- 1School of Business and Economics, University Putra Malaysia, Seri Kembangan, Malaysia

- 2School of Economics and Management, University of Chinese Academy of Sciences, Beijing, China

- 3Chinese International College, Dhurakij Pundit University, Bangkok, Thailand

- 4School of Economics and Management, Xinjiang University, Urumqi, China

- 5Center for Innovation Management, Xinjiang University, Urumqi, China

The existing literature show that there are uncertainty about the impact of environmental regulation on technological progress, and the digital financial inclusion is closely related to environmental regulation and technological progress. Therefore, the aim of this paper is to study the effect of environmental regulation on the volatility of technological progress with digital financial inclusion as the threshold variable by using the System GMM method and the dynamic threshold model. The sample employed in this paper is collected from 30 provinces in China from 2011 to 2018. The findings show that: first, environmental regulation insignificantly promotes the volatility of technological progress; second, the interaction term between environmental regulation and digital financial inclusion significantly inhibits the volatility of technological progress; third, taking digital financial inclusion as the threshold variable, there is an inverted U-shaped relationship between environmental regulation and the volatility of technological progress. In addition, this paper uses the law of entropy generation to explain the theoretical mechanism of this study. The empirical results of this paper emphasize that digital financial inclusion is of great significance to improve the efficiency of China’s environmental regulation and maintain the stability of technological progress, which is conducive to accelerating the green transformation of China’s economy. Therefore, the state should introduce relevant policies to support and promote the digitalization and inclusion of finance, so as to help improve China’s environmental quality.

1 Introduction

The problem of ecological environment is also a cosmic problem (Krichevsky and Levchenko, 2021; Tang et al., 2022; Wang J. et al., 2022). Up to now, the Earth is the only habitat within the scope of human cognition to survive and reproduce. Then we can believe that human beings are temporarily in a closed system relative to the universe. According to the law of entropy generation (Clausius, 1854), in a closed system, heat always flows from high-temperature objects to low-temperature objects, and under the premise of no external force to do work, all natural things will move from order to disorder, and invalid energy, that is, “entropy” will irreversibly fill the memory of the system (Bejan, 2002; Sekulic, 2009; Mistry et al., 2011; Lucia, 2012). In order to obtain a higher quality of life, human beings develop economy by consuming a large number of limited natural resources, but it leads to the gradual imbalance of ecological environment (Danish et al., 2019; Zafar et al., 2019; Yang et al., 2022b). The discharge of waste gas, waste water and solid waste is gradually increasing, which makes the ecosystem of the whole Earth chaotic (Kronenberg, 2004). Because there is a vacuum environment outside the Earth’s atmosphere, it is difficult to dissipate heat through space (Houghton and Firor, 1995; Philander, 2018; Altarhouni et al., 2021; Qashou et al., 2022). At the same time, global warming has led to frequent extreme weather in recent years (Abumunshar et al., 2020; Habeşoğlu et al., 2022; Samour et al., 2022). For example, the temperature of 38°C in some parts of the Arctic circle has led to the melting of frozen soil, which may release ancient bacteria. According to the report released by the National Oceanic and Atmospheric Administration (NOAA), the average level of CO2 in May 2021 was 419.13 parts per million, an increase of nearly 50% compared with the industrial era 300 years ago, while the world is still emitting CO2 at the rate of 40 billion tons per year. It has to be said that the destruction of the natural environment has become a stepping stone for China’s rapid economic development (Zhang et al., 2019; Yang et al., 2020; Yang X. et al., 2021). According to the data released by BP statistical review of world energy, in 2019, China’s original energy consumption reached 141.7 EJ, an increase of 4.4% over the previous year, and currently maintains the highest growth rate in the world (Cao J. et al., 2021; Cheng et al., 2021). At present, China’s CO2 emissions have accounted for about 29% of global emissions, and continue to increase (Cao S. et al., 2021; Ren et al., 2022).

In the whole relatively isolated Earth system, the increase of ecological environment damage is one of the external manifestations of the increase of entropy (Diaz-Mendez et al., 2013), that is, the disorder is gradually obvious. In addition, due to the strong externality of environmental pollution, there is often an asymmetry between the subjects of environmental protection cost expenditure and the subjects benefit from environmental protection (Que et al., 2018). Therefore, in a closed information environment, environmental uneconomic behavior is more likely to aggravate the entropy growth rate of ecological environment. So how can we resist entropy generation and make the system from disorder to order? First, open the system, exchange materials and information with the outside world (Lloyd, 1989), stay away from the equilibrium state, and form a “Dissipative Structure” (Segel and Jackson, 1972), so as to break the closed loop of multiple sub-level ecological environment damage (Addiscott, 1995; Popovic, 2014). Secondly, human beings can act as a processor to combat entropy generation through continuous work. For example, the state forcibly controls energy consumption and pollution by environmental regulation. According to the Paris Agreement, the world must reduce carbon emissions to 25 billion tons of CO2 equivalent by 2030. On 22 September 2020, the Chinese President Xi Jinping proposed for the first time at the 75th United Nations General Assembly that “China will adopt stronger policies and measures to reach the peak of CO2 emissions by 2030 and achieve carbon neutrality by 2060” (Yang et al., 2022a). The emphasis on the weak sustainable development centered on “human” has gradually shifted to the strong sustainable development centered on “nature” (Zhang, 2018). However, according to the hypothesis that “perpetual motion machine” does not exist (Lucia, 2018), any energy involved in the work process of resisting entropy increase cannot be 100% converted, and some “energy” will be lost, which will still lead to entropy increase or disorder. Therefore, what are the characteristics of environmental regulation as the work of human realize entropy reduction?

The subject of China’s environmental regulation is the Ministry of environmental protection and local environmental management departments (Tang et al., 2019). The main purpose of environmental regulation is to correct the externalities brought to the environment by the behavior of enterprises, organizations and individuals (Zhou et al., 2021). The Environmental Protection Law of the People’s Republic of China (for Trial Implementation) promulgated in 1979 covers about 26 laws, more than 50 regulations, 800 standards and more than 660 normative legal documents, mainly covering pollution prevention and control and natural resource protection (Cai et al., 2020). However, China’s environmental regulation has a dual management system, resulting in decentralization of power and weakening of function (Zhou, 2020; Wen, 2020). The real leadership of local environmental protection management organizations at all levels belongs to local governments at all levels. In addition, the environmental protection departments of various ministries and commissions are under the jurisdiction of various ministries and commissions and the central ministry of environmental protection, but the central ministry of environmental protection are often restrained by provincial governments (Wu et al., 2020a). For a long time in the past, Gross Domestic Product (GDP) was tied to the performance appraisal of local government officials (Ren et al., 2021). In order to pursue GDP growth, local governments have launched a “political competition,” for example, through lowering the threshold of environmental regulation to attract enterprises with “high energy consumption, high pollution and high output.” This “bottom-by-bottom competition” phenomenon of environmental regulation makes the environmental supervision of local governments fluctuate (Cumberland, 1981), thus the entropy reduction effect of environmental regulation has been weakened.

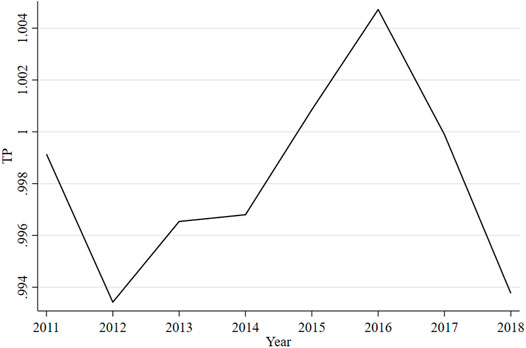

Some scholars have found that environmental regulation has heterogeneous effects on technological progress under different regulation intensity. First, the effect of following cost. According to the neoclassical economic theory, when the intensity of environmental regulation is low, enterprises often achieve compliance by purchasing energy-saving and pollutant discharge equipment (Lanoie et al., 2011; Hao et al., 2020), thus crowding out the expenses of enterprises for technology research and development (R&D) and producing “offset effect” on technological progress (Wang et al., 2018). Second, the effect of innovation compensation. According to Porter hypothesis (Porter and Linde, 1995; Zhao et al., 2022), when the intensity of environmental regulation is appropriately strengthened, environmental regulation seriously occupies the production cost of enterprises, and enterprises will realize technological progress through technological innovation to compensate the compliance cost (Wu et al., 2020b). Third, the effect of cross-border transfer. When the intensity of environmental regulation is too high, enterprises can no longer afford the huge cost of compliance, so enterprises will choose to flee to areas with low intensity of environmental regulation and high government preference (Ye et al., 2021; Lv et al., 2021), but they may also withdraw from the market, so as to maximize their own interests. Therefore, does environmental regulation promote the volatility of technological progress? Figure 1 shows the trend of technological progress. Technological progress can promote the equal product curve to move to the origin by changing the marginal substitution rate and marginal productivity among factors (Li et al., 2019), so as to improve the total factor productivity (TFP). Therefore, when technological progress fluctuates, it will inevitably affect the stability of TFP, so as to enhance the risk of economic development.

Although most studies find that there is uncertainty in the impact of environmental regulation on technological progress, few scholars study how to alleviate this volatility. In other words, how to reduce the “energy loss” in the process of combating entropy generation? Most studies are not combined with the financing environment of enterprises. Because the nature of the enterprise itself is profit driven (Qastharin, 2016), whether it is cost compliance, innovation compensation or cross-border transfer of polluting industries, enterprises are seeking to minimize compliance costs and maximize operating benefits (Ouyang et al., 2020). The choice of enterprises in this game process affects the impact direction of environmental regulation on technological progress. However, digital financial inclusion can improve the efficiency of alleviating the financing constraints of enterprises with the help of big data, cloud payment, blockchain, Internet, and artificial intelligence (Naumenkova et al., 2019), especially for small and medium-sized enterprises (SMEs), which is conducive to alleviating the “cost offset” effect and the “Cross-border transfer” effect of enterprises caused by too low or too high intensity of environmental regulation. In addition, digital information technology is a powerful instrument to improve the efficiency of entropy reduction, so as to reduce or slow down the “energy loss” in the process of processor work (Wu et al., 2021; Hao et al., 2022). For example, machine deep learning uses multi-layer neural network to extract eigenvalues from a group of chaotic information data and efficiently summarize and output ordered information (Xin et al., 2018; Dargan et al., 2020), so as to improve the transformation process from disorder to order. Therefore, how does the interaction between environmental regulation and digital financial inclusion affect the volatility of technological progress? Although by examining the interaction between environmental regulation and digital financial inclusion, we can understand their mutual moderating effect in the process of affecting the volatility of technological progress, in practical application, the specific threshold effect of digital financial inclusion is still uncertain, and then it cannot help the government to accurately formulate effective environmental regulation policies to avoid the economic risks caused by technological fluctuations. Therefore, what is the threshold effect of digital financial inclusion in the relationship between environmental regulation and the volatility of technological progress? The logical framework of this paper is as follows: the literature shows that local government competition causes the fluctuation of environmental regulation intensity, and the change of environmental regulation intensity will cause the fluctuation of technological progress. However, the previous literature has not clarified how to solve this volatility, so this paper will solve the shortcomings of the current research from the perspective of digital financial inclusion. In addition, the interpretation of this study from the theoretical perspective of entropy generation will broaden the depth and breadth of environmental research in the future. To sum up, the research objective of this paper is to study the effect of environmental regulation on the volatility of technological progress based on China’s inter provincial panel data from 2011 to 2018, using the System GMM method and the dynamic threshold model, taking digital financial inclusion as the threshold variable, and finally analyze it based on entropy growth theory.

The contributions of this study are as follows. First, this study defines the relationship between environmental regulation and the volatility of technological progress. Second, this study examines the impact of the interaction between digital financial inclusion and environmental regulation on reducing the volatility of technological progress. Third, this research examined the dynamic threshold effect of digital financial inclusion on the nexus of environmental regulation and the volatility of technological progress, which is conducive to the construction of a mechanism to avoid the volatility of technological progress in practical application. Fourth, this study analyzes the dynamic impact of the interaction between digital financial inclusion and environmental regulation on the volatility of technological progress from the perspective of the law of entropy generation for the first time. Fifth, this paper applies the entropy generation theory to analyze the relationship between environmental regulation and the volatility of technological progress for the first time, and believes that the work against entropy increase (environmental regulation) will inevitably produce additional “energy loss” (the volatility of technological progress), which is consistent with the research conclusion of this paper. Finally, this paper proposes that digital financial inclusion can reduce the additional “energy loss” caused by this entropy reduction activity, so as to suppress the volatility of technological progress. Therefore, this study will help to raise the efficiency of environmental regulation, promote the stability of the country’s overall technological progress, and maintain the stable development of China’s green economy.

The rest layout of this paper is: the second section reviews previous important literature and deduces research hypotheses; the third section describes the research model and variables; the fourth section reports and analyzes the estimated results; the fifth section presents the conclusion and policy recommendations.

2 Literature Review

2.1 The Law of Entropy Generation and the Dissipative Structure Theory

Clausius (1854) first proposed the concept of the law of entropy generation, that is, in a closed system, heat flows from high-temperature objects to low-temperature objects, from order to disorder and irreversible. For an isolated system that cannot exchange material and energy with the outside world, the entropy will eventually reach the maximum state, that is, “Heat Death” in physics. However, an open system can interact with the outside world and release the entropy generated within the system, so as to reduce the entropy and reach an orderly state. In 1944, Erwin Schrödinger mentioned in “What is life ?” that life lives on negative entropy (Perutz, 1987). Based on the study of open systems, Prigogine and Nicolis (1967) founded the dissipative structure theory. This theory points out that systems with openness, nonlinearity and far from equilibrium will constantly exchange material and energy with the outside world, and finally, when the external conditions reach a certain threshold, the system can be transformed from disorder to spatio-temporal and functional ordered structure through internal self-organization. The law of entropy generation and the dissipative structure theory are also applicable to eco-environmental systems. For instance, Diaz-Mendez et al. (2013) employs the law of entropy generation to study freshwater ecosystems eutrophication, and conducted a measurement of entropy generation.

2.2 Environmental Regulation and the Volatility of Technological Progress

Technological progress is an vital factor affecting the contradiction between economic growth and the destruction of natural ecological environment (Welsch and Ochsen, 2005; Fisher-Vanden et al., 2006; Sanstad et al., 2006; He and Wang, 2015; Chen et al., 2019; Cansino et al., 2019; Li et al., 2019; Yi et al., 2020; Wang L. et al., 2022). Meadows et al. (2013) suggests in the “limits to growth” that technological progress plays an important role in the coordinated development of economic growth and natural environment. Environmental regulation is the behavior of human beings to reduce the damage to the ecological environment in economic production activities, and it can also be regarded as the work of human beings against entropy generation in the relatively isolated Earth ecosystem. Environmental regulation can affect the natural ecological environment system by affecting technological progress. The government is generally the subject of the formulation, implementation and supervision of environmental regulation policies (Ye et al., 2021; Zhong et al., 2021). A number of researchers examined the relationship between environmental regulation and technological progress (Barbera and McConnell, 1990; Rubashkina et al., 2015; Wang et al., 2018; Deng et al., 2019; Ye et al., 2021), but they have not reached a consistent conclusion.

Some researches insist that environmental regulation hinders technological progress (Gollop and Roberts, 1983; Barbera and McConnell, 1990; Popp, 2003; Lanoie et al., 2011). On the one hand, in the process of China’s economic development, enterprises usually adopt the mode of pollution before treatment to deal with environmental regulation (Cai et al., 2020), and improve productivity through mature non green production technology, so as to offset the cost of compliance. Under the constraints of lower environmental regulations, enterprises will purchase environmental protection equipment to deal with pollution emissions or purchase existing technologies based on the principle of cost (Wang et al., 2018), which will have a crowding out effect on technology R&D and curb technological progress. On the other hand, there are also possibility that, high-intensity environmental regulation will lead to “green paradox” (Wang and Wei., 2020), which will lead enterprises to directly give up compensation for technological innovation and escape to regions with more looser regulation policy, and finally aggravate the damage to environmental quality. Other academics support that environmental regulation will enhance technological progress (Porter and Linde, 1995; Kassinis and Vafeas, 2006; Rubashkina et al., 2015; Yuan et al., 2017; Deng et al., 2019). According to Porter hypothesis, with the enhancement of environmental regulation, the purchase of existing cleaner production equipment and technology will consume more production costs. Therefore, enterprises will choose to compensate the compliance cost through technology research and development, so as to promote technological progress. The above literature reveals that the impact of environmental regulation on technological progress is uncertain, and the main reason is the change of regulation intensity. The volatility of environmental regulation is partly due to the “political competition” of local governments, that is, the “bottom-by-bottom competition” of environmental regulation in order to simply improve the growth of local GDP (Ye et al., 2021), which eventually leads to loose and tight environmental regulation policies (Rongwei and Xiaoying, 2020; Cao et al., 2021). Based on the above literature review, this study proposes Hypothesis 1: environmental regulation intensifies the volatility of technological progress.

2.3 Environmental Regulation and Digital Financial Inclusion

At present, most scholars study the relationship between environmental regulation and technological progress based on the characteristics of environmental regulation, and draw inconsistent conclusions, which makes environmental regulation aggravate the volatility of technological progress as a whole. However, few scholars introduce financial indicators as endogenous regulatory variables into the model to investigate the dynamic effect of the interaction between corporate financing constraints and environmental regulation on the volatility of technological progress, which will lead to the deviation of estimation results. What’s more, 75% of China’s non-financial listed companies face financing difficulties and seriously restrict their development (Claessens and Tzioumis, 2006; Wang L. et al., 2022). Wang L. et al. (2022) studied China’s environmental policy under financing constraints based on the new Keynesian method. The results show that the impact of environmental policy on environmental indicators is significantly affected by enterprise loan constraints. Because enterprises with large financing constraints usually respond to environmental policies based on their own cash flow (Rajan and Zingales, 1998; Wang L. et al., 2022), so when enterprises are faced with strong environmental target policies, enterprises with financing difficulties will reduce the expenditure dedicated to environmental pollution control and achieve compliance by reducing energy consumption. Therefore, the pollution emission of enterprises will decrease with the decline of output.

What’s more, Ye et al. (2021) found that sufficient financial support given by cities to enterprises can promote enterprises to reduce pollution emissions through technological innovation. Poncet et al. (2010) and Cull et al. (2015) pointed out that private enterprises face greater financing constraints than state-owned enterprises. Similarly, Ma and Li (2021) used the fixed effect model to study the impact of environmental regulation on technological innovation of China’s emerging marine enterprises from 2013 to 2018, and investigated the moderating role of government subsidies. The results show that in state-owned enterprises, government subsidies have a positive and insignificant moderating effect on the relationship between environmental regulation and technological innovation, but in non-state-owned enterprises, government subsidies have a significant negative moderating effect on the relationship between the two. It is worth noting that there is rent-seeking behavior between the government and enterprises, which can easily lead to enterprise innovation inertia. In addition, due to the information asymmetry between the government and enterprises, the impact of government subsidies on enterprise technology innovation may be inefficient. It is also worth noting that Fard et al. (2020) conducted an empirical study and found that banks are more sensitive to loans to enterprises with strong environmental regulation, which will increase the loan interest rate.

The above literature shows that enterprise financing is an important regulatory variable affecting national environmental regulation and enterprise technological progress, but there are the following problems: information asymmetry may lead to the inertia of enterprise technological innovation, the strong financing constraints faced by private enterprises, and banks are more sensitive to the loans of enterprises with strict environmental supervision. In order to avoid risks, Chinese banking institutions usually refuse to lend to enterprises with high environmental responsibility (He et al., 2021), because the projects used by enterprises for green technology R&D have long payback period and high risk (Cao et al., 2021). Although the state will give banks a certain risk guarantee fund as a risk aversion method to encourage banks to actively support loans to SMEs, bank executives will still refuse loan applications from such enterprises in order to avoid personal non-performing loan records. In addition, the positive moderating effect of stock market and equity financing on the nexus of environmental regulation and enterprise technological progress is not strong. On the one hand, the market entry audit procedure of China’s stock market is complex and in a young stage of development. On the other hand, in China, the investment period of private equity and venture capital in general enterprises is about 5–7 years (Zhang, 2018), while the investment period of enterprises with heavy green technology R&D tasks is about 7–10 years (Tan et al., 2013). Therefore, SMEs under the constraints of environmental regulation usually face financing difficulties.

Therefore, advanced information screening technology, high-efficiency and low threshold financial service model and multi-channel financing model will help to amplify the positive effect of environmental regulation on technological progress. The financial service characteristics of “digital + inclusive” of digital financial inclusion will help to alleviate the financing constraints of SMEs with high energy consumption and high pollution, which are greatly impacted by environmental regulation, thus affecting the uncertain interference of environmental regulation on technological progress. Here, digital financial inclusion plays a buffer role for the impact of changes in environmental regulation intensity on such enterprises, and provides low threshold, low-cost and efficient financing channels for enterprises’ choice of technological innovation (Jia et al., 2021). In addition, digital financial inclusion disperses the risk of enterprise technological innovation guided by environmental regulation through broader financing channels. At the technical level, digital financial inclusion provides more comprehensive, detailed and real enterprise information for government departments to formulate more efficient flexible environmental regulation policies through digital information technology (Demertzis et al., 2018; Naumenkova et al., 2019; Awan et al., 2021), so as to reduce the ineffective regulation caused by information asymmetry.

Therefore, to a certain extent, digital financial inclusion enhances the open ecological environment system by improving the openness of information, reduces the “energy loss” of environmental regulation against the entropy generation in natural ecological environment, and improves the efficiency of information from disorder to order. At the financial inclusion level, digital financial inclusion can cover more customers in the financial “long tail” market (Bachas et al., 2018; Gomber et al., 2018), including a large number of SMEs with high energy consumption, high pollution and poor financing ability, which are greatly impacted by the fluctuation of environmental regulation. Therefore, the change of environmental regulation will have a very sensitive impact on the decision-making of their production investment, environmental pollution control investment and green technology R&D investment. To sum up, this paper proposes Hypothesis 2: the interaction between environmental regulation and digital financial inclusion alleviates the volatility of technological progress.

2.4 Environmental Regulation, Digital Financial Inclusion and the Volatility of Technological Progress

Although digital financial inclusion may alleviate the positive effect of environmental regulation on the volatility of technological progress, it is still impossible to judge the range of the value of digital financial inclusion that environmental regulation will improve or reduce the volatility of technological progress if only studying the interaction between environmental regulation and digital financial inclusion, so the government can not judge the inflection point between environmental regulation and the volatility of technological progress according to a reference value in practical application. Therefore, it is necessary to introduce digital financial inclusion into the dynamic threshold model as an endogenous threshold variable. Part of researchers hold that the nexus of environmental regulation and technological progress is nonlinear (Boyd and McClelland, 1999; Yang et al., 2020). By employing the provincial data of China from 2004 to 2015, Wang et al. (2018) conducted an empirical study using the spatial Durbin model and found that there is a U-shaped nonlinear relationship between environmental regulation and all green factors. Moreover, Yang Z et al. (2021) studied the mediating effect of green technology in the relationship between environmental regulation and carbon concentration by using advanced SBM model, factor analysis method and nonlinear mediating effect model. The results show that there is an inverted U-shaped nonlinear relationship between environmental regulation and green technology.

However, the above literature does not consider the dynamic threshold of digital financial inclusion. Some scholars have found that the relationship between environmental regulation and technological progress is affected by financial development (Zhou and Du, 2021; Wang J. et al., 2022). Based on the data of Chinese listed companies from 2011 to 2017, He et al. (2021) designed a comprehensive model to investigate the relationship between environmental regulation, financial constraints and technological innovation. The results show that lower financial constraints help environmental regulation have a positive effect on technological innovation. Consequently, this paper proposes the Hypothesis 3: taking digital financial inclusion as the threshold variable, there is an inverted U-shaped relationship between environmental regulation and the volatility of technological progress.

3 Methodology

3.1 Model Specification

In order to clarify the relationship between ER and the VTP, according to the System GMM (Generalized method of moments) two-step estimation method, this paper constructs the following dynamic panel regression model.

In Eq. 1,

What’s more, for investigating the mutual moderating effect of ER and DFII on VTP, the interaction of ER and DFII (

In addition, in order to determine the threshold effect of DFII between ER and the VTP, this paper constructs the following dynamic threshold model with reference to Seo et al. (2019).

In Eq. 3,

3.2 Estimation Method

Firstly, in order to clarify the impact of environmental regulation and digital financial inclusion on the volatility of technological progress, this paper uses the System GMM two-step method to estimate Eqs 1–3. Introducing the first lag term of the explained variable (VTP) into the regression model makes the model have dynamic interpretation ability, but there may be endogenous problems in the model. In this case, Arellano and Bond (1991) proposed a difference GMM estimation method, that is, strongly invoking instrumental variables to derive moment conditions can eliminate the endogenous problem of the model, but weak instrumental variables may occur under the condition of limited samples. Based on this, the System GMM two-step method can estimate the original model and the difference transformed model, and then reduce the deviation of estimation. However, as the number of estimation periods increases, the instrumental variables of System GMM will increase greatly. Therefore, this paper uses System GMM two-step for estimation (Roodman, 2009). Moreover, the standard error of the estimated value of System GMM two-step may have an obvious decline deviation, resulting in a significant increase in the coefficient of the estimated value, but Windmeijer (2005) can solve this problem well.

Secondly, in order to investigate the relationship between environmental regulation and the volatility of technological progress with digital financial inclusion as the threshold variable, this paper estimates Eq. 3 with reference to the estimation method of dynamic threshold model proposed by Seo et al. (2019). The panel threshold regression model proposed by Hansen (1999) is widely used, but his model is static. In order to keep the estimator consistent, covariates are assumed to be strongly exogenous, but this does not match many practical application cases. However, the dynamic threshold model designed by Seo and Shin (2016) allows the first-order lag variables of the explained variables and the endogeneity of the threshold variables. The command (xthreg) of Wang (2015) can calculate Hansen’s estimator, but it is inconsistent under the setting of fixed effect estimator. However, the command (xthenreg) of Seo et al. (2019) can give consistent and asymptotically normal estimates. What’s more, they proposed a faster method to test the linearity. linearity tests are able to test the validity of the nonlinear relationships. In addition, the command can report the p value to ensure the validity of the threshold value. This command can also regress the static and dynamic model using the static option (Hao et al., 2021). Compared with the previous threshold model, the model used by Seo et al. (2019) is relatively simple and can allow the endogeneity of explanatory variables and threshold variables under the condition of providing linearity test.

3.3 Variable Description and Data Source

3.3.1 Explained Variable

3.3.1.1 The Volatility of Technological Progress

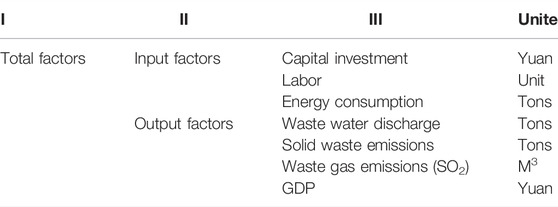

First step, measure the index of technological progress. Some scholars measure technological progress by indicators such as the number of patent applications and R&D expenditure (Keller, 2010; Yang X. et al., 2021), but these measurement methods are too single and may have deviation due to the lag of technological progress. Because technological progress can move the equal product curve to the origin by changing the marginal substitution rate of factors or factor productivity, this paper calculates technological progress based on TFP that considering economic and environmental indicators, so as to improve the accuracy and comprehensiveness of estimating technological progress. Table 1 presents the composition of total factors, including input and output factors.

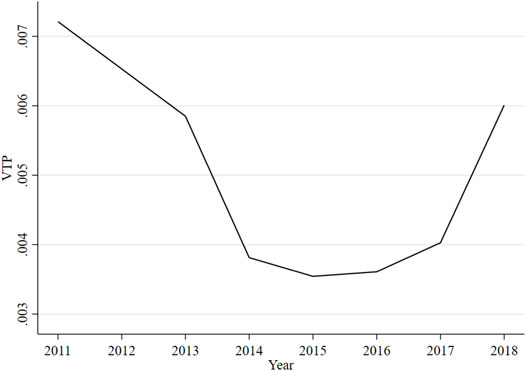

According to the DEA–Malmquist index method (Färe et al., 1994), this paper firstly calculates the TFP and further decomposes it into technical efficiency change index (EFFCH) and technical change index (TECH). What’s more, technology change index (TECH) still can be decomposed into neutral technology progress (NTP), output biased technological change (OBTP) and input biased technological change (IBTP) (Färe et al., 1997). This study uses MaxDEA software to measure the index. Figure 2 shows the trend of average provincial volatility of input biased technological progress in 2011–2018. It can be seen from the figure that the volatility of input biased technological progress changed greatly from 2011 to 2018, showing a U-shaped trend, and there was an obvious rebound from 2016 to 2018. Therefore, this paper mainly studies the volatility of input biased technological progress, which is regarded as the volatility of technological progress in this study.

Second step, calculate the volatility of technological progress (VTP). According to (Rongwei and Xiaoying, 2020; Cao J. et al., 2021; Wang et al., 2021), this study measures the volatility of technological progress (VTP) by calculating the 2 year’s moving standard deviation of technological progress (TP).

3.3.2 Explanatory Variables

3.3.2.1 Environmental Regulation

ER (Environmental regulation) is calculated by the proportion of the total industrial pollution control investment in the industrial added value (Xie and Liu 2019).

3.3.2.2 Digital Financial Inclusion Index

The index of digital financial inclusion this paper employed is collected from the Institute of Digital Finance, Peking University (Geng and He, 2021; Su et al., 2021). Digital Financial Inclusion Index consists of three dimensions. Table 2 presents the construction of digital financial inclusion index.

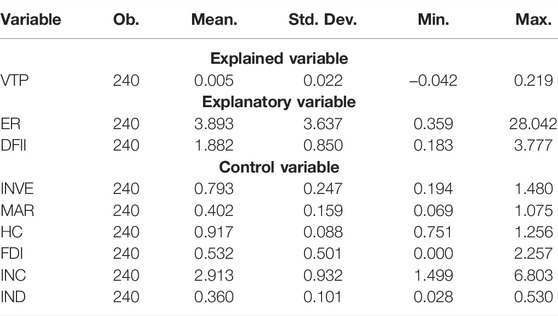

3.3.3 Control Variable

The control variables used in this paper are: INVE (Capital Investment), MAR (Marketization), HC (Human Capital), FDI (Foreign Direct Investment), INC (Income), IND (Industry). INVE (Investment) is calculated by the share of social fixed asset investment in GDP (Botev et al., 2019). MAR (Marketlization) is equal to the number of private sector employees divided by total employees (Lin and Zhu, 2019); HC (Human capital) is represented by the years of education per capita (Law and Singh, 2014). Because human capital can affect R&D ability, technological innovation ability and labor productivity, in the green transformation stage, human capital investment has an important impact on the relationship between policy change, enterprise technological progress and income volatility; FDI (Foreign direct investment) is measured by capital directly invested by foreign investors. FDI can break the limited scale of China’s domestic financial resources and the unreasonable rules of the distribution mechanism, expand the scale of financial markets and promote the development of high-productivity sectors (Yang Z et al., 2021). In addition, FDI enriches the financing channels of enterprises and lowers the financing threshold of enterprise technology R&D activities, thus affecting the stability of technological progress. INC (Income) is denoted by disposable income per capita of urban residents (Acheampong, 2019); IND (Industrialization) is calculated by the share of industrial sector added value in GDP (Yue et al., 2018). Table 3 statistically describes the variables used in this paper. The software used in this paper are stata 16 and MaxDEA.

3.3.4 Data Source

This paper employs panel data from 30 provinces (Beijing, Tianjin, Hebei, Shanxi, Inner Mongolia, Liaoning, Jilin, Heilongjiang, Shanghai, Jiangsu, Zhejiang, Anhui, Fujian, Jiangxi, Shandong, Henan, Hubei, Hunan, Guangdong, Guangxi, Hainan, Chongqing, Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang) in China from 2011 to 2018, and National Bureau of Statistics, China Environmental Statistics Yearbook, Institute of Digital Finance, Peking University, CElnet statistics Database and WIND Database are the main data source.

4 Result Analysis

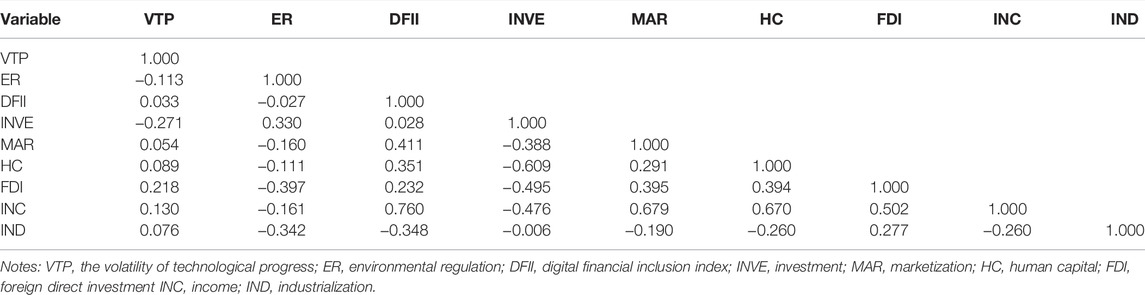

Before the main regression analysis, this paper first conducted a correlation test on the variables used, and the results are presented in Table 4. The results show that environmental regulation and digital financial inclusion are positively correlated with the volatility of technological progress, but their interaction terms are negatively correlated with the volatility of technological progress.

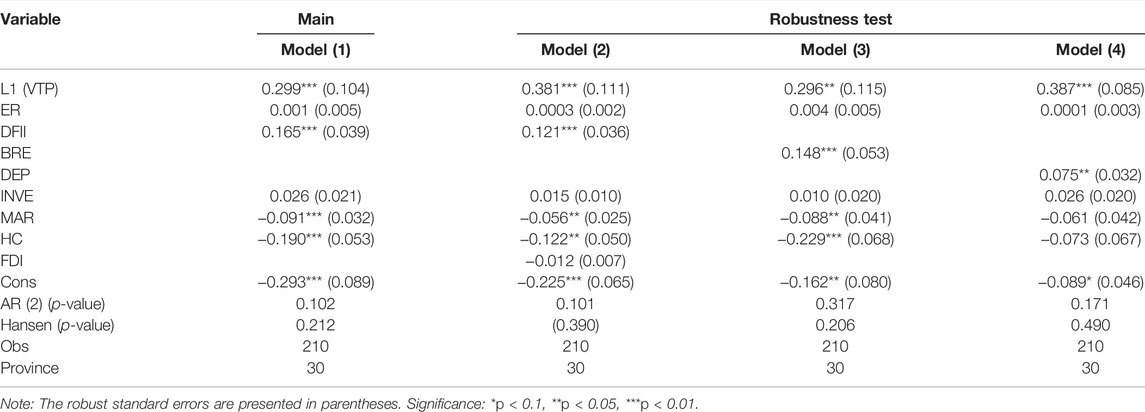

Table 5 mainly reports the dynamic panel regression results of ER and DFII on VTP. Among them, Model (1) is the main regression result, while Model (2)–Model (4) is the robustness test result. Model (2) tests the robustness of the regression results by adding the control variable FDI. Model (3) and Model (4) replace the explanatory variables with BRE and DEP respectively for robustness test. In addition, the p-values of AR (2) in Table 6 indicate that there are no second-order serial correlation in the regression equations, so it is reasonable to use a dynamic regression model. Moreover, the p-values of Hansen test show that there are no over identification of instrumental variables in the models. The results showed that L1VTP could significantly promote VTP, thus this means that avoiding the volatility of technological progress timely and reasonably can slow down the long-term volatility of technological progress and avoid the transmission amplification effect in the time dimension. What’s more, the effect of ER on VTP was not significantly positive. Although the above shows that the change of ER intensity will cause the fluctuation of technological progress, the overall ER intensity in China is still insufficient, the change cycle is long and the change range is small, so the impact on VTP is not significant. Thus, hypothesis 1 is confirmed. In addition, the results show that DFII has a positive and significant effect on VTP. On the one hand, when the income level is stable, DFII increases the purchasing power of small and medium-sized enterprises. Therefore, the investment in technology R&D has increased significantly, promoting technological progress. On the other hand, in the absence of ER’s impact on DFII, DFII prefers technology R&D projects to maximize the interests of enterprises, while there is relatively little support for green technology R&D. Compared with green technology R&D with large investment, long cycle and high risk, capital has a stronger leverage on technology R&D with small investment, short cycle and low risk. What’s more, the robustness test results of Model (3) and Model (4) show that BRE and DEP can significantly promote VTP. In addition, it is found that the regression coefficient of BRE is greater than that of DEP. The main reason is that with the improvement of network security technology and the change of people’s concept (Lin and Liao, 2017; Ali et al., 2020), the number of network payment users has increased significantly (Liébana-Cabanillas et al., 2014). In addition, due to the large proportion of users, scattered segments and small loan amount in the financial “long tail” market, the expansion of the coverage of digital financial inclusion can meet more market needs (Geng and He., 2021). However, as the concept of DFII is relatively new and the development is still in its infancy (Liu et al., 2021), the financial products covered still need to be improved, some functions are not perfect and the user demand is relatively single.

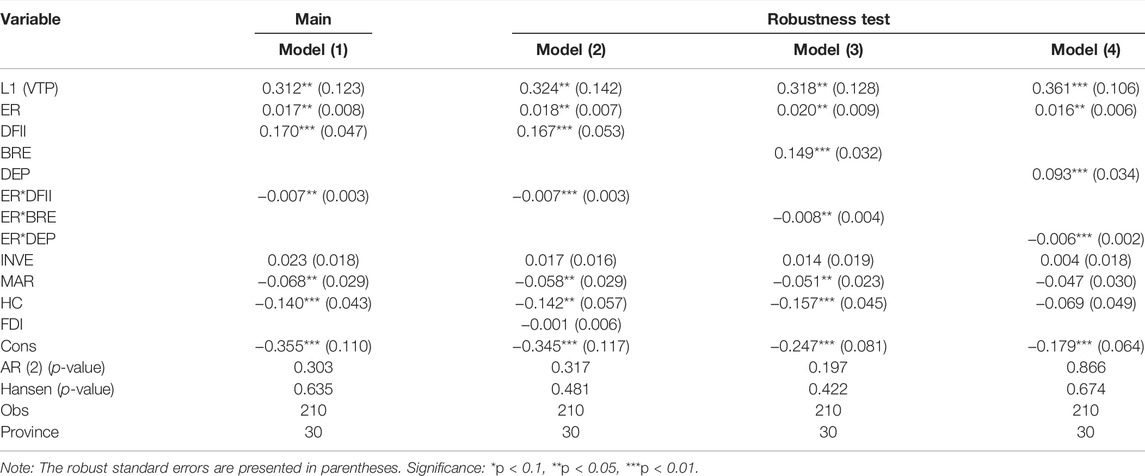

Table 6 shows the dynamic panel regression results of the interaction items of ER and DFII on VTP. Among them, Model (1) is the main regression result. Model (2) tests the robustness of the regression results by adding the control variable FDI. Model (3) and Model (4) replace the explanatory variables with BRE and DEP respectively for robustness test. The results of AR (2) and Hansen’s p value show the rationality of dynamic model setting and instrumental variable selection. The results show that the interaction term of ER and DFII significantly inhibits the volatility of VTP. In Model (1), the coefficient of ER*DFII is significantly negative at the 5% level. As mentioned in the section of literature review, in the process of interaction, this two term can moderate each other. DFII mitigates the impact of ER intensity change on VTP, while ER promotes DFII to guide enterprises to increase investment in green technology R&D, thus inhibiting VTP to some extent. Environmental regulation is human’s work against the entropy generation of natural ecosystem, and it mainly reduces human’s damage to the ecological environment by promoting the technological progress of enterprises (Yang et al., 2020; Lv et al., 2021). However, because digital financial inclusion will alleviate financing constraints to a certain extent to improve technological progress, so the interaction between environmental regulation and digital financial inclusion can further enhances the openness of the ecological environment system. Moreover, digital financial inclusion reduces the “energy loss” of environmental regulation in the process of combating entropy generation through lower information cost and inclusive financing channels, that is, it suppresses the volatility of technological progress. Therefore, the Hypothesis 2 provided before is proved. What’s more, the coefficients of MAR and HC in Table 6 are significant and negative, which indicate that the process of marketization and the improvement of human capital can restrain the volatility of technological progress.

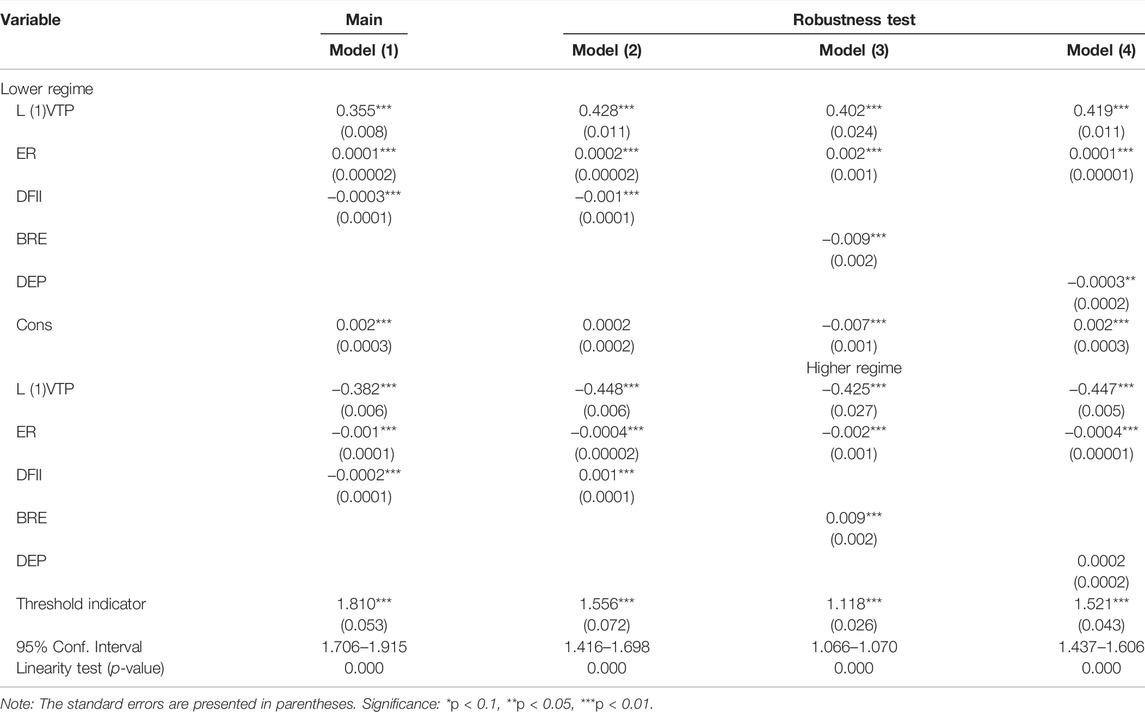

Table 7 provides the results of the dynamic threshold effect of ER on the VTP under the influence of DFII. Model (1) provides the main regression results. Model (2)–Model (4) presents the results of the robustness test. Based on the main regression, this section tests the robustness of the regression results by adding new control variables and replacing the threshold variables. The results show that there is an inverted U-shaped relationship between ER and VTP with DFII as the threshold variable. When the estimated value of the threshold variable DFII is ≤ 1.810, ER will aggravate the VTP at the significance level of 1%. At this time, the regression coefficient of ER is 0.0001. When the estimated value of the threshold variable DFII is >1.810, ER will significantly curb the VTP, and the coefficient of ER is −0.001. Due to the p-value of threshold indicator is significant at the level of 1%, so the threshold value is valid. Moreover, the p-value of linearity test also proved that the relationship between ER and VTP is nonlinear.

In addition, Model (2) proved the robustness of the results by adding new control variable. Model (3) in Table 7 shows that there is an inverted U-shaped relationship between ER and VTP with BRE as the threshold variable. When the estimated value of the threshold variable BRE is ≤ 1.118, ER will significantly promote the VTP, and the regression coefficient of ER is 0.002, which is significant at the level of 1%. When the estimated value of the threshold variable BRE is >1.118, ER will significantly inhibit the VTP, and the regression coefficient is −0.002. Model (4) in Table 7 show that with DEP as the threshold variable, there is an inverted U-shaped relationship between ER and VTP. When the estimated value of the threshold variable DEP is ≤ 1.521, ER will significantly increase the VTP, and the regression coefficient of ER is 0.0001. When the estimated value of the threshold variable DEP is >1.521, ER will significantly ease the VTP, and the regression coefficient of ER is −0.0004. Therefore the Hypothesis 3 proposed in the previous section is demonstrated.

5 Conclusion and Recommendations

This paper employs the China’s provincial (30 provinces) panel data in 2011–2018 and uses System GMM two-step method and dynamic threshold model to study the relationship between environmental regulation and the volatility of technological progress, the effect of the interaction between environmental regulation and digital financial inclusion on the volatility of technological progress, and the threshold effect of digital financial inclusion on the relationship between environmental regulation and technological progress. In addition, this paper also analyzes the operating mechanism of environmental regulation, digital financial inclusion and the volatility of technological progress within the theoretical framework of the law of entropy generation. This paper answered three questions: does environmental regulation cause the volatility of technological progress? Can the interaction between environmental regulation and digital financial inclusion alleviate the volatility of technological progress? At what threshold can digital financial inclusion avoid the volatility of technological progress caused by environmental regulation? Since technological progress is an important endogenous variable to promote the transformation from traditional economy to green economy, stable and sustainable technological progress can promote the sustainability of green growth. This study has reference significance for improving the efficiency of environmental regulation, maintaining the stability of technological progress and accelerating the green transformation of China’s economy. The results show that, first, environmental regulation insignificantly promotes the volatility of technological progress. These findings are consistent with Jiang et al. (2020), who argue that reasonable environmental regulation can facilitate and reward firms for technological innovation through the integration of available resources, which also contribute new evidence for smoothing out fluctuations in technological progress through reasonable moderation of environmental regulations. Second, the interaction between environmental regulation and digital financial inclusion significantly decrease the volatility of technological progress. Thirdly, taking digital financial inclusion as the threshold variable, there is an inverted U-shaped relationship between environmental regulation and the volatility of technological progress. Indeed, many scholars have examined the link between environmental regulation and the volatility of technological progress. However, most of them have failed to examine the possible impact of digital financial inclusion on its framework. Therefore, this study provides new empirical evidence to the existing literature by analyzing the threshold and interaction effects of digital financial inclusion on environmental regulation.

Consequently, this paper concludes the policy recommendations: first, the central government should avoid only taking GDP as the performance evaluation standard of local government officials, so as to prevent the fluctuation of environmental regulation intensity caused by “bottom-by-bottom competition” and “political competition” of local governments; second, China’s environmental protection departments should master the core power of environmental supervision and avoid power differentiation, so as to ensure the effective implementation of environmental regulation policies; third, the formulation of environmental regulation policies should consider the financial affordability or financing constraints of enterprises, so as to avoid the “technological innovation offset” effect and “cross-border escape” effect caused by too low or too high intensity; fourth, the state should encourage the development of digital financial inclusion in terms of coverage breadth and use depth, so as to fulfil the financing support of digital financial inclusion for green transformation of SMEs, improve the resistance of enterprises to changes in the intensity of environmental regulation, and promote the stability and sustainability of technological progress; fifth, environmental regulation should guide digital financial inclusion support enterprises to invest more funds in green technology R&D, so as to promote green technological progress; sixth, the development degree of digital financial inclusion can be used as one of the important reference indexes for the government to reasonably formulate environmental regulation policies and avoid technological fluctuations.

The limitations of this study include: firstly, this paper only studies the Chinese sample, and the same problem may also appear in other countries, thus the next step should expand the research sample; secondly, based on the theory that environmental regulation, as an entropy decreasing behavior of human beings against the entropy increase of natural environmental system, will still produce entropy increase, this paper only analyzes the research mechanism from the theoretical level of the law of entropy generation, but does not calculate the value of entropy generation in the impact of environmental regulation on the volatility of technological progress, nor quantify the effect of digital financial inclusion on minimizing the entropy generation of environmental regulation, but it has reference significance for future research. Therefore, future studies can quantify entropy increases in environmental systems by constructing new models.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding authors.

Author Contributions

JC: conceptualization, validation, investigation, writing-original draft, visualization. SL: conceptualization, validation, resources, DW: writing-review and editing, supervision, and funding acquisition. XT: writing-original draft, investigation, visualization, and validation. XY: writing-original draft, investigation, visualization, and validation. YF: writing-review and editing, supervision, and funding acquisition. All authors contributed to the article and approved the submitted version.

Funding

This work was supported in part by the Ministry of Science and Technology of China under Grant 2020AAA0108400, in part by the National Natural Science Foundation of China under Grant 71825007, in part by the Strategic Priority Research Program of CAS under Grant XDA2302020 and the graduate research and innovation project of Xinjiang University (Nos. XJ2019G005, XJ2020G020, XJ2021G013, and XJ2021G014).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abumunshar, M., Aga, M., and Samour, A. (2020). Oil Price, Energy Consumption, and CO2 Emissions in Turkey. New Evidence from a Bootstrap ARDL Test. Energies 13 (21), 5588. doi:10.3390/en13215588

Acheampong, A. O. (2019). Modelling for Insight: Does Financial Development Improve Environmental Quality? Energy Econ. 83, 156–179. doi:10.1016/j.eneco.2019.06.025

Addiscott, T. M. (1995). Entropy and Sustainability. Eur J Soil Sci. 46 (2), 161–168. doi:10.1111/j.1365-2389.1995.tb01823.x

Ali, O., Ally, M., Clutterbuck, Y., and Dwivedi, Y. (2020). The State of Play of Blockchain Technology in the Financial Services Sector: A Systematic Literature Review. Int. J. Inf. Manag. 54, 102199. doi:10.1016/j.ijinfomgt.2020.102199

Altarhouni, A., Danju, D., and Samour, A. (2021). Insurance Market Development, Energy Consumption, and Turkey's CO2 Emissions. New Perspectives from a Bootstrap ARDL Test. Energies 14 (23), 7830. doi:10.3390/en14237830

Arellano, M., and Bond, S. (1991). Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev. Econ. Stud. 58 (2), 277–297. doi:10.2307/2297968

Awan, U., Shamim, S., Khan, Z., Zia, N. U., Shariq, S. M., and Khan, M. N. (2021). Big Data Analytics Capability and Decision-Making: The Role of Data-Driven Insight on Circular Economy Performance. Technol. Forecast. Soc. Change 168, 120766. doi:10.1016/j.techfore.2021.120766

Bachas, P., Gertler, P., Higgins, S., and Seira, E. (2018). Digital Financial Services Go a Long Way: Transaction Costs and Financial Inclusion. AEA Pap. Proc. 108, 444–448. doi:10.1257/pandp.20181013

Barbera, A. J., and McConnell, V. D. (1990). The Impact of Environmental Regulations on Industry Productivity: Direct and Indirect Effects. J. Environ. Econ. Manag. 18 (1), 50–65. doi:10.1016/0095-0696(90)90051-y

Bejan, A. (2002). Fundamentals of Exergy Analysis, Entropy Generation Minimization, and the Generation of Flow Architecture. Int. J. energy Res. 26 (545), 565. doi:10.1002/er.804

Botev, J., Égert, B., and Jawadi, F. (2019). The Nonlinear Relationship between Economic Growth and Financial Development: Evidence from Developing, Emerging and Advanced Economies. Int. Econ. 160, 3–13. doi:10.1016/j.inteco.2019.06.004

Boyd, G. A., and McClelland, J. D. (1999). The Impact of Environmental Constraints on Productivity Improvement in Integrated Paper Plants. J. Environ. Econ. Manag. 38 (2), 121–142. doi:10.1006/jeem.1999.1082

Cai, X., Zhu, B., Zhang, H., Li, L., and Xie, M. (2020). Can Direct Environmental Regulation Promote Green Technology Innovation in Heavily Polluting Industries? Evidence from Chinese Listed Companies. Sci. Total Environ. 746, 140810. doi:10.1016/j.scitotenv.2020.140810

Cansino, J. M., Román-Collado, R., and Molina, J. C. (2019). Quality of Institutions, Technological Progress, and Pollution Havens in Latin America. An Analysis of the Environmental Kuznets Curve Hypothesis. Sustainability 11 (13), 3708. doi:10.3390/su11133708

Cao, J., Law, S. H., Samad, A. R. B. A., Mohamad, W. N. B. W., Wang, J., and Yang, X. (2021). Impact of Financial Development and Technological Innovation on the Volatility of Green Growth—Evidence from China. Environ. Sci. Pollut. Res. 28 (35), 48053–48069. doi:10.1007/s11356-021-13828-3

Cao, S., Nie, L., Sun, H., Sun, W., and Taghizadeh-Hesary, F. (2021). Digital Finance, Green Technological Innovation and Energy-Environmental Performance: Evidence from China's Regional Economies. J. Clean. Prod. 327, 129458. doi:10.1016/j.jclepro.2021.129458

Chen, J., Wang, S., Zhou, C., and Li, M. (2019). Does the Path of Technological Progress Matter in Mitigating China's PM2.5 Concentrations? Evidence from Three Urban Agglomerations in China. Environ. Pollut. 254, 113012. doi:10.1016/j.envpol.2019.113012

Cheng, Y., Awan, U., Ahmad, S., and Tan, Z. (2021). How Do Technological Innovation and Fiscal Decentralization Affect the Environment? A Story of the Fourth Industrial Revolution and Sustainable Growth. Technol. Forecast. Soc. Change 162, 120398. doi:10.1016/j.techfore.2020.120398

Claessens, S., and Tzioumis, K. (2006). Measuring Firms’ Access to Finance. Washington, DC: World Bank, 1–25.

Clausius, R. (1854). Ueber eine veränderte Form des zweiten Hauptsatzes der mechanischen Wärmetheorie. Ann. Phys. Chem. 169, 481–506. doi:10.1002/andp.18541691202

Cull, R., Li, W., Sun, B., and Xu, L. C. (2015). Government Connections and Financial Constraints: Evidence from a Large Representative Sample of Chinese Firms. J. Corp. Finance 32, 271–294. doi:10.1016/j.jcorpfin.2014.10.012

Danish, M. A., Baloch, M. A., Mahmood, N., and Zhang, J. W. (2019). Effect of Natural Resources, Renewable Energy and Economic Development on CO2 Emissions in BRICS Countries. Sci. Total Environ. 678, 632–638. doi:10.1016/j.scitotenv.2019.05.028

Dargan, S., Kumar, M., Ayyagari, M. R., and Kumar, G. (2020). A Survey of Deep Learning and its Applications: a New Paradigm to Machine Learning. Arch. Comput. Methods Eng. 27 (4), 1071–1092. doi:10.1007/s11831-019-09344-w

Demertzis, M., Merler, S., and Wolff, G. B. (2018). Capital Markets Union and the Fintech Opportunity. J. financial Regul. 4 (1), 157–165. doi:10.1093/jfr/fjx012

Deng, J., Zhang, N., Ahmad, F., and Draz, M. U. (2019). Local Government Competition, Environmental Regulation Intensity and Regional Innovation Performance: An Empirical Investigation of Chinese Provinces. Ijerph 16 (12), 2130. doi:10.3390/ijerph16122130

Diaz-Mendez, S. E., Sierra-Grajeda, J. M. T., Hernandez-Guerrero, A., and Rodriguez-Lelis, J. M. (2013). Entropy Generation as an Environmental Impact Indicator and a Sample Application to Freshwater Ecosystems Eutrophication. Energy 61, 234–239. doi:10.1016/j.energy.2013.09.042

Fard, A., Javadi, S., and Kim, I. (2020). Environmental Regulation and the Cost of Bank Loans: International Evidence. J. Financial Stab. 51, 100797. doi:10.1016/j.jfs.2020.100797

Färe, R., Grifell‐Tatjé, E., Grosskopf, S., and Knox Lovell, C. A. (1997). Biased Technical Change and the Malmquist Productivity Index. Scand. J. Econ. 99 (1), 119–127.

Färe, R., Grosskopf, S., Norris, M., and Zhang, Z. (1994). Productivity Growth, Technical Progress, and Efficiency Change in Industrialized Countries. Am. Econ. Rev. 84 (1), 66–83.

Fisher-Vanden, K., Jefferson, G. H., Jingkui, M., and Jianyi, X. (2006). Technology Development and Energy Productivity in China. Energy Econ. 28 (5-6), 690–705. doi:10.1016/j.eneco.2006.05.006

Geng, Z., and He, G. (2021). Digital Financial Inclusion and Sustainable Employment: Evidence from Countries along the Belt and Road. Borsa Istanb. Rev. 21 (3), 307–316. doi:10.1016/j.bir.2021.04.004

Gollop, F. M., and Roberts, M. J. (1983). Environmental Regulations and Productivity Growth: The Case of Fossil-Fueled Electric Power Generation. J. political Econ. 91 (4), 654–674. doi:10.1086/261170

Gomber, P., Kauffman, R. J., Parker, C., and Weber, B. W. (2018). On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inf. Syst. 35 (1), 220–265. doi:10.1080/07421222.2018.1440766

Habeşoğlu, O., Samour, A., Tursoy, T., Ahmadi, M., Abdullah, L., and Othman, M. (2022). A Study of Environmental Degradation in Turkey and its Relationship to Oil Prices and Financial Strategies: Novel Findings in Context of Energy Transition. Front. Environ. Sci. 10, 876809. doi:10.3389/fenvs.2022.876809

Hansen, B. E. (1999). Threshold Effects in Non-dynamic Panels: Estimation, Testing, and Inference. J. Econ. 93 (2), 345–368. doi:10.1016/s0304-4076(99)00025-1

Hao, Y., Ba, N., Ren, S., and Wu, H. (2021). How Does International Technology Spillover Affect China's Carbon Emissions? A New Perspective through Intellectual Property Protection. Sustain. Prod. Consum. 25, 577–590. doi:10.1016/j.spc.2020.12.008

Hao, Y., Guo, Y., and Wu, H. (2022). The Role of Information and Communication Technology on Green Total Factor Energy Efficiency: Does Environmental Regulation Work? Bus. Strat. Env. 31 (1), 403–424. doi:10.1002/bse.2901

Hao, Y., Wu, Y., Wu, H., and Ren, S. (2020). How Do FDI and Technical Innovation Affect Environmental Quality? Evidence from China. Environ. Sci. Pollut. Res. 27 (8), 7835–7850. doi:10.1007/s11356-019-07411-0

He, X. G., and Wang, Z. L. (2015). Energy Biased Technology Progress and Green Growth Transformation——An Empirical Analysis Based on 33 Industries of China. China Ind. Econ. (2), 50–62. (In Chinese). doi:10.19581/j.cnki.ciejournal.2015.02.006

He, Y., Ding, X., and Yang, C. (2021). Do environmental regulations and financial constraints stimulate corporate technological innovation? Evidence from China. J. Asian Econ. 72, 101265. doi:10.1016/j.asieco.2020.101265

Houghton, J., and Firor, J. (1995). Global Warming: The Complete Briefing. Vol. 2. Cambridge: Cambridge University Press.

Jia, S., Qiu, Y., and Yang, C. (2021). Sustainable Development Goals, Financial Inclusion, and Grain Security Efficiency. Agronomy 11 (12), 2542. doi:10.3390/agronomy11122542

Jiang, Z., Wang, Z., and Zeng, Y. (2020). Can voluntary environmental regulation promote corporate technological innovation? Bus. Strat. Env. 29 (2), 390–406. doi:10.1002/bse.2372

Kassinis, G., and Vafeas, N. (2006). Stakeholder pressures and environmental performance. Amj 49 (1), 145–159. doi:10.5465/amj.2006.20785799

Keller, W. (2010). “International trade, foreign direct investment, and technology spillovers,” in Handbook of the Economics of Innovation. North-Holland, 793–829. doi:10.1016/s0169-7218(10)02003-4

Krichevsky, S., and Levchenko, V. (2021). Human Life and Evolu tion in Biospheres on Earth and Outer Space: Problems and Pros pects. Future Hum. Image 15, 39–58. doi:10.29202/fhi/15/4

Kronenberg, T. (2004). The curse of natural resources in the transition economies*. Econ. transition 12 (3), 399–426. doi:10.1111/j.0967-0750.2004.00187.x

Lanoie, P., Laurent-Lucchetti, J., Johnstone, N., and Ambec, S. (2011). Environmental policy, innovation and performance: new insights on the Porter hypothesis. J. Econ. Manag. Strategy 20 (3), 803–842. doi:10.1111/j.1530-9134.2011.00301.x

Law, S. H., and Singh, N. (2014). Does too much finance harm economic growth? J. Bank. Finance 41, 36–44. doi:10.1016/j.jbankfin.2013.12.020

Li, J., See, K. F., and Chi, J. (2019). Water resources and water pollution emissions in China's industrial sector: A green-biased technological progress analysis. J. Clean. Prod. 229, 1412–1426. doi:10.1016/j.jclepro.2019.03.216

Liébana-Cabanillas, F., Sánchez-Fernández, J., and Muñoz-Leiva, F. (2014). The moderating effect of experience in the adoption of mobile payment tools in Virtual Social Networks: The m-Payment Acceptance Model in Virtual Social Networks (MPAM-VSN). Int. J. Inf. Manag. 34 (2), 151–166. doi:10.1016/j.ijinfomgt.2013.12.006

Lin, B., and Zhu, J. (2019). Fiscal spending and green economic growth: Evidence from China. Energy Econ. 83, 264–271. doi:10.1016/j.eneco.2019.07.010

Lin, I. C., and Liao, T. C. (2017). A survey of blockchain security issues and challenges. Int. J. Netw. Secur. 19 (5), 653–659. doi:10.6633/IJNS.201709.19(5).01

Liu, Y., Luan, L., Wu, W., Zhang, Z., and Hsu, Y. (2021). Can digital financial inclusion promote China's economic growth? Int. Rev. Financial Analysis 78, 101889. doi:10.1016/j.irfa.2021.101889

Lloyd, S. (1989). Use of mutual information to decrease entropy: Implications for the second law of thermodynamics. Phys. Rev. A 39 (10), 5378–5386. doi:10.1103/physreva.39.5378

Lucia, U. (2012). Maximum or minimum entropy generation for open systems? Phys. A Stat. Mech. its Appl. 391 (12), 3392–3398. doi:10.1016/j.physa.2012.01.055

Lucia, U. (2018). Unreal perpetual motion machine, Rydberg constant and Carnot non-unitary efficiency as a consequence of the atomic irreversibility. Phys. A Stat. Mech. its Appl. 492, 962–968. doi:10.1016/j.physa.2017.11.027

Lv, C., Shao, C., and Lee, C.-C. (2021). Green technology innovation and financial development: Do environmental regulation and innovation output matter? Energy Econ. 98, 105237. doi:10.1016/j.eneco.2021.105237

Ma, H., and Li, L. (2021). Could environmental regulation promote the technological innovation of China's emerging marine enterprises? Based on the moderating effect of government grants. Environ. Res. 202, 111682. doi:10.1016/j.envres.2021.111682

Meadows, D. H., Randers, J., and Meadows, D. L. (2013). The Limits to Growth (1972). New Haven, CT: Yale University Press, 101–116.

Mistry, K. H., McGovern, R. K., Thiel, G. P., Summers, E. K., Zubair, S. M., and Lienhard, J. H. (2011). Entropy generation analysis of desalination technologies. Entropy 13 (10), 1829–1864. doi:10.3390/e13101829

Naumenkova, S., Mishchenko, S., and Dorofeiev, D. (2019). Digital financial inclusion: Evidence from Ukraine. Invest. Manag. Financial Innovations 16 (3), 194–205. doi:10.21511/imfi.16(3).2019.18

Ouyang, X., Li, Q., and Du, K. (2020). How does environmental regulation promote technological innovations in the industrial sector? Evidence from Chinese provincial panel data. Energy Policy 139, 111310. doi:10.1016/j.enpol.2020.111310

Perutz, M. F. (1987). “Erwin Schrödinger's What is Life? and molecular,” in Schrödinger: Centenary Celebration of a Polymath. Cambridge Univ Press, 234–251. doi:10.1017/cbo9780511564253.020

Philander, S. G. (2018). Is the Temperature Rising?: The Uncertain Science of Global Warming. Princeton, NJ: Princeton University Press.

Poncet, S., Steingress, W., and Vandenbussche, H. (2010). Financial constraints in China: Firm-level evidence. China Econ. Rev. 21 (3), 411–422. doi:10.1016/j.chieco.2010.03.001

Popovic, M. (2014). Entropy change of open thermodynamic systems in self-organizing processes. Therm. Sci. 18 (4), 1425–1432. doi:10.2298/tsci140424065p

Popp, D. (2003). Pollution control innovations and the clean air act of 1990. J. Pol. Anal. Manage. 22 (4), 641–660. doi:10.1002/pam.10159

Porter, M. E., and Linde, C. v. d. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Prigogine, I., and Nicolis, G. (1967). On Symmetry‐Breaking Instabilities in Dissipative Systems. J. Chem. Phys. 46 (9), 3542–3550. doi:10.1063/1.1841255

Qashou, Y., Samour, A., and Abumunshar, M. (2022). Does the Real Estate Market and Renewable Energy Induce Carbon Dioxide Emissions? Novel Evidence from Turkey. Energies 15 (3), 763. doi:10.3390/en15030763

Qastharin, A. R. (2016). Business model canvas for social enterprise. J. Bus. Econ. 7 (4), 627–637. doi:10.15341/jbe(2155-7950)/04.07.2016/008

Que, W., Zhang, Y., Liu, S., and Yang, C. (2018). The spatial effect of fiscal decentralization and factor market segmentation on environmental pollution. J. Clean. Prod. 184, 402–413. doi:10.1016/j.jclepro.2018.02.285

Rajan, R. G., and Zingales, L. (1998). Financial Dependence and Growth. American Economic Review, 559–586.

Ren, S., Hao, Y., and Wu, H. (2021). Government corruption, market segmentation and renewable energy technology innovation: Evidence from China. J. Environ. Manag. 300, 113686. doi:10.1016/j.jenvman.2021.113686

Ren, S., Hao, Y., and Wu, H. (2022). How Does Green Investment Affect Environmental Pollution? Evidence from China. Environ. Resour. Econ. 81 (1), 25–51. doi:10.1007/s10640-021-00615-4

Rongwei, X., and Xiaoying, Z. (2020). Is financial development hampering or improving the resource curse? New evidence from China. Resour. Policy 67 (January), 101676. doi:10.1016/j.resourpol.2020.101676

Roodman, D. (2009). A note on the theme of too many instruments. Oxf. Bull. Econ. statistics 71 (1), 135–158. doi:10.1111/j.1468-0084.2008.00542.x

Rubashkina, Y., Galeotti, M., and Verdolini, E. (2015). Environmental regulation and competitiveness: Empirical evidence on the Porter Hypothesis from European manufacturing sectors. Energy Policy 83, 288–300. doi:10.1016/j.enpol.2015.02.014

Samour, A., Baskaya, M. M., and Tursoy, T. (2022). The impact of financial development and FDI on renewable energy in the UAE: a path towards sustainable development. Sustainability 14 (3), 1208. doi:10.3390/su14031208

Sanstad, A. H., Roy, J., and Sathaye, J. A. (2006). Estimating energy-augmenting technological change in developing country industries. Energy Econ. 28 (5-6), 720–729. doi:10.1016/j.eneco.2006.07.005

Segel, L. A., and Jackson, J. L. (1972). Dissipative structure: an explanation and an ecological example. J. Theor. Biol. 37 (3), 545–559. doi:10.1016/0022-5193(72)90090-2

Sekulic, D. P. (2009). An entropy generation metric for non-energy systems assessments. Energy 34 (5), 587–592. doi:10.1016/j.energy.2008.06.003

Seo, M. H., Kim, S., and Kim, Y.-J. (2019). Estimation of dynamic panel threshold model using Stata. Stata J. 19 (3), 685–697. doi:10.1177/1536867x19874243

Seo, M. H., and Shin, Y. (2016). Dynamic panels with threshold effect and endogeneity. J. Econ. 195 (2), 169–186. doi:10.1016/j.jeconom.2016.03.005

Su, Y., Li, Z., and Yang, C. (2021). Spatial Interaction Spillover Effects between Digital Financial Technology and Urban Ecological Efficiency in China: An Empirical Study Based on Spatial Simultaneous Equations. Ijerph 18 (16), 8535. doi:10.3390/ijerph18168535

Tan, Y., Huang, H., and Lu, H. (2013). The Effect of Venture Capital Investment-Evidence from China's Small and Medium-Sized Enterprises Board. J. Small Bus. Manag. 51 (1), 138–157. doi:10.1111/j.1540-627x.2012.00379.x

Tang, C., Xue, Y., Wu, H., Irfan, M., and Hao, Y. (2022). How does telecommunications infrastructure affect eco-efficiency? Evidence from a quasi-natural experiment in China. Technol. Soc. 69, 101963. doi:10.1016/j.techsoc.2022.101963

Tang, J., Zhong, S., and Xiang, G. (2019). Environmental regulation, directed technical change, and economic growth: Theoretic model and evidence from China. Int. Regional Sci. Rev. 42 (5-6), 519–549. doi:10.1177/0160017619835901

Wang, H., and Wei, W. (2020). Coordinating technological progress and environmental regulation in CO2 mitigation: The optimal levels for OECD countries & emerging economies. Energy Econ. 87, 104510. doi:10.1016/j.eneco.2019.104510

Wang, J., Wang, W., Ran, Q., Irfan, M., Ren, S., Yang, X., Wu, H., and Ahmad, M. (2022). Analysis of the mechanism of the impact of internet development on green economic growth: evidence from 269 prefecture cities in China. Environ. Sci. Pollut. Res. 29 (7), 9990–10004. doi:10.1007/s11356-021-16381-1

Wang, L., Wang, Y., Sun, Y., Han, K., and Chen, Y. (2022). Financial inclusion and green economic efficiency: evidence from China. J. Environ. Plan. Manag. 65 (2), 240–271. doi:10.1080/09640568.2021.1881459

Wang, Q. (2015). Fixed-effect panel threshold model using Stata. Stata J. 15 (1), 121–134. doi:10.1177/1536867x1501500108

Wang, R., Hou, J., and Jiang, Z. (2021). Environmental policies with financing constraints in China. Energy Econ. 94, 105089. doi:10.1016/j.eneco.2020.105089

Wang, X., Sun, C., Wang, S., Zhang, Z., and Zou, W. (2018). Going green or going away? A spatial empirical examination of the relationship between environmental regulations, biased technological progress, and green total factor productivity. Ijerph 15 (9), 1917. doi:10.3390/ijerph15091917

Welsch, H., and Ochsen, C. (2005). The determinants of aggregate energy use in West Germany: factor substitution, technological change, and trade. Energy Econ. 27 (1), 93–111. doi:10.1016/j.eneco.2004.11.004

Wen, B. (2020). Old problems and new dilemmas: the conundrum of environmental management reform in China. J. Environ. Policy & Plan. 22 (2), 281–299. doi:10.1080/1523908x.2020.1713067

Windmeijer, F. (2005). A finite sample correction for the variance of linear efficient two-step GMM estimators. J. Econ. 126 (1), 25–51. doi:10.1016/j.jeconom.2004.02.005

Wu, H., Hao, Y., and Ren, S. (2020b). How Do environmental regulation and environmental decentralization affect green total factor energy efficiency: Evidence from China. Energy Econ. 91, 104880. doi:10.1016/j.eneco.2020.104880

Wu, H., Li, Y., Hao, Y., Ren, S., and Zhang, P. (2020a). Environmental decentralization, local government competition, and regional green development: Evidence from China. Sci. Total Environ. 708, 135085. doi:10.1016/j.scitotenv.2019.135085

Wu, H., Xue, Y., Hao, Y., and Ren, S. (2021). How does internet development affect energy-saving and emission reduction? Evidence from China. Energy Econ. 103, 105577. doi:10.1016/j.eneco.2021.105577

Xie, T. T., and Liu, J. H. (2019). How does green credit affect China’s green economy growth. China Popul. Resour. Environ. 29 (9), 83–90.

Xin, Y., Kong, L., Liu, Z., Chen, Y., Li, Y., Zhu, H., et al. (2018). Machine learning and deep learning methods for cybersecurity. Ieee access 6, 35365–35381. doi:10.1109/access.2018.2836950

Yang, G., Zha, D., Wang, X., and Chen, Q. (2020). Exploring the nonlinear association between environmental regulation and carbon intensity in China: The mediating effect of green technology. Ecol. Indic. 114, 106309. doi:10.1016/j.ecolind.2020.106309

Yang, X., Su, X., Ran, Q., Ren, S., Chen, B., Wang, W., et al. (2022a). Assessing the impact of energy internet and energy misallocation on carbon emissions: new insights from China. Environ. Sci. Pollut. Res. 29 (16), 23436–23460. doi:10.1007/s11356-021-17217-8

Yang, X., Wang, J., Cao, J., Ren, S., Ran, Q., and Wu, H. (2021). The spatial spillover effect of urban sprawl and fiscal decentralization on air pollution: evidence from 269 cities in China. Empir. Econ., 1–29. doi:10.1007/s00181-021-02151-y

Yang, X., Wang, W., Su, X., Ren, S., Ran, Q., Wang, J., et al. (2022b). Analysis of the Influence of Land Finance on Haze Pollution: An Empirical Study Based on 269 Prefecture-level Cities in China. Growth Change 52 (6), 1923–1978. doi:10.1111/grow.12638

Yang, Z., Shao, S., Fan, M., and Yang, L. (2021). Wage distortion and green technological progress: A directed technological progress perspective. Ecol. Econ. 181, 106912. doi:10.1016/j.ecolecon.2020.106912

Ye, F., Quan, Y., He, Y., and Lin, X. (2021). The impact of government preferences and environmental regulations on green development of China's marine economy. Environ. Impact Assess. Rev. 87, 106522. doi:10.1016/j.eiar.2020.106522

Yi, M., Wang, Y., Sheng, M., Sharp, B., and Zhang, Y. (2020). Effects of heterogeneous technological progress on haze pollution: Evidence from China. Ecol. Econ. 169, 106533. doi:10.1016/j.ecolecon.2019.106533

Yuan, B., Ren, S., and Chen, X. (2017). Can environmental regulation promote the coordinated development of economy and environment in China's manufacturing industry?-A panel data analysis of 28 sub-sectors. J. Clean. Prod. 149, 11–24. doi:10.1016/j.jclepro.2017.02.065

Yue, S., Lu, R., Chen, H., and Yuan, J. (2018). Does financial development promote the win-win balance between environmental protection and economic growth? Environ. Sci. Pollut. Res. 25 (36), 36438–36448. doi:10.1007/s11356-018-3549-y

Zafar, M. W., Zaidi, S. A. H., Khan, N. R., Mirza, F. M., Hou, F., and Kirmani, S. A. A. (2019). The impact of natural resources, human capital, and foreign direct investment on the ecological footprint: the case of the United States. Resour. Policy 63, 101428. doi:10.1016/j.resourpol.2019.101428

Zhang, L., Pang, J., Chen, X., and Lu, Z. (2019). Carbon emissions, energy consumption and economic growth: Evidence from the agricultural sector of China's main grain-producing areas. Sci. Total Environ. 665, 1017–1025. doi:10.1016/j.scitotenv.2019.02.162

Zhang, Y. (2018). Gain or pain? New evidence on mixed syndication between governmental and private venture capital firms in China. Small Bus. Econ. 51 (4), 995–1031. doi:10.1007/s11187-018-9989-4

Zhao, S., Cao, Y., Feng, C., Guo, K., and Zhang, J. (2022). How Do heterogeneous R&D investments affect China's green productivity: Revisiting the Porter hypothesis. Sci. Total Environ. 825, 154090. doi:10.1016/j.scitotenv.2022.154090