTI. Digital finance can provide inclusive financial support to enterprises faced with tightening environmental regulations, allowing enterprises to have stable and sufficient funds for green production innovation, ultimately stimulating GTI. In addition, the results show that the indirect effect of er*dfi failed the significance test. The GIP results reveal that the coefficients of interaction terms Direct-er*dfi and Indirect-er*dfi are both significantly positive. This finding suggests that digital finance can act an important moderating function in environmental regulation’s influence on GIP. In addition to significantly alleviating the local financial constraints caused by environmental regulations and promoting the GIP level in the relevant region, the financial support provided by digital finance will also promote the GIP in neighboring regions. However, the GUP results reveal that the coefficients of interaction terms Direct-er*dfi and Indirect-er*dfi are not significant. This finding implies that digital finance has not acted as a moderating function in environmental regulation’s influence on GUP. Previous empirical analyses have suggested that GUP has not been affected by digital finance, so the moderating effect of digital finance is not obvious.

6.2 Estimation Results of Threshold Effect

Considering that the level of digital finance may influence the correlation between environmental regulation and GTI and lead to a nonlinear relationship between them, this study further investigates the effect of environmental regulation on GTI at different levels of digital finance. This is achieved by building a threshold effect model. Referring to Hansen’s threshold effect model design (1999), digital finance is taken as a threshold variable for further research and analysis.

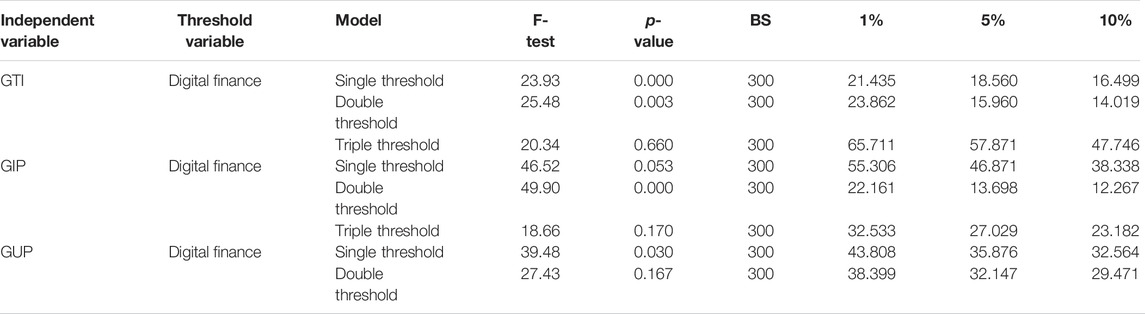

By using the self-sampling method (bootstrap) iteration 300 times, we tested the existence of the threshold effect of digital finance, and further estimated the specific threshold number. The results in Table 8 suggest that, when the explained variable is GTI, the influence of environmental regulation on GTI has double thresholds. When the explained variable is GIP, once again, there are double thresholds. When the explained variable is GUP, there is only a single threshold.

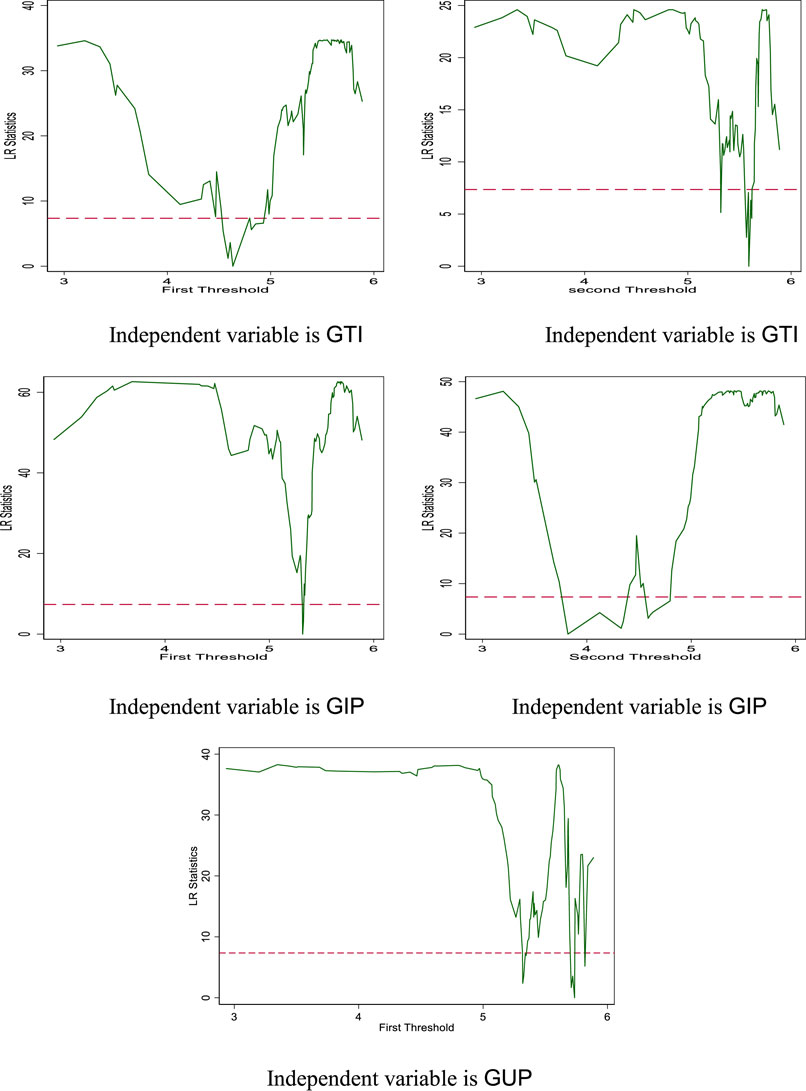

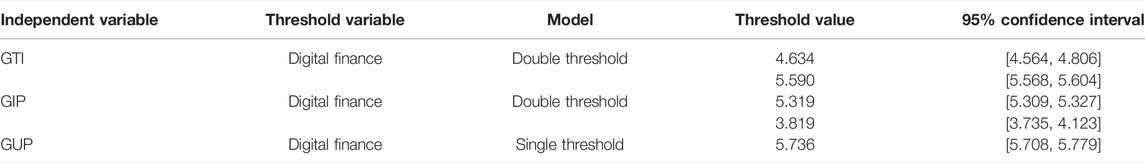

Table 9 presents the threshold estimation results. The double thresholds of the GTI model are 4.634 and 5.590; for the GIP model, they are 5.319 and 3.819, and the threshold of the GUP model is 5.736. The confidence intervals of the above threshold values are all narrow, indicating that the estimated threshold values are accurate. Further, this paper has drawn a likelihood ratio function diagram, to check whether the estimated values are consistent with the actual values of the threshold. The results are shown in Figure 5. One can observe that the LR values corresponding to the threshold values estimated by the model are obviously smaller than the critical value of 7.35. This finding proves that the above estimated threshold values are true and effective.

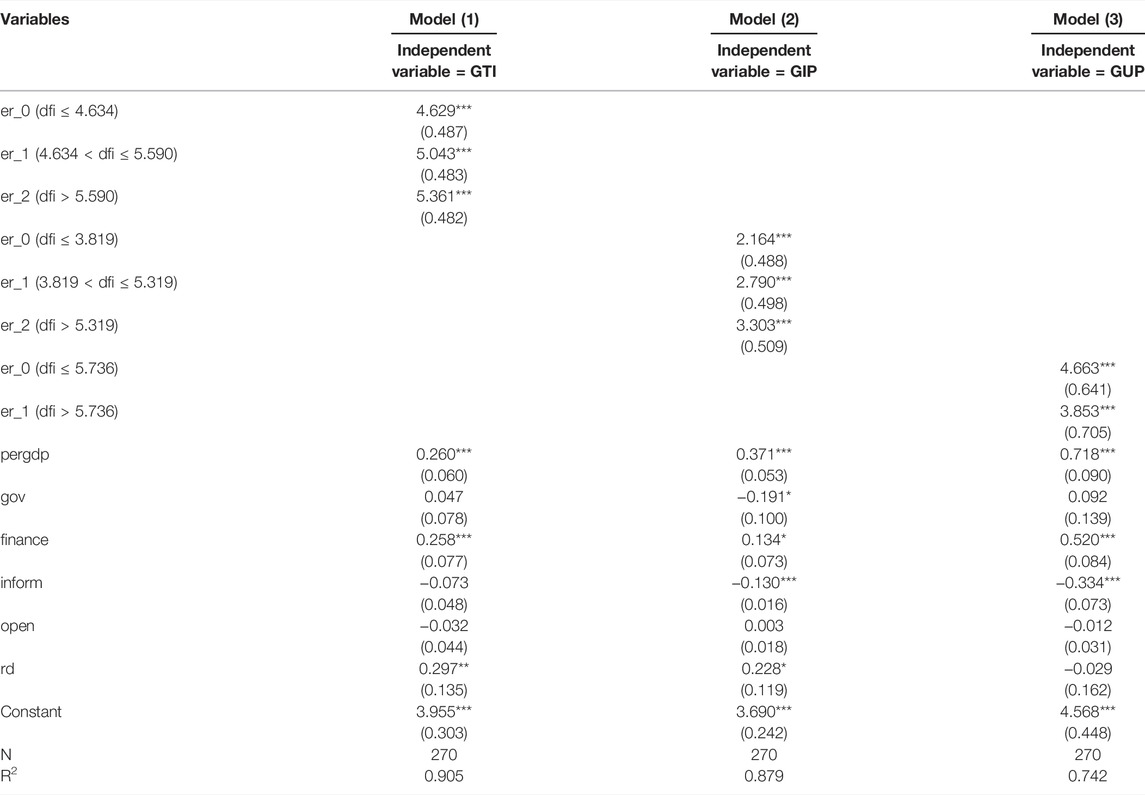

Table 10 displays the regression results of the panel threshold model. The GTI results show that, when the digital financial index is below 4.634 (i.e., with a coefficient of 4.629), environmental regulation can significantly promote GTI. When the digital financial index is between 4.634 and 5.590 (i.e., with a coefficient of 5.043), the promotion effect of environmental regulation intensity on GTI becomes greater. When the level of digital finance is above 5.590 (i.e., with a coefficient of 5.361), the influence effect is further enhanced. The above results mean that, when digital finance is in different stages of development, environmental regulation’s impact on GTI is not invariable. Rather, the impact presents a nonlinear characteristic of positive and increasing marginal effect.

The GIP regression results show that, when the digital financial index exceeds the threshold values of 3.819 and 5.319, the estimated coefficients of environmental regulation’s effect on GIP rises from 2.164 to 2.790 and 3.303, respectively. This finding indicates that a rise of the digital financial level can also cause the promotion effect of environmental regulation on GIP to increase marginally.

The GUP regression results reveal that, if the digital financial index is below the threshold value of 5.736 (i.e., with a coefficient of 4.663) digital finance can significantly promote GUP. When the digital financial index crosses the threshold value, the estimated parameter is still significantly positive, but the coefficient drops to 3.853. That is to say, environmental regulation can effectively elevate the GUP level, but under the threshold effect of digital finance, the marginal effect is decreasing.

7 Conclusion and Policy Recommendations

Under the macro background of tightening environmental regulations, digital finance, with its digital and inclusive characteristics, plays a particularly important role in green technology innovation (GTI). Using provincial panel data from China, covering the period from 2011 to 2019, this study discusses the direct effects and spatial spillover effects of environmental regulation and digital finance on GTI, by building a spatial Durbin model. In addition, the moderating effect and threshold effect of digital finance in environmental regulation’s influence on GTI is deeply analyzed. The following conclusions are obtained:

(1) Environmental regulation has significant positive effects on local GTI, GIP and GUP, while having negative spatial spillover effects on the three in neighboring regions. Furthermore, environmental regulation’s influence on the three is obviously different from region to region.

(2) Digital finance can significantly promote GTI and GUP. Specifically, the improvement of the digital financial level not only promotes local GTI and GIP in the relevant region, but also produces positive spillover effects on adjacent regions’ GTI and GIP. Moreover, in the eastern and central regions, the direct effect of digital finance on both GTI and GIP is significantly positive, while in the western region, this effect is not obvious. The spatial spillover effect in the three regions is also heterogeneous. Furthermore, the effect of digital finance on GUP in both local and neighboring areas is not significant. A regional analysis suggests that the influence of digital finance on GUP obviously varies between regions.

(3) Digital finance is an important moderating variable of environmental regulation’s effect on GTI. Environmental regulation’s effect on GTI and GIP in local and neighboring areas will also become stronger with the continuous improvement of digital finance. However, digital finance has not played a moderating role in the impact of environmental regulation on GUP.

(4) Digital finance is the threshold variable of environmental regulation’s effect on GTI. If the digital finance index exceeds a certain threshold, the promotion impact of environmental regulation on GTI and GIP will be greater. However, if the digital finance index crosses the threshold value, the role of environmental regulation in promoting GUP will weaken.

According to the above conclusions, the following policy recommendations are made:

First, environmental regulation can effectively promote GTI. For that reason, government departments should unswervingly adhere to and improve environmental protection laws and policies. At present, given the country’s severe environmental problems, enhanced environmental regulation must be part of China’s sustainable economic development. In the short term, enterprises’ production costs will rise to meet the prescribed environmental standards, and this will crowd out R&D investment and restrain GTI. However, with the optimization and adjustment of enterprises’ production processes, environmental regulation will help restrain the pollution behavior of enterprises by forcing enterprises to take the development road of a low-carbon life, and thereby promoting enterprises’ technological innovation.

Secondly, government departments and related financial institutions should focus on promoting the level of digital finance by insisting that digital finance plays an active role in funding GTI under the background of tightening environmental regulations. Specifically, this can be done from two aspects. First, the government should make full use of scientific and technological means to build a financial service platform. They should encourage the financial industry to transform into an industry characterized by digitalization and informatization, and they should enhance the mutual integration of the digital economy industry and financial industry. In addition, the government should expand the coverage of digital finance in central and western provinces and cities. The digital service level should be improved, and the application depth of digital financial innovations should be enhanced. Secondly, the government should actively guide and encourage digital finance to give targeted financial support to the research and application of green, low-pollution, low energy consumption and recyclable new technologies and products. This would promote the GTI of enterprises and achieve high-quality economic development.

Thirdly, economic activities have significant spatial spillover effects, so all regions should strengthen regional cooperation to jointly promote green development. The spillover effects of GTI show that, in addition to the impact on local GTI, environmental regulation and digital finance in one province will also have a significant impact on GTI in neighboring provinces. To promote high-quality economic development of the whole society, it is suggested that the government should strengthen the coordination and cooperation between neighboring regions when formulating relevant policies. The central and regional governments should jointly explore and improve the regional cooperation mechanism and coordination mechanism of environmental regulation and digital finance. Specifically, the government should carry out cross-regional cooperation in environmental law enforcement and the implementation of financial instruments. A cautious view should be taken with regard to the phenomenon of “bottom-to-bottom competition” among different areas, as well as the unbalanced level of digital finance. Addressing these issues would help build a harmonious environment and financial and economic ecosystem in various regions, and would jointly promote green innovation.

This paper makes a preliminary exploration of the influence of environmental regulation and digital finance on GTI, but there are still limitations, which can be further expanded in the following aspects in the future. Firstly, although this paper discusses the direct effect and spatial spillover effect of environmental regulation and digital finance on GTI, there is no in-depth discussion on their specific influence mechanisms on GTI. Therefore, the discussion of these influence mechanisms will be of great significance for future research. Secondly, the data used in this paper are macro data at the provincial level. Because the economic development level, environmental regulation level, digital financial development status and innovation level of different cities in the same province are obviously heterogeneous, the future research can use city level data to do further detailed research.

Data Availability Statement

Publicly available datasets were analyzed in this study. This data can be found here: https://data.stats.gov.cn/.

Author Contributions

RM: Conceptualization, Methodology, Funding acquisition, Supervision. FL: Software, Visualization, Writing -original draft, Conceptualization. MD: Formal analysis, Writing -review and editing, Visualization.

Funding

This work was financially supported by the Philosophy and Social Science Research Project of Shanxi Colleges and Universities (2019w159) and the Late-funded project of National Social Science Fund: Study on the characteristics and mechanism of financial risk contagion under the new development pattern (21FJYA002).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbasi, K. R., Shahbaz, M., Zhang, J., Irfan, M., and Alvarado, R. (2022). Analyze the Environmental Sustainability Factors of China: The Role of Fossil Fuel Energy and Renewable Energy. Renew. Energy 187, 390–402. doi:10.1016/j.renene.2022.01.066

Balli, H. O., and Sørensen, B. E. (2013). Interaction Effects in Econometrics. Empir. Econ. 45 (1), 583–603. doi:10.1007/s00181-012-0604-2

Bréchet, T., and Meunier, G. (2014). Are Clean Technology and Environmental Quality Conflicting Policy Goals? Resour. Energy Econ. 38, 61–83.

Bu, M., and Wagner, M. (2016). Racing to the Bottom and Racing to the Top: The Crucial Role of Firm Characteristics in Foreign Direct Investment Choices. J. Int. Bus. Stud. 47 (9), 1032–1057. doi:10.1057/s41267-016-0013-4

Cai, X., Zhu, B., Zhang, H., Li, L., and Xie, M. (2020). Can Direct Environmental Regulation Promote Green Technology Innovation in Heavily Polluting Industries? Evidence from Chinese Listed Companies. Sci. Total Environ. 746, 140810. doi:10.1016/j.scitotenv.2020.140810

Cainelli, G., D’Amato, A., and Mazzanti, M. (2020). Resource Efficient Eco-Innovations for a Circular Economy: Evidence from EU Firms. Res. Policy 49 (1), 103827. doi:10.1016/j.respol.2019.103827

Cao, B., and Wang, S. (2017). Opening up, International Trade, and Green Technology Progress. J. Clean. Prod. 142, 1002–1012. doi:10.1016/j.jclepro.2016.08.145

Cao, S., Nie, L., Sun, H., Sun, W., and Taghizadeh-Hesary, F. (2021). Digital Finance, Green Technological Innovation and Energy-Environmental Performance: Evidence from China's Regional Economies. J. Clean. Prod. 327, 129458. doi:10.1016/j.jclepro.2021.129458

Chakraborty, P., and Chatterjee, C. (2017). Does Environmental Regulation Indirectly Induce Upstream Innovation? New Evidence from India. Res. Policy 46 (5), 939–955. doi:10.1016/j.respol.2017.03.004

Dendramis, Y., Tzavalis, E., and Adraktas, G. (2018). Credit Risk Modelling under Recessionary and Financially Distressed Conditions. J. Bank. Finance 91, 160–175. doi:10.1016/j.jbankfin.2017.03.020

Dong, B., Xu, Y., and Fan, X. (2020). How to Achieve a Win-Win Situation between Economic Growth and Carbon Emission Reduction: Empirical Evidence from the Perspective of Industrial Structure Upgrading. Environ. Sci. Pollut. Res. Int. 27 (35), 43829–43844. doi:10.1007/s11356-020-09883-x

Du, G., Liu, Z., and Lu, H. (2021). Application of Innovative Risk Early Warning Mode under Big Data Technology in Internet Credit Financial Risk Assessment. J. Comput. Appl. Math. 386, 113260. doi:10.1016/j.cam.2020.113260

Du, W., and Li, M. (2020). Influence of Environmental Regulation on Promoting the Low-Carbon Transformation of China's Foreign Trade: Based on the Dual Margin of Export Enterprise. J. Clean. Prod. 244, 118687. doi:10.1016/j.jclepro.2019.118687

Fan, F., Lian, H., Liu, X., and Wang, X. (2021). Can Environmental Regulation Promote Urban Green Innovation Efficiency? an Empirical Study Based on Chinese Cities. J. Clean. Prod. 287, 125060. doi:10.1016/j.jclepro.2020.125060

Fang, Z., Razzaq, A., Mohsin, M., and Irfan, M. (2022). Spatial Spillovers and Threshold Effects of Internet Development and Entrepreneurship on Green Innovation Efficiency in China. Technol. Soc. 68, 101844. doi:10.1016/j.techsoc.2021.101844

Feng, S., Sui, B., Liu, H., and Li, G. (2020). Environmental Decentralization and Innovation in China. Econ. Model. 93, 660–674. doi:10.1016/j.econmod.2020.02.048

Feng, S., Zhang, R., and Li, G. (2022). Environmental Decentralization, Digital Finance and Green Technology Innovation. Struct. Change Econ. Dyn. 61, 70–83. doi:10.1016/j.strueco.2022.02.008

Feng, Y., Wang, X., Du, W., Wu, H., and Wang, J. (2019). Effects of Environmental Regulation and FDI on Urban Innovation in China: A Spatial Durbin Econometric Analysis. J. Clean. Prod. 235, 210–224. doi:10.1016/j.jclepro.2019.06.184

Feng, Z., and Chen, W. (2018). Environmental Regulation, Green Innovation, and Industrial Green Development: An Empirical Analysis Based on the Spatial Durbin Model. Sustainability 10 (1), 223. doi:10.3390/su10010223

Frost, J., Gambacorta, L., Huang, Y., Shin, H. S., and Zbinden, P. (2019). BigTech and the Changing Structure of Financial Intermediation. Econ. Policy 34 (100), 761–799. doi:10.1093/epolic/eiaa003

Gomber, P., Kauffman, R. J., Parker, C., and Weber, B. W. (2018). On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inf. Syst. 35 (1), 220–265. doi:10.1080/07421222.2018.1440766

Guellec, D., and Van Pottelsberghe De La Potterie, B. (2003). The Impact of Public R&D Expenditure on Business R&D*. Econ. innovation new Technol. 12 (3), 225–243. doi:10.1080/10438590290004555

Guo, F., Wang, J., Wang, F., Kong, T., Zhang, X., and Cheng, Z. (2020). Measuring China’s Digital Financial Inclusion: Index Compilation and Spatial Characteristics. China Econ. Q. 19 (4), 1401–1418.

Hansen, B. E. (1999). Threshold Effects in Non-dynamic Panels: Estimation, Testing, and Inference. J. Econ. 93 (2), 345–368. doi:10.1016/s0304-4076(99)00025-1

Hu, J., Pan, X., and Huang, Q. (2020). Quantity or Quality? the Impacts of Environmental Regulation on Firms' Innovation-Quasi-Natural Experiment Based on China's Carbon Emissions Trading Pilot. Technol. Forecast. Soc. Change 158, 120122. doi:10.1016/j.techfore.2020.120122

Irfan, M., and Ahmad, M. (2022). Modeling Consumers' Information Acquisition and 5G Technology Utilization: Is Personality Relevant? Personality Individ. Differ. 188, 111450. doi:10.1016/j.paid.2021.111450

Irfan, M., Elavarasan, R. M., Hao, Y., Feng, M., and Sailan, D. (2021). An Assessment of Consumers' Willingness to Utilize Solar Energy in China: End-Users' Perspective. J. Clean. Prod. 292, 126008. doi:10.1016/j.jclepro.2021.126008

Ji, Q., and Zhang, D. (2019). How Much Does Financial Development Contribute to Renewable Energy Growth and Upgrading of Energy Structure in China? Energy Policy 128, 114–124. doi:10.1016/j.enpol.2018.12.047

Johnstone, N., Haščič, I., and Popp, D. (2010). Renewable Energy Policies and Technological Innovation: Evidence Based on Patent Counts. Environ. Resour. Econ. 45 (1), 133–155. doi:10.1007/s10640-009-9309-1

Kaplan, S. N., and Zingales, L. (1997). Do investment-cash Flow Sensitivities Provide Useful Measures of Financing Constraints? Q. J. Econ. 112 (1), 169–215. doi:10.1162/003355397555163

Kesidou, E., and Wu, L. (2020). Stringency of Environmental Regulation and Eco-Innovation: Evidence from the Eleventh Five-Year Plan and Green Patents. Econ. Lett. 190, 109090. doi:10.1016/j.econlet.2020.109090

Khan, M. K., Khan, M. I., and Rehan, M. (2020). The Relationship between Energy Consumption, Economic Growth and Carbon Dioxide Emissions in Pakistan. Financ. Innov. 6 (1), 1–13. doi:10.1186/s40854-019-0162-0

Kshetri, N. (2016). Big Data's Role in Expanding Access to Financial Services in China. Int. J. Inf. Manag. 36 (3), 297–308. doi:10.1016/j.ijinfomgt.2015.11.014

LeSage, J., and Pace, R. K. (2009). Introduction to Spatial Econometrics. London, UK: Chapman and Hall/CRC.

Li, J., Wu, Y., and Xiao, J. J. (2020). The Impact of Digital Finance on Household Consumption: Evidence from China. Econ. Model. 86, 317–326. doi:10.1016/j.econmod.2019.09.027

Li, W., Gu, Y., Liu, F., and Li, C. (2019). The Effect of Command-And-Control Regulation on Environmental Technological Innovation in China: a Spatial Econometric Approach. Environ. Sci. Pollut. Res. Int. 26 (34), 34789–34800. doi:10.1007/s11356-018-3678-3

Liao, G., Yao, D., and Hu, Z. (2020). The Spatial Effect of the Efficiency of Regional Financial Resource Allocation from the Perspective of Internet Finance: Evidence from Chinese Provinces. Emerg. Mark. Finance Trade 56 (6), 1211–1223. doi:10.1080/1540496x.2018.1564658

List, J. A., and Co, C. Y. (2000). The Effects of Environmental Regulations on Foreign Direct Investment. J. Environ. Econ. Manag. 40 (1), 1–20. doi:10.1006/jeem.1999.1095

Liu, J., Jiang, Y., Gan, S., He, L., and Zhang, Q. (2022). Can Digital Finance Promote Corporate Green Innovation? Environ. Sci. Pollut. Res. 29, 35828–35840. doi:10.1007/s11356-022-18667-4

Liu, Y., Zhu, J., Li, E. Y., Meng, Z., and Song, Y. (2020). Environmental Regulation, Green Technological Innovation, and Eco-Efficiency: The Case of Yangtze River Economic Belt in China. Technol. Forecast. Soc. Change 155, 119993. doi:10.1016/j.techfore.2020.119993

Luo, L. W., and Liang, S. R. (2016). Green Technology Innovation Efficiency and Factor Decomposition of China’s Industrial Enterprises. China Popul. Resour. Environ. 26 (9), 149–157.

Ozili, P. K. (2021). Digital Finance, Green Finance and Social Finance: Is There a Link? SSRN J. 2021, 3786881. doi:10.2139/ssrn.3786881

Peng, X. (2020). Strategic Interaction of Environmental Regulation and Green Productivity Growth in China: Green Innovation or Pollution Refuge? Sci. Total Environ. 732, 139200. doi:10.1016/j.scitotenv.2020.139200

Perino, G., and Requate, T. (2012). Does More Stringent Environmental Regulation Induce or Reduce Technology Adoption? when the Rate of Technology Adoption Is Inverted U-Shaped. J. Environ. Econ. Manag. 64 (3), 456–467. doi:10.1016/j.jeem.2012.03.001

Peuckert, J. (2014). What Shapes the Impact of Environmental Regulation on Competitiveness? Evidence from Executive Opinion Surveys. Environ. Innovation Soc. Transitions 10, 77–94. doi:10.1016/j.eist.2013.09.009

Porter, M. E., and Van der Linde, C. (1995a). Green and Competitive: Ending the Stalemate. Harv. Bus. Rev. 73 (5), 120–134.

Porter, M. E., and Van der Linde, C. (1995b). Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Qiu, W., Bian, Y., Zhang, J., and Irfan, M. (2022). The Role of Environmental Regulation, Industrial Upgrading, and Resource Allocation on Foreign Direct Investment: Evidence from 276 Chinese Cities. Environ. Sci. Pollut. Res. 29, 32732–32748. doi:10.1007/s11356-022-18607-2

Rauf, A., Ozturk, I., Ahmad, F., Shehzad, K., Chandiao, A. A., Irfan, M., et al. (2021). Do Tourism Development, Energy Consumption and Transportation Demolish Sustainable Environments? Evidence from Chinese Provinces. Sustainability 13 (22), 12361. doi:10.3390/su132212361

Ren, S., Hao, Y., and Wu, H. (2022c). Digitalization and Environment Governance: Does Internet Development Reduce Environmental Pollution? J. Environ. Plan. Manag. 2022, 1–30. doi:10.1080/09640568.2022.2033959

Ren, S., Hao, Y., and Wu, H. (2021b). Government Corruption, Market Segmentation and Renewable Energy Technology Innovation: Evidence from China. J. Environ. Manag. 300, 113686. doi:10.1016/j.jenvman.2021.113686

Ren, S., Hao, Y., and Wu, H. (2022a). How Does Green Investment Affect Environmental Pollution? Evidence from China. Environ. Resour. Econ. 81 (1), 25–51. doi:10.1007/s10640-021-00615-4

Ren, S., Hao, Y., and Wu, H. (2022b). The Role of Outward Foreign Direct Investment (OFDI) on Green Total Factor Energy Efficiency: Does Institutional Quality Matters? Evidence from China. Resour. Policy 76, 102587. doi:10.1016/j.resourpol.2022.102587

Ren, S., Hao, Y., Xu, L., Wu, H., and Ba, N. (2021a). Digitalization and Energy: How Does Internet Development Affect China's Energy Consumption? Energy Econ. 98, 105220. doi:10.1016/j.eneco.2021.105220

Rubashkina, Y., Galeotti, M., and Verdolini, E. (2015). Environmental Regulation and Competitiveness: Empirical Evidence on the Porter Hypothesis from European Manufacturing Sectors. Energy Policy 83, 288–300. doi:10.1016/j.enpol.2015.02.014

Scherer, F. M., Harhoff, D., and Kukies, J. (2001). “Uncertainty and the Size Distribution of Rewards from Innovation,” in Capitalism and Democracy in the 21st Century (Heidelberg: Physica), 181–206. doi:10.1007/978-3-662-11287-8_10

Shang, L., Tan, D., Feng, S., and Zhou, W. (2022). Environmental Regulation, Import Trade, and Green Technology Innovation. Environ. Sci. Pollut. Res. 29 (9), 12864–12874. doi:10.1007/s11356-021-13490-9

Shao, L., Zhang, H., and Irfan, M. (2021). How Public Expenditure in Recreational and Cultural Industry and Socioeconomic Status Caused Environmental Sustainability in OECD Countries? Econ. Research-Ekonomska Istraživanja 2021, 1–18. doi:10.1080/1331677X.2021.2015614

Shen, Y., Hueng, C. J., and Hu, W. (2021). Measurement and Spillover Effect of Digital Financial Inclusion: a Cross-Country Analysis. Appl. Econ. Lett. 28 (20), 1738–1743. doi:10.1080/13504851.2020.1853663

Shi, R., Irfan, M., Liu, G., Yang, X., and Su, X. (2022). Analysis of the Impact of Livestock Structure on Carbon Emissions of Animal Husbandry: A Sustainable Way to Improving Public Health and Green Environment. Front. Public Health 145. doi:10.3389/fpubh.2022.835210

Stanko, M. A., and Henard, D. H. (2017). Toward a Better Understanding of Crowdfunding, Openness and the Consequences for Innovation. Res. Policy 46 (4), 784–798. doi:10.1016/j.respol.2017.02.003

Stucki, T., Woerter, M., Arvanitis, S., Peneder, M., and Rammer, C. (2018). How Different Policy Instruments Affect Green Product Innovation: A Differentiated Perspective. Energy Policy 114, 245–261. doi:10.1016/j.enpol.2017.11.049

Sun, C. (2020). Digital Finance, Technology Innovation, and Marine Ecological Efficiency. J. Coast. Res. 108 (SI), 109–112. doi:10.2112/jcr-si108-022.1

Talavera, O., Tsapin, A., and Zholud, O. (2012). Macroeconomic Uncertainty and Bank Lending: The Case of Ukraine. Econ. Syst. 36 (2), 279–293. doi:10.1016/j.ecosys.2011.06.005

Tong, T. W., He, W., He, Z.-L., and Lu, J. (2014). Patent Regime Shift and Firm Innovation: Evidence from the Second Amendment to China's Patent Law. Acad. Manag. Proc. 2014 (1), 14174. doi:10.5465/ambpp.2014.14174abstract

Wagner, M. (2007). On the Relationship between Environmental Management, Environmental Innovation and Patenting: Evidence from German Manufacturing Firms. Res. Policy 36 (10), 1587–1602. doi:10.1016/j.respol.2007.08.004

Wang, H., and Zhang, R. (2022). Effects of Environmental Regulation on CO2 Emissions: An Empirical Analysis of 282 Cities in China. Sustain. Prod. Consum. 29, 259–272. doi:10.1016/j.spc.2021.10.016

Wang, J., Wang, W., Ran, Q., Irfan, M., Ren, S., Yang, X., et al. (2022). Analysis of the Mechanism of the Impact of Internet Development on Green Economic Growth: Evidence from 269 Prefecture Cities in China. Environ. Sci. Pollut. Res. 29 (7), 9990–10004. doi:10.1007/s11356-021-16381-1

Wang, M., and Feng, C. (2021). The Win-Win Ability of Environmental Protection and Economic Development during China's Transition. Technol. Forecast. Soc. Change 166, 120617. doi:10.1016/j.techfore.2021.120617

Wang, X., and Guan, J. (2017). Financial Inclusion: Measurement, Spatial Effects and Influencing Factors. Appl. Econ. 49 (18), 1751–1762. doi:10.1080/00036846.2016.1226488

Wang, Y., and Shen, N. (2016). Environmental Regulation and Environmental Productivity: The Case of China. Renew. Sustain. Energy Rev. 62, 758–766. doi:10.1016/j.rser.2016.05.048

Wheeler, D. (2001). Racing to the Bottom? Foreign Investment and Air Pollution in Developing Countries. J. Environ. Dev. 10 (3), 225–245. doi:10.1177/10704965-0101003-02

Wu, H., Ba, N., Ren, S., Xu, L., Chai, J., Irfan, M., et al. (2021a). The Impact of Internet Development on the Health of Chinese Residents: Transmission Mechanisms and Empirical Tests. Socio-Economic Plan. Sci. 2021, 101178.

Wu, H., Guo, H., Zhang, B., and Bu, M. (2017). Westward Movement of New Polluting Firms in China: Pollution Reduction Mandates and Location Choice. J. Comp. Econ. 45 (1), 119–138. doi:10.1016/j.jce.2016.01.001

Wu, H., Hao, Y., Ren, S., Yang, X., and Xie, G. (2021b). Does Internet Development Improve Green Total Factor Energy Efficiency? Evidence from China. Energy Policy 153, 112247. doi:10.1016/j.enpol.2021.112247

Wu, H., Hao, Y., and Weng, J.-H. (2019). How Does Energy Consumption Affect China's Urbanization? New Evidence from Dynamic Threshold Panel Models. Energy policy 127, 24–38. doi:10.1016/j.enpol.2018.11.057

Xiang, H., Chau, K. Y., Iqbal, W., Irfan, M., and Dagar, V. (2022). Determinants of Social Commerce Usage and Online Impulse Purchase: Implications for Business and Digital Revolution. Front. Psychol. 13, 837042. doi:10.3389/fpsyg.2022.837042

Xing, Y., and Kolstad, C. D. (2002). Do lax Environmental Regulations Attract Foreign Investment? Environ. Resour. Econ. 21 (1), 1–22. doi:10.1023/a:1014537013353

Yan, G., Peng, Y., Hao, Y., Irfan, M., and Wu, H. (2021). Household Head's Educational Level and Household Education Expenditure in China: The Mediating Effect of Social Class Identification. Int. J. Educ. Dev. 83, 102400. doi:10.1016/j.ijedudev.2021.102400

Yang, C., Hao, Y., and Irfan, M. (2021). Energy Consumption Structural Adjustment and Carbon Neutrality in the Post-COVID-19 Era. Struct. Change Econ. Dyn. 59, 442–453. doi:10.1016/j.strueco.2021.06.017

Yi, M., Lu, Y., Wen, L., Luo, Y., Xu, S., and Zhang, T. (2022). Whether Green Technology Innovation Is Conducive to Haze Emission Reduction: Empirical Evidence from China. Environ. Sci. Pollut. Res. 29 (8), 12115–12127. doi:10.1007/s11356-021-16467-w

Yin, J., Zheng, M., and Chen, J. (2015). The Effects of Environmental Regulation and Technical Progress on CO2 Kuznets Curve: An Evidence from China. Energy Policy 77, 97–108. doi:10.1016/j.enpol.2014.11.008

Yu, C.-H., Wu, X., Zhang, D., Chen, S., and Zhao, J. (2021). Demand for Green Finance: Resolving Financing Constraints on Green Innovation in China. Energy Policy 153, 112255. doi:10.1016/j.enpol.2021.112255

Keywords: digital finance, green technological innovation, spatial spillover effect, moderating effect, environmental regulation

Citation: Ma R, Li F and Du M (2022) How Does Environmental Regulation and Digital Finance Affect Green Technological Innovation: Evidence From China. Front. Environ. Sci. 10:928320. doi: 10.3389/fenvs.2022.928320

Received: 25 April 2022; Accepted: 16 May 2022;

Published: 31 May 2022.

Edited by:

Muhammad Irfan, Beijing Institute of Technology, ChinaReviewed by:

Yunfeng Shang, Zhejiang Yuexiu University of Foreign Languages, ChinaXiaowei Song, Ocean University of China, China

Copyright © 2022 Ma, Li and Du. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Feifei Li, lff511935220@163.com; Mingyue Du, mydu@st.btbu.edu.cn

Ruowei Ma1

Ruowei Ma1 Mingyue Du

Mingyue Du