- 1School of Mathematics and Big Data, Foshan University, Foshan, China

- 2High Tech Research Institute, Hunan Institute of Traffic Engineering, Hengyang, China

- 3Department of Business Administration, ILMA University, Karachi, Pakistan

A green economy is one that mainstreams nature and people’s concerns and provides well-paying jobs for the economy. In the past, researchers examined the relationship between financial growth and carbon emissions, and very limited studies examined the role of green finance in carbon extenuation. Based on these four indicators, which are sustainable credit, sustainable safety, sustainable insurance, and sustainable asset, a green finance index was developed in this study. In this study, a vector error correction model (VECM) is used to examine associations between the growth level of green finance, public spending, and the zero-carbon mechanism using data from 2005 to 2018. The results of this study indicate that China’s green finance industry had grown quickly, with enhancements in green finance and increased public spending, all contributing to reducing the country’s environmental degradation. The simultaneous increase in carbon intensity slowed the expansion of non-fossil energy usage, reduced the flow of investing in green projects, and finally deteriorated the development of green finance. Furthermore, renewable energy usage in China is chiefly influenced by carbon intensity and green finance, both of which had clear policy-driven consequences. The effects of green finance strategies have consistently fallen short of expectations and lacked consistency. This study makes recommendations for improving the effectiveness of green finance policy implementation and increasing renewable energy to reduce or erode the economic gains of the zero-carbon mechanism.

1 Introduction

Across the globe, climate change and sustainability have received a lot of media attention. It is stated in the 2015 Paris Agreement, which was adopted as part of the United Nations Framework Convention on Climate Change (UNFCCC), that world leaders have come to a general consensus on this subject. As a result of the agreement of the member countries to work together to reduce greenhouse gas emissions, one of the most difficult challenges is financing climate change mitigation and adaptation actions and their long-term viability. We will have to invest highly into to get things back to normal. Global warming must be kept below 2°C by 2035, which will require $53 trillion for investments in energy-related projects (Moz-Christofoletti and Pereda, 2021).

The Chinese economy has expanded at a rapid pace in recent years. In 2019, China’s gross domestic product (GDP) amounted to 99.0865 trillion yuan (US$1.04 trillion). Contrary to popular belief, China’s economic situation is worsening (Khokhar et al., 2020; Abbas et al., 2020; Zhang et al., 2021a). Resources are becoming increasingly scarce, the ecosystem is deteriorating, the carrying capacity of natural resources has been exceeded, and environmental problems are becoming progressively severe. According to the "State of the Environment Bulletin of China" published in 2015, the following environmental conditions exist: the environmental air quality standard has exceeded up to 76.4% in the country’s 338 prefecture-level cities, according to the Environmental Protection Agency (EPA). According to the EPA, pollution is responsible for 35.5% of the water quality in important lakes, major rivers, and reservoirs (Feng et al., 2022; Huang et al., 2022). There are 2.49 million square kilometers of land affected by soil erosionacross the country, accounting for 31.1 % of the total area of the census; 61.3 % of the water has poor or extremely poor quality; 61.3 % of water is polluted, and 61.3 % of the water has poor or extremely poor quality (Hou et al., 2019). The public has been deeply affected by the deterioration of the living environment in recent years, which has sparked widespread concern among the general public (Khan et al., 2021c). No one can overstate the significance of environmental governance in today’s society. During the calendar year 2017, nitrogen oxides and carbon dioxide were released into the environment in the exhaust gas, and wastewater in 69.66 billion tons, 0.12 billion tons, and 9.297 billion ton was also released (Xiang et al., 2022). China's Ministry of Environmental Protection allocated 51,754 million yuan to energy conservation in 2019, raising concerns about the long-term sustainability of the Chinese economy's future development due to the high price of environmental governance 2019 (Lee 2020; Zhang Y. et al., 2021; Li et al., 2021). Currently, the Chinese economy is in transition, and issues such as resource consumption and overcapacity lurk behind the country’s rapid economic growth (Khan et al., 2021d; Wu et al., 2021). Future generations will be increasingly concerned with the issue of how to maintain environmentally friendly development practices. Environmental civilization construction is being implemented gradually, and the process of environmental transformation and development has emerged as a critical path in achieving the long-term development sustainability required (Chen et al., 2021; Safi et al., 2021).

Finance for environmental protection, whether as a design for an institutional arrangement or a design for a market mechanism, is required. Green finance not only achieves social energy conservation objectives but also engages in achieving financial sustainable development objectives. Investors and financial institutions are hesitant to get involved in the green field because of the lags inherent in green finance. This results in green finance being dependent on the market mechanism, making it difficult to meet the potential needs of the social ecosystem, while also improving its quality (Khan SAR. et al., 2021). Because of the limitations imposed by natural conditions, China has overlooked the significance of environmental security to society’s long-term viability, and the trend of environmental change is not encouraging. China must mobilize social resources to the maximum extent possible for green development through policy guidance, assistance, and market-oriented initiatives (Anderson et al., 2021; Khan et al., 2022). Regional environmental civilization development is promoted through green finance. Environmental degradation is effectively curtailed through green finance, resulting in incongruous cooperation between the financial and environmental systems (Huang et al., 2021; Truby et al., 2022).

Green finance has a significant influence on the development of clean energy and the preservation of the environment. Ecological issues have already become obstacles in our economy’s growth as the climate and ecology continue to stifle growth (Shahbaz et al., 2020; Khan et al., 2021b). As a result, green finance is now an unstoppable force in the economy. According to Chinese research, green finance is a financial activity that promotes better environmental development, increases resource efficiency, and combats climate change (Sovacool et al., 2021). To speed up the transition to green consumption, the financial industry must develop green features in its operations and trust financial novelty means to change the investing positioning of businesses (Boretti 2020). Subjects, objects, and media make up the bulk of the green financial market, facilitated by a trading platform. The government, financial institutions, businesses, and consumers all play a significant role in exchanging green derivatives, green credit, and green funds through various media, including stock exchanges and brokers (Herman and Shenk, 2021). Because of the wide range of products available, the green financial market is now more competitive, which has led to more stable social governance due to environmental-friendly development. Environmental and ecological benefits are valued more highly in green finance than in traditional financial activities (Jinru et al., 2021), which places a greater emphasis on the long-term growth of the environmental protection industry (Khan et al., 2021e).

Green finance and environmental degradation are the research topics of many studies, such as those conducted by Jinru et al. (2021). However, one of the first attempts to reduce CO2 emissions in China is the role of green finance in conjunction with public spending and economic growth. The investigation by Soltani et al. (2021) related to the connection between carbon emissions and green finance suggests that future research could inspect the influence of green finance and public spending on carbon emissions. This study fills that knowledge gap by observing how green finance, economic development, and government spending affect CO2 emissions. For policymakers who are developing strategies related to green finance and energy efficiency's role in reducing carbon emissions, the research is useful because China’s environmental protection authorities will also benefit from this research, as the country has a high rate of pollution (Yu et al., 2022). We are now focusing on connecting green finance, economic growth, energy consumption, and CO2 emissions. The objectives of this study are given below:

1) To investigate the impact of green financing on CO2 emissions in China.

2) China’s CO2 emissions will be studied to see if public spending influences it.

2 Economic Growth and Environmental Degradation are Intertwined

Continuing the discussion of this study, Section 2 shows a review of the associated literature and Section 3 presents the data and proposes an econometric analytical flow for the information contained within them. The findings of the econometric analyses are presented in Section 4. Section 5 summarizes the most significant findings and proposes policy implications.

3 Green Economic Recovery

To address the challenges of environmental protection projects and industry financing, green finance was developed. Environmental constraints are the driving force behind credit rationing. Green finance can encourage green investment and financing and transform environmental pollution into environmental-friendly businesses. As a result of the financing, investment yields and capital availability of polluting industries are reduced, while the green industry’s investment yields and capital availability are increased. Consequently, the green industry’s financial support is strengthened to pursue green economic development. Research by Bamisile et al. (2021) states that while green finance significantly influences polluting industries, it also significantly stimulates environmentally friendly initiatives. It was found that the mechanism by which GF improved agricultural innovation performance was examined by Ning et al. (2022). From 2012 to 2019, Saeed Meo and Karim (2021) used the green patent quantities of Chinese companies as a quasi-natural experiment to see if the green finance policy had any effect on corporate green innovation. By raising production costs and encouraging green transformation, Streimikiene and Kaftan (2021) demonstrated that green finance development could slow the growth of polluting industries. This research is also backed by the theory of a green economy (Wang et al., 2021), which emphasizes the interdependence of people and the environment. Each of us can contribute to protect the environment by promoting green economic growth, green financial practices, and the use of clean, efficient energy (Nassani et al., 2017). The theory of a green economy obliges people to use environmentally friendly financial and energy resources to promote green growth and minimize their impact on the environment (Tolliver et al., 2020).

Green financing appears to have positive effects on various macroeconomic variables instead of some studies’ neutral or negative findings. While conventional bonds were more effective during the COVID-19 era, green bonds were more effective due to their greater transparency in interest rates and investment returns. Another study examined the relationship between green bonds and other variables, such as clean energy, from 2008 to 2019 by Nguyen et al. (2022). These findings significantly impact clean energy development. Lee et al. (2021) examined the green bond market in various regions, focusing on Asia and the Pacific regions. According to their findings, green bonds in Asia tend to have higher returns and greater risk and heterogeneity. The banking industry is responsible for 60% of all Asian green bond issuances. After the COVID-19 pandemic is over, the researchers say that there should be more public sector involvement and de-risking regulations to encourage issuer diversification. For climate change and environmental threats, Zheng et al. (2021) observed the linkage between green finance, SDGs, and environmental issues. Intriguing results showed that the banking and financial sectors could entice private investors to invest in green financing.

Many academicians and researchers have written extensively about the function of green finance in environmental sustainability or degradation in various countries and regions. In particular, a quantile-on-quantile regression method (Taghizadeh-Hesary et al., 2022) was used to investigate the function of green finance in CO2 emission in the top ten green finance–supportive nations. According to the estimated results, green finance has a significant and negative impact on the region’s CO2 emissions. The authors argued that market and economic conditions of countries play a major role in the variation in the quantiles of their population. According to empirical evidence, green finance investment is held back by short-termism and policy uncertainty (Wang et al., 2021). The establishment of essential investment projects is still considered complex and unclear by Ren et al. (2020). The shift toward sustainable development is still seen as having an extremely high degree of complication and unpredictability. The conventional and green economies could benefit greatly from the inclusion of green finance to expedite the transition. There is a strong argument that green financing and the development of FinTech can assist in reducing pollution in China’s industrial sector (Taghizadeh-Hesary and Yoshino, 2019). Green finance and cap-and-trade schemes, on the other hand, have been shown to have a significant impact on medium- and high-emitting manufacturers (Yoshino et al., 2020). According to the findings, cap-and-trade schemes have a negative impact on manufacturers with high CO2 emissions, while having a positive impact on manufacturers with low-to-medium CO2 emissions. According to Guild (2020), another benefit of green finance integrity is that it helps promote a more environmentally friendly economy. It was suggested that tighter government regulations, lower costs for businesses and institutions involved in producing green finance, increased government oversight, and higher pollution compensation for consumers could all help mediate green finance’s impact on long-term development. Additional research shows that renewable energy consumption and FDI in N-11 countries, CO2 emissions, and R&D contribute to green finance and climate change mitigation (Sarma and Roy, 2021).

The results reveal that green finance has varying effects in different nations and depends on a wide range of parameters. To provide this new financing, green finance research in China would be applied and offer fresh understandings to these economies and all other countries looking to develop green finance markets. In addition, because of their role in realizing the UN’s Sustainable Development Goals (SDGs) set in 2015, understanding how this variable applies to energy consumption and green energy efficiency in these economies is critical.

4 Methodology and Selection of Variables

4.1 Data and Variable Selection

To achieve the purposes of this research, the present study used overall five variables, the most important of which is CO2 emission, which specifies the overall quality of the environment. While a high degree of CO2 emissions denotes ecological degradation, the absence or low level of CO2 emissions denotes improved environmental quality. In addition, the primary independent variable in this analysis is green finance, which is denoted as (GF). It is significant because it fosters and cares for the drift of financial tools and associated facilities toward formulating and implementing sustainable business models, investment, economic, trade, social and environmental initiatives, and regulations. To facilitate the creation and implementation of financial tools and allied services, the GF variable is crucial. As a result, GF has an impact on economic activities and contributes to the country’s ecological performance.

Furthermore, the flow of financial instruments (GF) is a factor that is highly dependent on the country’s economic conditions. Because of this, GDP could be an effective factor for presenting a country’s economic situation because it measures health and size over a particular period of time. It considers aggregate investment, consumption, production, and other macroeconomic variables to determine the health of an economy. As a result (Mastini et al., 2021), a high degree of GDP could stimulate financial activity, which would, in turn, consume more natural resources and energy, potentially having a negative influence on the environment. On the other hand, public spending has the potential to influence environmental conditions by implementing flexible or stringent policies and making investments that can potentially impact a country’s economic conditions significantly.

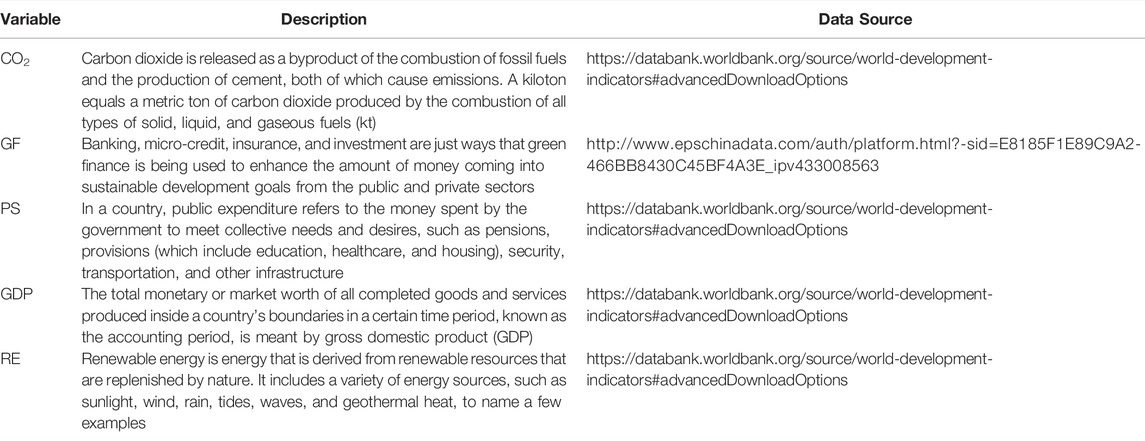

Consequently, it is important to look into both variables in environmental economics simultaneously. When it comes down to all of the variables listed above, the most recent dataset available for China was used, which covered the time period from 1990 to 2020. Throughout the world, technology has advanced at a rapid pace since 1990, both in developing and developed countries. This advancement in technology accelerates the rate of production and other economic activities, allowing for achieving higher economic goals. However, as a result of its rapid industrial development, countries such as China have risen to become the world’s leading carbon emitter and energy importer, making significant contributions to global warming and climate change. As a result (Zhang D. et al., 2021; Tang et al., 2022), China has concentrated on the growth of green finance to combat the potentially catastrophic issue of climate change and global warming. To fully recognize this connection, it is necessary to look back over the last three decades. Table 1 contains the specifications for the variables and the units of measurement and data sources.

4.2 Model Specification

The QARDL model, developed by Guild (2020) was used by researchers (Guild, 2020). This model can test green finance, public spending, and renewable energy for their long-term equilibrium effect on CO2 emissions. Green finance and carbon neutrality asymmetries can be tested using the QARDL model, which is a more advanced version of the “ARDL model.” The Wald test is used to examine the stability of integrating coefficients across the quantiles in the time-varying integration connection. Analyzing long- and short-run symmetries will be easier with this method. The basic form of ARDL is given below:

where

QARDL (p,q,r,s,u) was proposed by Ingham et al. (2015) as an extension of the model shown in Eq. 1.

where

Eq. 3, which depicts the QARDL-ECM model, is reformulated as follows:

The short-term influence on current stock prices of all previous stock price changes can be calculated using the delta approach given by

while the collective short-term influence of the earlier and current levels of CO2, GF, PS, RE, and GDP is determined by

The parameter associated with the long-run for GF, PS, RE, and GDP is calculated as follows:

The ECM parameter ρ should have a strong negative sign.

Academics used the Wald test to investigate the short- and long-term asymmetric effects of green finance, public spending, renewable energy, and GDP on CO2 emissions.

Contrary to an alternative one,

5 Results and Discussion

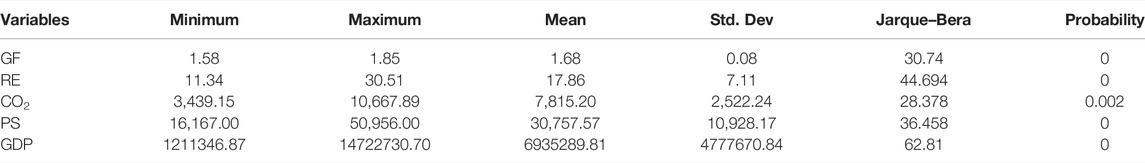

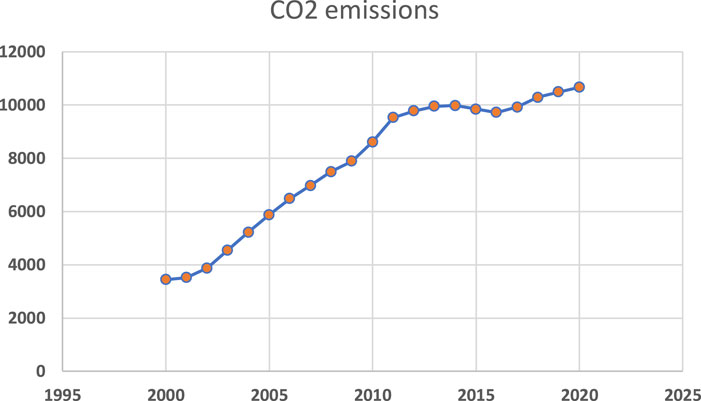

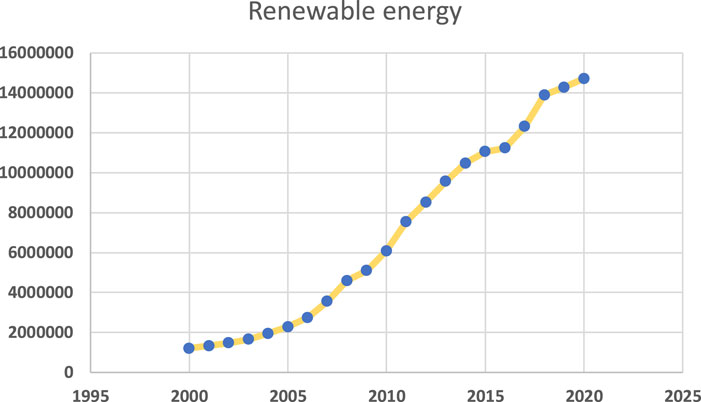

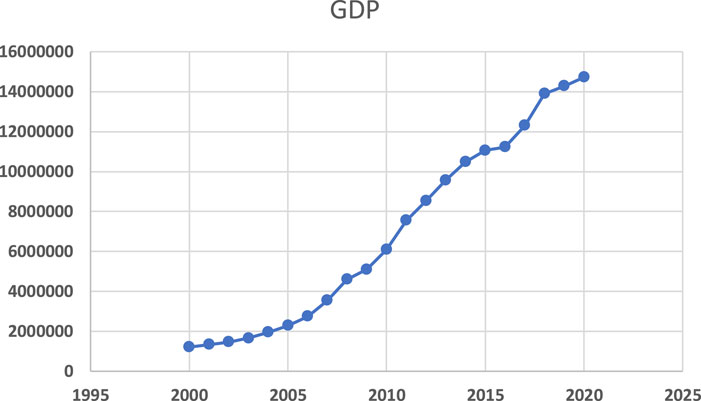

This section will analyze the findings of this study and discuss them in more detail. REN, CO2, PS, GDP, and GF are the variables selected for this study and are shown in Table 2 for the period from 2005 to 2019. All data were obtained from the World Bank. All of the mean values are positive. Averaging at 17.86, REN has minimum and maximum values of 11.34 and 30.51, respectively. There is a 7,815.20 million ton average CO2 level, ranging between 3,439.15 and 10,667.89 lower and higher values. In other words, PS has a mean value of 30,757.57 and a lower and higher value of 16,167 and 50,956, respectively. The mean value of GDP is 6935289.81 million USD, with the lower and higher values of 1211346.87 and 14722730.70, respectively. GF has a mean value of 1.68, with a minimum value of 1.58 and a maximum value of 0.926. The QARDL model can be used for further analysis because the Jarque–Bera test results show that REN distributions (CO2, PS, GDP, and GF) are not normally distributed at a 1% significance level. Figures 1–3 show the trends of data.

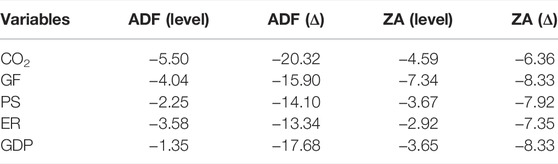

The unit root test (Im et al., 2003) and augmented Dickey–Fuller (ADF) test are used to identify the root of the problem. Table 3 shows the outcomes of the study. The ZA test’s advantage is that it also considers any structural breaks in the dataset. According to the results of the ZA and ADF tests, all of the data are stationary at the I (1) significance level, whether at a 5% or 10% significance level. According to the findings, the order of integration for all variables is I (1).

5.1 Quantile Regression Analysis

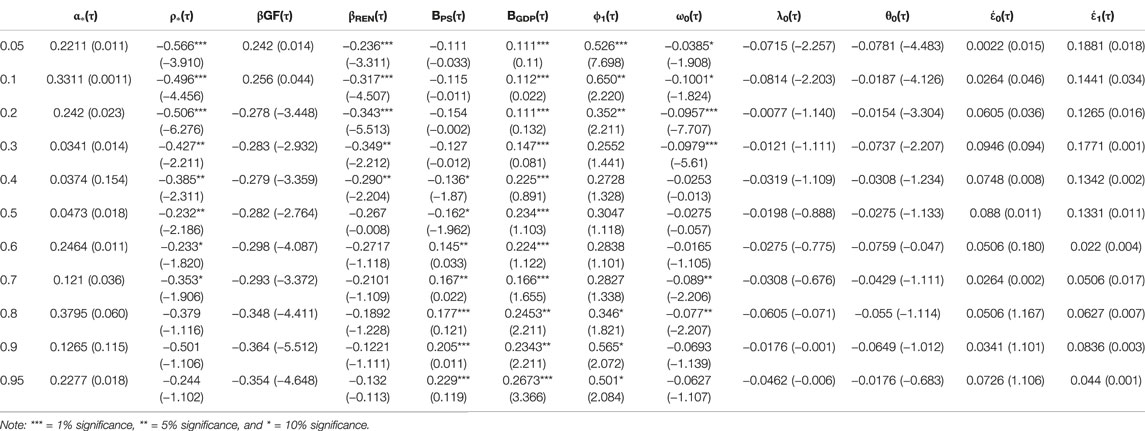

Table 4 shows the results of the QARDL model, which was used to generate the results. It demonstrates that the estimated coefficient is statistically significant at the negative level for all quantiles, but for 0.80, 0.90, and 0.95, it is significant at the positive level. This indicates a long-term equilibrium between carbon dioxide emissions and other variables, such as green finance, public spending, renewable energy, and economic growth, in the near future. Furthermore, in this study, the speed of adjustment for the coefficient was found to be significantly higher in the first quantile and lower in the 0.50th quantile, with the first quantile being significantly faster. The co-integration parameter for green finance, on the other hand, was found to be negatively significant in all quantiles, except for the two lowest quantiles, which were 0.05 and 0.10. Nine out of eleven quantiles show a negative long-term relationship between green finance and CO2 emissions, indicating a long-term downward relationship. Green finance and CO2 emissions appear to have a long-term inverted U shape, supporting the claim that there is an inverted U-shaped long-term link between green financing and CO2 emissions. The researchers’ findings confirmed the existence of a negative association between the two variables.

In addition, the cointegration coefficient for the association between public spending and carbon emissions in China is shown in Table 4. Findings from the study below of diverse quantiles indicate that there is a negative association between the two variables, but only for the medium and upper-level quantiles (0.40–0.95). As a result, more public spending has a negative and significant influence on carbon emissions. This is in accordance with the findings of a study by Mastini et al. (2021), which revealed related results in which different levels of public spending or carbon taxes can reduce the concentration of carbon emissions in the natural environment. Similarly, Yumei et al. (2021) confirmed that public expenditures negatively impact CO2 emissions, whereas Feng et al. (2022) reported that public spending contributes to environmental improvement while reducing CO2 emissions.

On the other hand, according to Table 4, the relationship between renewable energy and CO2 emissions is found to be negatively significant for the first five quantiles. It promotes the argument that increased use of renewable energy leads to lower levels of CO2 emissions in China, resulting in greater environmental sustainability overall. Previous studies (Tu et al., 2021) have found a similar relationship between renewable energy and carbon emission reduction. They confirmed that the use of renewable energy sources can result in carbon emission reduction. The bidirectional relationship between carbon emissions and renewable energy, on the other hand, was discovered only in the short run. Meanwhile, Nabeeh et al. (2021) examined the impact of renewable energy on CO2 emissions using the panel quantile regression method. The study found a positive inverted U-shaped tendency among the two variables at various quantiles. Muganyi et al. (2021) stated that renewable energy sources helped in reducing CO2 emissions in 46 countries across sub-Saharan Africa. The cointegration parameter for economic growth in terms of GDP is positive and significant for all quantiles, with the exception of the 0.60 and 0.70 quantiles, which indicates that there is an upward and long-term relationship between GDP and carbon emissions for nine out of eleven quantiles. As a result, the current findings have made a significant contribution to the existing body of literature, alongside the contributions made by Sarangi (2019); Zerbib (2019); Cui et al. (2020); Taghizadeh-Hesary and Musibau (2020), and others.

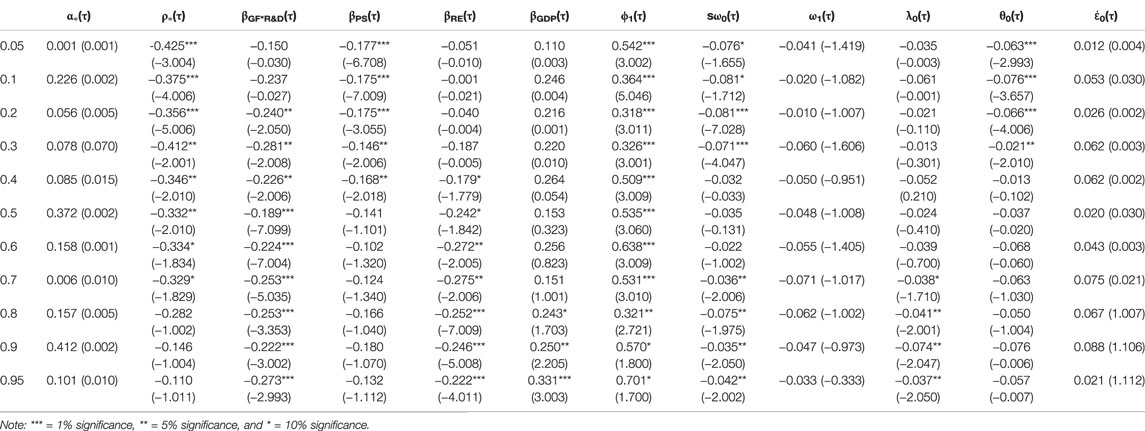

5.1.1 The Effect of Research and Development

As shown in Table 5, the results of the QARDL model estimation for India were obtained. All quantiles except 0.60 and 0.70 show a statistically significant association with the negative sign, as indicated by the parameter. It demonstrates the relationship between the parameter and other parameters. The results also show the long-term association between R&D and the interaction term GF*R&D, which is represented by the symbol. As a result of the research and development, it is highly significant and negatively correlated at all quantiles, that is, from 0.05 to 0.95. This finding indicates that research and development is negatively associated with CO2 emissions, which means that an increase in R&D will reduce CO2 emissions at all energy consumption levels in India. They are consistent with previous research, including that conducted by the United Nations Environment Programme (2017). Because of technological advancements, research and development produces novel knowledge, procedures, and products. In a study conducted by Shipalana (2020), it was discovered that the growth of innovative technologies could decrease damaging effects on the environment caused by energy consumption by refining energy efficiency.

According to many scholarly studies, government expenditures on education are critical to improving and further contributing to a greener economic system. Furthermore, according to the literature, investments in human capital can have a significant impact on the greening of the economic system (Liu et al., 2022; Nasir et al., 2022). In light of the current research findings, the two-pronged methods for preserving human capital were implemented as alternatives. The studies discovered that the percentage age of young talents for the entire part of the analysis can be used as a substitute for investing in human capital in the organization. In addition, junior high school instructors were chosen based on the ease with which the data pertaining to them could be accessed. As a result (Steckel et al., 2017), it met the needs of graduate students from various countries around the world. Although the strategies implemented in the context of increasing the ADSP yielded results, the volume of CO2 pollution has increased at the same time.

5.1.2 The Wald Test Results

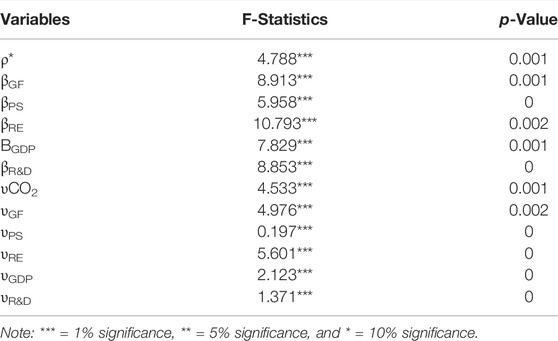

Detailed results of the Wald test are presented in Table 6. The Wald test is useful in determining whether a parameter remains constant across all quantiles. Linares et al. (2008) also found that the Wald test confirmed the nonlinearities in short- and long-run parameters for estimating locational asymmetries in both the short and long run. The acceptance of the null hypothesis demonstrates that there are no asymmetries or nonlinearities in the relationships examined. We found that the Wald test rejected the null hypothesis for all of the independent variables in our study in the long run, namely, green finance, public spending, renewable energy, and GDP and that the test rejected the null hypothesis for all of the independent variables in the short run. The findings demonstrate that all variables exhibit nonlinear and asymmetric relationships in the long run.

6 Conclusion and Policy Implications

Our research team has selected CO2 emissions as a proxy for environmental conditions for this investigation. Because of the human economy’s dependence on natural capital, CO2 emissions are a unique indicator of environmental conditions. This way measures the technological and social influence on the Earth’s ecosystem. To consolidate the determinants of CO2 emissions, there are some variables to consider, such as energy consumption, economic growth, transportation, tourist activities, and formal configurations. For this reason, and due to the importance of the variables described above to the environment, the QARDL model has been used to analyze the impact of green finance, public expenditures, renewable energy, and GDP on CO2 emissions from 2005 to 2017. According to the study results (Zhang S. et al., 2021), green finance, renewable energy utilization, and public spending improve the Chinese ecosystem. In contrast, GDP and institutional quality are positive and statistically significant at all quantiles. This demonstrates that the increase in GDP and institutional quality are both above-board associated with ecological situations at all quantiles.

Considering all of these affairs, our research has empirically authenticated the majority of the hypotheses. It is inferred from the findings that amplified use of renewable energy can help reduce environmental deprivation in China for low-to-medium quantiles, that an increase in tourism at high or low intensities of CO2 emissions can help improve the environment in China, that public spending can be both significant and positive at all quantiles (meaning that improvements in public spending are straightforwardly related to enhancements in ecological situations), and that an increase in GDP can lead to an increase in CO2 emissions for all quantiles. Meanwhile, the GDP square has a negative relationship with all quantiles, including the lowest. In the short term, dynamics reveal that current environmental footprint variations are significantly and positively affected by quantiles ranging from low to high. Current CO2 emissions are unaffected by current and previous variations in renewable energy, economic development, and institutional quality across the board. However, historical and present tourism fluctuations positively and significantly impact current carbon dioxide emissions, particularly in the low-to-moderate quantile ranges. In addition, there is a nonlinear and asymmetric relationship between CO2 emissions and tourism. According to the research findings, it was discovered that bidirectional causality exists between each exogenous variable and CO2 emissions, with the exclusion of institutional quality, which has unidirectional causality at all lags.

Environmental degradation is one of the most pressing issues facing the world today, and it affects both developing and developed countries. Several nations are vigorously engaged in developing environmental protection policies and programs. In the background of economic development and growth, ecological degradation turns out to be even more serious as economic growth has the potential to have negative consequences for the environment. The EKC hypothesis is a significant theory that attempts to explain the environment–economic tie. The findings also confirm the existence of the environmental Kuznets curve in China, which was previously hypothesized. According to the environmental Kuznets curve, economic growth initially causes an ecological disturbance, but after reaching a certain level of economic development, it contributes to improving the environment and preserving biodiversity.

Nonetheless, the argument for a carbon-free future is based on using a negative emission source until a significant proportion of renewable energy is included in the energy mix. As a result, fiscal policies and financial instruments must be implemented to gradually reduce taxes, while incentivizing policies to attract investment from financial crowdfunding and non-financial crowdfunding within the public and private sectors. Aside from that, due to the pressing need to upgrade existing infrastructure and construct new infrastructure in the energy sector, it is essential to develop an infrastructure strategy that makes use of funds from pollution trading schemes, such as carbon taxes or cap-and-trade programs, on conventional energy sources. The negative effects of fiscal policy on aggregate CO2 emissions and the gradual tradeoffs between hydrocarbons and natural gas as the primary energy sources should not be the final solution to CO2 mitigation in Thailand, according to the World Resources Institute. To be sure, it must be stated that this is a middle-of-the-road option. In the same way, a commitment should be noted to a gradual trade-off between traditional energy sources and the achievement of net zero-emissions energy sources.

6.1 Policy Recommendation

Based on the abovementioned findings, we recommend the following policies to promote the development of green finance:

1. To encourage the development of green finance, governments should use fiscal policies to direct credit funds and social capital into green investments, credit, and securities. Fiscal funding should direct credit funds and social capital into a green investment, credit, and securities.

2. In the approval process, green operations must be prioritized and the application procedure must be streamlined for environmentally friendly and low-carbon businesses.

3. The government should offer program support for green financial growth in underdeveloped regions, lower the issuance and trading thresholds for green bonds and securities, and prioritize initial public offerings of green concept companies, such as new energy, to encourage green financial development.

4. Provincial financial institutions should serve as trailblazers in developing environmentally friendly finance practices. Insurance, credit, and funds for the environment all play a significant role in implementing green finance policies.

5. As the primary vehicle for implementation, financial institutions should offer green financial instruments to relevant businesses, while also accelerating the alteration and promotion of usual enterprises.

6. Green financing should be efficient, and green loans should be readily available. Banks should also provide financial assistance to environmentally friendly businesses. Other financial institutions should be actively involved in the development and upgradation of financial technology, the support of enterprise financing, and the exploration of enterprise value.

7. Financial institutions should first organize internal cooperation, optimize business procedures, and create environmental awareness among their personnel to encourage the development of green financing in enterprises.

Data Availability Statement

Publicly available datasets were analyzed in this study. These data can be found here: FDI.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

This work was supported by the Special Projects in Key Fields of Universities in Guangdong (2021ZDZX1019) and the Hunan Provincial Innovation Foundation For Postgraduate (CX20200585).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbas, Q., Nurunnabi, M., Alfakhri, Y., Khan, W., Hussain, A., and Iqbal, W. (2020). The Role of Fixed Capital Formation, Renewable and Non-renewable Energy in Economic Growth and Carbon Emission: a Case Study of Belt and Road Initiative Project. Environ. Sci. Pollut. Res. 27, 45476–45486. doi:10.1007/s11356-020-10413-y

Anderson, J. J., Rode, D., Zhai, H., and Fischbeck, P. (2021). A Techno-Economic Assessment of Carbon-Sequestration Tax Incentives in the U.S. Power Sector. Int. J. Greenh. Gas Control 111, 103450. doi:10.1016/j.ijggc.2021.103450

Bamisile, O., Obiora, S., Huang, Q., Yimen, N., Abdelkhalikh Idriss, I., Cai, D., et al. (2021). Impact of Economic Development on CO2 Emission in Africa; the Role of BEVs and Hydrogen Production in Renewable Energy Integration. Int. J. Hydrogen Energy 46, 2755–2773. doi:10.1016/j.ijhydene.2020.10.134

Boretti, A. (2020). Production of Hydrogen for Export from Wind and Solar Energy, Natural Gas, and Coal in Australia. Int. J. Hydrogen Energy 45, 3899–3904. doi:10.1016/j.ijhydene.2019.12.080

Chen, J., Wang, Q., and Huang, J. (2021). Motorcycle Ban and Traffic Safety: Evidence from a Quasi-Experiment at Zhejiang, China. J. Adv. Transp. 2021, 1–13. doi:10.1155/2021/7552180

Cui, H., Wang, R., and Wang, H. (2020). An Evolutionary Analysis of Green Finance Sustainability Based on Multi-Agent Game. J. Clean. Prod. 269, 121799. doi:10.1016/j.jclepro.2020.121799

Feng, H., Liu, Z., Wu, J., Iqbal, W., Ahmad, W., and Marie, M. (2022). Nexus between Government Spending's and Green Economic Performance: Role of Green Finance and Structure Effect. Environ. Technol. Innovation 27, 102461. doi:10.1016/j.eti.2022.102461

Guild, J. (2020). The Political and Institutional Constraints on Green Finance in Indonesia. J. Sustain. Finance Invest. 10, 157–170. doi:10.1080/20430795.2019.1706312

Herman, K. S., and Shenk, J. (2021). Pattern Discovery for Climate and Environmental Policy Indicators. Environ. Sci. Policy 120, 89–98. doi:10.1016/j.envsci.2021.02.003

Hou, Y., Iqbal, W., Muhammad Shaikh, G., Iqbal, N., Ahmad Solangi, Y., and Fatima, A. (2019). Measuring Energy Efficiency and Environmental Performance: A Case of South Asia. Processes 7, 325. doi:10.3390/pr7060325

Huang, C., Wu, X., Wang, X., He, T., Jiang, F., Yu, H. H., et al. (2021). Exploring the Relationships between Achievement Goals, Community Identification and Online Collaborative Reflection: A Deep Learning and Bayesian Approach. Educ. Technol. Soc. 24, 210–223.

Huang, H., Chau, K. Y., Iqbal, W., and Fatima, A. (2022). Assessing the Role of Financing in Sustainable Business Environment. Environ. Sci. Pollut. Res. 29, 7889–7906. doi:10.1007/s11356-021-16118-0

Im, K. S., Pesaran, M. H., and Shin, Y. (2003). Testing for Unit Roots in Heterogeneous Panels. J. Econ. 115, 53–74. doi:10.1016/S0304-4076(03)00092-7

Ingham, J., Cadieux, J., and Mekki Berrada, A. (2015). E-shopping Acceptance: A Qualitative and Meta-Analytic Review. Inf. Manag. 52, 44–60. doi:10.1016/j.im.2014.10.002

Jinru, L., Changbiao, Z., Ahmad, B., Irfan, M., and Nazir, R. (2021). How Do Green Financing and Green Logistics Affect the Circular Economy in the Pandemic Situation: Key Mediating Role of Sustainable Production. Econ. Research-Ekonomska Istraživanja 1, 21. doi:10.1080/1331677X.2021.2004437

Khan, S. A. R., Godil, D. I., Jabbour, C. J. C., Shujaat, S., Razzaq, A., Yu, Z., et al. (2021a). Green Data Analytics, Blockchain Technology for Sustainable Development, and Sustainable Supply Chain Practices: Evidence from Small and Medium Enterprises. Ann. Oper. Res. 1, 25. doi:10.1007/S10479-021-04275-X/TABLES/5

Khan, S. A. R., Godil, D. I., Quddoos, M. U., Yu, Z., Akhtar, M. H., and Liang, Z. (2021b). Investigating the Nexus between Energy, Economic Growth, and Environmental Quality: A Road Map for the Sustainable Development. Sustain. Dev. 29, 835–846. doi:10.1002/SD.2178

Khan, S. A. R., Godil, D. I., Yu, Z., Abbas, F., and Shamim, M. A. (2022). Adoption of Renewable Energy Sources, Low‐carbon Initiatives, and Advanced Logistical Infrastructure-An Step toward Integrated Global Progress. Sustain. Dev. 30, 275–288. doi:10.1002/SD.2243

Khan, S. A. R., Ponce, P., Thomas, G., Yu, Z., Al-Ahmadi, M. S., and Tanveer, M. (2021c). Digital Technologies, Circular Economy Practices and Environmental Policies in the Era of COVID-19. Sustainability 202113, 12790. doi:10.3390/SU132212790

Khan, S. A. R., Ponce, P., and Yu, Z. (2021d). Technological Innovation and Environmental Taxes toward a Carbon-free Economy: An Empirical Study in the Context of COP-21. J. Environ. Manag. 298, 113418. doi:10.1016/j.jenvman.2021.113418

Khan, S. A. R., Yu, Z., and Sharif, A. (2021e). No Silver Bullet for De-carbonization: Preparing for Tomorrow, Today. Resour. Policy 71, 101942. doi:10.1016/J.RESOURPOL.2020.101942

Khokhar, M., Hou, Y., Rafique, M. A., and Iqbal, W. (2020). Evaluating the Social Sustainability Criteria of Supply Chain Management in Manufacturing Industries: A Role of BWM in MCDM. Probl. Ekorozwoju 15, 185–194. doi:10.35784/pe.2020.2.18

Lee, C.-C., Lee, C.-C., and Li, Y.-Y. (2021). Oil Price Shocks, Geopolitical Risks, and Green Bond Market Dynamics. North Am. J. Econ. Finance 55, 101309. doi:10.1016/j.najef.2020.101309

Lee, J. W. (2020). Green Finance and Sustainable Development Goals: The Case of China. Jafeb 7, 577–586. doi:10.13106/JAFEB.2020.VOL7.NO7.577

Li, M., Hamawandy, N. M., Wahid, F., Rjoub, H., and Bao, Z. (2021). Renewable Energy Resources Investment and Green Finance: Evidence from China. Resour. Policy 74, 102402. doi:10.1016/J.RESOURPOL.2021.102402

Linares, P., Javier Santos, F., Ventosa, M., and Lapiedra, L. (2008) Incorporating Oligopoly, CO2 Emissions Trading and Green Certificates into a Power Generation Expansion Model. Automatica 44, 1608–1620. doi:10.1016/j.automatica.2008.03.006

Liu, H., Tang, Y. M., Iqbal, W., and Raza, H. (2022). Assessing the Role of Energy Finance, Green Policies, and Investment towards Green Economic Recovery. Environ. Sci. Pollut. Res. 29, 21275–21288. doi:10.1007/s11356-021-17160-8

Mastini, R., Kallis, G., and Hickel, J. (2021). A Green New Deal without Growth? Ecol. Econ. 179, 106832. doi:10.1016/j.ecolecon.2020.106832

Moz-Christofoletti, M. A., and Pereda, P. C. (2021). Winners and Losers: the Distributional Impacts of a Carbon Tax in Brazil. Ecol. Econ. 183, 106945. doi:10.1016/j.ecolecon.2021.106945

Muganyi, T., Yan, L., and Sun, H.-p. (2021). Green Finance, Fintech and Environmental Protection: Evidence from China. Environ. Sci. Ecotechnology 7, 100107. doi:10.1016/j.ese.2021.100107

Nabeeh, N. A., Abdel-Basset, M., and Soliman, G. (2021). A Model for Evaluating Green Credit Rating and its Impact on Sustainability Performance. J. Clean. Prod. 280, 124299. doi:10.1016/j.jclepro.2020.124299

Nasir, M. H., Wen, J., Nassani, A. A., Haffar, M., Igharo, A. E., Musibau, H. O., et al. (2022). Energy Security and Energy Poverty in Emerging Economies: A Step towards Sustainable Energy Efficiency. Front. Energy Res. 10, 1–12. doi:10.3389/fenrg.2022.834614

Nassani, A. A., Aldakhil, A. M., Qazi Abro, M. M., and Zaman, K. (2017). Environmental Kuznets Curve Among BRICS Countries: Spot Lightening Finance, Transport, Energy and Growth Factors. J. Clean. Prod. 154, 474–487. doi:10.1016/j.jclepro.2017.04.025

Nguyen, , Phong, N., and Adomako, S. (2022). Stakeholder Pressure for Eco-Friendly Practices, International Orientation, and Eco-Innovation: A Study of Small and Medium-Sized Enterprises in Vietnam. Corp. Soc. Responsib. Environ. Manag. 29, 79–88.

Ning, Y., Cherian, J., Sial, M. S., Álvarez-Otero, S., Comite, U., Zia-Ud-Din, M., et al. (2022). Green Bond as a New Determinant of Sustainable Green Financing, Energy Efficiency Investment, and Economic Growth: a Global Perspective. Environ. Sci. Pollut. Res. 1, 1–16. doi:10.1007/S11356-021-18454-7/TABLES/10

Ren, X., Shao, Q., and Zhong, R. (2020). Nexus between Green Finance, Non-fossil Energy Use, and Carbon Intensity: Empirical Evidence from China Based on a Vector Error Correction Model. J. Clean. Prod. 277, 122844. doi:10.1016/j.jclepro.2020.122844

Saeed Meo, M., and Karim, M. Z. A. (2022). The Role of Green Finance in Reducing CO2 Emissions: An Empirical Analysis. Borsa Istanb. Rev. 22, 169–178. doi:10.1016/j.bir.2021.03.002

Safi, A., Chen, Y., Wahab, S., Zheng, L., and Rjoub, H. (2021). Does Environmental Taxes Achieve the Carbon Neutrality Target of G7 Economies? Evaluating the Importance of Environmental R&D. J. Environ. Manag. 293, 112908. doi:10.1016/j.jenvman.2021.112908

Sarangi, U. (2019). Green Economy, Environment and International Trade for Global Sustainable Development. J. Int. Econ.

Sarma, P., and Roy, A. (2021). A Scientometric Analysis of Literature on Green Banking (1995-March 2019). J. Sustain. Finance Invest. 11, 143–162. doi:10.1080/20430795.2020.1711500

Shahbaz, M., Nasir, M. A., Hille, E., and Mahalik, M. K. (2020). UK's Net-Zero Carbon Emissions Target: Investigating the Potential Role of Economic Growth, Financial Development, and R&D Expenditures Based on Historical Data (1870-2017). Technol. Forecast. Soc. Change 161, 120255. doi:10.1016/J.TECHFORE.2020.120255

Shipalana, P. (2020). Green Finance Mechanisms in Developing Countries : Emerging Practice. Covid-19 Macroecon. Policy Responses Afr. 2, 1–19.

Soltani, M., Moradi Kashkooli, F., Souri, M., Rafiei, B., Jabarifar, M., Gharali, K., et al. (2021) Environmental, Economic, and Social Impacts of Geothermal Energy Systems. Renew. Sustain. Energy Rev. 140, 110750. doi:10.1016/j.rser.2021.110750

Sovacool, B. K., Griffiths, S., Kim, J., and Bazilian, M. (2021). Climate Change and Industrial F-Gases: A Critical and Systematic Review of Developments, Sociotechnical Systems and Policy Options for Reducing Synthetic Greenhouse Gas Emissions. Renew. Sustain. Energy Rev. 141, 110759. doi:10.1016/j.rser.2021.110759

Steckel, J. C., Jakob, M., Flachsland, C., Kornek, U., Lessmann, K., and Edenhofer, O. (2017). From Climate Finance toward Sustainable Development Finance. WIREs Clim. Change 8, e437. doi:10.1002/WCC.437

Streimikiene, D., and Kaftan, V. (2021). Green Finance and the Economic Threats during COVID-19 Pandemic. Terra Econ. 19, 105–113. doi:10.18522/2073-6606-2021-19-2-105-113

Taghizadeh-Hesary, F., and Musibau, H. (2020). Greenfield Investments as a Source of Sustainable Green Finance? on the Relationships between Greenfield Investments, Environmental Performance, and Asian Economic Growth. AvaliableAt: https://www.econstor.eu/handle/10419/238434 (Accessed Mar 21, 2022).

Taghizadeh-Hesary, F., and Yoshino, N. (2019). The Way to Induce Private Participation in Green Finance and Investment. Finance Res. Lett. 31, 98–103. doi:10.1016/j.frl.2019.04.016

Taghizadeh-Hesary, F., Zakari, A., Alvarado, R., and Tawiah, V. (2022). The Green Bond Market and its Use for Energy Efficiency Finance in Africa. Cfri 12, 241–260. doi:10.1108/CFRI-12-2021-0225

Tang, Y. M., Chau, K. Y., Fatima, A., and Waqas, M. (2022). Industry 4.0 Technology and Circular Economy Practices: Business Management Strategies for Environmental Sustainability. Environ. Sci. Pollut. Res. doi:10.1007/s11356-022-19081-6

Tolliver, C., Keeley, A. R., and Managi, S. (2020). Policy Targets behind Green Bonds for Renewable Energy: Do Climate Commitments Matter? Technol. Forecast. Soc. Change 157, 120051. doi:10.1016/j.techfore.2020.120051

Truby, J., Brown, R. D., Dahdal, A., and Ibrahim, I. (2022). Blockchain, Climate Damage, and Death: Policy Interventions to Reduce the Carbon Emissions, Mortality, and Net-Zero Implications of Non-fungible Tokens and Bitcoin. Energy Res. Soc. Sci. 88, 102499. doi:10.1016/J.ERSS.2022.102499

Tu, Q., Mo, J., Liu, Z., Gong, C., and Fan, Y. (2021). Using Green Finance to Counteract the Adverse Effects of COVID-19 Pandemic on Renewable Energy Investment-The Case of Offshore Wind Power in China. Energy Policy 158, 112542. doi:10.1016/j.enpol.2021.112542

United Nations Environment Programme (2017). On the Role of Central Banks in Enhancing Green Finance. U. N. Environ. Program 1, 27.

Wang, M., Li, X., and Wang, S. (2021). Discovering Research Trends and Opportunities of Green Finance and Energy Policy: A Data-Driven Scientometric Analysis. Energy Policy 154, 112295. doi:10.1016/j.enpol.2021.112295

Wu, Y., Liu, F., He, J., Wu, M., and Ke, Y. (2021). Obstacle Identification, Analysis and Solutions of Hydrogen Fuel Cell Vehicles for Application in China under the Carbon Neutrality Target. Energy Policy 159, 112643. doi:10.1016/j.enpol.2021.112643

Xiang, H., Chau, K. Y., Tang, Y. M., and Iqbal, W. (2022). Business Ethics and Irrationality in SMEs: Does it Impact on Sustainable Business Resilience? Front. Environ. Sci. 10, 870476. doi:10.3389/fenvs.2022.870476

Yoshino, N., Schloesser, T., and Taghizadeh‐Hesary, F. (2020). Social Funding of Green Financing: An Application of Distributed Ledger Technologies. Int. J. Fin. Econ. 26, 6060–6073. doi:10.1002/ijfe.2108

Yu, Z., Khan, S. A. R., Ponce, P., Lopes de Sousa Jabbour, A. B., and Chiappetta Jabbour, C. J. (2022). Factors Affecting Carbon Emissions in Emerging Economies in the Context of a Green Recovery: Implications for Sustainable Development Goals. Technol. Forecast. Soc. Change 176, 121417. doi:10.1016/J.TECHFORE.2021.121417

Yumei, H., Iqbal, W., Irfan, M., and Fatima, A. (2021). The Dynamics of Public Spending on Sustainable Green Economy: Role of Technological Innovation and Industrial Structure Effects. Environ. Sci. Pollut. Res. 29, 22970–22988. doi:10.1007/s11356-021-17407-4

Zerbib, O. D. (2019). The Effect of Pro-environmental Preferences on Bond Prices: Evidence from Green Bonds. J. Bank. Finance 98, 39–60. doi:10.1016/j.jbankfin.2018.10.012

Zhang, D., Mohsin, M., Rasheed, A. K., Chang, Y., and Taghizadeh-Hesary, F. (2021a). Public Spending and Green Economic Growth in BRI Region: Mediating Role of Green Finance. Energy Policy 153, 112256. doi:10.1016/j.enpol.2021.112256

Zhang, S., Wu, Z., Wang, Y., and Hao, Y. (2021b). Fostering Green Development with Green Finance: An Empirical Study on the Environmental Effect of Green Credit Policy in China. J. Environ. Manag. 296, 113159. doi:10.1016/J.JENVMAN.2021.113159

Zhang, Y., Abbas, M., Koura, Y. H., Su, Y., and Iqbal, W. (2021c). The Impact Trilemma of Energy Prices, Taxation, and Population on Industrial and Residential Greenhouse Gas Emissions in Europe. Environ. Sci. Pollut. Res. 28, 6913–6928. doi:10.1007/s11356-020-10618-1

Keywords: green economy, econometric estimation, China, green finance, economic recovery, public expenditure

Citation: Xing L, Li J and Yu Z (2022) Green Finance Strategies for the Zero-Carbon Mechanism: Public Spending as New Determinants of Sustainable Development. Front. Environ. Sci. 10:925678. doi: 10.3389/fenvs.2022.925678

Received: 21 April 2022; Accepted: 09 May 2022;

Published: 08 July 2022.

Edited by:

Syed Abdul Rehman Khan, Xuzhou University of Technology, ChinaReviewed by:

Adeel Shah, College of Business Management, PakistanMajed Abbas, Yanshan University, China

Copyright © 2022 Xing, Li and Yu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jun Li, bGlqdW5fZm9zaGFuQDEyNi5jb20=

Lining Xing1

Lining Xing1 Jun Li

Jun Li