- School of Economics and Management/Institute of “Two Mountains” theory, Huzhou University, Huzhou, China

Carbon peaking and carbon neutralization have become catalysts for the development of green finance in China. The possible risks of climate change are also being considered by an increasing number of financial institutions. Environmental pollution and deterioration have become the main drivers of China’s unbalanced and insufficient development in the new era. As a new financial model, green finance has attracted much attention from people and the society. Promoting and integrating this concept into economic transformation and ecological civilization strategies can guarantee China’s high-quality green development through economic ecology. This paper analyzes the relationship between the development of green finance and the development of economic ecology. The research conclusion is of great significance to speed up the construction of ecological civilization in China. Firstly, this paper analyses the spatial correlation between green finance and economic ecological development in China using the Moran’s index. Secondly, this paper constructs a spatial econometric model and performs a regression empirical analysis using the panel data of 30 provinces in China from 1999 to 2020 to understand the impact of green finance on China’s ecological development. Results show that green finance demonstrates strong spatial agglomeration and that the development of economic ecology maintains a stable spatial positive correlation. Moreover, the spatial difference in economic ecological development is more obvious than that in green finance development. The development of green finance not only has a significantly positive role in promoting the economic and ecological development of a certain province but also promotes the development of economic ecology in the surrounding provinces. The development of economic ecology itself generates a positive spatial spillover effect, that is, improving the economic ecological level of a province will also improve the corresponding level of the surrounding provinces.

Introduction

Given that the construction of ecological civilization is fundamental in ensuring its sustainable development, China should continuously adhere to the strategic requirement of green development. Solving the tension between ecological environment and economic development is not only a common problem facing the world today, but also a severe challenge that China’s economy must deal with in the new era. China’s systematic project of ‘carbon peak and carbon neutralization, which involves a large number of stock asset transformation and incremental asset investment, aims to reshape the country’s energy and industrial structures. Whilst China’s dependence on energy input for its economic growth has decreased, its energy consumption remains in the deceleration growth stage of ‘total increase and growth decrease’. Since the reform and opening up, China has witnessed a rapid economic development. However, such growth is accompanied by several problems, including an excessive consumption of resources and a deteriorating natural environment, which are continuously growing severe. Pressures related to environmental protection threaten the driving force of China’s economic development and severely weakens its sustainability. Such threat also tends to bring irreparable harm to the lives and health of Chinese people. The persistence of air pollution and the sudden COVID-19 outbreak reflect the serious imbalance between man and nature. Therefore, realizing high-quality economic development through economic ecology is a fundamental way for China to achieve a harmonious development between man and nature.

As the blood and core of modern economy, finance is endowed with a ‘green’ mission. China’s green finance has made strides in improving the country’s legal and policy environment, scale and volume and the construction of its market institutions. Green finance is a huge engine of economic transformation and an inevitable choice for the development of ecological economy. Such practice, as represented by green credit, has been in the global forefront. China has become the first country in the world to promote the construction of a ‘green financial system’ by the government ‘from top to bottom’. The report of the 19th National Congress of the Communist Party of China identified green finance as an important direction of China’s financial reform. Accordingly, scholars at home and abroad have focused on how to guide the flow of funds, optimize the allocation of resources, improve environmental governance and promote the ecological development of an economy through green finance. China also faces three problems that need urgent solution: 1) how to integrate the green concept into the financial industry, 2) how to improve the scale and efficiency of green finance and 3) how to obtain better prospects for the ecological development of China’s economy. Green finance can promote industrial upgrades and accelerate the transformation of economic development from traditional resource consumption growth to environment-friendly growth guided by technological innovation. Green finance can also guide the investment of social funds in green projects consistent with the maximization of social welfare and cultivation of new economic growth points. Improving green finance is critical to optimizing and upgrading China’s industrial structure and promoting the ecological development of its economy. The main task of the Chinese government is to establish a green financial environment, explore and support green financial institutions, and strengthen the green financial market.

However, research on green finance at home and abroad remains in its infancy. Despite the continuous development of green finance and economic ecology, relevant studies have mostly focused on the qualitative aspect of these topics, and empirical studies are relatively scarce. Moreover, previous studies have explained the role of green finance in promoting economic ecological development only through qualitative analysis. Empirical research is critical to improving our understanding of how green finance influences economic ecology. Therefore, this paper has important research value in both theory and reality. This paper performs a quantitative evaluation based on the connotations of green finance and economic ecology and takes spatial factors into consideration to systematically analyse and elaborate the mechanism behind the impact of green finance on economic ecology. The results of this work offer theoretical significance by providing novel ideas related to green finance and sustainable economic development. Using China’s provincial panel data, this paper empirically analyses the spatial and spillover effects of green finance on economic ecological development. The findings can help China leverage the supporting role of green finance in transforming its economic development model and have practical significance for the current development of green finance in China.

Literature Review

Review of Green Finance Research

Since its introduction in the 1980s, green finance theory has attracted the attention of scholars at home and abroad, who define such concept as a bridge that connects the financial industry to the environmental protection industry (Scholtens and Dam, 2006). Green finance promotes the protection of environmental resources and the coordinated development of economy through the operation of financial business in order to realize a sustainable development of the financial industry (Robyn et al., 2018). Green finance is a complete system with multiple institutions and links (Beck et al., 2016). This concept acts as a financial lever that achieves environmental protection goals by supporting specific industries (Taghizadeh-Hesary and Yoshino, 2019). Salazar (1998) compared the operation modes of traditional finance and green finance and found that the latter connects the financial and environmental industries, guides the investment of funds in the environmental industry, and promotes the sustainable development of an economy. Green finance aims to integrate green economy and traditional finance and invests the funds gathered from the financial market in the environmental protection industry (Carolyn, 2017). This market-based financial instrument transfers environmental risks and promotes the improvement of environmental quality (Megan and Stephen. 2019). Apart from coordinating the development between the financial industry and environmental protection economy (Jeucken, 2006), green finance also reduces the emission of environmental pollutants, improves resource utilization efficiency, mitigates climate change and supports investment and financing activities for human sustainable development (Leonidas et al., 2019). Green finance requires the financial industry to carry out their financial business based on the principles of environmental protection and sustainable development in order to realize a coordinated development of resources, environment, economy and society (Ma, 2015). This instrument provides financial support for environmental protection (Lan, 2016) and promotes the development of the economy, society and environment through a rational allocation of resources (Liu and Peng, 2019).

Green finance invests funds in low-energy-consumption and energy-saving sectors (Pasquale et al., 2018). This instrument also curbs the development of high-energy-consumption and high-pollution enterprises, stimulates the transformation of enterprise development mode and establishes a solid micro foundation for rapidly promoting economic ecological development (Sachs et al., 2019). By building an incentive mechanism for the green finance development, the government contributes to the sustainable development of the environment and economy (Bergset, 2015). Green finance can positively promote sustainable economic and social development (Gilbert and Zhao, 2017) and effectively promote China’s shift from a traditional mode of production to a new mode with low energy consumption, low pollution and high output (Yan, 2021). Improving green development level is conducive to the sustainable development of the financial industry (Liu and Liu, 2020). Green finance not only promotes the formation of an efficient industrial model and an environmentally friendly energy structure but also broadens enterprise financing channels and promotes sustainable economic development to a greater extent (Wang, 2019). This instrument not only promotes the development of energy conservation and environmental protection technologies, the adjustment of energy structures and the energy conservation and emission reduction of enterprises but also plays an important role in transforming China’s economic structure (Zhang, 2018). Financial institutions engaged in green finance business not only meet the capital needs of environmental protection projects and ecological civilization construction but also reduce their own operational risks in policy regulation and achieve sustainable development (Yu, 2020). A new approach to investing money is green investments. Green investments are part of the green economy that contributes to the sustainable development concept. Nowadays, many banks in Europe, as well as many financial institutions in general, have realized the need to change their business activities, and must pay attention to “how to invest” (Djukic et al., 2021).

The development level of green finance is primarily measured based on green financial instruments, environmental improvement and the attention of local governments to such development. Evaluating green finance from a macro perspective and examining a country’s green finance and environmental protection levels as a system are critical (OECD, 2007). By performing a questionnaire survey and staking the environmental protection attitude of the banking industry as the starting point, this study builds a 5D green finance evaluation index system and concludes that green finance will be an inevitable path for banks to achieve sustainable development (Jeucken, 2001). By measuring green finance at home and abroad, this paper analyses the changes in China’s green finance development level from 2010 to 2012 (Zeng et al., 2014) and measures the development of green finance based on the government’s environmental protection expenditures, proportion of loans from financial institutions and amount of financing invested by listed companies in energy conservation and environmental protection. This paper also empirically analyses how economic growth affects green finance in China from a broad and narrow perspective (Qiu, 2017). The development of national green credit, green stocks, green bonds, green investment and green GDP is measured based on various financial indicators of environmental protection companies, and the development level and efficiency of national, inter-provincial and regional green finance are subsequently analyzed (Zhang et al., 2018). By using a green financial development index system built based on China’s high-speed and new normal economic development stages, this paper reveals a high green development level in Central China and suggests that the entire country should learn from the green financial development policy of this region (Zhou and Tian, 2019).

Review of Economic Ecology Research

Economic ecology is a relatively new research direction, and research on the theory of economic ecology at home and abroad remains at its infancy (Managi et al., 2021). An economic development model focused on economic growth will lead to resource depletion, environmental degradation and eventually economic recession, and such problem can only be addressed through a harmonious and sustainable human, economy and environment development (Lester, 2003). Economic ecology originates from the strong demand for a harmonious economy and environment development. The ecological development of an economy follows the laws of economy and nature, coordinates the development among industries, regions, investment and consumption, synchronizes economic growth rate and quality and pursues a rational, resource-saving and environment-friendly economic progress (Xie and Cao, 2010). Economic ecology aims to develop the economy following the concept of ecology and improves the sustainability of economic development (Yuan, 2019). Economic ecology is also the only way for humans to construct an ecological civilization. People must regulate and control their natural ecosystem under the objective laws of the ecosystem and ecological process. Unlike ecological economy, economic ecology abandons the mechanistic theory centred on the logic of economize. This concept, which carries many philosophical implications, aims to integrate the development of economic laws on the premise of respecting ecological laws (Cao, 2013). Ecological economic development is an essential requirement for integrating ecological civilization construction into economic construction (Chen et al., 2015). Economic ecology aims to develop the economy whilst protecting the environment on which humans depend, which would require promoting environmental protection awareness and improving environmental protection measures throughout the economic development process (Zhou, 2017). If such process violates ecological laws and destroys the ecosystem, then economic ecology cannot meet the needs of human sustainable development (Zhang, 2020).

Economic ecology theory has only experienced more than 10 years of evolution starting from its proposal to its empirical analysis in China’s context (Wang et al., 2019). Related studies have mostly measured the development level of economic ecology from the aspects of environmental protection, energy utilization, economic development, economic structure and scientific and technological innovation (Chami et al., 2002). On the basis of the balanced relationship between regional ecological efficiency growth and environmental protection investment, this study constructs a regional ecological economic evaluation model and assumes that regional ecological efficiency can be used as an index to measure the degree of coordination between economic development and environmental protection (Guo and Guo, 2006). This study uses a regional ecological and economic comprehensive evaluation index, ecological footprint, ecological efficiency, Energy analysis and model analysis to evaluate the ecological development of a regional economy (Liu, 2009). This study also discusses the construction of an economic ecological system. According to the dynamic and regional characteristics of ecological civilization, this paper studies and constructs an index system comprising the four dimensions of growth mode, industrial structure, consumption mode and ecological governance and uses the efficacy function method to evaluate the effect of the ecological civilization construction in Jiangsu Province from 2000 to 2007 (Gao and Huang, 2010). By taking 31 provinces in China as research objects, this study constructs an ecological civilization evaluation index system comprising the four dimensions of optimal land and space layout, resource and energy conservation and intensive utilization, ecological environment protection and ecological civilization system construction and then calculates the ecological civilization development index of each province. Afterwards, this study adopts the spatial auto-correlation method to analyse the spatial distribution and evolution pattern of the development level of ecological civilization in China (Cheng et al., 2015). This study also builds a multi-index framework system for studying China’s economic ecological development from five aspects, namely, industry, park, technological innovation, county and private. Four statistical methods are employed for the quantitative measurement and analysis to test the differences and multidimensional nature of economic ecological development from various perspectives (Chen et al., 2015). This study also builds an ecological civilization evaluation index system that includes the six dimensions of economic ecology, space greening, ecological capitalization, resource intensification, environmental health and people’s well-being. The Lagrange function optimization comprehensive weight method is adopted to measure the construction level of ecological civilization in 26 provinces of China from 2013 to 2017 and to identify its driving factors (Wu, 2019). The government needs to implement certain regulations while expanding trade to minimize the negative effect of non-renewable energy consumption and should also put certain limitations on population moving from rural to urban destinations (Han et al., 2022).

Review of the Relationship Between Green Finance and Economic Ecology

Economic development brings environmental problems, as well as the pressure of economic green transformation, and finally gives birth to green finance. Researchers generally believe that green finance is an important means to promote the ecological development of an economy (Zheng, 2020). Green finance is the product of green economy development in a certain period that can also promote the sustainable development of an economy by accelerating the upgrading of its industrial structure and the transformation of its economic structure (Deng, 2008). Green finance invests social resources into environment-friendly and environmental protection industries through financial instruments and financial power. This concept also promotes the development and growth of green industries, thereby changing the economic development mode to something sustainable and ecological. The ecological development of a regional economy is the goal, and green finance is the means. The essence of green finance lies in policy guidance, which promotes the investment of social resources into green industries that protect the ecological environment and promote the ecological development of regional economies (Zhang, 2000). This research starts from the macro and micro aspects, takes green finance as an independent variable and economic development as a dependent variable, performs a regression analysis and concludes that green finance can promote sustained economic growth (Lin, 2011). Green finance also promotes the sustainable development of regional economies, and those environmental protection industries with close ties to green finance generally have good profitability and development (Li and Xia, 2014). The objective is to induce the private participation in green finance and investment and paper contributes to literature by proposing two applied frameworks, backed by theoretical models on green finance and investment based on projects size (Taghizadeh-Hesary and Yoshino, 2019). With profit-making as its fundamental purpose, a financial market promotes a continuous expansion of the green industry and generates stable economic benefits (Chen, 2020). Green finance is considered a financing method for promoting sustainable economic development, that is, the funds gathered in financial markets are invested in green sectors to shift the current economic development mode to an environment-friendly type (Gong, 2018). Based on SRI theory, study investigates the relationship between green banking practices and their direct and indirect impact on environmental performance (Rehman et al., 2021). Therefore, the scale of green economy formed by promoting the ecological development of a regional economy is a necessary guarantee for the development of green finance (Liu and Peng, 2019). The result demonstrate an inverted U-shaped relationship of the determinants of the financial system and environmental quality (Zeeshan and Afridi, 2021).

Review of Existing Research

Previous studies have often adopted ordinary panel regression analysis to investigate the impact of green finance on economic ecological development. However, these studies have ignored spatial geographical factors. In real societies, regions and provinces do not exist independently, and the economic factors among provinces are more or less related due to the influence of geographical location. Therefore, spatial factors cannot be ignored when studying real economic problems. By constructing a spatial econometric model, this paper considers spatial factors in empirically examining the impact of green finance on economic ecological development. The innovation of this paper lies in its use of an evaluation index system of green finance development and economic ecologicalisation to empirically explore the spatial effect of green finance development. The economic ecologicalisation development index is taken as the explanatory variable, whereas the green finance development index is taken as the explanatory variable. The spatial spillover effect of green finance and economic ecologicalisation is fully considered by adding spatial factors. This paper not only analyses the impact of green finance development in a certain province on ecological development of the same province’s economy but also studies how the green finance development level of surrounding provinces affects the ecological development of a province’s economy. This paper also presents a comprehensive measurement of the spatial spillover effect and has strong guiding significance for policy adjustment.

Research Framework and Methods

Mechanism of Green Finance Affecting the Ecological Development of an Economy

This paper organically combines economic ecology with green finance. Using provincial data, this paper takes green finance as the explanatory variable and economic ecology as the explanatory variable to analyze the effect of Green Finance on the development of economic ecology. Thus, this paper discusses the strong support of green finance for economic development. Green finance plays a remarkable role in promoting a low-carbon lifestyle, which can improve top-level designs, strengthen information disclosure and innovate financial products. Therefore, the government should strengthen the incentive and restraint mechanisms of green finance. Penalties should be clearly defined for behaviors and market players that violate the principle of green and low carbon, and the cost of violating related laws and regulations should be increased by restricting market access and financing and implementing other restraint means and disciplinary measures. Green finance mainly affects financial institutions through the support of government policies and the investment willingness of the public. After obtaining funds, financial institutions promote green projects and green production through capital support, capital allocation, risk dispersion and enterprise supervision, thereby promoting the ecological development of economy. The core of ecological development lies in the development of the green industry. Financial institutions evaluate enterprises with limited fields and production forms. These institutions guide the flow of social capital into high-quality environmental protection enterprises and provide financial support for green industries. Green finance can improve the environmental friendliness of enterprise production, increase the output of green industries and promote the ecological development of an economy. Capital allocation is the core function of finance. Green finance can transfer enterprises with high pollution, high consumption and overcapacity of financial resources to efficient production enterprises with low pollution and consumption. The financial market optimizes capital allocation through green finance, which can encourage enterprises to use more funds to develop new technologies and products. In this way, green finance achieves the goals of energy saving, emission reduction and clean production.

The key to ecological development lies in the green technology innovation. Technological innovation is often characterized by high risks and returns. Green finance gathers social capital to be invested in green technology R&D. Investors with relevant rights and interests reap huge profits from successful R&Ds with enterprises and endure the risks associated with R&D failure. Therefore, enterprises are confident in carrying out green technology R&D. After securing the necessary financing, given the information asymmetry between two parties, an enterprise may demonstrate slacking behaviour, which would result in the loss of investment funds. At this time, financial institutions need to supervise the financing enterprises in real time, and enterprises are required to give information feedback to financial institutions in a timely manner. Banking plays a dominant role in China’s financial market, whereas green credit is the main form of green finance. As the creditor, the bank can track and detect the capital flow of an enterprise and understand its internal management and product operation procedures. Therefore, the business behaviors of banks need to be standardized, and enterprises should be supervised when carrying out environment-friendly production using the obtained funds.

Taken together, the mechanism behind the effect of green finance on economic ecologicalisation can be summarized as follows. The financial support focuses on the provision of green industry funds. Capital allocation focuses on improving capital utilization efficiency. Risk dispersion focuses on solving the R&D challenges faced by enterprises. Supervision focuses on facilitating the green management of enterprises and pursuing ecological development.

Model Building

This paper mainly discusses the influence of green finance on the ecological development of an economy. The basic model can be expressed as

where EEit is the economic ecological development level of province i in year t, where i = 1, 2, 3 .., 30, GFit is the development level of green finance in province i in year t and Xit is another control variable that affects the level of economic ecologicalisation. The control variables involved in this research mainly include pollution emission degree, energy use efficiency, proportion of tertiary industry, urbanization rate, proportion of coal consumption and level of science and technology. εit denotes the error term.

Regions in an economic ecology demonstrate a spatial dependence. Green finance and the related control variables also show a spatial correlation effect on the ecological development of interrelation economy. All these variables may have a spatial spillover effect on the surrounding areas. Given that the spatial spillover benefits of economies have complex impact paths, merely adding control variables cannot sufficiently account for all spatial spillover effects. Therefore, this study needs to consider the spatial factors based on formula (1) and adopt the panel spatial econometric model for the empirical analysis. This study further introduces the spatial lag term of the explained variable, explanatory variable and error term to control these spatial interaction effects. The basic form of the spatial measurement model is presented as follows:

where Yit is the explained variable, which is the economic ecological development level of province i in year t, Xit is the explanatory variable, which includes 7 variables denoting the green finance development level of province i in year t and 6 control variables, μi is the individual effect, γi is the time effect, ρ and λ are the coefficients of the spatial lag term, β is the spatial interaction term coefficient, W,i is the spatial weight matrix and εit and νit are the error terms.

From the perspective of externality, the spatial econometric model considers spatial correlations to highlight the impact of factors in one region on other regions. Various spatial econometric models describe different transmission mechanisms and represent different economic meanings. Three spatial econometric models are used in this study, namely, the panel spatial auto-regressive model (SAR), which only contains the spatial auto-correlation of the explained variables, the spatial Doberman model (SDM), which adds the spatial auto-correlation term of explanatory variables based on the model, and the spatial error model (SEM), which only contains the spatial auto-correlation term of the error term. The SAR model assumes that the economic ecological level of one region affects the economic ecological development of other regions through spatial interaction (λ = 0,εit = νit,ρ≠0,β = 0). The SDM model assumes that the economic ecological development of a region is affected not only by local explanatory variables but also by the economic ecological level and explanatory variables of other regions (λ = 0,εit = νit,ρ≠0,β≠0). The SEM model assumes that the spatial effect is mainly transmitted through the error term and that the spatial spillover effect is the result of random impact (λ≠0,εit = λW, iεi+νit). These three spatial econometric models are formulated as follows:

Description of Variables

Explained Variable: Economic Ecological Development Index

The evaluation index system of economic ecology is constructed from the five dimensions of environmental health, resource conservation, economic development, structural optimization and scientific and technological progress. Environmental health is measured by three indicators, namely, pollution discharge, pollution control and environmental optimization, whereas resource conservation is measured based on energy, water and land resources. The transformation of the economic structure due to the short-term shift of economic development to an ecological direction leads to an economic downturn. Economic development is mainly reflected in the two aspects of economic growth and people’s life. Structural optimization mainly considers three levels, namely, industrial structure, urban–rural structure and energy structure. The progress of science and technology inevitably improves both resource utilization efficiency and production efficiency and can reduce the utilization of resources and pollution emissions and promote the development of economic ecology. Scientific and technological progress is quantified through scientific and technological R&D and technology use. The entropy method is used to calculate the economic ecological development index of 30 provinces, municipalities and autonomous regions (excluding Tibet, Hong Kong, Macao and Taiwan) in China from 1999 to 2020.

Explanatory Variable: Green Financial Development Index

Given that China’s green finance is still in a period of growth, various green finance works are still in the experimental stage, and some related data, apart from being difficult to obtain, have limited systematization and coherence. Fortunately, the selected indicators in this study are currently available. This study constructs a green finance development evaluation index system to evaluate the development level of green finance from the four dimensions of green credit, green investment, green insurance and government support. The ratio of interest expenditure of high-energy-consuming industries to the interest expenditure of industrial industries can indirectly express the loan scale proportion of high-energy-consuming industries, which is the performance of green credit reverse control of the development of high pollution and high consumption industries. Green investment is measured by the proportion of environmental pollution control investments in GDP and can directly reflect the development scale of green environmental protection industry and the importance of the entire society to the development of the green industry. The green insurance index is expressed as the ratio of agricultural insurance income to total agricultural output value. Given that agriculture is greatly affected by changes in the natural environment, this industry can clearly reflect the development of green insurance. Government support is reflected by the proportion of fiscal environmental protection expenditure in the general budget expenditure. Government support for environmental protection plays an important role in promoting the establishment of environmental protection enterprises, reducing environmental pollution emissions and improving the environmental awareness of the whole society.

Control Variables

The control variables selected in the study cover six aspects, namely, pollution emission degree, energy use efficiency, industrial structure, urbanization level, energy structure and scientific and technological level. The degree of pollution emission is computed as industrial sulphur dioxide emissions divided by actual GDP. Energy efficiency is computed as real GDP divided by total energy consumption. Industrial structure is computed as added value of the tertiary industry divided by GDP. Urbanization level is computed as urban population divided by total population at the end of the year. Energy structure is computed as coal consumption divided by total energy consumption. Scientific and technological level is computed as turnover of technology contracts divided by GDP.

Data Sources

A panel data of 30 provinces in China from 1999 to 2020 are used as the sample. These data are mainly collected from the China Statistical Yearbooks for years 2000–2021, the statistical yearbook of various provinces, the China Environmental Statistical Yearbook, the China Insurance Yearbook, the China Energy Statistical Yearbook and the China Science and Technology Statistical Yearbook. The missing data are calculated using the 5-year average method.

Empirical Results and Analysis

Spatial Correlation and Heterogeneity of Green Finance and Ecological Economic Development in China’s Provinces

The development level of green finance in China demonstrates some regional characteristics. Provinces in the same region show similar development trends, and provinces from different regions show differences in their green finance development level. As a financial model, green finance development depends on the real economy and traditional finance. The business promotion and operation of green finance depend on geographical factors. The development of green finance has strong spatial agglomeration and heterogeneity. Ecological economic development aims to emphasize a coordinated development of the economy and environment. Given that the economy and environment are closely related to geographical conditions, the development of economic ecology also shows obvious spatial characteristics. This study then analyses the spatial correlation between green finance and economic ecological development across 30 provinces in China. This procedure serves as an important basis for the subsequent spatial econometric analysis.

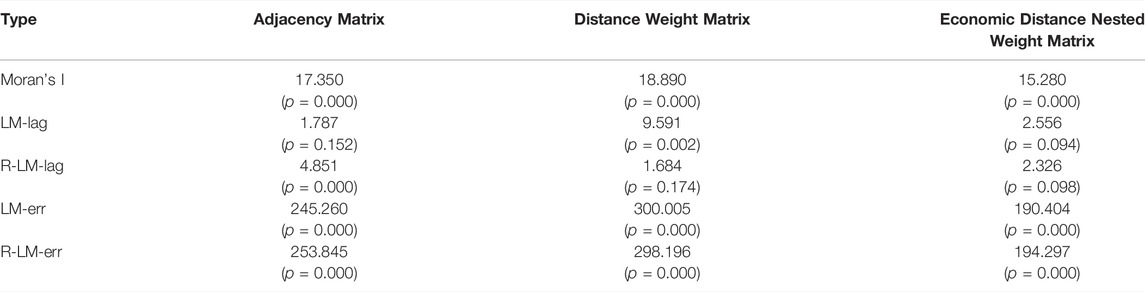

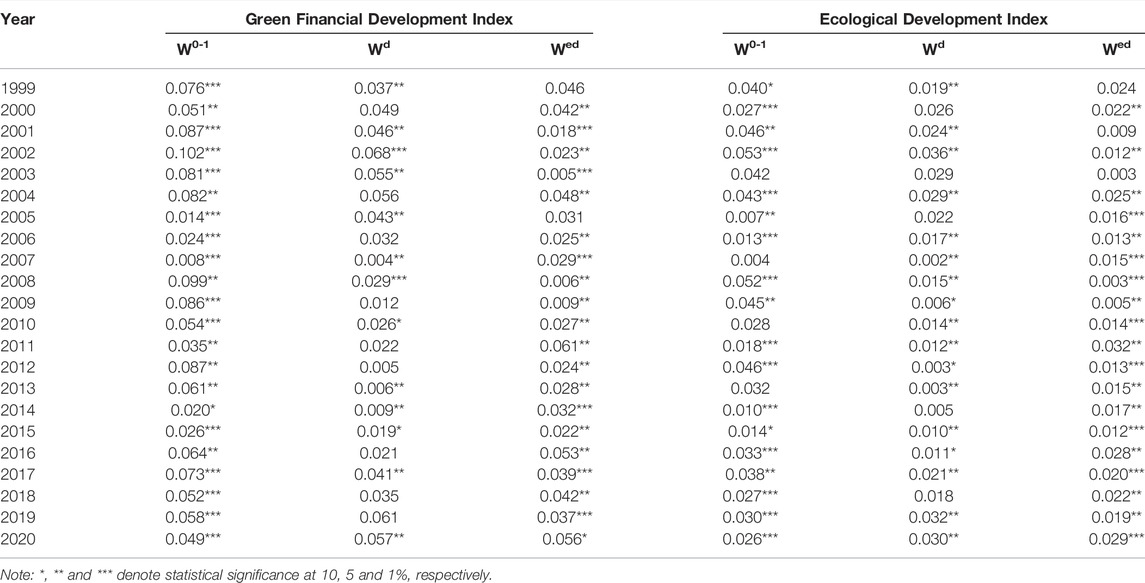

This study uses spatial auto-correlation index (Moran’s index) to measure the overall correlation between green finance and economic ecological development. The global Moran’s index ranges between –1 and 1, with an index greater than 0 indicating a positive correlation among the observed values. A larger Moran’s index corresponds to a stronger spatial positive correlation and a greater intensity of agglomeration. Meanwhile, a Moran’s index of less than 0 indicates a negative correlation, with a smaller Moran’s index indicating a stronger negative correlation of space and a lower agglomeration intensity. To set the spatial weight matrix Wij, this study uses the spatial adjacency matrix W0-1, spatial distance weight matrix Wd and economic distance nested weight matrix Wed to quantify the influence of various factors in the neighbourhood from geographic and economic aspects. Table 1 shows the Moran’s index of the spatial correlation between green finance and economic ecological development.

TABLE 1. Moran’s index of the spatial correlation between green finance and economic ecological development.

Table 1 shows that the Moran’s index of green financial development is significantly positive as a whole under any weight matrix. Therefore, the development of green finance in China shows a strong spatial positive correlation. Results for the distance weight matrix and economic distance nested weight matrix show huge differences in the spatial aggregation of green finance development across various periods. The spatial aggregation characteristics of green finance development have also weakened in recent years. Meanwhile, the Moran’s index value of economic ecological development is lower than that of green finance development. However, the Moran’s index shows a significant positive spatial correlation under the distance weight matrix. The development of green finance and economic ecology is obviously affected by geographical factors as reflected in their significant spatial correlation and strong spatial aggregation. Green finance also shows an obvious development momentum in the eastern and central regions of China. The eastern region, especially the coastal areas, also demonstrates a high level of economic and ecological development. Green finance development is shown to positively influence the development of economic ecology, thereby providing a practical basis for the spatial empirical analysis of the impact of green finance on economic ecology. A spatial correlation is also observed between China’s green finance and economic ecological development. Therefore, a spatial spillover effect is inferred between green finance and economic ecological development. Specifically, the level of green finance in a region not only affects the economic and ecological development of the region but also affects that of its surrounding regions, and vice versa. Therefore, this paper empirically investigates the impact of green finance on economic ecological development by constructing a spatial econometric model.

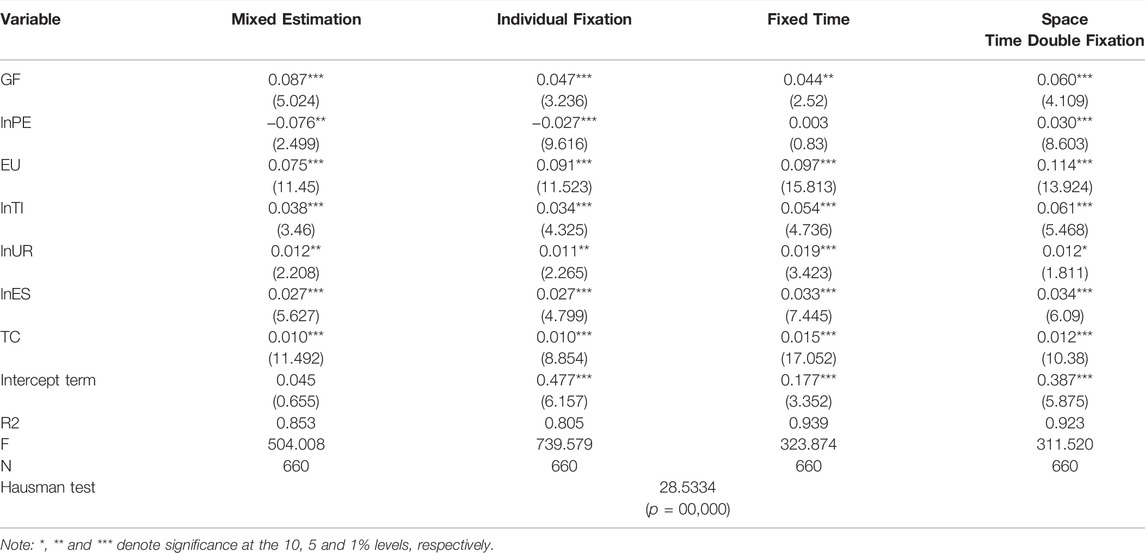

Analysis of Spatial Influencing Factors

Table 1 confirms the spatial spillover effects of the economic variables, thereby suggesting that the traditional ordinary least squares (OLS) estimation may bias the empirical results. In this case, the maximum likelihood (ML) estimation method is used for regressing the spatial econometric models. To comprehensively reflect the robustness of the parameter estimation results, the Stata software is used to estimate the model along with the empirical idea of ols-sar-sem-sdm. Given the large values of explanatory variables PE, Ti, ur and es, they are included in the regression in a logarithmic form. Table 2 shows the results of ordinary panel regression without the spatial weight matrix. The fixed effect model or random effect model is adopted for the ordinary panel regression. Results of the Hausman test support the use of the fixed effect model for the ordinary panel estimation.

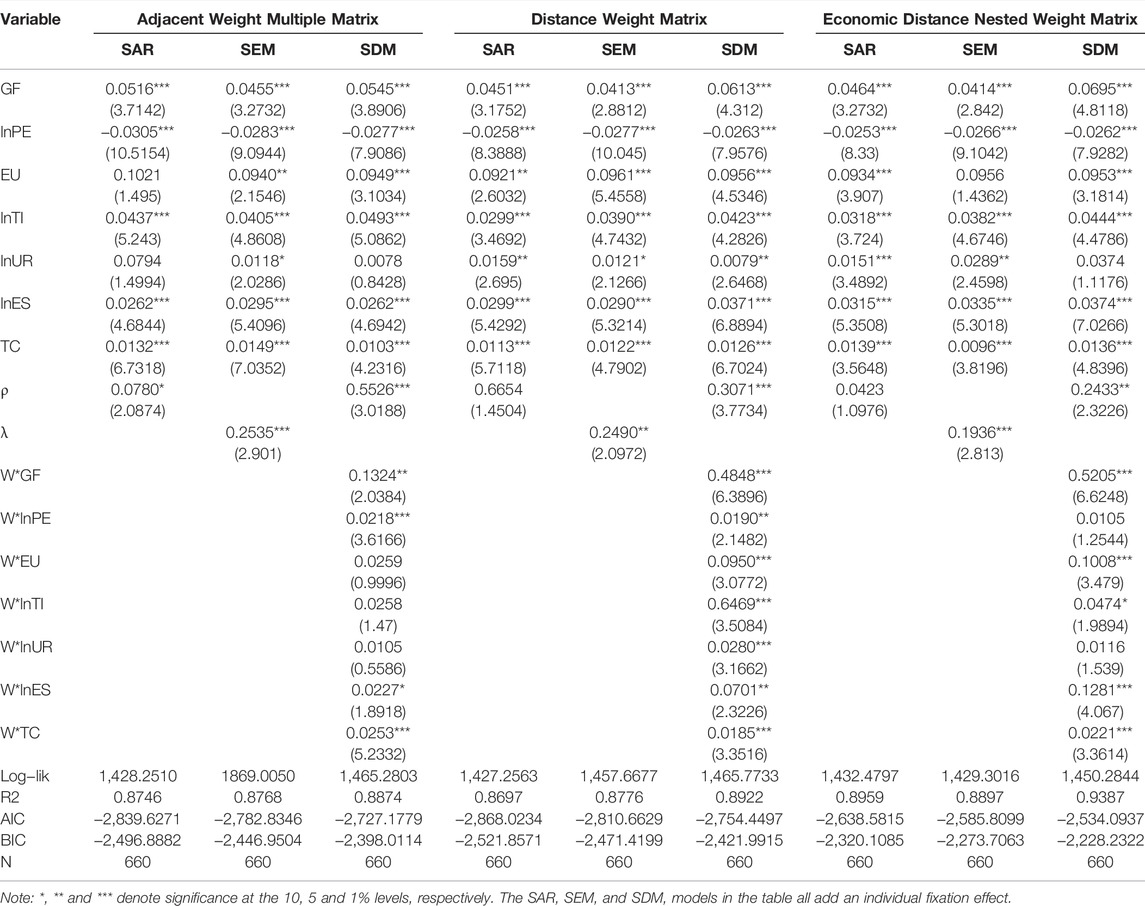

Table 2 shows that under the four regression methods of ordinary panel regression, the goodness of fit (R2) exceeds 0.8, thereby suggesting the good fitting effect of the model. Results show that the parameters of the explanatory and control variables of panel data are highly significant, and the symbols of the regression coefficients are in line with economic reality. Furthermore, the results of the mixed OLS estimation for the three weight matrices are tested by LM-lag, R-LM-lag, LM-err and R-LM-err to distinguish the advantages and disadvantages of SAR and SEM regressions. As shown in Table 3, the overall Moran’s index of these three weight matrices is significantly greater than 0, thereby indicating a significant spatial correlation. Apart from the LM-lag test of the adjacency matrix and the LM-lag and R-LM-lag tests of the distance weight matrix and the economic distance nested matrix, the other test results are significant at the 1% level. Therefore, the SEM model is more suitable than the SAR model in these three matrices. Meanwhile, results of the Hausman test for the spatial Dobbin model under the three weight matrices support the fixed effect spatial econometric model. The LR test of the SDM model also pass the significance test at the 1% level, indicating that the SDM model with fixed effect cannot be simplified into the SAR and SEM models. Therefore, the SDM model containing the explained variable and the spatial lag term of the explanatory variable is more suitable for estimating the panel data. To comprehensively reflect the robustness of the empirical results, this study also estimates the panel data using SAR and SEM models. Table 4 shows the regression results of the SAR, SEM and SDM models under the three weight matrices.

Table 4 shows that the spatial auto-regressive coefficient ρ of SDM is significantly positive under three spatial weights. An endogenous spatial interaction effect is also observed between regions. These results indicate that the development of economic ecology has significant spatial correlation characteristics, and those regions with high economic ecology development show agglomeration in space. The economic ecological development of one region also promotes that of the adjacent areas through a spatial spillover effect. The spatial auto-correlation coefficient of the SEM model λ suggests that the spatial interaction effect of the random error term is also an important factor leading to the spatial dependence of regional economic ecological development. In the case of the three spatial weight matrices, the regression coefficients of green finance development index in the SAR, SEM and SDM models are significantly positive, indicating that green finance plays a significant role in promoting economic ecological development.

Among the control variables, the degree of pollution emission and the proportion of coal consumption significantly inhibit the development of economic ecology. Meanwhile, energy efficiency, proportion of the tertiary industry and level of science and technology positively promote the development of economic ecology. In the SDM model regression, the spatial lag coefficient of the green financial development index is significantly positive under the three weight matrices, thereby suggesting that the development level of regional green finance has a significant positive spatial spillover effect on economic ecological development. The spatial lag coefficient of pollution emission is also significantly positive, which indicates that the aggravation of pollution emission in a certain area will improve the ecological level of the surrounding regional economy. This finding may be ascribed to the fact that areas with rapid economic and ecological development will transfer their heavily polluted production to adjacent areas.

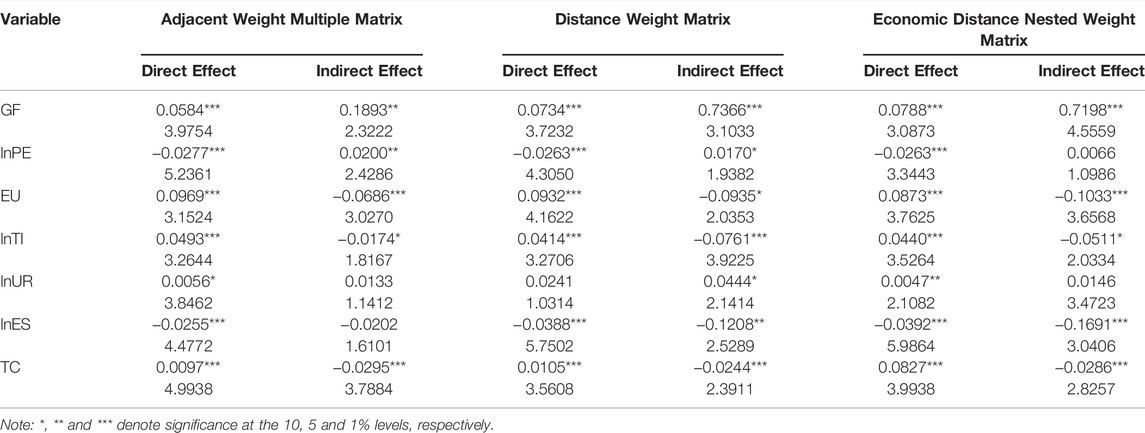

Spatial Effect Decomposition

Although Table 4 highlights a spatial dependence on the level of regional economic ecology, these results cannot fully reflect the marginal impact of green finance and various control variables on the development of economic ecology. In other words, these results cannot judge the amount of spatial spillover effect of green finance on adjacent areas. Therefore, merely relying on the point estimation results of spatial measurement to analyse the impact of explanatory variables on the explained variables and the spatial spillover effects may lead to wrong conclusions. In addition, the influence of explanatory variables on the explained variables cannot be simply analyse using regression coefficients. Therefore, this study adopts the partial differential method to compensate for the limitations of point estimation in explaining the spatial effects. The influence of the explanatory variables on the explained variables in the spatial econometric model is divided into direct and indirect effects (also called spatial spillover effect). The spatial spillover effect results from the influence of independent variables in one region on the dependent variables in the surrounding regions. Given that the R2 value of the SDM model is the highest under the three weight matrices as shown in Table 4, the direct and indirect effects in this model are further estimated. Results are shown in Table 5.

Table 5 shows that the direct effect of green financial development index on economic ecology is significantly positive in the three matrix cases. In other words, green finance significantly promotes the ecological development of an economy. Therefore, a region can accelerate the transformation of its economic development mode by innovating green financial products and increasing its green finance scale, which will eventually give birth to green enterprises, improve industrial production efficiency, promote the sustainable economic development of regions and improve the environmental friendliness of economic development. The spatial spillover effect of green finance is significantly positive across the three matrix cases, which suggests that improving the green finance development level in a region generates a positive spatial spillover impact on the economic and ecological development of the surrounding areas. Therefore, the development of green finance not only improves the economic ecological level of a region but also that of adjacent areas. By comparing the individual fixed estimation results of OLS, the direct effect coefficient of green financial development as estimated by the SDM model is greater than that estimated by OLS. Therefore, the regression results become biased when the spatial effect is not considered, consequently underestimating the direct effect of green finance on economic ecology.

For the control variables, pollution emission has a negative effect on the economic and ecological development of a province. A greater degree of pollution emissions corresponds to a lower level of economic ecology. However, pollution emission has a positive spatial spillover effect. Specifically, a higher pollution emission in a province corresponds to a higher economic ecological level in the surrounding provinces. In this case, the provinces surrounding an area with high economic and ecological level also have a high pollution emission degree. This finding, which is consistent with the spatial lag coefficient of pollution emission degree in the SDM regression, can be ascribed to the fact that the expansion and transfer of industry increases the pollution emissions in the surrounding provinces yet reduces the pollution emissions in the core province, thereby promoting the ecological economic development of the latter. However, the ‘beggar thy neighbour’ effect, which inhibits the economic and ecological development of the surrounding provinces, is also observed. The direct effect and spatial spillover effect of the proportion of coal consumption are significantly negative, thereby suggesting that reducing the proportion of coal will significantly promote the ecological development of the surrounding provinces. The above results also point to a high correlation in the energy structures of different provinces. The direct effects of energy efficiency, proportion of tertiary industry and level of science and technology are all significantly positive, whereas their spatial spillover effect is significant yet negative. In this case, increasing these three indicators will promote the economic ecological level of a province but negatively affects the economic ecological development of the surrounding provinces to varying degrees. These indicators show certain spatial limitations in promoting economic ecological development, and the relevant indicators are not enough to promote and enhance the overall economic and ecological development of a region. The links among provinces in their energy efficiency, tertiary industry development and scientific and technological innovation are also not tight enough. Given that scientific and technological innovation is relatively easy to coordinate and communicate across different provinces, technical exchanges among provinces can be further strengthened. By jointly improving the level of science and technology, the government can strive to transform the negative spatial spillover effect into a positive one. The model results for the direct and indirect effects of urbanization rate are not significant, hence suggesting that improving the urbanization level does not significantly affect the economic and ecological level of a province and its surrounding provinces probably due to the fact that increasing urbanization rate is a long-term continuous process that lags behind economic and ecological development.

Conclusion

Through a theoretical discussion about the impact mechanism of green finance on economic ecology, this paper empirically analyses the spatial evolution law and spatial spillover effect of green finance and economic ecology across 30 provinces in China by using a spatial econometric model. Results show that the development levels of green finance and economic ecology in China have greatly improved. Green finance shows a strong spatial agglomeration, and its demonstration zone shows an obvious effect. The development level of green finance has gradually evolved from ‘strong in the west and weak in the east’ to ‘strong in the east and weak in the west’. The development of economic ecology has maintained a stable spatial positive correlation. The spatial difference of China’s economic ecological development is more obvious than that of its green finance development. Ecological economic development also produces a positive spatial spillover effect. Specifically, improving the economic ecological level of a province will also increase the economic ecological level of the surrounding provinces. Green finance is an important driving force to promote sustainable economic development. Green finance plays a great role in the healthy and stable development of economy and ecology. Green finance can significantly promote the ecological development of regional economy. In the future, we can promote the ecological development of regional economy by improving the development level of green finance. However, it should also be noted that due to the great differences in the level of political, economic and cultural development among regions in China, the development of green finance and the ecological level of regional economy is relatively unbalanced. Banks lack the innovation power of green credit products. At present, the green financial products of banks are basically original products and lack innovative products. The overall development level of green finance in China is low, and the enthusiasm of enterprise departments to undertake social responsibility is not strong. The development level of domestic green finance is unbalanced, and most regions do not have a perfect green financial system. Therefore, the top-level design of financial institutions is very important.

Policy Implications

We should give full play to the regional driving role of green finance and build a perfect and multifaceted green financial system. Provinces and regions are interconnected to share information and expand the positive spatial spillover effect of green finance. The growth pole of green finance development level needs to be cultivated and leveraged to drive the development of green finance in the surrounding provinces. The rational use of green financial instruments should be encouraged, the development of green industries should be promoted and new economic growth points should be established. An efficient path for green finance also needs to be established to promote economic ecological development, to leverage the power of green finance and to realize harmony and synchronization between economic growth and economic ecological development. As an important platform for green finance, financial institutions must establish a perfect green financial credit system. A preferential green credit system can encourage enterprises to carry out green production and enhance their environmental protection awareness. The government should formulate unified green finance verification standards and create a green project library to lay a good foundation for financial institutions to issue loans and investors to invest in projects. The government should open up an exclusive channel for the mortgage guarantee of green assets and green credit secularization, so as to mobilize the enthusiasm of enterprises to invest in green industries. On the basis of giving full play to the role of the market, the government should introduce incentive policies for green industries. The government should improve the enterprise environmental information disclosure system and promote the construction of green financial infrastructure.

Research Limitations and Future Prospects

Although green finance has attracted much attention, relevant green development data and materials remain scarce. Therefore, this study merely used empirical methods and variable data, thereby limiting the depth and comprehensiveness of its empirical analysis. Although this research analyzed the spatial relationship between green financial development and economic ecological development in detail, the available data sources required for the research design are limited. Future studies should comprehensively deepen the findings of this work by using available data.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author Contributions

The author confirms being the sole contributor of this work and has approved it for publication.

Funding

This research is supported by the soft science project of Zhejiang science and technology department (fund number:2022C25024) and the Pre research project of Institute of “Two Mountains” theory (fund number:LSY2201).

Conflict of Interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Beck, T., Chen, T., Lin, C., and Song, F. M. (2016). Financial Innovation: The Bright and the Dark Sides. J. Banking Finance 72 (2), 28–51. doi:10.1016/j.jbankfin.2016.06.012

Bergset, L. (2015). The Rationality and Irrationality of Financing Green Start-Ups[J]. Administrative Sci. 5 (4), 1–26. doi:10.3390/admsci5040260

Cao, Zhenjie. (2013). Regional Development: Ecological Economy or Economic Ecology? based on the Viewpoint of Deep Ecology. [J]. Operation Management (10), 62–65. doi:10.16517/j.cnki.cn12-1034/f.2013.10.025

Chami, R., Cosimano, T. F., and Fullenkamp, C. (2002). Managing Ethical Risk: How Investing in Ethics Adds Value. J. Banking Finance 26 (9), 1697–1718. doi:10.1016/s0378-4266(02)00188-7

Chen, Wan. (2020). Green Finance Achieves New Breakthroughs in many fields [J]. Environ. economy (23), 16–23.

Chen, Xiaoxue., Xie, Qiuzhong., and Dong, Liu. (2015). Ecological Economic Development: Evidence and Path [M]. Economic Management Press.

Cheng, Jinhua., Yue, Li., and Chen, Jun. (2015). The Spatial Difference and Convergence of the Development Level of Ecological Civilization in China [J]. china Popul. Resour. Environ. 25 (5), 1–9.

Deng, Changchun. (2008). Environmental Finance: Financial Innovation in the Age of Low Carbon Economy [J]. china Popul. Resour. Environ. (18), 125–128.

Gao, Shan., and Huang, Xianjin. (2010). Construction of Regional Ecological Civilization index System Based on Performance Evaluation --Taking Jiangsu Province as an Example [J]. Econ. Geogr. 30 (5), 823–828.

Gilbert, S., and Zhao, L. (2017). “The Knowns and Unknowns of China’s Green Finance,” in The Sustainable Infrastructure Imperative: Financing for Better Growth and Development[C] (London and Washington,DC: New Climate Economy).

Gong, Hengqing. (2018). Research on the Impact of green Finance on Regional Economic Ecologicalization [J]. Market Res. (4), 32–35. doi:10.13999/j.cnki.scyj.2018.04.014

Guo, Li., and Guo, Yajun. (2006). Regional Eco-Economic Evaluation Model and Empirical Study. [J]. Technology Economy (8), 124–128.

Han, J., Zeeshan, M., Ullah, I., et al. (2022). Trade Openness and Urbanization Impact on Renewable and Non-renewable Energy Consumption in China. Environ. Sci. Pollut. Res. doi:10.1007/s11356-021-18353-x

Jeucken, M. (2001). Sustainable Finance and Banking: The Financial Sector and the Future of the Planet[M]. London: Earths Can Publications Ltd.

Lan, Yu. (2016). Research on Green Finance Development and Innovation [J]. Econ. Issues (1), 78–81. doi:10.16011/j.cnki.jjwt.2016.01.014

Leonidas, P., Kostas, F., and Panagiotis, F. (2019). Macro-economic Analysis of green Growth Policies: the Role of Finance and Technical Progress in Italian green Growth[J]. Climatic Change 160 (1).

Lin, Xiao. (2011). Research on the Development of Green Finance in China under the Background of Low Carbon Economy [D]. Guangzhou: School of Economics, Jinan University.

Liu, Sha., and Liu, Ming. (2020). Green Finance, Economic Growth and Environmental Change —— Is it Possible for Northwest China's Environmental index to Realize the Paris Commitment? [J]. Contemp. Econ. Sci. 42 (01), 71–84.

Liu, Wei. (2009). A Summary of the Research Progress of Regional Eco-Economic Theory [J]. J. Beijing For. Univ. (Social Sci. Edition) (3), 142–147.

Liu, Xia., and Peng, He. (2019). Study on the Influence of green Finance in the Economic Development of central China [J]. Ind. Technology Economy 38 (03), 76–84.

Ma, Jun. (2015). On Building China's green Financial System [J]. financial forum (5), 18–27. doi:10.16529/j.cnki.11-4613/f.2015.05.002

Managi, S., Broadstock, D., and Wurgler, J. (2021). Green and Climate Finance: Challenges and Opportunities[J]. Int. Rev. Financial Anal. (79). doi:10.1016/j.irfa.2021.101962

Megan, B., and Stephen, M. (2019). Resilience through Interlinkage: the green Climate Fund and Climate Finance Governance[J]. Clim. Pol. 19 (3), 342–353.

Pasquale, M. F., Piergiuseppe, M., and Edgardo, S. (2018). Greening of the Financial System and Fuelling a Sustainability Transition A Discursive Approach to Assess Landscape Pr Essures on the Italian Financial System[J]. Technol. Forecast. Soc. Change 127 (7), 23–37.

Qiu, Haiyang. (2017). Research on the Economic Growth Effect of Green Finance [J]. Econ. Res. Reference (38), 53–59. doi:10.16110/j.cnki.issn2095-3151.2017.38.007

Rehman, A., Ullah, I., Afridi, F.-e. -A., Ullah, Z., Zeeshan, M., Hussain, A., et al. (2021). Adoption of green Banking Practices and Environmental Performance in Pakistan: a Demonstration of Structural Equation Modelling. Environ. Dev. Sustain. 23 (9), 13200–13220. doi:10.1007/s10668-020-01206-x

Robyn, O., Geraldine, B., and Fergus, L. (2018). Enabling Investment for the Transition to a Low Carbon Economy: Government Policy to Finance Early Stage green Innovation[J]. Curr. Opin. Environ. Sustainability 31 (4), 137–145.

Sachs, J. D., Woo, W. Thye., Yoshino, N., and Hesary, F. T. (2019). Why Is Green Finance Important? Adbi Working Pape Ser. No. 917. doi:10.2139/ssrn.3327149

Salazar, J. (1998). Environmental Finance: Linking Two world[R]. Bratislava: Financial Innovations for Biodiversity.

Scholtens, B., and Dam, L. (2006). Banking on the Equator. Are Banks that Adopted the Equator Principles Different from Non-adopters? [J]. World Development 35 (8).

Taghizadeh-Hesary, F., and Yoshino, N. (2019). The Way to Induce Private Participation in green Finance and Investment[J]. Finance Res. Lett. 31, 98–103. doi:10.1016/j.frl.2019.04.016

Wang, Kangshi., Sun, Xuran., and Wang, Fengrong. (2019). Green Finance, Financing Constraint and Investment of Polluting Enterprises [J]. Contemp. Econ. Management 41 (12), 83–96.

Wang, K. (2019). Green Finance in Industrial Transformation: Driving Factors, Mechanism and Performance Analysis [D]. Shandong University.

Wu, Xuxiao. (2019). Evaluation of Regional Ecological Civilization Construction Level and its Driving Factors [J]. Reg. Econ. Rev. (04), 134–142. doi:10.14017/j.cnki.2095-5766.20190715.004

Xie, Gaodi., and Cao, Shuyan. (2010). The Process of Ecological Economy and Economic Ecologicalization in Development and Transformation [J]. J. resource Sci. 32 (04), 782–789.

Yan, R. (2021). Econometric Research on the Effect of green Financial Development Supporting Industrial Structure Transformation and Upgrading in China [D]. Jiangxi university of finance and economics.

Yu, Haiping. (2020). Path Selection of Commercial Banks to Develop Green Financial Business [J]. Knowledge Economy (01), 45–46. doi:10.15880/j.cnki.zsjj.2020.01.027

Yuan, Kai. (2019). Study on the Influence of Green Finance on Ecological Development of Regional Economy and Countermeasures [J]. Public Investment Guide (06), 24–26+28.

Zeeshan, M., and Afridi, F. (2021). Exploring Determinants of Financial System and Environmental Quality in High-Income Developed Countries of the World: the Demonstration of Robust Penal Data Estimation Techniques[J]. Environ. Sci. Pollut. Res. 28, 61665–61680. doi:10.1007/s11356-021-15105-9

Zeng, Xuewen., Liu, Yongqiang., Man, Mingjun., and Shen, Qilang. (2014). Measurement and Analysis of the Development Degree of green Finance in China [J]. J. Yan 'an Cadre Coll. China (6), 112–121.

Zhang, Dunfu. (2000). Research on Regional Economic Cooperation and Regional Division of Labor [J]. Changjiang Forum (6), 16–19.

Zhang, Jian. (2020). An Empirical Study on Green Finance Supporting Ecological Economic Development in Western China [D]. Lanzhou University of Finance and Economics.

Zhang, Jing. (2018). The Impact of green Finance on China's Economic Restructuring and Policy Recommendations [J]. Shanghai energy conservation (10), 764–770. doi:10.13580/j.cnki.fstc.2018.09.017

Zhang, Lili., Xiao, Liming., and Gao, Junfeng. (2018). Measurement and Comparison of the Development Level and Efficiency of green Finance in China —— Based on the Microscopic Data of 1040 Public Companies [J]. China Sci. Technology Forum (9), 100–112+120. doi:10.13580/j.cnki.fstc.2018.09.017

Zheng, L. (2020). Evaluation of the Quality and Effect of China's green Financial Policy [D]. Jilin University.

Zhou, Shiwen. (2017). Research on the Ecological Development Path of China's Economy from the Perspective of Marx's Ecological Economic Thought [D]. Lanzhou University of Technology.

Keywords: green finance, economic ecology, sustainable development, spatial effect, spatial econometric model

Citation: Wu G (2022) Research on the Spatial Impact of Green Finance on the Ecological Development of Chinese Economy. Front. Environ. Sci. 10:887896. doi: 10.3389/fenvs.2022.887896

Received: 02 March 2022; Accepted: 15 March 2022;

Published: 05 April 2022.

Edited by:

Munir Ahmad, Zhejiang University, ChinaReviewed by:

Mubeen Abdur Rehman, The University of Lahore, PakistanIrfan Ullah, Nanjing University of Information Science and Technology, China

Copyright © 2022 Wu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Guosong Wu, cGxveWJveTQzOUAxMjYuY29t

Guosong Wu

Guosong Wu