- 1School of Economics, Xihua University, Chengdu, China

- 2Tailong Finance School, Zhejiang Gongshang University, Hangzhou, China

- 3School of Business Administration, Yonsei University, Seoul, South Korea

Climate change impacts agricultural production negatively. Therefore, rural residents experience large income and consumption fluctuations when dealing with climate change risks. However, little is known about whether digital financial inclusion can help rural residents improve their ability to resist climate change. This study uses the Peking University Digital Financial Inclusion Index of China and China Household Finance Survey data, together with historical temperature data from major cities, to study the impact of digital financial inclusion on Chinese rural residents’ consumption in response to climate change. The results suggest that digital financial inclusion significantly promotes rural households’ total consumption and consumption upgrades. Heterogeneity analyses also show that digital financial inclusion predominantly affects low-income households, low-asset households, and households living in China’s central and western regions. The instrumental variable and control function methods were used for robustness, and our main conclusions are robust and reliable. Although climate change reduces rural residents’ consumption and increases their risks, digital finance inclusion significantly mitigates this negative effect. The government can increase the usage depth of digital financial inclusion in rural areas by promoting the construction of digital financial inclusion facilities. The government should strive to deepen the impact of digital financial inclusion on rural household income and consumption to further improve their ability to resist climate risks.

1 Introduction

Extreme weather conditions such as high temperatures, heatwaves, droughts, floods, hurricanes, and cold waves have extensive impacts on human health, agriculture, the economy, and natural ecosystems. Climate change has increased the frequency and severity of natural disasters (Aldunce et al., 2015). Additionally, it can also affect the economic growth rate (Babiker 2005), prolong poverty, and create new poverty predicaments (De Pryck Kari, 2021). According to the “2019 Global Climate Risk Index Report”, since 1998, 526,000 people have died from extreme weather conditions worldwide, and the direct economic loss has reached 3.47 trillion US dollars. The more vulnerable individuals, groups, classes, or regions are, the more easily they are affected by environmental shocks brought about by climate change (Bohle et al., 1994). Vulnerable groups, such as rural women, children, and herdsmen, have limited access to land, employment, and public services, and their ability to cope with climate change risks is also weaker (Paavola 2008; Maccini and Yang 2009). Harsh environmental conditions are often associated with low incomes, low consumption, and high savings (Zhang et al., 2021). Furthermore, the economic impacts of climate change are more pronounced in developing countries, with relatively few measures to address environmental challenges (Jury 2002; Thurlow et al., 2012).

Financial inclusion can help remove and overcome barriers to access to low-cost, fair, and secure formal financial services for certain social groups and individuals (Chakravarty and Pal 2013).Financial inclusion is a mechanism that ensures that vulnerable groups have access to timely and adequate financial services (storage, borrowing, insurance, payments, etc.) at affordable costs. Countries with a high population proportion without access to formal financial services exhibit higher levels of poverty and inequality (Bhanot et al., 2012).

Financial saving products can improve savings safety, smooth consumption for rural residents, help them achieve good asset management, and ensure sustainable development. In a state of sustainable development, traders and farmers can increase their savings, which can be translated into more investment and output and higher household consumption. Generally, people borrow money for business, to buy land or a house, to send children to school, or to respond to emergencies. Therefore, access to credit can provide adequate financial support for rural residents and is more effective than private borrowing in helping to alleviate poverty, increase household assets and consumption, and increase the child enrolment rate. People may use savings and credit to resist sudden shocks. However, as a financial product, insurance can spread risk by expanding risk-sharing groups. Farmers with agricultural insurance plant crops with higher risks but higher returns and invest more in planting to achieve higher yields (Demirgüç-Kunt et al., 2020). In this virtuous circle, rural residents can increase their income, improve their ability to resist climate change risks, and have more disposable income to achieve consumption.

Agricultural insurance is an important mechanism to effectively reduce the uncontrollable economic losses caused by climate change disasters. Additionally, it is a vital measure for farmers to stabilize their incomes and prevent the catastrophic effects of natural disasters. Agricultural insurance helps risk-averse people avoid the negative effects of extreme natural disasters. Effective risk reduction and loss management strategies, such as agricultural crop insurance, allow farmers to take huge risks without encountering difficulties; such strategies also improve their ability to resist risks, protect their continuous investment in agricultural production, encourage them to invest in high-input and high-yield crops, increase agricultural added value, and increase household income and consumption (Raju and Chand 2007). Credit can enhance farmers’ ability to minimize and manage risks. For example, suppose official institutional credit can improve credit flexibility, adapt credit to diversified market demands, and provide a variety of repayment methods in arid and non-arid regions. In that case, it can help farmers improve their risk-resistance ability (Jodha 1981). Moreover, credit for small-scale farmers can improve credit availability and increase the proportion of small-scale farmers in overall credit by increasing inputs, output, and employment—effectively improving social equity and efficiency (Mishra 1994).

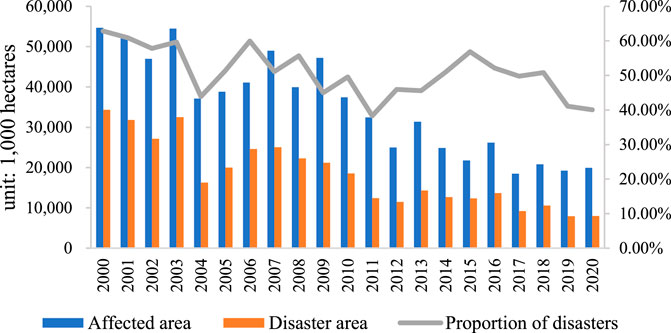

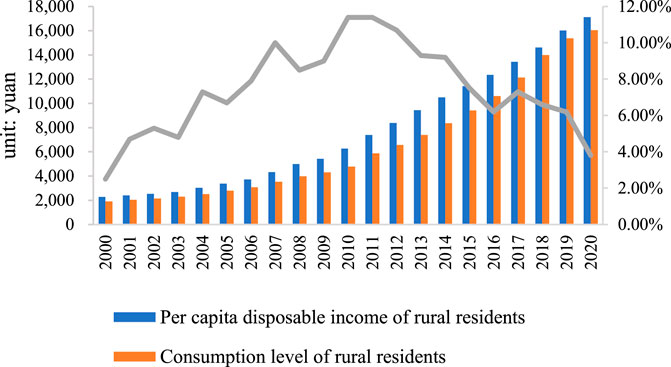

Figure 1 shows that, although the affected and the disaster areas decrease yearly, China’s proportion of disaster-affected crops is always above 40%. This suggests that the proportion of crops affected by extreme climate change has a greater impact on rural residents. Figure 2 shows the per capita disposable income and consumption of Chinese rural residents. The graph shows that in years with a high proportion of disasters, the annual growth rate of disposable income has a downward trend, indicating a positive relationship between the proportion of crops affected by disasters and the income of rural residents.

FIGURE 1. The affected area, disaster area, and the proportion of disasters in China from 2000 to 2020 (Data source: National Bureau of Statistics of China).

FIGURE 2. Per capita disposable income and consumption of rural residents in China from 2000 to 2020 (Data source: National Bureau of Statistics of China).

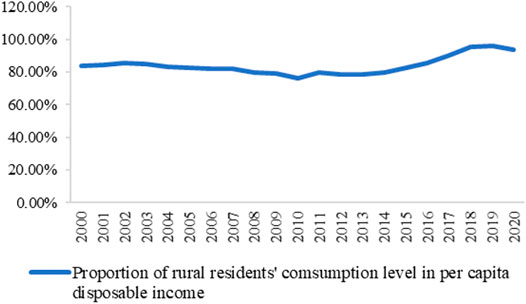

Although the per capita disposable income and consumption of rural residents shown in Figure 2 are increasing yearly, the annual growth rate of the per capita disposable income of rural residents shows great fluctuation. Combined with the proportion of per capita disposable income spent on rural residents’ consumption (shown in Figure 3), the statistical results show that in years with a low growth rate of disposable income and a high proportion of disasters, the proportion of consumption by rural residents gradually increased. Therefore, to ensure that rural residents’ income and consumption can be matched during times with declining annual disposable income growth rate, rural residents gradually reduce consumption in the later stage to avoid the risk of a subsequent reduction in agricultural production income caused by possible climate change. It can be considered that climate change may negatively impact rural residents’ consumption in China.

FIGURE 3. Proportion of rural residents’ consumption in per capita disposable income from 2000 to 2020 (Data source: National Bureau of Statistics of China).

Digital financial inclusion is developing rapidly and continuously in China. However, the existing literature pays little attention to promoting rural residents’ consumption under climate change. It is practical to study whether digital financial inclusion can promote the growth and upgrade of rural residents’ consumption in China, thereby reducing the negative impact of climate change. This study could help reduce poverty caused by climate change and promote rural revitalization in developing countries. We use Peking University Digital Financial Inclusion Index of China (PKU-DFIIC), China Household Financial Survey (CHFS) data, and temperature data for major cities to empirically analyze the impact of digital financial inclusion on consumption by China’s rural residents for a new climate change adaptation strategy. The other contributions of this study are as follows. 1) Compared with the case study on the impact of digital financial inclusion on residents’ consumption in the existing literature, this study is specifically concerned with its impact on rural residents’ consumption and consumption upgrading, which could provide a new strategy for alleviating rural poverty in developing countries. 2) Climate change will further exacerbate the poverty and vulnerability of vulnerable groups, reduce welfare, and affect the regional economic growth. Combining natural data and micro-survey data, this study tested whether digital finance inclusion mitigates the negative effect of climate change on rural residents’ consumption, which has not been covered in the existing literature.

The rest of this paper is organized as follows: Section 2 is a literature review. Section 3 contains the theoretical analysis. Section 4 presents the data sources and empirical methods used. Section 5 reports the empirical results, and section 6 summarizes the conclusions and proposed implications for promoting the growth and upgrading of rural residents’ consumption and reducing the negative impact of climate change.

2 Literature Review

2.1 Climate Change and Rural Residents’ Consumption

The ecological environment will always deeply affect economic growth and regional sustainable development (Zeraibi et al., 2020; Ahmad et al., 2021a). Greenhouse gases emitted by anthropogenic activities exacerbate climate change, and extreme climate events are occurring more frequently worldwide. As a result, climate change will continuously slow the global economic growth rate by 0.28% per year (Carleton and Hsiang 2016). Furthermore, Ciscar et al. (2011) showed that climate change could halve European residents’ annual wealth growth rate by 2080 if the economic damage caused by climate change is sustained. Climate change has a huge impact on agricultural industries that depend on rainfall, which can cause instability in rural residents’ consumption. Poverty is related to consumption and vulnerability. Poor rural households are especially vulnerable when facing income risks, which may restrain farmers’ agricultural investment and lead to a poverty trap (Karlan et al., 2014). Chen et al. (2020) found that an increase in the instability of agricultural income caused by climate change would further accelerate the decrease in farmers’ disposable incomes and force them to reduce their non-subsistence consumption. Regarding production input, rural residents will change crop varieties and increase investment in climate disaster prevention according to their climate change forecasts. Ultimately, this manifests as an increase in agricultural production costs and total input, reducing farmers’ net income and consumption (Offiong and Ita 2012). From the perspective of output, climate change manifests as changes in light conditions, heat sources, water resources, and so on, all of which change soil conditions. Changes in soil and other potential land productivity factors will ultimately be reflected in the yield and quality of crops (Gershon and Mbajekwe 2020), affecting farmers’ income and consumption patterns. Overall, the effects of climate change continue to reduce individual income and consumption (Skjeflo 2013).

2.2 Digital Financial Inclusion and Consumption

Financial development plays an important role in economic growth in China (Ahmad et al., 2021b; Shehzad et al., 2021). Rural financial development can improve rural resource allocation efficiency and promote income growth among rural residents (Adetiloye 2012; Peng et al., 2021). Galor and Moav (2006) found that credit capital was an important factor in smoothing consumption and alleviating poverty. Financial support to farmers from rural commercial banks and the rural financial market can significantly increase farming income (Attipoe et al., 2020). This is because such support leads to an increase in the use of fertilizers and tractors, which in turn results in higher agricultural productivity and strengthens rural resident income growth. Rural financial development was instrumental in accelerating the transformation of rural industries (Peng et al., 2021).

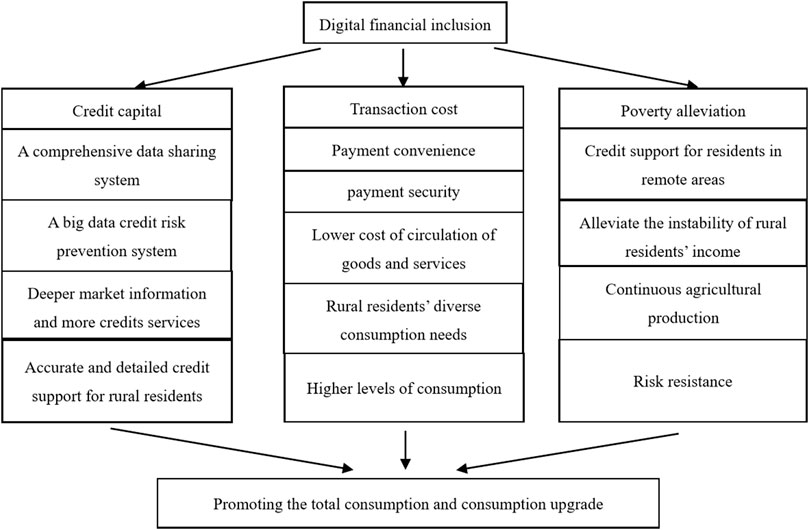

Regarding credit capital, digital financial inclusion can help the commercial banking system establish a more comprehensive data sharing system and a big data credit risk prevention system. A clearer and more comprehensive data-sharing system can also provide commercial banks with deeper market information. Thus, commercial banks can provide more credit service levels regarding credit support for rural residents, and they can make more accurate and detailed plans and arrangements to help smooth rural residents’ consumption patterns and achieve better asset management, thereby promoting rural residents’ consumption (Wang and Fu 2022; Ma and Li 2021). From the perspective of transaction costs, the convenience of digital financial inclusion can help rural residents save on the cost of long-distance payment, make it easier for residents in remote areas to obtain credit support, and increase payment security (Ji et al., 2021). Additionally, digital financial inclusion enables consumers to meet more diversified consumption needs at lower circulation costs for goods and services. It enables rural residents to access higher-level consumption, upgrading rural residents’ consumption. Moreover, digital financial inclusion can reach rural residents in remote areas that lack financial support, such as credit services (Zhou et al., 2020). Credit services can alleviate the instability of rural residents’ income caused by climate change and ensure that they can maintain their lives and carry out continuous agricultural production and operations, improving their ability to resist future risks (Wang and He 2020). Ultimately, credit services promote high-quality investment in agricultural production, increase family income, and promote consumption growth (Wang and Liu 2016).

The existing research primarily focuses on the impact of digital financial inclusion on economic growth. Some literature has recognized the relationship between digital financial inclusion and climate change. For example, Shehzad et al., 2021 found that negative shocks in the use of digital financial inclusion cause an upsurge in the level of CO2 emissions based on quarterly data from Pakistan. However, there is no direct evidence between digital financial inclusion and farmers’ ability to minimize the risks of climate change. To fill this gap, this study uses the Peking University Digital Financial Inclusion Index of China and China Household Finance Survey data, together with historical temperature data from major cities, to study the impact of digital financial inclusion on Chinese rural residents’ consumption in response to climate change.

3 Theoretical Framework

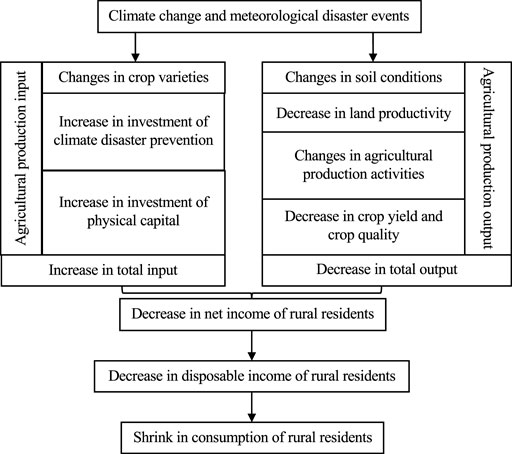

Extreme climate change, such as extremely high temperatures, low temperatures, and droughts, increases agricultural production risk. The most significant manifestation is a sharp drop in crop yields, which increases the volatility of farmers’ income and leads rural residents to reduce their consumption level to avoid future income instability caused by climate change risks. Additionally, the disposable income of rural residents, who mainly focus on agricultural production, is lower than that of urban residents. Meteorological catastrophic events caused by extreme climate change directly damage the physical capital of rural residents, increase the input of physical capital, and further lead to a decrease in income and a consumption decline. climate change also affects agricultural output, agricultural income, and farmers’ consumption by affecting agricultural production activities. For example, global warming has led to a continuous northward shift of the isotherm in China. This is reflected in the changes in the planting areas of heat-tolerant crops. However, the economic value differs by crop, leading to changes in farmers’ incomes and further affecting their consumption habits. Figure 4 shows the theoretical framework of this study.

FIGURE 4. Theoretical framework of the impact of climate change on the consumption of rural residents.

Regarding the increased volatility of rural residents’ incomes caused by climate change, digital financial inclusion provides rural residents with advantages in terms of digital payments, credit, and insurance options, which directly stimulates the growth of rural residents’ consumption (Karlan and Zinman 2010). Additionally, digital financial inclusion can help rural residents better manage their assets, smooth their consumption patterns (Gross and Souleles 2002), improve their risk resilience, and indirectly increase their income levels. As a result, it promotes rural residents’ consumption growth. According to the theory of mental accounts, the convenience of payment provided by digital financial inclusion can reduce rural residents’ sensitivity to price when they consume (Soman 2001), reduce psychological losses that are high under cash transaction conditions, and improve their willingness to pay, which can also promote rural household consumption (Prelec and Simester 2001). The theoretical mechanism of the impact of digital financial inclusion on rural residents’ consumption is reflected in the following three aspects (Figure 5).

4 Materials and Methods

4.1 Data

This study adopts the Peking University Digital Financial Inclusion Index of China (PKU-DFIIC), produced by a joint research team from the Peking University Digital Finance Research Center and Ant Technology Group to measure China’s digital finance development. The Peking University Digital Financial Inclusion Index of China (PKU-DFIIC) includes coverage breadth, usage depth, and digitization level. Usage depth involves sub-indexes such as payment, credit, insurance, investment, and money funds (Li et al., 2020). This study adopted the aggregate index, coverage breadth, and usage depth from the PKU-DFIIC system for empirical research.

Microdata on Chinese rural residents were obtained from the China Household Finance Survey (CHFS). The CHFS was the first nationwide survey program on Chinese household financial micro-issues. The investigated subject mainly includes housing assets and financial wealth, liabilities and credit constraints, income and consumption, social security and insurance, intergenerational transfers, demographics, employment, and payment habits. The CHFS provides high-quality micro-household financial data for academic research and government decisions. CHFS data fill the gaps in the micro-field of household finances in China and have a profound impact on academic research, industrial development, and policy formulation. The CHFS has conducted five rounds of large-scale household interviews nationwide in 2011, 2013, 2015, 2017, and 2019, involving more than 40,000 Chinese households.

4.2 Variables

With the popularization of digital financial products such as digital payments, credit, and insurance, digital financial services have continued to improve. Therefore, to study the impact of the development of digital financial inclusion on rural household consumption, this study constructs the following panel fixed effect model to reflect the relationship between digital financial inclusion and rural household consumption. The panel fixed effect model was adopted to control rural households’ unobservable factors. These may simultaneously affect the development of digital financial inclusion and some other unobservable factors that will not change with family consumption over a short-term period. Moreover, panel fixed effect data can also solve the problem of missing variables (individual heterogeneity) to a certain extent and reduce the endogeneity of the model.

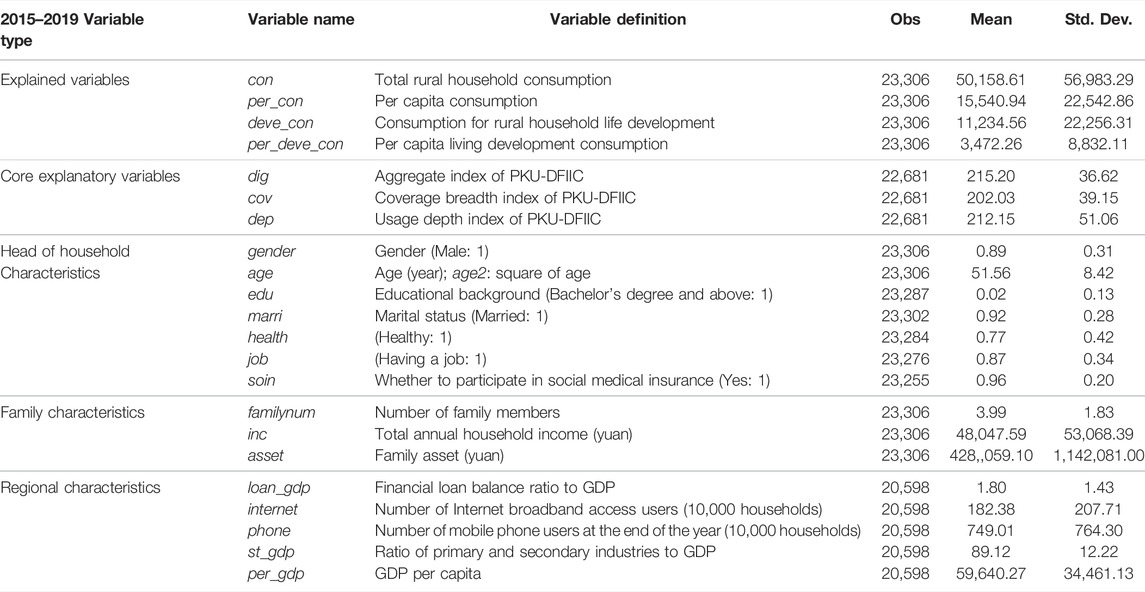

Rural household consumption is the explained variable. This study used the sample households’ total consumption expenditure and per capita consumption expenditure in the three rounds of surveys in 2015, 2017, and 2019. The sample data include household consumption expenditures on food, tobacco and alcohol, clothing, housing, daily necessities, transportation, communications, education, culture, entertainment, medical care, and other services. In the analysis process, we further focus on exploring changes in life development consumption, including education, culture, entertainment, and medical security.

The core explanatory variables are the aggregate index, coverage breadth, and usage depth index from the PKU-DFIIC. This study uses an aggregate index to measure the development of digital financial inclusion in China. Additionally, the coverage breadth and usage depth indices were used for specific research and analysis.

The control variables are sorted into three main categories: 1) Variables representing the personal characteristics of the household head—including gender, age, education, marital status, health, work status, and participation in social medical insurance—are used to control the impact of household head’s characteristics on household consumption. 2) Family characteristic variables—including the number of family members, annual family income, and total family assets—are used to measure the overall resource status of the family. 3) Regional characteristic variables—including the level of traditional financial development, number of users with Internet broadband access, number of mobile phone users at the end of the year, regional industrial structure, and per capita GDP—are used to control the impact of household location on household consumption (Table 1).

4.3 Benchmark Model

First, we test the impact of digital financial inclusion on rural residents’ consumption. The benchmark regressions are as follows.

The subscripts i,c represent the ith household in city c, and t represents time. The explained variable

4.4 Control Function Method

The study further addresses multiple concurrent endogeneity problems, such as sample selection bias and potential omitted variable bias in the estimation results. It also applies the control function (CF) method (Ebbes et al., 2011; Petrin and Train 2010; Wooldridge 2015; Sibande et al., 2017) for estimating the aggregate digital financial inclusion index with a lag of one order as an instrumental variable. The CF method directly introduces the residual term of the first-stage regression as an additional regression term into the original equation. The regression residuals of the first stage can capture the “missing variables” that cause endogeneity problems in the original model.

The first stage regression of this model is:

The regression residuals,

4.5 Climate-Digital Financial Inclusion–Consumption Link Model

Climate variations range from the freezing Mongolian Plateau to the mild Sichuan Basin in China. Zhang et al. (2021) found that a harsh climate in a region could reduce consumption. This section tests whether digital finance inclusion could attenuate the negative effects of climate change on rural residents’ consumption. Among all the climate factors, temperature is a good measure for climate change (Ji et al., 2014). Therefore, the standard deviation of the monthly average temperature over 11 years was used to measure climate change (Zhang et al., 2021). Our analysis focused on cross-sectional variability, and a coverage period of 11 years provided a sufficient description of a particular region’s climate.

We used data from the National Bureau of Statistics of China for 2009–2019. This dataset reports the monthly temperatures in China’s 32 major cities (including all provincial capital cities and municipalities). The monthly temperature is denoted as

The function STD (·) denotes the standard deviation of the variables in brackets.

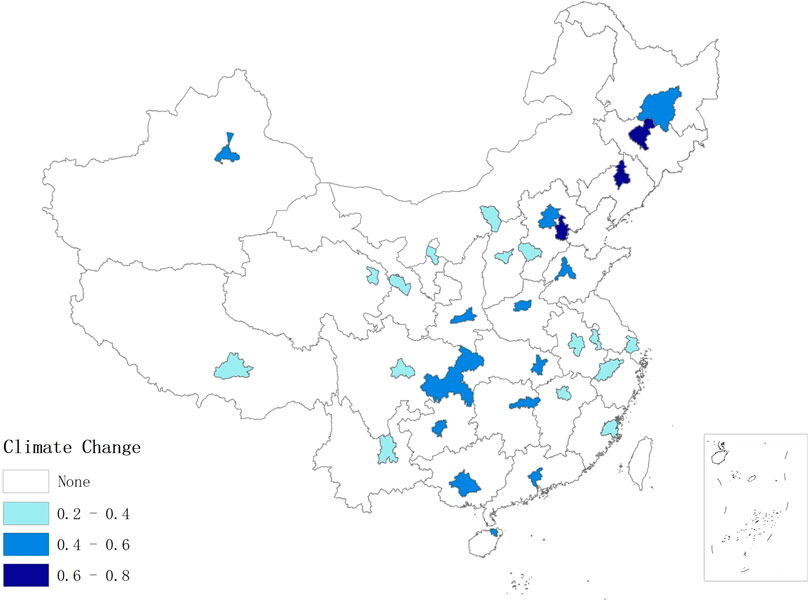

A high variable value for a city indicates greater climate change. Figure 6 shows a map of the temperature variations in the 32 sample cities. More comfortable living is expected in areas with less climate variation.

FIGURE 6. Standard deviation of the average temperature in provincial capital cities and municipalities.

Combining climate change data and China Household Financial Survey data from 2019, the climate–digital financial inclusion–consumption link model is designed as follows:

where

5 Results and Discussion

5.1 Impact of Digital Finance Inclusion on Rural Residents’ Consumption

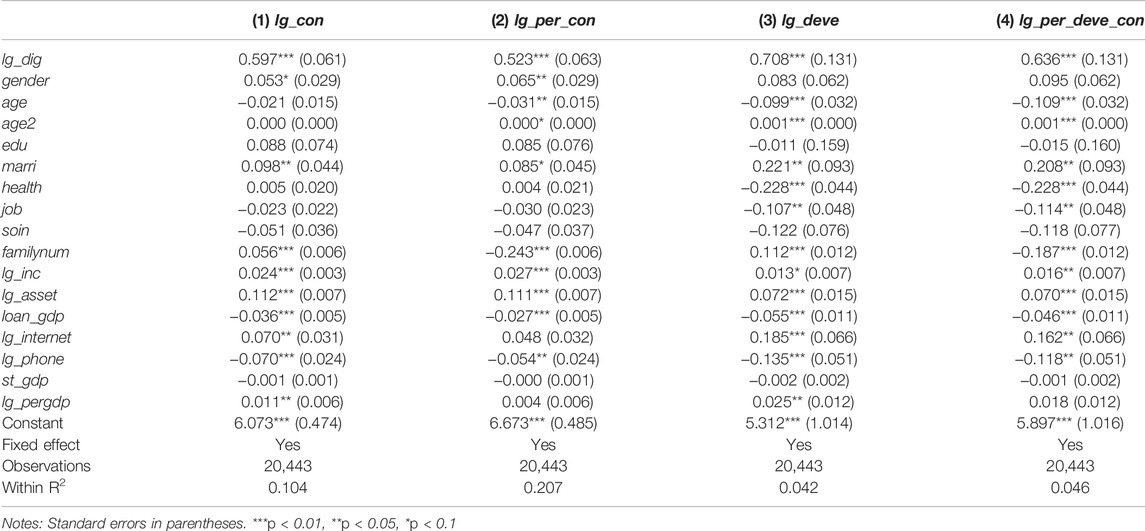

The basic regression examines and explains the impact of digital financial inclusion on rural residents’ consumption from different perspectives. To control for variables that vary across households but not over time, fixed effects models based on three-period panel data are applied. Models (1)–(4) in Table 2 analyze the impact of digital financial rural residents’ consumption growth. The regression results show that digital financial inclusion significantly promotes rural residents’ total and per capita consumption. Moreover, digital financial inclusion can also effectively promote the life development of rural residents. For every 1% increase in the level of digital financial inclusion, the total consumption, per capita consumption, life development consumption, and per capita life development consumption will increase 0.597%, 0.523%, 0.708%, and 0.636%, respectively. We also tested the impact using random effects models and obtained similar results. Overall, digital financial inclusion can promote the growth of rural residents’ consumption and upgrade their consumption.

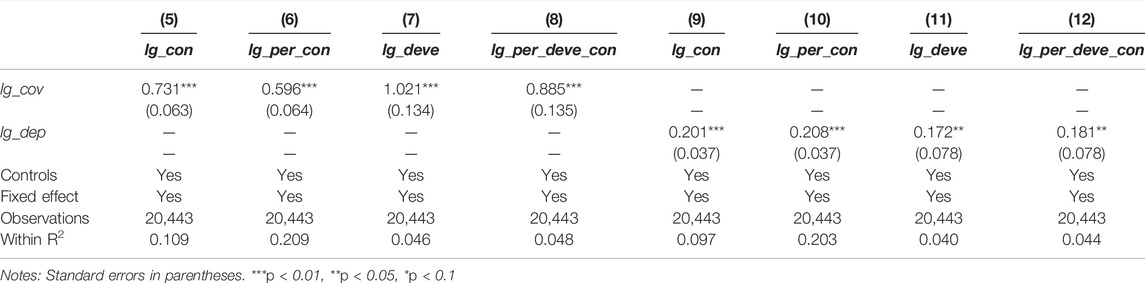

In Table 3, models (5)–(8) explore the relationship between the breadth of digital finance coverage and rural residents’ consumption. According to the regression results, the coverage breadth of digital financial inclusion can significantly promote rural residents’ overall and per capita consumption. Compared to the usage depth of digital financial inclusion in models (9)–(12), the promotion effect from coverage breadth is more obvious. The significant impact of digital finance coverage breadth suggests that digital financial inclusion can effectively reach underdeveloped rural areas that are currently difficult for the traditional financial system to reach. Digital finance can overcome the time and space limitations of the traditional financial system and provide more convenient and comprehensive financial services for financially underserved areas (Ozili 2018). However, areas with insufficient financial services are often remote rural areas with frequent climate disasters. To reduce income volatility caused by the impact of climate change on future agricultural production, rural residents in these areas are often inclined to reduce current consumption and increase savings. This situation is called precautionary savings (Omar and Inaba 2020). Digital financial inclusion provides diversified Internet insurance services. It broadens the risk avoidance channels for residents in remote areas and helps them prevent risks more efficiently, reducing precautionary savings and further ensuring the continued growth of rural residents’ consumption. Increasing the coverage breadth of digital financial inclusion can also improve life-development-related consumption among rural residents more efficiently, and it can promote consumption upgrades. The mechanism by which digital finance coverage promotes rural residents’ consumption can be analyzed from two aspects: 1) By covering remote areas, digital financial inclusion provides more diverse consumption methods for rural households with fewer choices in life development consumption, thereby promoting their pursuit of higher-level consumption. 2) The wide coverage of digital financial inclusion provides a strong financial guarantee to rural families who lack financial support, ensuring income stability for more disposable income, investing more in high-level consumption, and promoting consumption upgrading. Additionally, improving rural residents’ living development consumption can help them improve their education level and non-agricultural employment as well as increase their income channels. This leads to both increased and upgraded consumption among rural residents.

TABLE 3. Impact of digital finance coverage breadth and usage depth on rural residents’ consumption.

The usage depth of digital financial inclusion also has a significant impact on promoting rural residents’ consumption. Still, its consumption promotion effect on rural residents is lower than that of the aggregate digital financial inclusion index and the coverage breadth index. This result suggests that when China promotes the development of digital financial inclusion, it will reach a stage where the aggregate and coverage of digital financial inclusion is relatively mature. In that case, the government should focus more on developing the usage depth of digital financial inclusion. Therefore, more attention needs to be given to quality digital financial inclusion.

5.2 Robustness Checks

5.2.1 Instrumental Variable Method

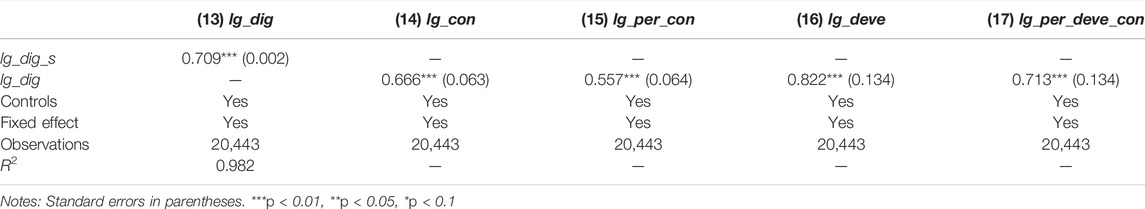

Econometric models (1)–(12) may have insurmountable endogeneity problems. Changes in rural residents’ consumption and the development of digital financial inclusion may be simultaneously affected by a series of other unobservable factors. This leads to biased regression coefficient estimates for digital financial inclusion. To avoid the endogeneity problem in measurement identification, we use the aggregate digital financial inclusion index with a lag of one order as an instrumental variable for estimation. The regression results based on the instrumental variable method in Table 4 show that the estimated coefficients are significant and positively correlate with the explanatory variables of interest. The weak instrumental variables test results also show that weak instrumental variables are unlikely. The estimation results suggest that after considering the endogeneity problem, the development of digital financial inclusion still significantly promotes rural residents’ consumption. Additionally, it can also significantly promote the consumption of life development, such as for education, culture, entertainment, and medical security, among rural residents, which is conducive to consumption upgrading. All the results were robust.

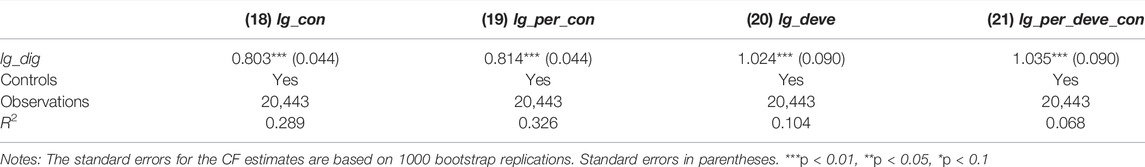

5.2.2 Control Function Method

The study further addresses multiple concurrent endogeneity problems, such as sample selection bias and potential omitted variable bias, in the estimation results. It also applies the control function method for estimating the aggregate digital financial inclusion index with a lag of one order as an instrumental variable. As a result, the endogeneity problem can be alleviated. Table 5 reports results consistent with the benchmark regression results.

5.3 Heterogeneity Analysis

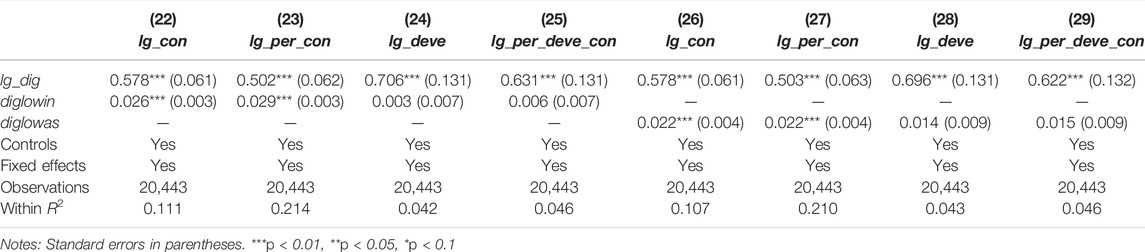

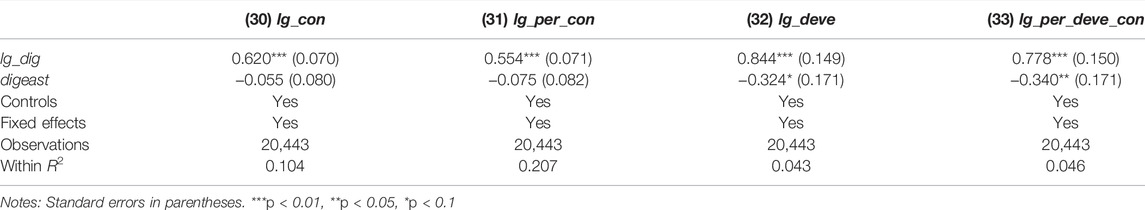

Regarding heterogeneity, all sample households are divided into two groups according to annual household income: high-income group (lowin = 0) and low-income group (lowin = 1), and then further subdivided into two groups according to total household assets: high-asset group (lowas = 0) and low-asset group (lowas = 1). Moreover, according to geographical location, the sample is divided into households in the eastern region (east = 1) and those in the central and western regions (east = 0). The multiplication (diglowin) of the aggregate digital financial inclusion index and low-income rural households, the multiplication (diglowas) of the aggregate digital financial inclusion index, low-asset rural households, and the multiplication (digeast) of the aggregate digital financial inclusion index and eastern rural households were introduced into the regressions. Tables 6, 7 report the results. Results (22)–(29) show that, compared with high-income and high-asset households, digital financial inclusion has a greater role in promoting the consumption of low-income and low-asset households. This indicates that digital financial inclusion can improve rural residents’ resilience to the risks brought about by climate change, especially for vulnerable groups in rural areas. Results (30)–(33) show that digital financial inclusion can especially promote rural residents’ consumption in central and western China, where the impact of climate change on agricultural production is more serious, and the economy is more undeveloped. Heterogeneous results indicate that digital financial inclusion can reduce the risk of poverty caused by climate change and is more conducive to helping disadvantaged groups who find it more difficult to obtain financial support.

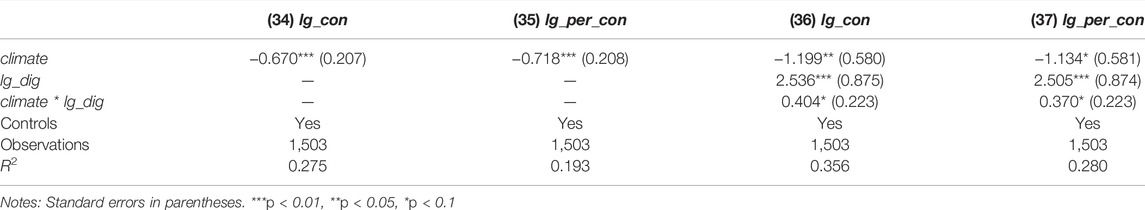

5.4 Impact of Digital Financial Inclusion on Climate Change Adaption

In the climate–consumption link, our main interest is the impact of climate change on rural residents’ consumption at the household level. Combining city-level climate change with household survey data in 2019, we perform regressions based on Eqs 5, 6. The main empirical findings are presented in Table 8. The first two models (models 34 and 35) study the impacts of climate change on consumption, whereas models 36 and 37 report results for the impacts of multiplication (climate * lg_dig) of climate change and the aggregate digital financial inclusion index. The results for models 34 and 35 are statistically significant at the 1% level, and the coefficients are all negative, which indicates that higher climate change in a city with one standard deviation is associated with a reduction in rural household consumption. Rural residents who live in areas with harsh weather conditions have low sensitivity to utility from consumption and thus have a low propensity to consume. With all other factors being equal, households in areas with harsh weather conditions or regions with high-temperature changes tend to consume less. Models 34 and 35 show that the coefficients of the multiplication variable are all positive and statistically significant at the 10% level. This indicates that, although climate change will reduce rural residents’ consumption and increase their risks, digital finance inclusion mitigates this negative effect significantly, further verifying the role of digital finance in moderating climate change.

6 Conclusions and Implications

Extreme weather conditions caused by climate change directly and negatively impact agricultural production. As the main source of agricultural production, rural residents are more affected by the reduction of income, lack of financial support, and consumption restrictions due to climate change (Harvey et al., 2014). This study explores the role of digital financial inclusion in promoting consumption among China’s rural residents to determine the mechanism for promoting their consumption under climate change risk. In the empirical analysis, this study uses data from the Peking University Digital Financial Inclusion Index of China and the China Household Finance Survey (CHFS) to perform benchmark regression. The study concludes that the development of digital financial inclusion can provide rural residents with more accurate financial services, such as credit and insurance, and help them smooth their consumption patterns. It can also enhance their ability to resist climate change risks and reduce the negative impact of climate change, thereby promoting rural residents’ consumption and complete consumption upgrades. Specifically, digital financial inclusion promotes rural residents’ consumption by increasing the coverage breadth and usage depth (especially coverage) of digital finance in rural areas.

The results of the heterogeneity analysis show that the development of digital financial inclusion can enhance the ability of low-income and low-asset rural families to cope with climate change risks, thereby increasing their consumption. The results also show that the development of digital financial inclusion can reduce the poverty risk caused by climate change. Therefore, digital financial inclusion plays a certain role in alleviating poverty. From the perspective of regional development, digital financial inclusion can significantly promote rural residents’ consumption in China’s central and western regions. Additionally, it enhances the ability of central and western rural residents to resist climate risks. It also helps narrow the poverty gap between regions and aids in forming better regional economic development.

Finally, we further verified the role of digital finance in moderating climate change and found that, although climate change reduces rural residents’ consumption and increases their risks, digital finance will mitigate this negative effect significantly by combining climate change data from major cities and China Household Financial Survey data from 2019.

This study offers policy implications from a bottom-up perspective. First, the results show that households suffer significant welfare losses owing to climate variation. These variations can cause a reluctance to consume among rural residents, negatively impacting the macroeconomy. Hence, policy support is required in regions with harsh weather conditions. Second, the long-term effects of cultural elements indicate that the behavioral consequences of climate variation can have long-lasting effects and are thus difficult to change. Therefore, to promote digital financial inclusion and consumption upgrades among rural households, the government should pay close attention to the digital-finance usage depth in rural areas and promote the construction of digital financial inclusion facilities. In so doing, it can strive for digital financial inclusion to have a deeper impact on rural household incomes and consumption, which can further improve their ability to withstand climate risks. Our specific recommendations are as follows: 1) The rural information infrastructure is quite different in developing countries such as China. In some rural areas, as internet infrastructure is poor, power supplies unstable, and logistics networks underdeveloped, rural digital finance and e-commerce development is restricted. Therefore, it is necessary to strengthen mobile communication networks in rural areas to increase network coverage and provide a safe, convenient, and cost-effective network environment. 2) In most developing countries, the majority of rural residents lack basic financial and internet knowledge. Therefore, financial institutions need to promote mobile and online payments in rural areas. Digital finance and agricultural supply chains need to be explored as well, and e-commerce companies need to be encouraged to improve rural area e-commerce systems. 3) Because of the imbalances in China’s rural populations, the left-behind elderly, children, and other groups have poor knowledge of digital financial risk prevention and control. Therefore, small financial service institutions, such as local rural commercial banks, village banks, and loan companies, need to strengthen their internal institutions to prevent information leakage and protect the rights and interests of their customers. Relevant departments also need to develop financial products that meet the wealth management needs of rural residents.

The limitations of this study are as follows: 1) Since the consumption data of rural residents comes from micro-surveys, we use three-period panel data. Because we use short panel data instead of long time series data, it is difficult to use advanced modeling techniques such as CS-ARDL to conduct empirical research. 2) Due to the difficulty in obtaining long-term average temperature data for each city, which can be calculated by using data released by each weather station, we were only able to use the official data on major cities published by the National Bureau of Statistics, resulting in the temperature data only covering some cities and reducing the sample size. These could be well addressed in future research.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author Contributions

Conceptualization, CH and WQ; methodology, CH; software, CH; formal analysis, WQ; data curation, JY; writing—original draft preparation, CH; writing—review and editing, CH and JY; visualization, JY; supervision, WQ; funding acquisition, CH. All authors have read and agreed to the published version of the manuscript.

Funding

The Research Center of Scientific Finance and Entrepreneurial Finance of the Ministry of Education of Sichuan Province (No. KJJR 2021-004).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adetiloye, K. A. (2012). Agricultural Financing in nigeria: An Assessment of the Agricultural Credit Guarantee Scheme Fund (ACGSF) for Food Security in Nigeria (1978-2006). J. Econ. 3 (1), 39–48. doi:10.1080/09765239.2012.11884951

Ahmad, M., Jiang, P., Murshed, M., Shehzad, K., Akram, R., Cui, L., et al. (2021a). Modelling the Dynamic Linkages between Eco-Innovation, Urbanization, Economic Growth and Ecological Footprints for G7 Countries: Does Financial Globalization Matter? Sust. Cities Soc. 70, 102881. doi:10.1016/j.scs.2021.102881

Ahmad, M., Majeed, A., Khan, M. A., Sohaib, M., and Shehzad, K. (2021b). Digital Financial Inclusion and Economic Growth: Provincial Data Analysis of China. China Econ. J. 14 (3), 291–310. doi:10.1080/17538963.2021.1882064

Aldunce, P., Beilin, R., Howden, M., and Handmer, J. (2015). Resilience for Disaster Risk Management in a Changing Climate: Practitioners' Frames and Practices. Glob. Environ. Change 30, 1–11. doi:10.1016/j.gloenvcha.2014.10.010

Attipoe, S. G., Jianmin, C., and Opoku-Kwanowaa, Y. (2020). Evaluating the Impact of Rural Finance on cocoa Farmers Productivity: A Case Study of Bodi District in Ghana. Asian J. Adv. Agric. Res. 12, 36–45. doi:10.9734/ajaar/2020/v12i430092

Babiker, M. H. (2005). Climate Change Policy, Market Structure, and Carbon Leakage. J. Int. Econ. 65 (2), 421–445. doi:10.1016/j.jinteco.2004.01.003

Bhanot, D., Bapat, V., and Bera, S. (2012). Studying Financial Inclusion in north‐east India. Intl Jnl of Bank Marketing 30 (6), 465–484. doi:10.1108/02652321211262221

Bohle, H. G., Downing, T. E., and Watts, M. J. (1994). Climate Change and Social Vulnerability. Glob. Environ. Change 4 (1), 37–48. doi:10.1016/0959-3780(94)90020-5

Carleton, T. A., and Hsiang, S. M. (2016). Social and Economic Impacts of Climate. Science 353, 6304. doi:10.1126/science.aad9837

Chakravarty, S. R., and Pal, R. (2013). Financial Inclusion in india: An Axiomatic Approach. J. Pol. Model. 35 (5), 813–837. doi:10.1016/j.jpolmod.2012.12.007

Chen, J., Rong, S., and Song, M. (2020). Poverty Vulnerability and Poverty Causes in Rural china. Soc. Indic. Res. 153 (1), 65–91. doi:10.1007/s11205-020-02481-x

Ciscar, J.-C., Iglesias, A., Feyen, L., Szabó, L., Van Regemorter, D., Amelung, B., et al. (2011). Physical and Economic Consequences of Climate Change in Europe. Proc. Natl. Acad. Sci. U.S.A. 108 (7), 2678–2683. doi:10.1073/pnas.1011612108

De Pryck, K. (2021). Intergovernmental Expert Consensus in the Making: The Case of the Summary for Policy Makers of the IPCC 2014 Synthesis Report. Glob. Environ. Polit. 21, 108–129. doi:10.1162/GLEP_A_00574

Demirgüç-Kunt, A., Klapper, L., Singer, D., Ansar, S., and Hess, J. (2020). The Global Findex Database 2017: Measuring Financial Inclusion and Opportunities to Expand Access to and Use of Financial Services*. World Bank Econ. Rev. 34 (Suppl. ment_1), S2–S8. doi:10.1093/wber/lhz013

Ebbes, P., Papies, D., and van Heerde, H. J. (2011). The Sense and Non-sense of Holdout Sample Validation in the Presence of Endogeneity. Marketing Sci. 30 (6), 1115–1122. doi:10.1287/mksc.1110.0666

Galor, O., and Moav, O. (2006). Das Human-Kapital: A Theory of the Demise of the Class Structure. Rev. Econ. Stud. 73 (1), 85–117. doi:10.1111/j.1467-937X.2006.00370.x

Gershon, O., and Mbajekwe, C. (2020). Investigating the Nexus of Climate Change and Agricultural Production in nigeria. Ijeep 10 (6), 1–8. doi:10.32479/ijeep.9843

Gross, D. B., and Souleles, N. S. (2002). An Empirical Analysis of Personal Bankruptcy and Delinquency. Rev. Financ. Stud. 15 (1), 319–347. doi:10.1093/rfs/15.1.319

Harvey, C. A., Rakotobe, Z. L., Rao, N. S., Dave, R., Razafimahatratra, H., Rabarijohn, R. H., et al. (2014). Extreme Vulnerability of Smallholder Farmers to Agricultural Risks and Climate Change in madagascar. Phil. Trans. R. Soc. B 369 (1639), 20130089. doi:10.1098/rstb.2013.0089

Ji, F., Wu, Z., Huang, J., and Chassignet, E. P. (2014). Evolution of Land Surface Air Temperature Trend. Nat. Clim Change 4 (6), 462–466. doi:10.1038/nclimate2223

Ji, X., Wang, K., Xu, H., and Li, M. (2021). Has Digital Financial Inclusion Narrowed the Urban-Rural Income gap: The Role of Entrepreneurship in china. Sustain 13, 8292. doi:10.3390/su13158292

Jodha, N. S. (1981). Role of Credit in Farmers’ Adjustment against Risk in Arid and Semi-Arid Tropical Areas of India. Econ. Polit. Wkly 16 (42/43), 1696–1709. Available at: http://www.jstor.org/stable/4370366

Jury, M. R. (2002). Economic Impacts of Climate Variability in south africa and Development of Resource Prediction Models. J. Appl. Meteorol. 41 (1), 46–55. doi:10.1175/1520-0450(2002)041<0046:eiocvi>2.0.co;2

Karlan, D., Osei, R., Osei-Akoto, I., and Udry, C. (2014). Agricultural Decisions after Relaxing Credit and Risk Constraints *. Constraints. Q. J. Econ. 129 (2), 597–652. doi:10.1093/qje/qju002

Karlan, D., and Zinman, J. (2010). Expanding Credit Access: Using Randomized Supply Decisions to Estimate the Impacts. Rev. Financ. Stud. 23 (1), 433–464. doi:10.1093/rfs/hhp092

Li, J., Wu, Y., and Xiao, J. J. (2020). The Impact of Digital Finance on Household Consumption: Evidence from china. Econ. Model. 86, 317–326. doi:10.1016/j.econmod.2019.09.027

Ma, J., and Li, Z. (2021). Does Digital Financial Inclusion Affect Agricultural Eco-Efficiency? A Case Study on china. Agronomy-Basel 11 (10). 1949 doi:10.3390/agronomy11101949

Maccini, S., and Yang, D. (2009). Under the Weather: Health, Schooling, and Economic Consequences of Early-Life Rainfall. Am. Econ. Rev. 99 (3), 1006–1026. doi:10.1257/aer.99.3.1006

Mishra, P. K. (1994). Crop Insurance and Crop Credit: Impact of the Comprehensive Crop Insurance Scheme on Cooperative Credit in gujarat. J. Int. Dev. 6 (5), 529–567. doi:10.1002/jid.3380060505

Offiong, E., and Ita, P. (2012). Climate Change and Agricultural Production. Glob. J. Agric. Sci. 11 (1), 25. doi:10.4314/gjass.v11i1.5

Omar, M. A., and Inaba, K. (2020). Does Financial Inclusion Reduce Poverty and Income Inequality in Developing Countries? A Panel Data Analysis. J. Econ. Structures 9 (1), 1–25. doi:10.1186/s40008-020-00214-4

Ozili, P. K. (2018). Impact of Digital Finance on Financial Inclusion and Stability. Borsa Istanbul Rev. 18 (4), 329–340. doi:10.1016/j.bir.2017.12.003

Paavola, J. (2008). Livelihoods, Vulnerability and Adaptation to Climate Change in Morogoro, tanzania. Environ. Sci. Pol. 11 (7), 642–654. doi:10.1016/j.envsci.2008.06.002

Peng, X., Lu, H., Fu, J., and Li, Z. (2021). Does Financial Development Promote the Growth of Property Income of China’s Urban and Rural Residents? Sustain 13 (5), 1–20. doi:10.3390/su13052849

Peng, Y., Latief, R., and Zhou, Y. (2021). The Relationship between Agricultural Credit, Regional Agricultural Growth, and Economic Development: The Role of Rural Commercial Banks in Jiangsu, China. Emerging Markets Finance and Trade 57 (7), 1878–1889. doi:10.1080/1540496x.2020.1829408

Petrin, A., and Train, K. (2010). A Control Function Approach to Endogeneity in Consumer Choice Models. J. Marketing Res. 47 (1), 3–13. doi:10.1509/jmkr.47.1.3

Prelec, D., and Simester, D. (2001). Always Leave home without it: A Further Investigation of the Credit-Card Effect on Willingness to Pay. Market Lett. 12 (1), 5–12. doi:10.1023/a:1008196717017

Raju, S. S., and Chand, R. (2007). Progress and Problems in Agricultural Insurance. Econ. Polit. Wkly. 42 (21), 1905–1908. Available at: http://www.jstor.org/stable/4419629

Shehzad, K., Zaman, U., José, A. E., Koçak, E., and Ferreira, P. (2021). An Officious Impact of Financial Innovations and ICT on Economic Evolution in china: Revealing the Substantial Role of BRI. Sustain 13 (16), 8962. doi:10.3390/su13168962

Sibande, L., Bailey, A., and Davidova, S. (2017). The Impact of Farm Input Subsidies on maize Marketing in malawi. Food Policy 69, 190–206. doi:10.1016/j.foodpol.2017.04.001

Skjeflo, S. (2013). Measuring Household Vulnerability to Climate Change-Why Markets Matter. Glob. Environ. Change 23 (6), 1694–1701. doi:10.1016/j.gloenvcha.2013.08.011

Soman, D. (2001). Effects of Payment Mechanism on Spending Behavior: The Role of Rehearsal and Immediacy of Payments. J. Consum. Res. 27 (4), 460–474. doi:10.1086/319621

Thurlow, J., Zhu, T., and Diao, X. (2012). Current Climate Variability and Future Climate Change: Estimated Growth and Poverty Impacts for zambia. Rev. Dev. Econ. 16 (3), 394–411. doi:10.1111/j.1467-9361.2012.00670.x

Wang, X., and Fu, Y. (2022). Digital Financial Inclusion and Vulnerability to Poverty: Evidence from Chinese Rural Households. China Agr. Econ. Rev. 14, 64–83. doi:10.1108/CAER-08-2020-0189

Wang, X., and He, G. (2020). Digital Financial Inclusion and Farmers' Vulnerability to Poverty: Evidence from Rural china. Sustain 12 (4), 1668. doi:10.3390/su12041668

Wang, X., and Liu, L. (2016). How County-Level Agricultural Loans and Fiscal Expenditure Impact Rural Residents’ Income in China——An Empirical Study of the Hierarchical Effect by Quantile Regression. Front. Econ. China 11 (2), 302–320. doi:10.3868/S060-005-016-0017-4

Wooldridge, J. M. (2015). Control Function Methods in Applied Econometrics. J. Hum. Resour. 50 (2), 420–445. doi:10.3368/jhr.50.2.420

Zeraibi, A., Balsalobre-Lorente, D., and Shehzad, K. (2020). Examining the Asymmetric Nexus between Energy Consumption, Technological Innovation, and Economic Growth; Does Energy Consumption and Technology Boost Economic Development? Sustain 12 (21), 8867. doi:10.3390/su12218867

Zhang, D., Li, J., Ji, Q., and Managi, S. (2021). Climate Variations, Culture and Economic Behaviour of Chinese Households. Climatic Change 9, 167. doi:10.1007/s10584-021-03145-6

Keywords: climate change adaptation, digital financial inclusion, rural, consumption, China household finance survey

Citation: He C, Qiu W and Yu J (2022) Climate Change Adaptation: A Study of Digital Financial Inclusion and Consumption Among Rural Residents in China. Front. Environ. Sci. 10:889869. doi: 10.3389/fenvs.2022.889869

Received: 04 March 2022; Accepted: 28 March 2022;

Published: 27 April 2022.

Edited by:

Li Peng, Sichuan Normal University, ChinaReviewed by:

Fei Fu, Southwest Jiaotong University, ChinaKhurram Shehzad, Southeast University, China

Jiancheng Wang, Sun Yat-sen University, China

Copyright © 2022 He, Qiu and Yu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Weisong Qiu, cWl1d2Vpc29uZzE5OTJAMTYzLmNvbQ==

Chunyan He

Chunyan He Weisong Qiu

Weisong Qiu Junlin Yu

Junlin Yu