94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 06 January 2023

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.1113383

Wenliang Tang1

Wenliang Tang1 Xue Yang2,3*

Xue Yang2,3*This study estimates the effect of environmental tax legislation on air pollution, using the implementation of China’s Environmental Protection Tax Law (EPTL) as a quasi-natural experiment. For cities which have been authorized to raise tax rates by the EPTL, the air quality index (AQI) is 2.36 lower after the reform. The effect is reinforced in cities with stricter tax enforcement, lower fiscal stress, as well as higher initial pollution levels. Heterogeneity analyses show that the reform is more effective in cities with lower levels of marketization and legalization, as well as in developed cities. In addition, the impact of the reform is more significant in cities with higher levels of public participation in environmental governance, higher tax competition levels, and higher share of secondary industry. A series of robustness tests corroborates the results. This paper provides evidence that environmental tax legislation is efficacious in pollution abatement for developing economies.

Air pollution menaces residents’ survival in multiple ways, including cardiovascular and respiratory diseases, losses in labor productivity, food security, and is even responsible for shortened lives (e.g., Seaton et al., 1995; Chen et al., 2013; Tai et al., 2014; Guan et al., 2016; Chang et al., 2019; Sinha and Kumar, 2019). If environmental tax legislation is efficacious in ameliorating air quality in developing economies, the countries would be able to enhance residents’ wellbeing using the laws. However, whether and to what extent environmental tax legislation is feasible in improving urban air quality for developing economies remains largely underexplored.

China provides a compelling setting to investigate the effectiveness of environmental taxes in developing economies. China’ rapid economic growth is accompanied by a variety of environmental issues. More than 300 large and medium-sized cities across China (approximately 70 percent) do not meet air quality standards set by the World Health Organization (Liao and Shi, 2018). In the last 4 decades, however, there has been no legislation for environmental taxes in China. The implementation of the Environmental Protection Tax Law (EPTL) in China thus provides a suitable opportunity for investigation.

The environmental tax reform affects air pollutant emissions in two ways. First, environmental taxes can incentivize firms to apply cleaner technologies and engage more in technological innovation, and further reduce pollutant emissions (Ekins, et al., 2011; Aghion et al., 2016; Leslie, 2018; Chen and Ma, 2021; Cheng et al., 2022). Second, environmental taxes can lead to increased costs for emissions, and contribute to lower output levels and fewer emissions. Air quality can thus be improved (Gray and Shadbegian, 2003; Pal and Saha, 2015).

We use the environmental tax reform, namely, the implementation of the EPTL in China as a quasi-natural experiment and use detailed data on prefecture-level cities over 2015-2021 to test the impact of the EPTL on air pollution. On 1 January 2018, the EPTL was officially implemented in China. From then on, emission charges are replaced by environmental taxes. Prior to the implementation of the EPTL, China applied the emission charging system for the discharge of pollutants. After the reform, charges on emissions were raised in 14 provinces, and remained unchanged for other provinces.

To test whether the implementation of the EPTL can help reduce air pollution, we obtain data on air pollution from the Ministry of Ecology and Environment of China (MEE), and investigate the effectiveness of the reform. Considering that air pollution is affected by meteorological factors, we also control for a series of weather variables. Weather data is obtained from the National Oceanic and Atmospheric Administration (NOAA). We match data on air pollution and weather at the prefecture-level cities, and obtain 826,916 observations for 336 cities over 2015-2021. In addition to weather variables, we also include city and date fixed effects in the model.

We find that the reform can reduce air pollution in regions with higher tax rates than emission charges. We further find that tax enforcement can vary the relationship between environmental taxes and air pollution. The implementation of the EPTL can improve air quality more significantly in cities with stricter tax enforcement. However, the reform is less effective in cities with greater fiscal stress and lower initial air pollution levels. In addition, the effect is more significant in regions with higher economic development, less tax competition, weaker environmental regulation, lower levels of marketization, higher levels of public participation, and a higher proportion of secondary industries.

This paper is instructive in the following ways. First, this paper provides experiences for policymakers regarding improving environmental quality in developing economies. This paper validates the effectiveness of the environmental tax reform on air pollution in China, and shows that similar laws can be enforced in countries beset by pollution, and further help them reduce the multiple negative effects of air pollution. In developing countries, pollution levels are often several times higher than that of developed ones, and have already been one of the major threats to residents’ health (Greenstone and Hanna, 2014; Ebenstein et al., 2015). Referring to China’s successful experience with the environmental tax reform, developing countries can implement similar policies to reduce the impediment of environmental degradation to economic development.

Second, this paper contributes to literature on the effect of environmental taxes on emission reduction. A number of factors can vary the effect of environmental taxes, ignoring such factors can be disadvantageous for maximizing policy effectiveness. Therefore, this paper explores the heterogeneous effect of environmental taxes, and discovers factors that vary the effect of this policy. Future policy implementation can refer to the results, and determine which cities are the priority targets.

Third, this paper is informative to pollution governance in China. Local governments are authorized to raise tax rates in accordance with the EPTL, and 14 provinces have raised the tax rates according to local circumstances. The results in this paper show that air pollution levels become lower after the reform in these provinces. Higher tax rates have therefore improved the local environment. Other provinces, especially those with serious air pollution, may adjust the tax rates accordingly.

China’s economic development has brought about a number of environmental issues, and the Chinese government has been trying to cope with environmental pollution through multiple policy tools. In 1979, the central government of China implemented the Environmental Protection Law, and a pilot system for emission charging was also proposed in some places to control the emission of industrial pollutants. In 1982, the central government further implemented the Tentative Provisions on Pollution Charge, and clarified the standards and methods for the collection of emission charges. However, the policy did not achieve the expected targets of emission reduction due to the low standard of emission charges. Along with the continuous development of industry, increased pollution issues emerged. China’s pollution problems have therefore not been effectively addressed (Jiang et al., 2014). After that, in 2003, the central government published the Administrative Regulations on Levy and Use of Emission Discharge Fee, as a further step to reduce pollution levels across the country.

Emission charges have always been a means for the Chinese government in emission reduction (Wang and Jin, 2007). However, the effect of emission charges on environmental improvement is weak because of lenient enforcement (Jiang et al., 2014; Maung et al., 2016). In order to solve the increasingly serious environmental problems, the Chinese government implemented the Environmental Protection Tax Law in 2018, which involves taxes on air pollutants, water pollutants, solid wastes and industrial noise. In contrast with the emission charging system, which is only an administrative rule, the EPTL has a stronger effect on pollution behaviors (Maung et al., 2016).

The EPTL sets minimum tax rates nationally, and provinces are authorized to levy environmental protection taxes within ten times of the prescribed minimum value. The EPTL is developed based on the previous emission charging system, and a number of provinces still charge the same amount of cash to polluters as before. In other words, the amount of money paid by polluters in these provinces for discharging pollutants remains unchanged after the reform. In contrast, 14 provinces have raised the charges for emission after the reform, including Beijing, Tianjin, Hebei, Jiangsu, Shandong, Henan, Sichuan, Chongqing, Hunan, Hainan, Guizhou, Guangdong, Guangxi and Shanxi.

This paper is related to two strands of literature. The first is the effect of environmental taxes. Environmental taxes can increase tax burden for polluting firms, which in turn influences both the environment and the economy (Pearce, 1991; Bonnet et al., 2018; Li et al., 2022). A growing body of literature indicates that environmental taxes are among the most effective ways to reduce pollution and improve environmental quality (Baumol et al., 1988; Bovenberg and Mooij, 1997; Patuelli et al., 2005; Ekins et al., 2011; Ekins et al., 2012; Bonnet et al., 2018; Li et al., 2022). For instance, Agnolucci (2009) investigates environmental tax reform in Germany and Britain, and finds that environmental taxes can reduce both energy consumption and carbon dioxide emissions in a significant way. Also, Bruvoll and Larsen (2004), Guo et al. (2014), Wang et al. (2018), Zhai et al. (2021) find that carbon taxes can reduce emissions of carbon dioxide and air pollutants at the same time.

Environmental taxes improve environmental quality primarily by forcing producers to reduce emissions, rather than lowering consumers’ consumption (Pang, 2018; van der Ploeg et al., 2022). This is because for producers, the supply elasticity is relatively higher, and producers can adjust their output to achieve emission reduction targets. While for consumers, the demand elasticity is relatively lower, which makes it difficult for consumers to change their demand significantly in a short time (van der Ploeg et al., 2022). For producers, environmental taxes increase the marginal cost of energy consumption, and thus lead to lower output levels as well as reduced emissions (Gray and Shadbegian, 2003; Pal and Saha, 2015). In addition, if environmental taxes paid by firms are higher than employing clean technologies, firms are more willing to pay for cleaner technologies and emission-related technological innovations (Cremer and Gahvari, 2004; Brécard, 2011; Ekins, et al., 2011; Lanoie et al., 2011; Ebenstein et al., 2015; Aghion et al., 2016; Leslie, 2018; Chen and Ma, 2021; Cheng et al., 2022).

Environmental taxes are widely regarded as an effective means for environmental governance (Patuelli et al., 2005; Ekins et al., 2011; Ekins et al., 2012; Leslie, 2018; Li et al., 2022), and that factors including industrial structure, the use of environmental tax revenues and trade liberalization can reduce the effectiveness of environmental taxes for pollution abatement (Bosquet, 2000; Yates, 2012; Duan et al., 2021; He et al., 2021; Zhang et al., 2022). For example, Fredriksson (2001) finds that environmental lobbyists can influence the effectiveness of environmental taxes. This is because, when politicians are able to influence the provision of related subsidies to firms, lobbyists may finance campaigns in exchange for the subsidies, which are greater than their lobbying costs. As a result, emission costs for lobbyist-associated polluters are reduced, and their emissions will further increase (Fredriksson, 2001). In addition, environmental benefits of environmental taxes may decline due to inflation, entry of new polluters, and government’s implementation of other alternative policies (Clinch et al., 2006; Cao et al., 2021).

In terms of economic effects, environmental taxes have impacts on economic growth, tax distortion, income distribution, and fiscal sustainability (Bosquet, 2000; Ekins et al., 2011; Karydas and Zhang, 2019; Costantini and Sforna, 2020; Spinesi, 2022; Zhang et al., 2022). Controversy remains over the economic impacts of environmental taxes. For instance, Ekins et al. (2011), Aubert and Chiroleu-Assouline (2019) argue that environmental taxes can reduce tax distortions through redistribution, and contribute to higher social welfare. While Bovenberg and De Mooij (1994), and Bonnet et al. (2018) propose that, when tax distortions already exist, environmental taxes will exacerbate distortions. This is because environmental taxes can contribute to increased production costs and lower wages for workers, and lead to higher tax distortions (Bovenberg and Goulder, 2002). Karydas and Zhang (2019) explores the influence of environmental taxes on economic growth and technological innovation and find that the impacts may vary due to related external factors. Oueslati (2014) also argues that the type of taxes vary the associated economic and welfare effects.

Previous studies focused on the environmental and economic effects of environmental taxes. However, the extent of environmental taxes on air pollution and the characteristics of the effects are relatively underexplored. In addition, most of the existing studies investigate the impact of environmental taxes through model derivation, no one has yet analyzed environmental taxes’ contribution to emission reduction using micro data from developing economies.

Another strand of literature is the influence of government related factors on pollution in three aspects. The first is environmental policies (e.g., Sadik-Zada and Sadik-Zada, 2020). For example, in the United States, the Clean Air Act has reduced pollution in hundreds of counties and has improved air quality in the long-term (Greenstone, 2002; Isen et al., 2017). And in China, the Environmental Protection Law has been proved to be effective in air pollution reduction (Li et al., 2016; Geng et al., 2021).

The second is local governments’ fiscal stress. Previous studies find that fiscal stress is closely associated with environmental quality (Wen and Zhang, 2022). Fiscal stress contributes to laxer environmental regulations, which is beneficial for local governments to attract investment, and contribute to environmental degradation (Chen 2017; Bai et al., 2019; Wen and Zhang, 2022). In addition, fiscal stress can distort the structure of government spending, governments may reduce expenditures on environmental conservation even though faced with severe pollution, environmental degradation can thus be accelerated (Hettige et al., 2000; López et al., 2011). For instance, Kong and Zhu (2022) find that the abolition of agricultural taxes caused increases in local fiscal stress, and led to a 4 percent increase in emissions.

The third is tax competition. Tax competition is the phenomenon that local governments compete with each other for tax sources. Cremer and Gahvari (2004) find that tax competition causes an increase in pollution emission. Tax competition can contribute to laxer environmental standards, and result in environmental degradation (Wilson, 1999; Bai et al., 2019). In general, local governments engage in tax competition by reducing tax rates and providing tax incentives, which lead to losses in tax revenues. Local governments are therefore motivated to provide fewer environment-related public goods. Environmental degradation can thus be accelerated. In conclusion, a large body of literature has focused on government-related factors that can affect pollution, little attention has been paid to the influence of the environmental tax reform on pollution in China.

The environmental tax reform increases the cost of emitting, and forces firms to reduce emissions by reducing production and applying cleaner technologies. Before the reform in 2018, China had been charging for emissions based on an administrative rule known as the “emission charging system”. Due to local governments’ various considerations of tax revenues, employment and economic development, the regulation had not been strictly enforced. For instance, a number of polluting firms with large contribution to government revenue are exempted from the charges, the effectiveness of the regulation on air pollution is therefore limited (Wu and Tal, 2018). After the EPTL reform, China taxes emissions according to the law. The emission charging system is only an administrative rule, while the EPTL is a law and is therefore of greater mandatory character (Wang et al., 2018). The EPTL contributes to higher regulatory pressures for firms and increased cost of emissions, and further forces polluting firms to participate in environmental management (Acemoglu et al., 2012).

In addition, on the basis of the emission charging system, 14 provinces have raised the charges according to the EPTL, which contribute to enhanced emission reduction effect of the EPTL in these provinces1. Local governments are authorized by the EPTL to adjust tax rates upward, and 14 provinces have raised tax rates. For other provinces, charges for emission remains unchanged as it was in the emission charging system. Existing studies show that higher charges increase the cost of emissions for firms remarkably (Ekins, et al., 2011; Pal and Saha, 2015; Leslie, 2018; Cheng et al., 2022). Higher tax rates can thus force firms to find ways for emission reduction, which in turn contribute to improved air quality (Gray and Shadbegian, 2003; Ekins, et al., 2011; Pal and Saha, 2015; Cheng et al., 2022). In additon, previous studies show that firms are less likely to invest in regions with higher tax rates (Dean et al., 2009). Therefore, we propose the following hypothesis.

As we discussed earlier, building on the emission charging system, 14 provinces have raised the charges according to the EPTL, which can further contribute to enhanced effectiveness of the EPTL in the provinces. Also, the appliance of exogenous policy shocks in this paper can reduce the problem of endogeneity bias (Friedrich, 2022). The environmental tax reform is implemented by the central government. Firms are thus almost impossible to influence the environmental tax reform. This addresses the reverse causality problem in the inferences of the paper. Hence, using environmental tax reform as a quasi-natural experiment and employing the difference-in-difference (DID) method can reduce endogeneity bias and increase the reliability of the results in this paper. To test the effect of the reform on air pollution, we adopt the difference-in-differences (DID) method and employ the following model:

In Eq. 1, AQIjt is air quality index for city j in date t. Treati is an indicator for cities in the 14 provinces that have raised the tax rates2. Postt is an indicator variable which equals one for years of 2018–2021, and zero otherwise. This is because the EPTL came into effect in January 2018. Wjt is a series of weather controls, including Wind speed, Wind direction, Temperature, Precipitation, Dew point, and Sea-level pressure, as well as the corresponding quadratic terms (Zhang et al., 2018). Weather variables are included because the existing studies show that meteorological factors can influence the aggregation and dissipation of air pollutants (Seaman, 2000; Arain et al., 2007; Greenstone et al., 2022). Following Agarwal et al. (2019) and Li et al. (2020), we introduce weather variables in the model. The definitions are presented in Table A1 θit is a set of fixed effects, including city and date fixed effects. We include city and date fixed effects to control for both ctiy- and time-level unobservables. We cluster standard errors at the city level. All continuous variables are winsorized at the .5 and 99.5 percent.

Data on air pollution comes from the Ministry of Ecology and Environment of China (CMEE). We obtain hourly data on AQI, PM2.5, and PM10 from the CMEE, and convert the data into daily mean values at the city level.

Data on meteorological factors comes from the National Oceanic and Atmospheric Administration (NOAA). Original data on weather are at three-hour intervals. Dew point is used to control for relative humidity (Zhang et al., 2018). We combine the data into daily mean levels. Quadratic terms of weather variables are constructed using daily mean values. An inverse-distance weighting method using weather stations within 200 km is applied to compute city level weighted weather data (Zhang et al., 2018). Distances are measured in great-circle distance for higher accuracy (Sager 2019). We convert Greenwich Mean Time (GMT) used in the NOAA data to Beijing time, and then match weather variables with pollution data. Descriptive statistics are shown in Table 1.

Table 2 reports the results from estimating Eq. 1. In column 1, we exclude control variables and fixed effects. The coefficient of Treat × Post is significantly negative at the 1% level. In column 2, fixed effects are introduced. The coefficient of Treat × Post is negative and significant at the 1% level, and declines from −4.523 to −2.634. In column 3, we exclude the quadratic terms of each weather variable. The coefficient of Treat × Post remains significant. Compared with column 3, the coefficient of Treat × Post in column 4 is only slightly disturbed. In Table 2, all the coefficients of Treat × Post are negative and statistically significant. This indicates that, to some extent, the reform is exogenous.

In column 4, the coefficient of Treat × Post indicates that in provinces which have raised tax rates, AQI is 2.361 lower than other provinces after the reform. Air quality in the provinces with higher tax rates is significantly improved. Hypothesis 1 is thus confirmed. Firms in regions with higher tax rates may have higher emission costs. The firms are therefore more inclined to reduce production and apply cleaner technologies.

Stricter enforcement of emission-related policies can make it increasingly harder for firms to avoid paying environmental taxes. To test the impact of tax enforcement on the causality between the reform and air pollution, we estimate Eq. 1 after introducing the interactions between TE and Treat × Post. TE refers to tax enforcement, defined as current tax burden minus the expected tax burden. We use the data from 2016 to calculate TE. The expected tax burden is calculated using the residual of Eq. 2.

In Eq. 2, Tjt is tax revenue for the city j in year t. GDPjt is gross domestic product of city j in year t. IND1 and IND2 are the proportion of first and secondary industry in GDP, respectively. Eq. 3 is used to measure the extent of tax enforcement. A higher value of TE indicates stricter tax enforcement.

The results are presented in Table 3. Introducing TE in the model changes the number of observations available for regression, we therefore drop observations for which TE is missing. The result in column 1 shows that although the sample size is reduced, the effect of the reform on air pollution remains significantly negative. In column 2, the coefficient of Treat × Post × TE is negative and significant. This suggests that stricter tax enforcement contributes to enhanced effect of the reform on emission reduction. The result is consistent with Hypothesis 2.

The findings in Table 3 show that tax enforcement can vary the effectiveness of the EPTL. And as we discussed in Section 2, during the implementation of the emission charging system, lax enforcement of the policy had contributed to weakened efficiency. Similarly, after the reform, if local governments’ do not enforce the law effectively, the implementation of the EPTL may not achieve its primary target, namely, reducing environmental pollution.

Tax competition is the phenomenon that local governments compete with each other for tax sources. Tax competition among local governments can lead to serious air pollution in multiple ways3. Tax competition can contribute to laxer environmental regulations and inefficiency of environment-related policies, and result in environmental pollution. In order to attract investment and labor, local governments may lower tax rates to engage in tax competition (Cremer and Gahvari, 2004; Bierbrauer et al., 2013). To maximize profits, firms may migrate from high-tax-rate regions to lower ones, which causes increased pollution in the latter. In China, local governments are not authorized to adjust tax rates without the approval of the central government, but are authorized to offer tax incentives, which further results in lower effective tax rate. This further helps local governments to attract more investment. Therefore, we can predict that the reform is more effective in regions with a lower level of tax competition.

According to Bai et al. (2019), tax competition is defined as income from value added tax divided by GDP. We then creat two subsamples according to the median value of tax competition. Column 1 and 2 of Table 4 displays the results for subsamples in which tax competition is above and below the median value, respectively. As predicted, the reform improves air quality in regions with lower tax competition.

The results show that a higher level of tax competition restricts the effectiveness of the reform. Existing studies also show that tax competition between governments has a negative impact on pollution for both local and surrounding regions (Wilson, 1999; Cremer and Gahvari, 2004; Bai et al., 2019). If local governments are overly involved in tax competition, the reform would be less effective.

Fiscal stress can lead local governments to apply laxer environmental regulations so as to attract investment. Also, fiscal stress is responsible for reduced expenditures on environment-related public goods. Hence, local governments’ fiscal stress may undermine the effectiveness of the reform. To investigate whether fiscal stress matters for the causality between the reform and air pollution, we apply interactions between FS, FS1 and Treat × Post in the model. The definitions of FS and FS1 are presented in Table A1. We use the data from 2016 to calculate FS and FS1.

The results are presented in Table 5. Introducing FS and FS1 in the model also changes the number of observations available for regression, hence, we drop observations for which data on FS or FS1 is missing. Column 1 shows the baseline results, the coefficient of Treat × Post remains negative and significant. Column 2 and 3 report the results after introducing the interactions. The coefficients of Treat × Post × FS and Treat × Post × FS1 are positive and significant. The findings show that the effectiveness of the reform can be reduced by local governments’ fiscal stress.

Initial pollution levels can vary the influence of the reform on air pollution. To examine the role of initial pollution levels, we induce the interaction between Treat × Post and Initial. Initial is the annual average AQI in 2017, the year before the reform. Annual mean values of AQI are calculated using daily data. Cities with daily data less than 100 days are excluded.

Table 6 displays the results. Due to missing values of Initial for a few cities, the sample size is smaller than the baseline regression. Hence, we re-estimate Eq. 1 using the reduced sample. In column 1, the coefficient of Treat × Post is negative and significant, indicating that the result is not influenced by the reduction in sample size. In column 2, the coefficient of Treat × Post × Initial is significantly negative. The result shows that the reform is particularly significant in heavily polluted regions. Regions with higher initial pollution levels have greater potential for environmental improvement.

Results in Table 6 indicate that initial pollution levels are able to vary the causality between the reform and air pollution. Regions with higher initial pollution levels are more sensitive to the reform. Gendron-Carrier et al. (2018) investigate the expansion of subway system on air pollution and find that, in cities with higher pollution levels, subway systems contribute to improvement of air quality. While the effect is weaker in less polluted cities. To some extent, our result is consistent with Gendron-Carrier et al. (2018).

The influence of the reform may differ across developed and under-developed regions. For regions with different levels of economic development, the importance of environmental governance also varies. In general, developed regions are faced with more environmental issues, and stricter emission reduction targets (Geng et al., 2021). Hence, local governments in developed regions are more motivated to improve air quality. In addition, governments in developed regions are faced with less fiscal stress because of sufficient fiscal revenues (Maung et al., 2016; Dang et al., 2019), and are therefore unlikely to attract investment using laxer environmental regulations (Maung et al., 2016). Furthermore, local governments in rich regions are able to invest more in environmental protection. Therefore, we can predict that the causality between the reform and air pollution is more significant in developed regions.

We then divide the sample into rich and poor regions using two methods. First, we split the sample into three parts according to the geographical regions they belong to. This is because eastern China is more developed while central and western China are relatively underdeveloped. Second, we employ city-level GDP as a measure for economic development, and divide the sample into two subsamples in which the GDP is above or below the median value.

In column 1 of Table 7, the coefficient of Treat × Post is statistically significant for cities in estern China. While in column 2 and 3, the coefficients are insignificant. Similarly, in column 4, The coefficient of Treat × Post is also significant for developed regions. We compare the results in column 1 and 4 and find that, classifying the level of economic development either by geographic region or by GDP yields consistent results, i.e., for developed regions, the effect of environmental taxes on pollution abatement is more significant.

We are not asserting that the reform is effective only in developed regions. What the results here show is that for develop regions, the causality between the reform and the improvement of air quality is clear. Previous studies suggest that environmental taxes are effective in environmental improvement (Bovenberg and De Mooij, 1997; Bonnet et al., 2018; Li et al., 2022). Findings in Table 7 show that when evaluating the effectiveness of environmental taxes, the degree of economic development ought to be taken into account.

Industrial development can also influence the relationship between the reform and air pollution. Industrial development can lead to increases in pollution and lower air quality (Zhao et al., 2021). According to the Corporate Citizenship Report, industrial firms create 70% of the total pollution in China. Hence, air pollution ought to be more serious in regions with higher development of industry. As we discussed earlier, the reform is influential in regions with higher initial pollution levels. Based on this, we can reasonably predict a significant effect of the reform on air pollution in industrially developed regions. We employ the proportion of secondary industry in GDP as a proxy for industrial development. In column 1 of Table 8, the coefficient of Treat × Post is significantly negative, while the coefficient is insignificant in column 2.

The effect of the reform may exhibit heterogeneity in cities with different environmental regulation levels. Firms are unlikely to reduce emissions if environmental regulation is weak (Pal and Saha, 2015). Also, polluting firms are inclined to choose regions with laxer environmental regulation (Dean et al., 2009). Strict environmental regulation can contribute to higher costs for emissions, and can thus reduce emissions. Polluting firms are also less likely to invest in regions with stricter regulation. Hence, regions with strict environmental regulation exhibit lower levels of pollution. As we discussed earlier, the reform has less potential to improve air quality in less polluted regions. We can predict that in regions with weaker environmental regulation, the effect of the reform can be more significant.

In China, the frequency of certain keywords in the Report on the Work of the Government reflects the focus of government administration. Following Chen et al. (2018), we calculate the proportion of environment-related words (e.g., environment, ecology, emission reduction) in the Report on the Work of the Government to measure the level of environmental regulation. A lower value of the proportion indicates laxer environmental regulation. To test the influence of environmental regulation on the relationship between the reform and air pollution, we construct subsamples according to the median value.

Column 1 and 2 of Table 9 displays the results for the regions with stricter and laxer environmental regulation, respectively. The results show that the reform has a greater impact on air pollution in regions with weaker environmental regulation. The results in Table 9 confirm that the importance that local governments attach to the environment varies the effectiveness of the reform. We fail to find the effect of the reform on air pollution in regions with stricter regulation. This seems to contradict our previous conclusions. As we discussed earlier, fiscal stress can lead to laxer environmental regulation, and further reduce the impact of the reform. Therefore, the reform has weaker effects on air pollution in regions with higher fiscal stress. However, laxer environmental regulation does not necessarily equal higher fiscal stress, because environmental regulation is affected by complex factors including local policies, environmental awareness of the governments, and the cost of pollution emissions. Local fiscal stress is just one of the reasons.

The effect of the reform on air pollution may differ across cities with different levels of marketization and legalization. Both the level of marketization and legalization are influential on government actions, including environmental governance and emissions information disclosure (Kong and Zhu, 2022). Following Kong and Zhu (2022), we apply the NERI index to test the influence of marketization and legalization. We use the score for product market and factor market to measure marketization. Similarly, the level of legalization is measured using the index of intermediary organizations and law development.

Column 1 and 3 of Table 10 report the relationship between the reform and air pollution in regions with higher levels of marketization. The coefficients on Treat × Post are insignificant. Column 2 and 4 present the results for those below the median value. Column 5 and 6 displays the results for regions with different levels of legalization. In column 5, the coefficient is insignificant. While the coefficient is significantly negative in column 6. The results in Table 10 show that the reform on air pollution is more significant in regions with lower levels of marketization and legalization. In the future enforcement of the EPTL, regions with lower levels of marketization and legalization ought to be given extra attention.

Public participation can incentivize governments to improve the local environment, and make them pay more attention to pollution control as well. For example, when residents’ complaints on environment issues increase, the government will be more committed to environmental management and green investments (Dasgupta et al., 2001; Liao and Shi, 2018). However, Zhang et al. (2019) argue that citizen complaints are unlikely to affect pollution. Therefore, we employ the number of reports about environmental problems as a measure for public participation (Liao and Shi, 2018). Data on the number of environment related reports is obtained from the CMEE.

Column 1 of Table 11 reports the result for provinces in which the number of reports is above the median value. The coefficient of Treat × Post is negative and significant. The coefficient is insignificant in column 2.

The DID method requires that treatment group and control group have similar trends before the reform. We employ the following model for parallel trend test to confirm the robustness of the results.

Yeart is an indicator variable equal to one if observations belong to year t, and zero otherwise. The results presented in Figure 1 indicate that both the treatment and control groups was in the same trend before the reform. In addition, Figure 1 displays that air pollution in the treatment group decreases significantly in the third and fourth years after the reform. This indicates a lagged effect of the reform. For polluting firms, both adjusting output levels and adopting clean technologies are relatively time-consuming.

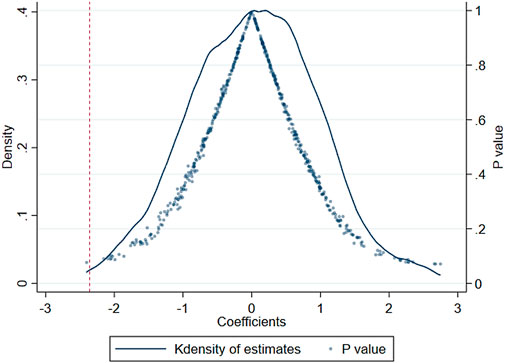

Following Cai et al. (2016), we randomly assign 14 provinces as the treatment group and apply Eq. 1 for estimation. We conduct the estimation for 500 times. The distribution of the coefficients and the corresponding p-values are shown in Figure 2. The coefficients center around zero and most of the associated p-values are above .1.

FIGURE 2. Kernel density of 500 estimates. Notes: X-axis shows the coefficients of Treat × Post. The curve presents the kernel density distribution of estimates. The dots are the corresponding p-values. The red line is the coefficient of Treat × Post in column 4 of Table 2.

Following La Ferrara et al. (2012) and Polyakov et al. (2022), we also conduct placebo tests as follows. We drop observations for 2018 and after, and use three indicators for placebo tests. The indicators are Post_6_months, Post_1_year and Post_2_years. Post_2_years equals one for 2016 and 2017. Post_6_months and Post_1_year are defined similarly. Table 12 shows that our results are not replicable in the placebo tests.

Environmental quality is subject to stricter monitoring for Beijing, Shanghai, Tianjin and Chongqing, which are under direct jurisdiction of China’s central government. In addition, vice-provincial cities receive more attention from the central government because of their developed economy and population size. Vice-provincial cities thus have stronger incentive to reduce emissions, even without the reform. To address the concern that the results are driven by these cities, we remove the cities and use Eq. 1 for estimation. The results are reported in column 1 and 2 of Table 13.

Another concern is that our results could rely on contemporaneous policies. We consider other policies that may affect air pollution. Therefore, we exclude cities involved in the Central Environmental Inspection, the emission trading system and the carbon emission trading system. Results are presented in column 3 to 5 in Table 13. The coefficients remain significant.

Finally, we apply alternative independent variables. We replace AQI by PM2.5 and PM10, and estimate Eq. 1. PM2.5 and PM10 are measures of particulate matter. Column 6 and 7 of Table 13 report the results. The coefficients of Treat × Post are all negative and significant.

This paper investigates whether the environmental tax reform in China can reduce air pollution, using detailed data on air pollution and weather variables. We find evidence that the reform has a significant effect on air quality improvement. We further find that, due to the effect of tax enforcement on emission costs, the reform is more effective in regions with stricter tax enforcement. In addition, we also find that the effect of the reform is more significant in cities with lower fiscal stress and higher initial pollution levels. We also find that the reform exhibits a number of heterogeneous features. A series of robustness checks also confirm our results.

Our results show that, on the whole, the reform is beneficial for improving air quality, and that a number of factors can vary the effectiveness. A growing body of research has shown that environmental pollution can not only result in severe health problems, such as cardiovascular and respiratory diseases, but can also cause loss of labor productivity, cognitive decline, and mental health impairment (e.g., Seaton et al., 1995; Guan et al., 2016; Zhang et al., 2017; Zhang et al., 2018). In other words, environmental pollution can reduce social welfare. This study shows that the environmental tax reform is able to improve environmental quality and can thus enhance social welfare.

Existing studies also suggest that numerous factors can vary the effectiveness of environmental taxes, for instance, industrial structure (He et al., 2021; Zhang et al., 2022) and trade liberalization (Duan et al., 2021). This paper also finds that the effectiveness of the environmental tax reform can be affected by external factors. Our findings are consistent with the existing literature. Building on the existing literature, this paper contributes to literature regarding factors that influence the effectiveness of environmental taxes. We find that the level of economic development, tax competition, and environmental regulation all affect the effectiveness of environmental taxes. Hence, in the implementation of the EPTL, factors mentioned in this study ought to be taken into account, so as to determine the priorities of the EPTL. This paper contributes to literature on environmental taxes, and is beneficial for a more accurate assessment of China’s environmental tax reform as well.

The findings are also instructive for policymakers. First, the findings of this paper suggest that when implementing environmental taxes, policymakers ought to take local tax enforcement and local fiscal stress into consideration, so that the taxes can be implemented effectively. Second, cooperation between environmental and taxation authorities ought to be strengthened. Our results show that environmental regulation can also vary the effectiveness of environmental taxes. Therefore, cooperation from environmental authorities is needed to enhance the effectiveness of environmental taxes. Third, we find that both economic development and tax competition can affect the effectiveness of the reform. Therefore, for future studies on environmental taxes, regional heterogeneity should be considered. This can contribute to a more accurate assessment of the effects of environmental taxes. Fourth, for provinces that have raised the tax rates, air quality improved after the reform. Therefore, for the rest of the provinces, applying higher tax rates can also be beneficial for pollution abatement.

Although our analysis focuses on air pollution in China, the findings can be generalized to countries faced with serious pollution issues, such as India and Bangladesh. This paper can thus provide lessons for these countries regarding pollution abatement. Also, this paper provides evidence that the reform can improve air quality. However, due to data limitations, how the reform influences water pollution, solid waste emissions and industrial noise pollution remains to be studied. In addition, existing studies suggest that environmental taxes can increase the emission costs, and induce firms to introduce cleaner production technologies and participate in R&D activities. This may further influence firms’ business decisions, such as compensation allocation and human resource policies. Future studies can start with firm behaviors, and explore the effects of environmental taxes.

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

WT: methodology, software, data curation, investigation, and writing–original draft. XY: conceptualization, investigation, supervision, writing–review, and editing.

This work was supported by the Hubei Provincial Department of Education (21Q214).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

1The provinces are Beijing, Tianjin, Hebei, Jiangsu, Shandong, Henan, Sichuan, Chongqing, Hunan, Hainan, Guizhou, Guangdong, Guangxi and Shanxi.

2The provinces are Beijing, Tianjin, Hebei, Jiangsu, Shandong, Henan, Sichuan, Chongqing, Hunan, Hainan, Guizhou, Guangdong, Guangxi and Shanxi.

3Tax competition is the phenomenon that local governments compete with each other for tax sources.

Acemoglu, D., Aghion, P., Bursztyn, L., and Hemous, D. (2012). The environment and directed technical change. Am. Econ. Rev. 102 (1), 131–166. doi:10.1257/aer.102.1.131

Agarwal, S., Qin, Y., and Zhu, H. (2019). Disguised pollution: Industrial activities in the dark. Available at SSRN 3359404.

Aghion, P., Dechezleprêtre, A., Hemous, D., Martin, R., and Van Reenen, J. (2016). Carbon taxes, path dependency, and directed technical change: Evidence from the auto industry. J. Political Econ. 124 (1), 1–51. doi:10.1086/684581

Agnolucci, P. (2009). The effect of the German and British environmental taxation reforms: A simple assessment. Energy Policy 37 (8), 3043–3051. doi:10.1016/j.enpol.2009.03.052

Arain, M. A., Blair, R., Finkelstein, N., Brook, J. R., Sahsuvaroglu, T., Beckerman, B., et al. (2007). The use of wind fields in a land use regression model to predict air pollution concentrations for health exposure studies. J. Atmos. Environ. 41 (16), 3453–3464. doi:10.1016/j.atmosenv.2006.11.063

Aubert, D., and Chiroleu-Assouline, M. (2019). Environmental tax reform and income distribution with imperfect heterogeneous labour markets. Eur. Econ. Rev. 116, 60–82. doi:10.1016/j.euroecorev.2019.03.006

Bai, J., Lu, J., and Li, S. (2019). Fiscal pressure, tax competition and environmental pollution. Environ. Resour. Econ. 73 (2), 431–447. doi:10.1007/s10640-018-0269-1

Baumol, W. J., Baumol, W. J., Oates, W. E., Bawa, V. S., Bawa, W. S., and Bradford, D. F. (1988). The theory of environmental policy. Cambridge: Cambridge University Press.

Bierbrauer, F., Brett, C., and Weymark, J. A. (2013). Strategic nonlinear income tax competition with perfect labor mobility. Games Econ. Behav. 82, 292–311. doi:10.1016/j.geb.2013.08.001

Bonnet, C., Bouamra-Mechemache, Z., and Corre, T. (2018). An environmental tax towards more sustainable food: Empirical evidence of the consumption of animal products in France. Ecol. Econ. 147, 48–61. doi:10.1016/j.ecolecon.2017.12.032

Bosquet, B. (2000). Environmental tax reform: Does it work? A survey of the empirical evidence. Ecol. Econ. 34 (1), 19–32. doi:10.1016/s0921-8009(00)00173-7

Bovenberg, A. L., and De Mooij, R. A. (1994). Environmental levies and distortionary taxation. Am. Econ. Rev. 84 (4), 1085–1089.

Bovenberg, A. L., and De Mooij, R. A. (1997). Environmental tax reform and endogenous growth. J. Public Econ. 63 (2), 207–237. doi:10.1016/s0047-2727(96)01596-4

Bovenberg, A. L., and Goulder, L. H. (2002)., 3. Elsevier, 1471–1545.Environmental taxation and regulationHandb. Public Econ.

Brécard, D. (2011). Environmental tax in a green market. Environ. Resour. Econ. 49 (3), 387–403. doi:10.1007/s10640-010-9438-6

Bruvoll, A., and Larsen, B. M. (2004). Greenhouse gas emissions in Norway: Do carbon taxes work? Energy Policy 32 (4), 493–505. doi:10.1016/s0301-4215(03)00151-4

Cai, X., Lu, Y., Wu, M., and Yu, L. (2016). Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J. Dev. Econ. 123, 73–85. doi:10.1016/j.jdeveco.2016.08.003

Cao, J., Dai, H., Li, S., Guo, C., Ho, M., Cai, W., et al. (2021). The general equilibrium impacts of carbon tax policy in China: A multi-model comparison. Energy Econ. 99, 105284. doi:10.1016/j.eneco.2021.105284

Chang, T. Y., Graff Zivin, J., Gross, T., and Neidell, M. (2019). The effect of pollution on worker productivity: Evidence from call center workers in China. Am. Econ. J. Appl. Econ. 11 (1), 151–172. doi:10.1257/app.20160436

Chen, H., Tang, S., Wu, D., and Yang, D. (2021). The political dynamics of corporate tax avoidance: The Chinese experience. Account. Rev. 96 (5), 157–180. doi:10.2308/tar-2017-0601

Chen, S. X. (2017). The effect of a fiscal squeeze on tax enforcement: Evidence from a natural experiment in China. J. Public Econ. 147, 62–76. doi:10.1016/j.jpubeco.2017.01.001

Chen, Y., Ebenstein, A., Greenstone, M., and Li, H. (2013). Evidence on the impact of sustained exposure to air pollution on life expectancy from China’s Huai River policy. Proc. Natl. Acad. Sci. 110 (32), 12936–12941. doi:10.1073/pnas.1300018110

Chen, Y., and Ma, Y. (2021). Does green investment improve energy firm performance? Energy Policy 153, 112252. doi:10.1016/j.enpol.2021.112252

Chen, Z., Kahn, M. E., Liu, Y., and Wang, Z. (2018). The consequences of spatially differentiated water pollution regulation in China. J. Environ. Econ. Manag. 88, 468–485. doi:10.1016/j.jeem.2018.01.010

Cheng, B., Qiu, B., Chan, K. C., and Zhang, H. (2022). Does a green tax impact a heavy-polluting firm’s green investments? Appl. Econ. 54 (2), 189–205. doi:10.1080/00036846.2021.1963663

Clinch, J. P., Dunne, L., and Dresner, S. (2006). Environmental and wider implications of political impediments to environmental tax reform. Energy Policy 34 (8), 960–970. doi:10.1016/j.enpol.2004.08.048

Costantini, V., and Sforna, G. (2020). A dynamic CGE model for jointly accounting ageing population, automation and environmental tax reform. European Union as a case study. Econ. Model. 87, 280–306. doi:10.1016/j.econmod.2019.08.004

Cremer, H., and Gahvari, F. (2004). Environmental taxation, tax competition, and harmonization. J. Urban Econ. 55 (1), 21–45. doi:10.1016/j.jue.2003.07.003

Dang, D., Fang, H., and He, M. (2019). Economic policy uncertainty, tax quotas and corporate tax burden: Evidence from China. China Econ. Rev. 56, 101303. doi:10.1016/j.chieco.2019.101303

Dasgupta, S., Laplante, B., Mamingi, N., and Wang, H. (2001). Inspections, pollution prices, and environmental performance: Evidence from China. Ecol. Econ. 36 (3), 487–498. doi:10.1016/s0921-8009(00)00249-4

Dean, J. M., Lovely, M. E., and Wang, H. (2009). Are foreign investors attracted to weak environmental regulations? Evaluating the evidence from China. J. Dev. Econ. 90 (1), 1–13. doi:10.1016/j.jdeveco.2008.11.007

Duan, Y., Ji, T., Lu, Y., and Wang, S. (2021). Environmental regulations and international trade: A quantitative economic analysis of world pollution emissions. J. Public Econ. 203, 104521. doi:10.1016/j.jpubeco.2021.104521

Ebenstein, A., Fan, M., Greenstone, M., He, G., Yin, P., and Zhou, M. (2015). Growth, pollution, and life expectancy: China from 1991-2012. Am. Econ. Rev. 105 (5), 226–231. doi:10.1257/aer.p20151094

Ekins, P., Pollitt, H., Summerton, P., and Chewpreecha, U. (2012). Increasing carbon and material productivity through environmental tax reform. Energy Policy 42, 365–376. doi:10.1016/j.enpol.2011.11.094

Ekins, P., Summerton, P., Thoung, C., and Lee, D. (2011). A major environmental tax reform for the UK: Results for the economy, employment and the environment. Environ. Resour. Econ. 50 (3), 447–474. doi:10.1007/s10640-011-9484-8

Fredriksson, P. G. (2001). How pollution taxes may increase pollution and reduce net revenues. Public Choice 107 (1), 65–85. doi:10.1023/a:1010360927680

Friedrich, B. U. (2022). Trade shocks, firm hierarchies, and wage inequality. Rev. Econ. Statistics 104 (4), 652–667. doi:10.1162/rest_a_00998

Gendron-Carrier, N., Gonzalez-Navarro, M., Polloni, S., and Turner, M. A. (2018). Subways and urban air pollution (No. w24183). National Bureau of Economic Research.

Geng, Y., Liu, W., Li, K., and Chen, H. (2021). Environmental regulation and corporate tax avoidance: A quasi-natural experiment based on the eleventh five-year plan in China. Energy Econ. 99, 105312. doi:10.1016/j.eneco.2021.105312

Gray, W. B., and Shadbegian, R. J. (2003). Plant vintage, technology, and environmental regulation. J. Environ. Econ. Manag. 46 (3), 384–402. doi:10.1016/s0095-0696(03)00031-7

Greenstone, M., and Hanna, R. (2014). Environmental regulations, air and water pollution, and infant mortality in India. Am. Econ. Rev. 104 (10), 3038–3072. doi:10.1257/aer.104.10.3038

Greenstone, M., He, G., Jia, R., and Liu, T. (2022). Can technology solve the principal-agent problem? Evidence from China's war on air pollution. [J], Am. Econ. Rev. Insights 4 (1), 54–70. doi:10.1257/aeri.20200373

Greenstone, M. (2002). The impacts of environmental regulations on industrial activity: Evidence from the 1970 and 1977 clean air act amendments and the census of manufactures. J. Political Econ. 110 (6), 1175–1219. doi:10.1086/342808

Guan, W. J., Zheng, X. Y., Chung, K. F., and Zhong, N. S. (2016). Impact of air pollution on the burden of chronic respiratory diseases in China: Time for urgent action. Lancet 388 (10054), 1939–1951. doi:10.1016/s0140-6736(16)31597-5

Guo, Z., Zhang, X., Zheng, Y., and Rao, R. (2014). Exploring the impacts of a carbon tax on the Chinese economy using a CGE model with a detailed disaggregation of energy sectors. Energy Econ. 45, 455–462. doi:10.1016/j.eneco.2014.08.016

Han, L., and Kung, J. K. S. (2015). Fiscal incentives and policy choices of local governments: Evidence from China. J. Dev. Econ. 116, 89–104. doi:10.1016/j.jdeveco.2015.04.003

He, P., Sun, Y., Niu, H., Long, C., and Li, S. (2021). The long and short-term effects of environmental tax on energy efficiency: Perspective of OECD energy tax and vehicle traffic tax. Econ. Model. 97, 307–325. doi:10.1016/j.econmod.2020.04.003

Hettige, H., Mani, M., and Wheeler, D. (2000). Industrial pollution in economic development: The environmental kuznets curve revisited. J. Dev. Econ. 62 (2), 445–476. doi:10.1016/s0304-3878(00)00092-4

Isen, A., Rossin-Slater, M., and Walker, W. R. (2017). Every breath you take—cvery dollar you’ll make: The long-term consequences of the clean air act of 1970. J. Political Econ. 125 (3), 848–902. doi:10.1086/691465

Jiang, L., Lin, C., and Lin, P. (2014). The determinants of pollution levels: Firm-level evidence from Chinese manufacturing. J. Comp. Econ. 42 (1), 118–142. doi:10.1016/j.jce.2013.07.007

Karydas, C., and Zhang, L. (2019). Green tax reform, endogenous innovation and the growth dividend. J. Environ. Econ. Manag. 97, 158–181. doi:10.1016/j.jeem.2017.09.005

Kong, D., and Zhu, L. (2022). Governments’ fiscal squeeze and firms’ pollution emissions: Evidence from a natural experiment in China. Environ. Resour. Econ. 81 (4), 833–866. doi:10.1007/s10640-022-00656-3

La Ferrara, E., Chong, A., and Duryea, S. (2012). Soap operas and fertility: Evidence from Brazil. Am. Econ. J. Appl. Econ. 4 (4), 1–31. doi:10.1257/app.4.4.1

Lanoie, P., Laurent-Lucchetti, J., Johnstone, N., and Ambec, S. (2011). Environmental policy, innovation and performance: New insights on the porter hypothesis. J. Econ. Manag. Strategy 20 (3), 803–842. doi:10.1111/j.1530-9134.2011.00301.x

Leslie, G. (2018). Tax induced emissions? Estimating short-run emission impacts from carbon taxation under different market structures. J. Public Econ. 167, 220–239. doi:10.1016/j.jpubeco.2018.09.010

Li, H., and Zhou, L. A. (2005). Political turnover and economic performance: The incentive role of personnel control in China. J. Public Econ. 89 (9-10), 1743–1762. doi:10.1016/j.jpubeco.2004.06.009

Li, P., Lu, Y., and Wang, J. (2016). Does flattening government improve economic performance? Evidence from China. J. Dev. Econ. 123, 18–37. doi:10.1016/j.jdeveco.2016.07.002

Li, P., Lu, Y., and Wang, J. (2020). The effects of fuel standards on air pollution: Evidence from China. J. Dev. Econ. 146, 102488. doi:10.1016/j.jdeveco.2020.102488

Li, S., Jia, N., Chen, Z., Du, H., Zhang, Z., and Bian, B. (2022). Multi-objective optimization of environmental tax for mitigating air pollution and greenhouse gas. J. Manag. Sci. Eng. 7, 473–488. doi:10.1016/j.jmse.2022.02.001

Liao, X., and Shi, X. R. (2018). Public appeal, environmental regulation and green investment: Evidence from China. Energy Policy 119, 554–562. doi:10.1016/j.enpol.2018.05.020

López, R., Galinato, G. I., and Islam, A. (2011). Fiscal spending and the environment: Theory and empirics. J. Environ. Econ. Manag. 62 (2), 180–198. doi:10.1016/j.jeem.2011.03.001

Maung, M., Wilson, C., and Tang, X. (2016). Political connections and industrial pollution: Evidence based on state ownership and environmental levies in China. J. Bus. Ethics 138 (4), 649–659. doi:10.1007/s10551-015-2771-5

Oueslati, W. (2014). Environmental tax reform: Short-term versus long-term macroeconomic effects. J. Macroecon. 40, 190–201. doi:10.1016/j.jmacro.2014.02.004

Pal, R., and Saha, B. (2015). Pollution tax, partial privatization and environment. Resour. Energy Econ. 40, 19–35. doi:10.1016/j.reseneeco.2015.01.004

Pang, R., Zheng, D., Shi, M., and Zhang, X. (2019). Pollute first, control later? Exploring the economic threshold of effective environmental regulation in China's context. J. Environ. Manag. 248, 109275. doi:10.1016/j.jenvman.2019.109275

Pang, Y. (2018). Profitable pollution abatement? A worker productivity perspective. Resour. Energy Econ. 52, 33–49. doi:10.1016/j.reseneeco.2017.12.003

Patuelli, R., Nijkamp, P., and Pels, E. (2005). Environmental tax reform and the double dividend: A meta-analytical performance assessment. Ecol. Econ. 55 (4), 564–583. doi:10.1016/j.ecolecon.2004.12.021

Pearce, D. (1991). The role of carbon taxes in adjusting to global warming. Econ. J. 101 (407), 938–948. doi:10.2307/2233865

Polyakov, M., Iftekhar, M. S., Fogarty, J., and Buurman, J. (2022). Renewal of waterways in a dense city creates value for residents. Ecol. Econ. 199, 107468. doi:10.1016/j.ecolecon.2022.107468

Sadik-Zada, E. R., and Ferrari, M. (2020). Environmental policy stringency, technical progress and pollution haven hypothesis. Sustainability 12 (9), 3880. doi:10.3390/su12093880

Sager, L. (2019). Estimating the effect of air pollution on road safety using atmospheric temperature inversions. J. Environ. Econ. Manag. 98, 102250. doi:10.1016/j.jeem.2019.102250

Seaman, N. L. (2000). Meteorological modeling for air-quality assessments. J. Atmos. Environ. 34 (12), 2231–2259. doi:10.1016/s1352-2310(99)00466-5

Seaton, A., Godden, D., MacNee, W., and Donaldson, K. (1995). Particulate air pollution and acute health effects. Lancet 345 (8943), 176–178. doi:10.1016/s0140-6736(95)90173-6

Sinha, J., Kumar, N., McLaughlin, M. D., and Hafner, S. F. (2019). Scientific data management in the age of big data: An approach supporting a resilience index development effort. Front. Environ. Sci. 7, 1–13. doi:10.3389/fenvs.2019.00072

Spinesi, L. (2022). The environmental tax: Effects on inequality and growth. Environ. Resour. Econ. 82, 529–572. doi:10.1007/s10640-022-00662-5

Tai, A. P., Martin, M. V., and Heald, C. L. (2014). Threat to future global food security from climate change and ozone air pollution. Nat. Clim. Change 4 (9), 817–821. doi:10.1038/nclimate2317

Van der Ploeg, F., Rezai, A., and Reanos, M. T. (2022). Gathering support for green tax reform: Evidence from German household surveys. Eur. Econ. Rev. 141, 103966. doi:10.1016/j.euroecorev.2021.103966

Wang, B., Liu, L., Huang, G. H., Li, W., and Xie, Y. L. (2018). Effects of carbon and environmental tax on power mix planning-A case study of Hebei Province, China. Energy 143, 645–657. doi:10.1016/j.energy.2017.11.025

Wang, H., and Jin, Y. (2007). Industrial ownership and environmental performance: Evidence from China. Environ. Resour. Econ. 36 (3), 255–273. doi:10.1007/s10640-006-9027-x

Wen, Q., and Zhang, T. (2022). Economic policy uncertainty and industrial pollution: The role of environmental supervision by local governments. China Econ. Rev. 71, 101723. doi:10.1016/j.chieco.2021.101723

Wilson, J. D. (1999). Theories of tax competition. Natl. tax J. 52 (2), 269–304. doi:10.1086/ntj41789394

Wu, J., and Tal, A. (2018). From pollution charge to environmental protection tax: A comparative analysis of the potential and limitations of China’s new environmental policy initiative. J. Comp. Policy Analysis Res. Pract. 20 (2), 223–236. doi:10.1080/13876988.2017.1361597

Yates, A. J. (2012). On a fundamental advantage of permits over taxes for the control of pollution. Environ. Resour. Econ. 51 (4), 583–598. doi:10.1007/s10640-011-9513-7

Zhai, M., Huang, G., Liu, L., Guo, Z., and Su, S. (2021). Segmented carbon tax may significantly affect the regional and national economy and environment-a CGE-based analysis for Guangdong Province. Energy 231, 120958. doi:10.1016/j.energy.2021.120958

Zhang, G., Deng, N., Mou, H., Zhang, Z. G., and Chen, X. (2019). The impact of the policy and behavior of public participation on environmental governance performance: Empirical analysis based on provincial panel data in China. Energy Policy 129, 1347–1354. doi:10.1016/j.enpol.2019.03.030

Zhang, J., Liu, Y., Zhou, M., Chen, B., Liu, Y., Cheng, B., et al. (2022). Regulatory effect of improving environmental information disclosure under environmental tax in China: From the perspectives of temporal and industrial heterogeneity. Energy Policy 164, 112760. doi:10.1016/j.enpol.2021.112760

Zhang, P., Deschenes, O., Meng, K., and Zhang, J. (2018). Temperature effects on productivity and factor reallocation: Evidence from a half million Chinese manufacturing plants. J. Environ. Econ. Manag. 88, 1–17. doi:10.1016/j.jeem.2017.11.001

Zhang, X., Zhang, X., and Chen, X. (2017). Happiness in the air: How does a dirty sky affect mental health and subjective well-being. J. Environ. Econ. Manag. 85, 81–94. doi:10.1016/j.jeem.2017.04.001

Zhao, J., Zhao, Z., and Zhang, H. (2021). The impact of growth, energy and financial development on environmental pollution in China: New evidence from a spatial econometric analysis. Energy Econ. 93, 104506. doi:10.1016/j.eneco.2019.104506

Keywords: environmental tax, environmental regulation, air pollution, pollution abatement, emerging economies

Citation: Tang W and Yang X (2023) Is environmental tax legislation effective for pollution abatement in emerging economies? Evidence from China. Front. Environ. Sci. 10:1113383. doi: 10.3389/fenvs.2022.1113383

Received: 01 December 2022; Accepted: 23 December 2022;

Published: 06 January 2023.

Edited by:

Rita Yi Man Li, Hong Kong Shue Yan University, Hong Kong, SAR ChinaReviewed by:

Elkhan Richard Sadik-Zada, Ruhr University Bochum, GermanyCopyright © 2023 Tang and Yang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xue Yang, NDc0MzczNzU5QHFxLmNvbQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.