- 1School of Statistics and Applied Mathematics, Anhui University of Finance and Economics, Bengbu, China

- 2School of Economics and Management, Beijing University of Posts and Telecommunications, Beijing, China

In the context of today’s sustainable development, green finance and industrial structure optimization and upgrading are important components of sustainable development and are new trends in today’s society. Based on the relevant data from 31 provinces in China from 2011 to 2020, this study considers the role of green finance in optimizing and upgrading industrial structure from the technological progress perspective. The entropy weight method and the principal component downscaling method are used to measure the level of green finance development and industrial structure optimization and upgrading indexes of each province; the existence of the intermediary effect is verified using stepwise regression and the Sobel test. Through model construction comparison, the two-step system GMM is optimal, and the corresponding final two-step system GMM model is constructed to verify the promotion effect of green finance on the optimization and upgrading of industrial structure. The model introduces the control variables of openness to the outside world, government support, human resources, environmental regulation, and urbanization rate. Except for the insignificant effect of the urbanization rate control variable, the rest of the control variables have a significant promotion effect on the optimization of industrial structure because the corresponding urbanization rate in China at this stage does not bring about the optimization and upgrading of industrial structure. After the robustness test of the model, a sub-regional regression using the constructed model reveals that the effect of green finance on the optimization and upgrading of industrial structure is most significant in the central region, whereas the central and western regions are weaker compared to the east.

1 Introduction

The great progress of the new era requires advocating sustainable development, combining green financial development with sustainable development, promoting sustainable development through the provision of financial intermediation, and allocating more financial resources to green industries will not only help curb pollution-related investments but also help modernize the industrial structure through the green financial system (Shahzad et al., 2021a). Accelerating the green transformation of industrial structure has become a top priority for the sustainable development of today’s society and is a foundation that cannot be ignored. Moreover, with the deepening of the sustainable development concept of “green water and green mountains are golden mountains,” the introduction of green energy projects and the upgrading of the industrial structure have become more important, and green finance has greatly promoted the optimization and upgrading of industrial structure, which is extremely effective in helping the strategic goal of sustainable development (Shahzad et al., 2021b; Zhao et al., 2022a; Samour et al., 2022).

The Fifth Plenary Session of the 19th Central Committee clearly stated that accelerating sustainable development requires strengthening green development, developing green financial services, supporting green development, promoting clean production, developing green industries, and realizing the transformation of key sectors. The report of the 19th National Congress also pointed out the need to promote sustainable development strategies, improve the corresponding green industries and green finance, create a financial system as a support tower for green transformation, promote the concept of green development, and deeply grasp the concept of sustainable development.

Adhering to the concept of sustainable development and bombing and promoting the green transformation of industry, green production, and green living is an inevitable way to promote sustainable development by balancing economic development and environmental linkages (Abumunshar et al., 2020; Zhao et al., 2022b; Qashou et al., 2022). Meanwhile, the optimization and upgrading of the industrial structure have evolved to transform the traditional industrial structure into a system of ecologically determined industries, making an important contribution to the realization of sustainable development.

Not only does China attach great importance to today’s green development, but the whole society is actively implementing the concept of green development and making efforts to build sustainable development goals. Some countries have formulated strategies related to green growth (Zhao et al., 2022c); some others have adopted energy strategies, which is an ecological challenge faced by all mankind (Habeşoğlu et al., 2022). Sustainable development involves various aspects, such as nature, environment, economy, and finance. All countries are trying to practice green development and sustainable development goals, make corresponding efforts to realize sustainable development, and make active efforts to develop green industries, green finance, and so on. Practicing sustainable development is a matter of urgency.

Therefore, it is of great significance to analyze how to promote the relationship between green finance and the optimization and upgrading of industrial structure in view of the newer realities to accelerate economic development and national transformation and promote sustainable development.

Regarding green finance studies, Salazar (1998) combined financial issues with environmental issues, comprehensively considered the relationship between the two, and believed that the financial world and the environment needed to build a bridge to make them relevant. Scholtens et al. (2006) studied the transmission mechanism between corporate social responsibility and economic development and sustainable development by considering credit channels. Perez (2007) analyzed green finance from project financing, green investment, and environmental reports. Shahbaz et al. (2013) used the ng-Perron stationarity test and Granger causality analysis to analyze whether financial development in Malaysia reduces corresponding carbon dioxide emissions and the corresponding cointegration relationship among finance, energy, and economy. However, Soundarrajan et al. (2016) corroborated the viability of the corresponding green finance in the Indian industry, while introducing the corresponding environmental factors and discussing the environmental issues related to the study. Hanhua et al. (2017) used the panel smooth transformation model to analyze the impact of financial development on carbon emission reduction. Hadj et al. (2017) conducted a corresponding study on sustainable green finance development based on the influence of market transparency, return, and other factors. Clark et al. (2018) discussed the inhibiting effects between capital investment and sustainable development from the low-carbon economic transformation perspective and improved effective opinions for corresponding fiscal and policy. Zhu (2020) linked green finance to the ocean and marine ecosystem and introduced a coupling degree model for comprehensive evaluation and analysis. Zhang et al. (2021a) used the data related to green finance of listed companies to make a relevant evaluation of green finance using the DEA model combined with energy efficiency and the corresponding debt and equity indices. Mngumi et al. (2022) conducted a study related to green finance and issues related to carbon dioxide emissions using data related to green finance for the period 2005–2019, introducing panel quantile regression in econometrics for an in-depth analytical study. In contrast, Gilchrist et al. (2021) focused on green finance and green lending, providing in-depth analysis and discussion of green finance theory. Zheng et al. (2021) used structural equations to conduct corresponding studies on green finance and the social and economic environment. Wang et al. (2021a) used provincial panels to analyze and test policies and green finance reform using a differential model. Huang (2022) studied the relationship between green credit and environmental regulation in 30 regions of China based on the SBM model and the Malmquist–Luenberger productivity index model. Zhang H. et al. (2022) considered the corresponding coupling between green finance and the environment from the perspective of space and analyzed the corresponding space-time and driving factors.

Concerning the relationship between green finance and industrial structure, Mingsheng & Yulu (2011) considered the interaction between economy and industrial structure from the relevant economic theories perspective and energy conservation and emission reduction for iron and steel enterprises. Wang et al. (2018) chose Guizhou province in China to analyze the relationship between green finance and tertiary industry at the provincial level using the grey correlation method and put forward corresponding suggestions. Hu et al. (2020) explored the relationship and influenced mechanism between green credit and industrial structure and considered corresponding regional differences using the fixed-effect model. Jiang et al. (2020) used panel data from 2008 to 2016 for the effects of outward investment, industrial structure, and technology spillovers using threshold regressions. Wang et al. (2020) conducted an analytical study related to the relationship between industrial structure and foreign trade imports and exports from a spatial perspective. Xu et al. (2020) analyzed sustainable development from the perspectives of industrial structure, financial development, and natural resources using robust generalized least squares and spatial measurement methods. Wang et al. (2020) studied and analyzed the three major economic zones and applied the corresponding mediating effect and image analysis to consider the relevant effects of dual environmental regulation on industrial structure in 30 provinces. Shao et al. (2021), on the contrary, considered the relationship between green credit and industrial structure from the perspective of green credit and investigated the corresponding coupling degree and impact coefficient. By establishing the corresponding VAR model and the DEA model, Gu et al. (2021) studied the relationship between green finance and industrial structure under a series of relevant conditions, such as environment and government regulation, and made relevant suggestions for the management of governments and enterprises. Zhang et al. (2021b) used GMM and DEA to explore the relationship and influence between R&D expenditure and energy in member countries of the Belt and Road initiative. Wang et al. (2021) used grey correlation to study the mechanism of green finance’s influence on industrial structure and introduced corresponding control variables to analyze the difference in influence among eastern, central, and western China. Cheng et al. (2021) considered data from 2005 to 2016 from the industrial sector, conducted a comprehensive analysis of industrial structure upgrading from three dimensions, and explored the dynamic panel’s corresponding impact. Shahzad et al. (2021a) and Zhang et al. (2022) considered the green credit policies’ impact on economic development and the study’s impact on the corresponding industrial level in China, focusing on industry analysis. Zhu (2022) conducted a comprehensive analysis and studied upgrading the industrial structure promoted using technological progress under green credit, introduced the intermediary effect, analyzed the total utility and comprehensive effect, and expanded the research on green credit. Gao et al. (2022) constructed a spatial panel Durbin model using Chinese provincial data and introduced the Thiel index and entropy method to synthesize the impact of corresponding green finance on industrial rationality and its spillover effects. Sun et al. (2022) studied the relationship between green finance and energy consumption structure, introducing corresponding control variables and conducting corresponding regional regressions with some research significance.

Academic research has found that a large measure of green financial development level, industrial structure, and green finance related to impact on upgrading the industrial structure has obtained comparatively good results, which provide a corresponding theoretical basis. However, the measurement of industrial structure is mostly measured by the proportion of the tertiary industry, and the regression model constructed is relatively simple, without considering the corresponding intermediary effect. This study is based on the concept of sustainable development. It considers a comprehensive measurement of industrial structure optimization and upgrading, conducts an in-depth study on the existence of the intermediary effect of technological progress, considers endogeneity and model robustness, and conducts corresponding sub-regional regression. It is theoretically and practically significant to study green finance and industrial structure optimization and upgrading and sustainable development.

2 Theoretical Mechanism

2.1 Mechanism of Green Finance on the Industrial Structure Optimization and Upgrading

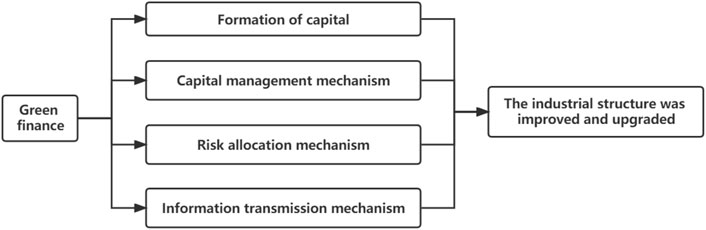

Green finance is now an indispensable element of China’s economic transformation, and supply-side reform plays an increasingly important role. The development of green and efficient industrial structures is starting, and the new growth of the industrial structure is imminent. Green finance mainly has the following mechanisms for industrial structure optimization and upgrading.

First, promote capital formation: financing issues are the central theme of the industrial structure modernization. The financial market can collect surplus market capital through savings to invest in certain sectors or institutions, creating capital for the industry development (Shahzad, 2020). Green finance finances green industries through financial instruments such as green loans, green bonds, and green funds and influences the allocation of resources among enterprises at the micro-level to promote corporate restructuring: by financing and reducing financing costs for “green” enterprises, enterprises can contribute to “green value-added” by expanding market size, making the market more competitive, and accelerating industrial expansion and development.

Second, capital management mechanism: the role of green finance in resource allocation is to revalue the industrial structure and the capital, thereby influencing resource allocation within sectors. Protect yourself from environmental risks by capitalizing and optimizing investment structures that complement imperfect markets and change investment structures by correctly allocating investment shares within or between sectors (Chen et al., 2022; Zhao et al., 2022d).

Third, risk-sharing mechanism: environmental protection, energy conservation, and new energy are part of the emerging industries, which tend to be larger in scale and riskier. If enterprises take on more risks by themselves, their motivation to operate “green enterprises” will be suppressed. The financial market is a function of risk redistribution (Wang et al., 2022; Xu et al., 2022). They can change the direction of risk aversion investment by investing capital into the green industry and initiating adjustment. They can identify and evaluate their business and investment risks, thus contributing to industrial structure modernization.

Fourth, information transmission mechanism: from the green financial system as the new green, green loans, equity, or financial ties can remind the market and give a signal, causing the enterprise to invest in the green industry, and, given the uncertainty of reducing the use of private capital, reduce investors’ risk on the new environmental protection projects.

As shown in Figure 1, in conclusion, based on the above theories, this study puts forward the first hypothesis: green finance can promote the optimization and upgrading of the industrial structure.

Action mechanism of green finance on industrial structure optimization and upgrading from the technological progress intermediary perspective.

Technological progress can transform the industry into a more environmentally friendly form of development through improvements that positively impact the environment and have a positive role in promoting the optimization and upgrading of industrial structures.

First, technological progress can create more value with fewer resources. Technological progress saves resources, reduces costs, and reduces the marginal production quota of resources, which increases resource use in the secondary and tertiary industries. When technologies change from non-green to green, they reduce energy consumption in secondary and tertiary industries, reducing costs and increasing resource use.

Second, green finance can promote technological progress through a risk dispersion mechanism to better realize the optimization and upgrading of industrial structures. Green finance can finance technological innovation and increase financing for technological progress while reducing risks and pooling capital, technology, and talent through a series of green finance financing, reducing investment risks, supporting technological progress, and promoting technological progress (Song et al., 2022). The ability to identify, evaluate, and manage green finance can promote the development of green technology and greatly promote the optimization and upgrading of the corresponding industrial structure.

Third, a green financial economy promotes technological progress through incentives and regulatory incentives to better realize the green upgrading of industrial structures. On the one hand, the green financial market has functions such as “pricing” and “information exchange,” which can identify corresponding technological innovations, provide green financial services for enterprises, and promote innovation. On the other hand, the mature green financial market can bring its advantages, provide timely information, effectively supervise invested technology projects, and urge the upgrading and optimization of industrial structure.

Therefore, this study puts forward the second hypothesis: green finance can achieve the optimization and upgrading of the industrial structure by promoting technological progress; that is, there is a corresponding intermediary effect of technological progress.

3 Core Research Variable Measure

3.1 Measurement of National Green Finance Development

3.1.1 Method Principle: The Entropy Weight Method

Step 1: the entropy weight method is adopted to assign weight to indicators, considering all indicators comprehensively, which is more objective. The calculation steps of the entropy weight method are as follows: assuming that there are n objects to be evaluated, the forward transformation matrix formed by M evaluation indicators is as follows:

Let the normalized matrix be denoted as Z, where Xij represents the elements of row I and column J in X:

Carry out corresponding standardization for positive and negative indicators.

Step 2: Normalize the matrix.Use

The information utility value is dj

Entropy weight Wj is

After the comprehensive weight is obtained, each province’s annual green finance development level can be obtained by adding the collected data.

3.1.2 Index Selection Principle and Source

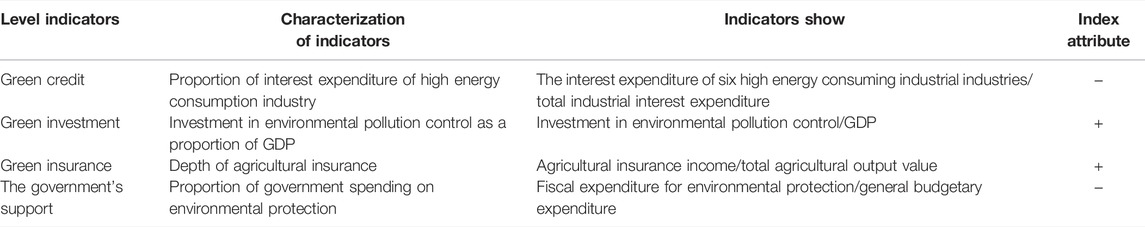

This study regards the scientific method, particularity, operability, and data availability, as its basic principles. It fully considers the existing studies. The corresponding selection includes green credit, green stock, green credit, and government support as four angles from which to measure the green financial development level of the country’s provinces.

Among them, green credit is a crucial part of financial policy. This study considers the availability of data, draws lessons from Li Xiaoxi and summer report used in energy-intensive industries that accounts for interest expense as a negative index, index selection for six energy-intensive industrial and six big energy-consuming industrial interest payments or industrial total, and comprehensively evaluates the credit index for green investment.

Green investment considers environmental factors and analyzes the investment in projects based on the goals of green development and sustainable development accordingly. This study selects the positive green investment indicator of the proportion of investment in environmental pollution control to GDP to measure the relative degree of green finance to able to reflect the financing ability of green projects.

Green insurance: green insurance needs to consider the corresponding policy of insurance and the environment. As China’s environmental pollution risks start late, the ginseng protection scope is limited. Agriculture is strongly influenced by the environment, agricultural insurance is closely related to green insurance, and agricultural insurance depth can reflect the size of the corresponding green insurance accordingly. Therefore, this study selects the relative ratio of agricultural insurance income to agricultural gross output value as a positive indicator to process and analyze the data.

Meanwhile, a positive indicator of government support, namely, the proportion of environmental protection expenditure, is added to make a comprehensive evaluation of the development level of green finance.

The selected indicators are from statistical yearbooks of various provinces in China and the Wind financial database. Indicators are selected, as shown in Table 1.

3.1.3 Measurement Results

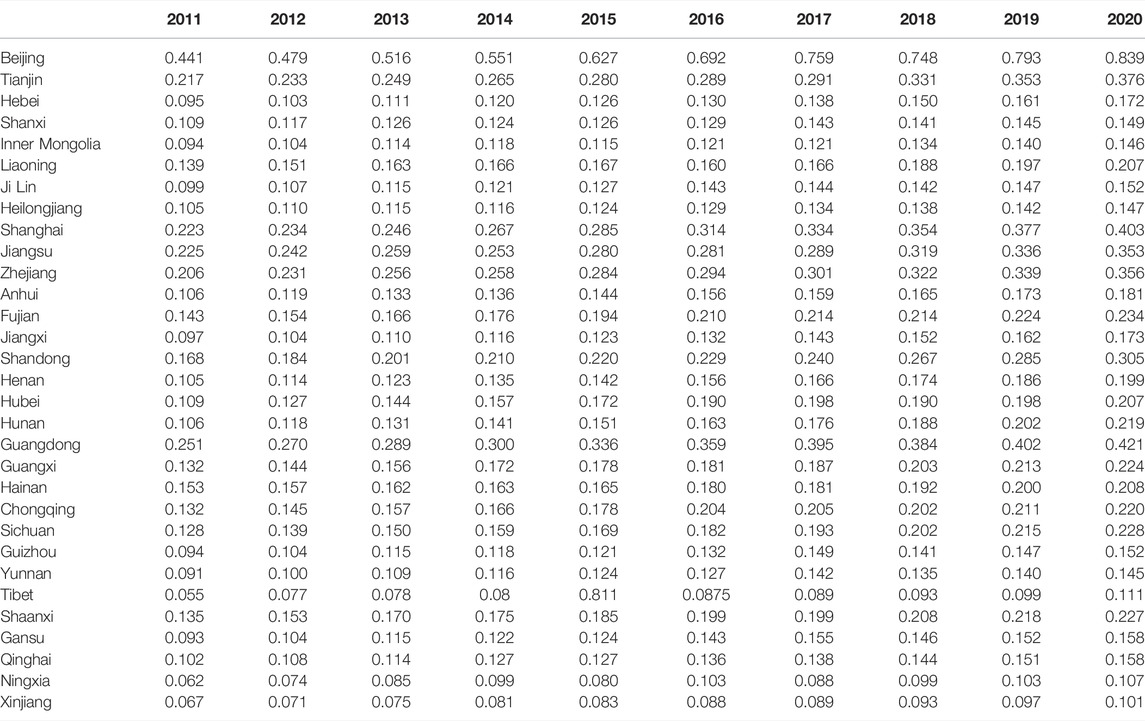

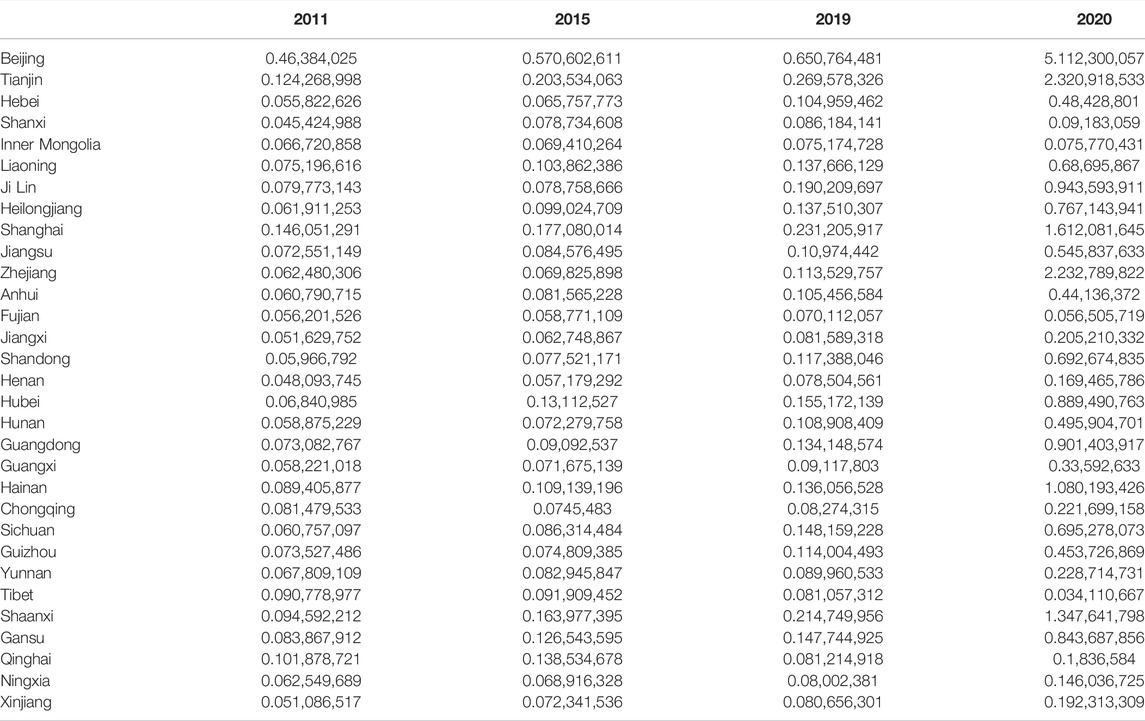

According to the first-level indicators of the above four aspects and relevant data collected, the entropy weight method is used to measure the development level of green finance. The green finance development level values of all provinces in China from 2011 to 2020 are obtained using the entropy weight method, as shown in Table 2.

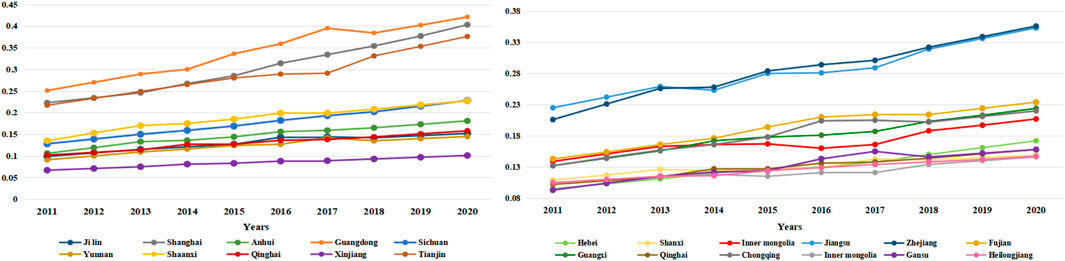

Some provinces in the central, western, and eastern parts of the country are selected to make the corresponding trend graphs of green financial development levels over time, as shown in Figure 2.

It can be seen that the selected provinces concerned all show a good development trend in the development level of green finance from 2010 to 2020. It indicates that the level of green finance development in the provinces of central, eastern, and western China all show a good upward trend, with differences in the upward trend in different regions.

The measurement results of green finance development level relative to the development level of 31 Provinces in China by the entropy weight method can be seen above. From the measurement of the financial development level of 31 provinces in China from 2011 to 2020, we can see the horizontal time span of each province. Mostly, from the start of the green financial development value at a low level to the situation in the development levels of 2020, all presented a good green financial development situation, all the provinces reasonably were on the path of green financial development, though development speed, and the rising rate is very different, but overall in the good green financial development direction.

The development level of green finance in all provinces in China increases yearly, showing a steady upward trend, indicating that all provinces in China attach importance to the development of green finance and strive to practice the green development view. Chinese provinces attach increasing importance to the development level of green finance, and most of them show a trend of slow growth in the first 5 years and rapid development in the last 5 years.

From the 10-year average level of green finance development, Beijing, Guangdong, Tianjin, Shanghai, Zhejiang, and Jiangsu rank higher in the level of green finance development, and their economic development level is also high in China. It shows that the relative development of green finance cannot be separated from the rapid development of the economy, which other provinces should learn from.

3.2 Measurement of Industrial Structure Optimization and Upgrading

3.2.1 Method Theory: The Principal Component Dimension Reduction Method

Indicators have units and directional points. We divide the indicators into positive and negative indicators according to their directivity and deal with them to eliminate the dimensional differences of the indicators.

For positive indicators,

For negative indicators,

The pre-processed data were used to construct data matrix samples, and SPSS software was used to conduct principal component analysis on normalized samples to determine the weight of each index. According to the cumulative contribution rate of 80%, principal components were selected to obtain the component matrix. Finally, the weight of each index is calculated according to the coefficient matrix, and the specific calculation formula is as follows:

n is the number of principal components; fk is the contribution rate of the KTH principal component to the total variance; aij is the coefficient in the KTH principal component; and Wij is the weight to xij when the target layer is not normalized.

To sum up, the normalized weight of the target layer is

Wj is the weight of item j after normalization.

3.2.2 Index Selection

The optimization and upgrading of industrial structure refer to the reallocation of production factors among various sectors of the economy and different industries, as well as the change in the proportion of output value of various sectors of the economy and different industries. In this study, we synthesize the current existing literature and select the index of industrial structure rationalization, the index of industrial structure heightening, and also add two aspects, namely, the proportion of third output value in each province and the market of technological achievements, to measure the indexes in four aspects in total. Industrial structure rationalization index

The industrial structure rationalization shows the aggregation quality and corresponding coordination degree and development degree of each province’s industry, which measures the corresponding coupling degree of factor input and output, indicating the industrial coordination between each province. To measure the industrial structure rationalization, most scholars mainly take the coupling degree of factor input structure and output structure and generally take the reciprocal of Theil index as the index to measure the industrial structure rationalization as shown in the following formula:

In contrast, this study integrates the approach of Gan Chunhui in terms of the coupling degree between industries and integrates the factor input and output structure coupling degree. The above equation treats all industries equally and ignores the importance of each industry in the economy. Because the state of economic disequilibrium is the norm, more so in developing countries, that is, the above value may be zero, the study of absolute value will have the corresponding inconvenience. In this study, we then modify and redefine accordingly; the formula for the rationalization of industrial structure is as follows:

For the above equation, TL = 0 exists even in the equilibrium, and the index considers the importance of different industries and avoids calculating absolute values. Meanwhile, according to the theoretical basis and economic connotation of structural deviation, we can better calculate the measurement of industrial structure rationalization.

2) Advanced Industrial Structure

With the development of science and technology and the deepening of the division of labor, the industrial structure continues to develop to the degree of deep processing and high added value to achieve the purpose of more effective use of resources. In this study, the industrial structure is measured by the proportion of each industry to reflect the evolution of the industrial structure:

where Y3 represents the output value of the tertiary industry and Y2 represents the output value of the secondary industry. The larger the value, the higher the degree of the industrial structure.

In this study, the ratio of the tertiary industry to the secondary industry in this formula can reflect the servitization tendency of the economic structure, which is a good measure. With a higher value, the economy moves toward the servitization angle, and the industrial structure shows a trend of advanced development.

3) The Proportion of Tertiary Industry and Technological Market Indicators

At the same time, the relative proportion of the tertiary industry and the marketization of the technology market, that is, the turnover index of the technology market, are added, and the structural index of industrial structure optimization and upgrading is considered more comprehensively from the economy and technology aspects.

In evaluating the relative degree of industrial structure optimization and upgrading, the index data selected are from the statistical yearbooks of Chinese provinces and statistical yearbooks of China. The data collected include the GDP of each province, the number of employed persons, the corresponding turnover of the technology market, the number of employed persons in each industry, the added value of each industry, the total number of employed persons, and the corresponding proportion of each industry.

3.2.3 Dimensionality Reduction Measure Results

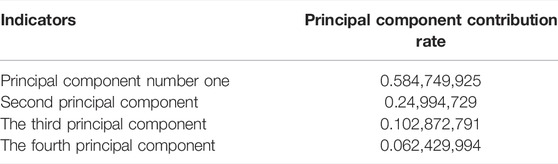

In order to obtain the most effective evaluation of the comprehensive industrial structure optimization and upgrade results by considering all the above factors, this study adopts the principal component method to comprehensively consider the influence of the above indicators and extracts four principal components. The contribution rates of the four principal components are shown in Table 3.

By using the extracted four principal components and the contribution rate of each principal component, the comprehensive score formula is used:

The principal component scores of each province each year are calculated and normalized accordingly to avoid large differences in corresponding values. Due to space issues, the specific indexes of industrial structure optimization collection in only part of the years are shown in Table 4.

It can be seen from the indexes of industrial structure optimization and upgrading of various provinces calculated using principal component dimension reduction in the above industries that only part of the measurement results are listed due to space problems. As can be seen from the corresponding measurement results, Beijing has always maintained the highest industrial structure optimization and upgrading index, showing its great economic vitality as capital. As China’s political and economic center, Beijing has shown a very high level of an industrial structure optimization, far ahead of other provinces in China. The optimization and upgrading index of industrial structure in the eastern region is at the forefront of China, while the index of industrial structure optimization and upgrading in the central and western regions is relatively weak, and the level of industrial structure optimization in individual regions in the western region is low.

Among them, the western region is relatively backward in development, which needs to be focused on, and the country needs to vigorously guide the optimization and upgrading of industrial structure in the western region.

From the final structure of the industrial structure optimization and upgrading measured by the principal components of the above table, we can see that the indexes of industrial structure optimization and upgrading of each province in China show a good upward trend from 2011 to 2020. It shows that China has focused on the optimization of industrial structure and the rationalization and advancement of industrial structure step by step toward a good state, showing an excellent development. The calculated data are retained as the core explanatory variables of this study.

4 Empirical Analysis

4.1 Theoretical Explanation of Mediating Effect

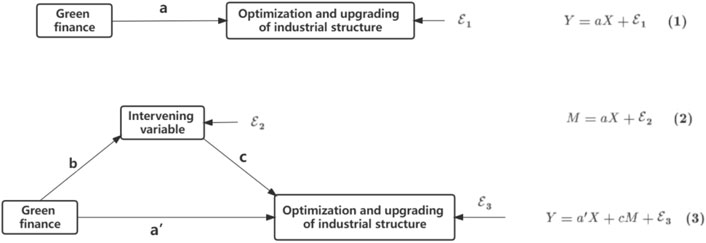

The mediating effect model was proposed to study the existence of some mediating variables. The commonly used test methods are the step regression method, the Sobel test method, and the Bootstrap method to judge the corresponding mediating effect because explanatory variables may not be explained by a single path to the explained variable, and there may be a related influence of intermediary variables. Explanatory variables can exert a corresponding influence on the explained variable through intermediary variables. The mechanism of the stepwise regression test is shown in Figure 3.

We need to build the corresponding model when the master model coefficient significantly shows that exist explained variables exist. Furthermore, there is a need to focus on validating the second model in the intermediary effect, namely, whether the corresponding coefficient b is significant. Finally, the final integrated regression model is constructed with significant mediating variables; where the coefficients c and and a’ denote the resulting impact effects while controlling for the corresponding explanatory and mediating variables that are constant.

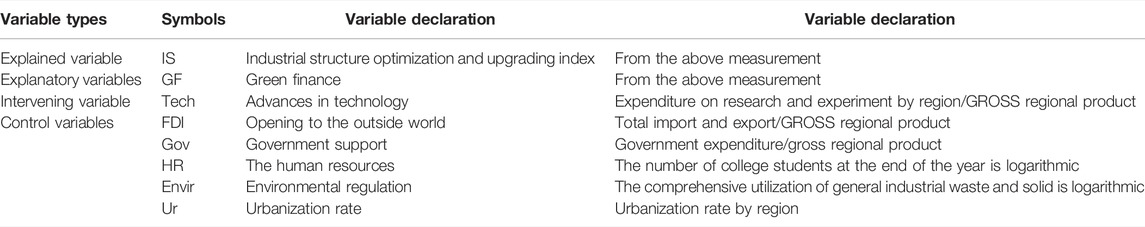

4.2 Index Selection

The core variables of this study are the green development index of each province and the optimization and upgrading measurement of the industrial structure obtained from the evaluation above. Meanwhile, the intermediate variable of technological progress is introduced. In order to control other relevant factors, green finance’s influence on the optimization and upgrading of industrial structure is studied, and the corresponding control variables are introduced. The opening up level, government support, human resources, environmental regulation, and urbanization rate are the five control variables to explain the research issues. Corresponding final empirical model indicators are shown in Table 5.

The indicators of the development level of green finance and the optimization and upgrading of the industrial structure are derived from the above calculation and will not be repeated. Meanwhile, to eliminate the possible heteroscedasticity, this study adopts logarithmic processing for non-ratio variables to construct corresponding models.

4.3 Data Sources

In this study, the relevant data sources of green finance and industrial economy in 31 provinces of China, China Statistical Yearbook, China Financial Yearbook, and WIND database are selected, and some missing values are calculated by the linear interpolation method.

4.4 Model Setting

This study needs to analyze the green financial impact on the industrial structure upgrade mechanism and its corresponding effect, simultaneously considering technological progress under the perspective of the green financial impact on industrial structure optimization and upgrading of the comprehensive, and verify whether there is a corresponding intermediary effect and a need to build the corresponding regression model, regression model, the intermediary, and the final comprehensive model.

Main model: with industrial structure optimization and upgrading as the explanatory variables, green financial development as the core explanatory variables, and considering the corresponding control variables, the main regression model is established:

Mediating effect model: because green finance can upgrade industrial structure through indirect channels, this study considers the mediating effect model from the perspective of technological progress and constructs a regression model with technological progress as the explained variable and green finance as the explained variable as follows:

Finally, the final comprehensive model is obtained by adding the corresponding intermediary model into the corresponding main model:

4.5 Empirical Analysis

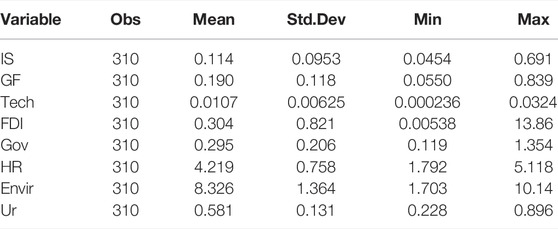

4.5.1 Descriptive Statistical Analysis

First, to collect relevant variables corresponding to the model descriptive analysis, the descriptive statistical analysis is shown in Table 6.

4.5.2 Preliminary Test Results of Mediation Effect

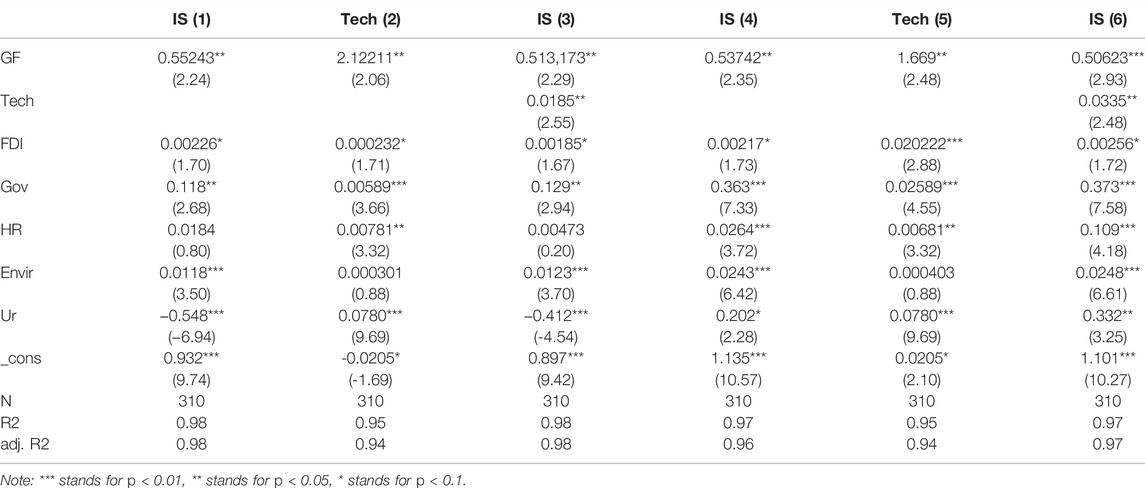

The stepwise regression method was used to test the corresponding mediation effect. Three models were constructed based on the mediation effect model described above, and the corresponding test results are shown in Table 7.

It can be concluded from the construction of the three relevant models of the above mediation effect test that, for the main model, green finance has a significant promoting effect on the industrial structure of the model, considering the effect of green finance on the industrial structure alone. The regression coefficient is positive, and the promoting effect is significant. Hypothesis 1 can be explained.

As for the test results of the second mediation effect model, it can also be concluded that technological progress has a significant effect on promoting the industrial structure, which verifies the existence of the mediation effect; that is, the green finance has a promoting effect on the development of the industrial structure. The development of green finance also plays a corresponding role in promoting technological progress, verifying the corresponding Hypothesis 2.

According to the above two models, green finance plays a positive role in promoting industrial structure, and technological progress also plays a corresponding role in promoting industrial structure. It is necessary to build a corresponding comprehensive model. As seen from the model regression results in the last column, green finance still plays a significant positive role in promoting the industrial structure. Technological progress also plays a significant positive role in promoting the optimization and upgrading of the industrial structure. The corresponding coefficients a′ and c are significant, and the indirect effect can be verified accordingly. The mediating effect is verified, and Hypothesis 2 is true.

4.5.3 Sobel Test

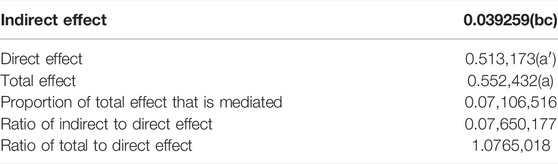

Meanwhile, the corresponding Sobel test results are further reported, and the test results are significant, indicating a corresponding mediating effect of technological progress. The p-value of the corresponding Sobel test was significantly less than 0.001, indicating that the mediating effect of technological progress existed and was significant. Meanwhile, the Sobel test also reported the proportion of some mediating effects in the total effect, as shown in Table 8.

The Sobel test further verified the mediation effect of technological progress, and the corresponding total effect, indirect effect, and the proportion of the mediation effect can be seen. Among them, the proportion of the mediation effect directly reported by the Sobel test to the total effect can be seen as 7.106%, indicating that 7.106% of the promotion effect of green finance on the industrial structure is explained by the partial mediation effect, and technological progress has partial mediation effect. It shows that the optimization and upgrading of the industrial structure by green finance can be achieved through corresponding technological progress.

The results of the preliminary test structure of the corresponding mediating effect and the Sobel test both together show that there is a corresponding partial mediating effect of technological progress on the industrial structure, and the corresponding hypothesis 2 is tested. It shows a corresponding partial intermediary effect of technological progress and the importance of technological progress in the development of the corresponding region, which can have a positive role in promoting the optimization and upgrading of the industrial structure by saving resources, reducing costs, and improving the corresponding production efficiency.

4.5.4 Discussion on Endogeneity

Through the above tests of intermediary effects, it can be seen that green finance has a promotion effect on industrial structure, and technological progress has a corresponding intermediary effect on the optimization and upgrading of industrial structure. There is a simple linear relationship between green finance development and industrial optimization and upgrading, and mutual influence between the two or existing corresponding lag effect can cause the corresponding endogenous problems; simultaneously, optimization and upgrading of industrial structure is a related problem and will be affected by the time the policy change could lead to the corresponding hysteresis effect. Therefore, the first-order lagged industrial structure indicators are considered to be introduced into the model as explanatory variables.

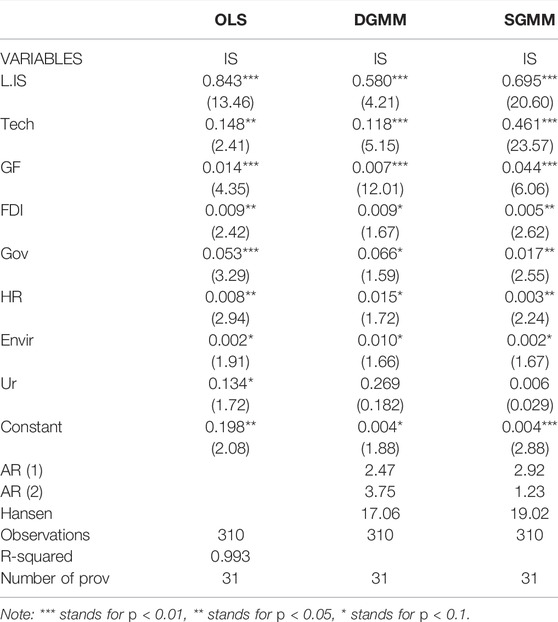

The least-square estimation method is used in the preliminary test of the corresponding intermediary effect model. When considering endogeneity and hysteresis, the industrial structure with first-order lag is considered in constructing the model to make the structure more rigorous. System GMM and differential GMM are used for analysis, and different models are comprehensively compared. The model results and comparison are described as shown in Table 9.

The individual time bidirectional fixed-effect model is constructed based on the corresponding basic regression model and the corresponding difference between GMM and system GMM models. The p-value of the first-order Ar test of the system GMM model is significant, whereas the p-value of the second-order Ar test is not significant, indicating that system GMM ensures the consistency of GMM estimation and is more suitable for the estimation of the corresponding model. Meanwhile, the Hansen test statistic p of differential GMM is 1. Generally, the p-value of the Hansen test statistic is between 0.1 and 1, and the p-value of the Hansen test of system GMM is between 0 and 1, indicating that the corresponding tool variable is valid. Therefore, the most appropriate model is the system GMM model. The two-step system GMM was selected to construct the corresponding final model.

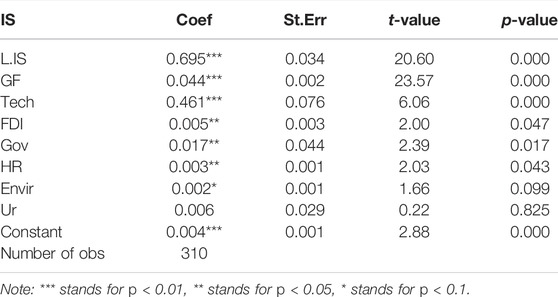

4.6 Final Model Regression Results

According to the final system difference model (Table 10), it can be seen that the corresponding lag first-order industrial structure optimization and upgrading variable introduced is significant. Meanwhile, green finance plays a corresponding promoting role in the industrial structure optimization and upgrading of all provinces in China, and the promoting effect is significant. Technological progress also plays a significant promoting role.

For the introduced control variables, opening up has a significantly positive effect on the optimization and upgrading of industrial structure, indicating that opening up can attract corresponding capital and technology and positively affects the optimization and upgrading of industrial structure, and government support has a significantly positive effect on the optimization and upgrading of industrial structure. It shows that the government increase in the corresponding financial expenditure is conducive to better optimization and upgrading of the industrial structure. Human resource has a significant positive effect on optimizing and upgrading industrial structure. However, it has a relatively small role in promoting the optimization and upgrading of industrial structures. It shows the importance of human resource quality education, and the cultivation of high-quality talents should be increased.

The promoting effect of environmental regulation on industrial structure passed at the significant 10% level, indicating that the promoting effect of environmental regulation on the industrial structure needs to be improved. Promoting environmental regulation can further promote the development of the industrial structure. The effect of the urbanization rate on the optimization and upgrading of industrial structure does not pass the significance test, indicating that the corresponding urbanization rate on the industrial structure has not passed; the corresponding urbanization rate does not bring about the optimization and upgrading of industrial structure, the corresponding influence mechanism is still not formed, and the corresponding urbanization rate in China at this stage does not bring about the optimization and upgrading of industrial structure, which is the direction to be worked on in the future, as shown in Table 10.

4.7 Robustness Test

The regression results above verify the promoting effect of green finance on the optimization and upgrading of industrial structures and illustrate the promoting effect of technological progress on the optimization and upgrading of industrial structures. In this study, the robustness of the model is tested by changing the measurement method. A method of changing the explanatory variables is adopted to test the robustness of the model; because the core of this article explains variable optimization and upgrading of industrial structure, the relative weight of the third industry can represent the corresponding greening to upgrade the concept of more accord in this study, the concept of the greening of the industrial structure upgrade, so the selection in different provinces in China accounts for the third industry ratios as a proxy index regression, Perform robustness tests.

By comparing the following robustness test results in Table 11, (4), (5), and (6) with the previous regression results (1), (2), and (3), it can be seen that the corresponding basic results remain unchanged. Green finance still promotes the optimization and upgrading of industrial structure, and the corresponding regression coefficient and significance change slightly, whereas the basic results remain unchanged. The robustness of the model can be tested by changing the measurement method.

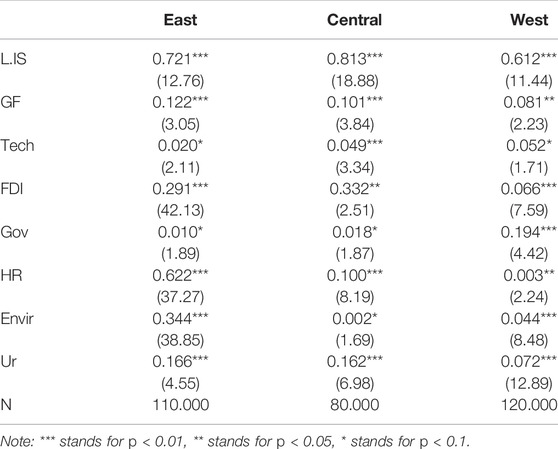

4.8 Inspection by Region

According to the model, China is divided into central, eastern, and western regions. The region’s eastern part consists of 11 provinces (municipalities): Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan. The central region includes a total of 8 provinces (cities): Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, and Hunan. The western region covers 12 provinces (cities), including Sichuan, Chongqing, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang, Guangxi, and Inner Mongolia. After China is divided into three regions, comprehensive analysis and comparison are made of the three regions. The relevant effects of green finance in each region of China on the industrial structure are analyzed and compared as shown in Table 12.

It can be seen from the above comprehensive model of the three regions in China that green finance plays a role in promoting the optimization and upgrading of industrial structure, which further verifies Hypothesis 1. However, there are also corresponding differences in different regions. The regression coefficient is the highest in the eastern region, followed by the central region, and the corresponding coefficient is the lowest in the western region. Among them, green finance, human resources, environmental regulation, and urbanization rate in the eastern region have the highest promoting effect on the optimization and upgrading of industrial structure, indicating that the eastern region has rapid financial and economic development, abundant human resources in colleges and universities, and a high urbanization rate. The role of green finance in the central region in the optimization and upgrading of industrial structure is second to that in the eastern region, in which the level of technological progress and opening to the outside world has the highest impact on the optimization and upgrading of industrial structure, indicating that the central region mainly develops science and technology and foreign trade, which is the advantage of the central region in upgrading industrial structure. In the western region, due to the geographical environment and the corresponding economic development level being relatively slow, the green finance effect on the optimization and upgrading of industrial structure is the weakest, but the corresponding control variables are significant. It shows that the western region needs to actively play the role of green finance for industrial structure development.

5 Conclusion and Policy Recommendations

Based on the corresponding theories of green finance and industrial structure optimization and upgrading, this study investigates the role of green finance on industrial structure optimization and upgrading in 31 Chinese provinces. The corresponding findings are as follows: the existence of the mediating effect of technological progress is verified using the stepwise regression method, and the existence of the partial mediating effect of technological progress is verified by the Sobel test. The two-step systematic GMM method is used to verify the significant influence of green finance on the optimization and upgrading of the industrial structure. The corresponding control variables are included in the model, and most of the corresponding control variables have significant promotion effects, except for the urbanization rate, which is not significant, indicating that the corresponding urbanization rate does not lead to the optimization and upgrading of industrial structure in China at this stage. Through the corresponding robustness tests and sub-regional regressions, it is found that the promotion effect of green finance is the most significant in the central region, while the central and western regions are the second most effective.

Based on the model establishment results and corresponding conclusions, the following suggestions are made.

First, the government should play a leading role in vigorously promoting the development of green finance, building a comprehensive green financial system, and establishing a sound green financial system. The state should expand financing channels through a broader political dimension, increase support for green finance, and guide, strengthen, and meet enterprises’ requirements for financial institutions, green projects, and the efficiency of green projects. Simultaneously, it should strengthen environmental risk management, strengthen the supervision of loans, prevent funds from flowing to companies with high environmental risks, and restrict high-pollution and high-polluting industries.

Second, the government should focus on investing in green technology, increase the level of green financial development in various places and the role of industrial structure optimization and upgrading, fully implement the sustainable development strategy, realize the greening and upgrading of industrial structure, and play the role of the intermediary effect of technological progress. It should increase the investment in technological innovation, encourage technological innovation around the world, realize technology-driven industrial structure optimization, and realize the joint development of both. At the same time, the relative strength of government support, the level of opening to the outside world, human resources and the corresponding environmental regulations, and the relative increase of urbanization rate can realize the relative upgrading of industrial structure.

Third, the government should strengthen information exchange in different places and share green financial information in a timely manner. All parts of China should strengthen information exchange and communication and share good financial resources and information to narrow the gap between the east and the west. While realizing the rapid development of the eastern region, it should use the eastern region to drive the relatively weak development of the central and western regions and realize the good development trend of green finance and the optimization and upgrading of industrial structure on a national scale.

Fourth, there is a need to strengthen green finance laws and regulations to reduce inequality, ensure smooth information channels, realize successful information circulation between the government and enterprises, and promote the healthy and rapid construction of green finance. Financial institutions should provide loan guarantees for green projects and green enterprises, increase loan interest rates, and improve credit flow so that additional financing flows to green industries.

This study introduces technological progress as a mediating variable from the perspective of green finance and considers the relative role of green finance on industrial structure optimization and upgrading from the perspective of technological progress mediation, which is innovative in terms of research ideas and research methods. However, limited to the constraints of research space, this study does not conduct in-depth heterogeneity analysis, and future research will be further improved. Meanwhile, future research will extend the research time and scope to conduct more detailed and in-depth research.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material. Further inquiries can be directed to the corresponding author.

Author Contributions

WW: writing–original draft, supervision, conceptualization, methodology, writing–review and editing, software. YL: project administration, resources, funding acquisition, formal analysis, investigation, validation.

Funding

This project was funded by the Research Innovation Fund for Undergraduates of Anhui University of Finance and Economics (Project no. XSKY22227).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abumunshar, M., Aga, M., and Samour, A. (2020). Oil Price, Energy Consumption, and CO2 Emissions in Turkey. New Evidence from a Bootstrap ARDL Test. Energies 13 (21), 5588. doi:10.3390/en13215588

Chen, H., Shi, Y., and Zhao, X. (2022). Investment in Renewable Energy Resources, Sustainable Financial Inclusion and Energy Efficiency: A Case of US Economy. Resour. Policy 77, 102680. doi:10.1016/j.resourpol.2022.102680

Cheng, Q., Lai, X., Liu, Y., Yang, Z., and Liu, J. (2021). The Influence of Green Credit on China's Industrial Structure Upgrade: Evidence from Industrial Sector Panel Data Exploration. Environ. Sci. Pollut. Res. 29, 22439–22453. doi:10.1007/s11356-021-17399-1

Clark, R., Reed, J., and Sunderland, T. (2018). Bridging Funding Gaps for Climate and Sustainable Development: Pitfalls, Progress and Potential of Private Finance. Land Use Policy 71, 335–346. doi:10.1016/j.landusepol.2017.12.013

Gao, L., Tian, Q., and Meng, F. (2022). The Impact of Green Finance on Industrial Reasonability in China: Empirical Research Based on the Spatial Panel Durbin Model. Environ. Sci. Pollut. Res. 2022, 1–17. doi:10.1007/s11356-022-18732-y

Gilchrist, D., Yu, J., and Zhong, R. (2021). The Limits of Green Finance: a Survey of Literature in the Context of Green Bonds and Green Loans. Sustainability 13 (2), 478. doi:10.3390/su13020478

Gu, B., Chen, F., and Zhang, K. (2021). The Policy Effect of Green Finance in Promoting Industrial Transformation and Upgrading Efficiency in China: Analysis from the Perspective of Government Regulation and Public Environmental Demands. Environ. Sci. Pollut. Res. 28 (34), 47474–47491. doi:10.1007/s11356-021-13944-0

Habeşoğlu, O., Samour, A., Tursoy, T., Ahmadi, M., Abdullah, L., and Othman, M. (2022). A Study of Environmental Degradation in Turkey and its Relationship to Oil Prices and Financial Strategies: Novel Findings in Context of Energy Transition. Front. Environ. Sci. 10, 876809. doi:10.3389/fenvs.2022.876809

Hadj, S. B., De Mulder, J., and Zachary, M. D. (2017). Sustainable and Green Finance: Exploring New Markets. Econ. Rev. 2017, 7–24.

Hu, Y., Jiang, H., and Zhong, Z. (2020). Impact of Green Credit on Industrial Structure in China: Theoretical Mechanism and Empirical Analysis. Environ. Sci. Pollut. Res. 27 (10), 10506–10519. doi:10.1007/s11356-020-07717-4

Huang, D. (2022). Green Finance, Environmental Regulation, and Regional Economic Growth: from the Perspective of Low-Carbon Technological Progress. Environ. Sci. Pollut. Res. 29, 33698–33712. doi:10.1007/s11356-022-18582-8

Jiang, M., Luo, S., and Zhou, G. (2020). Financial Development, OFDI Spillovers and Upgrading of Industrial Structure. Technol. Forecast. Soc. Change 155, 119974. doi:10.1016/j.techfore.2020.119974

Mingsheng, C., and Yulu, G. (2011). The Mechanism and Measures of Adjustment of Industrial Organization Structure: the Perspective of Energy Saving and Emission Reduction. Energy Procedia 5, 2562–2567. doi:10.1016/j.egypro.2011.03.440

Mngumi, F., Shaorong, S., Shair, F., and Waqas, M. (2022). Does Green Finance Mitigate the Effects of Climate Variability: Role of Renewable Energy Investment and Infrastructure. Environ. Sci. Pollut. Res. 2022, 1–13. doi:10.1007/s11356-022-19839-y

Perez, O. (2007). The New Universe of Green Finance: From Self-Regulation to Multi-Polar Governance.

Qashou, Y., Samour, A., and Abumunshar, M. (2022). Does the Real Estate Market and Renewable Energy Induce Carbon Dioxide Emissions? Novel Evidence from Turkey. Energies 15 (3), 763. doi:10.3390/en15030763

Samour, A., Baskaya, M. M., and Tursoy, T. (2022). The Impact of Financial Development and FDI on Renewable Energy in the UAE: a Path towards Sustainable Development. Sustainability 14 (3), 1208. doi:10.3390/su14031208

Shahbaz, M., Solarin, S. A., Mahmood, H., and Arouri, M. (2013). Does Financial Development Reduce CO2 Emissions in Malaysian Economy? A Time Series Analysis. Econ. Model. 35, 145–152. doi:10.1016/j.econmod.2013.06.037

Shahzad, U. (2020). Environmental Taxes, Energy Consumption, and Environmental Quality: Theoretical Survey with Policy Implications. Environ. Sci. Pollut. Res. 27 (20), 24848–24862. doi:10.1007/s11356-020-08349-4

Shahzad, U., Fareed, Z., Shahzad, F., and Shahzad, K. (2021a). Investigating the Nexus between Economic Complexity, Energy Consumption and Ecological Footprint for the United States: New Insights from Quantile Methods. J. Clean. Prod. 279, 123806. doi:10.1016/j.jclepro.2020.123806

Shahzad, U., Radulescu, M., Rahim, S., Isik, C., Yousaf, Z., and Ionescu, S. A. (2021b). Do environment-related Policy Instruments and Technologies Facilitate Renewable Energy Generation? Exploring the Contextual Evidence from Developed Economies. Energies 14 (3), 690. doi:10.3390/en14030690

Shao, C., Wei, J., and Liu, C. (2021). Empirical Analysis of the Influence of Green Credit on the Industrial Structure: A Case Study of China. Sustainability 13 (11), 5997. doi:10.3390/su13115997

Song, M., Peng, L., Shang, Y., and Zhao, X. (2022). Green Technology Progress and Total Factor Productivity of Resource-Based Enterprises: A Perspective of Technical Compensation of Environmental Regulation. Technol. Forecast. Soc. Change 174, 121276. doi:10.1016/j.techfore.2021.121276

Soundarrajan, P., and Vivek, N. (2016). Green Finance for Sustainable Green Economic Growth in India. Agric. Econ. 62 (1), 35–44. doi:10.17221/174/2014-agricecon

Sun, H., and Chen, F. (2022). The Impact of Green Finance on China's Regional Energy Consumption Structure Based on System GMM. Resour. Policy 76, 102588. doi:10.1016/j.resourpol.2022.102588

Wang, C., Elfaki, K. E., Zhao, X., Shang, Y., and Khan, Z. (2022). International Trade and Consumption-Based Carbon Emissions: Does Energy Efficiency and Financial Risk Ensure Sustainable Environment? Sustain. Dev. 2022, 1–11.

Wang, G., and Liu, S. (2020). Is Technological Innovation the Effective Way to Achieve the “Double Dividend” of Environmental Protection and Industrial Upgrading? Environ. Sci. Pollut. Res. 27 (15), 18541–18556. doi:10.1007/s11356-020-08399-8

Wang, H., and Zhu, J. (2018). “Research on Green Finance Promoting the Optimization of Industrial Structure——An Empirical Analysis Based on Guizhou Province,” in 2018 3rd International Conference on Politics, Economics and Law (ICPEL 2018) (Amsterdam, Netherlands: Atlantis Press), 180–183.

Wang, S.-L., Chen, F.-W., Liao, B., and Zhang, C. (2020). Foreign trade, FDI and the upgrading of regional industrial structure in China: Based on spatial econometric model. Sustainability 12 (3), 815. doi:10.3390/su12030815

Wang, X., and Wang, Q. (2021b). Research on the impact of green finance on the upgrading of China's regional industrial structure from the perspective of sustainable development. Resour. Policy 74, 102436. doi:10.1016/j.resourpol.2021.102436

Wang, Y., Zhao, N., Lei, X., and Long, R. (2021a). Green Finance Innovation and Regional Green Development. Sustainability 13 (15), 8230. doi:10.3390/su13158230

Xu, L., and Tan, J. (2020). Financial development, industrial structure and natural resource utilization efficiency in China. Resour. Policy 66, 101642. doi:10.1016/j.resourpol.2020.101642

Xu, Y., Li, S., Zhou, X., Shahzad, U., and Zhao, X. (2022). How environmental regulations affect the development of green finance: Recent evidence from polluting firms in China. Renew. Energy 189, 917–926. doi:10.1016/j.renene.2022.03.020

Zhang, A., Deng, R., and Wu, Y. (2022a). Does the green credit policy reduce the carbon emission intensity of heavily polluting industries? -Evidence from China's industrial sectors. J. Environ. Manag. 311, 114815. doi:10.1016/j.jenvman.2022.114815

Zhang, D., Awawdeh, A. E., Hussain, M. S., Ngo, Q. T., and Hieu, V. M. (2021a). Assessing the nexus mechanism between energy efficiency and green finance. Energy Effic. 14 (8), 1–18. doi:10.1007/s12053-021-09987-4

Zhang, D., Mohsin, M., Rasheed, A. K., Chang, Y., and Taghizadeh-Hesary, F. (2021b). Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy 153, 112256. doi:10.1016/j.enpol.2021.112256

Zhang, H., Geng, C., and Wei, J. (2022b). Coordinated development between green finance and environmental performance in China: The spatial-temporal difference and driving factors. J. Clean. Prod. 346, 131150. doi:10.1016/j.jclepro.2022.131150

Zhao, X., Ma, X., Chen, B., Shang, Y., and Song, M. (2022a). Challenges toward carbon neutrality in China: Strategies and countermeasures. Resour. Conservation Recycl. 176, 105959. doi:10.1016/j.resconrec.2021.105959

Zhao, X., Ma, X., Shang, Y., Yang, Z., and Shahzad, U. (2022b). Green economic growth and its inherent driving factors in Chinese cities: Based on the Metafrontier-global-SBM super-efficiency DEA model. Gondwana Res. 106, 315–328. doi:10.1016/j.gr.2022.01.013

Zhao, X., Mahendru, M., Ma, X., Rao, A., and Shang, Y. (2022d). Impacts of environmental regulations on green economic growth in China: New guidelines regarding renewable energy and energy efficiency. Renew. Energy 187, 728–742. doi:10.1016/j.renene.2022.01.076

Zhao, X., Ramzan, M., Sengupta, T., Deep Sharma, G., Shahzad, U., and Cui, L. (2022c). Impacts of bilateral trade on energy affordability and accessibility across Europe: Does economic globalization reduce energy poverty? Energy Build. 262, 112023. doi:10.1016/j.enbuild.2022.112023

Zheng, G.-W., Siddik, A. B., Masukujjaman, M., and Fatema, N. (2021). Factors Affecting the Sustainability Performance of Financial Institutions in Bangladesh: The Role of Green Finance. Sustainability 13 (18), 10165. doi:10.3390/su131810165

Zhu, F. (2020). Evaluating the coupling coordination degree of green finance and marine eco-environment based on AHP and grey system theory. J. Coast. Res. 110 (SI), 277–281. doi:10.2112/jcr-si110-065.1

Keywords: industrial structure, mediating effect, system GMM model, sustainable production, green finance

Citation: Wang W and Li Y (2022) Can Green Finance Promote the Optimization and Upgrading of Industrial Structures?—Based on the Intermediary Perspective of Technological Progress. Front. Environ. Sci. 10:919950. doi: 10.3389/fenvs.2022.919950

Received: 14 April 2022; Accepted: 09 May 2022;

Published: 15 June 2022.

Edited by:

Gagan Deep Sharma, Guru Gobind Singh Indraprastha University, IndiaReviewed by:

Yuping Shang, Hefei University of Technology, ChinaMohsen Ahmadi, Urmia University of Technology, Iran

Ahmed Samour, Near East University, Cyprus

Copyright © 2022 Wang and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yuexinyi Li, bDEzMjEwMzcyMTZAMTYzLmNvbQ==

Wenjing Wang1

Wenjing Wang1 Yuexinyi Li

Yuexinyi Li