- 1School of Management, Jiangsu University, Zhenjiang, China

- 2School of Finance and Economics, Jiangsu University, Zhenjiang, China

In the context of China’s path to industrialization advancement, environmental problems are becoming increasingly serious. Therefore, the cultivation of green technology innovation has become an urgent task during the current industrialization development. According to the “Porter hypothesis,” environmental regulation is an important driving force for green technology innovation. Environmental tax is a typical environmental regulation, although it was implemented late in China. Green technology innovation is one of the long-term effects of environmental tax collection. Using multiple regression analysis and taking Chinese manufacturing enterprises as samples, this study constructs and tests a model of environmental tax promotion and its effect on green technology innovation, revealing the micro-mechanism of environmental tax incentives and also finding that sufficient environmental tax incentives are lacking. The strategy of green technology innovation cultivation for manufacturing enterprises in China under the current environmental tax regulation is provided in this article in order to provide a current theoretical reference point for the development of China’s ecological economy.

Introduction

China’s economic development has made great strides owing to advances in industrialization; however, simultaneously, the environmental crisis is rapidly approaching. From the start of the Chinese economic reform and opening-up up to 1996, carbon dioxide emissions in China rose sharply. In this period, there were 5 years with stable data, subsequently followed by more rises (Han et al., 2017). Therefore, for China’s ecosystem, there is a “U”-shaped relationship between environmental pollution and economic growth, which has not reached a turning point (Bilgili et al., 2021). In this context, in China, green technological innovation has become not only an essential channel for deepening the industrialization process but also an important driving force for the development of the environmental economy.

Green technologies refer to the sum of technologies, processes, and products that can reduce environmental pollution, decrease raw material waste, and improve energy efficiency (Wang et al., 2019). With the environmental crisis approaching, green technology innovation is being derived from green technology. Green technology is a special technological innovation that encompasses and integrates the concepts of “green,” “technology,” and “innovation.” It is an innovative activity that enables adaptation to the development of the environmental economy, meeting the needs of environmental protection, and decreasing risks to the ecological environment (Hall et al., 2019).

In today’s world, environmental regulation has become an incentive for green technology innovation. In the early 1990s, Michael Porter of Harvard University proposed that reasonable environmental regulation could encourage enterprises to intensify environmental innovation and establish competitive advantages in the green market. Commonly referred to as the Porter hypothesis, this soon became a basic theoretical direction in the development of the environmental economy (Stoever and Weche, 2018).

Environmental regulation is a kind of tangible system and intangible consciousness that constrains individuals or organizations to protect the environment. It can be divided into formal environmental regulation and informal regulation. The former refers to laws, regulations, and behavioral norms implemented by public power to improve the ecological environment, while the latter refers to the external expression of residents’ environmental consciousness (Kong and Qin, 2021). China’s pollution problem is not entirely caused by rapid economic development; imperfect environmental regulations are the main cause (Zhang et al., 2019).

Environmental protection tax is a typical environmental regulation, which has a long history in European and North American countries and plays an important role in ecological environment protection. However, the effect of China’s environmental protection tax has lagged behind in terms of environmental protection. At the end of 1978, China implemented the pollution charging system by drawing lessons from the experience of developed countries. After 4 years of pilot projects, in 1982, the Interim Measures for Collection of Pollution Charges was promulgated, which marked the establishment of China’s pollution charging system. However, there were many shortcomings in the pollution charging system, such as not being compulsory and the lack of stationarity, which led to higher flexibility in the charge collection, and ultimately led to the implantation of fee-to-tax reforms.

On 1 January 2018, China’s Environmental Protection Tax Law was officially implemented. Fee-to-tax reforms enabled China to make full use of the mandatory and binding nature of the law, to impose legal sanctions on highly polluting enterprises, to promote energy conservation and emission reduction among enterprises, and to devote itself to the cultivation of green technology innovation ability. Therefore, the Environmental Protection Tax Law is a powerful tool to protect the ecological environment by using strict laws.

It was a long road, over 10 years, from the proposal to the final implementation of China’s Environmental Protection Tax Law. In 2007, the State Council deployed the “Energy Conservation and Emission Reduction Comprehensive Work Plan.” In 2008, three departments (the Ministry of Finance, the State Taxation Bureau, and the National Environmental Protection Bureau) jointly launched research work on environmental protection tax. In 2010, the Chinese Communist Party (CPC) Central Committee officially raised the goal of environmental protection tax collection in its “Suggestion on Developing the Twelfth Five-Year Plan of National Economic and Social Development.” In 2013, the CPC Central Committee emphasized this again in its “Decision on Solving Significant Questions on Comprehensively Deepening Reform,” vigorously promoting environmental protection fee-to-tax work. In 2014, in the “Government Work Report,” the State Council highlighted the need to speed up the legislative work of the Environmental Protection Tax Law in China. In November 2014, the Ministry of Finance, the Ministry of Environmental Protection, and the State Taxation Bureau submitted the “Environmental Protection Tax Law of the People’s Republic of China (Draft)” to the State Council. In 2015, the State Council published the Draft publicly, asking for suggested changes from the whole of society. From August 29 to 3 September 2016, at the 22nd Meeting of the 12th Session of the National People’s Congress Standing Committee, the Draft was reviewed for the first time. On 25 December 2016, at the 25th Meeting of the 12th Session of the National People’s Congress Standing Committee, China’s Environmental Protection Tax Law was formally accepted and was finally implemented on 1 January 2018.

For a long time, since there had been no independent tax mechanism for environmental protection, China’s tax system had not been able to truly reflect the environmental costs of goods and services. After introducing the Environmental Protection Tax Law, the governance and financial relations between the central government and local government in terms of environmental governance became clearer, which led to local government being more actively involved in environmental management and ecological monitoring, and strengthened the responsibility of enterprises in relation to energy conservation and emissions reduction. The Environmental Protection Tax Law represents China’s first green tax, which entails significant challenges for its collection and management.

The driving effect of environmental regulation on green technology innovation has attracted widespread attention. Zhou et al. (2020) pointed out that, under the Porter hypothesis, environmental regulation has a theoretical driving effect on enterprises’ green technology innovation. However, in many regions and industries in China, this driving effect is not obvious. According to Ranocchia and Lambertini (2021), with the deepening of the eco-economy, environmental regulation has become an important channel to drive the growth of enterprises’ green technology innovation ability, which has attracted the attention of all countries in the world. Wei and Zhang (2020) pointed out that China’s environmental regulation is in a developing stage, and that it does not yet have a strong driving effect on green technology innovation, requiring further deepening at the micro-level. Song et al. (2020) pointed out that, in Western countries, environmental regulation is a mature driving force for green technology innovation, and has become an indispensable core element in the development of ecological economics, which China should learn from.

Under the environmental regulation, the incentive effect of China’s Environmental Protection Tax Law on green technology innovation has become a research hotspot. Chen et al. (2016) pointed out that the progress of environmental protection technology is one of the macro effects of environmental protection tax collection, which helps to improve the environmental quality and to promote the development of the green economy. Takeda and Arimura (2021) found that there is a lag in the promotion effect of an environmental tax on enterprises’ green technology innovation, i.e., current environmental tax can increase the R&D investment and number of patent applications of enterprises in the next period, subsequently leading to the green technology innovation effect of enterprises showing the characteristics of high quality. Garon and Séguin (2021) asserted that the introduction of environmental protection tax can effectively play the green regulatory role of tax leverage, improve the environmental awareness of enterprises, strengthen pollution reduction, and drive green technology innovation.

Manufacturing enterprises are the backbone of a country’s national economy and are at the heart of global competition. However, manufacturing enterprises, including a large amount of highly polluting industries, are also the most significant contributors to environmental pollution, which makes them the key targets of environmental governance. Thus, manufacturing enterprises have become the main body driving the growth of the ecological economy. They represent the main target of the regulation and restraint enacted via the Environmental Protection Tax Law, and has an inescapable responsibility in the development of China’s green technology innovation strategy.

Under the Porter hypothesis, as a typical environmental regulation, China’s Environmental Protection Tax Law has a certain promotion effect on the green technology innovation of manufacturing enterprises. Due to its imperfections, however, it needs to be improved. Existing research has recognized, explained, and discussed the incentive value of environmental protection tax, but with some obvious defects. One defect is the existing research mostly focuses on environmental regulation policy and emissions trading system, but seldom on environmental protection tax. Another defect is the research is limited on how environmental protection tax influence green technology innovation. The existing research combined environment tax together with pollution emission fees and R&D subsidies, and carried out the study on green technology innovation. But it fails to analyze the microscopic mechanism between green technology innovation and environment tax regulation, and failed to find the specific path to further deepening incentives.

As an independent tax on green industry in China, environmental protection tax is an effective, preventive, and long-term means of environmental economic policy, which is a very important part in environmental economic and policy system. It will impact profoundly on China’s environment improvement and micro enterprise behavior. Thus, the contribution of this article may be as follows. Firstly, new research perspectives. By constructing multiple multivariate regression model, this article can accurately evaluate how environmental protection tax influences the green technology innovation. Secondly, this article analyzes different green technology innovation strategic behavior under the pressure of environmental protection tax by different enterprise type and size. Finally, this article extends the environment tax regulation effect, which can enhance the green technology innovation capability of manufacturing enterprises and reduce the harm done to the environment by manufacturing industry, to promote the smooth development of ecological economy in our country.

Research Model Design

The Promotion Effect of the Environmental Protection Tax Law on Manufacturing Enterprises’ Green Technology Innovation

The implementation of the Environmental Protection Tax Law has directly or indirectly promoted the green technology innovation of manufacturing enterprises in China, and it represents an important driving force for the growth of green technology innovation.

First of all, the Environmental Protection Tax Law strengthens the green technology innovation strategy of manufacturing enterprises. The Environmental Protection Tax Law improves enterprises’ awareness of emission reduction in rigid ways, changes their production and operation concepts, guides enterprises to continuously increase investment in environmental protection and pollution control, reduces pollutant emissions, considers economic and environmental benefits as a whole, and improves the environmental social responsibility of enterprises (Ohori, 2012). The Environmental Protection Tax Law transfers the social costs entailed by pollution emissions to the production and operation costs of enterprises, which reduces the profits of enterprises and increases the resistance to their operation. In order to survive and develop, enterprises can only change their ideas, strengthen green technology innovation, and improve green core competitiveness. If they are content with the status quo, they will inevitably be eliminated by the fiercely competitive market.

Second, the Environmental Protection Tax Law increases manufacturing enterprises’ need for green technology innovation. The Environmental Protection Tax Law measures tax according to the “three wastes” emission (waste gas, waste water, and waste residues) of enterprises, which leads to enterprises facing direct tax pressure. The fewer pollutants discharged by enterprises, the less tax will be levied. On the contrary, the more pollutants discharged, the more the tax will be levied. With the increasing calls for global environmental protection, the pressure on environmental protection in China is also increasing, more taxes are being levied on the discharge of the “three wastes,” the cost of enterprises is higher, and the profits are reduced. In this context, enterprises have to shift their strategic focus to green technology innovation, seeking a breakthrough in this area to enable them to beat their rivals (Nakada, 2020). Once seen as leaders in green technology innovation, enterprises will gain an advantage over the market competition.

Third, the Environmental Protection Tax Law provides the means for green technology innovation in manufacturing enterprises. The Environmental Protection Tax Law guides enterprises in saving energy and reducing emissions through the flexibility of the tax law, carries out differential collection according to the concentration value of pollutants discharged by enterprises, and sets two preferential tax rates of 50 and 75%, thus encouraging enterprises to update energy-saving and environmental protection equipment and to improve production technology, which subsequently increases enthusiasm for cleaner production among enterprises. Since the implementation of the Environmental Protection Tax Law, many enterprises have deeply felt the pressure of rising costs, so they have actively reduced harmful emissions through green technology innovation, and sought tax relief accordingly (Speck, 2017). The implementation of a preferential tax system provides the impetus for the green technology innovation of manufacturing enterprises, especially for high pollution manufacturing enterprises, such as leather, rubber, chemistry, paper making, and the petrochemical industry. The driving force of green technology innovation is thus stronger.

Fourth, the Environmental Protection Tax Law clears the obstacles for the deepening of green technology innovation in manufacturing enterprises. The implementation of the Environmental Protection Tax Law has effectively cracked down on environmental violations and improved the intensity of environmental credit management, which has not only created favorable conditions for pollution control but also opened up a good space for green technology innovation. After the implementation of the Environmental Protection Tax Law, the opportunistic behavior of enterprises has clearly been reduced, especially opportunistic behavior in environmental protection. Instead, enterprises honestly implement technological innovation and integrate green ideas and concepts into process improvement. Opportunistic behavior is the natural enemy of technological innovation both in Western countries and in China (Zárate-Marco and Vallés-Giménez, 2015). For manufacturing enterprises, by overcoming opportunistic behavior, the Environmental Protection Tax Law not only clears the ideological obstacles but also clears the mechanism obstacles for the deepening of green technology innovation.

Finally, the promotion effect of the Environmental Protection Tax Law on green technology innovation in manufacturing enterprises has begun to appear. The Environmental Protection Law has achieved a smooth transformation of China’s green tax system, from the sewage tax system to the environmental bonded system. After more than 2 years of implementation, it has played a clear driving role in green product design, green industrial innovation, and “three wastes” emission control. The effect is clear in many industries (Kou et al., 2021). Although there are differences in the breakthrough directions of green technology innovation in different industries, and even the breakthrough paths of green technology innovation in different enterprises in the same industry, on the whole, the promotion effect on green technology innovation has been widely recognized by society. With the improvement of the enforcement intensity of the Environmental Protection Tax Law, the scale effect of green technology innovation will become increasingly significant.

The Choice of Core Independent Variables

For manufacturing enterprises, the application benefits of the Environmental Protection Tax Law are reflected in manufacturing enterprises’ widespread cognition of its value. The higher the cognition of manufacturing enterprises, the better the implementation effect of environmental protection law will be, and the better green technology innovation will be. Manufacturing enterprises’ cognition of environmental protection law is embodied in five aspects: convenience; rationality; fairness; transparency; and compulsion (Böhringer and Müller, 2014).

Here, convenience refers to taxpayers’ perception of a good service attitude, the simplicity of the service mode, and the high efficiency of the service platform. Rationality refers to the perception of taxpayers regarding the rationality of the tax band, the rationality of tax measurement, and the rationality of taxation time. Fairness refers to taxpayers’ perception of fairness in terms of tax discretion, preferential object identification, and the undifferentiated property rights of enterprises. Transparency refers to taxpayers’ perception of tax collection standards, processes, and the results of information disclosure. Finally, compulsion refers to taxpayers’ perception of the strictness, impartiality, and authority of the implementation of environmental protection tax.

Therefore, in the research model design, we adopt five variables as core independent variables: environmental tax convenience; environmental tax rationality; environmental tax fairness; environmental tax transparency; and environmental tax compulsion.

The Choice of Control Variables

First of all, the scale of enterprises has an impact on the effectiveness of green technology innovation. To a certain extent, the implementation of enterprises’ green technology innovation strategy is influenced by the scale of enterprises, including not only the number of personnel but also the value of fixed assets. Under different scales, enterprises will adopt different levels of green strategies. The influence of enterprise scale on green technology innovation presents different forms in different environments. However, for manufacturing enterprises in China, the influence direction of enterprise scale on green technology innovation is not clear.

Second, the establishment date of enterprises has an impact on the effectiveness of green technology innovation. According to Porter’s organizational learning theory, as organizations, enterprises also have their own common vision, mental model, and systematic thinking. Therefore, with the accumulation of “experience,” the green technology innovation strategy of enterprises will be constantly adjusted. Enterprises will adopt different green development strategies in different development periods. The response of manufacturing enterprises in China in this context is complicated, and there is no clear path dependence at present.

Third, the type of enterprise has an impact on the effectiveness of green technology innovation. Chinese enterprises are generally divided into large enterprises, medium-sized enterprises, and small enterprises. Under the regulation of the Environmental Protection Tax Law, different types of enterprises have different green technology innovation strategies, and no regular path has yet been found. The enterprise type is different from the enterprise scale because enterprise types are generally set by relevant government departments, corresponding to different tax standards.

Finally, enterprise attributes have an impact on the effectiveness of green technology innovation. Chinese enterprises can be divided into three categories according to their attributes: state-owned enterprises; private enterprises; and foreign-funded enterprises. Enterprises with different attributes have different understandings of green environmental protection values, different behavior patterns, as well as different levels of respect for, and perceptions of, environmental protection law. Further, there are differences in the impact on the effectiveness of green technology innovation. In many economic management studies, attention has been paid to the influence of enterprise attribute differences in China.

Therefore, in the research model design, five variables are selected as control variables, namely enterprise personnel scale, enterprise fixed assets scale, enterprise establishment time, enterprise type, and enterprise scale. Among them, the first three control variables are common control variables and the last two are binary control variables.

The Choice of Dependent Variables

Green technology innovation has a compound structure, including many elements. Meirun et al. (2021) divided enterprises’ green technology innovation into three basic elements: green product innovation; green process innovation; and “three wastes” treatment innovation. Green product innovation refers to innovation in the environmental adaptability of products, i.e., the consumption process of products contributes to the protection of the ecological environment. Green process innovation refers to the innovation of products in the production process, i.e., the production process of products increasingly meets the needs of cleaner production. Innovation in “three wastes” treatment refers to the innovation of products in relation to waste treatment, i.e., enterprises continuously improve the treatment efficiency of waste water, waste gas, and waste residues, thus reducing the harm of these “three wastes” to the environment.

Therefore, in research model design, we choose three variables as dependent variables: green product innovation; green process innovation; and “three wastes” treatment innovation.

Establishment of the Research Model

According to the above analysis, taking green product innovation, green process innovation, and “three wastes” treatment innovation as dependent variables, the research model is constructed as shown in the following formulae:

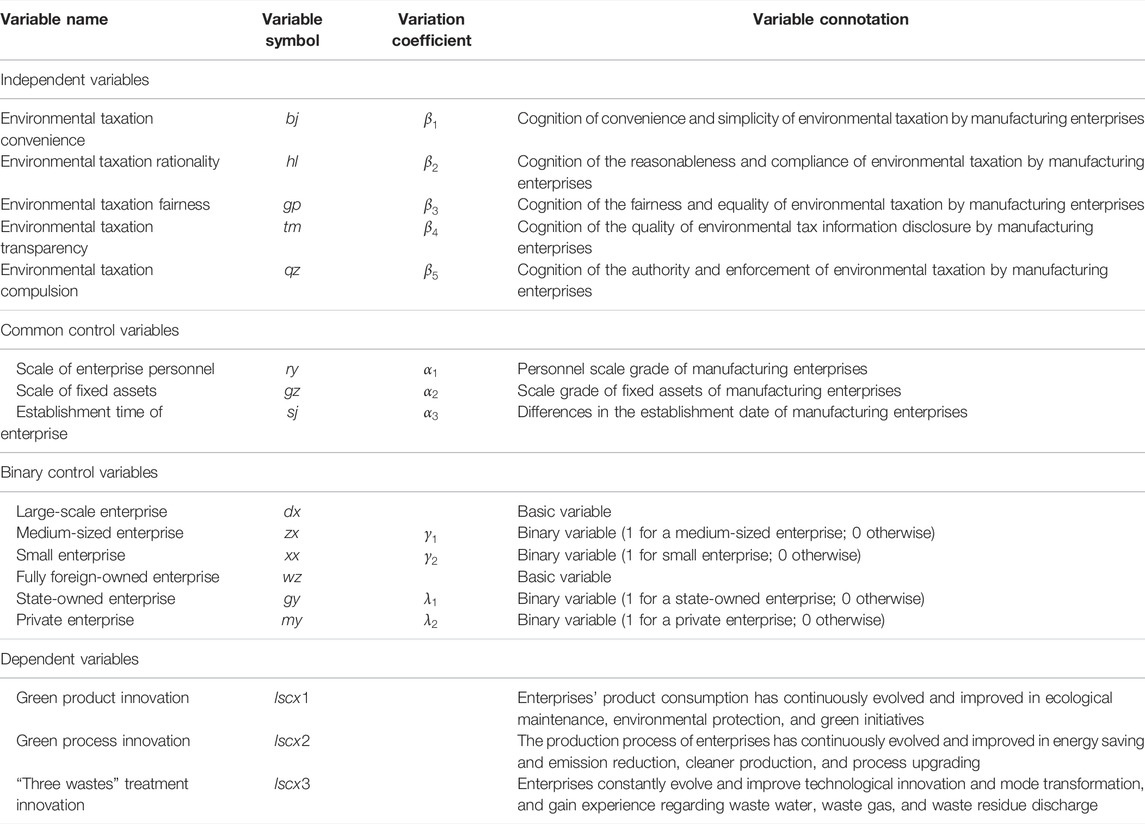

The characteristics of the independent variables, control variables, and dependent variables are shown in Table 1.

Research Model Test

Sample Data Collection

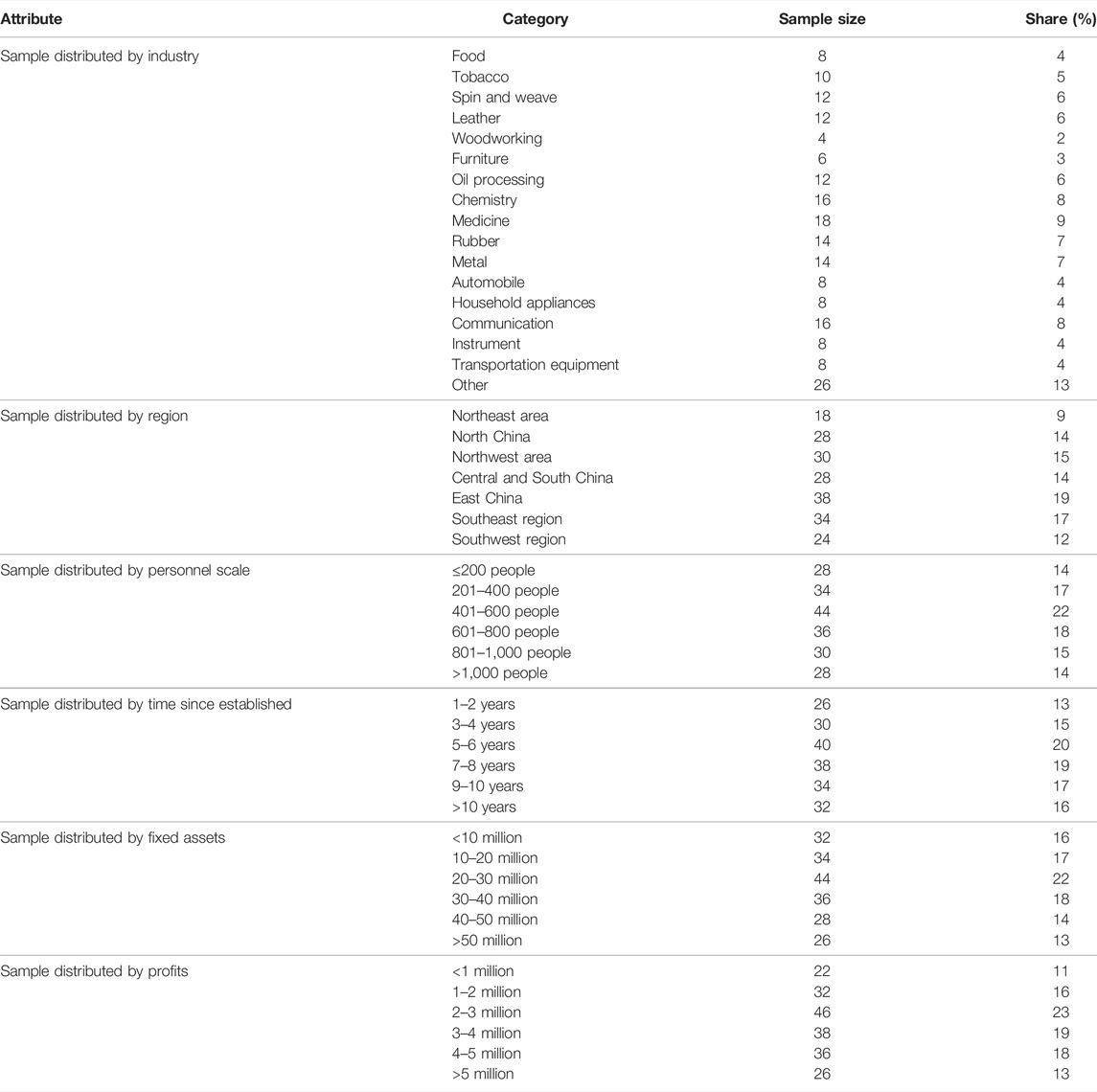

In this study, we used a seven-point Likert-type scale to collect sample data from Chinese manufacturing enterprises. Interviewees of manufacturing enterprises gave subjective judgments on the values of five independent variables: environmental tax convenience; environmental tax rationality; environmental tax fairness; environmental tax transparency; and environmental tax compulsion. For the values of the three general control variables (the scale of enterprise personnel, the scale of fixed assets, and the time of enterprise establishment), we first divided them into seven sections and then selected them one by one. The values for two binary control variables (enterprise type and enterprise attribute) were determined by the specific attributes of the enterprise. The values of three dependent variables (green product innovation, green process innovation, and “three wastes” treatment innovation) were judged by the environmental protection agency where the enterprise is located. This sample survey lasted for 1 month from March 1 to March 31, 2020, and 200 valid samples were obtained. The characteristics of the samples are shown in Table 2.

Research Model Test

Based on 200 sample data, using SPSS18.0 software, we carried out the multicollinearity analysis of the research model using the correlation coefficient matrix method (see Table 3). Because the correlation coefficient between variables is generally small, there is no multicollinearity problem in the research model.

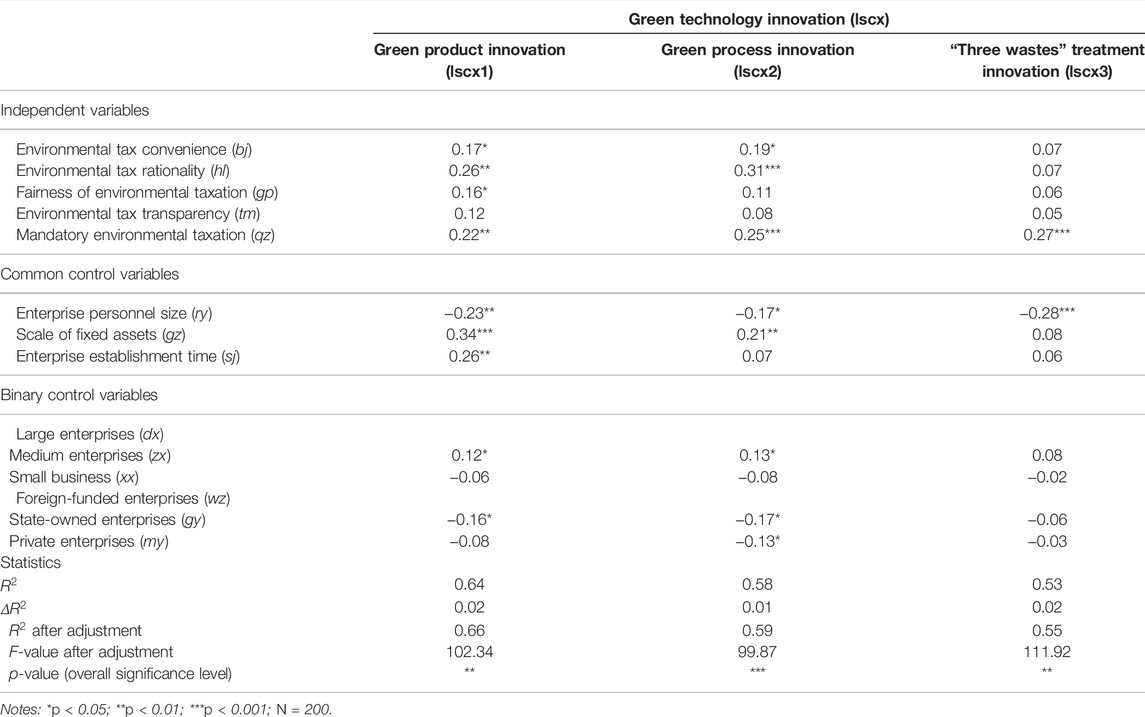

Based on multicollinearity test, on 200 sample data, using EViews18.0 software and OLS regression method, we tested the research models, respectively, and the test results are shown in Table 4.

According to the results, the influence by environmental taxation mandatory (p < 0.01, p < 0.001, and p < 0.001) and enterprise scale (p < 0.01, p < 0.05, and p < 0.001) to green product innovation, green technology innovation, and the “three wastes” treatment innovation are significant (p < 0.01, p < 0.001, and p < 0.001). The influence by fixed assets scale to green product innovation is the most significant (p < 0.001), while the influence to “three wastes” treatment innovation is not significant (p < 0.1). The influence by environmental tax transparency to green product innovation, green technology innovation, and the “three wastes” treatment innovation is not significant (p < 0.1). After the fitting degree comparison among models

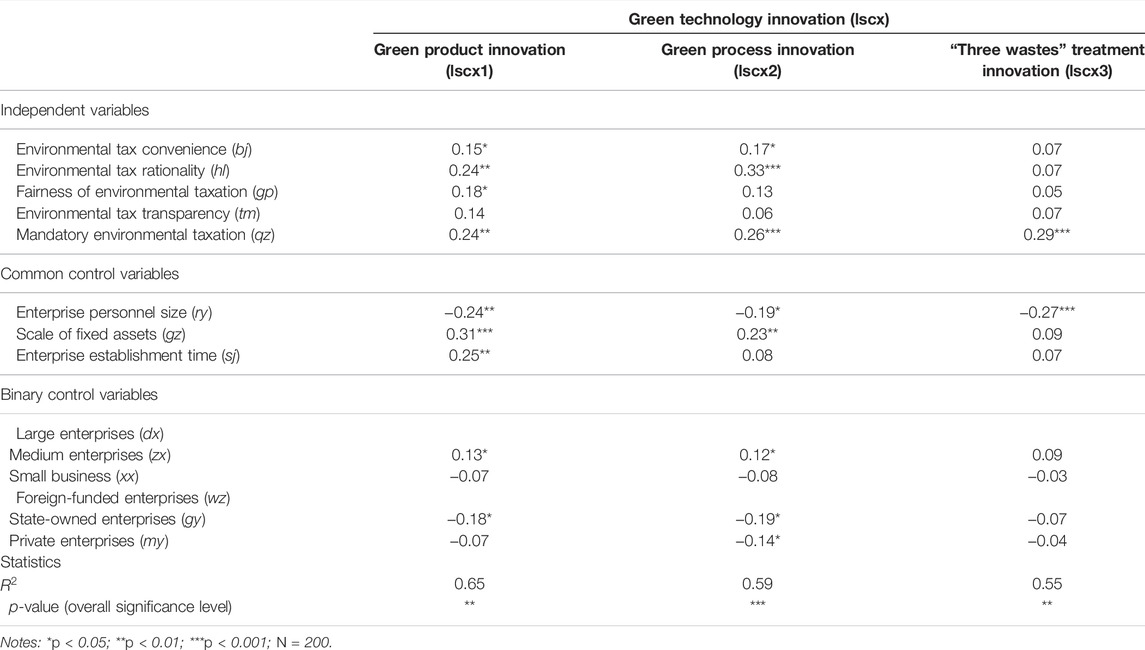

Robustness Test

In order to make the results more reliable, we used different data to re-estimate the model to verify the estimated results (data source: from another set of questionnaires with the same questions). Compared with the previous results, it can be seen that in the estimation result of the second model, although the coefficient of each parameter has changed, the sign and significance of the corresponding parameter have not changed significantly. The estimated coefficients of all models are above 0.5, and the equation fitting effect is good. Therefore, it can be judged that our regression model is robust. Table 5 lists the regression results of the second test using the new data.

Analysis of the Results

According to the test results, the implementation of the Environmental Protection Tax Law not only improves the intensity of ecological environmental protection in China, but also promotes the growth of green technology innovation in manufacturing enterprises. However, the distribution of this promotion effect is rather uneven; in fact, it is extremely lopsided. There is still much room for expansion, requiring further deepening and improvements. However, from the perspective of green technology innovation cultivation, under the regulation of Environmental Protection Tax Law, the progress of green product innovation is the most obvious, followed by green process innovation, while “three wastes” treatment innovation is the weakest.

According to the test results for the independent variables, it can be seen that environmental tax compulsion has the strongest promotion effect on green technology innovation, followed by the convenience and rationality of environmental tax, and the fairness of environmental tax, with the transparency of environmental tax being the weakest. Specifically, the results reveal that:

• Environmental taxation has an obvious promotion effect on green product innovation, green process innovation, and “three wastes” treatment innovation.

• The convenience of environmental taxation clearly promotes the innovation of green products and green processes, but does not promote “three wastes” treatment innovation.

• The rationality of environmental tax has an obvious promoting effect on green product innovation and green process innovation, but does not promote “three wastes” treatment innovation.

• Environmental tax transparency has no promotion effect for green product innovation, green process innovation, or “three wastes” treatment innovation.

• Compulsory environmental taxation has a clear promotion effect on green product innovation, green process innovation, and “three wastes” treatment innovation.

According to the test results for common control variables, it can be seen that:

• The larger the scale of enterprise personnel, the less the effect on green product innovation will be. The larger the scale of fixed assets and the longer the establishment time, the greater the effect on green product innovation of will be.

• The larger the scale of enterprise personnel, the less the effect on green process innovation will be. The larger the scale of fixed assets, the more effective the green process innovation will be. The establishment time of enterprises has no effect on green process innovation.

• The larger the scale of enterprise personnel, the less the effect on “three wastes” treatment innovation will be. The scale of fixed assets and the establishment time of enterprises have no influence on “three wastes” treatment innovation.

According to the test results for the binary control variables, it can be seen that:

• Under the regulation of environmental tax, the effect of green technology innovation for medium-sized enterprises is the most obvious, mainly reflected in green product innovation and green process innovation, followed by large enterprises, with the weakest effect seen in small enterprises.

• Under the regulation of environmental tax, the green technology innovation effect on foreign-funded enterprises is the most obvious, followed by private enterprises, and the weakest effect is seen in state-owned enterprises.

Conclusion and Policy Recommendations

Research Conclusion

According to the model’s test results, the research conclusion of this article is summarized as follows:

• The implementation of the Environmental Protection Tax Law not only improves ecological environment protection in China, but also promotes the growth of green technology innovation among manufacturing enterprises. This article also verifies that the promotion effect on green product innovation by environmental tax is the most significant.

• The mandatory feature of environmental tax effectively promotes enterprises’ implementation of green technology innovation. In contrast, the transparency of environmental tax’s influence on the green technology innovation is the weakest.

• The relationship between enterprise personnel scale and green product innovation is negative. In contrast, greater enterprise asset scale and operation time can effectively promote green technology innovation.

• Under the environmental tax regulation, there is no positive relationship between enterprise scale and green technological innovation. In contrast, medium-sized enterprises are more willing to undertake green technology innovation.

• Under the influence of environmental tax, green technology innovation initiatives are mainly seen in foreign capital enterprises, while this effect is weakest in state-owned enterprises.

Policy Recommendations

According to the analysis of the test results, combined with the investigation of the status quo of green technology innovation cultivation of manufacturing enterprises in China under the regulation of Environmental Protection Tax Law, we can suggest some specific strategies for green technology innovation cultivation among manufacturing enterprises in China under the regulation of the Environmental Protection Tax Law.

First, it is necessary to improve the transparency of environmental taxation. China’s tax authorities pay little attention to the positive and negative effects of transparency when collecting environmental tax, which is not conducive to exerting the incentive effect of environmental tax. Transparency is one of the core elements of modern taxation, which has always attracted great attention in Western countries. Transparency is a powerful support for fairness. Only by ensuring a high degree of transparency can we maintain a certain degree of fairness. When paying environmental protection tax, every manufacturing enterprise also cares about the payment by competitors and wants to know whether it is treated fairly, which needs to be backed up by transparency. Information disclosure is an effective way to improve transparency; local tax authorities should gradually increase and expand the width and depth of environmental tax collection information in the tax system, so that the promotion effect of transparency on green technology innovation ability can achieve convenience, rationality, and compulsion as soon as possible.

Second, to vigorously promote “three wastes” treatment innovation under the environmental tax regulations, the following is suggested. At present, “three wastes” treatment innovation in China’s manufacturing enterprises is mainly driven by mandatory environmental tax, and other factors have not yet shown an obvious driving effect. It can be seen that in the treatment of “three wastes,” China’s manufacturing enterprises generally lack initiative and enthusiasm, which has become a blind spot for environmental tax incentives. If the rationality, fairness, and transparency of environmental tax collection are improved, “three wastes” treatment innovation will also be improved. Tax incentives for “three wastes” treatment can be continuously adopted and detailed deeply, different preferential standards can be formulated for different industries, preferential grades for the same industry can be created, and tax-paying enterprises can be actively encouraged to suggest improvements. The collection and preferential results should also be made public. In this way, tax-paying enterprises will pay more attention to the technological innovation of “three wastes” treatment and increase the input of manpower and material resources.

Third, improvements are needed in the accuracy of sewage data accounting. The collection of environmental tax is based on sewage data, but the current accounting accuracy of sewage data is not high, which has a certain impact on the fairness and transparency of tax revenue, and thus inhibits green technology innovation to a certain extent. Some enterprises have installed automatic monitoring systems for pollutant discharge. However, most enterprises have not installed such systems, requiring instead manual verification by tax authorities and making direct and indirect judgments based on data obtained from the enterprise’s production ledger, water consumption, electricity consumption, energy consumption, and market sales. If the tax department’s sense of responsibility is not strong, manual accounting may produce deviations. Even with automatic monitoring equipment, due to the inconsistency of data standards, there will also be deviations. All these deviations restrict the growth of enterprises’ green technology innovation ability and hinder the development of China’s ecological economy.

Fourth, it is recommended to set several preferential tax rates and continuously improve fairness. According to the test results, by improving environmental tax fairness, manufacturing enterprises’ innovation abilities for green technological innovation and “three wastes” treatment will be continuously enhanced. At present, setting several preferential tax rates plays an important role in improving tax fairness. The main strategy is to classify multiple reduction levels by pollutant density, which means that the lower the emissions, the lower the tax rate adopted, according to the pollutant density standard. For example, if the pollutant emission is 70% lower than the national or local standard, the environmental protection tax rate will be 20%. If the pollutant emission is 90% lower than the national or local standard, the environmental protection tax rate will be 10%. This means that more taxpayers can enjoy tax reductions. It would also be helpful to make full use of the stimulating and adjusting effect of the Environment Protection Tax Law in order to reveal the technological innovation potential of green manufacturing enterprise. At the same time, we suggest that we can focus on enterprise energy consumption by applying higher energy consumption tax rate (Kassouri, 2022). For different types of manufacturing enterprises, the tax incentives need to be different and need to be flexibly adjusted according to industry characteristics.

Fifth, there is a need to pay attention to the influence of enterprise personnel scale and fixed assets scale when implementing green technology innovation and cultivation under the regulation of Environmental Protection Tax Law. At present, the scale of enterprise personnel hinders green technology innovation, which also reflects the low efficiency of green innovation of enterprise personnel in China, which is an issue that needs to be addressed by enterprises. In a mature ecological economy, the larger the scale of personnel, the stronger the overall ecological awareness of enterprises, and the stronger the atmosphere of green technology innovation. At the same time, the scale of fixed assets does not promote “three wastes” treatment innovation, which shows that the structure of fixed assets of enterprises is unreasonable, focusing only on the allocation of fixed assets at the front end of the production line, but not on the back end of the production line. Therefore, appropriate adjustments need to be made.

Sixth, there is a need to make full use of the incentive effect of the Environmental Protection Tax Law for green technology innovation among large state-owned enterprises. According to the test results, the incentive effect of environmental tax is weaker in large enterprises, and lowest in state-owned enterprises. Therefore, large-scale state-owned enterprises should be the focus of incentives, and a more detailed, scientific, and controllable tax scheme should be formulated. This would enable large state-owned enterprises to play a leading role in green technology innovation. Large state-owned enterprises make up half of China’s national economy and gather huge amounts of human capital and physical capital. If large state-owned enterprises lack vitality in green technology innovation, China’s ecological economic development will suffer many obstacles. Under the existing system in China, the realization of the goal of environmental tax collection mainly depends on tax incentives for large state-owned enterprises, but it seems that this journey still has a long way to go.

Seventh, there is a need to learn from foreign manufacturing enterprises’ green technology innovation skills and experience in the context of the Environmental Protection Tax Law. According to the test results, under the Environmental Protection Tax Law regulation, foreign enterprises do much better in terms of green product innovation, green technology innovation, and “three wastes” treatment innovation than state-owned enterprises and private enterprises. Therefore, the state-owned enterprises and private enterprises should learn from foreign enterprises to enhance their green technology innovation ability. State-owned enterprises, in particular, should pay great attention to green technology innovation property rights incentives, because this is an aspect that is even weaker than in private enterprises. State-owned enterprises and private enterprises should primarily learn from foreign enterprises in terms of consciousness of abiding by the law, the concept of energy conservation and emissions reduction, green technology upgrades, etc. Since the implementation of the Environmental Protection Tax Law, foreign enterprises have responded positively to re-plan the enterprise development strategy and readjust the key direction of green technology innovation according to the tax law, achieving good results. In contrast, state-owned enterprises and private enterprises have adopted relatively passive coping strategies, lacking initiative, and enterprising spirit. Thus, the incentive effect on green technology innovation property rights is significantly lower than that of foreign enterprises.

Finally, there is a need to improve the harmonious relationship among different departments in relation to environmental protection tax collection. Environmental protection tax is a kind of professional tax of a highly technical nature, with many tax categories, complex testing, measurement, and verification process, and high management costs, all of which pose a big challenge for China’s tax administration. According to the test results, the Environmental Protection Tax Law has had some promotion effect on manufacturing enterprises’ green technology innovation in China. However, there remains much room for improvement. Strengthening the coordination among departments will greatly facilitate manufacturing enterprises’ green technology innovation. China’s Environmental Protection Tax Law has created a model of tax collection and administration combined with “enterprise declaration, tax collection, environmental monitoring, and information sharing.” It has clarified the responsibility and collaboration mechanism between the tax authority and the environmental protection department, which helps to define the guarantee mechanism of the environmental protection tax. However, in the current tax collection process, we find that the rights and obligations of the tax authority and the environmental protection department need further clarification, that the degree of information needs to be improved, that the mechanism of cooperation and communication needs to be further optimized, and that the professional talent needs to be deployed. In this way, the green environmental protection tax driving force for technological innovation can be further strengthened.

Research Limitation and Prospects

In this article, the research has some limitations. Environmental protection tax has “double dividend” effect, which is not only a theoretical issue but also an empirical question. In this article, in the process of design variables, the “double dividend” is not considered when exploring the influence by environmental protection tax to enterprise green technology innovation.

The present study highlights are two key areas for future research. First, this study concludes that environmental tax can stimulate the innovation of green technology. However, the implementation of environmental tax needs to be promoted by the government. Therefore, in future research, government involvement can be one of the control variables, which would help in studying the government’s impact on environmental tax and green technology innovation. Second, in this article, we have studied the direct influence on green technology innovation of environmental tax. Considering that there is a research gap on the direct influence with different backgrounds, further research is required from the perspective of the intermediary effect, which will significantly improve the research mechanism for studying environmental tax as a driver of green technology innovation.

Data Availability Statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Bilgili, F., Nathaniel, S. P., Kuşkaya, S., and Kassouri, Y. (2021). Environmental Pollution and Energy Research and Development: An Environmental Kuznets Curve Model through Quantile Simulation Approach. Environ. Sci. Pollut. Res. 28, 53712–53727. doi:10.1007/s11356-021-14506-0

Böhringer, C., and Müller, A. (2014). Environmental Tax Reforms in Switzerland a Computable General Equilibrium Impact Analysis. Swiss J. Econ. Stat. 150 (1), 1–21. doi:10.1007/BF03399400

Chen, Y., Han, B., and Liu, W. (2016). Green Technology Innovation and Energy Intensity in China. Nat. Hazards 84 (1), 317–332. doi:10.1007/s11069-016-2158-7

Garon, J.-D., and Séguin, C. (2021). Environmental Tax Reform in a Federation with Rent-Induced Migration. Environ. Resource Econ. 78 (3), 487–519. doi:10.1007/s10640-021-00540-6

Hall, J., Matos, S., and Bachor, V. (2019). From Green Technology Development to Green Innovation: Inducing Regulatory Adoption of Pathogen Detection Technology for Sustainable Forestry. Small Bus Econ. 52 (4), 877–889. doi:10.1007/s11187-017-9940-0

Han, X., Jiao, J., Liu, L., and Li, L. (2017). China's Energy Demand and Carbon Dioxide Emissions: Do Carbon Emission Reduction Paths Matter? Nat. Hazards 86 (3), 1333–1345. doi:10.1007/s11069-017-2747-0

Kassouri, Y. (2022). Fiscal Decentralization and Public Budgets for Energy RD&D: A Race to the Bottom? Energy Policy 161, 112761. doi:10.1016/j.enpol.2021.112761

Kong, D., and Qin, N. (2021). Does Environmental Regulation Shape Entrepreneurship? Environ. Resource Econ. 80 (1), 169–196. doi:10.1007/s10640-021-00584-8

Kou, P., Han, Y., and Li, Y. (2021). An Evolutionary Analysis of Corruption in the Process of Collecting Environmental Tax in China. Environ. Sci. Pollut. Res. 28 (39), 54852–54862. doi:10.1007/s11356-021-13104-4

Meirun, T., Mihardjo, L. W., Haseeb, M., Khan, S. A. R., and Jermsittiparsert, K. (2021). The Dynamics Effect of green Technology Innovation on Economic Growth and CO2 Emission in Singapore: New Evidence from Bootstrap ARDL Approach. Environ. Sci. Pollut. Res. 28 (4), 4184–4194. doi:10.1007/s11356-020-10760-w

Nakada, M. (2020). The Impact of Environmental Tax Revenue Allocation on the Consequence of Lobbying Activities. Econ. Gov 21 (4), 335–349. doi:10.1007/s10101-020-00243-6

Ohori, S. (2012). Environmental Tax and Public Ownership in Vertically Related Markets. J. Ind. Compet Trade 12 (2), 169–176. doi:10.1007/s10842-010-0093-y

Ranocchia, C., and Lambertini, L. (2021). Porter Hypothesis vs Pollution Haven Hypothesis: Can There Be Environmental Policies Getting Two Eggs in One Basket? Environ. Resource Econ. 78 (1), 177–199. doi:10.1007/s10640-020-00533-x

Song, M., Wang, S., and Zhang, H. (2020). Could Environmental Regulation and R&D Tax Incentives Affect Green Product Innovation? J. Clean. Prod. 258, 120849. doi:10.1016/j.jclepro.2020.120849

Speck, S. (2017). Environmental Tax Reform and the Potential Implications of Tax Base Erosions in the Context of Emission Reduction Targets and Demographic Change. Econ. Polit. 34 (3), 407–423. doi:10.1007/s40888-017-0060-8

Stoever, J., and Weche, J. P. (2018). Environmental Regulation and Sustainable Competitiveness: Evaluating the Role of Firm-Level Green Investments in the Context of the Porter Hypothesis. Environ. Resource Econ. 70 (2), 429–455. doi:10.1007/s10640-017-0128-5

Takeda, S., and Arimura, T. H. (2021). A Computable General Equilibrium Analysis of Environmental Tax Reform in Japan with a Forward-Looking Dynamic Model. Sustain. Sci. 16 (2), 503–521. doi:10.1007/s11625-021-00903-4

Wang, Q., Qu, J., Wang, B., Wang, P., and Yang, T. (2019). Green Technology Innovation Development in China in 1990-2015. Sci. Total Environ. 696, 134008. doi:10.1016/j.scitotenv.2019.134008

Wei, L., and Zhang, H. (2020). How Environmental Regulations Affect the Efficiency of Green Technology Innovation? Am. J. Ind. Bus. Manag. 10 (3), 507–521. doi:10.4236/ajibm.2020.103034

Zárate-Marco, A., and Vallés-Giménez, J. (2015). Environmental Tax and Productivity in a Decentralized Context: New Findings on the Porter Hypothesis. Eur. J. L. Econ. 40 (2), 313–339. doi:10.1007/s10657-013-9400-510.1016/j.enpol.2021.112761

Zhang, K., Xu, D., and Li, S. (2019). The Impact of Environmental Regulation on Environmental Pollution in China: An Empirical Study Based on the Synergistic Effect of Industrial Agglomeration. Environ. Sci. Pollut. Res. 26 (25), 25775–25788. doi:10.1007/s11356-019-05854-z

Keywords: environmental protection tax law, environmental regulation, manufacturing enterprise, green technology innovation, Porter hypotheses

Citation: Chen Y, Zhang T and Ostic D (2022) Research on the Green Technology Innovation Cultivation Path of Manufacturing Enterprises Under the Regulation of Environmental Protection Tax Law in China. Front. Environ. Sci. 10:874865. doi: 10.3389/fenvs.2022.874865

Received: 13 February 2022; Accepted: 31 March 2022;

Published: 29 April 2022.

Edited by:

Kai Fang, Zhejiang University, ChinaReviewed by:

Luigi Aldieri, University of Salerno, ItalyYacouba Kassouri, Leipzig University, Germany

Copyright © 2022 Chen, Zhang and Ostic. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Dragana Ostic, ZG9zdGljQHVqcy5lZHUuY24=, b3JjaWQub3JnLzAwMDAtMDAwMi0wNDY5LTEzNDI=

Yongqing Chen1

Yongqing Chen1 Dragana Ostic

Dragana Ostic