- 1Business School, Huanggang Normal University, Huanggang, China

- 2College of Economics and Management, Huazhong Agricultural University, Wuhan, China

Pakistan is the world’s third-largest user of groundwater and the fourth-largest groundwater withdrawing country. The Indus Basin aquifer from where Pakistan withdraws its groundwater has become the world’s most “overstressed” groundwater aquifer. Given the growing shortages of surface and groundwater, the informal groundwater markets where farmers trade water have emerged in all provinces of Pakistan. Despite the considerable attention paid to the analysis of water markets in several countries, there is little evidence on the structure and implications of contractual agreements between the water users. This study includes buyers’ bargaining power in the contract choice model to estimate unbiased determinants of contract choice. The data was collected through a comprehensive survey of Punjab’s groundwater markets. Using several descriptive and econometric approaches, we find that the water markets in Pakistan are relatively competitive. A flat-rate water marketing contract is common in water-scarce regions, while a fuel-based contract is common in areas with large farmers. We find that buyers’ bargaining power is primarily determined by an agent’s ability to influence a joint decision between buyers and sellers. In addition, a seller’s landholding size also influences the choice of contract, as fuel-based contracts are more likely to be offered to large farmers. The relative bargaining power of buyers influences choice of fuel-based contracts, although this offers lower profits to sellers. We find evidence of price discrimination in which relatively well-off buyers with a long contractual history with sellers may receive discounts in the form of fuel-based contracts. As contract choice may also determine the extent of water use, these findings have implications for environmental sustainability. Policy intervention to standardize groundwater marketing contracts can help reduce overexploitation of groundwater and environmental externalities and promote sustainable development.

1 Introduction

In Pakistan, groundwater has emerged as a major irrigation resource. The nation is the third-largest user of groundwater and accounts for 9% of global groundwater abstraction. Most of this water is used for irrigation. Consequently, Pakistan’s groundwater-irrigated farmland accounts for 4.6% of the world’s total groundwater-irrigated land (Siebert et al., 2010; Watto et al., 2018). Until 1980, groundwater was only used to augment surface water sources because the area under cultivation was smaller and the need for irrigation water was rather conservative. Following this time, farmers began to use groundwater extensively to expand the cultivated area of wheat and other cash crops such as rice and sugarcane. Wheat, rice, and sugarcane cultivated areas grew by 33%, 42%, and 37%, respectively, between 1980 and 2017. The long-term sustainability of major crops like wheat, rice, and sugarcane is largely reliant on a limitless supply of groundwater. Together, these three crops account for more than 80% of Punjab’s total groundwater abstraction (Qureshi, 2020). However, Pakistan’s agriculture remains highly vulnerable to weather shocks and droughts due to its inability to develop advanced technology and implement it to improve its resilience to climate change (Elahi et al., 2021a).

Currently, groundwater is used to meet the irrigation needs of 76% of Punjab’s cultivated land, either directly or indirectly. Farmers have reaped numerous benefits because of this groundwater development. Groundwater availability has reversed the pattern of volatile crop yields into a more predictable and increased crop production. Farmers who have access to both surface and groundwater gain five times as much as those who only have access to surface water (Qureshi et al., 2010). However, the advantages of groundwater irrigation came at a major environmental cost. Groundwater levels in irrigated areas of Punjab and Baluchistan provinces have been significantly lowered due to unchecked groundwater extraction. Although groundwater is rapidly depleting, every farmer wants to use it for irrigation to increase yields and cultivable land (Watto et al., 2018; Qureshi, 2020). Farmers’ desire for water has put enormous pressure on groundwater resources and caused shortages in many regions, with numerous tubewells drying up.

Increased demand for groundwater in a scarcity situation prompted informal groundwater trading in Pakistan, especially in Punjab province, where it is heavily used for irrigated agriculture. In contrast to formal water markets in Australia, Chile, the United States, and other countries where water rights are relatively well-defined, informal water markets have evolved accidentally and spontaneously to promote market-based water reallocation (Easter and Huang, 2014). Since water delivery is only cost-effective within a certain range, these informal groundwater markets are geographically restricted and have a small number of sellers and buyers. The sellers are usually large farmers with a tubewell, while the buyers are small farmers who cannot afford to build one (Razzaq et al., 2019).

Water is traded informally between these agents based on informal contractual agreements. These contracts are between individuals on a bilateral basis. A farmer who has access to groundwater beneath their land can extract water by installing a tubewell. If the farmer has extra water, they may sell it to another farmer (buyer) who needs it. These contracts are popular throughout South Asia and parts of China (Easter and Huang, 2014; Saleth, 2014; Wang et al., 2016).

Groundwater users (agents) may have a variety of contractual arrangements in place. The evidence from other countries’ informal water markets shows that output-based and fixed-price contracts are common forms of the contract between buyers and sellers. The buyer pays water charges by giving the seller a portion of crop production at the end of the season in an output-based contract. In the fixed-price contracts, the agents should agree on a pre-decided sum to be charged for water supplied per season (Kajisa and Sakurai, 2005). These groundwater contracts help small and marginal farmers who cannot drill tubewells have access to water and increase the country’s irrigated area and food output (Meinzen-Dick, 1996; Shah, 2000; Mukherji and Shah, 2005). However, the influence of these contracts on productivity and income distribution equality has been called into question (Jacoby et al., 2004).

Currently, there is no limit to the extraction of groundwater in Pakistan. Anyone can buy and sell as much irrigation groundwater as they wish. Consequently, excessive groundwater usage in agriculture has inevitably resulted in a slew of sustainability concerns. For example, in Punjab, continuously falling groundwater levels have forced farmers to dig deeper boreholes and install larger capacity pumps, increasing the cost of irrigation. Furthermore, groundwater quality is continually declining, as shown by elevated levels of chloride, potassium, and magnesium in the water (Qureshi et al., 2010; Watto et al., 2018). Despite these issues, there is no effective policy mechanism in place in Punjab to limit the growth of tubewells. Therefore, there is an urgent need to establish an institutional structure that enables farmers to use groundwater as effectively as possible. To this end, groundwater markets may be a useful policy instrument for improving groundwater management in Pakistan (Razzaq et al., 2019; Bajaj et al., 2022).

The contractual arrangement between groundwater users (buyers and sellers) has important implications for the subsequent use of water and its environmental impact. Despite the considerable attention paid to the analysis of water markets in a number of countries, there is little evidence on the structure of groundwater markets and contractual agreements between water users in Pakistan. Particularly, there is only limited evidence regarding whether contract choice is influenced by participant characteristics, such as water buyers’ bargaining power. As pointed out by (Yashodha, 2020), bargaining power and market power, in theory, result in the extraction or redistribution of surplus. In addition, the bargaining power is relevant to informal agrarian markets due to the informal structure of groundwater markets. A market participant uses the threat of a contractual break in the context of bargaining power to get concessions or surplus from a different group, while market power is related to the capability to reduce supply and maintain demand by setting the price higher than the cost (Svejnar, 1986; Sorrentino et al., 2018). Cooperation and coordination arrangements are also used in bargaining systems, whereas non-cooperative models are used in market power (Sorrentino et al., 2018).

Some researchers in the land leasing and water markets have used participant characteristics as a substitute to define the role of bargaining power in deciding land leasing and water prices, respectively (Harding et al., 2003). Among such research, Kuethe and Bigelow (2018) conclude that landowner absence and a larger distance between the landowner’s position and the leased land parcel reduce the landowner’s negotiating power in US land rental markets. Barry et al. (2000) conclude a significant variance in fixed land rental rates is mainly motivated by profits in agriculture; however, bargaining between tenant and landlord rises in areas with higher rent-in competitiveness. Evidence from agricultural land rental markets in Germany supports similar claims that local rivalry raises farm rental prices (März et al., 2016). In the context of groundwater markets, Kajisa and Sakurai (2003) find that in India, buyers under output-based contracts pay 34% higher than buyers under flat-rate contracts, and price drops with the existence of potential sellers in the proximity of the tubewell. Furthermore, Cotteleer et al. (2008) note that when market participants have kinship ties, the agreed price is comparatively low, so consumers earn a greater share of the excess surplus. Current studies that integrate negotiating power are noteworthy in that they are mainly limited to fixed-price contractual arrangements in the land rental sector (Barry et al., 2000; Kuethe and Bigelow, 2018), while in the groundwater market the contract form is merely a covariate (Kajisa and Sakurai, 2003). In the context of the specific agrarian contractual situation, it is more fitting to research groundwater markets in an empirical context that involves bargaining power to understand how different parties jointly decide on a particular contract, which ultimately determines the price. Therefore, in this study, we examine whether bargaining power of water buyers has any effect on contract choice and water use.

Besides bargaining power, there is a lack of evidence on the nature of groundwater market contracts used by groundwater users and the factors that influence the choice between different types of contracts in the context of Pakistan’s informal groundwater markets. This research adds to the body of information on groundwater markets by analyzing the structure of informal groundwater markets. In addition, we contribute to the literature of contract choice by exploring the various types of contractual agreements between agents and the factors that influence the choice of these contracts. This knowledge is needed to comprehend groundwater markets’ current structure and devise effective policies to monitor the unsustainable use of groundwater for irrigation.

2 Materials and Methods

2.1 Study Area and Sampling Framework

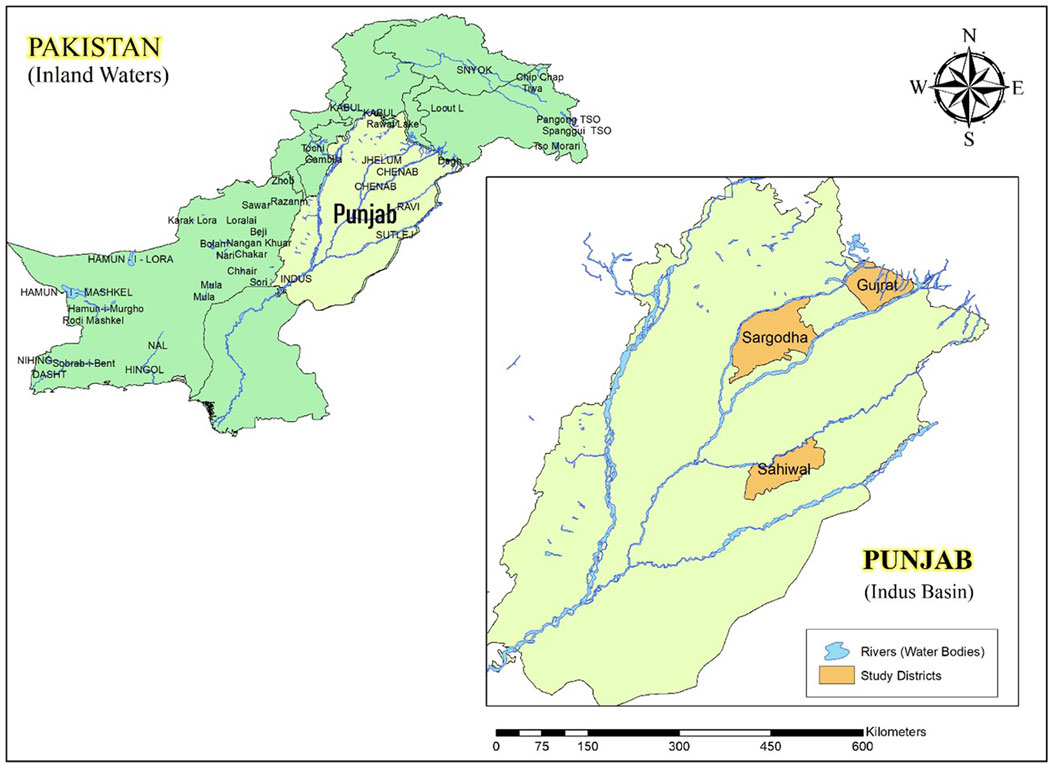

The research was conducted in Punjab, the largest agricultural producer of the country and the region with the most groundwater marketing activity in the country. The landscape of Punjab is dominated by the fertile alluvial plains of the Indus River and its four major tributaries in Pakistan, the Jhelum, Chenab, Ravi, and Sutlej rivers, which traverse Punjab north to south—the fifth of Punjab’s “five waters” the Beas River, is entirely within the Indian state of Punjab. The region is one of the most heavily irrigated on the planet (Figure 1). The province is divided into several ecological zones, but it is generally located in an arid to semi-arid region, with a 58:29 arid-semiarid ratio (Farooq et al., 2009). The Indus Basin Irrigation System (IBIS), a network of rivers and canals, is the province’s primary source of irrigation (Asghar et al., 2018). After choosing Punjab as the study Universe, a multi-stage random sampling procedure was adopted for the selection of respondents (Elahi et al., 2021a; Elahi et al., 2022a).

In the first stage, three districts from Punjab’s three main cropping zones were selected, i.e., one district from each of the rice-wheat, cotton-wheat, and mixed cropping zone. The selection of these districts was based on the number of tubewells in the area, the area under cultivation, and the ratio of tubewells to the total number of farms. Following this criterion, three districts, Gujrat, Sahiwal, and Sargodha, were selected from rice-wheat, cotton-wheat, and mixed cropping zones, respectively. These districts represented a varying degree of cropping pattern, groundwater development, and groundwater market activity. Furthermore, the cropping pattern, farm size, rainfall, and other agroecological indicators of these districts allowed for sufficient heterogeneity in the data. The chosen study districts rely heavily on groundwater irrigation. For example, in many parts of Sargodha and Sahiwal, the proportion of land equipped for groundwater is around 50%–60%, whereas, in the Gujrat district, the proportion is between 70% and 80%. Gujrat is characterized by semi-arid conditions in many parts. Groundwater serves as the main source of irrigation in many areas of the country. It is possible to get canal water during Kharif (April-September) in some areas season. However, the district has a very low percentage of canal water irrigation. As a result, the farmers must rely on groundwater irrigation. This has led to the emergence of informal groundwater markets (Razzaq et al., 2019). In contrast, most parts of Sahiwal and Sargodha districts have access to canal water. Furthermore, the quality of groundwater in these districts is better than that in Gujrat. Sargodha district has a relatively moderate climate, while Sahiwal district is extremely hot in summer averaging 45°C–50°C. Sahiwal and Sargodha are both more reliant on groundwater for irrigation in the winter, especially for the tailenders.

In the second stage, two tehsils were randomly selected from each district. Tehsil is an administrative unit in Punjab, and usually, each district is divided into various tehsils, whereas the minimum number of tehsils in each district is three. Two union councils were randomly selected from each tehsil in the third stage. One village was randomly selected from each union council in the fourth stage. In this way, the number of villages selected from each district was four, leading to a total of 12 villages in the final sample. Finally, we employed purposive sampling and random sampling for the selection of respondents. The sample was supposed to encompass tubewell water users, water buyers, and water sellers. From each sample village, we prepared a list of all self-users, buyers, and sellers, and randomly selected 10 people from each category. Consequently, 30 farmers from each village were selected, ten from each of the three categories of water users. In this way, 120 water users were selected each district, giving the final sample size of 360 farmers. This sample size included 120 water buyers, 120 water sellers, and 120 self-users of tubewell water. In addition, we also obtained information from all water buyers regarding their matching sellers. So, in total, the sample size included information on 480 farmers, including 120 water buyers, 120 matching sellers of water buyers, 120 independent water sellers, and 120 self-users.

2.1.1 Data Collection

Data from farmers were collected using a well-structured survey instrument (Elahi et al., 2017; Elahi et al., 2018b; Elahi et al., 2022b). In face-to-face interviews, the enumerators obtained detailed information from farmers involved in water trading and self-users of water. The questionnaire was designed to obtain information on socioeconomic characteristics, wheat production technology, detailed information on groundwater use, tubewell ownership and specifications, cost and mechanism of groundwater extraction, the power source of tubewells, contractual arrangements between groundwater users, and water prices. In addition, we also obtained information from water buyers regarding their matched water sellers, which included their matching sellers’ age, education, landholding size, farm and off-farm income, and other variables. A team of trained enumerators conducted the survey. We used a variety of quality assurance measures such as in-field training of enumerators and pre-testing of the questionnaires to refine the quality of the data. We explained the purpose of the study to respondents before collecting data, and all respondents gave verbal consent to participate. Participants were free to participate in the survey. They were assured that all data would be kept confidential and used anonymously. Other farmers replaced participants who declined to participate (Elahi et al., 2021b). The refusal rate was between 1% and 2%. Records of only those participants who willingly participated in the study were kept.

2.1.2 Variables Definition and Measurement

The first objective of this study is to understand the structure of groundwater markets. This was done by studying the characteristics of tubewells operating in the area, water buyers and sellers’ characteristics, the contract structure, and the competitiveness of groundwater markets in the study areas. The tubewell data was obtained from both tubewell owners (water sellers and self-users of water), and water buyers. This information included the type of tubewell by its ownership status, i.e., private and joint tubewell, and the power source of tubewells, i.e., diesel engine, electric, tractor, etc. The frequency and percentage of each tubewell type were calculated for each of the sample districts and overall data.

Similarly, the tubewell data was analyzed to understand the distribution of tubewell types by power source in different areas. The competitiveness was groundwater markets was assessed using the ratio of water prices (w) and the total variable pumping cost (c) of water (w/c), and the variation of water prices within villages and between villages. Several researchers have used these measure to assess the competitiveness of water markets in several countries such as India (Shah, 1993; Mukherji, 2004; Kumar, 2009), Nepal (Bhandari and Pandey, 2006), and China (Wang et al., 2014).

Water is traded between agents under certain contractual arrangements. We call these arrangements groundwater marketing contracts. In the survey, detailed information on the contractual arrangements of water trading was obtained from water buyers and sellers. This information included the terms of trade, the mode of payment, the tenure of payment, contractual history, kinship ties between buyers and sellers, the number of potential sellers in the deliverable area, and the number of potential buyers in the deliverable area. This data was first analyzed to study the distribution of different types of contracts in the study areas. This data was also used in the empirical model employed to determine the factors that influence contract choice.

Data on all variables were obtained directly from the farmers. However, the amount of water was estimated indirectly using the tubewell specification information obtained from farmers. This information included the irrigation duration for the wheat crop, the depth of the bore, the diameter of the suction pipe, the horsepower of the diesel engine, the electric motor, or the tractor used to operate the tubewell. Following Eyhorn et al. (2005), Srivastava et al. (2009), Watto and Mugera (2014), a pre-tested formula was used to estimate the amount of groundwater used for wheat crops:

In this formula, the amount of groundwater extracted Q is given in liters, the time t of the irrigation is given in hours, the depth of the borehole d is given in meters, the pump’s engine power BHP is given in horsepower, and the suction pipe diameter D is given in inches. We converted the amount of water into cubic meters to carry out the analysis.

Agrarian markets, like the land rental and water markets, tend to be localized, with a limited number of sellers and buyers in a given location (Easter and Huang, 2014). It encourages the parties to bargain bilaterally over the price and other contractual terms and conditions (Allen and Lueck, 1992; Barry et al., 2000; Aggarwal, 2007). Therefore, in the empirical estimation of contract choice, we also model the bargaining power of water buyers. The ability of agents to influence contract terms is affected by their inherent characteristics and their characteristics in relation to their contractual partners. A buyer who is wealthier than a seller, for example, may have more power to choose the type of contract than the seller. Therefore, we also asked water buyers to provide information on their matched sellers’ age, education, and landholding size. In groundwater contracts between buyers and sellers, the comparison of these variables for water buyers and their matched sellers has been used as a proxy for buyers’ bargaining power.

2.1.3 Determinants of Contract Choice (Binary Probit Model)

The choice equation to identify the determinants of groundwater contracts was constructed as follows:

where

Another problem that can lead to biased estimates of coefficients in choice equation 5-1 is the possibility of omitted variable bias. This bias is introduced due to agents’ ability to influence the contract choice. Harding et al. (2003) argued that the coefficients of agents’ characteristics cannot capture the effect of agents’ bargaining power if those characteristics also influence the agents’ preference for a contract. We overcome this problem by introducing additional characteristics of buyers relative to their matching sellers. These characteristics are supposed to denote their power to affect a contract. To this end, we take into account the variations in age, education, and land ownership of buyers relative to their matching sellers. For instance, if a buyer has more land than a seller, his social status is higher, and may have higher ability to affect the contract choice in his favor.

Our model also controls for contractual characteristics by controlling for factors such as buyer and seller characteristics, bargaining power, kinship ties between matching agents, and the availability of potential sellers in the delivery area. We believe that these variables can also affect the contract choice. Finally, equation 5-1 is estimated using a binary probit model as the dependent variable of groundwater contracts has two values. The marginal effects were also calculated.

3 Results and Discussion

3.1 The Structure of Groundwater Markets in the Indus Basin

The survey data were analyzed in order to better understand the operation and structure of groundwater markets in the study area. During the field survey, we found that groundwater markets are active in all of the study districts. We found water buyers and sellers in each of the 12 villages studied, regardless of cropping pattern, tubewell type, farm size, or other agricultural indicators. However, the characteristics of these markets vary by district. The structure of informal groundwater markets can vary even within a district. For example, we found significant differences in groundwater prices, tubewell types and power sources, tubewell installation costs, and groundwater market contracts.

3.1.1 Tubewell Types in Groundwater Markets by Ownership Status

Although we found a wide range of tubewells in the study area, these can be classified into types based on the ownership status of the tubewells. Private tubewells are owned by a single farmer, whereas joint tubewells are owned by several farmers who invest together in the installation of a tubewell. Aside from ownership, these tubewells differ in terms of power source. The two major types of tubewells found in the sample districts, according to ownership status, are as follows:

(i) Private Tubewells

(ii) Joint Tubewells

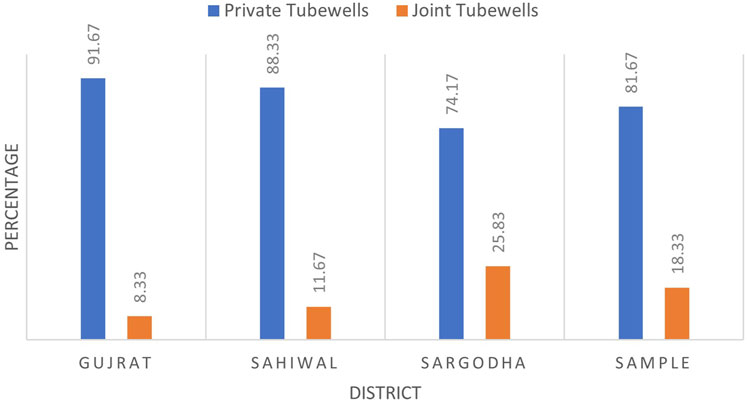

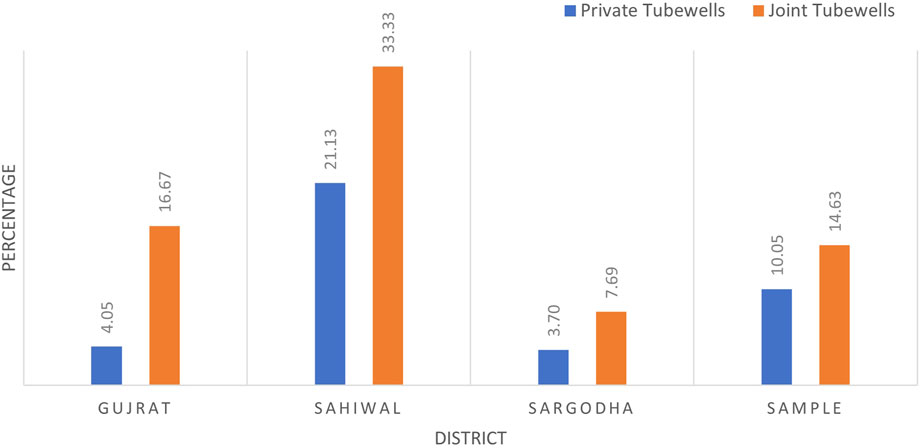

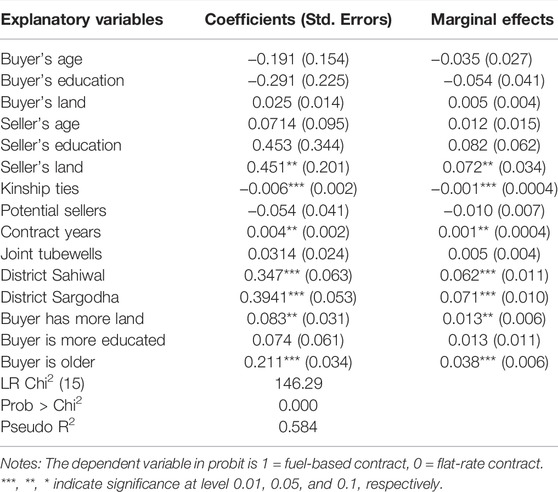

Private tubewells, as the name implies, are the sole property of a single tubewell owner. Private tubewells are more common in the sample districts, particularly in Gujrat and Sahiwal, where more than 80% of tubewells are private (Figure 2). This proportion is slightly lower in the Sargodha district, where approximately 74% of tubewell owners have private tubewells. Joint tubewells are the second most common type of tubewell in terms of ownership. In this type of arrangement, three to four farmers work together to install a tubewell by pooling their resources (Figure 2). These farmers can also choose to sell water to others. However, farmers share these tubewells even when they are not selling water to others. The proximity of fields and kinship relationships are usually factors in the selection of partners. Even if the fields are adjacent, a poor social relationship between the farmers prevents this type of arrangement from taking place. Joint tubewells are more expensive to install and pump more water per unit of time. As a result, these are the most common in areas with relatively large farm sizes and less fragmentation.

3.1.2 Groundwater Market Participation of Tubewell Owners

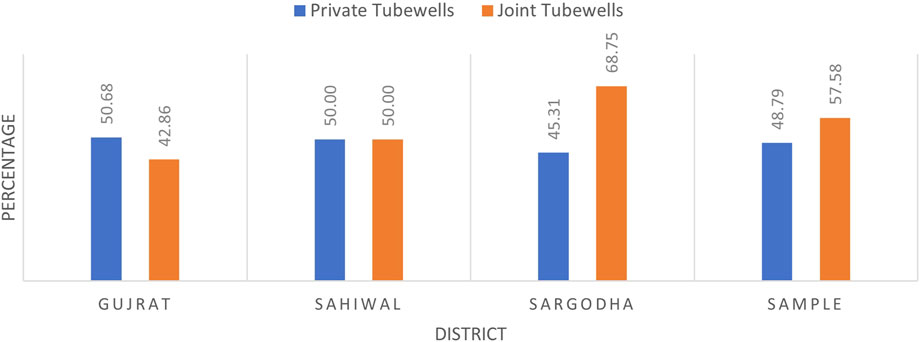

The descriptive findings show that the ownership status of tubewells influences the amount of water sold by tubewell owners. As previously stated, the majority of tubewell owners in the study area have private tubewells. However, the extent to which these different types of tubewell owners sell water varies. The overall sample results show a slightly higher proportion of water sellers among those who have joint tubewells, as shown in (Figure 3). The joint tubewell owners find a relatively higher demand for groundwater from buyers for various reasons. First, there are many owners who jointly operate these tubewells, so everyone must wait their turn to get irrigation water. Second, joint tubewell owners usually offer the electricity or fuel-based contracts, which are cheaper than flat-rate contracts. Therefore, more farmers want to buy groundwater from these tubewells for economic reasons.

3.2 Groundwater Marketing Contracts in the Study Area

Our findings show that various types of water marketing contracts are used in all study districts. These contracts are determined by a variety of factors, including the type of tubewell ownership, the power source of a tubewell, farmer landholding and resource endowment, farmer social networks, and the level of water scarcity in the region. As a result, various types of groundwater marketing contracts have emerged in various areas. The flat charge for pumping groundwater per hour is the most common type of groundwater marketing contract, which private tubewell owners mostly use. Fuel-based or electricity-based contracts, which joint tubewell owners typically use, are the second most common type of groundwater marketing contract. Buyers in this contract pay water charges based on their fuel or electricity consumption. The following paragraphs describe these contracts.

3.2.1 Flat Charge for Pumping of Groundwater

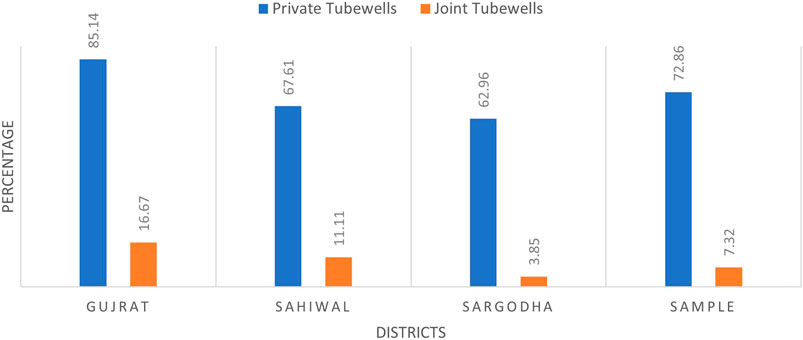

A flat charge for pumping groundwater per hour is the most common type of groundwater marketing contract observed in the study area. Under this contract, water buyers pay a fixed price per hour of groundwater pumping. The findings indicate that time-based flat charge contracts are typically used for private tubewells (Figure 4). For these tubewells, a district-by-district comparison reveals that the flat charge per hour of pumping is the most common type of groundwater market contract in the Gujrat district, accounting for nearly 85% of groundwater market contracts. The percentage of flat charge pumping contracts for private tubewells in the Sahiwal and Sargodha districts is slightly different, at 67% and 62%, respectively. Overall, approximately 73% of groundwater market contracts under private tubewells are based on flat charges per hour of pumping.

FIGURE 4. Proportion of groundwater market participants practicing flat charges for pumping contracts.

Flat charge contracts are uncommon for joint tubewells. According to the findings, approximately 7% of groundwater market contracts for these tubewells are based on flat charges. According to the district comparison, flat charges for joint tubewells are most common in Gujrat and least common in Sargodha.

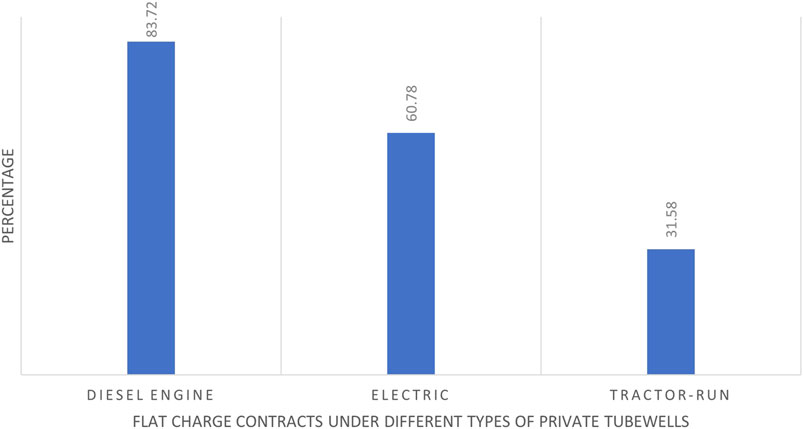

The findings also show that in Gujrat, this type of contract is common for both electric and diesel tubewells. We only present these results for private tubewells because the proportion of flat charge contracts for joint tubewells is lower. The tubewells here vary greatly in size, type, and power source. Water is sold under flat-rate contracts from 84% of diesel engine tubewells (Figure 5). This percentage is approximately 60% for electric tubewells. Even though there are fewer private tubewells operated by tractors, flat charge contracts are still used for tractor tubewells. According to our findings, approximately 31% of marketing contracts for tractor-run tubewells are based on flat pumping charges. According to the field observations, flat charges for water have to be adopted by small farmers who do not own tractors. Furthermore, there are many small farmers in Gujrat, which may be the reason why flat charge contracts are so common. In general, small farmers do not want to install tubewells on small and fragmented landholdings because it is not an economically viable option for every farmer. The same reason makes them reluctant to invest in joint tubewells as well. Due to this, most farmers in Gujrat get fixed-price pumping contracts per hour. Small farmers who cannot afford to install tubewells also use this type of contract in Sargodha and Sahiwal districts.

FIGURE 5. Distribution of flat charge contracts under different types of private tubewells (all districts)

3.2.2 Groundwater Contracts Based on Consumption of Fuel and Electricity

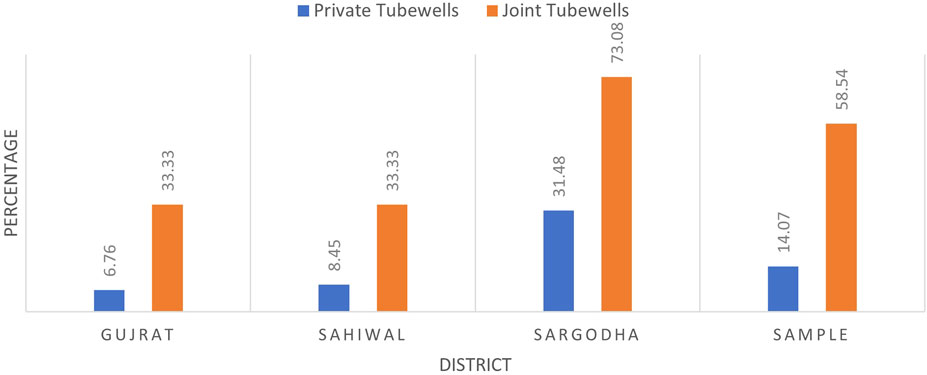

The price of groundwater is charged in this type of arrangement based on the amount of fuel or electricity consumed during tubewell operation. Contracts based on diesel fuel are used for diesel engines and tractor-run tubewells. The findings show that, when compared to private tubewells, diesel fuel-based contracts for joint tubewells are more common in all districts (Figure 6). These contracts are especially common in the Sargodha district for joint tubewells, where approximately 73% of joint tubewells sell water under diesel fuel-based contracts. Overall, 58% of joint tubewells use diesel fuel-based contracts, compared to 14% of private tubewells. Because the tubewell’s property rights are equally shared among the partners, any partner can sell water to any other farmer who is not a partner. The contract’s nature and the cost of irrigation for buyers differ depending on the power source of the tubewell. For example, in the case of tractor-driven joint tubewells, the buyer must use his own tractor to pump groundwater. A small rent is also charged for lending tubewells to buyers, even if the buyer pumps groundwater with his own tractor. Buyers of diesel engine joint tubewells bring their own diesel fuel to operate the tubewell. Buyers, on the other hand, are frequently unable to predict the exact amount of fuel required for irrigation. As a result, the remaining fuel in the diesel engine tank usually goes to the owners, reflecting the amount of rent charged by the owners. Furthermore, it is not socially acceptable for buyers to demand payment for the remaining fuel in the tank.

For joint tubewells, buyers pay the water price based on the number of electricity units consumed. Buyers are, however, charged a higher electricity price. The results show that electricity-based contracts are also most common for joint tubewells in the Gujrat and Sahiwal districts, whereas less than 10% of joint tubewells in the Sargodha district sell water under electricity-based contracts (Figure 7). This is also due to the district’s lower number of electric tubewells. Electricity-based contracts are used by about 10% of private tubewells and 14% of joint tubewells in the entire sample. Because fuel-based contracts are more common under joint tubewells, the proportion of electricity-based contracts in Sargodha is significantly lower for these tubewells. This is due to the scarcity of electricity-powered joint tubewells in the Sargodha district. Overall, electricity-based contracts are more prevalent in Sahiwal whereas fuel-based contracts are more prevalent in Sargodha. Gujrat farmers depend heavily on flat-rate contracts, as we discussed earlier. Gujrat has a lower number of electricity and fuel-based contracts because of the relatively small farm size and the low number of electric and joint tubewells.

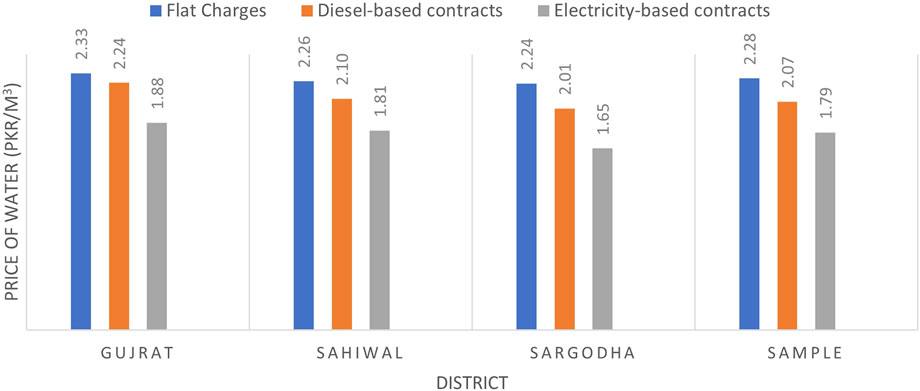

3.3 Price of Water Under Different Water Marketing Contracts

When water prices are compared under different types of marketing contracts, it is clear that sellers charge higher prices under flat charges contracts (Figure 8). This outcome can be found in all districts. Under flat charges contracts, buyers pay approximately 2.28 PKR/m3 of water. On the other hand, water costs the least under electricity-based contracts, at around 1.80 PKR/m3. This cost is approximately 22% less than the flat charges contracts. The results also show that the price of water under diesel fuel-based is approximately 10% lower than the price of water under flat charges-based contracts. Despite the highest water prices under flat-charge contracts, these contracts are the most common in all areas. The sellers most likely have a profit motive, which is why they prefer spot payments over other modes of payment.

Flat charges require buyers to pay water prices on an hourly basis rather than based on actual fuel or electricity consumption. However, these prices are typically determined by the amount of water extracted by the tubewell and the size of the delivery pipe and engine capacity. Water rates are higher for larger tubewells, while rates for tubewells with a small engine or electric motor capacity are lower.

Because buyers purchase fuel to operate the tubewells, the price of water is lower under diesel-based contracts. They are not required to pay a set fee here. For example, in the case of tractor-driven tubewells, the buyer must use his own tractor to pump groundwater. A small rent is also charged for lending tubewells to buyers, even if the buyer pumps groundwater with his own tractor. For diesel engine tubewells buyers, bring their own diesel fuel to operate the tubewell. On the other hand, buyers are frequently unable to predict the exact amount of fuel required for irrigation. As a result, the remaining fuel in the diesel engine tank usually goes to the owners, reflecting the amount of rent charged by the owners. Furthermore, it is not socially acceptable for buyers to demand payment for the remaining fuel in the tank. Sellers charge a lower fee to buyers for tractor-driven and diesel engine joint tubewells. As a result, if there is accidental damage to the tubewell in these cases, the buyer will be responsible for the cost of repairs.

Water prices are the lowest under electricity-based contracts because these tubewells are less expensive even for the sellers. This is because these tubewells have low operating and maintenance costs. However, our findings show that sellers charge buyers 20%–30% more for electricity than the actual price of electricity. This price differential reflects tubewell owners’ profit, which is shared among tubewell owners.

3.4 Competitiveness of Water Markets in Study Areas

The following measures were used to assess the competitiveness of groundwater markets in the study areas:

(i) the ratio of water price received by buyers (w) to the ratio of total variable water cost to water sellers (c),

(ii) the variation of water prices for buyers between villages.

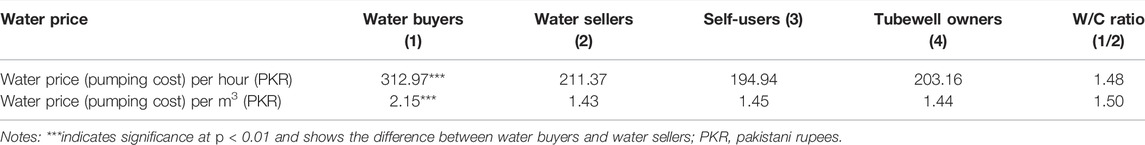

Table 1 shows the results of the water price received by buyers and the total variable water cost incurred by tubewell owners. First, the results show that water buyers pay about 1.5 times the pumping cost of water sellers per hour. When prices and costs per cubic meter of water are compared, the results do not differ significantly. Furthermore, there is no discernible difference in pumping costs between water sellers and self-users, both of whom own tubewells. Overall, the water price is 1.54 times the marginal pumping cost borne by tubewell owners. The w/c ratio, which is used to assess competitiveness, reveals a “competitive ratio” of 1.48. If a lower w/c ratio does indeed indicate competitiveness, then our findings suggest that water markets in Punjab are relatively more competitive, as studies have found a higher w/c ratio in informal water markets. For instance, Kumar (2009) found a w/c ratio as high as 3.6 in eastern India, while the average w/c ratio in rural China was around 2.2 (Wang et al., 2014).

Another method for assessing the level of competition in informal water markets is to compare price ratios between villages to variations within villages. According to Kajisa and Sakurai (2005), water prices in a competitive groundwater market should not vary significantly within villages because these markets are localized, and transactions take place between farmers within a single village. This argument corresponds to our dataset. Although the overall w/c ratio varies between villages from 1.23 to 2.44, the price variations within villages for most of the sample villages are much lower for a specific type of tubewell. Although there are differences in w/c ratios for tubewells depending on their power source and ownership status, the within-village price ratios are much less than 50% after controlling for tubewell ownership type and power source. Based on this finding, we conclude that informal water markets in the study areas are competitive. This is consistent with the findings of Kajisa and Sakurai (2005), who discovered that price variations in their sample were primarily due to regional differences, leading them to conclude that water markets in Madhya Pradesh, India, are not monopolistic.

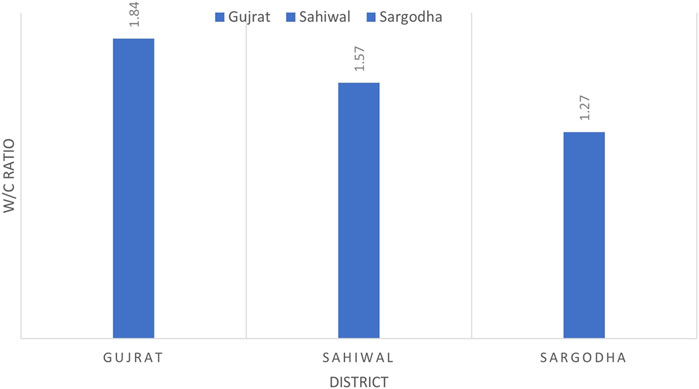

The district-level results show that Gujrat has the highest w/c ratios and Sargodha has the lowest (Figure 9). These regional differences may reflect varying levels of water scarcity and varying tubewell types, power sources, and contracts within a district. Gujrat, for example, is a semi-arid region with less surface water availability than the other two districts. As a result, the higher w/c ratio may also reflect the inclusion of a value for water scarcity. This finding is consistent with Singh (2002) who discovered evidence of monopolistic water pricing in acute water-scarce regions of India compared to regions with substantial groundwater deposits, where sellers charge lower prices, increasing water access for poor farmers. The lower w/c ratio in Sargodha may be explained by the district’s greater use of joint tubewells and diesel fuel-based contracts. As previously stated, water buyers are usually required to pay a lower price under fuel-based contracts. Furthermore, the district has an abundant water supply because the majority of the district is located in canal command areas with shallow water tables. These findings suggest that the competitiveness of groundwater markets in study areas is influenced by a variety of factors, including relative water scarcity, tubewell power source, and ownership status, and the prevalent type of contract between buyers and sellers. In the following section, we will look at how various characteristics of buyers and sellers influence the type of contract.

3.5 Determinants of Contract Choice in the Water Markets

The previous discussion of groundwater market contracts provided some insight into the choice of groundwater market contracts in different areas and for different types of tubewells. However, empirical estimation of factors affecting farmers’ contract choices is necessary to better understand the choices made by farmers. The choice of contracts to sell water depends entirely on the sellers of water and the buyers of water. Since self-users do not sell water, we do not include their data in the empirical estimation of the choice of groundwater contracts. Eq. 1 is estimated using a binary probit model because two main types of contracts are observed in the study area: flat charges per hour of pumping and fuel-based contracts (including diesel fuel-based and electricity-based contracts).

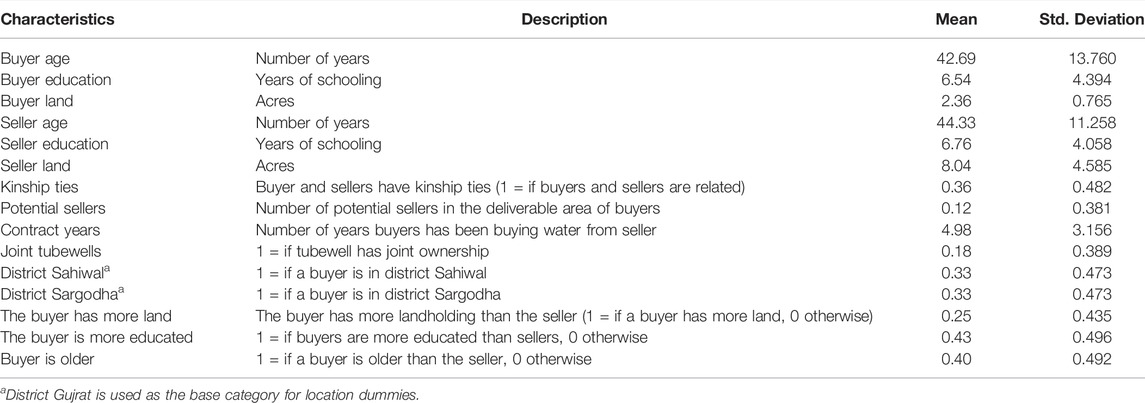

The descriptive statistics of the variables used in the probit model are shown in Table 2. The model’s explanatory variables include the socioeconomic characteristics of the buyers, the socioeconomic characteristics of their matching sellers, and the socioeconomic characteristics of the buyers in relation to their matching sellers. In addition, regional dummies, the type of tubewell, and the contractual history between buyers and sellers are also included in the model, since these variables may also influence the specific choice of contract.

The descriptive results show that buyers are 42 years of age on average with 6.5 years of schooling and 2.36 acres of landholdings. The sellers are slightly older, have a little more education, and a significantly higher landholding size of about 8 acres. Approximately 35% of buyers have kinship ties with their sellers, which is a general characteristic of the villages of Punjab, where many people share common ancestors as well as adjacent lands due to inheritance. There are almost no additional sellers in the area, as every buyer has an average of about 0.12 sellers in the vicinity. Contract history shows that the average period of purchase of water from sellers is about 5 years. Approximately 18% of the tubewells from which the buyers purchase water have joint ownership. The characteristics of the buyers relative to their sellers, which are also taken as a proxy for their bargaining power, indicate that only 25% of the buyers have more land than their sellers, indicating that the buyers are generally small and marginal farmers. These results are consistent with previous studies on informal water markets in several regions (Mukherji, 2004; Srivastava et al., 2009; Manjunatha et al., 2011). However, about 43% of buyers are more educated than sellers, and 40% are older than sellers. In the empiric model, we included data on buyers only because the sellers for whom detailed data were collected do not necessarily match the buyers in the sample due to random sampling. The indicators of the sellers from whom the buyers originally purchased the water are included in the data on the sellers. It was essential to avoid bias in the results.

Table 3 displays the probit model results as well as the marginal effects. The model fitness statistics show that the probit model chosen to estimate the contract choice determinants is appropriate. The model’s independent variables include buyers’ and sellers’ socioeconomic characteristics, buyers’ bargaining power as represented by their socioeconomic characteristics relative to the matching buyers, and some tubewell indicators. We find that fuel-based contracts are more likely if the sellers’ landholding size is larger. Because the agent’s landholding is a proxy for wealth, our findings imply that sellers with more land prefer fuel-based contracts because they are not liquidity constrained. Surprisingly, we find that fuel-based contracts are less likely when the buyers share kinship with the sellers. More specifically, when buyers have a relationship with the sellers, fuel-based contracts are more likely to be chosen. This implies that the contract was chosen based on one’s own material self-interest rather than family ties. Although previous research has shown that water sales can help sellers maintain social ties (Saleth, 2014), our study found no evidence of this relationship. we found no evidence of this in our study. These findings imply that a flat-rate contract is more likely to be selected for kin buyers. Because kin agents have a relationship that extends beyond the contract, the mechanism proposed by Sadoulet et al. (1997) be able to explain such choices.

The contractual history of buyers and sellers is also a significant factor in fuel-based contracts. More specifically, if the purchaser and seller have a longer contractual history, fuel-based contracts are more likely to be chosen. This result may indicate that a level of trust is involved in the contract selection process. Previous research in India found evidence of price discrimination in the form of secret discounts and preferential treatment for buyers who pay on time, buy water on a regular basis, and have a good relationship with sellers (Janakarajan, 1993). District-specific effects indicate that fuel-based contracts are more common in Sahiwal and Sargodha, most likely because these districts have relatively large farmers who may be less liquid. Furthermore, water availability in the Gujrat district is lower than in the other two districts, and sellers may be more inclined to charge a higher price under flat-rate contracts due to the scarcity of water.

Many socioeconomic characteristics of buyers in comparison to sellers are statistically significant determinants of fuel contracts. Fuel-based contracts are more likely to be chosen when the buyer has more land and is older than the seller. Land and age of buyers relative to sellers are likely to be correlated with bargaining power. As a result, these findings suggest that, in addition to the socioeconomic characteristics of sellers such as land, buyers’ relative bargaining power influences contract choice in informal water markets. The availability of potential sellers in the area has no bearing on contract selection because the number of additional sellers in the deliverable area is negligible. This result is consistent with the findings of (Yashodha, 2020), which find that there is no statistically significant relationship between the availability of potential sellers and the contract choice in the informal water markets in India. which shows that there is no statistically significant relationship between the availability of potential sellers and contract choice in India’s informal water markets. Furthermore, the ownership status of tubewells (joint or private) does not affect contract choice, demonstrating that most farmers in the study area are motivated by self-interest regardless of the type of tubewell or the kinship relationship between buyers and sellers.

4 Conclusion

In this study, we examined the structure of groundwater markets as well as the factors that influence contract selection in informal groundwater markets. Given the heterogeneity of farmers’ resources, we find that informal groundwater markets exist in all of the study areas. Water buyers are mostly small farmers with an average landholding size of 2.36 acres, whereas water sellers are mostly large farmers with an average land size of approximately 8 acres. Water is traded between buyers and sellers in both private and joint tubewells, with private tubewells being the most common, typically powered by diesel or electric motors. Although water is sold from all types of tubewells, the ownership status of tubewells affects the extent to which it is sold. The most common groundwater marketing contract in all study districts is a flat rate per hour of water pumping, but fuel-based contracts, in which buyers pay according to the consumption of electricity or diesel fuel, are also common. Water prices are 10%–22% lower under fuel-based contracts than flat-rate contracts. The findings also show that the ratio of the price of water to total variable cost (w/c) is around 1.5, which is lower than in other countries where higher w/c ratios are reported (Kumar, 2009; Wang et al., 2014). According to these findings, the water markets in Punjab are relatively competitive. An analysis of in-village price variations revealed lower variations when compared to between-village or regional price variations. The findings are consistent with the findings of Kajisa and Sakurai (2005), Wang et al. (2014), who found that informal water markets were competitive on the same basis. However, the w/c ratios were higher in the Gujrat district, which has a relatively higher scarcity of water, indicating that sellers consider the scarcity value of water in the price.

We find that the socioeconomic characteristics of both buyers and sellers influence contract choice. In particular, sellers’ landholding size is a significant determinant of contract choice, as cheaper fuel-based contracts are more likely to be chosen if sellers have large landholdings. This finding indicates that large farmers are less liquidity constrained. In contrast to previous research (Saleth, 2004; Saleth, 2014), we find that when buyers have kin relations with sellers, flat-rate contracts are more likely to be chosen than fuel-based contracts. This demonstrates that the contracts are chosen based on sellers’ material self-interest, which aligns with economic theory. According to district-specific effects, fuel-based contracts are more common in regions that have relatively large farmers who may be less cash-constrained. Furthermore, flat-rate contracts (which are typically more reflective of the cost of water scarcity than fuel-based contracts) are common in water-scarce regions.

Failure to account for the agent’s relative ability to influence decision-making results in a bias in contract choice. To represent the relative bargaining power of the agents, we used the socioeconomic characteristics of the buyers relative to their matching seller as proxy measures. The socioeconomic characteristics of buyers relative to their matching sellers suggest that when buyers are older and have more land than sellers, fuel-based contracts are more likely to be chosen. This finding indicates that these characteristics are related to the agents’ ability to influence the joint decision. The results are especially relevant to groundwater contracts, where the agents’ endogenous matching is less problematic.

This study’s findings have several implications. Because most water buyers are small farmers, they have less bargaining power, which is why flat-rate contracts are more common in all study areas. Although fuel-based contracts offer lower profits to sellers, the relative bargaining power of buyers positively influences the selection of this contract. This also suggests a form of price discrimination in which relatively well-off buyers with a long contractual history with sellers may receive discounts in the form of fuel-based contracts. This also implies that large farmers are likely to use more water because of lack of economic incentive to use water efficiently. To solve this problem, policy interventions are required to standardize contract structures, especially in the interest of small farmers. Furthermore, the amount of water being used by different groups of farmers under different water marketing contracts is not exactly known in Punjab. It is recommended to install water metering facilities and manage quotas in the regions that heavily rely on groundwater to better understand the relationship between prices and water (Xiqin et al., 2021). The limited availability of potential sellers in a deliverable area is another reason why small farmers are limited in their ability to buy water and become the victim of price discrimination. Currently, water markets are localized and limited by geographical restrictions because groundwater cannot be transported to longer distances without losses due to seepage and poor conditions of watercourses. Therefore, lining of watercourses and encouraging the use of efficiency-enhancing water conveyance infrastructure may increase the competition among sellers and ultimately reduce price discrimination. We also find that informal water markets in Punjab are more competitive than in other regions, indicating that the water markets in Punjab have matured. We recommend that policies be implemented to standardize groundwater marketing contracts in order to reflect the true cost of water scarcity. Currently, the majority of water marketing contracts only take into account the operational cost of pumping water, as well as some profits accruing to the seller. Because groundwater markets are common in the country’s largest province, where 90% of the groundwater is used, correcting the course of groundwater markets can help overcome existing problems such as droughts, overexploitation of water, and water quality issues.

This study has few limitations that warrant future research. First, although we carefully selected the study area based on higher water market activity and the country’s largest agricultural production share, it is evident that water markets exist in other Pakistani provinces, albeit with lower activity. However, due to financial and time constraints, we were unable to collect data from the provinces other than Punjab. Nevertheless, we believe that incorporating data from other regions, such as the arid regions of Baluchistan, will provide additional insight into the structure and effects of Pakistan’s water markets. Second, we chose to research markets for groundwater because groundwater is the most traded resource by farmers in the water markets. However, due to the changing socioeconomic environment in rural Punjab and the complex allocation of surface water through the warabandi allocation system, many farmers are selling their canal water shares, resulting in the emergence of surface water markets. Future research should examine whether there are any interaction effects in these two distinct water markets that influence the overall allocation of irrigation in Punjab’s rural areas. Finally, future research may also investigate non-agricultural groundwater markets to see if they have an impact on the conduct of agricultural water markets, especially water prices and contract choice.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding authors.

Author Contributions

AR: Conceptualization, Formal analysis, Investigation, Methodology, Writing—original draft. HL: Methodology, Resources, Validation, Writing—review and editing. YZ: Investigation, Methodology, Resources, Writing—review and editing. MX: Data curation, Software, Visualization, Validation, Writing—review and editing. PQ: Conceptualization, Validation, Resources, Supervision.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ackerberg, D. A., and Botticini, M. (2002). Endogenous Matching and the Empirical Determinants of Contract Form. Journal of Political Economy 110, 564–591. doi:10.1086/339712

Aggarwal, R. M. (2007). Role of Risk Sharing and Transaction Costs in Contract Choice: Theory and Evidence from Groundwater Contracts. J. Econ. Behav. Organ. 63, 475–496. doi:10.1016/j.jebo.2005.06.010

Allen, D., and Lueck, D. (1992). Contract Choice in Modern Agriculture: Cash Rent Versus Cropshare. J. Law Econ. 35, 397–426. doi:10.1086/467260

Asghar, S., Sasaki, N., Jourdain, D., and Tsusaka, T. (2018). Levels of Technical, Allocative, and Groundwater Use Efficiency and the Factors Affecting the Allocative Efficiency of Wheat Farmers in Pakistan. Sustainability 10, 1619. doi:10.3390/su10051619

Bajaj, A., Singh, S. P., and Nayak, D. (2022). Impact of Water Markets on Equity and Efficiency in Irrigation Water Use: a Systematic Review and Meta-Analysis. Agric. Water Manag. 259, 107182. doi:10.1016/j.agwat.2021.107182

Barry, P. J., Moss, L. M., Sotomayor, N. L., and Escalante, C. L. (2000). Lease Pricing for Farm Real Estate. Rev. Agric. Econ. 22, 2–16. doi:10.1111/1058-7195.00001

Bhandari, H., and Pandey, S. (2006). Economics of Groundwater Irrigation in Nepal: Some Farm-Level Evidences. J. Agric. Appl. Econ. 38, 185–199. doi:10.1017/s107407080002215x

Cotteleer, G., Gardebroek, C., and Luijt, J. (2008). Market Power in a GIS-Based Hedonic Price Model of Local Farmland Markets. Land Econ. 84, 573–592. doi:10.3368/le.84.4.573

Elahi, E., Zhang, L., Abid, M., Javed, M. T., and Xinru, H. (2017). Direct and Indirect Effects of Wastewater Use and Herd Environment on the Occurrence of Animal Diseases and Animal Health in Pakistan. Environ. Sci. Pollut. Res. Int. 24, 6819–6832. doi:10.1007/s11356-017-8423-9

Elahi, E., Abid, M., Zhang, H., Cui, W., and Ul Hasson, S. (2018a). Domestic Water Buffaloes: Access to Surface Water, Disease Prevalence and Associated Economic Losses. Prev. Veterinary Med. 154, 102–112. doi:10.1016/j.prevetmed.2018.03.021

Elahi, E., Abid, M., Zhang, L., Ul Haq, S., and Sahito, J. G. M. (2018b). Agricultural Advisory and Financial Services; Farm Level Access, Outreach and Impact in a Mixed Cropping District of Punjab, Pakistan. Land Use Policy 71, 249–260. doi:10.1016/j.landusepol.2017.12.006

Elahi, E., Khalid, Z., Tauni, M. Z., Zhang, H., and Lirong, X. (2021a). Extreme Weather Events Risk to Crop-Production and the Adaptation of Innovative Management Strategies to Mitigate the Risk: A Retrospective Survey of Rural Punjab, Pakistan. Technovation, 102255. doi:10.1016/j.technovation.2021.102255

Elahi, E., Khalid, Z., and Zhang, Z. (2022a). Understanding Farmers' Intention and Willingness to Install Renewable Energy Technology: A Solution to Reduce the Environmental Emissions of Agriculture. Appl. Energy 309, 118459. doi:10.1016/j.apenergy.2021.118459

Elahi, E., Zhang, H., Lirong, X., Khalid, Z., and Xu, H. (2021b). Understanding Cognitive and Socio-Psychological Factors Determining Farmers' Intentions to Use Improved Grassland: Implications of Land Use Policy for Sustainable Pasture Production. Land Use Policy 102, 105250. doi:10.1016/j.landusepol.2020.105250

Elahi, E., Zhang, Z., Khalid, Z., and Xu, H. (2022b). Application of an Artificial Neural Network to Optimise Energy Inputs: An Energy- and Cost-Saving Strategy for Commercial Poultry Farms. Energy 244, 123169. doi:10.1016/j.energy.2022.123169

Eyhorn, F., Mäder, P., and Ramakrishnan, M. (2005). The Impact of Organic Cotton Farming on the Livelihoods of Smallholders. Evidence from the Maikaal bioRe Poject in Central India. Ackerstrasse, Frick, Switzerland: Research Institute of Organic Agriculture FiBL.

Farooq, U., Ahmad, M., and Saeed, I. (2009). Enhancing Livestock Productivity in the Desert Ecologies of Pakistan: Setting the Development Priorities. Pak. Dev. Rev. 48, 795–820. doi:10.30541/v48i4iipp.795-820

Harding, J. P., Rosenthal, S. S., and Sirmans, C. F. (2003). Estimating Bargaining Power in the Market for Existing Homes. Rev. Econ. Stat. 85, 178–188. doi:10.1162/003465303762687794

Jacoby, H. G., Murgai, R., and Rehman, S. (2004). Monopoly Power and Distribution in Fragmented Markets: The Case of Groundwater. Rev. Econ. Stud. 71, 783–808. doi:10.1111/j.1467-937x.2004.00304.x

Janakarajan, S. (1993). Economic and Social Implications of Groundwater Irrigation: Some Evidence from South India. Indian J. Agric. Econ. 48, 65–75.

Kajisa, K., and Sakurai, T. (2003). Determinants of Groundwater Price under Bilateral Bargaining with Multiple Modes of Contracts: A Case from Madhya Pradesh, India. Jpn. J. Rural Econ. 5, 1–11. doi:10.18480/jjre.5.1

Kajisa, K., and Sakurai, T. (2005). Efficiency and Equity in Groundwater Markets: the Case of Madhya Pradesh, India. Envir. Dev. Econ. 10, 801–819. doi:10.1017/s1355770x05002536

Kuethe, T. H., and Bigelow, D. P. (2018). “Bargaining Power in Farmland Rental Markets,” in 2018 Annual Meeting, Washington, DC, August 5–7 (Milwaukee, WI: Agricultural and Applied Economics Association). 2018 Jun 20 (No. 274113).

Kumar, M. D. (2009). Water Management in India: What Works, What Doesn't. New Delhi: Gyan Books. Publishing House.

Manjunatha, A. V., Speelman, S., Chandrakanth, M. G., and Van Huylenbroeck, G. (2011). Impact of Groundwater Markets in India on Water Use Efficiency: A Data Envelopment Analysis Approach. J. Environ. Manag. 92, 2924–2929. doi:10.1016/j.jenvman.2011.07.001

März, A., Klein, N., Kneib, T., and Musshoff, O. (2016). Analysing Farmland Rental Rates Using Bayesian Geoadditive Quantile Regression. Eur. Rev. Agric. Econ. 43, 663–698. doi:10.1093/erae/jbv028

Meinzen-Dick, R. S. (1996). Groundwater Markets in Pakistan: Participation and Productivity. Washington, DC: International Food Policy Research Institute.

Mukherji, A. (2004). Groundwater Markets in Ganga-Meghna-Brahmaputra Basin: Theory and Evidence. Econ. Political Wkly. 39, 3514–3520. Available at: https://www.jstor.org/stable/4415349

Mukherji, A., and Shah, T. (2005). “Socio-Ecology of Groundwater Irrigation in South Asia: an Overview of Issues and Evidence,” in Groundwater Intensive Use: Selected Papers, Sinex, Valencia, Spain, 10-14 December 2002 (Netherlands: Lieden). Editor A. A. Balkema, 53–77.

Qureshi, A. S. (2020). Groundwater Governance in Pakistan: From Colossal Development to Neglected Management. Water 12, 3017. doi:10.3390/w12113017

Qureshi, A. S., Mccornick, P. G., Sarwar, A., and Sharma, B. R. (2010). Challenges and Prospects of Sustainable Groundwater Management in the Indus Basin, Pakistan. Water Resour. Manage 24, 1551–1569. doi:10.1007/s11269-009-9513-3

Razzaq, A., Qing, P., Naseer, M. A. U. R., Abid, M., Anwar, M., and Javed, I. (2019). Can the Informal Groundwater Markets Improve Water Use Efficiency and Equity? Evidence from a Semi-Arid Region of Pakistan. Sci. Total Environ. 666, 849–857. doi:10.1016/j.scitotenv.2019.02.266

Sadoulet, E., Janvry, A., and Fukui, S. (1997). The Meaning of Kinship in Sharecropping Contracts. Am. J. Agric. Econ. 79, 394–406. doi:10.2307/1244138

Saleth, R. M. (2004). Strategic Analysis of Water Institutions in India: Application of a New Research Paradigm. Colombo, Sri Lanka: International Water Management Institute IWMI. IWMI Research Report 79.

Saleth, R. M. (2014). “Water Markets in India: Extent and Impact,” in Water Markets for the 21st Century: What Have We Learned? Editors K.W. Easter, and Q. Huang (Dordrecht: Springer Netherlands), 239–261. doi:10.1007/978-94-017-9081-9_13

Shah, T. (2000). “Groundwater Markets and Agricultural Development: A South Asian Overview,” in Regional Groundwater Management Seminar, Islamabad, October 9-11, 2000, 255–278.

Siebert, S., Burke, J., Faures, J. M., Frenken, K., Hoogeveen, J., Döll, P., et al. (2010). Groundwater Use for Irrigation - a Global Inventory. Hydrol. Earth Syst. Sci. 14, 1863–1880. doi:10.5194/hess-14-1863-2010

Singh, D. (2002). Groundwater Markets in Fragile Environments: Key Issues in Sustainability. Indian J. Agric. Econ. 57, 180–196. doi:10.22004/ag.econ.274113

Sorrentino, A., Russo, C., and Cacchiarelli, L. (2018). Market Power and Bargaining Power in the EU Food Supply Chain: the Role of Producer Organizations. New Medit. 17 (4), 21–31. doi:10.30682/nm1804b

Srivastava, S. K., Kumar, R., and Singh, R. P. (2009). Extent of Groundwater Extraction and Irrigation Efficiency on Farms under Different Water-Market Regimes in Central Uttar Pradesh. Agric. Econ. Res. Rev. 22, 1–11. doi:10.1080/09670877609412068

Svejnar, J. (1986). Bargaining Power, Fear of Disagreement, and Wage Settlements: Theory and Evidence from U.S. Industry. Econometrica 54, 1055–1078. doi:10.2307/1912322

Wang, J., Huang, Q., Huang, J., and Rozelle, S. (2016). Managing Water on China's Farms: Institutions, Policies and the Transformation of Irrigation under Scarcity. Academic Press.

Wang, J., Zhang, L., Huang, Q., Huang, J., and Rozelle, S. (2014). “Assessment of the Development of Groundwater Market in Rural China,” in Water Markets for the 21st Century (Dordrecht: Springer), 263–282. doi:10.1007/978-94-017-9081-9_14

Watto, M. A., Mugera, A. W., Kingwell, R., and Saqab, M. M. (2018). Re-Thinking the Unimpeded Tube-Well Growth under the Depleting Groundwater Resources in the Punjab, Pakistan. Hydrogeol. J. 26, 2411–2425. doi:10.1007/s10040-018-1771-9

Watto, M. A., and Mugera, A. W. (2014). Measuring Production and Irrigation Efficiencies of Rice Farms: Evidence from the Punjab Province, Pakistan. Asian Econ. J. 28, 301–322. doi:10.1111/asej.12038

Xiqin, W., Xinyue, Z., Hao, C., and Ying, C. (2021). 'Overuse-Charge' Agricultural Water Price Mechanism in Groundwater Overdraft Areas. Water Policy 24, 132–144. doi:10.2166/wp.2021.195

Keywords: groundwater markets, competitiveness, contract choice, groundwater management, environmental sustainability, Pakistan

Citation: Razzaq A, Liu H, Zhou Y, Xiao M and Qing P (2022) The Competitiveness, Bargaining Power, and Contract Choice in Agricultural Water Markets in Pakistan: Implications for Price Discrimination and Environmental Sustainability. Front. Environ. Sci. 10:917984. doi: 10.3389/fenvs.2022.917984

Received: 11 April 2022; Accepted: 02 May 2022;

Published: 16 May 2022.

Edited by:

Ehsan Elahi, Shandong University of Technology, ChinaReviewed by:

Saimei Jin, Hunan University of Technology and Business, ChinaMoataz Eliw, Al-Azhar University, Egypt

Copyright © 2022 Razzaq, Liu, Zhou, Xiao and Qing. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hancheng Liu, bGFvbGl1MTk3MEAxNjMuY29t; Meizhen Xiao, bWVpemhlbi54aWFvQHdlYm1haWwuaHphdS5lZHUuY24=

Amar Razzaq

Amar Razzaq Hancheng Liu1*

Hancheng Liu1*